Quarterly Financial Report - For the quarter ended June 30, 2017

Table of contents

- 1.0 Introduction

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Personnel and Programs

- 5.0 Statement of Authorities (unaudited)

- 6.0 Departmental Budgetary Expenditures by Standard Object (unaudited)

- 7.0 Glossary

Quarterly Financial Report – For the quarter ended June 30, 2017 (PDF Version, 468 KB)

Free PDF download available

1.0 Introduction

This quarterly financial report should be read in conjunction with the 2017-18 Main Estimates. Shared Services Canada (SSC) had no items in the 2017-18 Supplementary Estimates (A) process. This report has been prepared by management as required by Section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

SSC was created on August 4, 2011 to transform how the Government of Canada manages its information technology (IT) infrastructure. SSC is delivering email, data centre, network and workplace technology device services to departments and agencies in a consolidated and standardized manner to support the delivery of Government of Canada programs and services. With a whole-of-government approach to IT infrastructure services, SSC is creating economies of scale to deliver more efficient, reliable and secure IT infrastructure services. SSC also provides certain optional technology services to other organizations on a cost-recovery basis.

SSC reports to Parliament through the Minister of Public Services and Procurement Canada and Minister responsible for SSC. By bringing together people, IT resources, and assets from 43 federal departments and agencies, SSC works to manage and improve the efficiency, reliability, and security of the government’s IT infrastructure. A more efficient use of technology will increase productivity across departments and support the vision of a 21st-century Public Service, as articulated in Blueprint 2020.

In carrying out its mandate, SSC is working in partnership with key public-sector and private-sector stakeholders; implementing enterprise-wide approaches for managing IT infrastructure services; and employing effective and efficient business management processes.

A full explanation of SSC’s main legislative authorities and responsibilities may be found in the Shared Services Canada Act.

SSC’s Program Alignment Architecture (PAA), as approved by the Treasury Board of Canada, supports the achievement of the following strategic outcome: Modern, reliable, secure, timely and cost-effective IT infrastructure services to support government priorities and program delivery. Significant changes were made to the 2017-18 PAA to move the sub-programs to the program level, and with the addition of two new programs. Changes were also made to the titles and descriptions of the PAA items in order to make them more plain language and understandable. In 2018-19, SSC’s PAA will evolve into the Departmental Results Framework (DRF) as per the Treasury Board Policy on Results. The DRF will be a plain language document which will describe, at a high level, the domains in which SSC acts, the changes it seeks to contribute to, and how it will measure and report on its progress.

Further details on SSC’s authority, mandate, responsibilities and programs may be found in SSC’s 2017-18 Main Estimates and in the 2017-18 Departmental Plan.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Department's spending authorities granted by Parliament, and those used by the Department consistent with the 2017-18 Main Estimates. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 Shared Services Canada Financial Structure

SSC has a financial structure composed mainly of voted budgetary authorities, namely Vote 1 - Operating Expenditures, including Vote Netted Revenues, and Vote 5 - Capital Expenditures, while the statutory authorities comprise the contributions to the Employee Benefit Plans (EBP). The contributions to EBP include both the contributions for SSC’s employees and for the members of Royal Canadian Mounted Police.

At the end of the first quarter of 2017-18, 93 percent of the Department’s budget was devoted to support its IT consolidation and standardization goals while ensuring that current and future IT infrastructure services offered to the Government of Canada are maintained in an environment of operational excellence. The remaining 7 percent was devoted to Internal Services which support services provided by SSC.

Total Vote Netted Revenue authority for 2017-18 is $407.1 million, which consists of respendable revenue for IT infrastructure services provided by SSC to partner organizations and other organizations on a cost-recovery basis.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

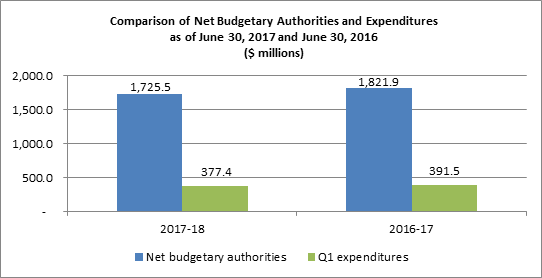

The following graph provides a comparison of the net budgetary authorities available for spending and the expenditures for the quarters ended June 30, 2017 and June 30, 2016, for the Department’s combined Vote 1 - Operating Expenditures, Vote 5 - Capital Expenditures and Statutory Authorities.

2.1 Significant Changes to Authorities

For the period ended June 30, 2017, the authorities provided to the Department include only the Main Estimates. Authorities available for spending in 2017‑18 were $1,725.5 million at the end of the first quarter, compared to $1,821.9 million at the end of the first quarter of 2016-17, representing a decrease of $96.4 million, or 5.3 percent. This total decrease is a combination of a decrease of $38.2 million in Vote 1 - Operating Expenditures, a decrease of $49.9 million in Vote 5 - Capital Expenditures and a decrease in Budgetary Statutory Authorities of $8.3 million.

SSC received additional authorities approved in Budget 2016 for the following initiatives: Refresh of the Mission Critical Infrastructure Technology and Secure Canada’s Government IT Infrastructure and Information. The bulk of these authorities was received in 2016-17, resulting in a net decrease of authorities in the first quarter of 2017-18, compared to the first quarter of 2016-17.

Comparison of Net Budgetary Authorities for the Quarters Ended June 30, 2017 and June 30, 2016

| Net Authorities Available ($ millions) | 2017–18 | 2016–17 | Variance |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,671.0 | 1,709.2 | (38.2) |

| Vote 5 - Capital Expenditures | 380.0 | 429.9 | (49.9) |

| Vote Netted Revenues | (407.1) | (407.1) | - |

| Statutory (EBP) | 81.6 | 89.9 | (8.3) |

| Total Net Authorities | 1,725.5 | 1,821.9 | (96.4) |

Vote 1 - Operating Expenditures (includes Vote Netted Revenues)

The Department’s Vote 1 decreased by $38.2 million, compared to the first quarter of 2016-17, mainly due to:

- A net decrease of $42.0 million related to funding for various projects and initiatives, such as:

- Refresh of the Mission Critical Infrastructure Technology (decrease of $51.1 million)

- Cyber Security (decrease of $15.1 million)

- High Performance Computing (increase of $18.0 million)

- Expanding Biometrics screening in Canada’s Immigration System (increase of $9.0 million).

- An increase of $3.8 million in transfers from partners related to funding for various projects.

Vote 5 - Capital Expenditures

The Department’s Vote 5 decreased by $49.9 million, compared to the first quarter of 2016-17, mainly due to:

- A decrease of $69.6 million related to funding received for various projects and initiatives, such as Refresh of the Mission Critical Infrastructure Technology ($30.1 million) and Carling Campus project ($29.4 million).

- An increase of $19.9 million related to the reprofiling of funding for Secure Canada’s Government IT Infrastructure and Information ($12.3 million) and for Carling Campus project ($7.6 million).

- A decrease of $0.2 million in transfers from partners related to funding for the Workspace Renewal project.

2.2 Explanations of Significant Variances from Previous Year Expenditures

Compared to the previous year, the total year-to-date expenditures, for the period ended June 30, 2017, have decreased by $14.1 million, from $391.5 million to $377.4 million as per the table below. This represents a decrease of 3.6 percent against expenditures recorded for the same period in 2016-17.

Comparison of Year-to-Date Expenditures for the Quarters Ended June 30, 2017 and June 30, 2016

| Net Year-to-Date Expenditures ($ millions) | 2017-18 | 2016-17 | Variance |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 377.1 | 353.3 | 23.8 |

| Vote 5 - Capital Expenditures | 26.7 | 38.1 | (11.4) |

| Vote Netted Revenues | (46.8) | (22.2) | (24.6) |

| Statutory (EBP) | 20.4 | 22.3 | (1.9) |

| Total Net Year-to-Date Expenditures | 377.4 | 391.5 | (14.1) |

Vote 1 - Increase of $23.8 million

The net increase in operating expenditures, compared to the first quarter of 2016-17, is mainly attributed to:

- Repair and maintenance expenditures increased by $11.8 million. This increase is mostly attributable to expenditures related to Refresh of the Mission Critical Infrastructure Technology, which did not commence until the second quarter of 2016-17. The increase is also attributable to a new contract for maintenance and support services related to computer hardware and software.

- Professional and special services expenditures increased by $7.0 million, mainly due to an amount of $5.5 million recorded in Professional services instead of Rentals expenditures, which was subsequently adjusted in the second quarter of 2017-18. This increase is also due to expenditures related to Refresh of the Mission Critical Infrastructure Technology.

- Transportation and communications expenditures increased by $3.6 million. This increase is mainly due to timing difference in payments made for IT and telecoms services in missions abroad.

- Personnel expenditures increased by $2.9 million due to the increase of the number of SSC’s employees in 2017-18.

- Rentals expenditures decreased by $2.7 million, mainly explained by a decrease of $15.3 million due to timing difference of the payments to IBM Canada for maintenance and support of IBM Enterprise License Agreement distributed suite of products, and by $5.5 million recorded in Professional services instead of Rentals expenditures in the first quarter of 2017-18. These decreases are offset by an increase of $15.9 million due to expenditures temporarily recorded in Vote 5 instead of Vote 1 in 2016-17 for a contract including both types of expenditures.

Vote 5 - Decrease of $11.4 million

The net decrease in capital expenditures, compared to the first quarter of 2016-17, is mainly attributed to:

- Rentals expenditures decreased by $21.8 million. This decrease is mainly explained by expenditures that were temporarily recorded in Vote 5 instead of Vote 1 in 2016-17 for a contract including both types of expenditures (15.9 million). The decrease is also due to a timing difference between fiscal years in reallocating the payments related to capital lease obligations.

- Acquisitions of Machinery and Equipment increased by $12.2 million. This increase is mainly explained by expenditures in Refresh of the Mission Critical Infrastructure Technology and in Secure Canada’s Government IT Infrastructure and Information, which did not commence until the second quarter of 2016‑17. The increase is also due to a timing difference between fiscal years in reallocating the payments related to capital lease obligations.

Vote Netted Revenue - Increase of $24.6 million

The increase in the collected Vote Netted Revenues, compared to the first quarter of 2016-17, is due to earlier billing in 2017-18 for services provided by SSC to partner departments that are funded through annual transfers instead of a one-time transfer when SSC was created.

3.0 Risks and Uncertainty

As SSC moves forward with the operationalization of its modernization agenda, the management of internal and external risks is vital in supporting strategic and business planning, as well as the successful delivery of SSC services to partner organizations and other organizations. SSC continues to improve its enabling functions such as financial management, project management and people management, which are essential to the successful implementation of spending plans and achievement of strategic objectives.

SSC is promoting effective financial management practices and financial sustainability to ensure that it has the financial resources, systems and funding mechanisms in place to maintain mission-critical systems and fund the modernization initiatives. The Department is also taking steps, such as developing recruitment and retention strategies that focus on learning, re-training, re-skilling, alternate and flexible work arrangements, and proactive classification and staffing resourcing strategies, to ensure a workforce with the right skills and capacity to sustain current, transitional and future business needs.

Additional risks that may impact the Department’s spending plans, as well as strategies to mitigate those risks, are described in the 2017-18 Departmental Plan.

4.0 Significant Changes in Relation to Operations, Personnel and Programs

On April 3, 2017, Sarah Paquet started her appointment as Senior Assistant Deputy Minister of the Strategy Branch.

Since April 6, 2017, Judy M. Foote, Minister of Public Services and Procurement and Minister responsible for SSC, is on leave. James Gordon Carr is acting during her absence, in addition to retaining his role as Minister of Natural Resources.

On May 12, 2017, Yves Genest, Chief Audit and Evaluation Executive, left SSC. Sharon Messerschmidt will join SSC as the new Chief Audit and Evaluation Executive. In the interim, the position is held by Patrice Prud’homme.

Approval by Senior Officials

Original signed by

Ron Parker, President

Original signed by

Ottawa, Canada

August 29, 2017

Original signed by

Alain Duplantie, MBA, CPA, CGA

Senior Assistant Deputy Minister,

Corporate Services and Chief Financial Officer

| Total available for use for the year ending March 31, 2018 * |

Used during the quarter ended June 30, 2017 |

Year-to-date used at quarter-end |

|

|---|---|---|---|

| Vote 1 - Operating expenditures | |||

| Gross Operating expenditures | 1,670,996 | 377,087 | 377,087 |

| Vote Netted Revenues | (407,094) | (46,758) | (46,758) |

| Net Operating expenditures | 1,263,902 | 330,329 | 330,329 |

| Vote 5 - Capital expenditures | 379,955 | 26,656 | 26,656 |

| (S) Contributions to employee benefit plans | 81,688 | 20,422 | 20,422 |

| Total Budgetary authorities | 1,725,545 | 377,407 | 377,407 |

Fiscal year 2016–17

(in thousands of dollars)

| Total available for use for the year ending March 31, 2017 * |

Used during the quarter ended June 30, 2016 |

Year-to-date used at quarter-end |

|

|---|---|---|---|

| Vote 1 - Operating expenditures | |||

| Gross Operating expenditures | 1,709,176 | 353,302 | 353,302 |

| Vote Netted Revenues | (407,094) | (22,233) | (22,233) |

| Net Operating expenditures | 1,302,082 | 331,069 | 331,069 |

| Vote 5 - Capital expenditures | 429,893 | 38,073 | 38,073 |

| (S) Contributions to employee benefit plans | 89,962 | 22,341 | 22,341 |

| Total Budgetary authorities | 1,821,937 | 391,483 | 391,483 |

*Includes only authorities available for use and granted by Parliament at quarter-end.

6.0 Departmental Budgetary Expenditures by Standard Object (unaudited)

Fiscal year 2017–18

(in thousands of dollars)

| Planned expenditures for the year ending March 31, 2018* |

Expended during the quarter ended June 30, 2017 |

Year-to-date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel (includes EBP) | 601,992 | 133,955 | 133,955 |

| Transportation and communications | 501,786 | 70,234 | 70,234 |

| Information | 692 | 118 | 118 |

| Professional and special services | 225,395 | 32,589 | 32,589 |

| Rentals | 323,767 | 122,461 | 122,461 |

| Repair and maintenance | 96,992 | 31,452 | 31,452 |

| Utilities, materials and supplies | 6,684 | 690 | 690 |

| Acquisition of land, buildings and works | 3,782 | - | - |

| Acquisition of machinery and equipment | 369,705 | 29,430 | 29,430 |

| Transfer payments | - | - | - |

| Public debt charges | - | - | - |

| Other subsidies and payments | 1,844 | 3,236 | 3,236 |

| Total gross budgetary expenditures | 2,132,639 | 424,165 | 424,165 |

| Less Revenues netted against expenditures: | |||

| Vote Netted Revenues | 407,094 | 46,758 | 46,758 |

| Total Revenues netted against expenditures | 407,094 | 46,758 | 46,758 |

| Total net budgetary expenditures | 1,725,545 | 377,407 | 377,407 |

Fiscal year 2016–17

(in thousands of dollars)

| Planned expenditures for the year ending March 31, 2017 * |

Expended during the quarter ended June 30, 2016 |

Year-to-date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel (includes EBP) | 612,509 | 132,916 | 132,916 |

| Transportation and communications | 444,176 | 69,137 | 69,137 |

| Information | 542 | 209 | 209 |

| Professional and special services | 227,424 | 24,204 | 24,204 |

| Rentals | 290,945 | 147,056 | 147,056 |

| Repair and maintenance | 144,362 | 20,355 | 20,355 |

| Utilities, materials and supplies | 5,525 | 751 | 751 |

| Acquisition of land, buildings and works | - | - | - |

| Acquisition of machinery and equipment | 498,084 | 16,438 | 16,438 |

| Transfer payments | - | - | - |

| Public debt charges | - | - | - |

| Other subsidies and payments | 5,464 | 2,650 | 2,650 |

| Total gross budgetary expenditures | 2,229,031 | 413,716 | 413,716 |

| Less Revenues netted against expenditures: | |||

| Vote Netted Revenues | 407,094 | 22,233 | 22,233 |

| Total Revenues netted against expenditures | 407,094 | 22,233 | 22,233 |

| Total net budgetary expenditures | 1,821,937 | 391,483 | 391,483 |

* Includes only authorities available for use and granted by Parliament at quarter-end, which are distributed based on historical financial data.

7.0 Glossary

Appropriations / Authorities

Expenditure authorities are approvals from Parliament for individual government organizations to spend up to specific amounts. Expenditure authority is provided in two ways: annual appropriation acts that specify the amounts and broad purposes for which funds can be spent; and other specific statutes that authorize payments and set out the amounts and time periods for those payments. The amounts approved in appropriation acts are referred to as voted amounts, and the expenditure authorities provided through other statutes are called statutory authorities.

- Vote 1 - Operating Expenditures

A vote that covers most day-to-day expenses, such as salaries, utilities and minor capital expenditures. - Vote 5 - Capital Expenditures

Capital expenditures are those made for the acquisition or development of items that are classified as tangible capital assets as defined by Government accounting policies. This vote is generally used for capital expenditures that exceed $10,000.

Capital Budget Carry Forward

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to twenty percent of their year-end allotments in the Capital Expenditures Vote as reflected in Public Accounts.

Cash method of accounting

The cash method recognizes revenues when they are received and expenses when they are paid for.

Collective agreement

Collective agreement means an agreement in writing entered into under the Public Service Staff Relations Act between the employer and a bargaining agent and containing provisions covering terms and conditions of employment and related matters.

Departmental Plan

The Departmental Plan (formerly known as the Report on Plans and Priorities) is an expenditure plan for each department and agency (excluding Crown corporations). It describes departmental priorities, expected results and associated resource requirements covering a three-year period, beginning with the year indicated in the title of the report.

Employee Benefit Plan (EBP)

A statutory item that includes employer contributions for the Public Service Superannuation Plan, the Canada and the Quebec Pension Plans, Death Benefits, and the Employment Insurance accounts. Expressed as a percentage of salary, the EBP rate is changed every year as directed by the Treasury Board Secretariat.

Expenditure basis of accounting

An accounting method that combines elements of the two major accounting methods, the cash method and the accrual method. The expenditure basis of accounting method recognizes revenues when cash is received and expenses when liabilities are incurred or cash is paid out.

Frozen allotments

Frozen allotments are used to prohibit the spending of funds previously appropriated by Parliament. There are two types of frozen allotments:

- Permanent: where the Treasury Board has directed that funds lapse at the end of the fiscal year

- Temporary: where an appropriation is frozen until such time as conditions have been met

Full accrual method of accounting

An accounting method that measures the performance and position of an organization by recognizing economic events regardless of when cash transactions occur. Therefore, the full accrual method of accounting recognizes revenues when they are earned (for example, when the terms of a contract are fulfilled) and expenses when they are incurred.

Government-wide Chart of Accounts

The Government-wide Chart of Accounts (COA) provides the framework for identifying, collecting and reporting financial transactions to satisfy the government’s corporate information requirements. The COA contains accounts and codes for all the fields that comprise the government-wide coding block.

Main Estimates

Each year, the government prepares estimates in support of its request to Parliament for authority to spend public funds. This request is formalized through the introduction of appropriation bills in Parliament. In support of the Appropriation Act, the Main Estimates identify the spending authorities (Votes) and amounts to be included in subsequent appropriation bills. Parliament is asked to approve these Votes to enable the government to proceed with its spending plans.

Operating Budget Carry Forward

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to five percent of their Main Estimates gross Operating Budget allotment.

Program Alignment Architecture (PAA)

A structured inventory of a department’s programs, where programs are arranged in a hierarchical manner to depict the logical relationship between each program and the strategic outcomes to which they contribute.

Standard objects

A system in accounting that classifies and summarizes the expenditures by categories, such as type of goods or services acquired, for monitoring and reporting.

Strategic Outcome

A long-term and enduring benefit to Canadians that is linked to the department's mandate, vision, and core functions.

Supplementary Estimates

The President of the Treasury Board tables three Supplementary Estimates usually in late spring, late fall and early spring to obtain the authority of Parliament to adjust the government's expenditure plan set out in the estimates for that fiscal year. Supplementary Estimates serve two purposes. First, they seek authority for revised spending levels that Parliament will be asked to approve in an Appropriation Act. Second, they provide Parliament with information on changes in the estimated expenditures to be made under the authority of statutes previously passed by Parliament. Each Supplementary Estimates document is identified alphabetically (A, B and C).

Vote Netted Revenues Authority

The authority by which Shared Services Canada has permission to collect and spend revenue earned and collected from the provision of IT services within the government.

Free PDF download

To access the Portable Document Format (PDF) version you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet: