2021-22 Departmental Results Report

Table of contents

From the minister

It is my pleasure to present the 2021-22 Departmental Results Report for the Atlantic Canada Opportunities Agency (ACOA).

Over the last 12 months, ACOA has continued to be there for Atlantic Canadians. By delivering relief and recovery support, in addition to its regular programming, the Agency helped communities, small and medium-sized enterprises (SMEs), and hard-hit sectors navigate the pandemic and position themselves to rebuild and grow. Overall, more than 13,500 jobs were created or maintained thanks to ACOA’s work.

With economic recovery under way in Canada and around the world, our government remains committed to ensuring that businesses and communities in all regions of the country have the tools they need to recover and rebuild. And when disaster strikes, like it did in Atlantic Canada where Hurricane Fiona devastated so many communities, the Government of Canada stands shoulder to shoulder with the region’s affected people. With its wealth of local knowledge and expertise, it is only natural that ACOA is called upon to play such a prominent role in recovery efforts and coordinating the Hurricane Fiona Recovery Fund.

With its regular programs, ACOA plays a key role in our government’s efforts to further strengthen the economy and keep stimulating economic growth that benefits everyone.

The Agency worked hard to foster a more inclusive, sustainable, and diversified regional economy by investing in Indigenous economic development, women-led, Black-led, and youth-focused projects, and by supporting communities with programs such as the Canada Coal Transition Initiative. I am particularly proud that ACOA took the lead in Atlantic Canada to help businesses become more innovative, grow and scale up their activities, and work with partners to foster digitalization and automation, advance the food sector, maximize the benefits of the ocean, position the region as a world-class tourist destination, and help Atlantic Canadian companies green their operations.

The Agency’s inter- and intragovernmental collaboration remained strong. I was very pleased to have supported the Minister of Intergovernmental Affairs, Infrastructure and Communities in leading the successful Atlantic Growth Strategy meeting in July 2022, based on the sustained work of ACOA and many other federal departments and provincial governments in 2021-22. ACOA is also collaborating with partners on an upcoming strategy for entrepreneurs in official language minority communities, consulting federal ministers, entrepreneurs and stakeholders as part of consultations for the Government of Canada’s Action Plan for Official Languages.

I invite you to read the pages that follow for greater detail on ACOA’s important work to develop a diverse, inclusive, and resilient economy in Atlantic Canada.

Results at a glance

| Total actual spending for 2021-22 |

Total actual full-time equivalents for 2021-22 |

|---|---|

| $443,490,213 | 595 |

In 2021-22, ACOA remained focused on recovering from the economic impacts of COVID-19 in Atlantic Canada with a long-term view to support economic growth. Building on the region’s competitive strengths, ACOA contributed to economic prosperity, inclusion and clean growth while advancing its three departmental results for Atlantic Canada: businesses that are innovative and growing; businesses that invest in developing and commercializing innovative technologies; and communities that are economically diversified.

| Success Stories by Departmental Result | ||

|---|---|---|

| Businesses Innovation and Growth The Covered Bridge Potato Chip Company in rural New Brunswick, with support from the Regional Economic Growth through Innovation program, automated its packing, improved efficiency and production, and conditions for its workforce. |

Diversified Communities The Verschuren Centre in Nova Scotia, with support from the Canada Coal Transition Initiative, is building an industrial bioprocessing scale-up facility to accelerate technologies with a focus on sustainability. while creating economic opportunities in communities affected by coal-power closures in Cape Breton. |

Innovative Technologies Newfoundland and Labrador’s Seaformatics Systems, with support from the Jobs and Growth Fund, advanced commercialization of its rugged microturbine charging device that harnesses renewable energy for outdoor enthusiasts, an innovative clean technology product. The company was able to increase its efficiency and productivity to meet increased demand for its innovative product. |

ACOA’s activities helped to secure the recovery by helping Atlantic Canada, its businesses, people and communities through the crisis. In doing so, it contributed to and complemented the Government of Canada’s COVID-19 economic response. As outlined in Budget 2021Footnote i, new initiatives focused on pillars of growth to act as the foundation on which to build the economic recovery and move the Canadian economy onto a higher and more inclusive growth path. These efforts directly contributed to the Government of Canada’s ambitious three-year, $100 billion recovery plan, including the objective to restore employment to pre-COVID-19 levels, outlined in the 2020 Fall Economic StatementFootnote ii. Activities also complemented federal initiatives such as the Innovation and Skills PlanFootnote iii and were guided by four overarching strategic lenses: digitization, supporting the workforce of the future, greening the economy, and inclusion of under-represented groups in Atlantic Canada’s workforce.

The Agency supported the Minister responsible for the Atlantic Canada Opportunities Agency and her ministerial mandate letter commitments, and engagements with Atlantic Canadians, key stakeholders, federal colleagues and provincial governments. For example:

Continue to promote short- and long-term job creation and economic development in Atlantic Canada

Building on its 35-year record of fuelling economic growth in the region, the Agency continued to provide regionally tailored, client-centric, and flexible place-based assistance to small and medium-sized businesses and to support job creation in communities recovering from the pandemic in both urban areas and rural communities.

In 2021-22, the Agency spent $363.9 million in 2,572 projects, estimated to have created or maintained over 13,500 jobs.Footnote 1 Approximately 40 percent of projects and spending went to rural communities thanks to ACOA’s extensive footprint and expertise across the region.Footnote 2 In addition to ACOA’s regular programming, the Agency delivered many new measures. The Agency supported COVID-19 economic recovery through new initiatives such as the Aerospace Regional Recovery InitiativeFootnote iv, the Canada Community Revitalization FundFootnote v, the Jobs and Growth FundFootnote vi, and the Tourism Relief FundFootnote vii, ten percent of which was targeted for Indigenous tourism initiatives and projects. The Agency also continued to offer COVID-19 relief Footnote 3 across the economy, supporting hard-hit businesses and protecting air transportation to the region. Overall, the Agency spent $121.8 million on COVID-19 initiatives for 640 projects that maintained or created an estimated 7,500 jobs of which the Regional Relief and Recovery Fund (RRRF) (delivered directly by ACOA) represented 25 percent of expenditures and accounted for an estimated 1,300 jobs being maintained or created. This increases to $135.1 million by including RRRF delivered by the Atlantic Association of Community Business Development Corporations.

Support initiatives that advance the goals of the Atlantic Growth Strategy

In July 2022, the federal Minister of Intergovernmental Affairs, Infrastructure and Communities and the Minister responsible for ACOA co-chaired the successful Leadership Committee meeting for the Atlantic Growth Strategy involving the four Atlantic Premiers and other federal ministers representing Atlantic Canada. This initiative built on strong ongoing collaboration between federal departments, including ACOA, and provincial governments. Throughout 2021-22, ACOA continued to advance the five pillars of the Atlantic Growth Strategy. On skilled workforce and immigration, ACOA supported many projects to accelerate capacity in areas such as digital skills with employers, business associations, colleges and universities. On innovation, 12 new high-growth firms enrolled in the Accelerated Growth Service in 2021-22, for a total of 123 since its inception. Atlantic Canada’s innovation ecosystem saw $61.3 million in ACOA spending to better assist entrepreneurs and start-ups. On clean growth, ACOA spent $29.6 million to help Atlantic Canadian companies green their operations and reduce the region’s environmental footprint. On trade and investment, ACOA spent $13.6 million across nearly 190 projects to increase the number of exporters and export sales and attract foreign direct investment. In addition, ACOA led efforts to update the successful Atlantic Trade and Investment Growth Strategy with all four Atlantic provincial governments, and to renew the key funding agreement designed to support its implementation for a new five-year period starting in 2022-23. On infrastructure, the Agency helped communities in New Brunswick and Nova Scotia affected by the coal phase out to diversify their economies, create jobs and prepare for the future, notably with $6.2 million and 19 projects through the Canada Coal Transition Initiative and its infrastructure fund.

Support entrepreneurs in official language minority communities and other under-represented communities

ACOA spent $138.5 million on over 850 projects aimed at creating more diversified and inclusive communities, solidifying economic development efforts. Throughout 2021-22, Agency officials led efforts to create a strategy to support entrepreneurs in official language minority communities by working diligently to understand the needs of entrepreneurs in those communities across Atlantic Canada. This was done in close collaboration with federal partners, private stakeholders and communities. The Agency also supported the current Action Plan for Official Languages (2018 – 2023) as well as engaging stakeholders toward its renewal.

For more information on ACOA’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core responsibilities

Economic development in Atlantic Canada

Description

Support Atlantic Canada’s economic growth, wealth creation and economic prosperity through inclusive clean growth and by building on competitive regional strengths. Help SME growth through direct financial assistance and indirectly through business support organizations. SMEs become more innovative by adopting new technologies and processes and by pursuing new avenues for expansion and market diversification to compete and succeed in a global market.

Results

In 2021-22, ACOA excelled at delivering temporary and regular programs in a timely and efficient way, building in flexibility to meet the changing needs of businesses as they transition into economic recovery. These efforts directly contributed to the Government of Canada’s strategy to build a resilient, sustainable and competitive economy, as outlined in the Speech from the ThroneFootnote viii and Budget from 2021Footnote ix. They supported recovery and long-term growth with economic development initiatives in communities of every size, helping SMEs access financing, and investing in the local infrastructure that helps communities grow.

Economic context in Atlantic Canada

In 2021, Atlantic Canada’s gross domestic product grew by 4.3 percent. While growth was slower for Newfoundland and Labrador, it reached 5.6 percent for the Maritime provinces, compared to 4.8 percent nationally. Inflation hit the Atlantic provinces hardest, with rates ranging from 5.1 percent in Prince Edward Island to 3.4 percent in Newfoundland and Labrador. Global supply chain issues also challenged Atlantic Canadian businesses but benefited certain key sectors such as seafood, where exports increased 34.9 percent to $37 billion. Population-wise, Atlantic Canada welcomed over 18,000 new residents from other provinces and countries, growing to approximately 2.5 million residents. This helped the region recover and surpass its pre-COVID-19 pandemic job levels. Despite these advancements, workforce challenges persist, with high job vacancy rates and only 7 new workers entering the labour market for every 10 retirees, compared to 8.5 new workers nationally.

Overall, ACOA spent $363.9 million toward 2,572 projects, helping to maintain or create an estimated 13,500 jobs in the region.Footnote 4 Regular programsFootnote 5 supported over 1,900 projects with $228.8 million in spending, which included $15.2 million on COVID-19 related spending for more than 180 projects.Footnote 6 The Agency’s investments leveraged $1.39 in partner funding for every dollar ACOA approved despite a challenging economic environment. These projects were developed and delivered collaboratively with Atlantic businesses, community stakeholders and support organizations such as the Community Business Development Corporations (CBDCs). The Agency worked closely with federal departments, provincial governments and stakeholders in the design and delivery of programs. These efforts were championed by ACOA staff to support economic recovery in areas of growth while prioritizing activities that accelerate digitization, the workforce of the future, greening and inclusion.

In addition, the Agency spent $121.8 million on COVID-19 initiatives (listed below) for 640 projects that maintained or created an estimated 7,500 jobsFootnote 7 of which the RRRF (delivered directly by ACOA) represented 25 percent of expenditures and accounted for an estimated 1,300 jobs being maintained or created. This increases to $135.1 million when including RRRF support delivered by the Atlantic Association of Community Business Development Corporations (AACBDC). Early in 2021-22, the Agency delivered Atlantic Canada’s share of the following emergency relief initiatives:

- The Regional Relief and Recovery FundFootnote x, spending $31.1 million in 193 projectsFootnote 8 that offered liquidity assistance to businesses affected by the COVID-19 pandemic, help that was complementary to other federal programs. This helped SMEs bridge the gap to recovery and supported sectors that are critical to the resilience and survival of Atlantic Canada’s economy such as advanced manufacturing, ocean industries, clean growth technology and tourism;

- The Canadian Seafood Stabilization FundFootnote xi, spending $9.4 million on 45 projects to help fish and seafood processors with COVID-19 related costs such as increasing storage capacity, enhancements to plant operations and meeting shifting market demands;

- The Regional Air Transportation InitiativeFootnote xii, spending $39.9 million on 13 projects, to help maintain vital air routes that connect travellers and businesses to the rest of Canada and the world.

As the economy stabilized, the Agency’s focus shifted to supporting economic recovery through Atlantic Canada’s share of the following initiatives:

- The Aerospace Regional Recovery InitiativeFootnote xiii, spending $1.2 million on three projects to help Atlantic Canada’s aerospace sector to green its operations and adopt environmentally sustainable practices, improve productivity and strengthen commercialization while furthering integration into regional and global supply chains.

- The Canada Community Revitalization FundFootnote xiv, spending $8.3 million on 187 projects to help communities across Canada build and improve community infrastructure, bring people back to public spaces safely as health measures eased, and create jobs and stimulate local economies

- The Jobs and Growth FundFootnote xv, spending $26.4 million on 103 projects to help create jobs and position local economies for long-term growth, especially activities that support the transition to a green economy, foster an inclusive recovery, increase SME competitiveness, and strengthen capacity in critical sectors.

- The Tourism Relief FundFootnote xvi, spending $5.5 million on 96 projects to help empower tourism businesses, including Indigenous-led entities, by supporting destination development and creating new or enhanced tourism experiences and products to attract more domestic and international visitors.

The Agency delivered targeted support such as the Black Entrepreneurship Program’s National Ecosystem FundFootnote xvii to strengthen capacity among two leading Atlantic Canadian Black-led non-profit business organizations, the Women Entrepreneurship Strategy’s Ecosystem FundFootnote xviii and the Canada Coal Transition InitiativeFootnote xix and its Infrastructure Fund to help affected communities diversify their economies.

ACOA’s investments targeted strategic sectors such as manufacturing and processing, seafood and aquaculture, tourism and cultural industries, information and communications technology, life sciences, and oceans. Efforts promoted advanced manufacturing, digital transformation, the start-up ecosystem, greening, and exports as drivers of competitiveness. Activities also focused on Indigenous economic development and supported a skilled workforce through immigration. The Agency played advocacy and pathfinding roles to improve access to federal investments for Atlantic businesses and communities. ACOA did so with federal departments, the four provincial governments and other stakeholders to support SMEs and communities.

This role was validated in a 2020-21 evaluation of ACOA business growth and trade and investment programs finding that “programming continues to address specific growth needs of SMEs in Atlantic Canada. It is well aligned with ACOA’s mandate and government priorities and complements other programming and initiatives offered in the region. There is evidence that the programming helps Atlantic Canadian SMEs to grow their business. Most important, it leads to improved planning and capacity for growth, increased productivity and market development. The design and delivery of the programming supports efficiency, awareness of changing needs, and the achievement of results. A strong regional presence allows ACOA to understand SME needs and capacities. The Agency plays an important role in developing and maintaining collaborations, pathfinding and convening partners across the ecosystem.”Footnote 9

In 2021-22, ACOA’s work advanced its three departmental results with the following initiatives, activities and actionsFootnote 10:

Departmental Result 1: Businesses are innovative and growing in Atlantic Canada

- The Agency supported 1,347 projects across its Business Growth, and Trade and Investment activities with investments of $144.7 million.

- The Agency helped businesses at various stages of development – from start-up to high growth – to adapt their operations to accelerate their growth and scale up, and to enhance their productivity and competitiveness in both domestic and global markets. Between 2013 and 2018, ACOA clients:

- Increased their sales by an average of 4.4 percent annually compared to 1.0 percent for comparable non-clients.

- Grew their productivity by an average of 2.3 percent annually compared to 1.9 percent for comparable non-clients.

- Expanded exports by an average of 11.4 percent compared to 10.5 percent for comparable non-clients.

- In 2018, 135 high growth firms received assistance from ACOA, an increase of 1.5 percent from 2013.

- The average growth rate in 2018 was 298 percent among start-ups that were ACOA clients compared to 236 percent for comparable non-clients.Footnote 11

- Despite economic headwinds, ACOA supported SME growth through exports in key industry sectors such as seafood. The 2018 – 2022 Atlantic Trade and Investment Growth Agreement with Atlantic provincial governments concluded with successful initiatives such as the Europe Market Development Program. ACOA and the Atlantic Provinces invested close to $20 million in over 120 projects, helping an estimated 258 firms with in-market activities and 1,286 firms in capacity building activities.

- ACOA supported the long-term recovery of the important tourism sector and its local businesses through the Tourism Innovation Action Plan, including planning the renewal of the Atlantic Canada Agreement on Tourism in 2023.

- Twelve businesses leveraged their growth plans under the Accelerated Growth Service, joining the 123 who have done so since the Service’s creation. Led by ACOA in Atlantic Canada and involving other federal and provincial organizations, activities helped to build a pipeline of clients with strong potential for growth and provided them with focused sales and export support.

| Success Stories | |

|---|---|

| Newfoundland and Labrador’s Notus Electronics undertook the development of a state-of-the-art research and development and manufacturing facility, specializing in advanced hydro-acoustic monitoring solutions for the oceans industries. The company has a long history of being a leader in advanced wireless net monitoring solutions for the commercial fisheries. | Nova Scotia’s Outcast Foods developed a marketing and branding strategy to enter a US national retailer with 340 stores in 23 states. The company creates supplements from food that is near the end of its saleable lifecycle, contributing to extending the use of precious food and enhancing the sustainability of the food sector. |

| Marshall Aerospace established a facility for land systems manufacturing and in-service support in New Brunswick, which involves the machining, fabrication, repair and overhaul, and assembly of land vehicle components using advanced manufacturing equipment. This brings high quality jobs to the province and helps strengthen the aerospace sector. | Prince Edward Island’s RWL Holdings acquired and installed new equipment to increase production speed and increase washing capacity in its potato processing facility, allowing the plant to run 24 hours a day, 7 days a week to supply up to 200 million pounds of potatoes. This created a greatly needed opportunity for Prince Edward Island potatoes. |

Departmental Result 2: Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada

- The Agency supported 347 projects across Innovation Ecosystem, Research and Development, and Commercialization activities with investments of $75.9 million. This was accomplished through key programs such as the Regional Innovation Ecosystem stream of the Regional Economic Growth through Innovation Program to create, grow and nurture inclusive regional ecosystems that support business needs and foster an entrepreneurial environment conducive to innovation, growth and competitiveness by convening innovation ecosystem stakeholders.

- Between 2008 and 2018, ACOA clients increased their research and development spending by an average of 1.3 percent annually compared to a decrease of 10.8 percent for comparable non -clients. Overall ACOA clients spent 0.60 percent of their revenues on research and development compared to 0.12 percent for comparable non-clients.Footnote 12

- ACOA invested in advanced manufacturing to help raise business awareness of the need to increase digitization and use of transformative technologies in Atlantic Canada, and ensure businesses have the capacity to implement advanced manufacturing solutions to be more innovative, agile and resilient in response to changing market conditions.

- ACOA supported the start-up ecosystem to help new companies emerge and scaleup. Startup Genome found that Atlantic Canada was a fast-growing and successful ecosystem, boasting innovation in ocean technology and several other sectors. It included the region in its top emerging ecosystems overall and in terms of funding, talent and experience.Footnote 13

- ACOA supported clean growth to help Atlantic Canadian companies green their operations, adapt and adopt technology, optimize waste, adopt clean energy and decarbonize key sectors.

| Success Stories | |

|---|---|

| Newfoundland and Labrador’s Ocean Startup Project (OSP), hosted by the Genesis Center, continued to foster the development of ocean technology startups in Atlantic Canada. Created in 2019, the initiative is a collaboration of partners in the four Atlantic provinces and includes direct mentoring and entrepreneurial training in this fast growing sector. | Nova Scotia’s Novonix Battery Technology Solutions expanded its capacity to develop and scale up its novel cathode production method, a key component for in lithium-ion batteries. It did so with specialized equipment to create multiple lab-scale research and development environments. These investments support the development of a Canadian industry in energy storage system used in electric cars, for example. |

| The New Brunswick Innovation Foundation helps the province’s SMEs integrate artificial intelligence (AI)-related technologies. It did so by increasing applied research capacity, building a strong talent pool, engaging industrial end users, and supporting and accelerating AI technology adoption in the field. | Prince Edward Island’s P.E.I. Bag Co. is purchasing specialized equipment to reduce the volume of wastewater from printing presses. This project greened the company’s operations and reduced its footprint by mitigating spillage risks that could contaminate the environment while reducing operational costs. |

Departmental Result 3: Communities are economically diversified in Atlantic Canada

- The Agency supported 854 projects across Inclusive Community and Diversified Community priorities with spending of $138.5 million. Every dollar approved by ACOA in community projects leveraged $1.02 in 2020-21, higher than the $0.60 target. Community organizations have begun to recover from COVID-19 impacts and enhance their ability to leverage other funding. Investments have shifted to recovering from the impacts of the pandemic, especially in rural and remote communities.

- ACOA provided $25.9 million to the CBDC network for the Community Futures Program to support the creation and expansion of small businesses throughout rural communities in Atlantic Canada.

- Regular levels of support to the CBDC network translated into 1,052 loans valued at $80.2 million overall and the leveraging of an additional $65.3 million in funds from partners.

- The RRRF increased regular funding levels by $13.4 million in 2021-22, injected to support COVID-19 mitigation measuresFootnote 14. One hundred ninety-one loans valued at $15 million were distributed to main street businesses and retailers in small, rural and remote communities throughout Atlantic Canada.

- ACOA has largely met its targets for economic diversification as demonstrated through the percentage of professional-, science- and technology-related jobs in the region, which represented 33.7 percent of all jobs in Atlantic Canada’s economy in 2021, above the Agency’s target of 32 percent.

- SME ownership from under-represented groups has seen a decline across Atlantic Canada from 2017 to 2020. However, the Agency’s clients from under-represented groups continued to demonstrate strong performance. Between 2013 and 2017:

- Women-owned SMEs that received ACOA support registered a higher-than-average labour productivity growth rate than men-owned ACOA commercial clients and comparable women-owned businesses that were not clients.

- Immigrant-owned SMEs that received ACOA support performed better on employment growth, wages, sales and labour productivity than ACOA clients born in Canada and comparable immigrant-owned business that were non-clients.

- YouthFootnote 15-owned SMEs that received ACOA support saw the highest wage growth rates among ACOA clients.

- ACOA continued to help bridge labour and skills gaps for SMEs and increased the region’s capacity to attract global talent and international students, retain newcomers through enhanced settlement support, and ensure immigrant entrepreneurs led successful businesses and were integrated into the economy, including in rural areas. For example, the Study and Stay Initiative delivered in all four Atlantic provinces saw more than 640 international student participants with 96 percent choosing to stay in the region, on average.

- ACOA supported entrepreneurs from under-represented groups, including women, Indigenous people, official languages minorities, black Canadians, racialized communities, recent immigrants, visible minorities, youth, and persons with disabilities.

- ACOA championed projects to support immigration in Atlantic Canada, focusing on attracting and retaining immigrants, including international students, and supporting employers as they address labour and skills shortages. The Agency also acted as a pathfinder, notably supporting federal and provincial partners in making the Atlantic Immigration Pilot permanent.

- ACOA championed projects to help reach a larger number of Indigenous businesses. This is part of ACOA’s commitment to reconciliation and to support the Federal Framework for Aboriginal Economic Development with Indigenous stakeholders such as the Ulnooweg Development Group, Indigenous leadership and businesses, the Atlantic provincial governments and Indigenous Services Canada. Activities built capacity and increased knowledge and awareness through interactive business mapping, and by convening federal, provincial, stakeholder and community partners to participate on committees, initiatives and communities of interest.

- ACOA championed projects that supported official language minority community business owners and partners across the Agency’s different programs.

- With the Canada Coal Transition Initiative, the Agency supported 19 projects for $6.2 million in spending for economic diversification in communities in New Brunswick and Nova Scotia. This helped communities affected by the future phase out of coal-fired electricity generation plants and the transition to a low-carbon economy.

| Success Stories | |

|---|---|

| Newfoundland and Labrador’s Organization of Women Entrepreneurs carried out activities to help women business owners grow their businesses through business counselling, virtual networking and training events, mentorship and the development and strengthening of business management skills. | Nova Scotia’s Mi'kmaw Native Friendship Society launched Every One Every Day Kjipuktuk-Halifax , an Indigenous-led long-term vision that centres reconciliation in the design of civic and social infrastructure. The multi-year project is built for social cohesion and inclusive participation in localized and circular economies. |

| The Green Economy New Brunswick Hub was created to guide 30 SMEs though a process to measure their greenhouse gas emissions, set reduction targets, build and implement an action plan, and track progress to achieve measurable results. The Hub will be the first Green Economy Hub setup east of Ontario, and the first Hub delivering services bilingually to the business community on a province wide scale. | In partnership with Holland College and Prince Edward Island’s Apprenticeship Program, the Island’s Abegweit First Nation will deliver an innovative targeted construction training program on site. The program will graduate employment-ready, Red Seal certified tradespeople, available to work throughout the province. The initiative also worked to create an Indigenous community-owned construction business. |

Gender-based analysis plus

ACOA investments reflected the Government of Canada’s commitment to grow a more inclusive economy and a stronger future for all Canadians. Across the Agency’s suite of programs and initiatives in 2021-22, ACOA spent more than $47.5 million for nearly 500 projects that supported GBA Plus objectives or entrepreneurs from under-represented groups. This includes support for ACOA clients from the following groups: $18.3 million for women clients, $13.3 million for Indigenous peoples, $15.0 million for official language minority community members, nearly $1.0 million for Black, racialized and visible minorities, $2.7 million for persons with disabilities, $3.4 million for recent immigrants, and $3.5 million for youth.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

ACOA contributes to the Government of Canada’s efforts to create good jobs and power economic opportunities through clean growth, clean energy and a low-carbon government. The Agency supports clean growth by helping communities to transition away from coal-energy industries, investing in the transition to the green economy through initiatives such as greenhouse gas mitigation, clean technology product development and adoption, as well as the green transformation and adaptation of SMEs. Together, these activities advance the Sustainable Development Goals 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), 9 (Industry, Innovation and Infrastructure) and 12 (Responsible Consumption and Production). See ACOA’s Departmental Sustainable Development StrategyFootnote xx for greater detail.

Experimentation

In 2021-22, ACOA worked with industry professionals specializing in digital transformation to assess the Agency’s level of readiness in applying Artificial Intelligence (AI) and create an adapted roadmap to increase digital maturity of its operations. In addition, the Agency consulted with AI practitioners within the Government of Canada to leverage their knowledge and lessons learned. As an important first step, the Agency worked with a partner to design and implement a data architecture that will help lay the foundation internally for the use of AI in the years to come. More specifically, the new architecture will help the Agency access, collect, use, safeguard and share data using a more efficient and safer process.

In another example, ACOA implemented the Digital Acceleration Pilot (DAP) through its regular programming to increase the level of digitization in firms through the deployment of digital strategy development and digital strategy implementation. Over 200 Atlantic firms were assisted under the DAP, and the digital ecosystem was also further developed. Training and tools were created to increase staff’s digital abilities. A digital maturity tool was also developed to measure digital advancement of companies using the pilot.

Key risks

ACOA faced two main risks to fulfilling its mandate. The first is that the Agency’s economic development programming was affected by external factors such as COVID-19’s continued economic disruption, which contributed to uncertainties for economic growth in Atlantic Canada. The second was the capacity of ACOA’s stakeholders – other governments, partners, communities and clients – for the identification, development and successful implementation of strategic projects. This was especially true in the balance of COVID-19 relief and recovery efforts, and the uneven economic recovery across sectors. This was not optimal to achievement of ACOA’s program objectives of economic growth. ACOA capitalized on the flexibility of its programs, on its advocacy role, and on its planning to mitigate risks associated with an evolving economy and the depth of regional stakeholders’ capacity. It supported analysis on regional economic issues and collaborated with stakeholders to foster client and community capacity to help achieve targets under key federal priorities.

Results achieved

The following table shows, for ACOA, the results achieved, the performance indicators, the targets, and the target dates for 2021-22, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019-20 Actual results |

2020-21 Actual results |

2021-22 Actual results |

|---|---|---|---|---|---|---|

| Communities are economically diversified in Atlantic Canada | Percentage of Atlantic Canadian SMEs that are majority owned by women, Indigenous people, youth, visible minorities and persons with disabilities | 17% female ownership; 1% Indigenous ownership; 10.5% youth ownership; 4% visible minority ownership; and, 0.3% persons with disabilities ownership |

March 31, 2022 | 17.1% female, 1.1% Indigenous, 10.6% youth, 4.5% visible minorities, and 0.3% persons with disabilities (2017) |

Not available (2017)Footnote 16 |

16.7% female, 0.4% Indigenous, 9% youth, 2.9% visible minorities, and 1.2% persons with disabilities (2020) |

| Percentage of professional, science and technology-related jobs in Atlantic Canada’s economy | 32% | March 31, 2022 | 31.8% (2019) | 33.7% (2020) | 33.7% (2021) | |

| Amount leveraged per dollar invested by ACOA in community projects | $0.60 for every dollar invested by ACOA in Atlantic Canada | March 31, 2022 | $1.00 (2019-20) | $0.58 (2020-21) | $1.02 (2021-22) | |

| Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada | Value of business expenditures in R&D by firms receiving ACOA program funding, in dollars | $86 million | March 31, 2022 | $113.2 million (2013 - 2017)Footnote 17 |

$99.6 million (2014 - 2018) |

$93.7 million (2015 - 2019)Footnote 17 |

| Percentage of businesses engaged in collaborations with higher education institutions in Atlantic Canada | 18% | March 31, 2022 | 18% (2017) | 16.9% (2019) | Not available (2021)Footnote 17 | |

| Businesses are innovative and growing in Atlantic Canada | Number of high-growth firms in Atlantic Canada | 550 | March 31, 2022 | 620 (2017) | 590 (2018) | 660 (2019) |

| Value of export of goods (in dollars) from Atlantic Canada | $22 billion | March 31, 2022 | $28 billion (2019) |

$23.3 billion (2020) |

$33.3 billion (2021) |

|

| Value of exports of clean technologies (in dollars) from Atlantic Canada | $400 million | March 31, 2022 | $555 million (2018) |

$489 million (2019)Footnote 18 |

$458 million (2020)Footnote 18 |

|

| Revenue growth rate of firms supported by ACOA programs | 3% | March 31, 2022 | 9.2% (2013 - 2017)Footnote 19 | 8.2% (2014 - 2019, excl. 2018)Footnote 19 | 6.9% (2015 - 2020, excl. 2018)Footnote 19 |

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.Footnote xxi

Budgetary financial resources (dollars)

The following table shows, for economic development in Atlantic Canada, budgetary spending for 2021-22, as well as actual spending for that year.

| 2021-22 Main Estimates |

2021-22 |

2021-22 |

2021-22 |

2021-22 |

|---|---|---|---|---|

319,416,160 |

319,416,160 |

429,311,379 |

414,266,127 |

94,849,967 |

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.Footnote xxii

Human resources (full-time equivalents)

The following table shows, in full-time equivalents, the human resources the department needed to fulfill this core responsibility for 2021-22.

| 2021-22 planned full-time equivalents |

2021-22 |

2021-22 |

|---|---|---|

394 |

394 |

0 |

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.Footnote xxiii

Internal services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refer to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

During its second year of virtual work due to the pandemic, ACOA continued to focus on well-being by supporting an agile, equipped, innovative and diverse workplace while also fostering a healthy, respectful, accessible and inclusive environment Specifically, ACOA undertook the following activities to support internal services in 2021-22:

- completed implementation and successfully deployed the first release of its new Grants and Contributions Program Management business system.

- implemented information management/information technology initiatives in support of the Government of Canada’s Digital Operations Strategic Plan 2021-2024, such as the implementation of the Government of Canada Secret Infrastructure system at its Ottawa office for transmitting classified information and further investments in more modern cloud-based infrastructure, such as SharePoint Online.

- worked in collaboration with central agencies to develop and implement strategies to identify and mitigate cybersecurity risks and the protection of information, such as the development of a Cyber Security Event Management Plan.

- undertook workplace modernization efforts by creating open, agile and connected workplaces in the Agency’s various locations across Atlantic Canada.

- implemented organizational initiatives to strengthen and improve the efficiency of services and program delivery and build upon its excellence. For example, the Agency developed an improved costing tool for new programs, improved its budget allocation tool, including the allocation for program delivery, and further streamlined processes related to its signature cards within its delegation framework, and digitized its approval process for travel and hospitality.

- continued to implement phases of the Agency’s Return to Occupancy plan while focusing on the safe return of Agency staff to the various offices. Through experimentation over the past year, the Agency is better positioned to welcome back its employees in a hybrid format with risk-mitigation strategies in place.

- continued to focus on effective organizational oversight and on safeguarding financial and other resources by creating new tools and by integrating new technologies for efficiency and to enhance the access to timely data to improve decision making and by continuing activities already under way to review and assess internal controls over financial management.

ACOA also responded to the Clerk’s Call to Action on Diversity and Inclusion. The Agency continued implementing its 2020-2022 Employment Equity, Inclusion and Anti-Racism Action Plan, which aims to increase representativeness and foster an inclusive workplace. Activities such as inclusive hiring practices and training to raise awareness on unconscious bias, talent and career development initiatives such as Building and Supporting Leaders, and diversity, inclusion, competency and excellence curriculum.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2021-22, as well as spending for that year.

| 2021-22 Main Estimates |

2021-22 |

2021-22 |

2021-22 |

2021-22 |

|---|---|---|---|---|

27,420,904 |

27,420,904 |

29,924,810 |

29,224,086 |

1,803,182 |

Human resources (full-time equivalents)

The following table shows, in full-time equivalents, the human resources the department needed to carry out its internal services for 2021-22.

| 2021-22 planned full-time equivalents |

2021-22 actual full-time equivalents |

2021-22 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 199 | 201 | 2 |

Spending and human resources

Spending

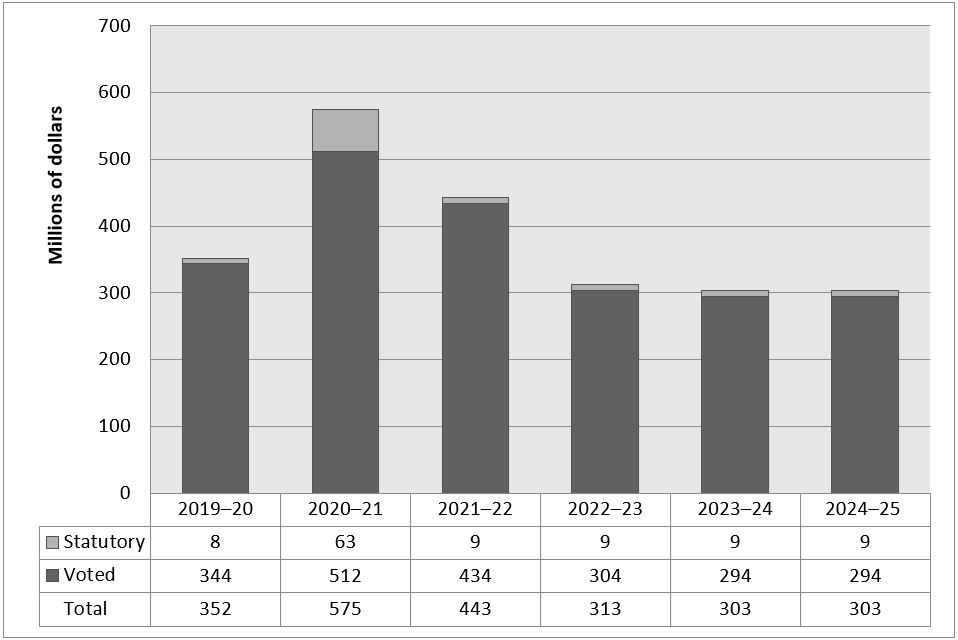

Spending 2019-20 to 2024-25

The following graph presents planned (voted and statutory) spending over time.

Actual spending: 2019-20, 2020-21, 2021-22. Planned spending: 2022-23, 2023-24, 2024-25.

Planned spending for 2022-23, 2023-24 and 2024-25 does not include amounts stemming from Budget 2022 and excess amounts related to the collection of repayable contributions that can be reinvested in the region by the Agency (because decisions on the excess amount of collections are only made later in the fiscal cycle).

In 2021-22, the Agency’s spending was $131.6 million less than the previous year, mainly due to the following changes in authorities:

- a total decrease of $216.4 million due to the reduction of:

- $148.5 million in temporary funding related to the Regional Relief and Recovery Fund;

- $29.0 million in temporary funding related to the Canadian Seafood Stabilization Fund;

- $24.1 million in excess amounts of collections related to the reinvestment of repayable contributions;

- $4.8 million in temporary funding for the Budget 2019 measure: launching a federal strategy on jobs and tourism;

- $3.0 million related to the reprofiling of funds as a result of project/contracting delays;

- $1.4 million related to compensation allocations resulting from revised collective agreements;

- $1.1 million in temporary funding for the Women Entrepreneurship Strategy – Ecosystem Fund;

- $0.8 million related to temporary funding transferred to Natural Resources Canada for Protecting Jobs in Eastern Canada’s Forestry Sector, as announced in Budget 2018; and

- various adjustments due to variations that occurred in the normal course of business.

- The decrease is offset by a total increase of $84.8 million due to:

- $42.0 million in temporary funding announced in Budget 2021, including:

- $17.4 million related to the Jobs and Growth Fund;

- $13.6 million related to the Canada Community Revitalization Fund;

- $8.5 million related to the Tourism Relief Fund; and

- $2.5 million related to the Aerospace Regional Recovery Initiative;

- $41.1 million in temporary funding announced in the Fall Economic Statement, 2020 related to the Regional Air Transportation Initiative; and

- $1.7 million in temporary funding related to the Black Entrepreneurship Program, such as:

- $1.2 million announced in Budget 2021; and

- $0.5 million announced on September 9, 2020, by the Prime Minister of Canada.

- $42.0 million in temporary funding announced in Budget 2021, including:

The decrease in planned spending in future years is attributable mainly to the conclusion of temporary funding received related to the COVID-19 pandemic.

Budgetary performance summary for core responsibilities and internal services (dollars)

The “Budgetary performance summary for core responsibilities and internal services” table presents the budgetary financial resources allocated for ACOA’s core responsibilities and for internal services.

| Core responsibilities and internal services | 2021-22 Main Estimates |

2021-22 planned spending |

2022-23 planned spending |

2023-24 planned spending |

2021-22 total authorities available for use |

2019-20 actual spending (authorities used) | 2020-21 actual spending (authorities used) | 2021-22 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Economic Development in Atlantic Canada | 319,416,160 | 319,416,160 | 285,340,452 | 275,840,040 | 429,311,379 | 324,518,205 | 545,036,957 | 414,266,127 |

| Subtotal | 319,416,160 | 319,416,160 | 285,340,452 | 275,840,040 | 429,311,379 | 324,518,205 | 545,036,957 | 414,266,127 |

| Internal services | 27,420,904 | 27,420,904 | 27,255,430 | 27,179,992 | 29,924,810 | 27,141,436 | 30,008,659 | 29,224,086 |

| Total | 346,837,064 | 346,837,064 | 312,595,882 | 303,020,032 | 459,236,189 | 351,659,641 | 575,045,616 | 443,490,213 |

For 2021-22, planned spending of $346.8 million increased by $112.4 million, resulting in total authorities available for use of $459.2 million. This was due to the following additional authorities received during the fiscal year:

- $52.5 million in temporary funding related to the RRRF, of which:

- $29.5 million announced in the Fall Economic Statement, 2020 to support small and medium-sized businesses;

- $18.0 million announced in Budget 2021 to support the Community Futures Network; and

- $5.0 million announced in Budget 2021 to support small and medium-sized businesses.

- $43.2 million in temporary funding announced in Budget 2021, including:

- $17.4 million related to the Jobs and Growth Fund;

- $13.6 million related to the Canada Community Revitalization Fund;

- $8.5 million related to the Tourism Relief Fund;

- $2.5 million related to the Aerospace Regional Recovery Initiative; and

- $1.2 million related to the Black Entrepreneurship Program.

- $10.0 million related to the reprofiling of funds from the previous year as a result of project/contracting delays;

- $3.1 million related to temporary funding in support of the Halifax International Security Forum. (ACOA continues its role as the delivering agency, with a transfer of funds from the Department of National Defence for the annual initiative);

- $2.9 million related to the Operating Budget Carry Forward from 2020-21;

- $0.6 million related to compensation allocations resulting from revised collective agreements; and

- $0.1 million in various adjustments.

From the 2021-22 total authorities of $459.2 million, actual spending was $443.5 million. This resulted in a surplus of $15.7 million. Of that amount, $3.3 million was carried forward as part of the Agency’s operating budget and the remaining balance was set aside as part of requests to reprofile funds into the next fiscal year and to support the Budget 2021 Travel Reduction.

Human resources

The “Human resources summary for core responsibilities and internal services” table presents the full-time equivalents (FTEs) allocated to each of ACOA’s core responsibilities and to internal services.

Human resources summary for core responsibilities and internal services

| Core responsibilities and internal services | 2019-20 actual full-time equivalents | 2020-21 actual full-time equivalents | 2021-22 planned full-time equivalents |

2021-22 actual full-time equivalents | 2022-23 planned full-time equivalents | 2023-24 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic Development in Atlantic Canada | 378 | 383 | 394 | 394 | 386 | 383 |

| Subtotal | 378 | 383 | 394 | 394 | 386 | 383 |

| Internal services | 197 | 201 | 199 | 201 | 198 | 196 |

| Total | 575 | 584 | 593 | 595 | 584 | 579 |

Human resource levels at ACOA show an increase starting in 2020-21 that reflects the additional human resources required to support the effort by the Government of Canada and ACOA to effectively deliver on COVID-19 emergency measures. The situation normalizes starting in fiscal year 2023-24. The remaining fluctuations occurring reflect the realignment of human resources to support priorities, projects and new temporary initiatives. The Agency will continue to achieve its results by allocating its human resources to best support its priorities and programs.

Expenditures by vote

For information on ACOA’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2021.Footnote xxiv

Government of Canada spending and activities

Information on the alignment of ACOA’s spending with the Government of Canada’s spending and activities is available in GC InfoBase.Footnote xxv

Financial statements and financial statements highlights

Financial statements

ACOA’s financial statements (unaudited) for the year ended March 31, 2022, are available on the Agency website.Footnote xxvi

Financial statement highlights

Condensed Statement of Operations (unaudited) for the year ended March 31, 2022 (dollars)

| Financial information | 2021-22 planned results |

2021-22 actual results |

2020-21 actual results |

Difference (2021-22 actual results minus 2021-22 planned results) |

Difference (2021-22 actual results minus 2020-21 actual results) |

|---|---|---|---|---|---|

| Total expenses | 271,377,082 | 328,996,368 | 371,479,101 | 57,619,286 | (42,482,733) |

| Total revenues | 18,831 | 25,650 | 20,071 | 6,819 | 5,579 |

| Net cost of operations before government funding and transfers | 271,358,251 | 328,970,718 | 371,459,030 | 57,612,467 | (42,488,312) |

Expenses:

Actual total expenses were $329.0 million in fiscal year 2021-22, a decrease of $42.5 million (11.4%) compared to fiscal year 2020-21.

The decrease was mainly due to a reduction in transfer payment expenses of $42.3 million. In fiscal year 2021-22, the incremental funding the Agency received in support of mitigating the economic impacts of the COVID-19 pandemic was less than in fiscal year 2020-21.

Of the total expenses of $329.0 million, $297.0 million (90.3%) was used to support economic development in Atlantic Canada while $32.0 million (9.7%) was expended for Internal Services.

Condensed Statement of Financial Position (unaudited) as of March 31, 2022 (dollars)

| Financial information | 2021 - 22 | 2020 - 21 | Difference (2021 - 22 minus 2020 - 21) |

|---|---|---|---|

| Total net liabilities | 66,575,071 | 48,988,928 | 17,586,143 |

| Total net financial assets | 59,020,021 | 40,432,814 | 18,587,207 |

| Departmental net debt | 7,555,050 | 8,556,114 | (1,001,064) |

| Total non-financial assets | 4,243,994 | 3,060,056 | 1,183,938 |

| Departmental net financial position | (3,311,056) | (5,496,058) | 2,185,002 |

Liabilities:

Total net liabilities were $66.6 million at the end of the 2021-22 fiscal year, representing an increase of $17.6 million (35.9%) from fiscal year 2020-21. The increase is attributable to a reduction in year-end accruals and payables being set up against repayable contributions. Repayable contributions are deducted from the gross payable as they are held on behalf of government.

Assets:

Total net financial assets equalled $59.0 million at the end of the 2021-22 fiscal year, an increase of $18.6 million (46.0%) over fiscal year 2020-21 total. The assets primarily consist of the “Due from the Consolidated Revenue Fund” ($58.5 million), which is used to discharge the Agency’s liabilities. The Due from Consolidated Revenue fund is an account that is directly impacted by the Agency’s accounts payable and accrued liabilities and is the reason for the increase in net financial assets.

Total non-financial assets were $4.2 million at the end of the 2021-22 fiscal year, an increase of $1.2 million (38.7%) over fiscal year 2020-2021 total. The increase is mainly attributable to work in progress related to the Grants and Contributions Program Management system.

The 2021-22 planned results information is provided in ACOA’s Future-Oriented Statement of Operations and Notes 2021-22Footnote xxvii.

Corporate information

Organizational profile

Appropriate minister: The Honourable Ginette Petitpas Taylor, PC, MP

Institutional head: Francis P. McGuire, President

Ministerial portfolio: Atlantic Canada Opportunities Agency

Enabling instrument: Part I of the Government Organization Act, Atlantic Canada 1987, R.S.C., 1985, c. 41 (4th Supp.), also known as the Atlantic Canada Opportunities Agency Act. See the Department of Justice Canada websiteFootnote xxviii for more information.

Year of incorporation / commencement: 1987

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on ACOA’s websiteFootnote xxix.

For more information on the department’s organizational mandate letter commitments, see the Minister’s mandate letterFootnote xxx.

Operating context

Information on the operating context is available on ACOA’s websiteFootnote xxxi.

Reporting framework

ACOA’s Departmental Results Framework and Program Inventory of record for 2021-22 are shown below.

| Departmental Results Framework | Core Responsibility: Economic development in Atlantic Canada |

Internal Services | |

|---|---|---|---|

| Departmental Result: Communities are economically diversified in Atlantic Canada |

Indicator: Percentage of Atlantic Canadian SMEs that are majority owned by women, Indigenous people, youth, visible minorities and persons with disabilities | ||

| Indicator: Percentage of professional, science and technology-related jobs in Atlantic Canada’s economy | |||

| Indicator: Amount leveraged per dollar invested by ACOA in community projects | |||

| Departmental Result: Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada |

Indicator: Value of business expenditures in R&D by firms receiving ACOA program funding in dollars | ||

| Indicator: Percentage of businesses engaged in collaborations with higher education institutions in Atlantic Canada | |||

| Departmental Result: Businesses are innovative and growing in Atlantic Canada |

Indicator: Number of high-growth firms in Atlantic Canada | ||

| Indicator: Value of exports of goods (in dollars) from Atlantic Canada | |||

| Indicator: Value of exports of clean technologies (in dollars) from Atlantic Canada | |||

| Indicator: Revenue growth rate of firms supported by ACOA programs | |||

| Program Inventory | Program: Inclusive Communities | ||

| Program: Diversified Communities | |||

| Program: Research and Development, and Commercialization | |||

| Program: Innovation Ecosystem | |||

| Program: Business Growth | |||

| Program: Trade and Investment | |||

| Program: Policy Research and Engagement | |||

Supporting information on the program inventory

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.Footnote xxxii

Supplementary information tables

The following supplementary information tables are available on ACOA’s websiteFootnote xxxiii:

- Reporting on green procurementFootnote xxxiv

- Details on transfer payment programsFootnote xxxv

- Gender-based analysis plusFootnote xxxvi

- Response to parliamentary committees and external auditsFootnote xxxvii

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals, and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures.Footnote xxxviii This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address:

Atlantic Canada Opportunities Agency

P.O. Box 6051

Moncton, New Brunswick, E1C 9J8

Telephone:

General inquiries: 506-851-2271

Toll free (Canada and the United States): 1-800-561-7862

TTY: 1-877-456-6500

Fax:

General: 506-851-7403

Secure: 506-857-1301

Email: acoa.information.apeca@acoa-apeca.gc.ca

Website: https://www.canada.ca/en/atlantic-canada-opportunities.htmlFootnote xxxix

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A report on the plans and expected performance of an appropriated department over a 3-year period. Departmental Plans are usually tabled in Parliament each spring.

departmental priority (priorité)

A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

departmental result (résultat ministériel)

A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

departmental result indicator (indicateur de résultat ministériel)

A quantitative measure of progress on a departmental result.

departmental results framework (cadre ministériel des résultats)

A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

experimentation (expérimentation)

The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

full-time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. For a particular position, the full-time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives; and understand how factors such as sex, race, national and ethnic origin, Indigenous origin or identity, age, sexual orientation, socio-economic conditions, geography, culture and disability, impact experiences and outcomes, and can affect access to and experience of government programs.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2021-22 Departmental Results Report, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2020 Speech from the Throne, namely: Protecting Canadians from COVID-19; Helping Canadians through the pandemic; Building back better – a resiliency agenda for the middle class; The Canada we’re fighting for.

horizontal initiative (initiative horizontale)

An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

non-budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

program inventory (répertoire des programmes)

Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

result (résultat)

A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.