Evaluation of the Working While on Claim Pilot Projects

From: Employment and Social Development Canada

Alternate formats

Evaluation of the Working While on Claim Pilot Projects [PDF - 346KB]

This evaluation focuses on the Dispute prevention and relationship development services component of the program.

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

On this page

List of Acronyms

- EI

- Employment Insurance

- ESDC

- Employment and Social Development Canada

List of Tables and Figures

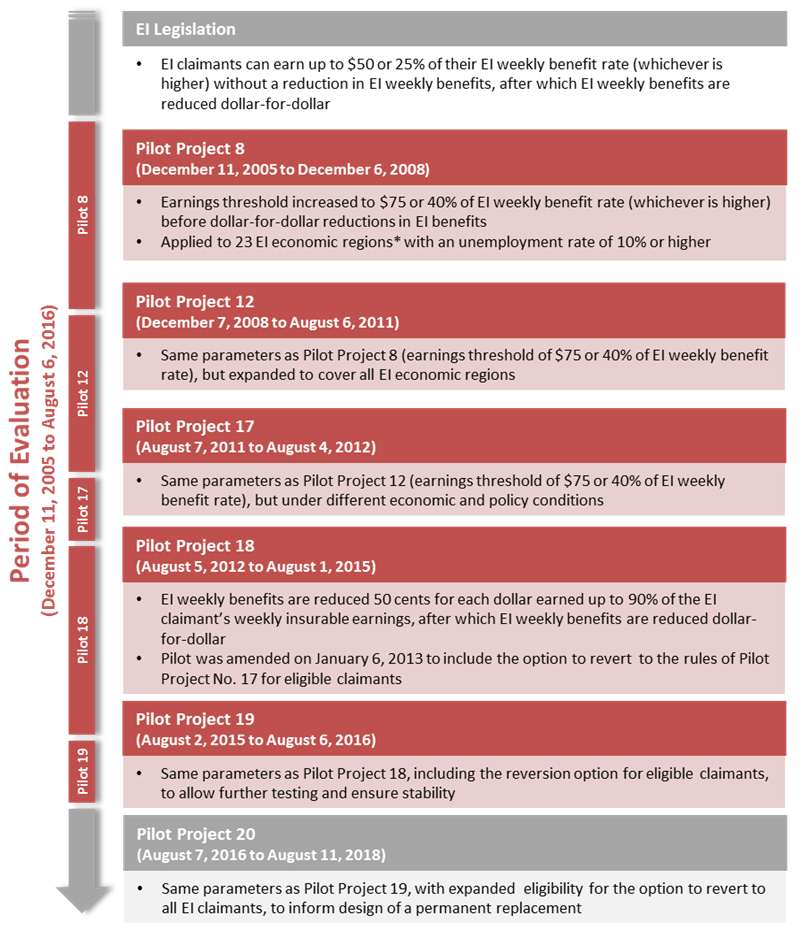

Figure 1. Timeline of Working While on Claim Pilot Projects

Box 1. Example: Labour Markey Attachment Incentives of Working While on Claim Rules

Executive Summary

The Employment Insurance (EI) Act allows pilot projects to run for up to three years to test the impacts of new approaches before permanent changes to the EI program are considered. Between 2005 and 2016, three sets of rules under five pilot projects were tested on varying claimant groups in the context of changing economic conditions under the Working While on Claim pilot projects. This was to test whether changes in the working while on claim rules would encourage claimants to work more while receiving EI benefits.

- Pilot Project 8 operated in 23 high unemployment regions from December 11, 2005 to December 6, 2008. It increased the allowable earnings threshold above which employment earnings are deducted dollar-for-dollar from EI benefits from $50 or 25% of a claimant’s weekly benefit rate, whichever is higher, to $75 or 40%.

- Pilot Projects 12 and 17 were introduced with the same parameters as the first pilot but it was made available in all regions. This national version of the pilot was in effect from December 7, 2008 to August 4, 2012.

- Pilot Projects 18 and 19 ran from August 5, 2012 through August 6, 2016. These pilots eliminated the allowable earnings threshold ($75 or 40%) and introduced a 50% reduction in benefits on the first dollar earned until earnings reached 90% of the claimant’s weekly insurable earnings. Beyond this level, a 100% reduction in benefits applied. Shortly after the implementation of Pilot Project 18 (in January 2013), the option of reverting to the rules that existed under the previous pilots was provided to claimants who had earnings that were subject to Pilot Project 17 during the period beginning August 7, 2011 and ending on August 4, 2012.

The summative evaluation of these working while on claim pilots was conducted to determine whether the pilots achieved their objective of encouraging EI claimants to work more during their claim and to assess other impacts. Throughout this period, analysis of the effect of the working while on claim rules was conducted and lines of evidence shared with the Department to support continuous policy development. The effects of Pilot Projects 8, 12 and 17 are measured in comparison to the legislation rules while the impacts of Pilot Projects 18 and 19 are assessed in comparison to the previous pilot rules (Pilot Projects 12 and 17). The main evaluation results are summarized below.

The Working While on Claim pilots were justified since the pre-existing working while on claim rules did constitute a disincentive to work for some claimants.

Interviews conducted with employers and unions representatives as well as focus groups held with EI claimants brought out examples of situations where the legislation rules limited the amount of work accepted by claimants. For example, a few companies in the fishing, construction, hospitality, and recreational sectors said that they had difficulties finding workers to work jobs one or two days per week under the legislation rules, but that it was no longer a challenge after the introduction of the first pilot.

Moreover, evidence indicates that working while on claim rules may be an important policy lever for improving long-term labour market attachment.

International literature generally suggests working while on claim provisions have positive effects, such as increased take-up of part-time jobs, which facilitates the transition to regular full-time work. An ESDC study of EI claimants between 2008 and 2012 suggests that about 50% of claimants who took a job during their claim were found to have started another job for the same employer after the claim. For the majority of them (76%), this employment lasted more than a year.

Pilot Projects 8, 12 and 17 partially achieved the objective of encouraging claimants to work more while on claim.

The increase in the allowable earnings threshold in 23 high unemployment regions in 2005 (Pilot Project 8) raised the probability of working with no reduction in EI benefits by 69% for women and 96% for menFootnote 1 and the average duration of work with full benefits by 3.0 to 3.5 days per claim compared to the legislation rules. The increase in the allowable earnings threshold in the remaining 35 regions in 2008 (Pilot Projects 12 and 17) increased the probability of working with full and partial benefits by about 7% and the average duration of work with partial benefits by 1.1 to 2.2 days per claim compared to the legislation rules. Findings from interviews and focus groups also confirm that Pilot Project 8 encouraged some claimants to take short-term jobs or work more hours during their claim.

However, Pilot Projects 8, 12 and 17 may have had the unintended effect of discouraging claimants to work with earnings above the threshold where benefits are reduced to zero (i.e. work with no benefits). The probability of working with no benefits declined by 16 to 20% under Pilot Project 8 and by 7% under Pilot Projects 12 and 17. The number of days worked with no benefits decreased by 2.0 to 3.5 days per claim under Pilot Project 8 and by 1.4 to 3.8 days per claim under Pilot Projects 12 and 17.

This suggests that Pilot Projects 8, 12 and 17 were not found to have increased the total incidence and duration of work while on claim. Also, Pilot Projects 8, 12 and 17 were not found to have had a clear effect on EI usage.

Pilot Projects 18 and 19 seemed more effective at encouraging claimants to work more while on claim.

The 50% reduction in benefits introduced in all regions on August 5, 2012 (Pilot Projects 18 and 19) increased the probability of working while on claim by about 27% and the number of weeks worked by about 1 week for claimants not eligible to revert. Work with any level of earnings increased for these claimants who represented the vast majority (about 97%) of claimants. Moreover, the increase in work while on claim by claimants not eligible to revert led to a decline in EI benefits paid to those claimants (by at least $100 per claim or 1%).

The reversion option had a limited impact among targeted clients.

Under Pilot Projects 18 and 19, the option to revert to the rules in effect under the previous pilots was given to claimants who had worked under Pilot Project 17 to help them transition to the new rules. Only 12% of eligible claims were reverted. The evidence suggests that the low rate of reversion was not entirely driven by claimants’ preferences but also reflected a lack of awareness and understanding of the pilot: less than half (47%) of claimants eligible to revert knew they had this option, and about a third (33%) of eligible claims that did not revert would have received more EI benefits if they had reverted. Moreover, the option to revert did not seem to prevent eligible claimants from being discouraged to work as desired. Claimants who were eligible to revert were less likely to work (by 15% to 48%) and worked fewer weeks (4 to 6 weeks less) compared to their work effort under the previous pilots. The lack of awareness and uncertainty over this option could have led to sub-optimal working decisions.

Recommendation

In light of the findings generated for the evaluation, it is recommended to:

Take appropriate steps to increase awareness of the rules amongst claimants.

Management Response

The Department would like to thank the Evaluation Directorate for its work on the Evaluation of Working While on Claim (WWC) Pilot Projects.

On August 11, 2018, Pilot Project 20 will expire. Budget 2018 proposes amendments to the Employment Insurance Act to make permanent the default treatment of employment earnings (50 cents on the dollar rule) of Pilot Projects 18, 19 and 20. These proposed amendments would include a three year transitional period during which claimants who had selected the optional treatment of employment earnings for weeks under Pilot Project 20 would continue to be permitted to select this option. The Department is now working to implement this commitment.

The Department accepts the evaluation findings and provides the following Management Response and Action Plan.

Recommendation:

Take appropriate steps to increase awareness of the rules amongst claimants.

Management accepts this recommendation.

The Department commits to supporting future EI policy changes – including the new Working While on Claim measure – with strong communication strategies that use multiple channels to connect with EI claimants to explain the changes and help claimants understand them.

| Management Action Plan | Completion Date |

|---|---|

| Make working while on claim information available to claimants via multiple channels | Ongoing |

1. Introduction

1.1 Overview

This report presents key findings from the evaluation of the Employment Insurance (EI) Pilot Project 8, Pilot Projects 12 and 17 and Pilot Projects 18 and 19. These pilots, referred to as the Working While on Claim pilot projects, were in effect during the 2005 to 2016 period and their main objective was to test whether changing the treatment of employment earnings gained while on an EI claim would encourage claimants to work more while receiving benefits.

1.2 Evaluation Approach

The evaluation of the pilots addressed 18 questions pertaining to the pilots’ relevance, performance and efficiency.Footnote 2 More emphasis was placed on the performance questions of whether the pilots would encourage claimants to work more while receiving EI benefits.

The evaluation only assessed the impact of the pilots on employment earnings of claimants and excluded analysis of other types of earnings subject to working while on claim provisions (for example wage loss insurance payments or workers’ compensation payments). This better aligns the evaluation with the main objective of the pilots, which was to encourage work while on claim.

A total of 10 studies, qualitative and quantitative, supported the evaluation of the working while on claim pilots. A matrix linking the studies to the evaluation questions they address is presented in Appendix A. A description of the 10 studies is provided in Appendix B.Footnote 3

2. Description of the Working While on Claim Pilot Projects

2.1 Rationale of the Working While on Claim Pilot Projects

By allowing EI claimants to keep a share of their EI benefits while they work while on claim, the program provides claimants with the opportunity to maintain their attachment to the workforce and increase their income. Since the EI program strives to find a balance between providing adequate benefits and encouraging claimants to transition to full-time employment, a reduction in benefits is applied to employment earnings while on claim. This ensures that claimants are never in a situation in which they would be better off staying on EI than working full-time. The reduction in benefits can, however, discourage some individuals from accepting work during their claim.

Reducing the disincentives to work beyond the threshold where benefits are reduced dollar for dollar motivated the introductions of the working while on claim pilots. Moreover, working while on claim was perceived as desirable since EI claimants who stay active in and connected to the labour market find permanent employment faster than those who do not.Footnote 4

2.2 Description and objectives of the Working While on Claim Pilot Projects

EI claimants have the obligations to conduct reasonable job searches and accept any offer of suitable employment while receiving EI regular and fishing benefits. Claimants can pick up part-time or occasional work during their EI claim, but still have to meet the job search requirements to continue receiving benefits.

EI legislation

Under the EI Act, claimants who are receiving regular, fishing, parental, parents of critically ill children, or compassionate care benefits can earn up to $50 per week or 25% of their average weekly benefits rate, whichever is higher, without having their benefits reduced (0% reduction in benefits). Any additional earnings above the earnings threshold reduce benefits payable in that week dollar for dollar. If a claimant’s weekly benefits are reduced dollar for dollar, that week of entitlement may be deferred for later use within the same benefit period.

Pilot Project 8

Pilot Project 8, (Pilot Project Increasing Allowable Earnings from Employment While Claimant is Receiving Benefits), increased the earnings threshold to $75 or 40% of average weekly benefits rate. Additional earnings continued to result in EI benefits being clawed back dollar-for-dollar. Pilot Project 8 operated in 23 regions of high unemployment (10% or greater) from December 11, 2005 to December 6, 2008.

This first version of the Working While on Claim pilot project was introduced to test whether increasing the allowable earnings threshold to $75 or 40% of the benefit rate in areas of high unemployment would encourage more individuals to accept employment while on claim. This pilot aimed to address some employers’ concern that EI claimants may, in some cases, decline work because they would be penalized by a reduction in EI benefits for each additional dollar earned.Footnote 5 Providing a stronger incentive for claimants to accept all available work was expected to make the EI program more responsive in rural and remote regions where recruiting workers was more difficult due to the irregular nature of work.Footnote 6

Pilot Projects 12 and 17

Pilot Project 12, Pilot Project Increasing Allowable Earnings from Employment While Claimant is Receiving Benefits (2), introduced Pilot Project 8 parameters to all regions on December 7, 2008 and ran until August 6, 2011. This national working while on claim pilot was re-introduced as Pilot Project 17. Pilot Project Increasing Allowable Earnings from Employment While Claimant is Receiving Benefits (3), on August 7, 2011 and was in effect until August 4, 2012.

The objective of this second version of the pilot was to gather additional evidence on the work incentive effects across regions experiencing varying economic circumstances.7 The pilots were expected to result in increased earnings for claimants and increased flexibility for employers.Footnote 8

Pilot Projects 18 and 19

Pilot Project 18 (Pilot Project to Encourage Claimant to Work More While Receiving Benefits), was introduced on August 5, 2012 and ran until August 1, 2015. Under this pilot, weekly benefits were reduced by 50 cents for each dollar earned while on claim (50% reduction in benefits), starting with the first dollar earned up to an earnings threshold set at 90% of the claimant’s weekly insurable earning. Above this cap, benefits were reduced dollar-for-dollar, until they were reduced to zero. Pilot Project 19, (Pilot Project to Encourage Claimant to Work More While Receiving Benefits (2), renewed the parameters of Pilot Project 18 for one year (August 2, 2015 to August 6, 2016).

The objective of these pilots was to test whether a different treatment of employment earnings gained while on claim would encourage claimants to work more while receiving benefits. Mixed results on the effectiveness of the previous pilots motivated the introduction of Pilot Projects 18 and 19. The previous pilots were found to have encouraged claimants to work up to the 40% or$75 threshold but not beyond it.Footnote 9

Reversion option under Pilot Projects 18 and 19

On January 6, 2013, the option to revert to the rules that existed under Pilot Project 17 was offered to claimants who had worked while on claim during Pilot Project 17, the period beginning on August 7, 2011 and ending on August 4, 2012. To request a reversion on their claim, clients had to contact the Service Canada Call Center no later than 30 days from the end of their claim.Footnote 10 Claimants who called before the end of their benefit period were encouraged to wait until the end of their claim before making a decision in order to have complete information regarding their earnings on their claim. Eligible claimants who did not revert an eligible claim lost their opportunity to revert any future claim under the pilot.

The reversion option was introduced to address concerns expressed by some clients that they were receiving lower weekly EI benefits for the same work effort as compared to the previous pilots. The reversion option was expected to help these claimants transition to the parameters of Pilot Projects 18 and 19.Footnote 11

*EI economic regions with an unemployment rate of 10% or higher: 1. St. John's; 2. Newfoundland/Labrador; 3. Prince Edward Island; 4. Eastern Nova Scotia; 5. Western Nova Scotia; 8. Madawaska-Charlotte; 9. Restigouche-Albert; 10. Gaspésie-Îles de la Madeleine; 12. Trois-Rivières; 17. Central Quebec; 18. North Western Quebec; 19. Lower St. Laurence and North Shore; 21. Chicoutimi-Jonquière; 36. Sudbury; 38. Northern Ontario; 41. Northern Manitoba; 45. Northern Saskatchewan; 48. Northern Alberta; 54. Southern Coastal British Columbia; 55. Northern BC; 56. Yukon; 57. Northwest Territories; 58. Nunavut.

Description of Figure 1. Timeline of Working While on Claim Pilot Projects

Figure 1 illustrates the timeline of the 5 working while on claim pilot projects that were evaluated. The evaluation period is between December 11, 2005 and August 6, 2016.

From top to bottom, the figure shows the pilot projects in chronological order, beginning with the oldest, as follows: Pilot Project 8 (December 11, 2005 to December 6, 2008), Pilot Project 12 (December 7, 2005 to August 6, 2011), Pilot Project 17, (August 7, 2011 to August 4, 2012), Pilot Project 18 (August 5, 2012 to August 1, 2015) and Pilot Project 19 (August 2, 2015 to August 6).

Pilot Project 20, implemented from August 7, 2016 to August 11, 2018, is not included in the present evaluation.

According to EI Legislation, EI claimants can earn up to $50 or 25% of their EI weekly benefit rate (whichever is higher) without a reduction in EI weekly benefits, after which EI weekly benefits are reduced dollar-for-dollar

Pilot Project 8, implemented from December 11, 2005 to December 6, 2008, had the earnings threshold increased to $75 or 40% of EI weekly benefit rate (whichever is higher) before dollar-for-dollar reductions in EI benefits. This project was implemented in 23 economic regions with an unemployment rate of 10% or higher.

Pilot Project 12, implemented from December 7, 2005 to August 6, 2011,had the same parameters as Project Pilot 8, but expanded to cover all EI economic regions.

Pilot Project 17, implemented from from August 7, 2011 to August 4, 2012, has the same parameters as Project 12, but under different economic and policy conditions.

Pilot Project 18, implemented from August 5, 2012 to August 1, 2015, had EI weekly benefits reduced by 50 cents for each dollar earned up to 90% of the EI claimant’s weekly insurable earnings.

Pilot Project 19, implemented from August 2, 2015 to August 6 2016, had the same parameters as Pilot Project 18, including the reversion option for eligible claimants, to allow further testing and ensure stability

Pilot Project 20, implemented from August 7, 2016 to August 11, 2018 had the same parameters as Pilot Project 19, with expanded eligibility for the option to revert.

3. Key Findings

3.1 Need for the Working While on Claim Pilot Projects

Pilot Projects 8, 12 and 17 were introduced to reduce disincentives to work created by the working while on claim rules in effect under the EI legislation. Similarly, Pilot Projects 18 and 19 were introduced to further reduce disincentives to work that were believed to still be present under the previous pilots. The evidence confirmed that the working while on claim rules do, for a small segment of the population, create barriers to work and result in weeks of work being turned down.

- Employers and union representatives provided examples of situations where the legislated rules created disincentives to work while on claim when interviewed in 2008 (for Pilot Project 8). For example, a few companies in the fishing sector believed that claimants did not return their phone call during the off-season because they did not want to “mess up” their EI claim for a short-term job. This was echoed by employers in the construction, hospitality, and recreation sectors. Union halls noted that they had difficulty finding workers who would agree to work 1 to 2 day job under the legislation’s rules.Footnote 12

- A few EI claimants from the focus groups conducted in 2007 (for Pilot 8) said that the legislation’s rules did affect the number of hours/days they worked in a week while on claim and that they had turned down work prior to Pilot Project 8 because of the lower level of allowable earnings. Most focus group participants indicated that the legislation rules did not affect how much they worked while on claim and that they never turned down jobs prior to Pilot Project 8 because of the lower level of allowable earnings. Many participants reported that they tend to work as much as they can, with some specifying that they do this as long as the work is in their field.Footnote 13

- Results from focus groups conducted in 2014 (when Pilot 18 was in effect) suggest that under the previous pilots work might have been structured so that it did not exceed the earnings threshold above which a 100% was imposed ($75 or 40% of the EI benefit rate).Footnote 14

- The Canadian Out-of-Employment Panel Survey suggests that the working while on claim rules under Pilot Projects 12 and 17 and Pilot Project 18 created a disincentive to work for about 19% and 18% of claimants who worked while on claim under Pilot Projects 12 and 17 and Pilot Project 18 respectively.Footnote 15

The rationale for seeking to reduce the disincentives to work while on claim was based on the belief that working while on claim can help claimants maintain their attachment to the workforce and transition to full-time employment faster. The international literature supports this view, finding that working while on claim provisions tend to have positive effects, such as the increased take-up of part-time jobs, which facilitates the transition to full-time work.Footnote 16

A Canadian study covering the period during which Pilot Projects 12 and 17 were in effect also suggests that working while on claim can help claimants maintain their employment relationship. About 50% of claimants who took a short-term job during their claim were found to have started another job for the same employer after the claim. Moreover, for the majority of them (76%), this employment lasted more than a year.Footnote 17

Results from focus groups conducted in 2007 (when Pilot 8 was in effect) provide some qualitative evidence of the positive employment effects of working while on claim. Many participants, including the majority in Prince Albert and Sudbury, indicated that working while on claim helped them apply for new jobs. Reasons provided to explain why included the following: it demonstrates work experience; it provides employers with evidence of a desire to work; it increases self-confidence; it makes it less difficult to get back into a work routine; it helps keep one active and in contact with others, which is important if one needs to work as part of a team; and it helps generate work-related contacts that might be able to help people find full-time employment.Footnote 18

3.2 Achievement of expected outcomes

3.2.1 Claimants’ working while on claim behaviours

The main objective of the working while on claim pilots was to encourage EI claimants to work more during their claim. The evaluation therefore focused on measuring the impact of the pilots on the probability of working and the number of days/weeks worked during a claim.

Pilot Projects 8, 12 and 17

Pilot Projects 8, 12 and 17 increased the amount of earnings claimants could earn without incurring a reduction in their EI benefits from $50 or 25% of a claimant’s weekly benefit rate, whichever is higher, to $75 or 40%. This change created an incentive to work with a higher level of earnings, specifically with earnings up to the $75 or 40% allowable earnings threshold.

The empirical evidence indicates that claimants responded to the incentive created by the pilots as they worked more with earnings up to 40% of the EI benefit rate (working with full benefits). In regions that did not participate in Pilot Project 8, the incentive effect of Pilot Projects 12 and 17 went beyond the expected effect since claimants also worked more with earnings between 40% and 125% of the EI benefit rate (working with partial benefits). The pilots, however, may have had the unintended effect of reducing work with earnings above 140% of the EI benefit rate, the threshold where benefits are reduced to zero (hereafter referred to as working with no benefits). As a result, the overall amount of work done while on claim was not found to have increased. Specifically:

- The increase in the allowable earnings threshold (from $50 or 25% to $75 or 40%) in 23 high unemployment regions in 2005 (Pilot Project 8) seemed to have increased the probability of working with full benefits by 69% for women and 96% for men–and to have reduced the probability of working with no benefits by 16% to 20%. The average duration of work with full benefits increased by about 3 to 3.5 days per claim, while the average duration of work with no benefits decreased by 2 to 3.5 days per claim. The impact of the pilot on the overall incidence and duration of working while on claim was not statistically significant.Footnote 19

- The increase in the allowable earnings threshold (from $50 or 25% to $75 or 40%) in the remaining 35 regions in 2008 (Pilot Projects 12 and 17) increased the probability of working with full and partial benefits by about 7% and decreased the probability of working with no benefits by about 7%. The impact of the pilots on the total incidence of working while on claim was negative for men and not significant for women. Results also indicates that Projects 12 and 17 increased the duration of work with partial benefits by about 1.1 to 2.2 days per claim and decreased the duration of work with no benefits by about 1.4 to 3.8 days. The impact of the pilots on the total duration of working while on claim was not found to be consistent across various specifications.Footnote 20

In line with the empirical evidence, focus group results also suggest that the overall work incentive effect of Pilot Project 8 over the legislated rules was limited:

- Most participants from the focus groups conducted in 2007 with EI claimants in St. John’s (Newfoundland), Trois-Rivières (Quebec), Sudbury (Ontario), Prince Albert (Saskatchewan) and Prince George (British-Columbia) did not feel that Pilot Project 8 allowed them to work more hours or provided them with more of an incentive to work while on claim. Participants said that they already tend to take additional work whenever they can. Some added that the problem in their region, especially in Prince Albert and Trois-Rivières, is not the lack of incentive to work while on claim, but rather the lack of work. Only in Prince Albert did most participants indicate that the pilot allowed them to work more hours and provided them with more of an incentive to work while on claim.Footnote 21

Pilot Projects 18 and 19

In 2012, Pilot Projects 18 and 19 eliminated the 0% reduction in benefits up to the allowable earnings threshold and introduced a 50% reduction in benefits from the first dollar earned until earnings reach 90% of the claimant’s average weekly insurable earnings. Above this threshold, a 100% reduction in benefits applied. The theoretical effect of this change on work incentives compared to the previous pilot was ambiguous and depended on the personal situation of claimants (i.e. on their eligibility to revert status, their reversion decision, and the timing of this decision).Footnote 22

The quantitative evidence seemed to suggest that Pilot Projects 18 and 19 encouraged claimants not eligible to revert (97% of claimants) to work more while on claim, while it seemed to have the opposite effect for claimants eligible to revert (remaining 3%).

- Pilot Projects 18 and 19 increased the probability of working while on claim by about 27% and the number of weeks worked by about 1 week for claimants not eligible to revert. Work at all level of earnings increased. This means that work with earnings below 80% of the EI benefit rate also increased even if claimants received less EI benefits for this work effort compared to what they would have received under the previous pilots. The largest increase in work was nevertheless observed for work with earnings above 80% of the EI benefit rate, the level above which claimants received more EI benefits compared to the previous pilots.Footnote 23

- Pilot Projects 18 and 19 however discouraged the minority of claimants eligible to revert to work while on claim. Both claimants who chose to revert and those who did not revert were less likely to work (by 15% and 48%) and worked fewer weeks during their claim (4 to 6 weeks less). For those claimants eligible to revert, work with practically all level of earnings declined but most of the reduction was observed for work with earnings below 40% of the EI benefit rate.Footnote 24

Focus groups were held with groups of claimants eligible to revert and groups of claimants not eligible to revert. The large majority of participants in both groups felt that Pilot Projects 18 and 19 was not advantageous for them:

- Most of the EI claimants who participated in the 2014 focus groups held in Laval (Quebec), Moncton (New Brunswick), Montague (Prince Edward Island) and Sudbury (Ontario) said that they did not start to work while on claim because of Pilot Project 18. Only one of the focus group participants stated he had increased his amount of work while on claim as a result of the pilot. This was however because he took on the work of other people receiving EI who had stopped working due to the impact of the new working while on claim rules.

- The large majority of focus groups participants preferred the previous pilots mainly because of the expectation that they could not find more than 1 to 2 days of work per week. In this situation, they perceived the previous pilots as more likely to result in higher total income. Focus groups participants also tended to perceive Pilot Project 18 as cutting their hourly wages in half. Working for a low hourly wage was seen as demotivating, especially when facing fixed costs of working (travel, childcare, source deductions).Footnote 25

Employers’ access to workers

By encouraging claimants to work more while on claim, the working while on claim pilots were expected to help employers recruit workers for part-time or short-term jobs. Interviews were conducted with businesses employing seasonal, part-time and temporary workers to obtain employers’ view on this effect. Findings indicate that Pilot Project 8 facilitated the recruiting of workers in specific sectors while Pilot Projects 18 and 19 had a range of effect on access to workers.

- Key informant interviews conducted with employers and union representatives revealed that Pilot Project 8 allowed some firms in the fishing, construction, recreational and agricultural sectors to hire workers during the off-season for short-term jobs that were previously impossible to fill. A few employers noted that prior to the introduction of the pilot they were convinced that employees, when called during the off-season period, saw the company’s name on their call display and did not answer because they did not want to “mess up” their EI claim for a short-term job. These companies said that they no longer had this challenge after the introduction of Pilot Project 8.Footnote 26

- Key informant interviews conducted in 2016 with employers who tried to hire EI claimants during Pilot Projects 18 and 19 suggested that the pilot had a range of effect on access to workers over Pilot Projects 12 and 17. Some employers said that the 50% reduction in benefits did not affect their ability to hire employees on EI for any week length. Others reported that claimants refused to work under the 50% reduction in benefits rate; in particular for short week duration (less than 2 days). However, no employers noted an overall change in the amount of work done as they were able to adapt their hiring practices. For example, one employer hired for full-weeks by filling up the week with maintenance tasks normally done at the start of the season while other employers expended their pool of potential workers.Footnote 27

Claimants’ choice of working while on claim rules

The reversion option under Pilot Projects 8, 12 and 17 was introduced after some claimants expressed distress that they were receiving, for the same amount of work, less EI benefits compared to what they used to receive under the previous pilots. The reversion option was expected to help these claimants.

Only 12% of claims eligible to revert were reverted (23,422 claims out of 191,411 eligible claims). Claimants who chose to revert received on average $457 in additional EI benefits per claim compared to what they would have received if they had not reverted.

The low take-up of the reversion option may be explained by the low level of awareness and perhaps understanding of the reversion option:

- The Canadian Out-of-Employment Panel survey revealed that less than half (47%) of claimants eligible to revert were aware that they had this option.

- EI administrative data indicate that about 33% of eligible claims that did not revert would have benefitted from reverting. These claims would have received $216 more per claim on average under the previous pilot provisions compared to what they received under Pilot Projects 18 and 19.

Results also suggest that awareness and understanding of the reversion option was not uniform across regions and claimant types. Indeed, the probability of reverting was significantly higher for frequent claimants and claimants residing in Quebec and the Atlantic provinces, even when financial advantages from reverting (that is, whether one would receive higher EI benefits under the previous pilots) were taken into account.Footnote 28

Nevertheless, claimants who sought information about the reversion option were able to obtain it from Service Canada. According to the Canadian Out-of-Employment Panel survey, close to 20% of claimants aware of their reversion option contacted an EI Call Center to discuss the option to revert. The majority of these clients (between 62.1% and 96.6%) reported being “satisfied” or “very satisfied” with the service received.Footnote 29 Moreover, the small number of participants to the 2014 focus groups who spoke with a Service Canada agent about the option to revert (whether by telephone or in an EI office) said they received enough information to make an informed and appropriate choice.Footnote 30

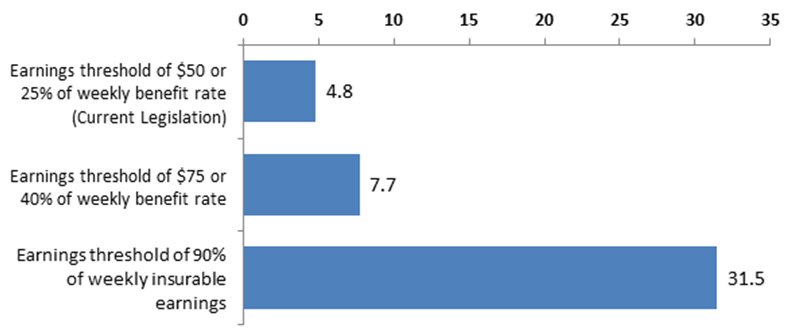

Box 1. Example: Labour market attachment incentives of working while on claim rules

The Employment Insurance Act’s Working While on Claim provision is designed to increase labour market attachment among EI claimants by encouraging them to accept available work while receiving EI benefits and to earn additional income while on claim. Under the provision, claimants may earn employment income up to a specified earnings threshold determined by the prevailing legislation or pilot project with either reduced or full Employment Insurance benefits. Above this threshold, a claimant’s weekly EI benefit is reduced dollar-for-dollar.

For example, an EI claimant with a weekly benefit rate of $385 could work up to 4.8 hours at $20/hour in a week before additional employment earnings resulted in dollar-for-dollar reductions in EI benefits under the existing legislation or up to 31.5 hours under Pilot 19 (with each dollar of employment income reducing EI benefits by 50 cents prior to that point).

Description of figure 2

| Working while on claim rules specification | Weekly hours worked at $20/hour before dollar-for-dollar EI benefit deductions for an EI claimant with a maximum EI weekly Benefit of $385 |

|---|---|

| Earnings threshold of $50 or 25% of weekly benefit rate (Current Legislation) | 4.8 |

| Earnings threshold of $75 or 40% of weekly benefit rate (Pilot Projects 8, 12 and 17) | 7.7 |

| Earnings threshold of 90% of weekly insurable earnings (Pilot Projects 18 and 19) | 31.5 |

3.3 Costs of the Working While on Claim Pilot Projects

Pilot Projects 8, 12 and 17

Without behavioural changes (assuming claimant work effort while on claim did not change), Pilot Projects 8, 12 and 17 rules would have cost about $156 more per claim than the legislation rules.Footnote 31

The true cost of the pilots, (the cost that takes into account the behavioural changes described in section 3.2.1), is unknown as results from the econometric studies were not conclusive:

- The econometric study on Pilot Projects 8 found that the pilot increased work while on claim with full benefits and the reduced work while on claim with no benefits. These behavioural changes were expected to increase the average amount of EI benefits paid per claim. However, results did not pass the main robustness checks performed.Footnote 32

- In the case of Pilot Project 12 and 17, it was found that the pilots increased work while on claim with full and partial benefits and reduced work while on claim with no benefits. Results from one specification suggest that the decline in EI benefits paid due to the increase in work with partial benefits more than cancelled out the increases in EI benefits paid due to the other behavioural changes, resulting in a decline in the average amount of EI benefits paid per claim. Other specifications generated opposite results.Footnote 33

Pilot Projects 18 and 19

Pilot Projects 18 and 19 rules would have cost about $138 more per claim than the previous pilots rules if no behavioural changes had been observed.Footnote 34

However, when the behavioural changes discussed in section 3.2.1 are taken into account, Pilot Projects 18 and 19 were found to have reduced the amount of EI benefits paid by at least $100 per claim for the majority of claimants (those claimants not eligible to revert) when compared to the previous pilots. This means that the elimination of the allowable earnings threshold combined with the increase in the amount of work done while on claim (which both reduced EI benefits paid) more than offset the reduction in benefits from 100% to 50% for earnings beyond the allowable earnings threshold (which increased EI benefits paid).

Pilot Projects 18 and 19 also significantly reduced the EI usage and claim duration of claimants eligible to revert who reverted despite the fact that these claimants worked less while on claim. This might suggest that these claimants may have accepted a full-time job and no longer needed to receive EI benefits while working during their claim. Results for claimants eligible to revert who did not choose to revert were not found to be consistent.Footnote 35

4. Conclusion and Recommendation

Evidence and analysis of the Working While on Claim pilot projects in support of this evaluation has been gathered and disseminated to the Department throughout the five pilots to promote continuous policy development in this area.

Compared to the pre-existing legislated working while on claim rules, claimants responded positively by working more short-term jobs (i.e. work with earnings below 40% of the EI benefit rate) when allowed to earn greater income without incurring any reduction in their EI benefits (Pilot Projects 8, 12 and 17).Footnote 36 This in turn, helped employers find workers for one or two-day jobs during the off-season.Footnote 37

When employment earnings are only partially deducted from EI benefits, as under Pilot Projects 18 and 19, claimants can increase their total income (employment earnings and EI benefits) by accepting work, which increases the incentive to work. The empirical evidence suggests that the introduction of a 50% reduction from the first dollar to a higher threshold encouraged the majority of claimants (claimants not eligible to revert) to work more with any level of earnings and did not discourage the majority of claimants (claimants not eligible to revert) from working at short-term jobs (i.e. work with earnings below 40% of the EI benefit rate).

However a minority of claimants reduced their work effort at short-term jobs of duration up to 6 weeksFootnote 38 and employers confirmed that the 50% reduction in benefits applied to the first dollar earned discouraged some claimants to work less than two days per week.Footnote 39 EI claimants also mentioned that they would be less motivated to work one or two days per week with a 50% reduction in benefits as the incremental income would be relatively small and might not cover the costs of working (travel, childcare).Footnote 40

Overall, the pilot projects represented an improvement in the incentive to work while on claim compared to the legislated provisions, but the existence of multiple and changing rules that may or may not apply to different workers in the EI economic region could have weakened the general understanding of the rules in later pilot projects. Under Pilot Projects 18 and 19, claimants eligible to revert to previous pilot rules saw a decline in work while on claim, with much of the decline being for work with earnings below 40% of the EI benefit rate. This result was unexpected as they received the same amount of EI benefits (full benefits) compared to the previous pilots for this amount of work. It is possible that uncertainty about the applicability of the working while on claim rules (either because they were unaware of their reversion option or their eligibility or because they were unsure about the decision to make) affected the behaviour of some claimants or their understanding of the options available to them. The lack of awareness and uncertainty could have led to sub-optimal working decision.Footnote 41

Results from the evaluation of Pilot Projects 8, 12, 17, 18 and 19 are used to make the following recommendation regarding the implementation of future working while on claim provisions.

Take appropriate steps to increase awareness of the rules amongst claimants.

The low level of awareness and understanding of Pilot Projects 18 and 19 could have limited its impact on working while on claim behaviour. When surveyed about two years after the introduction of Pilot Project 18, only 18% of claimants who worked while on claim said that they knew the rules used to deduct earnings from their EI benefits. Moreover, less than half (47%) of claimants eligible to revert were aware of their reversion option.Footnote 42

Shortly after the introduction of Pilot Project 18, a Service Canada letter was sent to provide information on the changes made to the working while on claim rules. However, the letter was limited to clients who had an open claim between July 20 and 27, 2012 and who had worked during this claim. Claimants who have not in the past (or are not currently) working while on claim could also benefit from information about the working while on claim provisions as the decision to work while on claim may be driven by awareness.

5. Bibliography

PDF version of the following documents can be ordered by calling 1 800 O-Canada (1-800-622-6232). If you use a TTY, call 1-800-926-9105. The PDF version can only be sent via e-mail. Please note there will be a certain delay before receiving the documents.

ESDC. (2008a). Evaluation of Employment Insurance Pilot Projects - Component Examining Impacts of the Pilot Projects on Target Groups of Claimants Using Focus Groups (by Phoenix Strategic Perspectives Inc.).

ESDC. (2008b). Key Informant Interviews of Employers for the 3 Employment Insurance Pilot Projects (by Fleishman-Hillard Canada).

ESDC. (2011a). Evaluation of the Impacts of the Increase in EI Allowable Earnings Pilot Project: Update Study (by McCall, Brian P. and Stephanie Lluis).

ESDC. (2014a). Literature Review for the Evaluation of the Working While on Claim Pilot Projects (by Fuller, David, and Stephane Auray).

ESDC. (2014b). Focus Groups for the Evaluation of Working While on Claim Pilot Project 18 (by SAGE).

ESDC. (2016a). Key Informant Interviews on Pilot Project 18 (by TNS).

ESDC. (2016b). Descriptive Analysis of the Working While on Claim Pilot Projects 8, 12, 17, 18 and 19.

ESDC. (2016c). Econometric Study on the Impacts of Working While on Claim Pilot Projects 12 and 17.

ESDC. (2016d). Who are Workers Working for When Working While on Claim? (by Data Probe).

ESDC. (2017). Econometric Study on the Impacts of Pilot Projects 18 and 19.

Appendix A – Evaluation Matrix

Need for the Program

1. What is the evidence suggesting that the working while on claim provisions are creating barriers to work during a claim?

Lines of evidence: Key informant interviews, focus groups, statistical study

2. What is the evidence suggesting that changing the working while on claim provisions can encourage work during a claim?

Lines of evidence: Literature review

3. What is the evidence suggesting that work during a claim promote workforce attachment?

Lines of evidence: Statistical study, literature review

Achievement of Expected Outcomes and Secondary Impacts

4. What proportion of claimants benefitted from the working while on claim pilots?

Section of this report:Lines of evidence: Statistical studies

5. What proportion of claimants was negatively affected by Pilot Projects 18 and 19?

Section of this report:

Lines of evidence: Statistical studies

6. What proportion of eligible claimants chose not to participate in Pilot Projects 18 and 19 and reverted to the previous pilot rules?

Lines of evidence: Statistical studies

7. Did the working while on claim pilots increase the incidence of working while on claim?

Lines of evidence: Focus groups, statistical studies

8. Did the working while on claim pilots increase the duration of working while on claim?

Lines of evidence: Focus groups, statistical studies

9. Did the working while on claim pilots reduce EI usage (number of weeks used, number of deferred weeks used, total benefits paid, frequency of claim, etc.)?

Lines of evidence: Statistical studies

10. Did the working while on claim pilots increase job search effort?

Lines of evidence: statistical studies, focus groups

11. Did the working while on claim pilots reduce unemployment duration?

Lines of evidence: Focus groups, statistical studies

12. Did the working while on claim pilots have an impact on post-claim job characteristics (wages, duration, full-time vs. part-time employment, etc.)?

Lines of evidence: Focus groups, statistical studies

13. Did the working while on claim pilots help employers have access to employees for short-week work?

Lines of evidence: Key informant interviews

14. Were claimants aware of the new working while on claim pilot and the option to revert to the previous pilot rules?

Lines of evidence: Focus groups, statistical studies

15. Did claimants understand the new working while on claim pilot and the consequences of reverting to previous pilot rules?

Lines of evidence: Focus groups, statistical studies

Demonstration of Efficiency and Economy

16. What were the administrative and program costs of the working while on claim pilots? Lines of evidence: Statistical studies

Appendix B – Lines of Evidence

The following studies were used as lines of evidence for the evaluation of the working while on claim Pilot Projects 8, 12, 17, 18 and 19.

Literature Review

A literature review on the impacts of provisions similar to the working while on claim pilots in other countries was conducted to assess the rationale of the pilots. The study helps determine, among other things, whether working part-time while receiving EI benefits tends to reduce unemployment duration and increase the transition rate to full-time employment.Footnote 43

Focus Groups

20 focus groups were conducted for the evaluation of four pilot projects introduced in the mid-2000s: Extended EI Benefits, New Entrants and Re-Entrants, Best 14 Weeks, and working while on claim pilots. The focus groups were held in St. John’s (Newfoundland), Trois-Rivières (Quebec), Sudbury (Ontario), Prince Albert (Saskatchewan), and Prince George (British Columbia) with individuals who participated in the pilots. One of the main objectives of the discussions was to explore the extent to which the various pilots had an impact on the labour market behaviour of claimants.Footnote 44

8 focus groups were held in Laval (Quebec), Moncton (New Brunswick), Montague (Prince Edward Island), and Sudbury (Ontario) with individuals who established a regular claim during Pilot Project 18 period. In each city, two focus groups were conducted. The first group was subject to the rules in effect under Pilot Project 18 while the other group was eligible to revert to the rules in effect under Pilot Project 17. Focus groups participants provided their views on 9 evaluation questions related to the rationale and the impacts of the pilot.Footnote 45

Key Informants Interviews

62 key informant interviews were conducted for the evaluation of three pilot projects introduced in 2005: New Entrants and Re-Entrants, Best 14 Weeks, and working while on claim pilots. Key informants were from sectors that traditionally employed part-time, seasonal and temporary workers. The interviews inquired about the role of EI as a help or a deterrent to hiring employees for part-time or seasonal work and about the impacts of the three pilots on their hiring practices and on the labour force behaviour of workers.Footnote 46

20 key informant interviews were completed in 2016 with employers who tried to hire employees for part-time or part-week work during the Pilot Project 18 period. The main goal of the interviews was to collect the views of employers on whether the pilot achieved its objective of encouraging EI claimants to work more while on claim and whether this helped employers to access employees for part-time or part-week work.Footnote 47

Statistical Studies

5 statistical studies were conducted with EI administrative data and the Canadian Out-of-Employment Panel survey.

A descriptive analysis provides basic statistics on Pilot Projects 8, 12, 17, 18 and 19, and helps address 11 evaluation questions.Footnote 48 Another descriptive analysis examined the work patterns of claimants before, during, and after their claim. Findings from this study help assess whether work during a claim can promote workforce attachment.Footnote 49

Three econometric studies measure the impacts of Pilot Project 8, Pilot Projects 12 and 17, and Pilot Projects 18 and 19 respectively. These studies estimate the effects of the pilots on several outcomes including the incidence and duration of working while on claim, EI usage, job search efforts and post-claim job characteristics.Footnote 50