Quarterly Financial Report

For the quarter ended September 30, 2020 (unaudited)

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and Supplementary Estimates for fiscal year 2020–21. It has been prepared by management, as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. It has been reviewed by the Internal Audit Committee of the Public Service Commission of Canada.

This quarterly report has not been subject to an external audit or review.1.1 Authority and objectives

The Public Service Commission (the agency) is an independent agency established under the Public Service Employment Act and listed in schedules I.1 and IV of the Financial Administration Act.

A summary description of the agency’s programs can be found in its 2020–21 Departmental Plan.

1.2 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the agency’s spending authorities granted by Parliament and those used by the agency consistent with the Main Estimates for the 2020–21 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The agency uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 Financial structure

The agency has a financial structure comprised of voted budgetary authorities for program expenditures and statutory authorities for contributions to employee benefit plans.

In addition, the agency has the authority to re-spend certain revenues received from other government departments and agencies in a fiscal year to offset expenditures incurred in that same year, for the provision of assessment and counselling products and services.

2. Highlights of fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the change in resources available for the current year and in the actual expenditures for the quarter ended September 30, 2020.

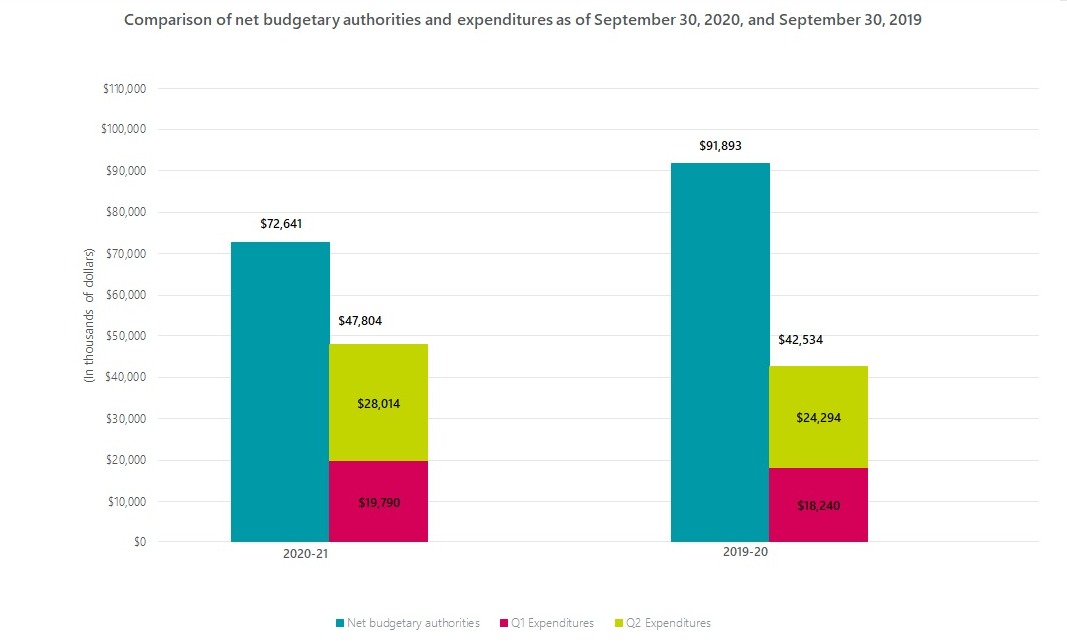

The following graph provides a comparison of the net budgetary authorities available for spending and the expenditures for the quarters ended September 30, 2020, and September 30, 2019, for the agency’s combined Vote 1 – Program Expenditures and Statutory Authorities.

Comparison of net budgetary authorities and expenditures as of September 30, 2020, and September 30, 2019

Text Alternative

| Net Budgetary Authorities | Q1 Expenditures | Q2 Expenditures | |

| 2020-21 | $72,641 | $19,790 | $28,014 |

| 2019-20 | $91,893 | $18,240 | $24,294 |

2.1 Significant changes to authorities

As shown in Section 6: Statement of Authorities, at September 30, 2020, there was a decrease of $19,252,000 in authorities available for use in the current year, as compared to the previous year.

The variance is due mainly to the following:

- $19,589,000 is explained by a decrease in funding that was due from the Main Estimates but not granted by Parliament at quarter-end; this is an unusual situation for this fiscal year, caused by the COVID-19 pandemic

- $1,966,000 is explained by an increase in funding received from the Treasury Board submission to cover higher current salary rates following the implementation of new collective agreements

- $1,265,000 is explained by a decrease in the year-end operating budget carry forward

- $165,000 is explained by a decrease in funding as a result of a transfer to Statistics Canada, as part of the census cost-sharing program, to contribute to a portion of the costs of collecting the comprehensive data for the 2021 Census Program

- $100,000 is mainly explained by a decrease in funding due to adjustments in the employer contributions to employee benefit plans

2.2 Significant variances in net expenditures from prior year

As shown in Section 7: Budgetary expenditures by standard object, total net budgetary expenditures during the quarter increased from $24,294,000 in 2019–20 to $28,014,000 in 2020–21; a variance of $3,720,000 or 15.3%.

The variance is due mainly to the following:

- an increase of $2,170,000 in personnel, mainly resulting from a salary cost increase of indeterminate employees

- a decrease of $533,000 in other subsidies and payments, mainly resulting from a decrease in salary recovery

- a decrease of $2,142,000 in revenues netted against expenditures, due mainly to the impact of the COVID-19 pandemic

- the demand for e-testing and test administration services and coaching decreased

- second language evaluation tests were given to departments free of charge

This decrease is also due to billing delays in the system. Invoicing was much slower in the current fiscal year than in the previous year.

3. Risks and uncertainties

The agency is evolving in a dynamic and complex environment that requires it to be effective, adaptive and innovative to support staffing in federal departments and agencies across Canada. As part of its departmental planning and reporting cycle, the agency undertakes an annual review of its organizational risks, as well as quarterly monitoring of mitigation strategies, activities and changes that are likely to have an impact on its expected results. This monitoring includes strategic oversight of the changes in external risk factors and internal vulnerabilities that may have an impact on the agency’s results.

The agency’s operational context, key risks as well as mitigation strategies can be found in its 2020–21 Departmental Plan.

In addition to the risks and uncertainties presented in its 2020–21 Departmental Plan, the agency has updated its analysis of the risks to which it is exposed as a result of the COVID-19 pandemic. The COVID-19 outbreak has a significant impact on financial revenue results. This impact had the effect of a decrease in the carry-over of 2019–20 planned funds and a significant decrease in projected cost-recovery revenues from its professional assessment products and services. This effect could heighten pressure on the agency in 2020–21 to deliver on its planned milestones and expected results. Mitigation measures will include ensuring that the agency’s resources are focused internally to fully realize its key priorities and initiatives, which involve reallocating internal resources to fully respond to emerging needs.

4. Significant changes in relation to operations, personnel and programs

The COVID-19 pandemic has affected the agency's operations as outlined in the risks and uncertainties section of this document.

5. Approved by senior officials

Approved by:

Patrick Borbey

President

Philip Morton, CPA, CGA

Chief Financial Officer

Gatineau, Canada

November 20, 2020

6. Statement of Authorities (unaudited)

| |

Total available for use for the year ending March 31, 2021* | Used during the quarter ended September 30, 2020 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Program Expenditures |

61,195 | 22,291 | 42,081 |

| Statutory – Refund of Previous Year Revenue | 1 | 1 | 1 |

| Statutory – Employer Contributions to Employee Benefit Plans | 11,445 | 5,722 | 5,722 |

| Total Budgetary Authorities |

72,641 | 28,014 | 47,804 |

* Includes only Authorities available for use and granted by Parliament at quarter-end. |

|||

| Total available for use for the year ending March 31, 2020* | Used during the quarter ended September 30, 2019 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Vote 1 – Program Expenditures | 80,320 | 19,515 | 37,755 |

| Statutory – Refund of Previous Year Revenue | 27 | 27 | 27 |

| Statutory – Spending of proceeds from the disposal of surplus Crown assets | 1 | 1 | 1 |

| Statutory – Employer Contributions to Employee Benefit Plans | 11,545 | 4,751 | 4,751 |

| Total Budgetary Authorities | 91,893 | 24,294 | 42,534 |

* Includes only Authorities available for use and granted by Parliament at quarter-end. |

|||

7. Budgetary expenditures by standard object (unaudited)

| Planned expenditures for the year ending March 31, 2021 | Expended during the quarter ended September 30, 2020 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Personnel | 70,739 | 24,946 | 43,389 |

| Transportation and telecommunications | 684 | 25 | 38 |

| Information | 284 | 16 | 19 |

| Professional and special services | 11,961 | 2,260 | 2,578 |

| Rentals | 1,184 | 806 | 1,052 |

| Repair and maintenance | 473 | 8 | 9 |

| Utilities, materials and supplies | 136 | 26 | 45 |

| Acquisition of machinery and equipment | 1,295 | 60 | 71 |

| Other subsidies and payments | 136 | (75) | 731 |

| Total gross budgetary expenditures | 86,892 | 28,072 | 47,932 |

| Less: Revenues netted against expenditures | (14,251) | (58) | (128) |

| Total net budgetary expenditures | 72,641 | 28,014 | 47,804 |

| Planned expenditures for the year ending March 31, 2020 | Expended during the quarter ended September 30, 2019 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Personnel | 84,840 | 22,776 | 40,097 |

| Transportation and telecommunications | 904 | 104 | 251 |

| Information | 415 | 25 | 107 |

| Professional and special services | 15,440 | 2,247 | 3,157 |

| Rentals | 1,871 | 777 | 891 |

| Repair and maintenance | 675 | 15 | 22 |

| Utilities, materials and supplies | 170 | 49 | 133 |

| Acquisition of machinery and equipment | 1,632 | 42 | 103 |

| Other subsidies and payments | 198 | 459 | 795 |

| Total gross budgetary expenditures | 106,145 | 26,494 | 45,556 |

| Less: Revenues netted against expenditures | (14,252) | (2,200) | (3,022) |

| Total net budgetary expenditures | 91,893 | 24,294 | 42,534 |