Horizontal Evaluation of the Labour Market Development Agreements

On this page

- List of abbreviations

- List of charts

- List of tables

- Executive summary

- Management response and action plan

- Introduction

- Labour Market Development Agreements

- Methodology

- Evaluation findings

- Supplemental studies

- Conclusions and recommendations

- References

- Appendix A. Heterogeneity of treatment effects study findings for active EI claimants in Skills Development

- Appendix B. List of 9 studies included in this national synthesis report

Alternate formats

Horizontal Evaluation of the Labour Market Development Agreements [PDF - 2,26 MB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of abbreviations

- ATE

- Average Treatment Effect

- ATET

- Average Treatment Effect on Treated

- EAS

- Employment Assistance Services

- EBSM

- Employment Benefits and Support Measures

- EI

- Employment Insurance

- ESDC

- Employment and Social Development Canada

- GATE

- Group Average Treatment Effect

- IATE

- Individualized Average Treatment Effect

- JCP

- Job Creation Partnerships

- LMDA

- Labour Market Development Agreements

- SA

- Social Assistance

- SD

- Skills Development

- TWS

- Targeted Wage Subsidies

List of charts

- Chart i. Change in probability of being employed in participants relative to non-participants (annual average)

- Chart ii. Employment earnings of participants relative to non-participants (annual average)

- Chart iii. Change in dependence on government income support (annual average)

- Chart 1. Change in probability of being employed in participants relative to non-participants (annual average)

- Chart 2. Employment earnings of participants relative to non-participants (annual average)

- Chart 3. Change in the use of EI benefits (annual average)

- Chart 4. Change in the use of SA benefits (annual average)

- Chart 5. Change in dependence on government income support (annual average)

- Chart 6. Average earnings for active claimant participants in Skills Development-Apprentices

- Chart 7. Average earnings for former claimant participants in Skills Development-Apprentices

- Chart A1. Individualized average treatment effects by all participants and subgroups

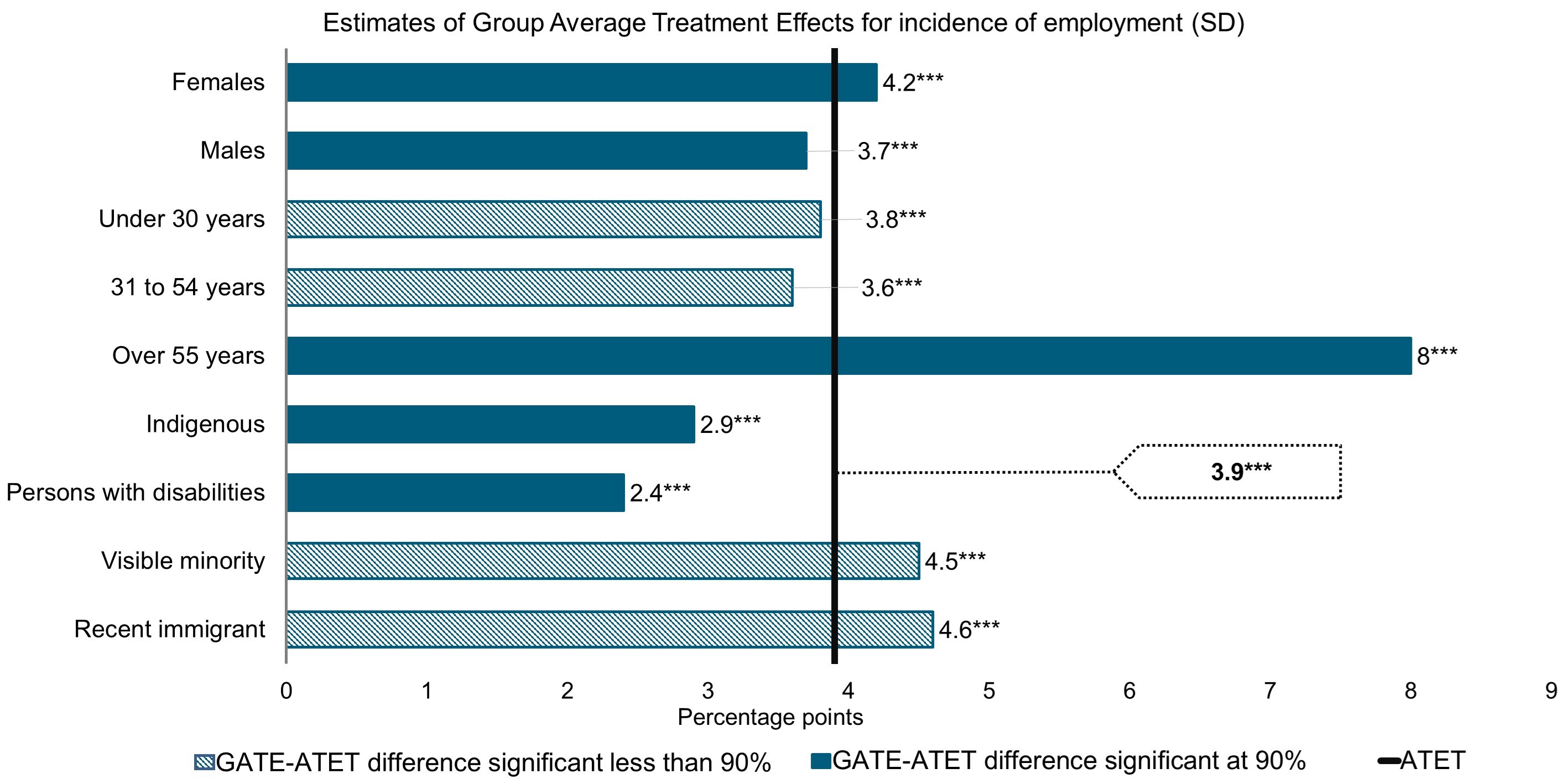

- Chart A2. Estimates of Group Average Treatment Effects for incidence of employment by subgroup

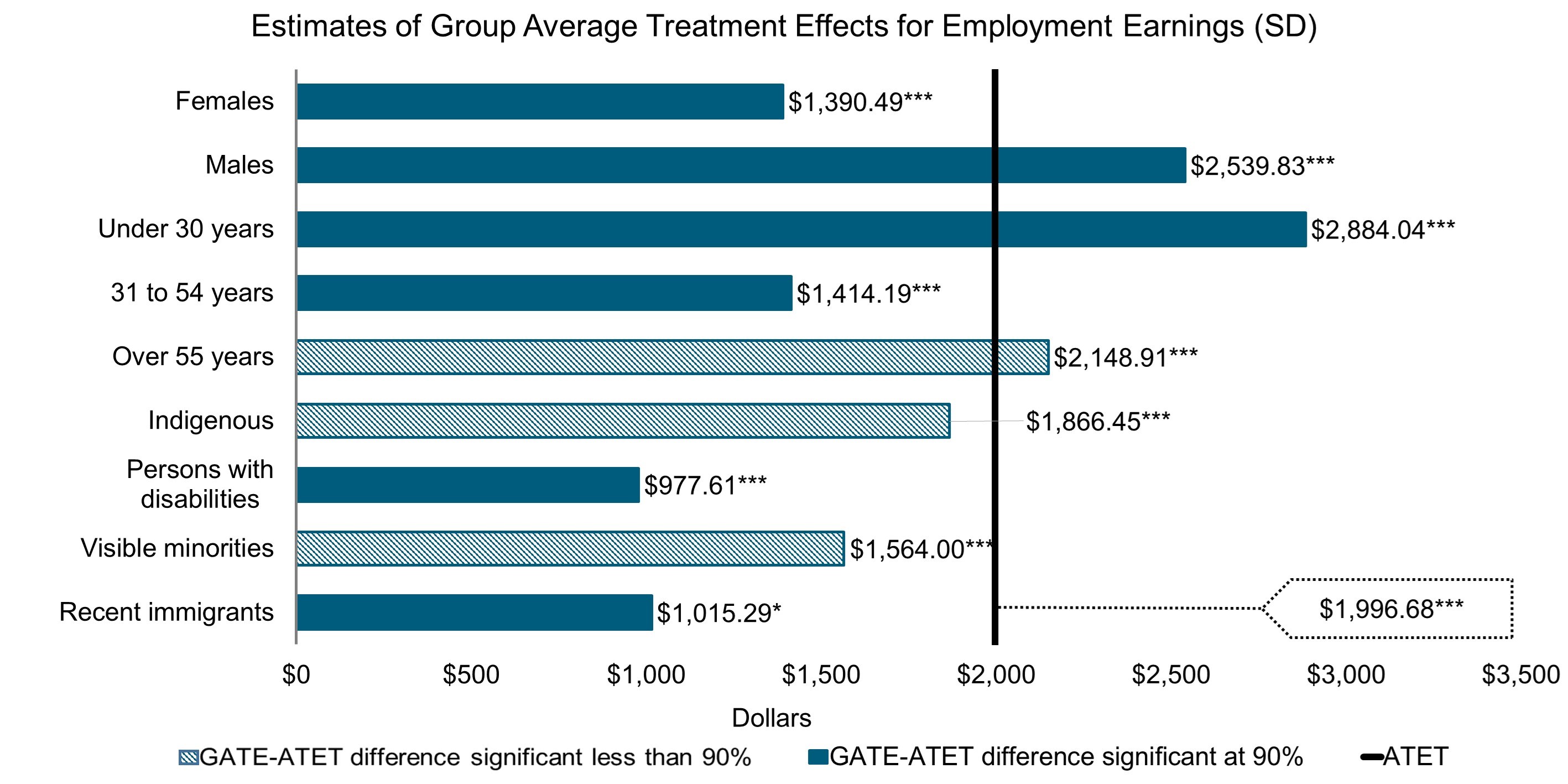

- Chart A3. Estimates of Group Average Treatment Effects for employment earnings by subgroup

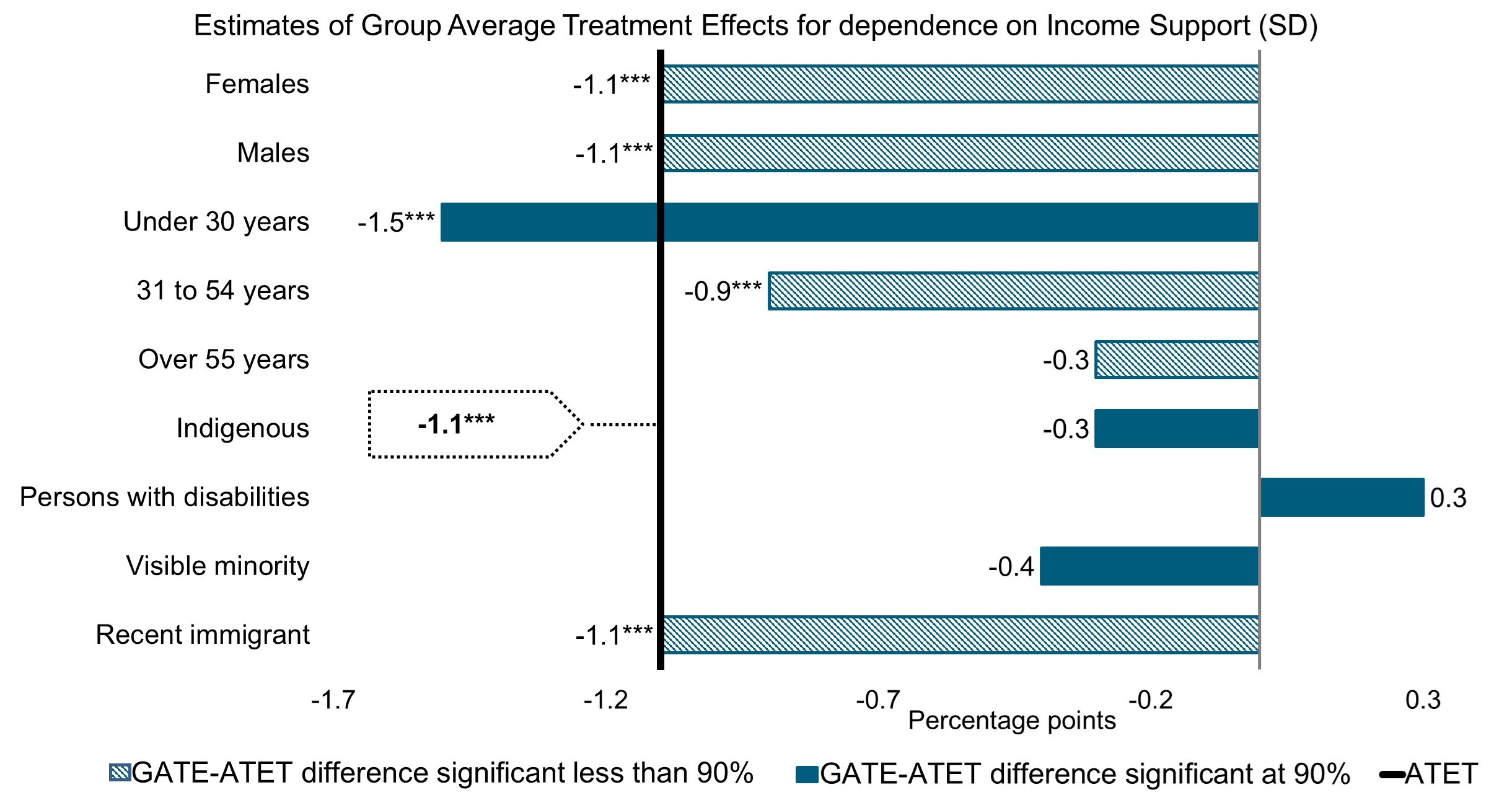

- Chart A4. Estimates of Group Average Treatment Effects for dependence on government income supports by subgroup

List of tables

- Table i. Share of LMDA funding and average cost per Action Plan Equivalent per participant across Canada, for 2010 to 2012 period

- Table ii. Number of years for the benefits to exceed program costs

- Table 1. LMDA devolution dates and total expenditures between 2018 and 2021

- Table 2. Share of LMDA funding and average cost per Action Plan Equivalent per participant across Canada

- Table 3. Profile of active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 4. Employment and earning levels, and use of SA in the year before participation in EBSMs

- Table 5. Profile of female active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 6. Incremental impacts for female participants (annual average)

- Table 7. Profile of male active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 8. Incremental impacts for male participants (annual average)

- Table 9. Profile of youth active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 10. Incremental impacts for youth participants (annual average)

- Table 11. Profile of older worker active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 12. Incremental impacts for older worker participants (annual average)

- Table 13. Profile of Indigenous active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 14. Incremental impacts for Indigenous participants (annual average)

- Table 15. Profile of persons with disabilities active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 16. Incremental impacts for persons with disabilities (annual average)

- Table 17. Profile of recent immigrant active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 18. Incremental impacts for recent immigrants (annual average)

- Table 19. Profile of visible minority active and former EI claimant participants in EBSMs across Canada in 2010 to 2012

- Table 20. Incremental impacts for visible minority participants (annual average)

- Table 21. Cost-benefit results for active and former EI claimant participants

- Table 22. Profile of active and former EI claimant participants in Skills Development-Apprentices programs across Canada in 2010 to 2012

- Table A1. Selected sociodemographic characteristics and outcomes of participants

- Table A2. Annual average post-program incremental impacts for Skills Development active claimants “Average Treatment Effect on the Treated”

Executive summary

The Labour Market Development Agreements (LMDAs) are bilateral agreements between Canada and each province and territory for the design and delivery of Employment Benefits and Support Measures (EBSMs).

The objective of EBSMs is to assist individuals to obtain or keep employment through various active employment programs, including training or employment assistance services. Successful delivery of EBSMs is expected to result in participants receiving needed services, a quick return to work, and savings to the Employment Insurance (EI) account.

Programs and services delivered by provinces and territories have to correspond to the EBSM categories defined under the EI Act. The following is a short description of the EBSMs examined in the evaluation:

- Skills Development (SD) helps participants obtain employment skills by giving them financial assistance in order to attend classroom training

- Targeted Wage Subsidies (TWS) help participants obtain on-the-job work experience by providing employers with a wage subsidy

- Self-Employment provides financial assistance and business planning advice to participants to help them start their own business

- Job Creation Partnerships (JCP) provide participants with opportunities to gain work experience that will lead to ongoing employment. Employment opportunities are provided by projects that contribute to developing the community and the local economy

- Employment Assistance Services (EAS) such as counselling, job search skills, job placement services, provision of labour market information and case management

- Labour Market Partnerships seeks to deal with labour force adjustments and meet human resources requirements by enabling employers, employee or employer associations, community groups, and communities to work together to develop or implement strategies

- Research and Innovation initiatives that seek to identify better ways of helping people prepare for, return to or keep employment, and be productive participants in the labour force

The LMDA investment

In fiscal year 2020 to 2021, Canada transferred nearly $2.5 billion (including nearly $186.6 million in administration funds) to provinces and territories.

Table i: provides an overview of the share of funding allocated to EBSMs and the average cost per participant. The average cost per participant is calculated based on the 2010 to 2012 data from the EI Monitoring and Assessment Reports. The 2010 to 2012 period corresponds with the cohort of participants selected for incremental impacts and cost-benefit analysis in the LMDA evaluation.

| Employment Benefits and Support Measures | Average share of funding | Average cost – active claimants | Average cost – former claimants |

|---|---|---|---|

| Skills Development | 52% | $10,193 | $10,052 |

| Employment Assistance Services | 30% | $826 | $826 |

| Labour Market Partnerships | 7% | n/a | n/a |

| Self-Employment | 6% | $15,551 | $15,833 |

| Targeted Wage Subsidies | 3% | $7,538 | $7,384 |

| Job Creation Partnerships | 2% | $11,750 | $10,940 |

| Research and Innovation | <1% | n/a | n/a |

| Total | 100% | n/a | n/a |

Sources: EI Monitoring and Assessment Reports for fiscal years 2010 and 2011 to 2011 and 2012.

Compared to the 2010 to 2012 period, the LMDA budget allocation varied for few programs and services in 2020 to 2021. For example, investments in SD decreased from 52% to 39%. As well, investments in Research and Innovation increased from less than 1% to 10% of total allocation.

Evaluation objectives

Building on the success of previous LMDA evaluation cycles, the aim of this evaluation is to fill in knowledge gaps about the effectiveness, efficiency, as well as design and delivery of EBSMs across Canada.

Evaluation methodology

The findings in this report are drawn from 9 separate evaluation studies. These studies examine issues related to program effectiveness, efficiency, and design and delivery. A mix of qualitative and quantitative methods are used, including:

- incremental impact analysis for participants who began an intervention between 2010 and 2012

- outcome analysis

- cost-benefit analysis (including savings to health care)

- key informant interviews with 287 provincial/territorial representatives, service providers, agreement holders and key stakeholders

- provincial/territorial questionnaires

- a national survey of 2,023 self-employment participants

- document and literature reviews

For the purposes of this evaluation, incremental impacts are estimated for 2 types of participants:

- active EI claimants are participants who started an EBSM intervention while collecting EI benefits

- former EI claimants are participants who started an EBSM intervention up to 3 years after the end of their EI benefitsFootnote 3

Key findings

Between 2010 and 2012, nearly 609,000 participants began participating in LMDA programs and services across Canada.

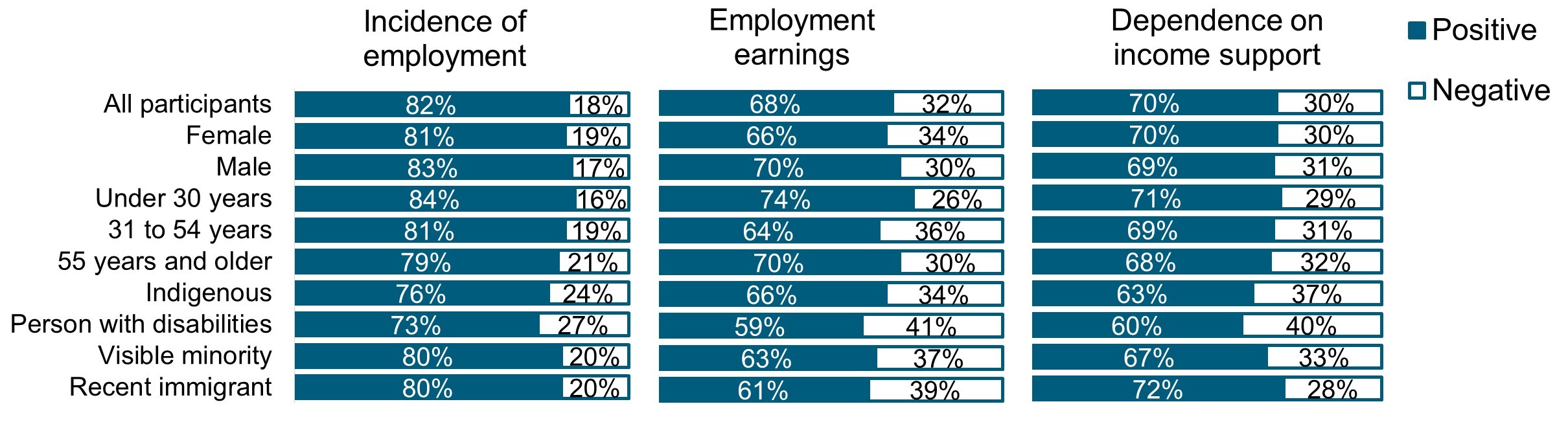

Effectiveness and efficiency of EBSMs

Overall, incremental impacts demonstrate that participation in most EBSMs improves labour market attachment and reduces dependence on government income supports compared to similar non-participants. These results are consistent with those found for earlier cohorts of participants as part of the previous evaluation cycle. A subgroup analysis shows that with some exceptions, SD and TWS interventions also benefit most subgroups of participants. EAS alone was found to improve the labour market attachment for female, Indigenous and recent immigrant participants, and decrease their use of EI. As well, for most interventions, the social benefits of participating in EBSMs exceed the initial investment costs over time.

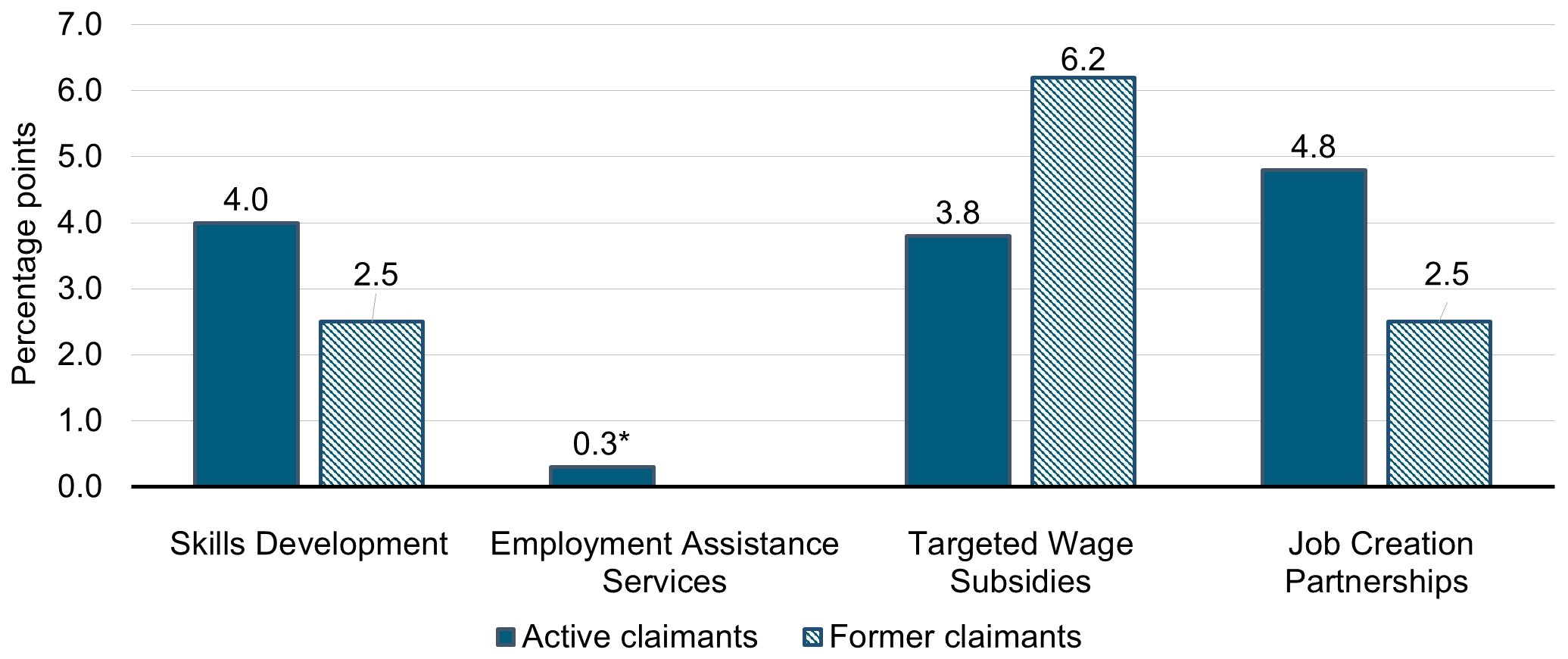

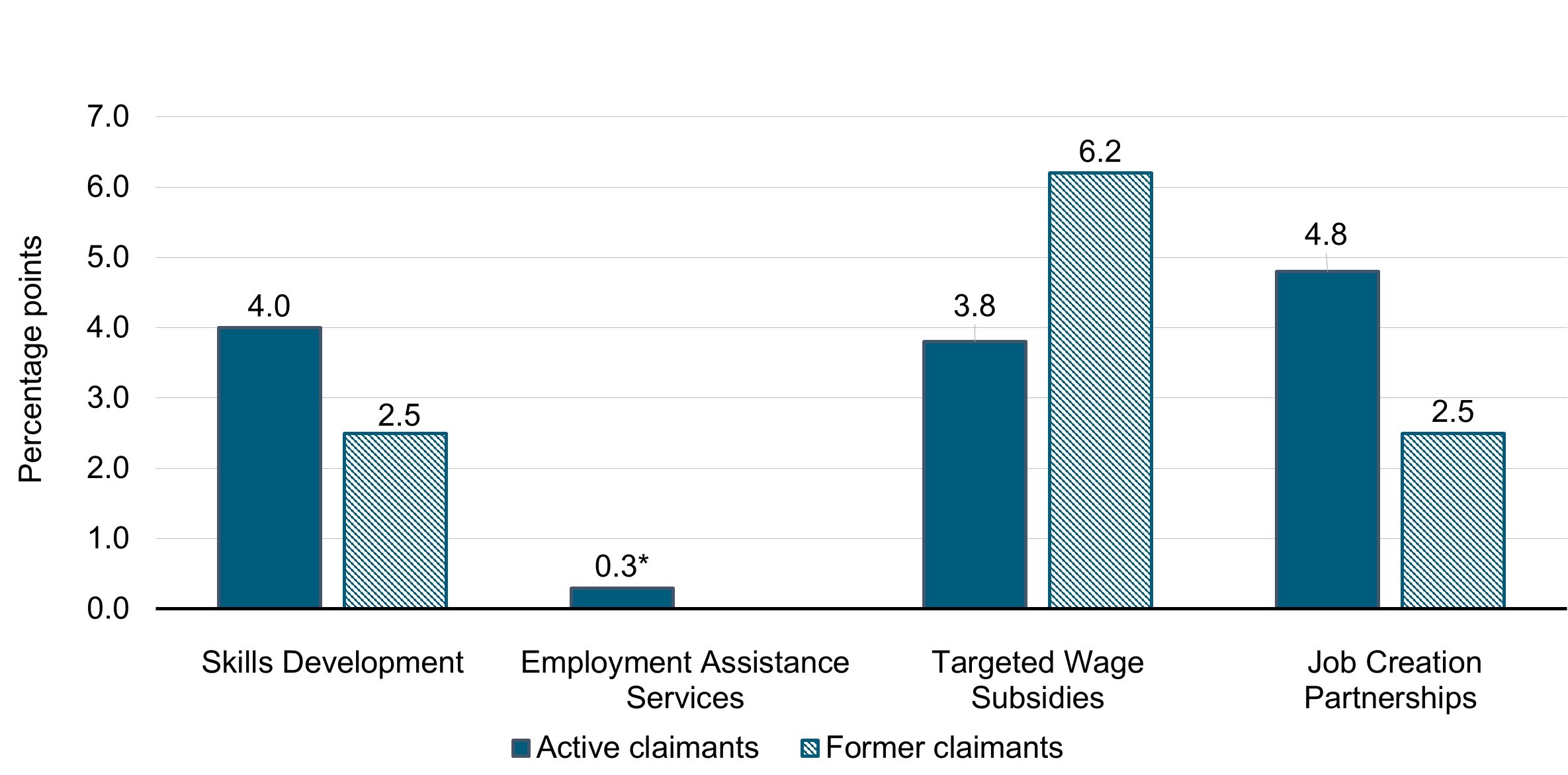

Chart i: presents the incremental impacts on the incidence of employment for active and former claimants by EBSM. The estimates can be interpreted as change in the probability of being employed following participation. For example, participation in SD increases the probability of being employed by 4 percentage points for active EI claimants relative to non-participants.

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart i

| Program name | Incidence of employment for active claimants (percentage points) | Incidence of employment for former claimants (percentage points) |

|---|---|---|

| Skills Development | 4.0 | 2.5 |

| Employment Assistance Services | 0.3* | n/a |

| Targeted Wage Subsidies | 3.8 | 6.2 |

| Job Creation Partnerships | 4.8 | 2.5 |

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

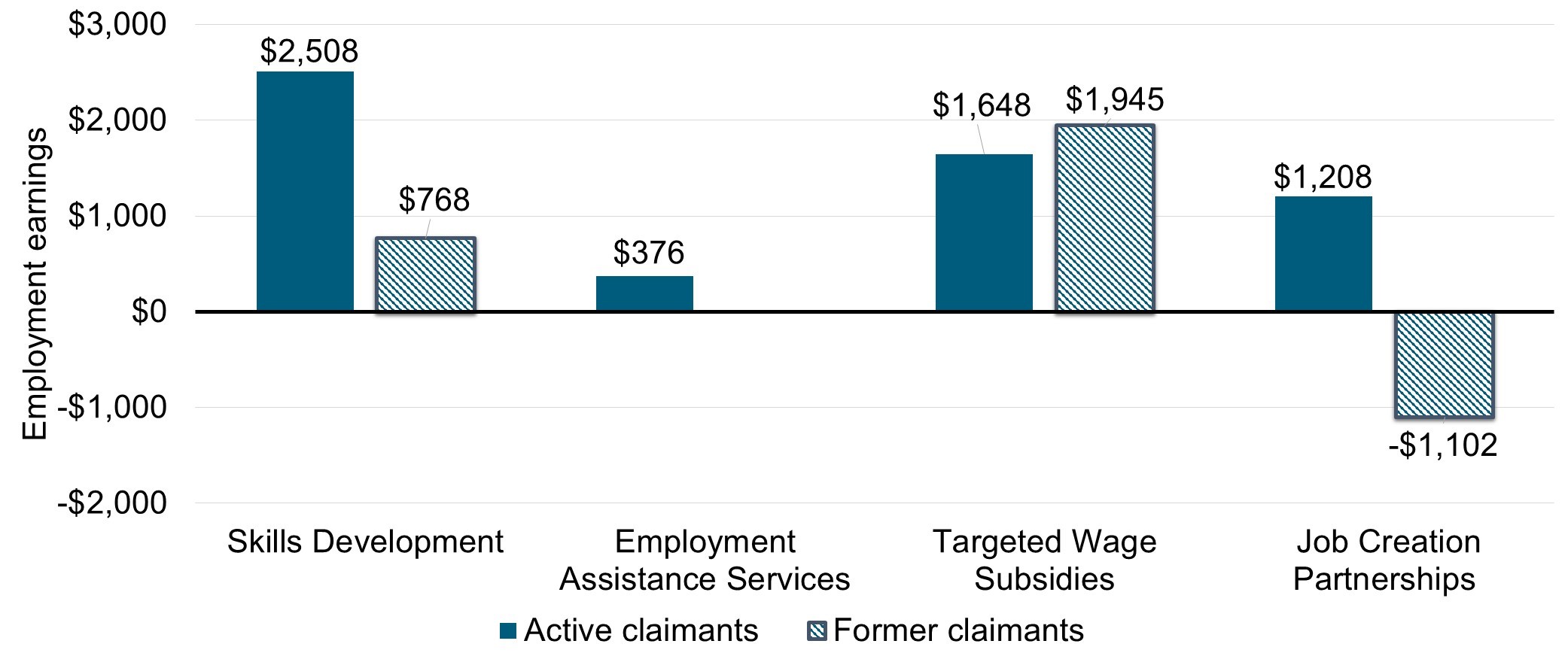

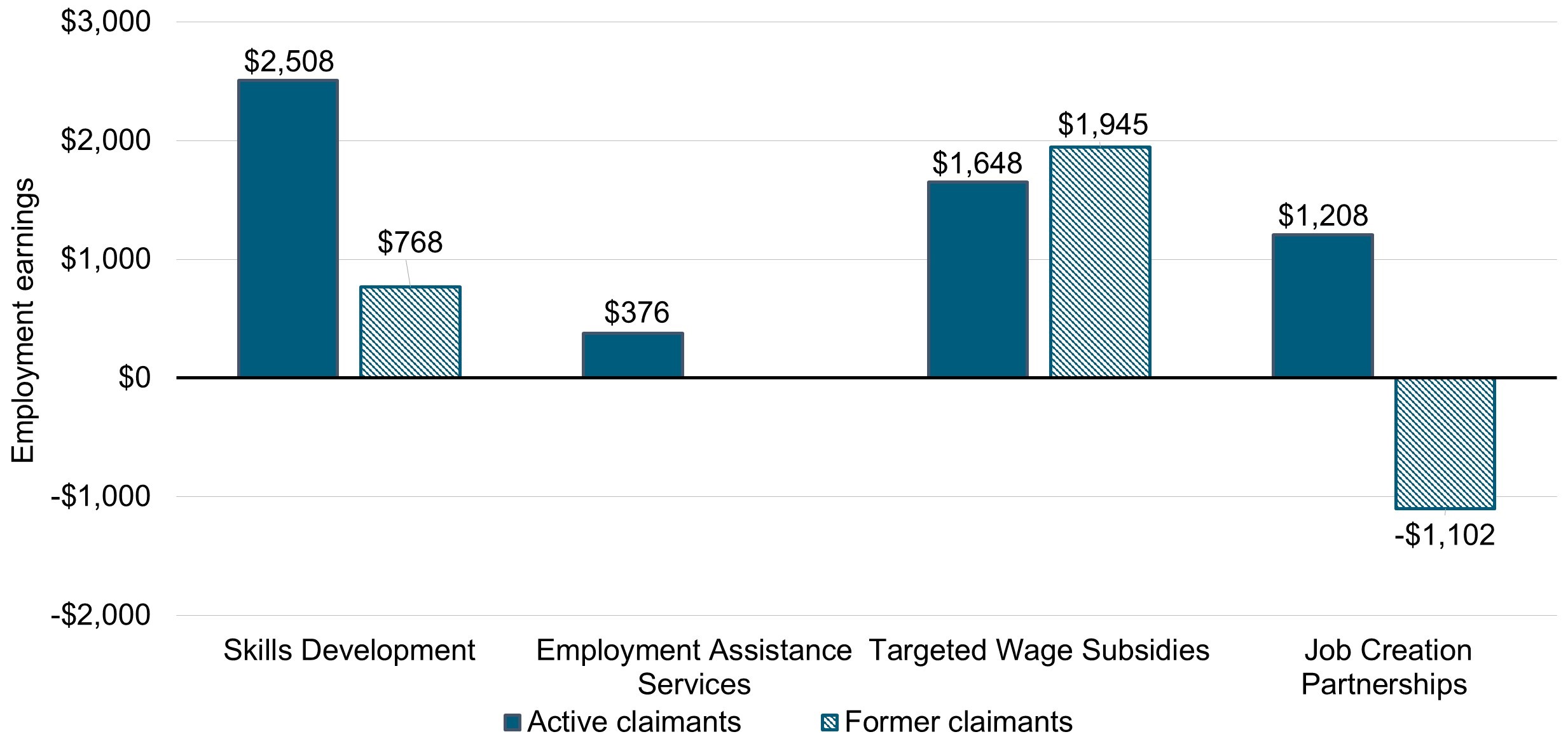

Chart ii: presents the annual average increase in employment earnings for active and former claimants over the post-participation period.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart ii

| Program name | Employment earnings of active claimants | Employment earnings of former claimants |

|---|---|---|

| Skills Development | $2,508 | $768 |

| Employment Assistance Services | $376 | n/a |

| Targeted Wage Subsidies | $1,648 | $1,945 |

| Job Creation Partnerships | $1,208 | -$1,102 |

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

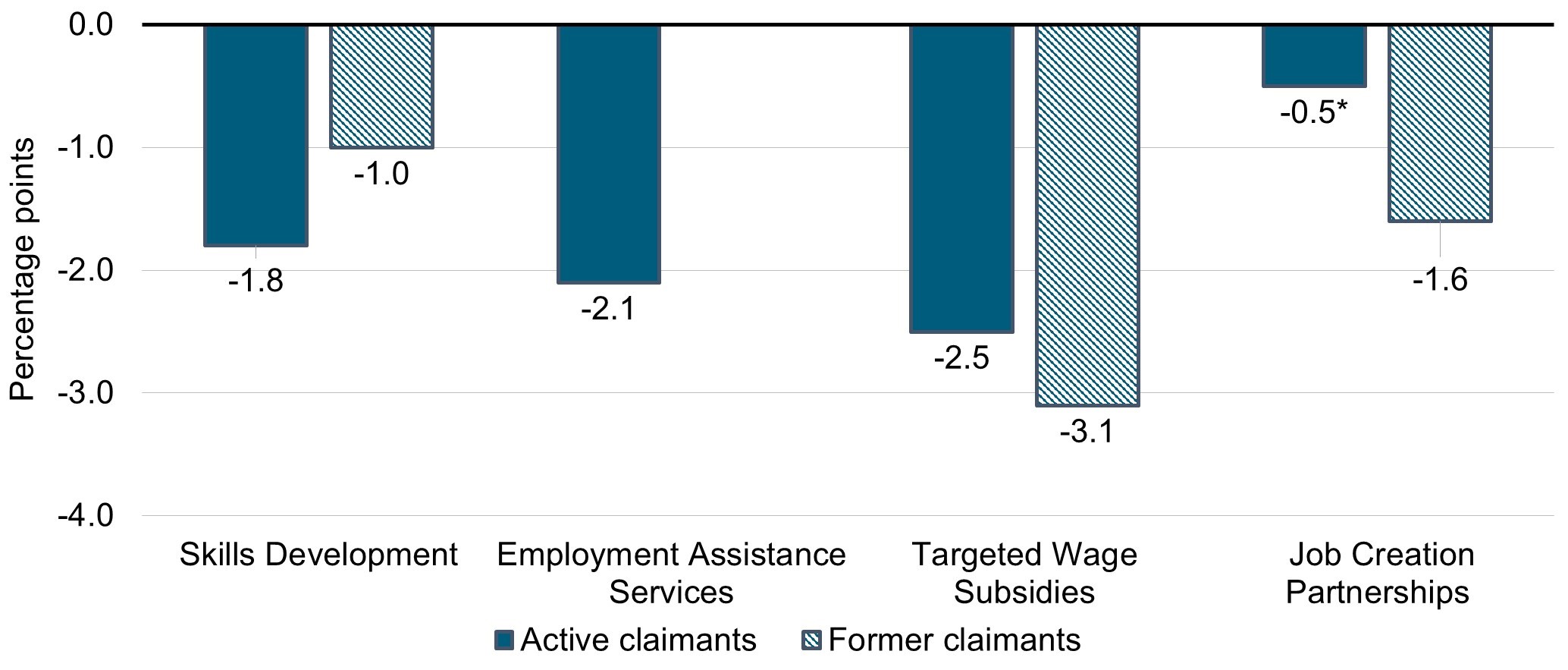

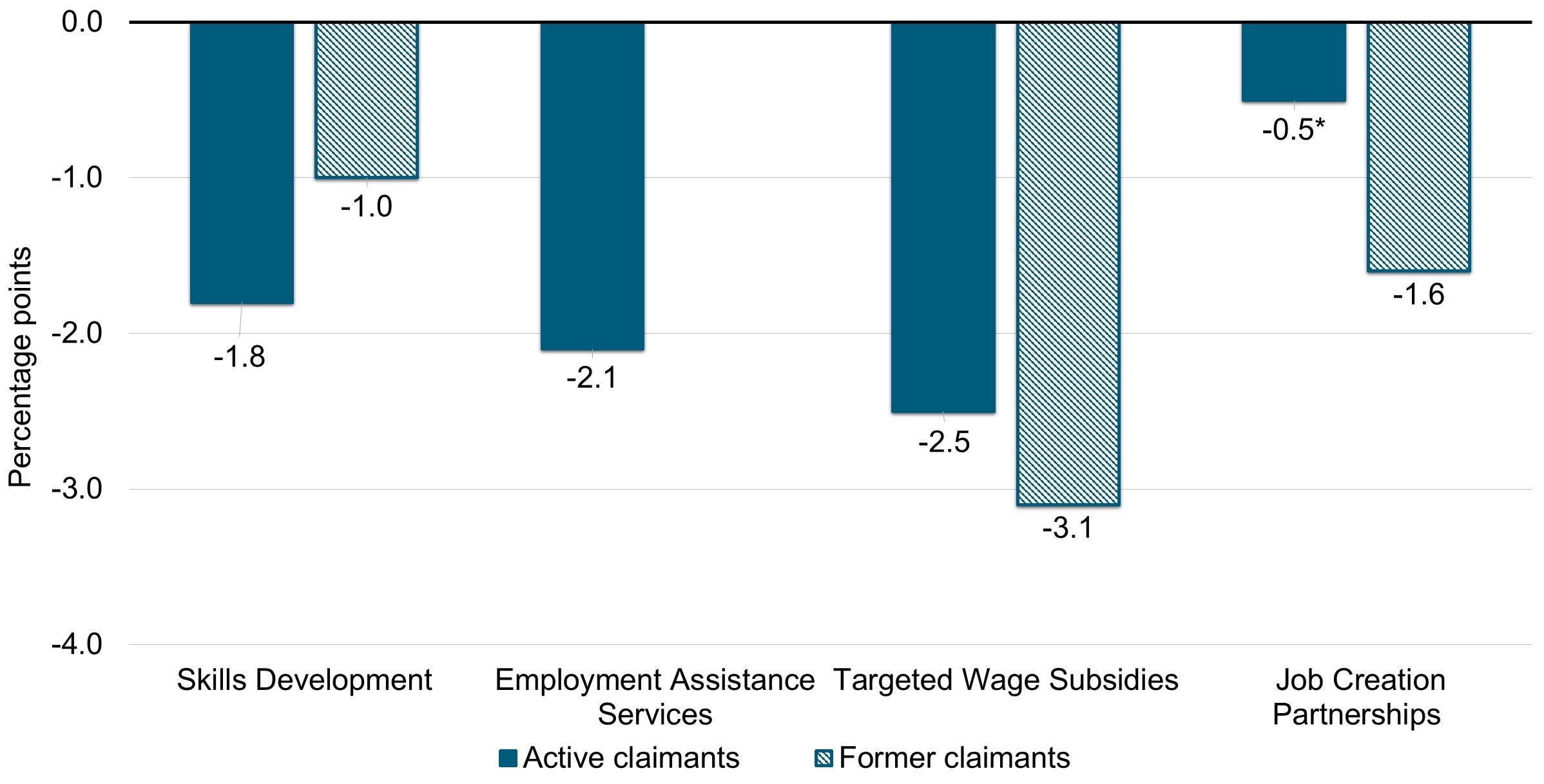

As shown in Chart iii, overall active and former claimants reduce their dependence on government income supports.

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart iii

| Program name | Dependence on government income support for active claimants (percentage points) | Dependence on government income support for former claimants (percentage points) |

|---|---|---|

| Skills Development | -1.8 | -1.0 |

| Employment Assistance Services | -2.1 | n/a |

| Targeted Wage Subsidies | -2.5 | -3.1 |

| Job Creation Partnerships | -0.5* | -1.6 |

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Table ii: presents the number of years required for the social benefits to exceed program costs. Social benefits to participation exceed initial investment costs over a period ranging from less than a year to 18.5 years.

| Category | SD active claimants (10 years post-program) | SD youth active claimants (10 years post-program) | TWS active claimants (5 years post-program) | JCP active claimants (5 years post-program) | EAS active claimants (5 years post-program) | SD former claimants (10 years post-program) | TWS former claimants (5 years post-program) |

|---|---|---|---|---|---|---|---|

| Payback period (years after end of participation) | 8.3 | 5.4 | 5.2 | 16.1 | 7.7 | 18.5 | 0.7 |

Supplemental studies

A series of supplemental studies address information gaps previously identified in LMDA evaluations regarding the design and delivery, challenges and lessons learned for Self-Employment, JCP, Labour Market Partnerships, and Research and Innovation.

Most of these interventions are not suitable for incremental impact analysis. For example, Labour Market Partnerships and Research and Innovation do not collect participant information. As a result, a mix of qualitative and quantitative methods are used to examine these EBSMs in detail. Key considerations are included to help guide future program and policy discussions.

Self-Employment study

The evaluation found that the Self-Employment program aims to assist participants in creating employment for themselves by providing them with a range of services.

Based on a survey, it was found that 2 to 4 years after program participation:

- participants increased their employment level by 15 percentage points from 59% in the year before participation to 74% at the time of survey; the increase is mainly due to an increase in the percentage of self-employed participants

- nearly 50% of survey respondents launched a self-employment business and it was still in operation

- half of self-employment businesses were launched in other servicesFootnote 4; professional, scientific and technical services; as well as in construction and retail trade

- 73% of respondents said that they were financially about the same or better off after the program

- 70% of respondents said that their household net worth was about the same or higher after the program

The survey did examine the contribution of the program to the success of self-employment businesses. At least 81% of survey respondents who launched a self-employment business rated the following services and training as very or somewhat important to the business launch, operation and success:

- assistance with business plan development

- one-on-one mentoring / advice or counselling supports

- discussion on risks and challenges of self-employment

- assessment of entrepreneurial readiness

- living allowance during participation and financial assistance with business start-up costs

- information about and assistance to access capital

- training on budgeting, financial management, marketing, business operation and sales

Job Creation Partnership (JCP) study

The design and delivery of JCP allows provinces and territories to address a variety of barriers to employment experienced by their citizens (such as, lack of work experience). Provinces and territories can use the program to address various labour market needs by targeting sub-groups of individuals, professions or economic sectors in demand and communities.

In addition to gaining work experience, key informants expect participants to develop work-related skills and to enhance their career development, job search abilities, and to improve their personal well-being. Project holders can benefit from the program through increased capacity, implementing their projects, and increasing their presence within local communities.

For employers that provide work experience to trained participants, benefits are mostly associated with gaining a source of trained employees. At the community level, projects support the local economy and provide new assets (such as, restored buildings or hiking trails) or services (such as, support for newcomers).

Labour Market Partnerships study

The Labour Market Partnerships program(s) aim to assist employers, communities and/or industries to address their labour force adjustments and human resource needs. Funded projects target current and/or forecasted skills and/or labour shortages. These projects also target specific unemployed populations (for example, women, youth, Indigenous peoples, newcomers, persons with disabilities and the self-employed).

All participating provinces and territories confirm that program officials carried out activities to support the formation and maintenance of partnerships. Provincial and territorial departments and key informants explained that partners’ expertise, network and financial contribution are all essential to project implementation and success.

Research and Innovation study

The Research and Innovation support measure provides funding to provinces and territories for research and demonstration projects. These projects aim to identify better ways of helping individuals prepare for, return to, or keep employment and to be productive in the labour force.

The document review reveals that Research and Innovation projects encompassed a variety of activities including:

- developing and/or testing new approaches to improve employment outcomes for clients with some projects also focusing on persons with disabilities, youth, Indigenous, and other demographic groups

- strengthening service delivery

- improving learning and post-secondary education with a focus on expanding online course delivery

- funding for cost-sharing of internships, temporary work placements, or training

- delivering career fairs or career/employment information presentations

- research

Provincial/territorial questionnaires reveal factors contributing to successful testing and identification of innovative approaches, including:

- project holders:

- employing experienced staff

- possessing organizational structure and financial reporting capacity

- having strong commitment from partners

- providing detailed cost estimates as part of their project proposals

- projects that have:

- a clear plan with measurable outcomes

- continuous project application intake to address on-going and emerging labour market issues

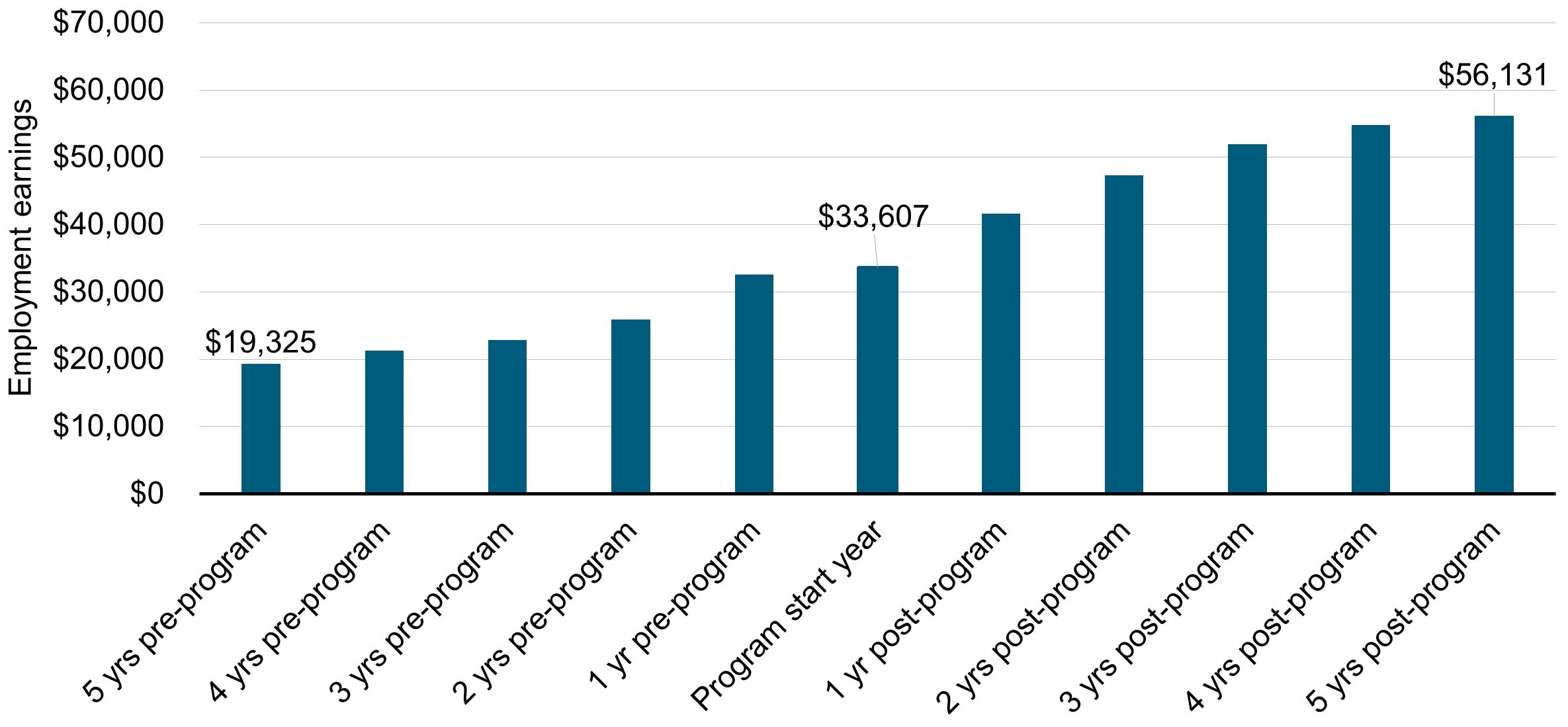

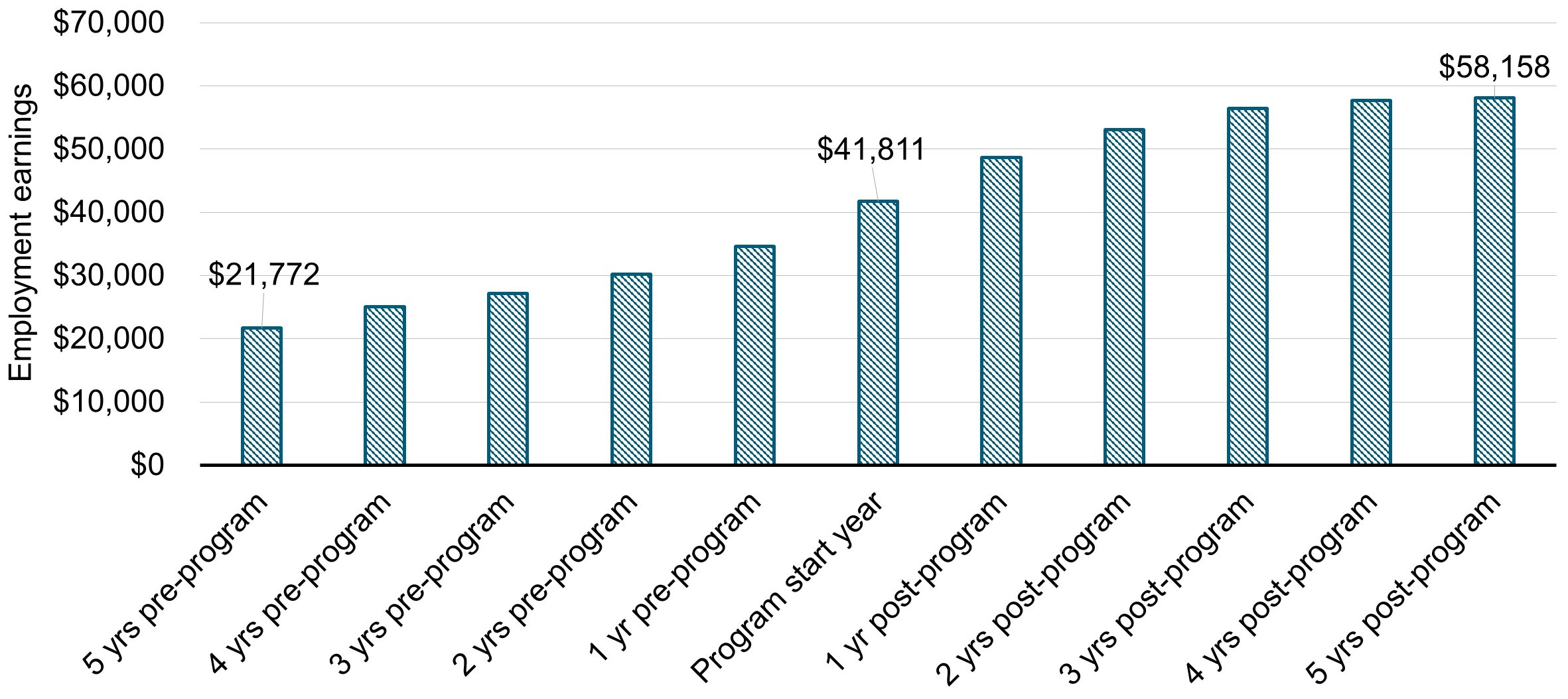

Skills Development-Apprentices study

The objective of the program is to help apprentices become skilled tradespeople and to increase their labour market attachment. Program participants have generally chosen a career and are already attached to the labour market. The apprenticeship process involves on-the-job learning and technical training in a classroom setting.

The evaluation found that active EI claimants increased their average earnings from $19,325 in the fifth year pre-program to $56,131 in the fifth year after the program start year. Former EI claimants increased their average earnings from $21,772 in the fifth year pre-program to $58,158 in the fifth year after the program start year. After participating in the program, both active and former claimants also decreased their dependence on government income supports.

Recommendations

Since 2012, 15 qualitative and quantitative studies addressed issues and questions related to EBSM design, delivery and effectiveness. The quantitative studies successfully assessed the effectiveness and efficiency of EBSMs by producing incremental impacts and cost-benefit analysis. The qualitative studies help to contextualize the findings from the quantitative studies and to identify specific challenges, lessons learned and best practices associated with the design and delivery of EBSMs. Each study included key considerations for program and policy development or recommendations.

In addition, the recently completed evaluation of the Workforce Development Agreements complements the LMDA qualitative studies. This comprehensive evaluation provided unique insights into challenges and lessons learned to assist persons with disabilities, immigrants and those further removed from the labour market.

Most results from this evaluation stem from the conduct of advance causal analysis whereby impacts found could be attributed to a specific EBSM. These analyses are predicated on having access to high quality administrative records, thereby confirming the importance of the capacity to leverage and integrate relevant administrative data.

From these main findings, 2 key recommendations emerge:

Recommendation #1: ESDC and provinces/territories are encouraged to share and discuss lessons learned, best practices and challenges associated with the design and delivery of EI-funded provincial/territorial programming. Discussions are encouraged at the bilateral or multilateral levels as well as with service delivery network if necessary.

Recommendation #2: ESDC and provinces/territories are encouraged to pursue efforts to maintain and strengthen data collection provisions in support of reporting, performance measurement and data-driven evaluations at the national and provincial/territorial levels. To that regard, ESDC should:

- continue to prioritize data integrity, including validating data uploads and documenting changes over time

- explore ways of accessing data on social assistance, unsuccessful EI applicants, and immigration and citizenship, in light of expanded eligibility to the LMDAs beyond active and former EI claimants

Management response and action plan

Overall management response

ESDC would like to thank all members of the Labour Market Development Agreements (LMDA) Evaluation Steering Committee for their valuable contributions to the evaluation of the LMDAs.

Recommendation #1

ESDC and provinces/territories are encouraged to share and discuss lessons learned, best practices and challenges associated with the design and delivery of EI-funded provincial/territorial programming. Discussions are encouraged at the bilateral or multilateral levels as well as with service delivery network if necessary.

Management response

As the evaluation demonstrates, participation in most LMDA programs similar to Employment Benefit and Support Measures (EBSMs) improves labour market attachment and reduces dependence on government income supports compared to similar non-participants. For example, a survey conducted after program participation in the Self-Employment program demonstrates that participants increased their employment levels from 59% to 74%. EI claimants who participated in Skills Development activities while collecting EI benefits reduced their use of EI benefits and had higher annual earnings ($2,508 higher on average) than those who did not take training.

To identify further opportunities to enhance participant outcomes under the LMDAs, ESDC will encourage discussions with provinces and territories on the lessons learned, best practices and challenges associated with the design and delivery of programs similar to EBSMs through existing bilateral and multilateral forums.

Management action plan

The Skills and Employment Branch, ESDC, will explore opportunities through existing bilateral and multilateral forums to discuss with provinces and territories the lessons learned, best practices and challenges associated with the design and delivery of programs similar to EBSMs.

Completion Date: April 1, 2024

Recommendation #2

ESDC and provinces/territories are encouraged to pursue efforts to maintain and strengthen data collection provisions in support of reporting, performance measurement and data-driven evaluations at the national and provincial/territorial levels. To that regard, ESDC should:

- continue to prioritize data integrity, including validating data uploads and documenting changes over time

- explore ways of accessing data on social assistance, unsuccessful EI applicants, and immigration and citizenship, in light of expanded eligibility to the LMDAs beyond active and former EI claimants

Management response

ESDC will explore opportunities to engage with provinces and territories on performance measurement and evaluation in order to improve reporting and better demonstrate results for Canadians.

Management action plan

2.1 The Skills and Employment Branch, ESDC, will engage with provinces and territories to develop an approach to strengthen data integrity and reporting to Canada, which will help ensure a continuous monitoring of trends.

Completion Date: April 1, 2024

2.2. ESDC will continue to support efforts led by Strategic and Service Policy Branch, to explore possible data development options aiming to improve, refine and allow more flexibilities for upcoming policy analysis, research and evaluations activities.

Completion Date: September, 2024

Introduction

Employment and Social Development Canada (ESDC) worked jointly with 12 provinces and territories to undertake the 2018 to 2023 third cycle for the Labour Market Development Agreement (LMDA) evaluations.

The first cycle of LMDA evaluations was carried out from 1998 to 2012. It involved the conduct of separate formative and summative evaluations in all provinces and territories under the guidance of bilateral Joint Evaluation Committees.

Building on lessons learned and best practices from the first cycle, the second cycle of LMDA evaluations was undertaken between 2012 and 2017. The second cycle was designed and implemented under the guidance of a federal-provincial/territorial LMDA Evaluation Steering Committee.Footnote 5 The work was supported by bilateral discussions at Joint Evaluation Committees.

Under the second cycle, studies generated evaluation evidence on the effectiveness, efficiency and design and delivery of Employment Benefits and Support Measures (EBSMs). Findings and conclusions from up to 9 studies were summarized in 1 national and 12 bilateral reports for public release.

The third LMDA evaluation cycle builds on the success of the second cycle. The aim is to fill in knowledge gaps about the effectiveness, efficiency, and design and delivery of EBSMs. The evaluation cycle was designed and implemented under the guidance of a federal-provincial/territorial LMDA Evaluation Steering Committee composed of ESDC and 12 participating provinces and territories.Footnote 6

This report presents a summary of the third cycle evaluation findings from 9 studies.Footnote 7

Labour Market Development Agreements

The LMDAs are bilateral agreements between Canada and each province and territory for the design and delivery of EBSM programs and services. They were established under Part II of the 1996 Employment Insurance (EI) Act.

In fiscal year 2020 to 2021, Canada transferred nearly $2.5 billion (including nearly $186.6 million in administration funds) to provinces and territories.Footnote 8 Each province and territory is responsible for the design and delivery of programs and services aimed at assisting individuals to prepare for, obtain, and maintain employment.

As of February 2010, the delivery of EBSMs became fully devolved to all provinces and territories. Table 1 provides the key dates related to the LMDAs’ devolution and recent LMDA expenditures by jurisdiction.

| Province / Territory | Devolution date | 2018 to 2019 | 2019 to 2020 | 2020 to 2021 |

|---|---|---|---|---|

| British Columbia | February 2, 2009 | $320,325,994 | $321,242,200 | $324,175,000 |

| Alberta | November 1, 1997 | $166,560,149 | $174,226,603 | $192,380,000 |

| Saskatchewan | January 1, 1999 | $48,105,020 | $ 50,028,901 | $54,371,000 |

| Manitoba | November 27, 1997 | $55,820,088 | $56,883,703 | $61,704,000 |

| Ontario | January 1, 2007 | $700,423,363 | $707,753,826 | $741,361,740 |

| Quebec | April 1, 1998 | $688,104,016 | $688,291,329 | $706,505,000 |

| Newfoundland & Labrador | November 2, 2009 | $142,334,176 | $145,579,812 | $150,306,000 |

| Nova Scotia | July 1, 2009 | $96,166,239 | $ 97,991,656 | $101,182,000 |

| New Brunswick | April 1, 1997 | $107,078,366 | $107,755,844 | $111,497,000 |

| Prince Edward Island | October 5, 2009 | $28,965,942 | $29,050,151 | $29,755,000 |

| Nunavut | April 1, 2000 | $3,769,642 | $ 3,799,455 | $3,954,000 |

| Northwest Territories | October 1, 1998 | $4,705,577 | $4,699,339 | $4,766,000 |

| Yukon | February 1, 2010 | $4,397,899 | $ 4,453,652 | $4,669,000 |

| Total | n/a | $2,366,756,471 | $2,391,756,471 | $2,486,625,740 |

Source: EI Monitoring and Assessment Reports (2018 to 2019, 2019 to 2020, and 2020 to 2021).

LMDA programs and services are classified under 2 categories:

- Employment benefitsFootnote 9,Footnote 10 fall into 5 sub-categories:

- Skills Development

- Targeted Wage Subsidies

- Self-Employment

- Job Creation Partnerships

- Targeted Earnings SupplementsFootnote 11

- Support measures fall into 3 sub-categories:

- Employment Assistance ServicesFootnote 12

- Labour Market Partnerships

- Research and Innovation

Provinces and territories have the flexibility to adapt EBSMs to their jurisdiction’s context as long as they are consistent with Part II of the EI Act.Footnote 13

The objective of EBSMs is to assist individuals to obtain or keep employment through various active employment programs, including training or employment assistance services. Successful delivery of EBSMs is expected to result in participants receiving needed services, a quick return to work, and savings to the EI account.

Programs and services examined in this study include:

Employment benefits

Skills Development (SD) provides direct financial assistance to individuals to select, arrange, and pay for training. Training is tailored to the needs of participants through counselling and career orientation, and averages 48.5 weeks. It can include adult-based education, literacy and essential skills, language training, short-term training and occupational training leading to certification from an accredited institution.

Targeted Wage Subsidies (TWS) subsidize the wages of individuals whom employers would not ordinarily hire. Subsidies range in duration from 16 to 52 weeks, with the maximum level ranging from 50% to 100% of the employee’s wage.

Job Creation Partnerships (JCP) support community-oriented projects that provide work experience to participants. Participants can take part in a finite project for up to 52 weeks.

Self-Employment provides financial assistance and business planning advice to participants to help them start their own business.

Support measures

Employment Assistance Services (EAS) support individuals as they prepare to enter or re-enter the workforce or assist them to find a better job. Services include job search services, career development and counselling, and résumé writing assistance. These services are light touch interventions due to their very short duration, and can be provided on a one-on-one basis or in a group setting. A typical intervention lasts less than 1 day, but a participant may receive multiple short interventions over a few weeks. These services are generally provided in combination with more intensive interventions.

Labour Market Partnerships seek to deal with labour force adjustments and meet human resources requirements. They enable employers, employee or employer associations, community groups, and communities to work together to develop or implement strategies.

Research and Innovation initiatives seek to identify better ways of helping people prepare for, return to or keep employment, and be productive participants in the labour force.

Eligible participants covered in this study

The incremental impacts are estimated for active and former EI claimants:

- active claimants are participants who started an EBSM intervention while collecting EI benefits

- former claimants are participants who started an EBSM intervention up to 3 years after the end of their EI benefitsFootnote 14

Table 2 provides an overview of the share of funding allocated to EBSMs and the average cost per participant. It is noted that the average cost per participant is calculated based on the 2010 to 2012 data from the EI Monitoring and Assessment Reports. The 2010 to 2012 period corresponds with the cohort of participants selected for incremental impacts and cost-benefit analysis in the LMDA evaluation.

From the 2010 to 2012 time period to the 2020 to 2021 fiscal year, investments in SD decreased by 13 percentage points and those in Self-Employment decreased by 4 percentage points. The largest increases in funding are noted for Research and Innovation (+9 percentage points) and Labour Market Partnerships (+5 percentage points).

| Employment Benefits and Support Measures | Share of funding (2010 to 2012 years) | Share of funding (year 2020 to 2021) | Average cost – active claimants (2010 to 2012) | Average cost – former claimants (2010 to 2012) |

|---|---|---|---|---|

| Skills Development | 52% | 39% | $10,193 | $10,052 |

| Employment Assistance Services | 30% | 31% | $826 | $826 |

| Labour Market Partnerships | 7% | 12% | n/a | n/a |

| Self-Employment | 6% | 2% | $15,551 | $15,833 |

| Targeted Wage Subsidies | 3% | 5% | $7,538 | $7,384 |

| Job Creation Partnerships | 2% | 2% | $11,750 | $10,940 |

| Research and Innovation | <1% | 10% | n/a | n/a |

Sources: EI Monitoring and Assessment Reports for fiscal years 2010 to 2011, 2011 to 2012 and 2020 to 2021.

Methodology

This section presents key aspects of the quantitative analyses carried out as part of the LMDA studies.

All quantitative analyses are based on administrative data from the EI Part I (EI claim data) and Part II (EBSM participation data). The EI Part I and II data are then linked to the T1 and T4 taxation files from the Canada Revenue Agency. Incremental impact and cost-benefit analyses are based on up to 100% of participants who began their EBSM participation in 2010 to 2012.

The 2010 to 2012 timeframe was selected in order to assess the impacts of EBSMs in the years following participation. Impacts were assessed over a period of at least 4 years after program completion up to the 2017 calendar year (most recent available information at the time of this evaluation).

Incremental impacts analysisFootnote 17

Program effectiveness is assessed by estimating incremental impacts from EBSM participation on participants’ labour market experience. That is, earnings from employment and self-employment, incidence of employment, use of EI, use of Social Assistance (SA), and dependence on government income supports after participation.

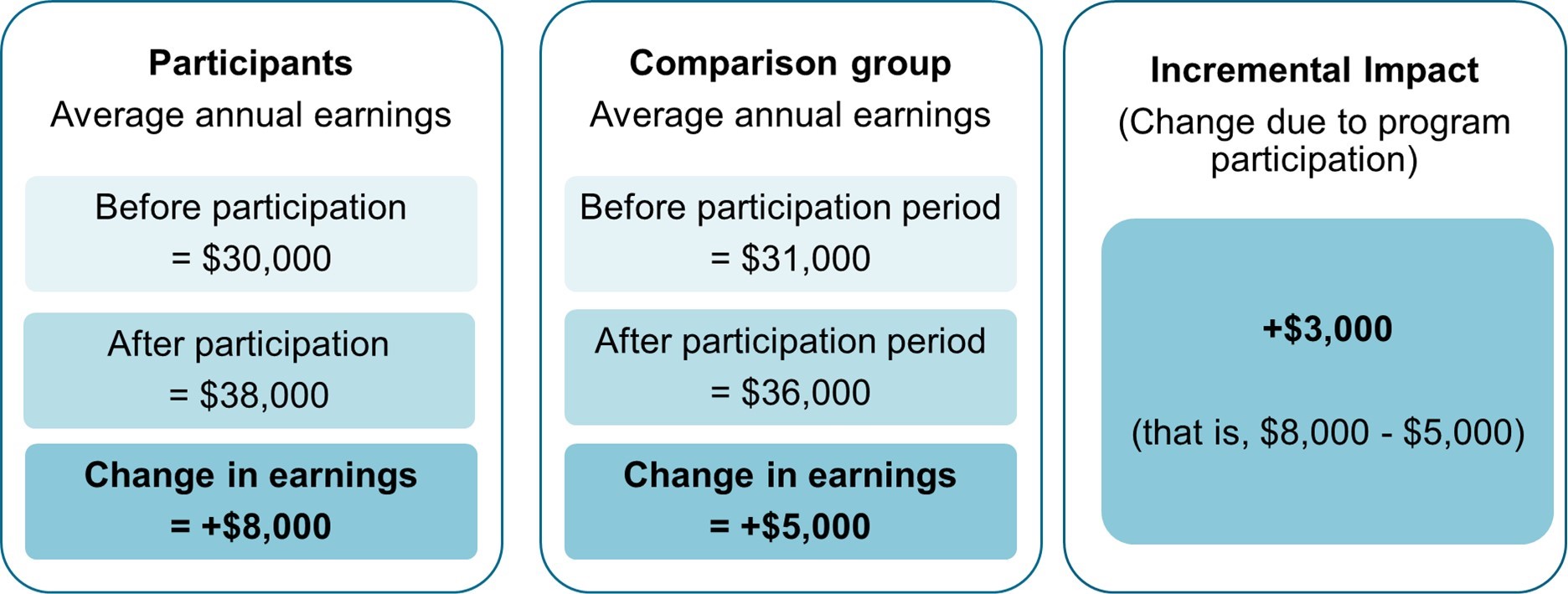

The role of the incremental impact analysis is to isolate the effects of participation from other factors. In order to achieve this, the incremental impact analysis compares the labour market experience of participants before and after their participation with that of similar non-participants. Figure1 presents an example of incremental impact calculation.

Text description – Figure 1

Incremental impacts are the difference in the pre-post participation outcomes between participants and similar non-participants.

For example:

- if the average annual earnings of participants are $30,000 before participation and $38,000 after participation, the change in earning for participants is an increase of $8,000

- if the average annual earnings in the comparison group are $31,000 before participation and $36,000 after participation, the change in earnings for the comparison group is an increase of $5,000

- the incremental impact, that is the change attributed to program participation, is $8,000 minus $5,000, which equals an increase of $3,000

The main estimator used is propensity score kernel matching technique combined with difference-in-differences estimator. Moreover, 3 different state-of-the-art estimation techniques (Inverse Probability Weighting, Nearest Neighbour and Cross-sectional Matching) were carried out separately for each type of EBSMs and EI claimants in order to validate the impact estimates.

As for previous LMDA evaluation studies, the Action Plan Equivalent is the unit of analysis used. Action Plan Equivalents regroup all EBSMs received by an individual within less than 6 months between the end of one EBSM and the start of the next. Action Plan Equivalents are categorized based on the longest EBSM they contain, except for EAS-only Action Plan Equivalents which include only EAS interventions.

The analysis includes Action Plan Equivalents that consist only of LMDA interventions. Action Plan Equivalents that include a combination of LMDA and other labour market programs funded by ESDC, were excluded from the participant sample.

The matching of participants and comparison group members used up to 75 socio-demographic and labour market variables observed over 5 years before participation. Two different comparison groups were used to measure impacts for active and former EI claimants.

For active claimants, incremental impacts were measured relative to a comparison group of active claimants who were eligible to, but did not, participate in EBSMs during the reference period.

For former claimants, the comparison group was created using individuals who participated in EAS only during the reference period.Footnote 18 In other words, the experience of former claimants in SD, TWS, or JCP interventions is compared to the experience of former claimants who received EAS only. This is a conservative approach given the fact that participation in EAS can lead to limited effects on labour market outcomes.

Due to this difference in measurement, incremental impacts estimated for active claimant participants should not be directly compared to those of former claimant participants.

Impacts are generated over 4 years for SD, JCP and TWS, while a fifth year is estimated for participants in EAS.Footnote 19

Factors accounted for in the cost-benefit analysisFootnote 20,Footnote 21

Building on the results of the incremental impacts, program efficiency is assessed through a cost-benefit analysis. The analysis compares the participants’ cost of participating and the government’s cost of delivering the program to the benefits associated with the program. Overall, this analysis provides insights on the extent to which the program is efficient for society (that is, for both participants and the government).

Sources of data and information

The analysis takes into account all the quantifiable costs and benefits directly related to EBSM delivery and participation that can be measured given the information available. The analysis is comprehensive in that it accounts for the vast majority of possible direct costs and benefits.

However, the analysis does not account for all costs and benefits. For example, there are factors that can lead to an understatement of the benefits (for example, positive spillovers to other family members) and other factors that can lead to an overstatement of the benefits (for example, effects on skill prices or displacement).

This study relied on integrated data from the EI Part I and II Databank and Income Tax records from the Canada Revenue Agency. Information about earnings, use of EI, and use of social assistance was taken from the study of incremental impacts.Footnote 22 The program costs were calculated using information available in the EI Monitoring and Assessment Reports.

Relative to the previous cycle of evaluation, the methodology has been extended to incorporate one of the indirect health benefits associated with increased labour market attachment. In particular, the methodology includes an estimate of the change in public health care cost due to the decline in health care utilization resulting from program participation.

Data on average public healthcare costs by income quintiles are taken from the report Lifetime Distributional Effects of Publicly Financed Health Care in Canada (2013) by the Canadian Institute for Health Information.

Program costs are measured using information on LMDA expenditures and new interventions reported in the EI Monitoring and Assessment Reports. Other costs and benefits are assessed using integrated administrative data from the EI Part I and II databank and the Canada Revenue Agency.

Incremental impacts measured over the second year of participation and up to 5 post-program years are discounted by 3% to bring them to a common base with the program cost and benefits incurred in the program start year. This 3% rate accounts for the interest the government could have collected if the funds used to pay for the program had been invested. Incremental impacts are estimated using 2010 constant dollars and this accounts for inflation.

The costs and benefits accounted for in the calculations

Program costs: costs incurred by the government for delivering the program (that is, administration and direct program costs calculated from data reported in the EI Monitoring and Assessment Reports).

Marginal social cost of public funds: loss incurred by society when raising additional revenues such as taxes to fund government spending. The value is estimated at 20% of the program cost, sales taxes, income taxes, impacts on EI and impacts on SA paid or collected by the government.

Foregone earnings: estimated net impacts on participants’ earnings during the participation period. During labour market program participation, some individuals have lower earnings than what they would have received if they had not participated.

Employment earnings: incremental impacts on participants’ earnings during and after participation. In-program earnings represent the foregone earnings for participants.

Fringe benefits: the employer-paid health and life insurance as well as pension contributions. They are estimated at 15% of the incremental impacts on earnings.

Federal and provincial income taxes: incremental impacts on federal, provincial and territorial taxes paid by participants.

Sales taxes: the sales taxes paid by participants estimated as incremental impacts on earnings multiplied by the propensity to consume (97%), the proportion of household spending on taxable goods and services (52%) and the total average federal and provincial sales tax rate (11%).

Social assistance and Employment Insurance benefits collected: incremental impacts on SA and EI benefits use by participants following participation.

Canada Pension Plan and Quebec Pension Plan contribution and EI premiums: these contributions and premiums were identified from the Canada Revenue Agency data and then, the incremental impacts on Canada Pension Plan and Quebec Pension Plan contributions and EI premiums were estimated.

Public health care costs: estimated impact of participation in EBSMs on public health care costs shown as an average change per participant over the post-program period examined.

Strengths and limitations of the studies

One of the key strengths from the studies is that all quantitative analyses are based on administrative data rather than survey responses. Compared to survey data, administrative data are not subject to recall errors or response bias.

The propensity score models used to match participants and non-participants for the incremental impact analyses are judged to be robust. In part, this is because they were based on 5 years of pre-participation data. Moreover, these models are based on a vast array of variables including sociodemographic characteristics, location, skill level related to last occupation, and indicators of labour market attachment.

However, the matching process can be further refined for specific subgroups if the following information is available in the future:

- persons with disabilities: the type and severity of the disability, and the capacity/willingness to work full-time

- recent immigrants: the country of origin, the proficiency in English or French, and the relevance of credentials and work experience

- visible minorities: place of birth; individuals who are born outside of Canada face different challenges compared to those born in Canada

Refining the matching process for population subgroups could broaden the scope for greater Gender-based Analysis Plus.

Sensitivity analysis and the use of alternative estimation methods have increased confidence in the incremental impact estimates. However, one limitation with the propensity score matching techniques is that no one can be fully sure the impacts are not influenced by factors not captured in the data.

The cost-benefit analysis accounted for all quantifiable costs and benefits directly attributable to the EBSMs and could be estimated with the available administrative data. It is furthered strengthened by incorporating one of the indirect benefits, which is the change in public health care expenditures associated with program participation. However, the analysis did not account for non-quantifiable factors that can lead to an understatement of the benefits (for example, positive spillovers to other family members) and factors that can lead to an overstatement of the benefits (for example, effects on skill prices or displacement).

In some studies that use qualitative data collection methods, the number of key informants interviewed is relatively small in some provinces and territories. Responses provided by key informants reflect their own experience and their own region, and may not be fully representative of the entire province and territory.

Overview of the studies summarized in this report

The findings in this report are drawn from 9 separate studies carried out at the national level. These studies examine issues related to program effectiveness, efficiency, design/delivery and used a mix of qualitative and quantitative methods. Appendix B presents an overview of these studies. The studies are:

- Examination of the medium-term outcomes from 2010 to 2017

- Estimation of the medium-terms incremental impacts from 2010 to 2017

- Cost-benefit analysis of Employment Benefits and Support Measures

- Cost-Benefit Analysis: Incorporating Public Health Care Costs Savings in the Context of the Labour Market Programs Evaluation

- Heterogeneity of treatment effects

- Design and delivery of the Job Creation Partnerships program

- Design and delivery of the self-employment program

- Design and delivery of the Labour Market Partnerships program

- Design and delivery of the Research and Innovation support measure

Evaluation findings

Profile of participants

Across Canada, nearly 609,000 EI active and former claimants participated in LMDA programs and services between 2010 and 2012. The profile of participants is presented in Table 3.

The profile of participants is presented in Table 3 by gender, age, sociodemographic group, and marital status. Information about their educational attainment, occupation and industry is based on the latest job they held prior to applying for EI benefits. Information about sociodemographic groups is self-reported.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 367,964 | 240,857 |

| Gender: Female | 49% | 50% |

| Gender: Male | 51% | 50% |

| Age: 30 and under | 27% | 31% |

| Age: 31 to 54 | 59% | 58% |

| Age: 55 and over | 14% | 12% |

| Sociodemographic group: Indigenous | 4% | 8% |

| Sociodemographic group: Person with disability | 5% | 8% |

| Sociodemographic group: Visible minority | 5% | 6% |

| Sociodemographic group: Recent immigrant | 4% | 4% |

| Marital status: Married or common-law | 43% | 34% |

| Marital status: Widow / divorced / separated | 13% | 14% |

| Marital status: Single | 41% | 46% |

| Education or skills level: High school or occupational training | 39% | 39% |

| Education or skills level: On-the-job training | 23% | 27% |

| Education or skills level: College, vocational education or apprenticeship training | 28% | 25% |

| Education or skills level: University degree | 5% | 4% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for EBSMs participants

Active claimants:

- semi-skilled manual workers =14%

- clerical personnel =14%

- other manual workers =13%

Former claimants:

- other manual workers =14%

- semi-skilled manual workers =14%

- clerical personnel =12%

Top 3 industries for EBSMs participants

Active claimants:

- manufacturing = 15%

- retail trade = 11%

- construction = 10%

Former claimants:

- manufacturing = 14%

- retail trade = 12%

- administrative and support, waste management and remediation services = 11%

As presented in Table 4, in the year before program participation, former claimants have lower levels of employment and earnings than active claimants. Former claimants also have a higher dependence on SA.

| Pre-EBSM participation employment characteristics | Active claimants | Former claimants |

|---|---|---|

| Average employment earnings | $24,910 | $12,547 |

| Percentage employed | 99% | 82% |

| Percentage on SA | 6% | 19% |

Incremental impacts for active and former EI claimants

The incremental impact results presented below are generally consistent with those found as part of the second LMDA evaluation cycle.

Incidence of employment

Chart 1 presents the incremental impacts on the incidence of employmentFootnote 23 for active and former claimants by type of program. The estimates can be interpreted as a change in the probability of being employed following participation.

Active claimants in SD, TWS and JCP increase their incidence of employment relative to similar non-participants. Former claimants in SD, TWS and JCP increase their incidence of employment relative to similar participants who receive only EAS.

Active claimants in EAS-only experience a small positive, but not statistically significant, impact on their incidence of employment. EAS are relatively modest activities such as counselling, job search assistance and case management, which focus on quicker returns to work for participants. EAS supports that are not provided with longer interventions, are not expected to increase participants’ skills or influence their employment levels to a large extent.

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart 1

| Program name | Incidence of employment for active claimants (percentage points) | Incidence of employment for former claimants (percentage points) |

|---|---|---|

| Skills Development | 4.0 | 2.5 |

| Employment Assistance Services | 0.3* | n/a |

| Targeted Wage Subsidies | 3.8 | 6.2 |

| Job Creation Partnerships | 4.8 | 2.5 |

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Employment earnings

Chart 2 presents the average annual increase in employment earnings for active and former EI claimants over the 4 years post-participation. Active EI claimants in SD, TWS, JCP, and EAS increase their employment earnings compared to similar non-participants.

Former EI claimants in SD and TWS increase their employment earnings relative to similar participants who receive only EAS services. Former claimants in JCP have lower employment earnings compared to similar participants in only EAS services.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart 2

| Program name | Employment earnings of active claimants | Employment earnings of former claimants |

|---|---|---|

| Skills Development | $2,508 | $768 |

| Employment Assistance Services | $376 | n/a |

| Targeted Wage Subsidies | $1,648 | $1,945 |

| Job Creation Partnerships | $1,208 | -$1,102 |

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

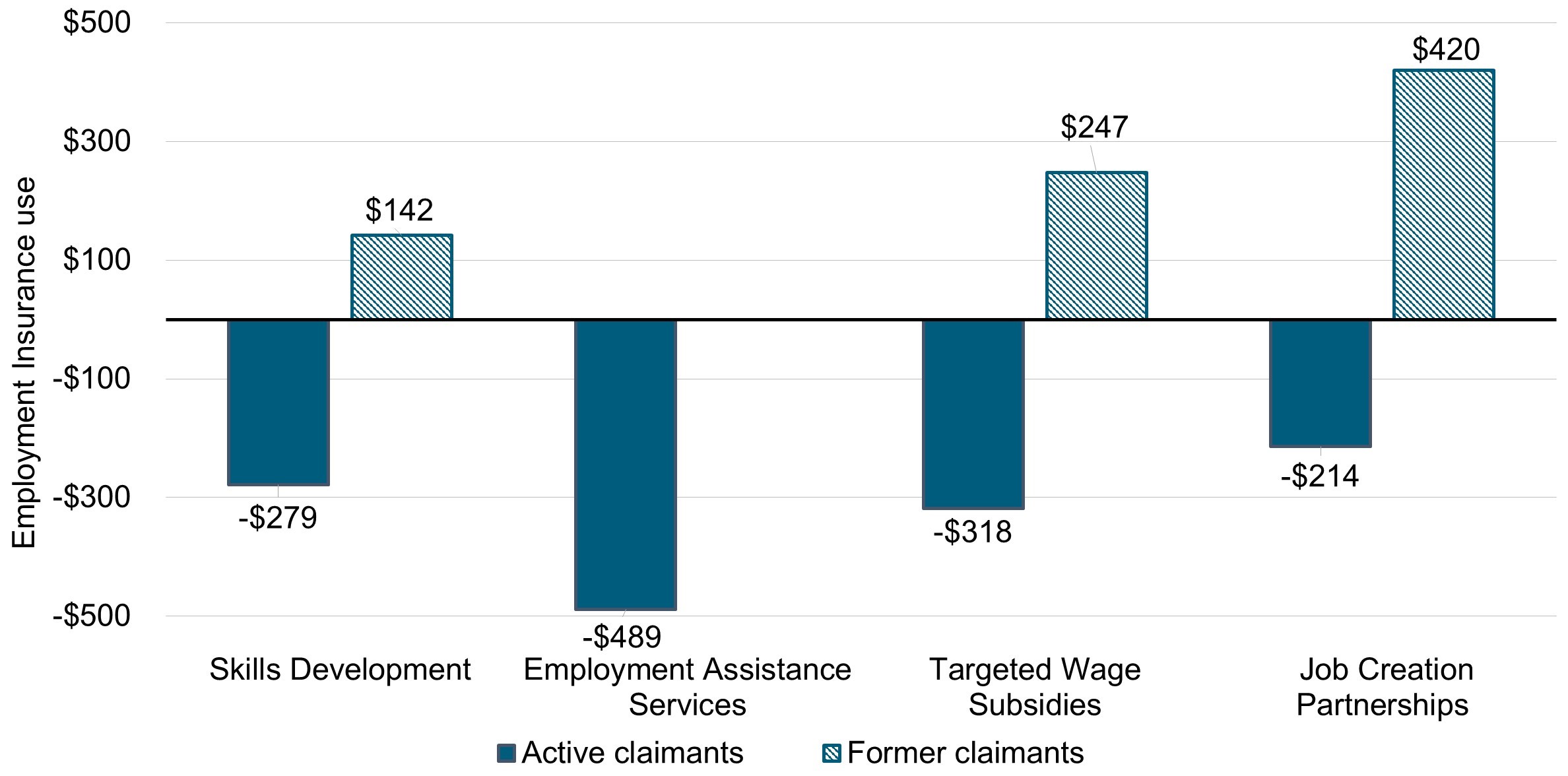

Use of EI benefits

As shown in Chart 3, active claimants reduce their use of EI benefits in the post-program period compared to similar non-participants. In the post-program period, former claimants in SD, TWS and JCP increase their EI benefits use relative to similar participants who receive EAS services only.

In the case of SD and TWS, the increase in the use of EI by former claimants is consistent with previous evaluations and is not necessarily a negative impact. Following participation, former claimants are likely to requalify for EI benefits due to their stronger labour market attachment demonstrated by increases in their incidence of employment and earnings.

The increase in the use of EI for former claimants in JCP is a negative impact given the decrease in employment earnings. Therefore, for former EI claimants, this intervention will not be effective from a cost-benefit perspective. However, the supplemental study for JCP confirmed that the program has added value for participants, employers, and communities that cannot be taken into account.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart 3

| Program name | Use of EI benefits for active claimants | Use of EI benefits for former claimants |

|---|---|---|

| Skills Development | -$279 | $142 |

| Employment Assistance Services | -$489 | n/a |

| Targeted Wage Subsidies | -$318 | $247 |

| Job Creation Partnerships | -$214 | $420 |

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

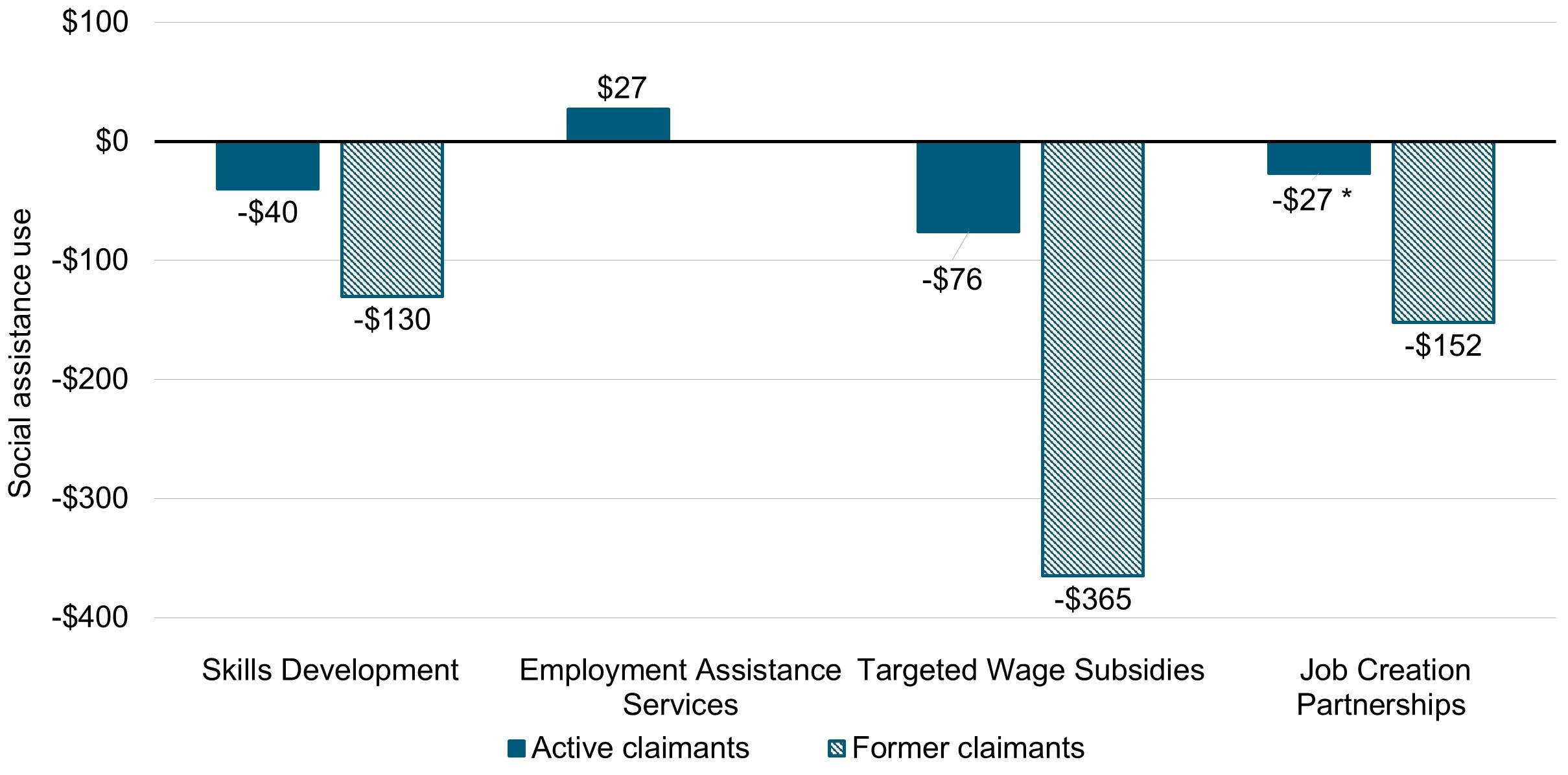

Use of social assistance (SA) benefits

As shown in Chart 4, most active and former EI claimant participants decrease their use of SA benefits in the post-program period.

Active EI claimants in SD and TWS decrease their use of SA benefits in the post-program period compared to similar non-participants. Active EI claimants in EAS services experience a small increase in the use of SA benefits compared to similar non-participants.Footnote 24

Former EI claimants in SD, TWS and JCP decrease their use of SA benefits compared to similar participants in only EAS services.

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart 4

| Program name | Use of SA benefits for active claimants | Use of SA benefits for former claimants |

|---|---|---|

| Skills Development | -$40 | -$130 |

| Employment Assistance Services | $27 | n/a |

| Targeted Wage Subsidies | -$76 | -$365 |

| Job Creation Partnerships | -$27* | -$152 |

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Dependence on income support

As shown in Chart 5, overall active and former claimants reduce their dependence on government income supports.

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Text description – Chart 5

| Program name | Dependence on government income support for active claimants (percentage points) | Dependence on government income support for former claimants (percentage points) |

|---|---|---|

| Skills Development | -1.8 | -1.0 |

| Employment Assistance Services | -2.1 | n/a |

| Targeted Wage Subsidies | -2.5 | -3.1 |

| Job Creation Partnerships | -0.5* | -1.6 |

*The impact is non-statistically significant, however, it is still valid in terms of informing the direction of the impact (negative or positive).

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Incremental impacts by subgroups of participants

Female participants

Nearly 300,350 EI active and former claimant participants in LMDA programs and services, between 2010 and 2012 are female, representing nearly 49% of participants.

The profile of female participants is presented in Table 5 by age, sociodemographic group, and marital status. Information about their educational attainment, occupation and industry is based on the latest job they held prior to applying for EI benefits. Information about sociodemographic groups is self-reported.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 179,882 | 120,469 |

| Age: 30 and under | 24% | 30% |

| Age: 31 to 54 | 62% | 59% |

| Age: 55 and over | 14% | 11% |

| Sociodemographic group: Indigenous individual | 4% | 8% |

| Sociodemographic group: Person with disability | 5% | 7% |

| Sociodemographic group: Visible minority | 4% | 6% |

| Sociodemographic group: Recent immigrant | 4% | 4% |

| Marital status: Married or common-law | 43% | 38% |

| Marital status: Widow / divorced / separated | 17% | 18% |

| Marital status: Single | 37% | 41% |

| Education or skills level: High school or occupational training | 44% | 44% |

| Education or skills level: On-the-job training | 18% | 22% |

| Education or skills level: College, vocational education or apprenticeship training | 25% | 22% |

| Education or skills level: University degree | 6% | 5% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for female participants

Active claimants:

- clerical personnel = 20%

- intermediate sales and service personnel = 17%

- other sales and service professionals = 11%

Former claimants:

- intermediate sales and service personnel = 20%

- clerical personnel = 18%

- other sales and service professionals = 15%

Top 3 industries for female participants

Active claimants:

- retail trade = 13%

- manufacturing = 11%

- healthcare and SA = 10%

Former claimants:

- retail trade = 15%

- accommodation and food services = 12%

- healthcare and SA = 10%

Main findings: Female participants improve their labour market attachment through increases in their incidence of employment and earnings. Excluding JCP, participants also decrease their dependence on government income supports. While female former claimants increase their use of EI benefits irrespective of the program received, only JCP participants saw an increase in their dependence on government income supports.

Table 6 presents the detailed incremental impacts.

For example, the results reveal that relative to similar non-participants female active claimants in SD have higher annual earnings (+$1,964 per year) and increase their incidence of employment (+4.7 percentage points). They also depend less on government income supports (-2.4 percentage points), by decreasing their use of EI (-$318 per year) and SA (-$75 per year) benefits.

Female former claimants in TWS increase their annual earnings (+$1,478 per year) and incidence of employment (+5.6 percentage points) compared to similar participants in EAS only. They also lower their reliance on government income supports (-2.3 percentage points), mostly by decreasing their use of SA benefits (-$344).

| Indicator | SD active claimants | SD former claimants | TWS active claimants | TWS former claimants | JCP active claimants | JCP former claimants | EAS active claimants |

|---|---|---|---|---|---|---|---|

| Incidence of employment (percentage points) | 4.7*** | 2.4*** | 5.4*** | 5.6*** | 6.6*** | 5.3*** | 1.4*** |

| Employment earnings ($) | 1,964*** | 679*** | 1,485*** | 1,478*** | 1,724*** | 614 | 605** |

| EI benefits ($) | -318*** | 113*** | -37 | 350*** | -26 | 635*** | -380*** |

| SA benefits ($) | -75*** | -130*** | -31 | -344*** | -21 | -236*** | 13 |

| Dependence on income support (percentage points) | -2.4*** | -1.0*** | -1.1*** | -2.3*** | 1.7** | 1.3 | -1.6*** |

| n= | 39,034 | 22,546 | 4,511 | 6,319 | 1,460 | 1,259 | 20,224 |

Statistical significance level *** 1%; ** 5%; * 10%, other values are non-statistically significant.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Male participants

Nearly 308,840 EI active and former claimant participants in LMDA programs and services between 2010 and 2012 are male, representing about 51% of participants.

The profile of male participants is presented in Table 7 by age, sociodemographic group, and marital status. Information about their educational attainment, occupation and industry is based on the latest job they held prior to applying for EI benefits. Information about sociodemographic groups is self-reported.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 188,280 | 120,563 |

| Age: 30 and under | 29% | 31% |

| Age: 31 to 54 | 57% | 56% |

| Age: 55 and over | 14% | 12% |

| Sociodemographic group: Indigenous individual | 5% | 9% |

| Sociodemographic group: Person with disability | 5% | 9% |

| Sociodemographic group: Visible minority | 4% | 5% |

| Sociodemographic group: Recent immigrant | 4% | 3% |

| Marital status: Married or common-law | 42% | 31% |

| Marital status: Widow / divorced / separated | 9% | 10% |

| Marital status: Single | 44% | 52% |

| Education or skills level: High school or occupational training | 33% | 33% |

| Education or skills level: On-the-job training | 27% | 31% |

| Education or skills level: College, vocational education or apprenticeship training | 31% | 29% |

| Education or skills level: University degree | 4% | 4% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for male participants

Active claimants:

- semi-skilled manual workers = 21%

- other manual workers = 19%

- skilled crafts and trades = 15%

Former claimants:

- semi-skilled manual workers = 21%

- other manual workers = 21%

- skilled crafts and trades = 15%

Top 3 industries for male participants

Active claimants:

- manufacturing = 18%

- construction = 16%

- administrative and support, waste management and remediation services = 10%

Former claimants:

- manufacturing = 19%

- construction = 16%

- administrative and support, waste management and remediation services = 11%

Main findings: Male participants in SD and TWS improve their labour market attachment through increases in their incidence of employment and employment earnings. They also decrease their dependence on government income support, that is, their combined use of EI and SA benefits. Mixed and non-statistically significant results are found for participants in JCP and EAS.

Table 8 presents the detailed incremental impacts.

For example, the results reveal that relative to similar participants in EAS only, male former claimants in SD have higher annual earnings (+$865 per year) and incidence of employment (+2.5 percentage points). They also depend less on government income supports (-0.9 percentage points), mostly by decreasing their use of SA benefits (-$128).

Male active claimants in TWS have higher annual earnings (+$1,657 per year) and incidence of employment (+3.9 percentage points) compared to similar non-participants. They also lower their income support reliance rate (-2.4 percentage points), by decreasing their use of EI benefits (-$379 per year).

| Indicator | SD active claimants | SD former claimants | TWS active claimants | TWS former claimants | JCP active claimants | JCP former claimants | EAS active claimants |

|---|---|---|---|---|---|---|---|

| Incidence of employment (percentage points) | 3.5*** | 2.5*** | 3.9*** | 6.7*** | 3.4*** | 0.6 | 0.1 |

| Employment earnings ($) | 3,291*** | 865*** | 1,657*** | 2,294*** | 832 | -4,068*** | 544 |

| EI benefits ($) | -224*** | 194*** | -379*** | 133*** | -55 | 284* | -448*** |

| SA benefits ($) | -48*** | -128*** | -51** | -395*** | -3 | -52 | 86*** |

| Dependence on income support (percentage points) | -2.1*** | -0.9*** | -2.4*** | -3.7*** | 0.6 | 2.1** | -1.4*** |

| n= | 44,052 | 20,273 | 4,999 | 7,495 | 1,095 | 1,261 | 20,697 |

Statistical significance level *** 1%; ** 5%; * 10%, other values are non-statistically significant.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Youth participants

Nearly 172,730 EI active and former claimant participants, between 2010 and 2012, were 30 years of age or younger when they began their program, representing about 28% of participants.

The profile of youth participants is presented in Table 9 by gender, sociodemographic group, and marital status. Information about their educational attainment, occupation and industry are based on the latest job they held prior to applying for EI benefits. Information about sociodemographic groups is self-reported.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 98,805 | 73,922 |

| Gender: Female | 44% | 49% |

| Gender: Male | 56% | 51% |

| Sociodemographic group: Indigenous individual | 5% | 9% |

| Sociodemographic group: Person with disability | 4% | 6% |

| Sociodemographic group: Visible minority | 3% | 4% |

| Sociodemographic group: Recent immigrant | 3% | 3% |

| Marital status: Married or common-law | 23% | 22% |

| Marital status: Widow / divorced / separated | 3% | 5% |

| Marital status: Single | 71% | 69% |

| Education or skills level: High school or occupational training | 36% | 38% |

| Education or skills level: On-the-job training | 28% | 33% |

| Education or skills level: College, vocational education or apprenticeship training | 27% | 24% |

| Education or skills level: University degree | 4% | 3% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for youth participants

Active claimants:

- other manual workers = 18%

- clerical personnel = 12%

- semi-skilled manual workers = 12%

Former claimants:

- other manual workers = 18%

- other sales and service professionals = 15%

- intermediate sales and service personnel = 14%

Top 3 industries for youth participants

Active claimants:

- construction = 14%

- retail trade = 13%

- manufacturing = 12%

Former claimants:

- retail trade = 15%

- manufacturing = 12%

- accommodation and food services = 12%

Main findings: Youth in SD and TWS improve their labour market attachment through increases in their incidence of employment and employment earnings. They also decrease their dependence on government income support (that is, the combined use of EI and SA benefits). Mixed and non-statistically significant results are found for participants in JCP and EAS.

Table 10 presents the detailed incremental impacts.

For example, the results reveal that relative to similar non-participants, youth active claimants in SD have higher annual earnings (+$1,887 per year) and incidence of employment (+1.9 percentage points). They also depend less on government income supports (-2.4 percentage points), by decreasing their use of EI (-$349 per year) and SA (-$150 per year) benefits.

Youth former claimants in TWS have higher annual earnings (+$2,122 per year) and incidence of employment (+5.1 percentage points) compared to similar participants in EAS only. They also lower their reliance on government income supports (- 3.3 percentage points), by decreasing their use of SA (- $409).

| Indicator | SD active claimants | SD former claimants | TWS active claimants | TWS former claimants | JCP active claimants | JCP former claimants | EAS active claimants |

|---|---|---|---|---|---|---|---|

| Incidence of employment (percentage points) | 1.9** | 2.9*** | 4.1*** | 5.1*** | -1.2 | 3.0*** | 0.1 |

| Employment earnings ($) | 1,887*** | 1,144*** | 2,345*** | 2,122*** | -1,857 | -911 | 218 |

| EI benefits ($) | -349*** | 209*** | -7 | 211*** | -284 | 463*** | -432*** |

| SA benefits ($) | -150*** | -140*** | -67* | -409*** | -188* | -171* | 46* |

| Dependence on income support (percentage points) | -2.4*** | -0.6* | -1.9*** | -3.3*** | -3.2* | 0 | -1.4*** |

| n= | 30,227 | 16,261 | 2,318 | 4,111 | 688 | 724 | 9,825 |

Statistical significance level *** 1%; ** 5%; * 10%, other values are non-statistically significant.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of EAS).

Older worker participants

Nearly 79,500 EI active and former claimant participants, between 2010 and 2012, were 55 years of age or older when they began their program, representing about 13% of participants.

The profile of older worker participants is presented in Table 11 by gender, sociodemographic group, and marital status. Information about their educational attainment, occupation and industry are based on the latest job they held prior to applying for EI benefits. Information about sociodemographic groups is self-reported.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 51,513 | 27,997 |

| Gender: Female | 50% | 47% |

| Gender: Male | 50% | 53% |

| Sociodemographic group: Indigenous individual | 3% | 5% |

| Sociodemographic group: Person with disability | 6% | 10% |

| Sociodemographic group: Visible minority | 4% | 6% |

| Sociodemographic group: Recent immigrant | 1% | 1% |

| Marital status: Married or common-law | 55% | 43% |

| Marital status: Widow / divorced / separated | 23% | 26% |

| Marital status: Single | 20% | 26% |

| Education or skills level: High school or occupational training | 42% | 40% |

| Education or skills level: On-the-job training | 22% | 24% |

| Education or skills level: College, vocational education or apprenticeship training | 26% | 25% |

| Education or skills level: University degree | 4% | 5% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for older worker participants

Active claimants:

- semi-skilled manual workers = 16%

- clerical personnel = 14%

- intermediate sales and service personnel = 11%

Former claimants:

- semi-skilled manual workers = 16%

- other sales and service professionals = 12%

- clerical personnel = 12%

Top 3 Industries for older worker participants

Active claimants:

- manufacturing = 16%

- retail trade = 12%

- administrative and support, waste management and remediation services = 9%

Former claimants:

- manufacturing = 16%

- retail trade = 11%

- administrative and support, waste management and remediation services = 11%

Main findings: Incremental impacts reveal that older workers in SD and TWS improve their labour market attachment. Older workers who are active claimants and participate in JCP also improve their labour market attachment. However, only former EI claimants in TWS also decrease their dependence on government support following participation.

Table 12 presents the detailed incremental impacts.

For example, the results reveal that compared to similar participants in EAS only , older worker former claimants in TWS have higher annual earnings (+$2,254) and incidence of employment (+8.9 percentage points). They also depend less on government income supports (-3.3 percentage points), mostly by decreasing their use of SA benefits (-$278).

Older worker active claimants in JCP have higher annual earnings (+$1,241) and incidence of employment (+8.3 percentage points) compared to similar non-participants. However, the increase in EI benefits (+$466) indicates that participants are unable to maintain the employment secured following the intervention.

| Indicator | SD active claimants | SD former claimants | TWS active claimants | TWS former claimants | JCP active claimants | JCP former claimants | EAS active claimants |

|---|---|---|---|---|---|---|---|

| Incidence of employment (percentage points) | 11.8*** | 4.1*** | 8.1*** | 8.9*** | 8.3*** | -0.2 | 0.2 |

| Employment earnings ($) | 3,847*** | 1,626*** | 3,479*** | 2,254*** | 1,241** | -2,498* | 180 |

| EI benefits ($) | 82 | 100 | 77 | 173* | 466** | 282 | -359*** |

| SA benefits ($) | 181*** | 71 | 132*** | -278*** | 20 | -35 | 135*** |

| Dependence on income support (percentage points) | 1.3*** | 0.5 | 0.1 | -3.3*** | 1.0 | 2.4 | -1.0*** |

| n= | 5,791 | 2,859 | 1,518 | 1,682 | 602 | 468 | 17,436 |

Statistical significance level *** 1%; ** 5%; * 10%, other values are non-statistically significant.

Note: Impacts are estimated over 4 post-program years (or 5 years in the case of Employment Assistance Services).

Indigenous participants

Nearly 36,400 EI active and former claimant participants, between 2010 and 2012, self-identify as being Indigenous Canadians, representing about 6% of participants.

The profile of Indigenous participants is presented in Table 13 by gender, age and marital status. Information about educational attainment, occupation and industry are based on the latest job held prior to applying for EI benefits. The profile of Indigenous participants is generally comparable to the one observed for LMDA participants at large across Canada.

| Categories | Active claimants | Former claimants |

|---|---|---|

| Number of participants | 16,416 | 19,981 |

| Gender: Women | 46% | 46% |

| Gender: Men | 54% | 54% |

| Age: 30 and under | 30% | 33% |

| Age: 31 to 54 | 61% | 60% |

| Age: 55 and over | 9% | 7% |

| Marital status: Married or common-law | 31% | 25% |

| Marital status: Widow / divorced / separated | 12% | 11% |

| Marital status: Single | 53% | 57% |

| Education or skills level: High school or occupational training | 35% | 33% |

| Education or skills level: On-the-job training | 29% | 33% |

| Education or skills level: College, vocational education or apprenticeship training | 28% | 26% |

| Education or skills level: University degree | 4% | 4% |

*Values may not equal 100% due to rounding or missing information.

Top 3 occupational groups for Indigenous participants

Active claimants:

- other manual workers = 18%

- semi-skilled manual workers = 15%

- intermediate sales and service personnel =11%

Former claimants:

- other manual workers = 20%

- semi-skilled manual workers = 13%

- other sales and service professionals = 13%

Top 3 industries for Indigenous participants

Active claimants:

- construction = 15%

- public administration = 14%

- accommodation and food services = 8%

Former claimants:

- construction = 15%

- public administration = 14%

- accommodation and food services = 10%