Insight into approvals, marketing, and pricing of new medicines, 2018 to 2023

Presented at ISPOR 2025, May 13–16, 2025 and at CAHSPR 2025, May 26–29, 2025

Blake Wladyka and Étienne Gaudette

Objective

High-cost specialty medicines are increasingly dominating the landscape of new medicines launched in Canada and around the world. A growing share of these medicines (including biologics, orphan drugs, and oncology products) have annual treatment costs in the tens or hundreds of thousands of dollars. This study provides an overview of new medicine approvals, sales, pricing, characteristics, and access in Canada and internationally.

Approach and data

This study explores the market entry dynamics of new active substances approved by Health Canada, the US Food and Drug Administration (FDA), or the Europe Medicines Agency (EMA) from 2018 to 2023. A new medicine is selected for analysis if it received its first market authorization from any of these regulatory bodies during the study period. The analysis explores the availability, treatment cost, and sales of these medicines within one calendar year following the year of first international approval and monitors how these metrics compare year over year. Primary data were sourced from the IQVIA MIDAS® database, with supplemental data from the Health Canada, FDA, and EMA online drug databases and from Canada’s Drug Agency (CDA-AMC).

Results

1. Trends in approvals and sales of new drugs

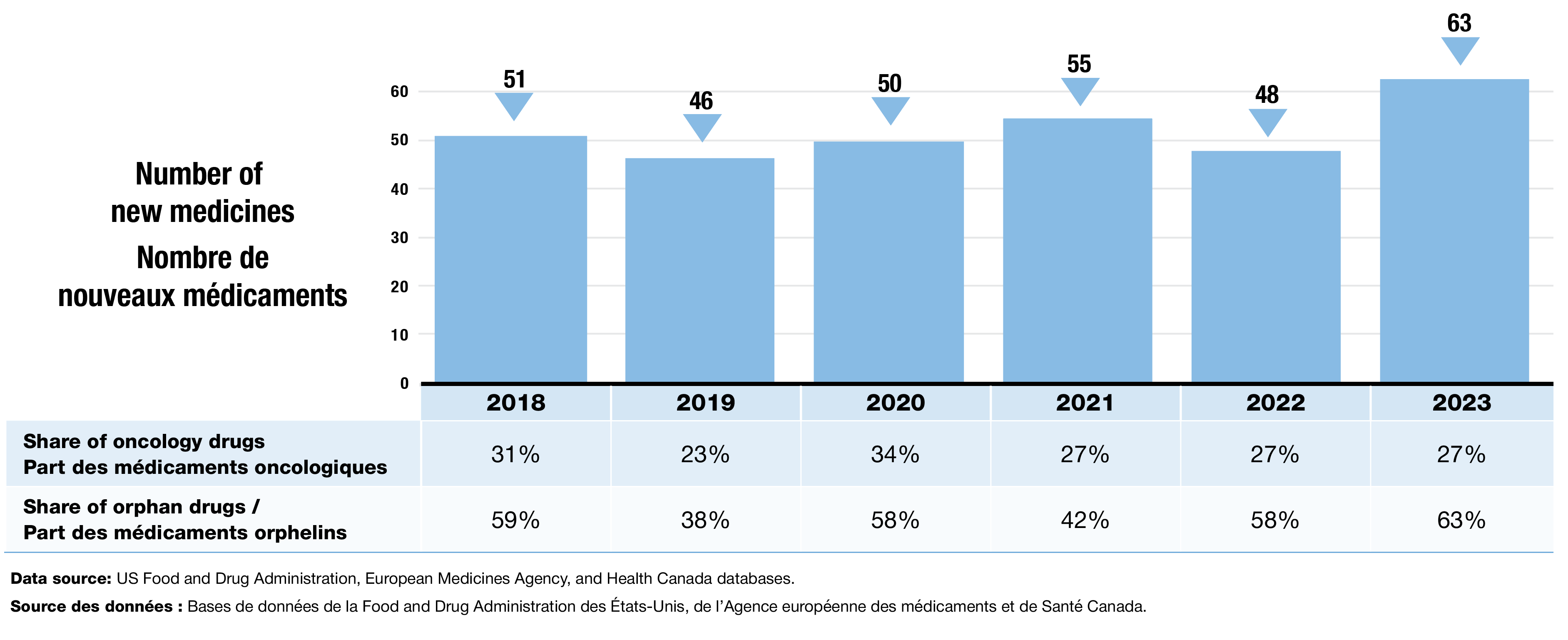

- An average of 52 new medicines were approved each year from 2018 to 2023. Orphan medicines consistently made up a significant portion of new approvals (Figure 1).

- 63 new medicines were approved in 2023, including a greater share of orphan drugs and a stable share of oncology treatments.

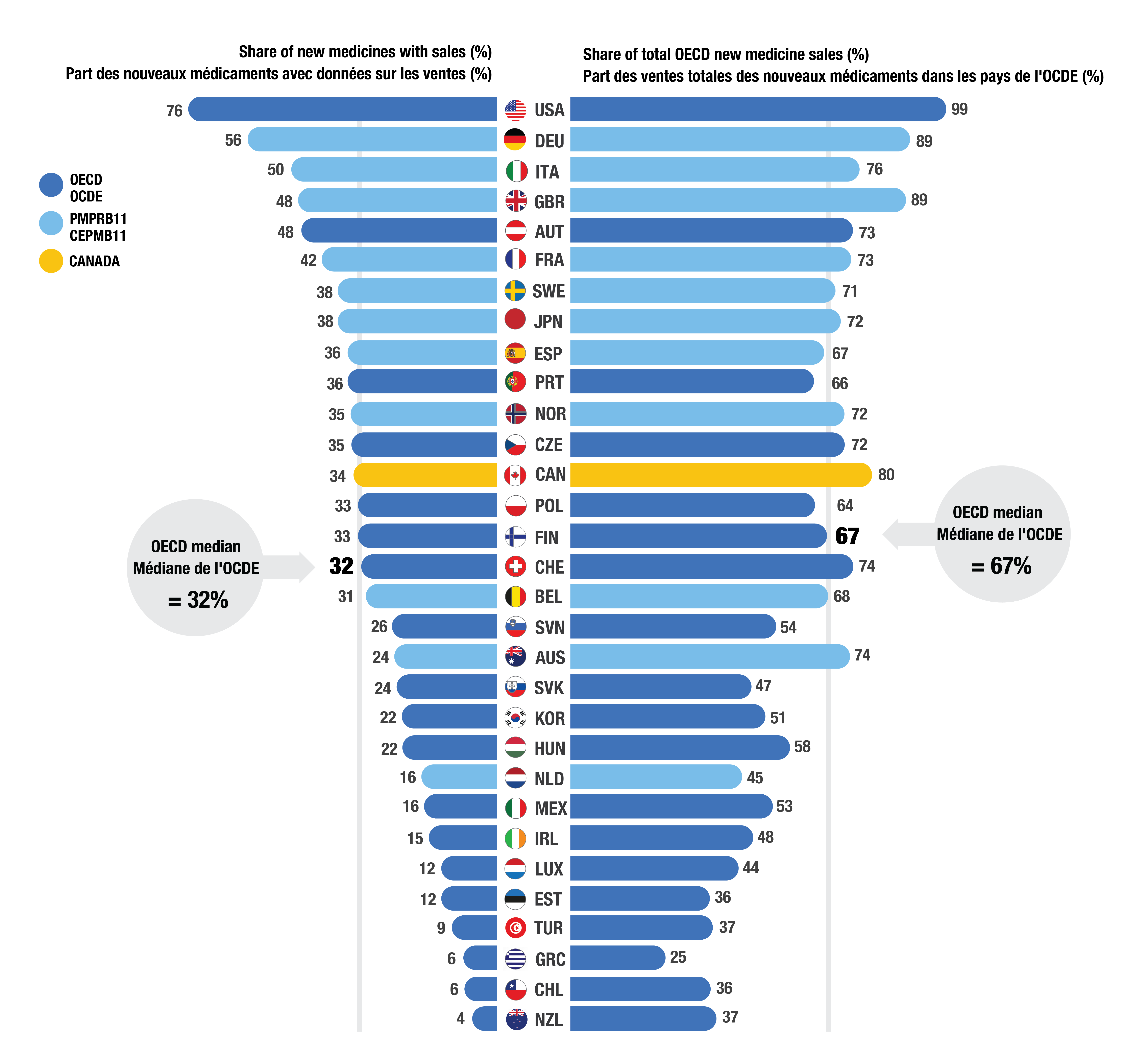

- Of the 250 medicines approved from 2018 to 2022, 85 (34%) had sales in Canada by Q4-2023 (Figure 2). While Canada’s proportion of new medicines with sales was higher than the OECD median of 32%, it ranked below eight PMPRB11 countries.

- In Q4-2023, 80% of total OECD sales of new medicines were for medicines that had sales in Canada, indicating that Canada approves and sells the highest-selling medicines approved internationally.

Figure 1. New medicines approved by the US FDA, the EMA, and/or Health Canada, 2018 to 2023

Figure - Text version

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

Number of new medicines |

51 |

46 |

50 |

55 |

48 |

63 |

Share of oncology drugs |

31% |

23% |

34% |

27% |

27% |

27% |

Share of orphan drugs |

59% |

38% |

58% |

42% |

58% |

63% |

Data source: US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

Figure 2. Share of new medicines from 2018 to 2022 with available sales and their respective share of OECD sales, by country, Q4-2023

Figure - Text version

| Country | Share of new medicines with sales | Share of total Organisation for Economic Co-operation and Development new medicine sales |

|---|---|---|

United States |

76% |

99% |

Germany |

56% |

89% |

Italy |

50% |

76% |

Austria |

48% |

73% |

United Kingdom |

48% |

89% |

France |

42% |

73% |

Sweden |

38% |

71% |

Japan |

38% |

72% |

Spain |

36% |

67% |

Portugal |

36% |

66% |

Czechia |

35% |

72% |

Norway |

35% |

72% |

Canada |

34% |

80% |

Finland |

33% |

67% |

Poland |

33% |

64% |

Switzerland |

32% |

74% |

Belgium |

31% |

68% |

Slovenia |

26% |

54% |

Slovakia |

24% |

47% |

Australia |

24% |

74% |

Korea |

22% |

51% |

Hungary |

22% |

58% |

Netherlands |

16% |

45% |

Mexico |

16% |

53% |

Ireland |

15% |

48% |

Luxembourg |

12% |

44% |

Estonia |

12% |

36% |

Türkiye |

9% |

37% |

Chile |

6% |

36% |

Greece |

6% |

25% |

New Zealand |

4% |

37% |

OECD median |

32% |

67% |

Note: Sales are based on manufacturer list prices and include sales for all OECD countries.

Data source: IQVIA MIDAS® (all rights reserved).

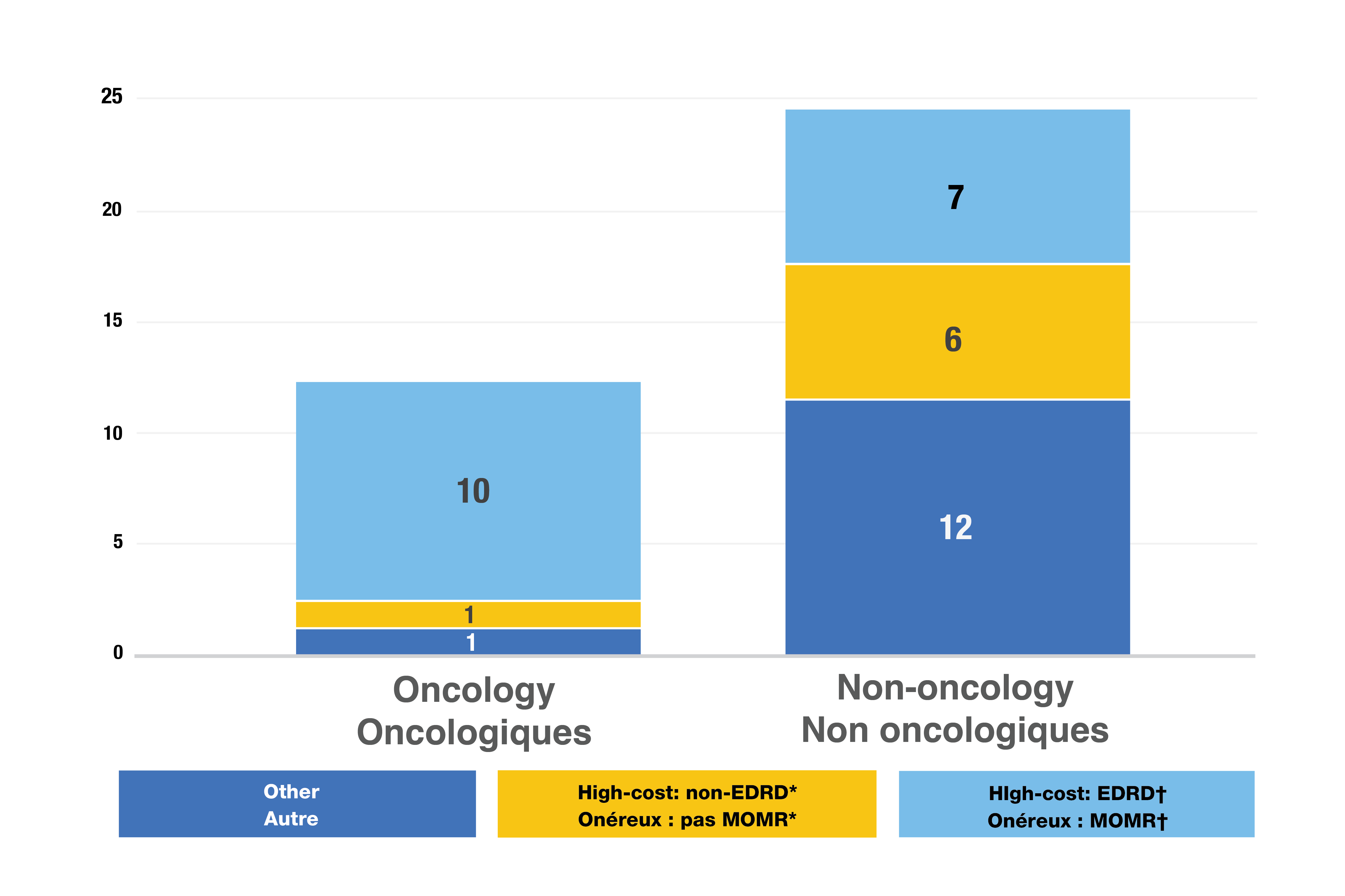

2. High-cost and specialty medicines approved in 2022

- Almost 60% of new medicines received and orphan designation, 52% were biologic, and 27% were for cancer (Figure 3). The greatest overlap was between cancer and orphan medicines: 12 of 13 new cancer medicines received an orphan designation.

- Of the 37 new medicines with available sales, 24 (65%) had high treatment costs: over $10,000 per year or $5,000 per 28-day cycle (Figure 4).

- 17 new drugs (46%) were expensive drugs for rare diseases (EDRDs)— orphan-designated therapies exceeding $100,000 in annual treatment costs, or $7,500 per 28-day cycle for oncology. EDRDs accounted for over 12% of new medicine sales.

- Cancer medicines accounted for 43% of new orphan designations despite representing roughly 27% of new medicine approvals

Figure 3. Distribution of new medicines approved in 2022 by treatment cost

Figure - Text version

| Category of speciality medicine | Number of 2022 new approvals |

|---|---|

Biologics only |

9 |

Orphan only |

8 |

Cancer only |

1 |

Cancer and orphan only |

4 |

Biologics and cancer only |

0 |

Biologics and orphan only |

8 |

Biologics, cancer and orphan |

8 |

Note: This analysis considers the 37 new medicines approved in 2022 with treatment costs available as of Q3-2024.

*High-cost medicines are defined as those with treatment costs exceeding $10,000 annually or $5,000 per 28-day cycle.

†Expensive drugs for rare diseases (EDRDs) are defined as those with an orphan designation through the FDA or EMA and treatment costs exceeding $100,000 annually or $7,500 per 28-day cycle for oncology.

Data source: IQVIA MIDAS® (all rights reserved); Canada’s Drug Agency (CDA-AMC) reports.

Figure 4. Distribution of 2022 new approvals for specialty medicines

Figure - Text version

| High-cost medicines: Expensive drugs for rare diseases† | High-cost medicines*, other than EDRDs | Other | Total | |

|---|---|---|---|---|

Oncology medicines |

10 |

1 |

1 |

12 |

Non-oncology medicines |

7 |

6 |

12 |

25 |

Data source: US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

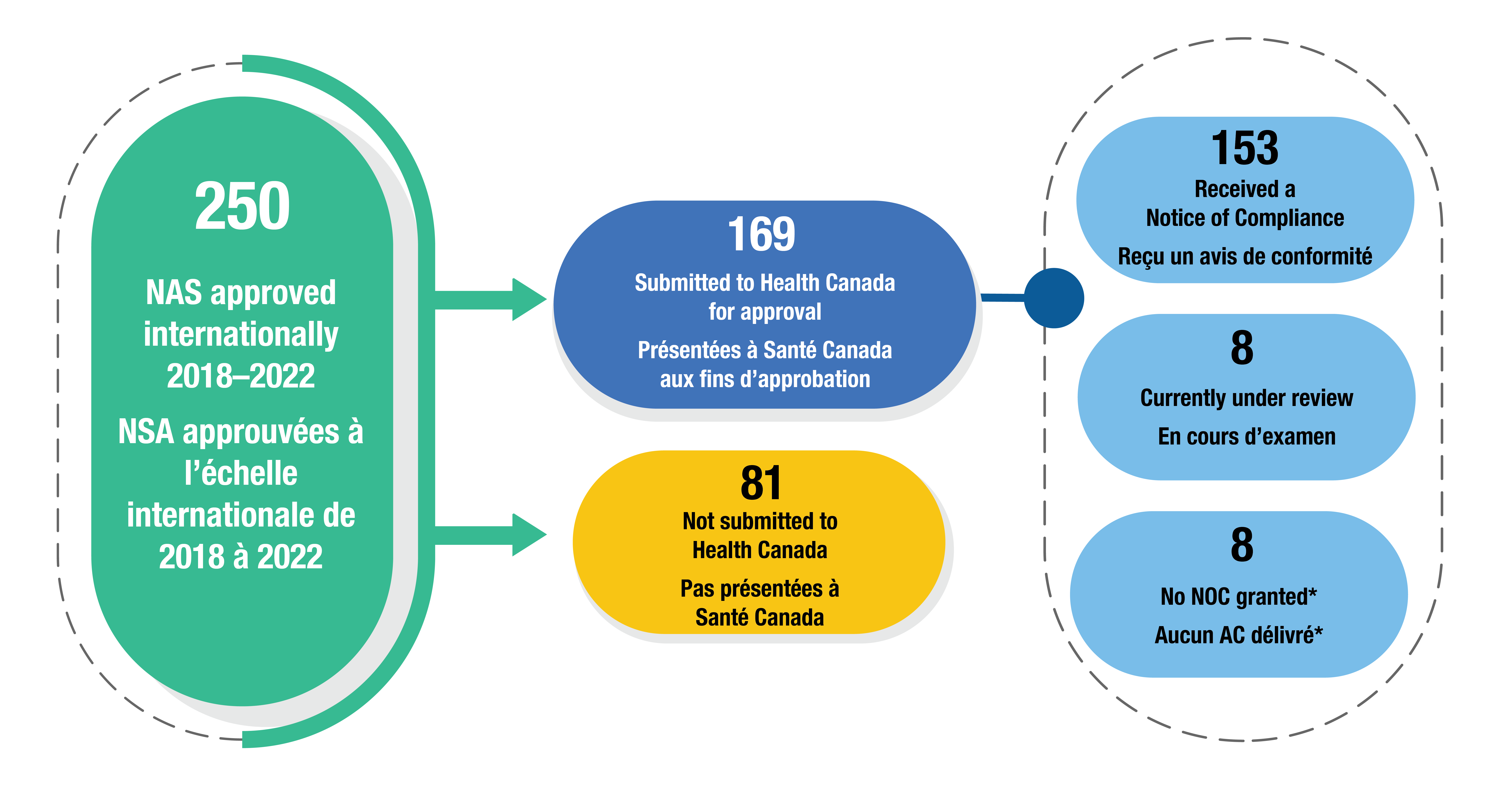

3. Canadian access to new medicines

- Of 250 new active substances approved internationally between 2018–2022, 169 (68%) had been submitted for Health Canada review by September 2024 (Figure 5). Of those, 153 received a Notice of Compliance (NOC), 8 were still under review, and 8 had an unsuccessful review process.

- 81 medicines (32%) were not submitted to Health Canada. These could be newer medicines that will be submitted later, or medicines for indications with no prevalence in Canada (such as Dengvaxia, approved by the FDA for the treatment of dengue fever).

- The sale of new active substances approved by Health Canada in 2022 occurred on average 14 months following first international sale.

Figure 5. Health Canada review status of new active substances with an international approval between 2018 and 2022

Figure - Text version

- 250 new active substances approved internationally between 2018 and 2022

- 81 not submitted to Health Canada

- 169 submitted to Health Canada for approval

- 153 received a Notice of Compliance

- 8 currently under review

- 8 no NOC granted*

Note: Review statuses were last updated on September 25, 2024.

*The submission resulted in a notice of non-compliance or the review was cancelled by the sponsor.

Data source: Health Canada’s Notice of Compliance database; Health Canada’s New Drug Submissions Completed website; and Health Canada’s New Drug Submissions Under Review website.

Conclusion

This study highlights the ongoing prevalence of high-cost and rare disease drugs among newly approved medicines. As Canada continues to approve and market the highest-selling new medicines, there is a need for more information on the impact of new approvals on payers and patients.

Limitations

As we focus on three approval bodies, it is possible that some new medicines included in the analysis may have an earlier approval date in other jurisdictions, and that some medicines with a first international approval between 2018 and 2023 are not included in the analysis.

Disclaimer

Although based in part on data under license by IQVIA™, the statements, findings, conclusions, views and opinions expressed in this report are exclusively those of the PMPRB.