100-day Service Improvement Plan - Closed

Status: Closed

Important Notice

This page will no longer be updated moving forward.

We know that many Canadians have faced difficulties accessing timely assistance from the CRA. Your experience with us is important, and we believe that every Canadian deserves easy access to the support they need, including timely assistance from our contact centre service representatives and reasonable processing times.

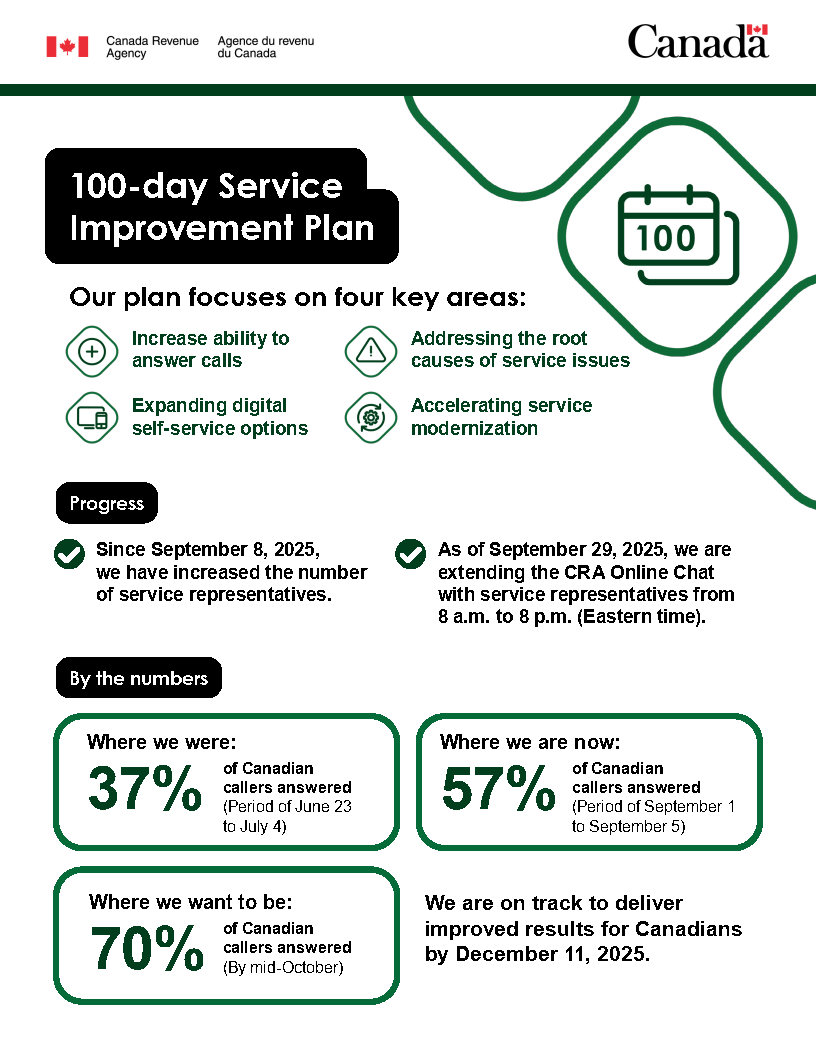

Our 100-day Service Improvement Plan focused on four key areas to strengthen service, improve access, and reduce delays. We committed to delivering results for Canadians by December 11, 2025. We will continue to build on the progress achieved under this plan.

On this page

Increasing the ability to answer calls

We are currently answering millions of calls, and the demand across the country exceeds our capacity. We understand that this can lead to frustration and repeated calls, and are fully committed to improving this situation. To provide better service, we have increased the number of service representatives available in our contact centres.

What we did to increase our ability to answer calls

Completed activities:

- Since September 8, 2025, we extended term contracts and rehired more employees. These additional resources are helping us to better meet the demands for assistance and reduce wait times.

- The CRA received more than 30 million calls during the 2024-25 fiscal year, around 80 percent of which were related to specific accounts. The Contact Centre Quality Monitoring Program reviews 100,000+ calls yearly, with the latest findings showing we have results of over 90 percent for professional and efficient service, as well as for accurate information provided. We are working to address the accuracy issues raised by the Auditor General for questions of a general nature, which make up 20 percent of our calls.

- We launched an experiment to offer callback requests for specific Disability Tax Credit (DTC) enquiries. This service enhances support for Canadians by providing efficient assistance, with callbacks expected within 2 business days.

- From September 15 to December 12, 2025, there were 3,890 callback requests related to DTC enquiries.

- While maintaining a 70% service target, calls answered and service representative levels will decrease during our low season due to reallocating some service representatives to support key workloads. These resources will help reduce processing delays in areas of the CRA that are causing calls from Canadians.

- From September 9 to December 12, 2025, 79,766 Canadians were assisted via a web-based priority call back service for issues related to both accessing their CRA account or Business Registration Online.

- More than 5,000 calls per week answered by this service.

Expanding digital self-service options

Our digital services, including the CRA's GenAI chatbot beta and a CRA account, are designed to help you find answers and access services conveniently and independently, reducing the need for phone calls. We also improved our web content to make it easier to complete self-service tasks.

What we did to expand digital self-service options

Completed activities:

- As of September 24, 2025, we enhanced the online information on registering your business with the CRA to make the process clearer and easier to complete online. The updated content walks users through how to prepare, register for a business number, and open CRA program accounts using self-serve options — helping businesses get started faster while reducing the need for calls to our contact centres.

- CRA Online chat with service representatives extended to 8 a.m. to 8 p.m. (Eastern time).

- Updated During the period of December 8 to December 12, 2025, there were 7,800 people who used CRA Online chat in My Account.

- As of October 20, 2025, existing CRA account users are now able to self-serve and register for a new credential if they are locked out of their account or they have forgotten their sign-in information. This will allow users to regain access without needing to call us for help.

- Updated Document verification service (DVS) use increased 29 percent month over month and 28 percent year over year in October with the addition of the new feature to register again.

- As of October 20, 2025, the CRA launched the Manage balance service within My Account, offering taxpayers with tax debts of $1,000 or more the ability to independently set up payment arrangements without needing to contact a service representative. This service provides options such as making full or partial payments, scheduling payment plans, connecting with a collections officer, or requesting a callback. It is now available to approximately 500,000 to 600,000 users.

- As of December 5, 2025, the new Manage balance service has been seen by ~1M Canadians.

- Updated During the period of December 8 to December 12, 2025, taxpayers selected to make a payment or payment arrangement from the Manage balance service 22,660 times through the self-serve tool in lieu of making a phone call.

- As of December 5, 2025, the new Manage balance service has been seen by ~1M Canadians.

- As of October 10, 2025, we enhanced the online information on the Tax-Free Savings Account (TFSA) so individuals can self-serve with confidence. The updated web pages now feature improved scenarios and information on contribution limits, withdrawals, and resolving overcontributions – making the experience smoother and more efficient while reducing the need for calls to our contact centres.

- As of October 17, 2025, user interface enhancements helped individuals submit documents electronically for tax adjustments and the Disability Tax Credit.

- In the month of November 2025, 3.2 million unique users actively accessed the CRA's portals to self-serve.

- As of November 3, 2025, registrations for a new business number (BN) or CRA program accounts must be done online. This change is designed to make the registration process quicker, easier, and more secure for businesses, and may reduce up to 200K calls to the Business Enquiries line, annually.

- On November 7, 2025, the CRA expanded the GenAI chatbot beta’s capabilities to address a broader range of topics. While maintaining its focus on essential subjects like personal income tax, CRA account access, and charities, the chatbot now goes deeper into specialized areas. For example, business owners are able to explore topics beyond the basics of business tax obligations, payroll deductions, and GST/HST returns. They are able to access detailed information on specialized topics such as tax credits, compliance guidelines, and industry-specific regulations, ensuring they receive comprehensive insights tailored to their unique needs.

- As of November 18, 2025, it is now easier for individuals to find clear answers on Canada.ca/Taxes regarding the Canada Child Benefit. If you have questions about the Canada Child Benefit (CCB), check out these web pages for information related to finding out if you are eligible for the CCB, when you will receive your CCB payment, and how to make sure you keep receiving your payment.

- As of November 19, 2025, it is now easier for individuals to find clear answers on Canada.ca/Taxes regarding Registering for a CRA Account. For more information about My Account, My Business Account, and Represent a Client, go to About your CRA account.

- As of November 19, 2025, improvements were made to the content of the “Register for a CRA account” webpage. These updates made the instructions clearer and easier to understand, resulting in a significant improvement in user experience. The success rate for users completing their registration tasks increased from 44 percent to 93 percent.

- As of December 11, 2025, it is now easier to find clear answers on Canada.ca/Taxes regarding GST/HST for Business. If you have questions about GST/HST for Business, check out these web pages for information related to filing a GST/HST return, getting a GST/HST access code, or changing a GST/HST account.

- As of December 11, 2025, it is now easier for individuals to find clear answers on Canada.ca/Taxes regarding finding a NETFILE access code. If you have questions about how to find a NETFILE access code, check out this web page for information.

Addressing the root causes of service issues

We are working to resolve the underlying factors that lead to service delays. The CRA has launched targeted teams to identify and implement key initiatives that improve processing times across programs where Canadians face service delays. These initiatives improved the overall client experience through streamlined processes and the use of advanced technologies like generative AI and robotic process automation.

What we did to address the root causes of service issues

Completed activities:

- A targeted plan was implemented to reduce wait times for tax adjustments, Disability Tax Credit (DTC) applications, and Canada Child Benefit claims.

- Reallocating resources to these areas resulted in more than 23,000 additional DTC cases being processed, while maintaining the 70% call-answer target.

- As of October 6, 2025, we implemented a system enhancement for T1 Adjustments to automatically process an additional 115,000 requests annually.

- We implemented a plan to reduce the backlog for tax adjustments to help Canadians receive more timely responses.

- We developed automations to streamline routine processing tasks and expedite application handling.

Accelerating service modernization

We piloted new ways to leverage existing AI tools at our disposal and worked with stakeholders to maximize current technology offerings while accelerating the deployment of others. For example, our new telephony platform is scheduled for deployment in 2026 and will include features that will enhance both client and service representative experience.

What we did to accelerate service modernization

Completed activities:

- The automated telephone system, which allows callers to interact with the CRA's menu, now automatically redirects payment enquiries to collections agents, reducing call volumes by approximately 95,000 annually and freeing up service representative capacity to address other inquiries.

- Updated As of November 3, 2025, the first enhancement has launched to redirect calls about payments to Collections, creating a smoother experience for taxpayers. In the first week, 3,000 calls were answered directly by Collections agents, increasing faster resolution for taxpayers by ensuring direct access to appropriate subject matter experts in collections.

- Plan developed for accelerated move to new contact engagement platform.

- Accelerated the timelines to implement a new contact engagement platform for Canadians starting in summer 2026.

- Test Co-Pilot GenAI Assistant tool to support contact centre service representatives.

By the numbers - Service improvement statistics

We recognized an opportunity to enhance our service delivery to better meet the needs and expectations of Canadians. We committed to taking action to make improvements within the 100-day period.

% of Canadian callers answered this summer

35%

Period of June 30 to July 4

Current % of Canadian callers answered

81%

Period of December 8 to December 12

Breakdown of call percentage

| Week ending | 2025-12-12 |

|---|---|

| Agent answered calls | 159,040 |

| Unique callerstable 1 note 1 | 195,810 |

| % unique callers answered (agent answered calls / unique callers* multiplied by 100) | 81% |

Table Note

|

|

Goal % of Canadian callers answered

70%

By Mid-December

The Future of service improvements

Our work is far from over. We know there is still more to do to deliver the level of service Canadians expect and deserve, especially as we prepare for the upcoming tax filing season. We will continue these efforts with the same focus and intensity to ensure we provide high-quality, reliable service to all Canadians. Explore our latest News Release, highlighting our commitment to continuous service improvements for the upcoming tax season.

Important Notice: This page will no longer be updated moving forward.

Resources

Check out how to Skip the line so you can see whether there is a faster and easier digital service for the task you want to complete.

Check the CRA processing times web page to know how long it will take to process a request.

Check Contact the CRA web page for call wait times and help with common topics if you have not been able to use self-serve options.