Notice #869– Interim direction on the BCTESG transfer policy and the RESP Transfer form

On this page

- Previous Information bulletin

- Purpose

- Background

- Documenting BCTESG information

- Coming into force

- Contact us

Information bulletin

Number: CESP/PCEE-2020/21-001-869

Date: May 28, 2020

Subject: Interim direction BCTESG transfer policy and RESP Transfer form

Previous Bulletin

This notice follows Information Bulletin #845, dated December 5, 2019, which informed promoters of the BCTESG Transfer Policy.

Purpose

The purpose of this Information Bulletin is to provide interim direction to promoters of the documentation required in situations where the BCTESG is not being transferred in the same proportion as other assets in the RESP, once the BCTESG transfer policy comes into effect.

Background

As announced in Information Bulletin #845, the BCTESG Transfer Policy comes into effect on June 15, 2020, and the RESP Transfer Form will be updated to reflect the changes.

ESDC regrets to advise you that the publishing of the updated transfer form has been delayed. As a result of the delay, the implementation of the updated transfer form and the effective date of the BCTESG transfer policy no longer correspond. In order to accommodate the BCTESG Transfer Policy in the absence of an updated transfer form, ESDC wishes to provide the industry with direction for situations where the BCTESG is not being transferred in the same proportion as other assets in the RESP that must be proportionally transferred.

No timelines are currently available for publishing of the updated transfer form due to the Government of Canada’s focus on its response to the COVID-19 pandemic. This will be re-evaluated as the situation evolves.

Documenting BCTESG information

Commencing on June 15, 2020, when a subscriber requests a partial transfer involving the non-proportional transfer of the BCTESG, promoters will be required to document additional information, which mirrors the information that is currently collected for accumulated income, incentives administered by ESDC, and the Canada Learning Bond.

The additional information that must be captured includes:

- the amount or percentage of the BCTESG to be transferred

- whether the BCTESG is being transferred in cash or in kind

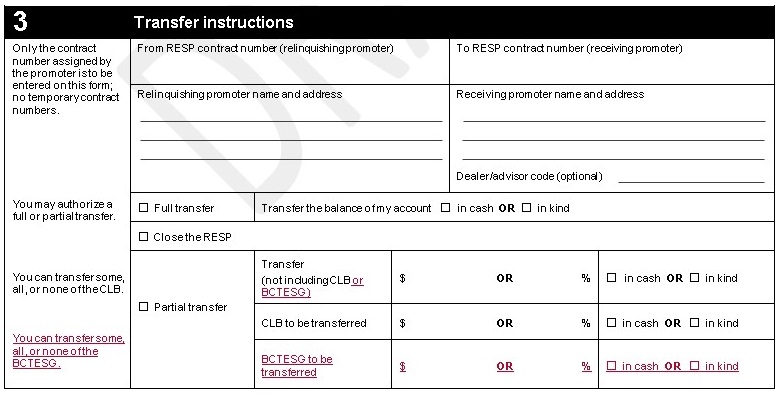

The same information will be captured on the updated transfer form, as shown below:

Image Description:

Section 3 (Transfer instructions) of the RESP Transfer form, Part A, form displays BCTESG information and options being added to the BCTESG Partial Transfers in draft form.

Section 3 of the forms displays the following information:

- only the contract number assigned by the promoter is to be entered on this form; no temporary contract numbers

- you may authorize a full or partial transfer

- you can transfer some, all, or none of the CLB

- you can transfer some, all, or none of the BCTESG

Section 3 of the forms displays the following input fields:

- from RESP contract number (relinquishing promoter)

- relinquishing promoter name and address

- to RESP contract number (receiving promoter)

- receiving promoter name and address

- dealer/advisor code (optional)

- full transfer

- transfer the blance of my account (in cash or in kind)

- close the RESP

- partial transfer:

- transfer (not including CLB or BCTESG):

- $ amount or % percentage

- in cash or in kind

- CLB to be transferred:

- $ amount or % percentage

- in cash or in kind

- BCTESG to be transferred:

- $ amount or % percentage

- in cash or in kind

- transfer (not including CLB or BCTESG):

This information must be attached or included in the RESP Transfer Form Part A: Subscriber request.

This may be accomplished by either:

- including a second copy of the first page of Part A of the Transfer Form and amending Section 3’s CLB fields to reflect the BCTESG information

or

- documenting the BCTESG information using an alternate method, as determined by the promoter

Coming into force

This information bulletin will come into force as of June 15, 2020, and will remain in force until repealed.

Contact us

Should you have any questions regarding this notice, please contact us by e-mail or by telephone at 1- 888-276-3624. Our hours of operation are from 8 am to 5 pm Eastern Time.