Legislation under the Purview of the Minister of Labour

Alternate formats

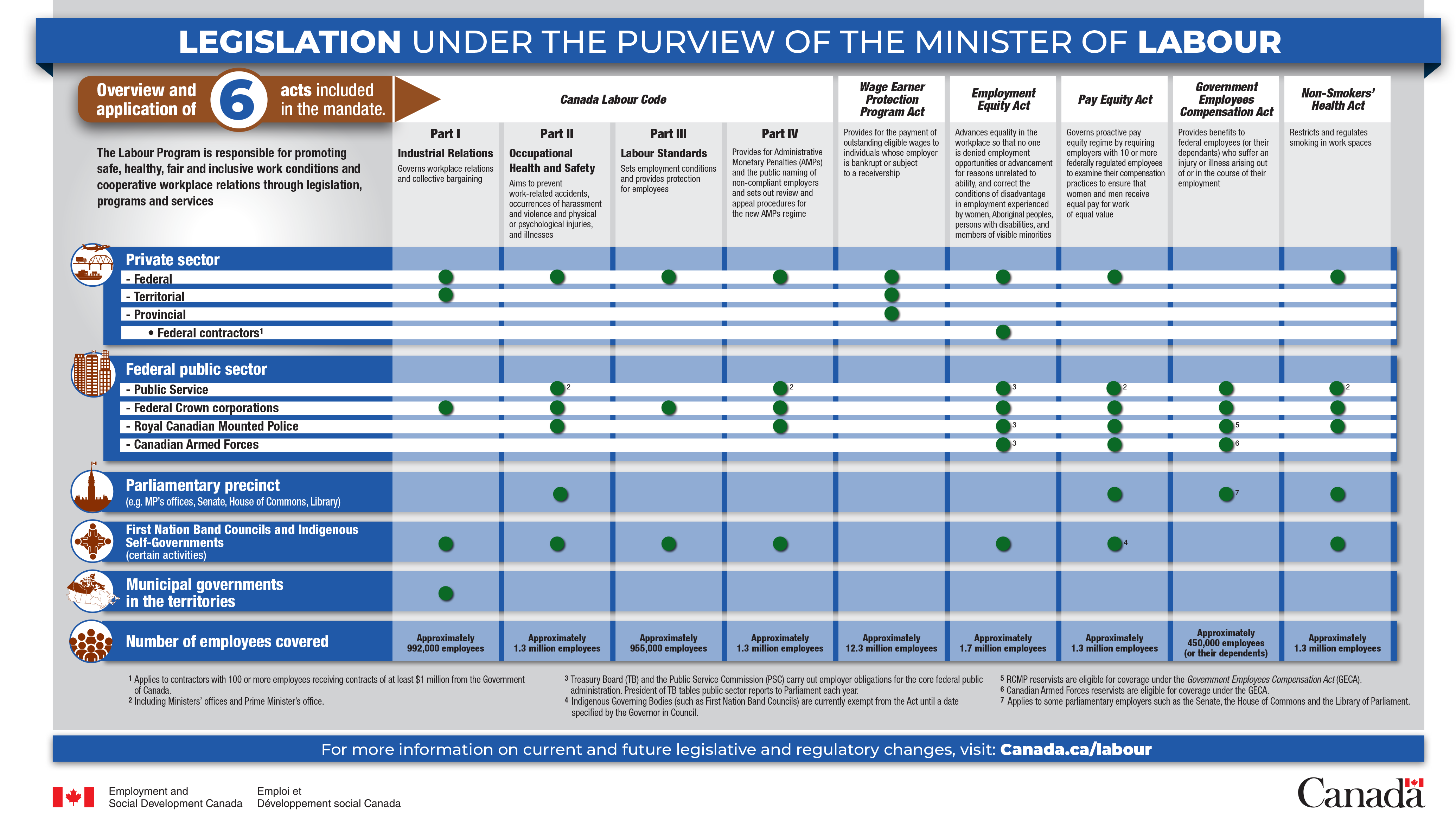

Figure 1: Legislation under the Purview of the Minister of Labour

Text description of figure 1

The Labour Program is responsible for promoting safe, healthy, fair and inclusive work conditions and cooperative workplace relations through legislation, programs and services.

Six pieces of legislation fall under the purview of the Minister of Labour.

Each of the 6 Acts cover different sectors in the federal jurisdiction. The number of employees covered by each Act also varies.

The 6 pieces of legislation included in the mandate of the Minister of Labour are as follows:

- Canada Labour Code

- Wage Earner Protection Program Act

- Employment Equity Act

- Pay Equity Act

- Government Employees Compensation Act

- Non-Smokers Health Act

The Canada Labour Code

- The Canada Labour Code has 4 parts:

- Part I (Industrial Relations) governs workplace relations and collective bargaining

- Part II (Occupational Health and Safety) aims to prevent work-related accidents, occurrences of harassment and violence and physical or psychological injuries, and illnesses

- Part III (Labour Standards) sets employment conditions and provides protection for employees

- Part IV provides for Administrative Monetary Penalties (AMPs) and the public naming of non-compliant employers and sets out review and appeal procedures for the new AMPs regime

Part I of the Canada Labour Code covers approximately 992,000 employees in the following sectors:

- the federal private sector

- the territorial private sector

- federal Crown corporations

- First Nation Band Councils and Indigenous Self-Governments (certain activities), and

- municipal governments in the territories

Part II of the Canada Labour Code covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the Public Service

- federal Crown corporations, and

- the Royal Canadian Mounted Police

- the Parliamentary precinct (for example, MP’s offices, Senate, House of Commons, Library)

- Ministers’ offices and the Prime Minister’s office, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

Part III of the Canada Labour Code covers approximately 955,000 employees in the following sectors:

- the federal private sector

- federal Crown corporations, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

Part IV of the Canada Labour Code covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the Public Service

- federal Crown corporations, and

- the Royal Canadian Mounted Police

- Ministers’ offices and the Prime Minister’s office, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

The Wage Earner Protection Program Act

The Wage Earner Protection Program Act provides for the payment of outstanding eligible wages to individuals whose employer is bankrupt or subject to a receivership. The Wage Earner Protection Program Act covers approximately 12.3 million employees in the following sectors:

- the federal private sector

- the territorial private sector, and

- the provincial private sector

The Employment Equity Act

The Employment Equity Act advances equality in the workplace so that no one is denied employment opportunities or advancement for reasons unrelated to ability. The Act also aims to correct the conditions of disadvantage in employment experienced by women, Aboriginal peoples, persons with disabilities, and members of visible minorities. The Employment Equity Act covers approximately 1.7 million employees in the following sectors:

- the federal private sector

- federal Crown corporations

- First Nation Band Councils and Indigenous Self-Governments (certain activities)

- federal contractors (applies to contractors with 100 or more employees receiving contracts of at least $1 million from the Government of Canada), and

- the federal public sector, including:

- the Public Service (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board reports to Parliament each year)

- the Royal Canadian Mounted Police (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board reports to Parliament each year), and

- Canadian Armed Forces (Treasury Board and the Public Service Commission carry out employer obligations for the core federal public administration. The President of Treasury Board reports to Parliament each year)

The Pay Equity Act

The Pay Equity Act governs the proactive pay equity regime by requiring employers with 10 or more federally regulated employees to examine their compensation practices to ensure that women and men receive equal pay for work of equal value. The Pay Equity Act covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the public service

- federal Crown corporations

- the Royal Canadian Mounted Police

- the Canadian Armed Forces

- the Parliamentary precinct (for example, MP’s offices, Senate, House of Commons, Library)

- Ministers’ offices and the Prime Minister’s office, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities). Indigenous Governing Bodies (such as First Nation Band Councils) are currently exempt from the Act until a date specified by the Governor in Council

The Government Employees Compensation Act

The Government Employees Compensation Act provides benefits to federal employees (or their dependents) who suffer an injury or illness arising out of or in the course of their employment. The Government Employees Compensation Act covers approximately 450,000 employees (or their dependents) in the following sectors:

- the federal public sector, including:

- the public service

- federal Crown corporations

- the Royal Canadian Mounted Police (RCMP reservists are eligible for coverage under the Government Employees Compensation Act)

- the Canadian Armed Forces (Canadian Armed Forces reservists are eligible for coverage under the Government Employees Compensation Act)

- the Parliamentary precinct (applies to some parliamentary employers such as the Senate, the House of Commons and the Library of Parliament)

The Non-Smokers’ Health Act

The Non-Smokers’ Health Act restricts and regulates smoking in work spaces. The Non-Smokers’ Health Act covers approximately 1.3 million employees in the following sectors:

- the federal private sector

- the federal public sector, including:

- the public service

- federal Crown corporations, and

- the Royal Canadian Mounted Police

- the Parliamentary precinct (for example, MP’s offices, Senate, House of Commons, Library)

- Ministers’ offices and the Prime Minister’s office, and

- First Nation Band Councils and Indigenous Self-Governments (certain activities)