Quarterly Financial Report - For the quarter ended June 30, 2020

Table of contents

1 Introduction

This quarterly financial report should be read in conjunction with the 2020-21 Main Estimates and the 2020-21 Supplementary Estimates (A). This report has been prepared by management as required by Section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It has not been subject to an external audit or review.

1.1 Authority, mandate and programs

Shared Services Canada (SSC) is responsible for digitally enabling government programs and services by providing IT services in the domains of networks and network security, data centers and cloud offerings, digital communications and providing IT tools that the public service needs to do its job. As a service provider to over 40 government departments and agencies, SSC is focussed on moving toward an IT service delivery model that encourages sharing common solutions and platforms across departments in an effort to reduce the variety of IT solutions across the government. In taking this enterprise approach, SSC is working to solidify network capacity and security, equip and empower employees to collaborate, and support partners in the design and delivery of their digital service offering to Canadians. The Minister of Digital Government is responsible for SSC.

In carrying out its mandate, SSC is supporting the Digital Operations Strategic Plan: 2018 to 2022 and the Government of Canada Cloud Adoption Strategy, as well as working in partnership with public and private sector stakeholders, implementing enterprise-wide approaches for managing IT infrastructure services, and employing effective and efficient business management processes.

The Shared Services Canada Act and related Orders-in-Council set out the powers, duties and functions of the Minister responsible for SSC. Amendments to the Act in June 2017 allow the Minister to delegate to other Ministers the power to procure certain items, thereby making it easier for federal departments to buy some of the most frequently purchased IT goods and services. SSC remains responsible for setting up IT contracts, standing offers and supply arrangements, and will continue to ensure only trusted IT equipment and software are used. The Minister responsible for SSC may also, in exceptional circumstances, authorize another Minister to obtain services from within their own department or from a source other than SSC. However, this authorization cannot be used to exempt the entire department from using SSC's services.

In 2019, the Minister of Digital Government became the Minister responsible for SSC as per Order-in-Council 2019-1366. The creation of the first stand-alone Minister of Digital Government underscores the importance of digital technology transforming society, and it centralizes decision-making with respect to GC-wide digital government policy and operations.

Further details on SSC's authority, mandate, responsibilities and programs may be found in the 2020-21 Main Estimates and in SSC's 2020-21 Departmental Plan.

1.2 Basis of presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department's spending authorities granted by Parliament, and those used by the department consistent with a reduced supply of the 2020-21 Main Estimates and the 2020-21 Supplementary Estimates (A). Due to the COVID-19 pandemic and limited sessions in the spring for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the study period into the fall. SSC is expected to receive full supply for the 2020-21 Main Estimates in December 2020. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis. The main difference between the Quarterly Financial Report and the Departmental Financial Statements is the timing of when revenues and expenses are recognized. The Quarterly Financial Report presents revenues only when the money is received and expenses only when the money is paid out. The Departmental Financial Statements report revenues when they are earned and expenses when they are incurred. In the latter case, revenues are recorded even if cash has not been received and expenses are incurred even if cash has not yet been paid out.

1.3 Shared Services Canada financial structure

SSC has a financial structure composed mainly of voted budgetary authorities, namely Vote 1 - Operating expenditures, including vote netted revenues, and Vote 5 - Capital expenditures, including vote netted revenues. Vote 10 - Making federal government workplaces more accessible, obtained in 2019-20, is no longer part of the voted budgetary authorities in 2020-21 since this funding has been included in Vote 1 for 2020-21. The statutory authorities comprise the contributions to the Employee Benefit Plans (EBP). The contributions to EBP consist of the contributions for SSC’s employees including the members of Royal Canadian Mounted Police.

At the end of the first quarter of 2020-21, 91% of the department’s budget was devoted to support its IT consolidation and standardization goals. This ensured that current and future IT infrastructure services offered to the Government of Canada are maintained in an environment of operational excellence. The remaining 9% was devoted to internal services, which are services in support of SSC programs and/or required to meet SSC’s corporate obligations.

Total vote netted revenue authority for 2020-21 is $665.0 million, which consists of respendable revenue for IT infrastructure services provided by SSC to partner organizations and other organizations on a cost-recovery basis.

2 Highlights of fiscal quarter and fiscal year-to-date results

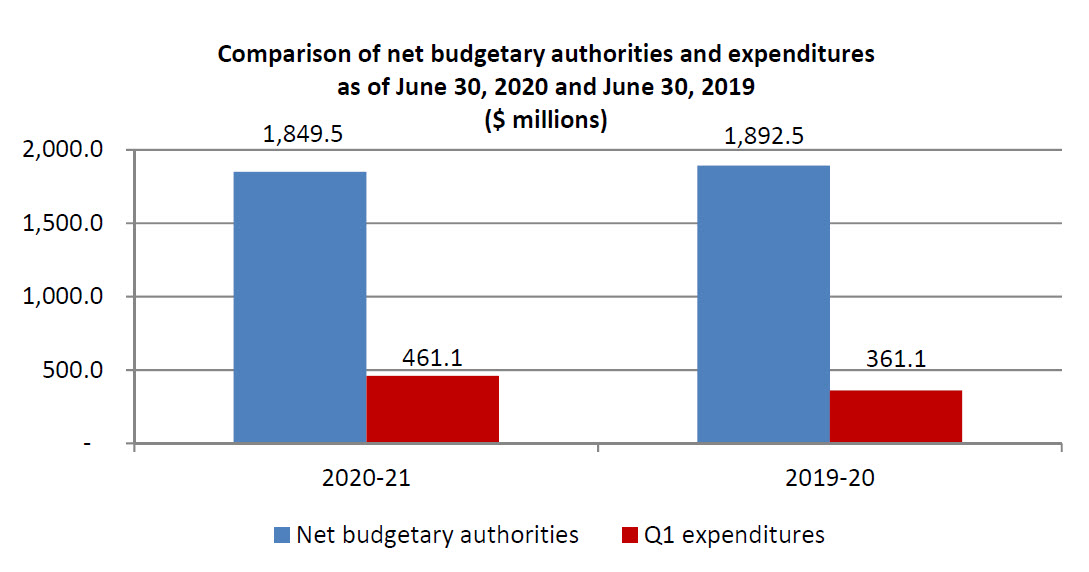

The following graph provides a comparison of the net budgetary authorities available for spending and the expenditures for the quarters ended June 30, 2020 and June 30, 2019, for the department's combined Vote 1 - Operating expenditures, Vote 5 - Capital expenditures, Vote 10 - Making federal government workplaces more accessible (for 2019-20 only), and statutory authorities.

Long description – Comparison of net budgetary authorities and expenditures

The graph shows total net budgetary authorities available for spending of $1,849.5 million as of June 30, 2020 and $1,892.5 million as of June 30, 2019. It also shows total expenditures of $461.1 million for the first quarter ended June 30, 2020, compared to $361.1 million for the first quarter ended June 30, 2019.

2.1 Significant changes to authorities

For the period ended June 30, 2020, the authorities available to the department include a reduced supply of the Main Estimates and the Supplementary Estimates (A). Due to the COVID-19 pandemic and limited sessions in the spring for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the study period into the fall. SSC is expected to receive full supply for the 2020-21 Main Estimates in December 2020. Authorities available for spending in 2020-21 were $1,849.5 million at the end of the first quarter, compared to $1,892.5 million at the end of the first quarter of 2019-20, representing a decrease of $43.0 million, or 2.3%. This total decrease is a combination of a decrease of $11.5 million in Vote 1 – Gross operating expenditures, a decrease of $30.0 million in Vote 5 – Gross capital expenditures, a decrease of $1.6 million in Vote 10 – Making federal government workplaces more accessible, and an increase in budgetary statutory authorities of $0.1 million.

| Net authorities available ($ millions) | 2020-21 | 2019-20 | Variance |

|---|---|---|---|

| Vote 1 - Operating expenditures | 2,134.0 | 2,145.5 | (11.5) |

| Vote 5 - Capital expenditures | 286.3 | 316.3 | (30.0) |

| Vote 10 - Making federal government workplaces more accessible | - | 1.6 | (1.6) |

| Vote netted revenues | (665.0) | (665.0) | - |

| Statutory (EBP) | 94.2 | 94.1 | 0.1 |

| Total net authorities | 1,849.5 | 1,892.5 | (43.0) |

Vote 1 – Gross operating expenditures

The department's Vote 1 decreased by $11.5 million, compared to the first quarter of 2019-20, mainly due to:

- A decrease of $139.6 million in the authorities available for use due to the reduced supply of the 2020‑21 Main Estimates

- A net decrease of $26.1 million in transfers with partners related to funding for various projects and initiatives:

- Transfer from SSC to the Department of Foreign Affairs, Trade and Development for missions abroad ($20.0 million)

- Other projects and initiatives ($6.1 million)

- A decrease of $8.0 million related to Service Integrity 2.0–Asset Discovery and Inventory Management and Maintenance and Support Contracts

- A decrease of $7.7 million related to Service Integrity Mission–Critical Projects

- An increase of $95.1 million related to the following projects and initiatives:

- Workload Migration, Cloud Architecture, Secure Cloud Enablement ($33.4 million)

- Improving service Integrity at Shared Services Canada ($19.4 million)

- Government of Canada Microsoft Enterprise Agreement ($12.7 million)

- Secure Canada's Government IT Infrastructure and Information (temporary frozen allotment of $10.0 million)

- Incremental cost of providing core information technology services to client departments and agencies ($8.5 million)

- Other projects and initiatives ($11.1 million)

- An increase of $71.6 million related to the reprofiling of funding for providing Information Technology Infrastructure for improving Service Integrity Mission–Critical projects ($4.7 million), Workload Migration and Cloud Enablement ($9.2 million) and Workload Migration and Cloud Architecture programs ($57.7 million)

- A decrease of $9.4 million for the reprofiling of funding for High Performance Computing for Environment and Climate Change Canada

- A decrease of $71.6 million in the authorities available for use due to the reduced supply of the 2020‑21 Main Estimates

- A decrease of 12.6 million due to a realignment of funding authority from Vote 1 to Vote 5 in 2019-20

- A net decrease of $2.3 million in transfers with partners related to funding for various projects and initiatives

- A net increase of $29.8 million for the reprofiling of funding for the following projects and initiatives:

- An increase of $49.5 million for the reprofiling of funding for the Workload Migration and Cloud Architecture programs ($47.5 million) and High Performance Computing for Environment and Climate Change Canada ($2.0 million)

- A decrease of $19.7 million for the reprofiling of funding for the Carling Campus Project

- A net increase of $26.7 million related to the following projects and initiatives:

- Workload Migration, Cloud Architecture, Secure Cloud Enablement (increase of $34.9 million)

- High Performance Computing for Environment and Climate Change Canada (increase of $2.6 million)

- Enhance the integrity of Canada's Borders and Asylum System (increase of $1.5 million)

- Various projects and initiatives (increase of $0.3 million)

- Information Technology Refresh Program (decrease of $6.1 million)

- 2021 Census of Population Program and Census of Agriculture (decrease of $5.1 million)

- Cyber and Information Technology Security initiatives (decrease of $1.4 million)

- An increase of $1.9 million for improving Service Integrity at Shared Services Canada

- A net decrease of $1.8 million in transfers with partners related to funding for various projects and initiatives

- Rentals expenditures increased by $48.9 million. This increase is mainly attributable to expenditures related to Microsoft Enterprise Agreement, as well as a change in operational requirements that resulted in a shift of expenditures from Acquisitions of machinery and equipment to Rentals

- Transportation and communications expenditures increased by $13.2 million. This increase is mainly attributable to expenditures related to communications and network services, voice communications services and data communications services

- Professional and special services increased by $11.9 million. This increase is mainly attributable to expenditures related to Mission-Critical projects, as well as expenditures related to architectural services, management consultants and information technology and telecommunications consultants

- Personnel expenditures increased by $10.8 million. This increase is mainly due to an increase in the number of SSC employees in 2020-21

- Acquisitions of machinery and equipment decreased by $12.4 million. This decrease is mainly attributable to a change in operational requirements that resulted in a shift of expenditures from Acquisitions of machinery and equipment to Rentals. This decrease is partially offset by an increase in expenditures related to the acquisition of hardware

- Other subsidies and payments expenditures decreased by $6.6 million. This decrease is mainly due to timing differences of payments between fiscal years

- Decrease of $2.3 million in other various expenditures

- Professional and special services increased by $11.5 million. This increase is mainly due to a new contract for the Information Technology Service Management Tool Project

- Acquisitions of machinery and equipment increased by $8.3 million. This increase is mainly due to the acquisition of hardware, software and communication network equipment. This increase is partially offset by a decrease in expenditures related to the 2021 Census of Population Program and Census of Agriculture

- Decrease of $0.5 million in other various expenditures

- Developing recruitment and retention strategies that focus on learning, re-training, re-skilling, alternate and flexible work arrangements

- Proactive classification and staffing resourcing strategies

- Driving the adoption of emerging technologies and work arrangements, as demonstrated by the Cloud First Strategy, modern office arrangements and designed, data analytics, mobile technologies among others

- Appropriations / Authorities

-

Expenditure authorities are approvals from Parliament for individual government organizations to spend up to specific amounts. Expenditure authority is provided in two ways: annual appropriation acts that specify the amounts and broad purposes for which funds can be spent; and other specific statutes that authorize payments and set out the amounts and time periods for those payments. The amounts approved in appropriation acts are referred to as voted amounts, and the expenditure authorities provided through other statutes are called statutory authorities.

- Vote 1 - Operating expenditures - A vote that covers most day-to-day expenses, such as salaries, utilities and minor capital expenditures.

- Vote 5 - Capital expenditures - Capital expenditures are those made for the acquisition or development of items that are classified as tangible capital assets as defined by Government accounting policies. This vote is generally used for capital expenditures that exceed $10,000.

- Capital budget carry forward

-

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to 20% of their year-end allotments in the Capital Expenditures Vote as reflected in Public Accounts.

- Cash method of accounting

-

The cash method recognizes revenues when they are received and expenses when they are paid for.

- Collective agreement

-

Collective agreement means an agreement in writing entered into under the Public Service Staff Relations Act between the employer and a bargaining agent and containing provisions covering terms and conditions of employment and related matters.

- Departmental Plan

-

The Departmental Plan is an expenditure plan for each department and agency (excluding Crown corporations). It describes departmental priorities, expected results and associated resource requirements covering a three-year period, beginning with the year indicated in the title of the report.

- Employee Benefit Plan (EBP)

-

A statutory item that includes employer contributions for the Public Service Superannuation Plan, the Canada and the Quebec Pension Plans, Death Benefits, and the Employment Insurance accounts. Expressed as a percentage of salary, the EBP rate is changed every year as directed by the Treasury Board Secretariat.

- Expenditure basis of accounting

-

An accounting method that combines elements of the two major accounting methods, the cash method and the accrual method. The expenditure basis of accounting method recognizes revenues when cash is received and expenses when liabilities are incurred or cash is paid out.

- Frozen allotments

-

Frozen allotments are used to prohibit the spending of funds previously appropriated by Parliament. There are two types of frozen allotments:

- Permanent: where the Treasury Board has directed that funds lapse at the end of the fiscal year

- Temporary: where an appropriation is frozen until such time as conditions have been met

- Full accrual method of accounting

-

An accounting method that measures the performance and position of an organization by recognizing economic events regardless of when cash transactions occur. Therefore, the full accrual method of accounting recognizes revenues when they are earned (for example, when the terms of a contract are fulfilled) and expenses when they are incurred.

- Main Estimates

-

Each year, the government prepares estimates in support of its request to Parliament for authority to spend public funds. This request is formalized through the introduction of appropriation bills in Parliament. In support of the Appropriation Act, the Main Estimates identify the spending authorities (Votes) and amounts to be included in subsequent appropriation bills. Parliament is asked to approve these Votes to enable the government to proceed with its spending plans.

- Operating budget carry forward

-

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to 5% of their Main Estimates gross operating budget allotment.

- Standard objects

-

A system in accounting that classifies and summarizes the expenditures by categories, such as type of goods or services acquired, for monitoring and reporting.

- Supplementary Estimates

-

The President of the Treasury Board tables two Supplementary Estimates usually in late fall and early spring to obtain the authority of Parliament to adjust the government's expenditure plan set out in the estimates for that fiscal year. Supplementary Estimates serve two purposes. First, they seek authority for revised spending levels that Parliament will be asked to approve in an Appropriation Act. Second, they provide Parliament with information on changes in the estimated expenditures to be made under the authority of statutes previously passed by Parliament. Each Supplementary Estimates document is identified alphabetically (A and B).

- Vote Netted Revenues Authority

-

The authority by which Shared Services Canada has permission to collect and spend revenue earned and collected from the provision of IT services within the government.

A net increase of $62.2 million for the reprofiling of funding for the following projects and initiatives:

An increase of $12.6 million due to a realignment of funding authority from Vote 1 to Vote 5 in 2019-20

Vote 5 – Gross capital expenditures

The department's Vote 5 decreased by $30.0 million, compared to the first quarter of 2019-20, mainly due to:

Vote 10 – Making federal government workplaces more accessible

The department's Vote 10 decreased by $1.6 million, compared to the first quarter of 2019-20, due to the initiative “Making federal government workplaces more accessible”, announced in Budget 2019. The funding has been included in Vote 1 for 2020-21 and is no longer part of Vote 10.

Statutory (EBP)

The department's Employee Benefits Plan (EBP) authority increased by $0.1 million, compared to the first quarter of 2019-20, mainly due to:

2.2 Explanations of significant variances from previous year expenditures

Compared to the previous year, the total year-to-date expenditures, for the period ended June 30, 2020, have increased by $100.0 million, from $361.1 million to $461.1 million as per the table below. This represents an increase of 27.7% against expenditures recorded for the same period in 2019-20.

| Net year-to-date expenditures ($ millions) | 2020-21 | 2019-20 | Variance |

|---|---|---|---|

| Vote 1 - Operating expenditures | 501.1 | 437.6 | 63.5 |

| Vote 5 - Capital expenditures | 43.4 | 24.1 | 19.3 |

| Vote 10 - Making federal government workplaces more accessible | - | - | - |

| Vote netted revenues | (106.9) | (124.1) | 17.2 |

| Statutory (EBP) | 23.5 | 23.5 | - |

| Total net year-to-date expenditures | 461.1 | 361.1 | 100.0 |

Vote 1 - Increase of $63.5 million

The net increase in operating expenditures, compared to the first quarter of 2019-20, is mainly attributed to:

Vote 5 - Increase of $19.3 million

The net increase in capital expenditures, compared to the first quarter of 2019-20, is mainly attributed to:

Vote netted revenues - decrease of $17.2 million

The decrease in the collected vote netted revenues, compared to the first quarter of 2019-20, is mainly due to timing difference between fiscal years in billing the services provided by SSC to partner departments.

3 Risks and uncertainty

SSC's mandate to ensure the availability of adequate resources to provide IT infrastructure, email, data centres and network services across government involves risks for both SSC as a department as well as the Government of Canada as a whole, both in the present and in the future. Maintaining the Government of Canada's existing IT infrastructure services while simultaneously undertaking IT modernization initiatives requires an engaged employee base possessing a specialized skill set, as well as sustainable, and reliable funding model. How well SSC will manage these risks impacts whether its partners can fulfill the execution of the departmental mandate and realize the collective expectations of Canadians. Therefore, SSC should refocus its efforts on core business functions such as financial management, project management and people management which are essential to the successful implementation of spending plans in order to achieve the strategic objectives of the department.

SSC promotes effective financial management practices and financial sustainability to ensure that it has the financial resources, systems and funding mechanisms in place to maintain and enhance mission-critical systems while funding the modernization initiatives. The department is also taking steps to ensure a workforce with the right skills and capacity to sustain current, transitional and future business needs. These include:

Transitional strategies and future expectations of the department have exposed SSC to new set of risks necessitating the revision of the existing risk profile of the department.

Additional risks that may impact the department's spending plans, adoption of new technologies and strategies, as well as steps to mitigate those risks caused by COVID-19, are described in SSC's 2020-21 Departmental Plan.4 Significant changes in relation to operations, personnel and programs

On March 9, 2020, Shereen Benzvy Miller joined SSC as the new Assistant Deputy Minister, Next Generation HR and Pay.

On April 1, 2020, Luc Gagnon, Chief Technology Officer, left SSC. In the interim, the position was held by Dinesh Mohan.

Approval by Senior Officials

Original signed by

Sarah Paquet, Executive Vice-President for

Paul Glover

President

Original signed by

Denis Bombardier, CPA, CGA

Senior Assistant Deputy Minister,

Chief Financial Officer

Ottawa, Canada

August 21, 2020

5 Statement of authorities (unaudited)

Table 3 - Statement of authorities for fiscal year 2020-21

| Fiscal year 2020-21 (in thousands of dollars) | Total available for use for the year ending March 31, 2021 Footnote * | Used during the quarter ended June 30, 2020 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Operating expenditures | |||

| Gross operating expenditures | 2,134,020 | 501,120 | 501,120 |

| Vote netted revenues | (595,000) | (106,875) | (106,875) |

| Net operating expenditures | 1,539,020 | 394,245 | 394,245 |

| Vote 5 - Capital expenditures | |||

| Gross capital expenditures | 286,326 | 43,416 | 43,416 |

| Vote netted revenues | (70,000) | - | - |

| Net capital expenditures | 216,326 | 43,416 | 43,416 |

| Vote 10 - Making federal government workplaces more accessible | - | - | - |

| (S) Contributions to employee benefit plans | 94,194 | 23,453 | 23,453 |

| Total budgetary authorities | 1,849,540 | 461,114 | 461,114 |

Table 4 - Statement of authorities for fiscal year 2019-20

| Fiscal year 2019-20 (in thousands of dollars) | Total available for use for the year ending March 31, 2020Footnote * | Used during the quarter ended June 30, 2019 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Operating expenditures | |||

| Gross operating expenditures | 2,145,489 | 437,650 | 437,650 |

| Vote netted revenues | (595,000) | (124,144) | (124,144) |

| Net operating expenditures | 1,550,489 | 313,506 | 313,506 |

| Vote 5 - Capital expenditures | |||

| Gross Capital expenditures | 316,323 | 24,101 | 24,101 |

| Vote netted revenues | (70,000) | - | - |

| Net capital expenditures | 246,323 | 24,101 | 24,101 |

| Vote 10 - Making federal government workplaces more accessible | 1,620 | - | - |

| (S) Contributions to employee benefit plans | 94,086 | 23,521 | 23,521 |

| Total budgetary authorities | 1,892,518 | 361,128 | 361,128 |

6 Departmental budgetary expenditures by Standard Object (unaudited)

Table 5 - Departmental budgetary expenditures by Standard Object for fiscal year 2020-21

| Fiscal year 2020-21 (in thousands of dollars) | Planned expenditures for the year ending March 31, 2021 Footnote * | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures: | |||

| Personnel (includes EBP) | 624,239 | 183,684 | 183,684 |

| Transportation and communications | 632,972 | 64,315 | 64,315 |

| Information | 1,199 | 2 | 2 |

| Professional and special services | 277,687 | 60,301 | 60,301 |

| Rentals | 397,711 | 184,684 | 184,684 |

| Repair and maintenance | 160,898 | 34,950 | 34,950 |

| Utilities, materials and supplies | 9,342 | 553 | 553 |

| Acquisition of land, buildings and works | 12,845 | 863 | 863 |

| Acquisition of machinery and equipment | 389,719 | 40,038 | 40,038 |

| Transfer payments | - | - | - |

| Public debt charges | 5,724 | 1,597 | 1,597 |

| Other subsidies and payments | 2,204 | (2,998) | (2,998) |

| Total gross budgetary expenditures | 2,514,540 | 567,989 | 567,989 |

| Less revenues netted against expenditures | |||

| Vote netted revenues | 665,000 | 106,875 | 106,875 |

| Total revenues netted against expenditures | 665,000 | 106,875 | 106,875 |

| Total net budgetary expenditures | 1,849,540 | 461,114 | 461,114 |

Table 6 - Departmental budgetary expenditures by Standard Object for fiscal year 2019-20

| Fiscal year 2019-20 (in thousands of dollars) | Planned expenditures for the year ending March 31, 2020 Footnote * | Expended during the quarter ended June 30, 2019 | Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures | |||

| Personnel (includes EBP) | 705,632 | 172,236 | 172,236 |

| Transportation and communications | 621,774 | 51,076 | 51,076 |

| Information | 968 | 136 | 136 |

| Professional and special services | 269,520 | 36,897 | 36,897 |

| Rentals | 377,781 | 135,814 | 135,814 |

| Repair and maintenance | 150,085 | 37,865 | 37,865 |

| Utilities, materials and supplies | 9,231 | 657 | 657 |

| Acquisition of land, buildings and works | 13,807 | 1,981 | 1,981 |

| Acquisition of machinery and equipment | 401,171 | 44,188 | 44,188 |

| Transfer payments | - | - | - |

| Public debt charges | 5,031 | 827 | 827 |

| Other subsidies and payments | 2,518 | 3,595 | 3,595 |

| Total gross budgetary expenditures | 2,557,518 |

485,272 |

485,272 |

| Less revenues netted against expenditures | |||

| Vote netted revenues | 665,000 | 124,144 | 124,144 |

| Total revenues netted against expenditures | 665,000 |

124,144 |

124,144 |

| Total net budgetary expenditures | 1,892,518 | 361,128 | 361,128 |