Pipeline Trends Shaping the Future of Drug Development

Presented at CADTH 2023, May 16-18, 2023 and at CAHSPR 2023, May 29-31, 2023

Allison Carey

On this page

Introduction

Drug development continues to increase year-over-year with more medicines undergoing clinical evaluation with shorter timelines to approval. The 2022 global pipeline contained over 9,000 new medicines in various stages of clinical development, compared to just under 8,500 the year before. Oncology continued to dominate the therapeutic mix in 2022, with cancer treatments representing almost one third (30%) of medicines in all phases of clinical trials. Nearly one third (31%) of medicines in Phase III clinical trials or pre-registration had an early orphan designation approved through the US FDA or EMA. Trends in the 2022 pipeline include a growing number of novel gene therapies that are expanding to larger patient groups (e.g., Duchenne muscular dystrophy). The biosimilars pipeline is also expanding to therapeutic areas including asthma, bone health, and myocardial infarction.

This poster provides a snapshot of the global pipeline and a breakdown of the various therapies undergoing clinical evaluation as well as a look at the most notable drug development trends in 2022.

Approach

For the purpose of this analysis, a full list of pipeline medicines was retrieved from GlobalData's Healthcare database in September 2022. New medicinal ingredients are identified as those with no prior approvals through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), or Health Canada. The distribution of new medicines by therapeutic area corresponds to the indication under evaluation, as reported by GlobalData. Note that a single new medicine may be undergoing multiple clinical studies for separate indications. The list of medicines used for the analysis of orphan medicines in the pipeline was retrieved in September 2022. For the purposes of this analysis, orphan medicines were defined as medicines that had been granted an orphan designation by the US FDA or the EMA.

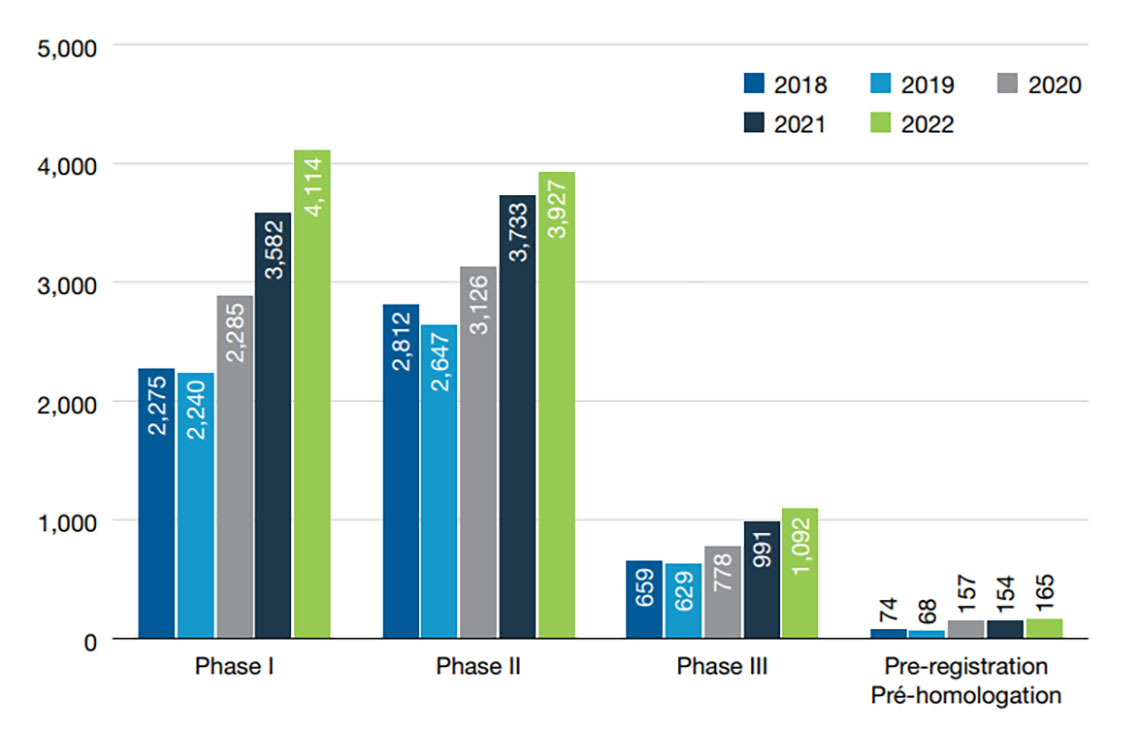

- The number of new pharmaceutical innovations in the pipeline is increasing year over year. In 2022, over 9,000 new medicines were undergoing clinical evaluation, which has been increasing by an average of 11% per year since 2018.

Figure 1: Number of new medicines in each phase of clinical evaluation, 2018-2022

Figure 1 - Text version

This bar graph illustrates the number of new medicines in the pipeline by their highest phase of clinical evaluation from 2018-2022.

| Phase | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Phase I | 2,275 | 2,240 | 2,285 | 3,582 | 4,114 |

| Phase II | 2,812 | 2,647 | 3,126 | 3,733 | 3,927 |

| Phase III | 659 | 629 | 778 | 991 | 1,092 |

| Pre-registration | 74 | 68 | 157 | 154 | 165 |

- Orphan medicines, as designated by the US Food and Drug Administration (FDA) or the European Medicines Agency (EMA), accounted for a notable share of medicines in the 2022 pipeline. Figure 2 provides the shares of orphan designated medicines for all phases in the pipeline from 2020-2022. Orphan designated medicines make up a greater share in the later stages of the pipeline, increasing from 7% in Phase I to 31% in pre-registration in 2022. This has been a consistent trend since 2020.

Figure 2: Share of orphan medicines in the pipeline by highest phase of clinical evaluation, 2020-2022

Figure 2 - Text version

A stacked bar graph gives the proportion of orphan designated medicines to non-orphan designated medicines in the pipeline.

| Phase of Development | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Orphan designation | Phase I | 8% | 7% | 7% |

| Phase II | 20% | 21% | 22% | |

| Phase III | 33% | 36% | 31% | |

| Pre-registration | 40% | 30% | 31% | |

| No Orphan designation | Phase I | 92% | 93% | 93% |

| Phase II | 80% | 79% | 78% | |

| Phase III | 67% | 64% | 69% | |

| Pre-registration | 60% | 70% | 69% |

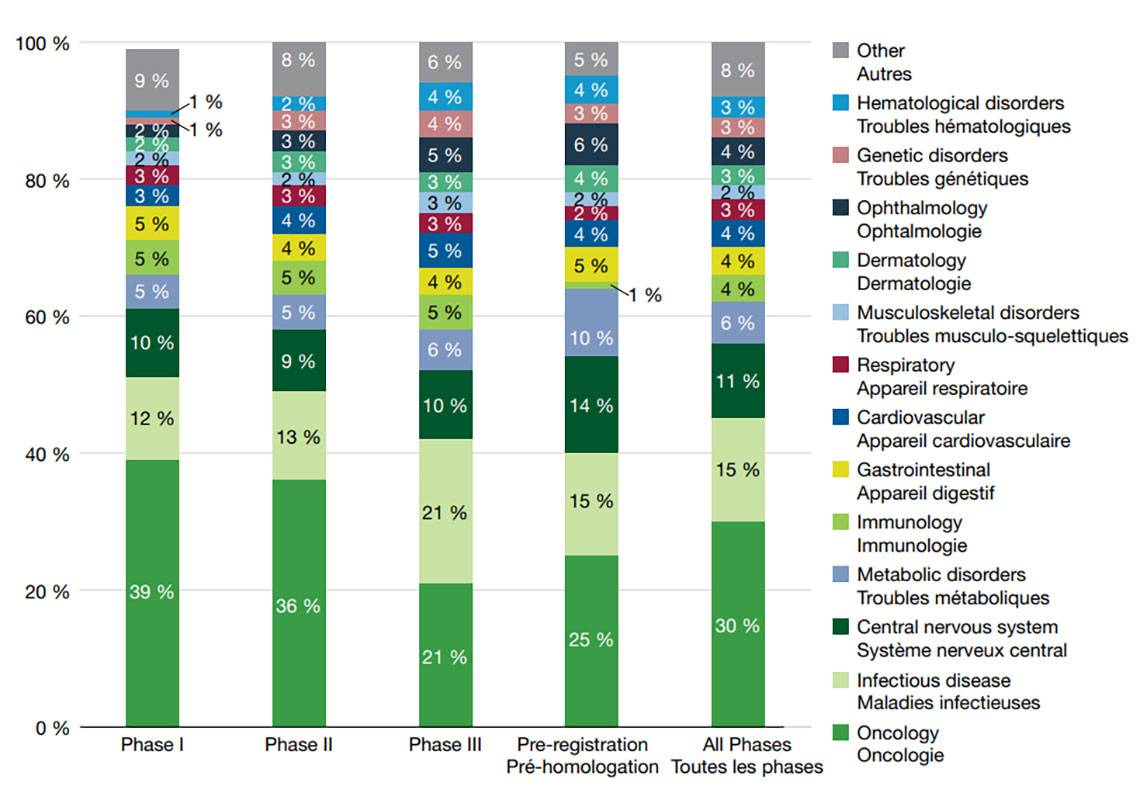

- Figure 3a. illustrates the distribution of new medicines by therapeutic area from Phase I through to pre-registration. Although the findings show that pipeline medicines represented a wide range of therapeutic areas in 2022, cancer treatments dominated the therapeutic mix in each phase of the pipeline, accounting for nearly one third (30%) of medicines in all phases of clinical evaluation. Other important pipeline therapies include those for infectious diseases (such as COVID-19) and central nervous system therapies. Figure 3b. identifies the top indications and number of medicines undergoing Phase II, Phase III or pre-registration in the major therapeutic areas in the 2022 pipeline.

Figure 3a: Therapeutic class distribution of pipeline medicines by phase of clinical evaluation, 2022

Figure 3a - Text version

A stacked bar graph gives the distribution of new medicines by therapeutic rea from Phase I through to pre-registration.

| Therapeutic Area | Phase I | Phase II | Phase III | Pre-registration | All Phases |

|---|---|---|---|---|---|

Oncology |

39% |

36% |

21% |

25% |

30% |

Infectious disease |

12% |

13% |

21% |

15% |

15% |

Central Nervous System |

10% |

9% |

10% |

14% |

11% |

Metabolic disorders |

5% |

5% |

6% |

10% |

6% |

Immunology |

5% |

5% |

5% |

1% |

4% |

Gastrointestinal |

5% |

4% |

4% |

5% |

4% |

Cardiovascular |

3% |

4% |

5% |

4% |

4% |

Respiratory |

3% |

3% |

3% |

2% |

3% |

Musculoskeletal disorders |

2% |

2% |

3% |

2% |

2% |

Dermatology |

2% |

3% |

3% |

4% |

3% |

Ophthalmology |

2% |

3% |

5% |

6% |

4% |

Genetic disorders |

1% |

3% |

4% |

3% |

3% |

Hematological disorders |

1% |

2% |

4% |

4% |

3% |

Other |

9% |

8% |

6% |

5% |

8% |

Figure 3b: Top indications for major therapeutic areas in the pipeline, 2022

Figure 3b - Text version

A horizontal bar graph indicates the top indications by number of medicines under clinical evaluation.

| Therapeutic Area | All Phases | |

|---|---|---|

| Oncology | 30% |

|

| Infectious disease | 15% |

|

| Central Nervous System | 11% |

|

| Metabolic disorders | 6% |

|

| Immunology | 4% |

|

| Gastrointestinal | 4% |

|

| Cardiovascular | 4% |

|

| Respiratory | 3% |

|

Trend Watch

1. Orphan drug approvals

Approvals for specialty medicines continue to increase, with orphan designated medicines accounting for 58% (29) of approved medicines in 2020 in Canada. When including orphan cancer drugs, an estimated 80% of the specialty drug development in 2022 was for orphan conditions.

2. Gene and cell therapies

The gene and cell therapy pipeline is growing rapidly, with more than 600 gene and cell therapies in various phases of development in 2022. Among the many therapies undergoing clinical evaluation are novel therapies for Duchenne muscular dystrophy (6 drugs in phase III and one in pre-registration), epidermolysis bullosa (3 drugs in pre-clinical, one in phase II and one in pre-registration), and β thalassemia/sickle cell disease (10 drugs in pre-clinical and discovery).

3. Biosimilars pipeline

Biosimilars can provide patients and doctors with more affordable treatment options, which have the potential to provide savings and contribute to drug coverage sustainability. As of June 2022, 47 biosimilars of 15 innovator reference products have been approved in Canada. The global pipeline is growing with over 140 biosimilars in phase III and pre-registration, including new therapeutic areas such as growth hormone, infertility, bone health, and immunosuppressants.