Evaluation of the International Public Sector Accounting Standards Board Contribution Program

Introduction

This report presents the results of the evaluation of the International Public Sector Accounting Standards Board (IPSASB) Contribution Program. The evaluation was conducted by the Internal Audit and Evaluation Bureau of the Treasury Board of Canada Secretariat (the Secretariat) and was included in the Secretariat's Five-Year Departmental Evaluation Plan. It was conducted in accordance with the Treasury Board Policy on Evaluation and the Financial Administration Act, which require an evaluation of the relevance and the performance of all grant and contribution programs every five years

Why Is This Program Important?

The Government of Canada adopted accrual-based accounting standards in 2004. However some governments continue to report on a cash basis which does not account for significant liabilities, such as loans, investments and employee pensions, or for assets such as properties, plants and equipment. The IPSASB encourages them to adopt the International Public Sector Accounting Standards (the Standards), which are accrual-based. The adoption of the Standards is expected to improve financial management and to increase transparency, resulting in a more comprehensive and accurate view of a government’s financial position.Footnote 1 The contribution program plays a role by supporting this work.

Program Context

The International Federation of Accountants (IFAC) is a global organization for the accountancy profession whose mission is to serve the public interest by contributing to the development of accounting standards and guidance, facilitating the adoption of them and strengthening the worldwide accountancy profession.

The IPSASB is one of four independent standard-setting boards under IFAC. It develops accounting standards and guidance for use by public sector entities. Its strategic objective is to strengthen public financial management and knowledge globally through increasing adoption of accrual-based standards by:

- Developing high-quality financial reporting standards;

- Producing publications for the public sector; and

- Raising awareness of the Standards and the benefits of their adoption.Footnote 2

Results At A Glance

- The contribution program is relevant, consistent with federal priorities, roles and responsibilities, and is consistent with the Secretariat’s strategic outcome.

- The contribution program is achieving its expected outcomes to a large extent; however, the international scope of the long-term outcomes prevented the evaluation team from effectively assessing their achievement.

- The contribution program is economical. Renewing it on a multi-year basis will support its efficiency.

- The recent economic and financial crises in Europe have highlighted the importance of international public sector accounting standards for complete and transparent financial reporting.

Program Background

The Secretariat implemented the contribution program in 2006 to support the development of the Standards and to increase Canada’s visibility and participation in the setting of these StandardsFootnote 3.

The Standards are based on the International Financial Reporting StandardsFootnote 4.The IPSASB receives both financial and in-kind support from the Asian Development Bank, the Chartered Professional Accountants of Canada (CPA Canada), the South African Accounting Standards Board, and the governments of Canada, New Zealand and Switzerland.

Under the contribution program, the Secretariat provided quarterly disbursements to the IPSASB totalling C$1,800,000 since 2006-2007. The contribution supports ongoing policy work to develop high-quality accounting standards. Allowable expenses include professional fees, travel costs, salaries, supplies, communication costs, and facilitiesFootnote5.It is administered by the Government Accounting Policy and Reporting Division of the Financial Management Sector within the Office of the Comptroller General of Canada (OCG).

The expected outcomes of the contribution program, as outlined in its logic model (see Appendix A), are as follows:

Immediate outcomes

- IPSASB member countries participate in the development of international public sector accounting standards; and

- Increased participation of Canada in the development of international public sector accounting standards.

Intermediate outcomes

- High-quality international public sector accounting standards that are adopted and implemented by member countries; and

- Increased visibility of Canada’s contribution to international public sector accounting standards.

Final outcomes

- Convergence (i.e., adoption) of international public sector accounting standards;

- Strengthened public policy debate and decisions based on relevant financial information; and

- Strengthened public confidence through enhancement of quality and transparency of financial reporting.

Evaluation Context

This evaluation covers the five-year period from 2010-11 to 2014-15. It was calibratedFootnote 6 based on the contribution program’s low risk and very low materiality - it represents less than one per cent of the Secretariat’s direct program spending. In addition, the contribution program was evaluated in 2010 and was considered relevant and effective at that time; the evaluators therefore streamlined processes, lightened the evaluation team, and wrote a more focused report.

The evaluation team validated existing information and, when there were gaps, collected additional information using a document review, group interviews and an administrative data review.

The evaluation team's approach is consistent with the Standard on Evaluation for the Government of Canada and aligns with the Policy on Transfer Payments. (See Appendix B for the methodology).

Limitations of the Evaluation

Because the Secretariat’s contribution supports IPSASB administration, rather than a specific program or product, connecting the impact of that funding directly to the achievement of the IPSASB’s outcomes is challenging.

The evaluation included a limited, indirect investigation into the long-term outcomes that flow from the program’s international profile. The program’s low materiality did not warrant the cost of evaluating the long-term outcomes in more depth.

Relevance

Conclusion: The program remains relevant because it meets current and emerging needs in the public sector worldwide. The program is also consistent with the roles, responsibilities and priorities of the Government of Canada and the Secretariat.

The sovereign debt crisis and the financial crisis in Greece intensified demand for international public sector accounting standards. These events also demonstrated the need for better financial information and increased transparency in public sector reporting.

According to the document review, the IPSASB is the only international body that develops international public sector accounting standardsFootnote 7.The document review and the interviews identified areas where these standards still need to be developed, including public sector measurement, heritage properties, infrastructure, revenues, non-exchange expenses, and employee benefits.

The contribution program supports the work of the IPSASB, whose strategic objective is consistent with the priorities set out in the 2013 Speech from the Throne and the 2015 Budget. In addition, the Secretariat’s 2015-16 Report on Plans and Priorities indicated that they will continue to “contribute to the development of public sector accounting standards, domestically and internationally”.

The contribution program is also in keeping with the OCG’s role to provide “government-wide leadership, direction, oversight and capacity building for financial management, internal audit and the management of assets and acquired servicesFootnote 8.”

The document review shows not only that the Standards meet public sector needs, but also that they are used by the Government of Canada as a source of information on certain topics that are not addressed in the Canadian public sector accounting standards.

Program Performance

Conclusion: To a large extent, the contribution program is achieving its expected outcomes; however, the evaluation team found some ambiguity in the logic model.

The logic model is not supported by a narrative and a performance measurement strategy, which leaves it open to interpretation. Because of the international reach of the IPSASB and how the evaluation was calibrated, the evaluation team could not assess the achievement of long-term outcomes effectively. Nonetheless, the team was able to make some observations based on the available data.

Increased participation by Canada

The IPSASB has a rigorous and transparent consultation process for drafting standards and for developing the strategic plan that guides its activities. Its consultation process gives countries and international organizations opportunities to comment on draft standards and on the proposed strategic direction. According to interviewees and the document review, each standard is issued through an “exposure draft,” which explains the context, objectives, scope, issues and proposed changes. The exposure draft is followed by a consultation period of about 120 days.

The administrative data review, which compared current data with those from the previous evaluation, showed that Canada’s participation in the IPSASB’s consultation process has increased. This increase resulted mainly from the consultations on the development of a conceptual framework. The conceptual framework sets out the concepts that will direct the IPSASB’s approach to standard-setting for the future.

The administrative data showed that Canada contributed 91 position papers between 2010 and 2015, nearly three times more than in the previous five-year period (Table 1), and about 10 per cent of overall contributions.

| 2005-2010 | 2010-2015 | |

|---|---|---|

| Position papers from Canada | 35 | 91 |

| Government of Canada | n/a | 14 |

| Provincial entities | n/a | 55 |

| Other entities | n/a | 22 |

Source: Data from previous evaluation and from IFAC

In addition to contributing position papers, the Secretariat promotes the Standards through meetings with provincial comptrollers and promotes the role of the IPSASB at conferences.

Participation of member countries

The evidence shows that other member countries significantly increased their participation in the development of the Standards, also partly through their involvement in the development of the conceptual framework.

A comparison of current administrative data with that from the previous evaluation showed that the IPSASB received 427 more position papers between 2010 and 2015 than it did during the previous five-year period. Countries and organizations contributed a total of 696 position papers between 2010 and 2015 compared with 269 between 2005 and 2010.

A number of international organizations also participate through non-voting observer status, which allows them to contribute to discussions at IPSASB meetings. These organizations include the Asian Development Bank, the World Bank, the European Commission, Eurostat, the International Monetary Fund, the United Nations, the Organisation for Economic Co-operation and Development, and the United Nations Development Program.

Canada’s Visibility

Canada has acquired a degree of visibility in the field of international public sector accounting as a result of the contribution program. It has provided nearly 10 per cent of the IPSASB’s entire budget since 2010, or over 25 per cent of donor funding (see “Financial Highlights” for more information). In addition, it has participated through the development of Standards, as discussed earlier.

Interviewees commented that since the IPSASB opened its offices in Toronto in 2006 and began sharing space with CPA Canada, Canada has strengthened its partnership with the IPSASB, more effectively supported discussions, increased its influence on the development of the Standards, and promoted awareness of the Canadian context among Board members.

Finally, Canada’s visibility remains strong because Canada is the only country that has two representatives (one from the OCG and one from the Public Sector Accounting Board), who have served on the organization’s board of directors since 2008.

Standards are adopted and implemented by member countries

The IPSASB’s administrative data indicate that the number of countries that have adopted the Standards, or that are in the process of adopting them, has increased from 80 (at the time of the last evaluation), to the current 93.

In spite of the progress, the document review highlighted a number of factors that have an impact on the adoption rate. For example, the Standards are insufficiently adapted to public sector requirements, are incompatible with accounting laws in some European Union (EU) countries, and are costly to implement.Footnote 10

Convergence towards international public sector accounting standards

Achieving convergence towards the Standards enhances global transparency and accountability. Governments at all levels can use the Standards to report to taxpayers, to their elected legislature and to borrowers around the world. International convergence towards common standards strengthens the authority and credibility of the Standards.Footnote 11

The administrative data review showed that some international organizations, including the European Space Agency (in 2010) and the European Organisation for the Exploitation of Meteorological Satellites (in 2012), had adopted the Standards since the previous evaluation. These organizations joined others that had already done so, for example, the Organisation for Economic Co-operation and Development, the Council of Europe, the European Commission, INTERPOL, NATO and the Commonwealth Secretariat.

Strengthening public confidence

All of the interviewees indicated that the Standards have improved the quality and transparency of financial information. According to Eurostat (the statistical office of the EU), the harmonization of accrual-accounting systems makes it possible to produce comparable financial data and provides an opportunity for establishing a comprehensive and reliable picture of financial results.Footnote 12

The document review and the interviews also indicate that the Standards have enhanced the comparability, uniformity, clarity and credibility of public sector financial statements. The use of financial statements that are based on the Standards is therefore expected to foster more accurate resource allocation, more informed decision making and greater accountability on the part of governments.

Strengthening public policy debate

The document review indicates that the IPSASB's outreach activities promote the use of the Standards and encourage users to demand better financial information from governments. During the evaluation period, IPSASB members participated in over 1,000 events, including presentations, speeches and workshops.

The document review shows that the IPSASB has promoted public policy debate through these events. For example, Europe and Canada are engaged in discussions about their public policies.

The European Commission has conducted public consultations with member countries to assess the suitability of the Standards. According to the document review, the Standards remain a primary reference for the development of European public sector accounting standards, but they cannot easily be implemented because of the particular needs, characteristics and interests of the EU public sector.

Although the EU is developing its own public sector accounting standards, the interviews and the administrative data review show that certain member countries (the Baltic States, Slovakia, Austria, Romania, Bulgaria, the Republic of Malta, and Portugal) have converged towards IPSASB's Standards instead of waiting for EU standards.

Efficiency and Economy

Efficiency and economy of the contribution program

Conclusion: The contribution program operates economically; however, its efficiency could be improved.

According to interviewees, the program is economical in that administration accounts for less than one full-time equivalent, but it could be more efficient. The document review and the interviews indicated that since 2011, the Secretariat has renewed the IPSASB contribution on an annual rather than multi-year basis. Renewing every year is noticeably less efficient than renewing every three or more years. Reducing the frequency of program renewal would increase program efficiencies. In addition, the administrative data showed that delays in program approval led to delays in the actual payment of the contributions.

Economy of the International Public Sector Accounting Standards Board

The document review and the interviews indicated that the IPSASB is operating economically, for the following reasons:

- Since 2012, the board of directors has held three of its four meetings in North America (at least two in Toronto) to minimize travel expenses for most members.

- IFAC shares a number of services, including human resources and communications, with the IPSASB.

- The board of directors serves in a volunteer capacity. However the position of Chair will be remunerated starting in 2016 because it has virtually become a full-time role.Footnote 13 The IPSASB explains that the level of uptake of the standards and the enhanced demands on the IPSASB as the standards setter for the public sector, led to the decision to establish the Chair as a compensated position.Footnote 14

- CPA Canada provides in-kind contributions by sharing its office space with IPSASB.

Financial highlights

According to IFAC's financial statements, the IPSASB's budget was US$2.0 million in 2014. Of this, C$200,000 (approximately US$179,935 based on the exchange rate at the time of quarterly payments) came from the Secretariat's contribution in the form of quarterly payments in the amount of approximately C$50,000.

The financial statements show that approximately 70 per cent of the IPSASB's funding comes from IFAC (through membership fees, product sales and the contribution of the Forum of Firms and Transnational Auditors Committee) and that approximately 30 per cent comes from donors.

The Secretariat's funding has remained steady at nearly 10 per cent of the organization's entire budget, or over 25 per cent of donor funding, since 2010. According to all of the interviewees, the Secretariat's contribution remains vital to IPSASB, however funding remains a challenge for the IPSASB in its efforts to carry out its activities and projects. The data shows a decrease in donor funding since 2008 and a corresponding increase in IFAC's funding ratio.

Table 2. International Public Sector Accounting Standards Board budget (US$)Footnote 15

| 2008 | 2010 | 2012 | 2014 | |

|---|---|---|---|---|

| Budget (revenue) | 1,514,015 | 1,845,757 | 2,229,760 | 2,007,617 |

| Donor funding | 744,375 | 779,056 | 772,094 | 636,507 |

| Ratio (IFAC/ donors) | 50/50 | 60/40 | 65/35 | 70/30 |

Source: International Federation of Accountants

The financial statements also show that resources from all Canadian sources combined (funding from the Secretariat and CPA Canada) represents approximately 20 per cent of the IPSASB's annual budget, or 50 per cent of donor funding, since 2010. Other donors include the World Bank, the Asian Development Bank, and the government of New Zealand.

Table 3. International Public Sector Accounting Standards Board Donor Funding (US$)Footnote 16

| Donors | 2010 | 2012 | 2014 |

|---|---|---|---|

| Asian Development Bank | 0 | 100 000 | 100 000 |

| World Bank | 250,000 | 187,000 | 90,000 |

| CPA Canada | 178,260 | 171,460 | 181,390 |

| Global Accounting Alliance | 0 | 100,000 | 0 |

| Secretariat | 195,431 (C$200,000) |

195,875 (C$200,000) |

179,935 (C$200,000) |

| New Zealand | 35,523 | 61,441 | 85,182 |

| United Nations | 100,000 | 0 | 0 |

Conclusion and Recommendations

Conclusion

The findings of this evaluation indicate that the contribution program remains relevant and is achieving its expected outcomes, although its efficiency could be improved. They also indicate that the program supports the achievement of the IPSASB's expected outcomes.

The evaluation did raise the following questions:

- On what basis was the level of the Secretariat's contribution funding for the IPSASB determined, and should it be re-examined after this evaluation, since it was established 10 years ago?

- What is the impact of the adoption of accrual-based accounting on countries and organizations?

- Can the program be more efficient by providing one lump sum rather than issuing quarterly payments?

Recommendation 1

It is recommended that the OCG continue renewing the contribution agreement on a multi-year basis to increase efficiency.

Recommendation 2

It is recommended that the OCG revise the current logic model to clarify the expected outcomes and to develop performance indicators for them.

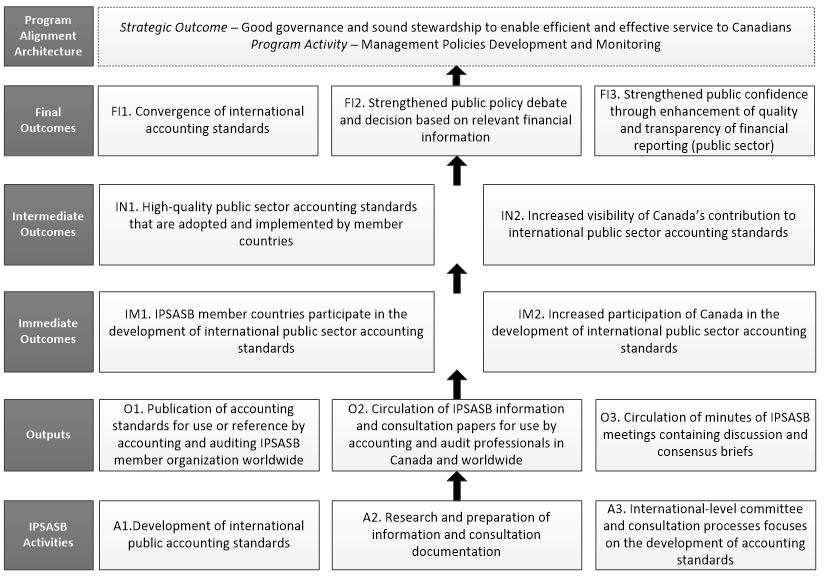

Appendix A: Logic Model

The logic model depicts the activities, outputs and immediate, intermediate and final outcomes of the IPSASB contribution program.

Figure 1 - Text version

This graphic illustrates the logic model of the International Public Sector Accounting Standards Board (IPSASB) contribution program. The logic model shows TBS strategic outcome which is "Good governance and sound stewardship to enable efficient and effective service to Canadians". Within the program alignment architecture, the IPSASB contribution program falls within the program activity knows as "Management policies development and monitoring".

The final outcomes of the contribution program are "Convergence of international accounting standards", "Strengthened public policy debate and decision based on relevant financial information" and "Strengthened public confidence through enhancement of quality and transparency of financial reporting (from the public sector)".

There are two intermediate outcomes which contribute to its final outcomes which are: "High-quality public sector accounting standards that are adopted and implemented by member countries" and "Increased visibility of Canada's contribution to international public sector accounting standards".

The contribution program's two immediate outcomes aim to contribute to the intermediate outcomes and are: "IPSASB member countries participate in the development of international public sector accounting standards" and "Increased participation of Canada in the development of international public sector accounting standards".

The contribution program has three outputs which are intended to lead to the achievement of the immediate outcomes. The first output is "Publication of accounting standards for use or reference by accounting and auditing IPSASB member organization worldwide". The second is "Circulation of IPSASB information and consultation papers for use by accounting and audit professionals in Canada and worldwide". The last output is "Circulation of minutes of IPSASB meetings containing discussion and consensus briefs".

Three activities are intended to lead to the three outputs. These are, "Development of international public accounting standards", "Research and preparation of information and consultation documentation", and "International-level committee and consultation processes focuses on the development of accounting standards".

Appendix B: Methodology Approach

The program evaluation of the International Public Sector Accounting Standards Board (IPSASB) is organized around five evaluation questions to measure the program's relevance and performance.

| Core Issues | Evaluation Questions | |

|---|---|---|

| Relevance | ||

Continued need for program |

|

|

Alignment with government priorities |

|

|

Alignment with federal roles and responsibilities |

||

| Performance | ||

Achievement of expected outcomes |

|

|

Demonstration of efficiency and economy |

|

|

This evaluation is also based on data collected from the following three sources from to .

Document review

A document review was conducted to better understand the impacts of the contribution program. Evaluators reviewed key government documents, departmental documents, program's documents, International Federation of Accountants documents (e.g., annual reports, financial statements, strategic plan), IPSASB documents (e.g., meeting minutes, exposure drafts, the Standards, and work plans) and other relevant documents (e.g., study on the sustainability of the Standards and their impact).

Group interviews

The evaluation team conducted group interviews with 10 key informants. They formed six interview groups that divided informants into four categories: program managers, the International Federation of Accountants, the International Public Sector Accounting Standards Board, and Canadian stakeholders. The interviews were semi-structured, with open-ended questions that allowed individuals working in similar areas to build on one another's observations. Interviewees also validated the interview notes to ensure quality.

Analysis of administrative data

Administrative data was provided by the International Federation of Accountant (i.e., the financial data) and the International Public Sector Accounting Standards Board (i.e., the adoption rate toward these standards) in order to reduce the time required for data collection. The evaluation team validated this data through the document review and the interviews.

Appendix C: Management Response and Action Plan

Government Accounting Policy and Reporting Division has reviewed the evaluation and provided the following comments to the recommendations of the report.

| Recommendations | Proposed Action | Start Date | Targeted Completion Date | Office of Primary Interest |

|---|---|---|---|---|

Recommendation 1 It is recommended that the OCG continue to renew the contribution agreement on a multi-year basis to increase efficiency. |

No action required - approval to renew this contribution agreement was granted in July 2015 by the President of the Treasury Board for five years, from 2015-2016 to 2020 - 2021. |

N/A | N/A | OCG |

Recommendation 2 It is recommended that the OCG revise the current logic model in order to clarify the expected outcomes and to develop performance indicators for them. |

We agree with the recommendation. The OCG will review the logic model and develop performance indicators for the outcomes. |

OCG |

Page details

- Date modified: