Annual report of the Canada Pension Plan for the fiscal year ending March 31, 2023

On this page

- Alternate formats

- List of abbreviations

- List of tables

- List of figures

- Fiscal year at a glance

- Canada Pension Plan in brief

- Beneficiaries and benefits

- Benefit protection provisions

- Other features

- Canada Pension Plan enhancement

- International social security agreements

- Collecting and recording contributions

- Services to contributors and beneficiaries

- Appeals process

- Ensuring program integrity

- Ensuring financial sustainability

- Financial accountability

- Other expenses

- Looking to the future

- Canada Pension Plan consolidated financial statements for the fiscal year ending March 31, 2023

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of abbreviations

- CPP

- Canada Pension Plan

- CPPIB

- Canada Pension Plan Investment Board

- CRA

- Canada Revenue Agency

- ESDC

- Employment and Social Development Canada

- MCR

- Minimum contribution rate

- MSCA

- My Service Canada Account

- OAS

- Old Age Security

- QPP

- Québec Pension Plan

- SST

- Social Security Tribunal

- YMPE

- Year’s maximum pensionable earnings

List of tables

- Table 1: CPP contributions for the calendar year 2023

- Table 2: Maximum monthly retirement pension amounts taken from the ages of 60 and 70 for January 2023

- Table 3: Monthly payments by benefit type

- Table 4: Social security agreements

- Table 5: Canada Pension Plan service standards

- Table 6: Appeal service standards

- Table 7: CPP operating expenses

List of figures

- Figure 1A: Number of CPP beneficiaries by fiscal year (in millions)

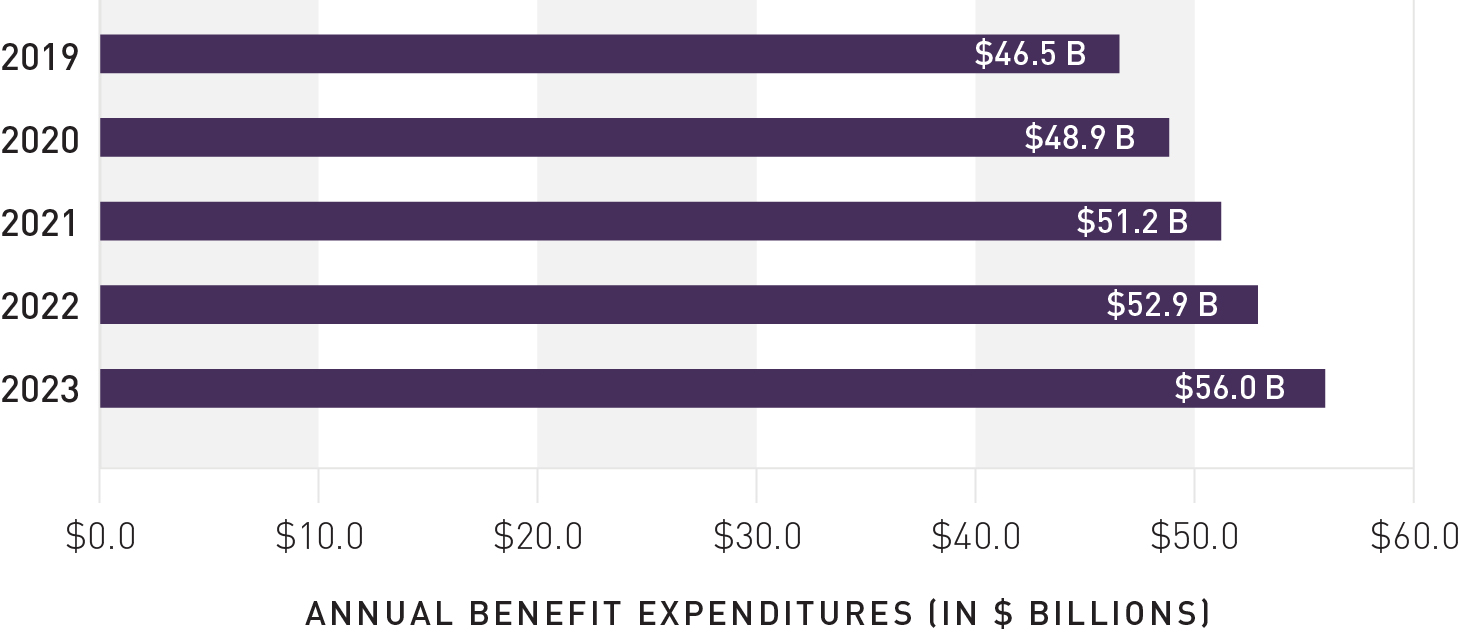

- Figure 1B: Annual benefit expenditures by fiscal year (in $ billions)

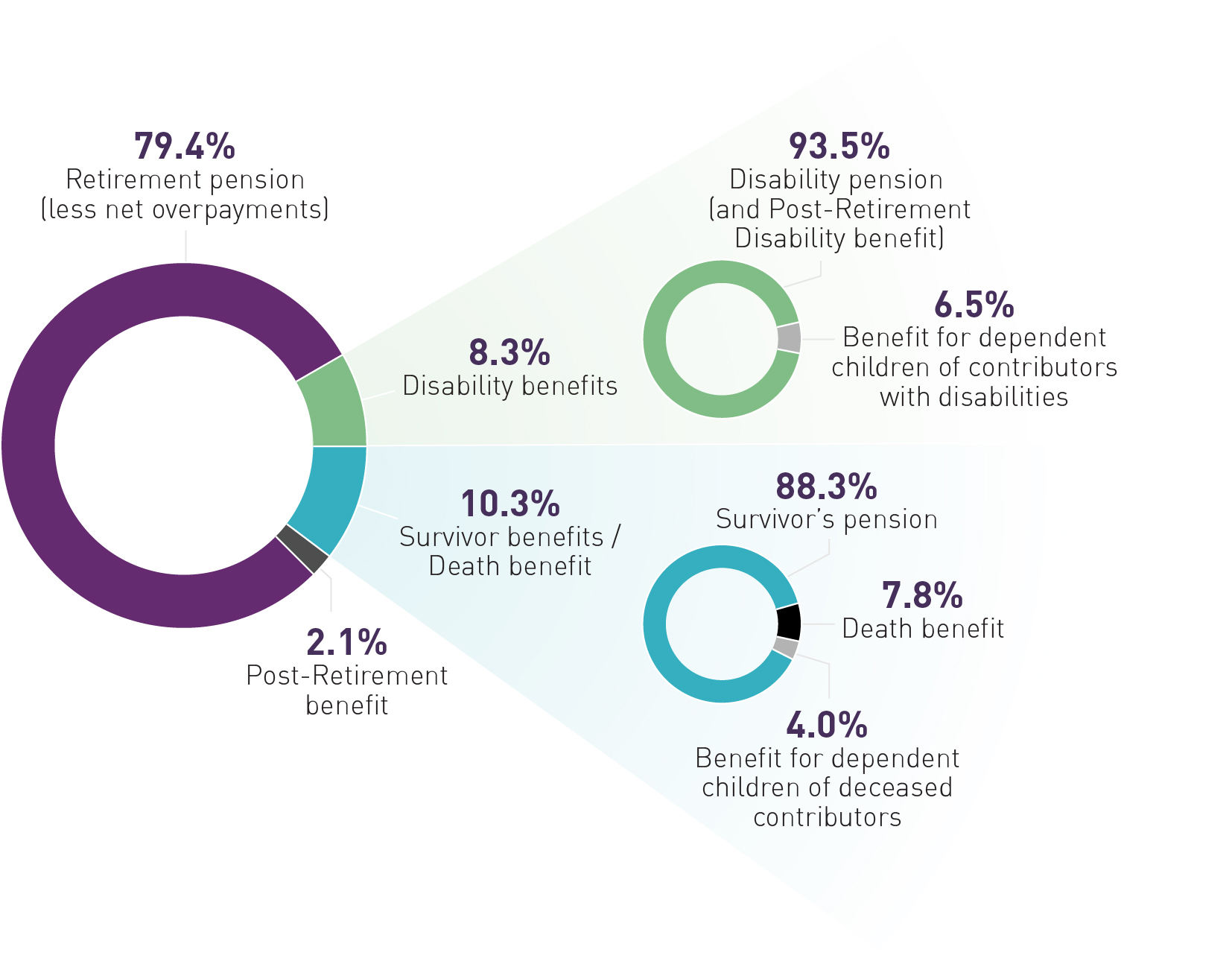

- Figure 2: Percentage of expenditures by CPP benefit type for the fiscal year ending March 31, 2023

- Figure 3: Illustration of enhancement replacement rate and year’s maximum pensionable earnings (YMPE)

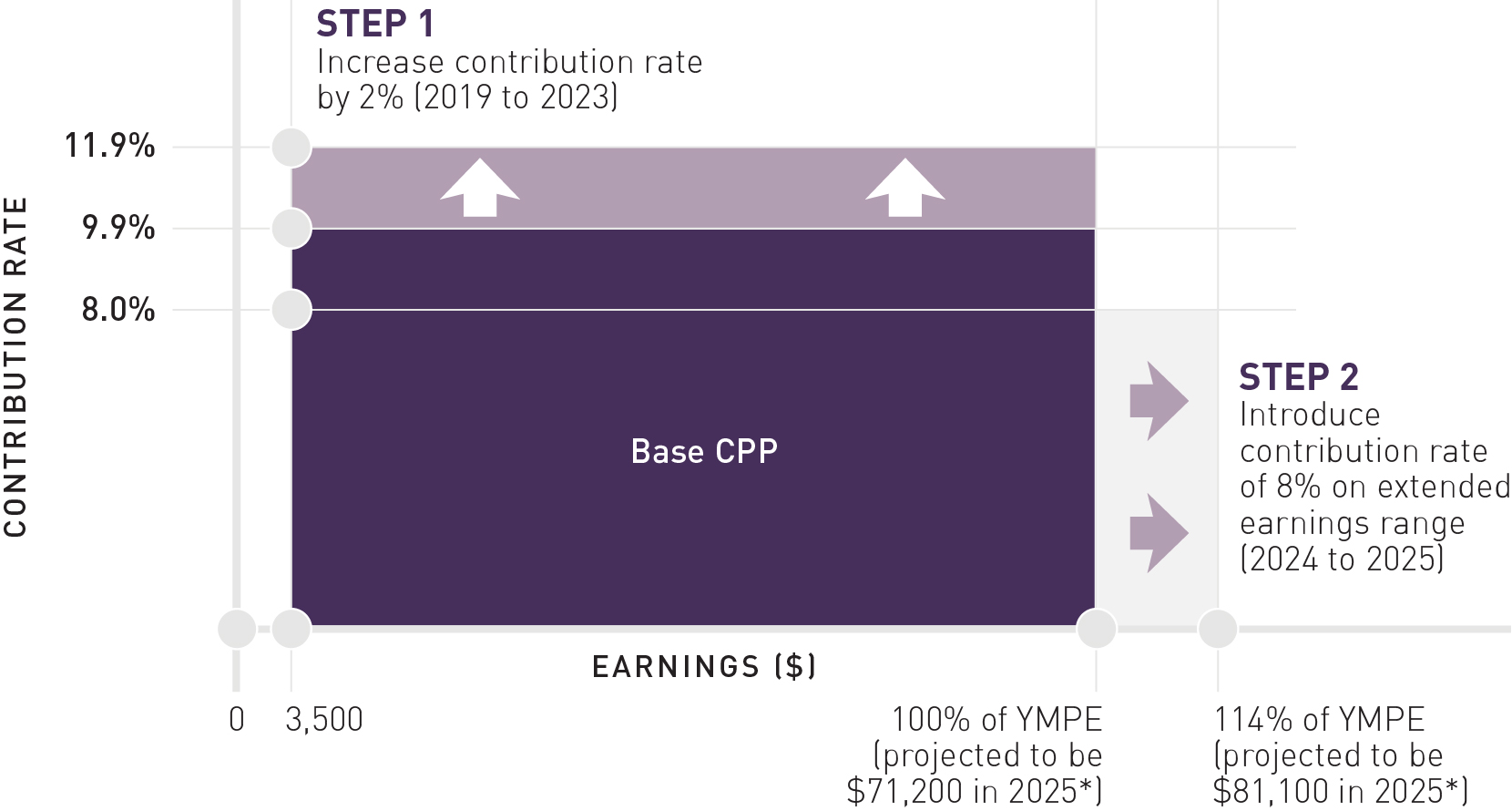

- Figure 4: Illustration of phase-in of contributions

Her Excellency

The Governor General of Canada

Excellency:

We have the pleasure of submitting the Annual Report of the Canada Pension Plan for the fiscal year ending March 31, 2023.

Respectfully,

The Honourable François-Philippe Champagne

Minister of Finance and National Revenue

The Honourable Patty Hajdu

Minister of Jobs and Families and Minister responsible for the Federal Economic Development Agency for Northern Ontario

Note: The following is the annual report of the Canada Pension Plan for the fiscal year ending March 31, 2023. This report is written to reflect the state of affairs as at March 31, 2023. All references to a fiscal year represent the fiscal year ending March 31st of that year.

Fiscal year at a glance

The maximum pensionable earnings of the Canada Pension Plan (CPP) increased from $64,900 in 2022 to $66,600 in 2023. The contribution rate for the base CPP remained unchanged at 9.9%. The CPP enhancement continued its 7‑year phase‑in, which began on January 1, 2019, with a contribution rate of 2.0% in 2023, for a combined contribution rate of 11.9%.

In the fiscal year ending March 31, 2023, CPP contributionsFootnote 1 totalled $74.8 billion. An average of 6.5 million CPP beneficiaries per month were paid, representing a total annual benefit value of $56.0 billion. Those beneficiaries consist of:

- 5.8 million CPP retirement pensioners were paid $44.4 billionFootnote 2 and 1.9 million post‑retirement beneficiaries were paid $1.2 billion

- 1.2 million surviving spouses or common‑law partners and 62,000 children of deceased contributors were paid $5.3 billion

- 321,000 people with disabilities and 75,000 of their children were paid $4.6 billion, and an additional $41 million was paid in post-retirement disability benefits

- 178,000 death benefits totalling $446 million were paid to the estates or next-of-kin of contributors

Operating expenses amounted to $2.4 billion, or 4.29% of the $56.0 billion in benefits.

As at March 31, 2023, total CPP net assets were valued at $573.9 billion, of which $570 billion is managed by the Canada Pension Plan Investment Board (CPPIB), operating as CPP Investments. The remaining $3.9 billion is managed by Employment and Social Development Canada (ESDC), which is responsible for the administration of the CPP program.

Note: Figures above have been rounded. A beneficiary may receive more than one type of benefit.

Canada Pension Plan in brief

Employees and self-employed people in Canada aged 18 and over contribute either to the CPP or to its sister plan, the Québec Pension Plan (QPP).

While the Government of Canada administers the CPP, it shares responsibility for the Plan with Canada’s provincial governments. Québec manages and administers its own comparable plan, the QPP, and participates in decision‑making for the CPP. The benefits of individuals who work and contribute to both the CPP and QPP over their careers are based on the sum of the contributions and credits accumulated under each planFootnote 3.

As of January 1, 2019, the CPP consists of 2 components:

- the base (or original) component, which began in 1966

- the enhanced component, which began in 2019 and serves as a top‑up to the base

Note: More details are available in the CPP enhancement section, which appears later in this report.

Find more information on the Québec Pension Plan.

Contributions

The CPP is financed through mandatory contributions from employees, employers and self‑employed people, and through the revenue earned on CPP investments. Workers start contributing to the Plan at age 18Footnote 4. As shown in Table 1, the first $3,500 of annual earnings is exempt from contributions. Contributions are then made on earnings between $3,500 and YMPE, the year’s maximum pensionable earnings, which was $66,600 in 2023.

As of January 1, 2023, employees contribute at a rate of 5.95% (4.95% to the base CPP and 1.0% to the CPP enhancement), and employers match that with equal contributions. Self‑employed individuals contribute at the combined rate for employees and employers of 11.9% (9.9% to the base and 2.0% to the enhancement) on net business income, after expenses. This combined contribution rate of 11.9% is not projected to increase further, as the first additional component of the CPP enhancement has been completely phased-in as of 2023.

Individuals with earnings above the YMPE will begin making second additional contributions in 2024. Employees will contribute at a rate of 4.0% on their earnings in this new range, and employers will match that with equal contributions. Self-employed individuals will contribute at the combined rate of 8.0% on net business income, after expenses. This new range of earnings will extend 7% above the YMPE in 2024, and 14% in 2025 and thereafter, when the phase-in of the enhancement is complete.

It is important to note that these two contribution rates (5.95% and 4.0%) are not added together. Rather, each applies to a specific range of earnings. Individuals who do not have earnings above the YMPE will not make second additional contributions.

In addition to providing retirement pensions, the CPP also provides disability, death, survivor, children’s and post‑retirement benefits.

Most benefit calculations are based on how much and for how long a contributor has paid into the CPP and at what age they begin to receive their pension. Generally, benefits are not paid automatically—everyone must apply. However, there are 2 exceptions:

- as of 2020, eligible seniors who have not yet started to collect their CPP retirement pension are proactively enrolled at age 70

- post-retirement benefits begin automatically the year after a worker made post-retirement contributions

| CPP contributions | Amount |

|---|---|

| Year’s maximum pensionable earnings | $66,600.00 |

| Year’s basic exemption | $3,500.00 |

| Year’s maximum contributory earnings | $63,100.00 |

| Year’s maximum employee and employer contributions (5.95% each) | $3,754.45 |

| Year’s maximum self-employed person’s contribution (11.90%) | $7,508.90 |

Beneficiaries and benefits

Given the aging of our population, the number of people receiving CPP benefits has increased steadily over the past decade. Expenditures on benefits have also increased. This reflects both the increase in the number of beneficiaries and the increase in value of the benefits paid to beneficiariesFootnote 5.

Figure 1A Text version

| Fiscal year | Number of beneficiaries (in millions) |

|---|---|

| 2019 | 5.9 |

| 2020 | 6.1 |

| 2021 | 6.2 |

| 2022 | 6.4 |

| 2023 | 6.5 |

Figure 1B Text version

| Fiscal year | Benefit expenditures (in billion dollars) |

|---|---|

| 2019 | $46.5 |

| 2020 | $48.9 |

| 2021 | $51.2 |

| 2022 | $52.9 |

| 2023 | $56.0 |

Figure 2 Text version

Drawing 1

| Benefit type | Percentage of expenditures |

|---|---|

| Retirement pension (less net overpayments) | 79.4 |

| Disability benefits | 8.3 |

| Survivor benefits and death benefit | 10.3 |

| Post-retirement benefit | 2.1 |

Drawing 2

| Benefit type | Percentage of expenditures |

|---|---|

| Disability pension (and Post-Retirement Disability benefit) | 93.5 |

| Benefit for dependent children of contributors with disabilities | 6.5 |

Drawing 3

| Benefit type | Percentage of expenditures |

|---|---|

| Survivor’s pension | 88.3 |

| Death benefit | 7.8 |

| Benefit for dependent children of deceased contributors | 4.0 |

- Source: Final audited consolidated financial statements of the CPP.

- Note: Numbers may not add up to 100% due to rounding.

Retirement benefits

The CPP provides 2 retirement benefits:

- the CPP retirement pension

- the post‑retirement benefit for individuals who continue to work and contribute while collecting the retirement pension

In the fiscal year ending March 31, 2023, retirement benefits (retirement pensions and post‑retirement benefitsFootnote 6) represent 81.4% ($45.6 billion) of the total benefit amount paid out ($56.0 billion) by the CPP.

Retirement pensions

The monthly retirement pension is the CPP’s primary benefit. To begin receiving a retirement pension, the applicant must have made at least one valid contribution to the Plan and must have reached the age of 60, which is the earliest age of eligibility (although the standard age of pension take-up is 65 and can even be delayed up to age 70). The amount of the contributors’ retirement pensions depends on how much and for how long they have contributed and at what age they begin to receive their pension.

In the fiscal year ending March 31, 2023, the CPP paid a total of $44.6 billionFootnote 7 in retirement pensions to 5.8 million pensioners. In January 2023, the maximum monthly retirement pension at age 65 was $1,306.57. The average monthly payment in the fiscal year was $639.79.

Adjustments for early and late receipt of a retirement pension

Canadians are living longer and healthier lives, and the transition from work to retirement is increasingly diverse. The CPP offers flexibility for older workers who are making the transition to retirement.

CPP contributors can choose when to start receiving their retirement pension based on their individual circumstances and needs. Contributors have the flexibility to take their retirement pension earlier or later than the standard age of 65. The pension could be collected as early as age 60 or delayed up to age 70. To ensure fair treatment of contributors and beneficiaries, people who take their retirement pension after age 65 receive a higher amount. Contributors could more than double their monthly retirement pension amount by delaying take-up from age 60 to 70. This adjustment reflects the fact that those who begin to collect their retirement pension later will, on average, contribute to the CPP for longer but receive their benefits for a shorter period of time. Conversely, those who take their retirement pension before age 65 receive a reduced amount, reflecting the fact that they will, on average, contribute to the CPP for shorter but receive their benefits for a longer period of time.

Retirement pension taken before age 65

The monthly pension amount for individuals who start receiving their retirement pension before age 65 is permanently reduced by 0.6% per month. This means that a contributor who starts receiving a retirement pension at age 60 receives an annual retirement pension that is 36% less than if it were taken at age 65.

Retirement pension taken after age 65

The monthly pension amount for individuals who start receiving their retirement pension after age 65 is permanently increased by 0.7% per month that they delay. This means that a contributor who delays receiving a retirement pension until age 70 receives an annual retirement pension that is 42% higher than if it were taken at age 65.

Because there is no additional financial advantage to waiting past age 70, as of 2020, individuals who have not yet applied for their retirement pension are proactively enrolled when they reach that age.

| Age | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Maximum monthly retirement pension payment | $836 | $930 | $1,024 | $1,118 | $1,213 | $1,306 | $1,416 | $1,526 | $1,636 | $1,746 | $1,855 |

| Yearly adjustment | -36% | -28.8% | -21.6% | -14.4% | -7.2% | 0% | +8.4% | +16.8% | +25.2% | +33.6% | +42% |

Note: Numbers in Table 2 have been rounded and calculated at the date the beneficiary turns the age referred to in the table (for example, at age 60 and 0 months).

Post-retirement benefits

The post‑retirement benefit allows CPP retirement pension beneficiaries who keep working to increase their retirement income by continuing to contribute to the CPP, even if they are already receiving the maximum CPP retirement pension.

Contributions made while collecting a CPP or QPP retirement pension are treated differently than other contributions. Post-retirement contributions do not affect or change the amount of CPP retirement, disability, or survivor's pensions, nor do they generate eligibility for a CPP survivor's pension or CPP disability pension. However, these post-retirement contributions can be used to qualify for the post-retirement disability benefit. Additionally, these contributions are not subject to division in the event of the end of a marriage or common-law relationship (this division is explained in greater detail in the section Other Features: Credit Splitting, later in this report).

Each year of post-retirement contributions results in a new post‑retirement benefit that is payable the following year. This new post-retirement benefit is added to the individual's total CPP amount, which includes all previously earned post‑retirement benefits. The amount of each post-retirement benefit increases annually with the cost of living and is payable until the death of the contributor. As each post-retirement benefit is based on a single year of contributions, a single individual could receive as many as 11 post-retirement benefits.

In the fiscal year ending March 31, 2023, 1.9 million CPP retirement pensioners received a total of $1.2 billion in post‑retirement benefits. The maximum monthly amount for a single post-retirement benefit at age 65 was $40.25. The average monthly payment for a single post‑retirement benefit in the fiscal year was $14.74. However, many individuals make post-retirement contributions in multiple years and thus receive multiple post-retirement benefits. As a result, the average total monthly amount reflecting the sum of all their post-retirement benefits received was $54.70.

Disability benefits

The CPP administers the largest long-term disability insurance plan in Canada. It provides 3 disability benefits:

- the monthly CPP disability pension provided to working-age contributors with sufficient recent contributions who have a severe and prolonged disability

- the post-retirement disability benefit provided to CPP retirement pension recipients under the age of 65 who meet the same disability criteria as the CPP disability pension

- the disabled contributor’s child’s benefit provides a flat-rate payment to the dependent children of beneficiaries with a disability

In the fiscal year ending March 31, 2023, a total of $4.6 billion in benefits were paid to 321,000 beneficiaries with a disability and to 75,000 dependent children of beneficiaries with a disability. These benefits represented 8.3% of the total benefits paid out by the CPP in that year.

The disability pension includes a monthly flat‑rate amount, which was $558.74 in 2023. It also includes an earnings-related portion that is equal to 75% of a retirement pension based on the individual's contributions to the Plan before the onset of their disability. In January 2023, the maximum disability pension was $1,538.67. The average monthly payment in the fiscal year was $1,013.41.

The post-retirement disability benefit was introduced in 2019 and provides income protection to CPP retirement pension recipients under the age of 65 who are found to have a disabilityFootnote 8. It recognizes that many individuals make a gradual transition to retirement, such that they plan to continue to work and contribute to the Plan but may later become disabled. Eligible individuals receive the post-retirement disability benefit in addition to their retirement pension. The value of the post-retirement disability benefit amount is equal to the monthly flat-rate component of the disability pension, which was $558.74 in 2023. A total of $41 million was paid in post-retirement disability benefits in the fiscal year.

The Disabled Contributor’s Child’s Benefit is a monthly benefit available to dependent children of individuals receiving the CPP Disability pension. To qualify, the dependent child must be under the age of 18 or between the ages of 18 and 25 and attending an educational institution full time. They must also be the biological child of the contributor, a child who was legally adopted or adopted “in fact” by the contributor before the age of 21, or a child who was legally or “in fact” in the custody and control of the contributor before the age of 21. In 2023, the monthly amount for this benefit was $281.72.

Survivor benefits

The CPP provides 3 survivor benefits:

- the monthly survivor's pension provided to a spouse or common-law partner of the deceased contributor regardless of the survivor’s age

- the flat rate children’s benefit provided to the dependent children of deceased contributors

- the one‑time, lump‑sum death benefit paid to the estate of the deceased contributor

In the fiscal year ending March 31, 2023, a total of $5.7 billion in survivor benefits were paid. These benefits represented 10.3% of the total benefits paid out by the CPP in that year.

Survivor's pensions are paid to the surviving spouse or common‑law partner of a contributor who made sufficient contributions to the Plan. In the fiscal year, 1.2 million survivors received a survivor’s pension. The average monthly survivor’s pension was $352.85. The benefit amount varies depending on a number of factors, including the contributions the deceased made to the Plan, the age of the surviving spouse or common‑law partner and whether the survivor also receives other CPP benefits.

The maximum survivor's pension for people under age 65 was $707.95 in January 2023. This included a flat‑rate portion of $217.99 and an earnings‑related portion, which is 37.5% of the deceased contributor's retirement pension. The maximum monthly amount at age 65 and over was $783.94, consisting of 60% of the deceased contributor's retirement pension.

There are special rules used to combine the CPP survivor's pension with either the retirement or the disability pension resulting in a single combined benefit. This benefit, however, cannot exceed the maximum retirement pension or the maximum disability pension. Consequently, it does not necessarily represent the sum of 2 pensions.

The benefit paid to dependent children of deceased contributors is a flat‑rate. In 2023, the amount was $281.72 per month. In the fiscal year, 62,000 children of deceased contributors received this benefit. To be eligible, children must be under 18 years of age or under 25 and in full‑time attendance at school or a post-secondary institution.

The CPP death benefit is a lump‑sum payment provided to the estate of the contributor. For individuals that died prior to 2019, the death benefit amounted to 6 times the amount of the deceased contributor's monthly retirement pension, up to a maximum of $2,500. However, for individuals that died on or after January 1, 2019, the value of the death benefit is no longer based on earnings but is a flat‑rate of $2,500. In the fiscal year, the average death benefit payment was $2,498.46Footnote 9.

Benefit summary

For up‑to‑date information on CPP amounts, refer to the Canada Pension Plans and the Old Age Security Quarterly Reports.

| Benefit type | Maximum monthly amount in January 2023 | Average monthly amount (for the fiscal year) * |

|---|---|---|

| Retirement pension | $1,306.57** | $639.79 |

| Post-retirement benefit | $40.25** | $14.74 |

| Disability pension | $1,538.67 | $1,013.41 |

| Benefit for children of disabled contributors | $281.72 | $268.65 |

| Benefit for children of deceased contributors | $281.72 | $268.72 |

| Survivor’s pension - 65 and over | $783.94 | $328.59 |

| Survivor’s pension - younger than 65 | $707.95 | $468.22 |

| Death benefit (one-time payment) | $2,500.00 | $2,498.46 |

- * Note: The average amounts reported are the averages of the monthly gross average entitlement amount and do not represent the total benefit amounts paid for the fiscal year divided by the number of beneficiaries.

- ** At age 65.

Benefit protection provisions

The CPP includes provisions that help to compensate for periods when individuals may have relatively low or no earnings.

Under the base CPP, the value of a pension is based on the contributor's average earnings across their lifetime. For this reason, dropping periods of low or no earnings from the calculation will increase the average, and therefore, the amount of the base component of one's CPP benefit.

The calculation of benefits under the enhanced component of the CPP follows a different formula. However, the CPP enhancement provides similar protection by means of “drop‑in” provisions that credit individuals with earnings in certain circumstances.

General drop-out provision

In the base component of the CPP, the general drop-out provision helps to offset periods of low or no earnings due to unemployment, schooling, or other reasons. Up to 17% of a person's contributory period with the lowest earnings, representing a maximum of 8 years, can be excluded from the benefit calculation. This increases the benefit amount for most people.

Over 65 drop-out provision

In the base component of the CPP, the over 65 drop-out provision allows periods of relatively low earnings before age 65 to be replaced by higher earnings after age 65. It may help to increase the benefit amounts of individuals who continue to work and make CPP contributions after reaching age 65, but do not yet receive the CPP retirement pension.

Unlike the base CPP, which uses the average of an individual's earnings across their entire careers and then applies drop-outs, the value of the enhanced component of CPP benefits is based on an individual's best 40 years of earnings. The enhancement's 40-year calculation largely replicates the effects of the base CPP's general drop‑out and over 65 drop-out provisions.

For a contributor who begins their pension at the standard age of 65, the best 40-year calculation will exclude the 7 years with the lowest earnings between the age of 18 and 65 from the calculation of the enhanced component of their pension, similar to the general drop-out in the base CPP.

The best 40-year calculation also allows an individual who continues to work and contribute after age 65 to use those later-life earnings to replace earlier years of lower earnings, similar to the over-65 drop-out in the base CPP.

Child-rearing provisions

In the base component of the CPP, the child-rearing drop-out provision excludes from the calculation of benefits the periods during which contributors took time off work, or reduced their participation in the workforce, to care for children under the age of 7. Every month until the child reaches 7 years of age can be excluded from the benefit calculation for a contributor who is eligible for this provision. In addition to increasing the amount of the benefit, this provision may also assist people applying for survivor or disability benefits in meeting the contributory requirements for eligibility.

In the enhanced component of the CPP, the child-rearing drop‑in provision will provide credits to the parents of young children who took time off work or reduced their participation in the labour force to care for children under the age of 7. Specifically, a credit is provided (or dropped in) for every year in which the parent provides care for a child under 7 years of age, if this credit is higher than the parent's actual earnings in that year. The value of the credit is based on the parent's average earnings in the 5 years before the birth or adoption of the child. These dropped in credits will increase the parent's average earnings, which will increase the value of the enhanced component of their CPP benefits.

Disability exclusion and disability drop‑in

In the base component of the CPP, periods during which individuals are disabled in accordance with the CPP legislation are not included in their contributory period. This ensures that individuals who are not able to pursue any substantial gainful work are not penalized.

In the enhanced component of the CPP, individuals who develop a disability in 2019 or later will have a credit “dropped in” for the months that they have a disability in accordance with the CPP legislation. The value of the credit is based on the individual's earnings in the 6 years before they become disabled. These credits will be used to calculate the individual's retirement pension or any subsequent survivor's pension.

Other features

The CPP also includes many progressive features that recognize family and individual circumstances. These features include pension sharing, credit splitting, portability, and indexation.

Indexation

CPP payments are indexed to the cost of living. Benefit amounts are adjusted in January of each year to reflect increases in the Consumer Price Index published by Statistics Canada. This means that as CPP beneficiaries age, the purchasing power of their CPP benefits are protected against inflation. In January 2023, benefits were indexed at a rate of 6.5%.

Pension sharing

Pension sharing allows spouses or common‑law partners who are receiving their CPP retirement pensions to share a portion of each other's pensions. This feature also allows one pension to be shared between them even if only one person has contributed to the Plan. The amount that can be shared depends on the time the couple has lived together while contributing to the CPP. Pension sharing affords a measure of financial protection to the lower‑earning spouse or common‑law partner. Also, while it does not increase or decrease the overall pension amount paid, it may result in tax savings. Each person is responsible for any income tax that may be payable on the pension amount they receive.

Credit splitting

When a marriage or common‑law relationship ends, the CPP credits accumulated by the couple during the time they lived together can be divided equally between them, if requested by or on behalf of either spouse or common‑law partner. This is called “credit splitting.” Credits can be split even if only one partner contributed to the Plan. Credit splitting may increase the value of CPP benefits payable, or even create eligibility for benefits. It may also reduce the benefits of one of the former partners. Credit splitting permanently alters the record of earnings, even after the death of a former spouse or common‑law partner.

Portability

No matter how many times workers change jobs, and no matter in which province they work, CPP and QPP coverage is uninterrupted. Furthermore, CPP and QPP benefits will be paid to you no matter where you reside in the world.

Canada Pension Plan enhancement

The Government of Canada worked with the provinces and territories to strengthen the retirement income system by enhancing the CPP. Following a historic agreement by Canada's ministers of Finance in June 2016, the CPP was enhanced on January 1, 2019.

The CPP enhancement was designed to complement the base (or original) CPP. It serves as a top‑up to the original part of the Plan, which first began in 1966. The CPP enhancement was designed to be fully funded, which means that benefits under the enhancement will build up gradually over time as individuals work and contribute. Each year of contributions to the enhanced CPP will allow workers to accrue partial additional benefits. Fully enhanced benefits will become available after about 40 years of contributions.

As indicated in Figure 3, the fully enhanced CPP retirement pension will replace one‑third of a contributor's eligible average earnings, up from the original one-quarter. The upper limit of eligible earnings covered by the CPP will also increase by 14%. Together, these changes will gradually increase the maximum retirement pension by about 50%.

The enhancement will also increase post‑retirement benefits and both the disability and survivor's pensions, based on the individual's contributions.

The enhancement does not affect eligibility for CPP benefits or the value of benefits that individuals are already receiving. Individuals who did not work and make contributions to the CPP in 2019 or later are not affected by the enhancement.

Figure 3 Text version

Figure 3 is a visual illustration of the replacement rate and year’s maximum pensionable earnings (YMPE) for the CPP enhancement. It shows the CPP enhancement is comprised of 2 components and how those components interact with the base CPP. The first component sits above the base CPP and increases the replacement rate from 25% to 33% over the same range of earnings. The second component provides 33% income replacement on earnings above the YMPE, up to 114% of the YMPE.

Contributions under the CPP enhancement

The enhancement's implementation began its 7-year phase-in in 2019. The changes to contributions are indicated in figure 4 and include the following key elements:

- the CPP contribution rate that is applied to the current eligible earnings range (from $3,500 to the upper limit, which is set at $66,600 in 2023) is increasing by 2 percentage points compared to the base CPP. This means the contribution rate has gradually increased from 9.9% to 11.9% by 2023 (shared equally by employers and employees, while self‑employed individuals contribute at the full rate)

- in 2024, workers will begin contributing on an additional range of earnings. This range will start at the current earnings limit, called the YMPE, and will extend to a new limit that is 7% higher by 2024 and then 14% higher in 2025 and thereafter. The contribution rate on earnings in this new range will be 8% (shared equally by employers and employees, with self‑employed individuals contributing at the full rate)

Figure 4 Text version

Figure 4 is a visual illustration of the 2-step phase-in of the contributions for the CPP enhancement, and how the increased contributions interact with the base CPP. The first step gradually increased the contribution rate by 2% over 5 years, from 2019 to 2023, on the same earnings covered by the base CPP. When fully phased in, this will result in a combined contribution rate of 11.9% on these earnings. The second step will introduce a new contribution rate of 8% on earnings above the YMPE, up to 114% of the YMPE. This new range will be phased in over 2 years, in 2024 and 2025.

- * Office of the Chief Actuary projection in the Thirty-First Actuarial Report on the Canada Pension Plan as at 31 December 2021.

Find more information on the CPP enhancement.

International social security agreements

Many individuals have lived or worked in Canada and in other countries. Consequently, Canada has entered into social security agreements with other countries to help people in Canada and abroad to qualify for CPP benefits and pensions from partner countries. In March 2023, 14,657 individuals received CPP benefits because of an international social security agreement. Further, social security agreements enable Canadian companies and their employees who are sent to work temporarily outside of Canada to continue to contribute to the CPP and eliminate the need to contribute to the social security program of the other country for the same work.

As of March 31, 2023, Canada has concluded social security agreements with 62 countries, of which 60 are in force (consult Table 4). Negotiations towards social security agreements are ongoing with many other countries.

Canada has concluded social security agreements with the following countries:

| Country | Date of entry into force of the agreement |

|---|---|

| Albania | August 1, 2022 |

| Antigua and Barbuda | January 1, 1994 |

| Australia | September 1, 1989 |

| Austria | November 1, 1987 |

| Barbados | January 1, 1986 |

| Belgium | January 1, 1987 |

| Brazil | August 1, 2014 |

| Bulgaria | March 1, 2014 |

| Chile | June 1, 1998 |

| China* | January 1, 2017 |

| Croatia | May 1, 1999 |

| Cyprus | May 1, 1991 |

| Czech Republic | January 1, 2003 |

| Denmark | January 1, 1986 |

| Dominica | January 1, 1989 |

| Estonia | November 1, 2006 |

| Finland | February 1, 1988 |

| France | March 1, 1981 |

| Germany | April 1, 1988 |

| Greece | May 1, 1983 |

| Grenada | February 1, 1999 |

| Hungary | October 1, 2003 |

| Iceland | October 1, 1989 |

| India | August 1, 2015 |

| Ireland | January 1, 1992 |

| Israel* | September 1, 2003 |

| Italy | January 1, 1979 |

| Jamaica | January 1, 1984 |

| Japan | March 1, 2008 |

| Jersey and Guernsey | January 1, 1994 |

| Korea (Republic of) | May 1, 1999 |

| Latvia | November 1, 2006 |

| Lithuania | November 1, 2006 |

| Luxembourg | April 1, 1990 |

| Macedonia (Republic of North) | November 1, 2011 |

| Malta | March 1, 1992 |

| Mexico | May 1, 1996 |

| Morocco | March 1, 2010 |

| Netherlands | October 1, 1990 |

| New Zealand | May 1, 1997 |

| Norway | January 1, 1987 |

| Peru | March 1, 2017 |

| Philippines | March 1, 1997 |

| Poland | October 1, 2009 |

| Portugal | May 1, 1981 |

| Romania | November 1, 2011 |

| Saint Lucia | January 1, 1988 |

| Saint Vincent and the Grenadines | November 1, 1998 |

| Serbia | December 1, 2014 |

| Slovak Republic | January 1, 2003 |

| Slovenia | January 1, 2001 |

| Spain | January 1, 1988 |

| St. Kitts and Nevis | January 1, 1994 |

| Sweden | January 1, 1986 |

| Switzerland | October 1, 1995 |

| Trinidad and Tobago | July 1, 1999 |

| Türkiye | January 1, 2005 |

| United Kingdom* | April 1, 1998 |

| United States of America | August 1, 1984 |

| Uruguay | January 1, 2002 |

- * The social security agreements with China, Israel and the United Kingdom provide an exemption from the obligation to contribute to the social security system of the other country for employers and their employees temporarily posted abroad. These agreements do not contain provisions concerning eligibility for pension benefits.

In addition, social security agreements have been signed with Argentina and Tunisia. They will enter into force once legal procedures have been completed in both countries.

Collecting and recording contributions

All CPP contributions are remitted to the Canada Revenue Agency (CRA). The CRA also assesses and verifies earnings and contributions, advises employers and employees of their rights and responsibilities, conducts audits and reconciles reports and T4 slips. To verify that contributory requirements are met, the CRA applies a compliance and enforcement process that can vary from a computerized data match to an on‑site audit.

As of March 31, 2023, the CRA reported that there are 2,212,707 employer accounts. In the fiscal year ending March 31, 2023, the CRA conducted 11,371 examinations to promote compliance with the requirements to withhold, report and remit employer source deductions. In the fiscal year, employers and employees accounted for approximately 95% of contributions, and the remaining 5% came from the self-employed. In the fiscal year, contributions amounted to $74.8 billion.

Services to contributors and beneficiaries

Within ESDC, Service Canada provides Canadians with easy single point access to a wide range of government services and benefits.

In the fiscal year ending March 31, 2023, Service Canada continued its efforts to ensure that eligible Canadians are receiving public pension benefits to which they are entitled, and to encourage them to actively plan and prepare for their retirement. Information on the CPP is available on the internet, by phone, in person at Service Canada Centres and through scheduled and community outreach. In 2023, a special Retirement Hub portal was launched to help clients understand the benefits of CPP retirement pension deferral and help them make informed decisions about the right time to take their public retirement pensions, given their personal circumstances. Clients now have access to a personalized retirement checklist, updated retirement calculators and educational pages with life examples discussed in simple terms.

Service Canada promotes the use of online services through various means:

- targeted mailing of inserts, including seasonal mailing such as at tax‑filing period

- messaging added to correspondence to Canadians

- messaging promoted through the Government of Canada website

- messaging provided by telephone through its pensions call centre network

- information provided in person by employees at Service Canada Centres

Service Canada continues to advance its e‑service agenda through enhancements to the online My Service Canada Account (MSCA). CPP clients can securely access their personal information online. MSCA provides a single point of access for people to apply for a CPP retirement pension. In the fiscal year, approximately 176,000 people, representing 53.1% of all applications, applied for their CPP retirement pension online.

Using MSCA, CPP clients can:

- update their home address, telephone numbers and direct deposit information, if they live in Canada

- view and print official copies of their tax slips for the current year and the previous 6 years

- view and print an official copy of their statement of contributions

- view the current and last 2 years of their payments

- print a benefit attestation letter

- start, change or stop a voluntary federal income tax deduction

- add, modify or delete their consent to communicate information to an authorized person acting on their behalf

- apply for the CPP retirement pension

- apply for the CPP regular, grave or terminal disability benefit

- upload documentation to support their CPP disability paper or online application

- submit their request for reconsideration of an initial decision made on their application

- apply for the child’s benefit (benefit for children aged 18 to 25 and in attendance in full-time school or university)

- submit their Declaration of Attendance at School or University online and upload proof of enrolment to renew or re-establish their children's benefit

- apply for the death benefit

- apply for the survivor pension and surviving child’s benefit

- apply for pension sharing of retirement pension(s)

- apply for a credit split provision (upon separation or divorce)

- view the status of their applications

More information is available on the Service Canada page.

For Service Canada, the successful launch of these initiatives supports improved service delivery to Canadians, including to some of Canada's most vulnerable citizens.

Processing benefits

Service Canada continues to deliver the CPP through a network of 10 processing centres located across the country. In the fiscal year ending March 31, 2023, Service Canada:

- processed approximately 7.4 million transactions, including 1.7 million transactions to put clients into pay for the first time and to renew benefits, and another 5.7 million benefit adjustments or account revisions

- made over 72.3 million payments valued at $56.0 billion to approximately 6.5 million beneficiaries, including $4.6 billion to 397,000 CPP disability beneficiaries

- supported 176,000 Canadians to apply for CPP retirement benefits online and fully automated the adjudication of 920,000 new post‑retirement benefits

- answered 2.1 million CPP and Old Age Security enquiries through its specialized call centre agents and resolved 3.1 million calls through its interactive voice response system

The timely payment of CPP benefits remains a priority. Overall, Service Canada aims to pay eligible clients their CPP retirement pension within their first month of entitlement with an objective of achieving this 90% of the time. In the fiscal year, Service Canada exceeded this objective and put 94% of clients in pay for their first month of entitlement (consult Table 5).

Service Canada continues to be committed to enhancing the delivery of the CPP disability benefits to make it easier for Canadians to access the benefits that they are entitled to. Service Canada has updated the CPP Disability Toolkit to help individuals, people supporting them in the application process, health care professionals, and non-government organizations access all required program information through a single document. Service Canada is actively modernizing pensions' correspondence to improve communication to pension beneficiaries through existing pension programs correspondence, including CPP disability. This includes simplifying, enhancing, and ensuring plain language in correspondence to clients.

| Service standard | National objective | National result | Average processing time |

|---|---|---|---|

| CPP retirement benefit application Benefits are paid within the first month of entitlement |

90% | 94% | 15 calendar days |

| CPP disability benefit application Decision is made within 120 calendar days of receiving a complete application |

80% | 79% | 76 calendar days |

| CPP disability benefit for applicants with a terminal illness Decision is made within 5 business days of receiving a complete application |

95% | 91% | 3 business days |

| CPP disability benefit for applicants with a grave medical condition Decision is made within 30 calendar days of receiving a complete application |

80% | 85% | 20 calendar days |

| CPP disability benefit reconsiderations Decision is made within 120 calendar days of receiving the reconsideration request |

80% | 75% | 94 calendar days |

Appeals process

Individuals who are not satisfied with a decision concerning CPP benefits may ask the Minister of Employment and Social Development Canada to reconsider or administratively review, that decision. Individuals may ask for reconsideration of their eligibility for a CPP benefit or the amount of the benefit.

Claimants who are not satisfied with the Minister's reconsideration decision may appeal to the Social Security Tribunal of Canada (SST).

The SST is an independent administrative tribunal that makes decisions on appeals related to the Canada Pension Plan, Old Age Security Act, and Employment Insurance Act.

The SST consists of 2 separate divisions: the General Division (GD) and the Appeal Division (AD). The General Division is composed of 2 sections: Income Security and Employment Insurance.

The General Division Income Security section hears both CPP appeals and Old Age Security (OAS) appeals. The Appeal Division hears appeals from the General Division.

On December 5, 2022, legislated changes intended to reduce barriers to claimants came into effect. Among other changes, at the General Division summary dismissal powers were repealed, and claimants now have more time to prepare their appeal. At the Appeal Division, the test for obtaining leave is broader, appeals are heard as a new proceeding, and cases can no longer be referred back to the General Division. Across the Tribunal, claimants choose their form of hearing: in person, videoconference, teleconference or in writing. Guiding these and other processes are new Rules of Procedure written in plain language and designed people-first.

The SST has service standards for how many days it should take to complete appeals under normal circumstances (consult Table 6).

| Service standard | Objective | Result | Average Processing Time (calendar days) |

|---|---|---|---|

| General Division – CPP appeals* Complete decisions within 70 days of the parties being ready for a hearing |

80% | 18% | 127 |

| General Division – CPP appeals* Complete decisions within 30 days of the date the hearing is held |

80% | 72% | 28 |

| Appeal Division – CPP appeals** Make a decision on permission to appeal within 45 days of an appeal being filed |

80% | 82% | 30 |

| Appeal Division – CPP appeals** Make a final decision within 150 days of leave to appeal being granted |

80% | 81% | 103 |

- *General Division results are from April 1, 2022 to March 31, 2023

- ** Appeal Division results are from April 1, 2022 to December 4, 2022

Find more information on the Social Security Tribunal appeal service standards.

General Division Income Security

In the fiscal year ending March 31, 2023, the General Division Income Security section received 2,004 new appeals, 17.1% (413) fewer appeals than in the fiscal year ending March 31, 2022 (2,417). Of those appeals, 89.2% (1,788) were related to CPP benefits, down from 90.6% (2,189) in the fiscal year ending March 31, 2022. This represented a decrease in CPP appeal volume by 18.3% (401) between fiscal years.

As of March 31, 2023, the General Division Income Security section concluded 2,271 appeals, 8.4% (176) more appeals than in the previous fiscal year (2,095). Of those concluded appeals, 88.9% (2,019) were related to CPP benefits, compared to 89.1% (1,866) appeals concluded in the fiscal year ending March 31, 2022. This represented an increase in CPP appeals concluded by 8.2% (153) between fiscal years.

As of March 31, 2023, the General Division Income Security section had 2,051 active appeals, a reduction in inventory of 11.5% (176), from 2,318 appeals in the fiscal year ending March 31, 2022. Of the active appeals, 88.2% (1,810) were related to a CPP benefit, virtually unchanged from 88.1% (2,043) in the fiscal year ending March 31, 2022. This represented a decrease in inventory of 11.4% (233) of CPP appeals between fiscal years.

Appeal Division

In the fiscal year ending March 31, 2023, the Appeal Division received 187 appeals of decisions from the General Division Income Security section, 8.7% (15) more than in the fiscal year ending March 31, 2022 (172). Of these appeals, 84.5% (158) were related to CPP benefits, compared to 77.3% (133) in the fiscal year ending March 31, 2022. This represented an increase of 18.8% (25) between fiscal years.

As of March 31, 2023, the Appeal Division concluded 178 appeals, 7.9% (13) more appeals than in the fiscal year ending March 31, 2022 (165). Of the concluded appeals, 83.7% (149) were related to CPP benefits, compared to 78.8% (130 appeals) in the fiscal year ending March 31, 2022. This represented an increase of 14.6% (19).

As of March 31, 2023, the Appeal Division had 57 active appeals, 21.3% (10) more than in the fiscal year ending March 31, 2022 (47). Of these active appeals, 71.9% (41) were related to CPP benefits, compared to 74.5% (35) in the fiscal year ending March 31, 2022. This represented an increase in CPP inventory at the Appeal Division of 17.1% (6) between fiscal years.

Ensuring program integrity

To ensure the accuracy of benefit payments, the security and privacy of personal information and the overall quality of service, ESDC continues to enhance the efficiency, accuracy, and integrity of its operations through various business improvement measures and through its regular integrity-based activities.

Meeting the expectations of Canadians, that government services and benefits are delivered to the right person, for the right amount, for the intended purpose and at the right time while ensuring responsible stewardship of program funds and protecting personal information, is a cornerstone of ESDC's service commitment. Enhanced and modernized integrity‑related activities within the CPP are essential to meeting these expectations and ensuring the public's trust and confidence in the effective management of this program. As such, ESDC remains committed in its ongoing work to analyse and implement solutions, changes and improvements that enable this.

Integrity‑based activities detect anomalies and potential issues with existing benefits and investigate them to bring resolution. This reduces program costs by preventing incorrect payments and identifying systemic impediments to clients receiving their correct and full benefit entitlement. This is achieved with risk‑based analysis measures, ensuring that appropriate and effective controls are in place, and that causes of incorrect payments are identified and mitigated. Integrity‑based activities also make use of modern analytical techniques to improve business intelligence and ensure that errors and fraud are managed throughout the program's life cycle.

As part of its effort to address overpayment situations, ESDC conducts reviews of benefit entitlements and investigations to address situations in which clients are suspected of receiving benefits to which they are not entitled. These activities resulted in $21.3 million in accounts receivable as overpayments in the fiscal year ending March 31, 2023. In addition, integrity-based activities prevented an estimated $32.7 million from being incorrectly paid in the fiscal year and a further estimated $96.8 million from being incorrectly paid in future years. The recovered overpayments are credited to the CPP, thereby helping to maintain the long-term sustainability of the Plan. In addition to overpayments, integrity activities sometimes identify underpayments, which is to say, clients who are eligible for more CPP benefits than they are currently receiving. In the fiscal year, ESDC identified $6.9 million in underpayments of CPP benefits.

The mitigation of risks associated with false or inaccurate claims regarding the identity of an individual or an organization is fundamental to the integrity of the CPP program. This is why the Department has a sound identity management program which starts with the Social Insurance Number Program and extends to a policy for the registration, authentication, and validation of identity across service delivery channels (in person, phone, mail and online).

This means clients know what is expected from them when asked to confirm their identity. The CPP program validates client's information against the Social Insurance Register, which contains verified identity information that was validated against provincial source documents through the Vital Event Linkages initiative.

The Department also provides guidance and tools to staff responsible for identity management practices and monitors outcomes for the ongoing refinement of identity management policy instruments. This approach enhances data integrity and quality, improves security and the protection of personal information, and enhances the service experience for clients by reducing errors and eliminating inefficiencies, which could affect wait times for benefits.

Ensuring financial sustainability

As joint stewards of the CPP, Canada's federal and provincial finance ministers review the CPP's financial state every 3 years and make recommendations as to whether benefits and/or contribution rates should be changed. This process is referred to as the CPP triennial review. As of January 1, 2019, both components of the CPP – the base and the enhancement – are part of the review.

The ministers of Finance make their recommendations based on several factors, including the results of an examination of the CPP by the Chief Actuary of the Government of Canada. The Chief Actuary is required under the legislation to produce an actuarial report on the CPP every 3 years (in the first year of the legislated ministerial triennial review of the Plan). The CPP legislation also provides that the Chief Actuary prepare an actuarial report any time a bill is introduced in the House of Commons that has, in the view of the Chief Actuary, a material impact on the estimates in the most recent triennial actuarial report. This reporting ensures that the long‑term financial implications of proposed changes to the Plan are given timely consideration by the ministers of Finance.

Changes to the CPP legislation governing the level of benefits or the rate of contributions and changes to the Canada Pension Plan Investment Board Act can be made only through an act of Parliament. Any such changes also require the agreement of at least two thirds of the provinces, representing at least two thirds of the population of the provincesFootnote 10. The changes come into force only after a notice period, unless all the provinces waive this requirement, and only after provinces have provided formal consent to the changes by way of orders-in-council. Québec participates in decision‑making regarding changes to the CPP legislation to ensure a high degree of portability of QPP and CPP benefits across Canada; however, Québec does not have a role in governance of the CPPIB.

Funding approach

When it was introduced in 1966, the CPP was designed as a pay‑as‑you‑go plan with a small reserve. This meant that the benefits for one generation would be paid largely from the contributions of later generations. This approach made sense under the demographic and economic circumstances of the time, due to the rapid growth in wages and labour force participation as well as the low rates of return on investments. However, demographic, and economic developments, as well as changes to benefits and an increase in disability claims in the following 3 decades, resulted in significantly higher costs. Starting in the mid‑1980s, the finances of the CPP came under increasing pressure as assets declined and increases in contribution rates became necessary. In 1993, it was projected that the pay‑as‑you‑go rate would be 14.2% by 2030 and that the reserve fund would be depleted by 2015. Continuing to finance the CPP on a pay‑as‑you‑go basis would have meant imposing a heavy financial burden on the future Canadian workforce. This was deemed unacceptable by the federal and provincial governments.

Amendments were therefore made in 1997 to gradually raise the level of CPP funding. Changes were implemented to increase the contribution rates over the short term, reduce the growth of benefits over the long term, and invest cash flows not needed to pay benefits in the financial markets through the CPPIB to achieve higher rates of return. A further amendment was included to ensure that any increase in benefits or new benefits provided under the CPP would be fully funded.

The reform package agreed to by the federal and provincial governments in 1997 included the introduction of dual funding objectives for the Plan at the time (for the base CPP):

- the introduction of steady‑state funding: this replaced pay‑as‑you‑go financing to build a reserve of assets and stabilize the ratio of assets to expenditures over time. Steady‑state funding is based on a lowest constant contribution rate that stabilizes the assets-to-expenditures ratio and finances the base CPP without the full‑funding requirement for increased or new benefits

- the introduction of full funding for new or increased benefits: this means that changes to the base CPP that increase or add new benefits are fully funded. In other words, benefit costs are paid as benefits are earned, and any costs associated with benefits that are already earned but not paid for are amortized and paid for over a defined period of time, consistent with common actuarial practices

The sum of the steady‑state and full-funding rates is the minimum contribution rate required to fund the base CPP. So long as the base CPP's minimum contribution rate remains below the legislated contribution rate of 9.9%, the base CPP is considered to be sustainable over the long term.

If the Chief Actuary determines that the base CPP is not sustainable – that is to say, that the minimum contribution rate is higher than the legislated contribution rate, then the ministers of Finance have a limited window in which to make changes to the Plan that restore its sustainability. Should the ministers of Finance not agree on a course of action, then automatic provisions in the CPP legislation would be triggered to sustain the base CPP. Specifically, an increase in the legislated rate would be phased in over 3 years, and indexation of benefits in pay would be suspended until the following triennial review.

The dual funding objectives for the base CPP of steady-state and full funding were introduced to improve fairness across generations. The move to steady‑state funding eases some of the contribution burden on future generations. Under full funding, each generation that receives benefit enrichments is more likely to pay for them in full and not pass on the cost to future generations.

In keeping with the dual funding nature of the Plan, the CPP enhancement is fully funded to ensure fairness across generations. The CPP enhancement is designed so that the additional contributions along with projected investment income will be sufficient to fully pay the projected benefits at the legislated first and second additional contribution rates.

The Additional Canada Pension Plan Sustainability Regulations, which came into force on February 1, 2021, set forth what happens if the CPP enhancement is not sustainable under the legislated additional contribution rates.

These new regulations will apply only if the additional minimum contribution rates deviate to a certain extent and for a certain amount of time from their respective legislated rates and no action is taken by the ministers of Finance to address the deviation. In such case, adjustments would be made to current and future benefits and possibly to the additional contribution rates.

Actuarial reporting on the financial state of the CPP

The Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021, prepared by the Office of the Chief Actuary, was tabled by the federal Minister of Finance in Parliament on December 14, 2022. This Report was the second triennial CPP actuarial report to be in respect of both the base and enhanced components of the Plan.

The Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021 took into account the continuing and evolving impacts of the COVID-19 pandemic as well as the impacts of the escalation of the conflict in Ukraine. The latter was considered to be a subsequent event (occurring after the valuation date but before the report date) which was deemed by the Chief Actuary to have material effects on the financial state of the CPP as projected under the Report.

For both the base and enhanced CPP, the Chief Actuary determines the minimum contribution rates required in accordance with regulations and states these rates in the actuarial report. The minimum contribution rates in the Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021 were determined in accordance with the most recent regulations – the Calculation of Contribution Rates Regulations, 2021, which came into force on February 1, 2021.

For the base CPP, the minimum contribution rate is 9.56% for years 2025 to 2033 and 9.54% for 2034 and thereafter. This rate is the sum of the base CPP steady-state and full-funding contribution rates. The steady-state contribution rate is determined to be 9.53% for 2025 and thereafter. The full-funding rate in respect of base CPP amendments is determined to be 0.03% for years 2025 to 2033 and 0.01% for 2034 and thereafter.

For the enhanced component of the CPP, the first and second additional minimum contribution rates are determined to be 1.97% for the year 2025 and thereafter, and 7.88% for 2025 and thereafter, respectively.

According to the financial projections of the Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021, the annual amount of contributions paid by Canadians into the base CPP is expected to exceed the annual amount of expenditures (benefits paid out and operating expenditures) until 2025 inclusive, and to be less than the amount of expenditures thereafter. For the enhanced CPP, contributions paid are projected to exceed expenditures until the year 2057 inclusive, and to be less than the amount of expenditures thereafter. Funds not immediately required to pay expenditures are transferred to the CPPIB according to different investment portfolios for the base and enhanced CPP.

The assets of the base CPP are projected under the actuarial report to first decrease in 2022, as a result of financial markets and then increase thereafter, with more significant growth in the first few years. Under the legislated contribution rate of 9.9%, total assets are expected to increase to $791 billion by the end of 2030 and then reach $2.2 trillion by 2050 and $17 trillion by 2100. The ratio of assets to the following year’s expenditures is projected to slowly grow from a level of 8.1 to 13.2 over the long term. The accumulation of base CPP assets will help pay for benefits as the population continues aging and more and more baby boomers begin to collect their retirement pensions.

After 2025, because of the aging population, the amount of base CPP expenditures is projected to exceed contributions. When this occurs, investment income from the base CPP’s accumulated assets will provide the funds necessary to make up the difference. However, contributions will remain the main source of funding for benefits for the base Plan. In 2030, about 9% of investment income will be required to pay for expenditures. This is expected to gradually increase to about 16% by 2050 and about 34% by 2070, after which it is expected to remain fairly stable. Investment income, which is expected to represent 32% of revenues in 2023 is further projected to represent 42% of revenues in 2050. This clearly illustrates the importance of investment income as a source of revenues for the base CPP. The Report confirms that, despite the projected substantial increase in benefits paid as a result of an aging population, the base CPP legislated contribution rate of 9.9% exceeds the minimum contribution rate and is thus sufficient to finance the base CPP over the long term.

Assets under the enhanced CPP are expected to increase rapidly over the next several decades as contributions are projected to exceed expenditures. The enhanced CPP assets are projected to increase to $200 billion by 2030, $1.4 trillion by 2050, and $12 trillion by 2100. The ratio of assets to the following year's expenditures is projected to increase rapidly until 2026 and then decrease after that, reaching a level of about 26 by 2080 and remaining close to that level up to 2100. Due to the financing approach of the enhanced Plan, investment income will become a major source of revenues for it. Demographic changes affecting the base CPP, particularly the aging of the population and retirement of the baby boomers, will also affect the enhanced CPP, but to a lesser extent than the base CPP due to the different financing approaches of the 2 plans.

The Thirty-first CPP Actuarial Report includes a new section that focuses on understanding and assessing downside risks due to 3 potential scenarios or emerging trends:

- different distributions workers’ earnings

- elevated inflation over a long period of time leading to stagflation, a phenomenon characterized by a simultaneous economic stagnation and increase in inflation

- and climate change that can affect the CPP through demographic, economic and investment environments

Given a higher reliance of both the base and enhanced CPP on investment returns, an analysis indicates there is a 16% probability that the minimum contribution rate (MCR) will exceed the legislated rate of 9.9% at the next valuation (as at 31 December 2024), due to investment experience alone.

The Report confirms that the legislated first additional contribution rate of 2.0% for the year 2023 and thereafter and second additional contribution rate of 8.0% for 2024 and thereafter are sufficient, along with projected investment income, to fully pay the projected expenditures of the enhanced CPP over the long term. Further, the legislated additional rates are sufficiently close to the minimum rates such that no action is needed to address the differences.

The previous triennial report was the Thirtieth Actuarial Report on the Canada Pension Plan as at 31 December 2018, which was tabled in Parliament on December 10, 2019. The CPP statute was subject to amendments since that report.

The Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021 takes into account all the amendments. It also considers the Calculation of Contribution Rates Regulations, 2021 and the Additional Canada Pension Plan Sustainability Regulations, mentioned above.

A panel of 3 independent actuaries, which was selected based on recommendations of the United Kingdom Government Actuary's Department, reviewed the Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021. The external panel's findings confirmed that the work performed by the Office of the Chief Actuary on the Report complied with all professional standards of practice and statutory requirements. The panel also concluded that the methods and assumptions used for the Report were reasonable, confirming that the legislated contribution rates are sufficient to finance the CPP over the long term.

In addition to these main conclusions, the panel made several recommendations regarding the various aspects of the actuarial report. The panel highlighted the context of heightened risk and uncertainty, and as such their recommendations place emphasis on the need for continued in-depth analysis and forward-looking approaches when developing assumptions, sensitivity measures, and alternative scenarios. The United Kingdom Government Actuary's Department affirmed that the reviewers carried out a sufficiently thorough review and that the work performed was appropriate and reasonable. As a result, Canadians can have confidence in the results of the Thirty-first Actuarial Report on the Canada Pension Plan as at 31 December 2021 and the conclusions reached by the Chief Actuary about the long‑term financial sustainability of the CPP.

The next triennial actuarial report on the CPP, which will report on the financial state of the base and enhanced components of the Plan as of December 31, 2024, is due by December 2025.

To view CPP actuarial reports, studies, and reviews, consult the Office of the Chief Actuary's website.

Financial accountability

The CPP uses the accrual basis of accounting for revenues and expenditures. This method gives administrators a detailed financial picture and allows accurate matching of revenue and expenditures in the year in which they occur.

CPP accounts

Two separate accounts, the CPP Account and the Additional CPP Account, have been established in the accounts of the Government of Canada to record the financial elements of the base CPP and the enhanced CPP respectively (such as contributions, interest, earned pensions and other benefits paid, as well as administrative expenditures). The CPP accounts also record the amounts transferred to, or received from, the CPP Investment Board. Spending authority, as per sections 108(4) and 108.2(4) of the CPP Legislation, is limited to the CPP net assets, which includes both accounts. It is important to note, however, that funds cannot be transferred between accounts such that the base CPP will be wholly funded from the CPP Account, while the enhancement will be funded from the Additional CPP Account. The CPP assets are not part of the federal government's revenues and expenditures.

In keeping with An Act to amend the Canada Pension Plan and the Canada Pension Plan Investment Board Act, which came into force on April 1, 2004, CPPIB is responsible for investing the remaining funds after the CPP operational needs have been met. The CPP Accounts' operating balances are managed by the Government of Canada.

CPP Investment Board

Created by an act of Parliament in 1997, the CPPIB is a professional investment management organization with a critical purpose: to help provide a foundation on which Canadians build financial security in retirement. The assets of the CPP not currently needed to pay pension, disability and survivor benefits are managed by CPPIB.

The organization is accountable to Parliament and to Canada's ministers of Finance, however it is governed independently from the CPP and operates at arm's length from governments. CPPIB's legislated mandate is to maximize investment returns without undue risk of loss. In doing so, it is required to act in the best interest of contributors and beneficiaries, and to consider factors that may affect the funding of the CPP and its ability to meet its financial obligations.

CPPIB is headquartered in Toronto with offices around the world.

Find more information on CPPIB's mandate, governance structure and investment policy.

CPP assets and cash management

Pursuant to section 108.1 of the Canada Pension Plan and an administrative agreement between the CPP and CPPIB, amounts not required to meet specified obligations of the CPP are transferred weekly to CPPIB to gain a better return. The cash flow forecasts of the CPP determine the amount to be transferred to or from CPPIB.

ESDC continues to work closely with CPPIB, various government departments and banks to coordinate these transfers and manage a tightly controlled process. A control framework is in place to ensure that the transfer process is followed correctly and that all controls are effective. For instance, ESDC obtains confirmation at all critical transfer points and can therefore monitor the cash flow from one point to the next.

CPP net assets

In the fiscal year ending March 31, 2023, the CPP Fund grew to $573.9 billion. The Government of Canada held an amount of $3.9 billion to meet CPP pensions, benefits and operating expenses obligations. The remaining $570 billion is managed by CPPIB. In terms of net assets, the CPP Fund ranks as one of the world's largest retirement funds.

For the 10‑year period ending March 31, 2023, the Fund held by CPPIB had an annualized net nominal rate of return of 10%. Over that 10‑year period, the organization has contributed $320 billion in cumulative net income to the Fund, after all costs.

Investing for our future

CPPIB made the strategic decision in 2006 to move away from largely index‑based investments towards the more active selection of investments to capitalize on its comparative advantages. CPPIB benefits from the CPP Fund's exceptionally long investment horizon, certainty of assets and scale. It has also developed a world‑class investment team, which is complemented with top‑tier external partners that support its internal capabilities. CPPIB takes a disciplined, prudent, long‑term approach to managing the portfolio.

In managing the Fund, CPPIB pursues a diverse set of investment programs that stabilize performance and contribute to the long‑term sustainability of the CPP. CPPIB ensures that the Fund has both asset and geographic diversification to make the Fund more resilient to single‑market volatility. In order to build a diversified portfolio of CPP assets, investments are made in public equities, private equities, real estate, credit, infrastructure and fixed income instruments. The investments have become increasingly international, benefitting from positive global growth in the world's largest investment markets, and fostering greater resiliency during periods of slow growth within specific regions.

CPPIB reporting

CPPIB reports its financial performance on a quarterly and annual basis. Legislation requires the organization to hold public meetings every 2 years in each province, excluding Québec, which operates the separate QPP.

The purpose of these meetings is for CPPIB to present its most recent annual report and to provide the public with the opportunity to ask questions about its policies, operations, and future plans.

Other expenses

CPP expenses consist of pensions and benefits paid, operating expenses and benefit overpayments as detailed in the CPP consolidated statement of operations for the year ended March 31, 2023.

Operating expenses

CPP operating expenses of $2.4 billion for the fiscal year represents 4.29% of the $56.0 billion in benefits paid.

| Department, Agency, Crown Corporation | Fiscal Year Ending March 31, 2023 (in millions of dollars) | Fiscal Year Ending March 31, 2022 (in millions of dollars) |

|---|---|---|

| CPPIB* | 1,540 | 1,428 |

| Employment and Social Development Canada | 539 | 546 |

| Canada Revenue Agency | 257 | 273 |

| Treasury Board Secretariat | 45 | 32 |

| Administrative Tribunals Support Service of Canada | 19 | 18 |

| Public Services and Procurement Canada | 4 | 6 |

| Office of the Superintendent of Financial Institutions (where the Office of the Chief Actuary is housed)/Finance Canada | 4 | 3 |

| Total | 2,408 | 2,306 |

- * The operating expenses do not include the transaction costs and investment management fees since these are presented as part of net investment income (loss). For more details, refer to the “Canada Pension Plan consolidated statement of operations” and the financial statements of the CPPIB Annual Report.

Overpayment of benefits

Consistent with its mandate to manage the CPP effectively, ESDC has procedures in place to detect benefit overpayments. During the fiscal year ending March 31, 2023, overpayments totaling $170 million were detected, $83 million in overpayments were recovered and debts of $4 million were forgiven. The above figures represent a net increase of $83 million in the accounts receivable for the year.

Looking to the future

The CPP is reviewed by ministers of Finance every 3 years to ensure that it continues to meet the evolving needs of Canadians. The 2022 to 2024 Triennial Review began in late 2022, following the tabling of the Thirty-first Actuarial Report on the Canada Pension Plan as at December 31, 2021. The consultations between federal, provincial, and territorial governments continue in 2023 and 2024. The final decision on the potential changes to the Plan, if any, are expected to be announced in 2024.

Canada Pension Plan consolidated financial statements

Consult the Canada Pension Plan consolidated financial statements for the year ended March 31, 2023.