CRA service consultations 2024 – Summary report

In the fall of 2024, the Canada Revenue Agency (CRA) held public consultations with individuals, non-professional representatives, and tax professionals to learn about their recent service experiences and inform future service improvements.

On this page

About the consultations

Why we consulted

At the CRA, we are committed to delivering seamless experiences and tailored interactions in support of our vision of being trusted, fair, and helpful by putting people first. To fulfill this commitment, we continuously seek feedback from the public on how we can improve our services.

While we regularly receive input through various channels, including surveys and service feedback, consultations provide a unique opportunity for deeper engagement, especially in a discussion format that allows for a two-way exchange. Consultations allow us to hear directly from participants, capture their experiences in greater detail, and gain a more comprehensive understanding of their needs.

The previous consultations on overall service experiences with the CRA, Serving Canadians Better, were conducted in 2019.

While progress has been made, there is still more work to do. Concerns about declining client satisfaction with CRA services highlight the need for proactive steps to improve service delivery.

As technology and expectations evolve, we also recognize that how people interact with government services is changing. We remain committed to listening, learning, and making improvements to help people access the services and support they need.

How we consulted

From September 25 to December 13, 2024, the CRA hosted a series of in-person and virtual group discussion sessions, as well as an online questionnaire available to the public on Canada.ca.

For the in-person and virtual sessions with individuals and non-professional representatives, a third party managed the recruitment of participants. For tax professionals, the CRA recruited participants through existing stakeholder relationships.

Recruitment aimed to include people of different ages, genders, and locations across Canada, with specific in-person sessions held in Whitehorse, Okotoks, Toronto, Gatineau, and Sherbrooke.

The online questionnaire was promoted through social media posts, a news release, and targeted messages to stakeholder organizations. The link to the online questionnaire was also provided to participants at the sessions, encouraging them to share it with their family, friends and colleagues.

The consultations aimed to learn about participants’ recent service experiences, ideas for improvement, and future vision for CRA services.

To encourage open dialogue, while fostering a safe and supportive environment for honest feedback, participants’ identities were kept confidential.

Who we consulted

2,369 total participants

139

attended 8 in-person sessions

150

attended 15 virtual sessions

2,080

online questionnaire submissions

Participants in the consultations included individuals, non-professional representatives, and tax professionals. Nearly 300 participants from across Canada attended in-person and virtual sessions.

The online questionnaire received over 2,000 submissions from respondents across Canada.

To be eligible to participate in either, participants had to have been 18 years of age or older and have interacted with the CRA within the past two years.

The CRA prioritized recruiting client groups that are typically harder to connect with, including youth, seniors, newcomers, and individuals experiencing housing insecurity. Certain participants also self-identified as having a disability.

Methodology note

This report summarizes findings from consultations conducted through in-person and virtual sessions and the online questionnaire. The objectives of the consultation included:

- listening to and learning from clients about general challenges they face when interacting with the CRA’s people, products, and services

- gaining insight into existing gaps between client perceptions and expectations, and their current relationship with the CRA, as well as how the CRA can inform clients of improvements

The consultation analysis and reporting followed a qualitative methodology that focused on understanding participants’ experiences and feedback. Quantitative data was used to support the qualitative findings where relevant. This method reflects the voice of the participant and their experience with the organization, highlighting challenges, positive experiences, needs, and opportunities for improvement.

The findings from the in-person and virtual sessions guided the overall narrative of the report as they provided a more comprehensive perspective through two-way dialogue. However, the results reflect the combined views of participants from both the sessions and the questionnaire, highlighting consensus, contradictions, and additional complexities. In this report, the term “participants” refers to individuals who took part in the in-person sessions, virtual sessions, and the questionnaire. “Questionnaire respondents” refers specifically to those who completed the online questionnaire, while “session participants” refers to those who attended either the in-person or virtual sessions.

While these findings provide valuable insights into the views of participants, they should not be interpreted as representative of the entire Canadian population, specific regions, or client groups.

Overall service experience

Service satisfaction

Participants shared a range of experiences with CRA services. While some reported positive experiences and noted improvements in certain areas, the common view was that interactions with the CRA are often frustrating and time-consuming.

Overall, participants expressed a clear need for improvements, desiring a service experience that is both positive and consistent. When describing their ideal service experience, participants commonly valued qualities like ease of access and inclusivity, efficiency, timeliness, proactivity, personalization, and transparency.

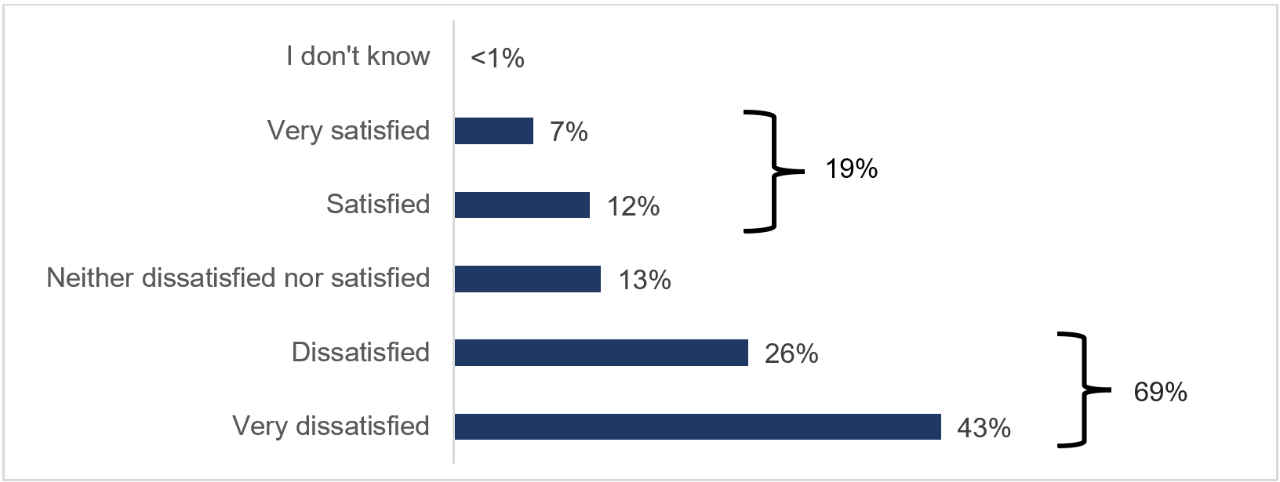

In the online questionnaire, when asked about satisfaction with a recent interaction with the CRA, questionnaire respondents reported the following:

Figure 1: Satisfaction with a recent interaction with the CRA

Response to: On a scale of 1 to 5, where 1 is very dissatisfied and 5 is very satisfied, how satisfied were you with this interaction? Base: All respondents (n=2,080)

Long description

| Response | Percentage |

|---|---|

| I don’t know | <1% |

| Very satisfied | 7% |

| Satisfied | 12% |

| Neither dissatisfied nor satisfied | 13% |

| Dissatisfied | 26% |

| Very dissatisfied | 43% |

| Net responses | Percentage |

|---|---|

| Net satisfaction (very satisfied, satisfied) | 19% |

| Net dissatisfaction (very dissatisfied, dissatisfied) | 69% |

Desire for support and transparency

Participants generally noted that it is becoming harder to reach the CRA for help, and the cost of professional assistance or software can be a barrier for some. They said that taxes are complex, which may lead them to miss out on important benefits and credits, and noted that money is a source of stress for many. Participants said they want to meet their tax obligations but often feel overwhelmed and worried about making a mistake. They said that it is important to have timely and easy access to support through various channels that prioritizes empathy and is tailored to individual needs.

When providing feedback on interactions with the CRA, participants expressed a sense of uncertainty, as though they had to figure out a complex system on their own. They emphasized the need for:

- transparent processes and expectations

- better coordination within the CRA

- clear communication regarding timelines, actions, and decisions on their files

- accurate and consistent information across different interactions and channels

Technology and access to services

Participants said they appreciated the convenience that digital tools can offer and welcomed technology that makes services faster and easier to use. At the same time, they were concerned that digital-first services could leave some people behind, especially seniors, persons with disabilities, and others without access to a computer or to reliable Internet. They stressed how important it is to have multiple service channels available to meet diverse needs and make sure everyone can access services.

Many older clients struggle with [online access], and there are a number of people who simply don't have Internet access in rural Canada . . . These clients are getting left behind.– Questionnaire respondent

While acknowledging that technology can improve efficiency, participants said it should enhance, not replace, the ability to speak with someone who understands and can help. They said that human connection made a real difference in how they experienced CRA services, especially in complex or sensitive situations.

Some participants were unaware of certain CRA services or tools. They suggested improving outreach, raising awareness of services, and providing more proactive communication to help more people get the support they need.

Trust, partnerships, and opportunities for feedback

Finally, session participants appreciated the chance to interact directly with the CRA and emphasized the importance of ongoing consultations and consistent opportunities to provide feedback. They noted that these conversations help build trust and ensure services reflect real needs.

Key findings

1. Make it easier to interact with the CRA

Interactions by phone

Participants want it to be easier to reach the CRA and to have more convenient and effective ways to interact. When calling the CRA, many participants expressed frustration with challenges such as long wait times, dropped calls, complex menu options, and frequent transfers.

To improve their experience, participants strongly suggested:

- implementing a callback service, where they can schedule the best time for them

- having the option to chat with a live agent online

- offering different ways to interact with the CRA to meet diverse needs, such as video call features, appointment scheduling, and in-person support options

- implementing a dedicated phone line for tax professionals for account-specific enquiries

Did you know…

The CRA offers an online chat service in My Account where you can discuss account-specific and general questions with a live CRA agent. The online chat service is available Monday to Friday from 8:00 am to 8:00 pm ET and can help with certain topics.

The CRA is also piloting a callback service for certain disability tax credit (DTC) enquiries.

To better support video relay service users who communicate with a sign language interpreter, the CRA now has dedicated phone lines that make it easier for them to connect with agents.

Interactions online

While participants have noticed some improvements to information on Canada.ca, many said that it is still difficult to find and understand. Participants suggested:

- making it easier to search for information by using keywords that are familiar to them

- improving the search function on Canada.ca to have a reliable way to find the most relevant CRA resources

- providing clear, step-by-step instructions in plain language

- introducing a chatbot powered by artificial intelligence (AI) to answer common questions and help users quickly find what they need

Did you know…

The CRA is testing a Generative Artificial Intelligence (GenAI) chatbot to improve our digital services and help users self-serve more easily. The GenAI chatbot beta is available 24/7 to answer questions relating to personal income tax, accessing a CRA account, charities, businesses, and trusts. You can also provide feedback to help us improve!

Participants appreciated the ability to do more tasks online, like seeing upcoming benefit payment dates in My Account. Tax professionals also mentioned positive improvements to Represent a Client and said they frequently use all features available to them.

Participants would like to see more improvements that make it easier to self-serve, such as:

- accepting more document submissions online

- digitizing more forms and applications

- improving payment transfers for individuals

At the same time, participants stressed that there still needs to be options available for anyone who cannot access online services.

Did you know…

The CRA continues to expand digital self-service options, including:

- offering the option to submit documents through a secure drop zone, where the CRA agent you are working with provides you with a link

- enabling newcomers to apply for the GST/HST credit more easily, thanks to the new online application

- introducing the Manage balance service in My Account, which provides individuals with tax debts of $1,000 or more with self-serve options to help them take control of their debt

- providing online services for non-resident tax account holders

2. Provide proactive and personalized support

Participants expressed that navigating taxes and benefits can be challenging, especially during major life changes or complex situations. They expressed the need for:

- information tailored to life events and client groups

- simple tools like checklists and decision trees to help determine what steps to take based on their circumstances

- access to specialized agents

When speaking to an agent, participants valued interactions where the agent offered detailed assistance and took the time to address their concerns. Not all participants had positive experiences, with many wanting more personalized and empathetic exchanges with the CRA.

They also expressed that they call the CRA expecting to speak to someone who is knowledgeable and can help them arrive at a resolution. To make it easier to reach the right agent, they suggested:

- adding more department-specific call lines

- improving call routing

- making it possible to submit an enquiry online and receive a callback from an appropriate agent

Additionally, participants would like to have a main point of contact or someone who is familiar with their file so they do not have to repeat their situation to different agents. This kind of support was especially important for newcomers, persons with disabilities, and those managing someone’s estate, who may need extra help navigating processes.

To create more personalized experiences, participants said that agents should have access to and review notes from previous interactions and provide post-call summaries to clients as a useful reference for them to complete their next steps.

Participants desired more education and outreach support from the CRA to help people better understand their tax obligations and available benefits.

More information on doing taxes by ourselves successfully and confidently so that we are getting the best return possible would be an amazing thing the CRA should offer.

– Session participant

Participants also desire more proactive communication throughout the year from the CRA to help them manage their taxes and benefits. For example, participants would like to receive reminders, updates, and tips about upcoming payments, new services, and benefits they may be eligible for.

Did you know…

The CRA offers online resources to help you better understand taxes and benefits, including:

- the CRA’s YouTube channel

- webinars and recordings

- the Taxology podcast

- Learn about your taxes, a self-guided learning tool, which includes an educator toolkit and lesson plans for students

- outreach materials such as factsheets and infographics

- Doing taxes for someone who died, a new brochure, which gives an overview for executors on how to settle taxes for a deceased person

- Persons with disabilities, their caregivers, and the CRA, a new one-stop hub of important information and links

- the taxpayer relief self-evaluation and learning tool, which helps guide you with requests to cancel or waive penalties and interest

- improved web pages on the Tax-Free Saving Account (TFSA), Canada child benefit, and GST/HST credit

The following support is also offered in person and virtually:

- Small business owners and self-employed individuals can get free, personalized support through the Liaison Officer service to understand their tax obligations, bookkeeping concepts, and more

- Through local organizations, CRA outreach officers can provide information sessions and handouts to help individuals learn about taxes and benefits

3. Ensure simple and secure identity verification

While participants strongly valued the protection of their personal information, they want simpler ways to verify their identity without compromising security.

Identity verification over the phone

When interacting over the phone, participants said it can be challenging to confirm their identity by providing specific information like details from past tax returns. Participants would like to see more user-friendly security processes, especially for groups who may have trouble accessing or providing the information needed, like seniors, persons with disabilities, individuals experiencing housing insecurity, and people who do not speak English or French. Participants said it should take no more than two or three steps to verify their identity and suggested that the CRA incorporate features like voice recognition or unique codes.

Identify verification online

For services requiring a sign-in, like My Account, participants find it easy and convenient to sign in through their bank. However, creating an account and signing in was still challenging for many. They spoke about issues like:

- waiting for an access code in the mail

- difficulty remembering login information and answers to security questions

- being locked out of their account

To improve their experience, participants, including tax professionals, want more support to help individuals register for a CRA account or resolve account access issues. They suggested:

- creating easy step-by-step videos

- developing a CRA app so they could log in using their fingerprint or face ID

Did you know…

The CRA has made it easier to register for a CRA account through the Document Verification Service, which allows you to verify your identity without having to wait for a code in the mail. If you are locked out of your account or forgot your sign-in information, you are now able to register again to regain access without needing to call.

The CRA has also introduced a single sign-in feature so you can sign in once to access My Account, My Business Account, and Represent a Client.

Other improvements include:

- a “show-password” feature to help you correct errors in the information entered

- updates that reduce the chance of being locked out after entering a one-time passcode incorrectly

- the option to use a one-time passcode for caller verification, available in certain cases when speaking with an agent on a call you initiated

- improved web content on registering for a CRA account

Online account authorization

Participants also want it to be easier to authorize a family member or friend on their account to help them interact with the CRA.

Tax professional participants stressed that the CRA should improve the process to authorize representatives for business accounts, estates, and trusts.

Did you know…

Represent a Client is not just a tool for professionals! If you are helping a family member or friend with their taxes or benefits, you can register for Represent a Client and request secure access to their account with their approval.

If you want to authorize someone as your representative, you can also make this request from your My Account.

4. Simplify tax filing and benefits and increase automation

Participants said that tax filing should be simple, automated, free of cost, and designed to make it easy for taxpayers to meet their obligations. While some participants had positive experiences filing their taxes and appreciated features like Auto-fill my return, many desired more automation and assistance from the CRA. For example, participants suggested:

- receiving pre-populated returns from the CRA that they could review and modify before submitting

- filing tax returns directly with the CRA, either online or through a CRA app, instead of through a third party

They suggested this approach would reduce errors, save time and costs, and make tax filing more accessible to everyone. Participants also noted that there should be simplified returns for individuals with basic income or tax situations.

Did you know…

The CRA offers free simplified tax filing methods to eligible individuals by invitation. If you are invited to use SimpleFile, you only need to answer a few short questions. The service will then use your answers and the information the CRA already has on file to complete and process a tax return on your behalf.

Through the Community Volunteer Income Tax Program, community organizations host free tax clinics where volunteers complete tax returns for people with a modest income and a simple tax situation. Volunteers may also be able to complete and file your taxes by video conference or by phone.

Some participants also had challenges applying for and managing benefits and credits, such as the disability tax credit and the Canada child benefit. They said there is a need for simpler application processes, as well as clearer requirements around eligibility and supporting documents.

Session participants supported increased sharing of their information within the federal government, and in some cases with financial institutions, to improve access to benefits, reduce duplicate steps or tasks, and make tax filing easier. At the same time, they emphasized the importance of having control over what information they choose to share.

5. Process files in a transparent and timely manner

Participants said they were concerned about how long it takes the CRA to process files that fall outside of routine tax filing or benefit applications. Many said the processing times were far too slow and that delays can cause worry and financial stress, especially for those waiting on benefit payments or refunds. Participants want:

- the CRA to meet service standards and process files more efficiently

- more time to respond to requests from the CRA, as short deadlines can be more challenging to meet for certain clients, such as those living in northern or rural areas

There is a lack of transparency and explanation in most of the CRA’s interactions. People would be less upset if they were told why there was an issue, why they were getting enhanced security questions, why their return is delayed, exactly how long to expect a reassessment to take, etc.– Session participant

Participants said that they had trouble getting meaningful status updates about their files. To improve their experience, they expressed the need for:

- more transparency from the CRA, such as detailed and accurate updates on processing timelines, the status of their files, and expected completion dates

- the CRA to clearly explain any changes to client tax and benefit files, why a benefit or credit was denied, and why they might owe money or face a penalty

- more two-way communication, such as being notified if a supporting document is missing, so they can fix issues early on and avoid extra steps like having to file an objection

Overall, participants emphasized the need for a more integrated and empathetic approach and for clear, timely, and transparent communication from the CRA

Did you know...

To reduce delays and improve client service across key programs, the CRA is increasing automation and streamlining its processes. This includes faster processing of tax adjustments and making it easier for you to change your return.

The CRA is also adding and improving features in CRA accounts, including the ability to track more file types through the Progress Tracker.

Conclusion

The CRA would like to thank all those who participated in the service consultations for their valuable feedback.

The findings from the consultations highlight participants’ desire for more positive, client-centric experiences with the CRA, as well as services that are easy to use, timely, and supportive. This feedback is in line with insights gathered through surveys, feedback submissions, and other engagement activities. As part of its ongoing effort to address key service challenges, the CRA is using the feedback from this consultation, as well as from other sources, to guide future improvements.

In September 2025, the CRA launched a 100-day Service Improvement Plan to deliver faster, more accessible and client-focused services. Through this plan, the CRA has advanced improvements aimed at:

- increasing its ability to answer more calls

- expanding digital self-service options

- addressing the root causes of service issues

- accelerating service modernization

Looking ahead, the CRA is committed to keeping people at the centre of service design and delivery. That means staying responsive, building on what’s working well, and adapting to meet changing expectations, feedback, and needs.

With this commitment in mind, the CRA is taking steps to turn feedback into action through its medium-term planning, focused on the following outcomes:

- improving the quality of our information and processes to make services more transparent, timely and seamless

- making identity validation easier for clients to complete, while keeping their information safe and protected from fraud and identity theft

- enhancing communication options and access to CRA services by offering channels that meet different needs and situations

Recognizing the importance of meaningful engagement, the CRA will continue engaging with people across Canada and offering ways to provide feedback to help improve its services.