Biosimilars in Canada: Policies to Promote Switching and What It Means for Payers

Presentation to the 2025 Annual CAHSPR Conference May 2025

Presented by: Yvonne Zhang, Senior Economist

NPDUIS Research Initiative, Patented Medicine Prices Review Board

Disclosure: I have no actual or potential conflict of interest in relation to this topic or presentation.

Background and Objectives

- Potential savings from biosimilars are a topic of international interest with relevance for Canada.

- Given Canada’s high-use, high-cost biologics market, increased biosimilar adoption offers a significant opportunity for cost savings for Canadian payers.

- This presentation compares the evolving Canadian market for biosimilars with international counterparts.

- The analysis focuses on biosimilar market dynamics in Canada, assessing the impact of biosimilar switching to date and the potential for further cost savings.

Data Sources and Limitations

- This study is part of the PMPRB’s broader reporting in the Biologics in Canada chartbook series.

- Data sources:

- IQVIA’s MIDAS® Database (2014–2023); US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada (HC) databases:

- for international comparisons of biosimilar availability, uptake, and sales.

- IQVIA’s Canadian Drugstore and Hospital Purchases Audit (CDH, 2019–2023):

- for Canadian biosimilar uptake and savings potential.

- IQVIA’s MIDAS® Database (2014–2023); US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada (HC) databases:

- Limitations:

- Biologic medicines were selected based on Health Canada’s Drug Product Database (DPD) Schedule D and Prescription lists and include insulin biologics.

- The cost savings model does not explore the impact of policy changes on biosimilar price levels; prices of biosimilars in the study period were used to calculate cost implications and savings.

Overview

- Biologics market trends in Canada and international comparisons

- Biosimilar availability and uptake in Canada and other OECD countries

- Biosimilar uptake challenges and current policies in Canada

- Cost-saving opportunities from biosimilars

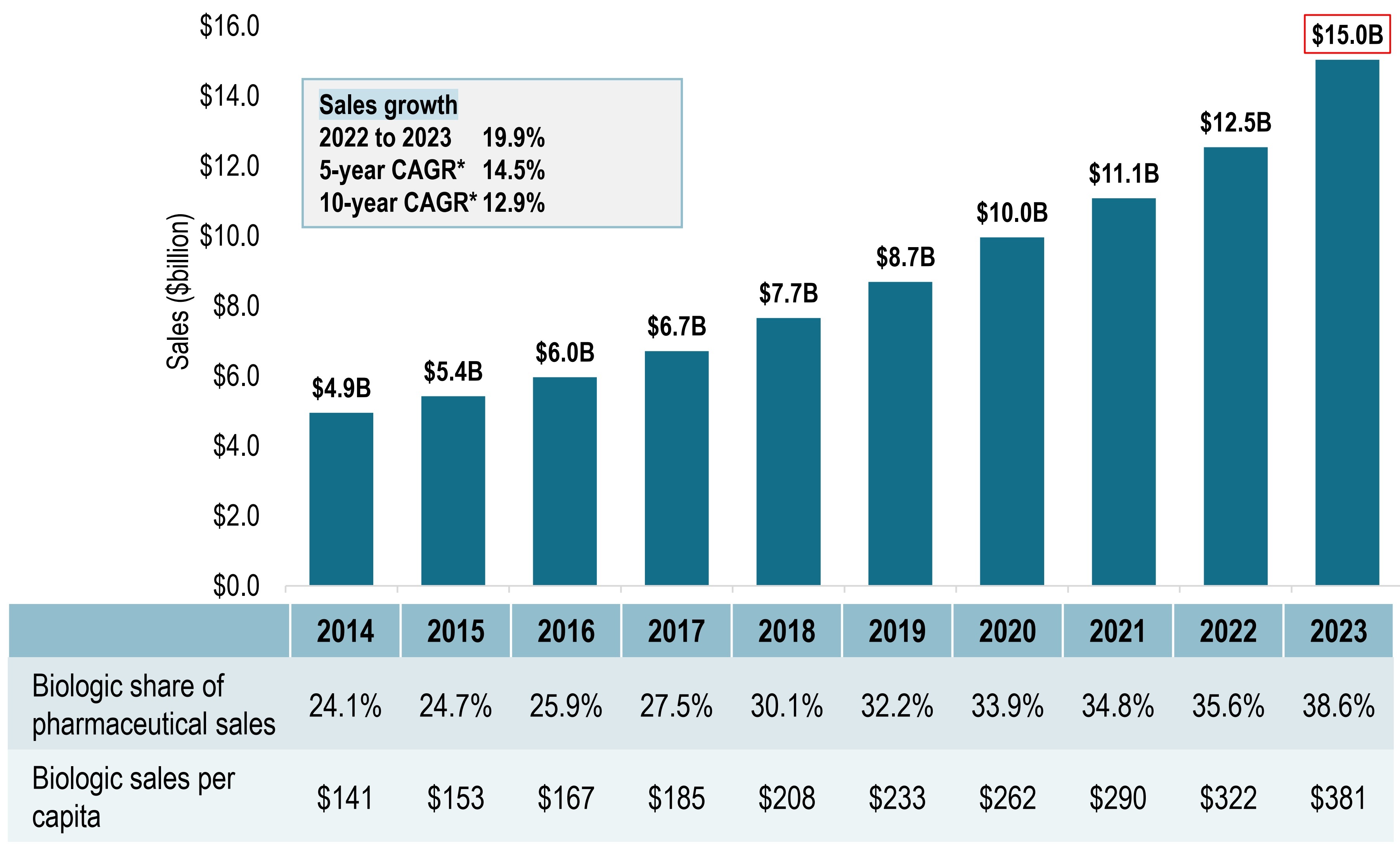

Biologic medicine sales tripled over the last decade

Sales of biologic medicines in Canada, 2014 to 2023

Figure - Text version

Sales growth, 2022 to 2023: 19.9%

5-year compound annual growth rate: 14.5%

10- year compound annual growth rate: 12.9%

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

Sales in billions of dollars |

$4.9 |

$5.4 |

$6.0 |

$6.7 |

$7.7 |

$8.7 |

$10.0 |

$11.1 |

$12.5 |

$15.0 |

Biologic share of pharmaceutical sales |

24.1% |

24.7% |

25.9% |

27.5% |

30.1% |

32.2% |

33.9% |

34.8% |

35.6% |

38.6% |

Biologic sales per capita |

$141 |

$153 |

$167 |

$185 |

$208 |

$233 |

$262 |

$290 |

$322 |

$381 |

Note: Includes all prescription biologics as per Health Canada’s Drug Product Database (DPD) Schedule D and Prescription lists, as well as insulin biologics.

Data source: IQVIA MIDAS® Database. All rights reserved.

- Sales of biologic medicines in Canada tripled from $4.9B in 2014 to $15.0B in 2023.

- This represents a 10-year compound annual growth rate of 12.9%.

- In 2023 alone, biologics sales increased by 19.9%.

Canada placed among the top-ranked countries in the OECD for biologics spending

Biologic share of total sales and sales per capita, OECD*, 2023

Figure - Text version

| Country | Biologic share of sales as a percentage | Biologic sales per capita in Canadian dollars |

|---|---|---|

US |

41.5% |

$1,176 |

Canada |

38.6% |

$381 |

Belgium |

38.0% |

$331 |

Australia |

37.5% |

$210 |

Ireland |

36.5% |

$273 |

France |

35.8% |

$301 |

Switzerland |

34.9% |

$393 |

Austria |

33.5% |

$321 |

Slovenia |

32.7% |

$187 |

Sweden |

32.7% |

$210 |

Norway |

32.7% |

$272 |

Germany |

30.3% |

$252 |

Spain |

30.1% |

$263 |

Finland |

29.6% |

$206 |

Czechia |

29.1% |

$155 |

United Kingdom |

28.5% |

$205 |

Hungary |

28.4% |

$112 |

Italy |

27.9% |

$245 |

Slovakia |

27.4% |

$118 |

New Zealand |

24.4% |

$74 |

Poland |

23.2% |

$75 |

Portugal |

21.9% |

$136 |

Japan |

19.4% |

$134 |

Turkïye |

15.4% |

$23 |

South Korea |

12.7% |

$55

|

OECD median |

30.1% |

$210 |

Note: Includes all prescription biologics as per Health Canada’s Drug Product

Database (DPD) Schedule D and Prescription lists, as well as insulin biologics.

Data source: IQVIA MIDAS® Database. All rights reserved.

* Six OECD countries with incomplete biologic sales data in 2023 were excluded from the figure.

- Biologics accounted for 38.6% of total pharmaceutical sales in Canada in 2023, a higher share than the OECD median of 30.1%.

- Per capita spending on biologics was $381, 80% more than the OECD median of $210, placing Canada second to the U.S.

Biosimilar availability and sales in Canada close to EU and exceed U.S.

Number of medicines* with biosimilars approved in Europe, the US, or Canada, as of 2023

| Biologic Medicine | EMA (n=22) | FDA (n=15) | Health Canada (n=18) |

|---|---|---|---|

Adalimumab |

✔ |

✔ |

✔ |

Aflibercept |

✔ |

|

|

Bevacizumab |

✔ |

✔ |

✔ |

Eculizumab |

✔ |

|

|

Enoxaparin sodium |

✔ |

|

✔ |

Epoetin alfa |

✔ |

✔ |

|

Epoetin zeta |

✔ |

|

|

Etanercept |

✔ |

✔ |

✔ |

Filgrastim |

✔ |

✔ |

✔ |

Follitropin alfa |

✔ |

|

|

Human insulin |

|

|

✔ |

Infliximab |

✔ |

✔ |

✔ |

Insulin aspart |

✔ |

|

✔ |

Insulin glargine |

✔ |

✔ |

✔ |

Insulin lispro |

✔ |

|

✔ |

Natalizumab |

✔ |

✔ |

|

Pegfilgrastim |

✔ |

✔ |

✔ |

Ranibizumab |

✔ |

✔ |

✔ |

Rituximab |

✔ |

✔ |

✔ |

Somatropin |

✔ |

✔ |

✔ |

Teriparatide |

✔ |

|

✔ |

Tocilizumab |

✔ |

✔ |

✔ |

Trastuzumab |

✔ |

✔ |

✔ |

Ustekinumab |

|

✔ |

✔ |

% Biosimilar sales of overall biologics, 2023 |

14.2% |

3.2% |

11.8% |

* Multiple biosimilar trade names referencing the same originator biologic are counted as one biosimilar medicine.

Data source: US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada databases;

IQVIA MIDAS® Database, prescription retail and hospital markets, All rights reserved.

- As of 2023, biosimilars were approved for 18 biologic medicines in Canada, compared to 22 in the EU and 15 in the U.S.

- Biosimilars accounted for 12% of total biologic sales in Canada, close to 14% in the EU and ahead of 3% in the U.S.

- Availability and market share of biosimilars in Canada have kept pace with Europe, despite fewer approvals.

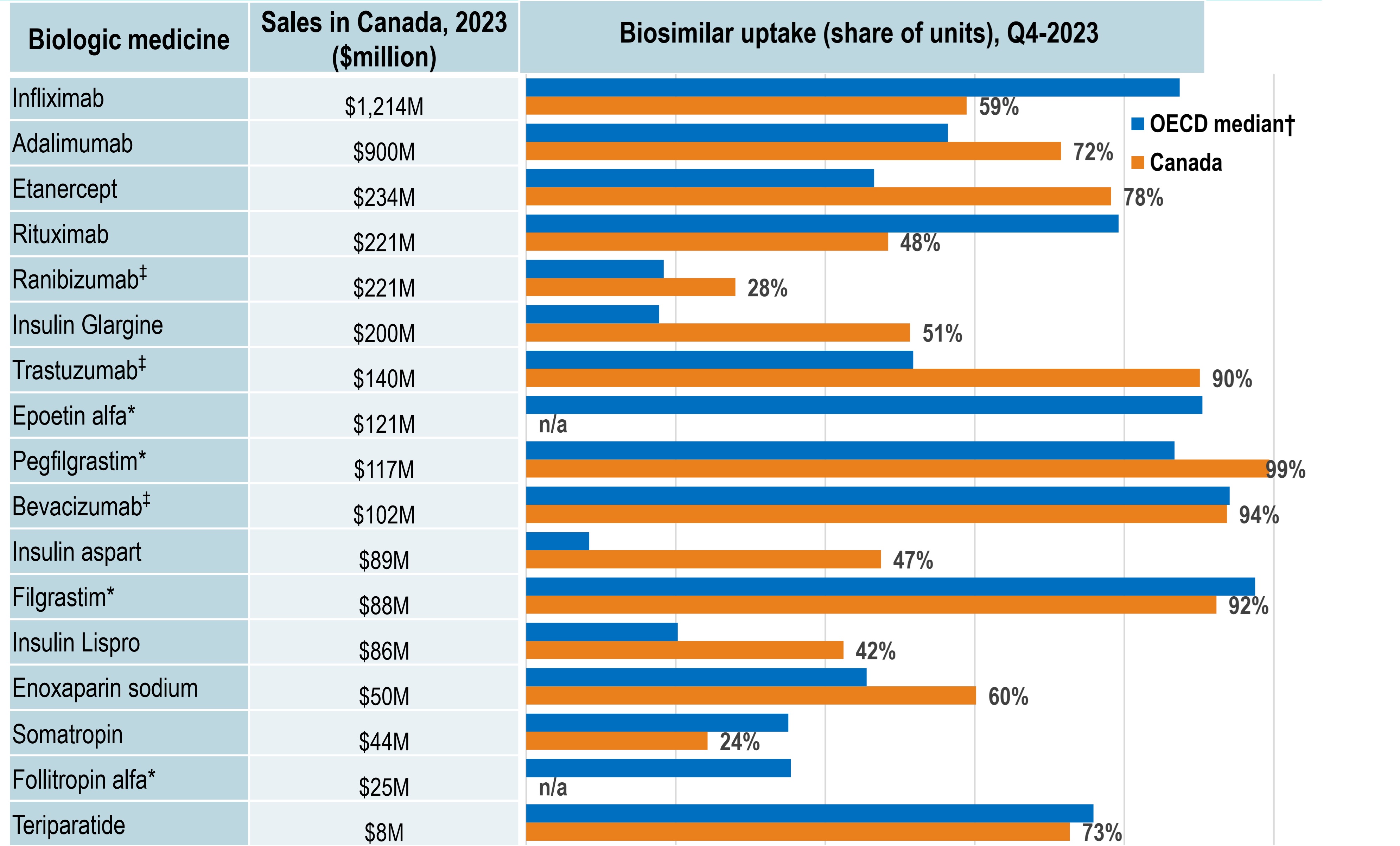

Canada’s biosimilar uptake kept pace with the OECD trends

Figure - Text version

| Biologic medicine | Sales in Canada, in millions of dollars, 2023 | Biosimilar uptake as a share of units, fourth quarter of 2023, Canada | Biosimilar uptake as a share of units, fourth quarter of 2023, OECD median |

|---|---|---|---|

Infliximab |

$1,214 |

59% |

87% |

Adalimumab |

$900 |

72% |

56% |

Etanercept |

$234 |

78% |

47% |

Rituximab |

$221 |

48% |

79% |

Ranibizumab‡ |

$221 |

28% |

18% |

Insulin glargine |

$200 |

51% |

18% |

Trastuzumab‡ |

$140 |

90% |

52% |

Epoetin alfa* |

$121 |

n/a |

90% |

Pegfilgrastim* |

$117 |

99% |

87% |

Bevacizumab‡ |

$102 |

94% |

94% |

Insulin aspart |

$89 |

47% |

8% |

Filgrastim* |

$88 |

92% |

97% |

Insulin lispro |

$86 |

42% |

20% |

Enoxaparin sodium |

$50 |

60% |

46% |

Somatropin |

$44 |

24% |

35% |

Follitropin alfa* |

$25 |

n/a |

35% |

Teriparatide |

$8 |

73% |

76% |

*Generally used on a short-term basis.

‡ Mainly indicated in oncology or ophthalmology.

Administered in hospitals or clinic setting in Canada.

† Canada is excluded from the median.

Data source: IQVIA MIDAS® Database. All rights reserved.

- Canada achieved biosimilar uptake similar to or above that of the OECD median for most high-selling biologics.

- Infliximab, the highest-selling biologic, had a 59% biosimilar share in Canada in 2023, below the OECD median of 87%.

- Adalimumab, another high-selling biologic medicine, had a 72% biosimilar uptake in Canada in 2023, higher than the OECD median of 56%.

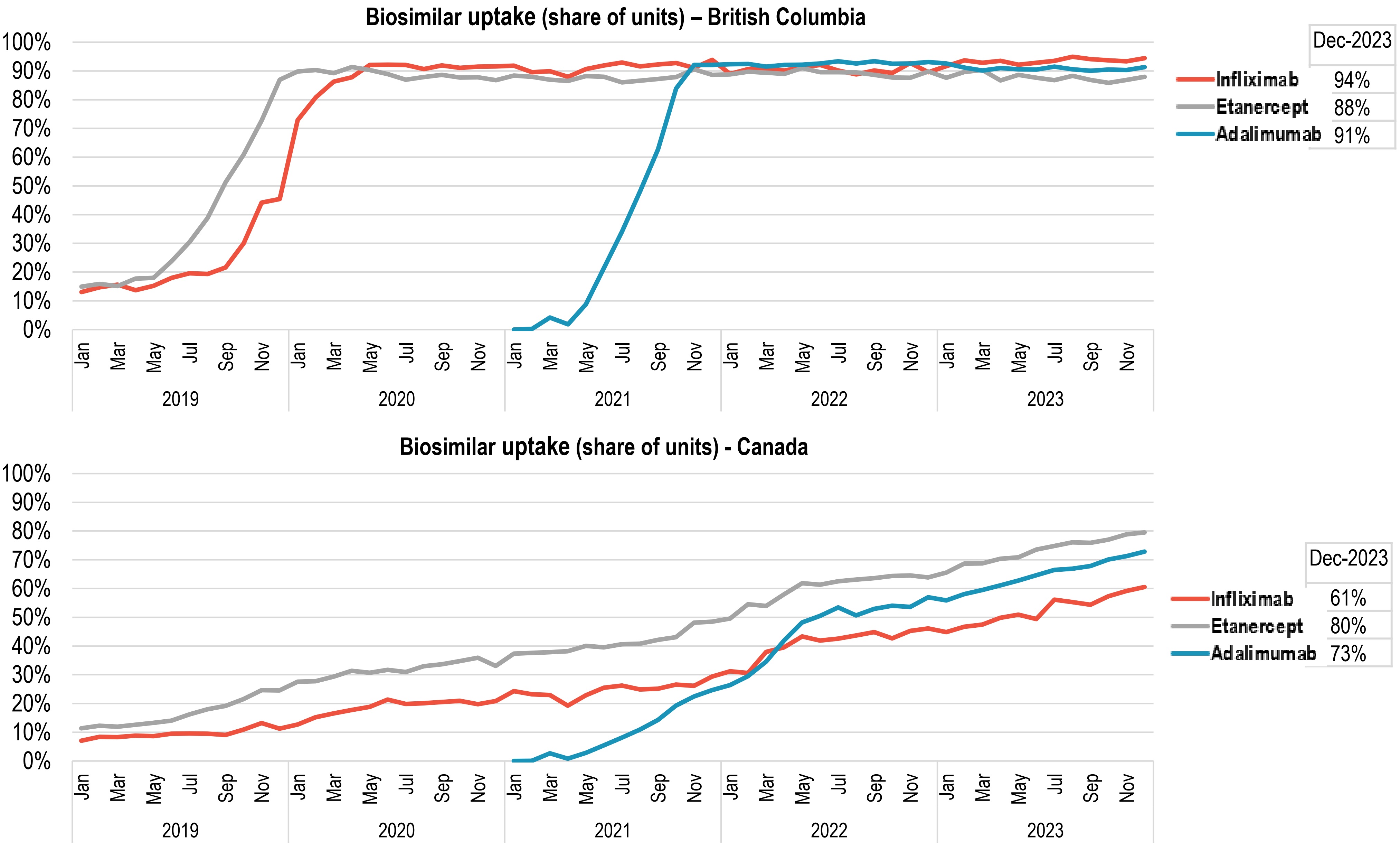

Uptake of biosimilars in Canada has increased following switching initiatives, led by BC

Figure - Text version

| Canada | British Columbia | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Biosimilar uptake by year and month | Infliximab | Etanercept | Adalimumab | Biosimilar uptake by year and month | Infliximab | Etanercept | Adalimumab | |||

2019 |

Jan |

7% |

11% |

- |

- |

2019 |

Jan |

13% |

15% |

- |

Feb |

8% |

12% |

- |

- |

Feb |

15% |

16% |

- |

||

Mar |

8% |

12% |

- |

- |

Mar |

16% |

15% |

- |

||

Apr |

9% |

13% |

- |

- |

Apr |

14% |

18% |

- |

||

May |

9% |

13% |

- |

- |

May |

15% |

18% |

- |

||

Jun |

9% |

14% |

- |

- |

Jun |

18% |

24% |

- |

||

Jul |

10% |

16% |

- |

- |

Jul |

20% |

30% |

- |

||

Aug |

9% |

18% |

- |

- |

Aug |

19% |

39% |

- |

||

Sep |

9% |

19% |

- |

- |

Sep |

22% |

51% |

- |

||

Oct |

11% |

22% |

- |

- |

Oct |

30% |

61% |

- |

||

Nov |

13% |

25% |

- |

- |

Nov |

44% |

73% |

- |

||

Dec |

11% |

25% |

- |

- |

Dec |

45% |

87% |

- |

||

2020 |

Jan |

13% |

28% |

- |

- |

2020 |

Jan |

73% |

90% |

- |

Feb |

15% |

28% |

- |

- |

Feb |

81% |

90% |

- |

||

Mar |

17% |

29% |

- |

- |

Mar |

86% |

89% |

- |

||

Apr |

18% |

31% |

- |

- |

Apr |

88% |

91% |

- |

||

May |

19% |

31% |

- |

- |

May |

92% |

90% |

- |

||

Jun |

21% |

32% |

- |

- |

Jun |

92% |

89% |

- |

||

Jul |

20% |

31% |

- |

- |

Jul |

92% |

87% |

- |

||

Aug |

20% |

33% |

- |

- |

Aug |

91% |

88% |

- |

||

Sep |

21% |

34% |

- |

- |

Sep |

92% |

89% |

- |

||

Oct |

21% |

35% |

- |

- |

Oct |

91% |

88% |

- |

||

Nov |

20% |

36% |

- |

- |

Nov |

91% |

88% |

- |

||

Dec |

21% |

33% |

- |

- |

Dec |

92% |

87% |

- |

||

2021 |

Jan |

24% |

37% |

0% |

- |

2021 |

Jan |

92% |

88% |

0% |

Feb |

23% |

38% |

0.1% |

- |

Feb |

90% |

88% |

0.2% |

||

Mar |

23% |

38% |

3% |

- |

Mar |

90% |

87% |

4% |

||

Apr |

19% |

38% |

1% |

- |

Apr |

88% |

87% |

2% |

||

May |

23% |

40% |

3% |

- |

May |

91% |

88% |

9% |

||

Jun |

25% |

40% |

5% |

- |

Jun |

92% |

88% |

22% |

||

Jul |

26% |

41% |

8% |

- |

Jul |

93% |

86% |

34% |

||

Aug |

25% |

41% |

11% |

- |

Aug |

92% |

87% |

48% |

||

Sep |

25% |

42% |

14% |

- |

Sep |

92% |

87% |

63% |

||

Oct |

27% |

43% |

19% |

- |

Oct |

93% |

88% |

84% |

||

Nov |

26% |

48% |

22% |

- |

Nov |

91% |

91% |

92% |

||

Dec |

29% |

48% |

25% |

- |

Dec |

94% |

89% |

92% |

||

2022 |

Jan |

31% |

50% |

26% |

- |

2022 |

Jan |

89% |

89% |

92% |

Feb |

31% |

54% |

30% |

- |

Feb |

91% |

90% |

92% |

||

Mar |

38% |

54% |

35% |

- |

Mar |

91% |

89% |

91% |

||

Apr |

40% |

58% |

42% |

- |

Apr |

90% |

89% |

92% |

||

May |

43% |

62% |

48% |

- |

May |

91% |

91% |

92% |

||

Jun |

42% |

61% |

51% |

- |

Jun |

92% |

90% |

93% |

||

Jul |

43% |

63% |

53% |

- |

Jul |

90% |

90% |

93% |

||

Aug |

44% |

63% |

51% |

- |

Aug |

89% |

89% |

93% |

||

Sep |

45% |

64% |

53% |

- |

Sep |

90% |

89% |

93% |

||

Oct |

43% |

64% |

54% |

- |

Oct |

89% |

88% |

93% |

||

Nov |

45% |

65% |

54% |

- |

Nov |

93% |

88% |

93% |

||

Dec |

46% |

64% |

57% |

- |

Dec |

90% |

90% |

93% |

||

2023 |

Jan |

45% |

66% |

56% |

- |

2023 |

Jan |

92% |

88% |

93% |

Feb |

47% |

69% |

58% |

- |

Feb |

94% |

90% |

91% |

||

Mar |

47% |

69% |

60% |

- |

Mar |

93% |

90% |

90% |

||

Apr |

50% |

70% |

61% |

- |

Apr |

94% |

87% |

91% |

||

May |

51% |

71% |

63% |

- |

May |

92% |

89% |

91% |

||

Jun |

49% |

74% |

65% |

- |

Jun |

93% |

88% |

91% |

||

Jul |

56% |

75% |

66% |

- |

Jul |

94% |

87% |

91% |

||

Aug |

55% |

76% |

67% |

- |

Aug |

95% |

88% |

91% |

||

Sep |

54% |

76% |

68% |

- |

Sep |

94% |

87% |

90% |

||

Oct |

57% |

77% |

70% |

- |

Oct |

94% |

86% |

90% |

||

Nov |

59% |

79% |

71% |

- |

Nov |

93% |

87% |

90% |

||

Dec |

61% |

80% |

73% |

- |

Dec |

94% |

88% |

91% |

||

Data source: Canadian Drugstore and Hospital Purchases Audit (CDH) databases, IQVIA. All rights reserved

- Since May 2019, Canadian payers have launched switching initiatives to increase uptake, led by British Columbia (BC).

- Biosimilars for three widely used anti-TNF-α drugs (adalimumab, infliximab, and etanercept) reached ~90% market share in BC between mid-2020 and late 2021.

- National uptake for these medicines gradually rose to 60– 80% of units sold by December 2023.

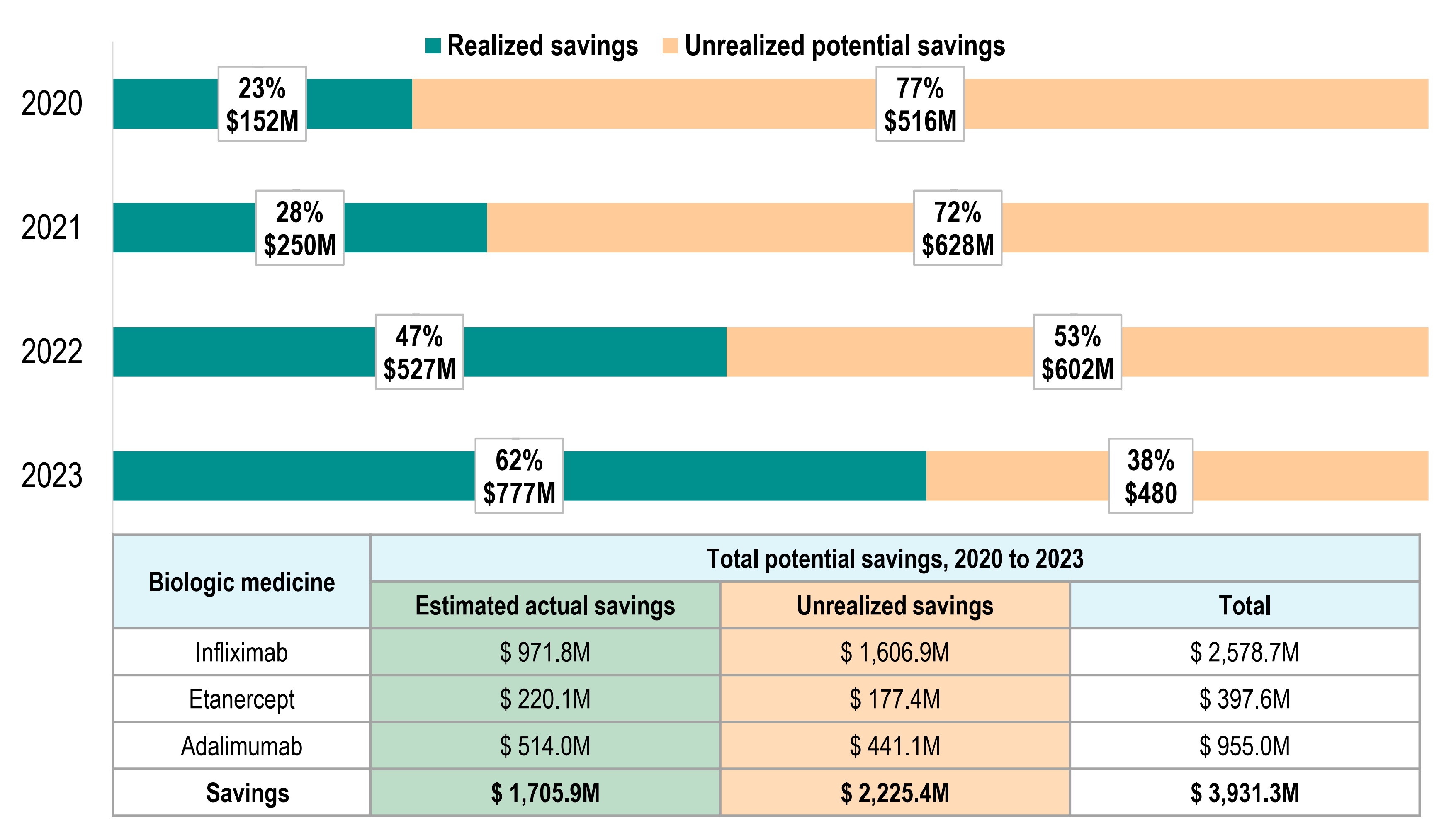

Growing biosimilar savings in Canada, with more to gain

Realized and potential savings from biosimilar use in Canada, 2020 to 2023

Figure - Text version

| Year | Realized savings from biosimilar use in Canada, in millions of dollars | Unrealized potential savings from biosimilar use in Canada, in millions of dollars | Potential savings from biosimilar use in Canada | Realized share of savings from biosimilar use in Canada | Unrealized potential share savings from biosimilar use in Canada as a share |

|---|---|---|---|---|---|

2020 |

$152 |

$516 |

$669 |

23% |

77% |

2021 |

$250 |

$628 |

$878 |

28% |

72% |

2022 |

$527 |

$602 |

$1,128 |

47% |

53% |

2023 |

$777 |

$480 |

$1,257 |

62% |

38% |

| Biologic medicine | Total potential savings, 2020 to 2023 | ||

|---|---|---|---|

| Estimated actual savings | Unrealized savings | Total | |

Infliximab |

$ 971.8M |

$ 1,606.9M |

$ 2,578.7M |

Etanercept |

$ 220.1M |

$ 177.4M |

$ 397.6M |

Adalimumab |

$ 514.0M |

$ 441.1M |

$ 955.0M |

Savings |

$ 1,705.9M |

$ 2,225.4M |

$ 3,931.3M |

Data source: Canadian Drugstore and Hospital Purchases Audit (CDH) databases, IQVIA. All rights reserved.

- Biosimilar use for three high-selling biologics — infliximab, adalimumab, and etanercept, generated $1.7B in savings between 2020 and 2023.

- If uptake across Canada had matched the higher uptake levels in British Columbia, an additional $2.2B in savings could have been realized.

- Biosimilar uptake has increased over time, with the realized share of potential savings growing from 23% in 2020 to 62% in 2023.

Conclusions

- Biologics are a high-growth market in Canada, with sales tripling over the last decade.

- Biosimilar availability and market share in Canada have kept pace with Europe.

- Biosimilars uptake for high-selling products aligns with the OECD trends.

- Biosimilar switching is led by provinces and payers, resulting in varied uptake across jurisdictions.

- With nearly 40% in savings still unrealized, broader adoption of switching initiatives could further reduce drug spending.