Market Intelligence Report: Antidiabetic Drugs, 2012-2021

Table of Contents

- Executive Summary

- Introduction

- Methods

- 1. Diabetes Backgrounder

- 2. Canada’s Regulatory and Reimbursement Landscape

- 3. Cost Drivers

- 4. A Look into the Future

- References

- Bibliography

- Appendix A: Methodology Notes

- Appendix B: Assessments, Recommendations, Negotiation Status, and Reimbursement Decisions

Acknowledgements

This report was prepared by the PMPRB as part of the NPDUIS initiative.

The PMPRB wishes to acknowledge and thank the members of the NPDUIS Advisory Committee for their expert oversight and guidance in the preparation of this report. Please note that the statements, findings, and conclusions do not necessarily reflect those of the members or their organizations.

Appreciation goes to Joan Fearnley and Allison Carey for leading this project and to Jared Berger, Kevin Pothier and Tanya Potashnik for their oversight in the development of the report. The PMPRB also wishes to acknowledge the contribution of the analytical staff Jun Yu and Yvonne Zhang; and editorial staff Shirin Paynter.

Disclaimer

NPDUIS operates independently of the regulatory activities of the Board of the PMPRB. The research priorities, data, statements, and opinions expressed or reflected in NPDUIS reports do not represent the position of the PMPRB with respect to any regulatory matter. NPDUIS reports do not contain information that is confidential or privileged under sections 87 and 88 of the Patent Act, and the mention of a medicine in a NPDUIS report is not and should not be understood as an admission or denial that the medicine is subject to filings under sections 80, 81, or 82 of the Patent Act or that its price is or is not excessive under section 85 of the Patent Act.

Although this information is based in part on data obtained from the NPDUIS Database of the Canadian Institute for Health Information (CIHI) and under license from IQVIA’s MIDAS® Database, Payer Insights database, and Private Pay Direct Drug Plan database, the statements, findings, conclusions, views, and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to CIHI or IQVIA.

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, ON K1P 1C1

Tel.: 1-877-861-2350

TTY 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Suggested Citation

Patented Medicine Prices Review Board. (2023). Market Intelligence Report: Antidiabetic Drugs, 2012-2021. Ottawa: PMPRB.

Executive Summary

One hundred years ago in 1923, the Nobel Prize for Physiology or Medicine was awarded to Frederick Grant Banting and Professor John James Rickard Macleod for the discovery of insulin, a milestone in the treatment for diabetes that has saved countless lives. Today, diabetes remains a common cause of illness and shortened life expectancy, putting pressure on health care budgets. In 2021, Canada ranked 9th in diabetes prevalence among the Organization for Economic Co-operation and Development (OECD) member countries and 2nd among the PMPRB’s 11 comparator countries. Diabetes will continue to be an ongoing concern for Canadian health care as the population ages.

This report explores the market dynamics affecting spending on antidiabetic drugs with an emphasis on new-generation/non-insulin drugs that experienced substantial growth over the course of the last decade. Trends in market shares and utilization are analysed at both the national and international levels. Foreign-to-Canadian price ratios and the impact of provincial biosimilar switching policies are also explored.

Key Findings

1. Antidiabetic drug growth outpaced the overall drug market

Growth in spending on antidiabetic drugs in Canada has continued to outpace spending in the overall drug market, effectively doubling the market share for these drugs from 4.2% to 7.9% (2012 to 2021). This growth reflects a shift to new classes of drugs for the treatment of diabetes resulting in a similar increase in the cost per capita for antidiabetic drugs from $26 to $71 (2012 to 2021). While OECD countries, particularly PMPRB11 comparators, faced similar spending trends and shifting utilization patterns, Canada ranked among those with higher costs and steeper increases.

2. New-generation treatments were the main driver of growth

In 2021, nearly three quarters (71%) of antidiabetic drug sales in Canada were for the new-generation/non-insulin subclasses. These drugs were responsible for almost all of Canada’s increase in cost per capita of antidiabetic drugs since 2012. The uptake of new-generation/non-insulin treatments began in late 2007 with the launch of the first DPP-4, Januvia. After a strong early growth, spending on DPP-4’s slowed following the launch of SGLT-2’s in the mid-2010’s suggesting a shift from DPP-4’s to SGLT-2’s. By 2021, DPP-4’s and SGLT-2’s accounted for 24% and 22% of spending on antidiabetic drugs, respectively. While GLP-1’s had little impact on spending in the early 2010’s, by 2021, GLP-1’s accounted for 25% of all antidiabetic drug spending due to the substantial growth of semaglutide (Ozempic) launched in 2018. In addition to changing prescribing guidelines for antidiabetics, additional indications for the treatment of heart failure and weight management have contributed to the uptake of the new-generation/non-insulin drugs.

3. Canadian prices were higher than PMPRB11 countries

Canada has higher prices for top-selling antidiabetic drugs compared to prices in the PMPRB11 comparator countries, which were roughly half to two-thirds of Canadian prices in 2021. It is estimated that these higher prices could represent additional spending of up to $703M in Canada, all payers (public, private, cash) and segments (retail and hospital) combined. It is possible that some payers have already achieved savings through confidential pricing agreements, which are not reported in the data and list prices.

4. Biosimilar policies led to more switching

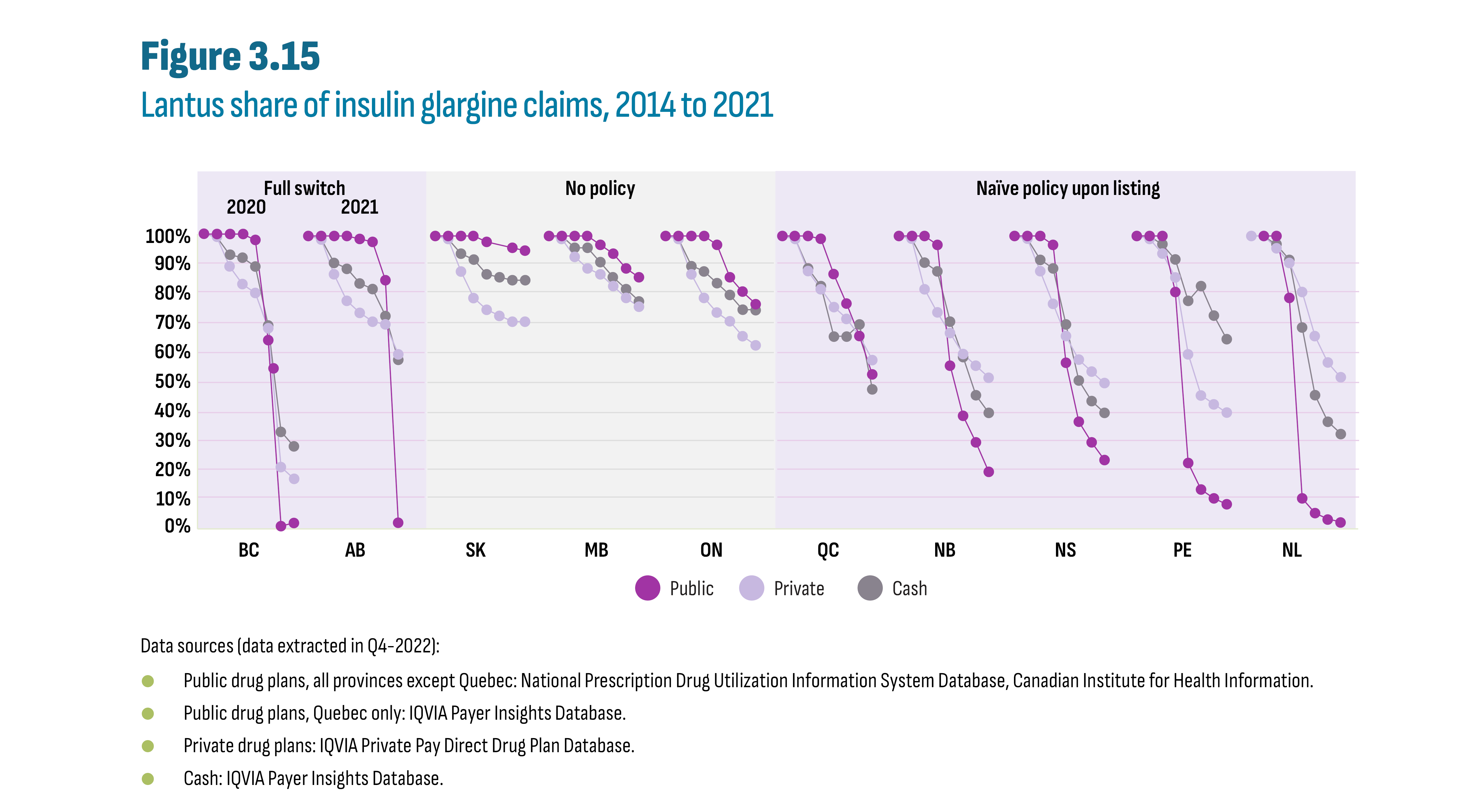

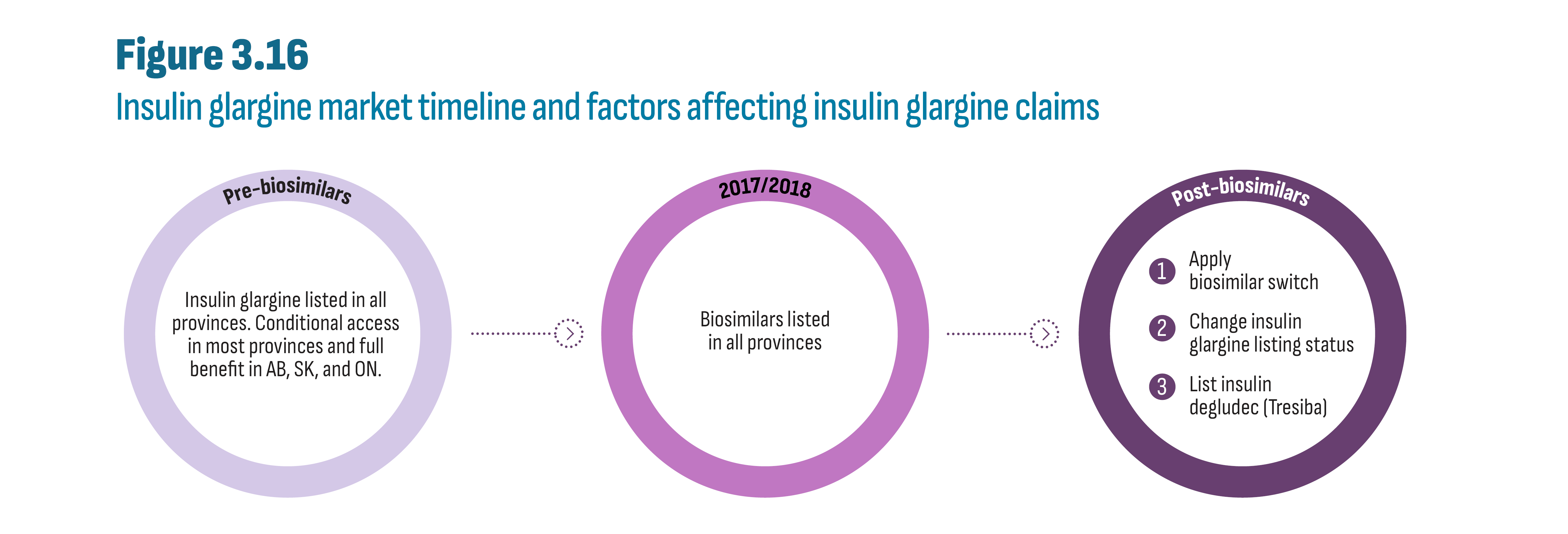

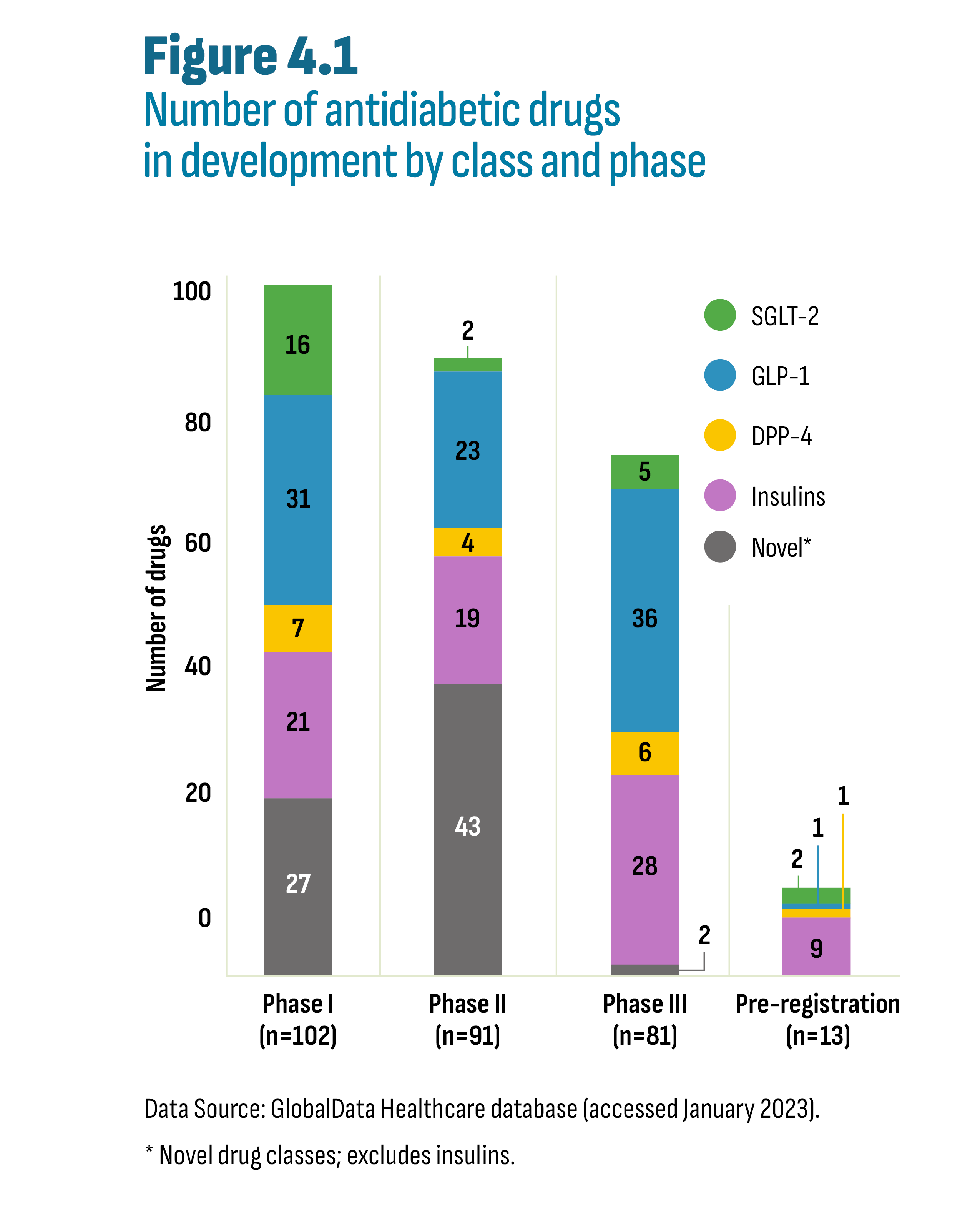

Drugs in the new-generation/non-insulin market in Canada were still patented during the study period and generic competition will be gradual as the first DPP-4’s face competition in the future. Rather, during the study period, it is the biosimilars in the insulin market that offered opportunity for savings. A case study of insulin glargine (Lantus) showed a near-total switch to biosimilars in public plans in both British Columbia (by 2020) and Alberta (by 2021) following the implementation of a biosimilar switching policy affecting all patients, i.e., established and naïve (new) patients. Switching policies that target only naïve patients, in effect since 2017/18 in Quebec and Atlantic provinces, resulted in a significant, albeit smaller, shift to biosimilars by 2021 (53% to 80% biosimilars), outperforming provinces without biosimilar policies (5% to 23% biosimilars). The total market for insulin glargine (Lantus and biosimilars) was further affected by provincial plan formulary decisions such as removing reimbursement criteria for this class of insulins, and the decision to list insulin degludec (Tresiba), a new long-acting insulin. For example, in Alberta, the implementation of the biosimilar policy coincided with the listing of insulin degludec, which may have contributed to a 33% drop in total insulin glargine claims. Finally, market shares observed in private plans and in the cash market reflected the extent to which these segments operate in an integrated environment.

Introduction

This report on antidiabetic drugs is part of the PMPRB’s Market Intelligence Report series. These reports dive into specific therapeutic market segments that matter to Canadians. They use real-word evidence to inform policy discussions and support decision making while providing Canadians with an understanding of the issues that affect drug prices and utilization, both in Canada and internationally.

The Public Health Agency of Canada estimates the total number of individuals diagnosed with diabetes at over 3 million Canadians, representing an 8.9% prevalence rate. Furthermore, according to estimates by Diabetes Canada, the combined number of diagnosed and undiagnosed patients reached 5.7 million in 2022 and an additional 6 million Canadians are likely prediabetic. The cost burden of diabetes in Canada is estimated at $29 billion.Footnote 1 Type 1 diabetes is an autoimmune condition and represents roughly 10% of individuals living with diabetes. The risk of developing type 2 diabetes, however, is linked to common lifestyle factors such as diet, exercise, and smoking. Once diabetes is diagnosed, most patients will require antidiabetic drugs in addition to lifestyle changes to manage their condition. Over time other co-morbidities can surface leading to additional costs to health care systems and decreased quality of life and life expectancy for the patient.

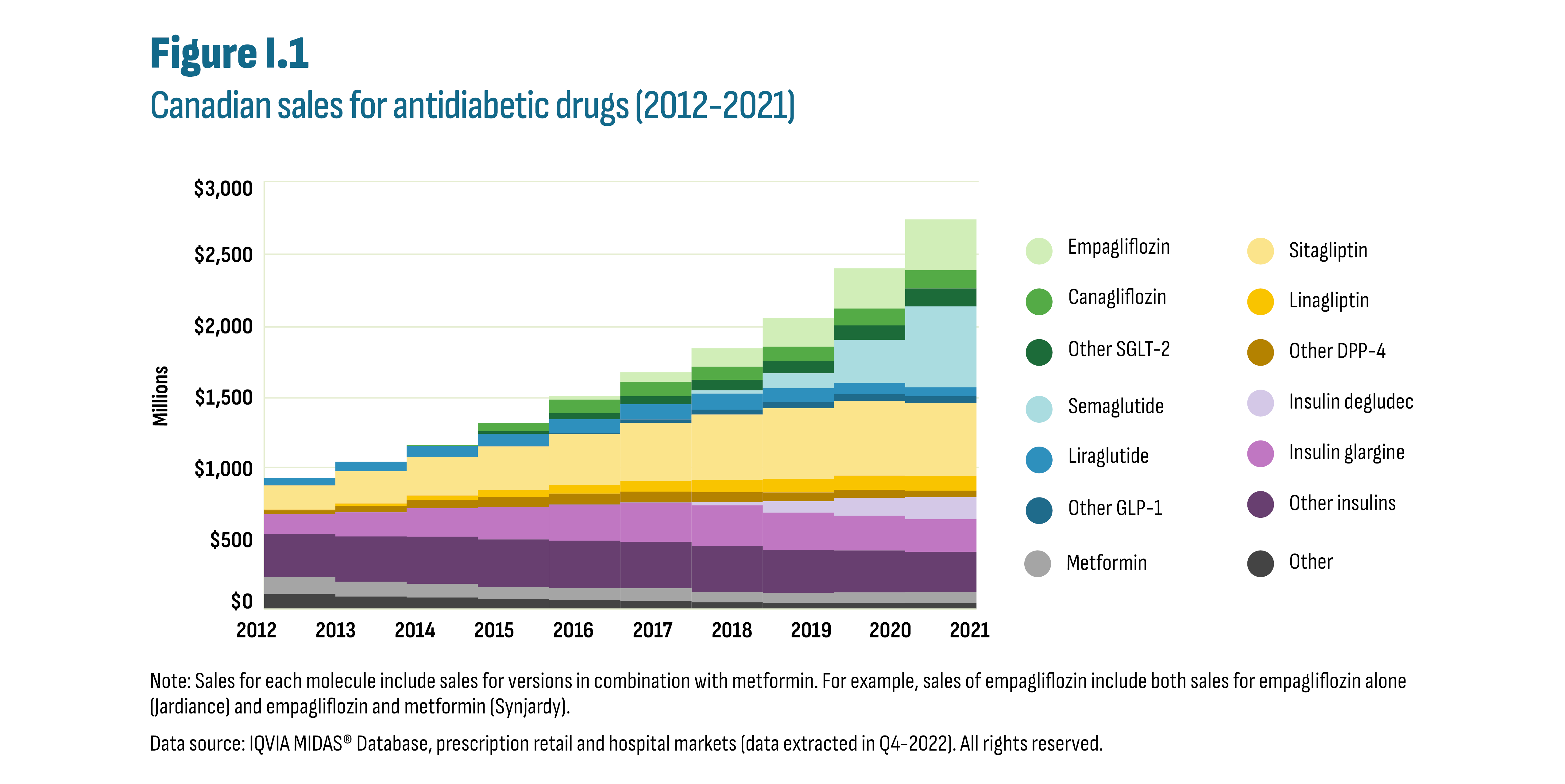

Spending on antidiabetic drugs in Canada increased substantially from $0.9 billion in 2012 to $2.7 billion in 2021 (see Figure I.1). This increase outpaced the growth in the overall drug market resulting in an increased market share for antidiabetic drugs from 4.9% (2012) to 7.9% (2021). The three new-generation/non-insulin drug subclasses, which are the focus of this report, were the key drivers of this increase: glucagon-like peptide 1 (GLP-1) agonists, dipeptidyl peptidase (DPP-4) inhibitors, and sodium glucose cotransporter 2 (SGLT-2) inhibitors. While insulin sales remained stable during this period, notable changes occurred in Canada: provincial drug plans implemented biosimilar switching policies and insulin degludec (Tresiba) entered the market.

These trends in market shares and underlying utilization patterns are explored throughout this report. Section 1 provides a primer on diabetes in Canada and looks at diagnosis, treatment, and prevalence. Section 2 provides an overview of the regulatory and reimbursement landscape, highlighting key decisions and advice from major agencies and regulatory bodies. Section 3 dives into the numbers and explores the PMPRB’s real-world databases to reveal the cost drivers at play in this market. These include cost and utilization trends as well as international price comparisons and domestic competition. Finally, Section 4 looks at what the future may hold for new drugs in the pipeline for the treatment of diabetes.

Figure description

This stacked area graph shows the trends in Canadian sales revenues for antidiabetic drugs from 2012 to 2021.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

SGLT-2 |

Empagliflozin |

$0 million |

$0 million |

$0 million |

$1 million |

$25 million |

$67 million |

$130 million |

$201 million |

$282 million |

$355 million |

Canagliflozin |

$0 million |

$0 million |

$8 million |

$58 million |

$93 million |

$100 million |

$92 million |

$101 million |

$119 million |

$129 million |

|

Other SGLT-2 |

$0 million |

$0 million |

$0 million |

$18 million |

$45 million |

$57 million |

$74 million |

$86 million |

$102 million |

$126 million |

|

DPP-4 |

Sitagliptin |

$170 million |

$226 million |

$269 million |

$306 million |

$356 million |

$409 million |

$458 million |

$495 million |

$524 million |

$514 million |

Linagliptin |

$4 million |

$17 million |

$30 million |

$48 million |

$61 million |

$74 million |

$86 million |

$95 million |

$100 million |

$101 million |

|

Other DPP-4 |

$28 million |

$46 million |

$60 million |

$72 million |

$76 million |

$75 million |

$69 million |

$62 million |

$56 million |

$45 million |

|

GLP-1 |

Semaglutide |

$0 million |

$0 million |

$0 million |

$0 million |

$0 million |

$0 million |

$23 million |

$105 million |

$301 million |

$567 million |

Liraglutide |

$51 million |

$65 million |

$76 million |

$88 million |

$97 million |

$106 million |

$113 million |

$97 million |

$77 million |

$61 million |

|

Other GLP-1 |

$1 million |

$1 million |

$1 million |

$1 million |

$8 million |

$23 million |

$34 million |

$43 million |

$49 million |

$49 million |

|

Insulin |

Degludec |

$0 million |

$0 million |

$0 million |

$0 million |

$0 million |

$2 million |

$22 million |

$80 million |

$126 million |

$155 million |

Glargine |

$138 million |

$169 million |

$199 million |

$226 million |

$254 million |

$275 million |

$284 million |

$260 million |

$244 million |

$228 million |

|

Other Insulin |

$304 million |

$318 million |

$331 million |

$335 million |

$332 million |

$327 million |

$324 million |

$304 million |

$295 million |

$283 million |

|

Other |

Metformin |

$118 million |

$103 million |

$96 million |

$84 million |

$83 million |

$88 million |

$71 million |

$70 million |

$73 million |

$78 million |

Other antidiabetics |

$106 million |

$87 million |

$81 million |

$69 million |

$64 million |

$57 million |

$48 million |

$43 million |

$43 million |

$41 million |

Note: Sales for each molecule include sales for versions in combination with metformin. For example, sales of empagliflozin include both sales for empagliflozin alone (Jardiance) and empagliflozin & metformin (Synjardy).

Note: Sales for each molecule include sales for versions in combination with metformin. For example, sales of empagliflozin include both sales for empagliflozin alone (Jardiance) and empagliflozin and metformin (Synjardy).

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

Methods

Drug Selection

Antidiabetic drugs were selected at level 4 of the World Health Organization (WHO) Anatomic Therapeutic Chemical (ATC) classification system in the A10A (insulin) and A10B (non-insulin) categories (see Table M1). Devices were excluded. While diabetes is the primary indication for these drugs, some have other indications such as drugs in the SGLT-2 class that are also indicated for heart failure. The databases analyzed do not include information on the patient’s diagnosis and consequently it is not possible to determine with certainty the indication for which a drug is prescribed.

Table M1 Antidiabetic drugs included in analysis, by subclass

| Subclass | ATC | Molecules |

|---|---|---|

SGLT-2: sodium-glucose cotransporter-2 inhibitors. Oral solid medications that block the reabsorption of glucose in the kidney, thereby increasing the amount of glucose excreted through the urine. |

A10BK A10BD |

Canagliflozin, dapagliflozin, empagliflozin, ertugliflozin, and their combinations with metformin or with DPP-4’s. Combinations with insulins are grouped with insulins. |

GLP-1: glucagon-like peptide-1 receptor agonists. Primarily injectable pens that stimulate the release of insulin and reduce the release of glucagon from the pancreas. |

A10BJ |

Semaglutide, liraglutide, dulaglutide, exenatide, lixisenatide. |

DPP-4: dipeptidyl peptidase-4 inhibitors. Oral solid medications that stimulate the release of insulin when blood glucose is rising and inhibit the release of glucose from the liver. |

A10BH A10BD |

Sitagliptin, saxagliptin, linagliptin, alogliptin, and their combinations with metformin. Combinations with SGLT-2 are grouped with SGLT-2. |

Insulins: All forms of insulin (injectables). |

A10A A10AE |

Featured analysis looks at insulin glargine and insulin degludec in the subclass of long-acting soluble basal insulin analogue (A10AE). |

Metformin: Biguanides. |

A10BA |

All sources of metformin not in combination with other molecules. |

Other |

A10BB |

Sulfonylureas |

Comparator countries

This report compares Canada to members of the Organization for Economic Co-operation and Development (OECD), and specifically focuses on the PMPRB’s new basket of 11 comparator countries (PMPRB11): Australia, Belgium, France, Germany, Italy, Japan, the Netherlands, Norway, Spain, Sweden, and the United Kingdom (UK). When appropriate, the United States (US) and Switzerland are included as they were both in the original PMPRB basket of 7 countries (PMPRB7). For reference, countries are labelled in the figures with 7 and/or 11 to indicate their inclusion in the current PMPRB11 basket and the PMPRB7 historical basket (e.g., France (7/11)).

Data sources

The findings in this report are based on an analysis of databases from IQVIA and the National Prescription Drug Utilization Information System (NPDUIS) database managed by the Canadian Institute for Health Information (CIHI). These are detailed below along with notes on notable considerations. Further descriptions of PMPRB source materials can be found in the Reference Documents section of the Analytical Studies page on the PMPRB website. Additional databases and resources consulted are listed below.

Drug sales and drug plan databases

NPDUIS |

Provincial drug plan administrative data for all provinces except Quebec. Quebec public plan data provided in the report are estimates calculated using the IQVIA Payer Insights database (see below). |

IQVIA MIDAS® Database (all rights reserved) |

Country-specific international data for both retail and hospital sales. It includes units sold and sales amounts. These data are the primary source for international trends and price comparisons in Sections 3.1 and 3.2. |

IQVIA Private Drug Plan database |

Private drug plan administrative data obtained from pay-direct private insurers. While each supplier’s data are complete, not all Canadian insurers are included in this database and coverage varies across provinces. |

IQVIA Payer Insights database |

Database generated from a sampling of retail (community) pharmacies that specifies first payer: public plan, private plan, or out-of-pocket (cash). Used mainly to calculate market shares for each payer (public/private/cash). Also used as a proxy to analyze drug utilization in the Quebec public drug plan (data not included in the NPDUIS database). These estimates are provided for market shares only where additional context is relevant. |

Additional databases and online resources

- Information on provincial drug programs and formularies consulted online through their respective websites.

- Public Health Agency of Canada. Canadian Chronic Disease Surveillance System (CCDSS), Data Tool 2000–2017, 2019 Edition. Ottawa (ON): Public Health Agency of Canada; 2021. Available at: Canadian Chronic Disease Surveillance System (CCDSS) (canada.ca)

- Health Canada. Notice of Compliance Database. Government of Canada. Retrieved from: Notice of Compliance - Drug Products - Canada.ca.

- Statistics Canada. Table 11-10-0190-01 Market income, government transfers, total income, income tax and after-tax income by economic family type.

- World Health Organization. A10AE Insulins and analogues for injection, long-acting. Available at: WHOCC - ATC/DDD Index.

- Organisation for Economic Co-operation and Development. Dataset: Historical Population. Available at: https://stats.oecd.org/.

- pan-Canadian Pharmaceutical Alliance. Brand Name Drug Negotiations. Available at: https://www.pcpacanada.ca/negotiations

- GlobalData Healthcare database

Data limitations

Sales and spending reported in the drug sales and drug plan databases listed do not capture confidential price discounts. Price differentials and expenditure values may be overestimated or underestimated depending on these discounts in both Canadian and foreign markets. In addition, drug plan databases do not contain information on the reason a drug is prescribed. While most antidiabetic drugs are prescribed for treating diabetes, some drug classes may be used for other indications (see: Drug selection, above).

1. Diabetes Backgrounder

This section provides key information on the causes, diagnosis, and drug therapies for diabetes as well as the current prevalence and incidence of diabetes in Canada.

1.1 About diabetes mellitus: definition, diagnosis, and treatment

Figure description

This figure groups antidiabetic drug classes according to their use as first- or second-line therapies in the treatment of type 2 diabetes.

| Drug class | Treatment | Insulin/non-insulin | Category |

|---|---|---|---|

Metformin |

First line |

Non-insulin |

|

Other: Alpha-glucosidase inhibitors, Meglitinides, Sulfonylureas, Thiazolidinediones (TZDs) |

Second line |

Non-insulin |

|

SGLT-2: sodium-glucose cotransporter-2 inhibitors |

Second line |

Non-insulin |

New-generation |

DPP-4: dipeptidyl peptidase-4 inhibitors |

Second line |

Non-insulin |

New-generation |

GLP-1: glucagon-like peptide-1 receptor agonists |

Second line |

Non-insulin |

New-generation |

Insulins |

Second line |

Insulin |

|

Diabetes mellitus is a chronic condition associated with impairment of insulin secretion. Insulin is a hormone produced by the pancreas and is essential for regulating blood glucose (sugar) levels. Diabetes occurs when insulin levels are insufficient or when the body responds poorly to the insulin produced (insulin resistance). The goal of diabetes treatment is to regulate blood glucose to a healthy level. It is diagnosed and monitored by measuring the amount of glucose present in the patient’s bloodstream. Poorly regulated glucose levels can lead to major complications such as heart disease, vision loss, and kidney disease.

Diabetes falls predominantly under two types.Footnote i Type 1 diabetes is an autoimmune condition where the immune system destroys the insulin-producing cells found in the pancreas which can no longer produce sufficient insulin. It is usually diagnosed in childhood. There is no known cure and daily insulin injections are currently the only treatment option. In type 2 diabetes, the body is either unable to process insulin effectively or the pancreas does not produce enough insulin. It is considered preventable given its strong link to lifestyle risk factors (diet, activity, smoking), but there are other non-modifiable risk factors at play such as genetic predisposition and ethnicity. It is a condition that develops gradually over time and is primarily diagnosed in adults. However, recent years have seen an increase of the disease in adolescents and children, although they remain a very small proportion of overall cases.

Drug treatment for type 2 diabetes can be complex with many non-insulin drug options (see Figure 1.1 and Methods section for a detailed list). These may be prescribed as monotherapy or as various combination drug regimens. Metformin is generally considered the first-line choice for people with type 2 diabetes because of its safety, low cost, and possible heart benefits.Footnote 2 If optimal glucose levels are not reached, and prior to introducing insulin, a variety of second-line therapies are considered. Of these possible second-line therapies, the DPP-4’s, GLP-1’s, and SGLT-2’s are relatively recent additions (see Section 2) and are referred to as “new-generation/non-insulin” drugs throughout this report. Drug treatments are tailored according to each patient’s unique circumstances considering overall health, age, severity of disease, as well as the presence of co-morbidities such as heart disease and kidney function. In addition, the management of the overall drug load for patients with multiple chronic conditions presents unique challenges related to possible drug interactions and treatment adherence. This affects the dosing schedule and the choice of oral versus injectable forms. Only insulins and most GLP-1’s are injectable drugs. The remainder of antidiabetic drugs are oral solids. Semaglutide is the only GLP-1 sold as both an injectable (Ozempic) and an oral option (Rybelsus).

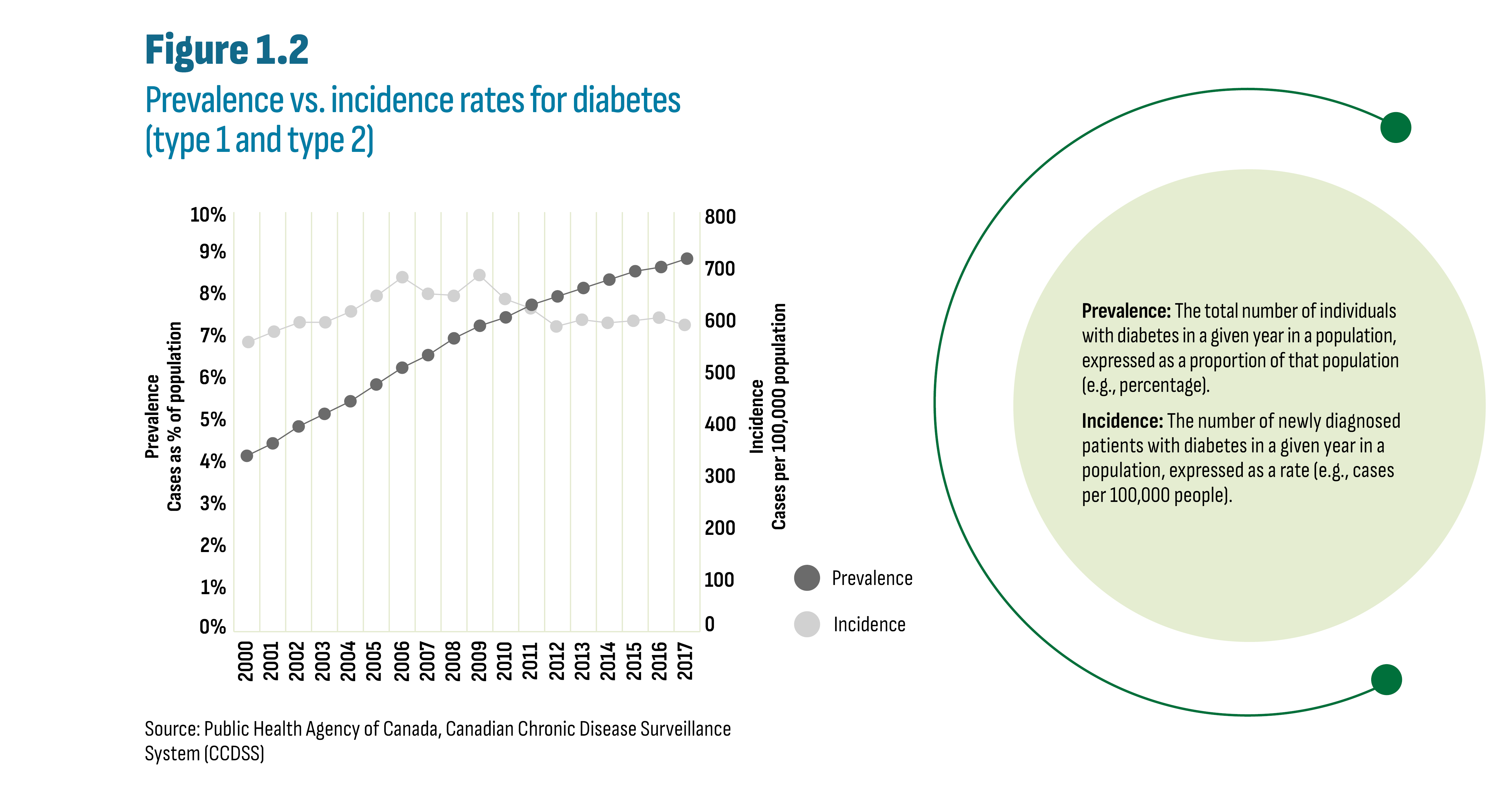

1.2 Diabetes prevalence and incidence

The Public Health Agency of Canada (PHAC) estimates that 8.9% of Canadians have been diagnosed with diabetes (over 3 million Canadians). Type 2 diabetes accounts for most cases (90%) followed by type 1 diabetes (9%) and gestational diabetes (1%). In addition, it estimates that 6.1% of adults (age 20 to 79) have prediabetes. PHAC provides data on incidence and prevalence of diabetes through the Canadian Chronic Disease Surveillance System (CCDSS). The data reported are for type 1 and type 2 diabetes combined and exclude gestational diabetes. As shown in Figure 1.2, diabetes prevalence has been steadily increasing over the past decades despite a slight drop in incidence. These trends may appear contradictory; however, improved treatment can increase survival, thus increasing the number of individuals living with diabetes in a given year.

Figure description

This line graph shows the trend in diabetes prevalence and diabetes incidence from 2000 to 2017.

| Year | Prevalence (cases as percentage of population) | Incidence (cases per 100,000 population) |

|---|---|---|

2000 |

4% |

554 |

2001 |

5% |

574 |

2002 |

5% |

592 |

2003 |

5% |

581 |

2004 |

6% |

613 |

2005 |

6% |

643 |

2006 |

6% |

679 |

2007 |

7% |

647 |

2008 |

7% |

644 |

2009 |

7% |

683 |

2010 |

8% |

637 |

2011 |

8% |

619 |

2012 |

8% |

584 |

2013 |

8% |

597 |

2014 |

8% |

591 |

2015 |

9% |

595 |

2016 |

9% |

601 |

2017 |

9% |

587 |

Source: Public Health Agency of Canada, Canadian Chronic Disease Surveillance System (CCDSS)

Prevalence: The total number of individuals with diabetes in a given year in a population, expressed as a proportion of that population (e.g., percentage).

Incidence: The number of newly diagnosed patients with diabetes in a given year in a population, expressed as a rate (e.g., cases per 100,000 people).

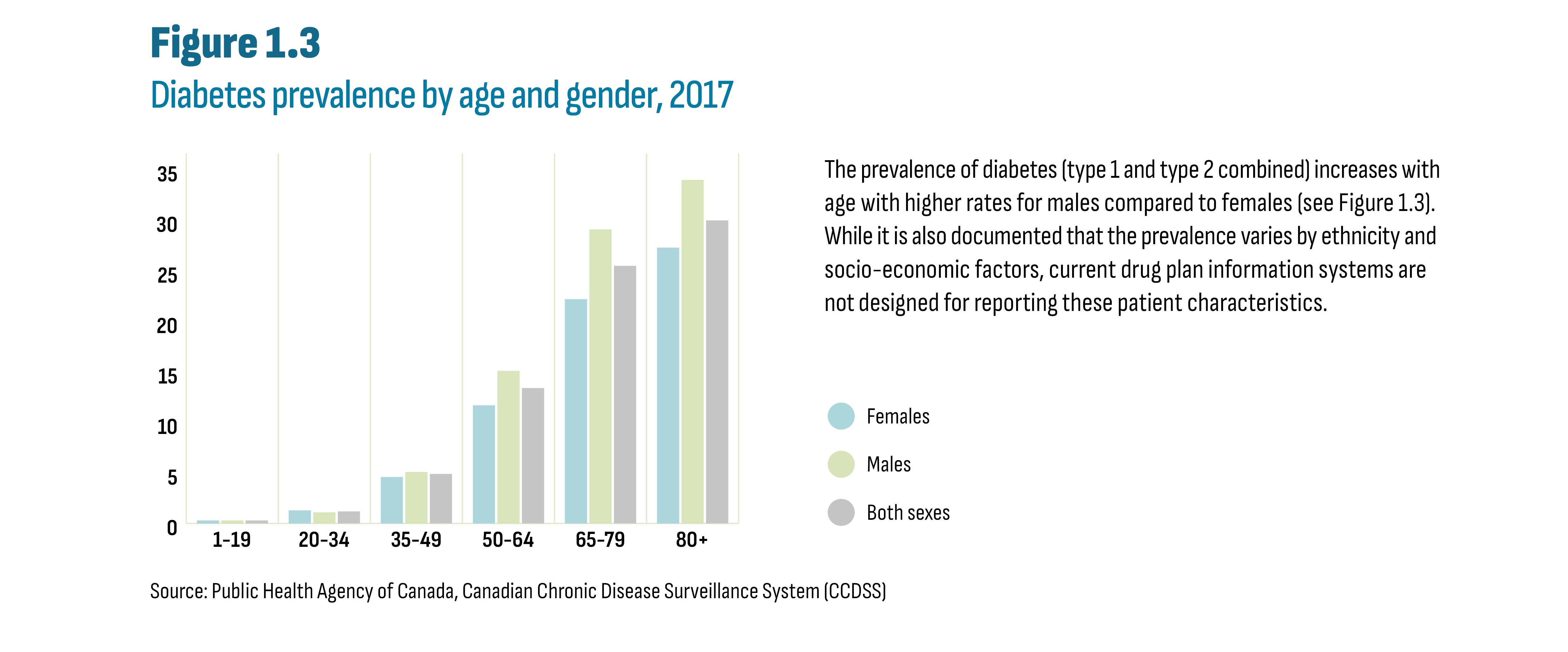

The prevalence of diabetes (type 1 and type 2 combined) increases with age with higher rates for males compared to females (see Figure 1.3). While it is also documented that the prevalence varies by ethnicity and socio-economic factors, current drug plan information systems are not designed for reporting these patient characteristics.

Figure description

This column graph shows diabetes prevalence by age group and gender in 2017.

Age group |

Both sexes |

Females |

Males |

1-19 |

0.3% |

0.3% |

0.3% |

20-34 |

1.2% |

1.3% |

1.1% |

35-49 |

4.9% |

4.6% |

5.1% |

50-64 |

13.4% |

11.7% |

15.1% |

65-79 |

25.5% |

22.2% |

29.1% |

80+ |

30.0% |

27.3% |

34.0% |

Source: Public Health Agency of Canada, Canadian Chronic Disease Surveillance System (CCDSS)

2. International Market Overview

This section situates new antidiabetic drugs within the Canadian regulatory and reimbursement landscape, beginning with the launch of the first new-generation/non-insulin drug sitagliptin (Januvia) in late 2007. The section begins with a timeline outlining the entry of the first brand of each drug. This is followed by an overview of the PMPRB’s classification of these drugs. The section ends with highlights of the advice from economic assessments and provincial negotiations and listing decisions.

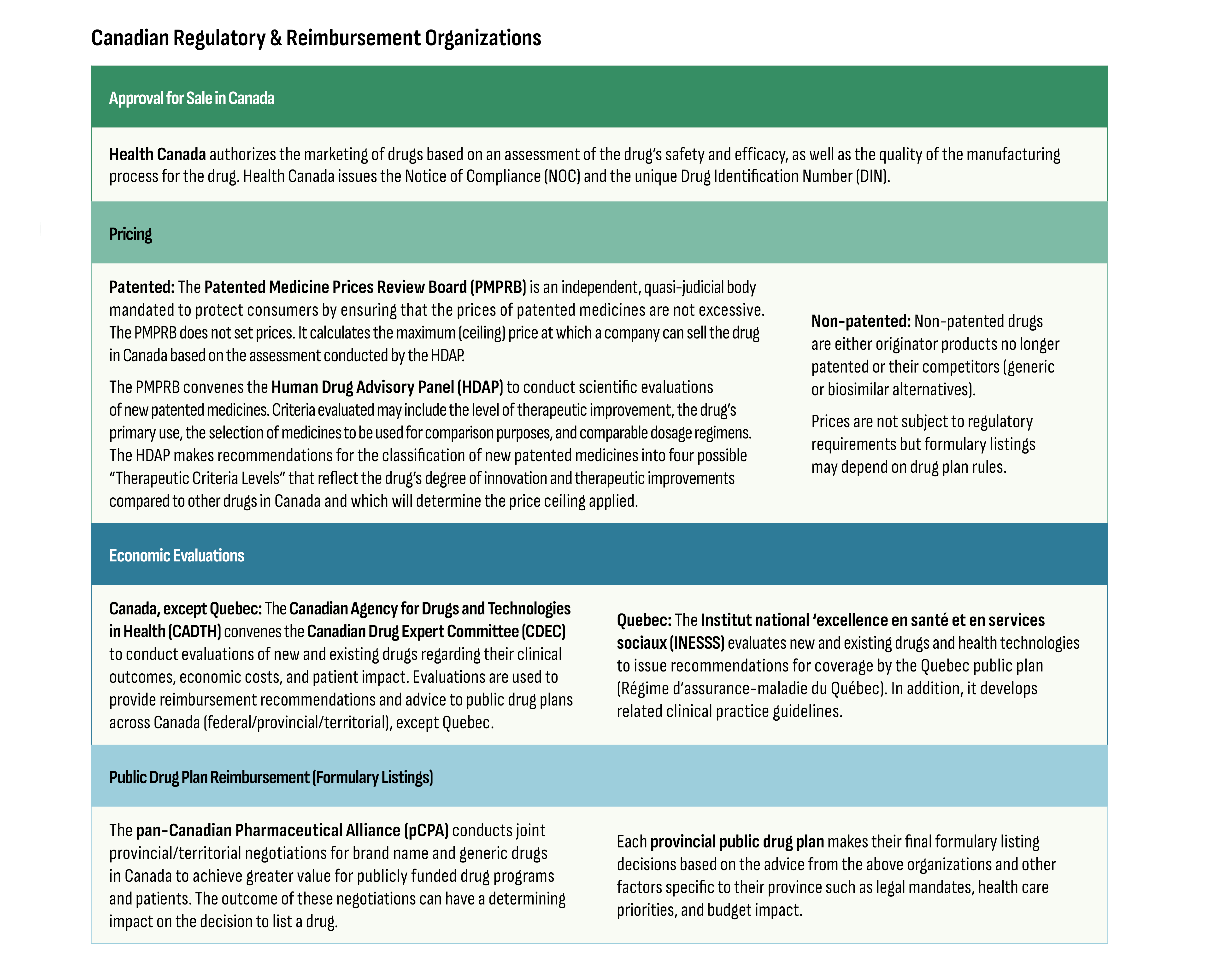

The text box Canadian Regulatory and Reimbursement Organizations describes the organizations involved in making drugs accessible to Canadians. Appendix B provides details on the decisions and advice by these organizations for all the drugs selected for this report.

Figure description

Approval for Sale in Canada

Health Canada authorizes the marketing of drugs based on an assessment of the drug’s safety and efficacy, as well as the quality of the manufacturing process for the drug. Health Canada issues the Notice of Compliance (NOC) and the unique Drug Identification Number (DIN).

Pricing

Patented: The Patented Medicine Prices Review Board (PMPRB) is an independent, quasi-judicial body mandated to protect consumers by ensuring that the prices of patented medicines are not excessive.The PMPRB does not set prices. It calculates the maximum (ceiling) price at which a company can sell the drug in Canada based on the assessment conducted by the HDAP.

The PMPRB convenes the Human Drug Advisory Panel (HDAP) to conduct scientific evaluationsof new patented medicines. Criteria evaluated may include the level of therapeutic improvement, the drug’s primary use, the selection of medicines to be used for comparison purposes, and comparable dosage regimens.The HDAP makes recommendations for the classification of new patented medicines into four possible“Therapeutic Criteria Levels” that reflect the drug’s degree of innovation and therapeutic improvements compared to other drugs in Canada and which will determine the price ceiling applied.

Non-patented: Non-patented drugs are either originator products no longer patented or their competitors (generic or biosimilar alternatives).

Prices are not subject to regulatory requirements but formulary listings may depend on drug plan rules.

Economic Evaluations

Canada, except Quebec: The Canadian Agency for Drugs and Technologies in Health (CADTH) convenes the Canadian Drug Expert Committee (CDEC) to conduct evaluations of new and existing drugs regarding their clinical outcomes, economic costs, and patient impact. Evaluations are used to provide reimbursement recommendations and advice to public drug plans across Canada (federal/provincial/territorial), except Quebec.

Quebec: The Institut national ‘excellence en santé et en services sociaux (INESSS) evaluates new and existing drugs and health technologies to issue recommendations for coverage by the Quebec public plan(Régime d’assurance-maladie du Québec). In addition, it develops related clinical practice guidelines.

Public Drug Plan Reimbursement (Formulary Listings)

The pan-Canadian Pharmaceutical Alliance (pCPA) conducts joint provincial/territorial negotiations for brand name and generic drugsin Canada to achieve greater value for publicly funded drug programs and patients. The outcome of these negotiations can have a determining impact on the decision to list a drug.

Each provincial public drug plan makes their final formulary listing decisions based on the advice from the above organizations and other factors specific to their province such as legal mandates, health care priorities, and budget impact.

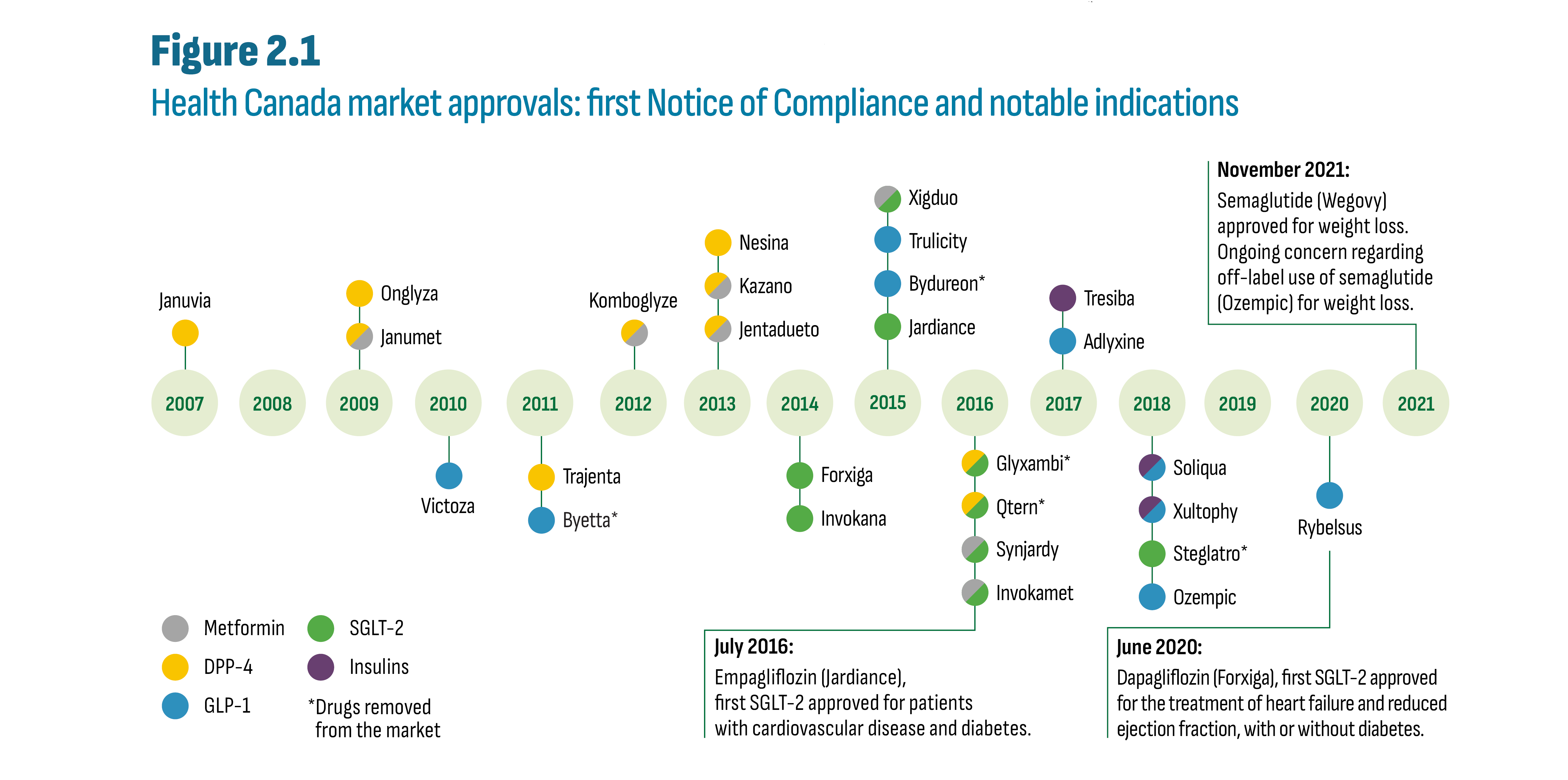

Figure 2.1 illustrates the timeline of the allocation of the first Notice of Compliance (NOC) by Health Canada for each new antidiabetic drug, beginning in 2007 with sitagliptin (Januvia), the first DPP-4. For simplicity, only brand names are provided in the figure. While all drugs shown in Figure 2.1 are indicated for diabetes, some acquired indications for other conditions or may be used off-label. The figure indicates instances where utilization may be significantly impacted and attributable to indications other than diabetes. Finally, except for insulin degludec (Tresiba), all drugs shown in Figure 2.1 are currently patented medicines.Footnote ii

Figure description

This figure shows the timeline of the granting of NOC for the first brand of each antidiabetic drug launched since 2007. Also shown are three notable new indications for three drugs as follows:

- July 2016: Empagliflozin (Jardiance), first SGLT-2 approved for patients with cardiovascular disease and diabetes.

- June 2020: Dapagliflozin (Forxiga), first SGLT-2 approved for the treatment of heart failure and reduced ejection fraction, with or without diabetes.

- November 2021: Semaglutide (Wegovy) approved for weight loss. Ongoing concern regarding off label use of semaglutide (Ozempic) for weight loss.

| Drug name | Chemical name(s) | Drug class | NOC date | Status |

|---|---|---|---|---|

Rybelsus |

Semaglutide |

GLP-1 |

30-Mar-20 |

Marketed |

Soliqua |

Insulin Glargine, Lixisenatide |

GLP-1/Insulin |

06-Jul-18 |

Marketed |

Xultophy |

Insulin Degludec, Liraglutide |

GLP-1/Insulin |

11-Apr-18 |

Marketed |

Steglatro |

Ertugliflozin |

SGLT-2 |

09-May-18 |

Cancelled Post-Market |

Ozempic |

Semaglutide |

GLP-1 |

04-Jan-18 |

Marketed |

Tresiba |

Insulin Degludec |

Insulin |

25-Aug-17 |

Marketed |

Adlyxine |

Lixisenatide |

GLP-1 |

25-May-17 |

Marketed |

Glyxambi |

Empagliflozin, Linagliptin |

SGLT-2/DPP-4 |

15-Dec-16 |

Cancelled Post-Market |

Synjardy |

Empagliflozin, Metformin |

SGLT-2/metformin |

29-Jul-16 |

Marketed |

Qtern |

Dapagliflozin, Saxagliptin |

SGLT-2/DPP-4 |

22-Nov-16 |

Cancelled Pre-Market |

Invokamet |

Canagliflozin, Metformin |

SGLT-2/metformin |

01-Jun-16 |

Marketed |

Xigduo |

Dapagliflozin, Metformin |

SGLT-2/metformin |

10-Dec-15 |

Marketed |

Trulicity |

Dulaglutide |

GLP-1 |

10-Nov-15 |

Marketed |

Bydureon |

Exenatide |

GLP-1 |

30-Oct-15 |

Cancelled Post-Market |

Jardiance |

Empagliflozin |

SGLT-2 |

23-Jul-15 |

Marketed |

Forxiga |

Dapagliflozin |

SGLT-2 |

12-Dec-14 |

Marketed |

Invokana |

Canagliflozin |

SGLT-2 |

23-May-14 |

Marketed |

Kazano |

Alogliptin, Metformin |

DPP-4/metformin |

27-Nov-13 |

Marketed |

Nesina |

Alogliptin |

DPP-4 |

27-Nov-13 |

Marketed |

Jentadueto |

Linagliptin, Metformin |

DPP-4/metformin |

07-Mar-13 |

Marketed |

Komboglyze |

Metformin, Saxagliptin |

DPP-4/metformin |

09-Jul-12 |

Marketed |

Trajenta |

Linagliptin |

DPP-4 |

28-Jul-11 |

Marketed |

Byetta |

Exenatide |

GLP-1 |

13-Jan-11 |

Cancelled Post-Market |

Victoza |

Liraglutide |

GLP-1 |

21-May-10 |

Marketed |

Janumet |

Metformin, Sitagliptin |

DPP-4/metformin |

24-Sep-09 |

Marketed |

Onglyza |

Saxagliptin |

DPP-4 |

14-Sep-09 |

Marketed |

Januvia |

Sitagliptin |

DPP-4 |

14-Dec-07 |

Marketed |

The PMPRB’s Human Drug Advisory Panel (HDAP) provides recommendations for the categorization of new products and the selection of comparable drug productsFootnote iii. Sitagliptin (Januvia) was not only the first DPP-4, but also the first new-generation/non-insulin product. It was classified as a Category 3 medicine (moderate, little or no therapeutic advantage) according to the guidelines in effect at the time. The HDAP compared Januvia to existing classes (α-glucosidase inhibitors, meglitinides, thiazolidinediones, and sulfonylureas) because there were no comparators within the same 4th level ATC class. Subsequent DPP-4’s and their metformin combinations received similar designations. Liraglutide (Victoza) was the first GLP-1 and was also classified as a Category 3 medicine. The HDAP recommended insulin glargine (Lantus) as the most appropriate comparator, stating that both would be prescribed similarly as second- or third-line therapy despite not sharing the same 4th level ATC class and despite the availability of DPP-4’s. Subsequent GLP-1 and insulin combinations and all SGLT-2’s (beginning with canagliflozin (Invokana) in 2014) were similarly classified as “slight or no therapeutic improvement” under the new (2010) guidelines. The HDAP included DPP-4’s and other oral agents as comparators in their evaluation of SGLT-2’s.

The initial review by the CADTH Canadian Drug Expert Committee (CDEC) of the first DPP-4 drugs (Januvia and Onglyza) resulted in a recommendation to provincial drugs plans to not list these drugs. By 2012, the beginning of the period analyzed in this report, the CDEC’s recommendation for all DPP-4’s was reimbursement with criteria (e.g., limited use). It then continued with this advice for all subsequent new-generation/non-insulin drugs including combination drugs with insulin (Soliqua, Xultophy) as well as insulin degludec (Tresiba). These reimbursement criteria consider failure on alternate therapies and contraindications (such as kidney function, heart-related risk factors, or inadequate blood glucose control on alternate drugs, typically metformin and/or sulfonylurea).Footnote 5

For the most part, provinces followed CADTH’s advice and listed DPP-4’s and SGLT-2’s with limited criteria, except for Ontario, which listed these drugs as open benefits. The two GLP-1’s, Adlyxine and Ozempic, were listed as full benefits in Ontario and with criteria in Alberta, Saskatchewan, and New Brunswick. No province listed Rybelsus. All provinces except British Columbia listed Tresiba as a full benefit. For the new combination GLP-1/ insulin drugs, no province listed Xultophy and Soliqua was listed as a full benefit in Ontario and with criteria in Saskatchewan.Footnote 6

3. Cost Drivers

Spending on antidiabetic drugs varies based on drug prices and utilization. Drug utilization, in turn, depends on factors discussed in Sections 1 and 2, such as drug options, drug access, and disease prevalence. Subsection 3.1 compares Canadian prices for a sample of top-selling antidiabetic drugs to the prices in the current PMPRB basket of 11 countries (PMPRB11), the former basket of 7 countries (PMPRB7), and across the OECD countries. Subsection 3.2 situates Canadian market trends among its international peers. Subsection 3.3 provides an extensive analysis of public (provincial) and private payers in Canada.

3.1 International price comparison

Top-selling drugs selected for price comparison

DPP-4

- Sitagliptin (Januvia/Janumet*)

- Linagliptin (Tradjenta/Jentadueto*)

SGLT-2

- Canagliflozin (Invokana)

- Empagliflozin (Jardiance)

GLP-1

- Semaglutide (Ozempic)

- Liraglutide (Victoza)

Insulin

- Insulin degludec (Tresiba)

* Janumet and Jentadueto are the related ingredient combinations with metformin.

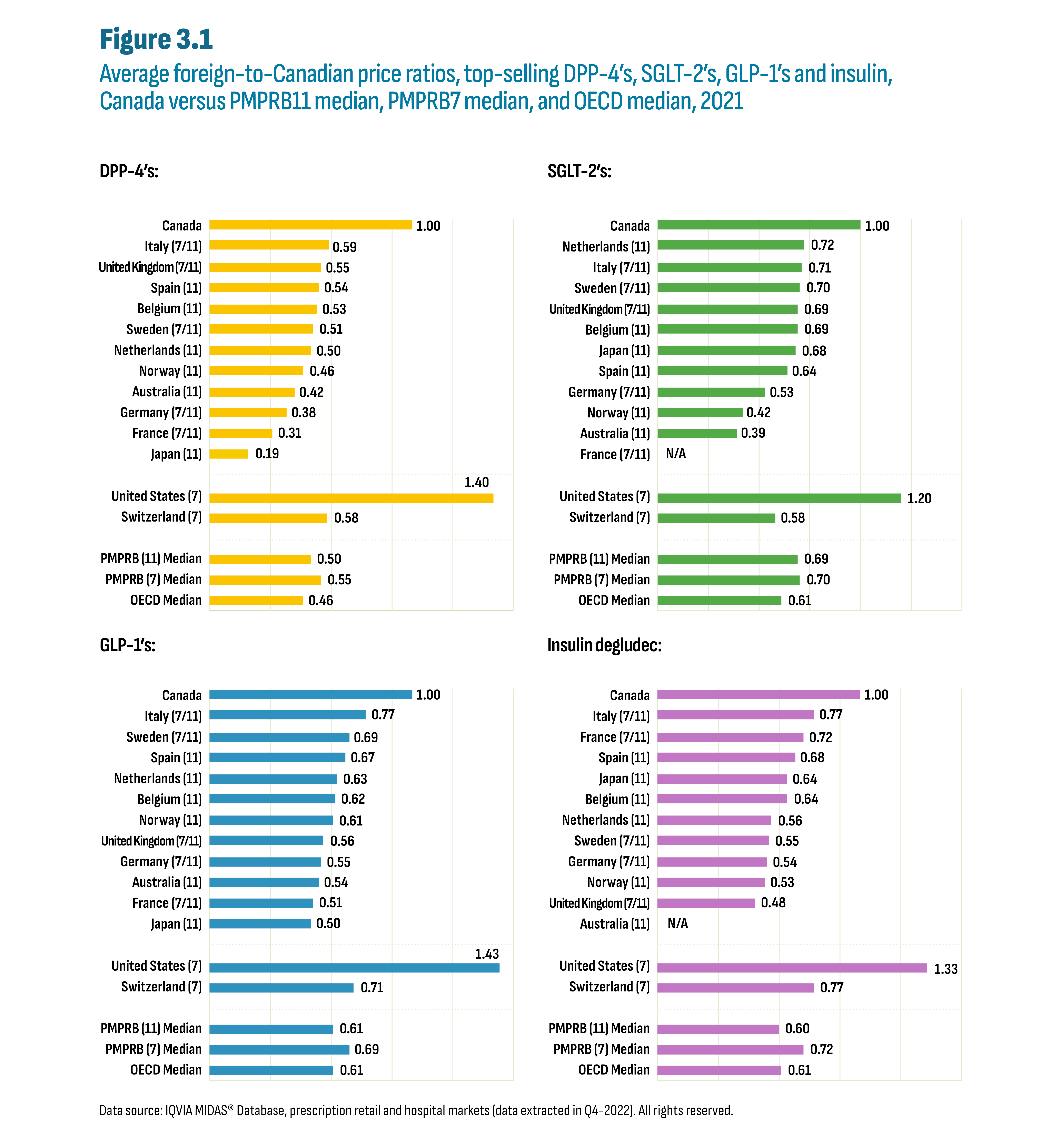

International prices are compared by calculating the ratio of the foreign price divided by the Canadian priceFootnote iv. For each ratio, the Canadian price is set to one and the corresponding foreign prices are determined to be either higher than (above) or lower than (below) this level. The average price ratios are calculated using sales-weighted arithmetic means of price ratios obtained for the top-selling drugs in the DPP-4, SGLT-2, and GLP-1 subclasses. This ratio was also calculated for insulin degludec (Tresiba), the only new insulin product launched in Canada over the last decade. It is worth noting that insulin degludec was never subject to PMPRB reporting due its patent lapsing before receiving its NOC (see Section 2).

Figure 3.1 reports foreign-to-Canadian price ratios in 2021 for the PMPRB11 countries as well as Switzerland and the United States, which were part of the PMPRB7 list of comparator countries. The median for the PMPRB11, the PMPRB7, and OECD countries are provided at the bottom of each graph. The prices of the selected products in the PMPRB11 countries were 30% to 50% lower than the Canadian prices. Italy was most often second to Canada with ratios ranging from 0.59 for the DPP-4’s to 0.77 for the GLP-1’s and insulin degludec. The median PMPRB11-to-Canadian price ratio was 0.50 for DPP-4’s, 0.69 for SGLT-2’s, 0.61 for GLP-1’s, and 0.60 for insulin degludec. The OECD-to-Canadian price ratio followed a similar trend.

Figure description

This figure consists of four separate bar graphs showing the average foreign-to-Canadian price ratios for top-selling drugs by country. There is one bar graph for each drug class: DPP-4’s, SGLT-2’s, GLP-1’s and insulin degludec. The graphs also indicate whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses.

| DPP-4’s | SGLT-2’s | GLP-1’s | Insulin degludec | ||||

|---|---|---|---|---|---|---|---|

Canada |

1.00 |

Canada |

1.00 |

Canada |

1.00 |

Canada |

1.00 |

Italy (7/11) |

0.59 |

Netherlands (11) |

0.72 |

Italy (7/11) |

0.77 |

Italy (7/11) |

0.77 |

United Kingdom (7/11) |

0.55 |

Italy (7/11) |

0.71 |

Sweden (7/11) |

0.69 |

France (7/11) |

0.72 |

Spain (11) |

0.54 |

Sweden (7/11) |

0.70 |

Spain (11) |

0.67 |

Spain (11) |

0.68 |

Belgium (11) |

0.53 |

United Kingdom (7/11) |

0.69 |

Netherlands (11) |

0.63 |

Japan (11) |

0.64 |

Sweden (7/11) |

0.51 |

Belgium (11) |

0.69 |

Belgium (11) |

0.62 |

Belgium (11) |

0.64 |

Netherlands (11) |

0.50 |

Japan (11) |

0.68 |

Norway (11) |

0.61 |

Netherlands (11) |

0.56 |

Norway (11) |

0.46 |

Spain (11) |

0.64 |

United Kingdom (7/11) |

0.56 |

Sweden (7/11) |

0.55 |

Australia (11) |

0.42 |

Germany (7/11) |

0.53 |

Germany (7/11) |

0.55 |

Germany (7/11) |

0.54 |

Germany (7/11) |

0.38 |

Norway (11) |

0.42 |

Australia (11) |

0.54 |

Norway (11) |

0.53 |

France (7/11) |

0.31 |

Australia (11) |

0.39 |

France (7/11) |

0.51 |

United Kingdom (7/11) |

0.48 |

Japan (11) |

0.19 |

France (7/11) |

N/A |

Japan (11) |

0.50 |

Australia (11) |

N/A |

United States (7) |

1.40 |

United States (7) |

1.20 |

United States (7) |

1.43 |

United States (7) |

1.33 |

Switzerland (7) |

0.58 |

Switzerland (7) |

0.58 |

Switzerland (7) |

0.71 |

Switzerland (7) |

0.77 |

PMPRB (11) Median |

0.50 |

PMPRB (11) Median |

0.69 |

PMPRB (11) Median |

0.61 |

PMPRB (11) Median |

0.60 |

PMPRB (7) Median |

0.55 |

PMPRB (7) Median |

0.70 |

PMPRB (7) Median |

0.69 |

PMPRB (7) Median |

0.72 |

OECD Median |

0.46 |

OECD Median |

0.61 |

OECD Median |

0.61 |

OECD Median |

0.61 |

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

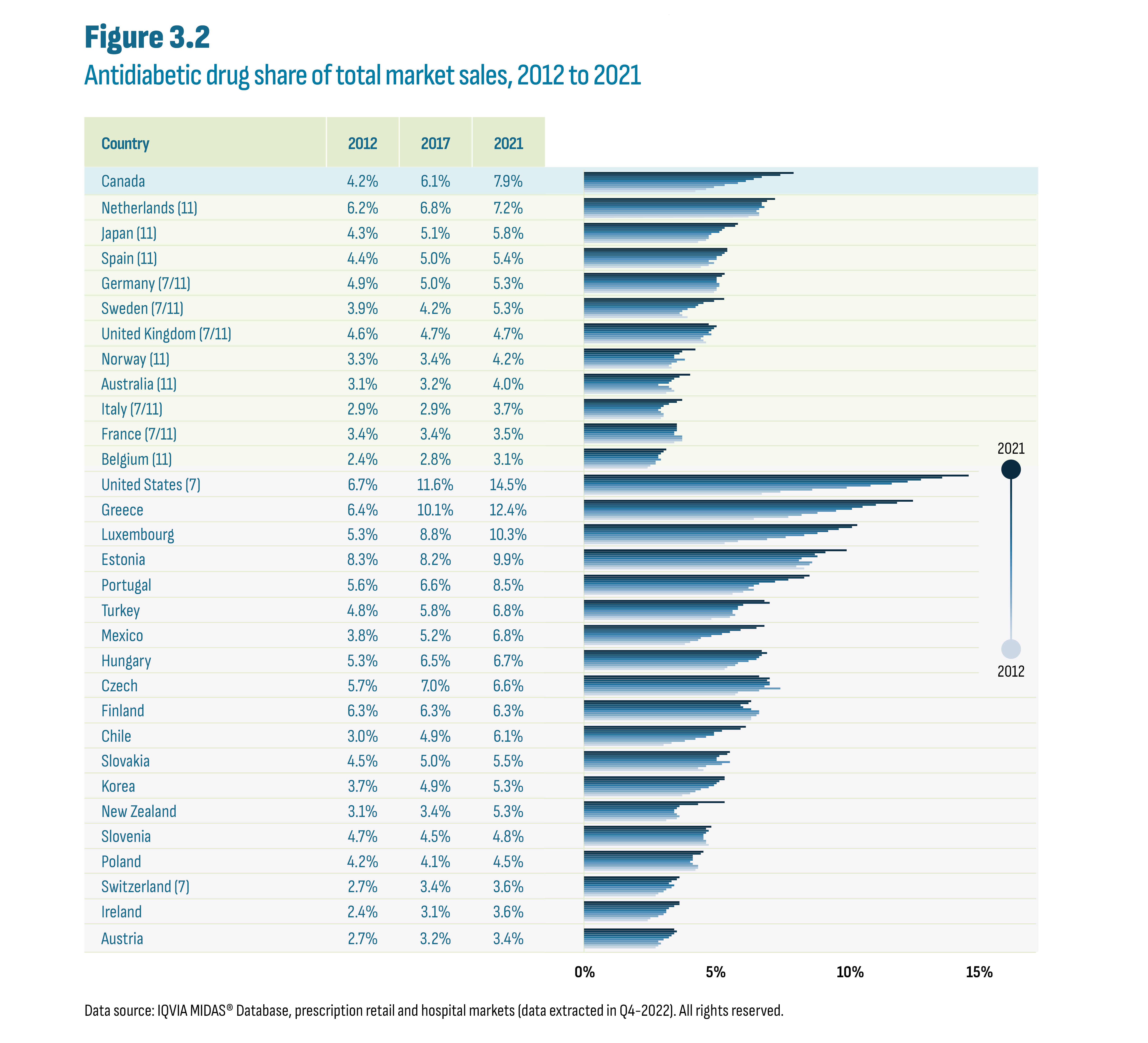

3.2 International markets

Sales of antidiabetic drugs in all OECD countries have outpaced sales growth in the overall drug market, resulting in a growth in market share for antidiabetic drugs over the last decade (see Figure 3.2). This growth in market share was predominantly the result of the increased utilization of new-generation/non-insulin drugs. International market share comparisons in any given year have limitations due to market-specific factors in each country. However, the overall level and growth of these market shares are indicative of shared challenges in diabetes management.

The Canadian market share for antidiabetic drugs relative to the overall drug market in 2021 (7.9%) was the highest among the PMPRB11, almost doubling from 2012 (4.2%). While the PMPRB11 countries also saw an increase in share since 2012, the growth in spending for antidiabetic drugs was more in line with the general growth of their respective domestic drug markets. For the PMPRB11 countries, the market share increase during this period was comparatively modest. Outside the PMPRB11, the US stood out among OECD countries with the highest market share for antidiabetic drugs in 2021 (14.5%) nearly doubling from its already significant share in 2012 (6.7%). Greece came in second with a 12.4% share in 2021.

Figure description

This figure shows a bar graph of the antidiabetic drug share of the total market by country and by year from 2012 to 2021. The figure also indicates whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses.

| Country | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

Canada |

4.2% |

4.6% |

4.9% |

5.3% |

5.8% |

6.1% |

6.4% |

6.7% |

7.4% |

7.9% |

Netherlands (11) |

6.2% |

6.6% |

6.6% |

6.5% |

6.6% |

6.8% |

6.7% |

6.7% |

6.9% |

7.2% |

Japan (11) |

4.3% |

4.6% |

4.7% |

4.7% |

4.8% |

5.1% |

5.2% |

5.3% |

5.7% |

5.8% |

Spain (11) |

4.4% |

4.7% |

4.9% |

4.7% |

5.0% |

5.0% |

5.2% |

5.3% |

5.4% |

5.4% |

Germany (7/11) |

4.9% |

5.0% |

5.0% |

5.1% |

5.1% |

5.0% |

5.0% |

5.0% |

5.2% |

5.3% |

Sweden (7/11) |

3.9% |

3.7% |

3.6% |

3.7% |

3.9% |

4.2% |

4.3% |

4.5% |

4.9% |

5.3% |

United Kingdom (7/11) |

4.6% |

4.5% |

4.4% |

4.5% |

4.8% |

4.7% |

4.8% |

4.9% |

5.0% |

4.7% |

Norway (11) |

3.3% |

3.2% |

3.3% |

3.5% |

3.8% |

3.4% |

3.4% |

3.6% |

3.7% |

4.2% |

Australia (11) |

3.1% |

3.4% |

3.3% |

3.2% |

2.8% |

3.2% |

3.3% |

3.4% |

3.6% |

4.0% |

Italy (7/11) |

2.9% |

3.0% |

3.0% |

2.9% |

2.8% |

2.9% |

3.0% |

3.2% |

3.5% |

3.7% |

France (7/11) |

3.4% |

3.7% |

3.7% |

3.7% |

3.4% |

3.4% |

3.5% |

3.5% |

3.5% |

3.5% |

Belgium (11) |

2.4% |

2.5% |

2.7% |

2.7% |

2.9% |

2.8% |

2.8% |

2.9% |

3.0% |

3.1% |

United States (7) |

6.7% |

7.4% |

8.6% |

9.9% |

10.8% |

11.6% |

12.2% |

12.7% |

13.5% |

14.5% |

Greece |

6.4% |

7.7% |

8.2% |

8.8% |

9.5% |

10.1% |

10.5% |

11.0% |

11.8% |

12.4% |

Luxembourg |

5.3% |

5.8% |

6.9% |

7.6% |

8.3% |

8.8% |

9.2% |

9.6% |

10.1% |

10.3% |

Estonia |

8.3% |

8.0% |

8.5% |

8.6% |

8.1% |

8.2% |

8.8% |

8.7% |

9.1% |

9.9% |

Portugal |

5.6% |

6.0% |

6.4% |

6.2% |

6.4% |

6.6% |

7.2% |

7.7% |

8.3% |

8.5% |

Turkey |

4.8% |

5.5% |

5.7% |

5.6% |

5.6% |

5.8% |

5.8% |

6.0% |

7.0% |

6.8% |

Mexico |

3.8% |

4.0% |

4.3% |

4.4% |

4.8% |

5.2% |

5.5% |

5.9% |

6.5% |

6.8% |

Hungary |

5.3% |

5.4% |

5.7% |

5.8% |

6.2% |

6.5% |

6.6% |

6.7% |

6.9% |

6.7% |

Czech |

5.7% |

5.8% |

6.6% |

7.4% |

6.8% |

7.0% |

7.0% |

6.9% |

7.0% |

6.6% |

Finland |

6.3% |

6.3% |

6.5% |

6.6% |

6.6% |

6.3% |

6.0% |

5.9% |

6.2% |

6.3% |

Chile |

3.0% |

3.3% |

3.8% |

4.2% |

4.6% |

4.9% |

4.9% |

5.2% |

5.9% |

6.1% |

Slovakia |

4.5% |

4.3% |

4.6% |

5.2% |

5.5% |

5.0% |

5.0% |

5.1% |

5.4% |

5.5% |

Korea |

3.7% |

4.0% |

4.2% |

4.4% |

4.7% |

4.9% |

5.0% |

5.1% |

5.3% |

5.3% |

New Zealand |

3.1% |

3.5% |

3.6% |

3.5% |

3.4% |

3.4% |

3.5% |

3.6% |

4.3% |

5.3% |

Slovenia |

4.7% |

4.6% |

4.6% |

4.5% |

4.5% |

4.5% |

4.6% |

4.7% |

4.6% |

4.8% |

Poland |

4.2% |

4.3% |

4.3% |

4.1% |

4.0% |

4.1% |

4.1% |

4.1% |

4.4% |

4.5% |

Switzerland (7) |

2.7% |

2.8% |

3.0% |

3.1% |

3.3% |

3.4% |

3.2% |

3.3% |

3.5% |

3.6% |

Ireland |

2.4% |

2.5% |

2.8% |

3.0% |

3.1% |

3.1% |

3.2% |

3.4% |

3.6% |

3.6% |

Austria |

2.7% |

2.8% |

2.9% |

2.8% |

3.0% |

3.2% |

3.3% |

3.4% |

3.5% |

3.4% |

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

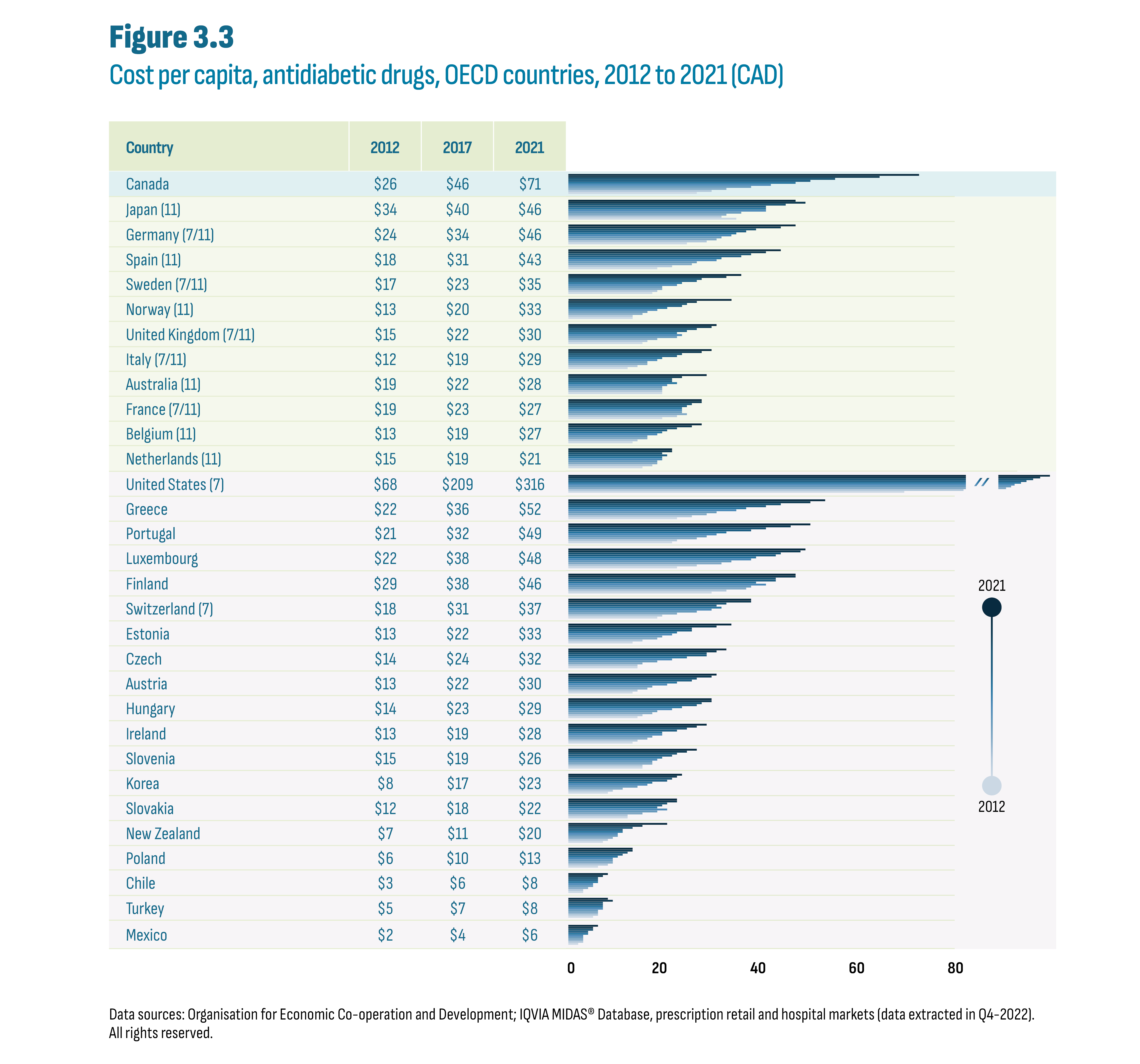

The cost increases resulted in cost per capita increases over the same period, most notably in the latter years. In 2021, Canada had the highest cost per capita ($71) of the PMPRB11, ahead of Japan ($46), Germany ($46), and Spain ($43) (Figure 3.3). Among OECD countries, Canada was a distant second to the US ($316) but ahead of the next highest countries beginning with Greece ($52) and was more than double the median for both the OECD ($30) and PMPRB11 ($30).

Figure description

This figure shows a bar graph of the cost per capita in Canadian dollars for antidiabetic drugs by country and by year from 2012 to 2021. The figure also indicates whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses.

| Country | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

Canada |

$26 |

$29 |

$32 |

$37 |

$41 |

$46 |

$49 |

$54 |

$63 |

$71 |

Japan (11) |

$34 |

$31 |

$32 |

$35 |

$40 |

$40 |

$40 |

$44 |

$48 |

$46 |

Germany (7/11) |

$24 |

$28 |

$30 |

$31 |

$33 |

$34 |

$36 |

$38 |

$43 |

$46 |

Spain (11) |

$18 |

$21 |

$25 |

$26 |

$30 |

$31 |

$35 |

$37 |

$40 |

$43 |

Sweden (7/11) |

$17 |

$18 |

$19 |

$19 |

$22 |

$23 |

$26 |

$27 |

$32 |

$35 |

Norway (11) |

$13 |

$13 |

$15 |

$16 |

$18 |

$20 |

$23 |

$24 |

$26 |

$33 |

United Kingdom (7/11) |

$15 |

$16 |

$18 |

$22 |

$23 |

$22 |

$24 |

$26 |

$29 |

$30 |

Italy (7/11) |

$12 |

$14 |

$16 |

$16 |

$18 |

$19 |

$22 |

$23 |

$27 |

$29 |

Australia (11) |

$19 |

$19 |

$19 |

$19 |

$20 |

$22 |

$21 |

$21 |

$23 |

$28 |

France (7/11) |

$19 |

$22 |

$24 |

$23 |

$23 |

$23 |

$24 |

$25 |

$27 |

$27 |

Belgium (11) |

$13 |

$14 |

$16 |

$16 |

$18 |

$19 |

$20 |

$22 |

$25 |

$27 |

Netherlands (11) |

$15 |

$17 |

$18 |

$18 |

$19 |

$19 |

$20 |

$19 |

$21 |

$21 |

United States (7) |

$68 |

$80 |

$112 |

$167 |

$196 |

$209 |

$232 |

$259 |

$291 |

$316 |

Greece |

$22 |

$25 |

$28 |

$30 |

$34 |

$36 |

$40 |

$43 |

$49 |

$52 |

Portugal |

$21 |

$22 |

$26 |

$28 |

$30 |

$32 |

$37 |

$40 |

$45 |

$49 |

Luxembourg |

$22 |

$26 |

$31 |

$33 |

$37 |

$38 |

$42 |

$43 |

$47 |

$48 |

Finland |

$29 |

$32 |

$36 |

$37 |

$40 |

$38 |

$42 |

$42 |

$46 |

$46 |

Switzerland (7) |

$18 |

$19 |

$22 |

$26 |

$29 |

$31 |

$30 |

$32 |

$37 |

$37 |

Estonia |

$13 |

$15 |

$18 |

$19 |

$21 |

$22 |

$25 |

$25 |

$30 |

$33 |

Czech |

$14 |

$14 |

$15 |

$18 |

$21 |

$24 |

$28 |

$28 |

$30 |

$32 |

Austria |

$13 |

$14 |

$16 |

$17 |

$20 |

$22 |

$25 |

$26 |

$29 |

$30 |

Hungary |

$14 |

$15 |

$17 |

$18 |

$21 |

$23 |

$26 |

$27 |

$29 |

$29 |

Ireland |

$13 |

$14 |

$16 |

$17 |

$19 |

$19 |

$22 |

$24 |

$26 |

$28 |

Slovenia |

$15 |

$15 |

$17 |

$17 |

$18 |

$19 |

$21 |

$22 |

$24 |

$26 |

Korea |

$8 |

$9 |

$11 |

$14 |

$16 |

$17 |

$20 |

$21 |

$22 |

$23 |

Slovakia |

$12 |

$12 |

$15 |

$18 |

$20 |

$18 |

$19 |

$20 |

$22 |

$22 |

New Zealand |

$7 |

$8 |

$9 |

$10 |

$10 |

$11 |

$11 |

$13 |

$15 |

$20 |

Poland |

$6 |

$8 |

$9 |

$9 |

$9 |

$10 |

$11 |

$12 |

$13 |

$13 |

Chile |

$3 |

$3 |

$4 |

$5 |

$5 |

$6 |

$6 |

$6 |

$7 |

$8 |

Turkey |

$5 |

$6 |

$6 |

$6 |

$7 |

$7 |

$7 |

$7 |

$9 |

$8 |

Mexico |

$2 |

$3 |

$3 |

$3 |

$3 |

$4 |

$4 |

$5 |

$5 |

$6 |

Data sources: Organisation for Economic Co-operation and Development; IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

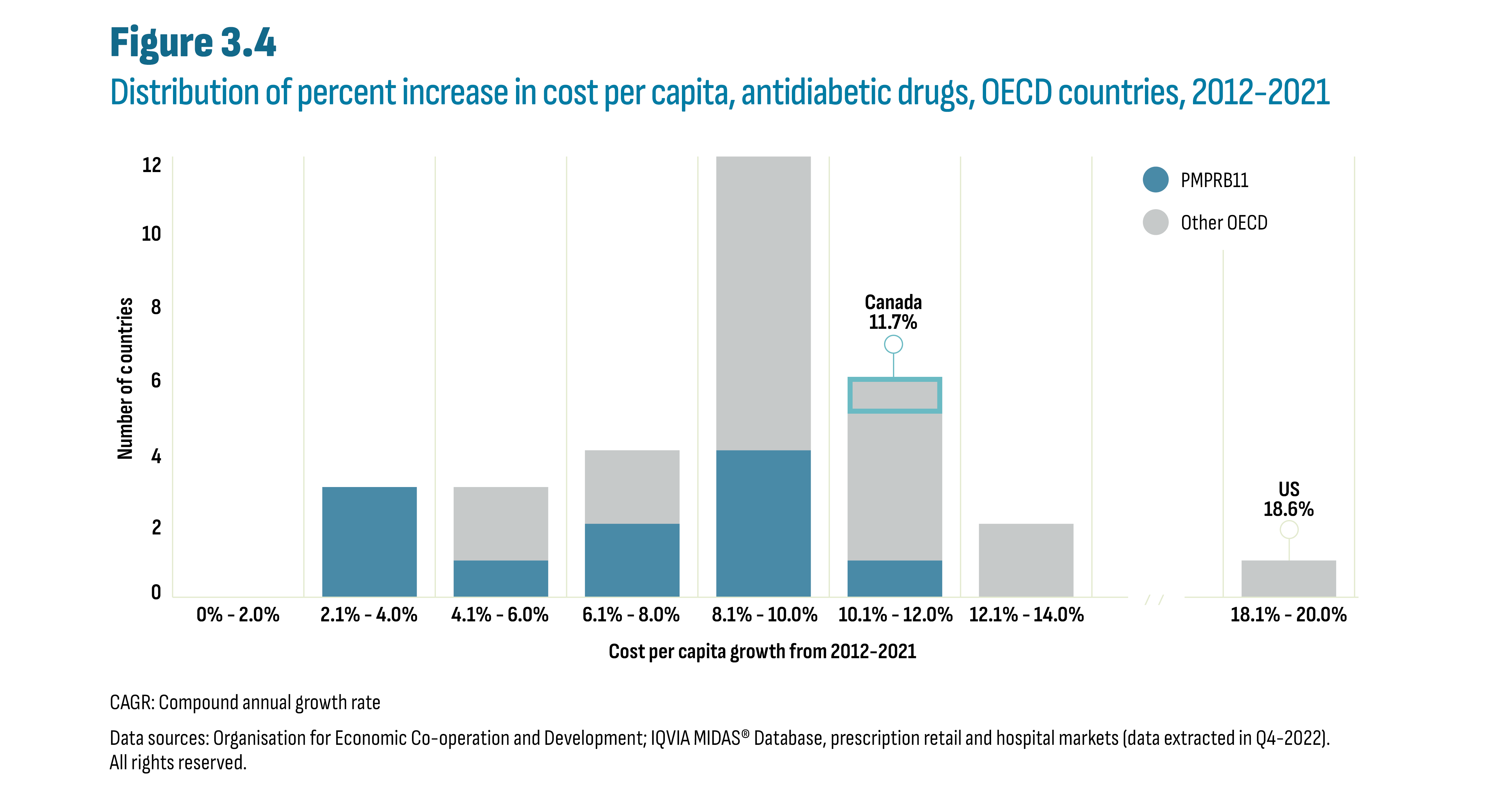

While the cost per capita increased in all OECD countries (Figure 3.3), the key difference among countries is the size of this increase. Figure 3.4 shows the distribution of all OECD countries according to their respective percent increase in cost per capita since 2012. Each category on the horizontal axis displays a compound annual growth rate (CAGR) range in cost per capita from the smallest change observed (0% to 2.0%) to the largest (18.1% to 20.0%). Three PMPRB11 countries experienced increases below 4% in cost per capita: Japan (3.5%); the Netherlands (3.6%); and France (3.9%). An 8% CAGR represents a doubling in the cost per capita over this period and four countries were in this range: the UK (7.6%); Sweden (8.2%); Hungary (8.4%); and Switzerland (8.4%). Overall, two-thirds of countries had increase over 8%, including Canada (11.7%). The PMPRB11 was split with 5 countries below 8% and 6 above while other OECD more often saw increases above 8% (15 versus 4 countries).

Figure description

This is a stacked column graph that shows the distribution of all OECD countries according to their respective percent increase in cost per capita over the 2012 to 2021 period. The number of countries is provided for each increment of 2 percentage points: 0% to 2.0%, 2.1% to 4.0%, and so on. The graph highlights that the compound annual growth rate or CAGR for Canada was 11.7% and for the United States was 18.6%.

| Cost per Capita Growth (CAGR) from 2012-2021 | Number of countries | ||

|---|---|---|---|

| PMPRB11 | Other OECD | Canada | |

0% - 2.0% |

0 |

0 |

|

2.1% - 4.0% |

3 |

0 |

|

4.1% - 6.0% |

1 |

2 |

|

6.1% - 8.0% |

2 |

2 |

|

8.1% - 10.0% |

4 |

8 |

|

10.1% - 12.0% |

1 |

4 |

1 |

12.1% - 14.0% |

0 |

2 |

|

/ / |

|

||

18.1% - 20.0% |

0 |

1 |

|

CAGR: Compound annual growth rate

Data sources: Organisation for Economic Co-operation and Development; IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

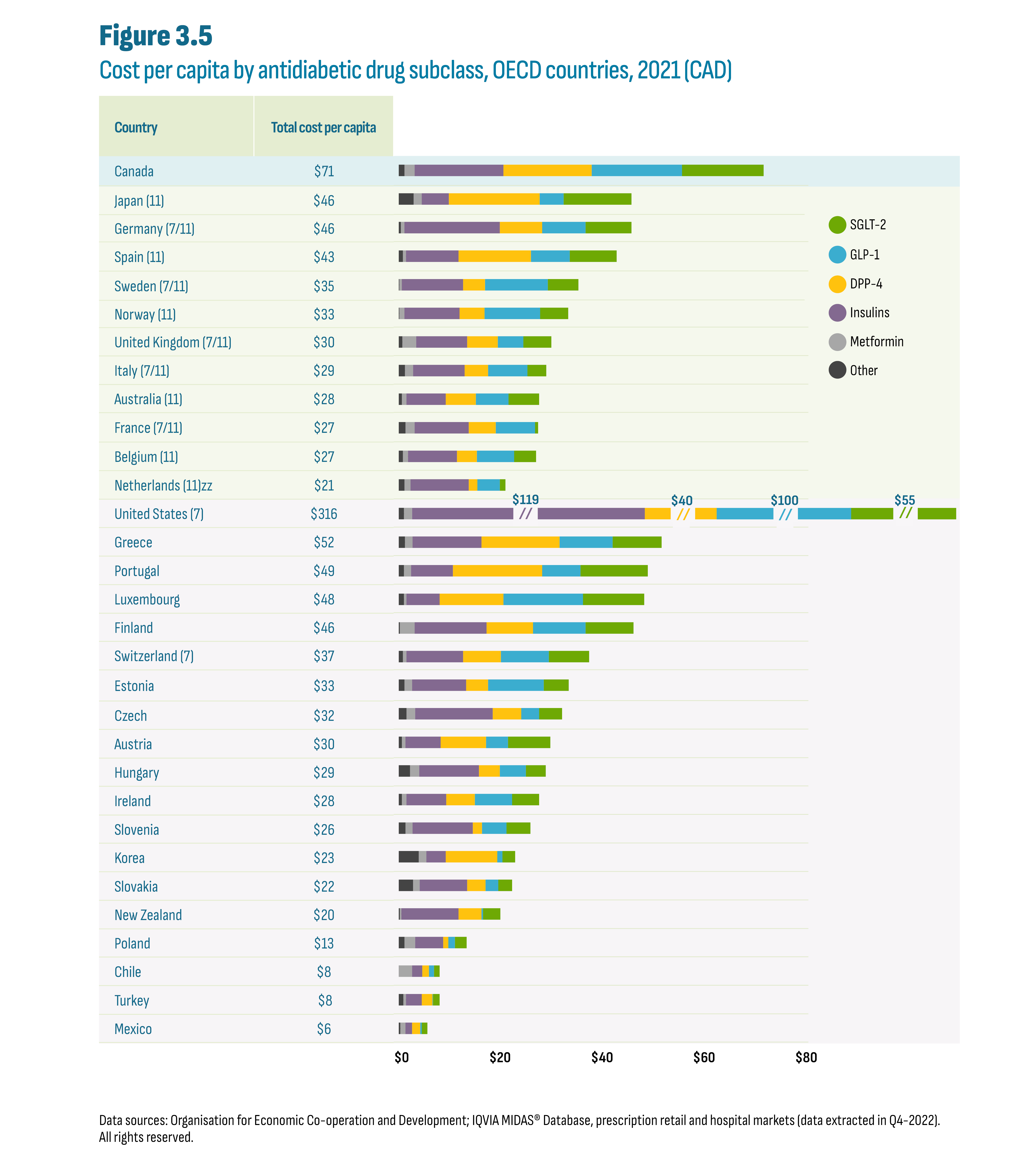

Growth in cost per capita, regardless of scale, was driven by shifts in prescribing toward the new-generation/non-insulin drugs as further detailed below. It is also worth noting that the US experienced substantial increases in insulin prices over the last decade, particularly in the first half. Figure 3.5 divides the 2021 cost per capita by subclass. While the overall cost per capita varies across countries, the subclass distributions are similar and illustrate the relative importance of the new-generation/non-insulin subclasses (DPP-4, GLP-1, SGLT-2).

Figure description

This figure shows a horizontal stacked bar graph of the 2021 cost per capita in Canadian dollars for antidiabetic drugs by country and by drug subclass. The total cost per capita is indicated for each country. The figure also indicates whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses. The horizontal axis for cost per capita ranges from $0 to $80. The United States bars for Insulins, DPP-4, GLP-1, and SGLT-2 are broken to fit the graph due to their relative size. For the United States, cost per capita subtotals are shown above the broken bars for the subclasses of Insulins ($119); DPP-4 ($40); GLP-1 ($100) and SGLT-2 ($55).

| Country | Total cost per capita | Other | Metformin | Insulins | DPP-4 | GLP-1 | SGLT-2 |

|---|---|---|---|---|---|---|---|

Canada |

$71 |

$1.1 |

$2.0 |

$17.4 |

$17.3 |

$17.7 |

$16.0 |

Japan (11) |

$46 |

$2.9 |

$1.6 |

$5.3 |

$17.8 |

$4.7 |

$13.3 |

Germany (7/11) |

$46 |

$0.4 |

$0.7 |

$18.7 |

$8.3 |

$8.5 |

$9.0 |

Spain (11) |

$43 |

$0.8 |

$0.6 |

$10.3 |

$14.2 |

$7.6 |

$9.2 |

Sweden (7/11) |

$35 |

$0.1 |

$0.5 |

$12.0 |

$4.3 |

$12.3 |

$6.0 |

Norway (11) |

$33 |

$0.1 |

$1.0 |

$10.8 |

$4.9 |

$10.9 |

$5.5 |

United Kingdom (7/11) |

$30 |

$0.7 |

$2.7 |

$10.0 |

$6.0 |

$5.0 |

$5.5 |

Italy (7/11) |

$29 |

$1.2 |

$1.6 |

$10.1 |

$4.6 |

$7.7 |

$3.7 |

Australia (11) |

$28 |

$0.6 |

$0.9 |

$7.7 |

$5.9 |

$6.4 |

$6.0 |

France (7/11) |

$27 |

$1.3 |

$1.8 |

$10.6 |

$5.3 |

$7.7 |

$0.6 |

Belgium (11) |

$27 |

$0.8 |

$1.0 |

$9.6 |

$3.9 |

$7.3 |

$4.3 |

Netherlands (11) |

$21 |

$1.1 |

$1.2 |

$11.4 |

$1.7 |

$4.4 |

$1.1 |

United States (7) |

$316 |

$1.0 |

$1.6 |

$118.5 |

$39.8 |

$99.9 |

$54.7 |

Greece |

$52 |

$1.2 |

$1.5 |

$13.5 |

$15.3 |

$10.4 |

$9.6 |

Portugal |

$49 |

$1.0 |

$1.4 |

$8.2 |

$17.5 |

$7.5 |

$13.2 |

Luxembourg |

$48 |

$1.0 |

$0.5 |

$6.5 |

$12.5 |

$15.6 |

$12.0 |

Finland |

$46 |

$0.2 |

$2.9 |

$14.1 |

$9.1 |

$10.3 |

$9.4 |

Switzerland (7) |

$37 |

$0.8 |

$0.7 |

$11.1 |

$7.4 |

$9.4 |

$7.9 |

Estonia |

$33 |

$1.1 |

$1.5 |

$10.6 |

$4.3 |

$10.9 |

$4.9 |

Czech |

$32 |

$1.5 |

$1.7 |

$15.2 |

$5.6 |

$3.5 |

$4.5 |

Austria |

$30 |

$0.6 |

$0.7 |

$6.9 |

$8.9 |

$4.3 |

$8.3 |

Hungary |

$29 |

$2.2 |

$1.8 |

$11.7 |

$4.1 |

$5.1 |

$3.9 |

Ireland |

$28 |

$0.6 |

$0.9 |

$7.8 |

$5.6 |

$7.3 |

$5.3 |

Slovenia |

$26 |

$1.3 |

$1.4 |

$11.8 |

$1.8 |

$4.8 |

$4.7 |

Korea |

$23 |

$3.9 |

$1.5 |

$3.8 |

$10.1 |

$1.0 |

$2.5 |

Slovakia |

$22 |

$2.8 |

$1.3 |

$9.3 |

$3.6 |

$2.5 |

$2.7 |

New Zealand |

$20 |

$0.2 |

$0.3 |

$11.2 |

$4.5 |

$0.3 |

$3.4 |

Poland |

$13 |

$1.1 |

$2.1 |

$5.5 |

$1.0 |

$1.3 |

$2.3 |

Chile |

$8 |

$0.0 |

$2.6 |

$2.0 |

$1.3 |

$1.0 |

$1.1 |

Turkey |

$8 |

$0.9 |

$0.5 |

$3.1 |

$2.1 |

$0.1 |

$1.3 |

Mexico |

$6 |

$0.3 |

$1.0 |

$1.3 |

$1.6 |

$0.3 |

$1.1 |

Data sources: Organisation for Economic Co-operation and Development; IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

The shift to the new subclasses, particularly since the arrival of the SGLT-2’s in the mid-2010’s, is analysed in Figure 3.6. For example, Canada’s cost per capita increased by $26 since 2017, from $46 (2017) to $71 (2021). Of this change, SGLT-2’s and GLP-1’s each contributed $9.8 and $14.2, respectively. This reflects the uptake of a new class (SGLT-2’s) and the impact of semaglutide on the growth of the GLP-1 subclass. The modest $2.0 contribution by DPP-4’s is consistent with an established class facing competition. Insulins contributed $0.9, and all other antidiabetic drugs mitigated the increase with a cost per capita decrease of $0.9. Similar results are observed across the PMPRB11 and only the magnitude of the change varies. However, while in most countries insulins contributed to modest growth, some countries saw the reverse effect: Japan (-$0.8), Sweden (-$1.3), Australia (-$3.0), and the Netherlands (-$3.2).

Figure description

This figure shows a table and a bar graph that provide the total increase in cost per capita from 2017 to 2021 by class and by country. It also shows the contribution of each class to the increase in both dollars and as a percentage of the total increase. The figure also indicates whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses.

| Total | Change by subclass | |||||

|---|---|---|---|---|---|---|

| SGLT-2 | GLP-1 | DPP-4 | Insulins | Other | ||

Canada |

$26 |

$9.8 |

$14.2 |

$2.0 |

$0.9 |

-$0.9 |

Japan (11) |

$6 |

$9.0 |

$2.6 |

-$2.3 |

-$0.8 |

-$2.5 |

Germany (7/11) |

$12 |

$6.3 |

$5.4 |

$0.2 |

$0.0 |

-$0.1 |

Spain (11) |

$11 |

$6.1 |

$4.6 |

$0.8 |

$0.2 |

-$0.2 |

Sweden (7/11) |

$12 |

$4.6 |

$8.0 |

$0.8 |

-$1.3 |

-$0.2 |

Norway (11) |

$13 |

$3.4 |

$7.4 |

$0.3 |

$1.7 |

$0.1 |

United Kingdom (7/11) |

$8 |

$3.4 |

$2.6 |

$1.0 |

$0.5 |

$0.2 |

Italy (7/11) |

$10 |

$2.7 |

$5.7 |

$0.8 |

$1.2 |

-$0.6 |

Australia (11) |

$6 |

$3.3 |

$4.9 |

$0.8 |

-$3.0 |

-$0.1 |

France (7/11) |

$4 |

$0.6 |

$3.7 |

-$0.3 |

$0.8 |

-$0.4 |

Belgium (11) |

$8 |

$3.4 |

$4.4 |

-$0.1 |

$0.8 |

-$0.1 |

Netherlands (11) |

$2 |

$0.7 |

$3.1 |

$0.3 |

-$3.2 |

$0.9 |

Data sources: Organisation for Economic Co-operation and Development; IQVIA MIDAS® Database, prescription retail and hospital markets (data extracted in Q4-2022). All rights reserved.

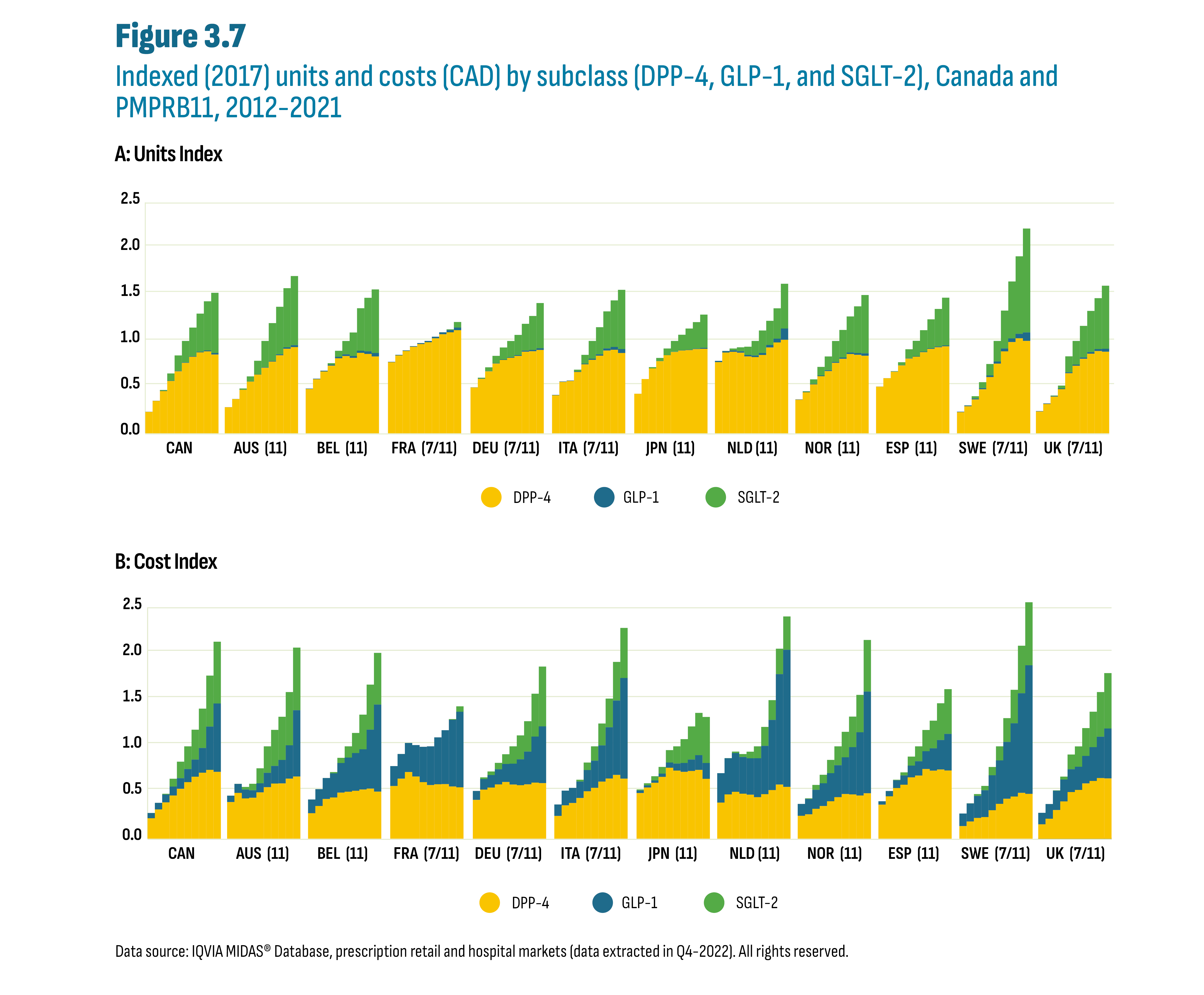

A closer look at shifts in utilization indicate that the changes in cost per capita discussed above were the result of increases in utilization of the relatively more expensive new-generation/non-insulin drugs and not the result of price increases. Figure 3.7 shows both overall growth and market share shifts in the units (Chart A) and costs (Chart B) for these subclasses over the past decade (2012-2021). The data are shown as a series of ten clustered stacked columns for each country. The data are indexed, with the total reported market for the drugs set at a value of 1 in 2017 across all countries (see Appendix A: Methodology Notes). It is important to keep in mind that both units and costs have limitations as metrics to analyse utilization. For example, units reported for semaglutide (Ozempic), the leading GLP-1, are comparatively low given its once per week dosing regimen, but costs remain substantial given its relatively higher price. This contrasts with DPP-4’s and SGLT-2’s that are taken once or twice a day. As such, GLP-1 utilization will be underestimated when measured in units and overestimated when measured in costs.

Overall, the international data suggest an evolving shift in prescribing from DPP-4’s to SGLT-2’s following the launch of SGLT-2’s. However, it remains unclear whether the further decrease of DPP-4’s is due to the launch of Ozempic or ongoing competition from the SGLT-2’s. It is also unclear whether GLP-1 prescribing displaced SGLT-2’s or if growth in GLP-1’s was the result of off-label prescribing given semaglutide (Ozempic)’s documented effects on weight loss. It is worth noting that drugs in the SGLT-2 subclass are also indicated for the treatment of heart failure even in the absence of diabetes. It is not possible to determine if these drugs were used to treat diabetes or heart failure.

Figure description

This figure shows two stacked column graphs of indexed units (graph A) and indexed costs (graph B) by subclass, by year from 2012 to 2021, and by country for Canada and the PMPRB11 countries. The figure also indicates whether each country was part of the PMPRB7 or PMPRB11 comparator countries, with 7 and/or 11 in parentheses.

| A: Unit Index | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Class | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Canada |

DPP-4 |

0.2 |

0.4 |

0.5 |

0.6 |

0.7 |

0.8 |

0.8 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

0.7 |

|

Australia (11) |

DPP-4 |

0.3 |

0.4 |

0.5 |

0.6 |

0.6 |

0.7 |

0.8 |

0.8 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.3 |

0.4 |

0.5 |

0.6 |

0.7 |

|

Belgium (11) |

DPP-4 |

0.5 |

0.6 |

0.7 |

0.7 |

0.8 |

0.8 |

0.8 |

0.9 |

0.9 |

0.8 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.3 |

0.5 |

0.6 |

0.7 |

|

France (7/11) |

DPP-4 |

0.8 |

0.8 |

0.9 |

0.9 |

1.0 |

1.0 |

1.0 |

1.1 |

1.1 |

1.1 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

Germany (7/11) |

DPP-4 |

0.5 |

0.6 |

0.7 |

0.8 |

0.8 |

0.8 |

0.8 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

|

Italy (7/11) |

DPP-4 |

0.4 |

0.6 |

0.6 |

0.7 |

0.7 |

0.8 |

0.8 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

|

Japan (11) |

DPP-4 |

0.4 |

0.6 |

0.7 |

0.8 |

0.8 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

|

Netherlands (11) |

DPP-4 |

0.8 |

0.9 |

0.9 |

0.9 |

0.8 |

0.8 |

0.8 |

0.9 |

1.0 |

1.0 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.3 |

0.5 |

|

Norway (11) |

DPP-4 |

0.4 |

0.4 |

0.5 |

0.6 |

0.7 |

0.8 |

0.8 |

0.9 |

0.8 |

0.8 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

|

Spain (11) |

DPP-4 |

0.5 |

0.6 |

0.7 |

0.7 |

0.8 |

0.8 |

0.9 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

|

Sweden (7/11) |

DPP-4 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

0.8 |

0.9 |

1.0 |

1.0 |

1.0 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.4 |

0.6 |

0.8 |

1.1 |

|

United Kingdom (7/11) |

DPP-4 |

0.2 |

0.3 |

0.4 |

0.5 |

0.7 |

0.7 |

0.8 |

0.9 |

0.9 |

0.9 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.2 |

0.3 |

0.3 |

0.4 |

0.6 |

0.7 |

|

| B: Cost Index | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Class | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Canada |

DPP-4 |

0.2 |

0.3 |

0.4 |

0.5 |

0.5 |

0.6 |

0.7 |

0.7 |

0.7 |

0.7 |

GLP-1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.3 |

0.5 |

0.7 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.6 |

0.7 |

|

Australia (11) |

DPP-4 |

0.4 |

0.5 |

0.4 |

0.4 |

0.5 |

0.6 |

0.6 |

0.6 |

0.6 |

0.7 |

GLP-1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.7 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

0.7 |

|

Belgium (11) |

DPP-4 |

0.3 |

0.4 |

0.4 |

0.4 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

GLP-1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.6 |

0.9 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.4 |

0.5 |

0.6 |

|

France (7/11) |

DPP-4 |

0.6 |

0.6 |

0.7 |

0.7 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

GLP-1 |

0.2 |

0.3 |

0.3 |

0.3 |

0.4 |

0.4 |

0.5 |

0.6 |

0.7 |

0.8 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

Germany (7/11) |

DPP-4 |

0.4 |

0.5 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

GLP-1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.3 |

0.3 |

0.5 |

0.6 |

|

Italy (7/11) |

DPP-4 |

0.2 |

0.4 |

0.4 |

0.4 |

0.5 |

0.6 |

0.6 |

0.7 |

0.7 |

0.6 |

GLP-1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.3 |

0.4 |

0.6 |

0.8 |

1.1 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

|

Japan (11) |

DPP-4 |

0.5 |

0.6 |

0.6 |

0.7 |

0.8 |

0.7 |

0.7 |

0.7 |

0.7 |

0.6 |

GLP-1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.5 |

|

Netherlands (11) |

DPP-4 |

0.4 |

0.5 |

0.5 |

0.5 |

0.5 |

0.4 |

0.5 |

0.5 |

0.6 |

0.6 |

GLP-1 |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.5 |

0.8 |

1.2 |

1.5 |

|

SGLT-2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

|

Norway (11) |

DPP-4 |

0.2 |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.5 |

0.5 |

0.5 |

0.5 |

GLP-1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.3 |

0.3 |

0.4 |

0.5 |

0.7 |

1.1 |

|

SGLT-2 |

0.0 |

0.0 |

0.1 |

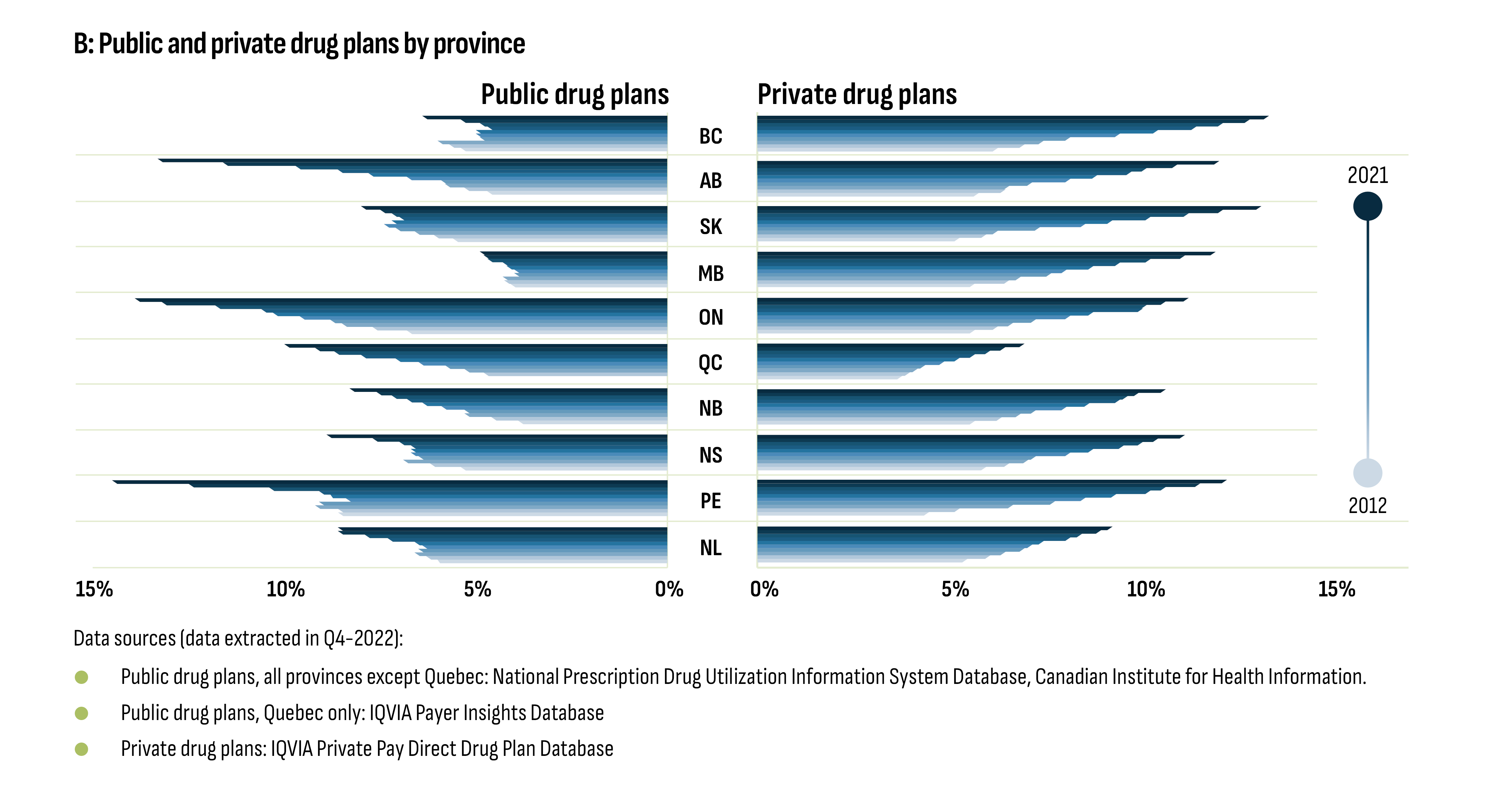

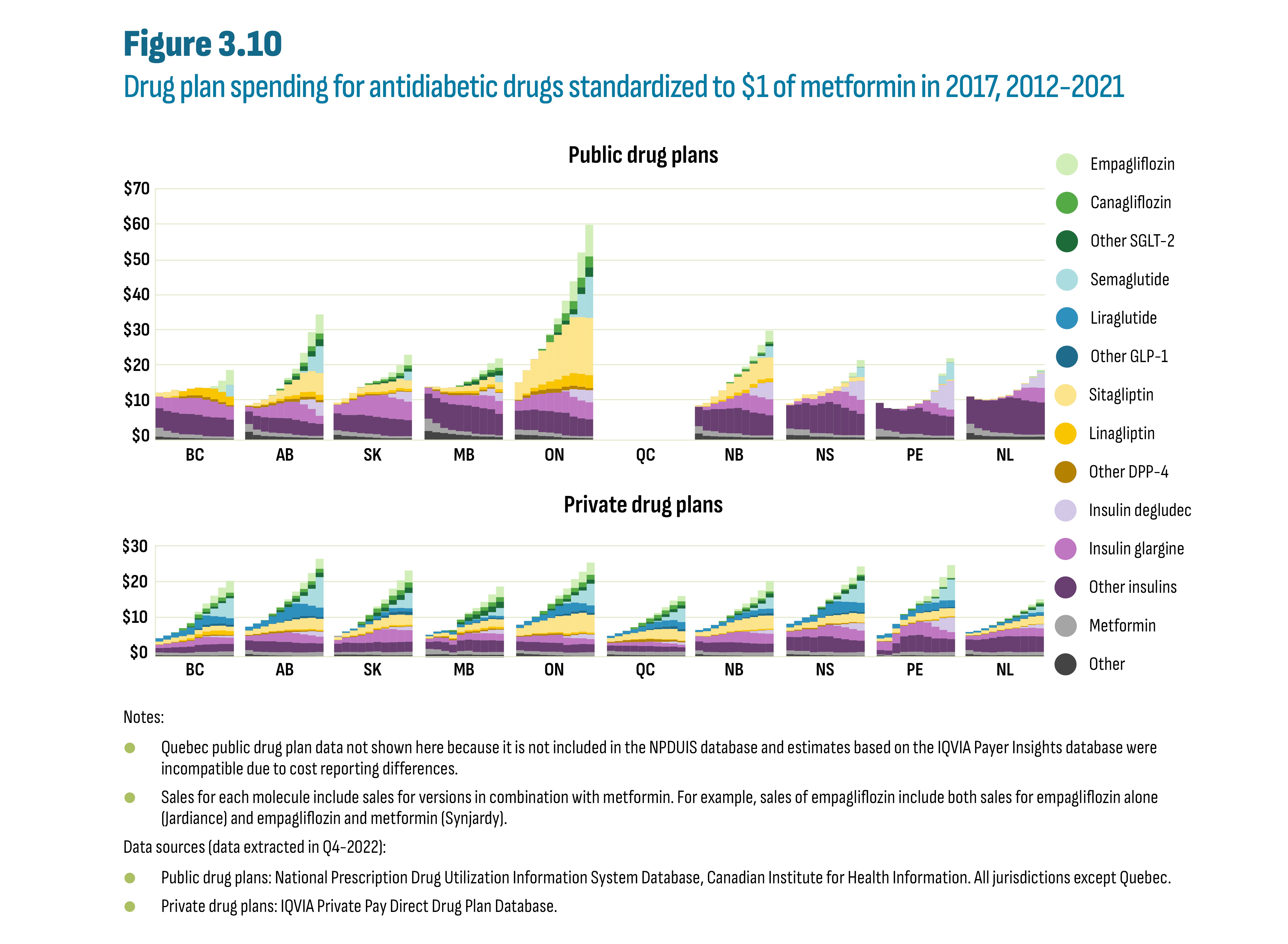

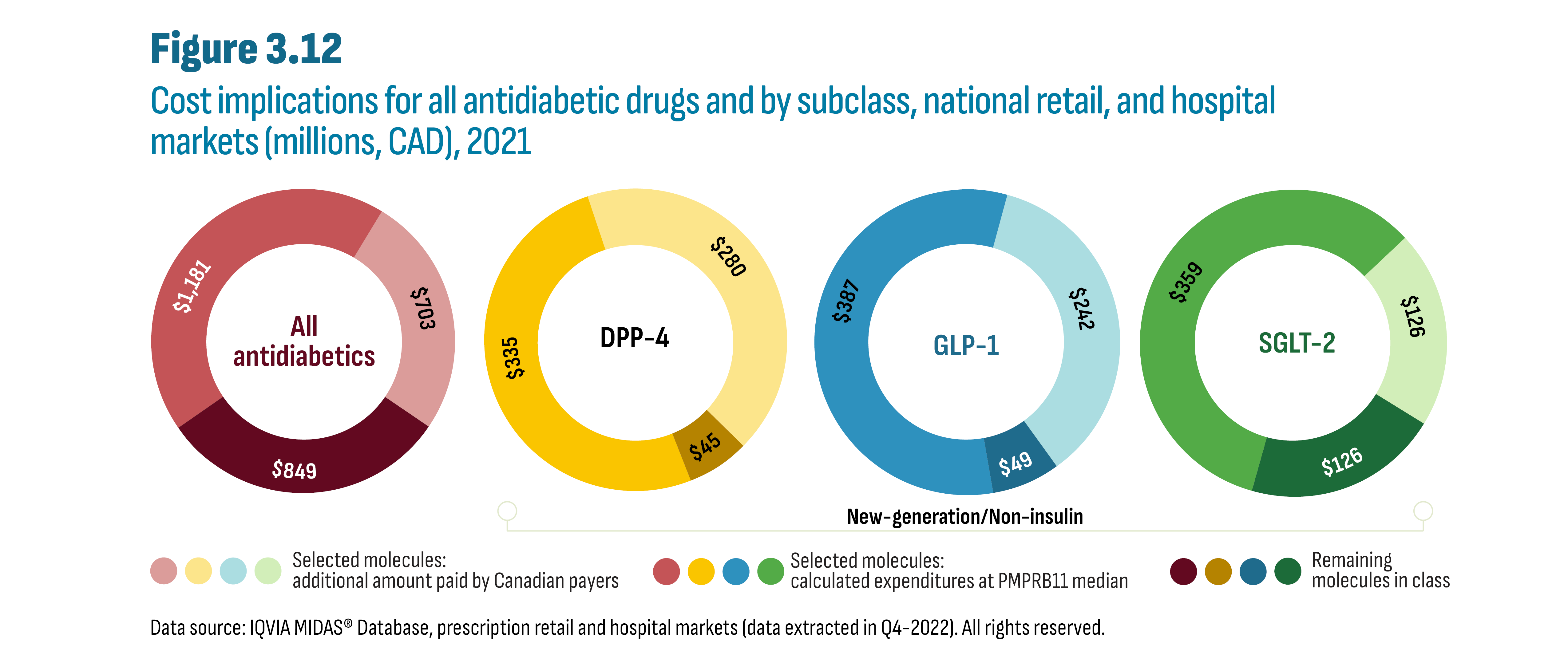

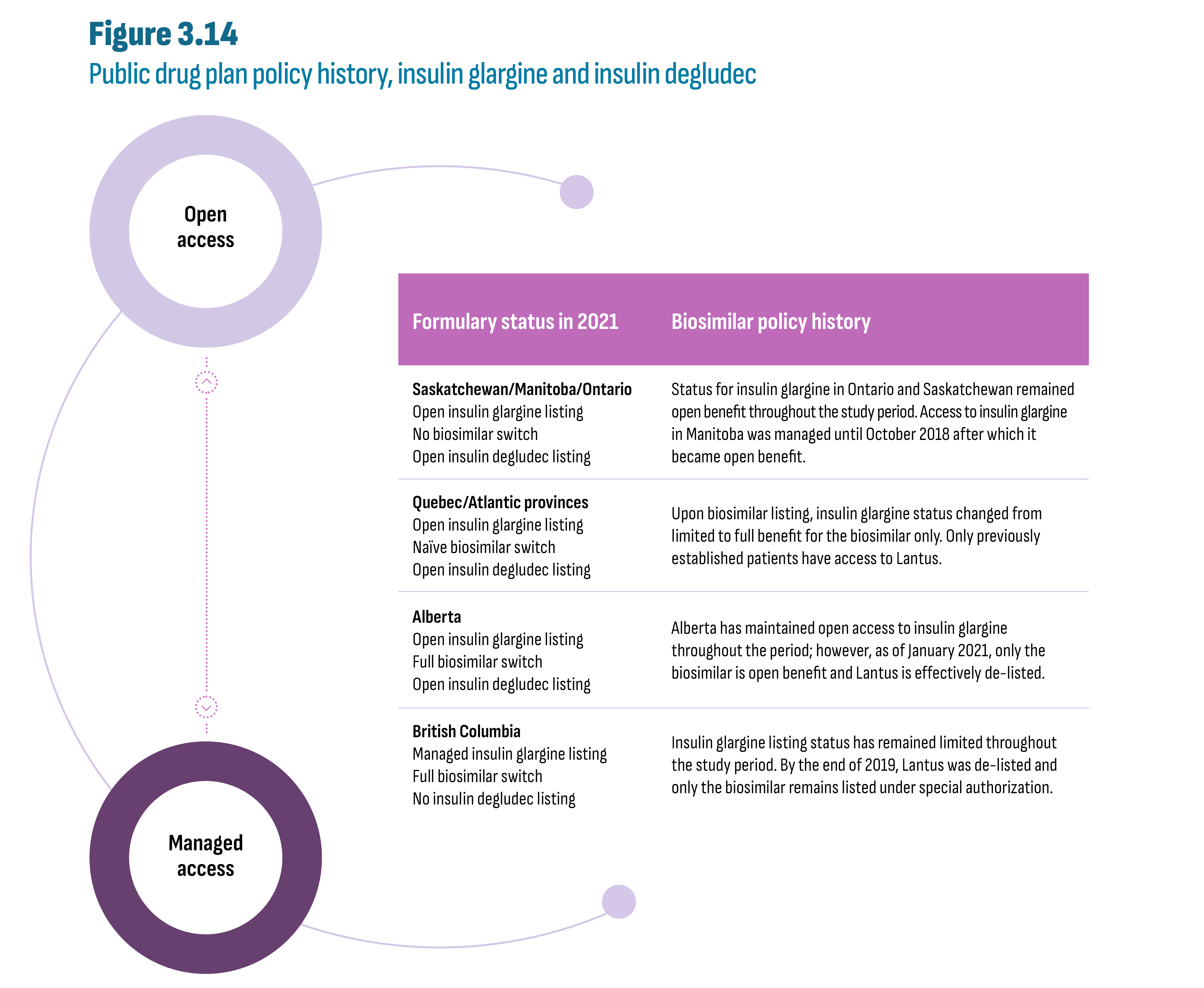

0.1 |