Minister’s Transition Book 2: Departmental business—March 2025

On this page

Note: Shared Services Canada (in a separate binder).

Plans and Priorities at Public Services and Procurement Canada

As of March 2025, Public Services and Procurement Canada (PSPC) has approximately 19,000 employees.

Public Services and Procurement Canada Core Responsibilities

In this section

- Acquisitions

- Infrastructure

- Payments and accounting

- Government services

- Corporate enablers

- Minister Mandate Letter Commitments 2020

Acquisitions

- $27 billion of procurements annually:

- 8% for construction

- 43% for goods

- 49% for services

- 2.7% of total value of contracts awarded for PSPC to Indigenous businesses

- Largest client departments:

- Department of National Defence (DND) $13.5 billion (50%)

- PSPC $4.9 billion (18%)

- Public Health Agency of Canada (PHAC) $2.9 billion (11%)

- More than 31,000 transactions

- Supports Canada’s defence policy, Our North, Strong and Free and the National Shipbuilding Strategy (NSS):

- NSS large ship construction contracts awarded between 2012 and 2023 are estimated to contribute close to $30 billion ($2.3 billion annually) to the Gross Domestic Product (GDP)

Infrastructure

Real Property

- $8 billion total market value of Crown-owned and lease purchase real property

- $1.2 billion rental payments

- 288,000 public servants accommodated in close to 1,500 locations across Canada including GCcoworking sites

Engineering Assets

- 5 interprovincial crossings in National Capital Region (NCR)

- 17 engineering assets across the country including bridges, roads, docks and dams

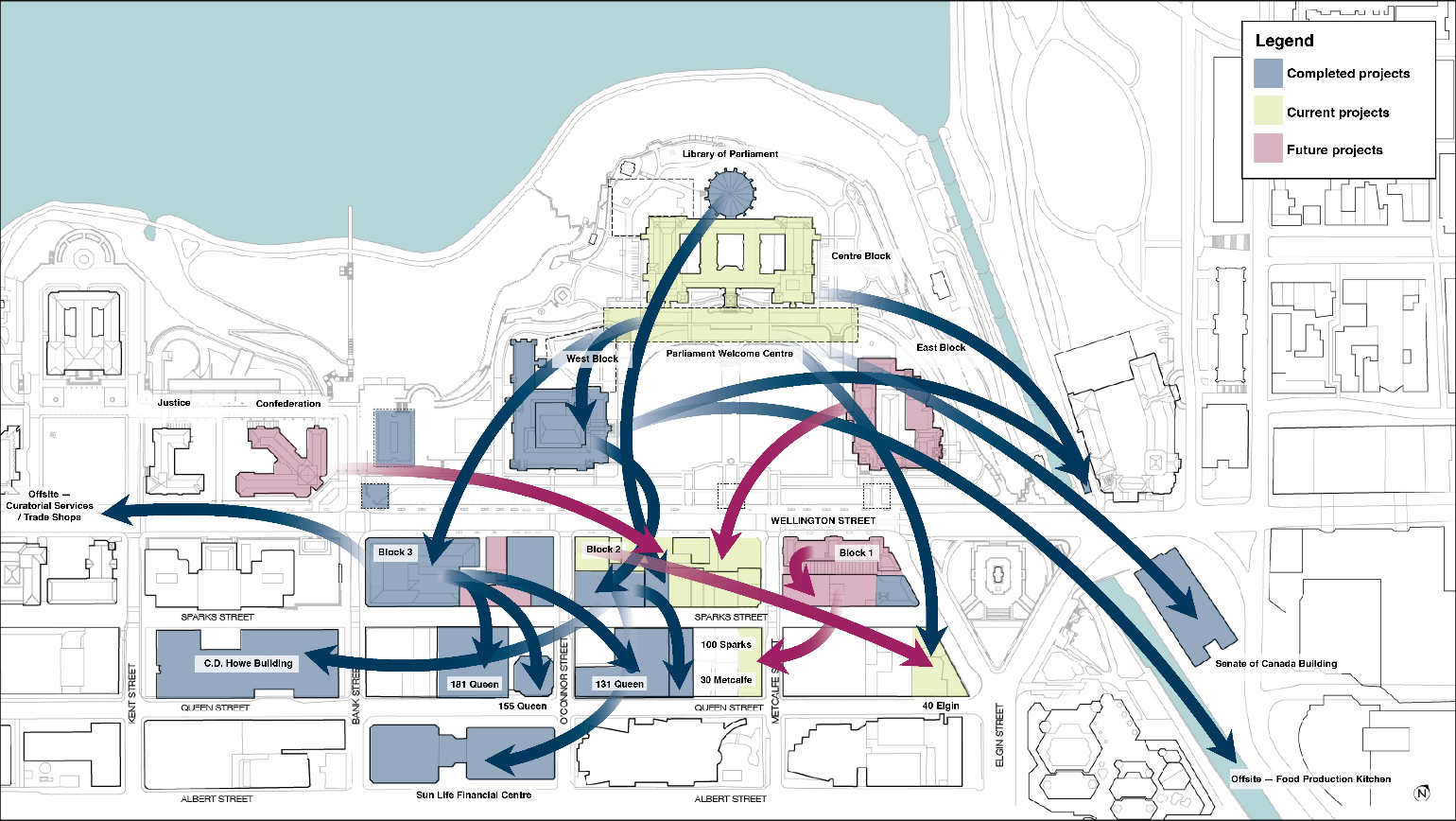

Parliamentary Precinct

- $16.4 billion to restore and modernize the Parliamentary Precinct as per the Long Term Vision and Plan (LTVP). Current major projects underway include:

- Centre Block

- Parliament Welcome Centre Block 2

Science Infrastructure

$3.7 billion Laboratories Canada projects working with 5 Science Hubs across Canada.

Payments and accounting

Pay Administration

- Accountable for the administration of compensation activities and initiatives to stabilize human resources (HR) and pay

- PSPC is responsible for administering pay for more than 415,000 government pay accounts, while also delivering full compensation services to approximately 270,000 Government of Canada employees

Receiver General

Issues over 405 million payments annually on behalf of federal departments and agencies. The department managed cash flows of $3.55 trillion in 2023 to 2024.

Pensions

Over $15.8 billion in pension payments to over one million active and retired members.

Government services

Translation Bureau

- Offers services in more than 100 languages, including Indigenous languages and sign languages

- 370 million words translated, including more than one million in Indigenous languages

- 47,000 hours of interpretation for Parliament and departments

- 10,000 hours of interpretation in Indigenous languages, American Sign Language (ASL), and Quebec Sign Language (QSL)

Security and Oversight

Office of Supplier Integrity and Compliance established in May 2024:

- processes over 120,000 personnel security screening requests per year

- 100 active fairness monitoring engagements

- completed over 30,000 integrity verification requests

Other

- Travel

- GCSurplus

- Advertising Services

- Canada Gazette

Corporate enablers

- Audit, Evaluation and Risk

- Policy and Communication Services

- Legal Services (Department of Justice)

- Human Resources Management Services

- Financial Management Services

- Information Management and Information Technology Services

- Security and Oversight Services

Minister Mandate Letter Commitments 2020

Innovative and Client-Focused Service Delivery.

Public Services and Procurement Canada-Led

- Continue the modernization of procurement practices

- Continue to advance government-wide initiatives to increase diversity of bidders on governments contracts

- Require federal departments and agencies to ensure a minimum of 5% of the total value of federal contracts are held by Indigenous businesses

- Renew the fleets of the Canadian Coast Guard (CCG) and Royal Canadian Navy (RCN) and advance the shipbuilding industry

- Continue to improve crossings in the National Capital Region

- Resolve outstanding Phoenix Pay System issues for public, while advancing work through Shared Services Canada (SSC) on the Next Generation Pay and Human Resources System

- Advance work to rehabilitate and reinvigorate places and buildings of national significance under the responsibility of the National Capital Commission (NCC) and PSPC

- Ensure the ongoing delivery of defence procurements in support of Canada’s Defence Policy, Strong, Secure, Engaged

Commitments Met

- Continue to procure COVID-19 therapeutics, tests and vaccines

- Prioritizing reusable and recyclable products in procurement to support zero plastic waste and supporting Canadian clean technology

Public Services and Procurement Canada-Supported

- Introduce legislation to eradicate forced labour from Canadian supply chains

- Introduce a new Buy Clean Strategy to support and prioritize the use of made-in-Canada low-carbon products in Canadian infrastructure projects

Crown Corporation-Led

Ensure that Canada Post provides high-quality service and better reaches Canadians in rural and remote areas.

Overview of Public Services and Procurement Canada

Public Services and Procurement Canada at a Glance

- PSPC’s mission is to focus on high-quality services to enable operations across Government

- Payments and accounting

- Procurement of goods and services

- Property and infrastructure

- Government-wide services

- PSPC has over 19,000 employees and a current annual gross budget of $9.7 billion, of which $5.7 billion is appropriated by Parliament and $4 billion is revenue

Procurement of Goods and Services

- Manages the annual procurement of goods and services valued at approximately $25 billion on behalf of federal departments and agencies:

- identifying the goods or services to be procured

- selecting the most effective procurement approach

- considering socio-economic and environmental factors

- developing procurement instruments

- negotiating and administering contracts

- contract security

- ethical business practices

- Leads major defence and marine procurements for DND and CCG

- Outreach to businesses interested in becoming government suppliers

- Advances modernization of procurement to simplify procurement and contracting management practices

Property and Infrastructure

Other Responsibilities

The department also has responsibility for:

The Parliamentary Precinct

- stewardship, rehabilitation and modernization of Crown-owned buildings and associated lands

- current work is focussed on Centre Block and redevelopment of Block 2, as well as the Indigenous Peoples’ Space at 100 Wellington

Federal Laboratories

The revitalization of federal laboratories across Canada to support world-class science.

Engineering assets

- building, maintaining and managing infrastructure, including roads, bridges and dams across the country, as well as heating and cooling plants in the NCR

- contaminated site clean-up and environmental remediation

Payments and Accounting

PSPC collects revenues and issues payments, maintains the financial accounts of Canada, issues Government-wide financial reports, and administers payroll and pension services across the Government of Canada. PSPC ensures that employees receive timely and accurate pay and benefits and is making progress towards reducing the backlog of pay transactions. The department continues to work with other departments and agencies to further stabilize pay administration, while work is underway to develop a new pay system.

As part of Budget 2024, the Government of Canada allocated $135 million to expand testing and design of a new HR and pay solution for the public service (Dayforce). This decision supports the eventual replacement of the Phoenix pay system and its HR systems.

The Department :

- handles over $3 trillion in cash flow transactions each year

- issues approximately 400 million payments annually on behalf of federal departments and agencies

- provides pension services to over one million active and retired members of eight public sector pension plans and administers over five million pension payments valued at $15 billion annually

- makes payments in lieu of taxes, on behalf of departments and agencies, toward the cost of local government in communities where it owns real property (for example, office buildings, harbours, national parks)

Government-wide Services and Support

Translation

- PSPC offers services to federal institutions and Canadians as the Government’s linguistic authority and common service provider

- PSPC’s Translation Bureau provides translation and interpretation services for government and Parliamentarians

- The Bureau is also working to provide quality remote interpretation services, maintain capacity to support Indigenous languages, and offer sign languages interpretation

Government Services

- Through the Office of Supplier Integrity and Compliance (OSIC), PSPC helps to ensure that the government does business with ethical suppliers in Canada and abroad

- PSPC also manages government information services to support the delivery of media monitoring and analysis, and public opinion research and advertising contracting

- PSPC is responsible for GCSurplus and the Seized Property Management programs for sale and divestiture of surplus assets and seized assets, respectively

- The department also processes security screenings for contractors and sub-contractors requiring access to protected information

Internal Services

PSPC operations are supported by a range of corporate services, including:

- human resources management

- finance management

- information management/information technology

- policy and communications (services also provided to the Minister of Public Services and Procurement)

- cabinet and parliamentary affairs (services also provided to the Minister of Public Services and Procurement)

Public Services and Procurement Canada: Portfolio Organizations

Partner Departments in portfolio

Shared Services Canada

Responsible for digitally enabling government programs and services. It does this by providing networks and network security, data centres and Cloud offerings, digital communications and Information technology (IT) tools to enable the public service to effectively deliver services to Canadians.

Crown Corporations

Defence Construction Canada

- Provides infrastructure and environmental services for defence projects

- Carries out a wide range of procurement, disposal, construction, operation, maintenance and professional activities required to support the defence of Canada, with its primary clients being DND and the Canadian Forces

National Capital Commission

- Responsible for acting as the long-term planner, principle steward and a partner in the development, conservation and improvement of Canada’s NCR

- Region’s largest landowner and owns 11% of all lands in NCR, which includes 6 official residences, NCR interprovincial crossings and LeBreton Flats, among others

Canada Post Corporation

- Canada Post Corporation Act mandates the establishment and operation of a postal service that meets the needs of Canadians and that conducts operations on a financially self-sustaining basis

- More than $9.7 billion in revenues annually

- Exclusive privilege to collect, transmit and deliver letters up to 500 grams within Canada

Canada Lands Company Limited

- Holds, develops and disposes of Government of Canada real property.

- It is a shell parent Crown corporation with three operational subsidiaries:

- Canada Lands Company CLC Limited

- Parc Downsview Park

- Old Port of Montreal Corporation

Adjudicative, Regulatory and Oversight Bodies

Office of the Procurement Ombud

The procurement Ombud plays a crucial role in ensuring fairness, transparency, and accountability in federal procurement processes.

Its key functions include:

- reviewing complaints

- conducting investigations

- providing alternative dispute resolution services

- promoting best practices

- raising awareness and understanding of procurement issues among suppliers and federal departments

Payments in Lieu of Taxes Dispute Advisory Panel

Provides advice to the Minister of Public Services and Procurement and heads of Federal Crown Corporations in the event a taxing authority disagrees with the property value, dimension or effective rate applicable to any federal property.

Number of Public Services and Procurement Canada employees

Located in five geographic regions across Canada and in the NCR.

- Pacific: 598

- Western: 690

- Ontario: 680

- Quebec: 1,485

- Atlantic: 3,010

- National Capital Region: 10,920

Public Services and Procurement Canada Supply for 2025 to 2026

Mandate

The Estimates process falls under the democratic principle that no money can be spent without the approval of Parliament. This process, which includes the Main Estimates and the Supplementary Estimates, provides elected officials and Canadians with an overview of the Government’s spending plans to deliver on its priorities and mandate.

The Main Estimates outline the proposed budget required for a department to deliver on its programs for the upcoming fiscal year, excluding Budget items. The tabling of the Main Estimates results in two supply bills (interim and full supply) that require approval through a vote. These are normally voted in March and June of every year.

Key Activities

As the fiscal year begins on April 1, Parliament annually approves a standard interim supply of three-twelfths of the Main Estimates (representing the first quarter of the year) to provide government departments with sufficient cash flow to sustain operations while the Main Estimates are reviewed and full supply approved, normally in June as per the supply cycle. Organizations may request additional twelfths when justified, such as when greater expenditures are anticipated in the opening quarter.

Under normal circumstances, Royal Assent of the interim supply bill for the 2025 to 2026 fiscal year is expected to be granted before April 1, 2025.

Partners and Stakeholders

The Main Estimates (interim supply and full supply) is an annual exercise that is managed internally by departments and in collaboration with central agencies.

Key Challenges

The Treasury Board of Canada Secretariat (TBS) is preparing for the possibility that Parliament could be dissolved for a democratic event prior to the end of the fiscal year. In such cases, all business in the Senate and House of Commons would end, including the business of supply:

- should Parliament be dissolved, thus affecting the 2025 to 2026 Main Estimates (interim and full supply), the Financial Administration Act confers on the Governor in Council a separate and independent authority to authorize payments out of the Consolidated Revenue Fund. This process involves the application of an authority known as the Governor General Special Warrant

- the Financial Administration Act restricts Governor General Special Warrant to payments urgently required for the public good. This includes payments for items that have received Cabinet and Treasury Board approval, and are required to ensure the normal operations of Government, such as delivering ongoing programs and meeting contractual obligations

- should parliament be dissolved before there is an appropriation bill on the 2025 to 2026 Interim Supply or 2025 to 2026 Main Estimates, the Minister of Public Services and Procurement will be required to sign-off on warrant certificates

Key files

Canada and United States Relations

Asylum Seekers, Detainees and Borders

Mandate

PSPC in its role as a common service provider, will continue to support the Canada Border Services Agency (CBSA), the Royal Canadian Mounted Police (RCMP), and Immigration, Refugees and Citizenship Canada (IRCC) for procurements related to asylum seekers, immigration detention and borders.

Key Activities

PSPC has led several procurements over the last few years, on behalf of federal departments, to manage a surge in asylum seekers. The procurements were for a wide variety of goods and services including, for example, accommodations, guard services, social support services, transportation, temporary infrastructure, generators, and other equipment. There was significant public attention on the Roxham Road, Quebec, entry point, as well as on Dev Centre accommodations contract.

PSPC is supporting the CBSA for procurements related to detention of high risk detainees, which became necessary following a decision from provinces to withdraw from agreements to house these detainees in provincial prisons.

More recently, the CBSA, the RCMP, and IRCC have identified additional procurements related to border control and a potential surge in asylum seekers. These requirements have arisen recently as a result of the political context with the United States and have been identified as high priority and in some cases urgent. PSPC is in communication with all three departments and is ready to provide procurement and leasing support, as needed.

PSPC is working with client departments to use standard competitive procurement practices to the greatest extent possible in order to reduce risks and obtain best value for money on procurements related to asylum seekers, detainees and borders. However, several of the procurements have taken place under urgent timelines, and as a result some were awarded without competition. In all cases, proper processes were followed.

Partners and Stakeholders

PSPC continues to support client departments including CBSA, the RCMP, and IRCC for procurements related to asylum seekers, immigration detention and borders. These departments are responsible for managing their programs, providing funding, and defining requirements for the procurements.

Key Challenges

Given strategic considerations and the urgency of requirements, PSPC is called upon to devote significant attention and prioritization to supporting procurements related to asylum seekers, immigration detention and borders.

Procurement of United States Goods and Services

Mandate

It is estimated that United States (US) suppliers are awarded approximately 10% of the value of all Canadian federal procurement contracts, including for defence. Over the past three fiscal years, PSPC has awarded an average of approximately $1.3 billion per year to suppliers located in the US. This excludes Canadian-based suppliers that are subsidiaries of US companies as well as contracts under the Foreign Military Sales program.

On February 1, 2025, the Trump Administration issued an Executive Order to apply tariffs on imports from Canada “to address the flow of illicit drugs across the US northern border.” The Order stated that, effective February 4, 2025, a tariff rate of 25% would apply on all imports of goods from Canada to the US, except for energy products, which would be subject to a tariff rate of 10%. On February 3, 2025, the Trump Administration announced a delay of at least one month for the application of these tariffs, until at least March 3, 2025.

On March 3, the Executive Order announced in February came into effect. In response, the Government of Canada moved forward with 25% tariffs on $155 billion worth of US goods, beginning with a list of goods worth $30 billion effective March 4, 2025, with tariffs on an additional $125 billion in imports from the US to come info force following a 21-day comment period. The Government also announced that other measures, including potential non-tariff measures, remain on the table should the US continue to apply unjustified tariffs against Canada.

On March 6, the US announced a tariff reprieve applicable to Canadian exports that are compliant with the Canada-US-Mexico Agreement (CUSMA) until April 2.

Key Activities

Canada and the US are both parties to the World Trade Organization Agreement on Government Procurement. In 2022, approximately CAD 5.8 billion (USD 4 billion) of Canadian federal procurements were subject to the Agreement. US federal procurement opportunities under the same Agreement are worth nearly USD 130 billion (CAD 184 billion) annually. The Government Procurement Chapter of the CUSMA does not apply to Canada.

Canada currently operates an open procurement system that generally allows firms from every country to bid on federal procurement opportunities, even where trade agreements do not apply. The 2024 Fall Economic Statement announced that starting in spring 2025, the Government will strictly enforce its procurement trade obligations to limit access to Canada’s federal procurement market to Canadians and trading partners that provide Canada with a similar level of access to their public market, with the exception of defence procurement. This reciprocal procurement policy would reduce US access to the non-defence Canadian federal procurement market to what is strictly required under the Agreement.

In addition, PSPC is closely monitoring the trade situation in the US, assessing potential impacts to existing projects, and, in consultation with provincial and territorial counterparts, exploring the use of non-tariff procurement countermeasures as part of a balanced and strong response if needed.

Partners and Stakeholders

Key partners and stakeholders on the response to potential US tariffs, including any potential non-tariff measures, would include the Privy Council Office (PCO) and the Department of Finance Canada (FIN). Key partners on reciprocal procurement include TBS, and Global Affairs Canada (GAC).

Key Challenges

PSPC has incomplete statistical data on the origin of the suppliers it contracts with or the origin of the goods and services it receives, including with respect to the US. The department is, however, taking action to address this and is gathering key information on all contracts that are in the process of being awarded to US suppliers.

The frequent changes in the US approach to tariffs presents uncertainty.

Acquisitions

Large procurements in support of other government departments

Digital Transformation Procurement Overview

Mandate

PSPC is facilitating the procurements associated with digital transformation projects, notably major digital transformation initiatives for Employment and Social Development Canada (ESDC) and IRCC.

Key Service Delivery Projects: Benefit Delivery Modernization

Benefit Delivery Modernization is a multi-year program led by ESDC to replace aging and complex legacy systems with a single, modern, easy to use, and secure software platform. Its goal is to provide a seamless experience for Canadians accessing Employment Insurance and Canada Pension Plan and Old Age Security (OAS) benefits. ESDC was initially granted Benefit Delivery Modernization project authority of $1.8 billion in 2017. Project authority was then increased to $2.2 billion in April 2022, and to $6.6 billion in November 2024.

Through a competitive procurement process, PSPC awarded four Master Systems Integrator Contracts to four qualified Systems Integrators in spring 2021. Work packages are either competed for amongst these four qualified suppliers, or, if appropriate, the work is allocated amongst all four suppliers that work collaboratively in advancing a project. The Minister of Public Services and Procurement has advance contract authority from TBS to award contracts up to a value of $2.6 billion under this program.

The department has also awarded a competitive contract for the Core Technology Platform to International Business Machines Corporation (IBM) Canada, valued at $249 million, and a large competitive contract for strategic transformation advice to Price Waterhouse Coopers valued at $179 million.

Benefit Delivery Modernization is being advanced in four tranches of work, ending in 2031. Work in Tranche one to deliver a new OAS system is currently underway and Tranche two will begin with the issuance of the Employment Insurance Build and Implementation Task Authorization.

OAS is the first benefit to be added to the new Benefit Delivery Modernization Platform and the third release is scheduled for March 2025.

The next benefit to be on-boarded will be Employment Insurance with the Build and Implement phase, which launched at the beginning of January 2025.

Key Service Delivery Projects: Digital Platform Modernization

The Digital Platform Modernization procurements will provide IRCC with a modernized web presence and supporting information technology systems, allowing users to access services in a streamlined way and have visibility into the status of their transactions.

The Client Experience Platform will provide a new interface wherein clients can interact with IRCC in a manner that allows for a simplified and intuitive experience across multiple channels and devices. The Client Experience Platform contracts were awarded to Accenture Inc. and Salesforce Canada Corporation on July 14, 2023, for a combined initial contract value of $85.4 million. In June 2024, the Temporary Resident Visa business line entered into production. Applicants are able to apply for visas and track the application progress online. On December 11, 2024, adult passport renewal launched online for eligible applicants for the first time, Canadians have the option to renew their passports online.

The Case Management Platform will replace IRCC’s current immigration application system, the Global Case Management System, used for processing all immigration and citizenship related applications. The system contains over 60 million personal records and is used by over 20,000 users across six government departments. Following a competitive procurement process, the Case Management Platform contracts were awarded to Accenture Inc. and Microsoft Corporation on September 19, 2024, for a combined initial contract value of approximately $122 million.

A contract for Programme Management Strategic Advisory Services was awarded on May 3, 2023, to Ernst and Young Limited Liability Partnership (LLP) for an initial contract value of $9.6 million to provide a team of experts to support transformation objectives of Digital Platform Modernization.

Examples of strategic advisory services that are currently being provided include:

- advising the IRCC leadership team on how best to achieve the Program’s transformation objectives

- promoting Digital Platform Modernization’s change agenda

- interacting with a wide variety of senior stakeholders

- assisting IRCC in determining Case Management Platform Request for Proposal (RFP) requirements

Canadian Dental Care Plan

Mandate

The Canadian Dental Care Plan (CDCP) is led by Health Canada (HC). PSPC was responsible for managing the procurement to select a private partner for the delivery of dental claims processing, and is now responsible for administering the contract. This has involved engaging with industry, developing procurement documentation, conducting the procurement process and managing the resulting contract associated with the program.

Key Activities

In December 2023, a contract was awarded to Sun Life, worth approximately $750 million for a five-year operational period, to provide claims processing for the CDCP. The Operations Phase launched on May 1, 2024, and claims processing services began. This phase is running simultaneously along with the Start-up Phase, which will be completed by April 2025. The CDCP contract contains an Indigenous Participation Component, designed to support Indigenous economic development.

As of November 1, 2024, the scope of the CDCP expanded with the launch of services that require preauthorization as well as paper claims processing. As of February 2025, over 1.5 million Canadians are using the CDCP. All current members will be required to re-apply between March and April of 2025 to keep their eligibility under the CDCP. All remaining eligible Canadians will be able to apply in May 2025 with cohorts rolling out over a six-week period, ending in June 2025. The exact roll-out is still being finalized by HC.

The next steps consist of Sun Life implementing and finalizing a Member portal, a HC user interface and a robust fraud risk management program.

Partners and Stakeholders

As the department responsible for providing dental care coverage to Canadians, HC is the program authority and main partner for the CDCP.

Other partners include:

- Canada Revenue Agency (CRA), which delivered the Dental Benefit as an interim measure and provides the data necessary to determine eligibility of CDCP members

- ESDC, which is responsible for enrolment of CDCP members

- Statistics Canada, which collects and reports on data to inform the rollout of the CDCP and the overall oral health of Canadians

HC has also engaged and collaborated with external stakeholders including academic experts in oral health and oral public health, national professional organizations (such as the Canadian Dental Association), provinces and territories, dental care providers, and the insurance and claims processing industry.

Key Challenges

Since the implementation of services that require pre-authorizations on November 1, 2024, HC has identified issues with the adjudication rules adapted from an existing federal program. These rules are not functioning as intended when applied to the CDCP, resulting in a very high denial rate of the requests. To resolve this situation, changes to the adjudication process are necessary. A few specific items, such as crowns and dentures, have been reviewed by Sun Life and different rules have been implemented. The next step would be to complete an assessment of other items and to implement updated rules, as needed, to ensure the successful processing of these requests. A Task Authorization will be signed shortly to commence this work.

The implementation of contract amendments and task authorizations necessary for important work or clarification under the contract have taken longer than anticipated for all parties. PSPC is actively working with HC and Sun Life to establish a change management process and to determine where timelines for reviews and approvals could possibly be tightened.

Procurement policy

Procurement Strategy for Indigenous Businesses

Mandate

Federal procurement is an important lever for increasing socio-economic benefits for Indigenous businesses and Peoples. The Indigenous business sector is also a key driver of wealth in Indigenous communities and in closing the socio-economic gaps between Indigenous Peoples and non-Indigenous people.

Key Activities: Five Percent Target

To create more opportunities for Indigenous businesses to succeed and grow, PSPC, Indigenous Services Canada (ISC) and TBS are implementing approaches to ensure that at least 5% of the total value of federal contracts are awarded to businesses owned and controlled by Indigenous Peoples. In 2022 to 2023, the latest year for which data is available, the Government of Canada awarded $33.5 billion in contracts to businesses, with $1.6 billion (6.3%) going to Indigenous businesses. Additional efforts are needed for PSPC to meet the target as the department awarded $143 million (3.4%) of the total value of its procurements to Indigenous businesses in 2023 to 2024.

Innovative approaches are being put forward to accelerate the progress in increasing opportunities for Indigenous participation in federal procurement. The department is also working to accelerate progress through engagement and outreach efforts with Indigenous suppliers. In 2023 to 2024, the department held 524 events to specifically enhance collaboration with Indigenous businesses; these events had a total of 8,382 participants.

Key Activities: Modern Treaties and Nunavut Agreement

There are currently 25 modern treaties, 22 of which contain procurement obligations. The department works with Indigenous Modern Treaty Partners to establish implementation plans and measures to implement those provisions. It also provides support to procurement officials involved in procurement projects subject to modern treaties and self-government agreements to help them meet these obligations.

The Nunavut Agreement is a Comprehensive Land Claim Agreement that contains procurement obligations and the requirement for Canada to develop its procurement policies in close collaboration with Nunavut Tunngavik Incorporated. PSPC continues to provide procurement services, advice and guidance on Nunavut Settlement Area procurements.

Key Activities: Procurement Strategy for Indigenous Business

PSPC supports ISC in implementing the Procurement Strategy for Indigenous Business (PSIB), including ensuring that eligible procurements are leveraged. It aims to increase the number of suppliers that are at least 51% owned and controlled by an Indigenous person or joint ventures majority-owned and controlled by an Indigenous business bidding for, and winning, federal contracts. Contracts awarded under PSIB are a key part of meeting the 5% target. Under the PSIB program, businesses submitting bids must attest to meeting the Indigenous business definition at the time of submission and throughout the contract, with their certification subject to audits by ISC at any time.

Key Activities: Transformative Indigenous Procurement Strategy

The Government of Canada, led by ISC and supported by the TBS and PSPC, continues to actively work with Indigenous partners to co-develop a Transformative Indigenous Procurement Strategy that will improve procurement policies, safeguards, and processes for Indigenous businesses.

Partners and Stakeholders

PSPC, ISC and TBS continue to build external partnerships that will help meet the 5% target. Organizations involved include:

- Assembly of First Nations

- Canadian Council of Aboriginal Business

- Council for the Advancement of Native Development Officers

- Inuit Tapiriit Kanatami

- National Aboriginal Capital Corporations Association

- National Indigenous Economic Development Board

- Métis National Council

- Corporate Canada

Key Challenges

Results to date show that while the Government of Canada is overall achieving the 5% target overall, PSPC itself must significantly increase procurement efforts to align with this objective. Stronger action and intensified collaboration with stakeholder departments will be critical to expanding opportunities for Indigenous businesses.

Questions have arisen in recent months, including at parliamentary committees, about potential misrepresentation in the PSIB program, with concerns that some businesses that are not truly Indigenous may be benefiting improperly. To address these concerns, ISC is auditing the businesses listed in its Indigenous Business Directory to strengthen the directory's integrity. Additionally, PSPC is exploring options to address cases of misrepresentation, including Indigenous misrepresentation, through contracting measures. This significant issue demands ongoing attention and possibly additional measures to prevent and deter misrepresentation.

Supporting Canadian Small and Medium Sized Enterprises

Mandate

In line with Budget 2021 commitments, the department implemented a Policy on Social Procurement to leverage the government’s purchasing power to increase supplier diversity among disadvantaged or underrepresented businesses.

The 2024 FES announced the government’s intention to introduce the Small Business Innovation and Procurement Act to obligate federal government departments and agencies to procure a minimum of 20% of goods and services from small and medium sized Canadian businesses and a minimum of 1% of goods and services from innovative firms.

Further, Budget 2024 announced the government’s intention to explore the possibility of creating a program to prioritize doing business with small Canadian businesses and Canadian innovators.

Key Activities

PSPC is exploring initiatives to increase both the number of small and medium suppliers participating in federal procurements, including those owned by members of underrepresented groups, and the value of contracts awarded to them. These activities mainly target engagement and outreach to small Canadian enterprises.

Through its six regional offices, PSPC helps small and medium enterprises understand and navigate the federal procurement system. It provides assistance to businesses on procurement tools, processes and resources available to help them sell to the Government of Canada.

PSPC also supports Innovation, Science and Economic Development Canada (ISED) in the creation of a small business innovation program to help federal departments and agencies meet the new procurement targets for Canadian small businesses and innovators. This program will focus on the development of new procurement service standards and changes to Government Contracts Regulations. ISED aims to establish the new program in spring 2025, following targeted stakeholder engagement.

PSPC also supports procurements for the Innovation for Defence Excellence and Security (IDEaS) program in its role as central service provider. DND’s IDEaS program aims to promote Canadian innovations of interest to the Canadian Armed Forces (CAF) and, while open to businesses of all sizes, does provide opportunities for small and medium enterprise participation.

Partners and Stakeholders

PSPC aims to maintain consistent engagement with representatives of various industries and to learn about the barriers that some businesses face in joining the federal supply chain. The goal is to bring a positive economic impact for thousands of Canadian small businesses, including those owned or led by groups who are often underrepresented in federal procurement supply chains. Ongoing engagement with these groups allows for discussions on shared issues and feedback from industry, and provides a venue for disseminating critical information about federal procurement.

The National Supplier Advisory Committee is an ongoing consultative body co-chaired by PSPC and a representative of the private sector. It is composed of representatives from leading national industry associations who provide advice, feedback and make recommendations concerning procurement issues, including improvement of the procurement process.

Key Challenges

The department continues to modernize and simplify its procurement processes, but small and medium enterprises still experience challenges in navigating the federal procurement process. There is also a need to better understand how federal procurement can support innovation given the complexity of trade agreements and government contracting regulations.

Concerning supplier diversity, the department is considering options to align efforts to increase the participation of Indigenous businesses in federal procurement with work to increase the diversity of bidders under the Policy on Social Procurement.

Reciprocal Procurement

Mandate

Budgets 2021 and 2023, as well as the 2023 Fall Economic Statement, committed to pursuing “reciprocal procurement policies to ensure that goods and services are only procured from countries that grant Canadian businesses a similar level of market access.”

The 2024 FES announced that starting in spring 2025, the Government will strictly enforce its procurement trade obligations to limit access to Canada’s federal procurement market to Canadians and trading partners that provide access to Canada, with the exception of defence procurement. The 2024 FES further indicated the Government’s intention to explore the possibility of placing domestic content conditions on the participation of foreign suppliers in federally-funded infrastructure projects and of creating a program to prioritize doing business with small Canadian firms and Canadian innovators.

Key Activities

Since 2021, departments have collaborated to develop three approaches to reciprocal procurement. Pursuant to the FES announcement, the implementation of these components will be phased.

- Establish a reciprocal-by-default procurement system where the ability of suppliers to bid for federal procurements is based on trade agreement applicability

- PSPC is working with TBS, GAC, and other procuring departments to initially implement, by June 2025, strict reciprocity for new federal procurement processes, excluding defence procurements, based on the location of the supplier. Under this model, only Canadian suppliers and suppliers from countries that have a trade agreement with Canada would be allowed to compete for procurements subject to the relevant trade agreement. An appropriate system of exceptions will be developed to exclude key strategic commodities and to permit procurement from non-trading partners where necessary

- subsequently, in collaboration with TBS and CBSA, PSPC will explore the possibility of transitioning from reciprocity based on the location of supplier to a model based on the origin of production of the goods or services procured. Under this rules of origin model, suppliers of commodities from Canada or from trading partners would be granted access, again subject to the relevant trade agreement

- Attach domestic content requirements to provincial/territorial infrastructure funding

- in parallel, Housing, Infrastructure and Communities Canada (HICC) is leading analysis of potential options to include domestic content requirements in federally-funded infrastructure projects undertaken by provinces and territories. This approach will not impact federal procurement. Implementation options will be brought forward for further consideration at a later date

- Establish a broad set-aside program to reserve procurements for Canadian small businesses

- finally, PSPC is working with ISED and other procuring departments to explore the establishment of a procurement set-aside program for Canadian small businesses. The set-aside program would apply to all federal departments and would require limiting certain procurements to Canadian small businesses, subject to trade agreement obligations and market availability in Canada. Additional approvals would be required prior to implementation

Next Steps

PSPC is working with stakeholders from other government departments on a progressive implementation of the reciprocal-by-default procurement system, beginning in June 2025. The Department is currently preparing implementation guidance for procurement officers and supporting contract clauses.

Following implementation of the reciprocal procurement system based on supplier, PSPC will seek additional approvals to transition to commodity origin, and to implement a small business set-aside program.

Partners and Stakeholders

Key partners and stakeholders include TBS, FIN, GAC, ISED and CBSA, which provide expertise on key elements of reciprocity in federal procurement and set-asides for Canadian small businesses.

Key Challenges

Significant exceptions for reciprocal procurement policies are planned and will be required to mitigate potential negative domestic consequences. The exact mechanism for applying exceptions has not been decided on and is currently under discussion. Additionally, applying rules of origin for commodities will be a new and complex function for PSPC.

A notable challenge for the set-aside program are the Canada-European Union Comprehensive Economic and Trade Agreement and the Canada-UK Trade Continuity Agreement, neither of which contain small business set-aside provisions.

Defence procurement and major projects

Defence Procurement Review

Mandate

The Defence Procurement Review was established in December 2023 to deliver concrete and actionable recommendations to improve and reform how the Government procures and sustains defence capabilities. The initiative aligns with the Government’s defence policy update, Our North, Strong and Free: A Renewed Vision for Canada’s Defence, and Budget 2024. PSPC is leading the review with key federal departments, and has regularly engaged with industry, industry associations, research and academic institutions, and allied nations.

The review is being led by a working group at the Assistant Deputy Minister level and falls under the established governance for defence procurement. Review efforts are focused on three pillars of work:

- changing the rules, regulation and policies to speed up acquisitions

- changing our approach to working with industry, innovators and researchers, and

- examining internal processes used by DND and other departments to define requirements and approve projects

Key Activities: Defence Procurement Reform: Delivering on Canada’s Defence Policy

Recommendations were provided for minister’s consideration in late 2024. Concurrently, efforts and major initiatives are underway including:

- the development of strategic partnerships with Canada’s defence industry is being led by PSPC. The first was announced in November 2024 with L3Harris MAS and the F-35 Joint Program office to investigate requirements for an F-35 airframe depot. Subsequently, CAE has also been identified as a strategic partner for Future Fighter Lead in Training

- a Defence Industrial Strategy is being developed under DND leadership. In tandem, a Ministerial-CEO forum is being stood-up to enhance strategic planning and leveraging of Canada’s domestic defence industrial base

- efforts to modernize PSPC’s Contract Security Program are under way to better posture Canada’s defence industry base to more effectively compete for work in a classified domain

The Defence Procurement Review continues to provide analysis and advice on changes to the defence procurement ecosystem as outlined below:

- acquisition pathways are being developed for specific procurement situations or commodity types. These are intended to provide increased speed, flexibility and predictability to decision-making

- exploring opportunities to enable additional flexibilities for defence procurement through amendments to Defence Production Act, including by providing clarity on when to solicit bids and when to proceed with limited tendering or sole sourcing, and on the use of authorities for critical mineral and commodity stockpiling, multilateral procurements and strategic partnerships

- accelerating the acquisition of innovations by enhancing processes and programs to bring innovative defence technologies into service for CAF and allied militaries

Key Challenges

- Culture Change in Government

- there is an ingrained culture of risk aversion across defence procurement partner departments and central agencies. A whole-of-government focus and approach is required to challenge the existing status-quo with an emphasis on expediency in order to meet the moment

- The new US Administration and The North Atlantic Treaty Organization (NATO)

- the new US Administration has pressed NATO countries to meet and exceed the two percent defence spending targets. To achieve this in the timeframes being discussed would require significant infusion of capital, streamlined procurement processes and oversight, and an acceptance of enhanced levels of risk

- The new US Administration Tariffs Measures

- should the US Administration subject Canadian imports to tariffs, there could be significant economic damage to the economy, making enhanced defence spending and associated investments more challenging

National Shipbuilding Strategy

Mandate

The NSS is a long-term commitment to renew the vessel fleets of the RCN and the CCG, to create a sustainable marine sector in Canada, and to generate economic benefits for Canadians.

To date, eight large vessels and 34 small ships have been delivered, and many more are under construction across Canada. Several vessels have also undergone, and continue to undergo, repair, refit, and maintenance.

The NSS consists of three distinct pillars: large ship construction (more than 1,000 tonnes of displacement); small ship construction (less than 1,000 tonnes of displacement); and ship repair, refit and maintenance.

Key Activities

From January 2012 to February 2025, the Government signed approximately $36.35 billion in NSS contracts across the country and, of these, $1.17 billion went to small and medium businesses with less than 250 employees.

NSS contracts awarded since 2012 are estimated to contribute close to $30 billion ($2.3 billion annually) to Canada’s gross domestic product and to create or maintain approximately 20,400 jobs annually.

Large Vessels

Irving Shipbuilding Inc. has delivered five Arctic and Offshore Patrol Ships to the RCN, with the sixth launched in December 2024. For the CCG, the keel laying for the seventh ship and steel cutting for the eighth took place in July 2024. The Government, in partnership with industry, is developing the implementation contract for the River-class destroyer, which will outline the terms for constructing and delivering the first three ships. Full-rate production at Irving Shipbuilding is expected to begin in April 2025.

Seaspan’s Vancouver Shipyards has delivered three Offshore Fisheries Science Vessels to the CCG, and launched the Offshore Oceanographic Science Vessel in August 2024, with delivery set for 2025. Work continues on two Joint Support Ships for the RCN, with the first launched in December 2024 and scheduled for delivery in 2026. Design work is also progressing on one Polar Icebreaker and up to 16 Multi-Purpose Vessels for the CCG.

Chantier Davie Canada Inc. is advancing the work on one Polar Icebreaker and six Program Icebreakers for the CCG, under separate ancillary contracts. The shipyard is also designing two Transport Canada (TC) ferries, expected in 2028 and 2029.

Small vessels

Small vessels delivered under this pillar include: 18 search and rescue lifeboats for the CCG, with construction ongoing on the 19th and 20th; and two Naval Large Tugs for the RCN, with construction ongoing for the remaining two.

Repair, refit and maintenance

Work under the third pillar includes ongoing Halifax-class frigate upgrades to extend their service life until the River-class destroyers are operational. Work on providing an Interim Auxiliary Oiler Replenishment capability to the RCN continues to support at-sea supply needs until the Joint Support Ships are delivered. Additionally, in-service support is being provided for approximately 70 minor warships and auxiliary vessels, including small boats and Maritime Coastal Defence Vessels.

Partners and Stakeholders

Five key departments play a central role in achieving the Strategy’s defence and marine objectives. PSPC oversees procurement, solicitation, contracting, and vendor performance. DND, Fisheries and Oceans Canada (DFO) for the CCG, and TC define requirements, analyze costs and options, secure policy approval, and manage projects and budgets. ISED administers the Industrial and Technological Benefits Policy, ensuring economic benefits are leveraged from resulting contracts.

Canada has established strategic partnerships with Irving Shipbuilding, Seaspan, and Chantier Davie for large ship construction. Small ship projects (1,000 tonnes or less) are competitively procured among other Canadian companies. Ship repair, refit, and maintenance projects are awarded through open requests for proposals, including the three strategic shipyards.

Key Considerations

Shipbuilding is complex, and original budgets for large vessel projects were set years ago with limited data. The Government applies lessons learned to improve future budget and timeline projections, working closely with shipyards to address cost, timing, and productivity challenges.

The NSS continues to evolve, strengthened by the Icebreaker Collaboration Effort (ICE) Pact an enhanced partnership announced in July 2024 with Finland, and the US. The ICE Pact aims to accelerate polar vessel production, strengthen marine industries and enhance technical cooperation, creating new opportunities for Canadian shipyards and supply chains.

River-class Destroyer Project

Mandate

As part of the NSS, the River-class Destroyer (RCD) Project, formerly referred to as the Canadian Surface Combatant Project, will replace the RCN’s Iroquois-class destroyers and Halifax-class multi-role patrol frigates with a single class of ship capable of meeting multiple threats on both the open ocean and the highly complex coastal environment. The RCD Project is Canada’s largest and most complex shipbuilding initiative since the Second World War. This project will equip the RCN with 15 new state-of-the-art warships to bolster Canada’s naval capabilities at home and abroad, for decades to come.

The RCD project supports DND’s delivery of Canada’s Defence Policy, Our North, Strong and Free: A Renewed Vision for Canada’s Defence. It also delivers on other important NSS priorities, such as providing social and economic benefits for Canada through its Industrial and Technological Benefits Policy.

Key Activities

The RCD Project is currently in the Definition (Design) phase and is transitioning into the Implementation phase, with the start of full-rate production commencing in April 2025.

On March 4, 2025, the Implementation contract was awarded to Irving Shipbuilding Inc., defining the terms and conditions for the construction and delivery of the first batch of ships (ships 1 to 3) and the early procurement of select long-lead items for Batch 2 RCD ships. The initial Implementation contract value is $8 billion (taxes included).

As ship design progresses in parallel to the start of ship construction, Canada’s Definition Contract and Implementation Contract with Irving Shipbuilding Inc., will be open concurrently for a period of time, as will the associated subcontracts, facilitating a seamless transition of items from Definition to Implementation.

Work is underway between Canada and its industry partners to ensure appropriate delineation of roles, responsibilities, and contractual reporting structures during the period of overlap, which is expected to last until 2028.

On June 28, 2024, the Minister of National Defence and the Commander of the Royal Canadian Navy announced that the new fleet of warships will be known as River-class destroyers, and the first three ships will be named His Majesty’s Canadian Ships (HMCS) Fraser, Saint-Laurent, and Mackenzie. It also marked the start of construction activities on the Production Test Module through which the Government of Canada and Irving Shipbuilding Inc. will be able to test and streamline processes and implement lessons learned into the build process, to enable the start of full rate production in April 2025.

RCD construction will extend over approximately 25 to 30 years. Delivery of the first RCD, the HMCS Fraser, is expected in the early 2030s, with the final ship expected by 2050.

Partners and Stakeholders

- Clients: DND and RCN

- Prime Contractor: Irving Shipbuilding Inc.

- Design Subcontractor: Lockheed Martin Canada

- Warship Design Sub-subcontractor: BAE Systems

- Partners:

- ISED

- Justice Canada

- Global Combat User Ship Group (Royal Australian Navy, Royal Navy)

- United States Navy

Key Challenges

Global supply chain disruptions, exacerbated by geopolitical issues, could impact the availability of critical components and the overall cost of the project.

Canadian Patrol Submarine Project

Mandate

Through the Canadian Patrol Submarine Project (CPSP), the Government of Canada intends to replace its current fleet of Victoria-class Submarines with up to 12 conventionally powered, diesel-electric submarines. Parallel procurements will also provide the training, infrastructure and in-service support needed to ensure the effective and continued operation of these critical platforms for RCN.

For the CPSP, PSPC is the contracting authority and will be the lead with respect to the procurement process, including all industry engagements between the Government of Canada and the supplier community. The department will also lead the development of the procurement strategy and all procurement and management activities.

Key Activities

A Request for Information (RFI) was issued on September 16, 2024, to obtain feedback from industry on key project elements, including but not limited to: High Level Mandatory Requirements of the envisaged platform; in-service support; training; and infrastructure requirements needed to support the future fleet. Initial responses were received on November 18, 2024. The results of the RFI will allow for an Invitation to Qualify (ITQ) to be developed and posted in March 2025. It is anticipated that successful ITQ respondents will be placed on a pre-qualified suppliers list for participation in future engagement activities.

Partners and Stakeholders

PSPC works with DND, RCN, ISED, ISC, and GAC to fulfill its mandate on the submarine project. DND is the client and technical authority and manages the technical elements of the project. The RCN is responsible for defining the requirements of the future Canadian Patrol Submarine. ISED leads the implementation of the Industrial and Technological Benefits Policy. ISC provides guidance related to maximising Indigenous participation. GAC provides guidance on government-to-government relations and geopolitical strategic considerations.

Key Challenges

Canada’s key submarine capability requirements will be stealth, lethality, persistence and Arctic deployability meaning that the submarine must have extended range and endurance. Canada’s new fleet will need to provide a unique combination of these requirements to ensure that Canada can detect, track, deter and, if necessary, defeat adversaries in all three of Canada’s oceans. In view of these requirements and to avoid any gaps in Canadian submarine capabilities, Canada anticipates that a contract must be awarded no later than 2028 to allow for the delivery of the first replacement submarine no later than 2035. In the context of other large scale, complex military procurement projects, meeting these timelines may present a challenge given that past competitive procurement processes for similar major capabilities have typically taken longer than three years to complete due to the complexity of the equipment being acquired, and the need for extensive industry engagement. Additionally, there are challenges associated with the timelines for the design and completion of submarine-specific infrastructure ahead of the delivery of the first Canadian Patrol Submarine. The project will need to engage Canadian industry, including Indigenous businesses and communities, to ensure the required enablers are in-place to effectively accept on-time delivery of the new platform.

To meet demanding timelines and minimize operational risks for the RCN, it is suggested that the most effective method to ensure timely delivery of the future fleet is to acquire military-off-the-shelf submarines from a foreign supplier. Depending on the eventual platform, this may present a challenge in maximizing benefits to Canadian industry on the platform acquisition. This challenge is mitigated by the intent to perform in-service maintenance and support domestically, thereby dramatically expanding the current submarine in-service support and infrastructure enterprise in Canada.

Personnel availability, including the loss of suitably qualified and experienced personnel due to gaps in sustainment activities, as well as retention of talent in direct competition with other marine industries, represent significant challenges facing the project. The RCN will need to address this challenge by executing a strategy that serves to attract and retain talent for the management, operation and the continued support of the future fleet.

Polar Icebreaker Project

Mandate

The CCG is mandated to provide icebreaking, search and rescue, environmental response, navigation aids, and science-related services. In keeping with this mandate, and to increase Canada’s operational capability and year-round presence in the High Arctic, the Government decided in 2021 to launch construction of two Polar Class Icebreakers as part of the NSS. The first will be built at Vancouver Shipyards (VSY), while the other will be built at Chantier Davie Canada Inc. (CDCI) in Lévis, Québec.

The construction of the two Polar Icebreakers is projected to support approximately 300 jobs at both shipyards, and 2,500 jobs across the marine supply chain. Once built, these Polar Icebreakers will be the largest vessels in the CCG fleet.

Key Activities: Vancouver shipyards

The Polar Icebreaker Project at VSY (Polar-VSY) is currently in the design phase with the Construction Engineering and Long Lead Items Contracts awarded in December 2022. Work is progressing well and the project has now fully entered production design activities after completion of the functional design in early 2025. Over 90% of the Long Lead Items subcontracts have also been issued by the shipyard.

A RFP for a Build Contract, the final project phase, was issued to VSY on December 22, 2023. Following the receipt of a revised proposal on November 29, 2024 and negotiations with the contractor, on March 7, 2025, a contract of $3.15 billion, excluding taxes, was awarded to VSY for the construction of one polar icebreaker for the CCG as part of its fleet renewal plan. The ship is expected to be delivered by 2032.

Key Activities: Chantier Davie Canada Inc.

In November 2023, Chantier Davie Canada Inc. (CDCI) acquired Helsinki Shipyard Oy in Finland, now known as CDCI Nordic Yard, which has significant experience in constructing various types of icebreaking vessels. At that time, CDCI also acquired the PolarMax design, which had been previously developed at Helsinki Shipyard. Subsequently, in June 2024, CDCI submitted an unsolicited proposal to build the PolarMax design as their Polar Icebreaker for the CCG. To explore the suitability of PolarMax, an Ancillary Contract was awarded to CDCI in September 2024. CDCI proposed a hybrid domestic-international build strategy with vessel construction allocated between CDCI Nordic Yard in Helsinki and CDCI in Lévis, that would enable a delivery of the vessel in 2030.

With this strategy as a driver, negotiation of a Shipbuilding Contract was conducted in February 2025 and a contract was awarded in early March 2025.

Partners and Stakeholders

- Client: DFO and CCG

- Prime Contractor:

- Polar-VSY: Vancouver Shipyards Co. Ltd.

- PolarMax: Chantier Davie Canada Inc.

- Partners:

- ISED

- Justice Canada

Key Challenges

Global supply chain disruptions, exacerbated by geopolitical issues, could impact the availability of critical components and the overall cost of the projects. Additionally, potential short-term challenges in workforce availability, particularly skilled trades, engineering personnel, and technical experts could impact project schedules.

Icebreaker Collaboration Effort Pact

Mandate

The Icebreaker Collaboration Effort (ICE) between Canada, the United States and Finland is a partnership that will deepen existing co-operation among these three Arctic countries by strengthening their marine industries and allowing new equipment and capabilities to be produced more quickly. As the first initiative under this trilateral arrangement, the three partners committed to a collaborative effort to design and build best-in-class Arctic and Polar icebreakers and related capabilities in each country by sharing expertise, information, and resources. Over time, it is anticipated that the three partner countries could produce Arctic and Polar icebreakers for allies and partners or, that allies and partners could join the Pact as producers. PSPC is the lead department in Canada for the ICE Pact and works in partnership with other federal departments and agencies.

Key Activities

A Memorandum of Understanding (MOU) was signed in Washington, District of Columbia (DC), on November 13, 2024, by the previous Minister of Public Services and Procurement, the former United States Department of Homeland Security Secretary of State Alejandro Mayorkas, and the Republic of Finland’s Minister of Economic Affairs, Wille Rydman.

Each country has identified a Trilateral Coordinator at the Assistant Deputy Minister level and each country has established the following four working groups, which are scoping issues for a trilateral strategy:

- technical and information exchange

- workforce development

- ally and partnership collaboration

- innovation, research and development

Canada has developed a RFI from Industry and is coordinating with the United States to post it at the same time, to the extent possible. The purpose of this RFI is to gather insights from Industry about the opportunities and challenges related to the four identified areas of work. For Canada, an engagement strategy through industry associations is being developed in tandem with the RFI and tentatively planned for spring 2025.

Partners and Stakeholders

Internal partners:

- DFO and CCG: lead department for icebreakers

- DND: lead for defence policy; expertise in requirement setting for RCN and defence research and innovation

- GAC: lead on foreign policy, including Arctic Foreign Policy and lead on international trade and trade promotion

- ISED: lead on industrial policy and sectoral analysis

- TC: lead for marine safety and security, regulations and licensing

- National Research Council: research and innovation

External stakeholders that will be engaged as part of Icebreaker Collaboration Effort (ICE) Pact:

- shipyards, especially the main yards in the NSS (Seaspan, Davie and Irving) and smaller yards

- suppliers in the shipbuilding sector, which will have an interest in business opportunities

- marine industry associations, such as the Canadian Marine Industry and Shipbuilder Association or Naval Quebec, and defence industry associations, such as the Canadian Association of Defence and Security Industries, which will seek to present their members views on the ICE Pact

Key Challenges

The ICE Pact is an example of a regional “mini-pact” that presents a novel way of building a partnership among like-minded countries to achieve shared objectives in this case, related to defence and security, jobs and growth in the shipbuilding sector, and protection of Indigenous peoples. To ensure the success of the ICE Pact, new forms of procurement, information exchange, labour mobility, and shipbuilding practices will be essential.

The immediate challenge will be to scope the objectives of the ICE Pact and identify the appropriate role for governments and industry. Each partner country brings unique expertise and needs, which should be harnessed to foster effective collaboration. On the government side, extensive trilateral engagement and collaboration will be required to align expectations as well as domestic budgetary, congressional/parliamentary and decision-making cycles.

The ICE Pact is “shipyard neutral”. Therefore, a fair open and transparent process needs to be put in place to engage with Industry through the planned RFI. It will be important to move quickly to ensure ongoing interest from Industry.

Engagement with the new Administration on ICE Pact confirms that the United States remains firmly committed to the objectives of the MOU. The United States has an aging and ineffective icebreaking fleet, which the ICE Pact aims to modernize. The Administration has stood up a new Maritime Security and Industrial Capacity directorate at the White House National Security Council to oversee the ICE Pact. The new Administration has named a National Coordinator at the Department of Homeland Security, which oversees the US Coast Guard.

Firearms Compensation Program

Mandate

In December 2023, the Government of Canada launched a competitive process to procure services for the collection, storage, validation, verification and destruction of firearms in support of a mandatory compensation program of assault-style firearms that were prohibited on May 1, 2020.

Key Activities

On May 1, 2020, the Government of Canada announced a prohibition on more than 1,500 models and variants of assault-style firearms, such as the AR-15. Since then, approximately 500 additional variants of these prohibited firearms have also been prohibited. These firearms can no longer be legally used, imported, or sold in Canada.

The 2021 Speech from the Throne and mandate letter for the Minister of Public Safety reiterated the commitment to make it mandatory for owners to dispose of their assault-style firearms, by surrendering them to the Government for the purposes of destruction or having them deactivated at the Government’s expense.

The estimated volume of these firearms held by businesses is within the range of 10,000 to 15,000, and the estimated volume held by individuals is within the range of 125,000 to 175,000.

The competitive process is comprised of two components, one RFP for the Business Phase, which includes stock from resellers such as sporting goods stores, and one subsequent RFP for the Individuals Phase, which will cover prohibited firearms owned by individuals.

On September 26, 2024, PSPC awarded a contract for up to $4.5 million (before applicable taxes), for one year and a one-year option, for the Business component of the program. The name of the company will remain confidential for security reasons.

A draft RFP for the Individuals component of the program was sent directly to three pre-qualified suppliers on November 29, 2024. The final RFP was sent to the qualified suppliers on December 17, 2024 and closed on January 24, 2025. The names of the companies will remain confidential for security reasons.

On December 5, 2024, the Government announced the addition of 324 unique makes and models to the list of prohibited firearms.

The Government will collaborate with businesses to determine how some of the prohibited firearms could be donated to Ukraine.

Partners and Stakeholders

PSPC works with Public Safety Canada (PS) and the RCMP. PS is the client and technical authority and manages the project.

Key Challenges

PS is still refining parts of the program and therefore readiness to launch the Individuals component is uncertain for the targeted May timeframe.

For parts of the population, this program is very unpopular. There are legitimate security concerns that need to be and are being addressed through the program and the procurement process.

Another key challenge is the capacity of the to-be-determined contractor to delivery results in the desired timeframe.

Assets

Federal properties

Office Portfolio Reduction Plan

Mandate

PSPC is the federal government’s administrator of real property and is responsible for approximately 6.1 million square metres of office space across Canada. As a custodian of federal real property, PSPC works to continually assess office portfolio functionality, condition, environmental impact, use, and financial performance.

Key Activities

Budget 2023 directed PSPC to present a detailed proposal to optimize the physical footprint of its office portfolio. Subsequent analysis indicated that with adoption of unassigned seating by default and based on a hybrid work model, space reduction of up to 50% of the office portfolio was possible over ten years. Budget 2024 then provided the department with $1.1 billion over ten years ($1.6 billion over 20 years) in “invest to divest” funding for the Office Portfolio Reduction Plan to pursue this 50% reduction target and achieve an associated $4.4 billion in projected savings over ten years.

To chart the way forward, PSPC has developed an Office Portfolio Reduction Plan Implementation Plan that outlines the strategic actions required to right-size the office portfolio over the next ten years. The Plan identifies key programs of work, and will be updated over time to reflect changes in client space requirements, employee growth, or any new and related government direction.

In keeping with direction provided in Budget 2024, [Redacted]. PSPC has also stood up a new service line focusing on accelerating the disposal of surplus and underutilized properties that will enable PSPC to realize Office Portfolio Reduction Plan efficiencies and savings and support the Public Lands for Homes Program.

Partners and Stakeholders

All client departments and agencies have a shared responsibility with PSPC that is established through the Accommodation Management Framework. PSPC is responsible for managing the quality, quantity, and location of office spaces to align with clients’ program requirements and ensure the best value to the Crown. Concurrently, clients must confirm space requirements and develop space optimization, consolidation, and modernization strategies in consultation with PSPC to efficiently use office space. This collaborative model aims to balance both parties' needs. Success of the Office Portfolio Reduction Plan Implementation Plan will depend upon broad cooperation across government from all parties.

SSC is a key stakeholder in office space optimization efforts, playing a crucial role in ensuring that information technology infrastructures are effectively deployed to support the office needs.

The Office of the Chief Human Resources Officer within TBS plays a pivotal role in defining the parameters of the future workplace, establishing policies and guidelines that shape how work is conducted across government departments and agencies. This includes overseeing the implementation of the hybrid work model and the Direction on Prescribed Presence in the Workplace, which aims to bring greater fairness and consistency to the application of hybrid work, ensure departments ability to perform as organizations by building stronger teams and cultures, contribute to better service delivery for Canadians, and reinforce their confidence in public service.

The Office of the Chief Information Officer within the TBS serves as the lead for the government's security policy, ensuring that security measures across all departments and agencies are robust and consistent. The Office of the Chief Information Officer 's leadership is pivotal in maintaining a secure environment that supports the government's operations and protects sensitive information.

Key Challenges

Recent developments have impacted Office Portfolio Reduction Plan projections for achievable reductions and associated savings. These include growth in the number of employees that require office accommodation, the updated Directive on Prescribed Presence in the Workplace, as well as revised direction regarding the transfer of surplus assets at a nominal value to the Canada Public Lands Bank to support the government’s housing agenda.

As a result of these developments, the Office Portfolio Reduction Plan is now projecting a reduction of approximately 33% over the ten-year period (34% if reductions already achieved in 2023 to 2024 are included), with associated operations and maintenance savings of approximately $2.45 billion over the first 10 years.

PSPC remains committed to the 50% reduction target and is exploring opportunities for further reductions. PSPC will work with other custodial departments and agencies to explore government-wide space optimization opportunities and undertake a review of the current funding model to ensure that all clients are incentivized to help seek reductions. Securing buy-in from across the public service on the effort required to meet stated reduction targets will be key.

Changes in future Government priorities (for example : amendments to the Directive on Prescribed Presence in the Workplace or the creation of new programs) may require additional future accommodation requirements that will impact PSPC ’s ability to reach stated targets.

Delays in the implementation of projects could result in loss of funding as the current funding structure prevents reprofiling. In addition, lack of funding to address modernization and deferred maintenance within existing assets may impact operational efficiency and space optimization efforts.

Key Large Projects

Mandate

PSPC is carrying out a number of key major federal property rehabilitation projects in the National Capital Region, and continuing important work towards conserving Canada’s heritage by rehabilitating and restoring places and buildings of national significance.

Key Activities: Supreme Court of Canada Building Rehabilitation