Treasury Board of Canada Secretariat's Quarterly Financial Report for the Quarter Ended June 30, 2016

Statement outlining results, risks and significant changes in operations, personnel and programs

Table of Contents

1. Introduction

This quarterly report has been prepared by management as required by Section 65.1 of the Financial Administration Act (FAA) and manner prescribed by the Treasury Board (TB). The quarterly report should be read in conjunction with the Main Estimates and the Supplementary Estimates (A) as well as Budget Plan 2013, Budget Plan 2014, Budget Plan 2015, and Budget Plan 2016.

The quarterly report has been reviewed by the Departmental Audit Committee.

1.1 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Treasury Board Secretariat's (the Secretariat’s) spending authorities granted by Parliament and those used by the department, consistent with the Main Estimates and the Supplementary Estimates (A) for the 2016-17 fiscal year. The quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.2 Raison d'être

The Secretariat is the administrative arm of the TB, a committee of ministers. The Secretariat supports TB in undertaking the following principal roles:

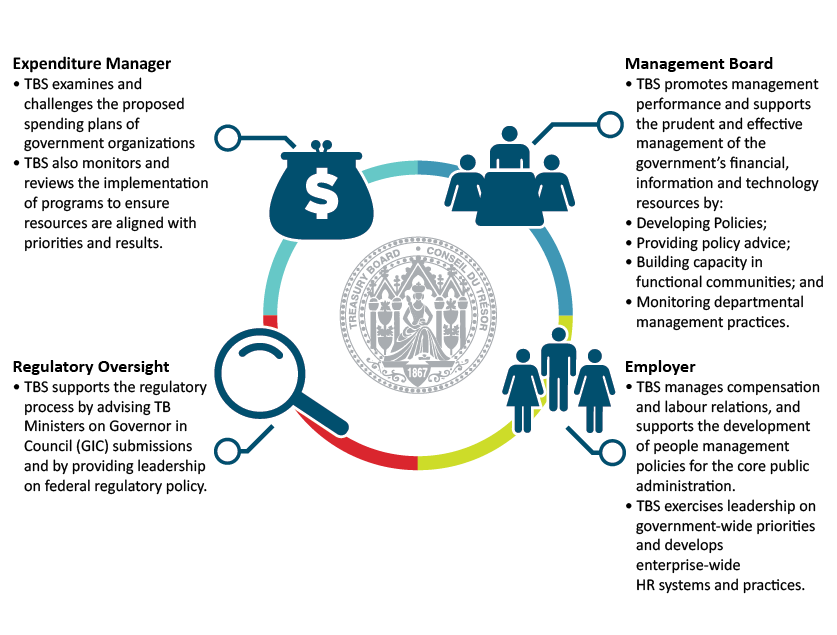

Figure 1 - Text version

The image depicts the four roles that the Secretariat undertakes to support the Treasury Board.

The image is a ring. In the middle of the ring is a graphic of the Treasury Board coat of arms.

Situated on the top left of the ring is a graphic of a pot of money that depicts the Expenditure Manager role.

Situated on the top right of the ring is a graphic of the silhouettes of three people standing behind a podium, one man with a woman on each side of him, that depicts the Management Board role.

Situated on the bottom left of the ring is a graphic of a magnifying glass that depicts the Regulatory Oversight role.

Situated on the bottom right of the ring is a graphic of the silhouettes of three people, one man with a woman on each side of him, that depicts the Employer role.

1.3 The Secretariat's financial structure

The Secretariat manages both departmental and Treasury Board Central votes. Its departmental operating expenditures and revenues are managed under Vote 1, Program Expenditures.

The Secretariat manages seven different Central votes:

- Vote 5, Government Contingencies which serves to supplement other appropriations to provide government departments and agencies temporary advances for urgent or unforeseen departmental expenditures between Parliamentary supply periods;

- Vote 10, Government-Wide Initiatives which serves to supplement other appropriations to support the implementation of strategic management initiatives that cut across many departments;

- Vote 15, Compensation Adjustments which serves to supplement other appropriations to provide funding for adjustments made to terms and conditions of service or employment of the federal public administration as a result of collective bargaining;

- Vote 20, Public Service Insurance which provides the employer's share of group benefit plan coverage costs as part of Treasury Board’s role as the employer of the core public administration. This includes the Public Service Health Care Plan (PSHCP), Public Service Dental Care Plan (PSDCP), Pensioners' Dental Services Plan (PDSP), Disability Insurance, Provincial Payroll Taxes (Manitoba, Newfoundland, Ontario and Québec), Public Service Management Insurance Plan (PSMIP) and other programs;

- Vote 25, Operating Budget Carry Forward which serves to supplement other appropriations for the carry forward of unused operating funds from the previous fiscal year, up to 5% of the operating budgets contained in an organization’s Main Estimates;

- Vote 30, Paylist Requirements which serves to supplement other appropriations to meet legal requirements for the government as employer for items such as parental benefits and severance payments; and

- Vote 33, Capital Budget Carry Forward which serves to supplement other appropriations for the carry forward of unused capital funds from the previous fiscal year, up to 20% of an organization’s Capital vote.

The funding within these votes is approved by Parliament. With the exception of Vote 20, funding within Central votes is transferred from the Secretariat to individual departments and agencies, once specified criteria are met. Like any other department, the Secretariat also receives its own share of appropriations from these votes. Any unused balance from these votes is returned to the fiscal framework at the end of the year and is reported as the Secretariat lapse.

Expenditures incurred against Statutory Authorities mainly reflect the government’s obligation to pay the employer's share of Public Service Pension Plans, Canada/Quebec Pension Plans (CPP/QPP), Employment Insurance (EI) premiums and Public Service Death Benefits. These expenditures are initially charged to the Secretariat's Statutory vote but are attributed throughout the fiscal year to individual departments’ Statutory votes, including that of the Secretariat.

This quarterly report will highlight the financial results of Vote 1 – Program Expenditures related to the delivery of the Secretariat's mandate, Vote 20 – Public Service Insurance related to TB's employer role, and Statutory Authorities related to the government's obligation to pay the employer's share of employee benefit plans.

2. Highlights of fiscal quarter and fiscal year-to-date

The following section highlights the financial results for the fiscal quarter ended June 30, 2016 and provides explanations of differences, exceeding a materiality threshold of $1M, as compared to the same period last year.

| - Authorities to | - Authorities to | Variance in Authorities | Year-to-date expenditures as at Q1 - | Year-to-date expenditures as at Q1 - | Variance in Expenditures | |

|---|---|---|---|---|---|---|

| Vote 1 - Program Expenditures | 236,703 | 255,058 | 18,354 | 46,325 | 49,600 | 3,275 |

| Vote 20 - Public Service Insurance | 2,250,071 | 2,338,971 | 88,900 | 562,064 | 563,359 | 1,295 |

| Statutory Authorities | 470,735 | 471,326 | 591 | -118,241 | -170,857 | -52,616 |

| Total | 2,957,509 | 3,065,354 | 107,845 | 490,147 | 442,102 | -48,046 |

Statement of voted and Statutory Authorities

Total budgetary authorities available for use increased in 2016-17 by $107.8M (3.6%) from those in 2015-16. The table below explains the changes in program funding that caused an increase in Vote 1 authorities of $18.4M, an increase in Vote 20 authorities of $88.9M, and an increase in authority to make statutory payments of $0.6M as explained below:

| Explanation of Changes (2016-17 compared to 2015-16) |

Change (thousands of dollars) |

|---|---|

| Vote 1 - Program Expenditures | |

|

Transfer-in of funding from other government departments and agencies to support the TBS-led Government-Wide Back Office Transformation Initiative

|

23,363

|

|

Transfer-in from the Privy Council Office for the Regulatory Cooperation Council Secretariat effective April 1, 2016, which facilitates closer regulatory cooperation between Canada and the United States

|

2,155

|

|

Funding received for a third-party resource alignment review of Shared Services Canada (SSC) that will look at SSC’s 2016 IT Transformation Plan, its revised service strategy, and its relationships with partner organizations, and recommend ways to improve the delivery of modernized IT services for the Government of Canada

|

2,144

|

|

Sunset of funding for the Workspace Renewal Initiative (Phase 1) which involved the consolidation of the Secretariat's operations from 11 locations to two office locations in downtown Ottawa

|

-6,043

|

|

Sunset of funding for the Web Renewal Initiative to streamline the Government of Canada Web presence which includes the consolidation of web content to Canada.ca

|

-1,103

|

|

Sunset of funding for the Workplace Wellness & Productivity Strategy to modernize sick leave and disability management in the federal public service

|

-932

|

|

Sunset of funding for the ongoing implementation of Canada’s Cyber Security Strategy

|

-921

|

|

Other miscellaneous decreases

|

-308

|

| Sub-total Program Expenditures | 18,354 |

| Vote 20 - Public Service Insurance | |

|

Restores funding to 2008 levels for employer payments related to Public Service Insurance. Savings resulting from the Strategic Review have now been fully achieved. Implementing the Strategic Review allowed the Secretariat to streamline operations, realign programs to core public service activities, and increase efficiency and effectiveness of group insurance and benefits program spending. The addition of $88.9 million in annual Vote 20 funding will partially address rising insurance and benefits costs, as the price and volume of benefits claimed continues to rise.

|

88,900

|

| Sub-total Public Service Insurance | 88,900 |

| Statutory | |

| Sub-total Statutory Authorities | 591 |

| Total Authorities | 107,845 |

Statement of departmental budgetary expenditures by standard object

At the end of Q1, budgetary expenditures had decreased by $48.0M (9.8%) as compared to the same period last year. The change in expenditures by standard object is summarized below:

| Standard Object | Explanation of Changes (2016-17 compared to 2015-16) |

Change (thousands of dollars) |

|---|---|---|

| Vote 1 - Program Expenditures | ||

| 4 Professional services |

The increase is primarily due to a new billing model introduced by the Department of Justice for legal service costs. As a result, the Secretariat will make three advance installments in 2016-17 (May - 50%, August - 40% and November - 10%) as opposed to paying monthly invoices for actual costs incurred. |

2,750

|

| Other | Miscellaneous Expenditures |

525

|

| Sub-total Program Expenditures | 3,275 | |

| Vote 20 - Public Service Insurance | ||

| 1 Personnel | The increase is primarily due to the timing of payments made by the Secretariat in 2016-17 to Public Services and Procurement Canada (PSPC) as compared to 2015-16, related to the employer paid premiums for the Disability Insurance Plan, which are subsequently transferred by PSPC to Sunlife, the insurance underwriter. The increase was partially offset by a decrease due to the timing of payments also remitted to PSPC for Provincial Payroll Taxes. PSPC subsequently transfers the latter to Quebec, Manitoba, Newfoundland and Ontario to fund provincial health and education programs. |

17,789

|

| 45/46 Vote- netted revenue |

This is mainly due to an increase in revenue received from pensioners to reflect changes implemented to the PSHCP, in order to achieve a 50-50 cost-sharing ratio with pensioners by April 1, 2018. The planned cost-sharing ratio is currently 37.5% for pensioners and 62.5% for the employer in this 2nd year of a four year gradual transition. To a lesser extent, the increase is also due to the timing of remittances made in 2016-17 by the Canada Revenue Agency (CRA) to the Secretariat, as compared to 2015-16. These remittances are for employer-paid benefits attributable to CRA employees supporting the administration of the CPP and EI programs. Such programs are accountable for the full cost of their operations including the cost of employer-paid benefits which are payable to Vote 20. |

-16,020

|

| Other | Miscellaneous Expenditures |

-474

|

| Sub-total Public Service Insurance | 1,295 | |

| Statutory | ||

| 1 Personnel | The Secretariat recovers from other government departments and agencies their share of the employer contributions under the Public Service Superannuation Act (PSSA). The majority of these contributions are then remitted to PSPC who subsequently transfers them to the Public Service Pension Investment Board. The decrease in statutory expenditures at Q1 is mainly due to the timing of payments to date, however the net effect on the financial statements of the Secretariat will be zero by year-end. |

-52,616

|

| Sub-total Statutory Items | -52,616 | |

| Total Expenditures | -48,046 | |

3. Risks and uncertainties

The Secretariat continued to operate in a dynamic environment, dominated by economic fluctuations, rapid technological change and a shifting demographic profile. Its risk landscape changed significantly as a result of the new mandate given to the President of the Treasury Board which included multiple new mandate priorities that need to be completed within a short timeframe. Each year the Secretariat identifies corporate level risks and develops response measures in order to minimize their likelihood and/or impact, as it advances its core responsibilities and key priority initiatives.

Slow pace of implementation

Due to the number and complexity of priority initiatives, the Secretariat may not have the necessary capacity to generate sustainable results in the expected timeframes.

To address this emerging risk, the Secretariat adopted a results and delivery approach by articulating clear goals and performance indicators that will be reported on a quarterly basis. This approach is being led by a Chief Results and Delivery Officer and supported by a small Results and Delivery Unit. Moving forward, the Secretariat's efforts will focus on further prioritization and sequencing as well as strengthening an evidenced based approach to implementation and decision making.

Limited IT capacity

Many priority initiatives are IT dependent and there is always a risk that the current IT infrastructure and expertise may not evolve at the desired pace and subsequently not adequately support the Secretariat's objectives. The Secretariat is acting to improve the acquisition of new IT infrastructure by strengthening its collaboration with Shared Services Canada. It will also focus on decommissioning old applications and optimizing its current IT infrastructure.

Insufficient capacity for delivery of government-wide projects

Insufficient capacity to support government-wide project delivery could also derail timely delivery of the Secretariat-led priorities. The Secretariat’s risk response is focusing on strengthening governance for the Back Office Transformation Initiative in order to lead an integrated approach to enterprise-wide decision-making and resource allocation, as well as the project delivery capacity for both the Back Office and other horizontal initiatives. Other responses include development of a change management and communication strategy.

Security vulnerabilities

Constantly evolving cyber and insider threats could result in significant disruptions to program and service delivery. To address the potential disruptions the Secretariat will be conducting regular government-wide exercises to identify and monitor gaps in existing capacity, and will be renewing the Policy on Government Security and associated guidelines, tools and training, to comply with the evolving internal and external environment.

Increasing costs of PSHCP

The cost of delivering the PSHCP is driven by many variables. As a result there could be significant shifts in spending in a given year due to: changes in plan membership; the cost of drugs and medical treatments; use of plan entitlements; and provincial tax regulations. The Secretariat continues to closely monitor spending activity and trends in Vote 20.

4. Significant changes in relation to operations, personnel and programs

This section highlights significant changes to Operations, Personnel and Programs which occurred in the Secretariat during the first quarter of the fiscal year.

As of April 1, 2016, the Regulatory Cooperation Council (RCC) Secretariat, previously housed in the Privy Council Office (PCO), rejoined the Secretariat. The RCC was originally housed at the Secretariat when it was created in early 2011, and was moved to PCO in 2012. The RCC facilitates closer regulatory cooperation between Canada and the United States, while maintaining high levels of protection for health, safety and the environment for Canadians.

TB approved the new Policy on Results in June 2016. The new Policy directly supports the government's commitment to deliver and demonstrate progress towards clear results for Canadians. The new approach aims to improve how the government articulates its results, measures performance, allocates and aligns resources to core responsibilities and priorities, and reports on outcomes that matter most to Canadians. By implementing the new approach, both Canadians and Parliamentarians will receive clear, transparent, useful information on the results that departments have achieved and the resources used to do so. Departments are expected to begin reporting using their new Departmental Results Frameworks in Estimates and Public Accounts, as of the 2018-19 fiscal year.

5. Approval by Senior Officials

Approved by,

Original signed by Bill Matthews for

Yaprak Baltacıoğlu, Secretary

Original signed by

Renée LaFontaine, Chief Financial Officer

Ottawa, Canada

Date:

Appendix

For the quarter ended

| Fiscal year - | Fiscal year - | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending | Expended during the quarter ended | Year to date used at quarter-end | Planned expenditures for the year ending | Expended during the quarter ended | Year to date used at quarter-end | |

Table 1 Notes

|

||||||

| Expenditures: | ||||||

|

1 Personnel

|

3,354,698,206 | 557,057,286 | 557,057,286 | 3,462,453,905 | 522,851,221 | 522,851,221 |

|

2 Transportation and communications

|

2,197,671 | 254,941 | 254,941 | 1,915,895 | 306,445 | 306,445 |

|

3 Information

|

522,397 | 31,748 | 31,748 | 363,980 | 61,309 | 61,309 |

|

4 Professional and special services

|

69,615,421 | 12,688,822 | 12,688,822 | 89,553,399 | 14,722,393 | 14,722,393 |

|

5 Rentals

|

3,806,894 | 251,649 | 251,649 | 2,535,535 | 220,421 | 220,421 |

|

6 Repair and maintenance

|

610,064 | 9,511 | 9,511 | 1,230,818 | 37,590 | 37,590 |

|

7 Utilities, materials and supplies

|

760,963 | 79,592 | 79,592 | 1,457,617 | 50,664 | 50,664 |

|

9 Acquisition of machinery and equipment

|

2,526,721 | 800,776 | 800,776 | 3,803,533 | 635,979 | 635,979 |

|

10 Transfer payments

|

500,000 | 406,359 | 406,359 | 500,000 | 1,301 | 1,301 |

|

12 Other subsidies and payments

|

7,261,676 | 1,152,860 | 1,152,860 | 2,448,746 | 1,820,220 | 1,820,220 |

|

Total gross budgetary expenditures

|

3,442,500,013 | 572,733,545 | 572,733,545 | 3,566,263,428 | 540,707,543 | 540,707,543 |

| Less Revenues netted against expenditures: | ||||||

|

Vote Netted Revenues (VNR) - Centrally managed items

|

-471,752,479 | -82,586,189 | -82,586,189 | -489,060,581 | -98,605,858 | -98,605,858 |

|

Vote Netted Revenues (VNR) - Program expenditures

|

-13,238,655 | 0 | 0 | -11,848,562 | 0 | 0 |

|

Total Revenues netted against expenditures

|

-484,991,134 | -82,586,189 | -82,586,189 | -500,909,143 | -98,605,858 | -98,605,858 |

| Total net budgetary expenditures | 2,957,508,879 | 490,147,356 | 490,147,356 | 3,065,354,285 | 442,101,685 | 442,101,685 |

| Government-Wide Expenses included abovetable note 1 * | ||||||

|

1 Personnel

|

3,162,413,876 | 510,660,953 | 510,660,953 | 3,268,621,978 | 475,763,478 | 475,763,478 |

|

2 Transportation and communications

|

0 | 1,223 | 1,223 | 0 | 2,596 | 2,596 |

|

4 Professional and special services

|

0 | 7,354,283 | 7,354,283 | 1,909,207 | 6,637,451 | 6,637,451 |

|

5 Rentals

|

0 | 1,750 | 1,750 | 0 | 3,200 | 3,200 |

|

10 Transfer payments

|

500,000 | 406,359 | 406,359 | 500,000 | 1,301 | 1,301 |

|

12 Other subsidies and payments

|

1,909,207 | 1,063,738 | 1,063,738 | 0 | 1,708,602 | 1,708,602 |

| Total | 3,164,823,083 | 519,488,307 | 519,488,307 | 3,271,031,185 | 484,116,628 | 484,116,628 |

| Fiscal year - | Fiscal year - | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending table 2 note 1 * | Used during the quarter ended | Year to date used at quarter-end | Total available for use for the year ending table 2 note 1 * | Used during the quarter ended | Year to date used at quarter-end | |

Table 2 Notes

|

||||||

| Vote 1 - Program Expenditures | 236,703,394 | 46,324,757 | 46,324,757 | 255,057,889 | 49,599,783 | 49,599,783 |

| Vote 20 - Public Service Insurance | 2,250,070,604 | 562,063,856 | 562,063,856 | 2,338,970,604 | 563,358,796 | 563,358,796 |

| Statutory Authorities | ||||||

|

A111 - President of the Treasury Board - Salary and motor car allowance

|

82,100 | 20,525 | 20,525 | 83,500 | 6,958 | 6,958 |

|

A140 - Contributions to employee benefit plans

|

27,652,781 | 6,899,956 | 6,899,956 | 28,242,292 | 6,984,173 | 6,984,173 |

|

A145 - Unallocated employer contributions made under the PSSA and other retirement acts and the Employment Act (EI)

|

443,000,000 | -125,161,898 | -125,161,898 | 443,000,000 | -177,848,113 | -177,848,113 |

|

A681 - Payments under the Public Service Pension Adjustment Act

|

0 | 161 | 161 | 0 | 88 | 88 |

|

A683 - Payments for the pay equity settlement pursuant to section 30 of the Crown Liability and Proceedings Act

|

0 | 0 | 0 | 0 | 0 | 0 |

| Total Statutory Authorities | 470,734,881 | -118,241,256 | -118,241,256 | 471,325,792 | -170,856,894 | -170,856,894 |

| Total authorities | 2,957,508,879 | 490,147,356 | 490,147,356 | 3,065,354,285 | 442,101,685 | 442,101,685 |