Impact Assessment Agency of Canada's Quarterly Financial Report for Quarter ended September 30, 2019

From: Impact Assessment Agency of Canada

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

On August 28, 2019, Bill C-69 came into force establishing the Impact Assessment Act (IAAC 2019) and repealing the Canadian Environmental Assessment Act (CEAA 2012).

The Impact Assessment Agency of Canada's (the Agency) second quarterly financial statement report for the period ended September 30, 2019 has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board under the Directive on Accounting Standards. It should be read in conjunction with the Main Estimates and Supplementary Estimates for the current year.

This report has not been subject to an external audit or review.

The Agency is the responsible authority for all projects subject to the Impact Assessment Act (IAAC 2019) except for those that are regulated by the Canadian Energy Regulator or the Canadian Nuclear Safety Commission. In accordance with the transitional provisions of IAAC 2019, the Agency is also responsible for managing the environmental assessment (EA) of most projects that are required to be completed under the former Canadian Environmental Assessment Act (CEAA 2012).

In addition, the Agency advises and assists the Minister of Environment and Climate Change in establishing review panels and supports panels in their work. It also supports the Minister in fulfilling responsibilities under IAAC 2019, including the development and issuance of enforceable impact assessment (IA) decision statements.

The Agency administers a Participant Funding Program that supports individuals, not-for-profit organizations, and Indigenous groups participating in federal IAs.

The Agency also has responsibilities for reviewing projects of a federal nature under the environmental and social protection regimes set out in sections 22 and 23 of the 1975 James Bay and Northern Quebec Agreement. The President of the Agency is designated by Order-in-Council as the federal administrator of these processes.

The Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals establishes a self-assessment process for conducting a strategic IA of a policy, plan or program proposal. The Agency supports the Minister of Environment and Climate Change in promoting the application of the Cabinet Directive and provides training and guidance for federal authorities.

The Agency's activities are carried out under two core responsibilities: Impact Assessments and Internal Services.

The Agency delivers high-quality impact assessments that contribute to the informed decision making on major projects, in support of sustainable development. Through its delivery of IA, the Agency serves Canadians by looking at both positive and negative environmental, economic, social and health impacts of potential projects. The Agency:

- Leads and manages the impact assessment process for all federally designated major projects;

- Leads Crown engagement and serves as the single point of contact for consultation and engagement with Indigenous peoples during impact assessments for designated projects;

- Provides opportunities and funding to support public participation in impact assessments;

- Works to ensure that mitigation measures are applied and are working as intended;

- Promotes uniformity and coordination of impact assessment practices across Canada through research, guidance and ongoing discussion with stakeholders and partners; and

- Works with a range of international jurisdictions and organizations to exchange best practices in impact assessment.

Internal Services are those groups of related activities and resources that the Agency considers to be services in support of Programs and/or required to meet corporate obligations of an organization. Internal Services are:

- Management and Oversight Services

- Communications Services

- Legal Services

- Human Resources Management Services

- Financial Management Services

- Information Management and Technology Services

- Real Property Management Services

- Material Management Services

- Acquisition Management Services

The Agency was established in 1994 and is led by a President, who reports directly to the Minister of Environment and Climate Change. It has its headquarters in Ottawa and regional offices in St. John's, Halifax, Quebec City, Toronto, Edmonton, and Vancouver.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Agency's spending authorities granted by Parliament and those used by the Agency consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2019-2020 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Agency uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year-to-date (YTD) results

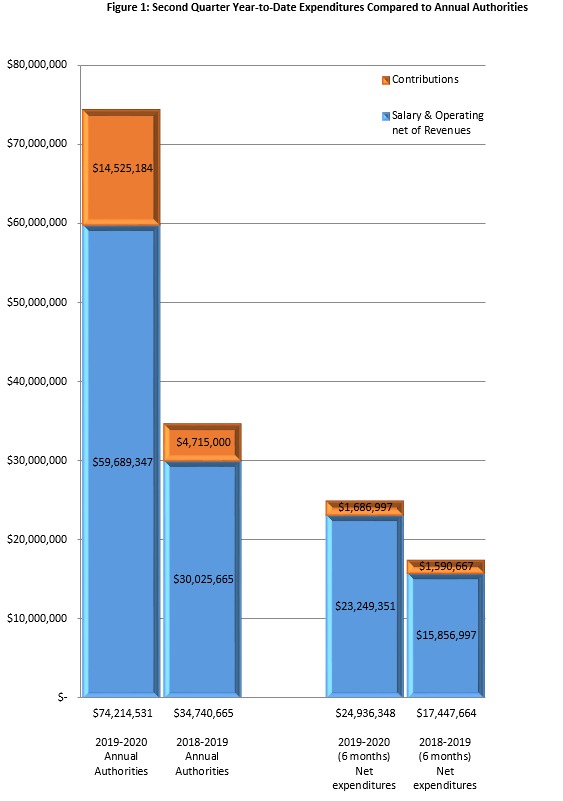

Figure 1 outlines the net budgetary authorities ($74.21M in 2019-2020 and $34.74M in 2018-2019), which represent the resources available for the year as at September 30, 2019 net of the revenue that is forecasted to be collected. Within those resources, a separate budgetary vote for Grants and Contributions was established in 2019-2020 to include new Grants and Contributions funding received to support the implementation of the Impact Assessment Agency of Canada. The Agency's available authorities, net of revenues, increased by $39.47M from the previous year for the implementation of the Impact Assessment Agency of Canada.

Figure 1: Second Quarter Year-to-Date Expenditures Compared to Annual Authorities

Figure 1 also outlines the Agency's second quarter year-to-date budgetary expenditures net of revenues that have increased by $7.49M from the previous year ($24.94M in 2019-2020 and $17.45M in 2018-2019).

- An increase in personnel costs of $ 4.83M for the implementation of the Impact Assessment Agency of Canada.

- An increase in professional services costs of $2.36M for the implementation of the Impact Assessment Agency of Canada.

- An increase in the acquisition of Machinery and Equipment of $275K to support the growth in resources involved with the implementation of the Impact Assessment Agency of Canada.

- All other expenditures net of revenues represent an increase of $720K over Q2 of 2018-2019.

Risks and Uncertainties

The Agency's expenditures and revenues are influenced by the number of EAs underway during any given fiscal year and with the number of EAs influenced by economic conditions outside the control of the Agency. To off-set portions of its expenditures, the Agency has vote-netted authority to recover certain costs from proponents in the conduct of EAs by review panels. The timing of revenue collection is uncertain and may impact the Agency's overall financial results.

In addition, the timing of requests for participant funding for consultation varies and is unpredictable. A commitment to participant funding may be planned in one year but could be realized across multiple fiscal years depending on the progression of the environmental assessment. Unused commitments are carried forward from one year to another and are honoured by the Agency as they become due.

The Agency is also subject to litigation, the extent and costs are uncertain and are normally covered by the Agency's annual appropriations.

Significant Changes in Relation to Operations, Personnel and Programs

As the Government of Canada passed legislation in June 2019, which came into force on August 28, 2019, to establish the Impact Assessment Agency of Canada, the Agency's operations will expand from conducting Environmental Assessments to Impact Assessments.

Approval by Senior Officials

Approved by:

David McGovern

President

Alan Kerr, CPA,CMA

Vice-President, Corporate Services and Chief Financial Officer

Ottawa, Canada

November 29, 2019

Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2020 | Used during the quarter ended September 30, 2019 | Year to date used at quarter-end | |

|---|---|---|---|

VOTE 1 - Net Operating Expenditures |

$ 53,550,638 |

$ 11,241,963 |

$ 20,179,997 |

VOTE 5 - Grants and Contributions |

$ 14,525,184 |

$ 1,248,895 |

$ 1,686,997 |

Statutory Authorities - Employee Benefits |

$ 6,138,709 |

$ 1,534,677 |

$ 3,069,354 |

Total Authorities |

$ 74,214,531 |

$ 14,025,535 |

$ 24,936,348 |

| Total available for use for the year ending March 31, 2019 | Used during the quarter ended September 30, 2018 | Year to date used at quarter-end | |

|---|---|---|---|

VOTE 1 - Net Operating Expenditures |

$ 31,343,210 |

$ 7,933,603 |

$ 16,584,562 |

Statutory Authorities - Employee Benefits |

$ 3,397,455 |

$ 863,102 |

$ 863,102 |

Total Authorities |

$ 34,740,665 |

$ 8,796,705 |

$ 17,447,664 |

Agency Budgetary Expenditures by Standard Object (unaudited)

| Planned Expenditures for the year ending March 31, 2019 | Expended during the quarter ended September 30, 2018 | Year to date used at quarter-end | |

|---|---|---|---|

Expenditures |

|||

Personnel |

$ 46,297,720 |

$ 10,084,878 |

$ 19,341,925 |

Transportation and Telecommunications |

$ 1,968,122 |

$ 493,231 |

$ 852,497 |

Information |

$ 391,485 |

$ 255,141 |

$ 374,302 |

Professional Services |

$ 6,865,994 |

$ 2,475,981 |

$ 3,300,700 |

Rentals |

$ 4,963,089 |

$ 87,715 |

$ 144,939 |

Purchased Repair and Maintenance |

$ 8,557 |

$ 300 |

$ 390 |

Utilities, materials and supplies |

$ 213,926 |

$ 68,161 |

$ 96,856 |

Acquisition of Machinery & Equipment |

$ 1,307,089 |

$ 397,451 |

$ 465,567 |

Transfer Payments |

$ 14,525,184 |

$ 1,248,895 |

$ 1,686,997 |

Other expenses |

$ 973,364 |

- $ 2,731 |

- $ 2,717 |

Total Gross Budgetary Expenditures |

$ 77,514,531 |

$ 15,109,023 |

$ 26,261,455 |

Less Revenues netted against Expenditures |

|||

Planned Revenues |

|||

Panel Reviews |

$ 3,300,000 |

$ 1,083,487 |

$ 1,325,107 |

Total Revenue netted against expenditures |

$ 3,300,000 |

$ 1,083,487 |

$ 1,325,107 |

Total net budgetary expenditures |

$ 74,214,531 |

$ 14,025,535 |

$ 24,936,348 |

| Planned Expenditures for the year ending March 31, 2019 | Expended during the quarter ended September 30, 2018 | Year to date used at quarter-end | |

|---|---|---|---|

Expenditures |

|||

Personnel |

$ 25,749,131 |

$ 7,180,089 |

$ 14,512,419 |

Transportation and Telecommunications |

$ 1,129,533 |

$ 251,364 |

$ 452,220 |

Information |

$ 224,679 |

$ 60,435 |

$ 105,366 |

Professional Services |

$ 2,637,463 |

$ 536,894 |

$ 944,030 |

Rentals |

$ 2,848,388 |

$ 101,175 |

$ 155,690 |

Purchased Repair and Maintenance |

$ 4,911 |

$ 77,811 |

$ 78,067 |

Utilities, materials and supplies |

$ 122,775 |

$ 33,540 |

$ 50,233 |

Acquisition of Machinery & Equipment |

$ 750,157 |

$ 172,713 |

$ 190,805 |

Transfer Payments |

$ 4,715,000 |

$ 780,121 |

$ 1,590,667 |

Other expenses |

$ 558,628 |

$ - |

$ 1,068 |

Total Gross Budgetary Expenditures |

$ 38,740,665 |

$ 9,194,143 |

$ 18,080,566 |

Less Revenues netted against Expenditures |

|||

Planned Revenues |

|||

Panel Reviews |

$ 4,000,000 |

$ 397,438 |

$ 632,902 |

Total Revenue netted against expenditures |

$ 4,000,000 |

$ 397,438 |

$ 632,902 |

Total net budgetary expenditures |

$ 34,740,665 |

$ 8,796,705 |

$ 17,447,664 |

Note 1: The Agency has authority to collect up to $8,001,000 in vote-netted revenue