2017–18 Departmental Results Report: Treasury Board of Canada Secretariat

Complete a survey on your experience using this Departmental Results Report

On this page

President’s message

President of the Treasury Board and Minister of Digital Government

I am pleased to present the Departmental Results Report of the Treasury Board of Canada Secretariat (TBS) for the 2017–18 fiscal year.

Canadians deserve to know how the government spends their tax dollars, what results are expected from government programs, and what is being achieved. This report, the first based on the new Departmental Results Framework, does exactly that.

In the past fiscal year, TBS accomplished much in delivering on the government’s management agenda, and I would like to highlight a few of the achievements.

We successfully negotiated 7 new collective agreements in the context of the round of bargaining covering 2014 to 2018. As of March 31, we had concluded 23 out of 27 agreements, applying to about 97% of represented employees in the core public administration.

In the area of expenditure management, we changed the timing and content of the Main Estimates to make them easier to understand, giving parliamentarians and Canadians the information they need to hold the government to account for its spending of public funds.

We have also taken other steps to modernize government. We launched the Canadian Digital Service to help government departments and agencies meet Canadians’ need for high-quality services that can be delivered anywhere and at any time. In addition, TBS led Canada’s domestic and international efforts on Open Government, resulting in Canada being named lead government chair of the international Open Government Partnership for 2018–19. This provides an ongoing opportunity to bring governments closer to their citizens, improve public policy, and deepen democracy around the world.

We also proposed important changes to the Access to Information Act, such as new requirements for proactive publication of information of interest to Canadians, covering more than 240 government institutions, as well as ministers’ offices such as my own.

I am encouraged by the progress TBS made last year, and I invite all Canadians to read this report to see exactly how we are delivering the kind of government you deserve.

Original signed by

The Honourable Scott Brison

President of the Treasury Board and Minister of Digital Government

Results at a glance

Context

In 2017–18,Footnote 1 the Treasury Board of Canada Secretariat (TBS) started using a new Departmental Results Framework.

Under this new framework, TBS is reporting to Canadians on the results it aims to achieve in relation to the following core responsibilities:

- Spending Oversight

- Administrative Leadership

- Employer

- Regulatory Oversight

TBS is using 37 performance indicators to track progress on its results.

The targets that TBS set in relation to these indicators, as well as its plans for meeting those targets and for achieving the results set out in the framework, are outlined in its 2017–18 Departmental Plan.

This Departmental Results Report reports against the targets in TBS’s 2017–18 Departmental Plan and outlines the resources that it allocated toward achieving its results.

Results

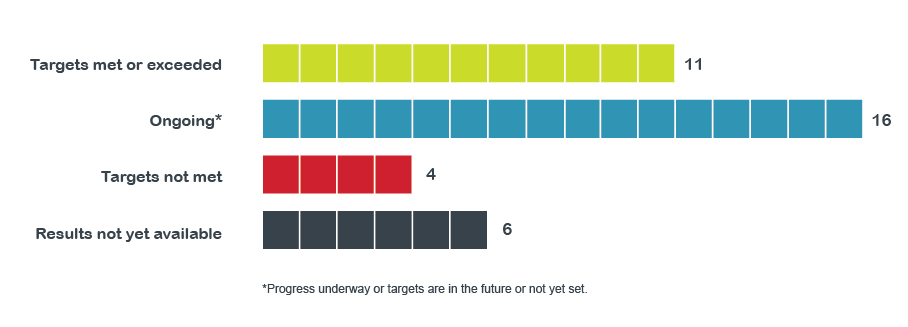

11 targets met or exceeded

TBS met or exceeded 11 of its targets. Notably, in the area of government openness, over 1,800 new datasets were released on open.canada.ca (the target was 800) and for 97% of federal regulatory initiatives, public consultations were undertaken before the first publication of regulations (the target was 90%).

Tracking continued in 16 areas

TBS continued to track progress in 16 areas where it was still working to achieve targets after , or it was still developing performance targets.Footnote 2 For example, TBS continued to work with departments to achieve the target of making 70% of priority services available online by (currently at 62%).

4 targets missed

TBS did not meet 4 of its targets. In one case, 70% of priority services met their service standards (the target was 80%). In another case, 80% of departments effectively maintained and managed their assets over their life cycle (the target was 90%). In the other cases, 76% of access to information requests and 75% of personal information requests were responded to within established timelines (the targets were 80%).

Results to come in 6 areas

TBS’s progress on 6 of its indicators is not yet known because performance data is not yet available. For example, TBS is still gathering, validating and analyzing data from departments on their greenhouse gas emissions. Data on these indicators will be published in the GC Infobase and in TBS’s upcoming reports to Parliament.

Figure 1 illustrates TBS’s progress on its performance indicators for 2017–18 as of .

Figure 1 - Text version

| Progress | Number of targets |

|---|---|

| Targets met or exceeded | 11 |

| Ongoingtable 6 note * | 16 |

| Targets not met | 4 |

| Results not yet available | 6 |

Table 6 Note

|

|

In working toward these results, in 2017–18, TBS’s total actual spending was $3,806,902,003 and its total actual full-time equivalents was 1,970.

For more information on the indicators, targets and results that are summarized above, see the “Results: what we achieved” section of this report.

Raison d’être, mandate and role: who we are and what we do

-

In this section

Raison d’être

TBS is the central agency that acts as the administrative arm of the Treasury Board.

The Treasury Board is a committee of Cabinet that:

- acts as the government’s management board

- provides oversight of the government’s financial management and spending, as well as oversight of human resources issues

- is the employer for the public service

- establishes policies and common standards for administrative, personnel, financial and organizational practices across government

- fulfills the role of the Committee of Council in approving regulatory policies and regulations, and most orders-in-council

- is responsible for reporting to Parliament

The President of the Treasury Board and Minister of Digital Government is the minister responsible for TBS.

Mandate and role

As the administrative arm of the Treasury Board, TBS has a dual mandate:

- to support the Treasury Board as a committee of ministers

- to fulfill the statutory responsibilities of a central government agency

To fulfill its mandate, TBS organizes its business and resources around 4 core responsibilities:

- Spending Oversight

- Administrative Leadership

- Employer

- Regulatory Oversight

For more general information about the department, see the “Supplementary information” section of this report. For more information on the department’s organizational mandate letter commitments, see the President’s mandate letter.

Operating context and key risks

-

In this section

Operating context

As the administrative arm of the Treasury Board, TBS is leading efforts to rethink how the government operates so that it can respond to citizens’ evolving expectations.

These efforts involve undertaking a greater number of complex, high-priority initiatives that must be completed within short timeframes. These initiatives are creating workload pressures and increased expectations for quality and timely advice.

Key risks

In its 2017–18 Departmental Plan, TBS identified 3 risk areas relating to its ability to deliver results for Canadians:

- slow pace of implementation

- insufficient capacity for delivery of government-wide initiatives

- limited information technology capacity

Over the course of the year, TBS identified 2 additional risk areas:

- employee well-being

- impacts of the Phoenix public service pay system

The risks, as well as some highlights of the strategies to manage them, are provided below.

| Risks | Mitigating strategy and effectiveness | Link to the department’s Core Responsibilities | Link to mandate letter commitments and any government-wide or departmental priorities |

|---|---|---|---|

Slow pace of implementation Due to the number and complexity of priority initiatives, TBS may not be able to generate sustainable results in the expected timeframes. |

To mitigate this risk, TBS:

As of , TBS had met 2 of the President’s 16 mandate letter commitments. It will continue to monitor progress on the remaining 14 commitments, 13 of which are on track. It will reallocate resources as required to meet them. |

|

|

Insufficient capacity for delivery of TBS-led government-wide initiatives Insufficient capacity to deliver TBS-led government-wide initiatives may hinder the achievement of project objectives. |

To mitigate this risk, TBS:

Departments’ satisfaction with TBS’s guidance to support the implementation of enterprise-wide systems improved from 38% in 2016–17 to 73.5% in 2017–18. That being said, some TBS-led government-wide projects still face challenges. TBS therefore continues to review and enhance its departmental approach to project management. |

|

|

Limited information technology capacity Without enhancements to TBS’s information technology infrastructure, TBS may not be able to deliver on some key priorities. |

To mitigate this risk, TBS leveraged the GC IT planning process to enhance collaboration with Shared Services Canada. This ensured the timely delivery of key IT infrastructure components (for example, services at TBS’s new workplace) based on TBS’s priorities. In addition, TBS started implementing its cloud sourcing strategy. TBS continues to be affected by issues with its IT systems. It is working to upgrade key IT services. |

|

|

Employee well-being TBS may not be able to sustain the volume and pace of work without adversely affecting the well-being of employees and the wellness of the organization. |

This risk was identified mid-year. To mitigate the risk, TBS launched the Wellness Action Plan and established the Disability Management and Return to Work program in the winter of 2017–18. As part of the Wellness Action Plan, TBS has developed communication products, training and tools to support employee well-being and will continue to do so over the plan’s 3-year implementation period. TBS will assess the success of this mitigation strategy by monitoring the results of the annual Public Service Employee Survey, which includes questions specific to employee well-being and organizational wellness. |

|

|

Phoenix impacts Problems with the Phoenix pay system may continue to affect TBS’s ability to exercise its role as government-wide employer because they could adversely affect relations with bargaining agents and could reduce employee morale and increase employee stress. |

To mitigate this risk, TBS:

Continued mitigation is required. TBS will therefore:

|

|

|

Results: what we achieved

This section describes, for each core responsibility, the results TBS achieved in 2017–18 and how TBS performed against the targets it set in its Departmental Plan for that year.

Core Responsibilities

Spending Oversight

Description

- Review spending proposals and authorities

- Review existing and proposed government programs for efficiency, effectiveness and relevance

- Provide information to Parliament and Canadians on government spending

Results

In 2017–18, TBS aimed to achieve 4 results in exercising its Spending Oversight responsibility.

Departmental result 1: Departments achieve measurable results

Context: TBS works with departments to set ambitious but achievable targets and to review departmental spending to help them comply with the Treasury Board Policy on Results. It also supports the President in fulfilling his mandate letter commitments to:

- strengthen the oversight of taxpayer dollars

- improve the use of evidence and data in program evaluation

- reduce poorly targeted and inefficient measures

Results for 2017–18: In 2017–18, departments met their targets for 65% of their departmental results indicators. TBS is strengthening its support and guidance to departments on:

- developing departmental results, results indicators and targets, including in departmental spending proposals

- developing experimental approaches to policies and programs to address persistent problems that traditional approaches have failed to solve

- integrating gender-based analysis plus into departmental performance measurement and reporting to explain how planned results help achieve the government-wide priorities of gender equality, diversity and inclusiveness

TBS is also undertaking a departmental review of the Canada Revenue Agency, a horizontal review of skills programming, and establishing a central performance evaluation team to undertake innovation performance evaluations.

Departmental result 2: Treasury Board proposals contain information that helps Cabinet ministers make decisions

Context: TBS works with departments to clearly present details, costs and risks in their Treasury Board submissions. This work supports the President in fulfilling his mandate letter commitment to strengthen the oversight of taxpayer dollars.

Results for 2017–18: In 2017–18, TBS reviewed the degree to which Treasury Board submissions transparently disclosed financial risk, and found that 13% did so. This result is consistent with the findings of a 2016 external benchmarking study on the maturity of cost estimating in the Government of Canada, which identified the disclosure of financial risk as a specific area of improvement. In response to this study, TBS is developing new guidance for departments on presenting cost information. This new guidance will have a special focus on building comprehensive and well-documented cost estimates. It will, for example, help departments identify and document costing assumptions, which will enable them to better identify and communicate financial risks. This guidance is expected to lead to improvement in this result.

Departmental result 3: Budget initiatives are approved for implementation quickly

Context: TBS helps implement budget initiatives by making the budget and the Estimates more consistent and better aligned. This work supports the President in fulfilling his mandate letter commitments to:

- strengthen the oversight of taxpayer dollars

- improve the clarity and consistency of financial reporting

Results for 2017–18: In 2017–18, 40% of Budget 2017 initiatives were included in the next available Estimates document. Although this is down from the previous year (66% of Budget 2016 initiatives), the government introduced, and the House of Commons adopted, changes to the Standing Orders of the House of Commons to allow for better alignment between the budget and the Estimates.

These changes, which are in effect for the duration of this Parliament, allow for the Main Estimates to be tabled by April 16 to incorporate budget measures to the greatest extent possible. Because of the changes, in 2018–19 and 2019–20, TBS should be able to meet its target of having 100% of budget initiatives included in the next available Estimates.

Departmental result 4: Reporting on government spending is clear

Context: TBS is taking steps to simplify Departmental Plans and Departmental Results Reports, and to enhance the content and functionality of the GC InfoBase. This work supports the President in fulfilling his mandate letter commitment to improve reporting to Parliament.

Results for 2017–18: In 2017–18, 77% of GC InfoBase users found the spending information they wanted. The tool contains years’ worth of government financial, people and results data, bringing together information previously scattered across over 500 government reports such as the Public Accounts, Main Estimates and Departmental Plans. This information is now presented in a way that facilitates Canadians’ analysis and broader understanding of how government resources are being used.

TBS is also gathering data on the degree to which visitors to online departmental planning and reporting documents found the information useful. It will report the result in the 2018–19 Departmental Results Report.

| Departmental Results | Performance Indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Departments achieve measurable results | Percentage of departmental results indicators for which targets are achieved | 80% | 65%table 1 note a | 69% | Not available | |

| Treasury Board proposals contain information that helps Cabinet ministers make decisions | Degree to which Treasury Board submissions transparently disclose financial risk | To be determined | To be determined | 13%table 1 note b | Not available (new indicator) | Not available |

| Budget initiatives are approved for implementation quickly | Percentage of budget initiatives included in the next available Estimates | 100% | 40% for Budget 2017 | 66% | Not available | |

| Reporting on government spending is clear | Degree to which GC InfoBase users found the spending information they sought | To be determined | 77% | Not available | Not available | |

| Degree to which visitors to online departmental planning and reporting documents found the information useful | To be determined | User survey implemented with tabling of 2018–19 Departmental Plans; Results will be reported in 2018–19 Departmental Results Report (fall 2019) |

Not available (new indicator) | Not available | ||

Table 1 Notes

|

||||||

| 2017–18 Main Estimates | 2017–18 Planned spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2017–18 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 3,596,236,789 | 3,596,236,789 | 1,090,978,606 | 42,055,064 | -3,554,181,725 |

| 2017–18 Planned full-time equivalents | 2017–18 Actual full-time equivalents | 2017–18 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 319 | 302 | -17 |

The variance between planned and actual spending in relation to this Core Responsibility is mainly attributable to the way government-wide funds are transferred between TBS and other government organizations. Every year, TBS includes funding in its reference level to be transferred to other government organizations once specific criteria that have been approved by the Treasury Board are met. If these funds are needed, they are transferred to the appropriate department. If they are not needed, the unused balance is returned to the fiscal framework at the end of the fiscal year and is reported as a TBS lapse. TBS does not incur actual spending under government-wide funds.

Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase.

Administrative Leadership

Description

- Lead government-wide initiatives

- Develop policies and set the strategic direction for government administration related to:

- service delivery

- access to government information

- the management of assets, finances, information and technology

Results

In 2017–18, TBS aimed to achieve 5 results in exercising its Administrative Leadership responsibility.

Departmental result 1: Canadians have timely access to government information

Context: TBS works with departments to provide Canadians with timely access to government information. This work supports the President in fulfilling his mandate letter commitments to:

- enhance the openness of government

- make government data available digitally

Results for 2017–18: In 2017–18, TBS supported departments in releasing 1,807 new datasets on open.canada.ca. It also helped departments publish a total of 456,136 proactive disclosures, a 240% increase from 2016–17. However, the targets for timely responses to access to information requests and personal information requests were not met.

In 2017–18, the President of the Treasury Board and Minister of Digital Government proposed amendments to modernize the Access to Information Act. A number of these amendments are intended to improve the functioning of access to information and personal information request services. TBS is also exploring other measures that could help institutions improve the timeliness of responses.

Departmental result 2: Government service delivery meets the needs of Canadians

Context: TBS works with departments to improve and simplify their services and better meet the needs of Canadians. This work supports the President in fulfilling his mandate letter commitment to improve government service delivery.

Results for 2017–18: The targets for improving service delivery have not yet been met. The percentage of priority services that met service standards dropped from 85% in 2016–17 to 70% in 2017–18, which is below the 80% target. This drop occurred as TBS worked with departments to set new, more demanding service standards that better align with Canadians’ expectations. TBS is also working with departments to achieve the target of having 70% of priority services available by 2020 (currently at 62%), and to achieve the future target of 60% client satisfaction with the delivery of government services (currently at 58%).

TBS is working with departments to improve results in this area by continuing to implement the Treasury Board Policy on Service and the Government of Canada Service Strategy, and by providing hands-on capacity to departments to improve service delivery through the Canadian Digital Service.

Departmental result 3: Government promotes good asset and financial management

Context: TBS works with departments to improve their asset and financial management practices. This work supports the President in fulfilling his mandate letter commitment to take a more modern approach to comptrollership.

Results for 2017–18: In 2017–18, 97% of departments had assessed all internal controls over financial reporting in high-risk areas and annually realign, implement and monitor systems on internal control. That result exceeded TBS’s target of 90%.

In 2017–18, TBS introduced a new indicator that showed that 80% of departments effectively maintain and manage their assets over their life cycle. This baseline result fell short of the 90% target and was based on a small sample of only 10 departments. As a result, TBS is reviewing both the data and the methodology to improve how it measures federal asset management.

Departmental result 4: Technology enhances the effectiveness of government operations

Context: TBS works with departments to help them develop and deliver secure, reliable, accessible and agile digital business solutions.

Results for 2017–18: Results relating to the effectiveness of government technology are mixed.

Departments’ satisfaction with the health of the government’s information technology improved from 37% in 2016–17 to 51% in 2017–18, exceeding TBS’s target of 50%.

Performance for managing cyber risks also improved. In 2017–18, TBS determined that cyber risks were being effectively managed for 93% of the government’s information technology systems, up from 82% in the previous year. TBS is therefore steadily approaching its target of 100%.

More work is required, however, to reduce the number of outages that affect the government’s information technology systems. In 2017–18, only 21% of departments supported by Shared Services Canada had fewer than 3 significant outages affecting key systems. Work is being done under the Strategic Plan for Information Management and Information Technology to improve service management processes and replace aging technology. This work will prevent some outages from occurring, assist in resolving outages more quickly and reduce the number of outages related to failing infrastructure components. TBS is also reviewing the target for this indicator (currently 100%) and may adjust it so that it remains ambitious but is more realistic.

Departmental result 5: Government demonstrates leadership in making its operations low-carbon

Context: TBS works with departments to make the transition to low-carbon, climate-resilient and green government operations and to reduce greenhouse gas emissions. This work supports the Federal Sustainability Development Strategy goal of low-carbon government.

Results for 2017–18: TBS continued to pursue the target of reducing government greenhouse gas emissions by 40% relative to 2005 levels by 2030. In 2016–17, emissions had been reduced by 28% relative to 2005 levels. The 2017–18 results are still being collected and validated. They will be reported in the GC Infobase in and in the 2019–20 Departmental Plan. TBS is leading the Greening Government Strategy, which identifies the key actions the government is taking to reach both the 2030 emissions reduction target and the new target set in the Strategy to reduce emissions from government operations by 80% by 2050 relative to 2005 levels.

| Departmental results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Canadians have timely access to government information | Number of datasets available to the public | 800 new data sets | 1,807 new datasets published (12,039 total non-geospatial datasets available in 2017–18 on open.canada.ca) |

2,079 new datasets published (10,232 total non-geospatial datasets available in 2016–17 on open.canada.ca) |

192 new datasets published (about 8,300 total non-geospatial datasets available in 2015–16 on open.canada.ca) |

|

| Percentage of access to information requests responded to within established timelines | 80% | 76% | 80.7% | 86% | ||

| Percentage of personal information requests responded to within established timelines | 80% | 75% | 80.4% | 80% | ||

| Government service delivery meets the needs of Canadians | Percentage of Government of Canada priority services available online | 70% | 62% | Not available (new indicator) | Not available | |

| Degree to which clients are satisfied with the delivery of Government of Canada services | 60% | To be determined | 58% | Canadians were not asked this question in 2016–17 | Canadians were not asked this question in 2015–16 | |

| Percentage of priority services that meet service standard | 80% | 70% | 85% | Not available | ||

| Government promotes good asset and financial management | Percentage of departments that effectively maintain and manage their assets over their life cycle | 90% | 80% | Not available (new indicator) | Not available | |

| Percentage of departments that have assessed all internal controls over financial reporting in high-risk areas and annually realign, implement and monitor systems on internal control | 90% | 97% | 94% | 77% of the 35 departments assessed had reached the ongoing monitoring stage (had looked at their key controls at least once) | ||

| Technology enhances the effectiveness of government operations | Degree to which departments are satisfied with the health of government’s information technology, expressed as a percentage | 50% | To be determined | 51% | 37% | Not available |

| Percentage of information technology systems for which cyber risks are managed effectively | 100% | To be determined | 93% | 82% | 69% (based on 2015–16 Management Accountability Framework assessment of mission-critical applications currently in operation) | |

| Percentage of departments that have fewer than 3 significant outages impacting key systems in a year | 100% | To be determined | 21%table 2 note a | Not available (new indicator) | Not available | |

| Government demonstrates leadership in making its operations low-carbon | The level of overall government greenhouse gas emissions | 40% reduction from 2005 baseline | Will be available in the GC InfoBase by and reported in the 2019–20 Departmental Plan (spring 2019) |

28% | 24% | |

Table 2 Notes

|

||||||

2017–18 Main Estimates |

2017–18 Planned spending |

2017–18 Total authorities available for use |

2017–18 Actual spending (authorities used) |

2017–18 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

61,764,271 |

61,764,271 |

120,038,058 |

103,822,405 |

42,058,134 |

| 2017–18 Planned full-time equivalents | 2017–18 Actual full-time equivalents | 2017–18 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 494 | 589 | 95 |

| Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase. | ||

Employer

Description

- Develop policies and set the strategic direction for people management in the public service

- Manage total compensation (including pensions and benefits) and labour relations

- Undertake initiatives to improve performance in support of recruitment and retention

Results

In 2017–18, TBS aimed to achieve 4 results in exercising its Employer responsibility.

Departmental result 1: Public service is high-performing

Context: TBS works with departments to improve employee performance, to provide career development opportunities for employees and to ensure that services are provided in accordance with the Official Languages Act. This work supports the President in fulfilling his mandate letter commitment to ensure that all federal services are delivered in full compliance with the act.

Results for 2017–18: TBS met its targets in this area. In 2017–18, 94.9% of employees met their performance objectives. As well, public service employees are increasingly indicating that their department does a good job of supporting employee career development (57% in 2017 versus 52% in 2014). Furthermore, in 2017–18, 92.6% of federal organizations indicated that communications in their designated bilingual offices “nearly always” occurred in the official language chosen by the public.

Departmental result 2: Public service attracts and retains a diverse workforce

Third gender option in 2017 Public Service Employee Survey

The Public Service Employee Survey allows the federal public service to identify employee perceptions of what it is doing well and what it could be doing better in the area of people management. To make the survey more inclusive, the 2017 survey included, for the first time, a third gender option in addition to male or female.

All results are available by gender, as well as by other demographic characteristics, which means that TBS and departments can analyze them using full gender based analysis plus.

Context: TBS leads efforts to attract and retain public servants and to create diverse and inclusive workplaces (for example, providing strategic direction on government-wide recruitment strategies and engaging bargaining agents on diversity issues). These efforts support the government’s commitment to ensure gender parity and to have more Aboriginal persons, members of visible minority groups and persons with disabilities in positions of leadership in the federal public service.

Results for 2017–18: With respect to attracting new employees, in 2017–18, 36% of indeterminate hires were under the age of 30. This is similar to the rate in 2016–17.

With respect to employee retention, employees’ sense of satisfaction from their work increased in 2017:

- Employees overall: 77%, up from 74% in 2014

- Employees under 30, who represent the next generation of public servants: 78%, up from 74% in 2014

With respect to diversity, as of March 2017, representation of 3 employment equity groups (visible minorities, women, and persons with a disability) at the executive levels exceeded workforce availability rates.Footnote 3 Although the representation of Aboriginal persons at the executive levels increased from 3.7% in 2016 to 3.9% in 2017, it remains below workforce availability. TBS will work to address this gap through the Public Service Centre on Diversity, Inclusion and Wellness, which it is establishing to support departments in creating safe, healthy, diverse and inclusive workplaces.

Departmental result 3: Employee wellness is improved

Context: TBS leads efforts to improve employee wellness across the public service (for example, providing mental health resources, tools and services to organizations, managers and employees). These efforts support the President in fulfilling his mandate letter commitment to ensure that the public service is free from harassment and sexual violence.

Results for 2017–18: In 2017–18, employee wellness results were mixed:

- The percentage of employees who indicate that they have been harassed on the job in the past 2 years decreased from the previous year (18% in 2017–18 versus 22% in 2016–17)

- The percentage of employees who believe that their workplace is psychologically healthy decreased from the previous year (56% in 2017–18 versus 60% in 2016–17)

- The average length of time on long-term disability leave for mental health reasons increased by 12% (from 2.65 years in 2016–17 to 2.97 years in 2017–18)

- Gender-diverse employees generally report having more negative workplace experiences (for example, harassment and psychologically unhealthy workplaces) than employees who identify as male or female

TBS is in the process of establishing the Public Service Centre on Diversity, Inclusion and Wellness, which will provide leadership and integrated support to departments in creating safe, healthy, diverse and inclusive workplaces. It is also helping departments to develop their action plans under the Federal Public Service Workplace Mental Health Strategy. As well, it is working with bargaining agents to design a new employee wellness support program for employees.

Departmental result 4: Modernized employment conditions

Context: TBS works with bargaining agents to create modern employment conditions for employees. This work supports the President in fulfilling his mandate letter commitment to bargain in good faith with Canada’s public sector unions.

Results for 2017–18: In 2017–18, TBS successfully negotiated 7 new collective agreements in the context of the 2014–18 round of bargaining. As of , TBS had reached 23 out of 27 agreements, which are applicable to approximately 97% of represented employees in the core public administration. In addition, in 2017–18, the Public Sector Labour Relations and Employment Board made no rulings of bad-faith bargaining against the Government of Canada.

At the same time, the Phoenix pay system continues to negatively affect public service employees. In 2017–18, 69% of public service employees indicated that their pay or other compensation has been affected by system issues. Phoenix-related matters have also been the subject of various litigation actions and individual grievances. To help address this situation, TBS is working with:

- departments to reduce the time it takes to process key human resources transactions

- Public Services and Procurement Canada, as part of an integrated HR-to-Pay team focused on stabilization efforts

- experts, bargaining agents and technology providers on a way forward for a new pay system

- bargaining agents to address employee morale and stress, to find the best way forward to process complaints and grievances, and to develop an approach for addressing damages

| Departmental results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Public service is high-performing | Percentage of eligible employees who meet performance objectives | To be determined | To be determined | 94.9% | 94.9% | 93.8% |

| Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public | 90% | 92.6% | 90.5%table 3 note a | 84.5% | ||

| Percentage of employees who believe their department does a good job of supporting employee career development | Greater than 52% | 57% | Employees were not asked this question in 2016–17 | Employees were not asked this question in 2015–16 | ||

| Public service attracts and retains a diverse workforce | Percentage of indeterminate hires who are under the age of 30 | To be determined | To be determined | 36% | 37.3% | 32.7% |

| Percentage of employees under the age of 30 who receive a sense of satisfaction from their work | To be determined | To be determined | 78% | Employees were not asked this question in 2016–17 | Employees were not asked this question in 2015–16 | |

| Percentage of all employees who receive a sense of satisfaction from their work | Greater than 74% | 77% | Employees were not asked this question in 2016–17 | Employees were not asked this question in 2015–16 | ||

| Percentage of executive employees (compared with workforce availability) who are members of a visible minority group | Greater than 9.5% | Data being validated and analyzed Result will be reported in the 2019–20 Departmental Plan |

10.2% | 9.4% | ||

| Percentage of executive employees (compared with workforce availability) who are women | Greater than 47.8% | Data being validated and analyzed Result will be reported in the 2019–20 Departmental Plan |

48.0% | 47.3% | ||

| Percentage of executive employees (compared with workforce availability) who are Aboriginal persons | Greater than 5.2% | Data being validated and analyzed Result will be reported in the 2019–20 Departmental Plan |

3.9% | 3.7% | ||

| Percentage of executive employees (compared with workforce availability) who are persons with a disability | Greater than 2.3% | Data being validated and analyzed Result will be reported in the 2019–20 Departmental Plan |

5.2% | 5.1% | ||

| Employee wellness is improved | Percentage of employees who believe their workplace is psychologically healthy | To be determined | To be determined | 56%table 3 note b | 60% | Employees were not asked this question in 2015–16 |

| Percentage decrease in the length of time off work on long-term disability due to mental health issuestable 3 note c | To be determined | To be determined | 2.97 (12% increase) | 2.65 years | Not available | |

| Percentage of employees who indicate that they have been the victim of harassment on the job in the past 2 years | To be determined | To be determined | 18%table 3 note d | 22% | Employees were not asked this question in 2015–16 | |

| Percentage of employees who indicate that the nature of harassment experienced is a sexual comment or gesture | To be determined | To be determined | 1.8% | Employees were not asked this question in 2016–17 | Employees were not asked this question in 2015–16 | |

| Modernized employment conditions | Percentage of Federal Public Sector Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | 0 outcomes of bad-faith bargaining | 0 outcomes of bad-faith bargaining | 0 outcomes of bad-faith bargaining | |

Table 3 Notes

|

||||||

| 2017–18 Main Estimates | 2017–18 Planned spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2017–18 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 2,793,646,260 | 2,793,646,260 | 3,686,180,264 | 3,568,437,380 | 774,791,120 |

| 2017–18 Planned full-time equivalents | 2017–18 Actual full-time equivalents | 2017–18 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 422 | 435 | 13 |

| Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase. | ||

Regulatory Oversight

Description

- Develop and oversee policies to promote good regulatory practices

- Review proposed regulations to ensure they adhere to the requirements of government policy

- Advance regulatory cooperation across jurisdictions

Results

In 2017–18, TBS aimed to achieve 2 results in exercising its Regulatory Oversight responsibility.

Departmental result 1: Government regulatory practices and processes are open, transparent, and informed by evidence

Cabinet Directive on Regulation

In 2017–18, TBS launched public consultations on changes to federal regulatory policy. The changes seek to:

- strengthen the requirements for early stakeholder engagement, regulatory cooperation and alignment, mandatory stock reviews, gender-based analysis plus, consultations with Indigenous peoples, and assessing environmental impacts

- maintain important tools to minimize burden on business, including small enterprises

Context: TBS promotes open, transparent and evidence-based regulatory practices and processes to protect and advance Canadians’ health, safety and environment, and to help create the conditions for an innovative and prosperous economy.

Results for 2017–18: In 2017–18, TBS performed well in this area. The public was consulted on 97% of regulations that had public implications that were published. In addition, 99% of regulatory proposals had an appropriate impact assessment (for example, including cost-benefit analysis). As well, Canada’s regulatory system maintained its high international rankings, as reported in the OECD Regulatory Policy Outlook 2018.

Departmental result 2: Regulatory cooperation among jurisdictions is advanced

Context: TBS promotes regulatory cooperation among jurisdictions to support the interests of industry, consumers and regulators, both domestically and internationally.

Results for 2017–18: In 2017–18, TBS met its target for ensuring that regulators consider regulatory cooperation as part of their significant regulatory proposals, where appropriate. However, TBS did not meet its target for increasing the number of regulatory programs that have a regulatory cooperation work plan. New work plans will be created in 2018–19 through new regulatory cooperation forums that TBS is setting up. These forums include the Regulatory Cooperation Forum, established under the Canada-E.U. Comprehensive Economic Trade Agreement, and the domestic Regulatory Reconciliation and Cooperation Table, established under the Canadian Free Trade Agreement.

| Departmental results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Government regulatory practices and processes are open, transparent, and informed by evidence | Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development (OECD) | Canada is ranked in the top 5 of participating OECD countries. | table 4 note a | In the 2018 report, Canada’s rankings among 38 OECD member and accession countries, and the European Union were as follows:

|

The OECD ranking is on a 3-year cycle. The next result will be reported in the 2019–20 Departmental Plan (spring 2019) | Out of 35 countries in the 2015 report, Canada ranked 3rd for stakeholder engagement, 4th for regulatory impact analysis, 4th for ex-post evaluation |

| Percentage of regulatory initiativestable 4 note b that report on early public consultation undertaken prior to first publication | 90% | 97% | Not available (new indicator as of 2016–17) | Not available | ||

| Percentage of regulatory proposalstable 4 note c that have an appropriate impact assessment (for example, cost-benefit analysis) | 90% | 99% | Not available (new indicator as of 2016–17) | Not available | ||

| Regulatory cooperation among jurisdictions is advanced | Number of federal regulatory programs that have a regulatory cooperation work plan | 25 | Work plans are in place for 23 federal regulatory programs | Work plans are in place for 23 federal regulatory programs | Work plans are in place for 23 federal regulatory programs | |

| Percentage of significant regulatory proposals (for example, high and medium impact) that promote regulatory cooperation considerations, when relevant | 90% | 100% | Not available (new indicator as of 2016–17) | Not available | ||

Table 4 Notes

|

||||||

| 2017–18 Main Estimates | 2017–18 Planned spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2017–18 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 4,663,000 | 4,663,000 | 6,664,370 | 5,983,551 | 1,320,551 |

| 2017–18 Planned full-time equivalents | 2017–18 Actual full-time equivalents | 2017–18 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 33 | 40 | 7 |

| Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase. | ||

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Results

In 2017–18, TBS was named one of Canada’s top 100 employers for the second year in a row and one of the National Capital Region’s top employers.

It achieved this by continuing to enhance its internal services and to support its workforce. For example, in 2017–18, TBS:

- supported effective and transparent workforce planning and strategic recruitment by developing the Talent Acquisition Strategy, which is aimed at attracting high-performing talent and at promoting employment equity recruitment. TBS also successfully rebooted its analyst recruitment campaign to attract new and diverse talent

- supported workforce mobility through the launch of Canada’s Free Agent Pilot at TBS, which gives select public servants the opportunity to arrange short-term assignments that match their skills and interests

- invested in employee learning and development by, for example, launching TBS Learning Roadmap to provide employees with a curated list of learning opportunities, and streamlining the language training registration process

- launched the Wellness Action Plan to support efforts to address issues such as employee health and wellness, work-life balance, workload, and harassment and discrimination

- established the Disability Management and Return to Work Program in order to provide individualized, timely and comprehensive information, guidance and support to employees and managers to help prevent or manage prolonged absences from work due to illness, injury or disability, and to support successful return to work strategies

- completed Phase II of the TBS Workplace Renewal Transformation Initiative, launched in 2011, to reduce TBS’s footprint from 11 locations across National Capital Region to 2 modern workplaces

| 2017–18 Main Estimates | 2017–18 Planned spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2017–18 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 85,551,044 | 85,551,044 | 95,020,219 | 86,603,603 | 1,052,559 |

| 2017–18 Planned full-time equivalents | 2017–18 Actual full-time equivalents | 2017–18 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 607 | 605 | -2 |

Analysis of trends in spending and human resources

Actual expenditures

Departmental spending breakdown

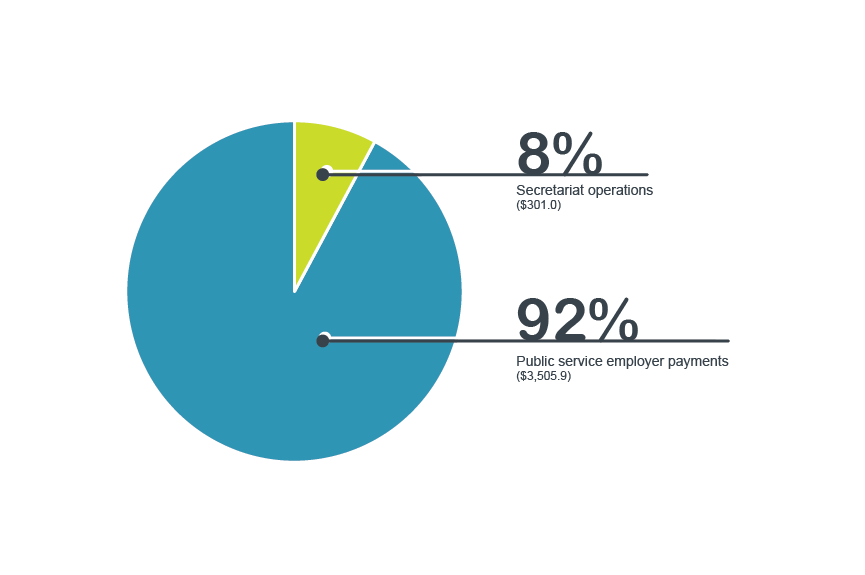

In 2017–18, TBS’s total spending was $3,807 million. Figure 2 shows a breakdown of spending by category. Approximately 8% of spending was for operations. The balance was for public service employer payments, which TBS makes as employer for the core public administration.

Figure 2 - Text version

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending for 2017–18 in two categories: public service employer payments and various statutory items, which accounted for 92% of actual spending, or $3,505.9 million; and Secretariat operations, which accounted for 8% of actual spending, or $301.0 million).

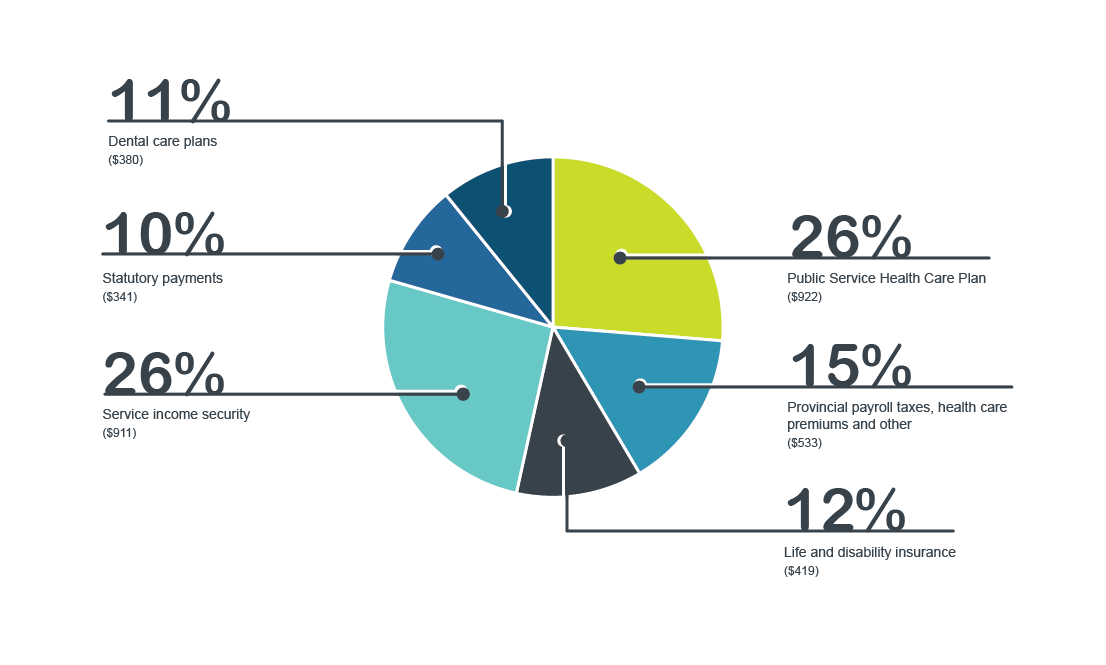

Figure 3 shows a breakdown of TBS’s spending of approximately $3,506 million in public service employer payments. These payments cover, for the core public administration, the employer’s share of employee and pensioner benefit plans, provincial health care premiums and other payroll taxes, as well as statutory payments,Footnote 4 which relate mostly to pensions.

Figure 3 - Text version

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending on public service employer payments and various statutory items for 2017–18. The pie chart is divided into six spending categories, broken down as follows:

| Category | Amount | Percentage of total |

|---|---|---|

| Public Service Health Care Plan | $922 million | 26% |

| Provincial Payroll Taxes / Health Care Premiums and Other | $533 million | 15% |

| Life and disability insurance | $419 million | 12% |

| Dental care plans | $380 million | 11% |

| Statutory payments | $341 million | 10% |

| Service income security | $911 million | 26% |

Figure 4 shows TBS’s operating expenditures over time. Operating expenditures include TBS employees’ salaries, non-salary costs to deliver programs, and statutory items relating to the employer’s contributions to TBS employees’ benefit plans.

Figure 4 - Text version

This bar graph illustrates the Secretariat’s actual spending (Vote 1) for fiscal years 2015-16, 2016-17 and 2017-18 and planned spending for fiscal years 2018-19, 2019-20 and 2020-21. Financial figures are presented in dollars along the y axis, increasing by $50 million and ending at $350 million. These are graphed against fiscal years 2015-16 to 2020-21 on the x axis.

For each fiscal year, amounts for the Secretariat’s program expenditures (Vote 1), and statutory vote (largely comprised of contributions to employee benefit plans).

In 2015-16, actual spending was $26,316,063 for statutory items, $248,942,508 for program expenditures for a total of $275,258,571.

In 2016-17, actual spending was $27,019,489 for statutory items and $290,787,248 for program expenditures for a total of $317,806,737.

In 2017-18, actual spending was $28,017,325 for statutory items and $272,955,611 for program expenditures for a total of $300,972,936.

Planned spending for statutory items goes from $27,983,303 in 2018-19, to $27,765,131 in 2019-20 and to $26,139,349 in 2020-21.

Planned spending for program expenditures goes from $233,305,792 in 2018-19, to $230,395,033 in 2019-20, and to $212,302,843 in 2020-21.

Total planned spending goes from $261,289,095 in 2018-19, to $258,160,164 in 2019-20, and to $238,442,192 in 2020-21.

The increase of $43 million between 2015–16 and 2016–17 resulted mostly from implementing TBS’s Budget 2016 initiatives; and the plans to enhance access to information, develop a client-first service strategy and expand open data across the Government of Canada. In addition, one-time funding was received through the fiscal framework in conjunction with departmental contributions, to make progress on the government-wide Enabling Functions Transformation Initiative.

The one-time Budget 2016 funding received in 2016–17 to accelerate the Enabling Functions Transformation Initiative sunsetted in 2017–18, which resulted in a decrease of $17 million. Reduced levels of departmental contributions for this initiative and the sunsetting of the majority of funding for phase II of the Workspace Renewal Initiative has further reduced planned spending by $40 million in 2018–19.

A decrease of $20 million in 2020–21 is projected as the Classification Program funding transitions and the mandates for the Canadian Digital Service and the Regulatory Cooperation Council come up for renewal.

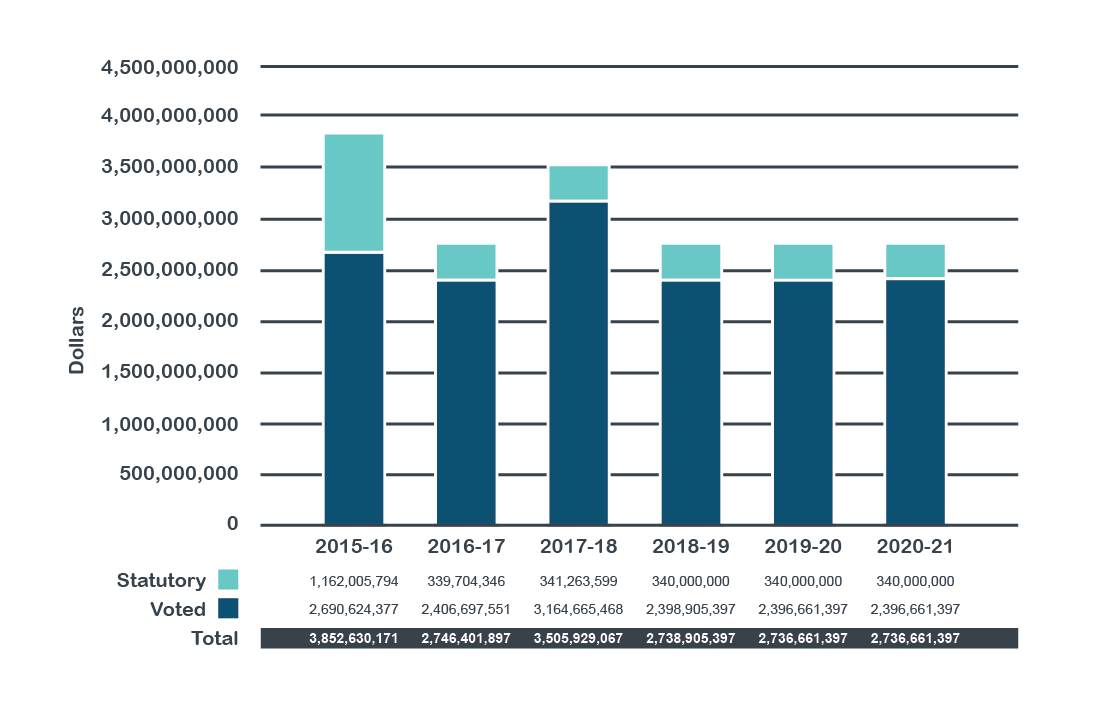

Figure 5 shows TBS’s spending on public service employer payments, over time, for the core public administration.

Figure 5 - Text version

This bar graph illustrates the Secretariat’s actual spending for the public service employer payments (Vote 20) and various statutory items for fiscal years 2015-16, 2016-17 and 2017-18 and planned spending for fiscal years 2018-19, 2019-20 and 2020-21. Financial figures are presented in dollars along the y axis, increasing by $500 million and ending at $4.5 billion. These are graphed against fiscal years 2015-16 to 2020-21 on the x axis.

For each fiscal year, amounts for the Secretariat’s public service employer payments (Vote 20), and statutory items (largely comprised of payments under the Public Service Pension Adjustment Act).

In 2015-16, actual spending was $1,162,005,794 for statutory items and $2,690,624,377 for public service employer payments for a total of $3,852,630,171.

In 2016-17, actual spending was $339,704,346 for statutory items and $2,406,697,551 for public service employer payments for a total of $2,746,401,897.

In 2017-18, actual spending was $341,263,599 for statutory items and $3,164,665,468 for public service employer payments for a total of $3,505,929,067.

Planned spending for statutory items will remain the same for fiscal years 2018-19 to 2020-21 in the amount of $340,000,000.

Planned spending for public service employer payments goes from $2,398,905,397 in 2018-19, to $2,396,661,397 in 2019-20, and will remain the same for fiscal years 2020-21.

The decrease in expenditures of $1,106 million from 2015–16 to 2016–17 is largely attributed to the one-time payment made in 2015–16 for the actuarial adjustment and the Service Income Security Insurance Plan, and a special payment made in 2015–16 to the Public Service Superannuation Account to address deficiencies.

The increase in expenditures of $760 million from 2016–17 to 2017–18 largely reflects a top-up payment to the Service Income Security Insurance Plan in 2017–18 and higher employer costs following the implementation of collective agreements ratified in 2017.

Approved (voted) reference levels for 2018–19 and beyond are approximately $765 million below actual spending in 2017–18. The planned expenses for 2018–19 exclude pending allocations from Budget 2018 for various initiatives such as the funding requirements for the Service Income Security Insurance Plan and other Public Service Employee Benefits.

| Core Responsibilities and Internal Services | 2017–18 Main Estimates | 2017–18 Planned Spending | 2018–19 Planned Spending | 2019–20 Planned Spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2016–17 Actual spending (authorities used) | 2015–16 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Spending Oversight | 3,596,236,789 | 3,596,236,789 | 10,662,340,900 | 3,596,948,900 | 1,090,978,606 | 42,055,064 | 40,721,685 | 38,905,284 |

| Administrative Leadership | 61,764,271 | 61,764,271 | 74,523,877 | 73,504,136 | 120,038,058 | 103,822,405 | 121,470,940 | 84,033,041 |

| Employer | 2,793,646,260 | 2,793,646,260 | 2,798,285,112 | 2,794,021,224 | 3,686,180,264 | 3,568,437,380 | 2,823,956,155 | 3,919,813,169 |

| Regulatory Oversight | 4,663,000 | 4,663,000 | 6,361,066 | 6,356,524 | 6,664,370 | 5,983,551 | 4,704,732 | 3,861,456 |

| Subtotal | 6,456,310,320 | 6,456,310,320 | 13,541,510,955 | 6,470,830,784 | 4,903,861,298 | 3,720,298,400 | 2,990,853,512 | 4,046,612,950 |

| Internal Services | 85,551,044 | 85,551,044 | 77,268,537 | 77,183,777 | 95,020,219 | 86,603,603 | 73,355,122 | 81,275,792 |

| Total | 6,541,861,364 | 6,541,861,364 | 13,618,779,492 | 6,548,014,561 | 4,998,881,517 | 3,806,902,003 | 3,064,208,634 | 4,127,888,742 |

The budgetary performance summary table above provides the following:

- Main Estimates for 2017–18

- planned spending for 2017–18, as reported in TBS’s 2017–18 Departmental Plan

- planned spending for 2018–19 and 2019–20, as reported in TBS’s 2018–19 Departmental Plan

- total authorities available for use in 2017–18, which reflects the authorities received to date, including in-year contributions from other government departments for the Enabling Functions Transformation Initiative

- actual spending for 2015–16, 2016–17 and 2017–18, as reported in the Public Accounts

For additional details on planned spending, see the section “Supporting information on lower-level programs” in Supplementary Information.

The Government-Wide Funds and Public Service Employer Payments program represents the largest portion of TBS’s planned spending. On average, the Treasury Board approves transfers of approximately 54% of this program’s funding to other federal organizations for items such as government contingencies, government-wide initiatives, compensation requirements, operating and capital budget carry forward, and paylist expenditures (Central Votes 5, 10, 15, 25, 30 and 33). TBS’s total funding available for use, in its reference levels, is reduced accordingly. The remaining 46% of this program’s funding pertains to public service employer payments.

Overall, planned spending is expected to increase by $7,077 million in 2018–19, mainly because of the new central budget implementation vote. This vote was added in 2018–19 for new measures approved in Budget 2018 to facilitate timely availability of supply for Budget 2018 activities being carried out in that fiscal year. Funding provided through Vote 40 for 2018–19 is tied to a detailed table from Budget 2018 showing the amount of funding required by each department to implement each budget initiative.

As reported in TBS’s 2016–17 Departmental Results Report, actual spending decreased by $1,064 million from 2015–16 to 2016–17, primarily because of the one-time payments no longer required for the actuarial adjustment and the Service Income Security Insurance Plan. These decreases were offset by an increase in TBS’s operating expenditures used for:

- Budget 2016 initiatives to accelerate the Enabling Functions Transformation Initiative, to enhance access to information, to develop a client-first service strategy, and to expand open data

- establishing a Centre for Greening Government at TBS

- the additional claims related to the White class action lawsuit

- the third-party Shared Services Canada resource alignment review

- the transfer of the Regulatory Cooperation Council Secretariat from the Privy Council Office to TBS

Actual human resources

| Core Responsibilities and Internal Services | 2015–16 Actuals | 2016–17 Actuals | 2017–18 Planned | 2017–18 Actual | 2018–19 Planned | 2019–20 Planned |

|---|---|---|---|---|---|---|

| Spending Oversight | 316 | 314 | 319 | 302 | 316 | 316 |

| Administrative Leadership | 455 | 538 | 494 | 589 | 509 | 514 |

| Employer | 421 | 456 | 422 | 435 | 453 | 453 |

| Regulatory Oversight | 30 | 33 | 33 | 40 | 43 | 43 |

| Subtotal | 1,222 | 1,341 | 1,268 | 1,366 | 1,321 | 1,326 |

| Internal Services | 585 | 581 | 607 | 605 | 606 | 600 |

| Total | 1,807 | 1,922 | 1,875 | 1,971 | 1,927 | 1,926 |

The increase of 115 full-time equivalents between 2015–16 and 2016–17 relates primarily to the hiring of new staff to implement Budget 2016 initiatives to:

- accomplish the Enabling Functions Transformation Initiative

- enhance access to information

- develop a client-first service strategy

- expand open data

Full-time equivalents also increased between 2015–16 and 2016–17 because employees who worked in the Regulatory Cooperation Council Secretariat at the Privy Council Office and in the Centre for Greening Government at Public Services and Procurement Canada were transferred to TBS in 2016.

Full-time equivalents increased by 49 from 2016–17 to 2017–18 as a result of the hiring of additional resources for the following initiatives and for the Internal Services to support them:

- stabilization of the Government of Canada pay system (under the Employer Core Responsibility)

- Regulatory Cooperation Council (under the Regulatory Oversight Core Responsibility)

- Web Renewal Initiative (under the Administrative Leadership Core Responsibility)

- Canadian Digital Service (under the Administrative Leadership Core Responsibility)

Full-time equivalents are expected to decline by 44 from 2017–18 to 2018–19 because of the reduction of departmental contributions to the Enabling Function Transformation.

Expenditures by vote

For information on TBS’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2017–2018.

Government of Canada spending and activities

Information on the alignment of TBS’s spending with the Government of Canada’s spending and activities is available in the GC InfoBase.

Financial statements and financial statements highlights

Financial statements

TBS financial statements (unaudited) for the year ended , are available on TBS’s website.

Financial statements highlights

The highlights presented in this section are drawn from TBS’s financial statements. The financial statements were prepared using Government of Canada accounting policies, which are based on Canadian public sector accounting standards.

The figures provided in this section were prepared on an accrual basis; the figures in the other sections were prepared on an expenditure basis. The difference between the figures in the different sections is the result of accrual entries, such as the recognition of services provided without charge by other government departments, the acquisition of tangible capital assets and related amortization expenses, and accrued liability adjustments.

| Financial information | 2017–18 Planned resultstable 5 note * | 2017–18 Actual results | 2016–17 Actual results | Difference (2017–18 Actual results minus 2017–18 Planned results) | Difference (2017–18 Actual results minus 2016–17 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 3,014,964,612 | 3,833,411,081 | 3,077,669,086 | 818,446,469 | 755,741,995 |

| Total net revenues | 12,638,671 | 14,620,955 | 10,890,100 | 1,982,284 | 3,730,855 |

| Net cost of operations before government funding and transfers | 3,002,325,941 | 3,818,790,126 | 3,066,778,986 | 816,464,185 | 752,011,140 |

Table 5 Notes

|

|||||

TBS’s total expenses consist of:

- public service employer payments ($3.5 billion in 2017–18 and $2.7 billion in 2016–17) (as employer for the core public administration, TBS makes these payments to cover the employer’s share of employee and pensioner benefit plans, provincial health care premiums and other payroll taxes, as well as statutory payments, which relate mostly to pensions and include an annual lump-sum contribution to the Public Service Pension Plan to address current actuarial deficits)

- departmental program expenses ($0.3 billion in 2017–18 and $0.4 billion in 2016–17)

The increase of $756 million (24.6%) in total actual expenses from 2016–17 to 2017–18 stems from:

- a net increase of $769 million in public service employer payments, primarily due to a top-up payment made in 2017–18 to address a deficit in the Service Income Security Insurance Plan that related to increased disability insurance claims from medically released members of the Canadian Armed Forces, as well as higher employer costs following the implementation of new collective agreements

- a net decrease of $13 million in departmental program expenses, mostly attributable to reduced expenses incurred in 2017–18 for the Enabling Functions Transformation Initiative

The difference of $818 million (27.1%) in total expenses between planned and actual results for 2017–18 is primarily due to the increase in public service employer payments, unplanned expenses related to collective bargaining adjustments, and new or increased funding received for various initiatives such as the Enabling Functions Transformation Initiative, Executive Leadership Development Programs, the Web Renewal Initiative, the Canadian Digital Service and the stabilization of the Government of Canada’s pay system.

TBS’s total net revenues include the recovery of costs incurred by TBS to administer the Public Service Pension Plan, and recoveries from other government departments for costs associated with providing internal support services related to financial and human resources management systems, accounting and mail services.

The increase of $3.7 million (34.3%) in total actual net revenues from 2016–17 to 2017–18 is mostly due to an increase in recoveries related to internal support services, which corresponds to an increase in costs incurred by the Central Agencies Shared Systems Cluster to implement a new version of the human resources management system and to bring a new member into the cluster.

The difference of $2.0 million (15.7%) in total net revenues between planned and actual results for 2017–18 results primarily from the increase in recoveries related to internal support services noted above, which was partially offset by lower than expected recoveries related to the administration of the Public Service Pension Plan.

| Financial Information | 2017–18 | 2016–17 | Difference (2017–18 minus 2016–17) |

|---|---|---|---|

| Total net liabilities | 1,092,603,798 | 714,404,674 | 378,199,124 |

| Total net financial assets | 1,013,247,319 | 642,232,112 | 371,015,207 |

| Departmental net debt | 79,356,479 | 72,172,562 | 7,183,917 |

| Total non-financial assets | 46,847,721 | 33,511,879 | 13,335,842 |

| Departmental net financial position | (32,508,758) | (38,660,683) | 6,151,925 |

TBS’s liabilities consist mainly of accounts payable to other government departments and agencies related to employer contributions to employee benefit plans and to accrued employee claims for benefits under the public service health and dental care plans. The increase of $378 million in total liabilities from 2016–17 to 2017–18 is mostly due to an account payable to address a shortfall under Service Income Security Insurance Plan, which is partially offset by a reduction in accounts payable to other government departments and agencies to adjust their share of employer contributions to employee benefit plans.

TBS’s assets consist mainly of accounts receivable from other government departments and agencies to pay for their share of employer contributions to employee benefit plans, as well as amounts due from the Consolidated Revenue Fund (CRF) that may be disbursed without further charges to TBS’s authorities. The increase of $371 million in total net financial assets from 2016–17 to 2017–18 is mostly the result of an increase in amounts due from the CRF.

TBS’s departmental net debt consists mainly of accrued liabilities to be paid from authorities in future years. The increase of $7 million from 2016–17 to 2017–18 is mostly due to an increase in accrued employee claims for benefits under the public service health and dental care plans.

TBS’s non-financial assets consist mainly of tangible capital assets. The increase of $13 million from 2016–17 to 2017–18 is mostly due to the capitalization of software development costs related to the Enabling Functions Transformation Initiative, and leasehold improvements and office furniture acquisitions related to the Workspace Renewal Initiative.

The decrease of $6 million in TBS’s departmental net financial position, which is the difference between total non-financial assets and the departmental net debt, is therefore attributable to the increase in tangible capital assets, which is partially offset by the increase in accrued liabilities to be paid from future authorities.

Supplementary information

Corporate information

Organizational profile

Appropriate minister: The Honourable Scott Brison, President of the Treasury Board and Minister of Digital Government

Institutional head: Peter Wallace, Secretary of the Treasury Board

Ministerial portfolio: The minister’s portfolio consists of TBS and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board and Minister of Digital Government:

- the Public Sector Pension Investment Board

- the Office of the Commissioner of Lobbying of Canada

- the Office of the Public Sector Integrity Commissioner of Canada

Enabling instrument: The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Reporting framework

TBS’s Departmental Results Framework and Program Inventory of record for 2017–18 are shown below.

| Core Responsibility | Spending Oversight | Administrative Leadership | Employer | Regulatory Oversight |

|---|---|---|---|---|

| Description |

|

|

|

|

| Results and indicators | Departments achieve measurable results

Treasury Board proposals contain information that helps Cabinet ministers make decisions

Budget initiatives are approved for implementation quickly

Reporting on government spending is clear

|

Canadians have timely access to government information

Government service delivery meets the needs of Canadians

Government promotes good asset and financial management

Technology enhances the effectiveness of government operations

Government demonstrates leadership in making its operations low-carbon

|

Public service is high-performing

Public service attracts and retains a diverse workforce

Employee wellness is improved

Modernized employment conditions

|

Government regulatory practices and processes are open, transparent, and informed by evidence

Regulatory cooperation among jurisdictions is advanced

|

| Program inventory |

|

|

|

|

Concordance between the Departmental Results Framework and the Program Inventory, 2017–18, and the Program Alignment Architecture, 2016–17

The following table shows how the current Departmental Results Framework and Program Inventory relates to TBS’s previous reporting structure, the Program Alignment Architecture. For example, the current program of Oversight and Treasury Board Support has 66% of dollars previously allocated to the old program (Cabinet Decision Support), 13% of dollars previously allocated to the old program (Expenditure Analysis and Allocation Management), and so on.

| 2017–18 Core Responsibilities and Program Inventory | 2016–17 Lowest-level program of the Program Alignment Architecture | Percentage of lowest-level Program Alignment Architecture program (dollars) corresponding to the Program in the Program Inventory |

|---|---|---|

| Core Responsibility 1: Spending Oversight | ||

| Oversight and Treasury Board Support | 1.1.1 Cabinet Decision Support | 66% |

| 1.1.2 Expenditure Analysis and Allocation Management | 13% | |

| 1.2.1 Financial Management Policy | 13% | |

| 1.2.5 Organization Management Policy | 11% | |

| 1.5.1 Management and Oversight Services | 10% | |

| Expenditure Data, Analysis, and Reviews | 1.1.1 Cabinet Decision Support | 10% |

| 1.1.2 Expenditure Analysis and Allocation Management | 57% | |

| Results and Performance Reporting Policies and Initiatives | 1.1.1 Cabinet Decision Support | 1% |

| 1.1.2 Expenditure Analysis and Allocation Management | 16% | |

| 1.2.5. Organization Management Policy | 20% | |

| Government-wide Funds | 1.4 Government-Wide Funds and Public Service Employer Payments | 30% |

| Core Responsibility 2: Administrative Leadership | ||

| Comptrollership Policies and Initiatives | 1.1.1 Cabinet Decision Support | 8% |

| 1.1.2 Expenditure Analysis and Allocation Management | 12% | |

| 1.2.1 Financial Management Policy | 87% | |

| 1.2.5 Organization Management Policy | 32% | |

| 1.3.3 Government-Wide Operations | 46% | |

| 1.3.4 Transformation Leadership | 59% | |

| 1.5.5 Financial Management Services | 1% | |

| Service Delivery Policies and Initiatives | 1.2.3 Information Management and Information Technology Policy | 19% |

| 1.2.4 External Facing Policy | 36% | |

| 1.3.3 Government-Wide Operations | 3% | |

| 1.3.4 Transformation Leadership | 17% | |

| Digital Technology and Security Policies and Initiatives | 1.1.1 Cabinet Decision Support | 6% |

| 1.1.2 Expenditure Analysis and Allocation Management | 0% | |

| 1.2.1 Financial Management Policy | 0% | |

| 1.2.3 Information Management and Information Technology Policy | 81% | |

| 1.2.4 External Facing Policy | 19% | |

| 1.2.5 Organization Management Policy | 22% | |

| 1.3.3 Government-Wide Operations | 2% | |

| 1.3.4 Transformation Leadership | 6% | |

| Management Accountability Framework and Policy Suite Integrity | 1.2.4 External Facing Policy | 3% |

| 1.2.5 Organization Management Policy | 14% | |

| 1.3.3 Government-Wide Operations | 2% | |

| 1.3.4 Transformation Leadership | 3% | |

| Core Responsibility 3: Employer | ||

| Collective Bargaining and Labour Relations | 1.2.2 People Management Policy | 36% |

| 1.3.2 Labour Relations | 82% | |

| Pensions and Benefits Management | 1.2.2 People Management Policy | 5% |

| 1.3.1 Pensions and Benefits | 99% | |

| People Management and Executive Policies and Initiatives | 1.1.1 Cabinet Decision Support | 3% |

| 1.1.2 Expenditure Analysis and Allocation Management | 2% | |

| 1.2.2 People Management Policy | 59% | |

| 1.3.1 Pensions and Benefits | 1% | |

| 1.3.2 Labour Relations | 1% | |

| 1.3.3 Government-Wide Operations | 24% | |

| 1.3.4 Transformation Leadership | 14% | |

| Public Service Employer Payments | 1.4 Government-Wide Funds and Public Service Employer Payments | 70% |

| Core Responsibility 4: Regulatory Oversight | ||

| Regulatory Policy and Oversight | 1.1.1 Cabinet Decision Support | 6% |

| 1.2.4 External-Facing Policy | 38% | |

| Regulatory Cooperation | Not applicable | Not applicable |

| Core Responsibility 5: Internal Services | Internal Services | 100% |

Supporting information on the Program Inventory

Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on TBS’s website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Treasury Board of Canada Secretariat

90 Elgin St

Ottawa ON

K1A 0R5

Telephone: 613-369-3200

Toll-free: 1-877-636-0656

Teletypewriter (TTY): 613-369-9371

Email: questions@tbs-sct.gc.ca

Website: https://www.canada.ca/en/treasury-board-secretariat.html

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3-year period. Departmental Plans are tabled in Parliament each spring.

- Departmental Result (résultat ministériel)

- A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- Departmental Result Indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

- Departmental Results Framework (cadre ministériel des résultats)

- Consists of the department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

- Departmental Results Report (rapport sur les résultats ministériels)