Evaluation of Canada Pension Plan Disability – Reassessment Element

From: Employment and Social Development Canada

Alternate formats

Evaluation of Canada Pension Plan Disability – Reassessment Element [PDF - 2.9 MB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of acronyms

- ESDC

- Employment and Social Development Canada

Introduction

The Evaluation of the Canada Pension Plan Disability (here after referred to as ‘the Program’) program focussed on the reassessment of continuous eligibility of beneficiaries and their potential work capacity.

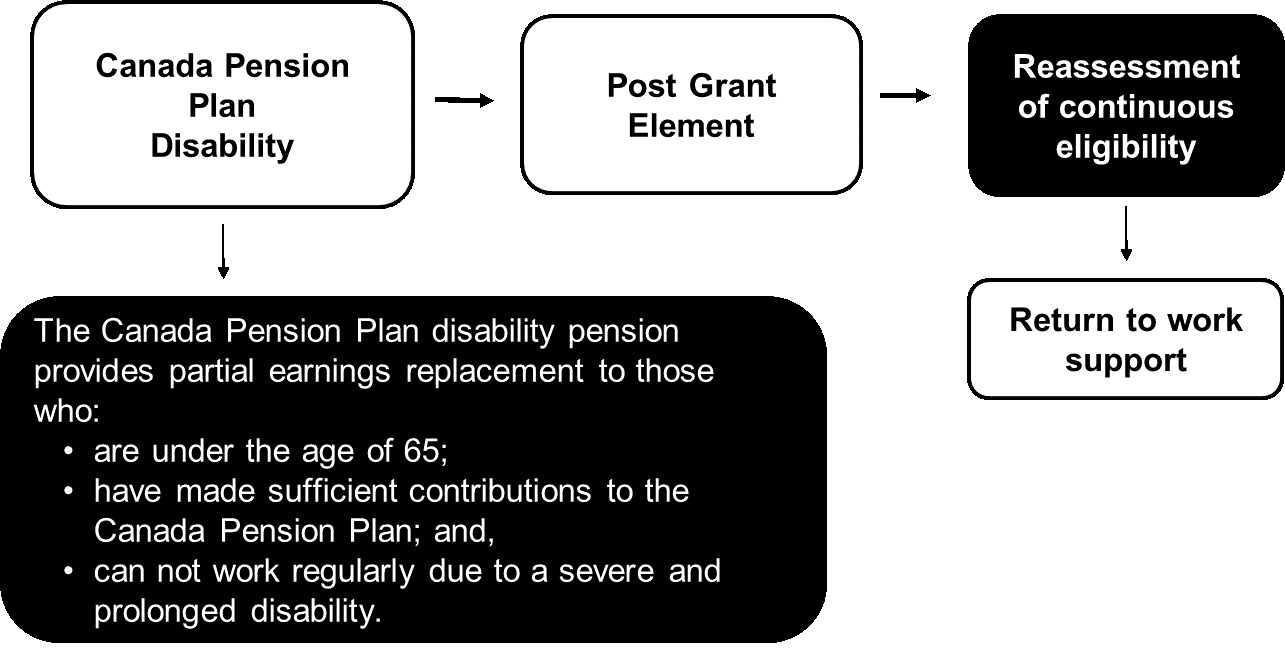

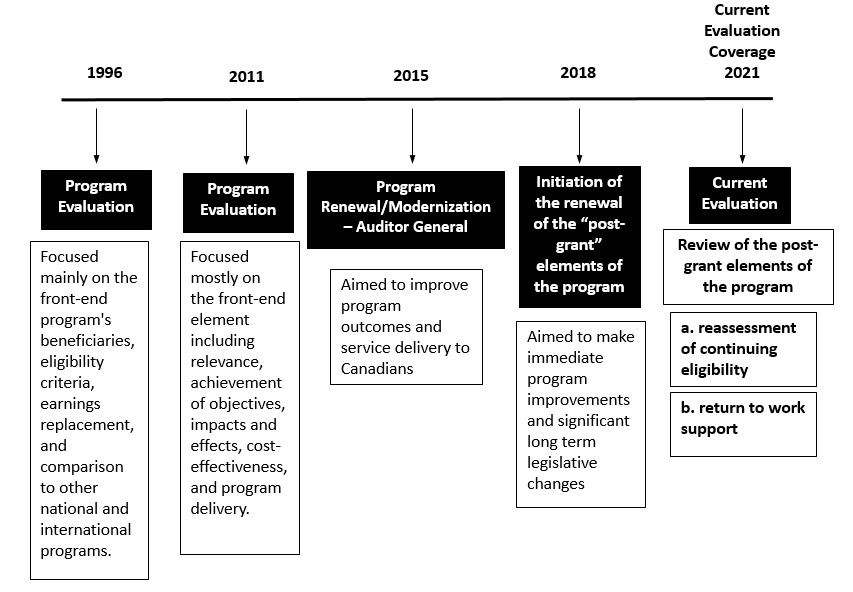

Although an important component of the post-grant element of the program,Footnote 1 the reassessment of continuous eligibility of beneficiaries had not been evaluated in over 25 years. Thus, the current evaluation examined this process – its efficiency, consistency, as well as the experiences of current and former Canada Pension Plan Disability beneficiaries in relation to the reassessment process. (Figure 1)

In 2018, the program initiated a renewal review of its post-grant element, which provided the context for this evaluation. (Annex 1)

Figure 1 - Text version

- Canada Pension Plan Disability

- The Canada Pension Plan disability pension provides partial earnings replacement to those who:

- are under the age of 65

- have made sufficient contributions to the Canada Pension Plan

- can not work regularly due to a severe and prolonged disability

- The Canada Pension Plan disability pension provides partial earnings replacement to those who:

- Post grant element

- Reassessment of continuous eligibility

- Return to work support

In January 2019, ESDC’s Performance Measurement and Evaluation Committee approved the Evaluability Assessment of the Program. The Evaluability Assessment identified several key areas of reassessment that could contribute to longer-term program development under the 2018 Program Renewal Initiative.

This evaluation covered program data during fiscal years 2010 and 2011 to 2017 and 2018. The key findings of the previous 2 evaluations (in 1996 and 2011) can be found in Annex 2. The evaluation questions are listed in Annex 3. Detailed information about the evaluation methodology, the 6 lines of evidence used, and their limitations are provided in Annex 4.

Summary of key findings

- The work capacity of beneficiaries was contingent on various economic, personal and external factors

- There was an average of 401,131 program beneficiaries per year between 2010 and 2011 to 2017 and 2018. The average age of beneficiaries was 55 years old, 53% were women, and 78% came from Ontario, British Columbia, and Alberta

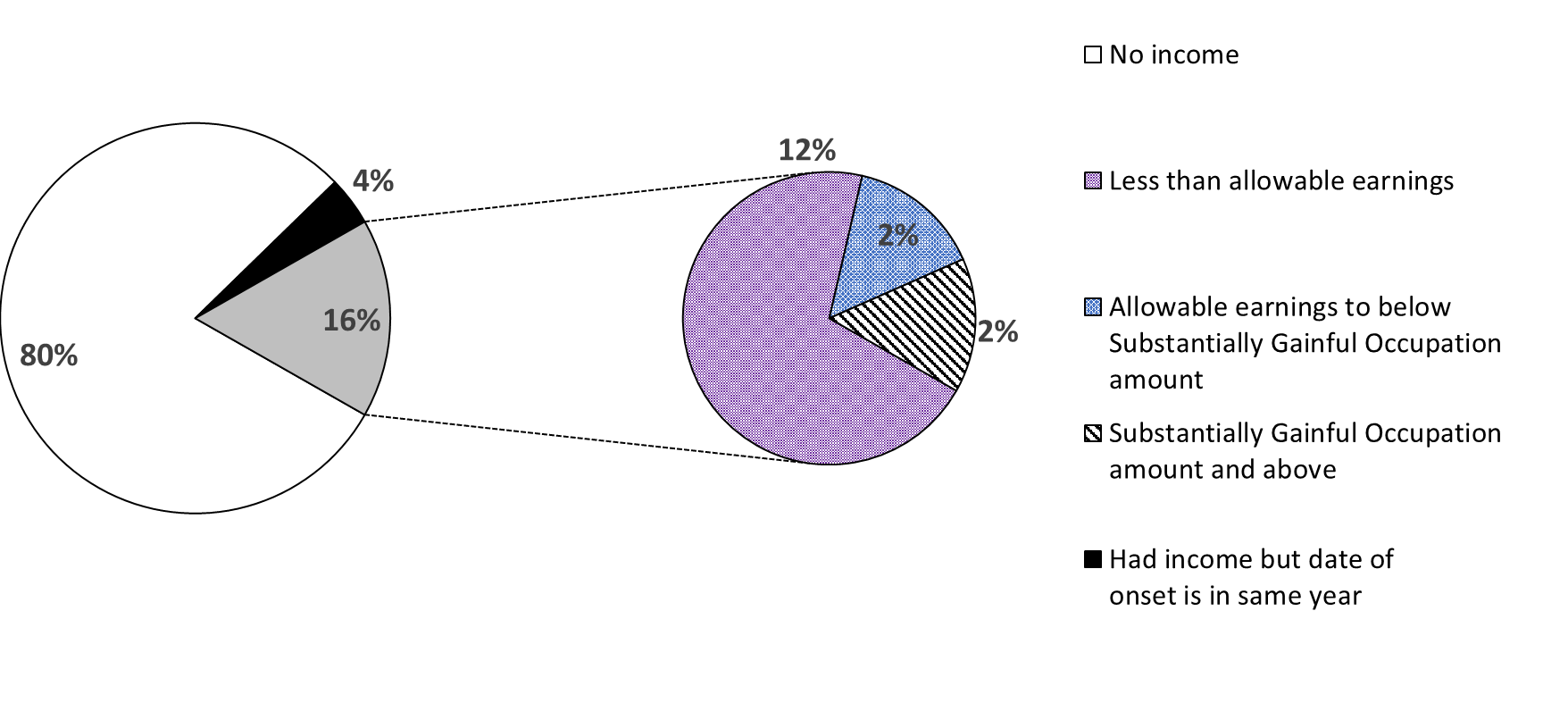

- On average, 16% of all beneficiaries reported employment income (including disability benefits and severance pay).Footnote 2 Among them, 2% of beneficiaries reported income above the substantially gainful amount suggesting a potential regained work capacity

- Only 1.6% of total beneficiaries were reassessed each year during the evaluation period and 41% amongst them had their pension ceased

- Reassessment is vital to the program operation, however, some reassessment processes lack efficiency

- Continuous emphasis on resourcing the Program’s front-end process resulted in a shortage of resources for the back-end process, especially the reassessment element

- The reassessment process was usually timely for those who were reassessed due to a self-reported return to work. However, pre-scheduled reassessments and those resulting from earnings not reported directly to the Program were often delayed

- Cease decisionsFootnote 3 made retroactively caused overpayments of approximately $79 millionFootnote 4 for the period of 2010 and 2011 to 2017 and 2018. It is acknowledged that the program had processes in place to recover overpayments. However, the efficiency of these processes were unknown at this time due to data limitations

- There was room for improving the selection of beneficiaries who were reassessed based on employment income and review type to bring efficiency, program savings, and reduce overpayments

- A lack of consistency and comprehensive guidance in the reassessment process remained an issue. There were regional variations in training staff, prioritization of reassessment workloads, and the decision-making process

- Beneficiaries had different levels of awareness during the reassessment process and different levels of knowledge about return-to-work supports, suggesting a need for more effective and clear communications regarding program requirements

Recommendations

Recommendation 1: Ensure consistent decision-making processes and appropriate alignment of resources (for example training, staffing, work clarity, etc.) to bring further efficiency to the reassessment process.

Recommendation 2: Improve communication with beneficiaries so they are better aware of their responsibilities, program provisions, and available supports

Recommendation 3: Have a more timely approach to the pre-scheduled reassessments and those resulting from earnings not reported directly to the Program

Recommendation 4: Determine the effectiveness of support(s) to those who want to return to the workforce

Recommendation 5: Currently, Medical Adjudicators make decisions on self-reported return to work, despite there being no (or minimal) medical components to most of those decisions. To facilitate more timely completion of reassessments, medical adjudicators should be assigned to cases that require a medical decision, leaving non-medical cases for other program officials

Program background

Introduced in 1966, the Canada Pension Plan Disability program is currently the single largest public long-term disability insurance benefit in Canada, delivered by Service Canada. This pension is 1 of 8 supports provided under the Canada Pension Plan.Footnote 5

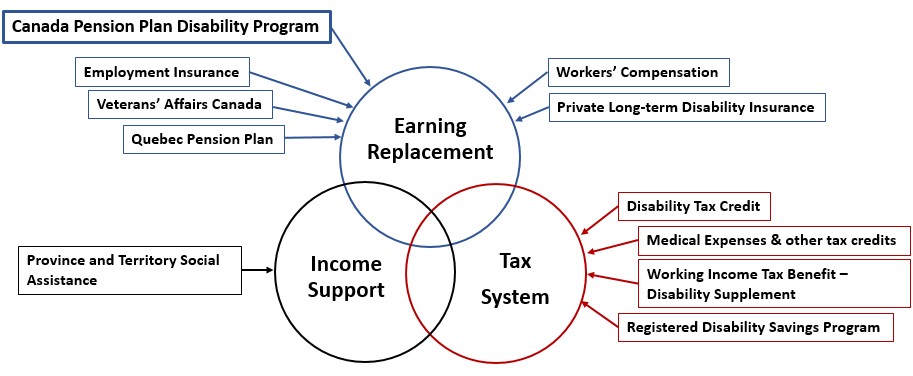

The pension belongs within a group of programs including other earningsFootnote 6 replacement and income support programs, and tax systems that may assist persons with disabilities in Canada (Figure 2). The Program provides partial income replacement to individuals who meet established criteria; and is administered throughout Canada, except Québec where the Québec Pension Plan provides similar supports.Footnote 7

Did you know?

The Canada Pension Plan Disability program may also offer support to dependent children of beneficiaries through the Disabled Contributors Child Benefit.

Source: Evaluability Assessment

Figure 2 - Text version

Disability support programs offered in Canada and their components

Earning replacement:

- Canada Pension Plan Disability Program

- Employment Insurance

- Veterans’ Affair Canada

- Quebec Pension Plan

- Workers’ compensation

- Private Long-term Disability Insurance

Income support:

- Province and Territory Social Assistance

Tax system:

- Disability tax credit

- Medical expenses and other tax credits

- Working income Tax Benefit – Disability Supplement

- Registered Disability Savings Program

The ultimate outcome to providing financial security to beneficiaries came from the interaction of multiple sources, including the Canada Pension Plan Disability program. In 2000 and 2001, the Program distributed an estimated $2.8 billion to 282,111 beneficiaries and their dependent children. By 2017 and 2018, over $4.4 billion in benefits were paid out to 337,505 beneficiaries and their dependent children.

Who is eligible for Canada Pension Plan Disability

To be eligible for the Program, applicants must meet the following criteria:

- be under the age of 65

- have a “severe and prolonged” disability (Textbox 1 for definition) meaning that:

- the individual has a mental or physical disability that prevents them from regularly pursuing a substantially gainful occupation

- the individual’s disability is long-term

- the individual’s disability is of an indefinite duration or is likely terminal

- meet the Canada Pension Plan contribution requirements:

- applicant must have contributed to the program in 4 of the last 6 years with minimum levels of earnings in each of these years, or

- or 3 of the last 6 years for those with 25 or more years of contributions

After initial granting of pension to applicants, reassessment of continuing eligibility is a central responsibility of Service Canada.

If a reassessment is conducted and the beneficiary is found not capable to return to work, then the pension continues.

Textbox 1: Canada Pension Plan definition of disability

The Canada Pension Plan defines a severe and prolonged disability as below:

- a disability is severe only if by reason thereof the person in respect of whom the determination is made is incapable regularly of pursuing any Substantially Gainful Occupation

- a disability is prolonged only if it is determined in a prescribed manner that the disability is likely to be long continued and of indefinite duration or is likely to result in death

Please refer to Annex 5 how the perception of disability has changed over time

Source: ESDC, Evaluability Assessment, 2019; Government of Canada, CPPD Benefits 2019a; Office of the Auditor General, 2015

What is reassessment of continued eligibility

The purpose of reassessment is to maintain the program integrity by ensuring the pension is delivered only to those who continue to be eligible and ceasing benefits for those who are no longer eligible. Reassessment can also identify clients with potential work capacity who might benefit from assistance to return to work.

Reassessment can occur due to self-reported return to work, pre-scheduled reviews, and non self-reported return to work. Annex 6 defines and depicts in diagrams the different types of reassessments conducted by the program.

Three types of reassessments

- Self-reported reassessments

- Trigger-related reassessmentsFootnote 8

- Pre-scheduled reassessments

Textbox 2: Reassessment decision process

During reassessment, the Program staff review the beneficiary’s medical and employment information to determine whether or not the beneficiary’s disability continues to prevent them from being capable of working on a regular basis (refer to Annex 7 for details about the disability adjudication process).

At the end of the reassessment process, the beneficiary is given a decision that they may continue to receive the pension, or that they are no longer eligible to receive the pension. The pension can be ceased if the reassessment deems that the beneficiary is no longer disabled or can work again on a regular basis.

If a pension is ceased upon reassessment any children’s benefits related to the Program will automatically be cancelled and will require repayment as applicable.

The beneficiary may have to repay any amount received unduly. Beneficiaries who disagree with the decision can request a reconsideration within 90 days of receiving a decision letter.

What are return to work and supports

The Program’s main goal is to provide partial income replacement to those who are incapable of working due to a severe and prolonged disability. Due to this high threshold to approval, few beneficiaries return to work, however for those who consider returning to the workforce, supports are available.

Beneficiaries must report an update to their work status should they:

- do volunteer work or go to school while receiving the pension

- be employed and earn more than the allowable amount, for example, this amount is $6,100 before tax in 2021

Once it is determined the beneficiary is capable of earning the Substantially Gainful Occupation amount, the program will consider ceasing the pension. This amount was $16,963.92 in 2021.Footnote 9

The program offers the following incentives to support beneficiaries’ return to work (Table 1).

| Types of return to work supports | Description of return to work supports |

|---|---|

| Allowable earnings | Program’s beneficiaries can earn up to 10% of the year’s maximum pensionable earnings per calendar year before having to report their earnings. Allowable Earnings is not the amount at which benefits are ceased, it is the amount at which beneficiaries are required to report a return to work. |

| Three month work trial | The three month work trial is a 3-month period during which beneficiaries can test their ability to re-enter the workforce on a regular basis while continuing to receive the full pension. |

| Automatic Reinstatement | The Automatic Reinstatement incentive reinstates the pension if the beneficiary has a reoccurrence of the same or related medical condition within 2 years of their cease date. This incentive is only available to the beneficiaries who self-report a return to work. |

| Fast-Track Reapplication | The Fast-Track Reapplication initiative is an accelerated application process for any beneficiary who was previously a beneficiary and who stopped working within 5 years of their cease date due to a recurrence of the same or related disability. |

| Vocational Rehabilitation Program | The Vocational Rehabilitation Program is a voluntary program that supports beneficiaries with employment counselling, return to work planning, job training, and skills training for employment. This support is offered to pre-scheduled review and self-reported return to work beneficiaries, and additionally to beneficiaries who contact the program directly and request the Vocational Rehabilitation program services.Footnote 10 |

Findings: Beneficiary characteristics

What were the characteristics of program beneficiaries

Over the period of the evaluation, 537,476 individuals applied for the Program.

There were an average of 401,131 beneficiaries in Canada in receipt of the pension per year between the 2010 and 2011 to 2017 and 2018 fiscal year.Footnote 11

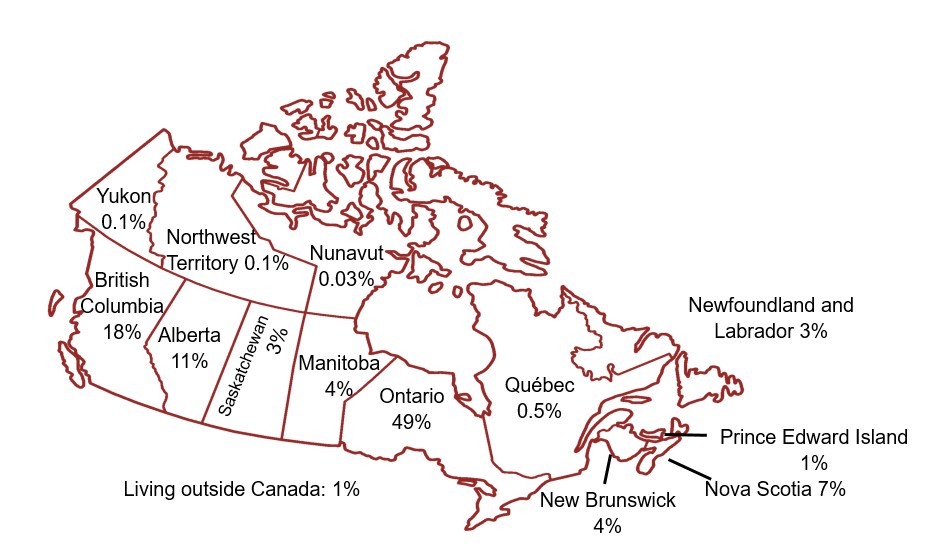

- 78% of beneficiaries came from 3 different provinces - Ontario, British Columbia, and Alberta (Figure 3)

- 53% of beneficiaries were women

- The average age of beneficiaries is 55 years, and 79% were aged 50 and above

- 80% of beneficiaries had no employment income, followed by 14% of beneficiaries with less than $15,000 in reported employment income

Source: Administrative data

Note 1: All proportions and numbers represent “average per year” for the period between 2010 and 2011 to 2017 and 2018.

Note 2: Other important characteristics namely education, marital status, other forms of disability support, and occupation class had missing data for nearly 50% of beneficiaries making the sample unrepresentative of the population to report.

Figure 3 - Text version

| Geographic distribution of Canada | Canada Pension Plan Disability beneficiaries (percentage) |

|---|---|

| Ontario | 49% |

| British Columbia | 18% |

| Alberta | 11% |

| Nova Scotia | 7% |

| Manitoba | 4% |

| New Brunswick | 4% |

| Newfoundland and Labrador | 3% |

| Prince Edwards Island | 1% |

| Living out Canada | 1% |

| Québec | 0.5% |

| Northwest Territory | 0.1% |

| Yukon | 0.1% |

| Nunavut | 0.03% |

| Saskatchewan | 3% |

Over 70% of beneficiaries had 1 type of disability classes during 2010 and 2011 to 2017 and 2018.

| Number disability classes | Distribution of beneficiaries (percentage) |

|---|---|

| One disability class | 73% |

| Two or more disability classes | 27% |

| Three or more disability classes | 9% |

Source: Administrative data

A survey of current beneficiaries showed that 68% had a severe form of disability (Table 3).

| Disability severity class | Distribution of beneficiaries (percentage) |

|---|---|

| More severe | 68% |

| Less severe | 24% |

| No disability | 8% |

Source: Survey with Canada Pension Plan Disability Beneficiaries

Note: The definition used to define disability severity in the survey is not the same criteria used by the Canada Pension Plan.Footnote 12

Mental disorders (30%) and diseases of the Musculoskeletal System and Connective Tissue (23%) were the primary conditions among beneficiaries (Table 4).

| Disability classes | Distribution of beneficiaries (percentage) |

|---|---|

| Mental disorders | 30% |

| Diseases of the musculoskeletal system and connective tissue | 23% |

| Medical condition classes with <5% beneficiaries | 14% |

| Diseases of the nervous system and sense organs | 11% |

| Diseases of the circulatory system | 8% |

| Neoplasms | 8% |

| Injury and poisoning | 7% |

Source: Administrative data

80% of beneficiaries had no reported employment income (Table 5).

| Reported Employment Income | Average (percentage) |

|---|---|

| No income | 80% |

| Income is less than allowable earnings | 12% |

| Had income but date of onset of disability is in the same year | 4% |

| Allowable earnings is equal or greater to income but less than the substantially gainful occupation amount | 2% |

| Income is equal or greater substantially gainful occupation amount | 2% |

Source: Administrative data

Key findings

Key finding: Work capacity

Key finding 1. On average 16% of all beneficiaries had reported employment income, of which 2% of beneficiaries reported income above the substantially gainful amount which may suggest a potential regained work capacity

Source: Administrative data

Figure 4 - Text version

| Reported employment income | Average for annual proportion of beneficiaries (percentage) |

|---|---|

| No income | 80% |

| Less than allowable earnings | 12% |

| Allowable earnings to below substantially gainful occupation amount | 2% |

| Substantially gainful occupation amount and above | 2% |

| Had income but date of onset in same year | 4% |

Based on the Record of Earnings (Canada Revenue Agency) tax data, on average, 16% (66,101) of all beneficiaries each year had reported employment income between 2010 and 2011 to 2017 and 2018 (Figure 4). Record of Earnings included income from work activity (wages and salary) and other employment income (disability benefits, severance pay, etc.) suggesting that not all employment income was work-activity related.

Only 2% (9,815) of all beneficiaries each year had reported employment income at or above the Substantially Gainful Occupation amount.Footnote 13 A reassessment would be required to determine if the reported employment income was work-activity related, and if these beneficiaries were considered to have regained work capacity.

About 2% of all beneficiaries each year reported employment income above allowable earnings and below the Substantially Gainful Occupation amount, which indicates potential regained work capacity and may be able to demonstrate further work capacity if provided with appropriate supports, such as vocational rehabilitation or work-place accommodations. The remaining 12% of beneficiaries report employment income under allowable earnings which was most likely a result of income related to disability benefits.

Key finding 2. Beneficiaries’ personal characteristics played a significant role in work capacity and reported employment income

Younger beneficiaries aged 20 to 44 were more likely to have reported employment income (4%) compared to older beneficiaries aged 55 and above (2%).

Interviews with beneficiaries indicated that demographic factors such as marital status, location, and educational attainment also impacted work capacity.

“It’s really hard to find employment … while supporting 2 boys as a single dad.” (Beneficiary; continued after a self-reported reassessment)

Majority of the beneficiaries interviewed expressed their return to work was negatively impacted by their disability and overall health. For example, those with severe or degenerative primary disabilities or secondary health issues were less likely to regain their work capacity and return to work.

“Apart from the diabetes and neuropathy [nerve damage] it’s just my pain level… I liked the job […] that killed me. It was too much … And it just feeds into the pain cycle.” (Beneficiary; continued after a self-reported reassessment).

In a few cases, rehabilitation or recovery from the illness allowed the beneficiary to return to work.

In the Survey with Canada Pension Plan Disability Beneficiaries, several personal factors were associated with increased return to work capacity, including gender, age, education, marital status, health status, etc. (Table 6).

Key finding 3. External factors also play a significant role in work capacity and reported employment income

Among beneficiaries who returned to work, some suggested that support from previous employers, allowed them to return to work.

“[My employer] was very encouraging. They kept saying, ‘hey, we’re here, your position is waiting for you.’ And I’m back to working with [the same employer] full-time.” (Beneficiary; ceased after a self-reported assessment)

A few beneficiaries’ employers were supportive to the point that they completed all the applications on the beneficiaries’ behalf while the beneficiary recovered.

“I’ve been a full-time, permanent law enforcement officer with the federal government for 19 years… [My employer] took care of all my paperwork on my behalf… I discussed my return to work date with [my employer] and they were very supportive and flexible... I am still working at the same job.” (Beneficiary; ceased after a pre-scheduled reassessment)

Beneficiaries, internal program officials and external experts mentioned that the fear of losing the pension was one of the most significant barriers to return-to-work. The reasons for their fear included the fact that the Program represents their only source of income, or that their health would deteriorate as a result of working more.

A few beneficiaries noted that they experienced difficulties in finding employers that would accept long periods of unemployment in their resumes. They also indicated that some employers were unable to accommodate their disability.

Some beneficiaries stated that they were unable to return to their previous job as their disability prevented them from performing essential duties of that job. These beneficiaries included those who worked in the skilled trades.

Beneficiaries who were aware and accessed return to work supports, specifically, the 3-month work trial, were more likely to indicate that the Program contributed to financial security and encouraged labour force participation.

In the Survey with Beneficiaries, several external factors were associated with increased return to work capacity, including job characteristics and regional unemployment (Table 6).

Almost all survey respondents reported that they would gain work capacity if given appropriate support such as return-to-work incentives, training, coaching. However, the percentages who anticipated gaining work capacity to a medium or high extent were much greater amongst beneficiaries who had been reassessed and ceased.

| Related factors | Association with increased return to work capacity |

|---|---|

| Gender | Females were 4% more likely to return to work, compared to males. |

| Age | Being younger in age had an advantage in returning to work, compared to those with older age. |

| Education | Beneficiaries with a university certificate or diploma below bachelor’s level are 8% more likely to return to work, compared to less than high school diploma. |

| Marital status | Those who are married were more likely to return to work, compared to beneficiaries in common-law relationships. |

| Health status | Beneficiaries with excellent, very good, good and fair physical health or mental health status were more likely to return to work, compared to those with poor physical or mental health. |

| Health needs | Those whose healthcare services needs were met are more likely to return to work. |

| Job characteristics | Those who have been refused a job or promotion over the past 5 years owing to their disability were more likely to return to work.Footnote 14 |

| Region unemployment | The lower the region’s unemployment rate (3 year average), the higher likelihood of a beneficiary to be employed. |

Source: Survey with Canada Pension Plan Disability Beneficiaries

Note 1: The results in Table 6 were extracted from the regression analysis using the Survey with Canada Pension Plan Disability Beneficiaries’ data on 1918 beneficiaries. These factors were found to contribute to increasing the likelihood of beneficiaries returning to work. For more details about the methodology of this approach, please refer to Annex 4.

Key finding: Efficiency

Key finding 4. Reassessment of beneficiaries helps determine their continued eligibility

The primary goal of reassessment to determine if the beneficiary continued to be eligible for the pension was reinforced by the legislation. [Canada Pension Plan Regulations subsection 69(1)]. Reassessment is a systematic process used to periodically review updated medical and employment information of Canada Pension Plan Disability beneficiaries.

Key Informants suggested that reassessment would maintain the integrity of the program.

“[Reassessment is] making sure right benefit [is] going to right client in right amount” (Key Informant)

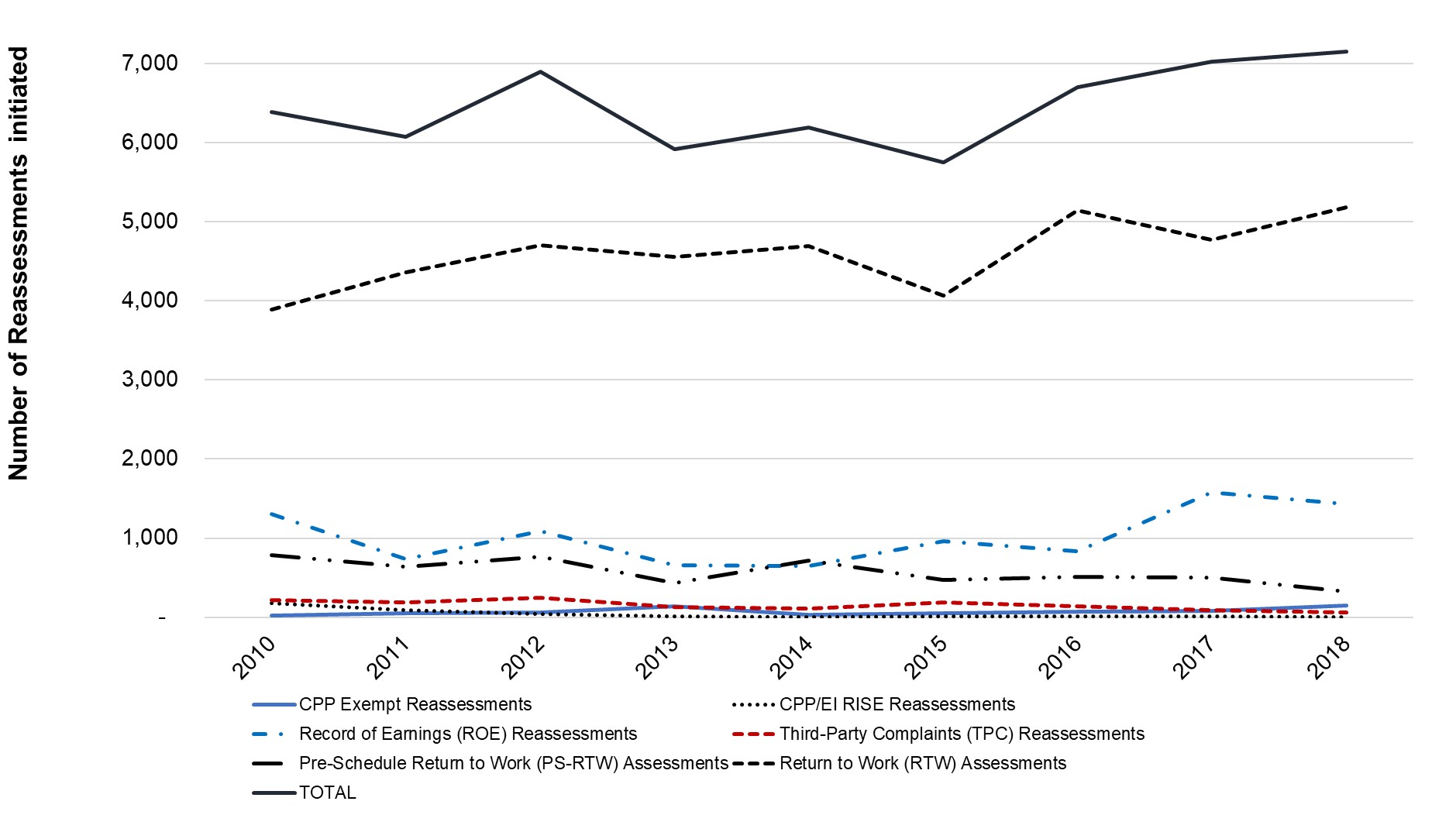

Key finding 5. Only 1.6% (an average of 6,279) of total beneficiaries were reassessedFootnote 15 each year during the evaluation period of 2010 and 2011 to 2017 and 2018 (Figure 5)

Source: Administrative data

Figure 5 - Text version

| Reassessment type | Average number of reassessments initiated | Average (percentage) |

|---|---|---|

| Self- reported return to work | 4,595 | 71% |

| Record of earnings | 1, 023 | 16% |

| Pre-scheduled | 571 | 9% |

| Informant lead | 151 | 2% |

| Canada Pension Plan exempt | 71 | 1% |

| Canada Pension Plan/ Employment Insurance Record of Employment Inquiry Statistic and Extraction system register | 40 | 1% |

| Total reassessments | 6,451 | 100% |

Key finding 6. There is continuous emphasis on the Program’s front-end process resulting in a shortage of resources for the back-end process, especially the reassessment element

During the program’s renewal initiative, program officials noted a continuous emphasis on the pension’s front-end processes compared to the back-end or post-grant element.Footnote 16 Reassessment staff were often reassigned to assist in reducing backlogs in processing of initial application assessments, and consequently, the reassessment process was negatively impacted by a shortage of staff.

According to a few National Headquarter program officials, there were about 65 employees (reassessment medical adjudicators, Service Canada Benefit Officers, and Program and Service Delivery Clerks) working in the 3 regions.Footnote 17

The number of Service Canada Benefit Officers and support staff was difficult to estimate since there were no full time staff allocated to the reassessment process:

- according to an interviewee, there were about 5 Service Canada Benefit Officers and 3.5 Program and Service Delivery Clerks working on reassessments in the Atlantic region

- Service Canada employees in the Ontario region identified 7 Service Canada Benefit Officers and 3.5 support staff working on reassessment

As mentioned by a few informants, reassessment is very complex work, which requires highly experienced and fully trained medical adjudicators and Service Canada Benefit Officers. The hiring and training of new reassessment medical adjudicators did not keep the pace with the turnover rates in the reassessment units, who witnessed a dramatic decrease in the number of staff during the last years.

As highlighted by a few stakeholders, there seemed to be a continuous shuffling of files among reassessment units which left files sitting on shelves for long periods of time because of the lack of human resources in the reassessment units.

A majority of Service Canada informants suggested reason for large backlogs of trigger-related case reassessments is lack of staff.

At the time of the interview, a few key informants noted a shortage of appropriate human resources allocated to reassessment:

- from the 12 medical adjudicators assigned to the reassessment unit in Edmonton, only 2 were still there

- the Scarborough unit in Ontario closed because the last 3 reassessment medical adjudicators were not replaced when they retired

- in Newfoundland and Labrador or Nova Scotia, when adjudicators retired, they were not replaced and the reassessment units became smaller and smaller

Key finding 7. Reassessment was generally timely for self-reported cases, although the same trend was not observed in other types of reassessments

The administrative data analysis showed that 71% of reassessments were self-reported (Table 7), and timely with 81% of the ‘cease’ and 88% of the ‘continues to be in pay’ decisions made within 6 months of the assessment initiation. This result was confirmed by the key informant interviews where there was a general consensus among internal stakeholders regarding the timeliness of reassessment decisions for self-reported cases. Beneficiaries who self-reported return to work also reported that the reassessment process was timely.

“I had no problem [with the timeliness]. Whenever I phoned them they answered me, they answered my question… They told me that I would receive the decision within 6 weeks, but I received it sooner than that.” (Beneficiary; ceased after a self-reported reassessment

The program’s data highlights approximately 20% of reassessments were trigger related and 9% were pre-scheduled (Table 7), with many of those cases having delayed decisions. 30% of the ‘cease’ decisions for trigger related and 19% of the ‘cease’ decisions for pre-scheduled assessments cases were created after 12 months or later.

Beneficiaries that were reassessed due to a trigger or pre-scheduled reassessment indicated that it took longer to receive a notification of decision. During the time between the initiation of reassessment and the notification of decision, some beneficiaries continued to receive the pension, even if they were no longer eligible, leading to overpayment.

A few participants mentioned other factors contributing to a lack of timeliness, such as getting earnings information from Canada Revenue Agency with 2 years’ delay.

| Reassessment type | Average (percentage) |

|---|---|

| Self-reported | 71% |

| Trigger related | 20% |

| Pre-scheduled | 9% |

Source: Administrative data

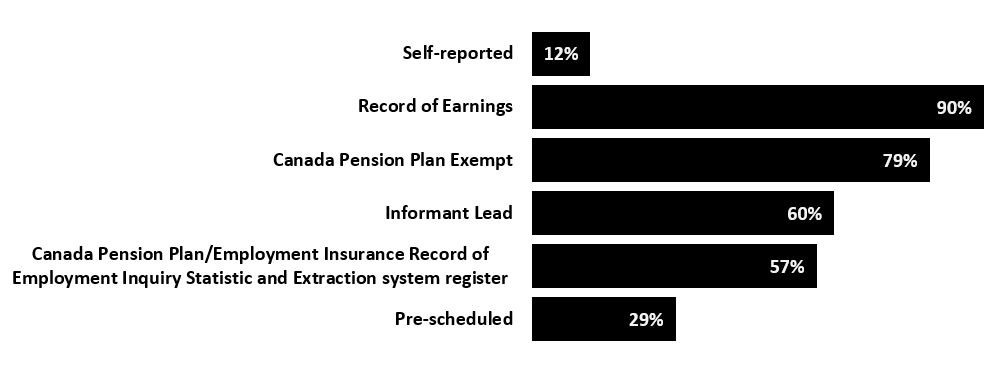

Key finding 8. Retroactive cease decisions and overpayments remain a burden

According to the administrative data, almost 24% of reassessed cases per year had retroactive cessation and overpayment established.

Overpayments up to $79 million were identified between 2010 and 2011 to 2017 and 2018. It is acknowledged that the program has processes in place to recover overpayments, however, the efficiency of these processes is unknown due data limitations.

Trigger-related reassessments, such as Record of Earnings (90%), etc., were more likely to result in a retroactive cease decision, compared to self-reported (12%) return to work and pre-scheduled (29%) assessments (Figure 6).

Figure 6 - Text version

| Overpayment by reassessment type | Average (percentage) |

|---|---|

| Self- reported | 12% |

| Record of earnings | 90% |

| Canada Pension Plan exempt | 79% |

| Informant lead | 60% |

| Canada Pension Plan/ Employment Insurance Record of Employment Inquiry Statistic and Extraction system register | 57% |

| Pre-scheduled | 29% |

Source: Administrative data

Textbox 3: What is overpayment?

An overpayment refers to payments that a beneficiary has received to which there was no entitlement. According to the Canada Pension Plan, section 66, a beneficiary with an overpayment “shall return the amount of the benefit payment, or the excess amount, as the case may be,… constitutes a debt due to Her Majesty and is recoverable at any time...”

After overpayment is established, the recovery of fundsFootnote 19 was challenging due to:

- the lack of enforcement from the programFootnote 20

- the medical condition of the beneficiary restricting their understanding of responsibility to pay

- the financial state of beneficiaries

Key finding 9. Retroactively ceasing the pension led to negative perception about the program

Some Key Informants suggested that the impact of retroactively ceasing benefits and overpayments on beneficiaries was negative as they were asked to return large sums of money, and often immediately. Words used to qualify the impact were: “huge”, “traumatic”, and “devastating”, while learning about the fact that they have to pay an overpayment is “shocking”.

“Obviously receiving a big overpayment is problematic for most of these clients because even if they are at the Substantially Gainful Occupation level, [the] Substantially Gainful Occupation [amount] is below the poverty line, so most of them are not in a position to repay the money.” (Program official)

Retroactive ceasing of benefits negatively impacted beneficiaries’ sense of financial security and overall well-being. For example:

- the short-term impacts of retroactive ceasing, as indicated above, included shock, fear and a greater loss of financial security

- long term impacts included feeling a lack of control related to their financial security, and a loss of trust in the program and government

“I had surgery [for my] brain tumour, and I’m almost blind. [But] I had to try to work because the benefit wasn’t enough… My medication alone is more expensive than what the [Canada Pension Plan Disability] program was giving me… [But] the program claimed that I was able to work and received overpayments… They’re asking me to pay back $31,000… I wish I was informed earlier… but the whole process is too confusing.” (Beneficiary; ceased after a triggers-related reassessment)

As several key informants mentioned, when benefits were retroactively ceased, this had an impact on the eligibility of other benefits - including going back to the disability benefit or, depending on the number of years of retroactive payments, the ability to use Automatic Reinstatement or Fast Track.

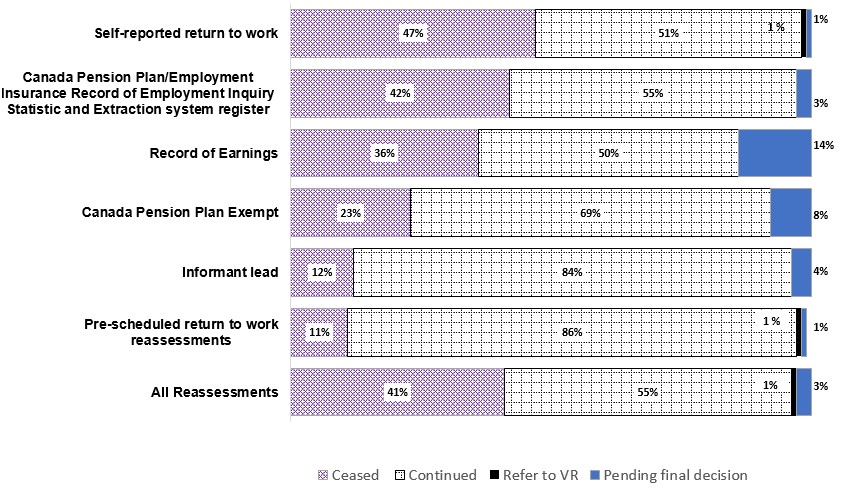

Key finding 10. There is room for improvement in selection of beneficiaries for reassessment

Approximately 71% of all reassessment resources were dedicated to self-reported return-to-work. Medical Adjudicators made decisions on those self-reported return to work cases, despite there being no medical components to those decisions.Footnote 21 A vast majority of overpayments and backlog of cases came from trigger-related return to work reassessments.

Overall, 41% of reassessments resulting in a cease suggested that there was room for improving the selection of beneficiaries for reassessments and reducing unnecessary reviews.

Administrative data noted certain beneficiary characteristics were more likely to be ceased:

- males (46%) were more likely to have their benefits ceased upon reassessment than females (41%)

- younger beneficiaries were more likely have their benefits ceased upon reassessment (50% of those aged 20 to 34 versus 39% of those aged 55 to 64)

- Ontario region (47%) and the Western Canada and Territories region (46%) had a higher rate of ceased benefits compared to the Atlantic region (31%)

- beneficiaries with neoplasms had the highest rate of ceased benefits (58%) compared to beneficiaries with any other primary disability class

Reassessment cases could be selected on beneficiaries with employment income at or above Substantially Gainful Occupation amount. For example characteristics including:

- age

- gender

- residence region

- disability class (Table 8)

| Characteristics | Income at or above substantially gainful occupation | Reassessed cases |

|---|---|---|

| Age | From the age group of 35 to 65 | There is a discrepancy of 1% between earning at or above Substantially Gainful Occupation and reassessed cases |

| Gender | Men: 3% | Men: 2% |

| Residence region |

|

|

| Primary disability class |

|

|

Source: Administrative data

Cases may be selected for reassessment based on the type of review (Figure 7). Around 47% of self-reported cases resulted in a ceased pension, followed by trigger-related assessments. Pre-scheduled return to work reassessments resulted in 86% of cases continuing on the pension.

Source: Administrative data

Figure 7 - Text version

| Reassessment decisions | Ceased | Continued | Refer to vocational training | Pending final decision |

|---|---|---|---|---|

| Self-reported return to work | 47% | 51% | 1% | 1% |

| Canada Pension Plan and Employment Insurance record of employment inquiry statistic and extraction system register | 42% | 55% | 0% | 3% |

| Record of earnings | 36% | 50% | 0% | 14% |

| Canada Pension Plan exemption | 23% | 69% | 0% | 8% |

| Informant lead | 12% | 84% | 0% | 4% |

| Pre-scheduled return to work reassessments | 11% | 86% | 1% | 1% |

| All reassessment | 41% | 55% | 1% | 3% |

Cases with higher cease rates could be a starting point for a better managed reassessment process that can result in the identification of beneficiaries who no longer qualify. This would also bring a greater return on investment when looking through the lens of the true purpose of the reassessment process

Key finding: Consistency

Key finding 11. Lack of comprehensive guidance in the reassessment process remains an issue

Internal and external evaluations since the 1990s have suggested that the program had no overarching policy framework in place governing the reassessment process.

In 2004, the program developed a national reassessment guide, and updated it in 2014, which provided guidance for reassessment decisions. However, internal documents and files noted that respective regions have implemented their own decision-making guides since delivery of the pension was regionalized.

Three program officials in the National Headquarters acknowledged that regions created their own procedures “to fill the gaps in national directions”. Ontario region provided its own reassessment training for its Medical Adjudicators incorporating regional guidelines, which may or may not be consistent with national training.

A review of the internal documents indicated there continues to be no quality assurance framework in place for the reassessment decisions made by the medical adjudicators and Service Canada Benefit Officers.

The large majority of the key informants were of opinion that there have not been any significant changes in the design and delivery of the reassessment process in the last 5 to 10 years.

Interviews with internal informants noted inconsistencies in the prioritization of reassessment workloads and the selection of accounts for reassessment.

Key Informants noted program officials and regional staff emphasized different reassessment objectives:

- medical adjudicators and Service Canada Benefit Officers were more likely to emphasize the role in supporting beneficiaries to return to work

- most program officials in the National Headquarters emphasized the Program’s stewardship role which ensures continuous eligibility and maintains program integrity

Key finding 12. Regional staff and program officers used their own discretion in the selection process

Key informants indicated significant regional variations on how cases were selected for reassessments. One participant was of the opinion that there are sometimes inconsistent decisions made by the various medical adjudicators within the same reassessment unit.

Across all regions, self-reported return to work reassessments are prioritized (Table 9). However, for pre-scheduled and trigger-related reassessments, the individual Service Canada Benefit Officers determined which accounts will be prioritized at their own discretion.

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

Table 9: Regional reassessment case preferences

Ontario region

- focus on the self-reported return to work cases while also prioritizing cases with multiple triggers

Western Canada and Territories

- prioritize in order:

- self-reported return to work cases followed by

- trigger related reassessments

Atlantic region

- Pre-scheduled return to work cases are preferred in Nova Scotia, while it is no longer done in other centers

- Trigger-related reassessments are not prioritized and are addressed differently by individual officers

Source: Compilation from the Key Informant Interviews Technical Report (pg. 27 and 28)

Several Service Canada regions and program officials were unclear on which cases to prioritize from the trigger list for reassessment. Some files are often very old, which made the investigations very difficult.

In some regions, reassessment staff noted a lot of confusion and lack of information about the process of selecting of cases.

Several front-line staff identified challenges related to the ambiguous decision-making process involving complex self-employed beneficiaries.Footnote 22

Key finding 13. There were regional variations in training and resources provided to Medical Adjudicators and Service Canada Benefit Officers

Participants from Key Informants Interviews were of the opinion that the procedure manual was the only existing mechanism to ensure the quality and consistency of the reassessment process. A few informants, however, suggested the training modules have not been updated to reflect regional needs.

Information obtained from the Key Informant Interviews and Document Reviews indicated that the training provided to regional staff (medical adjudicators and Service Canada Benefit Officers) varies considerably which resulted in oversight and inconsistent application of the reassessment process.

One key informant noted that managers in reassessment units may not have a medical background nor are they trained in reassessment.

“it’s hard coming in, and you see these inconsistencies and I am trying to gauge [what feels] appropriate, and client service and best for the department, but we are almost left to our own devices.” (Service Canada Benefit Officer)

Training for Service Canada Benefit Officers in Ontario, Western Canada and the Territories was often provided by Medical Adjudicator Consultants. This practice was not always appropriate because Medical Adjudicator Consultants are not familiar with all the aspects of the Service Canada Benefit Officers' job.

Service Canada Benefit Officers and medical adjudicators in smaller units vis-à-vis larger units had access to unequal access to resources to perform their jobs.

Key finding: Communication

Key finding 14. The program area communicated with beneficiaries, however more could have been done to assist beneficiaries understand their responsibilities

The Post-Grant Review conducted in 2018 noted that the Program did not have information on beneficiaries’ level of understanding of the back-end provisions.

There was limited phone communication with the beneficiaries between the time they were granted the pension and when the reassessment was initiated to inform them about the reassessment process and their responsibilities.

Most of the communications occurred primarily via mail, and in some circumstances by phone, after the initial grant of the pension. Communications occurred annually via a tax slip insert and during the reassessment process, if one was triggered.

While self-reported return to work individuals had to be contacted by telephone within 48 hours of receipt of a return to work notice, no other review type had mandated telephone contact, nor would it be expected that multiple phone calls be made at different stages of review.

Beginning 2001 and 2002, the Program had started to send a newsletter with useful information, inspirational stories, to beneficiaries with their T4 tax information mailing. Over time, the amount of information provided in that newsletter had been reduced.

“A real lost opportunity they used to be more proactive with communication to help prevent overpayments, keeping people informed of what their rights and responsibilities.” (Program official)

Front-line staff expressed concerns related to the level of clarity and readability of some of the communications.

“The only time I’ve ever heard from them is when they wanted money.” (Beneficiary; ceased after a pre-scheduled reassessment)

Key finding 15. Beneficiaries had different levels of awareness and experiences during the reassessment process

The Program’s Client and Stakeholder Roundtable,Footnote 23 held in 2018, reported a high level of confusion around reassessment, particularly with respect to allowable earnings versus Substantially Gainful Occupation amount thresholds.Footnote 24 footnote Members had also reported a lack of awareness and limited communications regarding the pension’s return-to-work supports.

As highlighted by several key informants (both program and regional officials), the Allowable Earnings incentive was sometimes a source of confusion among beneficiaries, who think they have to stop working before reaching it.

All beneficiaries that discussed allowable earnings misunderstood it as the amount they were allowed to earn in a given year, rather than the amount at which they were required to report their earnings.

“We are telling people they have to report a return to work immediately, but then we are telling people they don’t have to tell us before they reach the allowable earnings...” (National Headquarter program official)

Many key informants were of the opinion that some beneficiaries did not report a return to work because they either did not understand the program communication documents or simply did not read them. Interviews with beneficiaries identified return to work supports provided by the program was not always clearly outlined to them.

Most beneficiaries (63% to a high extent and 16% to a medium extent) were aware of their responsibilities and obligations, which was also confirmed by several internal informants and the document and file review. For example:

- self-reported beneficiaries had a better awareness of their responsibilities compared to trigger-related beneficiaries

- the top 2 responsibilities and obligations that beneficiaries were aware of was:

- 70% in case of reporting a return to work to the Program when their earnings in a calendar year exceeded a certain amount

- 64% in case of reporting an improvement in medical condition

- however, there were also a significant proportion of beneficiaries that were not aware of their obligation to report a return to work after exceeding allowable earnings (30%) or improvement in medical condition (36%)

In the Survey with Canada Pension Plan Disability Beneficiaries, among 265 beneficiaries who recalled being reassessed, 76% were satisfied with the reassessment process and 81% were satisfied with the program communication.

“I filled out my paperwork properly, my doctor filled it out properly, and it was good… The lady [that did my reassessment] was nice, informative, and I did what she told me to do, and I understood everything.” (Beneficiary; ceased after a self-reported reassessment)

Most interviewed beneficiaries, regardless of reassessment type or decision, generally did not understand the objectives of the reassessment process, however approximately 42% of surveyed beneficiaries were aware about reassessment process and objectives. Among surveyed beneficiaries that recalled the reassessment:

- 29% indicated that the Program had told them that they were being reassessed

- 21% indicated that the Program had told them why they were being reassessed

- 18% indicated that the Program had explained to them the objectives of reassessment

Some beneficiaries were not aware of objectives or process of the Program since they relied on public trustees, employment counselors, employers, family members or healthcare providers to complete their paperwork on their behalf.

Even in cases where beneficiaries’ family members assisted with paperwork and communications with the program, the beneficiary or their family member indicated that the objectives of the reassessment or continuing eligibility requirements were not clear.

“They did not [provide this information]… Had he known – and I was not aware of all of this, otherwise I would have informed them… We thought he was just collecting and everything was okay. I guess that could be a bit of a complaint.” (Family member of beneficiary; ceased after a triggers-related reassessment)

Key finding 16. Beneficiaries had different levels of awareness and knowledge with return-to-work supports

In the Survey with Canada Pension Plan Disability Beneficiaries, 41% were aware about return-to-work supports to a medium or high extent:

In terms of awareness about specific return-to-work supports, 20% were aware of allowable earnings and 16% were aware of the vocational rehabilitation program as well as the three-month work trial. (Table 10)

Although most beneficiaries may not have been aware of the various types of supports, they may have still received them.Footnote 25

| Types of support | Average (percentage) |

|---|---|

| Allowable Earnings | 20% |

| Three-month work trial | 16% |

| Vocational rehabilitation program | 16% |

| Automatic reinstatement | 12% |

| Fast-track reapplication | 11% |

| Other | 11% |

| None of the above | 43% |

| Used or received any return-to-work support (n = 1,763) | 12% |

Source: Survey with Canada Pension Plan Disability Beneficiaries

In the Survey with Canada Pension Plan Disability Beneficiaries, the majority of beneficiaries (76%) who were reassessed and had their benefits ceased did not use or receive any return-to-work supports.Footnote 26

- For those (reassessed and ceased) who used supports, 45% used the 3-month work trial, followed by 26% allowable income.

In the Survey with Canada Pension Plan Disability Beneficiaries, over 50% of those in the labour force indicated a higher awareness and use of return-to-work supports.

- Beneficiaries who are unemployed had similar levels of awareness as those who are employed, for the following 2 categories:

- three-month work trial (26% versus 25%)

- automatic reinstatement (23% versus 21%)

- Beneficiaries who were unemployed had different levels of awareness as those who are employed for the following 3 categories:

- vocational rehabilitation (8% versus 15%)

- allowable earnings (33% versus 23%)

- fast-track reapplication (28% versus 22%)

Key finding 17. More frequent and adapted communication could increase awareness and understanding about the reassessment process

The majority of beneficiaries indicated the program should increase proactive communication before, during and after the reassessment process, to improve their overall experience of the reassessment process.

Being contacted by phone only at the initial stage of being granted the pension may not have been sufficient to keep these beneficiaries informed of their responsibilities.

The most common suggestion was for beneficiaries to have case managers to check in on them, and ensure that beneficiaries have the information and support they need in a timely manner throughout their Program journey, and particularly during reassessment process. Some participants wished they could receive regular reminders and updates to keep them abreast of program updates, available supports, and other important information pertinent to their reassessment.

“Providing information shouldn’t just be a one-off… The information is too overwhelming… I think most of us with long term physical issues and pain have mental health aspects to it as well, whether we recognize it or not... I’ve been able to take care of everything… But I imagine for most people the program is just hard to understand.” (Beneficiary; continued upon a self-reported reassessment)

A few interviewed beneficiaries suggest adapted communication to accommodate their individual circumstances:

- some interviewed beneficiaries noted that human contact would make the whole reassessment process smoother and comforting

- for example, it is not appropriate to send letters to beneficiaries that have visual impairments

- phone communication would also be important to consider since mail communication may be difficult to understand especially by beneficiaries with low literacy or lower levels of education

According to key informants, the program should be more proactive in reaching out to beneficiaries, informing them of their obligations, and notifying them about existing return to work incentives. For example:

- the Program could send beneficiaries a yearly question to ask them if they work and if there was any change in their medical condition), exploring with them possible alternatives

- however, 3 experts stated that the process should be “risk-free”, not “forced” and completely based on personal circumstances

Beneficiaries suggest the following as tactics that could improve proactive communication:

- increase awareness about the return to work incentives and supports

- more frequent, adapted and easier to understand communications

- use more sensitive language while communicating with beneficiaries

- have a consistent point of contact, such as a case manager

Surveyed beneficiaries who suggested improving the communication side of the reassessment process were further asked which specific aspects of communication the program should improve, and the commonly mentioned aspects are as follows:

- internet (40 mentions, 44%), for instance by uploading more information on the website, or setting up an interactive online help center for questions and guidance

- telephone (53 mentions, 58%), for example by shortening waiting time to get hold of a agent on phone, or calling back faster

- direct mail (52 mentions, 57%)

- information accuracy and relevance (9 mentions, 10%)

- email (4 mentions, 4%), for example by allowing communication through email

- in-person or human contact (3 mentions, 3%)

Key finding: Timely and supportive approach

Key finding 18. Timely and supportive program elements could contribute to more efficient reassessments

There was an overall consensus among National Headquarters and regional Service Canada key informants on the need for reassessment to be more proactive. Some stated proactive reassessments would be “a fantastic idea for sustainability...”, “absolutely essential”, “simply what we should be doing”.

Most disability related programs examined in the literature review provided interactive and personalized supports to beneficiaries who are able to return to work.

According to external experts, most people on disability benefits want to return to work. Thus, reassessment and return-to-work supports should build on this good will and should be voluntary. According to one expert, a better approach in getting people off the pension was to provide additional supports, access to the tools, and provide resources that would enable beneficiaries to go back into the workforce.

6 (out of the 33) internal key informants agreed that the entire reassessment process should be more proactive and timely, which would result in positive effects through reduced overpayments for beneficiaries. The program data confirmed that during the period of the evaluation, the government had up to $79 million worth of overpayment to the beneficiaries.Footnote 27

9 (out of the 33) respondents in the National Headquarters and the regional Service Canada offices talked about a more proactive approach with regard to the pre-scheduled return to work assessments. They also mentioned that these types of reassessments were not done anymore or required more guidance.

Beneficiaries suggested the program should use a more flexible work-trial period. While the 3-month work-trial period was sufficient in facilitating some beneficiaries’ transition back to work, others felt that it needed to be more flexible since the severity of a disability can vary.

Key finding 19. Some elements observed in various domestic, private, and international programs seemed to contribute to better outcomes

Note: This section highlights best practices seen across disability programs in Canada and select international countries. It is acknowledged that these programs may not be equivalent or entirely comparable to the Canada Pension Plan Disability.

Québec Pension Plan Disability, which is similar to Canada Pension Plan Disability, required beneficiaries to have earnings below a certain threshold to continue receiving the pension. However, if a beneficiary exceeded an earning threshold (in 2019, this amount was $3600 in 3 consecutive months), their pension was ceased automatically, which may prevent future overpayment.

In Canada, provincial disability programs offered supports including the:

- Ontario Disability Support program which had the goal of providing employment support to help persons with disabilities find and keep a job while receiving income benefitsFootnote 28

- WorkSafe British Columbia and Worker Compensation Board of Prince Edward Island’s primary objectives were to offer rehabilitation and monetary supports for lost wages to those recovering from injuries occurred at work

Some practices of Canadian private long term disability providers, including Sun Life and Great West Life, followed:

- active case management for beneficiaries that have work potential including working with former employers and offering vocational rehabilitation and workplace accommodations as appropriateFootnote 29

- annual communication with all beneficiaries who were not under active case management to monitor any changes in status

In international cases, disability programs were designed in their unique context, where many use an interactive and proactive reassessment approach right at the start of the process.

- in Germany, the program required rehabilitation before the grant of the benefit and covered the costs involved in making a return to work possible

- in the United Kingdom, those with less severe disabilities were required to participate in work-focused interviews to improve their chances of finding suitable work

- Denmark required beneficiaries with less severe disabilities to participate in a flexible work environment while receiving partial benefits

Overall, best practices of disability programs included a strong reintegration focus with their ‘rehabilitation-before-pension’ principle. A disability pension was only granted when reintegration efforts have failed.

Management response and action plan

Overall Management Response

The Department agrees with the five recommendations, and is taking steps to improve the process for reassessment of continued eligibility of beneficiaries and their potential work capacity.

The findings indicate that reassessment is vital to the Canada Pension Plan Disability program’s operation, and that the Department has opportunities to improve the level of service that is provided to beneficiaries. The evaluation points to several important key findings:

- The reassessment process is usually timely for those who are reassessed due to a self-reported return to work. However, pre-scheduled reassessments and those resulting from earnings not reported directly to the Program are often delayed.

- A lack of consistency and comprehensive guidance in the reassessment process continues to remain an issue. There are regional variations in training staff, prioritization of reassessment workloads, and the decision-making process.

- Beneficiaries have different levels of awareness during the reassessment process and different levels of knowledge about return-to-work supports, suggesting a need for more effective and clear communications regarding program requirements.

The Department acknowledges that services are not always timely for clients who are reassessed, and will take steps to reduce delays and improve the timeliness of reviews resulting from unreported work activity (triggers) and prescheduled reassessment reviews. This includes addressing the lack of consistency and comprehensive guidance in the reassessment process with improved operational guidance.

The Department also acknowledges that beneficiaries have different levels of awareness during the reassessment process and has been taking steps to ensure effective and clear communication for clients.

In February 2020, the Department sought and obtained expenditure authority for three years, 2020 to 2021 and 2022 to 2023, to support work related to processing Canada Pension Plan and Canada Pension Plan Disability workload. This included $13.7 million over three years to address the Canada Pension Plan Disability reassessment workload. The Department recognized that under-resourcing and competing priorities had led to large reassessment inventories. The funding has allowed the Department to hire additional staff across Service Canada regional processing offices to conduct reassessments and reduce the inventory. The Department recently established a specialized processing unit to further advance this work. The funding also provided $13.9 million to support continuous improvement efforts in the Canada Pension Plan Disability program. This includes funds to improve client communication and streamline business processes to advance more timely, responsive, and consistent processing of benefits. It also includes funding to redesign and innovate training, guidance and support for employees.

The Department’s Canada Pension Plan Disability Renewal work plan is also supporting improvements to reassessment. Canada Pension Plan Disability Renewal includes work to enhance the openness of the program through better communication with clients and other stakeholders, and work to review post-grant activities, including reassessment of eligibility, return to work incentives, and vocational rehabilitation.

Recommendation 1

Ensure consistent decision-making processes and appropriate alignment of resources (example: training, staffing, work clarity, etc.) to bring further efficiency to the reassessment process.

Management Response

The Department agrees with the recommendation, and is taking steps to ensure appropriate decision-making processes, and allocation of resources, including ensuring sufficient workforce and training. Since the evaluation period, the Department has increased reassessment workforce capacity in the regions and reduced inventories. The lead for activities 1.1 to 1.4 is Service Canada national headquarters and Service Canada regional offices. The lead for 1.5 is the Income Security and Social Development Branch of ESDC in consultation with Service Canada. The lead for activity 1.6 is Service Canada, in consultation with the Income Security and Social Development Branch of ESDC.

| Management Action Plan | Completion date |

|---|---|

| 1.1 Increase in medical and non-medical capacity in reassessment across Service Canada’s regional processing network to address the reassessment inventory. | Q3 2021-2022 |

| 1.2 Establishment of a Reassessment Centre of Specialization to handle reassessment work, including triggers to help balance and reduce inventories more expeditiously. | Q1 2021-2022 |

| 1.3 Update to the reassessment training curriculum for Medical Adjudicators and non-medical employees. Service Canada regional processing centres allocated additional resources, including Medical Adjudicator Consultants, Business Expertise Advisors, and Business Expertise Consultants, to assist the College@ESDC in the development and launch of the training packages. Training packages include updated job aids, and a suite of Medical Reference Guides on complex medical conditions to support fair, sound, and early decision-making at all stages of the program. | November 2021 |

| 1.4 Establishment of National Reassessment Case Conferencing to collectively review case approaches to ensure consistent decision making and assess gaps in policy and procedures. This is a joint effort between Service Canada national headquarters, Service Canada regional offices and Income Security and Social Development, ESDC’s policy arm for the Canada Pension Plan Disability Program. | October 2021 |

| 1.5 Income Security Social Development Branch in collaboration with Benefits and Integrated Services Branch will develop a reassessment policy framework. | May 2023 |

1.6 Benefits and Integrated Services Branch, in collaboration with Income Security Social Development Branch will refresh the Canada Pension Plan Disability Reassessment Functional Guidance and Procedures:

|

Q2/Q3 2022-2023 Q4 2023-2024 |

Recommendation 2

Improve communication with beneficiaries so they are better aware of their responsibilities, program provisions, and available supports.

Management Response

The Department agrees with the recommendation and recognizes the importance of clear and consistent communication with beneficiaries. Canada Pension Plan Disability Renewal and Canada Pension Plan Disability Continuous Improvement work continue to drive improvement of Canada Pension Plan Disability program communications to clients. The lead on activities 2.1, 2.2 and 2.4 is Service Canada national headquarters and Service Canada regional offices. The lead on activities 2.3 and 2.5 is Service Canada and the Income Security Social Development Branch of ESDC.

| Management Action Plan | Completion date |

|---|---|

| 2.1 Optimization of the Canada.ca Canada Pension Plan Disability web pages to align web content with the Treasury Board Secretariat web standards. This included improving navigation, readability, accessibility, and taking a web-first approach to providing program information. | August 2020 |

| 2.2 Update to the Canada Pension Plan Disability Toolkit. The Department developed the Toolkit in 2019 to help clients, people supporting them in the application process, health care professionals, and non-government organizations, access all required program information through a single document. | October 2021 |

| 2.3 Benefits and Integrated Services Branch and Income Security Social Development Branch will update and improve key Canada Pension Plan Disability client communications to align with recent policy updates affecting reassessment. This will ensure information is clear and concise so that clients are aware of their responsibilities and return to work supports provided by Service Canada. This includes updates to the Canada Pension Plan Disability information sheet, Canada Pension Plan Disability post-grant letter, and the annual Canada Pension Plan Disability T4 insert. | February 2022 |

| 2.4 Pensions Correspondence Modernization will improve communication to pension beneficiaries through a broad review of existing pension programs correspondence (including Canada Pension Plan Disability), to simplify, enhance, and ensure plain language in correspondence to clients. | March 2023 |

| 2.5 Income Security Social Development Branch and Benefits and Integrated Services Branch will collaborate to further update and improve Canada Pension Plan Disability client communications to ensure alignment with the new reassessment policy framework. | May 2023 |

Recommendation 3

Have a more timely approach to the pre-scheduled reassessments and those resulting from earnings not reported directly to the Program.

Management Response

The Department agrees with the recommendation and recognizes the need to improve the timeliness of trigger-related and pre-scheduled reassessments. The increased hiring in Service Canada as a result of the funding authority received in 2020, has enabled the department to allocate more resources to this work across the regional processing network and give higher priority to this area. As part of its effort to reduce the Canada Pension Plan Disability inventory, the Department is also undertaking different measures to ensure timelier decisions for clients, including automating certain business processes. The lead on these activities is Service Canada national headquarters and Service Canada regional offices.

| Management Action Plan | Completion date |

|---|---|

| 3.1 Standardization of Reassessment work types in the Pensions Workload System to include trigger-related reassessment work items. Pensions Workload System is the Department’s workload management tool for the Canada Pension Plan and Old Age Security programs. The incorporation of trigger-related reassessment work items into Pensions Workload System as well as in regular performance reporting, is enabling the department to better track, manage and prioritize reassessment work. | November 2021 |

| 3.2 Update and partially automate the pre-scheduled reassessment triggers and the reassessment process. | Q2 2022-2023 |

| 3.3 Automate the pre-screening steps for triggers indicating potential work income, such as Employment Insurance Record of Employment Inquiry Statistic and Extraction system register, Canada Pension Plan Exempt, and Record of Earnings. Record of Earnings triggers will be automated to identify benefits-related income to help distinguish between income generated from employment and a potential return to work. This will result in efficiencies and help increase the number of trigger-related reassessments processed each year, which will in turn help to avoid burdensome overpayment situations for clients. | Q4 2022-2023 |

Recommendation 4

Determine the effectiveness of support(s) to those who want to return to the workforce.

Management Response

The Department agrees with the recommendation.

The Canada Pension Plan Disability program is designing a pilot project to assess an evidence-based approach to better support Canada Pension Plan Disability beneficiaries in their attempts to return to work.

The pilot to test Canada Pension Plan Disability return-to-work supports is currently being designed and will be implemented beginning in 2023. This pilot will help gather evidence on new and existing return-to-work supports to identify which suite of supports is most effective in helping Canada Pension Plan Disability beneficiaries who would like to attempt to reintegrate into the workforce. This pilot will take into account the changing dynamics of the labour market and the impacts on vulnerable populations due to COVID-19.

Income Security and Social Development Branch and Service Canada national headquarters are co-leading this initiative.

| Management Action Plan | Completion date |

|---|---|

| 4.1 Development and implementation of a pilot project to test and identify the most effective suite of supports to help Canada Pension Plan Disability beneficiaries who wish to attempt a return to work. | December 2025 |

Recommendation 5

Currently, Medical Adjudicators make decisions on self-reported return to work, despite there being no (or minimal) medical components to most of those decisions. To facilitate more timely completion of reassessments, medical adjudicators should be assigned to cases that require a medical decision, leaving non-medical cases for other program officials.

Management Response

The Department agrees with the recommendation and that the alignment of roles and responsibilities between medical and non-medical staff involved in reassessments could be improved to enhance the timeliness of decisions. The lead on this activity is Service Canada national headquarters and Service Canada regional offices.

| Management Action Plan | Completion date |

|---|---|

| 5.1 Develop and implement strategy to improve alignment of Medical Adjudicator and Service Canada Benefit Officer roles with respect to the nature of reassessment cases. | Q4 2022-2023 |

Annexes

Annex 1. Canada Pension Plan Disability Program (1990 to 2018)

Since the 1990s, several internal and external reviews have suggested a need for a comprehensive renewal of the program, including the 2011 Canada Pension Plan Disability program evaluation, and the 2015 Report of the Auditor General. The Renewal Initiative was approved by the Deputy Minister of ESDC in summer 2015 as a cross-branch responsibility between the Income Security and Social Development, the Transformation and Integrated Service Management Branch,Footnote 30 and regional offices.

Until recently, the pension’s renewal initiative has focused on the “front-end” elements of the program. However, in spring 2018, the Program initiated a renewal review of the “back-end,” or “post-grant” elements of the program. These elements apply to beneficiaries in pay and former beneficiaries who may be eligible to return to the pension, and comprise reassessment of continuing eligibility, return-to-work incentives, and vocational rehabilitation.

Figure A1 depicts the timeline of the program’s changes and development over time.

In its Renewal Initiative, the program area identified several outcomes related to return to work and reassessments and possible improvements related to post- grant aspects (Table A1).

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

Table A1. Renewal initiative’s outcomes and Potential Improvement

Outcome: Program facilities return to work

- more beneficiaries successfully return to work

- provisions to return to work are effective (beneficiaries pursue work re-entry with a consistent Program “safety net”)

- beneficiaries have access to effective supports to build work capacity

- the Program is coordinated with other labour market and disability supports

Outcome: criteria for continued Program eligibility are clear, reflect legislation, and are applied in a fair, consistent and efficient manner

- reassessment process is effective and efficient

- there are clear criteria related to continuing eligibility, uniformly applied in a timely manner

- data and reporting are the evidence base to support the development of policy guidance, up date processes, and efficient and effective workload strategies

Outcome: Program beneficiaries have the information they need to understand the program provisions and reporting responsibilities

- program recipients report understanding conditions of benefits and responsibilities related to reporting income and medical changes

- recipients accurately report return to work and income above allowable earnings

- recipients are aware of program provisions and supports

Work plan to achieve outcomes

- immediate program improvements: ensure alignment with existing legislation and regulations, and maintain program integrity

- longer-term program development: develop evidence from which to consider more significant changes, prepare proposals, and develop action plans

Figure A1 - Text version

| Year | Program change/ development | Description of program change |

|---|---|---|

| 1996 | Program evaluation | Focused mainly on the front-end program's beneficiaries, eligibility criteria, earnings replacement, and comparison to other national and international programs |

| 2011 | Program evaluation | Focused mostly on the front-end element including relevance, achievement of objectives, impacts and effects, cost-effectiveness, and program delivery. |

| 2015 | Program renewal/ Modernization - Auditor General | Aimed to improve program outcomes and service delivery to Canadians |

| 2018 | Initiation of the renewal of the “post-grant” elements of the program | Aimed to make immediate program improvements and significant long term |

| 2021 | Current evaluation coverage | Review of the post-grant elements of the program:

|

Annex 2. Key findings of the previous evaluation

Evaluation of the Canada Pension Plan (Disability Component) Final Report from 1996

The Phase I evaluation examined the Canada Pension Plan retirement pension. The Phase II evaluation examined the Canada Pension Plan Disability with a wide range of key questions covering the period from 1991 to 1994. The issue of whether the program has achieved its objectives, and the main impacts and effects of the program, were significant questions for the evaluation. These questions were examined in terms of the program's beneficiaries, eligibility criteria, earnings replacement, and comparison to other programs, including the Québec Pension Plan Disability and programs of major international trading partners.

On the reassessment issue, the evaluation noted that reassessment activity was sporadic before 1993. Since 1993, reassessments have been intensified under a special project focusing on beneficiaries who have a high probability of being gainfully employed. The encouraging initial results of the recent Program reassessment initiatives suggest that consideration should be given to a substantial expansion of these reassessment initiatives. The evaluation concludes that there is considerable potential for significantly expanded reassessment efforts to ensure the removal of beneficiaries from the caseload who can undertake gainful employment.

Summative Evaluation of the Canada Pension Plan Disability Program from 2011