Southern mountain caribou (Rangifer tarandus caribou) protection study 2017: chapter 5

5. Preliminary review of risks

5.1 Preliminary review of risk factors that could impact the likelihood that critical habitat destruction will occur

In areas where there are no legislative instruments in place to constrain any activity in the context of caribou habitat, or where instruments prohibit or constrain some but not all activities, or where discretion is exercised to allow certain activities, there is potential for activities to occur that could result in destruction of critical habitat. However, the risk of habitat destruction is a function of the likelihood of an activity occurring, and the consequence to critical habitat if it does occur. Therefore, areas where legislative instruments are not in place for any or all activities correlate only partly with the risk of critical habitat destruction. In addition, decision-makers have discretion to prohibit or mitigate activities through permits and authorizations. These factors, as well as market drivers, make it difficult to forecast time-specific and place-specific risks to critical habitat.

However, within the Central Group, it is possible to spatially demonstrate where the different activity types could be permitted by examining the areas to which the various legislative instruments do not apply. The geography and geology of the Central Group LPUs broadly identify the capability of the land base to support industrial and recreational activities, and therefore indicate where there may be demand for future activities. However, if proposed, there is no obligation to grant authorization for activities that may destroy critical habitat.

In addition, in 2013, the Natural Resource Board provided direction to Statutory Decision Makers to consider caribou habitat when making decisions related to development in high elevation ranges Planning and Approval of Development Activities in the South Peace Northern Caribou Area [PDF, 297 KB].

As indicated in section 2.3, Standardized Industry Management Practices [Word doc 10.2 MB] have been developed and are in the process of being formally endorsed. Guidelines provide sound technical but not legally binding advice to resource professionals to mitigate possible impacts to caribou.

5.1.1 Mining

Introduction

Much of the geology of the Central Group is captured within the Western Canadian Sedimentary Basin and is comprised of sedimentary rocks and formations at high elevations which support bands of high quality metallurgical (steel making) coal which has been exposed in the “Quintette Coal Block” in the ridgelines around Tumbler Ridge.

The Quintette region is underlain by a thick pile of marine and terrestrial sediments that formed at and near the western margin of North America. The foothills and plains parts of the region are underlain by clastic sediments with a thick mantle of glacial materials. Relief is low to rolling with little outcrop exposed.

Coal potential

The coal mines in the Quintette parcel have driven both the production and also exploration throughout the region. There are eight former producing mines in the region. Some have been closed and reclaimed but others are periodically put into care and maintenance until economic conditions improve and they can be reopened. Coal exploration and development can be expected to continue for years to come because of the value and availability of metallurgical coal.

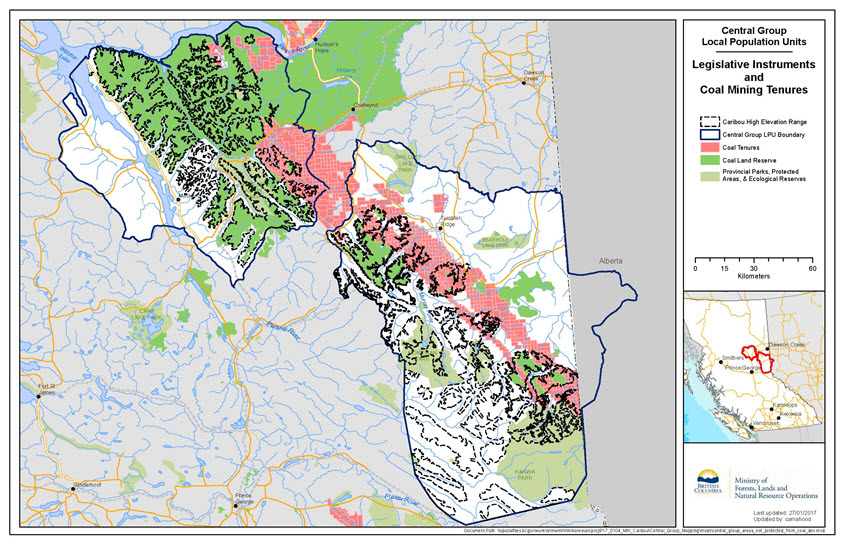

There are extensive coal tenures and leases across the region, blanketing virtually all of the area that can or may host economically viable coal deposits (see red polygons on Map 15). These are areas within which the risk of destruction of caribou habitat from coal mining is the highest. It should be noted that tenured areas represent a large area within which more site-specific activities may be authorized; the entire area of a given tenure is not necessarily at risk of habitat destruction, and neither does the existence of a tenure necessarily lead to any development that would impact caribou habitat.

The majority of mining to date has been from surface mines, but some work now in development includes underground operations. Based on current and anticipated technologies, plus geological potential, this could extend in excess of another century. Coal economics will be the greatest control of the degree and pace of development. The MEM considers the development of coal projects outside these red polygons area unlikely over the next 20 years, but it should be noted that market forces can determine that areas which have not been historically or currently economic for industrial development could become economic and therefore subject to new authorizations should coal prices significantly increase outside of historic ranges.

Long description for map 15

This map shows both legislative instruments that constrain coal mining development, and areas currently tenured for coal mining development within the boundaries of the Central Group LPUs. Coal tenures are shown in red; coal land reserves (coal no registration reserves) are shown in bright green, and provincial parks, protected areas, and ecological reserves are shown in greyish-green. Coal tenures are in a northwest to southeast band roughly through the middle of the Quintette and Narraway LPU boundaries, and extending north into the Pine River LPU. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

Metal and minerals potential

The low mineral potential of the rocks in this area is reflected in virtually nonexistent exploration activity. Geologically, the potential for mineral varieties is limited in number. Limestone, for both agricultural and cement use, would be the most likely target. To date, the phosphate potential has not been determined, but its presence could be of economic interest, even if only at a local scale.

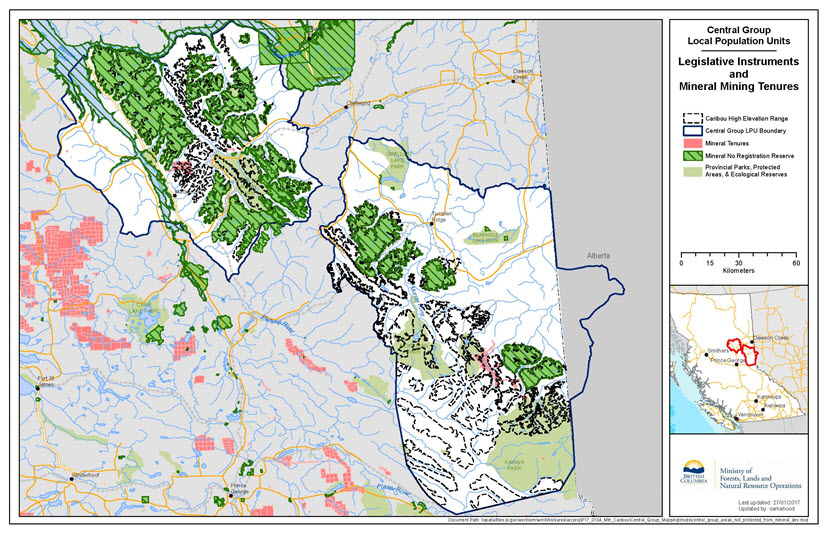

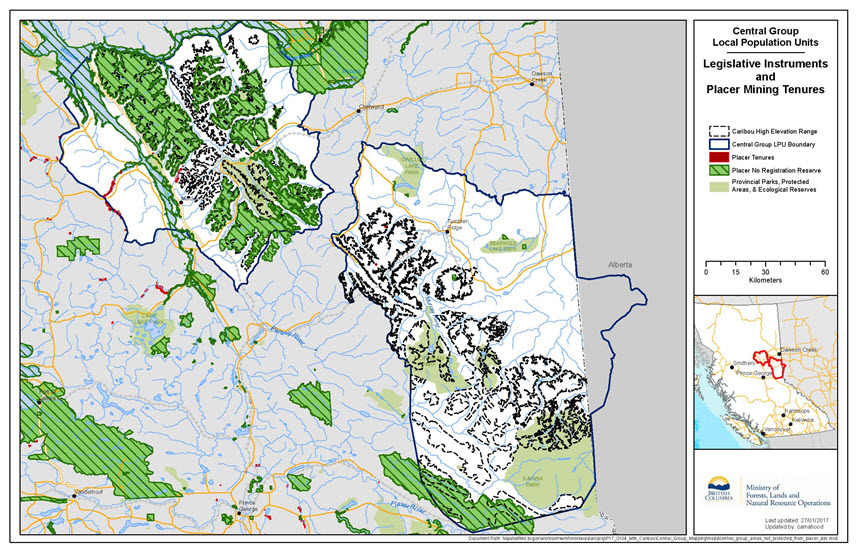

With respect to metal mining, the geology of the Western Canadian Sedimentary Basin, which produces high value coal deposits, is not the type of geology which could support high value placer or hard rock mines, which tend to be found in igneous porphyry rock which is more commonly found in Northwest BC. As a result, metal mining activities, including placer mining, in the Central Group are considered by MEM to represent a low risk to caribou habitat over the next 20 years.

Long description for map 16

This map shows both legislative instruments that constrain mineral mining development, and areas currently tenured for mineral mining development within the boundaries of the Central Group LPUs. Mineral tenures are shown in red; mineral no registration reserves are shown in bright green with horizontal lines, and provincial parks, protected areas, and ecological reserves are shown in greyish-green. There are very few existing mineral tenures within the boundaries of the Central Group LPUs. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

Long description for map 17

This map shows both legislative instruments that constrain placer mining development, and areas currently tenured for placer mining development within the boundaries of the Central Group LPUs. Placer tenures are shown in red; placer no registration reserves are shown in bright green with horizontal lines, and provincial parks, protected areas, and ecological reserves are shown in greyish-green. There are very few existing placer tenures within the boundaries of the Central Group LPUs. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

5.1.2 Oil and gas

Introduction

Industry has increasingly placed the majority of its development effort into the new “unconventional resource plays” such as shale gas and shale oil, where the geological risk of failure is eliminated because the target zones contain hydrocarbons throughout their extent and new technology successfully brings in production. In BC, this has resulted in well over 90% of development being focused on these shale gas resources. As a result of this shift in industry focus, development of conventional resources is minimal. In addition, most of those conventional resources in BC have either been heavily developed in the past or will not be developed until the easier resource plays have been fully developed, a process expected to take 50 to 100 years.

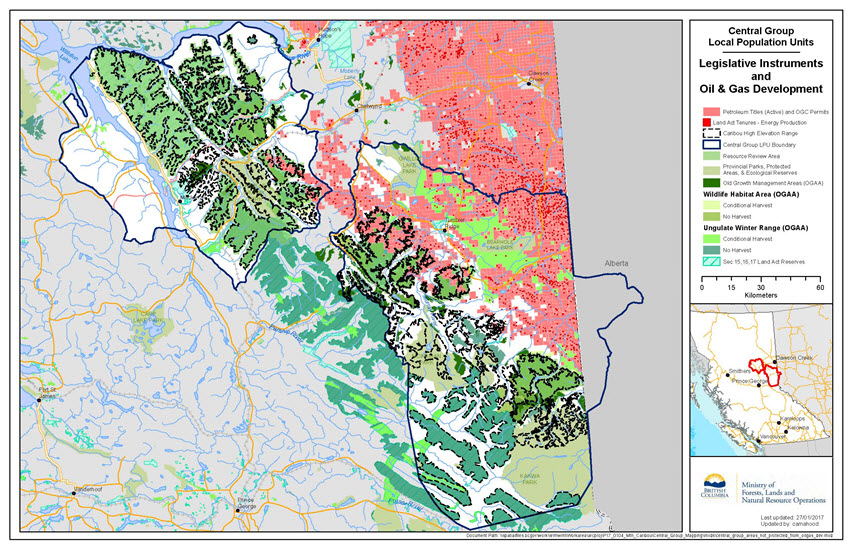

The Central Group LPUs contain some areas of conventional resource potential, much of it already developed. The remainder of these conventional resources are expected to remain undeveloped pending the further exploitation of the unconventional shale gas resources in BC. This process is expected to take many decades.

The Montney unconventional shale gas play overlaps small areas in the northeastern extremities of the Central Group. These small areas are expected to receive development drilling activity on multi-well drilling pads as the Montney resource play is developed. The timing of this development, however, depends on the timing of a Liquefied Natural Gas (LNG) export capability. Current economic and market analyses suggest that this development may not occur for a decade or more. In addition, it is expected these areas are in the dry gas window and further from proposed infrastructure development, therefore having less desirable economics for development.

The domestic market for natural gas in eastern Canada is being displaced by lower cost gas from the eastern United States, while exports of natural gas from western Canada to the United States are declining due to greater U.S. gas production. Therefore, although the domestic western Canada market is sustained and rising, exports off the continent via LNG are important to the timing of BC Montney gas development activity.

Pine River LPU

The entire Pine River range is west of and outside any unconventional Montney resource play. No Montney development will occur. Due to the nature of the geology and absence of hydrocarbon reservoirs, there is no oil and gas potential in the west half of the Pine River range. A small area in the southeast contains existing title, but it has been developed and no further activity is expected.

The remaining area of the eastern part of the range contains conventional gas potential but there is no current title and no interest in conventional exploration, for the reasons noted in the general comments above. Therefore, no conventional exploration is expected in the next 50 years or more.

Quintette LPU

A small area in the extreme northeastern part of Quintette range is within the Montney resource play area. Therefore, development is expected here, but will depend on the timing of the arrival of gas markets. If the export market for LNG proceeds in the next 5 years then development is expected in this area over the next 25 years. If LNG proceeds in the next cycle in about 15 years, Montney gas development is expected to proceed over the ensuing 25 years. Otherwise, development is dependent on domestic western Canadian markets.

The southwestern 25% of the Quintette range area is untenured and has some very low gas potential. No interest in acquiring title or drilling is expected in this area in the future.

The remaining 75% of the Quintette range contains existing tenure that has been heavily developed for conventional gas. Some of the tenure remains to be developed. However, this development is expected to be delayed while Montney development occurs, and then to proceed very slowly. Little conventional development activity is expected in the next 20 to 30 years, and even then it is expected to be at a very slow pace.

Narraway LPU

About 10 to 15% of the Narraway range in the farthest north is within the Montney resource play. Therefore, development is expected here, but depending on the timing of the arrival of gas markets. If the export market for LNG proceeds in the next 5 years then development is expected in this area over the next 25 years. If LNG proceeds in the next cycle in about 15 years, Montney gas development is expected to proceed over the ensuing 25 years if it has not occurred in the first LNG cycle. Otherwise, development is dependent on domestic western Canadian markets.

The northwest 50% of the Narraway range area contains both Deep Basin gas potential and foothills gas-filled anticlines. This area is partially tenured and the tenured areas are heavily developed. Therefore, only sparse infill development may occur, and new development will draw very little interest due to the predominant interest in resource plays elsewhere.

The southwest 50% of Narraway range is untenured and no exploration or development activity is expected. Most of the area has no hydrocarbon potential.

Long description for map 18

This map shows both legislative instruments that constrain oil and gas development, and areas with active petroleum titles and OGC permits in place or currently tenured for energy production within the boundaries of the Central Group LPUs. Tenures are shown in red, and appear primarily in the north of the Quintette and Narraway LPUs; legislative instruments that constrain activities are show in various shades of green. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

5.1.3 Forestry

All lands that are contained with the Timber Harvesting Land Base (THLB) are considered feasible for harvest and contribute to the Allowable Annual Cut. Those areas, unless otherwise constrained, are assumed to be harvested at some point in a normal forest rotation (between 80 and 100 years). Forest companies will prioritize areas for harvest based on economic factors as well as environmental factors (managing the rate of harvesting in a watershed, for example). As a result, any particular stand has a low probability of being harvested in the short term, but a high probability of being harvested in the long term.

Lands that are outside the THLB are excluded from harvestable inventory either due to environmental reasons (unstable slopes, riparian reserves, etc.), or because they are not productive (low site index), or are not economic (steep slopes, low volume, etc.). There is no prohibition on harvest in these areas, but operational experience confirms they are rarely harvested for commercial forest purposes.

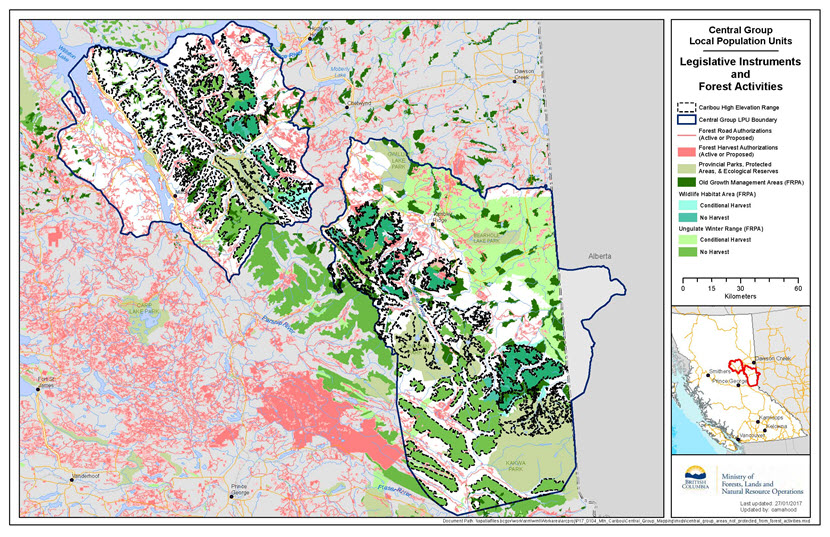

Long description for map 19

This map shows both legislative instruments that constrain forestry activities, and areas with active forest authorizations within the boundaries of the Central Group LPUs. Authorizations are shown in red, and appear primarily in the north of the Quintette and Narraway LPUs; legislative instruments that constrain activities are show in various shades of green and blue. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

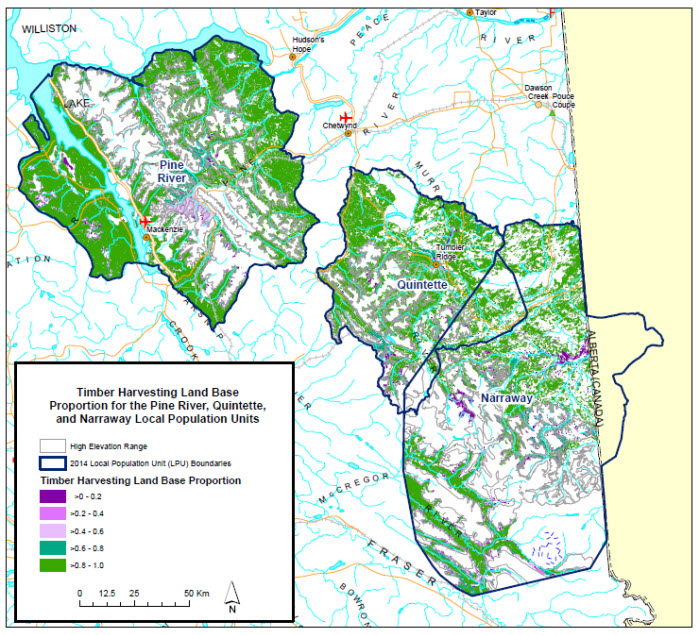

Long description for map 20

This map shows both the proportion of the timber harvesting land base (THLB) that appears throughout the LPUs. The LPU boundaries are shown in thick dark blue lines. Dark purple shows a proportion of greater than 0 to 0.2; bright green shows a proportion of greater than 0.8 to 1.0, with colours in between showing other proportions. High elevation range is outlined in grey.

5.1.4 Wind energy

Most of the wind project developments in the province are located in the South Peace region near Tumbler Ridge, Dawson Creek and Chetwynd. Wind projects provide approximately 10% of the electricity that BC Hydro purchases from Clean Energy Producers (approximately 2% of total Provincial electricity generation). The most favourable wind resources tend to be located on higher elevation ridge lines.

There are currently two developments within the Central Group range: the 142 megawatt (MW) Quality Wind Project and the 144 MW Dokie Wind Project. There are also three projects in development that have electricity purchase agreements with BC Hydro: the 185 MW Meikle Wind Project, the 15 MW Septimus Creek Wind Project and the 15 MW Moose Lake Wind Project. The Land Use Operation Policy for wind power [PDF, 454 KB] requires that proponents submit a Development Plan on the environmental impacts and mitigation measures; requires buffer areas, sound and noise attenuation; and diligent use requirements.

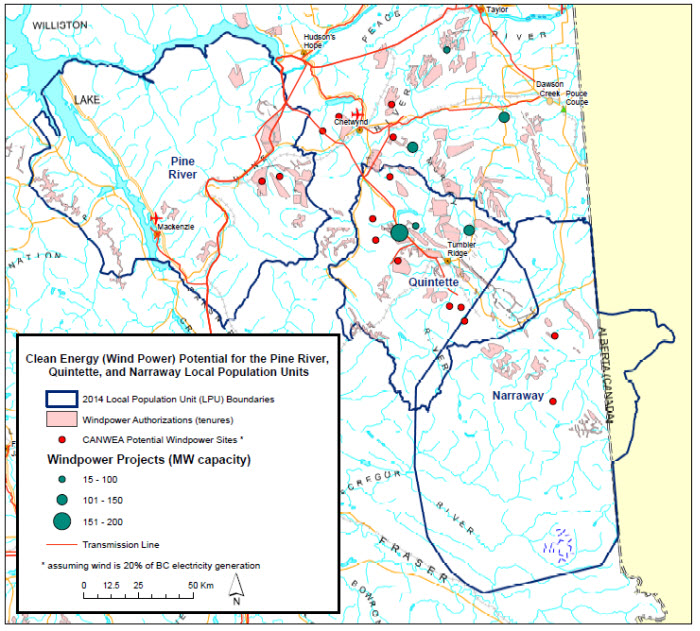

Long description for map 21

This map shows wind power authorizations (tenures) in pale red, Canadian Wind Energy Association (CANWEA) potential windpower sites (which assume wind is 20% of BC’s electricity generation) with small red circles, and windpower projects with varying megawatt (MW) capacities are show in increasingly large blue-filled circles, with the largest showing projects with a 151-200MW capacity. Transmission lines are shown with orange lines.

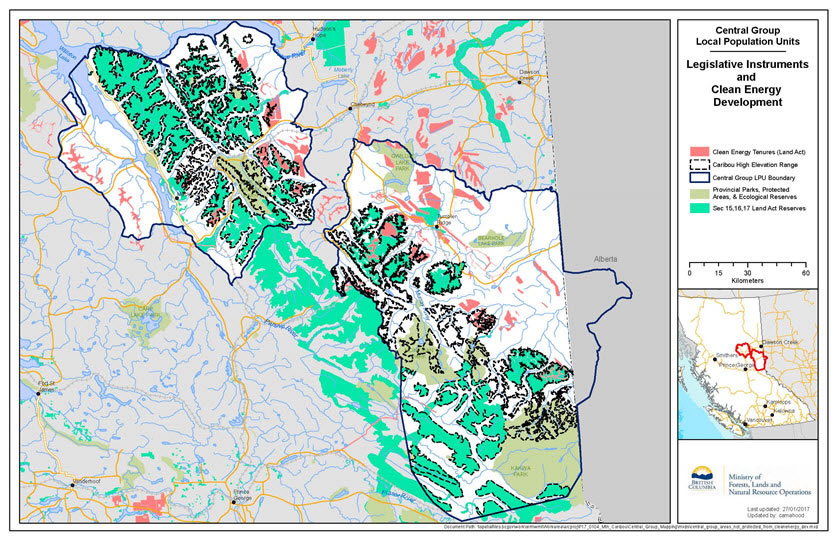

Long description for map 22

This map shows both legislative instruments that constrain clean energy (e.g. wind power) development, and areas with existing tenures for clean energy under the Land Act. Tenures are shown in red; legislative instruments that constrain activities are show in various shades of green. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

5.1.5 Recreation

Within the Central Group, despite the amount of tenured area, recreational activities are not considered a widespread concern. Popular snowmobiling areas are limited in number, well established and believed to be unlikely to expand, based on preferred terrain and access constraints. Higher risk would result when known high use recreation areas transition between low & high elevation habitat and/or intersect with a time & location when caribou are using the habitat.

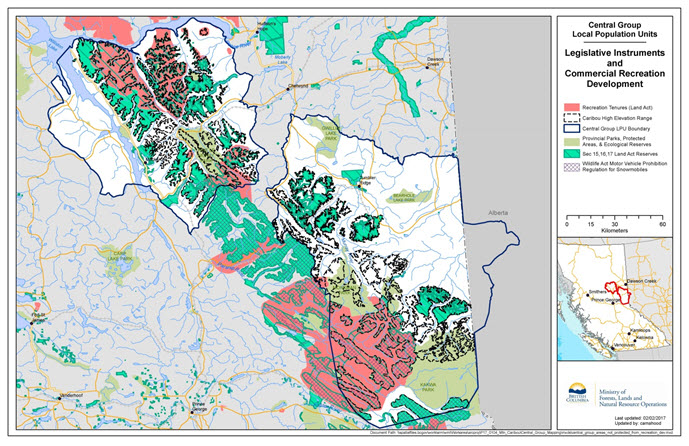

Long description for map 23

This map shows both legislative instruments that constrain commercial recreation, and areas with existing tenures for recreation under the Land Act. Tenures are shown in red; legislative instruments that constrain activities are show in various shades of green. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

5.1.6 Other

Particularly under the Land Act, tenure can be granted for multiple purposes not included in the discussion above. Within tenured areas, site-specific activities may be authorized, and therefore represent an area within which risk may be higher.

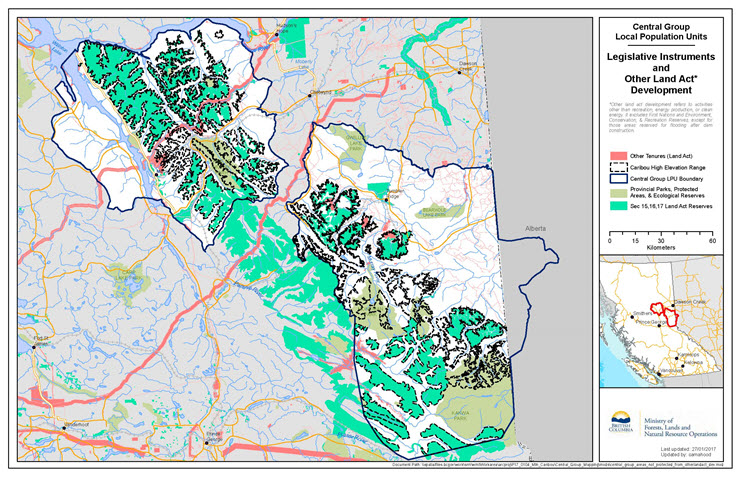

Long description for map 24

This map shows both legislative instruments that constrain other development which is regulated under the Land Act, and areas with existing tenures for other activities under the Land Act. “Other” refers to activities other than recreation, energy production, or clean energy. It excludes First Nations and Environment, Conservation and Recreation reserves, except for those areas reserved for flooding after dam construction. Tenures are shown in red, and primarily show linear tenures; legislative instruments that constrain activities are show in various shades of green. The LPU boundaries are shown in thick dark blue lines. High elevation range is outlined in grey.

5.1.7 Summary of existing tenures within the Central Group LPU area

| Activity | High elevation habitat (823,717 ha) | Non-high elevation habitat (2,152,154 ha) |

|---|---|---|

| Mining Coal | Coal tenures (leases and licences) (Quintette Coal Belt) 176,323 ha / 21% |

Coal tenures (leases and licences) (Quintette Coal Belt) 515,814 ha / 24% |

| Mining Metal & placer | Mineral and placer tenures - claims 122,069 ha / 15% |

Mineral and placer tenures - claims 141,950 ha / 7% |

| Mining Gravel | Land Act tenures (quarrying) 1 ha / 0 % |

Land Act tenures (quarrying) 609 ha / 0 % |

| Oil and Gas | Petroleum Titles, Land Act tenures (energy production), & OGC permits 63,773 ha / 77% - entire Central Group LPU 0 ha / 0 % - in unconventional Montney resource play area |

Petroleum Titles, Land Act tenures (energy production), & OGC permits 1,472,282 ha / 68% - entire Central Group LPU 147,175 ha / 7% - in unconventional Montney resource play area |

| Forestry | Area inside the THLB 113,200 ha / 14% |

Area inside the THLB 995,469 ha / 46% |

| Forestry | Forest harvest authorizations & forest roads 1491 ha / % |

Forest harvest authorizations & forest roads 98,894 ha / 5% |

| Clean Energy | Land Act tenures (windpower & water power) 41,085 ha / 5% |

Land Act tenures (windpower & water power) 138,267 ha / 6.4% |

| Commercial Recreation | Land Act tenures (recreation) 254,318 ha / 31% |

Land Act tenures (recreation) 251,594 ha /12 % |

| Other (Land Act) | Land Act tenures (other purposes) 8,417 ha /1 % |

Land Act tenures (other purposes) 102,220 ha / 5% |