Deputy Minister of Labour - Labour Program Mandate briefing binder March, 2021

On this page

- List of abbreviations

- A: Mandate of the Minister of Labour

- Mandate Letters

- Labour mandate

- Labour mandate overview

- Legislation under the purview of the Minister of Labour

- Federal mandate

- Federal mandate overview

- Industrial relations

- Occupational health and safety

- Application of Part II of the Canada Labour Code to parliamentary employees

- Work Place Harassment and Violence Prevention Regulations

- Labour standards

- Administrative Monetary Penalties

- Employment equity and pay transparency

- Workers compensation

- Non-smokers’ health

- Proactive pay equity

- Regulatory Initiatives

- National mandate

- International mandate

- Labour Program portfolio organizations

- B. Partners and stakeholders

- C. Labour Program Fact Sheet 2019 to 2020

List of abbreviations

- AMP

- Administrative Monetary Penalty

- ADM-COPD

- Assistant Deputy Minister, Compliance, Operations and Program Development

- AVCs

- Assurances of Voluntary Compliance

- BCMEA

- The British Columbia Maritime Employers Association

- CAALL

- Canadian Association of Administrators of Labour Legislation

- CAIRP

- Canadian Association of Insolvency and Restructuring Professionals

- CAS

- Committee on the Application of Standards

- CBSA

- Canada Border Services Agency

- CATSA

- Canadian Air Transport Security Authority

- CCOHS

- Canadian Centre for Occupational Health and Safety

- CER

- Canada Energy Regulator

- CERB

- Canada Emergency Response Benefit

- CFA

- Committee on Freedom of Association

- CGI

- Canada Gazette, Part I

- CGII

- Canada Gazette, Part II

- CHRA

- Canadian Human Rights Act

- CHRC

- Canadian Human Rights Commission

- CIRB

- Canada Industrial Relations Board

- CLCAs

- Comprehensive Land Claims Agreements

- Code

- Canada Labour Code

- Congress

- World Congress on Safety and Health at Work

- CPTPP

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership

- CUSMA

- Canada-United States-Mexico Agreement

- DPRDP

- Dispute Prevention and Relationship Development Program

- EEA

- Employment Equity Act

- EEAA

- Employment Equity Achievement Awards

- EPIC

- Equal Pay International Coalition

- EU

- European Union

- FCP

- Federal Contractors Program

- FETCO

- Federally Regulated Employers-Transportation and Communications

- FPSLREB

- Federal Public Sector Labour Relations and Employment Board

- FPT

- Federal-Provincial-Territorial

- FRP

- Forward Regulatory Plan

- FTA

- Free Trade Agreements

- FWCS

- Federal Workers’ Compensation Service

- GECA

- Government Employees’ Compensation Act

- Global Deal

- Global Deal for Decent Work and Inclusive Growth

- HOCE

- Head of Compliance and Enforcement

- IACML

- Inter-American Conference of Ministers of Labour

- ILC

- International Labour Conference

- ILO

- International Labour Organization

- IMEC

- Industrialized Market Economy Countries

- IPG

- Interpretations, Policies and Guidelines

- ISSA

- International Social Security Association

- ITL

- International Trade and Labour

- LEEP

- Legislated Employment Equity Program

- LMA

- Labour Market Availability

- MP

- Member of Parliament

- NSHA

- Non-smokers’ Health Act

- NSHR

- Nonsmokers’ Health Regulations

- OECD

- Organisation for Economic Co-operation and Development

- PAHO

- Pan-American Health Organization

- PEA

- Pay Equity Act

- PESRA

- Parliamentary Employment and Staff Relations Act

- PPE

- Personal Protective Equipment

- PSEA

- Public Service Employment Act

- PSPC

- Public Services and Procurement Canada

- RCMP

- Royal Canadian Mounted Police

- RIRSD

- Recognition of Indigenous Rights and Self-Determination

- Roster

- Roster of Investigators

- SDIR

- Standing Committee on Foreign Affairs and International Development

- SGAs

- Self-Government Agreements

- TC

- Transport Canada

- WCBs

- Workers’ Compensation Boards

- WEPP

- Wage Earner Protection Program

- WEPPA

- Wage Earner Protection Program Act

- WGEA

- Western Grain Elevator Association

- WORBE

- Workplace Opportunities: Removing Barriers to Equity

A: Mandate of the Minister of Labour

Mandate Letters

Minister of Labour Mandate Letter, 2019, the Prime Minister of Canada website.

Minister of Labour Supplementary Mandate Letter, 2021, the Prime Minister of Canada website.

Labour mandate

Overview

Federal mandate

The core mandate of the Minister of Labour is to promote safe, healthy, fair and inclusive work conditions and cooperative workplace relations in:

- the federal private sector, which includes key industries such as banking, telecommunications and air, rail and maritime transportation

- most Crown corporations (for example, Canada Post), and

- certain activities (in other words, governance and administration) of First Nations band councils and Indigenous self-governments

In some circumstances, the Minister of Labour’s responsibilities also extend to parts of the federal public sector (in other words, the core federal public service, federal agencies, the Canadian Forces, the Royal Canadian Mounted Police and Parliament), as well as to private-sector firms and municipal governments in Yukon, the Northwest Territories and Nunavut.

The key pieces of legislation underpinning the Minister of Labour’s mandate are:

- Canada Labour Code

- Government Employees Compensation Act

- Employment Equity Act

- Wage Earner Protection Program Act

- Non-smokers’ Health Act

- Pay Equity Act

- Parliamentary Employment and Staff Relations Act

National mandate

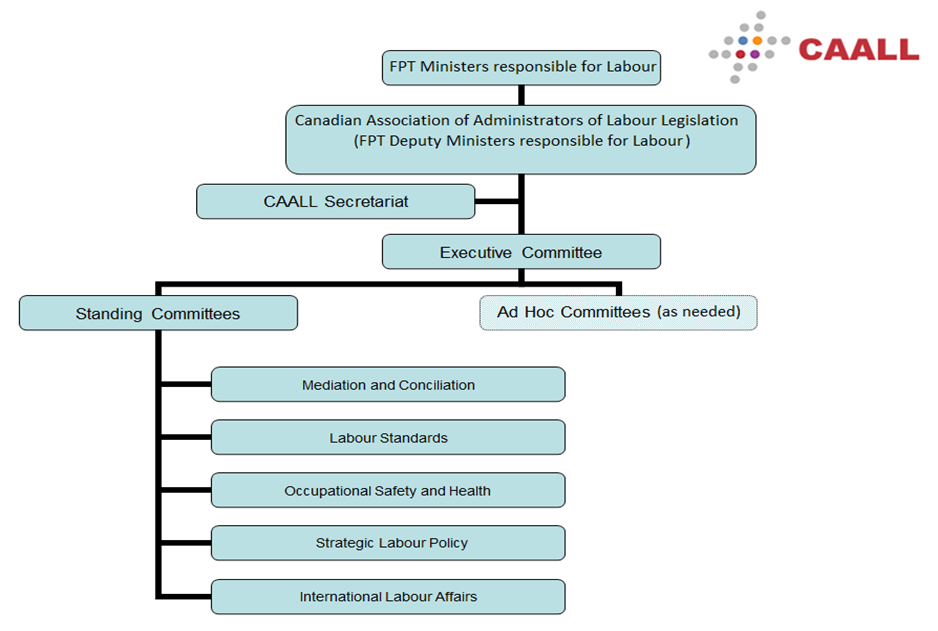

Given that responsibility for labour matters is divided under the Canadian constitution, the Minister of Labour works with the provinces and territories to foster cooperation and coherence on labour issues that affect all Canadian workplaces, workers and employers. In addition, the Labour Program supports the promotion of safe, fair, stable and productive workplaces in Indigenous communities where federal labour laws may apply depending on the nature of employers’ activities.

International mandate

The Minister of Labour manages Canada’s international labour affairs and plays an important role in the development and realization of Canada’s foreign and trade policy objectives by strengthening respect for internationally recognized labour standards and human rights.

Portfolio organizations

The Minister of Labour’s portfolio includes the Canada Industrial Relations Board (CIRB) and the Canadian Centre for Occupational Health and Safety (CCOHS). The CIRB’s mandate is to contribute to harmonious industrial relations while also ensuring compliance with health and safety legislation and adherence to minimum employment standards in federal workplaces through the administration of the labour relations framework and the interpretation of the Canada Labour Code. The CCOHS’ mandate is to promote workplace health and safety and the physical and mental health of working people in Canada, which it achieves through the provision of programs, products and services, and collaboration with various key partners, researchers and stakeholders.

Partners and stakeholders

A key element in delivering the Labour mandate is engagement with employer and union representatives. The federal government has traditionally been able to create a high degree of consensus with respect to labour laws and policies through such engagement and this, in turn, has played an important role in ensuring stable and healthy labour relations in Canada’s federally regulated industries. In addition, the Labour Program engages with non-governmental organizations and experts on key mandate priorities to inform policy development, build relationships and share information on issues of mutual interest.

In carrying out the Labour mandate, the Minister of Labour has an opportunity to contribute to:

- enhancing the employment conditions and well-being of working Canadians

- improving the success of businesses and the Canadian economy

- promoting respect for international labour principles and standards, and

- strengthening the overall performance of Canada’s socio-economic system

Legislation under the purview of the Minister of Labour

Text description of Figure 1

The Labour Program is responsible for promoting safe, healthy, fair and inclusive work conditions and cooperative workplace relations through legislation, programs and services.

6 pieces of legislation fall under the purview of the Minister of Labour.

Each of the 6 Acts cover different sectors in the federal jurisdiction. The number of employees covered by each Act also varies.

The 6 pieces of legislation included in the mandate of the Minister of Labour are as follows:

- Canada Labour Code

- Wage Earner Protection Program Act

- Employment Equity Act

- Pay Equity Act (not yet in force)

- Government Employees Compensation Act

- Non-Smokers Health Act

The Canada Labour Code

The Canada Labour Code has 4 parts:

- Part I (Industrial Relations) governs workplace relations and collective bargaining

- Part II (Occupational Health and Safety) aims to prevent workplace-related accidents and injuries, including occupational diseases

- Part III (Labour Standards) sets employment conditions and provides protection for employees

- Part IV (effective January 1, 2021) provides for Administrative Monetary Penalties (AMPs) and the naming of non-compliant employers and sets out review and appeal procedures for the new AMPs regime

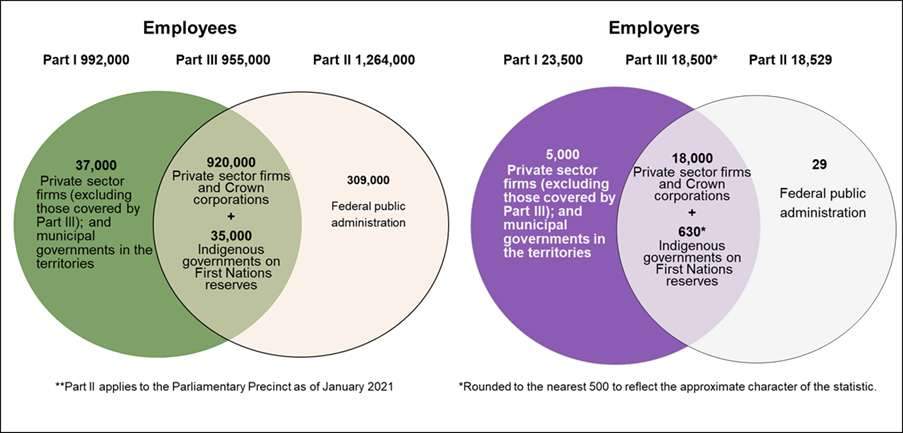

Part I of the Canada Labour Code covers approximately 992,000 employees in the following sectors:

- the federal private sector

- the territorial private sector

- federal Crown corporations

- First Nation Band Councils and Indigenous Self-Governments (certain activities), and

- municipal governments in the territories

Part II of the Canada Labour Code covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the Public Service

- federal Crown corporations

- agencies

- the Royal Canadian Mounted Police

- the Canadian Armed Forces (civilian employees only)

- the Parliamentary precinct (for example, Minister’s offices, Senate, House of Commons, Library), and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

Part III of the Canada Labour Code covers approximately 955,000 employees in the following sectors:

- the federal private sector

- federal Crown corporations, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

Part IV of the Canada Labour Code (effective January 1, 2021) covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the Public Service

- federal Crown corporations

- agencies

- the Royal Canadian Mounted Police

- the Canadian Armed Forces (civilian employees only)

- the Parliamentary precinct (for example, Minister’s offices, Senate, House of Commons, Library), and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

The Wage Earner Protection Program Act

The Wage Earner Protection Program Act provides for the payment of outstanding eligible wages to individuals whose employer is bankrupt or subject to a receivership. The Wage Earner Protection Program Act covers approximately 12.3 million employees in the following sectors:

- the federal private sector

- the territorial private sector, and

- the provincial private sector

The Employment Equity Act

The Employment Equity Act advances equality in the workplace so that no one is denied employment opportunities or advancement for reasons unrelated to ability. The Act also aims to correct the conditions of disadvantage in employment experienced by women, Aboriginal peoples, persons with disabilities, and members of visible minorities. The Employment Equity Act covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- federal contractors (applies to contractors with over 100 employees receiving contracts of more than $1 million from the Government of Canada)

- the federal public sector, including:

- the public service (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board tables public sector reports to Parliament each year)

- federal Crown corporations

- agencies (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board tables public sector reports to Parliament each year)

- the Royal Canadian Mounted Police (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board tables public sector reports to Parliament each year)

- Canadian Armed Forces (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board tables public sector reports to Parliament each year)

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

The Pay Equity Act

The Pay Equity Act (not yet in force) governs the proactive pay equity regime in Canada. The Act requires employers with 10 or more federally regulated employees to examine their compensation practices to ensure that women and men receive equal pay for work of equal value. The Pay Equity Act covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- federal contractors (applies to contractors with over 100 employees receiving contracts of more than $1 million from the Government of Canada)

- the federal public sector, including:

- the public service

- federal Crown corporations

- agencies

- the Royal Canadian Mounted Police

- the Canadian Armed Forces

- the Parliamentary precinct (for example, Minister’s offices, Senate, House of Commons, Library), and

- First Nation Band Councils and Indigenous Self-Governments (certain activities). The Pay Equity Act will apply to First Nation Band Councils after consultations are held and a regulatory process has been completed

The Government Employees Compensation Act

The Government Employees Compensation Act provides benefits to federal employees (or their dependants) who suffer an injury or illness arising out of or in the course of their employment. The Government Employees Compensation Act covers approximately 440,000 employees (or their dependants) in the following sectors:

- the federal public sector, including:

- the public service

- federal Crown corporations

- agencies

- the Royal Canadian Mounted Police (RCMP reservists are eligible for coverage under the Government Employees Compensation Act)

- the Canadian Armed Forces (Canadian Armed Forces reservists are eligible for coverage under the Government Employees Compensation Act)

- the Parliamentary precinct (applies to some parliamentary employers such as the Senate, the House of Commons and the Library of Parliament)

The Non-Smokers’ Health Act

The Non-Smokers’ Health Act restricts and regulates smoking in work spaces. The Non-Smokers’ Health Act covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the public service

- federal Crown corporations

- agencies

- the Royal Canadian Mounted Police

- the Canadian Armed Forces (civilian employees only)

- the Parliamentary precinct (for example, Minister’s offices, Senate, House of Commons, Library)

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

For more information on current and future legislative and regulatory changes, visit: Canada.ca/labour

Federal mandate

Overview

The mandate of the Minister of Labour is to promote safe, healthy, fair and inclusive work conditions and cooperative workplace relations in federal private-sector industries and, in some cases, for the federal public service and other federal establishments. This is accomplished through the development and administration of labour-related legislation and policies designed to regulate the employment relationship and improve the work environment for the benefit of workers (and their families), employers, the national economy and Canadian society as whole.

Key areas of responsibility under the federal labour mandate are:

- promotion and facilitation of constructive industrial relations including labour dispute prevention and resolution activities (mediation and conciliation)

- promotion and enforcement of occupational health and safety standards

- promotion and enforcement of labour standards (for example, hours of work, payment of wages, protected leaves and rights on termination of employment)

- promotion of employment equity for women, persons with disabilities, Indigenous people and visible minorities

- management of workers’ compensation for employees of the federal government

- restriction and regulation of smoking in any federally regulated work space including aircraft, trains and ships, except in designated smoking areas, and

- promotion of equal pay for work of equal value (in other words, pay equity)

Federal jurisdiction

Under the Canadian Constitution, responsibility for labour matters is divided between the federal government and the provinces and territories. Most of the legislation for which the federal Minister of Labour is responsible applies to the following sectors:

- marine shipping, ferry and port services

- air transportation, including airports, navigation, aerodromes and airlines

- rail and road (truck, bus) transportation that crosses provincial or international borders

- canals, pipelines, tunnels and bridges that cross provincial or international borders

- banks

- telecommunications

- radio and television broadcasting

- Crown corporations (for example, Canada Post, Via Rail)

- certain activities (in other words, governance and administration) of First Nations band councils and Indigenous self-governments, and

- industries declared by Parliament to be “for the general advantage of Canada or for the advantage of 2 or more of the provinces”, such as grain handling and uranium mining

There are approximately 18,500 employers in these sectors that together employ 955,000 employees (or 6.2% of the Canadian workforce), the vast majority (87%) of whom work in medium to large-size firms (in other words those with 100 or more employees).

Although a relatively small share of enterprises and employees fall under the Minister of Labour’s mandate, they make a vital contribution to Canada’s economy and the well-being of Canadians. For example, in 2019, the federal private sector and Crown corporations alone generated direct economic activity accounting for about 9%, or $207 billion, of Canada’s total economic output (Gross Domestic Product). The critical infrastructure services provided by these employees, such as banking, transportation and telecommunications, is essential for the well-being of Canadians through the support they provide to the rest of the Canadian economy. For example, natural resource and agriculture producers depend on the ports and the rail companies to export their products; retail firms depend on the ports and rail and trucking companies to import goods, either from overseas or from the U.S. or Mexico.

Detailed notes on each area of responsibility of the mandate are provided, but it may be useful to note that some legislation for which the Minister of Labour is responsible covers a larger or smaller number of enterprises and employees:

- industrial relations responsibilities, like mediation and conciliation, also apply to private-sector firms and municipalities in the 3 territories

- occupational health and safety responsibilities, including provisions on workplace violence and harassment, also apply to the federal public service, the Royal Canadian Mounted Police (RCMP) and employees on Parliament Hill

- pay equity responsibilities also apply to the federal public service, the RCMP and employees on Parliament Hill, but do not apply to employers with fewer than 10 employees

- employment equity responsibilities extend to the federal public service, the Canadian Forces and the RCMP, and to firms regulated by provinces and territories who contract with the federal government, but do not apply to firms with fewer than 100 employees

- workers’ compensation responsibilities apply only to federal government employees

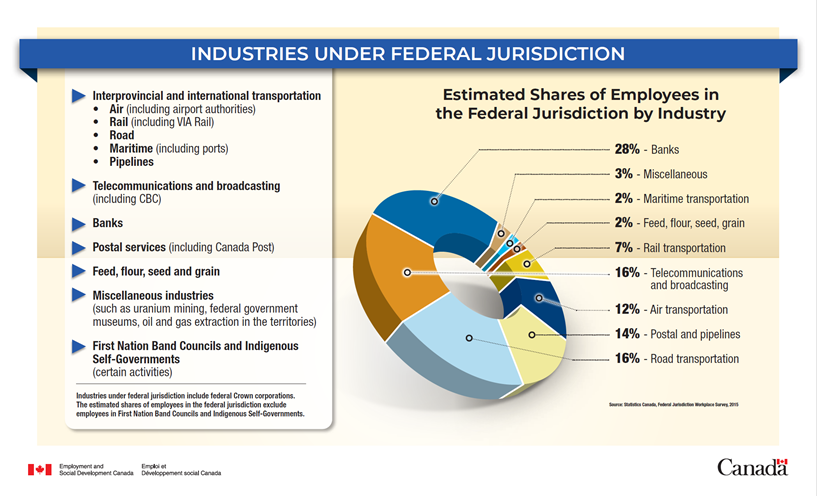

Text description of Figure 2

The estimated shares of employees in the federal jurisdiction, by industry, are as follows:

- Banks 28%

- Road transportation 16%

- Telecommunications and broadcasting, including CBC 16%

- Postal services, including Canada Post, and pipelines 14%

- Air transportation, including airport authorities 12%

- Rail transportation, including VIA Rail 7%

- Feed, flour, seed and grain 2%

- Maritime transportation, including ports 2%

- Miscellaneous industries such as uranium mining, federal government museums, oil and gas extraction in the territories 3%

Industries under federal jurisdiction also include federal Crown corporations. The estimated shares of employees in the federal jurisdiction exclude employees in First Nation Band Councils and Indigenous Self-Governments.

Source: Statistics Canada, Federal Jurisdiction Workplace Survey, 2015

Industrial relations

Part I of the Canada Labour Code (Code) is the legislative framework governing workplace relations and collective bargaining for private-sector employers and trade unions under federal jurisdiction. Part I also applies to private-sector and municipal employers and employees in Yukon, Nunavut and the Northwest Territories. In 2019, approximately 992,000 employees (or 6.2% of all Canadian employees) were employed in enterprises subject to Part I. About 35% of these workers were covered by a collective agreement.

The Minister of Labour is responsible to Parliament for the administration of the Code. The Federal Mediation and Conciliation Service of the Labour Program administers the dispute resolution provisions of the Code. The Canada Industrial Relations Board (CIRB) is an independent tribunal whose mandate includes the determination of collective bargaining rights, unfair labour practices, illegal strikes and lockouts, activities to be maintained during a strike or lockout, and the adjudication of certain other matters (for example, claims by non-unionized employees about unfair dismissal).

The Code sets out the following general framework for collective bargaining in the federally regulated private sector:

- exclusive bargaining rights are granted by the CIRB to unions (also referred to as bargaining agents) when they can demonstrate majority support from employees

- the parties have an obligation to negotiate in good faith

- collective agreements establish the terms and conditions of employment between the parties. The agreements must be of a fixed term of at least a year, and strikes and lockouts are not permitted while a collective agreement is in force

- the bargaining process begins when a notice to bargain is given by 1 party to the other to start negotiating the renewal of a collective agreement

- when a notice of dispute is received from 1 of the parties, the Minister may (and almost always does) appoint a conciliation officer to assist the parties in resolving their differences

- the conciliation process is normally for a period of 60 days unless it is extended by the parties by mutual agreement. At the end of the conciliation period, a 21-day “cooling off” period begins

- the employer can give the union a 72-hour notice of a lockout, or the union can serve the employer a 72-hour notice of a strike, and they must notify the Minister, prior to the end of the 21-day cooling off period. However, a legal work stoppage cannot take place until the 21 days have expired

- a legal strike or lockout cannot take place until the following conditions are met:

- a notice to bargain has been given

- the conciliation process has taken place

- 21 days have elapsed since the end of the conciliation process

- a strike vote has been taken, and

- a 72-hour strike or lockout notice has been given

- the Minister can refer specific issues to the CIRB. For example, parties must have an agreement on the maintenance of services during a work stoppage to prevent an immediate and serious danger to the safety or health of the public, if any. Where they cannot reach such an agreement, or the agreement seems insufficient, the Minister may refer the matter to the CIRB for determination

- such a referral suspends the parties’ acquisition of strike or lockout rights until a decision is rendered by the CIRB if the referral is made before the beginning of a work stoppage

- the Minister may appoint a mediator at any time, either at the request of the parties, or on the Minister’s own initiative. The appointment of a mediator does not influence the acquisition of the right to strike or lockout

Other important provisions of Part I of the Code include:

- a range of unfair labour practices relating to employers and unions

- offences and penalties for actions by employers, trade unions or individuals that are contrary to the Code’s provisions

- general provisions relating to the promotion of industrial peace, including the power to appoint industrial inquiry commissions and refer questions to the CIRB, and

- the appointment of members of the CIRB is made on the recommendation of the Minister

The Labour Program’s Federal Mediation and Conciliation Service offers employers and unions dispute resolution assistance through the services of conciliation and mediation officers whose job is to assist the parties in reaching a collective agreement. During fiscal year 2019 to 2020, conciliation and mediation officers dealt with 210 collective bargaining disputes. 93% of all disputes that were referred to the Federal Mediation and Conciliation Service (and settled in 2019 to 2020) were resolved without a work stoppage.

Conciliation and mediation officers also offer dispute prevention and relationship development services intended to help employers and unions build and maintain constructive working relationships while the collective agreement is in force. During fiscal year 2019 to 2020, the Dispute Prevention and Relationship Development Program (DPRDP) held a total of 109 dispute prevention and relationship development sessions for a total of 156 days. Of these, facilitation services represented the highest number of sessions, while workshop delivery and grievance mediation were also significant contributors.

Status of the Artist Act

For people working in the federal cultural sector in Canada (for example, the National Arts Centre, National Film Board and CBC/Radio Canada) the Status of the Artist Act (the Act) protects the rights of artists. The Act guarantees their freedom to associate and authorizes the negotiation of wage scales. Artists cannot be paid below the minimum by a producer bound by the scale. Under the Act, the Minister of Labour may appoint mediators and grievance arbitrators to assist artists, producers and film-makers, even if they are independent contractors working on films.

Under the Act, the CIRB is responsible for professional relations between self-employed artists and producers at federally regulated broadcasters, and federal government departments, agencies, and Crown corporations.

Occupational health and safety

The purpose of Part II of the Canada Labour Code (Code) is to prevent workplace‑related accidents and injuries, including occupational diseases. It applies to private sector employers in the federal jurisdiction, Crown corporations, the federal public service, and as of July 29, 2019, to Parliamentary workplaces (for example, House of Commons, Senate).

Under the Code, employers have a general obligation to protect the health and safety of employees while at work, as well as non-employees (for example, contractors or members of the public) who are granted access to the workplace. It also places obligations on employees and health and safety committees or representatives to help prevent occupational-related injuries and diseases.

The standards in Part II and its related regulations cover matters such as:

- the right to know about every known or foreseeable health or safety hazard in the area where they work

- the right to participate in identifying and correcting job-related health and safety concerns

- the right to refuse dangerous work

- the requirement for all workplaces with 20 or more employees to establish a workplace health and safety committee

- the duties of the health and safety committee and health and safety representative

- the requirements for protective equipment and other preventative measure

- the requirements for first aid

- the reporting requirements of a hazardous occurrence to the Minister

- the powers and duties of the Minister, the majority of which are delegated to Health and Safety Officers (HSO) and Senior Investigators through a delegation instrument

- the requirements to develop, implement and monitor a program for the prevention of hazards, and

- work place harassment and violence prevention

Many specific rules and requirements are also outlined in regulations enabled by Part II of the Code, such as:

- Canada Occupational Health and Safety Regulations

- Aviation Occupational Health and Safety Regulations

- Maritime Occupational Health and Safety Regulations

- On Board Trains Occupational Safety and Health Regulations

- Oil and Gas Occupational Safety and Health Regulations

- Policy Committees, Work Place Committees and Health and Safety Representatives Regulations

- Work Place Harassment and Violence Prevention Regulations

Compliance with Part II is achieved using a variety of approaches, including education, counseling, and assurance of voluntary compliance. Part II also establishes offences for non-compliance, and allows for directions and prosecutions.

When an HSO issues a direction, the HSO’s role is “functus officio” and the direction cannot be changed or withdrawn unless it is appealed. This means that the appeals hearing is considered de novo (new), and although it reviews the records, new evidence/information is considered in making the determination. If a workplace party wishes to appeal a direction or decision made by an HSO or Senior Investigator, there is an arms-length appeal process laid out in the Code and administered by the Canadian Industrial Relations Board.

Transport Canada (TC) and the Canada Energy Regulator (CER) have roles in administering Part II, on behalf of the Labour Program, for persons working in the on-board aviation, marine and rail, and in the oil and gas industries.

The Labour Program’s relationships with TC and CER are governed by Memoranda of Understanding. Certain health and safety services are also administered by the provinces through Memoranda of Understanding in specific sectors (such as uranium mines and mills in Saskatchewan, mining and smelting in Manitoba and nuclear facilities in Ontario).

The new Work Place Harassment and Violence Prevention Regulations came into force on January 1, 2021. A new Part IV of the Code also came into force on January 1, 2021, allowing the establishment of an administrative monetary penalty regime with the goal of promoting and encouraging compliance with occupational health and safety and labour standards requirements. The regulations designate violations and establish penalty amounts (not exceeding $250,000), and prescribe certain elements related to public naming of employers that have committed a violation.

Finally, January 1, 2021 was also the date when the Minister of Labour designated a Head of Compliance and Enforcement (HOCE). The HOCE exercises the powers and performs administrative duties and functions currently conferred on inspectors, regional directors and the Minister of Labour by the Code. The Minister will still have key responsibilities at the policy level. The HOCE will have authority to delegate to any qualified person any of these powers, duties or functions. This measure is intended to improve client service through improved oversight and consistency in program delivery, greater operational flexibility and specialization, and the optimization of workloads.

The delegation instruments were updated to reflect the changes introduced on January 1, 2021. Additional updates to the instruments will be needed likely early in the new fiscal year, as further regulatory changes are introduced, including transitioning all the regulations made pursuant to the Code under the authority of the HOCE.

Next steps

There are a number of regulatory changes that are at varying stages of the regulatory process. Over the coming year, regulatory packages will be brought forward to the Minister of Labour for consideration.

Education and awareness-raising activities for employers and employees, as well as training for Health and Safety Officers, will be provided to support the implementation of the new provisions.

Application of Part II of the Canada Labour Code to parliamentary employees

Parliamentary Employment and Staff Relations Act (PESRA) and its application

Employees within the Parliamentary Precinct are subject to the Parliamentary Employment and Staff Relations Act (PESRA).

- Part I of the PESRA (Industrial Relations), which was proclaimed on December 24, 1986, extended collective bargaining rights to most employees of the House of Commons, the Senate, and the Library of Parliament, but not to exempt Ministerial staff

- Part III (Occupational Safety and Health) of the PESRA was proclaimed on July 29, 2019. It extended provisions of Parts II of the Canada Labour Code (Code) protecting the occupational health and safety of employees, while respecting Parliamentary Privilege

- Part II (Labour Standards) of the PESRA remains unproclaimed

Part III of the PESRA applies to employees of the Library of Parliament, the Office of the Parliamentary Budget Officer, the Office of the Conflict of Interest and Ethics Officer, the Office of the Senate Ethics Officer, the Parliamentary Protective Service, the Senate, the House of Commons administration and their members.

It also covers any Member of Parliament (MP) who, in that capacity, employs any person or has the direction or control of staff employed to provide research or associated services to caucus members of a political party represented in Parliament.

MPs are subject to the PESRA and Ministers are subject to Part II of the Code. This means that where an MP has a dual role as a Minister, they will be subject to the PESRA as an MP. In their role as a Minister, they are subject to the Code.

This is why MPs are subject to the Work Place Harassment and Violence Prevention Regulations that are pursuant to Part II of the Code, but not to Administrative Monetary Penalties or their Regulations as these are not referenced in the PESRA.

Parliamentary privilege

An explicit protection of Parliamentary Privilege is included in Part III of the PESRA to ensure that its implementation does not obstruct the Senate or House of Commons from conducting business, nor limit or interfere with their powers, privileges and immunities.

The mandate of the Labour Program

The Labour Program is responsible for protecting the rights and well-being of employees in federally regulated workplaces through the enforcement of the occupational health and safety provisions of the Code.

The role of the Speakers of the House and Senate

The Minister has the obligation to notify the Speaker of the Senate or the House of Commons, or both in certain situations. This activity would be undertaken by the Deputy Minister of Labour when the situation involves the Senate or a MP work place, in order to avoid the perception of a conflict of interest.

The Speaker or Speakers must be notified if the Labour Program:

- intends to enter a workplace controlled by a parliamentary employer

- commences an investigation involving a parliamentary employer or employee under Part II of the Code; or

- issues a direction, as a result of a compliance activity, to a parliamentary employer or employee under that Part

The Speaker or Speakers must also be notified if the Federal Public Sector Labour Relations and Employment Board (FPSLREB):

- receives a complaint of reprisals in relation to a parliamentary employer; or

- receives an appeal of a direction issued to a parliamentary employer or employee

Additionally, if notified of an appeal before the FPSLREB, the Speaker or Speakers may request a copy of any document that is filed with the Board and present evidence and make representations in relation to that appeal.

The role of Members of Parliament

Each Member of Parliament (MP) is considered an individual employer per the definitions of an employer in Part III of the PESRA.

As such, each MP is responsible for protecting the occupational health and safety of their employees, putting in place a health and safety representative or committee for each of their workplaces, providing their staff with required training, and establishing the necessary policies for their workplaces. Many requirements of the Code are performance-based rather than prescriptive, which allows employers to choose a way to comply that best suits their workplace.

Senators are represented by the Senate Administration, as a single employer.

If an employer (each MP, or the Senate Administration) controls more than 1 workplace, but for logistical or administrative reasons wants to establish a single occupational health and safety committee or representative for these workplaces, provisions in the Code allow the employer to make a request to a Health and Safety Officer for consideration.

Work Place Harassment and Violence Prevention Regulations

Bill C-65, An Act to amend the Canada Labour Code (harassment and violence), the Parliamentary Employment and Staff Relations Act and the Budget Implementation Act, 2017, No. 1 is legislation aimed at ensuring that federally regulated workplaces, and Parliament Hill, are free from harassment and violence. The Bill received Royal Assent on October 25, 2018, and the legislation and associated Work Place Harassment and Violence Regulations (the Regulations) came into force on January 1, 2021.

Starting in fiscal year 2018 to 2019, the Government of Canada has committed $34.9 million over 5 years to support the implementation of Bill C-65. This includes $7.4 million annually, of which $3.5 million annually is dedicated to grants and contributions through the Workplace Harassment and Violence Prevention Fund. The remaining funding has been used to develop training programs for labour inspectors, create an awareness campaign, provide educational materials and tools to workplace parties, hire additional labour investigators, put in place an outreach hub accessible through a 1-800 number and support regulatory development and enforcement activities.

The new Harassment and Violence Prevention regime:

- includes a new definition of harassment and violence: any action, conduct, or comment, including of a sexual nature, that can reasonably be expected to cause offence, humiliation or other physical or psychological injury or illness to an employee, including any prescribed action, conduct or comment

- amended the purpose of Part II to explicitly include the prevention of harassment and violence, and physical and psychological injuries and illnesses

- requires employers to follow steps of a resolution process within specific timelines when responding to notifications of harassment and violence

- requires employers to ensure that all employees receive harassment and violence prevention training, and

- adds privacy protections and new employer obligations towards former employees

Employer obligations

Under the Regulations, employers have key obligations including:

- developing a workplace harassment and violence prevention policy which must contain a number of elements

- responding to every notification of an occurrence of harassment and violence

- ensuring that the resolution process is conducted in a timely and transparent manner

- assuring that the complainant is provided the options of negotiated resolution, conciliation, and/or an investigation

- ensuring that a workplace assessment addresses the risk of harassment and violence in the workplace

- requiring that all parties in the workplace, including the employer, undertake harassment and violence related training

- requiring joint (employee-management) development of a prevention policy, joint determination of harassment and violence prevention training, if undertaken, joint determination of a list of investigators, etc

- maintaining records on, among other things, every occurrence of harassment and violence and reporting aggregated information to the Minister on an annual basis, and

- reporting to the Labour Program Minister within 24 hours of any occurrence of harassment and violence that results in the death of an employee

Tools and resources

The Labour Program worked closely with stakeholders to develop and disseminate a series of tools and resources to assist all federally regulated employers with the implementation of the Bill and Regulations.

The tools and resources include:

- Harassment and Violence Prevention Outreach Hub

- Interpretations, Policies and Guidelines (IPG)

- Sample Workplace Risk Assessment

- Sample Workplace Harassment and Violence Prevention Policy

- Sample Harassment and Violence Training Syllabus

- Employer Requirements Checklist

- sample template to notify an employer of an occurrence

- sample template to respond to a notice of an occurrence

- sample monthly update template

The Labour Program also worked closely with the Canadian Centre for Occupational Health and Safety (CCOHS) to establish a Roster of Investigators (Roster), which serves as an online repository of qualified, professional investigators by organizations in need to investigate and address occurrences of workplace harassment and violence. Developed in consultation with a tripartite expert group of federally regulated employers and labour representatives, the Roster supports the Regulations and its requirements to provide a list of persons whom the CCOHS identifies as having the knowledge, training and experience to act as investigators.

Workplace Harassment and Violence Prevention Fund

The Labour Program’s Workplace Harassment and Violence Prevention Fund delivers $3.5 million funding annually to partner organizations to support workplaces to implement Bill C-65 and the associated Regulations. More specifically, this funding is provided to organizations to co-develop sector-specific tools and resources that address harassment and violence in the workplace and help guide culture change around these issues. Approaches include behavioural changes, education and guidance, and mandatory training. These projects support workplaces to implement Bill C-65 and the associated Regulations.

Current initiatives

There are currently 7 projects supported by the Fund whose objectives are to develop tools, resources and training materials for a variety of workplaces across Canada, including workplaces in First Nations communities and in the marine, trucking, banking and performing arts sectors. The organizations that are receiving funding include:

- the British Columbia Maritime Employers Association (BCMEA) – $3,099,200

- project title: Violence and Harassment Awareness, Management and Training for the BC Waterfront

- the Nokiiwin Tribal Council – $2,155,967

- project title: G’minoomaadozimin (We Are Living Well) – Our Respectful Community

- Trucking Human Resources (HR) Canada – $2,245,860

- project title: Anti-Harassment Training for the Trucking Sector

- UNI Financial Cooperation – $182,508

- project title: Implementation and Upgrade of Practices Related to Bill C-65

- the Centre for Research and Education on Violence Against Women & Children at Western University – this organization is receiving funding for 2 projects

- project title: Addressing Domestic Violence in the Workplace through Collaboration – $2,088,828

- project title: Research & Training for Vulnerable Workers Experiencing Sexual Violence – $874,196

- the Canadian Women’s Foundation – $2,786,696

- project title: Roadmap to Future Workplaces

Further information on the projects can be found on the Workplace Harassment and Violence Prevention Fund’s webpage.

Labour standards

Part III of the Canada Labour Code (the Code) establishes the conditions of work and provides protection for employees in the federally regulated private sector and most federal Crown corporations. Part III does not apply to the federal public service or employees of Parliament.

Employers have an obligation to provide the minimum labour standards in Part III, such as:

- hours of work (maximum of 48 hours/week; overtime after 8 hours/day or 40 hours/week; right to refuse overtime; 96 hours’ notice of work schedules; 24 hours’ notice of shift changes; unpaid 30-minute breaks; nursing and medical breaks; 8-hour rest period between shifts)

- the right to request flexible work arrangements (for example, changes to hours worked, work schedule and location of work)

- minimum wages (rate set by province in which work is performed)

- annual vacation (2 weeks; 3 weeks after 5 years; 4 weeks after 10 years)

- general holidays (9 holidays/year)

- severance pay (2 days’ pay per year, with a minimum of 5 days’ pay)

- individual termination (2 weeks’ notice or pay in lieu)

- group termination (for terminations of 50 or more employees in a 4 week period in the same industrial establishment, 16 weeks’ notice must be provided and a joint planning committee established)

- unjust dismissal (recourse for non-unionized employees who have at least 12 months of continuous employment)

- the requirement to insure their long-term disability plans, and

- the prohibition from misclassifying employees (in other words, treating them as if they were not employees) in order to avoid obligations under Part III of the Code or to deprive employees of their rights

Employers are also prohibited from taking any disciplinary actions against an employee because of the employee’s genetic test results, or because the employee refused to take a genetic test or disclose the results. Employees may file complaints with the Labour Program if the employer collected or used the genetic test results without the employee’s written consent.

Complaints related to third-party disclosure of genetic testing results, are filed with the Privacy Commissioner of Canada or with the provincial Privacy Commissioner in the province in which the employee resides.

Part III also provides for different types of leave, generally without pay:

- maternity-related reassignment leave (up to the 24th week after birth, if unable to work because there is a risk to the pregnant or nursing mother or her child and no reassignment or modification of job functions is reasonably practicable, or if the employee is unable to work because of pregnancy or nursing)

- maternity* (up to 17 weeks) and parental* (up to 63 weeks) leaves (up to 78 weeks when combined; up to 86 weeks when combined and the parental leave is shared)

- compassionate care* leave to provide care and support to a family member who has a serious medical condition with a significant risk of death within 26 weeks (up to 28 weeks in a 52-week period)

- leave for critically ill children* (up to 37 weeks) and adult* (up to 17 weeks)

- leave for parents of murdered** (up to 104 weeks) and missing** (up to 52 weeks) children

- personal leave (up to 5 days, first 3 days with pay)

- leave for victims of family violence (up to 10 days, first 5 days with pay)

- leave for traditional Aboriginal practices (up to 5 days)

- leave for court or jury duty (unlimited time for jury selection, to serve on a jury or to attend court as a witness)

- bereavement leave (up to 5 days, 3 days with pay)

- medical* leave (up to 17 weeks) that can be taken for personal illness or injury, organ or tissue donation, and medical appointments

- work-related illness and injury leave (for the duration of the employee’s recovery)

- leave for Members of Reserve force (to attend all types of Canadian Armed Forces military skills training, plus time necessary to participate and recuperate from designated operations)

- new job-protected unpaid leave for the purposes of quarantine (up to 16 weeks)

- temporary unpaid job-protected leave related to COVID-19 aligned with the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit (ending September 25, 2021)

* The protected leaves generally align with Employment Insurance special benefits and the Canadian Benefit for Parents of Young Victims of Crime.

** The protected leaves (partly for missing children) align with the Canadian Benefit for Parents of Young Victims of Crime.

Upcoming changes to labour standards

As of September 1, 2020, interns in federally regulated workplaces are protected under Part III of the Code and are extended certain labour standards protections including, hours of work, general holidays and short-term protected leaves.

Once in force on dates in 2021 (and later), and subject to Ministerial approval, employers will also have to provide the following minimum labour standards introduced as part of several budget bills since 2017:

- individual notice of termination (current 2 weeks notice or pay in lieu will be replaced by a graduated notice of termination system ranging from 2 weeks for employees with between 3 months and 3 years of service to 8 weeks after 8 years of service)

- group notice of termination (the current 16 weeks notice will be enhanced by allowing employers to provide pay in lieu of the 16 week notice or a combination of notice and pay in lieu)

- minimum age of employment (from 17 to 18 years of age to align with international labour convention related to child labour)

- recovery of work-related expenses

- equal treatment protections prohibiting an employer from paying a part-time, casual, seasonal or temporary employee a lower rate of wage than another employee simply because of their employment status, if certain conditions are met, and

- temporary help agencies (prohibited practices)

Regulations are required in support of certain new hours of work rules, including modifications of the rules and exemptions of certain classes of employees in various industries. Regulatory work is underway for the development and implementation of these regulatory modifications and exemptions. Additionally, a number of new regulations will be required in support of the new standards that are not yet in force.

Compliance with Part III is achieved using a variety of approaches, including education and counseling, investigation of complaints and inspections of workplaces. Additional tools, such as the power to order an internal audit of the employer’s practices and records, were recently added to Part III.

As of January 1, 2021, enforcement tools were further strengthened with the coming into force of a new Part IV of the Code, and the related Administrative Monetary Penalties (Canada Labour Code) Regulations. Part IV of the Code establishes an administrative monetary penalty regime to promote and encourage compliance with occupational health and safety and labour standards requirements. The AMP Regulations designate violations and establish penalty amounts (not exceeding $250,000), and prescribe certain elements related to the public naming of employers that have committed a violation.

An employee who believes that their rights under Part III have not been respected, including in situations of non-payment of wages, non-monetary complaints, unjust dismissal complaints or complaints related to genetic testing, may file a complaint with the Labour Program. In the case of non-payment of wages, a labour affairs officer will investigate and take appropriate action, including wage recovery measures, if a contravention is found. In the case of unjust dismissal complaints and complaints related to genetic testing, a labour affairs officer will endeavor to settle the matter.

Adjudicative functions under Part III of the Code were transferred to the Canada Industrial Relations Board (CIRB) on July 29, 2019. The aim is to simplify employment-related recourse for federally regulated employees and employers by creating a single access point to adjudicate certain employment disputes and provide employees with a new recourse mechanism against employer reprisals under Part III of the Code. At the request of the employee, the CIRB has authority to adjudicate unjust dismissal complaints and complaints related to genetic testing that have not been settled. The CIRB may also hear appeals of notices and orders including payment orders, notices of unfounded complaints and notices of voluntary compliance.

Provisions allowing the Minister of Labour to designate a Head of Compliance and Enforcement (HOCE) came into force on January 1, 2021. The Minister designated the Assistant Deputy Minister, Compliance, Operations and Program Development (ADM-COPD) as the HOCE, who exercises all the powers and performs all the administrative duties and functions that were previously conferred on inspectors and regional directors, and most of those conferred on the Minister of Labour. Although the HOCE is responsible for the day-to-day administration and enforcement of the Code, the Minister will retain certain authorities, due to their sensitivity, high-profile nature or potential impact (for example, recommending regulations to the Governor in Council, consenting to prosecutions). The HOCE has authority to delegate to any qualified person any of the powers, duties or functions. Changes to the delegation instruments were made in order to reflect the transfer of powers, duties and functions to the HOCE, as well as to extend delegations to qualified persons in order to allow for operational efficiency. The purpose of these changes is to improve client service through improved oversight and consistency in program delivery, greater operational flexibility and specialization, and the optimization of workloads.

Next steps

The legislative provisions that are not yet in force require regulations that are at varying stages of the regulatory process. For modifications and exemptions from certain hours of work rules, consultations were completed in February and March 2020 and proposed regulations for these modifications and exemptions are being addressed in 2 phases. Phase 1 covers the road transportation, postal and courier, marine and longshoring, and grain sectors and proposed regulations were pre-published in the Canada Gazette, Part I on December 19, 2020 for a 60 day public comment period. Phase 2 will cover rail, telecommunications and broadcasting, and the banking sector. Phase 2 is targeted for pre-publication in the Canada Gazette, Part I in spring/summer 2021.

Other regulatory initiatives, including equal treatment and minimum age of employment, are still in the early development phases and consultations are planned over the coming months.

Education and awareness-raising activities for employers and employees, as well as training for inspectors, is being provided to support the implementation of the new provisions.

Administrative Monetary Penalties – Part IV of the Canada Labour Code

Budget Implementation Act, 2017, No. 1 (Bill C-44) included new compliance and enforcement measures under the Canada Labour Code (the Code) to address long-standing concerns about the lack of adequate enforcement tools. Bill C-44 created a new Part IV (Administrative Monetary Penalties (AMPs)) of the Code, which came into force on January 1, 2021. AMPs are intended to promote compliance with occupational health and safety and labour standards requirements, and to supplement and reinforce existing enforcement tools under the Code. It is not intended to be overly punitive, but to deter non-compliance.

Between April 1, 2016, and March 31, 2020, non-compliance with Part II and Part III of the Code has persisted:

- Part II, about 50,500 violations were identified regarding approximately 2,340 employers, with about 43% being repeat offenders. Only 28% of serious and 47% of non-serious hazardous occurrences were reported on time

- Part III, about 10,300 violations were identified regarding approximately 2,710 employers, with about 26% being repeat offenders, which took multiple interventions to bring them into compliance

The AMP system consists of the legislative and regulatory framework, and operational policy. The Administrative Monetary Penalties (Canada Labour Code) Regulations (the AMPs Regulations) were published in the Canada Gazette, Part II, on Dec. 23, 2020 and the Interpretation Policy Guideline (IPG) has been finalized in collaboration with stakeholders. The IPG sets out national guidelines and defines the scope of Part IV of the Code and the AMPs Regulations. Its objective is to ensure stakeholders understand when an AMP will be issued, who will issue an AMP, and to know where an AMP fits within the compliance and enforcement continuum under Part II and Part III of the Code.

Prior to Part IV coming in force, enforcement measures included assurances of voluntary compliance (AVCs), directions and orders, but were not sufficient in all cases to promote ongoing compliance. AMPs offer an alternative measure for cases that do not warrant a prosecution. With some exceptions, issuance of an AMP may result from continued or recurring non-compliance with the Code and its Regulations where attempts at obtaining voluntary compliance have failed.

Part IV of the Code prescribes that an AMP may be issued to any person (including a corporation) or a department. Part IV applies to any department in, or other portion of, the federal public administration, to which Part II applies. A Minister of the Crown can be issued an AMP with respect to a Part II violation as an employer of exempt staff covered by the Public Service Employment Act (PSEA).

The AMPs Regulations include schedules designating all provisions that specify legal obligations under Part II and Part III of the Code and related regulations as violations, and classify the violations on a scale of increasing severity from “A” to “E”, based on the gravity of the conduct. The associated classification is tied to an AMP amount. A transitory provision was included in the AMPs Regulations, which provides that AMPs for Type A (administrative) violations will only be issued on and after January 1, 2022. This will allow stakeholders to adjust to new Code provisions, and to familiarize themselves with their obligations under Part IV.

The AMPs Regulations also specify the base penalty amounts, which vary depending on the type of person or department believed to have committed a violation, and the classification of the violation. A history of non-compliance may increase the AMP amount. A penalty amount may be reduced by half if it is paid within 20 days after the AMP was served. This option is available exclusively in cases where the alleged violation falls under a Type A, B or C classification. Once a person makes the payment, they will be considered to have committed the violation and all related proceedings are closed.

A person or department that is served with an AMP may, within 30 days of service request an administrative review of the penalty, the facts of the alleged violation, or both. An appeal may be requested within 15 days from when the review decision is served. If no appeal is requested, the AMP must be paid as determined by the review decision. Appeals will be heard by the Canada Industrial Relations Board.

The designation of a Head of Compliance and Enforcement (HOCE), with the continued support of the Labour Program’s inspectorate, intends to improve oversight and consistency in program delivery, provide greater operational flexibility and better align the different parts of the Code. As an added measure, the Labour Program has assembled a team of experts to ensure national consistency in the implementation of the new AMPs system.

AMPs constitute a debt to the Crown and are recoverable in the Federal Court or any other court of competent jurisdiction (for example, Federal Court of Appeal, Ontario Superior Court). In the event of unpaid AMP amounts, the Canada Revenue Agency will be responsible for AMP collection activities, in accordance with their role to collect certain ESDC and Canada Employment Insurance Commission debts.

To further strengthen compliance with Part II and Part III of the Code and their related regulations, Part IV of the Code allows for the names and information regarding employers who have received an AMP to be published. Information will be published after all review and appeal processes have been exhausted. When there has been a category B, C, D or E violation, employers will be publically named for a minimum of two years after the AMP is paid and compliance with the Code is achieved.

Next steps

In order to provide stakeholders time to adjust to new Code provisions that have been introduced since 2017, and to familiarize themselves with their obligations under the Code, the AMPs Regulations provide that AMPs for Type A (administrative) violations will only be issued on and after January 1, 2022.

The Labour Program will continue to work with employers to address non-compliance that occurred prior to AMPs. AMPs will be reserved for violations committed after the coming into force of Part IV. Work will continue to ensure stakeholder understanding of their obligations under the Code by informing them of their obligations, raising awareness through educational activities, and promoting voluntary compliance.

Employment equity and pay transparency

Employment Equity Act

The purpose of the Employment Equity Act (EEA) is to achieve equality in the workplace so that no one is denied employment opportunities or benefits for reasons unrelated to ability and, in the fulfillment of that goal, to correct the conditions of disadvantage in employment experienced by 4 designated groups listed in the Act:

- women

- Aboriginal peoples

- persons with disabilities

- members of visible minorities

The EEA emphasizes that employment equity means more than treating persons in the same way. It also requires special measures and the accommodation of differences.

The EEA is a proactive framework that aims to:

- bring about significant change by focusing on awareness, education, and enforcement

- achieve equality in the workplace

- correct conditions of disadvantage in employment experienced by members of the 4 designated groups, and

- identify and remove barriers to employment

The EEA applies to federally regulated private-sector employers, including federal Crown corporations and other federal organizations, the federal public service, separate agencies (for example, Canada Revenue Agency and Parks Canada) and other federal public-sector employers (Royal Canadian Mounted Police and Canadian Forces). These employers must create equitable workplaces and build a workforce that is representative of the 4 designated groups by implementing employment equity and reporting on their progress.

Employment equity programs and initiatives

The Minister of Labour is responsible for 2 employment equity programs and 2 initiatives that are delivered by the Labour Program:

- Legislated Employment Equity Program (LEEP)

- Federal Contractors Program (FCP)

- Workplace Opportunities: Removing Barriers to Equity (WORBE)

- Employment Equity Achievement Awards (EEAA)

Employment equity programs

Legislated Employment Equity Program

The LEEP covers federally regulated private-sector employers with 100 or more employees, including federal Crown corporations, other federal consolidated entities (Canada Pension Plan Investment Board, Public Sector Pension Investment Board, and St. Lawrence Seaway Management Corporation), and other federal government business enterprises (PortsToronto, Vancouver Fraser Port Authority, and Montreal Port Authority). This program applied to 595 employers in 2019 (unpublished data), covering approximately 3.8% of the Canadian workforce.

Employers under LEEP are required to:

- survey their workforce to collect data on the representation, occupational group, salary distribution, and shares of hires, promotions and terminations of designated group members

- identify any under representation of the designated groups in each occupational group in their workforce

- review their employment systems including written and unwritten policies and practices in order to identify employment barriers, and

- prepare and implement a plan to remove employment barriers and achieve equitable representation

Each year, the employers covered by LEEP are required to file an employment equity report with the Minister of Labour. This report comprises 6 forms that include representation data, employee occupational groups, employee salary ranges, and the number of employees hired, promoted and terminated, as well as a narrative report describing the measures they have taken, consultations with employee representatives, and results achieved in implementing employment equity.

Federal Contractors Program

The FCP applies to provincially regulated employers with at least 100 employees receiving goods and services contracts of $1 million or more from the Government of Canada. The FCP ensures that provincially regulated private-sector employers who do business with the Government of Canada seek to achieve and maintain a workforce that is representative of the Canadian workforce, with respect to the members of the 4 designated groups under the Act.

Once an employer receives an eligible contract from the Government of Canada, the contractor must fulfill the following requirements:

- collect workforce information

- complete a workforce analysis and an achievement report

- establish short term and long term numerical goals, and

- make reasonable efforts to ensure that reasonable progress is made towards having full representation of the 4 designated groups within its workforce

As of January 2021, this program applied to 371 employers covering 502,166 employees.

Employment equity initiatives designed to support the 2 employment equity programs

Workplace Opportunities: Removing Barriers to Equity

WORBE is a grants and contributions initiative designed to support private-sector employers subject to the EEA in their efforts to improve designated group representation through partnerships and industry-tailored strategies. It provides up to $500,000 per year in funding to eligible recipients to develop tailored solutions to support areas experiencing low representation. In the 2020 Fall Economic Statement, the government committed $3.6 million on an ongoing basis to expand WORBE, to promote projects that help federally regulated workplaces become more representative of Canada’s diversity.

Launched in 2014, the initiative has funded 10 projects to date (4 completed in 2016, 2 in 2017, 3 in 2018 and 1 project with Ryerson University is in progress). Projects funded through WORBE seek to raise awareness, identify barriers and best practices, or test innovative approaches to improve employment equity in specific sectors, such as the Transportation industry, or for specific designated groups, such as Indigenous peoples and persons with disabilities. A $1.5 million contribution agreement with Ryerson University Diversity Institute for the “ALiGN Network for Employment Equity and Inclusion” project began in 2018 and is planned to conclude in March 2022.

[One sentence redacted]

Employment Equity Achievement Awards

The EEAA seek to publicly recognize LEEP employers, federal contractors, and individual business leaders from these organizations for their employment equity achievements and their commitment to creating diverse and inclusive Canadian workplaces. Awards are usually presented by the Minister of Labour at an official ceremony for 4 categories: Outstanding Commitment, Innovation, Sector Distinction, and Employment Equity Champion (introduced in 2018). For 2019, 4 Employment Equity Champion recipients and 14 private-sector employers were recognized with an award. In light of COVID-19, the Labour Program determined that no application process for awards would take place in 2020 to 2021 and instead will host a virtual event for employers in the spring 2021 to recognize employer efforts in implementing employment equity.

Labour program activities

The Labour Program provides tools and guidance to employers and contractors to assist them in complying with their employment equity obligations. In addition, it is responsible for assessing compliance with the requirements of the FCP.

The Labour Program receives and validates annual reports submitted by the LEEP employers. These reports are consolidated and analyzed to form the Minister of Labour’s Employment Equity Act: Annual Report to Parliament. The report highlights the statistical results achieved by the LEEP employers in implementing employment equity.

In 2019, the Labour Program completed 104 (34 first and 70 subsequent) FCP compliance assessments. Employers subject to the FCP do not report annually to the Labour Program, therefore their statistical results are not consolidated and summarized in the Minister’s EEA annual report to Parliament.

Pay transparency

Pay transparency is a new initiative that will provide Canadians with accessible, comparable online information about the wage gaps of the LEEP employers covered under the EEA. These measures will raise awareness of wage gaps that affect women, Aboriginal peoples, persons with disabilities and members of visible minorities, helping to shift business culture and expectations towards greater equality.

To support the implementation of pay transparency, the Labour Program introduced amendments to the EEA and the Employment Equity Regulations (the Regulations). The Regulations were published in Part II of the Canada Gazette on

November 25, 2020, and came into force on January 1, 2021.

The proposed regulatory amendments will refine the way the 2021 salary information is collected and reported, improve data gathering, and support the implementation of pay transparency. These changes will enable wage gap calculations that will be included in employers’ 2022 annual submissions to the Labour Program. [One sentence redacted]

Employment equity reporting

The most common quantitative measure of employment equity is the extent to which the representation of members of designated groups in the employers’ workforce meets their representation in the Canadian workforce. The representation of each of the 4 designated groups is compared to their availability in the Canadian labour market—referred to as labour market availability (LMA). This availability is determined based on Census information obtained through Statistics Canada. A workforce is considered representative when the representation of designated group members is equal to their LMA. The attainment rate refers to the extent to which representation approaches, meets or exceeds labour market availability by dividing the representation rate by the LMA rate.

The 2019 (unpublished data) representation rates of the designated groups working for employers covered under the LEEP, along with their LMA and attainment rates, are presented below:

- women were represented at 39.5%, compared to LMA of 48.2%, which is an attainment rate of 81.9%

- Aboriginal peoples were represented at 2.3%, compared to LMA of 4.0%, which is an attainment rate of 57.8%

- persons with disabilities were represented at 3.5%, compared to LMA of 9.1%, which is an attainment rate of 37.9%

- members of visible minorities were represented at 24.4%, compared to LMA of 21.3%, which is an attainment rate of 114.5%

The President of the Treasury Board is responsible for submitting an annual report on the state of employment equity in the federal public service to Parliament. Separate agencies and other public-sector employers submit their annual reports to the President of the Treasury Board for tabling in Parliament at the same time. The Public Service Commission also reports annually on employment equity as it relates to staffing processes in the public service.

Compliance audits

The Canadian Human Rights Commission conducts compliance audits to verify that federally regulated public and private-sector employers subject to the EEA meet their legislative obligations to implement employment equity. According to its 2019 annual report to Parliament, the Commission completed its first horizontal audit, looking at systemic issues in Indigenous employment in the banking and financial sector. The audit findings confirm that there is still a gap in employment opportunity when it comes to Indigenous representation in this sector. The audit also uncovered effective approaches that all employers in Canada can use to attract or retain Indigenous employees. These best practices include: an application screening process that takes lived-experience or career gaps into consideration; anti-harassment training for managers and employees; wider advertising of all opportunities (including senior management positions) throughout the organization, and putting robust anti-discrimination and anti-harassment policies into place.

Review of the Employment Equity Act

In the 2020 Fall Economic Statement, the government committed funding to support a task force on modernizing the EEA. Of the $6.6 million announced, $4 million will be allocated to the task force, which will have a mandate to study, consult and advise on how a renewed EEA can help ensure that Canada’s economic recovery is equitable, inclusive and fair. The Minister of Labour’s supplementary mandate letter also contains this commitment, with the support of the President of the Treasury Board and the Minister of Diversity, Inclusion and Youth, to launch a review of the EEA, as the government advances work on equity, diversity and inclusion for women, LGBTQ2 Canadians, Indigenous peoples, Black and racialized Canadians, persons with disabilities and other underrepresented groups.

Launch of the Task Force is likely to occur in early spring, and they will have 9 months to complete their study and provide recommendations.

Additionally, complementary to the review of the Act, the Labour Program will initiate a research project to study the effects of self-identification underreporting by designated groups.

Federal Workers Compensation Services

The Government Employees’ Compensation Act (GECA) provides benefits to federal public sector employees (or their dependants) who suffer an occupational injury or illness arising out of or in the course of their employment, or who are slain on duty. GECA currently covers approximately 435,600 employees.

The legislation applies to federal departments and agencies, most Crown corporations, and some parliamentary employers such as the Senate, the House of Commons and the Library of Parliament. It does not apply to regular members of the Canadian Armed Forces or to members of the Royal Canadian Mounted Police (these organizations administer their own workers’ compensation systems).

The GECA is administered by the Labour Program’s Federal Workers’ Compensation Service (FWCS) in partnership with provincial workers’ compensation boards (WCBs). Business relationships between the Labour Program and WCBs are governed by bilateral service agreements (which are signed by the Deputy Minister).

WCBs adjudicate compensation claims according to the laws and policies of their jurisdiction. A WCB verifies the incident details, adjudicates the claim, and provides compensation and benefits to the injured employee. Either the employee or the employer may request a review of a WCB claim determination or may appeal the decision to an external tribunal.

Through FWCS, federal employers reimburse WCBs for GECA claims costs plus an administrative fee, as set out in the service agreements.