Persons with disabilities, their caregivers, and the CRA

The Canada Revenue Agency (CRA) offers financial support through benefits, credits, and programs.

File a return using SimpleFile starting in March

SimpleFile services will open on March 9, 2026. The digital option will be available to eligible individuals with or without an invitation. Refer to: SimpleFile services

Having a disability, or caring for someone who does, can come with extra challenges and costs. Some of these costs may be reduced, or even eliminated through payments, reductions to the amount of tax you owe or eligibility for other support programs.

Services for persons with disabilities

-

Video relay service

The CRA now offers a dedicated line for video relay service (VRS) interpreters to help make it as easy as possible for those who are deaf, hard of hearing, or speech-impaired to get the tax and benefit answers they need. To use the service, register with Canada VRS and dial 272877 (CRAVRS) within the application to connect with an agent.

-

Teletypewriter

If you have a hearing or speech impairment, you can use a teletypewriter (TTY) and call 1-800-665-0354.

-

Operator-assisted relay service

You can contact the CRA during our business hours. You do not need to authorize the relay service operator to communicate with the CRA.

-

Sign language interpretation

If you let us know beforehand, we can have a sign language interpreter at an interview or meeting.

-

Alternate formats

Some of the CRA’s forms and publications are available in e-text or large print format on Canada.ca. To use this service:

- Go to CRA forms or CRA publications

- Select the form of your choice and download the e-text or large print format

If the product you are looking for is not available in your preferred format, you can order it using our alternate formats order form.

Individuals and business owners can get most of their CRA correspondence online through their CRA account.

Do your taxes to get payments

In most cases, the CRA automatically considers you for benefit and credit payments when you do your taxes. However, you may need to apply and be approved for some payments.

Even if you do not owe tax, are tax-exempt, or have no income to report, you should do your taxes every year. You could be eligible for a refund and filing an annual tax return is a requirement to continue to get the benefit and credit payments you are entitled to. The CRA uses the information from your tax return to calculate your payment amounts and without that information, your payments could be stopped.

You and your spouse or common-law partner, if applicable, have until April 30 each year to do your taxes. If you or your spouse are self-employed, the deadline to do your taxes is June 15.

If you live in Quebec, you also need to file a provincial tax return each year with Revenu Québec.

Find out when you must file a tax return and how to get ready to do your taxes.

If you are new to Canada, find out what you need to know about applying to get benefit and credit payments, including certain provincial and territorial program payments, even before doing your taxes for the first time.

Free solutions

- Free tax software

- You can do your taxes online with NETFILE-certified tax software. A variety of tax software packages and web apps are available, some of which are free.

- Free tax clinics

- If you have a modest income and a simple tax situation, you may be eligible to get your taxes done for free by a volunteer.

- Support from the CRA

- Organizations can request free outreach services.

Payments you may be eligible for

You may be eligible to receive some of these payments. You can use the benefits calculator to determine how much you could get.

This is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the goods and services tax/harmonized sales tax (GST/HST) that they pay. Eligible single individuals can get up to $533 per year. A couple with two children under 19 could get up to $1,066 per year.

If you are eligible for the GST/HST credit, you may automatically be entitled to certain benefits and credits that the CRA administers on behalf of the provinces and territories.

Payments from the provinces and territories related (or similar) to the GST/HST credit

Based on where you live, you may also get the:

New Brunswick harmonized sales tax credit

New Brunswick harmonized sales tax credit  Newfoundland and Labrador income supplement

Newfoundland and Labrador income supplement  Newfoundland and Labrador disability amount

Newfoundland and Labrador disability amount  Newfoundland and Labrador disability benefit

Newfoundland and Labrador disability benefit Newfoundland and Labrador seniors' benefit

Newfoundland and Labrador seniors' benefit  Nova Scotia affordable living tax credit

Nova Scotia affordable living tax credit Ontario trillium benefit which includes:

Ontario trillium benefit which includes:

Ontario senior homeowners’ property tax grant

Ontario senior homeowners’ property tax grant-

Prince Edward Island sales tax credit

Prince Edward Island sales tax credit  Saskatchewan low-income tax credit

Saskatchewan low-income tax credit

This is a monthly tax-free payment that helps with the cost of raising children under 18. Eligible families can get up to $7,997 per year for each child under 6 and up to $6,748 per year, for each child aged 6 to 17.

If you are eligible for the Canada child benefit (CCB), you may automatically be entitled to certain benefits that the CRA administers on behalf of the provinces and territories.

Payments from the provinces and territories for families with children

Based on where you live, you may also get the:

Alberta child and family benefit

Alberta child and family benefit BC family benefit

BC family benefit New Brunswick child tax benefit

New Brunswick child tax benefit  Newfoundland and Labrador child benefit (and Early childhood nutrition

supplement)

Newfoundland and Labrador child benefit (and Early childhood nutrition

supplement) Northwest Territories child benefit

Northwest Territories child benefit Nova Scotia child benefit

Nova Scotia child benefit Nunavut child benefit

Nunavut child benefit Ontario child benefit

Ontario child benefit-

Prince Edward Island child benefit

Prince Edward Island child benefit  Yukon child benefit

Yukon child benefit

This is a monthly tax-free payment for families caring for a child under 18 who is eligible for the disability tax credit (DTC). Eligible families can get up to $284.25 per child per month. To get the child disability benefit, you must also be eligible for the CCB.

This is an amount that reduces tax owed and can be paid as part of a refund to those working and earning a low income. Eligible individuals can get up to $1,633, and a family can get up to $2,813. Persons with disabilities who are approved for the DTC may be eligible for the Canada workers benefit (CWB) disability supplement and get an additional amount up to $843. Individuals who are entitled to CWB when filing their income tax and benefit return will be entitled to 50% of the eligible CWB as advanced payments under the Advanced Canada workers benefit (ACWB) and will be issued in 3 payments for the following benefit period.

This was a tax-free payment to help eligible individuals and families offset the cost of the federal pollution pricing. On March 15, 2025, the Government of Canada stopped the federal fuel charge and the Canada Carbon Rebate for individuals. If you were eligible but you have not yet filed your tax return for 2021, 2022, 2023, or 2024, you are still able to receive your payments once your tax returns are assessed.

This is a refund payment for part of the federal excise tax on gasoline for eligible individuals with a permanent mobility impairment that cannot safely use public transportation.

Additional payments

More payments are available from the Government of Canada. Go to Disability benefits to see what else you may be eligible to receive.

This is a refund payment based on the amount the CRA determines after assessing the individual’s income tax and benefit return.

Provincial and territorial programs

In addition to federal benefits, individuals may be eligible for more programs depending on where they live.

Claim deductions on your tax return

Claim credits and other allowances

If you are a person with an impairment or disability, you may be able to claim credits and allowances on your taxes.

This is a non-refundable tax credit that helps people with disabilities, or their supporting family member, reduce the amount of income tax they may have to pay. Eligible individuals can claim up to $10,138, with an additional $5,914 for those under 18.

People eligible for the DTC experience severe and prolonged impairments in one or more of the following categories:

Over 1.6 million people were approved for the DTC in 2023

For statistics, refer to DTC statistics.

Applicants and medical practitioners can watch webinars and recordings for information to further support those living with disabilities.

To learn more, including common misconceptions, go to

Demystifying

the disability tax credit.

Apply any time using the digital application form or paper form. See how to apply for instructions on filling out the applicant section. If you are a legal representative of a person with a disability, you may apply for the disability tax credit (DTC) on their behalf. You may claim the DTC amount for previous years directly on the application form if you are the person with the disability, or you are the parent or guardian of the person with a disability who is under the age of majority in their province or territory. Otherwise, you will have to send a separate adjustment request.

You can complete the self-assessment questionnaire in Guide RC4064, Disability-Related Information, to learn about eligibility criteria. Apply for the DTC if you think you may be eligible, even if you have no income to report. If the CRA approves your application, the DTC may help you access other federal programs.

This non-refundable tax credit is available to individuals who support a spouse, a common‑law partner, or other qualifying dependant with a mental or physical impairment.

An individual can claim this deduction on their tax return if they have a physical or mental impairment and have paid for certain medical expenses.

This is a non-refundable tax credit for eligible renovations to improve the accessibility of an individual’s home.

This is a non-refundable tax credit for the purchase of a home. If you or the relative you acquired the home for are eligible for the DTC, you do not have to be a first-time home buyer to claim the home buyers’ amount.

Multigenerational home renovation tax credit

An individual may be able to claim this refundable tax credit on their tax return to help with the cost of renovating an eligible dwelling to establish a self-contained secondary unit.

Refundable medical expense supplement

An individual may be able to claim this refundable tax credit on their tax return if they have a modest income.

This is a non-refundable tax credit if you made donations to a Canadian registered charity or another qualified donee.

Tax deductible contributions to a registered retirement savings plan can reduce the tax an individual owes.

Amounts transferred from your spouse or common-law partner

An individual may be able to claim all or part of certain amounts that their spouse or common-law partner qualifies for if they do not need to use them to reduce their federal tax to zero.

An individual may be able to claim this non-refundable tax credit on their tax return if they are not self-employed. This amount is meant to recognize work-related expenses that employees typically incur.

British Columbia home renovation tax credit for seniors and persons with disabilities

An individual can claim this tax credit on their return if they or their family member living with them are 65 or older or if they are eligible for the DTC. The credit helps with the costs of improvements to a principal residence or the land it is on.

Claim your expenses

Claiming expenses on your income tax return lets you lower your taxable income and potentially reduce the amount of income tax you owe.

Common expenses claimed by persons with disabilities include:

- attendant care expenses

- medical expenses

- home accessibility expenses

- education expenses

- child care expenses

For all deduction types you can claim on your tax return, refer to: All deductions, credits and expenses.

Savings plans you may be eligible for

Home Buyers’ Plan

This program allows an individual to withdraw from their registered retirement savings plans (RRSPs) under certain conditions to buy or build a qualifying home for themselves or for a related person with a disability.

Registered disability savings plan (RDSP)

This savings plan is intended to help an individual who is approved to receive the disability tax credit save for their long-term financial security.

First home savings account

This is a registered plan which allows an individual, if they are a first-time home buyer, to save to buy or build a qualifying home tax-free (up to certain limits).

Manage your information with the CRA

You can access your CRA account information in multiple ways, making it easier and faster to make changes, view your benefit details, arrange payments and more.

Making or receiving a payment

Stay connected and stay informed

For all digital services offered by the CRA, go to Digital services for individuals.

Learn about your taxes

Take our free online course to help you understand Canadian taxes, how to do them, and what’s in it for you. We’ve got 5-minute lessons, fun quizzes, and quick videos to break down everything you need to know.

Protect yourself from scams

Beware of scammers pretending to be the CRA. When in doubt, check your information in My Account or call the CRA. To learn what to expect if the CRA contacts you, go to Scam prevention and the CRA.

Know your rights

You have 16 rights when dealing with the CRA, outlined in the Taxpayer Bill of Rights. These rights build upon the CRA’s corporate values of professionalism, respect, integrity, and collaboration.

Forms and guides

- Income Tax Package – Guide, return and schedules

- Guide RC4064, Disability-Related Information

- Income Tax Folio S1-F1-C3, Disability Supports Deduction

- Form T2201, Disability Tax Credit Certificate

- Income Tax Folio S1-F1-C2, Disability Tax Credit

- Guide RC4065, Medical Expenses

- Income Tax Folio S1-F1-C1, Medical Expense Tax Credit

- Guide RC4460, Registered Disability Savings Plan

For all forms and guides, go to Forms and publications.

Multimedia

Webinar: New digital application form for the disability tax credit (DTC) - For medical practitioners

Learn about the new fully digital DTC application as it relates to medical practitioners.

Webinar: New digital application form for the disability tax credit (DTC) - For applicants

Learn about the new fully digital DTC application as it relates to applicants.

Webinar: Persons with disabilities

Learn about the benefits and credits available to persons with disabilities.

Factsheet: Persons with disabilities

Benefits and credits available for persons with disabilities and their caregivers.

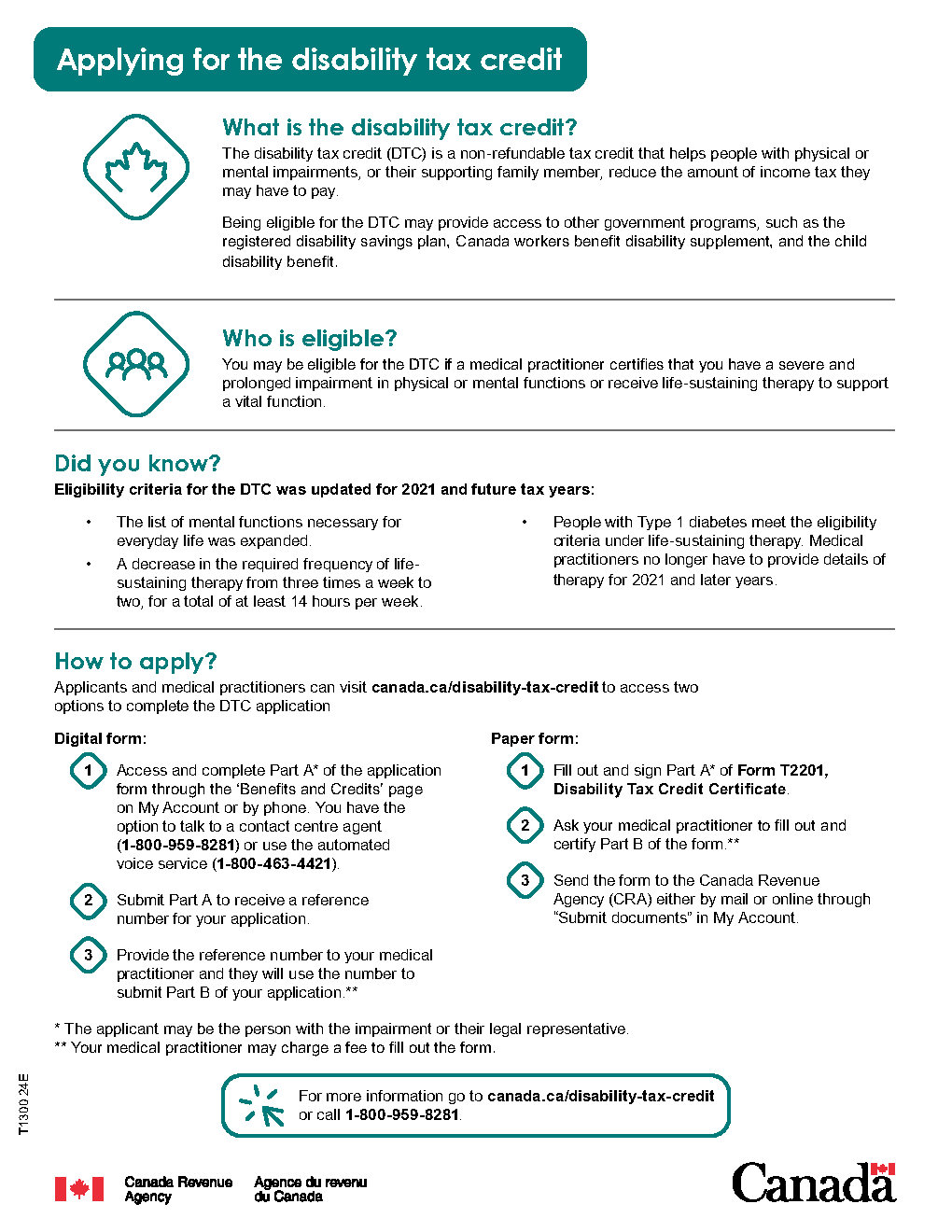

Factsheet: Applying for the disability tax credit (DTC)

The DTC is a non-refundable tax credit that helps people with physical or mental impairments, or their supporting family member, reduce the amount of income tax they may have to pay.

All multimedia outreach materials to print and share

Learning events

View recordings and register for upcoming national webinars

What’s new and upcoming at the CRA

We are continually improving our services to better support persons with disabilities.

SimpleFile tax filing services

The CRA offers simplified tax filing options to eligible individuals with a lower income and a simple tax situation. With SimpleFile services, you only need to answer a series of quick questions. The services use your answers and the information the CRA has on file to complete and process an income tax and benefit return on your behalf.

Invitation packages will go out in early March to CRA accounts and by mail. Note that you may receive your package in your CRA account, even if you have received your package by mail in the past.

If you don’t receive a letter, you may still be eligible to use SimpleFile Digital. Use our eligibility questionnaire, which will be available starting February 23, 2026, and see if you may be eligible to use SimpleFile Digital to complete your 2025 tax return.

Employment opportunities

A career at the CRA is an opportunity to join one of Canada’s top 100 employers. Make sure you self-declare if you are a member of an employment equity group when applying to federal public service jobs.

Students with disabilities can apply for employment with the public service through the Federal Student Work Experience Program.