Canada Student Financial Assistance Program annual report 2022 to 2023

On this page

Alternate formats

Canada Student Financial Assistance Program – Annual Report 2022–2023 [PDF - 1953 KB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of figures

List of tables

- Table 1 – Canada Student Grants by type

- Table 2 – Canada Student Loans for full- and part-time students

- Table 3 – Profile of students who received Canada Student Grants and/or Canada Student Loans in 2022 to 2023

- Table 4 – Share of full-time students studying inside and outside of Canada in 2022 to 2023

- Table 5 – Canada Student Loan 3-year default rates

- Table 6 – RAP expense

- Table 7 – Direct loan portfolio

List of abbreviations

- CAL

- Canada Apprentice Loan

- CRA

- Canada Revenue Agency

- CSFA Program

- Canada Student Financial Assistance Program

- CSG

- Canada Student Grant

- CSL

- Canada Student Loan

- ESDC

- Employment and Social Development Canada

- MSCA

- My Service Canada Account

- NSLSC

- National Student Loans Service Centre

- PD

- Permanent Disability

- PPD

- Persistent or Prolonged Disability

- RAP

- Repayment Assistance Plan

- RAP-D

- Repayment Assistance Plan for Borrowers with Disabilities

Message from the Minister

The 2022-2023 Annual Report of the Canada Student Financial Assistance Program is a demonstration of the great progress and commitment our Government has for young Canadians. Providing support for Canadians to pursue post-secondary education is a key component of building a Canada that works better for everyone.

In this report, we announce that in the 2022-2023 school year, the Program provided 558,000 students with $3.5 billion in non-repayable grants and 566,000 students with $3.1 billion in loans.

We have listened to Canadians -- and made several changes to make post-secondary education more affordable. On April 1, 2023, we permanently eliminated interest on student loans and apprentice loans. This measure will save student loan borrowers an average of $610 per year. Grants for students, including students with disabilities and students with dependants, were doubled until July 31, 2023. Even more, as of August 1, 2022, access to supports for students with disabilities was expanded to those with a persistent or prolonged disability. On November 1, 2022, we launched improvements to the Repayment Assistance Plan so that borrowers are not required to repay their loan until they earn at least $40,000 per year. All these adjustments will make a real difference in the lives of Canadians.

Accessibility to education is core to our plan to grow the economy. In Budget 2024, we announced our plan to improve and expand student grants and loans. Budget ‘24 proposed the modernizing of shelter allowances that the Program uses when determining financial need, to reflect the true cost of housing today. Finally, we announced our intent to permanently expand the reach of the Program to more health care and social services professionals working in rural and remote communities. This is in addition to other recent measures to expand and enhance student loan forgiveness for doctors and nurses in rural and remote communities - to ensure all Canadians have access to the quality services that they deserve.

As we present the 2022-2023 Annual Report of the CSFA Program, we are reminded of the progress we as a country have made and of the many improvements that can and will be made in the years to come. Providing students with the resources they need to pursue post-secondary education is key to inspiring Canadians to build and innovate for tomorrow's green economy.

The Honourable Randy Boissonnault, P.C., M.P.

Minister of Employment, Workforce Development and Official Languages

Introduction

This annual report serves to inform Parliament and Canadians about student financial assistance for post-secondary education under the Canada Student Financial Assistance (CSFA) Program. It provides information and data on grants, loans, repayment assistance and other program benefits during the 2022 to 2023 academic year (August 1, 2022 to July 31, 2023).

Further detailed information, including past reports and comprehensive statistical reviews of the CSFA Program, is available on the Government of Canada website: Canada Student Financial Assistance Program reports.

Vision and mission

Employment and Social Development Canada

The mission of Employment and Social Development Canada (ESDC), including the Labour Program and Service Canada, is to build a stronger and more inclusive Canada, to help Canadians live productive and rewarding lives and to improve Canadians' quality of life.

Canada Student Financial Assistance Program

The CSFA Program provides targeted grants and needs based loans to help students access and afford post-secondary education. It also offers repayment assistance to borrowers with financial difficulty.

Program highlights and results

The Government of Canada recognizes the importance of student financial assistance to help post secondary students in achieving their educational goals and, ultimately, succeeding as contributing members of a productive workforce.

Through the CSFA Program, the Government of Canada funds about 60% of a full-time student's financial need. The province or territory covers the remaining 40%. To achieve this, the CSFA Program works collaboratively with provincial and territorial governments to deliver student financial assistance to eligible students. Quebec, Nunavut, and the Northwest Territories do not participate in the CSFA Program but receive annual alternative payments in support of their own student financial assistance programs. Applicants in the remaining 10 jurisdictions are assessed for federal and provincial grants and loans through a single application process.

In the 2022 to 2023 academic year, approximately 682,000 post-secondary students received financial assistance from the CSFA Program, in the form of grants and loans. The CSFA Program provided $3.5 billion in non-repayable Canada Student Grants (CSGs) to approximately 558,000 students and $3.1 billion in Canada Student Loans (CSLs) to 566,000 students. In addition, the 3 non-participating jurisdictions will receive $1,138.0 million in alternative payments based on the CSFA Program's expenses and revenues for the 2022 to 2023 fiscal year.

The Government of Canada implemented a number of measures in academic year 2022 to 2023 to help ensure that the cost of post-secondary education remains predictable and affordable for everyone during the economic recovery:

- extended the temporary waiver of interest on CSLs and Canadian Apprentice Loans (CALs) from April 1, 2022 until March 31, 2023

- extended the temporary doubling of the CSGs for full- and part-time students, students with disabilities, and students with dependants for 2 additional years, from August 1, 2021 until July 31, 2023

- supported adult learners in their efforts to up-skill or re-skill by extending the $1,600 Skills Boost adult learner pilot project top-up to the full-time CSGs for an additional 2 school years, from August 1, 2021 until July 31, 2023

- as of August 1, 2022, extended disability supports under the CSFA Program to include those with a persistent or prolonged disability. Disability supports were previously only available to students with a permanent disability. In addition, the CSFA Program has increased flexibility for the documentation that can be accepted when applying for CSFA Program disability supports

- as of November 1, 2022, enhanced the Repayment Assistance Plan (RAP) by increasing the zero-payment income thresholds, indexing the thresholds to inflation, and reducing the cap on monthly payments for borrowers on RAP from 20% of family income to 10%, so that no borrower has to pay more than they can reasonably afford

- as announced in the 2022 Fall Economic Statement, and building on the temporary waiver of interest, effective April 1, 2023, the Government of Canada has made permanent the elimination of interest accrual for CSLs and CALs to reduce the financial burden on CSFA Program borrowers

Program results

The following are key highlights and results of the CSFA Program in the 2022 to 2023 academic year.

A. Canada Student Grants

In 2022 to 2023, nearly 558,000 students received $3.5 billion in financial assistance they will not have to pay back. This represents an increase of 3% in the number of recipients, and an increase of 8% in the value of grants relative to the previous academic year. Select grants continue to be temporarily doubled until the end of the 2022 to 2023 academic year.

CSGs provide non-repayable funding to full- and part-time students and are targeted to students from low- and middle-income families, students with disabilities, and those with dependants. Students are automatically assessed for CSGs when applying for student financial assistance through their province or territory of residence.

In 2022 to 2023, the CSFA Program provided the following grants to eligible students:

- CSG for full-time students: up to $750 per month of study ($6,000 for an 8-month study period)

- CSG for full-time students with dependants: up to $400 per month of study ($3,200 for an 8-month study period) for each dependant under 12 years of age (and for each dependant over 12 years of age with a disability)

- CSG for students with disabilities: $4,000 per academic year for full- and part-time students with permanent or persistent or prolonged disabilities

- CSG for services and equipment for students with disabilities: up to $20,000 per academic year to cover exceptional education-related costs

- CSG for part-time students: up to $3,600 per academic year

- CSG for part-time students with dependants: up to a maximum of $3,840 per academic year

The CSFA Program also provides the Skills Boost Top-up grant of $1,600 to eligible recipients of the CSG for Full-Time Students. This top-up is intended for adult learners from low- and middle-income families who have been out of high school for at least 10 years. Initially introduced in the 2018 to 2019 academic year as a temporary measure, the Skills Boost adult learner top-up grant was extended for an additional 2 years through Budget 2021, until July 31, 2023.

The following table provides a summary of the distribution of Canada Students Grants by type.

Table 1: Canada Student Grants by type

| Canada Student Grant | 2020 to 2021 | 2021 to 2022 | 2022 to 2023 |

|---|---|---|---|

| For Full-Time students | 471,826 | 470,663 | 481,165 |

| For Skills Boost Top-up | 82,784 | 94,138 | 113,884 |

| For Full-Time Students with Dependants | 80,930 | 89,140 | 101,904 |

| For Full-Time Students with Disabilities | 52,519 | 57,873 | 67,166 |

| For Services and Equipment for Full-Time Students with Disabilities | 9,597 | 10,342 | 12,584 |

| For Part-Time Students | 40,902 | 39,501 | 41,145 |

| For Part-Time Students with Dependants | 2,020 | 2,485 | 2,604 |

| For Part-Time Students with Disabilities | 2,115 | 2,361 | 2,642 |

| For Services and Equipment for Part-Time Students with Disabilities | 443 | 452 | 498 |

| Total | 541,777 | 544,055 | 557,684 |

- *Students can receive multiple grants but are only counted as 1 recipient in the total number of recipients. Therefore, the total is smaller than the sum of all recipients.

| Canada Student Grant | 2020 to 2021 | 2021 to 2022 | 2022 to 2023 |

|---|---|---|---|

| For Full‑Time Students | 2,365.1 | 2,338.6 | 2,434.6 |

| For Skills Boost Top-up | 127.1 | 143.5 | 177.3 |

| For Full-Time Students with Dependants | 377.5 | 431.5 | 515.2 |

| For Full-Time Students with Disabilities | 200.7 | 221.5 | 258.7 |

| For Services and Equipment for Full-Time Students with Disabilities | 26.6 | 28.5 | 35.4 |

| For Part-Time Students | 78.6 | 79.1 | 84.0 |

| For Part-Time Students with Dependants | 2.2 | 2.9 | 3.2 |

| For Part-Time Students with Disabilities | 8.4 | 9.3 | 10.4 |

| For Services and Equipment for Part-Time Students with Disabilities | 1.4 | 1.3 | 1.5 |

| Total | 3,187.5 | 3,256.2 | 3,520.3 |

The following figure shows the distribution of CSGs for full- and part-time students by province or territory.

Figure 1 – Text version

| Province or territory | Number of recipients | Millions of dollars |

|---|---|---|

| Newfoundland and Labrador | 6,143 | 40.9 |

| Prince Edward Island | 2,691 | 16.0 |

| Nova Scotia | 14,753 | 99.7 |

| New Brunswick | 9,538 | 57.8 |

| Ontario | 321,520 | 1,868.8 |

| Manitoba | 14,770 | 90.2 |

| Saskatchewan | 19,318 | 131.9 |

| Alberta | 116,637 | 909.6 |

| British Columbia | 52,065 | 303.8 |

| Yukon | 249 | 1.7 |

| Total | 557,684 | 3,520.3 |

B. Canada Student Loans

In the 2022 to 2023 academic year, approximately 566,000 students received $3.1 billion in CSLs. This represents an increase of 1% in the number of recipients and an increase of 7% in the value of loans relative to the previous academic year.

CSLs are available to eligible students who demonstrate financial need, and who are enrolled in a degree, diploma or certificate program at a designated post-secondary educational institution in Canada or abroad. While CSLs have always been interest-free for the entire period of studies, they are now also interest-free during repayment.

The following table provides a summary of CSLs for full- and part-time students by province or territory.

Table 2: Canada Student Loans for full- and part-time students

| Province or territory | 2020 to 2021 | 2021 to 2022 | 2022 to 2023 |

|---|---|---|---|

| Newfoundland and Labrador | 6,720 | 6,724 | 7,142 |

| Prince Edward Island | 2,346 | 2,146 | 2,106 |

| Nova Scotia | 18,060 | 17,681 | 17,694 |

| New Brunswick | 12,344 | 11,693 | 11,449 |

| Ontario | 343,144 | 315,877 | 310,924 |

| Manitoba | 15,429 | 14,081 | 15,913 |

| Saskatchewan | 18,354 | 17,967 | 17,615 |

| Alberta | 100,674 | 113,776 | 125,030 |

| British Columbia | 59,185 | 58,207 | 57,763 |

| Yukon | 206 | 204 | 212 |

| Total | 576,462 | 558,356 | 565,848 |

| Province or territory | 2020 to 2021 | 2021 to 2022 | 2022 to 2023 |

|---|---|---|---|

| Newfoundland and Labrador | 56.4 | 40.6 | 44.0 |

| Prince Edward Island | 14.7 | 11.5 | 11.6 |

| Nova Scotia | 182.9 | 122.0 | 123.7 |

| New Brunswick | 85.5 | 60.6 | 63.0 |

| Ontario | 2,076.9 | 1,503.9 | 1,530.5 |

| Manitoba | 94.1 | 66.1 | 75.6 |

| Saskatchewan | 157.7 | 108.5 | 108.2 |

| Alberta | 771.4 | 686.4 | 842.6 |

| British Columbia | 527.7 | 339.2 | 336.9 |

| Yukon | 1.6 | 1.3 | 1.4 |

| Total | 3,968.8 | 2,940.0 | 3,137.5 |

C. Loan repayment, assistance, and forgiveness

As of April 2023, the CSFA Program no longer charges interest on federal student loans, making student loan repayment more affordable for all borrowers in repayment. This measure follows the temporary elimination of interest accrual on student loans, from April 2021 to March 2023.

Following the end of their studies, borrowers enter a 6-month non-repayment period, wherein they are not required to make payments on their CSLs. Borrowers repay their loans through monthly required payments, typically over a 114-month period (9.5 years). Depending on their financial situation, borrowers may revise their repayment terms to pay more quickly or extend their repayment period by reducing their monthly payments (up to a maximum of 14.5 years).

Prior to the permanent elimination of interest, the Government of Canada temporarily eliminated interest on the repayment of CSLs and CALs, between April 2021 and March 2023. Borrowers continue to be responsible to pay any interest that may have accrued on their federal student loans prior to the measures to eliminate interest.

The average CSL balance at the time of leaving school was $15,091 for the 2022 to 2023 academic year. This represents an 3% decrease compared to the previous year.

Differences in loan balances reflect each student's particular situation. Loan balances are measured at the time of leaving school, which includes students who graduate as well as those who do not complete their program of study. Among the key factors attributed to differences are the type and location of the post-secondary education institution, and the program of study. In the 2022 to 2023 academic year, the average loan balance of university students was $18,704, compared to the average loan balance of college students at $11,107, and those attending private institutions at $13,818.

Repayment Assistance Plan

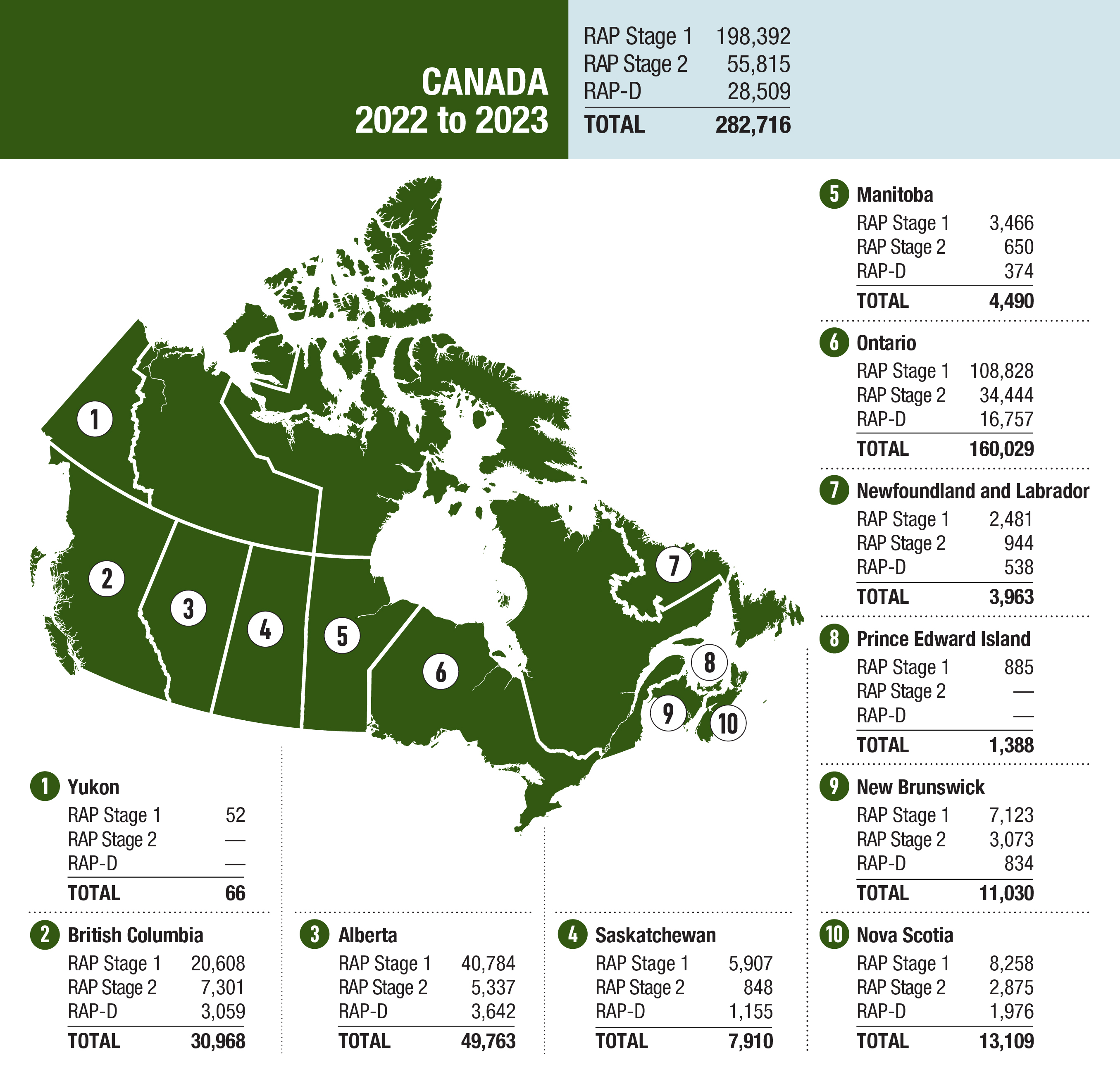

Approximately 283,000 student loan borrowers received support under the Repayment Assistance Plan (RAP) in the 2022 to 2023 academic year, which is similar to the previous academic year. Significant enhancements were made to RAP in the 2022 to 2023 academic year in order to make repayment more affordable for borrowers who need assistance repaying their loans.

RAP offers different benefits depending on whether borrowers need short-term assistance soon after entering repayment or longer-term assistance after multiple years in repayment. To remain on RAP, borrowers must re-apply every 6 months.

In November 2022, the CSFA Program implemented significant changes to expand RAP eligibility and support repayment affordability. The new RAP enhancements significantly increased the income thresholds for eligibility. Income thresholds are adjusted upwards based on family size and indexed to inflation annually, accounting for annual cost of living and wage increases. For example, a single borrower does not have to repay their CSL until their earnings reach a minimum threshold of at least $40,000 per year (for academic year 2022 to 2023), a significant increase from the previous threshold of $25,000. For a family of 4, no payment is required until they earn at least $66,360 (previously this threshold was $59,512).

Furthermore, for borrowers on RAP with a reduced affordable payment, their monthly required payment has been capped at 10% of their monthly family income, compared to the previous requirement to cap at 20% of monthly family income.

During the first 5 years on RAP (RAP Stage 1), no borrower has to repay their CSL until they are earning at least $40,000 per year (2022 to 2023 threshold); this income threshold is adjusted upward based on family size. For those with an income over this threshold, they could be eligible for a reduced affordable payment. For borrowers with longer-term financial difficulty (beyond 5 years), the Government begins to contribute towards the principal (RAP Stage 2) such that the loan is fully paid off 15 years after leaving school. If a borrower has not defaulted on a loan and they have already spent at least 10 years in repayment when they first apply for RAP, they immediately enter Stage 2 and the Government contributes to principal payments. However, if a borrower had previously defaulted on their loan, these timelines are reset to when the loan was brought back into good standing.

There is also the Repayment Assistance Plan for Borrowers with Disabilities (RAP-D). For borrowers eligible for RAP-D, the Government pays the principal not covered by the monthly affordable payments, such that the loan is paid off 10 years after the completion of studies, for those who remain on RAP-D. In addition, disability-related expenses are taken into account in the eligibility assessment, which may further reduce the individual's monthly payments.

The following figure provides a summary of the number of RAP recipients by RAP stage and payment type in 2022 to 2023.

Figure 2 – Text version

| Province or territory | All Stages | Stage 1 | Stage 2 | Disability (D) |

|---|---|---|---|---|

| Newfoundland and Labrador | 3,963 | 2,481 | 944 | 538 |

| Prince Edward Island | 1,388 | 885 | x | x |

| Nova Scotia | 13,109 | 8,258 | 2,875 | 1,976 |

| New Brunswick | 11,030 | 7,123 | 3,073 | 834 |

| Ontario | 160,029 | 108,828 | 34,444 | 16,757 |

| Manitoba | 4,490 | 3,466 | 650 | 374 |

| Saskatchewan | 7,910 | 5,907 | 848 | 1,155 |

| Alberta | 49,763 | 40,784 | 5,337 | 3,642 |

| British Columbia | 30,968 | 20,608 | 7,301 | 3,059 |

| Yukon | 66 | 52 | x | x |

| Total | 282,716 | 198,392 | 55,815 | 28,509 |

- x Denotes values that are suppressed to prevent statistical disclosure of number of recipients greater than 0 but less than 10.

Severe Permanent Disability Benefit

In very particular cases, borrowers may be eligible for loan forgiveness. The Severe Permanent Disability Benefit makes it possible to cancel the repayment obligations of borrowers who have a severe permanent disability.

In order to determine eligibility, a medical assessment must be completed by a physician or nurse practitioner stating that the borrower suffers from a severe permanent disability. This is defined as any impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment - or a functional limitation - that prevents a person from performing the daily activities necessary to participate in the labour force in a manner that is substantially gainful, as defined in section 68.1 of the Canada Pension Plan Regulations, and is expected to remain with the person for their expected life.

In the 2022 to 2023 academic year, 479 borrowers were forgiven an average amount of $15,765 in CSLs under this measure, for a total of $7.6Footnote 1 million. This represents a 4% increase in the number of borrowers and a 9% decrease in total CSLs forgiven compared to the previous year.

Loan forgiveness for family doctors and nurses

The Government of Canada offers CSL forgiveness for eligible family doctors, residents in family medicine, nurse practitioners, and nurses who work in under-served rural or remote communities. This benefit is aimed at increasing health care services across Canada.

Family doctors or residents in family medicine may receive up to $40,000 in CSL forgiveness over a maximum of 5 years ($8,000 per year), and nurse practitioners and nurses may receive up to $20,000 in loan forgiveness over a maximum of 5 years ($4,000 per year).

In the 2022 to 2023 fiscal year, almost 5,600 health care professionals working in various under-served rural and remote communities received an average of $4,757 of CSL forgiveness for a total of $26.5 million. This represents a 4% increase in the number of recipients and a 6% increase in total CSL forgiveness, compared to the previous year.

D. Student demographics

The demographic profile of CSFA Program recipients remained relatively consistent with previous years. Most students who received a grant and/or loan in 2022 to 2023 were: female (60%); between the ages of 20 to 24 (38%); attending university (53%); and enrolled in an undergraduate program (54%). Students 30 years and older made up 24% of the population. Students with disabilities made up 10% of grant and/or loan recipients in 2022 to 2023 compared to 9% in 2021 to 2022. Indigenous students made up 6% of grant and/or loan recipients (7% in 2021 to 2022).

The following table provides a summary of the profile of students who received CSGs and/or CSLs in 2022 to 2023.

Table 3: Profile of students who received Canada Student Grants and/or Canada Student Loans in 2022 to 2023

| Gender | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| Women | 405,959 | 60 | 3,999.2 | 60 |

| Men | 255,283 | 37 | 2,416.3 | 36 |

| Gender diverse identities | 2,256 | 0* | 19.3 | 0* |

| Unspecified** | 18,317 | 3 | 223.0 | 3 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

- *Value rounded to zero.

- **Gender information was not provided.

| Disability status | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| Students with disabilities | 70,189 | 10 | 824.1 | 12 |

| Students without disabilities | 611,626 | 90 | 5,833.7 | 88 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

| Indigenous status | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| Indigenous students | 40,506 | 6 | 486.5 | 7 |

| Non-indigenous students | 641,309 | 94 | 6,171.4 | 93 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

| Age group | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| Younger than 20 years | 154,747 | 23 | 1,175.4 | 18 |

| 20 to 24 years | 261,352 | 38 | 2,269.2 | 34 |

| 25 to 29 years | 101,658 | 15 | 1,045.7 | 16 |

| 30 to 34 years | 54,812 | 8 | 677.8 | 10 |

| 35 to 39 years | 43,129 | 6 | 606.9 | 9 |

| 40 to 44 years | 32,337 | 5 | 455.1 | 7 |

| 45 to 49 years | 18,125 | 3 | 235.4 | 4 |

| 50 years and older | 15,655 | 2 | 192.3 | 3 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

| Level of study | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| Certificate or diploma | 271,746 | 40 | 2,859.8 | 43 |

| Undergraduate | 370,308 | 54 | 3,447.7 | 52 |

| Master | 33,384 | 5 | 289.0 | 4 |

| Doctorate | 6,377 | 1 | 61.4 | 1 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

| Type of institution | Number | Percent | Millions of dollars | Percent |

|---|---|---|---|---|

| University | 364,566 | 53 | 3,347.7 | 50 |

| College | 186,860 | 27 | 1,608.7 | 24 |

| Private | 130,389 | 19 | 1,701.4 | 26 |

| Total | 681,815 | 100 | 6,657.8 | 100 |

In the 2022 to 2023 academic year, the vast majority of full-time students (90%) remained in their home province or territory to pursue post-secondary education. Only 7% studied outside their home province or territory within Canada, while around 3% of Program beneficiaries studied outside Canada.

The following table provides a summary of the share of full-time students studying inside and outside of Canada in 2022 to 2023.

| Province or territory of origin | Study in home province or territory | Study in Canada but away from home province or territory | Study in the United States | Study outside Canada and the United States |

|---|---|---|---|---|

| Newfoundland and Labrador | 6,072 | 1,229 | 44 | 54 |

| Prince Edward Island | 2,058 | 1,061 | x | x |

| Nova Scotia | 14,999 | 3,112 | 108 | 124 |

| New Brunswick | 9,021 | 3,097 | 126 | 55 |

| Ontario | 373,603 | 11,279 | 4,046 | 4,897 |

| Manitoba | 14,599 | 3,101 | 227 | 124 |

| Saskatchewan | 16,733 | 5,592 | 263 | 132 |

| Alberta | 122,069 | 14,298 | 2,456 | 1,774 |

| British Columbia | 56,138 | 6,865 | 856 | 1,247 |

| Yukon | 69 | 247 | x | x |

| Total | 615,361 | 49,881 | 8,149 | 8,424 |

- x Denotes values that are suppressed to prevent statistical disclosure of number of recipients greater than 0 but less than 10.

Program delivery

Working with partners

The CSFA Program works collaboratively with provincial and territorial governments to deliver student financial assistance to eligible students. In participating provinces and territories, approximately 60% of a full-time student's assessed financial need is funded by the Government of Canada, while the province or territory covers the remaining 40%.

A private-sector service provider, contracted by the Government of Canada, and branded as the National Student Loans Service Centre (NSLSC), administers federal grant and loan disbursement as well as federal loan repayment. The NSLSC administers federal and provincial student aid in 6 integrated provinces (British Columbia, Saskatchewan, Ontario, New Brunswick, Newfoundland and Labrador, and the newly integrated Manitoba) as a single, integrated loan. The Government of Canada and the Government of Manitoba fully completed Manitoba's integration in July 2023, meaning all of Manitoba's new and existing borrowers now benefit from the use of a single point of service. Provinces and territories that have not integrated their program administration with the CSFA Program manage the provincial/territorial portion of financial assistance themselves.

In support of their own student aid programs, the 3 non-participating jurisdictions (Quebec, Nunavut, and the Northwest Territories) receive alternative payments each year according to the CSFA Program's expenses and revenues from the previous year. In January 2024, these jurisdictions received $1,138.0 million based on expenses and revenues from the 2022 to 2023 academic year, as follows:

- Quebec received $1,123.3 million - an increase of $137.0 million from the last payment of $986.3 million

- Nunavut received $7.6 million - an increase of $1.0 million from the last payment of $6.6 million

- the Northwest Territories received $7.1 million - an increase of $0.8 million from the last payment of $6.3 million

Service modernization

The Government of Canada is committed to the continuous improvement of the CSFA Program for the benefit of students. In order to respond to the expectations of Canadians with respect to e-services, the Government introduced a series of enhancements to online services for students in academic year 2022 to 2023. These enhancements helped to advance the CSFA Program's progress towards a digital-first service delivery model. In collaboration with the service provider and provincial and territorial partners, the CSFA Program will continue these efforts to provide students with additional digital self-service options.

Below is an overview of recent achievements and planned improvements to enhance the service experience of students.

Recent achievements

Over the past year, the financial systems underlying loan and grant disbursements, and systems related to adjudicating and verifying RAP applications, were modernized. This represents significant progress towards enhancing the reliability and effectiveness of services provided to students.

Planned improvements

Some of the planned improvements to service delivery include:

- additional client-facing changes, such as updates to the NSLSC website to enable borrowers to upload documents and send specific account questions in the secure online portal

- further enhancements to systems and tools used by CSFA Program agents to improve client service delivery to students

- online tools and resources developed in collaboration with internal and external partners and stakeholders to increase awareness of CSFA Program supports and financial literacy of current and prospective borrowers

- the CSFA Program also planned to modernize the Canada Apprentice Loan (CAL) Electronic Identity Verification process to align with ESDC's approved Enterprise Cyber Authentication Solution platform by leveraging the My Service Canada Account (MSCA) starting in the Fall of 2023

Program performance measurement

Client satisfaction

The CSFA Program is committed to ensuring that clients receive quality service. An annual client satisfaction survey assesses clients' satisfaction with services related to their grants and loans. Overall, satisfaction levels remained high over the past number of years. In the 2022 to 2023 academic year, 75.6% of clients were satisfied with the quality of service they received from the NSLSC.

Portfolio performance

The CSFA Program's direct loan portfolio includes the balance of outstanding loans (in-study and in-repayment) and the balance of loans in default. With more than 1.9 million active recipients, its value as of July 31, 2023, was $23.8 billion, representing a 1% increase as compared to the previous year. The CSFA Program works with the service provider to minimize the number of loans going into default. Although most students repay their loans in full and on time, some borrowers experience difficulty in repayment. A loan is deemed in default when in arrears for more than 270 days (roughly equivalent to missing 9 monthly payments).

The CSFA Program uses a 3-year default rate as the main indicator of the portfolio performance. This rate compares the value of loans that enter repayment in a given academic year and default within 3 years to the value of all loans that entered repayment in that academic year. As such, the most recent 3-year default rate available in academic year 2022 to 2023 is that of borrowers who entered repayment during the 2020 to 2021 academic year.

As noted in the following table, the default rate has been reduced by half by over the last decade, from 14% in 2010 to 2011, to 7% in 2020 to 2021. The introduction of grants and RAP, coupled with increased and targeted communications by the service provider, have helped a greater number of students manage their repayment obligations, leading to a lower default rate. Furthermore, major enhancements in student financial supports in recent years (for example, increase in grants and interest waiver on CSLs) have all contributed to the improvement in repayment outcomes.

| Years | 2010 to 2011 | 2011 to 2012 | 2012 to 2013 | 2013 to 2014 | 2014 to 2015 | 2015 to 2016 | 2016 to 2017 | 2017 to 2018 | 2018 to 2019 | 2019 to 2020 | 2020 to 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rates | 14% | 13% | 12% | 11% | 10% | 9% | 9% | 8% | 8% | 7% | 7% |

RAP expense

RAP is a benefit provided by the Government of Canada to help borrowers who experience difficulty in repaying their student loans. To measure the total amount of support the Government provides through RAP in a given year, the CSFA Program has developed a RAP expense indicator. This indicator measures the amount of principal repaid by the Government of Canada through RAP in a given year, as a percentage of the total loan principal in repayment during the same year.

For the 2022 to 2023 academic year, the Government of Canada's RAP expenses represented 1.3% of the loan principal in repayment.

The following table provides a summary of the Government of Canada's yearly expenses in providing RAP as a support benefit.

| Academic year | Principal repaid by Government through RAP (in million $) | Principal in repayment (in million $) | RAP expense indicator |

|---|---|---|---|

| 2018 to 2019 | 104.5 | 10,101.1 | 1.0% |

| 2019 to 2020 | 82.2 | 10,706.6 | 0.8% |

| 2020 to 2021 | 147.1 | 11,770.1 | 1.2% |

| 2021 to 2022 | 155.7* | 11,998.0 | 1.3% |

| 2022 to 2023 | 169.9 | 12,942.5 | 1.3% |

- *Revised

Loan rehabilitation

The CSFA Program offers loan rehabilitation as a way for borrowers to bring their defaulted loans back into good standing. Borrowers can rehabilitate their defaulted loans by paying the equivalent of 2 regular monthly payments plus their outstanding interest. Borrowers also have the 1-time option to capitalize the interest owing on their student loans and moving the outstanding balance to their loan principal. If they choose to exercise this option, they would still have to make an equivalent payment of 2 regular monthly payments. The CSFA Program works closely with the Canada Revenue Agency (CRA) to raise awareness of loan rehabilitation. Loan rehabilitation helps borrowers by making them eligible for RAP or additional grants and loans to continue their studies.

During the 2022 to 2023 academic year, 7,573 borrowers rehabilitated a total of $98.1 million in CSLs. This represents a 24.1% increase in the total number of rehabilitated borrowers and a 17.5% increase in the value of rehabilitated CSLs, as compared to the previous year.

Loan write-off

The Government of Canada writes off some CSLs from the Public Accounts on an annual basis. This includes loans deemed unrecoverable after all reasonable collection efforts are undertaken by the Program and the CRA. Prior to recommending CSLs for write-off, the CRA's comprehensive collections model to recover Crown debt focuses on 4 distinct activities: contacting the debtor via telephone; contact tracing to locate debtors and sources of revenue for collection; collection activities; and legal action. The majority of the write-off dollar-value is attributed to loans that have not been acknowledged or for which no payment has been received and have subsequently reached the 6-year statute of limitations. Other reasons for write-off include bankruptcy, financial hardship, compromise settlements, and low dollar-value balances remaining on the account (less than $20).

The total amount written-off in 2022 to 2023 for directly financed student loans was $220.6 million. This value is higher than the 2021 to 2022 write-off value of $168.8 million and represents less than 1% of the directly financed student loan portfolio.

The write-off of any debt does not mean the debt is forgiven. In most cases, should an individual who had their student loan written-off wish to access student financial assistance from the CSFA Program in the future, the debt must be repaid in full. In a situation where a CSL debt is reinstated after write-off, any interest charges that accrued on the debt are also reinstated.

Program integrity

The CSFA Program strives to safeguard the integrity of the Program by ensuring that all aspects of the Program are operating within the legal framework of the Canada Student Financial Assistance Act and the Canada Student Loans Act.

The CSFA Program has in place a number of policies and activities designed to ensure its integrity and to enhance governance and accountability:

- losses of public money due to fraud or misrepresentation are reported in the Public Accounts of Canada on a fiscal year basis. For the academic year 2022 to 2023, the CSFA Program identified 131 cases, of which 113 were due to identity theft where an individual used another person's information to obtain funds. The remaining 18 cases involved individuals who misrepresented themselves to obtain student financial assistance. For these cases, administrative measures were imposed. Administrative measures can include restricting an individual from receiving student financial assistance for a specified period, requiring them to immediately repay any money obtained as a result of false information and converting grants to repayable loans. If warranted, further action may be taken such as criminal investigation or civil litigation

- in keeping with provisions of the Canada Student Financial Assistance Act, the Office of the Chief Actuary conducts a statutory actuarial review of the Program in order to provide a long-term forecast of the portfolio and program costs. The most recent Actuarial Report (2023) (PDF format) is available on the website of the Office of the Superintendent of Financial Institutions

- the Designation Policy Framework establishes Canada-wide criteria for designation, the process whereby post-secondary educational institutions are deemed eligible for students to receive student financial assistance while attending the educational institution. The Framework ensures that federal, provincial and territorial student financial assistance portfolios operate within the principles and practices of reasonable financial stewardship. As a part of this framework, the CSFA Program calculates and tracks the repayment rates of CSLs for designated Canadian institutions. The 2023 repayment rate for borrowers who entered repayment in 2021 to 2022 was 91.9%. This means that 91.9% of the total loans to students who entered repayment in the 2021 to 2022 academic year have been repaid or are being repaid on time and those accounts are in good standing. This is one of the highest repayment rates that the CSFA Program has recorded since direct loans were introduced in 2000

- starting in February 2023, the CSFA Program, provinces and territories instituted a federal-provincial-territorial Sub Committee on Fraud and Integrity aimed at rapidly informing members of potential and confirmed fraud attempts, as well as identifying integrity gaps and mitigation strategies to identify and deter fraud attempts

Appendix A - Canada Apprentice Loan

Support for apprentices

The Canada Apprentice Loan (CAL) provides financial support to apprentices in listed Red Seal trades during periods of technical training. This helps them complete their apprenticeship and encourages more Canadians to consider a career in the skilled trades.

Eligible apprentices may apply for loans of up to $4,000 per period of technical training, for a maximum of 5 periods. As of April 1, 2023, CALs are permanently interest-free. Apprentices are not required to start repaying their CAL until 6 months after they end their apprenticeship, as long as their registration in a Red Seal Trade apprenticeship program is confirmed every 12 months. Apprentice loans can be payment free for up to 6 years to give borrowers time to complete their apprenticeship program. Given the timing of technical training requirements in their province, apprentices in Quebec do not qualify for CAL. Instead, Quebec receives an annual special payment. In September 2023, Quebec received $3.3 million based on expenses and revenues from the 2022 to 2023 fiscal year.

In the 2022 to 2023 academic year, CALs amounting to $39.3 million were disbursed to 9,400 apprentices. This represents a 14% increase in total CALs disbursed and 15% increase of the number of apprentices, as compared to the previous year. Most disbursed apprenticeship loans (78%) went to apprentices from 3 provinces: Alberta (34%), British Columbia (26%) and Ontario (18%).

Appendix B - Financial data

Consolidated report on the Canada Student Financial Assistance Program

Since 2000, the Government of Canada has provided student financial assistance directly to borrowers. Prior to 2000, Program lending regimes were administered by financial institutions. Under direct lending, the Government of Canada finances and administers the CSFA Program, contracting with a private-sector service provider (branded as the NSLSC) to manage student loan accounts from disbursement to repayment.

Reporting entity

The entity detailed in this report is the CSFA Program only and does not include departmental operations related to the delivery of the CSFA Program. Expenditure figures are primarily statutory in nature, made under the authority of the Canada Student Financial Assistance Act and the Canada Student Loans Act. Information in Table 7 is reported on a fiscal year basis (April 1 to March 31), rather than on an academic year basis (August 1 to July 31).

Table 7: Direct loan portfolio*

| Interest | 2020 to 2021 Actual (in million $) |

2021 to 2022 Actual (in million $) |

2022 to 2023 Actual (in millions $) |

|---|---|---|---|

| Interest payments received on direct loans** | 129.6 | 30.8 | 28.5 |

- *This is not a financial statement. This table shows the direct loan portfolio related expenses and interest received on student loans in repayment on a fiscal year basis (April 1 to March 31).

- **This line item represents the interest portion of payments received on certain direct loans in collection accrued before September 2020.

| Student related expenses | 2020 to 2021 Actual (in million $) |

2021 to 2022 Actual (in million $) |

2022 to 2023 Actual (in millions $) |

|---|---|---|---|

| Canada Student Grants | 2,920.8 | 3,154.5 | 3,367.9 |

| Alternative payments*** | 487.2 | 927.4 | 999.2 |

| Repayment assistance - principal**** | 93.4 | 160.8 | 159.5 |

| Repayment assistance - interest | 49.1 | 1.6 | 0.0 |

| Loans forgiven - doctors and nurses | 19.7 | 25.1 | 26.5 |

| Loans forgiven - severe permanent disability | 4.8 | 6.1 | 6.4 |

| Loans forgiven - death | 11.8 | 10.7 | 8.7 |

| Loans forgiven - bankruptcy***** | 0 | 0 | 0 |

| Total | 3,589.3 | 4,288.7 | 4,568.2 |

- ***Payments made to non-participating jurisdictions to support them with their own student financial assistance program. Payments are reported in the year in which they were received by non-participating jurisdictions.

- ****Amounts are different than those in Table 6 because they are presented on a fiscal year basis rather than an academic year basis.

- *****Previous amounts were adjusted to conform to the current year's presentation.

| Other expenses | 2020 to 2021 Actual (in million $) |

2021 to 2022 Actual (in million $) |

2022 to 2023 Actual (in millions $) |

|---|---|---|---|

| Loan write-off | 185.5 | 168.8 | 220.6 |

| Interest subsidy****** | 154.9 | 342.8 | 649.2 |

| Collection cost******* | 24.6 | 25.4 | 24.0 |

- ******Estimated cost to fund Canada Student Loans reported by the Department of Finance.

- *******These are costs incurred by the Canada Revenue Agency to collect on loans in default.

| Administrative fees | 2020 to 2021 Actual (in million $) |

2021 to 2022 Actual (in million $) |

2022 to 2023 Actual (in millions $) |

|---|---|---|---|

| Program delivery expenses******** | 39.1 | 45.9 | 44.3 |

| Administrative fees to provinces | 39.5 | 42.6 | 42.3 |

| Other operating expenses | 1.2 | 1.5 | 1.9 |

| Total | 79.9 | 90.0 | 88.6 |

- ********CSFA Program delivery expenses include portfolio management, third-party administration, audit, actuarial and survey fees.

Glossary

- Academic year

- August 1 to July 31.

- Consolidation

- Borrowers consolidate their student loan(s) 6 months after the end of their post-secondary studies (or ending full-time studies). Repayment begins once they have consolidated their loans.

- Default

- A loan is deemed in default when it is in arrears for greater than 270 days under the direct lending regime.

- Default rate

- The CSFA Program measures default using a 3-year default rate. This rate shows the proportion of loan dollars that enter repayment in a given academic year and default within 3 years. For example, the 2020 to 2021 default rate represents the proportion of loan dollars that entered repayment in the 2020 to 2021 academic year and defaulted before August 1, 2023.

- Designated

- A designated post-secondary educational institution meets provincial/territorial and federal eligibility criteria, and students attending these schools can apply for government-sponsored student financial assistance, such as CSGs and CSLs.

- Direct loans

- As of August 2000, the federal government issued CSLs under the direct loans regime. Loans are directly financed by the Government and a third-party service provider administers the loan process.

- Fiscal year

- April 1 to March 31.

- Full-time student

- A full-time student is a student enrolled in at least 60% of a full course load (or 40% for students with disabilities) in a program of study of at least 12 consecutive weeks at a designated post-secondary educational institution.

- Integrated province

- In integrated provinces, federal and provincial loans are combined so that borrowers receive and repay 1 federal and provincial integrated loan. The federal and provincial governments work together to make disbursing, managing, and repaying loans easier. The CSFA Program has integration agreements with 6 provinces: British Columbia, Saskatchewan, Manitoba, Ontario, New Brunswick and Newfoundland and Labrador.

- In-repayment status

- The status of borrowers who have begun repaying their CSL. Repayment begins 6 months following the end of studies.

- In-study status

- The status of borrowers attending full- or part-time studies at a post-secondary institution, or who have finished school less than 6 months ago.

- Part-time student

- A part-time student is a student taking between 20% and 59% of a full course load. Students with disabilities may be accorded part-time status if they are taking between 20% and 39% of a full course load. If they are taking between 40% and 59% of a full course load they can elect to be considered either as a full-time or part-time student for the purpose of the CSFA Program.

- Participating provinces and territories

- The provinces and territories that choose to deliver financial assistance to students within the framework of the CSFA Program include Newfoundland and Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Ontario, Manitoba, Saskatchewan, Alberta, British Columbia and Yukon.

- Permanent disability

- Any impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment — or a functional limitation — that restricts the ability of a person to perform the daily activities necessary to pursue studies at a post-secondary school level or to participate in the labour force and that is expected to remain with the person for the person’s expected life.

- Persistent or prolonged disability

- Any impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment — or a functional limitation — that restricts the ability of a person to perform the daily activities necessary to pursue studies at a post-secondary school level or to participate in the labour force and has lasted, or is expected to last, for a period of at least 12 months but is not expected to remain with the person for the person’s expected life.

- Province or territory of residence

- A student’s province or territory of residence is the province or territory where they have most recently lived for at least 12 consecutive months prior to starting post-secondary education. This does not include time spent in a province or territory as a full-time student at a post-secondary institution. For example, an individual from Manitoba studying in Ontario would be considered a Manitoba student.

- Post-secondary education

- Levels of education following secondary school (high school) at all designated public or private post-secondary institutions.

- RAP expense

- This represents the amount of principal repaid by the Government of Canada through the RAP in a given year, as a percentage of the total loan principal in repayment during the same year.

- Repayment rate

- The repayment rate is the percentage of the total principal amount of CSLs consolidated in a given academic year that is repaid or in good standing at the end of the subsequent academic year.

- Student financial assistance

- Student financial assistance is any form of financial aid provided by the CSFA Program to students while enrolled in designated post-secondary education institutions, including CSGs, CSLs and in-study interest subsidies.