Annual Report to Parliament for the 2017 to 2018 Fiscal Year: Federal Regulatory Management Initiatives

December 2018

This is the second annual report to Parliament on federal regulatory management initiatives. This report is part of regular monitoring of certain aspects of Canada’s regulatory system.

This year’s report has four main sections:

- section 1 describes the benefits and costs of regulations that were made by the Governor in Council (GIC) and that have a significantFootnote 1 impact

- section 2 reports on the implementation of the one-for-one rule, fulfilling the Red Tape Reduction Act reporting requirement

- section 3 sets out the Administrative Burden Baseline for 2017 and for previous years, providing a count of administrative requirements in federal regulations

- section 4 describes the new Cabinet Directive on Regulation, which replaced the Cabinet Directive on Regulatory Management on , as well as associated improvements to the federal regulatory process

The regulations reported on in this document were published in the Canada Gazette, Part II, between , and . As such, they fall under the former Cabinet Directive on Regulatory Management.

On this page

- Message from the President

- Types of federal regulations

- Section 1: benefits and costs of regulations

- Section 2: implementation of the one-for-one rule

- Section 3: update on the Administrative Burden Baseline

- Section 4: looking forward: the Cabinet Directive on Regulation

- Appendix A: detailed report on cost-benefit analyses for the 2017 to 2018 fiscal year

- Appendix B: detailed report on the one-for-one rule for the 2017 to 2018 fiscal year

- Appendix C: administrative burden count

Message from the President

President of the Treasury Board

and Minister of Digital Government

This second annual report to Parliament on federal regulatory management initiatives marks an important milestone in the government’s march to regulatory modernization.

The Government of Canada is committed to openness and transparency, including informing Parliament and Canadians about the management of federal regulations. This report provides important information about the costs and benefits of significant regulations, as well as the implementation of the one-for-one rule, just one key element in a suite of continuing and new measures to limit the administrative burden on businesses that deal with the federal government. It also includes information about the Administrative Burden Baseline count, a measure of the number of administrative requirements in federal regulations.

While Canada’s regulatory system is internationally recognized as world-class by bodies such as the Organisation for Economic Co-operation and Development, we must continue to keep pace with emerging economic opportunities and evolving challenges. For this reason, we are taking steps to make the system more agile, transparent and responsive, which will have a positive impact on business growth and the lives of all Canadians.

On , the government’s Cabinet Directive on Regulation came into effect. It provides a strong foundation for the ongoing modernization of our regulatory system. The directive emphasizes that regulations should support and promote entrepreneurship, innovation that benefits people and businesses, and economic growth that includes as many Canadians as possible. The directive is also supported by a series of new policies, including the first-ever Government of Canada Policy on Cost-Benefit Analysis.

In addition, the 2018 Fall Economic Statement announced a number of measures aimed at revitalizing our regulatory system to improve business innovation and economic growth, while safeguarding our citizens and natural resources.

I invite you to read this report to see how the government is continuing its work to create effective, agile and efficient regulations that protect our environment and the health, safety and security of Canadians.

Original signed by:

The Honourable Scott Brison

President of the Treasury Board and Minister of Digital Government

Types of federal regulations

Regulations are a type of law intended to change behaviours and achieve public policy objectives. They have legal binding effect and support a broad range of objectives, such as:

- health and safety

- security

- culture and heritage

- a strong and equitable economy

- the environment

Regulations are made by every order of government in Canada in accordance with responsibilities set out in the Constitution Act. Federal regulations deal with areas of federal jurisdiction, such as patent rules, vehicle emissions standards and drug licensing.

There are three principal categories of federal regulations. Each is based on where the authority to make regulations lies:

- GIC regulations are reviewed by a group of ministers who recommend approval to the Governor General. This role is performed by the Treasury Board.

- Ministerial regulations are made by a minister who is given the authority to do so by law.

- Example: The Canadian Environmental Protection Act, 1999 gives the Minister of the Environment the authority to amend the Domestic Substances List to include substances introduced to the Canadian marketplace that have been risk-assessed and for which control measures have been taken.

- Regulations made by an agency, tribunal or other entity that has been given the authority by law to do so in a given area, and that do not require the approval of the GIC or a minister.

- Example: The Farm Products Agencies Act authorizes Turkey Farmers of Canada to make regulations that set production quotas and levies on the Canadian turkey sector as part of the supply management system.

Section 1: benefits and costs of regulations

What is cost-benefit analysis?

In the regulatory context, cost-benefit analysis (CBA) is a structured approach to identifying and considering the economic, environmental and social effects of a regulatory proposal. CBA identifies and measures the positive and negative impacts of a regulatory proposal and any feasible alternative options so that decision-makers can determine the best course of action. CBA monetizes, quantifies and qualitatively analyzes the direct and indirect costs and benefits of the regulatory proposal to determine the proposal’s overall benefit.

Since 1986, the Government of Canada has required that a CBA be done for most regulatory proposals in order to assess their potential impact on areas such as:

- the environment

- workers

- businesses

- consumers

- other sectors of society

The results of the CBA are summarized in a Regulatory Impact Analysis Statement (RIAS), which is published with proposed regulations in the Canada Gazette, Part I. The RIAS enables the public to:

- review the analysis

- provide comments to regulators before final consideration by the GIC and subsequent publication of approved final regulations in the Canada Gazette, Part II

Analytical requirements

Regulatory proposals are categorized according to their expected level of impact. The level of impact is determined by the anticipated cost of the proposal.

| Impact level | Present value of costs (over 10 years) | Annual cost |

|---|---|---|

| Low-impact | Less than $10 million | Less than $1 million |

| Medium-impact | $10 million to $100 million | $1 million to $10 million |

| High-impact | More than $100 million | More than $10 million |

The level of impact determines the degree of analysis and assessment required for a given regulatory proposal. This proportionate approach is consistent with regulatory best practices set out by the Organisation for Economic Co-operation and Development (OECD).

| Impact level | Description of costs | Description of benefits |

|---|---|---|

| Low-impact | Qualitative or quantitative | Qualitative |

| Medium-impact | Quantified and monetized | Quantified and monetized (if data are readily available) |

| High-impact | Quantified and monetized | Quantified and monetized |

This report covers GIC regulations only and is limited to regulations that are considered significant, that is, those that have a medium impact or a high impact. Figures are taken from the RIAS for regulations published in the Canada Gazette, Part II, in the 2017 to 2018 fiscal year.Footnote 2 To remove the effect of inflation, figures are expressed in 2012 dollars and, as such, will vary from those published in the RIASs. This approach permits meaningful and consistent comparison of figures, regardless of the year in which regulatory impacts were originally measured.

Overview of benefits and costs of regulations

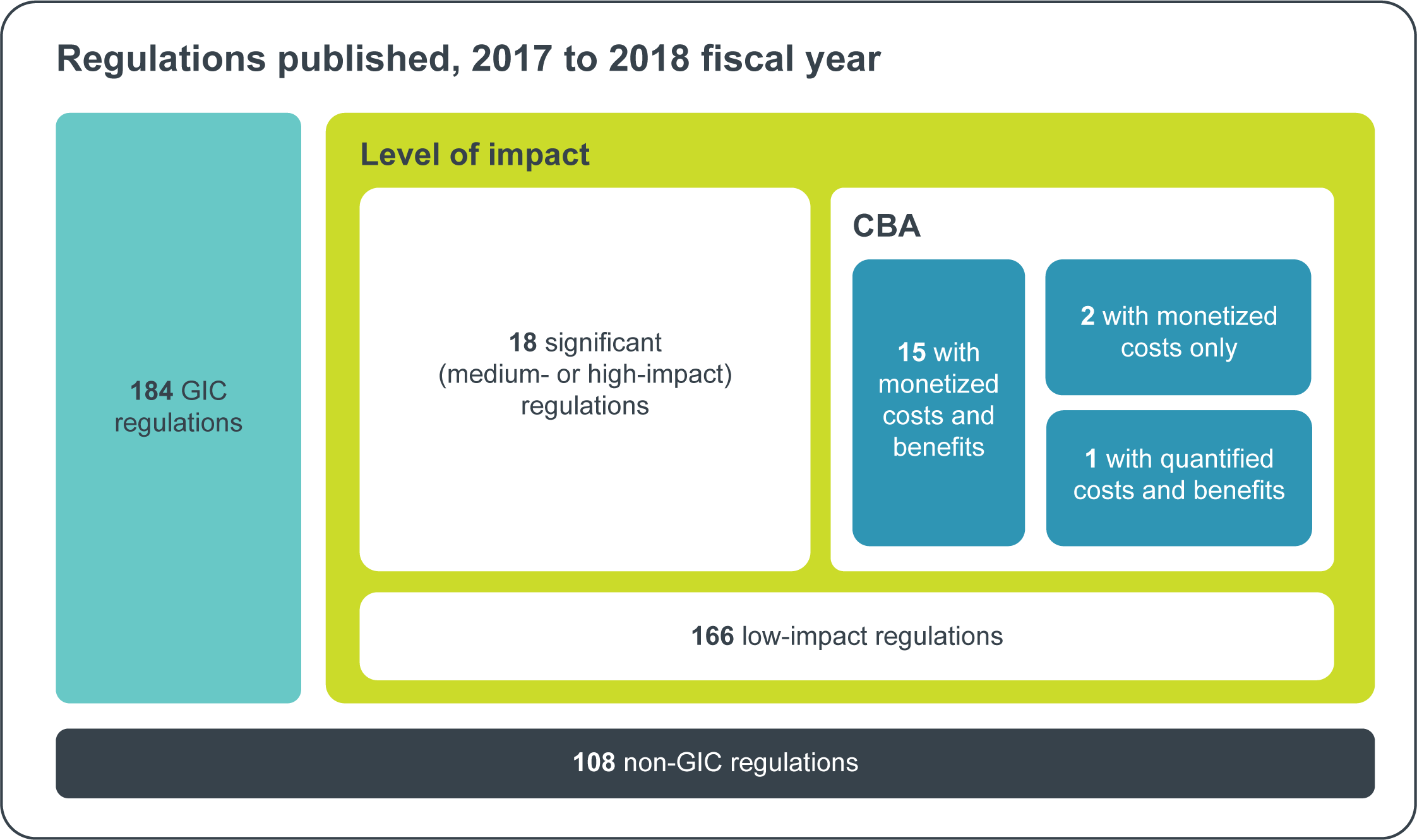

In the 2017 to 2018 fiscal year, a total of 292 regulations were published in the Canada Gazette, Part II, compared with 326 in the 2016 to 2017 fiscal year. Of these 292 regulations:

- 184 were GIC regulations (63.0% of all regulations)

- 108 were non-GIC regulations (37.0% of all regulations)

Of the 184 GIC regulations (compared with 189 in the previous fiscal year):

- 166 were low-impact (90.2% of GIC regulations and 56.8% of all regulations)

- 18 were significant (9.8% of GIC regulations and 6.2% of all regulations)

Figure 1 - Text version

Figure 1 provides an overview of the categories of regulations approved and published in the 2017 to 2018 fiscal year.

During this period, 108 non-Governor in Council regulations were published, and 184 Governor in Council regulations were published.

Of the 184 Governor in Council regulations, 166 were low-impact regulations, and 18 were medium- or high-impact regulations, also known as significant regulations.

Of the 18 significant regulations, 15 had a cost-benefit analysis of monetized costs and benefits, two had an analysis of monetized costs only, and one had quantified costs and benefits.

Qualitative benefits and costs

The most basic element of any analysis of costs and benefits is a text description of the expected impacts associated with the regulatory proposal. This description is referred to as qualitative analysis and is used to:

- provide decision-makers with an evidence-based understanding of the anticipated impacts of the regulation

- provide context for further analysis that is expressed in numerical or monetary terms

Qualitative analysis should be part of every CBA. Regulators are required to describe the expected impacts of the proposal in qualitative terms, including for low-impact proposals, as this qualitative information supports the basis for decision-making.

The following are examples of qualitative impacts identified in significant regulations in the 2017 to 2018 fiscal year:

- “The emission reductions realized…will lead to improvements in air quality and in associated health benefits to Canadians.”

- “Bilateral relations with key trading partners (Brazil and the European Union) will be improved as visa screening shifts towards screening tailored to individual risk.”

- “Continuance of the Government’s commitment and leadership to help support the well-being of veterans and their families.”

Quantitative benefits and costs

Quantitative benefits and costs are those that are described as a measurement. Examples of quantitative information are:

- the number of recipients of a benefit

- the amount of pollution reduced

- the amount of time saved

As is the case with qualitative information, quantitative benefits and costs can be used in two ways:

- on their own, they illustrate the expected magnitude of a proposal by providing measurable figures to decision-makers

- they can be used as a factor in developing cost estimates

Quantitative analysis is an element of all significant proposals. It provides key metrics on the frequency or number of instances of an activity, and is essential for the development of benefit and cost estimates. It can also be used on its own alongside qualitative information to illustrate the overall impact of a proposal in non-monetary terms. Although quantitative analysis is not required for low-impact proposals, it is often included alongside qualitative information to provide information that is useful to decision-makers.

The following are examples of quantified benefits and costs identified in significant regulations in the 2017 to 2018 fiscal year:

- measures introduced under the Regulations Amending the Off-Road Small Spark-Ignition Engine Emission Regulations and Making a Consequential Amendment to Another Regulation will reduce emissions of nitrogen oxides (NO2) by 20,000 tonnes between 2019 and 2032

- the Regulations Amending the Canada Student Financial Assistance Regulations will result in 12,623 more students per year being able to pursue training as skilled workers

- changes under the Regulations Amending the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations are expected to benefit up to 615 eligible recipients of rehabilitation services and vocational assistance from 2017 to 2027

Monetized benefits and costs

Monetized benefits and costs are those that are expressed in a currency amount, such as dollars, using an approach that considers both the value of an impact and when it occurs.Footnote 3

An analysis of monetized costs and benefits is required for all high-impact regulatory proposals. Medium-impact proposals must always include monetized costs, although benefits may be expressed quantitatively or qualitatively when data are not readily available. Most regulatory proposals that are medium- and high-impact typically include both monetized benefits and costs as part of the analysis.

In order for costs and benefits to be considered monetized, the dollar values used in a CBA are adjusted so that values and prices that occur at different times are equal:

- to their exchange value (inflation adjustment)

- when they occur (discounting)

Of the 18 significant regulations finalized in the 2017 to 2018 year, 17 had monetized impacts, representing 9.2% of GIC regulations and 5.8% of all regulations. Of these:

- 15 had monetized benefits and costs

- 2 had monetized costs only

- 1 had quantified costs and benefits

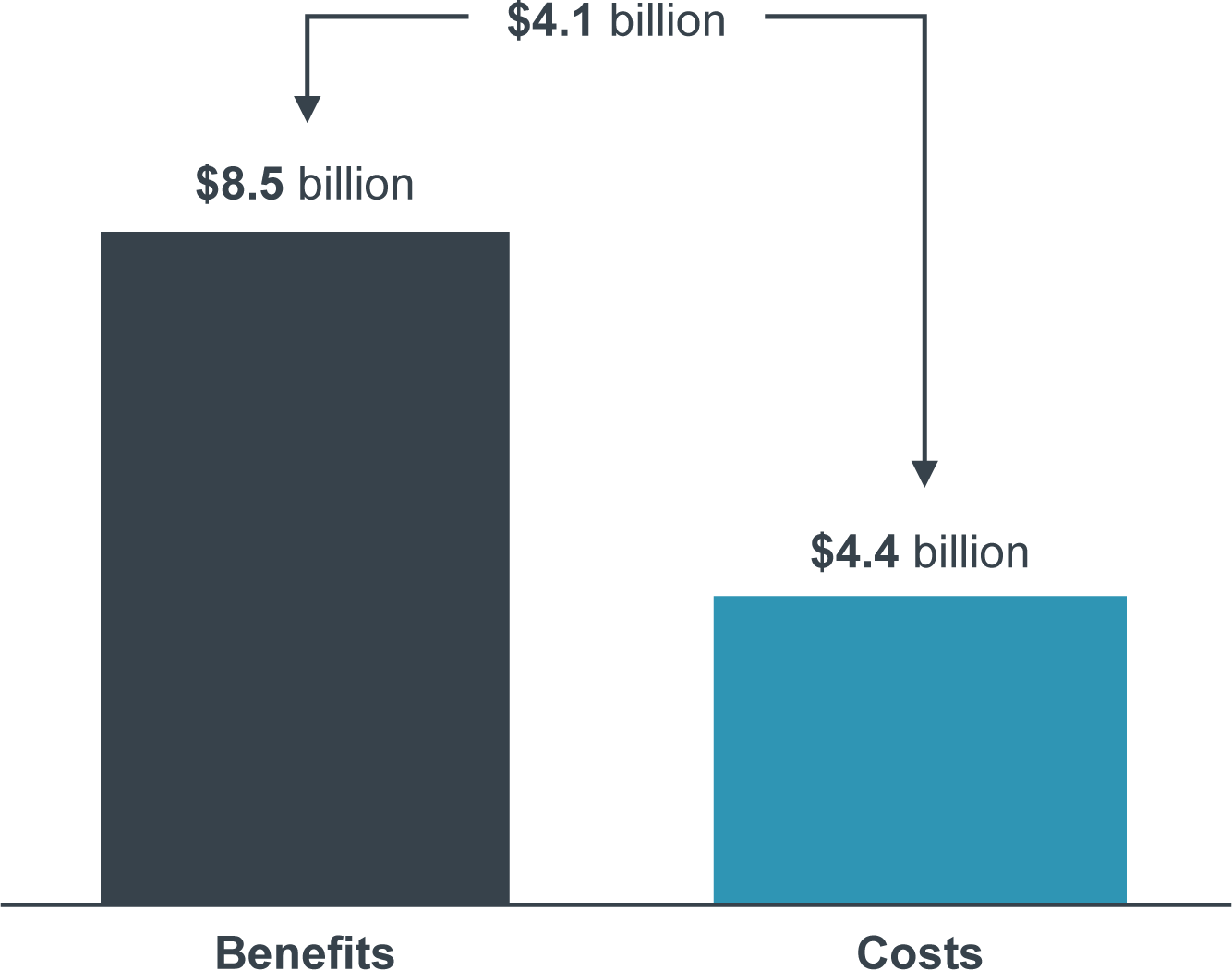

Figure 2 - Text version

Figure 2 depicts the net benefit of significant regulations published during the 2017 to 2018 fiscal year.

The total cost associated with significant regulations was $4.4 billion.

The total benefit associated with significant regulations was $8.5 billion.

The difference between the total cost and total benefit is a net benefit of $4.1 billion.

Of the 15 regulations that had monetized estimates of both benefits and costs (expressed as total present value):Footnote 4

- total costs were $4,429,808,584

- total benefits were $8,533,837,575

- net benefits were $4,104,028,991

The following are examples of monetized benefits and costs identified in regulations in the 2017 to 2018 fiscal year:

- The Regulations Amending the Ozone-Depleting Substances and Halocarbon Alternatives Regulations aim to avert future hydrofluorocarbon (HFC) releases to the environment by reducing:

- the supply of HFCs that enter into Canada

- the demand for HFCs in manufactured products

Such reductions will:

- decrease Canada’s greenhouse gas (GHG) emissions

- help limit increases in global average temperatures

- contribute to Canada’s international obligations to combat climate change

Additionally, the amendments enabled Canada to ratify and implement the Kigali Amendment to the Montreal Protocol. The cumulative net benefit associated with the measures in this regulation is estimated at $3.725 billion (net present value) from 2018 to 2040.

- The Regulations Amending the Immigration and Refugee Protection Regulations expand electronic travel authorization eligibility to travellers from Brazil, Bulgaria and Romania who have held a Canadian temporary resident visa at any time during the last 10 years, or who, at the time of application, hold a valid non-immigrant visa from the US. The amendments also enable a new immigration information-sharing connection with the US to confirm the validity of a visa issued by the other country. The cumulative net benefit associated with the measures in this regulation is estimated at $115.3 million from 2017 to 2026.

- The Regulations Amending the Off-Road Small Spark-Ignition Engine Emission Regulations and Making a Consequential Amendment to Another Regulation will reduce smog caused by air pollutant emissions from small spark-ignition (SSI) engines, which has a significant adverse impact on the health and environment of Canadians and, as a result, on the Canadian economy. In addition to providing important health and environmental benefits, the amendments aim to:

- restore common Canada-US standards for air pollutant emissions from SSI engines

- contribute to minimizing the administrative burden costs incurred by companies importing these engines into Canada

The estimated net benefit of the changes is $107.6 million (net present value) from 2019 to 2032.

The purpose of CBA is to demonstrate that the expected benefits of a proposal are greater than the expected costs. This determination, however, is not based entirely on monetized benefits and costs. CBAs frequently include quantitative and qualitative analysis in addition to monetized analysis, and the overall analysis must consider this broader range of evidence. In the 2017 to 2018 fiscal year:

- three regulatory proposals had monetized costs that were equal to monetized benefits, which is usually associated with a direct transfer from one party to another

- three regulatory proposals had monetized costs that were greater than monetized benefits

For detailed benefits and costs by regulation, see Appendix A.

Section 2: implementation of the one-for-one rule

The one-for-one rule

In order to comply with the annual reporting requirements of the Red Tape Reduction Act, this report also provides an update on the implementation of the one-for-one rule.

The one-for-one rule, instituted in the 2012 to 2013 fiscal year, seeks to control the growth of administrative burden on business that arises from regulations. When a new or amended regulation increases the administrative burden on business, the rule requires that the cost of this burden be offset via other regulatory changes. Administrative burden includes:

- planning, collecting, processing and reporting of information

- completing forms

- retaining data required by the federal government to comply with a regulation

The rule also requires that an existing regulation be repealed each time a new regulation imposes new administrative burden on business.

The rule applies to all regulatory changes that impose new administrative burden costs on business. There are three categories of exemptions established under the Red Tape Reduction Act:

- regulations related to tax or tax administration

- regulations where there is no discretion regarding what is to be included in the regulation (for example, treaty obligations or the implementation of a court decision)

- regulations made in response to an emergency or other unique circumstance where compliance with the rule would compromise the Canadian economy, public health or safety

Regulators are required to monetize and report on:

- the change in administrative burden

- feedback from stakeholders and Canadians on regulators’ estimates of administrative burden costs or savings to business

- the number of regulations created or removed

As with CBA, the dollar values used in estimates of administrative burden are adjusted so that values and prices that occur at different times are equal in their exchange value (inflation adjustment) and when they occur (discounting). In this report, all figures related to the one-for-one rule are expressed in 2012 dollars to permit meaningful and consistent comparison of regulations, regardless of the fiscal year in which they were introduced.

In 2015, the Red Tape Reduction Act enshrined the existing policy requirement for the one-for-one rule in law. Section 9 of the Red Tape Reduction Act requires that the President of the Treasury Board prepare and make public an annual report on the application of the rule.

The Red Tape Reduction Regulations state that the following must be included in the annual report:

- a summary of the increases and decreases in the cost of administrative burden that results from regulatory changes that are made in accordance with section 5 of the act within the 12-month period ending on March 31 of the year in which the report is made public

- the number of regulations that are amended or repealed as a result of regulatory changes that are made in accordance with section 5 of the act within that 12-month period

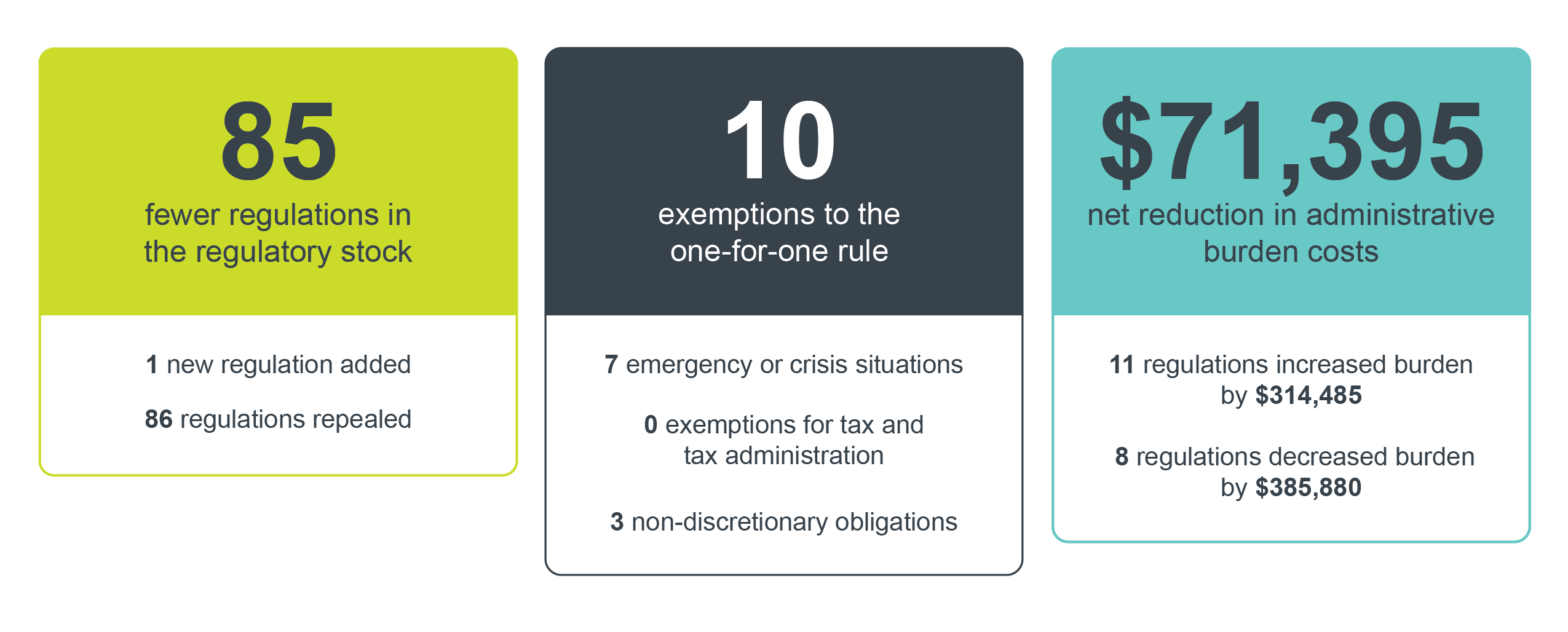

Key findings on the implementation of the one-for-one rule

The main findings on changes in administrative regulatory burden and the overall number of regulations for the 2017 to 2018 fiscal year are as follows:

- administrative burden reductions of $71,395 per year were achieved in the 2017 to 2018 fiscal year, resulting in approximately $30.3 million reduced since the 2012 to 2013 fiscal year

- 85 regulatory titles (net) were taken off the books, with a total net reduction of 131 titles since the 2012 to 2013 fiscal year

A detailed report on regulations that had implications under the one-for-one rule is in Appendix B.

The regulations that removed the most regulatory burden in the 2017 to 2018 fiscal year were the Regulations Amending the Off-Road Small Spark-Ignition Engine Emission Regulations and Making a Consequential Amendment to Another Regulation. These regulations reduced administrative burden on businesses by $169,541 per year by:

- shifting from per-shipment to annual submission of importation declarations for companies importing fewer than 500 SSI engines into Canada per year

- eliminating the requirement altogether for companies that import fewer than 50 SSI engines per year

The Treasury Board monitors regulators’ compliance with the requirement to offset administrative burden and titles imposed on business through regulatory changes:

- System-wide, the federal government remains in compliance with the requirement in the Red Tape Reduction Act to offset administrative burden and titles within 24 months.

- The Treasury Board of Canada Secretariat also tracks offsetting requirements by portfolio, and the Fisheries and Oceans portfolio currently has an outstanding balance of $258,490, related primarily to the Aquaculture Activities Regulations, which were introduced . Officials from the Secretariat and Fisheries and Oceans Canada continue to work together to identify offsets that will balance the account.

Figure 3 - Text version

Figure 3 provides statistics on the implementation of the one-for-one rule for significant regulations published in the 2017 to 2018 fiscal year.

There was one new regulatory title added to the regulatory stock and 86 regulatory titles repealed, for a net of 85 fewer regulations in the regulatory stock.

There were 10 instances where regulations were exempted from the one-for-one rule, including seven emergency or crisis situations, zero exemptions for tax and tax administration, and three non-discretionary obligations.

In total, 11 regulations increased administrative burden by $314,485, and 8 regulations decreased administrative burden by $385,880, for a net reduction of $71,395 in administrative burden costs.

Section 3: update on the Administrative Burden Baseline

The Administrative Burden Baseline

The Administrative Burden Baseline (ABB) provides Canadians with a count of the total number of administrative requirements in federal regulations (GIC and non-GIC) and associated forms.

The ABB was first publicly reported on in , providing a baseline count of administrative requirements by regulator. Since then, regulators continue to:

- re-examine the count of their administrative requirements occurring from July 1 to June 30 each year

- publicly post updates to their ABB count by September 30 each year

Key findings on the Administrative Burden Baseline

The baseline provides Canadians with information on 38 regulators.

As of :

- the total number of administrative requirements was 136,121, a reduction of 458 from the 2016 count of 136,579

- there were 580 regulations identified by regulators as having administrative requirements, a reduction of 19 from the 2016 figure of 599

- the average number of administrative requirements per regulation was 235, up from the 2016 average of 228

The top three changes in the ABB in 2017 were:

- There were 344 fewer net administrative requirements for Health Canada, related mainly to the replacement of the Marihuana for Medical Purposes Regulations (SOR/2013-199) with the Access to Cannabis for Medical Purposes Regulations (SOR/2016-230).

- A net increase of 167 administrative requirements for the Canadian Food Inspection Agency related mainly to changes to the Health of Animals Regulations (Import Reference Document).

- A net increase of 153 administrative requirements for Transport Canada associated with amendments to the following cumulatively added 279 administrative requirements:

- Regulations Amending the Canadian Aviation Regulations (Aerodrome Work Consultations)

- Locomotive Emissions Regulations

- Marine Liability and Information Return Regulations

- Prevention and Control of Fires on Line Works Regulations

- Vessel Fire Safety Regulations

However, the Order Repealing Certain Regulations Made Under the Railway Safety Act removed 126 administrative requirements.

A detailed summary of the ABB count for 2017 and for previous years is in Appendix B.

Section 4: looking forward: the Cabinet Directive on Regulation

-

In this section

Overview

On , the Cabinet Directive on Regulation came into effect, replacing the Cabinet Directive on Regulatory Management as the policy for the regulation-making process.

The new directive updates Canada’s regulatory policy and is based on three broad concepts:

- emphasis on the regulatory life-cycle approach

- reinforcing good regulatory practices in the regulatory development process (consultation, transparency and CBA)

- alignment of the directive with government priorities such as regulatory cooperation, gender-based analysis, environmental impact assessment and Indigenous-Crown consultation, as well as requiring periodic reviews of the stock of regulations

Because this report covers the period of , to , it covers regulations that were developed and finalized under the former Cabinet Directive on Regulatory Management.

Policies supporting the new directive

The Cabinet Directive on Regulation is supported by a new suite of policies that regulators must follow as they develop proposed regulations. These policies include the following:

- Policy on Regulatory Development: The Policy on Regulatory Development outlines the requirements and process for regulators when developing and bringing forward a draft regulation to the GIC:

- the policy maintains consultation and engagement requirements throughout the regulatory development process

- the policy also sets out renewed Regulatory Impact Analysis requirements for draft regulations, including adding regulatory cooperation, gender-based analysis plus and environmental impact lenses

- Policy on Cost-Benefit Analysis: The Policy on Cost-Benefit Analysis represents the first time that CBA requirements for Canadian regulations are enshrined in policy. The policy outlines overarching mandatory requirements for analyzing the benefits and costs of proposed regulations:

- it requires both robust analysis and public transparency, including:

- reporting stakeholder consultations on CBA in the RIAS

- making the CBA available publicly

- regulators are now required to monetize both benefits and costs of all significant regulations (high- and medium-impact), which previously had been mandatory for high-impact regulations only

- it requires both robust analysis and public transparency, including:

- Policy on Limiting Regulatory Burden on Business: The Policy on Limiting Regulatory Burden sets out the requirements for the one-for-one rule and the small business lens:

- the one-for-one rule is established by the Red Tape Reduction Act and the Red Tape Reduction Regulations, and the policy sets out the operational details related to the rule’s application

- the small business lens will now apply to all regulatory proposals, thereby contributing to a more systematic consideration of small business impacts in federal regulations

- Policy on Regulatory Transparency and Accountability: The Policy on Regulatory Transparency and Accountability modernizes requirements for government-wide initiatives that contribute to the openness of the regulatory system:

- forward regulatory plans will be updated more frequently, with increased transparency on:

- regulatory cooperation

- expected impacts

- upcoming regulatory reviews

- access to supporting analysis in order to provide better predictability

- service standards will be developed for high-volume regulatory transactions affecting any regulated party to:

- promote timeliness of decision-making

- provide clear information on expectations for interactions and service

- policies on providing guidance on regulatory requirements (formerly “interpretation policies”) will continue to be published to explain how regulators help regulated parties understand their regulatory obligations

- forward regulatory plans will be updated more frequently, with increased transparency on:

Appendix A: detailed report on cost-benefit analyses for the 2017 to 2018 fiscal yearFootnote 5

Table A1 indicates significant proposals that included both monetized benefits and monetized costs. These proposals may also include quantitative and/or qualitative CBA data to supplement the monetized CBA.

Table A2 indicates a medium-impact proposal that included monetized costs and quantified benefits. Monetized costs are required for all significant proposals; however, a medium-impact proposal may express benefits in quantitative or quantitative terms in situations where it is impractical to monetize those benefits.

| Department | Regulation | Costs (total present value) |

|---|---|---|

| Medium-impact regulations | ||

| Health Canada | Regulations Amending the Food and Drug Regulations (Veterinary Drugs: Antimicrobial Resistance) (SOR/2017-76) Note: CBA included in Regulations Amending the Establishment Licensing Fees (Veterinary Drugs) Regulations (SOR/2017-77) |

$39,486,039 |

| Total | $39,486,039 | |

Table A3 indicates a significant proposal for which quantified benefits and costs were provided.

| Department | Regulation |

|---|---|

| Transport Canada | Regulations Amending the Motor Vehicle Safety Regulations (Electronic Stability Control Systems for Heavy Vehicles) (SOR/2017-104) |

Appendix B: detailed report on the one-for-one rule for the 2017 to 2018 fiscal year

| Portfolio | Regulation | Net impact on regulatory stock |

|---|---|---|

| New regulatory titles that have administrative burden | ||

| Transport Canada | Locomotive Emissions Regulations (SOR/2017-121) | 1 |

| Subtotal | 1 | |

| Repealed regulations | ||

| Agriculture and Agri-Food Canada |

Regulations Repealing the Certain

Regulations Under the Farm Income Protection Act (Miscellaneous Program) (SOR/2017-84) repealed:

|

(74) |

| Agriculture and Agri-Food Canada |

Regulations Amending and

Repealing Certain Canadian Food Inspection Agency Regulations (Miscellaneous Program) (SOR/2017-94) repealed:

|

(1) |

| Employment and Social Development Canada |

Regulations Amending the Canada

Pension Plan Regulations and Repealing the Canada Pension Plan (Social Insurance Numbers) Regulations (SOR/2017-120) repealed:

|

(1) |

| Fisheries and Oceans Canada |

Regulations Repealing the Fish

Health Protection Regulations (SOR/2017-122) repealed:

|

(1) |

| Global Affairs Canada |

Regulations Repealing the United

Nations Côte d'Ivoire Regulations (SOR/2017-54) repealed:

|

(1) |

| Global Affairs Canada |

Regulations Repealing the

Regulations Implementing the United Nations Resolutions on Liberia (SOR/2017-55) repealed:

|

(1) |

| Indigenous and Northern Affairs Canada |

Regulations Repealing the Certain

Regulations Made Under the Arctic Waters Pollution Prevention Act (Miscellaneous Program) (SOR/2017-135)

repealed:

|

(4) |

| Innovation, Science and Economic Development Canada |

Regulations Repealing the Canada

Corporations Regulations (SOR/2017-283) repealed:

|

(1) |

| Public Services and Procurement Canada |

Regulations Amending and Repealing

Certain Regulations Made Under the Public Service Employment Act (SOR/2017-252) repealed:

|

(2) |

| Subtotal | (86) | |

| New regulations that simultaneously repealed and replaced existing regulations | ||

| Transport Canada | Arctic Shipping Safety and Pollution Prevention Regulations (SOR/2017-286) replaced the Arctic Shipping Pollution Prevention Regulations (C.R.C., c. 353) | 0 |

| Subtotal | 0 | |

| Total net impact on regulatory stock for the 2017 to 2018 fiscal year | 85 | |

Appendix C: administrative burden count

| Department or agency | 2014 | 2015 | 2016 | 2017 | ||||

|---|---|---|---|---|---|---|---|---|

| Number of requirements |

Number of regulations |

Number of requirements |

Number of regulations |

Number of requirements |

Number of regulations |

Number of requirements |

Number of regulations |

|

Table C1 Notes

|

||||||||

| Indian and Northern Affairs Canada | 288 | 12 | 288 | 11 | 288 | 11 | 288 | 12 |

| Agriculture and Agri-Food Canada | 134 | 4 | 134 | 4 | 133 | 4 | 133 | 4 |

| Canada Border Services Agency | 1,426 | 30 | 1,470 | 30 | 1,473 | 30 | 1,473 | 30 |

| Canada Revenue Agency | 1,776 | 30 | 1,776 | 30 | 1,807 | 31 | 1,807 | 30 |

| Canadian Dairy Commission | 4 | 2 | 4 | 2 | 4 | 2 | 4 | 2 |

| Canadian Environmental Assessment Agency | 89 | 1 | 89 | 1 | 89 | 1 | 89 | 1 |

| Canadian Food Inspection Agency | 10,989 | 34 | 11,021 | 13 | 11,880 | 23 | 12,047 | 21 |

| Canadian Grain Commission | 1,056 | 1 | 1,056 | 1 | 1,056 | 1 | 1,056 | 1 |

| Canadian Heritage | 797 | 3 | 798 | 3 | 802 | 3 | 802 | 3 |

| Canadian Intellectual Property Office | 569 | 6 | 568 | 6 | 568 | 6 | 568 | 6 |

| Canadian Nuclear Safety Commission | 8,169 | 10 | 8,169 | 10 | 8,169 | 10 | 8,169 | 10 |

| Canadian Pari-Mutuel Agency | 731 | 2 | 731 | 2 | 731 | 2 | 731 | 2 |

| Canadian Transportation Agency | 545 | 7 | 545 | 7 | 545 | 7 | 545 | 7 |

| Immigration, Refugees and Citizenship Canada | 14 | 1 | 73 | 1 | 59 | 1 | 59 | 1 |

| Competition Bureau | 444 | 3 | 444 | 3 | 444 | 3 | 444 | 3 |

| Copyright Board Canada | 16 | 1 | 16 | 1 | 17 | 1 | 17 | 1 |

| Employment and Social Development Canada | 2,791 | 7 | 3,256 | 7 | 3,104 | 7 | 3,100 | 6 |

| Environment Canada and Climate Change Canada | 9,985 | 53 | 10,099 | 53 | 11,500 | 53 | 11,515 | 52 |

| Farm Products Council of Canada | 47 | 3 | 47 | 3 | 47 | 3 | 47 | 3 |

| Department of Finance Canada | 1,818 | 42 | 1,891 | 42 | 1,919 | 42 | 1,928 | 42 |

| Fisheries and Oceans Canada | 5,350 | 30 | 5,350 | 31 | 5,446 | 31 | 5,367 | 30 |

| Global Affairs Canada | 2,809 | 55 | 2,820 | 58 | 2,784 | 57 | 2,774 | 56 |

| Health Canada | 15,649 | 95 | 15,945 | 32 | 15,627 | 31 | 15,283 | 31 |

| Innovation, Science and Economic Development Canada | 1,693 | 8 | 1,904 | 8 | 1,330 | 7 | 1,332 | 7 |

| Labour Program | 21,468 | 32 | 21,468 | 17 | 21,791 | 17 | 21,791 | 17 |

| Measurement Canada | 335 | 2 | 359 | 2 | 359 | 2 | 359 | 2 |

| National Energy Board | 1,298 | 14 | 1,298 | 14 | 4,012 | 13 | 4,012 | 13 |

| Natural Resources Canada | 4,507 | 28 | 4,507 | 28 | 4,507 | 28 | 4,432 | 28 |

| Office of the Superintendent of Bankruptcy | 799 | 4 | 799 | 3 | 799 | 3 | 799 | 3 |

| Office of the Superintendent of Financial Institutionstable C1 note a | 2,875 | 33 | 2,875 | 33 | 2,899 | 33 | 2,586 | 23 |

| Parks Canada | 773 | 25 | 773 | 25 | 773 | 25 | 773 | 25 |

| Patented Medicine Prices Review Board | 59 | 1 | 59 | 1 | 59 | 1 | 59 | 1 |

| Public Health Agency of Canada | 42 | 2 | 42 | 2 | 173 | 2 | 189 | 2 |

| Public Safety Canada | 229 | 6 | 229 | 6 | 229 | 6 | 229 | 6 |

| Public Services and Procurement Canada | 388 | 1 | 388 | 1 | 493 | 1 | 498 | 1 |

| Statistics Canada | 157 | 1 | 157 | 1 | 157 | 1 | 157 | 1 |

| Transport Canada | 29,695 | 94 | 30,258 | 94 | 30,458 | 98 | 30,611 | 95 |

| Treasury Board of Canada Secretariat | 46 | 1 | 48 | 2 | 48 | 2 | 48 | 2 |

| Grand total | 129,860 | 684 | 131,754 | 588 | 136,579 | 599 | 136,121 | 580 |

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2018, ISSN: 2561-4290