Consultation on the Guideline Monitoring and Evaluation Plan

Through the Guideline Monitoring and Evaluation Plan (GMEP), the PMPRB will seek to monitor and evaluate trends in the pharmaceutical market that may impact patentees, as well as the consumers, patients and payers that it is mandated to protect.

The GMEP consultation period closed on June 21, 2021. We would like to thank our stakeholders for the feedback submitted, which will be carefully reviewed. The 37 submissions received during the consultation are now available.

GMEP

Guideline Monitoring & Evaluation Plan 2021

Table of Contents

About the Patented Medicine Prices Review Board

The Patented Medicine Prices Review Board (“PMPRB”) is an independent, quasi-judicial body established by Parliament in 1987 under the Patent Act.

The PMPRB has a dual mandate: in its regulatory role, it protects consumers by ensuring that the prices of patented medicines are not excessive; in its reporting role, it provides information on pricing trends in the pharmaceutical industry via its Annual Reports. Further to a directive from the Minister of Health under section 90 of the Act, the PMPRB also supports informed and evidence-based health policy by reporting on medicine price, utilization and cost trends under the National Prescription Drug Utilization Information System (NPDUIS) initiative.

Pursuant to subsection 96(4) of the Patent Act, the PMPRB issues non-binding guidelines (“Guidelines”) which are intended to provide transparency and predictability to patentees regarding the triage and review process typically engaged in by public servant employees of the PMPRB (“Staff”) in seeking to determine whether a patented medicine appears to be priced excessively in any market in Canada. If a patented medicine appears to be priced excessively under the Guidelines and an acceptable Voluntary Compliance Undertaking (VCU) has not been submitted by the patentee, the Chairperson of the PMPRB may decide to hold a hearing into the matter if it is deemed to be in the public interest. A hearing panel composed of Board members will then review the evidence and issue an order requiring the patentee to lower its price and/or pay back excessive revenues if it is determined that the price is in fact excessive.

Our Mission

The PMPRB is a respected agency that makes a unique and valued contribution to sustainable spending on pharmaceuticals in Canada by:

- Providing stakeholders with price, cost and utilization information to help them make timely and knowledgeable pricing, purchasing and reimbursement decisions; and

- Acting as an effective check on the prices of patented medicines through the responsible and efficient use of its consumer protection powers.

Building a monitoring and evaluation plan for the PMPRB Guidelines

As part of Canada’s response to the issue of high-priced patented medicines in a rapidly evolving pharmaceutical market, the government is strengthening and modernizing the PMPRB’s regulatory framework. The revised framework equips the PMPRB with the tools it needs to continue to fulfill its mandate to protect Canadian consumers from excessive prices now and into the future. This includes substantial amendments to the Patented Medicines Regulations in August 2019 and the issuance of revised PMPRB Guidelines in October 2020. The new framework comes into force in July 2021.

The PMPRB is putting in place a Guideline Monitoring and Evaluation Plan (GMEP) that will analyze trends in the pharmaceutical market before and after the implementation of the new framework to assess whether it is working as intended, and to inform the need for any future adjustments. Past changes to the Guidelines have prompted similarly intentioned evaluation plans. However, given the unparalleled scale and scope of the changes reflected in the new Guidelines, this GMEP will be the most comprehensive one of its kind to date. The PMPRB’s stakeholders are invited to help shape the development of this plan and comment on the outline described in this document.

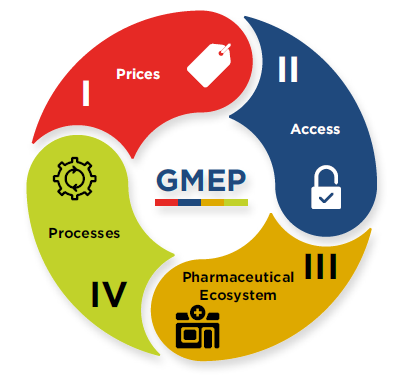

Based on the nature of the changes contained in the new Guidelines and in response to the feedback received from its stakeholders during the consultation process that led to those changes, the PMPRB is proposing a GMEP that will assess four key areas of focus: I. prices of medicines; II. access to medicines; III. the pharmaceutical ecosystem; and IV. PMPRB processes.

For each of these four areas, the PMPRB, in consultation with its stakeholders, will identify relevant indicators to monitor. Baseline results (benchmarks) will be generated based on the years immediately preceding the coming-into-force of the amended Regulations. Starting with 2022, changes will be monitored on an ongoing basis and compared to the benchmarks to identify and evaluate any relevant changes in the trends in the data.

Figure description

This circular graphic shows the four parts of the Guideline Monitoring and Evaluation Plan: I. Prices; II. Access; III. Pharmaceutical Ecosystem; and IV. Processes.

Trends in the pharmaceutical market are driven by multiple variables, many of which are difficult to quantify. The greater the number of variables at play, the less certain are the conclusions one can draw about the import of any single one. Changes in the magnitude of a factor may correlate with an overall trend, but that does not necessarily mean that the factor is causing the trend. While the PMPRB is the first to recognize the complexities and limitations in analyzing these issues, it nevertheless intends to monitor the relevant trends in the pharmaceutical environment and, to the extent possible, report on them in support of an evidence-based evaluation of the Guidelines.

This document provides an overview of the proposed GMEP based on the current areas of research identified. It is intended to serve as a starting point for discussions with stakeholders and will be further developed based on feedback received in the coming months. For information on how you can participate in the engagement sessions and provide feedback, see the Next Steps section.

Key features of the Guidelines

The new Guidelines introduce a risk-based approach to reviewing the prices of new patented medicines, grouping them into one of two categories depending on indicators of potential risk of excessive pricing. Higher risk new medicines—those that are High CostFootnote 1 or are expected to have a High Market SizeFootnote 2—will face greater regulatory scrutiny in Category I. All other new medicines will be classified as Category II. This will be the case even for patented generic medicines and biosimilar medicines that would otherwise meet the Category I criteria.

- The PMPRB will focus its regulatory lens on the minority of medicines that are believed to be at greater risk of excessive pricing.

- It is estimated that these medicines will account for over three-quarters of new patented medicine spending in Canada by 2030.

The Guidelines provide for the calculation of a Maximum List Price (MLP) for all patented medicines. For Grandfathered medicinesFootnote 3 and their line extensions, the MLP is set by the highest price (HIP) in the new group of PMPRB11Footnote 4 countries. For all other patented medicines, the MLP is set by the median price in the PMPRB11 (MIP).

- Compliance with the PMPRB’s new price ceilings under the Guidelines could lead to immediate list price reductions for 34% of existing medicines, with an average overall reduction of 5%.

- The price of new medicines will be on average 8% lower for Category I and 13% for Category II.

In addition, the Guidelines provide for the calculation of a Maximum Rebated Price (MRP) to be assessed against the average transaction prices (ATP) of Category I medicines. The MRP is derived by taking into account the new economic factors introduced through the amended Regulations, namely pharmacoeconomic value, market size, the gross domestic product (GDP) and the GDP per capita in Canada. However, for the time being, the PMPRB will only commence an investigation into the price of a new patented medicine if it appears not to comply with the MLP, or if the PMPRB receives a pricing complaint in respect of the medicine.

Guidelines Monitoring and Evaluation Plan

What follows is an overview of the four areas the PMPRB is proposing to assess under the GMEP, along with the research objectives that will inform the evaluation.

The GMEP will encompass both qualitative and quantitative metrics and indicators under each area of assessment and will evaluate trends across various market segments, including existing and new medicines, Category I and II medicines, oncology medicines, biologics and medicines for rare diseases, and will also group medicines based on therapeutic criteria levelFootnote 5, treatment cost and market size. Results may be analyzed by payer type and in comparison with international norms. A number of administrative, commercial, international, domestic and internal data sources will be used, including the PMPRB’s own regulatory and reporting datasets.

I. Prices

The PMPRB reforms modernize a 30-year-old regulatory regime that has not kept pace with significant changes in the pharmaceutical market. Canada currently pays some of the highest prices for patented medicines in the world. The new framework is intended to better align ceiling prices of patented medicines in Canada with prices in comparable, like-minded developed countries, their underlying therapeutic value and the affordability constraints of the Canadian economy.

Under the new Guidelines, the list price ceilings (MLP) are based on a lower-priced group of countries than before (PMPRB11Footnote 6). In addition, for Category I medicines, the Guidelines also call for the calculation of a Maximum Rebated Price (MRP) ceiling, which takes into consideration the medicine’s pharmacoeconomic value and market size, as per the amended Regulations.

As part of the GMEP, the PMPRB intends to monitor and evaluate whether the prices of patented medicines become more aligned with international norms, and, if so, how long it takes for this to happen. The PMPRB will also monitor the extent to which the prices of patented medicines align with their therapeutic value, and where possible, how that compares to trends prior to the reforms.

Canadian list prices for patented medicines are fourth highest among the OECD countries and 23% higher than median prices in the OECD.

Notwithstanding the reforms, Canada’s prices are expected to remain at the higher end of the international scale over the next decade as existing medicines continue to account for the majority (59%) of patented medicine sales. The prices of these medicines are expected to be reduced by an average of 5%.

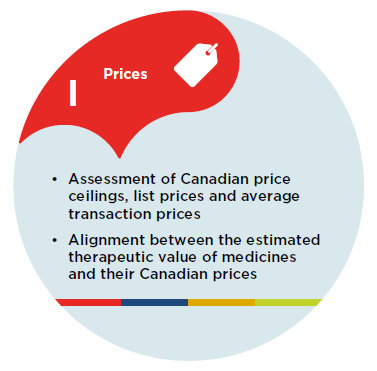

Figure description

I. Prices

- Assessment of Canadian price ceilings, list prices and average transaction prices

- Alignment between the estimated therapeutic value of medicines and their Canadian prices

Assessment of Canadian price ceilings, list prices and average transaction prices

The PMPRB intends to monitor and assess the reduction in the list and average transaction prices of existing and new medicines as a result of lower price ceilings post-reforms, compare Canadian prices against international levels and evaluate the impact of price reductions on sales.

Alignment between the estimated therapeutic value of medicines and their Canadian prices

The amended Regulations require patentees to provide the PMPRB with cost-utility analyses prepared by publicly funded Canadian organizationsFootnote 7 for patented medicines with annual treatment costs over 50% of GDP per capita in Canada. The inclusion of this factor requires the PMPRB to consider the relationship between the medicine’s price and the value it provides to patients within the context of the Canadian health care system.

The PMPRB intends to monitor and measure whether there is a convergence between the cost-effective price, the new price ceilings and the prevailing prices in Canada.

Let us know what you think

In your view, what is the importance of monitoring and evaluating the changes in prices following the Guideline changes?

Which of the proposed objectives around the assessment of price are most important to you?

Are there other aspects of assessment of price that are relevant to you and not already reflected in the PMPRB plan?

II. Access

The high prices of new patented medicines pose a financial barrier to access for Canadians, creating a strain on the budgets of public and private insurers and severe affordability challenges for individuals who pay out of pocket for their medicines.

The PMPRB’s regulatory mandate concerns excessive prices and does not pertain to the issue of access. However, patentees and some patient groups have voiced concern that lower ceiling prices under the new framework may have deleterious effects on clinical trials and the availability of new medicines in Canada.

The price ceilings under the new Guidelines seek to align the Canadian price with those prevailing in comparable developed countries. By requiring the PMPRB to consider value and affordability in determining what constitutes an excessive price, the government is borrowing the best practices observed in other developed countries for ensuring sustainable spending on pharmaceuticals and adapting them to the Canadian context. High-cost medicines that have a very small market size will be exempt from the value and affordability analysis under the PMPRB’s new Guidelines in order to address concerns that the manufacturers of these products might otherwise be discouraged from bringing them to the Canadian market.

Access to medicines is a multifaceted issue with numerous factors contributing to shifting trends in the availability and affordability of new treatments. The PMPRB will monitor and evaluate the continuum of access to medicines for the Canadian consumer. This starts with an assessment of the extent to which medicines undergo clinical development in Canada and are accessed by patients early on. It continues with an assessment of whether new medicines are approved by Health Canada for the general population and concludes with an evaluation of the extent to which the reimbursement system is able to assess the value of these medicines, negotiate prices and fund them for Canadian patients.

Medicines with annual treatment cost exceeding $100,000 now account for one tenth of patented medicine sales in Canada.

Canadian payers often negotiate under very challenging circumstances, and patient access to high-cost medicines varies depends on where one lives in Canada and whether one is covered by a public or private insurer. Even patients with private insurance are paying out of pocket for an increasing portion of their prescriptions for high-cost medicines.

Canada has a sizable number of clinical trials underway, however the number of new medicines approved and sold is below most comparator countries, despite Canada paying some of the highest prices in the world. There have been no material variations in recent years in the number of clinical trials and new medicines approved in Canada.

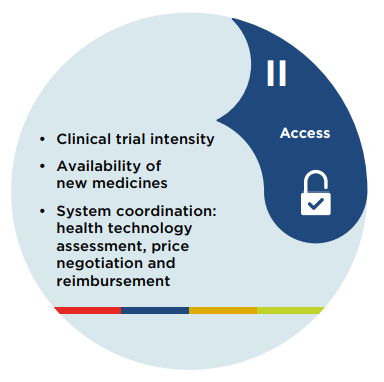

Figure description

II. Access

- Clinical trial intensity

- Availability of new medicines

- System coordination: health technology assessment, price negotiation and reimbursement

Clinical trial intensity

The PMPRB proposes to undertake a literature review, and to monitor and evaluate the trends in clinical trial levels in Canada and internationally, to determine if there is any evidence to support claims that pharmaceutical prices in a market and clinical trial intensity are linked.

The trends in the number of new clinical trials will be analyzed by source of funds, phase of clinical evaluation, and therapeutic area. Results for Canada will be compared with foreign markets and an analysis of trends in single-country versus multinational trials will also be conducted.

Availability of new medicines

The analysis will monitor and evaluate the trends in the availability of new medicines in Canada and compare these to trends in foreign markets. Availability will be measured both in terms of the New Active Substances (NAS) being approved by Health Canada and the extent to which these medicines are subsequently marketed in Canada, including an assessment of the time from regulatory approval to actual sale. This analysis will also look at medicines that are made available through the Special Access Program (SAP) in Canada, rather than just the formal regulatory approval processes. Finally, the analysis will seek to ascertain whether there is any material change in the number and type of medicines that are approved in Canada but subsequently pulled from the Canadian market, or that are subject to recurring shortages.

Trends in the proportion of internationally launched medicines that come to the Canadian market will be assessed, as well as any changes in the international sequencing of new medicine launches impacting Canada.

More generally, the PMPRB will continue to look for evidence of a link between pharmaceutical prices and availability of new medicines internationally.

System coordination: health technology assessment, price negotiation and reimbursement

This analysis is from a health systems perspective and will look at the number of medicines undergoing health technology assessment (HTA) in Canada, those that undergo price negotiation with the pan-Canadian Pharmaceutical Alliance (pCPA), and the conditions under which they are ultimately reimbursed by public and private payers.

Health Technology Assessment (HTA)

The amended Regulations require patentees to report cost-utility analyses prepared by publicly funded Canadian HTA agencies for all medicines with a treatment cost greater than or equal to 50% of the GDP per capita in Canada to the PMPRB. The PMPRB will monitor and evaluate to what extent patentees are submitting their products to the Canadian Agency for Drugs and Technologies in Health (CADTH) or the Institut national d’excellence en santé et services sociaux (INESSS) (in particular for Category I High Cost medicines) for review, the circumstances in which medicines are not submitted for HTA review and whether patentees are making the same decisions about whether to submit these products to HTA review in other countries.

The analysis will also look at the degree of alignment between the indication reviewed by CADTH or INESSS and the indication used by the PMPRB for price review purposes. Given the increasing emphasis on real world evidence (RWE) and the phenomenon of “indication creep”, the PMPRB will track how often medicines are resubmitted to CADTH or INESSS for new indications or because of developing evidence and what impact this has on their cost effectiveness.

Price negotiation

The PMPRB will look at whether there is any measurable change in the number or proportion of new medicines that are subject to price negotiations with the pCPA, and any changes in the average duration of those negotiations.

Reimbursement

The PMPRB will evaluate any changes in the degree to which new medicines are being accepted for reimbursement by federal, provincial and territorial (FPT) public drug plans and any changes in the nature and scope of coverage. In addition, the PMPRB will monitor any measurable shifts in FPT plan design (deductible/copayment structures) and eligibility criteria, as well as subprograms that expand or limit coverage.

Similarly, the PMPRB will monitor trends in private insurance plans, including any changes in the extent of coverage of high-cost medicines, patient copayments and deductibles and the share of total pharmaceutical expenditure accounted for by private insurers in Canada. The PMPRB will also seek to survey private insurers on whether the reforms are having a positive or negative impact on their ability to provide meaningful drug plan coverage to their customers.

Finally, the PMPRB will also monitor how its own review processes are lining up with the processes for the HTA assessment, price negotiation and positive reimbursement decisions.

Let us know what you think

In your view, what is the importance of monitoring and evaluating possible changes in the access to medicines following the Guideline changes?

Which of the proposed objectives around the assessment of access to medicines are most important to you?

Are there other aspects of assessment of the access to medicines that are relevant to you and not already reflected in the PMPRB plan?

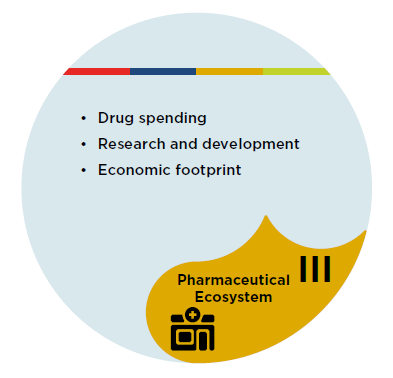

III. Pharmaceutical Ecosystem

The Canadian health care system is complex and dynamic with many interconnected parts as they relate to patented medicines. An influx in high-cost medicines in recent years is straining the budget envelope of public and private insurers, placing added financial burdens on patients who pay out of pocket for their medicines and resulting in fewer resources for other critical areas of the health care system. The reforms to the PMPRB’s regulatory framework were driven in large part by concerns of public and private payers with the sustainability of the health care system in Canada. Conversely, the pharmaceutical industry has been steadfast in its opposition to the reforms because it believes lower prices will make Canada a less attractive market for new medicines and for research and development (R&D) investment, and will result in further attrition in the industry’s domestic economic footprint.

Health expenditures capture an increasing share of Canadian GDP, from about 9% two decades ago to 12% in 2019, making Canada among the top spenders on health among the OECD.

Drugs are now the second largest component of this spending, ahead of physicians. Growth in patented medicine spending (4.5%, 2014-2019) has outpaced the growth in GDP and is almost 3x that of inflation. Canadian spending per capita on patented medicines ($459 in 2019) is second highest internationally and more than double the OECD average.

Sales of patented medicines are expected to continue to grow even as prices come down, from an estimated $17.9B in 2020 to $22.8B in 2030. However, these sales are expected to be 3.9% lower than they would have been in the absence of the reforms to the PMPRB’s regulatory framework.

A closer analysis of these concerns and claims must contend with the multiple contributing factors influencing these trends. While recognizing the limitations in analyzing these issues, the PMPRB intends to monitor and evaluate the trends in total spending on patented medicines in Canada, investments in R&D as well as any changes in the industry’s economic footprint.

Figure description

III. Pharmaceutical Ecosystem

- Drug spending

- Research and development

- Economic footprint

Drug spending

The PMPRB will monitor and evaluate any changes in the sales of patented medicines and associated shifts in the proportions of total spending accounted for by individuals, public plans and private insurers. The spending on these medicines will also be evaluated in relation to macroeconomic measures of overall health expenditures and GDP. The evolving pharmaceutical landscape in Canada will be compared and contrasted with comparable developments in international markets. The PMPRB will also seek to determine the extent to which price and utilization account for differences in patented medicine spending per capita between Canada and comparator countries.

Research and development

This analysis will monitor and assess domestic trends in pharmaceutical R&D expenditures by patentees, the share of patented medicine sales they represent and the type of investments, such as those in manufacturing and clinical trials. To the extent there is relevant data available, the PMPRB will also consider any R&D investments by industry beyond the SR&EDFootnote 8 definition, as well as pharmaceutical research that is publicly funded. The trends in these metrics will be monitored for Canada and compared with international norms. This analysis will also investigate the broader determinants of R&D investments and any evidence of a relationship with pharmaceutical pricing.

Economic footprint

In measuring economic footprint, the PMPRB will look at patentee investments in Canada, including sector performance, economic output, direct and indirect employment, profitability and returns, as well as how these compare with other sectors of the economy domestically and globally.

Let us know what you think

In your view, what is the importance of monitoring and evaluating the changes in the pharmaceutical ecosystem following the Guideline changes?

Which of the proposed objectives around the assessment of the pharmaceutical ecosystem are most important to you?

Are there other aspects of assessment of the pharmaceutical ecosystem that are relevant to you and not already reflected in the PMPRB plan?

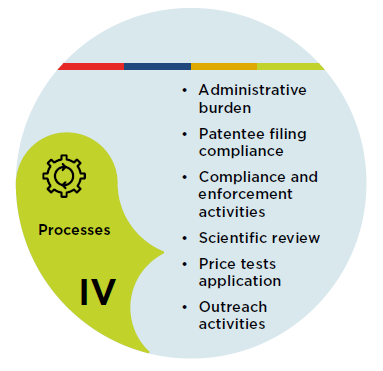

IV. Processes

The implementation of the new framework will require changes in some PMPRB processes. As such, a thorough assessment of six key processes is proposed to measure the extent and effects of these changes.

The PMPRB will assess the administrative burden of the reforms on patentees and PMPRB staff, patentee compliance with the filing requirements and ceilings, enforcement activities, the scientific review, the application of the price tests as well as the number of engagement activities the PMPRB is undertaking to assist patentees in understanding the Guidelines and their application.

Figure description

IV. Processes

- Administrative burden

- Patentee filing compliance

- Compliance and enforcement activities

- Scientific review

- Price tests application

- Outreach activities

Administrative burden

Changes in the resources patentees allocate to complying with the new filing requirements will be evaluated, including changes in the volume of information required to be reported by the patentees and the associated time and cost of doing so.

Patentee filing compliance

Patentee adherence with the filing requirements will be monitored.

Compliance and enforcement activities

The PMPRB will report on general compliance and enforcement activities and identify any notable changes following the implementation of the regulatory amendments, including the total number of investigations, the number of voluntary compliance undertakings (VCUs) and related payments, notices of hearings and matters before the courts.

Scientific review

The analysis will assess how considerations to the pharmacoeconomic value, treatment cost, therapeutic criteria level and the set of comparators impact PMPRB processes.

Price tests application

The PMPRB will evaluate the operational requirements of applying the new MLP and MRP price tests and their impact on the price assessment process for various categories of patented medicines (e.g., Grandfathered, Line Extensions, Gap and New Medicines (MLP and MRP)). This includes monitoring why and how often new patented medicines are screened into Category I.

Outreach activities

The PMPRB will track the number and frequency of its outreach efforts to help patentees and other stakeholders understand the application and impact of the new Guidelines.

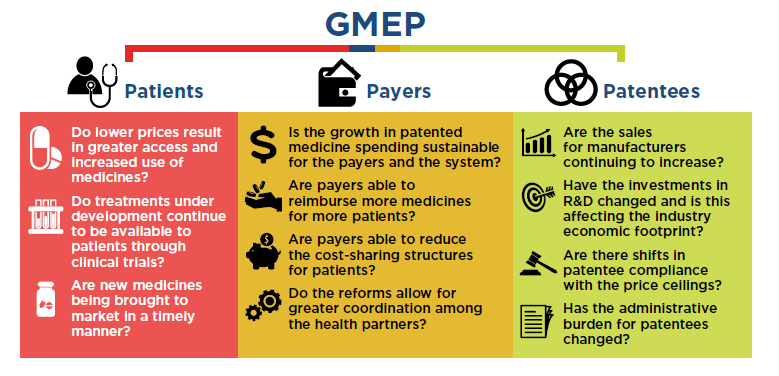

Next Steps: Engaging with Canadians in the development of the GMEP

Through the GMEP, the PMPRB will seek to monitor and evaluate trends in the pharmaceutical market that may be impacting patentees, as well as the consumers, patients and payers that it is mandated to protect. The PMPRB’s stakeholders are invited to help shape the development of this plan and comment on the outline described in this document.

Figure description

This graphic summarizes the questions posed in the proposed Guideline Monitoring and Evaluation Plan for three key stakeholder groups: patients, payers, and patentees.

Patients

- Do lower prices result in greater access and increased use of medicines?

- Do treatments under development continue to be available to patients through clinical trials?

- Are new medicines being brought to market in a timely manner?

Payers

- Is the growth in patented medicine spending sustainable for the payers and the system?

- Are payers able to reimburse more medicines for more patients?

- Are payers able to reduce the cost-sharing structures for patients?

- Do the reforms allow for greater coordination among the health partners?

Patentees

- Are the sales for manufacturers continuing to increase?

- Have the investments in R&D changed and is this affecting the industry economic footprint?

- Are there shifts in patentee compliance with the price ceilings?

- Has the administrative burden for patentees changed?

A series of outreach sessions is planned. The first such session, with intergovernmental partners, took place in January. A webinar for technical experts and another for the general public are currently under development. The Technical Webinar will bring together key experts in the GMEP’s four key areas of focus and will seek their feedback on specific research questions, metrics and methodologies. The Public Webinar will provide a more rudimentary overview of the GMEP and seek more general feedback from stakeholders.

How to get involved

The PMPRB invites stakeholders to comment on this proposed GMEP by June 21, 2021, by sending feedback through the PMPRB website.

The PMPRB also invites stakeholders to participate in the GMEP Public Webinar on May 31, 2021.

For further details on how you can participate in the engagement sessions and provide your feedback, see the PMPRB’s website and Twitter account.

Webinar

The PMPRB hosted a public webinar on the Guideline Monitoring and Evaluation Plan.