Quarterly Financial Report - Statement outlining results, risks and significant changes in operations, personnel and programs - For the quarter ended June 30, 2025

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly financial report should be read in conjunction with the Main Estimates and previous Quarterly Financial Reports. For more information on Privy Council Office (PCO), please visit PCO's website.

This quarterly report has not been subject to an external audit or review but has been shared with and reviewed by the PCO Departmental Audit Committee.

1.1 Mandate

PCO supports the development and implementation of the Government of Canada's policy and legislative agendas, coordinates responses to issues facing the Government and the country and supports the effective operation of Cabinet. PCO is led by the Clerk of the Privy Council, who also serves as Secretary to the Cabinet and the Head of the Public Service.

PCO’s key priorities are to:

- Provide non-partisan advice to the Prime Minister, PCO’s portfolio ministers, Cabinet, and Cabinet committees on matters of national and international importance;

- Support the smooth functioning of the Cabinet decision-making process to help implement the Government’s agenda;

- Ensure Canada is safe and secure, and promote a fair, transparent, and democratic government; and

- Foster an effective, diverse, inclusive, and innovative public service.

1.2 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes PCO’s spending authorities granted by Parliament and those used by the department, consistent with the 2025-26 Main Estimates and Supplementary Estimates (A). This quarterly report has been prepared using a special purpose financial reporting framework (expenditure basis) designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

PCO uses the full accrual method of accounting to prepare and present its annual departmental financial statements1 that are part of the departmental results reporting process. The spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended June 30, 2025.

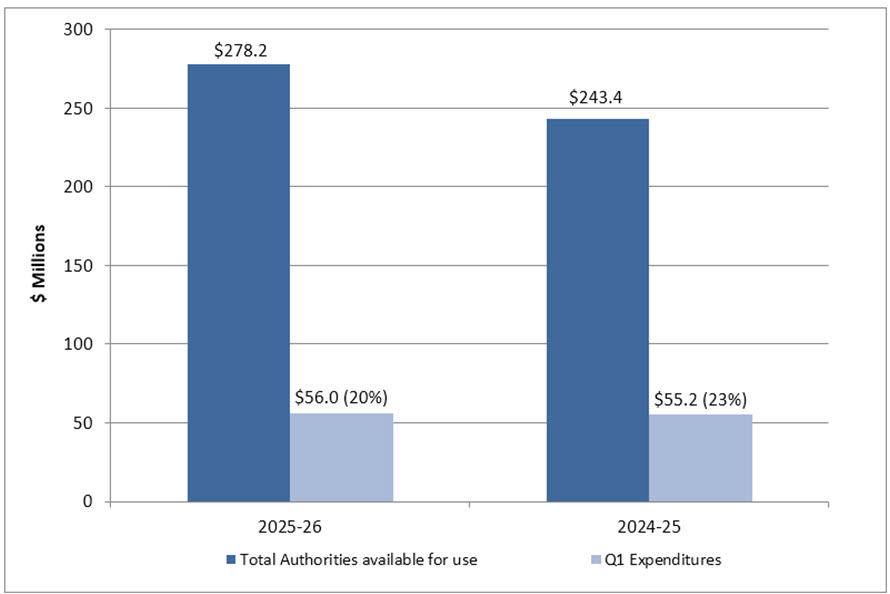

PCO spent approximately 20% of its authorities available for use at the end of the first quarter of 2025-26, compared to 23% at the end of the same quarter of 2024-25 (see graph 1 below).

Graph 1: Comparison of total authorities available for use and total net budgetary expenditures as of Q1 2025-26 and 2024-25

Text version - Graph 1

| 2025-26 | 2024-25 | |

|---|---|---|

| Total authorities available for use | 278.2 | 243.4 |

| Q1 expenditures | 56.0 (20%) | 55.2 (23%) |

2.1 Significant changes to authorities

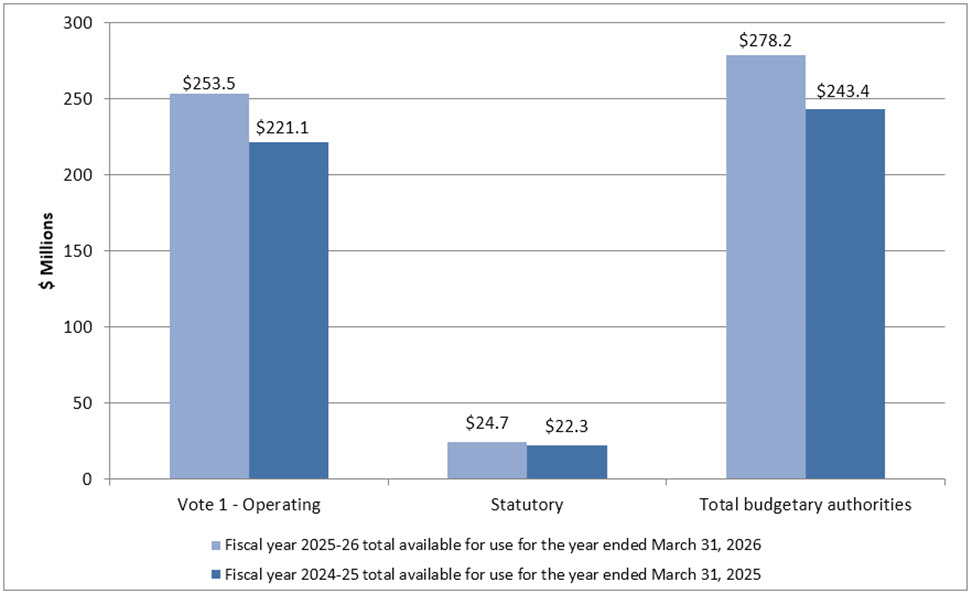

Further to graph 2 below and Annex A, presented at the end of this document, as of June 30, 2025, PCO has authorities available for use of $278.2 million in 2025-26 compared to $243.4 million as of June 30, 2024, for a net increase of $34.9 million or 14%. The net increase in authorities is mainly explained by funding allocated in 2025-26 for the provision of candidate security services during the federal electoral process and for election or post-election related costs, as well as additional funding allocated to enhance PCO’s security posture and support the National Security Council. This is partially offset by a decrease in funding stemming from the conclusion of the core mandate of the Public Inquiry into Foreign Interference in Federal Electoral Processes and Democratic Institutions on February 11, 2025. Commissions of Inquiry are independent organizations but are reported under PCO’s financial statements.

Graph 2: Variance in authorities as of June 30, 2025

Text version - Graph 2

| Vote 1 - Operating | Statutory | Total budgetary authorities | |

|---|---|---|---|

| Fiscal year 2025-26 total available for use for the year ended March 31, 2026 | 253.5 | 24.7 | 278.2 |

| Fiscal year 2024-25 total available for use for the year ended March 31, 2025 | 221.1 | 22.3 | 243.4 |

2.2 Significant changes to expenditures

Year-to-date net expenditures recorded to the end of the first quarter increased by $0.8 million, or 1%, from the same period of the previous year (from $55.2 million for 2024-25 to $56.0 million for 2025-26). Table 1 below presents budgetary expenditures by standard object.

Table 1

| Material Variances to Expenditures by Standard Object | Fiscal year 2025-26 Expended during the quarter ended June 30, 2025 |

Fiscal year 2024-25 Expended during the quarter ended June 30, 2024 |

Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 48,520 | 46,159 | 2,361 | 5% |

| Transportation and communications | 1,464 | 1,712 | (248) | (14%) |

| Information | 398 | 1,162 | (764) | (66%) |

| Professional and special services | 3,059 | 5,726 | (2,667) | (47%) |

| Rentals | 1,070 | 1,950 | (880) | (45%) |

| Repair and maintenance | 155 | 87 | 68 | 78% |

| Utilities, materials and supplies | 72 | 78 | (6) | (8%) |

| Acquisition of machinery and equipment | 904 | 943 | (39) | (4%) |

| Transfer payments | - | 279 | (279) | (100%) |

| Other subsidies and payments | 374 | 300 | 74 | 25% |

| Total gross budgetary expenditures | 56,018 | 58,397 | (2,379) | (4%) |

| Less revenues netted against expenditures | 0 | (3,151) | 3,151 | 100% |

| Total net budgetary expenditures* | 56,018 | 55,246 | 772 | 1% |

| * Details may not add to totals due to rounding | ||||

Personnel

The increase of $2.4 million in personnel spending is mainly due to transition-related costs associated with Cabinet changes following the 45th federal general election held on April 28, 2025.

Professional and special services

The decrease of $2.7 million in professional and special services is mainly due to reduced spending on legal and other professional services for the Public Inquiry into Foreign Interference in Federal Electoral Processes and Democratic Institutions, which completed its core mandate on February 11, 2025.

Transfer payments

The decrease of $0.3 million in transfer payments is mainly due to the conclusion of the core mandate of the Public Inquiry into Foreign Interference in Federal Electoral Processes and Democratic Institutions on February 11, 2025.

Revenues netted against expenditures

The decrease of $3.2 million in revenues netted against expenditures is due to the delayed approval of the first appropriation act for 2025–26 (Bill C-6: Appropriation Act No. 1, 2025–26) on June 26, 2025, which granted full supply for 2025-26 and authority for departments to re-spend revenues. Until then, following the dissolution of Parliament for the 45th federal general election, PCO operated under spending authorities granted through special warrants, which did not permit the re-spending of revenues. As a result, PCO postponed the collection of re-spendable revenues in the first quarter of 2025-26.

3. Risks and uncertainties

The principal financial risks to PCO lie in the need to reallocate departmental resources to deal with issues that may emerge unexpectedly. As part of its coordinating role, PCO must be able to address emerging issues on short notice, and either manage the necessary expenditures within its own spending authorities, or cash manage until increased spending authorities are approved.

PCO has identified other key risks that could have an impact on the achievement of its mandate and its financial situation. These risks revolve around areas such as threats to security (cybersecurity/insider/physical), information management, increasing horizontality, complexity and scope of work, and the recruitment and retention of employees.

The department will continue to effectively manage its existing and emerging risks through cooperation, engagement and sharing of expertise and best practices with other federal departments and agencies, provincial and territorial governments, as well as community partners, the private sector, international counterparts, and its Department Audit Committee.

4. Significant changes in relation to operations, personnel and programs

Personnel

Following the federal general election on April 28, 2025, the Liberal Party retained a minority government, and Mark Carney continued as Prime Minister and lead Minister for PCO.

Effective June 19, 2025, Dr. Brenda Dogbey, previously Chief Diversity Officer, PCO, became the Central Agencies Chief Equity and Inclusion Officer (CEIO) at the Treasury Board Secretariat (TBS).

Effective June 26, 2025, Eric Bélair began serving as the Acting Deputy Secretary to the Cabinet (Plans and Consultations) and Acting Deputy Secretary to the Cabinet (Clean Growth). Effective June 30, 2025, Mollie Johnson, who previously held this position, became Deputy Minister of Environment and Climate Change. Effective June 30, 2025, Jean-François Tremblay, previously Deputy Minister of Environment and Climate Change, became Senior Official, Privy Council Office, while he prepares for his upcoming role as Ambassador and Permanent Representative of Canada to the Organization for Economic Co-operation and Development.

Operations

Effective June 19, 2025, PCO’s Inclusion, Diversity, Equity and Anti-racism (IDEA) Secretariat transitioned to TBS to form a new Central Agencies IDEA Secretariat.

5. Approval by senior officials

Michael Sabia

Clerk of the Privy Council and

Secretary to the Cabinet

Matthew Shea

Assistant Secretary to the Cabinet, Ministerial Services and Corporate Affairs and Chief Financial Officer

Ottawa, Canada

Friday August 29, 2025

6. Annexes A & B

Annex A

Privy Council Office

Quarterly Financial Report

For the quarter ended June 30, 2025

Statement of authorities (unaudited) (note 2)

| Expenditures/Authorities | Fiscal year 2025-2026 | Fiscal year 2024-2025 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2026 (note 1) |

Used during the quarter ended June 30, 2025 |

Year-to-date used at quarter–end | Total available for use for the year ending March 31, 2025 (note 1) |

Used during the quarter ended June 30, 2024 |

Year-to-date used at quarter–end | |

| Vote 1 - Net operating expenditures | 253,455 | 49,841 | 49,841 | 221,058 | 49,648 | 49,648 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefits plans | 24,329 | 6,082 | 6,082 | 21,891 | 5,473 | 5,473 |

| Prime Minister - Salary and motor car allowance | 213 | 35 | 35 | 205 | 51 | 51 |

| Leader of the Government in the House of Commons - Salary and motor car allowance | 94 | 8 | 8 | 99 | 49 | 49 |

| Leader of the Government in the House of Commons and Minister of Democratic Institutions - Salary and motor car allowance | 8 | 8 | 8 | - | - | - |

| President of the King's Privy Council for Canada and Minister responsible for Canada-U.S. Trade, Intergovernmental Affairs and One Canadian Economy - Salary and motor car allowance | 91 | 14 | 14 | - | - | - |

| Minister of International Trade and Intergovernmental Affairs and President of the King’s Privy Council for Canada - Salary and motor car allowance | 12 | 12 | 12 | - | - | - |

| President of the King's Privy Council for Canada and Minister of Emergency Preparedness and Minister responsible for the Pacific Economic Development Agency of Canada - Salary and motor car allowance | - | - | - | 99 | 25 | 25 |

| Chief Government Whip - Salary and motor car allowance | 17 | 17 | 17 | - | - | - |

| Total budgetary authorities | 278,218 | 56,018 | 56,018 | 243,351 | 55,246 | 55,246 |

| Total authorities | 278,218 | 56,018 | 56,018 | 243,351 | 55,246 | 55,246 |

| Note 1: Includes only authorities available for use and granted by Parliament at quarter-end for each respective fiscal year (Including Frozen Allotments). Note 2: Details may not add to totals due to rounding. |

||||||

Annex B

Privy Council Office

Quarterly Financial Report

For the quarter ended June 30, 2025

Departmental budgetary expenditures by Standard Object (unaudited) (note 2)

| Departmental budgetary expenditures | Fiscal year 2025-2026 | Fiscal year 2024-2025 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2026 (note 1) |

Expended during the quarter ended June 30, 2025 |

Year-to-date used at quarter–end | Planned expenditures for the year ending March 31, 2025 (note 1) |

Expended during the quarter ended June 30, 2024 |

Year-to-date used at quarter–end | |

| Budgetary expenditures | ||||||

| Personnel | 183,777 | 48,520 | 48,520 | 180,924 | 46,159 | 46,159 |

| Transportation and communications | 5,970 | 1,464 | 1,464 | 5,285 | 1,712 | 1,712 |

| Information | 3,782 | 398 | 398 | 5,217 | 1,162 | 1,162 |

| Professional and special services | 77,812 | 3,059 | 3,059 | 41,195 | 5,726 | 5,726 |

| Rentals | 6,613 | 1,070 | 1,070 | 5,721 | 1,950 | 1,950 |

| Repair and maintenance | 1,692 | 155 | 155 | 1,787 | 87 | 87 |

| Utilities, materials and supplies | 981 | 72 | 72 | 569 | 78 | 78 |

| Acquisition of machinery and equipment | 5,540 | 904 | 904 | 8,997 | 943 | 943 |

| Transfer payments | - | - | - | 2,248 | 279 | 279 |

| Other subsidies and payments | - | 374 | 374 | 34 | 300 | 300 |

| Total gross budgetary expenditures | 286,166 | 56,018 | 56,018 | 251,979 | 58,397 | 58,397 |

| Less revenues netted against expenditures Revenues (note 3) |

(7,947) | - | - | (8,628) | (3,151) | (3,151) |

| Total revenues netted against expenditures | (7,947) | - | - | (8,628) | (3,151) | (3,151) |

| Total net budgetary expenditures | 278,218 | 56,018 | 56,018 | 243,351 | 55,246 | 55,246 |

| Note 1: Includes only authorities available for use and granted by Parliament at quarter-end for each respective fiscal year (Including Frozen Allotments). Note 2: Details may not add to totals due to rounding. Note 3: PCO's revenues are sourced from the provision of intelligence analysis training and the provision of internal support services to other departments. |

||||||