Annual Report to Parliament for the 2019 to 2020 Fiscal Year: Federal Regulatory Management Initiatives

On this page

- Message from the President

- Introduction

- Types of federal regulations

- Cabinet Directive on Regulation

- Section 1: benefits and costs of regulations

- Section 2: implementation of the one-for-one rule

- Section 3: update on the Administrative Burden Baseline

- Appendix A: detailed report on cost-benefit analyses for the 2019–20 fiscal year

- Appendix B: detailed report on the one-for-one rule for the 2019–20 fiscal year

- Appendix C: administrative burden count

Message from the President

President of the Treasury Board

As the President of the Treasury Board and the Minister responsible for federal regulatory policy and oversight, I am pleased to present this fourth annual report to Parliament on federal regulatory management initiatives.

This report provides important information on three key regulatory initiatives: the analysis of benefits and costs in federal regulations; the one-for-one rule; and the administrative burden baseline.

The end of the 2019-20 fiscal year coincided with the onset of the COVID-19 pandemic. The sudden and severe economic and social impacts of the pandemic have touched every Canadian in some way.

Canada’s regulatory system has been an integral part of our country’s response. Canadian society always needs an effective regulatory system to help protect our health, safety, security, and the environment. But the pandemic has made the importance of these safeguards as well as the ability to respond rapidly and effectively readily apparent.

Our regulatory system adapted nimbly, giving COVID-related issues top priority and finding options to help businesses fulfill their regulatory obligations while functioning at reduced capacity. From border closures and quarantines, to financial support for workers and businesses, to the procurement of personal protective equipment and the development of a potential vaccine, regulations and other statutory instruments helped streamline nearly every aspect of our response.

As we look to an economic and social recovery after COVID-19, we will continue to see the benefits of Canada’s regulatory modernization initiatives already under way. For example, the External Advisory Committee on Regulatory Competitiveness reconvened this fall, and I look forward to receiving their advice on ways our regulatory system can become more agile and competitive in the current environment and beyond.

In addition, last April, I directed officials at the Treasury Board of Canada Secretariat to begin a review of the Red Tape Reduction Act, as required under the legislation. This review will evaluate how the one-for-one rule has performed in addressing unnecessary administrative burden on businesses and identify potential improvements to further benefit Canadians, businesses and organizations.

I invite you to read this year’s report to see how the regulatory system continues to protect the economic and social fabric of Canada.

Introduction

This is the fourth annual report to Parliament on federal regulatory management initiatives. This report is part of regular monitoring of certain aspects of Canada’s regulatory system.

This year’s report has three main sections:

- Section 1 describes the benefits and costs of regulations that were made by the Governor in Council and that have a significantFootnote 1 cost impact

- Section 2 reports on the implementation of the one-for-one rule, fulfilling the Red Tape Reduction Act reporting requirement

- Section 3 sets out the Administrative Burden Baseline for 2019 and for previous years, providing a count of administrative requirements in federal regulations

The regulations reported on in this document were published in the Canada Gazette, Part II, in the 2019–20 fiscal year, which covers the period from April 1, 2019, to March 31, 2020.

Types of federal regulations

Regulations are a type of law intended to change behaviours and achieve public policy objectives. They have legally binding effect and support a broad range of objectives, such as:

- health and safety

- security

- culture and heritage

- a strong and equitable economy

- the environment

Regulations are made by every order of government in Canada in accordance with responsibilities set out in the Constitution Act. Federal regulations deal with areas of federal jurisdiction, such as patent rules, vehicle emissions standards and drug licensing.

There are three principal categories of federal regulations. Each is based on where the authority to make regulations lies:

- Governor in Council (GIC) regulations are reviewed by a group of ministers who recommend approval to the Governor General. This role is performed by the Treasury Board.

- Ministerial regulations are made by a minister who is given the authority to do so by law.

- Example: The Oceans Act authorizes the Minister of Fisheries and Oceans to make orders or regulations that designate marine protected areas, which conserve and protect marine habitat, species and resources.

- Regulations made by an agency, tribunal or other entity that has been given the authority by law to do so in a given area, and that do not require the approval of the GIC or a minister.

- Example: The Canadian Energy Regulator Act authorizes the Canada Energy Regulator to make regulations related to activities near international or interprovincial power lines.

Cabinet Directive on Regulation

The Cabinet Directive on Regulation (CDR) came into effect on September 1, 2018, replacing the Cabinet Directive on Regulatory Management (CDRM) as the policy instrument that governs the federal regulatory system.

The directive is based on three broad concepts:

- emphasis on the regulatory life-cycle approach

- reinforcement of good practices in the regulatory development process (consultation, transparency and cost-benefit analysis)

- alignment with government priorities, such as regulatory co-operation, gender-based analysis, environmental impact assessment and Indigenous-Crown consultation, as well as required periodic reviews of the stock of regulations

A transition period was established, recognizing that regulatory proposals normally take several months to develop. Proposals that were at an advanced stage of development when the CDR came into effect were able to continue under the CDRM requirements so long as they were finalized by June 30, 2019.

Because the transition period to the CDR continued into the 2019–20 fiscal year, this report covers regulations made under both it and its predecessor, the CDRM.

A total of 116 GIC regulations were finalized under the CDR in the 2019–20 fiscal year, accounting for 63% of the 184 regulations finalized in that year.

A total of 21 regulations that had a significant cost impact were finalized under the CDR in the 2019–20 fiscal year, accounting for 55.3% of the 38 regulations in that category of impact level that were finalized in that year. All proposals are now being developed under the CDR analytical requirements.

Section 1: benefits and costs of regulations

What is cost-benefit analysis?

In the regulatory context, cost-benefit analysis (CBA) is a structured approach to identifying and considering the economic, environmental and social effects of a regulatory proposal. CBA identifies and measures the positive and negative impacts of a regulatory proposal and any feasible alternative options so that decision-makers can determine the best course of action. CBA monetizes, quantifies and qualitatively analyzes the direct and indirect costs and benefits of the regulatory proposal to determine the proposal’s overall benefit.

Since 1986, the Government of Canada has required that a CBA be done for most regulatory proposals in order to assess their potential impact on areas such as:

- the environment

- workers

- businesses

- consumers

- other sectors of society

The results of the CBA are summarized in a Regulatory Impact Analysis Statement (RIAS), which is published with proposed regulations in the Canada Gazette, Part I. The RIAS enables the public to:

- review the analysis

- provide comments to regulators before final consideration by the GIC and subsequent publication of approved final regulations in the Canada Gazette, Part II

Analytical requirements

The analytical requirements for CBA as part of a RIAS are set out in the Policy on Cost-Benefit Analysis, which was introduced on September 1, 2018, in support of the Cabinet Directive on Regulation. The policy requires both robust analysis and public transparency, including:

- reporting stakeholder consultations on CBA in the RIAS

- making the CBA available publicly

Regulatory proposals are categorized according to their expected level of impact, which is determined by the anticipated cost of the proposal. Under the new directive, the categories of impact level were realigned with the analytical requirements for CBA. This report presents results according to the new categories, which are as follows:

- no-cost-impact regulatory proposals: proposals that have no identified costs

- low-cost-impact regulatory proposals: proposals that have annual national costs of less than $1 million

- significant-cost-impact regulatory proposals: proposals that have $1 million or more in annual national costs (merges the former medium- and high-impact categories)

Table 1 illustrates how the new categories align with the former categories.

| New cost impact level | Former cost impact level | Present value of costs (over 10 years) | Annual cost |

|---|---|---|---|

| None | Low | No costs | No costs |

| Low | Low | Less than $10 million | Less than $1 million |

| Significant | Medium or high | More than $10 million | More than $1 million |

The level of impact determines the degree of analysis and assessment that is required for a given regulatory proposal. This proportionate approach is consistent with regulatory best practices set out by the Organisation for Economic Co-operation and Development (OECD). Table 2 shows the analysis required for each level of impact.

| Impact level | Description of costs | Description of benefits |

|---|---|---|

| None | Qualitative statement that there are no anticipated costs | Qualitative |

| Low | Qualitative | Qualitative |

| Significant |

Quantified and monetized (if data are readily available) |

Quantified and monetized (if data are readily available) |

In this report, information on CBA covers GIC regulations only and is limited to regulatory proposals that have a significant cost impact under the new categories and to those that have a medium- or high-impact under the former categories. When the new directive was introduced, a transitional strategy allowed proposals that were in the latter stages of development to proceed for approval using the former requirements. Consequently, this report includes regulations made under both the new requirements and the former requirements.

Figures in this report are taken from the RIASs for regulations published in the Canada Gazette, Part II, in the 2019–20 fiscal year. To remove the effect of inflation, figures are expressed in 2012 dollars and, therefore, will vary from those published in the RIASs. This approach permits meaningful and consistent comparison of figures, regardless of the year in which regulatory impacts were originally measured.

Overview of benefits and costs of regulations

In the 2019–20 fiscal year, a total of 324 regulations were published in the Canada Gazette, Part II, compared with 316 in the 2018–19 fiscal year. Of these 324 regulations:

- 184 were GIC regulations (56.8% of all regulations)

- 140 were non-GIC regulations (43.2% of all regulations)

Of the 184 GIC regulations (compared with 192 in the 2018–19 fiscal year):

- 146 had no cost impact or low cost impact (79.3% of GIC regulations and 45.1% of all regulations)

- 38 had significant cost impact (20.7% of GIC regulations and 11.7% of all regulations)

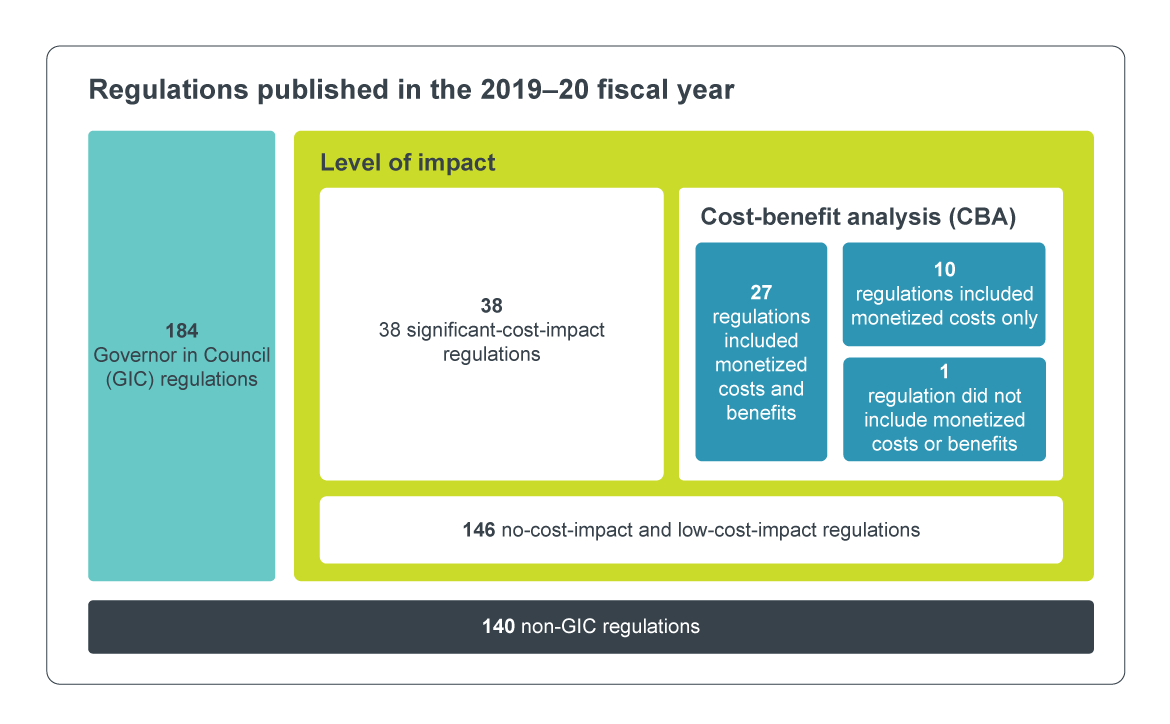

Figure 1 provides an overview of regulations approved and published in the 2019–20 fiscal year.

Figure 1 - Text version

Figure 1 provides an overview of the regulations published in the 2019–20 fiscal year.

During this period, 140 non-Governor in Council regulations were published, and 184 Governor in Council regulations were published.

Of the 184 Governor in Council regulations, 146 were no-cost-impact or low-cost-impact regulations, and 38 were significant-cost-impact regulations.

Of the 38 significant-cost-impact regulations, 27 included monetized costs and benefits, 10 included monetized costs only, and 1 did not include monetized costs or benefits.

Qualitative benefits and costs

The most basic element of any analysis of costs and benefits is a description of the expected impacts of the regulatory proposal. This description is based on a qualitative analysis and is used to:

- provide decision-makers with an evidence-based understanding of the anticipated impacts of the regulation

- provide context for further analysis that is expressed in numerical or monetary terms

Qualitative analysis should be part of the CBA of all regulatory proposals, including those that have no cost impact or low cost impact.

The following are examples of qualitative impacts identified in significant-cost-impact regulations in the 2019–20 fiscal year:

- The Safety of Sperm and Ova Regulations (SOR/2019-192) strengthen the safety requirements for donor sperm and ova, including donor screening and testing requirements, to prevent disease transmission to recipients of donor sperm and ova and persons created from donor sperm and ova.

- The Regulations Amending the Cannabis Regulations (New Classes of Cannabis) (SOR/2019-206) address the public health and public safety risks of edible cannabis, cannabis extracts and cannabis topicals, including their appeal to youth and the risks of accidental consumption, overconsumption, and foodborne illness, among other risks.

- The Exit Information Regulations (SOR/2019-241) authorize the Canada Border Services Agency to collect exit information on all travellers leaving the country by land or air modes. These regulations enable the Canada Border Services Agency to better monitor compliance with Canada’s customs and immigration laws by verifying travel dates to confirm applicable duties and taxes for returning residents, identify temporary residents who attempt to remain in Canada illegally, focus immigration enforcement investigations on persons still in Canada, and verify whether permanent residents returning to Canada have complied with statutory residency requirements based on residency-based eligibility criteria.

Quantitative benefits and costs

Quantitative benefits and costs are those that are expressed as a quantity, for example:

- the number of recipients of a benefit

- the percentage reduction in pollution

- the amount of time saved

As is the case with qualitative information, quantitative benefits and costs can be used in two ways:

- On their own, they can illustrate the expected magnitude of a proposal by providing measurable figures to decision-makers

- They can be used as a factor in developing cost estimates

Quantitative analysis is an element of nearly all regulatory proposals that have a significant cost impact. Such analysis provides key metrics on the frequency or number of instances of an activity, and is essential for estimating benefits and costs. Quantitative analysis can also be used on its own to illustrate the overall impact of a proposal in non-monetary terms. Although quantitative analysis is not required for proposals that have no cost impact or low cost impact, it is often included alongside qualitative information because it can be useful to decision-makers.

The following are examples of quantified benefits and costs identified in significant-cost-impact regulations that were finalized in the 2019–20 fiscal year:

- The Regulations Amending the Canada Student Financial Assistance Regulations (SOR/2019-214) will result in 115,135 more skilled workers being trained over 10 years due to more affordable and accessible student loans.

- The Regulations Amending the Official Languages (Communications with and Services to the Public) Regulations (SOR/2019-242) revise the criteria used to estimate the demand for bilingual services from federal institutions. As a result, an estimated 738 offices that are currently unilingual will be required to provide their services in both official languages.

- The Corded Window Coverings Regulations (SOR/2019-97) are expected to result in six fewer deaths over the next 20 years due to reduced strangulation risk.

Monetized benefits and costs

Monetized benefits and costs are those that are expressed in a currency amount, such as dollars, using an approach that considers both the value of an impact and when it occurs.Footnote 2

An analysis of monetized costs and benefits is required for all regulatory proposals that have a significant cost impact. If the benefits or costs cannot be monetized, a rigorous qualitative analysis of the costs or benefits of the proposed regulation is required, and the Treasury Board of Canada Secretariat (TBS) must be satisfied that there are legitimate obstacles to monetizing the impacts. In practice, most regulatory proposals with significant cost impacts include both monetized benefits and costs as part of the analysis.

In order for costs and benefits to be considered monetized, the dollar values used in a CBA are adjusted so that values and prices that occur at different times are equal:

- to their exchange value (inflation adjustment)

- when they occur (discounting)

Of the 38 regulations with significant cost impacts that were finalized in the 2019–20 fiscal year, 37 of them had monetized impacts, representing 20.1% of GIC regulations and 11.4% of all regulations. Of the 38 regulations:

- 27 had monetized benefits and costs

- 10 had monetized costs only

- 1 did not include monetized costs or benefits

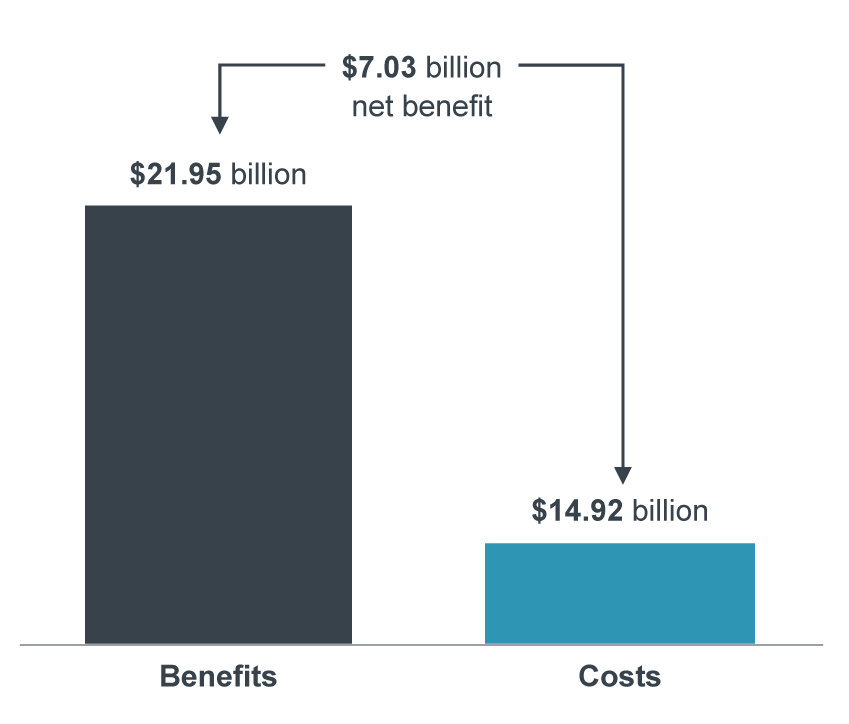

For the 27 regulations with significant cost impacts that had monetized estimates of both benefits and costs, expressed as total present value (see Figure 2):Footnote 3

- total benefits were $21,953,676,024

- total costs were $14,924,841,277

- net benefits were $7,028,834,747

Figure 2 - Text version

Figure 2 depicts the benefits and costs of significant-cost-impact regulations published in the 2019–20 fiscal year.

The benefits associated with significant-cost-impact regulations totalled $21.95 billion.

The costs associated with significant-cost-impact regulations totalled $14.92 billion.

The difference between the benefits and the costs is a net benefit of $7.03 billion.

The following three significant-cost-impact regulatory proposals had the greatest net benefit of all proposals that were finalized in the 2019–20 fiscal year and that had monetized benefits and costs:

- Two amendments to the Energy Efficiency Regulations, 2016 (SOR/2016-311) introduce or update minimum energy performance standards, testing standards, verification and reporting requirements to improve the energy efficiency of various consumer, commercial and industrial energy-using products. These changes reduce greenhouse gas emissions and energy consumption associated with products that use energy in a manner that aligns with other jurisdictions, where feasible and appropriate:

- The Regulations Amending the Energy Efficiency Regulations, 2016 (Amendment 15) (SOR/2019-164) support the federal government’s commitment to set new standards for heating equipment and other key technologies to the highest level of efficiency that is economically and technically achievable. The amendment deals with 12 heating and ventilation product categories and results in a net benefit of $2.476 billion (net present value) between 2019 and 2040.

- The Regulations Amending the Energy Efficiency Regulations, 2016 (Amendment 16) (SOR/2019-163) deal with nine residential, commercial and industrial product categories. Two of these categories – clean water pumps and miscellaneous refrigeration products – were not previously federally regulated. The amendment results in a net benefit of $1.284 billion (net present value) between 2019 and 2040.

- The Output-Based Pricing System Regulations (SOR/2019-266) establish a regulatory trading system for industrial facilities. Regulated facilities will generally not pay the carbon pollution price on fuel they purchase for use at their facility; instead, they will pay the carbon pollution price on their greenhouse gas emissions that exceed their annual facility emissions limit. In addition, such facilities will receive credits for unused emissions below their limit, which can be sold to other facilities that need credits for compliance or be banked for future use. This system of credits creates an ongoing financial incentive for facilities to reduce their emission intensity in order to reduce the amount owed for compensation or to emit below their limit and earn surplus credits. The cumulative net benefit of the changes is $1.965 billion between 2019 and 2030.

The purpose of CBA is to determine whether the expected benefits of a proposal are greater than the expected costs. This determination, however, is not based entirely on monetized benefits and costs. CBAs frequently include quantitative and qualitative analysis, in addition to monetized analysis, and the overall analysis must consider this broader range of evidence. In the 2019–20 fiscal year:

- four regulations that had a significant cost impact had monetized costs that were equal to monetized benefits, a result that is usually associated with a direct transfer from one party to another

- 10 regulations that had a significant cost impact had monetized costs that were greater than monetized benefits, which typically indicates that some benefits – such as broader societal benefits – could not be monetized and were stated qualitatively alongside benefits that were monetized

For detailed benefits and costs by regulation, see Appendix A.

Section 2: implementation of the one-for-one rule

The one-for-one rule

To comply with the annual reporting requirements of the Red Tape Reduction Act and the Policy on Limiting Regulatory Burden on Business, this report also provides an update on the implementation of the one-for-one rule.

The one-for-one rule, which was instituted in the 2012–13 fiscal year under the CDRM and continues under the CDR, seeks to control the administrative burden that regulations impose on businesses.

Administrative burden includes:

- planning, collecting, processing and reporting of information

- completing forms

- retaining data required by the federal government to comply with a regulation

Under the rule, when a new or amended regulation increases the administrative burden on businesses, the cost of this burden must be offset through other regulatory changes. The rule also requires that an existing regulation be repealed each time a new regulation imposes new administrative burden on business.

The rule applies to all regulatory changes that impose new administrative burden on business. Under the Red Tape Reduction Regulations, the Treasury Board can exempt three categories of regulations from the requirement to offset burden and regulatory titles:

- regulations related to tax or tax administration

- regulations where there is no discretion regarding what is to be included in the regulation (for example, treaty obligations or the implementation of a court decision)

- regulations made in response to emergency, unique or exceptional circumstances, including where compliance with the rule would compromise the Canadian economy, public health or safety

Regulators are required to monetize and report on:

- the change in administrative burden

- feedback from stakeholders and Canadians on regulators’ estimates of administrative burden costs or savings to business

- the number of regulations created or removed

As with CBA, the dollar values used in estimating administrative burden are adjusted so that values and prices that occur at different times are equal in their exchange value (inflation adjustment) and when they occur (discounting). In this report, all figures related to the one-for-one rule are expressed in 2012 dollars to permit meaningful and consistent comparison of regulations, regardless of the fiscal year in which they were introduced.

In 2015, the Red Tape Reduction Act enshrined the existing policy requirement for the one-for-one rule in law. Section 9 of the Red Tape Reduction Act requires that the President of the Treasury Board prepare and make public an annual report on the application of the rule. The Policy on Limiting Regulatory Burden on Business further specifies that this report be tabled in Parliament.

The Red Tape Reduction Regulations state that the following must be included in the annual report:

- a summary of the increases and decreases in the cost of administrative burden that results from regulatory changes that are made in accordance with section 5 of the act within the 12-month period ending on March 31 of the year in which the report is made public

- the number of regulations that are amended or repealed as a result of regulatory changes that are made in accordance with section 5 of the act within that 12-month period

Key findings on the implementation of the one-for-one rule

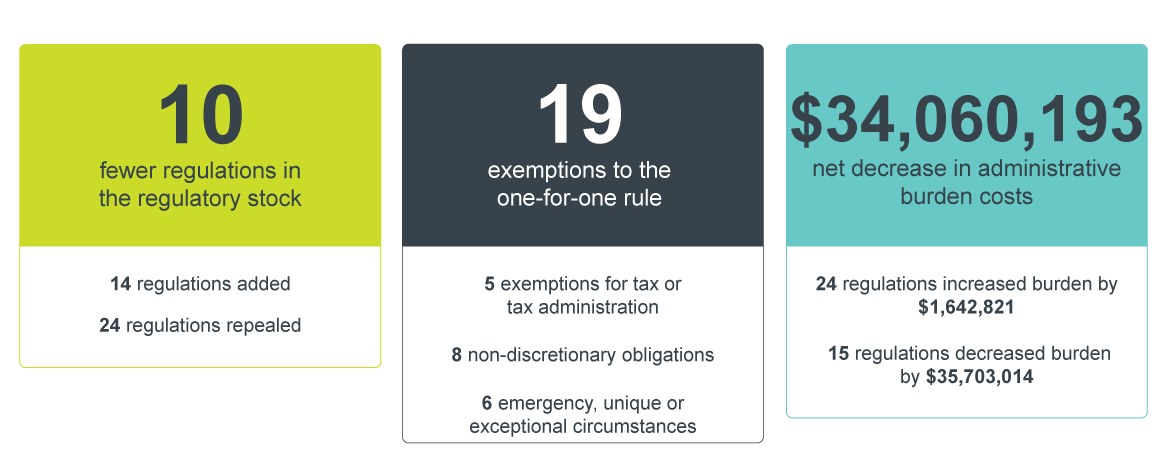

The main findings on changes in administrative burden and the overall number of regulations for the 2019–20 fiscal year are as follows:

- system-wide, the federal government remains in compliance with the requirement in the Red Tape Reduction Act to offset administrative burden and titles within 24 months

- net administrative burden decreased by $34,060,193 in the 2019–20 fiscal year; since the 2012–13 fiscal year, net burden has been reduced by approximately $58.4 million

- 10 regulatory titles (net) were taken off the books, with a total net reduction of 154 titles since the 2012–13 fiscal year

A detailed report on regulations that had implications under the one-for-one rule is in Appendix B.

Under the one-for-one rule, regulatory changes in the 2019–20 fiscal year resulted in the following increases and decreases in the cost of administrative burden on businesses:

- $1,642,821 of new burden introduced

- $35,703,014 of existing burden removed

- net decrease of $34,060,193

The rule allows individual portfolios two years to offset any new burden introduced. As well, portfolios are allowed to bank burden reductions for future offsets within that portfolio. As a result, more than half of the $1,642,821 in new burden introduced in the 2019–20 fiscal year has already been offset:

- $891,868 of new burden was offset immediately by previously removed burden

- $750,953 of new burden had not yet been offset as of March 31, 2020

The changes introduced by the following three final regulations represented the largest increases and the largest decrease in administrative burden in the 2019‒20 fiscal year:

- The Regulations Amending the Commercial Vehicle Drivers Hours of Service Regulations (Electronic Logging Devices and Other Amendments) (SOR/2019-165) mandate the use of electronic logging devices to record information related to a driver’s duty status for all federally regulated motor carriers and their drivers of commercial buses and trucks. These requirements eliminate the use of daily paper logs, resulting in a net decrease in annual administrative burden costs on business of $27,302,094. This represents the largest single reduction in administrative burden on business since the one-for-one rule was introduced in 2012.

- The Indian Oil and Gas Regulations (SOR/2019-196) update the regulatory regime for First Nations oil and gas exploration and development, and ensure that First Nations and industry have a predictable regulatory environment in which to make investment decisions. The changes provide for a more robust and flexible compliance and enforcement regime that includes criteria for regulatory decision-making, a definition of the rights and responsibilities of all parties, and clear authorities and tools to encourage compliance. Administrative burden on business has been reduced by introducing new rules for permits, licences and contracts, as well as new procedures for record keeping, reporting and electronic data submission. The changes will reduce administrative burden on business by $6,654,296 annually.

- The Output-Based Pricing System Regulations (SOR/2019-266) establish a regulatory trading system for industrial facilities. The regulations introduce administrative requirements associated with the gathering, recording and monitoring of information, including data relating to facilities’ production and greenhouse gas emission levels. The regulations also contain requirements to prepare and verify annual reports, and to provide the carbon price of emissions that exceed a facility’s emissions limit to the Canada Revenue Agency. These changes represent an increase in annual administrative burden on business of $592,657.

Under the one-for-one rule, regulatory changes in the 2019–20 fiscal year resulted in the following increases and decreases in the stock of federal regulations:

- five new regulatory titles imposing administrative burden on business were introduced

- 12 regulatory titles were repealed

- 12 existing titles were repealed and replaced with nine new titles

While 14 new titles were introduced over the course of the year, the rule allows individual portfolios two years to offset these titles. As is the case with administrative burden, portfolios are allowed to bank title repeals for future offsets within the portfolio. As a result, 13 of these 14 new titles were offset immediately by previously removed titles.

The Treasury Board monitors regulators’ compliance with the requirement to offset new administrative burden and titles. System-wide, the federal government remains in compliance with the requirement in the Red Tape Reduction Act to offset new administrative burden and titles within 24 months.

TBS also tracks offsetting requirements by portfolio. As of March 31, 2020, Fisheries and Oceans Canada had an outstanding amount of $257,752 of burden that had exceeded the 24-month period for offsetting. This balance relates to the Aquaculture Activities Regulations (SOR/2015-177), which were registered on June 29, 2015. The regulation introduced $409,513 in administrative burden on business, of which the department has already offset $151,761. This situation has been reported in previous annual reports to Parliament, and officials from TBS and from Fisheries and Oceans Canada continue to work together to identify opportunities to offset the remaining amount.

In the 2019–20 fiscal year, the Treasury Board approved the exemption of 19 regulations from the requirement to offset burden and titles:

- 5 were related to tax and tax administration

- 8 were related to non-discretionary obligations

- 6 were related to emergency, unique or exceptional circumstances

Figure 3 - Text version

Figure 3 provides an overview of the implementation of the one-for-one rule for regulations published in the 2019–20 fiscal year.

There were 14 new regulations added and 24 regulations repealed, resulting in 10 fewer regulations in the regulatory stock.

There were 19 exemptions to the one-for-one rule, including 5 exemptions for tax or tax administration, 8 non-discretionary obligations, and 6 emergency, unique or exceptional circumstances.

In total, 24 regulations increased burden by $1,642,821, and 15 regulations decreased burden by $35,703,014, for a net decrease of $34,060,193 in administrative burden costs.

Section 3: update on the Administrative Burden Baseline

The Administrative Burden Baseline

The Administrative Burden Baseline (ABB) provides Canadians with a count of the total number of administrative requirements on businesses in federal regulations (GIC and non-GIC) and associated forms.

For the purposes of the ABB, an administrative requirement is a compulsion, obligation, demand or prohibition placed on a business, its activities or its operations through a GIC or non-GIC regulation. A requirement may also be thought of as any obligation that a business must satisfy to avoid penalties or delays. Regulatory requirements generally use directive words or phrases such as “shall,” “must,” and “is to,” and the ABB counts these references in the regulatory text or other documents.

The ABB was first publicly reported on in September 2014, providing a baseline count of administrative requirements by regulator. Since then, regulators continue to:

- do a count of their administrative requirements occurring from July 1 to June 30 each year

- publicly post updates to their ABB count by September 30 each year

Key findings on the Administrative Burden Baseline

The baseline provides Canadians with information on 39 regulators.

As of June 30, 2019:

- the total number of administrative requirements was 132,483, a decrease of 3,896 (or 2.9%) from the 2018 count of 136,379

- there were 586 regulations identified by regulators as having administrative requirements, an increase of 1 (or 0.17%) from the 2018 figure of 585

- the average number of administrative requirements per regulation was 226.1, a decrease of 6.6 (or 2.8%) from the 2018 average of 232.7

The top three changes in the ABB in 2019 were:

- The Canadian Food Inspection Agency (CFIA) reduced its count by 6,921 requirements (from 12,075 to 5,154) as a result of amendments, modifications and changes made to CFIA regulations, directives and forms, mainly in relation to the Safe Food for Canadians Regulations (SOR/2018-108). Fifteen regulations administered and enforced by the CFIA were amended or repealed, nine incorporated directives were modified, existing forms were updated, and new forms were introduced to collect data to enable evidence-based decision-making.

- Environment and Climate Change Canada’s requirements increased by 1,152 (from 11,390 to 12,542) mainly as a result of new requirements under the Prohibition of Asbestos and Products Containing Asbestos Regulations (SOR/2018-196) and the Output-Based Pricing Systems Regulations (SOR/2019-266).

- Transport Canada’s requirements increased by 845 (from 30,749 to 31,594) as a result of minor increases associated with several new regulations and regulatory amendments.

A detailed summary of the ABB count for 2019 and for previous years can be found in Appendix C.

Appendix A: detailed report on cost-benefit analyses for the 2019–20 fiscal year

Figures in this appendix are taken from the RIASs in final federal regulations published in the Canada Gazette, Part II, in the 2019–20 fiscal year. To remove the effect of inflation, figures are expressed in 2012 dollars and vary from those published in the RIASs.

Table A1 shows regulations finalized in the 2019–20 fiscal year that had significant cost impacts and that included both monetized benefits and monetized costs. These regulations may also include quantitative and qualitative data from a cost-benefit analysis (CBA) to supplement the monetized CBA.

| Department or agency | Regulation | Benefits (total present value) | Costs (total present value) | Net present value |

|---|---|---|---|---|

| Transport Canada | Regulations Amending the Transportation of Dangerous Goods Regulations (Containers for Transport of Dangerous Goods by Rail) (SOR/2019-75) (medium impact) | $195,601,649 | $16,651,917 | $178,949,732 |

| Health Canada | Corded Window Coverings Regulations (SOR/2019-97) (high impact) | $72,087,433 | $135,222,222 | -$63,134,789 |

| Transport Canada | Air Passenger Protection Regulations (SOR/2019-150) (significant cost impact) | $1,509,600,000 | $1,423,500,000 | $86,100,000 |

| Natural Resources Canada | Regulations Amending the Energy Efficiency Regulations, 2016 (Amendment 16) (SOR/2019-163) (high impact) | $1,791,626,529 | $507,700,652 | $1,283,925,877 |

| Natural Resources Canada | Regulations Amending the Energy Efficiency Regulations, 2016 (Amendment 15) (SOR/2019-164) (high impact) | $3,847,134,055 | $1,370,986,079 | $2,476,147,976 |

| Transport Canada | Regulations Amending the Commercial Vehicle Drivers Hours of Service Regulations (Electronic Logging Devices and Other Amendments) (SOR/2019-165) (high impact) | $346,981,844 | $272,949,198 | $74,032,646 |

| Transport Canada | Regulations Amending the Transportation Information Regulations (Air Travel Performance Data Collection) (SOR/2019-166) (significant cost impact) | $1,417,502 | $13,083,964 | -$11,666,462 |

| Health Canada |

Safety of Sperm and Ova Regulations (SOR/2019-192) (significant cost impact) Includes the following: |

$96,939 | $10,497,630 | -$10,400,691 |

| Indigenous Services Canada | Indian Oil and Gas Regulations (SOR/2019-196) (significant cost impact) | $75,312,566 | $432,493 | $74,880,073 |

| Health Canada |

Regulations Amending the Cannabis Regulations (New Classes of Cannabis) (SOR/2019-206) (significant cost impact) Includes the Order Amending Schedules 3 and 4 to the Cannabis Act (SOR/2019-207) |

$12,198,861 | $50,618,053 | -$38,419,192 |

| Labour Program |

Regulations Amending the Canada Student Financial Assistance Regulations (SOR/2019-214) (significant cost impact) Includes the following:

|

$1,939,146,324 | $1,567,782,353 | $371,363,971 |

| Innovation, Science and Economic Development Canada (Corporations Canada) | Regulations Amending the Canada Business Corporations Regulations, 2001 (SOR/2019-225) (medium impact) | $35,646,443 | $35,646,443 | $0 |

| Department of Finance Canada | Regulations Amending Certain Regulations Made Under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, 2019 (SOR/2019-240) (high impact) | $1,867,698 | $69,868,122 | -$68,000,424 |

| Canada Border Services Agency | Exit Information Regulations (SOR/2019-241) (high impact) | $325,847,645 | $100,618,714 | $225,228,931 |

| Labour Program | Regulations Amending the Canada Occupational Health and Safety Regulations (SOR/2019-243) (medium impact) | $33,288,529 | $19,507,794 | $13,780,735 |

| Canadian Transportation Agency | Accessible Transportation for Persons with Disabilities Regulations (SOR/2019-244) (significant cost impact) | $574,730,000 | $46,150,000 | $528,580,000 |

| Environment and Climate Change Canada | Output-Based Pricing System Regulations (SOR/2019-266) (significant cost impact) | $2,941,235,382 | $976,154,423 | $1,965,080,960 |

| Health Canada | Regulations Amending the Patented Medicines Regulations (Additional Factors and Information Reporting Requirements) (SOR/2019-298) (high impact) | $8,194,465,228 | $8,252,079,822 | -$57,614,594 |

| Public Services and Procurement Canada (Canada Post Corporation) |

Regulations Amending the Letter Mail Regulations (SOR/2020-5) (significant cost impact) Includes the following: |

$55,391,397 | $55,391,397 | $0 |

| TotalFootnote * | $21,953,676,024 | $14,924,841,277 | $7,028,834,747 | |

Table Footnote

|

||||

Table A2 shows regulations finalized in the 2019–20 fiscal year that had significant cost impacts and that included monetized costs only. Under the previous Cabinet Directive on Regulatory Management, medium-impact proposals could express benefits in quantitative or qualitative terms in situations where it was impractical to monetize those benefits. Similarly, under the new Cabinet Directive on Regulation, if it is not possible to quantify the benefits or costs of a proposal that has significant cost impacts, a rigorous qualitative analysis of costs or benefits of the proposed regulation is required, with the concurrence of the Treasury Board of Canada Secretariat.

Table A3 shows regulations finalized in the 2019–20 fiscal year that had significant cost impacts and that did not include monetized benefits and costs.

| Department or agency | Regulation |

|---|---|

| Agriculture and Agri-Food Canada | Regulations Amending the Agricultural Marketing Programs Regulations (SOR/2019-157) (significant cost impact) |

Appendix B: detailed report on the one-for-one rule for the 2019–20 fiscal year

| Department or agency | Regulation | Net title change |

|---|---|---|

| New regulatory titles that have administrative burden | ||

| Transport Canada | Transportation of Dangerous Goods by Rail Security Regulations (SOR/2019-113) | 1 |

| Health Canada | Reimbursement Related to Assisted Human Reproduction Regulations (SOR/2019-193) | 1 |

| Canadian Transportation Agency | Accessible Transportation for Persons with Disabilities Regulations (SOR/2019-244) | 1 |

| Environment and Climate Change Canada | Output-Based Pricing System Regulations (SOR/2019-266) | 1 |

| Health Canada | Vaping Products Labelling and Packaging Regulations (SOR/2019-353) | 1 |

| Subtotal | 5 | |

| Repealed regulatory titles | ||

| Atlantic Pilotage Authority Canada |

Regulations Repealing the Atlantic Pilotage Authority Non-compulsory Area Regulations (SOR/2019-80) repealed: |

(1) |

| Environment and Climate Change Canada |

Regulations Repealing the Chlor-Alkali Mercury Release Regulations (SOR/2019-88) repealed:

|

(1) |

| Health Canada |

Regulations Amending and Repealing Certain Regulations Made Under the Financial Administration Act (SOR/2019-134) repealed: |

(3) |

| Department of Finance Canada |

Order Repealing the United States Surtax Order (Steel and Aluminum) (SOR/2019-143) repealed:

Note: The one-for-one rule section of the RIAS did not indicate that the repeal of the regulatory title would be counted as a title out under element B of the one-for-one rule. It has been counted as a title out despite this omission. |

(1) |

| Department of Finance Canada |

Order Repealing the United States Surtax Order (Other Goods) (SOR/2019-144) repealed:

Note: The one-for-one rule section of the RIAS did not indicate that the repeal of the regulatory title would be counted as a title out under element B of the one-for-one rule. It has been counted as a title out despite this omission. |

(1) |

| Public Services and Procurement Canada |

Regulations Repealing the Publication of Statutes Regulations (SOR/2019-175) repealed:

Note: The one-for-one rule section of the RIAS did not indicate that the repeal of the regulatory title would be counted as a title out under element B of the one-for-one rule. It has been counted as a title out despite this omission. |

(1) |

| Environment and Climate Change Canada |

Order Repealing Certain Legislative Instruments (SOR/2019-268) repealed: |

(2) |

| Department of Finance Canada |

Regulations Repealing the CCRFTA Non-entitlement to Preference Regulations (SOR/2019-291) repealed:

|

(1) |

| Health Canada |

Regulations Amending the Hazardous Materials Information Review Regulations and Repealing the Hazardous Materials Information Review Act Appeal Board Procedures Regulations (SOR/2020-39) repealed: |

(1) |

| Subtotal | (12) | |

| New regulatory titles that simultaneously repealed and replaced existing titles | ||

| Health Canada |

Corded Window Coverings Regulations (SOR/2019-97) replaced:

|

0 |

| Environment and Climate Change Canada |

Preclearance in Canada Regulations (SOR/2019-183) replaced:

|

(3) |

| Health Canada |

Safety of Sperm and Ova Regulations (SOR/2019-192) replaced: |

0 |

| Indigenous Services Canada |

Indian Oil and Gas Regulations (SOR/2019-196) replaced:

|

0 |

| Public Safety Canada |

Cannabis Tracking System Order (SOR/2019-202) replaced:

|

0 |

| Innovation, Science and Economic Development Canada |

Patent Rules (SOR/2019-251) replaced:

|

0 |

| Transport Canada |

Environmental Response Regulations (SOR/2019-252) replaced:

|

0 |

| Environment and Climate Change Canada |

Information and Management of Time Limits Regulations (SOR/2019-283) replaced: |

0 |

| Fisheries and Oceans Canada |

Authorizations Concerning Fish and Fish Habitat Protection Regulations (SOR/2019-286) replaced: |

0 |

| Subtotal | (3) | |

| Total net impact on regulatory stock in the 2019–20 fiscal year | (10) | |

| Department or agency | Regulation | Publication date | Exemption type |

|---|---|---|---|

| Department of Finance Canada | Order Amending the United States Surtax Remission Order, No. 2019-1 (SOR/2019-104) | May 1, 2019 | Tax or tax administration |

| Department of Finance Canada | Large Diameter Line Pipe Anti-dumping Duty Remission Order (SOR/2019-261) | July 10, 2019 | Tax or tax administration |

| Department of Finance Canada | Order Amending the United States Surtax Remission Order, No. 2019-2 (SOR/2019-262) | July 10, 2019 | Tax or tax administration |

| Department of Finance Canada | Fabricated Industrial Steel Components Anti-dumping and Countervailing Duty Remission Order (SOR/2019-297) | August 21, 2019 | Tax or tax administration |

| Department of Finance Canada | Surtax on the Importation of Certain Steel Goods Remission Order (SOR/2019-315) | September 4, 2019 | Tax or tax administration |

| Fisheries and Oceans Canada | Regulations Amending the Coastal Fisheries Protection Regulations (SOR/2019-218) | June 26, 2019 | Non-discretionary obligation |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2019-71) | April 3, 2019 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Ukraine) Regulations (SOR/2019-72) | April 3, 2019 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Order Amending the Export Control List (SOR/2019-92) | April 17, 2019 | Non-discretionary obligation |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Venezuela) Regulations (SOR/2019-106) | May 1, 2019 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Brokering Control List (SOR/2019-220) | June 26, 2019 | Non-discretionary obligations |

| Global Affairs Canada | Brokering Permit Regulations (SOR/2019-221) | June 26, 2019 | Non-discretionary obligations |

| Global Affairs Canada | Order Amending the Export Control List (Arms Trade Treaty) (SOR/2019-223) | June 26, 2019 | Non-discretionary obligations |

| Global Affairs Canada | Special Economic Measures (Nicaragua) Regulations (SOR/2019-232) | July 10, 2019 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Special Economic Measures (Nicaragua) Permit Authorization Order (SOR/2019-233) | July 10, 2019 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Order Amending the General Import Permit No. 80 — Carbon Steel (SOR/2019-317) | September 4, 2019 | Non-discretionary obligations |

| Global Affairs Canada | Order Amending the General Import Permit No. 81 — Specialty Steel Products (SOR/2019-318) | September 4, 2019 | Non-discretionary obligations |

| Global Affairs Canada | General Import Permit No. 83 — Aluminum Products (SOR/2019-319) | September 4, 2019 | Non-discretionary obligations |

| Public Safety Canada | Regulations Amending the Regulations Establishing a List of Entities (SOR/2019-231) | June 26, 2019 | Emergency, unique or exceptional circumstance |

Appendix C: administrative burden count

| Department or agencyFootnote * | 2014 (baseline count) | 2017 | 2018 | 2019 | ||||

|---|---|---|---|---|---|---|---|---|

| Requirements | Regulations | Requirements | Regulations | Requirements | Regulations | Requirements | Regulations | |

| Agriculture and Agri-Food Canada | 134 | 4 | 133 | 4 | 133 | 4 | 133 | 4 |

| Canada Border Services Agency | 1,426 | 30 | 1,473 | 30 | 1,473 | 30 | 1,274 | 30 |

| Canada Energy Regulator | 1,298 | 14 | 4,012 | 13 | 4,539 | 13 | 4,563 | 14 |

| Canada Revenue Agency | 1,776 | 30 | 1,807 | 30 | 1,808 | 31 | 1,824 | 30 |

| Canadian Dairy Commission | 4 | 2 | 4 | 2 | 4 | 2 | 4 | 2 |

| Impact Assessment Agency of Canada | 89 | 1 | 89 | 1 | 89 | 1 | 206 | 1 |

| Canadian Food Inspection Agency | 10,989 | 34 | 12,047 | 21 | 12,075 | 23 | 5,154 | 11 |

| Canadian Grain Commission | 1,056 | 1 | 1,056 | 1 | 1,056 | 1 | 1,056 | 1 |

| Canadian Heritage | 797 | 3 | 802 | 3 | 700 | 3 | 706 | 3 |

| Canadian Intellectual Property Office | 569 | 6 | 568 | 6 | 543 | 5 | 613 | 5 |

| Canadian Nuclear Safety Commission | 8,169 | 10 | 8,169 | 10 | 7,007 | 10 | 6,993 | 10 |

| Canadian Pari-Mutuel Agency | 731 | 2 | 731 | 2 | 731 | 2 | 731 | 2 |

| Canadian Transportation Agency | 545 | 7 | 545 | 7 | 545 | 7 | 545 | 7 |

| Competition Bureau Canada | 444 | 3 | 444 | 3 | 444 | 3 | 444 | 3 |

| Copyright Board Canada | 16 | 1 | 17 | 1 | 17 | 1 | 17 | 1 |

| Crown-Indigenous Relations and Northern Affairs CanadaFootnote † | 0 | 0 | 0 | 0 | 0 | 0 | 247 | 11 |

| Employment and Social Development Canada | 2,791 | 7 | 3,100 | 6 | 3,102 | 6 | 3,102 | 6 |

| Environment and Climate Change Canada | 9,985 | 53 | 11,515 | 52 | 11,390 | 51 | 12,542 | 53 |

| Farm Products Council of Canada | 47 | 3 | 47 | 3 | 47 | 3 | 47 | 3 |

| Department of Finance Canada | 1,818 | 42 | 1,928 | 42 | 1,928 | 42 | 2,027 | 43 |

| Fisheries and Oceans Canada | 5,350 | 30 | 5,367 | 30 | 5,367 | 30 | 5,368 | 30 |

| Global Affairs Canada | 2,809 | 55 | 2,774 | 56 | 2,896 | 60 | 2,921 | 62 |

| Health Canada | 15,649 | 95 | 15,283 | 31 | 15,879 | 31 | 16,495 | 33 |

| Immigration, Refugees and Citizenship Canada | 14 | 1 | 59 | 1 | 59 | 1 | 59 | 1 |

| Indigenous and Northern Affairs CanadaFootnote † | 288 | 12 | 288 | 12 | 288 | 12 | 0 | 0 |

| Indigenous Services CanadaFootnote † | 0 | 0 | 0 | 0 | 0 | 0 | 148 | 1 |

| Innovation, Science and Economic Development Canada | 1,693 | 8 | 1,332 | 7 | 1,415 | 8 | 1,419 | 8 |

| Labour Program | 21,468 | 32 | 21,791 | 17 | 22,081 | 17 | 22,168 | 19 |

| Measurement Canada | 335 | 2 | 359 | 2 | 359 | 2 | 359 | 2 |

| Natural Resources Canada | 4,507 | 28 | 4,432 | 28 | 4,312 | 26 | 4,363 | 26 |

| Office of the Superintendent of Bankruptcy Canada | 799 | 4 | 799 | 3 | 799 | 3 | 799 | 3 |

| Office of the Superintendent of Financial Institutions Canada | 2,875 | 33 | 2,586 | 23 | 2591 | 23 | 2,642 | 24 |

| Parks Canada | 773 | 25 | 773 | 25 | 773 | 25 | 773 | 25 |

| Patented Medicine Prices Review Board Canada | 59 | 1 | 59 | 1 | 59 | 1 | 59 | 1 |

| Public Health Agency of Canada | 42 | 2 | 189 | 2 | 189 | 2 | 189 | 2 |

| Public Safety Canada | 229 | 6 | 229 | 6 | 229 | 6 | 229 | 6 |

| Public Services and Procurement Canada | 388 | 1 | 498 | 1 | 498 | 1 | 498 | 1 |

| Statistics Canada | 157 | 1 | 157 | 1 | 157 | 1 | 157 | 1 |

| Transport Canada | 29,695 | 94 | 30,611 | 95 | 30,749 | 96 | 31,594 | 99 |

| Treasury Board of Canada Secretariat | 46 | 1 | 48 | 2 | 48 | 2 | 15 | 2 |

| Total | 129,860 | 684 | 136,121 | 580 | 136,379 | 585 | 132,483 | 586 |

Table Footnotes

|

||||||||

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2020, ISSN: 2561-4290