Prairies Economic Development Canada’s Quarterly Financial Report for the quarter ended June 30, 2022

View the print-friendly version: PDF

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subject to an external audit or review.

Authority, mandate and program activities

Prairies Economic Development Canada’s (PrairiesCan) mandate is to grow and diversify the economy of the prairie provinces and advance its interests of the region in national economic policy, programs, and projects. The department will achieve this mandate by working with clients and partners in our four roles as investor, advisor, pathfinder, and convenor.

PrairiesCan operates under the provision of the Western Economic Diversification Act, which came into force on June 28, 1988. As a federal department, PrairiesCan is headed by a minister and a deputy head (interim deputy minister).

The Departmental Plan and Main Estimates provide further information on PrairiesCan’s authority, mandate and program activities.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department’s spending authorities granted by Parliament and those used by the department, consistent with the Main Estimates for the 2022-2023 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Financial structure

PrairiesCan manages its expenditures under 2 votes:

- Vote 1 – Net operating expenditures include salary, and other operating costs (e.g., transportation and communications; professional and special services).

- Vote 5 – Grants and contributions include all transfer payments.

Budgetary statutory authorities represent payments made under legislation approved by Parliament, and include items such as the Government of Canada’s share of employee benefit plans and other minor items.

Highlights of fiscal quarter and fiscal year-to-date (YTD) results

The following section highlights significant changes to fiscal quarter results as of June 30, 2022.

Statement of Authorities: Vote 1 – net operating expenditures

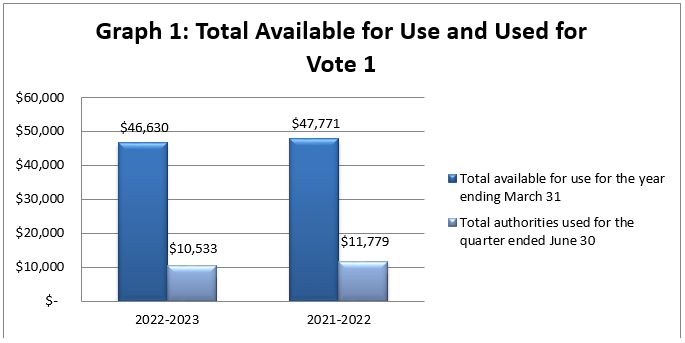

Total authorities available for use for fiscal year 2022-2023 are $46.6 million, a net decrease of $1.2 million, or -2%, compared to the $47.8 million for 2021-2022. The net decrease is explained by:

- $2.6 million increase in funding for the Tourism Relief Fund announced in Budget 2021

- $2.1 million increase in funding for the Canada Community Revitalization Fund announced in Budget 2021

- $1.7 million increase in funding for the Jobs and Growth Fund initiative announced in Budget 2021

- $3.8 million decrease in funding for the completion of the Regional Relief and Recovery Fund to support businesses and tourism operators facing hardship due to COVID-19

- $3.0 million decrease in funding for the completion of the Investing in a Diverse and Growing Western Economy announced in Budget 2019

- $0.8 million net decrease in various other minor adjustments

Total authorities used has decreased to $10.5 million for the quarter ended June 30, 2022, compared to $11.8 million at June 30, 2021. The decrease of $1.3 million, or -11%, is explained mainly by the shift in BC Region staff who are now with PacifiCan as a result of the restructuring of Western Economic Diversification Canada (WD) to the Pacific and Prairies regional development agencies (RDA) as announced in Budget 2021.

Graph 1 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for Vote 1 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-2023 and the authorities used at quarter end and then compares them to fiscal year 2021-2022.

2022-2023

- $46,630 represents total available for use for the year ending March 31

- $10,533 represents total authorities used for the quarter ending June 30

2021-2022

- $47,771 represents total available for use for the year ending March 31

- $11,779 represents total authorities used for the quarter ending June 30

Statement of Authorities: Vote 5 – grants and contributions

Total authorities available for use for fiscal year 2022-2023 are $371.4 million, a net decrease of $148.3 million, or -29%, compared to the $519.7 million for 2021-2022. The net decrease is explained by:

- $53.5 million net increase in funding for the Tourism Relief Fund announced in Budget 2021

- $49.2 million increase in funding for the Jobs and Growth Initiative announced in Budget 2021

- $46.8 million increase in funding for the Canada Community Revitalization Fund announced in Budget 2021

- $14.4 million net increase in funding for the Vaccine and Infectious Disease Organization announced in Budget 2021

- $12.5 million increase in funding for the Aerospace Regional Recovery Initiative announced in Budget 2021

- $6.5 million net increase in funding for the Canada Coal Transition Initiative announced in Budget 2018

- $1.9 million increase in funding to support the Quantum Strategy announced in Budget 2021

- $1.4 million net increase in funding for the Black Entrepreneurship Fund

- $211.4 million net decrease in funding for the completion the Regional Relief and Recovery Fund

- $53.1 million net decrease in funding for the Air Sector Economic Recovery Strategy

- $32.4 million net decrease in funding as part of the transfers to PacifiCan for the LNG Haisla Bridge project and the Praxis Spinal Cord Institute

- $29.4 million decrease in funding for the completion of the Investing in a Diverse and Growing Western Economy announced in Budget 2019

- $5.0 million decrease in funding for the completion of the Western Diversification Top Up announced in Budget 2017

- $1.7 million net decrease in funding for transfers and other minor operating adjustments

- $1.5 million decrease for the completion of the International Policy Program

Total authorities used for the quarter-ended June 30, 2022 decreased to $20.2 million, compared to $132.4 million at June 30, 2021. The $112.2 million decrease, or -85% is explained by:

- $1.0 million increase in payments for the Black Entrepreneurship Program

- $99.1 million decrease in Regional Relief and Recovery Fund transfer payments aiming to help western Canadian businesses cope with the financial hardship resulting from COVID-19

- $5.0 million decrease in Western Diversification Program payments, investing in a diverse and growing economy

- $4.4 million decrease for payment timing differences made to network partners

- $2.4 million decrease for payments restoring rail service to Churchill, Manitoba

- $2.3 million decrease in Regional Economic Growth through Innovation payments to deliver the Innovation and Skills Plan

Graph 2 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for Vote 5 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-2023 and the authorities used at quarter end and then compares them to fiscal year 2021-2022.

2022-2023

- $371,435 represents total available for use for the year ending March 31

- $20,209 represents total authorities used for the quarter ending June 30

2021-2022

- $519,724 represents total available for use for the year ending March 31

- $132,412 represents total authorities used for the quarter ending June 30

Statement of Authorities: budgetary statutory authorities

Budgetary statutory authorities available for use for fiscal year 2022-2023 are $5.4 million, an increase of $0.1 million when compared to the $5.3 million in 2021-2022. The variance is due to minor net adjustments in funding.

Budgetary statutory authorities used for fiscal year 2022-2023 are $1.4 million, an increase of $0.2 million when compared to the $1.2 million in 2021-2022.

Graph 3 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for budgetary statutory authorities (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-2023 and the authorities used at quarter end and then compares them to fiscal year 2021-2022.

2022-2023

- $5,404 represents total available for use for the year ending March 31

- $1,351 represents year-to-date authorities used for the quarter ending June 30

2021-2022

- $5,333 represents total available for use for the year ending March 31

- $1,174 represents year-to-date authorities used for the quarter ending June 30

Statement of the departmental budgetary expenditures by standard object

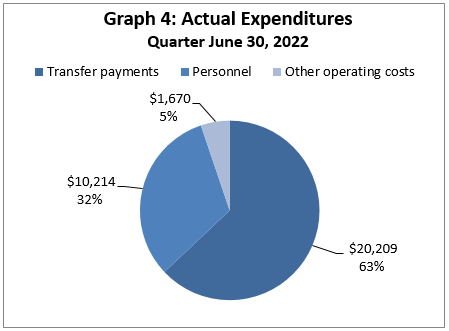

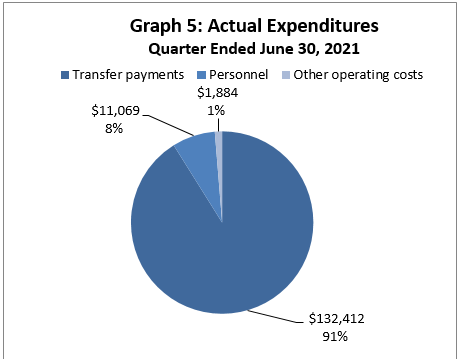

Expenditures by standard object for the quarter ended June 30, 2022, were $32.1 million, which reflects a decrease of $113.3 million, or -78% from the $145.4 million at June 30, 2021.

The variance is largely due to:

- $1.0 million increase in payments for the Black Entrepreneurship Program

- $99.1 million decrease in Regional Relief and Recovery Fund transfer payments, aiming to help western Canadian businesses cope with the financial hardship resulting from COVID-19

- $4.8 million decrease in Western Diversification Program payments, investing in a diverse and growing economy

- $4.4 million decrease for payment timing differences made to network partners

- $2.4 million decrease for payments restoring rail service to Churchill, Manitoba

- $2.3 million decrease in Regional Economic Growth through Innovation payments to deliver the Innovation and Skills Plan

- $0.9 million decrease in salary and other personnel costs with the completion of the Regional Relief and Recovery Fund program

- $0.2 million decrease in payments supporting the Canada Coal Transition Initiative

- $0.2 million decrease in operations and maintenance costs

Additional information can be found in the Statement of Authorities, Vote 1 and Vote 5 sections above.

Graphs 4 and 5 illustrate actual expenditures for the quarter-end.

(in thousands of dollars)

Text version: actual expenditures quarter ended June 30, 2022 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended June 30, 2022.

- $20,209 represents actual spending on Transfer Payments, which accounts for 63% of Actual Expenditures quarter ended June 30, 2022

- $10,214 represents actual spending on Personnel, which accounts for 32% of Actual Expenditures quarter ended June 30, 2022

- $1,670 represents actual spending on Other operating costs, which accounts for 5% of Actual Expenditures quarter ended June 30, 2022

Text version: actual expenditures quarter ended June 30, 2021 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended June 30, 2021.

- $132,412 represents actual spending on Transfer Payments, which accounts for 91% of Actual Expenditures quarter ended June 30, 2021

- $11,069 represents actual spending on Personnel, which accounts for 8% of Actual Expenditures quarter ended June 30, 2021

- $1,884 represents actual spending on Other operating costs, which accounts for 1% of Actual Expenditures quarter ended June 30, 2021

Risks and uncertainties

The department is managing the allocation of resources within a well-defined framework of accountabilities, policies and procedures including a system of budgets, reporting and other internal controls to manage within available resources and Parliamentary authorities.

PrairiesCan conducts an annual risk assessment exercise as part of its overall risk management approach. Prior to the COVID 19 pandemic, PrairiesCan did not identify any significant financial risks from their annual risk assessment.

In response to the COVID-19 pandemic, PrairiesCan had identified increased enterprise-wide risks including risks to employee physical and mental health, cyber risk, and risks due to the speed of program delivery to get funding to Canadians economically affected by COVID-19 in a timely manner. PrairiesCan employs risk-based mitigation such as business continuity planning, occupational health and safety planning and people management strategies; a robust system of network systems including encrypted signature, electronic security protocols and mobile equipment to employ remote connectivity; and risk assessments, governance processes, process mapping and segregation of duties when implementing programs.

Significant changes in relation to operations, personnel and programs

The overall decrease in voted spending in fiscal year 2022-2023 relates primarily to the conclusion of the Regional Relief and Recovery Fund as part of the Government of Canada’s COVID-19 Economic Response Plan. The decrease in voted spending is also attributed to the sunsetting of previous program initiatives announced in Budget 2017 for the Enhancement of the Western Diversification Program and Budget 2019 for Investing in a Diverse and Growing Western Economy.

Approval by Senior Officials

Approved by:

Original signed by:

________________________

Dylan Jones

Interim Deputy Minister

Edmonton, Canada

Date: August 29, 2022

Original signed by:

________________________

Sundeep Cheema

Chief Financial Officer

Statement of Authorities (unaudited)

Fiscal year 2022-2023 (in thousands of dollars)

| Authorities | Total available for use for the year ending March 31, 2023* | Used during the quarter ended June 30, 2022 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $46,630 | $10,533 | $10,533 |

| Vote 5 - Grants and contributions | 371,435 | 20,209 | 20,209 |

| Budgetary statutory authorities: Employee benefit plans |

5,404 | 1,351 | 1,351 |

| Total authorities | $423,469 | $32,093 | $32,093 |

Fiscal year 2021-2022 (in thousands of dollars)

| Authorities | Total available for use for the year ending March 31, 2022* | Used during the quarter ended June 30, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $47,771 | $11,779 | $11,779 |

| Vote 5 - Grants and contributions | 519,724 | 132,412 | 132,412 |

| Budgetary statutory authorities: Employee benefit plans |

5,333 | 1,171 | 1,171 |

| Budgetary statutory authorities: Transfer payments |

0 | 3 | 3 |

| Total authorities | $572,828 | $145,365 | $145,365 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental Budgetary Expenditures by Standard Object (unaudited)

Fiscal Year 2022-2023 (in thousands of dollars)

| Expenditures | Planned expenditures for the year ending March 31, 2023* | Expended during the quarter ended June 30, 2022 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $41,430 | $10,214 | $10,214 |

| Transportation and communications | 1,369 | 154 | 154 |

| Information | 1,318 | 126 | 126 |

| Professional and special services | 7,673 | 1,031 | 1,031 |

| Rentals | 1,437 | 195 | 195 |

| Repair and maintenance | 785 | 2 | 2 |

| Utilities, materials and supplies | 473 | 13 | 13 |

Acquisition of machinery and equipment |

1,549 | 9 | 9 |

| Transfer payments | 371,435 | 20,209 | 20,209 |

| Other subsidies and payments | 0 | 140 | 140 |

| Revenues and reductions | (4,000) | 0 | 0 |

| Total net budgetary expenditures | $423,469 | $32,093 | $32,093 |

Departmental Budgetary Expenditures by Standard Object (unaudited)

Fiscal Year 2021-2022 (in thousands of dollars)

| Expenditures | Planned expenditures for the year ending March 31, 2022* | Expended during the quarter ended June 30, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $39,386 | $11,069 | $11,069 |

| Transportation and communications | 933 | 4 | 4 |

| Information | 884 | 45 | 45 |

| Professional and special services | 7,781 | 1,413 | 1,413 |

| Rentals | 1,201 | 194 | 194 |

| Repair and maintenance | 862 | 0 | 0 |

| Utilities, materials and supplies | 477 | 8 | 8 |

Acquisition of machinery and equipment |

1,580 | 9 | 9 |

| Transfer payments | 519,724 | 132,412 | 132,412 |

| Other subsidies and payments | 0 | 211 | 211 |

| Total net budgetary expenditures | $572,828 | $145,365 | $145,365 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.