Social Assistance Statistical Report: 2009-2013

Alternate formats

- Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

- Large print, braille, audio cassette, audio CD, e-text diskette, e-text CD and DAISY are available on demand.

On this page

- Chapter 1: Summary

- Chapter 2: Social assistance in Canada: an overview

- Chapter 3: Newfoundland and Labrador - Income Support

- Chapter 4: Prince Edward Island - Social assistance

- Chapter 5: Nova Scotia - Employment Support and Income Assistance

- Chapter 6: New Brunswick - Social Assistance

- Chapter 7: Quebec - Last-resort financial assistance

- Chapter 8: Ontario

- Chapter 9: Manitoba - Employment and Income Assistance

- Chapter 10: Saskatchewan - Social Assistance Programs

- Chapter 11: Alberta

- Chapter 12: British Columbia - Employment and Assistance

- Chapter 13: Yukon - Social Assistance

- Chapter 14: Northwest Territories - Income Assistance

- Chapter 15: Nunavut - Income Assistance

Chapter 1 - Summary

Social assistance in Canada is also known as income support, income assistance, welfare and a few other program names, depending on the jurisdiction. No matter the name, all provincial and territorial social assistance programs provide financial assistance and in-kind goods and services to cover the cost of basic living requirements for an individual or family when all other financial resources of that individual or family have been exhausted. For the purpose of this report, in Chapter 1 and 2, the term social assistance program has been adopted.

In recognition of the growing public demand for comprehensive information on provincial and territorial social assistance programs and caseloads, the Social Assistance Statistical Report: 2009-13 is the sixth annual joint publication by federal, provincial and territorial governments. The report provides a general overview of social assistance in Canada, as well as a description of income support-related/social assistance programs in each jurisdiction.

This report does not include social assistance rates as this information is currently available to the public on most provincial and territorial government websites.

Methodology

The data in this report was provided by provincial and territorial ministries responsible for administering social assistance programs. It was extracted from jurisdictional data systems developed to meet their administrative and case management needs. As such, there are extensive variations in the types of data collected, the manner in which the data is reported, and in the definitions and terminology used. The data in this report should not be used for the purpose of cross-jurisdictional comparison.

Chapter 2 - Social assistance in Canada: an overview

The formal division of powers between the federal government and the provincial and territorial governments respecting social services is based on The Constitution Act, 1867. The Act itself did not refer to social services; however, the legislative authority for social services has been inferred from the interpretations of sections 91 and 92 of the Act. These sections of the Act set out the division of authority between the federal and provincial governments and the Constitution has been interpreted to mean that the provinces have primary jurisdiction over social services. As such, the legislation governing the provision of social assistance varies by jurisdiction.

Following the approach of their provincial or territorial counterpart, Aboriginal Affairs and Northern Development Canada (AANDC) has adopted similar terms and conditions of social assistance programs. Funding for social assistance activities is provided by AANDC to First Nations communities, who in turn deliver programs and services to community members.Footnote 1

A brief history of federal social assistance

1966 - Canada Assistance Plan (CAP) - The federal government shared the eligible costs that provincial, territorial and municipal governments incurred in providing provincial social assistance and welfare services to persons in need.

1996 - The Canada Health and Social Transfer (CHST) replaced CAP. The CHST was a federal transfer provided to provinces and territories in support of provincial health care, post-secondary education, social assistance and social services, including early childhood development and early learning and child care.

2004 - The CHST was replaced by the Canada Health Transfer (CHT) in support of health care and the Canada Social Transfer (CST) in support of post-secondary education, social assistance and social services, including early childhood development and early learning and child care.

Eligibility

In general, assistance may be granted to any individual or family head who has been determined, on the basis of need, to be unable to provide adequately for themselves and any dependants. Employable recipients may be required to participate in one or more employment activities as a condition of eligibility for financial assistance. Most jurisdictions require applicants to attain the age of majority prior to application, and be a resident at the time of their application and while receiving benefits.

The following groups of individuals may be eligible for social assistance:

- Canadian citizens

- persons granted permanent resident status under the Immigration and Refugee Protection Act; and

- persons who have made a claim for refugee status or have been granted asylum in Canada under the Immigration and Refugee Protection Act

Administrative requirements

Depending on the jurisdiction, to establish initial eligibility for social assistance, an applicant may be required to:

- submit a completed application

- provide all documentation or necessary information to verify his/her eligibility, such as proof of age, medical information related to a disability, if applicable, pay cheque stubs, etc.

- meet a representative from the ministry and discuss the financial and social situation of the household;

- provide consent for verification of any statement made in the application and any supporting documents concerning financial resources or any other circumstances of the household

- report any change in circumstances that may affect continuing program eligibility or the amount of assistance to which the household is entitled

Employment requirements

Eligible employable persons are actively encouraged or require pursuing, accepting, and retaining any reasonable offer of employment or re-training as an initial and continuing condition of eligibility for social assistance. Thus, many jurisdictions offer employment services and training opportunities in combination with financial assistance. Should a recipient choose not to pursue employment or re-training, he/she may be subject to penalties ranging from a specified reduction in benefits over a prescribed period of time to the full cancellation of benefits.

To ensure that those who successfully leave social assistance for employment are better off working, the federal government (Working Income Tax Benefit - WITB) and a number of provinces and territories have introduced earned income or working income supplements.

Categories of beneficiaries

Employable persons - A number of measures promote the entry or re-entry of employable persons into the active labour force. These measures may include different exemption levels on assets and income, lower benefit levels to reflect the temporary nature of their reliance on social assistance, and a wide range of employment support services and programs.

Recipients may be required to sign and adhere to an individualized contract that stipulates training and rehabilitation measures to be undertaken in order to regain financial independence.

However, assistance may be granted only when:

- unemployment is due to circumstances beyond the person's control

- the person is willing to accept employment which he/she is capable of handling, or to engage in academic upgrading, re-training or other measures to reach a state of job readiness; and

- the person is making reasonable efforts to secure employment

Single-parent families - A sole support parent may be required to either initiate legal proceedings against an absent spouse (or ex-spouse) including common-law partners, respecting maintenance payments, or to subrogate that right to the government. Generally, single parents are considered as employable and required to actively seek and accept reasonable employment, where the parent and dependent child(ren) are physically and mentally healthy and generally when the dependants have reached a certain age.

Persons with disabilities - An applicant with a disability is generally required to undergo an adjudication process or submit a medical certificate completed by a licensed physician indicating the level of the impairment and the potential for rehabilitation. Evidence of a continuing disability on an annual or other basis may also be required. These requirements may be waived where the disability is obvious.

All programs have design features to assist persons with disabilities, which may include higher exemption levels on assets and income, higher basic assistance levels, special disability-related allowances, and supplementary health and medical benefits.

Persons with multiple barriers to employment - Some recipients face multiple significant barriers that make it difficult to find and maintain employment. Barriers to employment may include substance abuse, child care or transportation issues, histories of long-term unemployment, and/or low basic skills.

These individuals require interventions to address their personal circumstances in order to be able to find and maintain employment. They may have higher benefit levels and exemptions to reflect their longer-term reliance on social assistance.

Aged persons - Seniors may qualify for social assistance notwithstanding their eligibility for benefits from other federal, provincial and territorial programs. Financial hardship might be due to some age-related special needs, the number of dependants in the household, or ineligibility for Old Age Security benefits. Most jurisdictions have established higher basic assistance benefit levels or other special considerations for aged persons.

Students - Post-secondary students are generally not permitted to receive social assistance while attending university, college or trade school. Students requiring financial assistance during their study period are generally expected to contact the appropriate student loan organization to receive financial assistance.

Financial eligibility

Needs or means test - Social assistance is generally granted to eligible persons on the basis of a needs test. It takes into account the basic needs and the financial resources available to an individual or family (assets and income), and the ability of those financial resources to meet their basic needs.

Assets - A household's assets may be considered as exempt or non-exempt for the purpose of calculating the social assistance entitlement. In most jurisdictions, liquid assets are defined as any assets that are readily convertible into cash including cash-on-hand, bank accounts, stocks and bonds, or other securities. Certain exemptions are allowed with respect to actual and potential liquid assets and the property of an individual or family. A portion of the cash value of a life insurance policy may be exempt from the calculation of liquid assets.

Homeowners applying for social assistance are not required to sell their principal residence and household effects (within reason) as a condition of eligibility. Similarly, applicants are not required to sell their primary vehicle, generally as long as the value of the vehicle does not exceed an allowable limit. Provisions regarding the treatment of assets such as Registered Retirement Savings Plans and Registered Education Savings Plans vary between the provinces and territories.

Assistance may be withheld, reduced or terminated where an applicant or recipient has disposed of his/her assets in an unreasonable manner in order to qualify for assistance.

Income - In addition to assets, income from all sources is examined in the calculation of entitlement to social assistance. The following types of income may be fully or partially exempt:

- Canada Child Tax Benefit

- foster home payments

- child welfare payments

- GST/HST rebates

- insurance settlements

- federal compensation payments (such as payments to those under the Hepatitis C Program, to those infected with the human immunodeficiency virus (HIV) through blood transfusions or blood products, and to Canadian merchant mariners who served in the Second World War or the Korean War)

- involuntary deductions from pay

- gifts and inheritances; and

- income from full-time employment held by dependants who are students

Partial exemptions for employment income exist in most provinces and territories. These income exemptions may be granted as an incentive for the individual to gain financial independence. The income exemption provision may take effect only after initial eligibility for social assistance has been established.

Other types of unearned income, such as Workers' Compensation benefits and Old Age Security, are non-exempt and reduce the amount of social assistance payable dollar-for-dollar.

In the determination of financial eligibility, some jurisdictional authorities may include imputed income as part of a household's income even though the household is not actually receiving money from a particular source. Living rent-free in return for janitorial or superintendent services is a common example of imputed income.

Benefits

Basic assistance - Basic assistance is generally intended to help with the cost of food, shelter, clothing, personal and household items, and may cover regularly recurring special needs. There are three basic methods used to calculate the amount of benefits to which an individual or family are entitled:

- Pre-added budget method - It combines all non-shelter requirements into a single support allowance. A separate shelter component is then provided.

- Itemized budget method - It provides a standard allowance for each of the non-shelter and shelter requirements. The sum of the individual items to which the individual or family is entitled then forms the total benefit payable.

- Flat rate of assistance - It provides a lump sum amount for non-shelter and shelter items based on a household's structure and the program in which it is participating.

Variables affecting the amount of shelter allowance payable include the number of beneficiaries in any given household, the type of living arrangement and the cost of fuel and utilities. In some jurisdictions, the shelter amount varies depending on the season, location and relative remoteness of the area in question.

Special needs assistance - Generally, this type of assistance provides items, services, or allowances related to age, disability, employment, education, training, and other special circumstances. It varies widely between jurisdictions but examples include transportation allowances, employment-related allowances, child care subsidies, drug and medical services, as well as furniture replacement, minor home repair allowances, special diet allowances, school supply allowances, and funeral services. The provision of items of special need is generally on a case-by-case basis in accordance with the applicable policies and guidelines.

Transitional assistance - In an effort to increase labour market attachment and reduce reliance on social assistance, attempts have been made to lessen the financial impact of the transition from social assistance to employment. In some jurisdictions, child care and transportation allowances have been increased to facilitate the participation in employment and re-training activities. Extended drug cards and supplementary health benefits, valid after leaving social assistance (subject to renewal) have further lessened the financial impact of accepting employment.

Indexation - Each province and territory is responsible for deciding whether to index its benefits. Most revise their rates on an ad hoc basis. Yukon annually indexes most items of basic maintenance, using the average Consumer Price Index for Whitehorse and Quebec annually indexes its benefits paid within their financial assistance program. In Quebec, benefits paid are adjusted at the same indexation rates used in the personal taxation system.

Administration

Referral to other government programs - An applicant's circumstances are reviewed to determine if social assistance is the most appropriate intervention for them. If it is determined that another governmental program may be more suitable, the applicant is referred to that program.

Method of payment - Social assistance benefits can be paid in one or more ways - such as, cash, payroll or manual cheque issue, direct deposit, voucher or authorization to purchase or direct payment to a third-party vendor or supplier.

Case review - As a condition of continuing eligibility for financial assistance, beneficiaries must report immediately any change in the circumstances of their household that would affect their entitlement to financial assistance. In addition, some jurisdictions require that long-term social assistance recipients be reviewed periodically, while short-term recipients may be reviewed more frequently.

Recoveries and reimbursement - Policies and procedures are in place concerning the recovery of social assistance granted to a person who was not entitled because of a change in household income or other circumstances, such as accidental or wilful representation or fraud. Certain forms of assistance may be conditional upon a formal agreement signed by the recipient to reimburse the government for such assistance.

Appeals - An applicant or recipient is entitled to file a request for reconsideration or appeal where he/she is dissatisfied with a decision affecting his/her entitlement to social assistance. Some provinces and territories have established limits on the type of issues that may be formally appealed, while others allow an individual to question any determination bearing on his/her case. Most jurisdictions have adopted a two-step appeal process. Social assistance personnel first conduct an internal administrative review. The applicant or recipient may then decide whether to withdraw their appeal or go forward to a formal appeals committee or board consisting of appointed members.

Children's benefits

Prior to 1998, there was minimal coordination between the federal system, which delivered child benefits through the income tax system, and provincial/territorial systems, which delivered child benefits through social assistance programs. In July 1998, the National Child Benefit (NCB) was introduced. The NCB is a joint initiative of federal, provincial and territorial governmentsFootnote 2, including a First Nations component to support Canadian children living in low-income families. The goals of the NCB are to help prevent and reduce the depth of child poverty, to promote attachment to the labour market by ensuring that families will always be better off as a result of working; and to reduce overlap and duplication by harmonizing program objectives and benefits, and through simplified administration.

Under this initiative, a new federal child benefit, the NCB Supplement, was introduced as a component of the Canada Child Tax Benefit (CCTB). The CCTB provides a base benefit to all low- and middle-income families with children. The NCB Supplement provides an additional benefit targeted to children in low-income families, whether the parents are receiving social assistance or working.

The NCB Supplement provided provinces and territories the opportunity to adjust children's social assistance by an amount equivalent to the NCB Supplement. Resulting savings are reinvested in new or enhanced programs benefiting low-income families with children.

Approaches to replacing social assistance benefits for children

Since the inception of the NCB initiative, three distinct approaches have evolved by which provinces and territories replace social assistance benefits for children with the NCB Supplement. First Nations follow the approach of the province or territory in which they are located. In two jurisdictions, New Brunswick and ManitobaFootnote 3, social assistance is not adjusted by federal increases to the NCB Supplement.

The social assistance offset approach - Under this approach child benefits remain within the social assistance system, but these benefits have been gradually displaced by federal increases to the NCB Supplement. Provinces and territories either deduct the NCB Supplement as an unearned income charge against social assistance or reduce their social assistance rates for children. In the case of income offset, social assistance recipients have the amount of the NCB Supplement they receive deducted from their social assistance entitlement. This approach is used in Prince Edward IslandFootnote 4, Yukon, Northwest Territories and Nunavut. In the case of rate reduction, social assistance rates are reduced by the maximum NCB Supplement. AlbertaFootnote 5, Footnote 6 uses this approach. Reinvestment funds under the social assistance offset approach are the savings in social assistance.

The integrated child benefit approach with adjustment - Several jurisdictions restructured their social assistance system and children's benefits are now delivered through a separate income-tested child benefit program that is integrated with the CCTB. Under this approach, increases in the NCB Supplement are offset in full or in part against the provincial child benefit. In British Columbia, the savings from this offset become the province's reinvestment funds. In Saskatchewan, the amount of reinvestment funds is set at the amount that was being spent on basic child benefits under the social assistance system at the time the system was restructured, and remains the same for subsequent years.

The integrated child benefit approach without adjustment - Other jurisdictions also restructured their social assistance system as basic benefits for children were removed from the social assistance program and are now provided through a separate income-tested program integrated with the CCTB. In these cases, however, there is no offset of the NCB Supplement against provincial child benefits. The amount of reinvestment funds is set at the funds that were being spent on basic child benefits under the social assistance system at the time the system was restructured and remains the same for subsequent years. Newfoundland and LabradorFootnote 7, Nova ScotiaFootnote 8 and OntarioFootnote 9 have adopted this approach.

Other approach - In Quebec, children needs are covered by the Canada Child Tax Benefit and the improved Quebec Family Allowances and, since January 2005, by a Tax Credit Reimbursement for Child Support. This income support allows Quebec families with children, particularly those receiving last-resort financial benefits or those with low income, to obtain transfer payments benefiting their children. These benefits are adjusted on January 1st of each year at the same indexation rate as the personal taxation system.

In 2013, provinces and territories provided NCB programs and services in six key areas: child/day care initiatives; child benefits and earned income supplements; early childhood and children-at-risk services; supplementary health benefits; youth initiatives; and other NCB programs, benefits and services. First Nations reinvestments covered a broader range of programs in five key areas: child care; child nutrition; support to parents; home-to-work transition; and cultural enrichment.

Additional information on the NCB is available in annual progress reports, which are available on the National Child Benefit website.

Chapter 3 - Newfoundland and Labrador - Income support

In Newfoundland and Labrador, the provincial social assistance program is known as Income Support. The Income and Employment Support Act and the Income and Employment Support Regulations govern Newfoundland and Labrador's social assistance program.

Income Support provides basic benefits to adults only.

Children's basic benefits are provided through the Newfoundland and Labrador Child Benefit.

Service delivery

The Department of Advanced Education and Skills is responsible for the delivery of the Income Support program to adults within the province.

Eligibility

General

In order to be eligible for the Income Support program, applicants must meet the general eligibility requirements outlined in the "Social Assistance Overview" in this report.

Liquid assets

At the time of application, applicants' liquid assets may not exceed the following allowable limits:

| Clients without disabilities | Clients with disabilities a | |

|---|---|---|

| Single | $3,000 | $3,000 |

| Family | $5,500 | $5,500 |

- Table note a. These clients must require supportive services.

- Note: The Liquid asset exemptions for clients without disabilities was increased in 2011 (single - $500 to $3,000, and family - $1,500 to $5,500)

Earnings exemptions

Once an application for assistance has been approved, Income Support program clients are eligible for the following monthly exemptions on earned income:

| Clients without disabilities | Clients with disabilities a | |

|---|---|---|

| Single | $75, plus 20% of income in excess of $75. | $150, plus 20% of income in excess of $150. |

| Family | $150, plus 20% of income in excess of $150. | $250, plus 20% of income in excess of $250. |

- Table note a. These clients must require supportive services.

- Note: The exemptions for clients requiring supportive services increased in July 2008 (from $95 to $150 for singles and $190 to $250 for families). The percentage factor also increased from 10% to 20% for all clients in July 2008.

Benefits

Basic assistance consists of individual/family benefits and a shelter allowance. Individual/family benefits cover the cost of food, clothing, and utilities for adults only. Maximum individual/family benefits rates are based primarily on the number of adults in the household. There is a differential between a single person and a single parent, and couples with and without children - however, the number of children does not impact the rates. Maximum shelter allowance rates are based on family composition - single vs. family, and the type of accommodation.

Newfoundland and Labrador provides clients who leave social assistance for employment with an extended drug card that is valid for six months.

Children's basic benefits are paid through the Newfoundland and Labrador Child Benefit.

Newfoundland and Labrador Child Benefit

The Newfoundland and Labrador Child Benefit (NLCB) is a non-taxable amount paid monthly to help low-income families with the cost of raising children under the age of 18 years. The creation of the Newfoundland and Labrador Child Benefit in July 1999, effectively removed children's benefits from the social assistance system.

The Canada Revenue Agency delivers the NLCB as an integrated payment with the CCTB and the NCB Supplement. The NLCB rates are based on net income and number of children. For instance, maximum NLCB benefits are paid to those families whose income is less than $17,397 per year. In 2013, families whose annual income falls between $17,397 and $24,580 per year (depending on the number of children) may be eligible for partial NLCB benefits.

Effective July 2013, in addition to the National Child Benefit Supplement, families with one child may be entitled to receive $364 per year. Families are eligible to receive $386 per year for their second child, $415 per year for their third child, and $445 per year for each additional child.

| Year | Families | Children |

|---|---|---|

| 2003-2004 | 19,800 | 30,000 |

| 2004-2005 | 18,834 | 29,306 |

| 2005-2006 | 18,246 | 28,393 |

| 2006-2007 | 17,329 | 27,072 |

| 2007-2008 | 16,258 | 25,297 |

| 2008-2009 | 14,956 | 23,640 |

| 2009-2010 | 14,072 | 22,325 |

| 2010-2011 | 13,416 | 21,257 |

| 2011-2012 | 13,036 | 20,694 |

| 2012-2013 | 12,298 | 19,601 |

More information

For more information, please consult the Newfoundland and Labrador Department of Advanced Education and Skills website.

Statistics

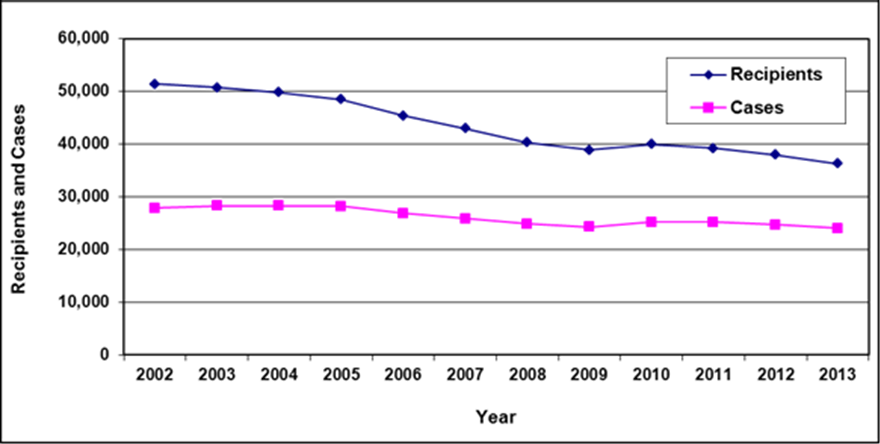

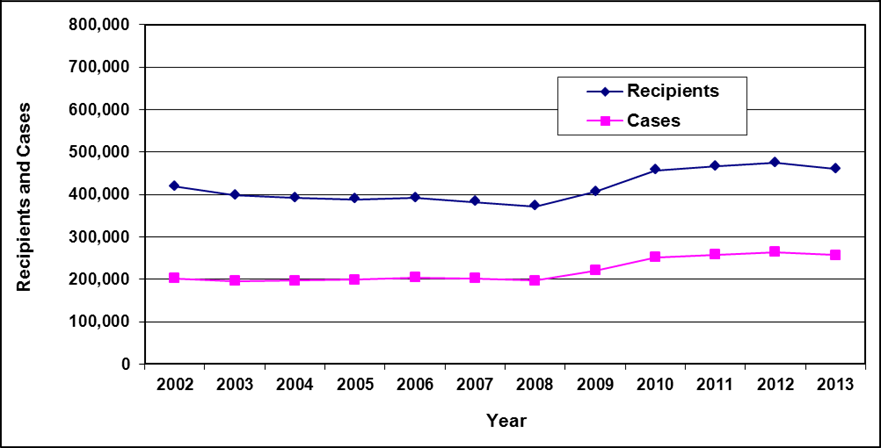

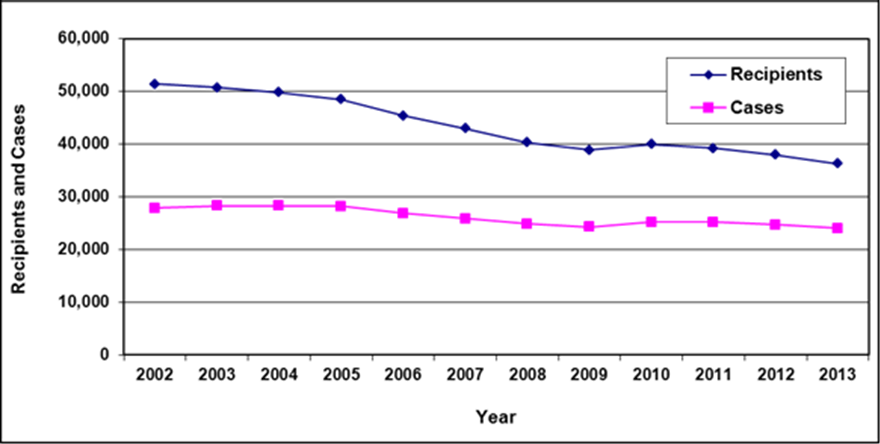

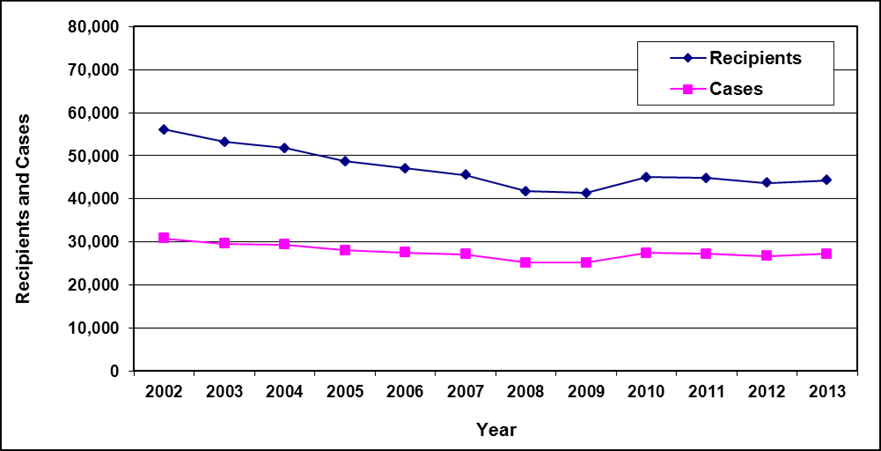

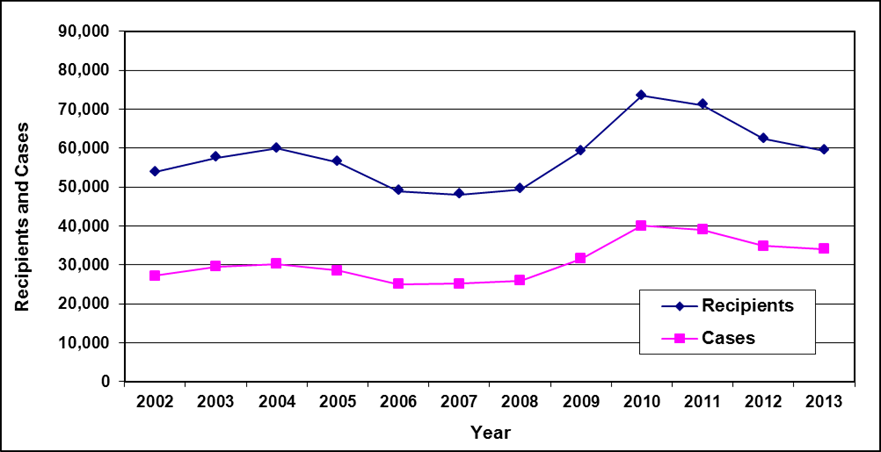

Recipients and cases

Text description of Table 3-1

| Year | 2002 | 2003 | 2004 a | 2005 a | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Recipients | 51,400 | 50,700 | 49,800 | 48,500 | 45,400 | 43,000 | 40,300 | 38,900 | 40,000 | 39,200 | 38,000 | 36,300 |

| Cases | 27,900 | 28,300 | 28,300 | 28,200 | 26,900 | 25,900 | 24,900 | 24,300 | 25,200 | 25,200 | 24,700 | 24,000 |

- Table note a. "The total caseload for March 2004 and March 2005 includes a small number of cases paid through other means. Additional differences are due to slight variations in the selection criterion used to derive the official count and the criterion used to produce data extracts for subsequent detailed analysis."

Cases by reason for assistance

| Reason for assistance | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employed | 1,000 | 4% | 900 | 4% | 800 | 3% | 800 | 3% | 800 | 3% |

| Unemployed | 14,700 | 60% | 15,700 | 62% | 16,000 | 63% | 15,800 | 64% | 15,400 | 64% |

| Disability | 5,500 | 23% | 5,600 | 22% | 5,600 | 22% | 5,500 | 22% | 5,300 | 22% |

| Sole support parent | 1,000 | 4% | 1,000 | 4% | 1,000 | 4% | 900 | 4% | 800 | 3% |

| Age-related | 300 | 1% | 300 | 1% | 300 | 1% | 200 | 1% | 200 | 1% |

| Student | 400 | 2% | 500 | 2% | 500 | 2% | 500 | 2% | 500 | 2% |

| Other a | 1,400 | 6% | 1,200 | 5% | 1,100 | 4% | 1,000 | 4% | 900 | 4% |

| Total | 24,300 | 100% | 25,200 | 100% | 25,200 | 100% | 24,700 | 100% | 24,000 | 100% |

- Table note a. "Other" includes clients paid in the new CAPS pay system. This field did not match upon conversion from the old system. Until cases are reviewed in the new pay system and the reason for assistance field is updated, the number of cases in the "other" category will continue to be higher than previous years. Accuracy in this area will improve over time.

- Note: Totals may not add due to rounding.

Recipients by family type

| Family type | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Adults - Single | 15,200 | 39% | 16,100 | 40% | 16,600 | 42% | 16,500 | 43% | 16,300 | 45% |

| Adults - Couple, no dependants | 4,900 | 13% | 4,700 | 12% | 4,400 | 11% | 4,200 | 11% | 3,900 | 11% |

| Adults - Single parent | 5,300 | 14% | 5,400 | 14% | 5,200 | 13% | 5,000 | 13% | 4,800 | 13% |

| Adults - Couple with dependants | 2,800 | 7% | 2,800 | 7% | 2,500 | 6% | 2,200 | 6% | 1,900 | 5% |

| Total adults | 28,200 | 72% | 29,000 | 73% | 28,700 | 73% | 27,900 | 73% | 26,900 | 74% |

| Children - Single parent | 8,100 | 21% | 8,400 | 21% | 8,200 | 21% | 7,900 | 21% | 7,600 | 21% |

| Children - Couple with dependants | 2,600 | 7% | 2,600 | 7% | 2,300 | 6% | 2,100 | 6% | 1,900 | 5% |

| Total children | 10,700 | 28% | 11,000 | 28% | 10,500 | 27% | 10,000 | 26% | 9,500 | 26% |

| Total recipients | 38,900 | 100% | 40,000 | 100% | 39,200 | 100% | 38,000 | 100% | 36,300 | 100% |

- Note: Totals may not add due to rounding.

Cases by age of head

| Age of head | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| <20 | 700 | 700 | 600 | 700 | 600 |

| 20-24 | 2,200 | 2,500 | 2,600 | 2,400 | 2,200 |

| 25-29 | 2,300 | 2,500 | 2,500 | 2,500 | 2,400 |

| 30-34 | 2,400 | 2,500 | 2,400 | 2,500 | 2,400 |

| 35-39 | 2,700 | 2,700 | 2,600 | 2,500 | 2,400 |

| 40-44 | 2,800 | 2,800 | 2,700 | 2,600 | 2,500 |

| 45-49 | 3,000 | 3,100 | 3,000 | 3,000 | 2,900 |

| 50-54 | 3,000 | 3,000 | 3,100 | 3,000 | 3,000 |

| 55-59 | 2,800 | 2,900 | 3,000 | 3,000 | 2,900 |

| 60-64 | 2,200 | 2,300 | 2,300 | 2,300 | 2,400 |

| 65+ | 300 | 300 | 300 | 200 | 200 |

| Total | 24,300 | 25,200 | 25,200 | 24,700 | 24,000 |

- Note: Totals may not add due to rounding.

Cases by education of head

| Education of head a | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Primary b | 6,800 | 28% | 6,600 | 26% | 6,300 | 25% | 6,000 | 24% | 5,600 | 23% |

| Secondary c | 13,200 | 54% | 14,100 | 56% | 14,300 | 57% | 14,100 | 57% | 13,800 | 58% |

| Community/technical college | 2,500 | 10% | 2,800 | 11% | 2,900 | 12% | 2,900 | 12% | 2,900 | 12% |

| University | 700 | 3% | 700 | 3% | 800 | 3% | 700 | 3% | 800 | 3% |

| Other | 1,000 | 4% | 1,000 | 4% | 1,000 | 4% | 1,000 | 4% | 900 | 4% |

| Total | 24,300 | 100% | 25,200 | 100% | 25,200 | 100% | 24,700 | 100% | 24,000 | 100% |

- Table note a. Education is defined as level of education attained by the head of the household as of March 31.

- Table note b. "Primary" includes Kindergarten to Grade 8.

- Table note c. "Secondary" includes Grade 9 to Grade 12.

- Note: Totals may not add due to rounding.

Cases reporting income by source of income

| Source of income | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employment | 1,000 | 19% | 900 | 17% | 800 | 15% | 800 | 16% | 800 | 16% |

| Government transfers | 2,600 | 49% | 2,700 | 51% | 2,700 | 52% | 2,700 | 54% | 2,600 | 53% |

| Support payments | 1,300 | 25% | 1,300 | 25% | 1,300 | 25% | 1,200 | 24% | 1,200 | 24% |

| Employment Insurance | 200 | 4% | 200 | 4% | 200 | 4% | 100 | 2% | 100 | 2% |

| Other a | 200 | 4% | 200 | 4% | 200 | 4% | 200 | 4% | 200 | 4% |

| Total b (includes double-counting) |

5,300 | 100% | 5,300 | 100% | 5,200 | 100% | 5,000 | 100% | 4,900 | 100% |

- Table note a. "Other" includes training allowances and other income.

- Table note b. Total cases in these categories may include double-counting, since cases that have more than one source of income are counted for each source reported.

- Note: Totals may not add due to rounding.

| Year | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| Reporting income | 5,000 | 5,100 | 4,900 | 4,800 | 4,600 |

| No income | 19,300 | 20,100 | 20,300 | 19,900 | 19,400 |

| Total | 24,300 | 25,200 | 25,200 | 24,700 | 24,000 |

- Note: Totals may not add due to rounding.

Chapter 4 - Prince Edward Island - Social assistance

In Prince Edward Island, the provincial social assistance program is known as Social Assistance (SA). The Social Assistance Act and the Social Assistance Regulations govern Prince Edward Island's Social Assistance program.

Social Assistance provides basic benefits to both adults and children.

Disability supports are provided through Prince Edward Island's Disability Support Program.

Service delivery

The Department of Community Services and SeniorsFootnote 10 is responsible for the delivery of the Social Assistance program to adults and children within the province.

Eligibility

General

In order to be eligible for the Social Assistance program, applicants must meet the general eligibility requirements outlined in the "Social Assistance Overview" in this report.

Liquid assets

At the time of application, applicants' liquid assets may not exceed the following allowable limits.

Short-term assistance

Single persons who are expected to receive benefits for less than four months (short-term assistance) and/or who are seasonally unemployed are entitled to retain $50.

Long-term assistanceFootnote 11

| Clients without disabilities | Clients with disabilities | |

|---|---|---|

| Single | $200 | $900 |

| Single-parent family | $900 plus $300 per dependant to a maximum of $2,400. | $900 plus $300 per dependant to a maximum of $2,400. |

| Childless couple | $1,200 | $1,800 |

| Two-parent family | $1,200 plus $300 per dependant to a maximum of $2,400. | $1,800 plus $300 per dependant to a maximum of $2,400. |

Earnings exemptions

Social Assistance program clients are eligible for the following monthly exemptions on earned income:

Prince Edward Island - Earnings exemptions, March 2013

- Single: $75 plus 10% of the excess

- Family: $125 plus 10% of the excess

Benefits

Basic assistance consists of a basic allowance and a shelter allowance. The basic allowance covers the cost of food, clothing, utilities, and personal and household items. Maximum basic allowance rates are based on the number of persons in the household and the age of the children. Maximum shelter allowance rates are based on the number of persons in the household (including children) and the type of living arrangements.

Disability Support Program

In October 2001, Prince Edward Island launched the PEI Disability Support Program. Designed to meet the unique needs of persons with disabilities, the Disability Support Program offers both financial and case planning assistance to eligible individuals. It is comprised of three components: Adult Disability Supports, Child Disability Supports, and Employment and Vocational Supports.

The Disability Support Program is available to individuals under 65 years of age who have a physical, neurological, or intellectual disability that limits their ability to perform activities necessary for their independence and well-being.

Individuals and families receiving benefits through the Disability Support Program must assume a portion of the cost associated with the provision of services. The amount of this contribution is based on the individual or family's ability to contributeFootnote 12.

Persons with disabilities continue to receive financial assistance through the Social Assistance program, but now receive targeted disability-related supports through the Disability Support Program. Individuals and families receiving support through the Disability Support Program are ineligible for certain benefits provided by the Social Assistance program.

Prince Edward Island - Disability Support Program number of recipients 2001-2002 to 2012-2013

- 2001-2002: 691

- 2002-2003: 991

- 2003-2004: 1,047

- 2004-2005: 1,117

- 2005-2006: 1,076

- 2006-2007: 1,106

- 2007-2008: 1,065

- 2008-2009: 1,115

- 2009-2010: 1,183

- 2010-2011: 1,215

- 2011-2012: 1,232

- 2012-2013: 1,269

More information

For more information, please consult the Prince Edward Island Department of Community Services and Seniors website.

Statistics

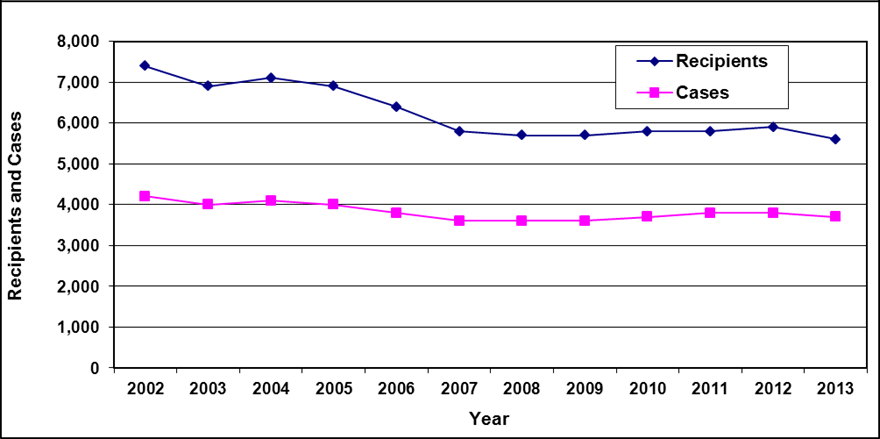

Recipients and cases

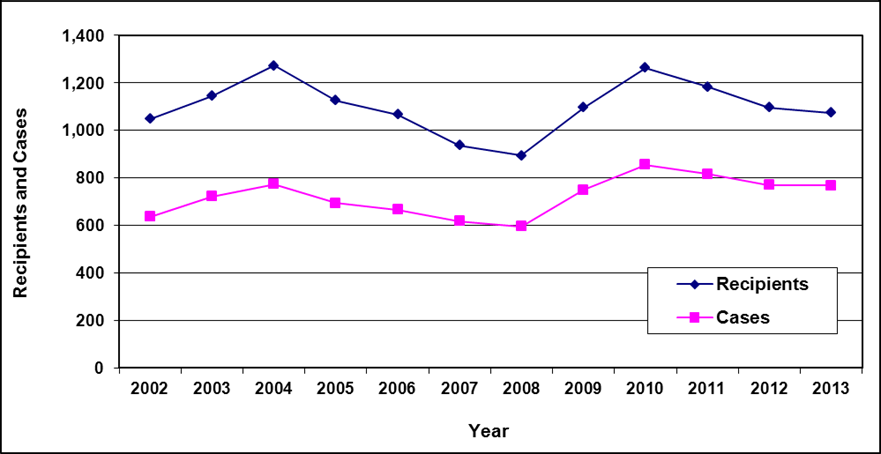

Text description of Table 4-1:

| Year | 2002 | 2003 | 2004a | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Recipients | 7,400 | 6,900 | 7,100 | 6,900 | 6,400 | 5,800 | 5,700 | 5,700 | 5,800 | 5,800 | 5,900 | 5,600 |

| Cases | 4,200 | 4,000 | 4,100 | 4,000 | 3,800 | 3,600 | 3,600 | 3,600 | 3,700 | 3,800 | 3,800 | 3,700 |

- Table note a. "For 2004, due to changes in reporting system, February data was used."

Cases by reason for assistance

| Reason for assistance | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employed | 400 | 11% | 400 | 11% | 400 | 11% | 400 | 11% | 300 | 8% |

| Unemployed | 800 | 22% | 800 | 22% | 800 | 21% | 800 | 21% | 700 | 19% |

| Short term disability | 200 | 6% | 200 | 5% | 300 | 8% | 300 | 8% | 300 | 8% |

| Long term disability | 2,000 | 56% | 2,100 | 57% | 2,100 | 55% | 2,100 | 55% | 2,100 | 57% |

| High support needs a | 200 | 6% | 200 | 5% | 200 | 5% | 200 | 5% | 200 | 5% |

| Total | 3,600 | 100% | 3,700 | 100% | 3,800 | 100% | 3,800 | 100% | 3,700 | 100% |

- Table note a. "High support needs" includes clients with multiple barriers to employment.

- Note: Totals may not add due to rounding.

Recipients by family type

| Family type | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Adults - Single | 2,500 | 44% | 2,600 | 45% | 2,800 | 48% | 2,800 | 47% | 2,700 | 48% |

| Adults - Couple, no dependants | 400 | 7% | 300 | 5% | 400 | 7% | 300 | 5% | 300 | 5% |

| Adults - Single parent | 700 | 12% | 700 | 12% | 700 | 12% | 700 | 12% | 600 | 11% |

| Adults - Couple with dependants | 400 | 7% | 400 | 7% | 400 | 7% | 400 | 7% | 300 | 5% |

| Total adults | 4,000 | 70% | 4,100 | 71% | 4,200 | 72% | 4,200 | 71% | 4,000 | 71% |

| Children - Single parent | 1,300 | 23% | 1,300 | 22% | 1,200 | 21% | 1,200 | 20% | 1,200 | 21% |

| Children - Couple with dependants | 500 | 9% | 400 | 7% | 400 | 7% | 400 | 7% | 400 | 7% |

| Total children | 1,700 | 30% | 1,700 | 29% | 1,600 | 28% | 1,700 | 29% | 1,600 | 29% |

| Total recipients | 5,700 | 100% | 5,800 | 100% | 5,800 | 100% | 5,900 | 100% | 5,600 | 100% |

- Note: Totals may not add due to rounding.

Cases by age of head

| Age of head | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| <20 | 100 | 100 | 100 | 100 | 100 |

| 20-24 | 200 | 300 | 300 | 300 | 300 |

| 25-29 | 300 | 300 | 400 | 300 | 300 |

| 30-34 | 300 | 300 | 300 | 300 | 300 |

| 35-39 | 300 | 300 | 300 | 300 | 300 |

| 40-44 | 400 | 400 | 400 | 400 | 300 |

| 45-49 | 400 | 400 | 400 | 400 | 400 |

| 50-54 | 400 | 400 | 400 | 400 | 400 |

| 55-59 | 400 | 400 | 400 | 400 | 400 |

| 60-64 | 400 | 400 | 400 | 400 | 400 |

| 65+ | 400 | 400 | 400 | 400 | 400 |

| Total | 3,600 | 3,700 | 3,800 | 3,800 | 3,700 |

- Note: Totals may not add due to rounding.

Cases by education of head

| Education of head a | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Primary | 800 | 22% | 800 | 22% | 800 | 21% | 700 | 18% | 700 | 19% |

| Secondary | 1,900 | 53% | 2,000 | 54% | 2,000 | 53% | 2,000 | 53% | 1,900 | 51% |

| Community/technical college | 400 | 11% | 500 | 14% | 500 | 13% | 500 | 13% | 500 | 14% |

| University | 200 | 6% | 100 | 3% | 100 | 3% | 200 | 5% | 200 | 5% |

| Unknown | 400 | 11% | 400 | 11% | 400 | 11% | 400 | 11% | 400 | 11% |

| Total | 3,600 | 100% | 3,700 | 100% | 3,800 | 100% | 3,800 | 100% | 3,700 | 100% |

- Table note a. Education is defined as level of education attained as of date of application.

- Note: Totals may not add due to rounding.

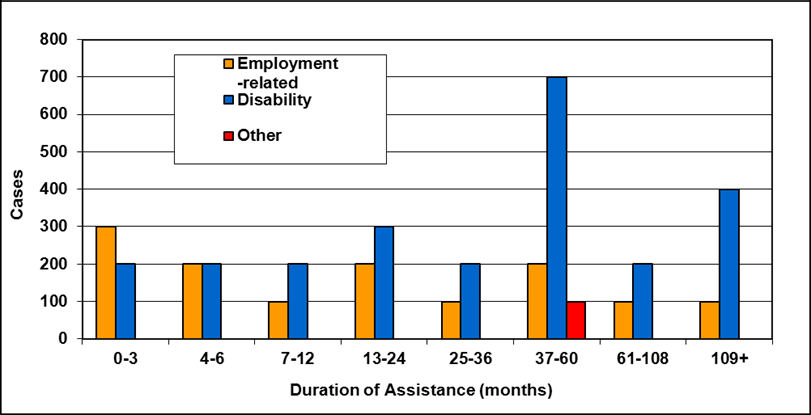

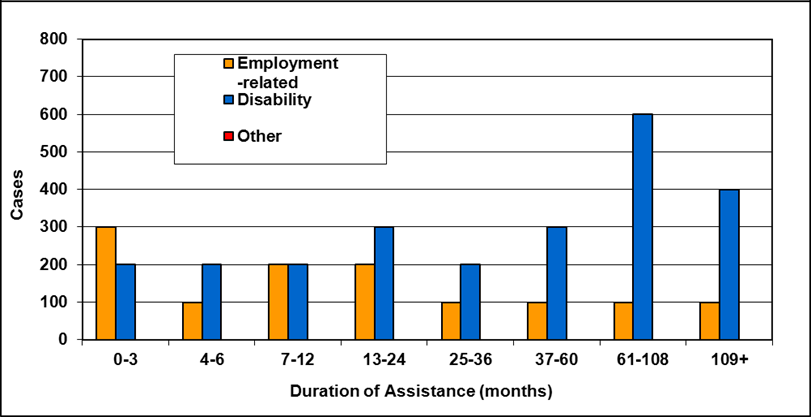

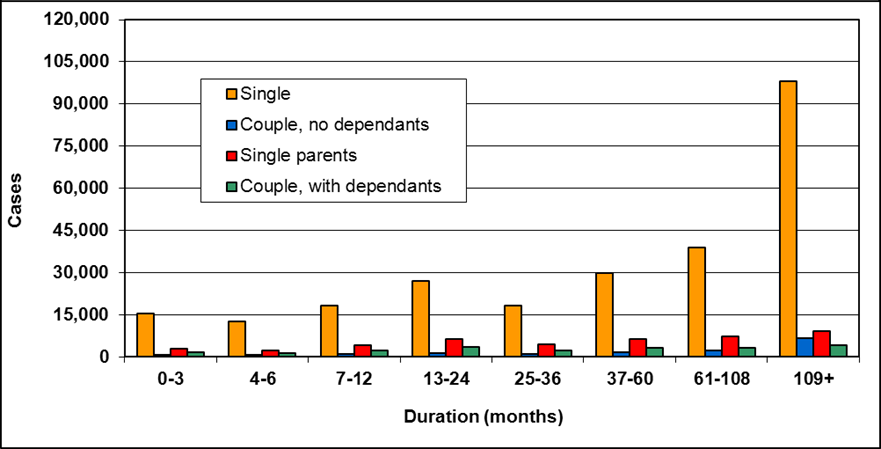

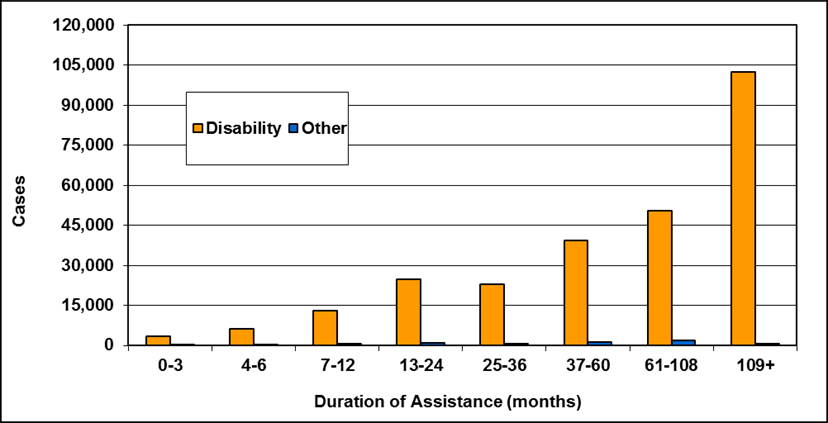

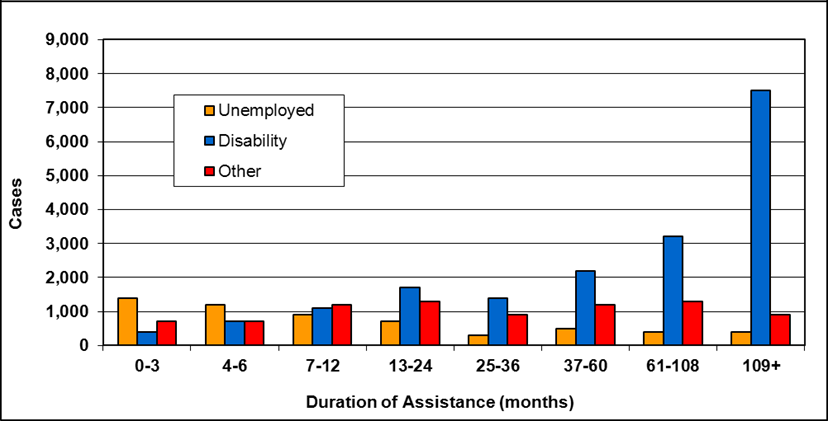

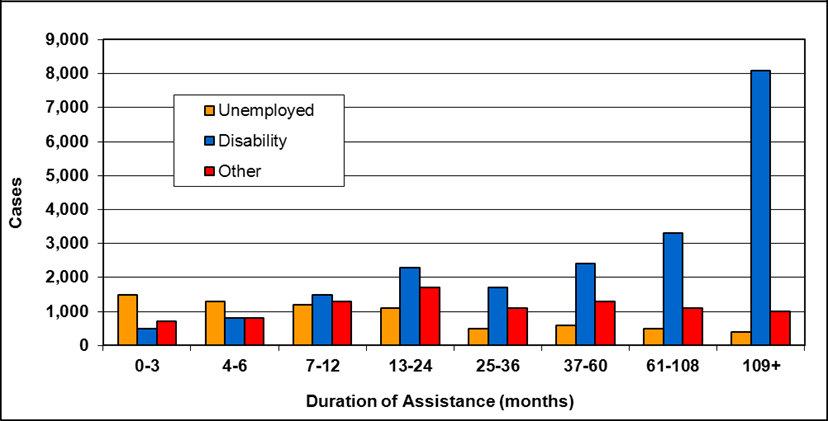

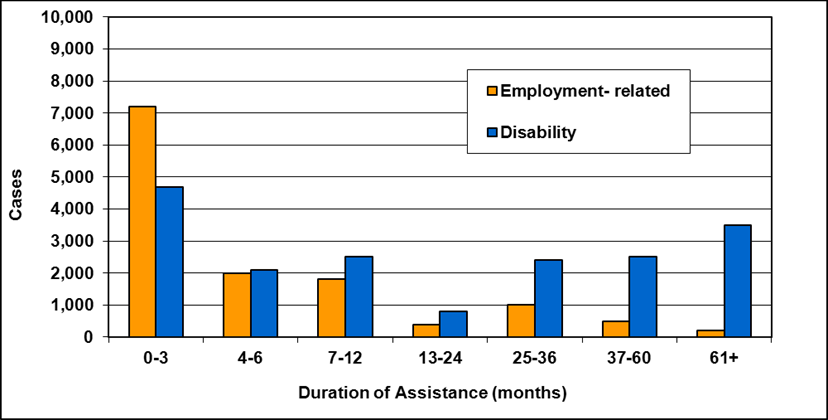

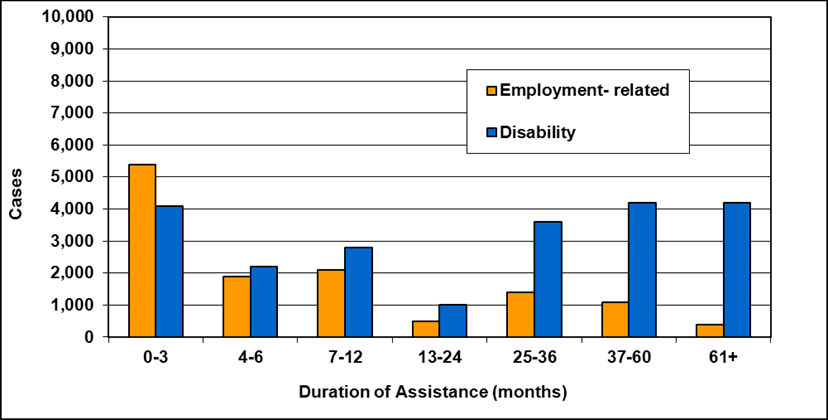

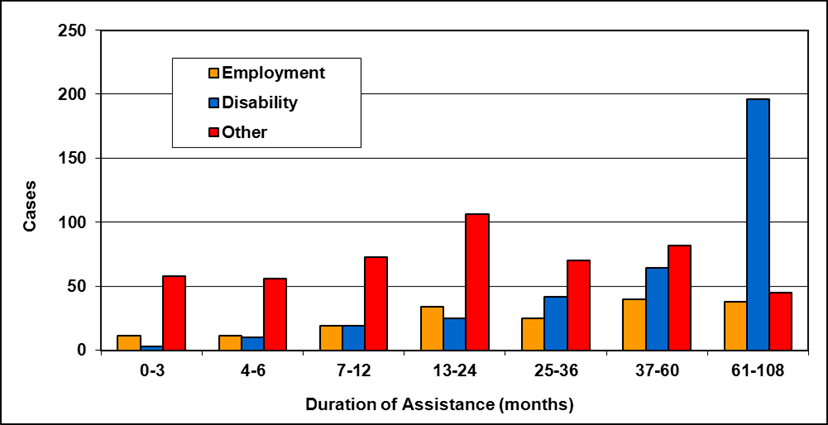

Cases by reason for assistance and duration of assistance

Text description of Table 4-6a

| Duration of assistance a (months) | Reason for assistance | |||

|---|---|---|---|---|

| Employment-related b | Disability c | Other d | Total | |

| 0-3 | 300 | 200 | - | 500 |

| 4-6 | 200 | 200 | - | 300 |

| 7-12 | 100 | 200 | - | 400 |

| 13-24 | 200 | 300 | - | 400 |

| 25-36 | 100 | 200 | - | 300 |

| 37-60 | 200 | 700 | 100 | 900 |

| 61-108 | 100 | 200 | - | 300 |

| 109+ | 100 | 400 | - | 500 |

| Total | 1,200 | 2,200 | 200 | 3,600 |

- Table note a. "Duration of assistance measures length of current spell only."

- Table note b. "Employment-related includes employed and unemployed."

- Table note c. "Disability includes long-term disability and short-term disability."

- Table note d. "Other includes high support needs, age related and unknown."

- Note: Totals may not add due to rounding.

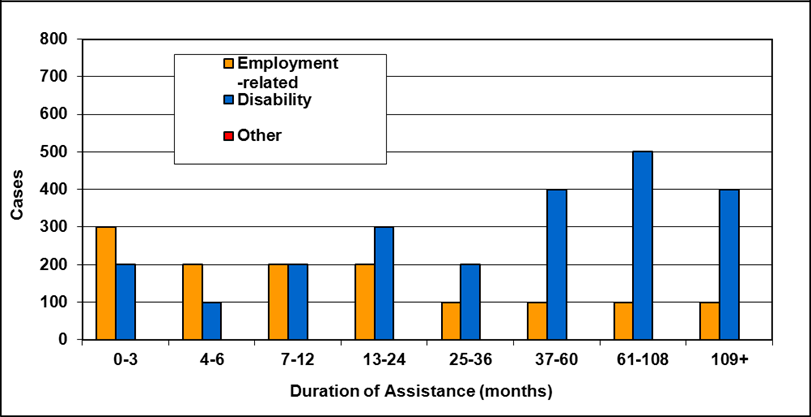

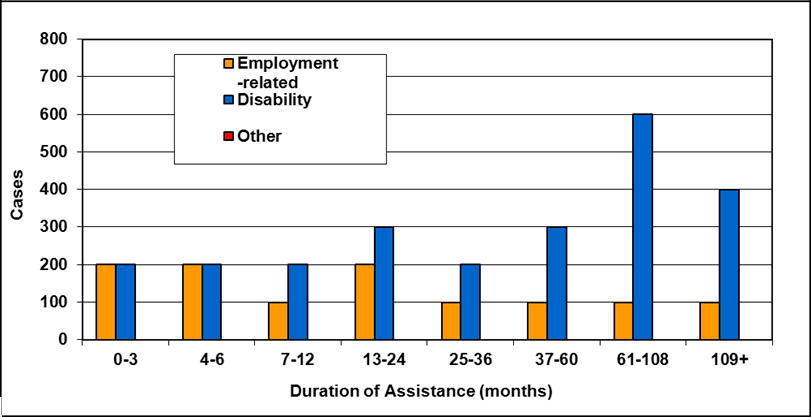

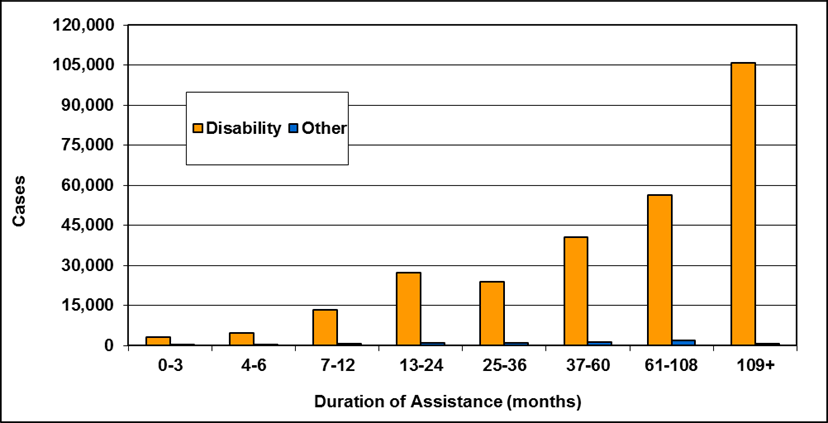

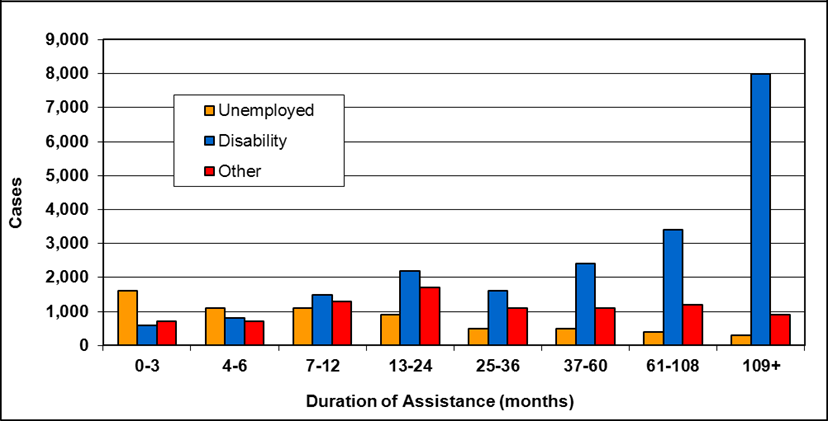

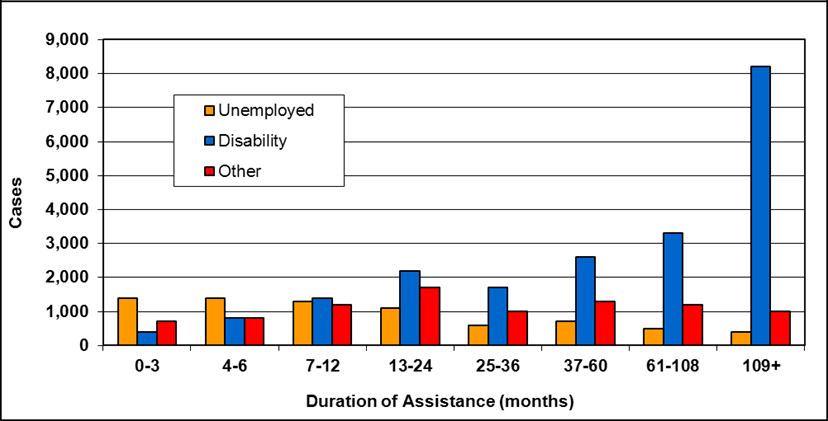

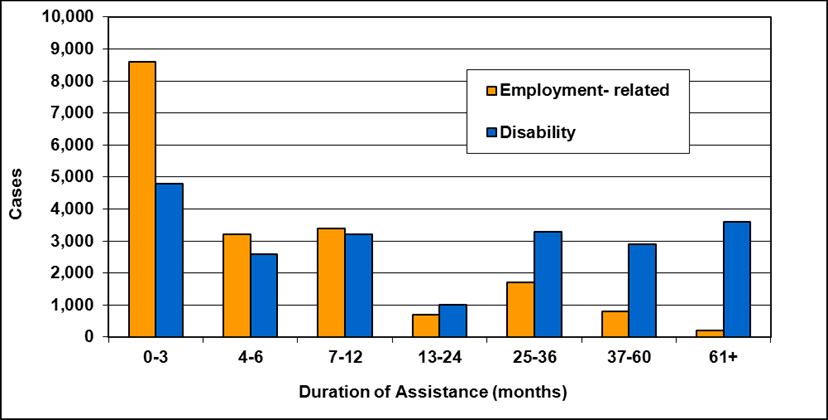

Text description of Table 4-6b

| Duration of assistance a (months) | Reason for assistance | |||

|---|---|---|---|---|

| Employment-related b | Disability c | Other d | Total | |

| 0-3 | 300 | 200 | - | 500 |

| 4-6 | 200 | 100 | - | 300 |

| 7-12 | 200 | 200 | - | 400 |

| 13-24 | 200 | 300 | - | 500 |

| 25-36 | 100 | 200 | - | 300 |

| 37-60 | 100 | 400 | - | 500 |

| 61-108 | 100 | 500 | - | 600 |

| 109+ | 100 | 400 | - | 500 |

| Total | 1,200 | 2,300 | 200 | 3,700 |

- Table note a. "Duration of assistance measures length of current spell only."

- Table note b. "Employment-related includes employed and unemployed."

- Table note c. "Disability includes long-term disability and short-term disability."

- Table note d. "Other includes high support needs, age related and unknown."

- Note: Totals may not add due to rounding.

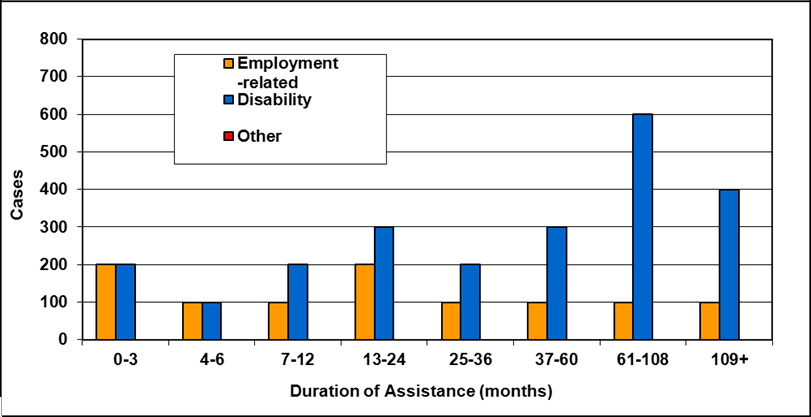

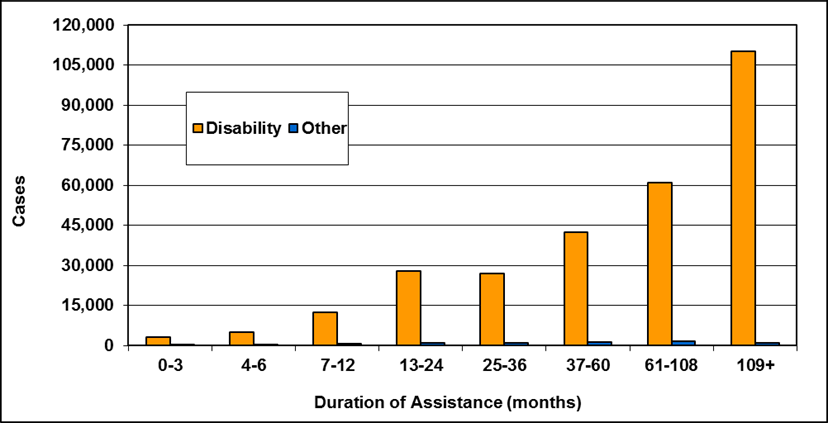

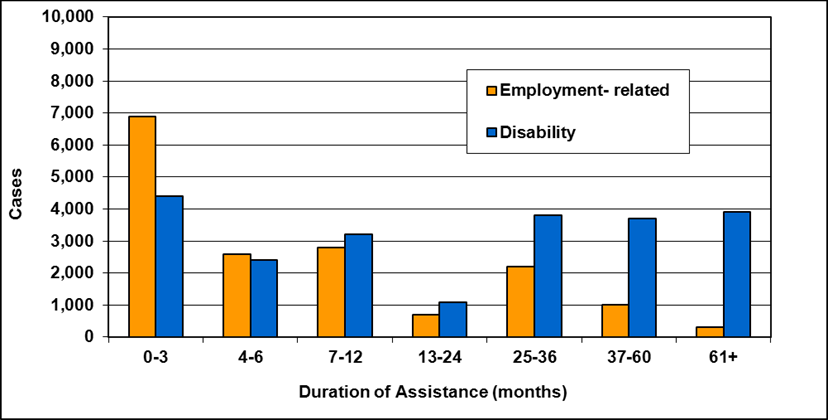

Text description of Table 4-6c

| Duration of assistance a (months) | Reason for assistance | |||

|---|---|---|---|---|

| Employment-related b | Disability c | Other d | Total | |

| 0-3 | 300 | 200 | - | 500 |

| 4-6 | 100 | 200 | - | 300 |

| 7-12 | 200 | 200 | - | 400 |

| 13-24 | 200 | 300 | - | 500 |

| 25-36 | 100 | 200 | - | 300 |

| 37-60 | 100 | 300 | - | 400 |

| 61-108 | 100 | 600 | - | 800 |

| 109+ | 100 | 400 | - | 500 |

| Total | 1,200 | 2,400 | 200 | 3,800 |

- Table note a. "Duration of assistance measures length of current spell only."

- Table note b. "Employment-related includes employed and unemployed."

- Table note c. "Disability includes long-term disability and short-term disability."

- Table note d. "Other includes high support needs, age related and unknown."

- Note: Totals may not add due to rounding.

Text description of Table 4-6d

| Duration of assistance a (months) | Reason for assistance | |||

|---|---|---|---|---|

| Employment-related b | Disability c | Other d | Total | |

| 0-3 | 200 | 200 | - | 500 |

| 4-6 | 200 | 200 | - | 400 |

| 7-12 | 100 | 200 | - | 400 |

| 13-24 | 200 | 300 | - | 500 |

| 25-36 | 100 | 200 | - | 300 |

| 37-60 | 100 | 300 | - | 500 |

| 61-108 | 100 | 600 | - | 800 |

| 109+ | 100 | 400 | - | 500 |

| Total | 1,200 | 2,400 | 200 | 3,800 |

- Table note a. "Duration of assistance measures length of current spell only."

- Table note b. "Employment-related includes employed and unemployed."

- Table note c. "Disability includes long-term disability and short-term disability."

- Table note d. "Other includes high support needs, age related and unknown."

- Note: Totals may not add due to rounding.

Text description of Table 4-6e

| Duration of assistance a (months) | Reason for assistance | |||

|---|---|---|---|---|

| Employment-related b | Disability c | Other d | Total | |

| 0-3 | 200 | 200 | - | 400 |

| 4-6 | 100 | 100 | - | 300 |

| 7-12 | 100 | 200 | - | 400 |

| 13-24 | 200 | 300 | - | 500 |

| 25-36 | 100 | 200 | - | 400 |

| 37-60 | 100 | 300 | - | 500 |

| 61-108 | 100 | 600 | - | 800 |

| 109+ | 100 | 400 | - | 500 |

| Total | 1,100 | 2,400 | 200 | 3,700 |

- Table note a. "Duration of assistance measures length of current spell only."

- Table note b. "Employment-related includes employed and unemployed."

- Table note c. "Disability includes long-term disability and short-term disability."

- Table note d. "Other includes high support needs, age related and unknown."

- Note: Totals may not add due to rounding.

Cases reporting income by source of income

| Source of income | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employment | 400 | 13% | 400 | 13% | 400 | 13% | 400 | 17% | 300 | 14% |

| Government transfers | 2,000 | 67% | 2,100 | 68% | 2,200 | 71% | 1,400 | 61% | 1,400 | 67% |

| Support payments | 200 | 7% | 200 | 6% | 100 | 3% | 100 | 4% | 100 | 5% |

| Employment Insurance | 100 | 3% | 100 | 3% | 100 | 3% | 100 | 4% | 100 | 5% |

| Other a | 200 | 7% | 200 | 6% | 300 | 10% | 300 | 13% | 300 | 14% |

| Total b (includes double-counting) |

3,000 | 100% | 3,100 | 100% | 3,100 | 100% | 2,300 | 100% | 2,100 | 100% |

- Table note a. "Other" includes training allowances and other income.

- Table note b. Total cases in these categories may include double-counting, since cases that have more than one source of income are counted for each source reported.

- Note: Totals may not add due to rounding.

| Year | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| Reporting income | 2,000 | 2,000 | 2,100 | 1,600 | 1,600 |

| No income | 1,600 | 1,700 | 1,800 | 2,200 | 2,100 |

| Total | 3,600 | 3,700 | 3,800 | 3,800 | 3,700 |

- Note: Totals may not add due to rounding.

Chapter 5 - Nova Scotia - Employment Support and Income Assistance

In Nova Scotia, the provincial social assistance program is known as Employment Support and Income Assistance (ESIA). The Employment Support and Income Assistance Act and the Employment Support and Income Assistance Regulations govern Nova Scotia's Employment Support and Income Assistance program.

The Employment Support and Income Assistance program provides financial assistance and supports to help people maximize their self-sufficiency by increasing their employability and their independence.

Children's basic benefits are provided through the Nova Scotia Child Benefit as part of the Canada Child Tax Benefit.

Service delivery

The Department of Community Services is responsible for the delivery of the Employment Support and Income Assistance program to individuals and families within the province.

Eligibility

General

In order to be eligible for the Employment Support and Income Assistance program, applicants must meet the general eligibility requirements outlined in the "Social Assistance Overview" in this report.

Liquid assets

At the time of application, applicants' liquid assets may not exceed the following allowable limits:

| Clients without disabilities | Clients with disabilities | |

|---|---|---|

| Single | $1,000 | $1,000 |

| Family | $2,000 | $2,000 |

- Note: Effective January 1, 2011, liquid asset exemption levels increased from $500 to $1,000 for single individuals with and without disabilities and from $1,000 to $2,000 for families with and without disabilities.

Earnings exemptions

When determining initial eligibility for Employment Support and Income Assistance, earned income is considered in determination of eligibility. To determine ongoing eligibility, clients are eligible for the following monthly exemptions on earned income:

| Clients without disabilities | Clients with disabilities a | |

|---|---|---|

| Single | $150 per individual plus 30% of remaining net wages. | $300 per individual (if applicable) plus 30% of remaining net wages. |

| Family | $150 per individual plus 30% of remaining net wages. | $300 per individual (if applicable) plus 30% of remaining net wages. |

- Table note a. These clients are in supported employment.

- Note: Effective July 1, 2011, recipients who have earned wages from employment will retain the first $150 of their earnings, plus 30% of the remaining net wages. ESIA recipients participating in supported employment will retain an additional $150 for a total of $300 per month as exempt in calculating net wages, plus retain 30% of the remaining net wages.

Benefits

Basic assistance consists of a personal allowance and a shelter allowance. The personal allowance covers the cost of food, clothing, and miscellaneous essentials for adults in the family. The shelter allowance includes the actual amount for rent/mortgage, fuel and utilities, up to the allowed maximum. Maximum shelter allowance rates are based on the number of persons in the household (including children) and the type of accommodation.

Nova Scotia provides transitional drug coverage for twelve months to clients who leave social assistance for employment.

Children's basic benefits are paid through the Nova Scotia Child Benefit, as part of the Canada Child Tax Benefit, which is exempt as chargeable income.

Nova Scotia Child Benefit

The Nova Scotia Child Benefit (NSCB) is a non-taxable amount paid monthly to help low-income families with the cost of raising children under the age of 18 years. The implementation of the Employment Support and Income Assistance Act and Employment Support and Income Assistance Regulations in August 2001 removed children's benefits from the social assistance system.

The Canada Revenue Agency delivers the NSCB as an integrated payment with the CCTB and the NCB Supplement. The NSCB rates are based on net income and number of children. For instance, maximum NSCB benefits are paid to those families whose income is less than $15,999, while families whose annual income falls between $16,000 and $20,921 per year (depending on the number of children) are eligible for partial NSCB benefits.

Effective July 2001, in addition to the National Child Benefit Supplement, families with one child may be entitled to receive a NSCB benefit. Currently, families may be entitled to receive benefits for one child up to $625 per year. Families may be entitled to receive $825 per year for their second child, and $900 per year for their third and each additional child.

The income threshold of the NSCB increased in July 2012 providing additional families to receive benefits. Prior to this, there has been a decline in the number of families receiving the Nova Scotia Child Benefit. The changing demographics and improved economy in the Province of Nova Scotia contribute to this decline.

There continues to be a decline in the number of families receiving the Nova Scotia Child Benefit. The changing demographics and improved economy in the Province of Nova Scotia contribute to this decline.

The Nova Scotia government funds the Low Income Pharmacare Program that provides prescription drug coverage for children of low-income families. The program is available for families who receive the Nova Scotia Child Benefit.

| Year | Families | Children |

|---|---|---|

| 2001-2002 | 33,224 | 55,986 |

| 2002-2003 | 31,905 | 53,961 |

| 2003-2004 | 30,743 | 52,054 |

| 2004-2005 | 29,247 | 49,690 |

| 2005-2006 | 28,215 | 48,033 |

| 2006-2007 | 26,762 | 45,511 |

| 2007-2008 | 24,836 | 42,468 |

| 2008-2009 | 23,006 | 39,572 |

| 2009-2010 | 22,940 | 39,388 |

| 2010-2011 | 23,830 | 40,684 |

| 2011-2012 | 22,433 | 38,042 |

| 2012-2013 | 22,713 | 38,423 |

More information

For more information, please consult the Nova Scotia Department of Community Services website.

Statistics

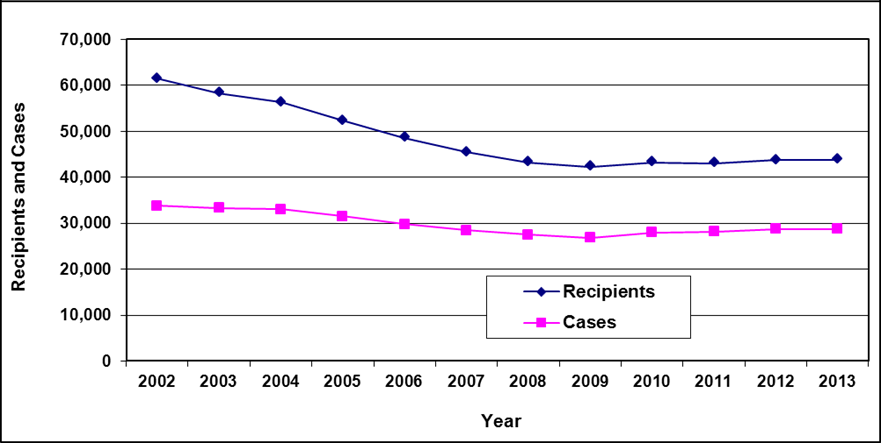

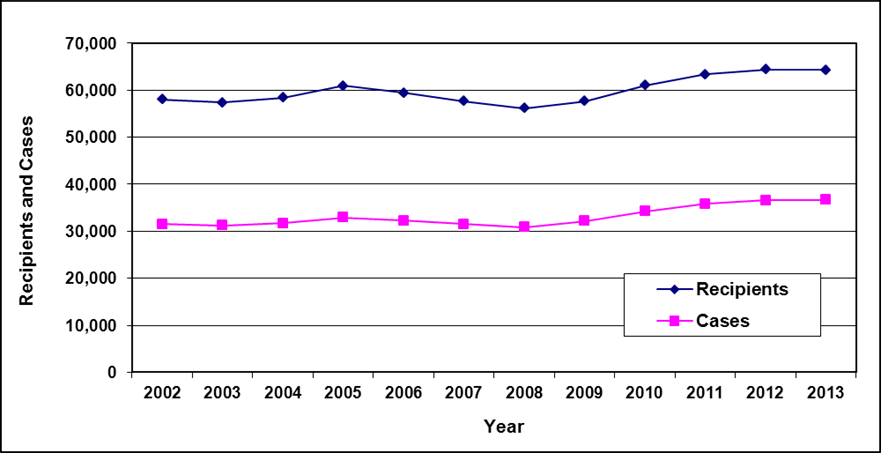

Recipients and cases

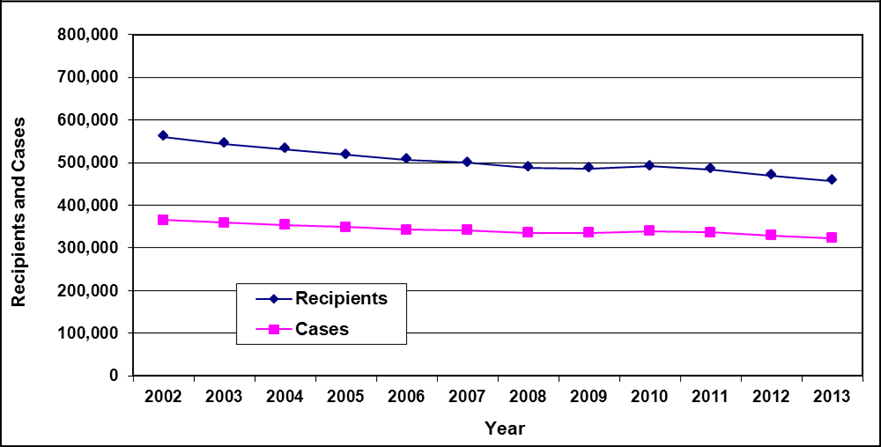

Text description of Table 5-1

| Year | 2002 | 2003 | 2004 | 2005 a | 2006 a | 2007 a, b | 2008 a | 2009 a | 2010 a | 2011 a | 2012 a | 2013 a |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Recipients | 61,500 | 58,300 | 56,300 | 52,300 | 48,600 | 45,400 | 43,200 | 42,300 | 43,200 | 43,100 | 43,700 | 43,800 |

| Cases | 33,800 | 33,300 | 33,000 | 31,500 | 29,800 | 28,500 | 27,500 | 26,800 | 28,000 | 28,200 | 28,700 | 28,700 |

- Table note a. "Starting in March 2005, recipients and cases do not include Transitional Pharmacare."

- Table note b. "Caseload data represents January 2007. Concurrent data for the month ending March 31, 2007 is not available."

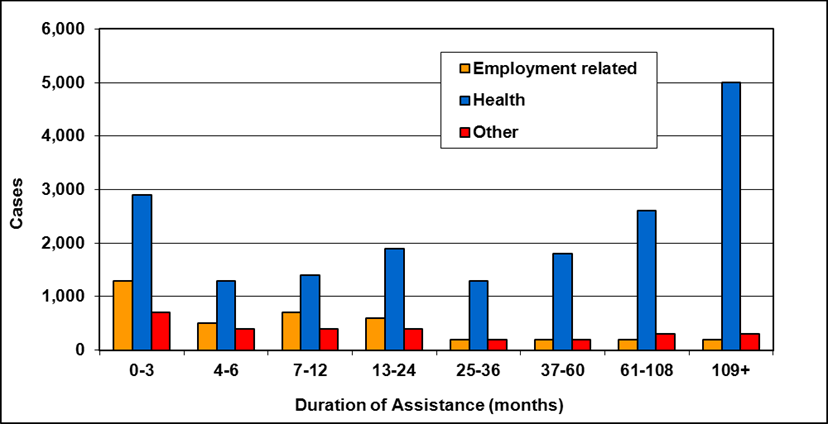

Cases by reason for assistance

| Reason for assistance | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employed | 500 | 2% | 600 | 2% | 500 | 2% | 600 | 2% | 600 | 2% |

| Unemployed | 5,000 | 19% | 5,800 | 21% | 6,000 | 21% | 6,500 | 23% | 6,500 | 23% |

| Short term disabled | 3,200 | 12% | 3,600 | 13% | 4,000 | 14% | 4,200 | 15% | 4,200 | 15% |

| Long term disabled | 12,400 | 46% | 12,400 | 44% | 12,400 | 44% | 12,300 | 43% | 12,200 | 43% |

| Sole support parent | 2,800 | 10% | 2,700 | 10% | 2,600 | 9% | 2,500 | 9% | 2,400 | 8% |

| Age-related b | 900 | 3% | 1,100 | 4% | 1,200 | 4% | 1,200 | 4% | 1,300 | 5% |

| Student | 300 | 1% | 400 | 1% | 400 | 1% | 300 | 1% | 300 | 1% |

| Other c | 1,700 | 6% | 1,500 | 5% | 1,300 | 5% | 1,200 | 4% | 1,200 | 4% |

| Total | 26,800 | 100% | 28,000 | 100% | 28,200 | 100% | 28,700 | 100% | 28,700 | 100% |

- Table note a. Cases do not include Transitional Pharmacare.

- Table note b. "Age-related" includes persons 55 years and over.

- Table note c. "Other" includes clients receiving a one-time payment and clients receiving extended pharmacare (prescription drug benefits).

- Note: Totals may not add due to rounding.

Recipients by family type

| Family type | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Adults - Single | 18,500 | 43% | 19,300 | 44% | 19,800 | 45% | 20,200 | 45% | 20,300 | 45% |

| Adults - Couple, no dependants | 1,700 | 4% | 1,700 | 4% | 1,700 | 4% | 1,600 | 4% | 1,500 | 3% |

| - Spouse | 1,700 | 4% | 1,700 | 4% | 1,700 | 4% | 1,600 | 4% | 1,500 | 3% |

| Adults - Single parent | 6,000 | 14% | 6,100 | 14% | 6,000 | 14% | 6,000 | 13% | 6,000 | 13% |

| Adults - Couple with dependants | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% |

| - Spouse | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% | 1,300 | 3% |

| Total adults | 30,400 | 71% | 31,400 | 71% | 31,700 | 72% | 32,000 | 72% | 32,000 | 72% |

| Children - Single parent | 9,900 | 23% | 10,200 | 23% | 9,800 | 22% | 9,900 | 22% | 9,900 | 22% |

| Children - Couple with dependants | 2,500 | 6% | 2,500 | 6% | 2,600 | 6% | 2,600 | 6% | 2,700 | 6% |

| Total children | 12,500 | 29% | 12,700 | 29% | 12,400 | 28% | 12,500 | 28% | 12,600 | 28% |

| Total recipients | 42,800 | 100% | 44,100 | 100% | 44,100 | 100% | 44,500 | 100% | 44,700 | 100% |

- Table note a. The above table includes recipients receiving Transitional Pharmacare, which are not to be considered part of the total social assistance recipients that appears in Table 5-1.

- Note: Totals may not add due to rounding.

Cases by age of head

| Age of head | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| <20 | 400 | 600 | 600 | 600 | 500 |

| 20-24 | 2,600 | 3,000 | 3,100 | 3,400 | 3,300 |

| 25-29 | 2,700 | 2,900 | 2,900 | 3,000 | 2,900 |

| 30-34 | 2,400 | 2,600 | 2,700 | 2,700 | 2,700 |

| 35-39 | 2,600 | 2,700 | 2,600 | 2,700 | 2,600 |

| 40-44 | 3,000 | 2,900 | 2,900 | 2,800 | 2,900 |

| 45-49 | 3,600 | 3,700 | 3,600 | 3,600 | 3,400 |

| 50-54 | 3,500 | 3,500 | 3,600 | 3,700 | 3,900 |

| 55-59 | 3,100 | 3,200 | 3,200 | 3,400 | 3,500 |

| 60-64 | 2,700 | 2,700 | 2,800 | 2,700 | 2,700 |

| 65+ | 100 | 100 | 100 | 200 | 100 |

| Total | 26,800 | 28,000 | 28,200 | 28,700 | 28,700 |

- Table note a. Cases do not include Transitional Pharmacare.

- Note: Totals may not add due to rounding.

Cases reporting income by source of income

| Source of income | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employment | 2,700 | 13% | 2,700 | 12% | 2,600 | 12% | 2,900 | 13% | 3,100 | 14% |

| Government transfers | 13,900 | 66% | 14,700 | 67% | 15,000 | 69% | 15,400 | 68% | 15,600 | 68% |

| Support payments | 2,800 | 13% | 2,700 | 12% | 2,600 | 12% | 2,600 | 12% | 2,600 | 11% |

| Employment Insurance | 200 | 1% | 300 | 1% | 200 | 1% | 200 | 1% | 200 | 1% |

| Other b | 1,500 | 7% | 1,400 | 6% | 1,400 | 6% | 1,400 | 6% | 1,400 | 6% |

| Total c (includes double-counting) |

21,100 | 100% | 21,800 | 100% | 21,800 | 100% | 22,500 | 100% | 22,800 | 100% |

- Table note a. Cases include Transitional Pharmacare, but for the "Employment" category only.

- Table note b. "Other" includes clients receiving workers' compensation, training income, income tax refund, or income from rental or from room and board and roomers.

- Table note c. Total cases in these categories may include double-counting, since cases that have more than one source of income are counted for each source reported.

- Note: Totals may not add due to rounding.

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Reporting income | 13,600 | 14,400 | 14,600 | 14,900 | 15,000 |

| Not reporting income | 13,300 | 13,600 | 13,600 | 13,800 | 13,700 |

| Total | 26,800 | 28,000 | 28,200 | 28,700 | 28,700 |

- Table note a. Cases do not include Transitional Pharmacare. Cases do not include double counting. Cases do not differentiate between chargeable and non-chargeable income.

- Note: Totals may not add due to rounding.

Chapter 6 - New Brunswick - Social Assistance

In New Brunswick, the provincial social assistance program is known as Social Assistance (SA). The Family Income Security Act and the Family Income Security Regulations govern New Brunswick's Social Assistance program.

Social Assistance provides basic benefits to both adults and children.

Service delivery

The Department of Social Development is responsible for the delivery of the Social Assistance program to adults and children within the province.

Eligibility

General

In order to be eligible for the Social Assistance program, applicants must meet the general eligibility requirements outlined in the "Social Assistance Overview" in this report.

Liquid assets

At the time of application, applicants' liquid assets may not exceed the following allowable limits:

| Clients without disabilities | Clients with disabilities | |

|---|---|---|

| Single | $1,000 | $3,000 |

| Single-parent family | $2,000 | $3,000 for each person with a certified disability plus $1,000 for each non-disabled person up to a maximum of $4,000 per household. |

| Childless couple | $2,000 | $3,000 for each person with a certified disability plus $1,000 for each non-disabled person up to a maximum of $4,000 per household. |

| Two-parent family | $2,000 | $3,000 for each person with a certified disability plus $1,000 for each non-disabled person up to a maximum of $4,000 per household. |

Earnings exemptions

Different levels of earning exemptions are in effect for each of the two programs in place: Transitional Assistance Program and Extended Benefits Program. For more information on these social assistance programs, please refer to the paragraphs below. Once an application for assistance has been approved, program clients are eligible for the following monthly exemptions on earned income:

| Transitional Assistance Program |

Extended Benefits Program |

|

|---|---|---|

| Single | $150 | $250 |

| Family | $200 | $300 |

There is also the Extended Wage Exemption (EWE) available. The EWE is a benefit structure separate from the usual earnings exemption (provided above). The amount of the EWE is changed according to three different time frames within the two-year duration of the benefit. The first two time frames are six months in duration each, and allow clients the option of having a percentage of their salary exempted; which results in a higher exemption than the usual earnings exemption. In months 13 through 24, the earnings exemption amount will revert back to the appropriate maximum flat rate amount; that is, the usual earnings exemption.

Benefits

Basic assistance, also known as the basic unit rate, covers the cost of food, clothing, shelter, routine transportation, fuel and utilities, as well as personal and household items. Maximum basic assistance rates are based on the three rate programs involved (see below) and the number of persons in the household.

The Social Assistance program has two rate programs: Transitional Assistance Program (TAP) and Extended Benefits Program (EBP). On January 1, 2010, the Interim Assistance Program (INT) was eliminated. All clients receiving social assistance under this program will convert to the Transitional Assistance Program.

The Transitional Assistance Program provides financial assistance to individuals and families who have a variety of intermittent foreseeable needs. This is a category of financial assistance for individuals and families who have the potential to achieve self-sufficiency once barriers to their employment are addressed.

The Extended Benefits Program provides financial assistance to individuals and families who are certified by the Medical Advisory Board as blind, deaf, or disabled. This is a category of financial assistance for those clients who, because of their disability, have long-term predictable needs.

Effective September 2005, New Brunswick provides extended drug coverage for twelve months to clients who leave social assistance for employment.

More information

For more information, please consult the New Brunswick Department of Social Development website.

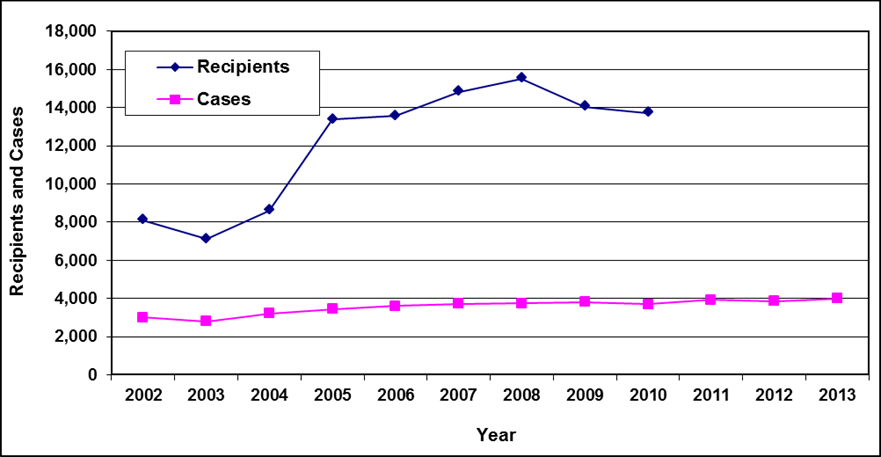

Statistics: A - Transitional Assistance Program

Recipients and cases

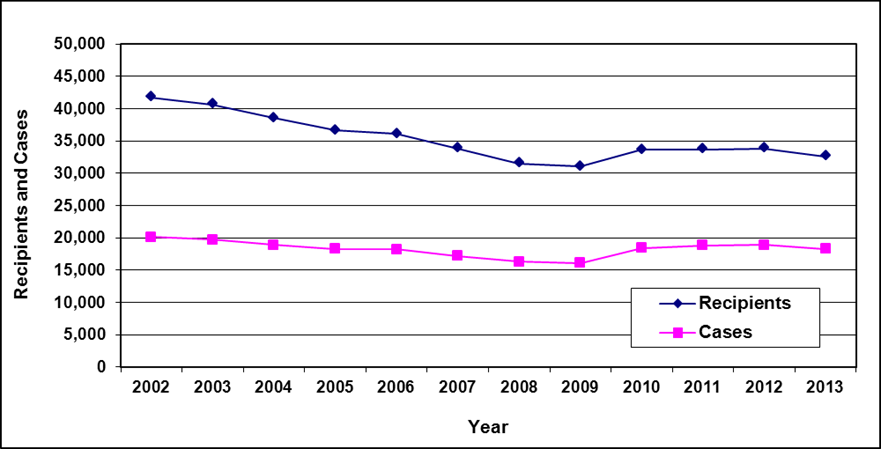

Text description of Table 6a-1

| Year | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Recipients | 41,700 | 40,600 | 38,500 | 36,600 | 36,100 | 33,800 | 31,500 | 31,000 | 33,600 | 33,700 | 33,800 | 32,600 |

| Cases | 20,100 | 19,700 | 18,900 | 18,300 | 18,200 | 17,200 | 16,300 | 16,100 | 18,400 | 18,800 | 18,900 | 18,300 |

- Table note a. "Data are as of March 31, unless otherwise specified. In those cases, data are as of the end of month."

Recipients by family type

| Family type | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Adults - Single | 7,700 | 25% | 9,700 | 29% | 10,300 | 31% | 10,500 | 31% | 10,300 | 32% |

| Adults - Couple, no dependants | 2,800 | 9% | 2,900 | 9% | 2,700 | 8% | 2,600 | 8% | 2,600 | 8% |

| Adults - Single parent | 5,700 | 18% | 5,900 | 18% | 5,900 | 18% | 5,900 | 17% | 5,500 | 17% |

| Adults - Couple with dependants | 3,000 | 10% | 3,000 | 9% | 2,900 | 9% | 2,800 | 8% | 2,700 | 8% |

| Total adults | 19,200 | 62% | 21,500 | 64% | 21,700 | 64% | 21,800 | 64% | 21,100 | 65% |

| Children - Single parent | 8,800 | 28% | 9,200 | 27% | 9,200 | 27% | 9,200 | 27% | 8,800 | 27% |

| Children - Couple with dependants | 3,000 | 10% | 2,900 | 9% | 2,800 | 8% | 2,800 | 8% | 2,700 | 8% |

| Total children | 11,900 | 38% | 12,100 | 36% | 12,000 | 36% | 12,000 | 36% | 11,500 | 35% |

| Total recipients | 31,000 | 100% | 33,600 | 100% | 33,700 | 100% | 33,800 | 100% | 32,600 | 100% |

- Note: Totals may not add due to rounding.

Cases by age of head

| Age of head | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| <20 | 500 | 600 | 500 | 500 | 400 |

| 20-24 | 1,400 | 1,900 | 2,000 | 2,000 | 2,000 |

| 25-29 | 1,700 | 2,000 | 2,100 | 2,100 | 2,000 |

| 30-34 | 1,700 | 2,000 | 2,000 | 2,100 | 2,000 |

| 35-39 | 1,700 | 1,900 | 2,000 | 2,000 | 1,900 |

| 40-44 | 1,700 | 1,900 | 1,900 | 1,900 | 1,900 |

| 45-49 | 1,900 | 2,300 | 2,200 | 2,200 | 2,100 |

| 50-54 | 1,900 | 2,200 | 2,300 | 2,300 | 2,300 |

| 55-59 | 2,100 | 2,100 | 2,100 | 2,200 | 2,200 |

| 60-64 | 1,400 | 1,500 | 1,600 | 1,700 | 1,700 |

| 65+ | - | - | - | 100 | - |

| Total | 16,100 | 18,400 | 18,800 | 18,900 | 18,300 |

- Note: Totals may not add due to rounding.

Cases reporting income by source of income

| Source of income | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employment | 1,800 | 6% | 2,000 | 7% | 1,800 | 7% | 1,800 | 6% | 1,800 | 6% |

| Government transfers | 22,500 | 74% | 26,300 | 90% | 24,900 | 91% | 28,100 | 92% | 27,300 | 92% |

| Support payments | 5,600 | 18% | - | 0% | - | 0% | - | 0% | - | 0% |

| Employment Insurance | 200 | 1% | 200 | 1% | 100 | 0% | 100 | 0% | 100 | 0% |

| Other a | 600 | 2% | 700 | 2% | 700 | 3% | 700 | 2% | 700 | 2% |

| Total b (includes double-counting) |

30,600 | 100% | 29,100 | 100% | 27,400 | 100% | 30,700 | 100% | 29,800 | 100% |

- Table note a. "Other" includes training allowances and other income.

- Table note b. Total cases in these categories may include double-counting, since cases that have more than one source of income are counted for each source reported.

- Note: Totals may not add due to rounding.

Statistics: B - Extended Benefits Program

Recipients and cases

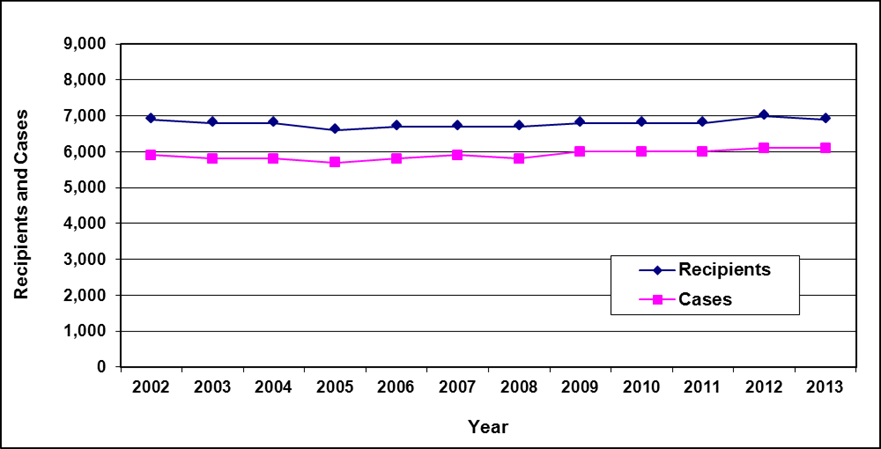

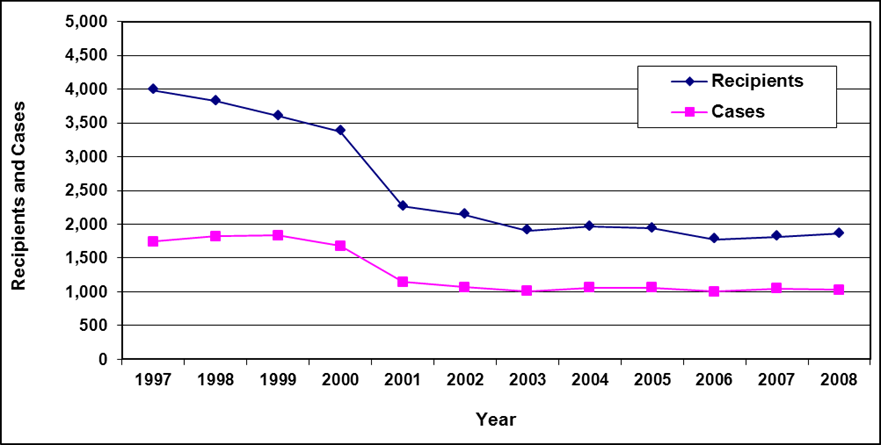

Text description of Table 6b-1

| Year | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Recipients | 6,900 | 6,800 | 6,800 | 6,600 | 6,700 | 6,700 | 6,700 | 6,800 | 6,800 | 6,800 | 7,000 | 6,900 |

| Cases | 5,900 | 5,800 | 5,800 | 5,700 | 5,800 | 5,900 | 5,800 | 6,000 | 6,000 | 6,000 | 6,100 | 6,100 |

- Table note a. "Data are as of March 31, unless otherwise specified. In those cases, data are as of the end of month."

Recipients by family type

| Family type | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Adults - Single | 5,300 | 78% | 5,300 | 78% | 5,400 | 79% | 5,500 | 79% | 5,500 | 80% |

| Adults - Couple, no dependants | 800 | 12% | 800 | 12% | 700 | 10% | 700 | 10% | 700 | 10% |

| Adults - Single parent | 200 | 3% | 100 | 1% | 200 | 3% | 200 | 3% | 200 | 3% |

| Adults - Couple with dependants | 200 | 3% | 200 | 3% | 200 | 3% | 200 | 3% | 200 | 3% |

| Total adults | 6,500 | 96% | 6,500 | 96% | 6,500 | 96% | 6,600 | 94% | 6,600 | 96% |

| Children - Single parent | 100 | 1% | 100 | 1% | 200 | 3% | 200 | 3% | 200 | 3% |

| Children - Couple with dependants | 200 | 3% | 200 | 3% | 200 | 3% | 200 | 3% | 200 | 3% |

| Total children | 300 | 4% | 300 | 4% | 300 | 4% | 400 | 6% | 400 | 6% |

| Total recipients | 6,800 | 100% | 6,800 | 100% | 6,800 | 100% | 7,000 | 100% | 6,900 | 100% |

- Note: Totals may not add due to rounding.

Cases by age of head

| Age of head | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| <20 | 100 | 100 | 100 | 100 | 100 |

| 20-24 | 400 | 400 | 400 | 500 | 500 |

| 25-29 | 500 | 500 | 500 | 500 | 500 |

| 30-34 | 500 | 500 | 500 | 500 | 500 |

| 35-39 | 600 | 600 | 600 | 600 | 600 |

| 40-44 | 700 | 600 | 600 | 600 | 600 |

| 45-49 | 800 | 900 | 900 | 800 | 800 |

| 50-54 | 900 | 900 | 900 | 900 | 900 |

| 55-59 | 700 | 700 | 700 | 800 | 800 |

| 60-64 | 800 | 800 | 700 | 700 | 700 |

| 65+ | - | - | - | - | - |

| Total | 6,000 | 6,000 | 6,000 | 6,100 | 6,100 |

- Note: Totals may not add due to rounding.

Cases reporting income by source of income

| Source of income | 2009 | 2010 | 2011 | 2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| # | % | # | % | # | % | # | % | # | % | |

| Employment | 400 | 4% | 500 | 5% | 300 | 3% | 300 | 3% | 300 | 3% |

| Government transfers | 6,400 | 67% | 6,600 | 67% | 6,400 | 67% | 6,800 | 67% | 6,800 | 67% |

| Other a | 2,800 | 29% | 2,700 | 27% | 2,900 | 30% | 3,000 | 30% | 3,000 | 30% |

| Total b(includes double-counting) | 9,500 | 100% | 9,900 | 100% | 9,600 | 100% | 10,100 | 100% | 10,100 | 100% |

- Table note a. "Other" includes training allowances and other income.

- Table note b. Total cases in these categories may include double-counting, since cases that have more than one source of income are counted for each source reported.

- Note: Totals may not add due to rounding.

Chapter 7 - Quebec - Last-resort financial assistance

In Quebec, the provincial social assistance programs are known as Last-Resort Financial Assistance which includes the Social Assistance Program and the Social Solidarity Program. The Individual and Family Assistance ActFootnote 13 and the Individual and Family Assistance Regulation govern Quebec's Last-Resort Financial Assistance programs.

The Last-Resort Financial Assistance provides basic benefits to adults only. Between September 1997 and January 2005, children's basic benefits were provided through the Quebec Family Allowance. Since January 2005, children's basic benefits have been provided through the Child Assistance Measure.

Service delivery

The Department of Employment and Social Solidarity is responsible for the Last-Resort Financial Assistance program to adults within the province.

Eligibility

General

In order to be eligible for the Last-Resort Financial Assistance programs, applicants must meet the general eligibility requirements outlined in the "Social Assistance Overview" in this report.

Liquid assets

At the time of application, applicants' liquid assets may not exceed the following allowable limits:

| Number of adults | Number of children | Liquid assets |

|---|---|---|

| 1 | 0 | $887 |

| 1 | $1,268 | |

| 2 | $1,502 | |

| 2 | 0 | $1,319 |

| 1 | $1,573 | |

| 2 | $1,807 |

- Table note a. Individual and Family Assistance Regulation, Article 52.

- Note: Exemptions increased in 2009 and again 2010 to the 2013 levels above.

- 2009 Increases - For one adult ($862 to $883), for one adult and one child ($1,232 to $1,262), for one adult and 2 children ($1,460 to $1,495) for two adults ($1,282 to $1,313), for two adults and one child ($1,529 to $1,566), and for two adults and two children ($1,757 to $1,799).

| Number of adults | Number of children | Liquid assets |

|---|---|---|

| 1 | 0 | $2,500 |

| 1 | $2,906 | |

| 2 | $3,155 | |

| 2 | 0 | $5,000 |

| 1 | $5,271 | |

| 2 | $5,520 |

- Table note a. Individual and Family Assistance Regulation, Article 155.

- Note: There have been yearly increases to exemption levels for both one and two parent families with children since 2009:

- For one adult and one child (2009: $2,879, 2010: $2,881, 2011: $2,886, 2012: $2,896).

- For one adult and two children (2009: $3,112, 2010: $3,115, 2011: $3,123, 2012: $3,140).

- For two adults and one child (2009: $5,253, 2010: $5,254, 2011: $5,257, 2012: $5,264).

- For two adults and two children (2009: $5,486, 2010: $5,488, 2011: $5,494, 2012: $5,507).

Once an application for assistance has been approved, clients' liquid assets may not exceed the following allowable limits:

| Social Assistance Program a | Social Solidarity Program b | |

|---|---|---|

| Independent adult, family of an ineligible student's spouse, or an adult who is a minor sheltered with her dependent child. |

$1,500 | $2,500 |

| Other families | $2,500 | $5,000 |

| Additional amounts for minor dependent children: | ||

| 1 adult and 1 child | $406 | $406 |

| 1 adult and 2 children | $655 | $655 |

| 2 adults and 1 child | $271 | $271 |

| 2 adults and 2 children | $520 | $520 |

- Table note a. Individual and Family Assistance Regulation, Articles 131, 132.

- Table note b. Individual and Family Assistance Regulation, Articles 163

- Note: There have been yearly increases to the additional amounts for minor dependant children since 2009 for both the Social Assistance Program and the Social Solidarity Program.

- For one adult and one child (2009: $379, 2010: $381, 2011: $386, 2012: $396)

- For one adult and two children (2009: $612, 2010: $615, 2011: $623, 2012: $640)

- For two adults and one child (2009: $253, 2010: $254, 2011: $257, 2012: $264)

- For two adults and two children (2009: $486, 2010: $488, 2011: $494, 2012: $507)

Earnings exemptions

Once an application for assistance has been approved, the beneficiaries of the Last-Resort Financial Assistance are eligible for the following monthly exemptions on earned income:

| Clients with no limitations to employment a |

Clients with temporary limitations to employment a |

Clients with severe limitations to employment b |

|

|---|---|---|---|

| Single | $200 | $200 | $100 |

| Single-parent family | $200 | $200 | $100 |

| Two-parent family | $300 | $300 | $100 |

- Table note a. Exemption under the Social Assistance Program.

- Table note b. Exemption under the Social Solidarity Program.

Benefits

Financial assistance consists of a basic benefit, paid monthly, which may be supplemented by an allowance for individuals who are facing temporary or severe employment limitations. The basic benefit covers the cost of food and clothing, shelter, as well as personal and household items for adults only. Maximum basic benefit rates are based on family composition.