Evaluation of the Canada Book Fund 2012-13 to 2017-18

Evaluation Services Directorate

July 31, 2019

On this page

- Executive summary

- 1. Introduction

- 2. Program profile

- 3. Approach and methodology

- 4. Findings

- 5. Conclusions

- 6. Recommendations, management response and action plan

- Annex A: evaluation framework

- Annex B: additional tables and figures

- Annex C: bibliography

List of tables

- Table 1: CBF objective and expected results

- Table 2: CBF target population, stakeholders and delivery partner

- Table 3: provincial distribution of SFO recipient organizations and approved applications between 2012-13 and 2017-18

- Table 4: CBF resources and expenditures

- Table 5: CBF Full-time equivalents (FTEs)

- Table 6: SFP – applications and funding approved, 2012-13 to 2017-18

- Table 7: SFO – applications and funding approved, 2012-13 to 2017-18

- Table 8: SFO – funding approved for new versus recurrent projects

- Table 9: SFP – number of publishers funded and amount approved, 2012-13 to 2017-18

- Table 10: SFP – marketing expenditures as a proportion of revenues

- Table 11: SFP – distribution of export supplement

- Table 12: SFO – marketing applications approved and application amount approved, 2012-13 to 2017-18

- Table 13: SFP – digital sales as a proportion of total eligible sales

- Table 14: CBF administrative Ratio and O&M as a % of Gs&Cs delivered

- Table 15: CBF planned (reference levels) versus actual spending ($), 2014-15 to 2017-18

- Table 16: CBF planned versus actual salary spending ($), 2012-13 to 2017-18

- Table 17: ratio of SFP Gs&Cs relative to other sources of revenue, 2013-14 to 2017-18

- Table 18: SFO – treatment of files by application fiscal year

- Table 19: SFO – use of multi-year funding

- Table 20: recommendation 1 – action plan

- Table 21: recommendation 2 – action plan

- Table 22: recommendation 3 – action plan

- Table A: distribution of employees by province and territory, 2012-13 to 2017-18

- Table B: CBF as a % of total government funding and % total net revenues, 2013-14 to 2017-18

- Table C: profit margin by company size

- Table D: number of new Canadian-authored titles by province/territory

- Table E: total new Canadian-authored titles by genre

- Table F: total Canadian-authored domestic and export sales (2012-13 to 2017-18)

- Table G: sales in English (upper table) compared to sales in French (lower table)

- Table H: SFO – approved grants and contributions 2012-13 to 2017-18

List of figures

- Figure 1: SFP – distribution of companies and employees, 2013-14 to 2017-18

- Figure 2: SFP – distribution of publishers by revenues, 2013-14 to 2017-18

- Figure 3: SFP – recipients – sources of government funding (all publishers)

- Figure 4: SFP – sources of government funding of Indigenous (left) and OLM publishers (right)

- Figure 5: profit margin for SFP recipients

- Figure 6: SFO oversubscription

- Figure 7: new Canadian-authored titles as a % of total new titles produced by SFP recipients, 2012-13 to 2017-18

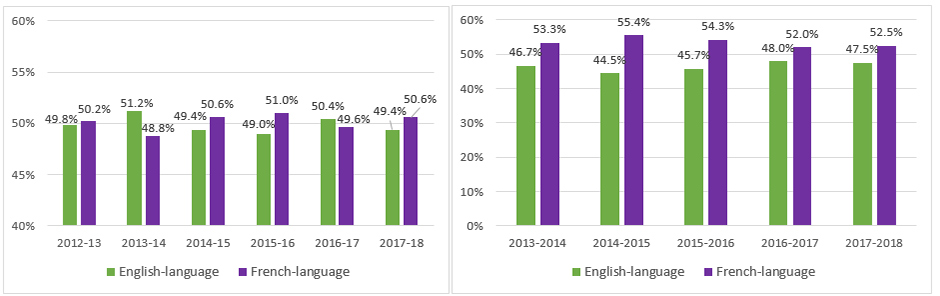

- Figure 8: number of new Canadian-authored titles by language, 2012-13 to 2017-18

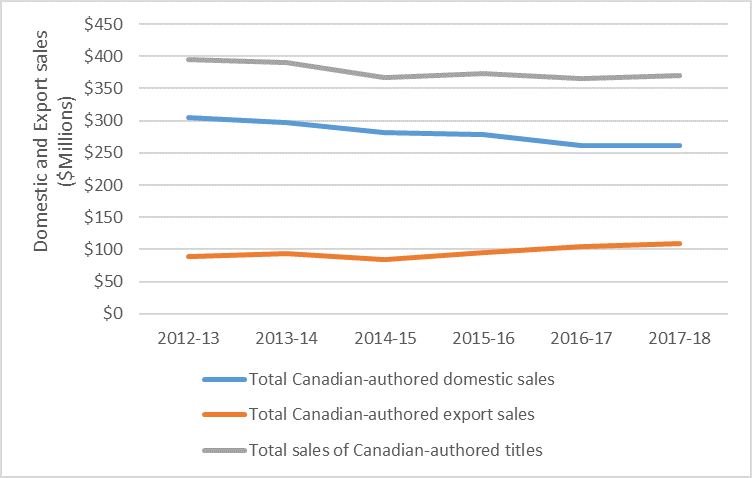

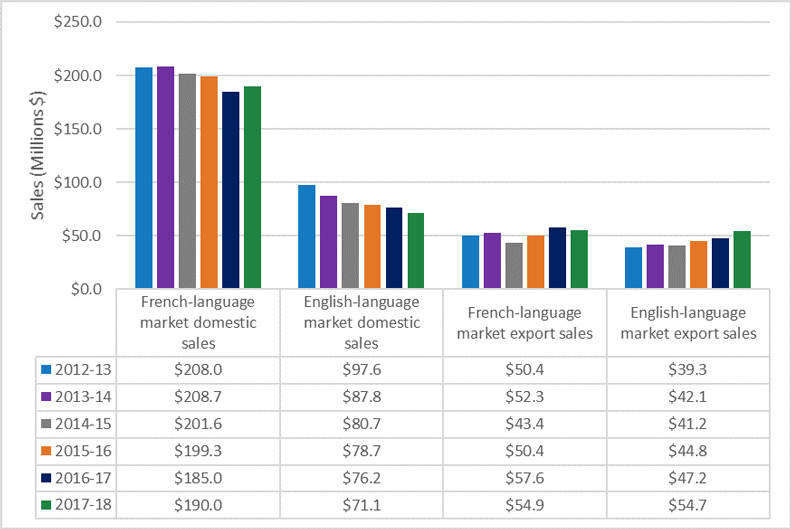

- Figure 9: SFP recipients' domestic and export sales, 2012-13 to 2017-18

- Figure A: distribution of employees in Canada (full-time, part-time, interns) by market segment, 2013-14 to 2017-18

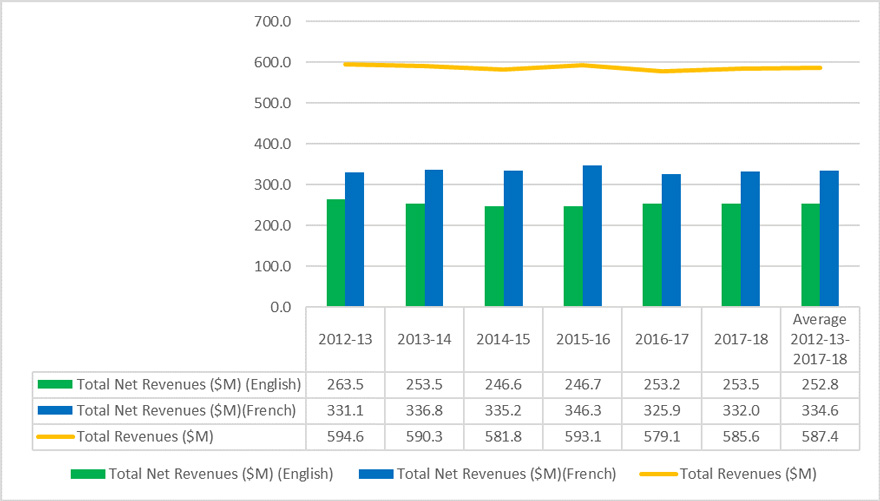

- Figure B: revenues of CBF recipients, 2012-13 to 2017-18

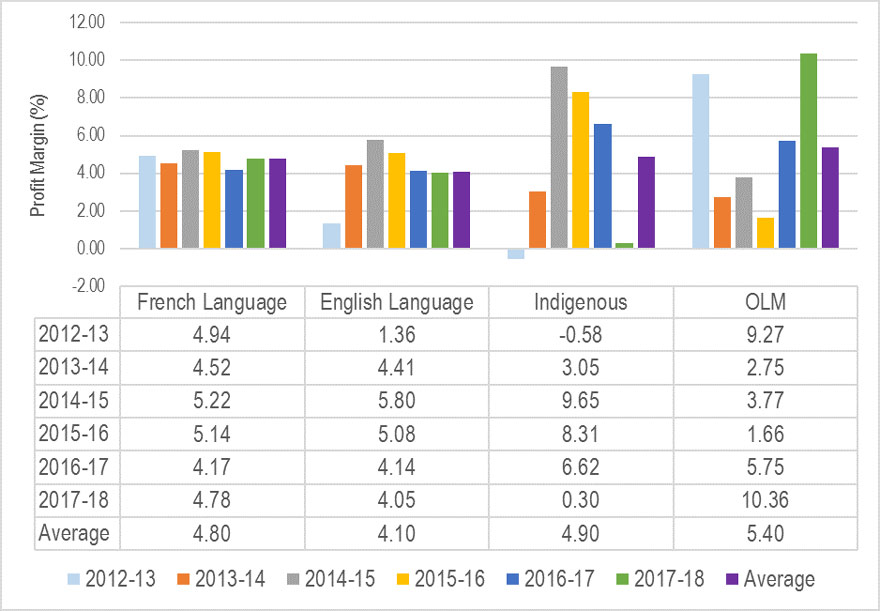

- Figure C: profit margins of English and French-language markets and Indigenous and OLM publishers

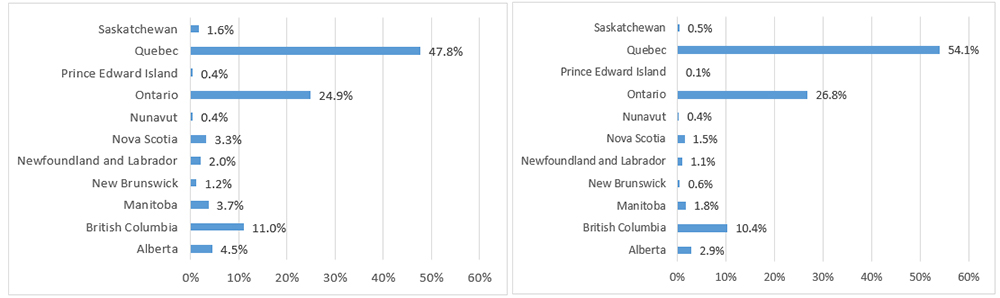

- Figure D: distribution of recipients by province (left) and distribution of funding by province (right)

- Figure E: distribution of recipients, by language sector (left) and distribution of funding, by language sector (right)

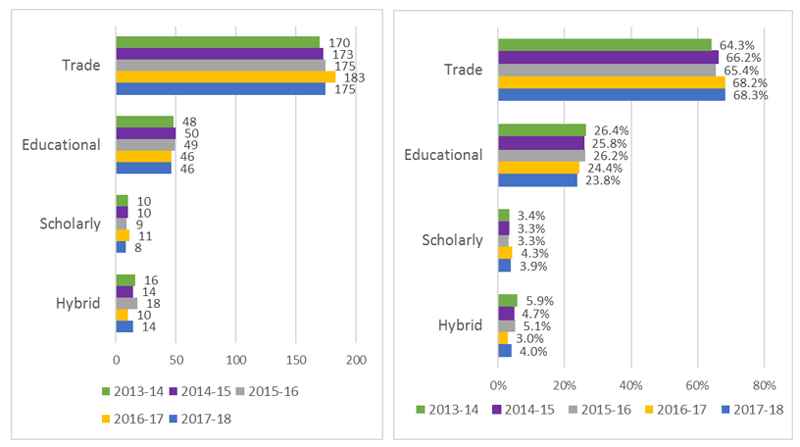

- Figure F: distribution of recipients, by market segment (left), compared to distribution of funding, by market segment (right)

- Figure G: French and English-language markets – domestic and export sales of Canadian-authored titles, 2012-13 to 2017-18

- Figure H: CBF recipients: domestic and export sales of Canadian-authored titles by market segment

List of acronyms and abbreviations

- ACP

- Association of Canadian Publishers

- ACUP

- Association of Canadian University Presses

- ADM

- Assistant Deputy Minister

- ALQ

- Association des libraires du Québec

- ANEL

- Association nationale des éditeurs de livres

- BPIDP

- Book Publishing Industry Development Program

- BTLF

- Banque de titres de langue française

- CBF

- Canada Book Fund

- CCA

- Canada Council for the Arts

- CPC

- Canadian Publishers' CouncilFootnote 1

- DP

- Departmental Plan

- DRR

- Departmental Results Report

- ESD

- Evaluation Services Directorate

- FAA

- Financial Administration Act

- FMB

- Financial Management Branch

- FTE

- Full-time Equivalents

- FRMAP

- Foreign Rights Marketing Assistance Program

- GCIMS

- Grants and Contributions Information Management System

- Gs&Cs

- Grants and Contributions

- GCMI

- Grants and Contributions Modernization Initiative

- GC

- Government of Canada

- LCB

- Livres Canada Books

- LPG

- Literary Press Group

- OLM

- Official Language Minority

- OLMC

- Official Language Minority Community

- O&M

- Operation and Maintenance

- PCH

- Department of Canadian Heritage

- PRG

- Policy Research Group

- RÉFC

- Regroupement des éditeurs franco-canadiens

- SFO

- Support for Organizations

- SFP

- Support for Publishers

- Ts&Cs

- Terms and Conditions

- TWUC

- The Writers' Union of Canada

- UNEQ

- Union des écrivaines et des écrivains québécois

Executive summary

This report presents the findings from the evaluation of the Department of Canadian Heritage's (PCH) Canada Book Fund (CBF).

Program description

For the past 40 years, the CBF has been the Government of Canada's (GC) main support mechanism for the Canadian-owned book publishing industry. The objective of the CBF is to ensure access to a diverse range of Canadian-authored books, nationally and internationally, by fostering a strong industry that publishes and markets Canadian-authored books. The Program is delivered by the Cultural Industries Branch of the Cultural Affairs Sector of PCH.

The CBF delivers its mandate through two funding streams:

- Support for Publishers (SFP) provides financial assistance, through a sales-based formula, to Canadian-owned book publishers in all market segments of the industry to support the production, marketing and distribution of Canadian-authored books. This stream also provides project funding to support internships and business planning projects.

- Support for Organizations (SFO) helps to develop the Canadian book industry and the market for its products by supporting collective projects that offer a broad benefit to book industry stakeholders and value-for-money from efficiencies achieved through investment in collective initiatives and services, including, but not limited to, technology-driven projects that build industry capacity and competitiveness and support for international marketing delivered by Livre Canada Books (LCB).

Evaluation approach and methodology

The evaluation covered the period of 2012-13 to 2017-18 and, as required by the Financial Administration Act (FAA) and the Treasury Board Policy on Results (2016), assessed the relevance, effectiveness and efficiency of the CBF. The evaluation involved a multi-method approach and included a combination of qualitative and quantitative data collection methods and primary and secondary data sources to address the evaluation issues and questions.

Findings

Relevance

The CBF remains relevant. The CBF plays an economic and culturally significant role. Over the evaluation period, the Program has been under pressures brought about by rapidly evolving technological changes, including digitization of all facets of the industry, and changes to the publishing and retail landscapes which have contributed to a reduced visibility of Canadian-authored books. The small to medium-sized publishers, who are the primary recipients of the CBF, remain financially fragile as demonstrated by flat revenues and low profit margins. Therefore, there is a need for continued investment in the Canadian-owned book publishing industry to foster an environment in which publishers can continue to adapt to industry challenges, keep pace with technological advancements, remain competitive and innovate and take risks in today's digital and international markets.

The CBF was responsive to industry needs by providing $220.6M in grants and contributions (Gs&Cs), between 2012-13 and 2017-18, to support the industry, of which over 80% was allocated directly to publishers to support the production, marketing and distribution of Canadian-authored books. In particular, recipients were given the flexibility to use their contribution to address their particular needs. The Program also adjusted application guidelines and its funding formula to support industry challenges, including supporting the industry's adjustment to digitization and enhancing support for international marketing. Adjustments were also made to the application guidelines and funding formula to align with GC, PCH and Program priorities and to direct proportionally more funding to smaller publishers and certain priority groups.

Though the Program worked to address industry challenges, the evaluation identified some unmet needs. More specifically, the SFO stream of the CBF, which supports collective projects of broad benefit to the industry, has been oversubscribed in recent years. While there have been increased funding pressures on SFO, the program has a high level of commitment to recurring projects. The budget and scope of these recurrent projects have generally grown over the years. As a result, there is little flexibility to accept new innovative projects or new applicants.

Addressing the issue of discoverability of Canadian-authored books in a crowded market and, related to discoverability, how best to market and promote Canadian books in the new digital and online marketplace were identified as areas where industry stakeholders continue to experience challenges and where further support is needed.

The CBF aligns with the GC and PCH vision for the creative industries by maintaining a viable and competitive industry that creates and provides access to a diverse range of Canadian cultural content in Canada and abroad.

Effectiveness

The program achieved the immediate result: a broad range of Canadian-owned publishers invest in ongoing publishing operations. During the period covered by the evaluation, the Program approved $189M to support an average of 245 Canadian-owned publishers annually for the production, marketing and distribution of Canadian-authored books. The CBF supported a diversity of publishers by language, region, market segment, as well as Indigenous and official language minority (OLM) publishers.

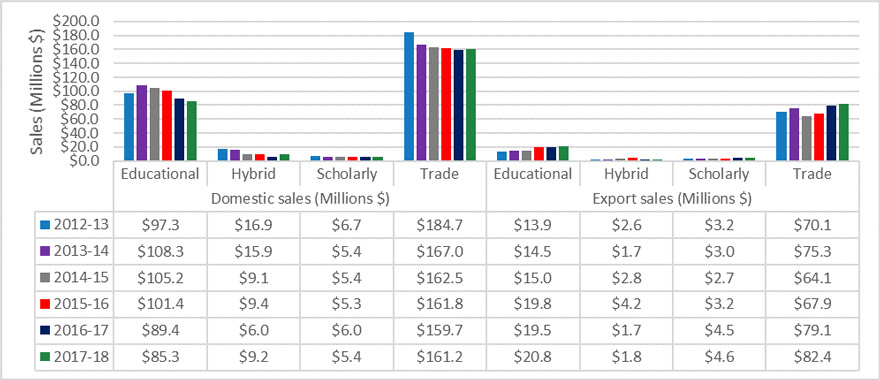

The evaluation could not conclude that the CBF achieved its result: marketing initiatives have built the demand for Canadian-authored books. There was no performance data to establish a link between marketing activities and demand for Canadian-authored books. Similar to the trend in the Canadian book publishing industry generally,Footnote 2 CBF recipients experienced a decline in domestic sales and an increase in export sales during the evaluation period. The CBF's investment in international marketing may have contributed to an increased demand for Canadian-authored books.

The evaluation found strong evidence, based on interviews with industry stakeholders, that some of the larger technological projects fostered technological innovation and encouraged the adoption of industry best practices. Key informants indicated that these projects have contributed to publisher's success in marketing and adapting to digital technologies.

The Program achieved its intermediate result: readers in Canada and abroad have access to a broad range of Canadian-authored books. The Program exceeded its annual target for the production of new Canadian-authored titles. Books were produced by CBF recipients in each province and one territory, in both official languages and represented a diversity of genres. However, while Canadian-authored books are being produced, with sales being flat, the extent to which they are being accessed is an issue. This could be due to challenges associated with the visibility of Canadian-authored books. Recipients reported challenges associated with effective approaches to marketing books due to changes to the retail landscape and the growth of e-books and on-line purchasing options.

In terms of its ultimate result: readers everywhere consume a broad range of Canadian-authored books, the Program did not meet its sales target in 2012-13 and 2014-15. After revising its sales target, the Program was successful in achieving the revised target between 2014-15 and 2017-18. The program experienced an overall decline in its domestic sales of Canadian-authored books by 14% in 2017-18, when compared to 2012-13. However, the decline in domestic sales was partially offset by an increase in export sales of Canadian-authored books of 22%. The decline in domestic sales and increase in export sales was experienced in both language markets.

In response to the recommendations of the 2014 Cultural Industries Cluster Evaluation of the Canada Music Fund and the Canada Book Fund, the program introduced incentives to encourage a greater production of digital books. CBF recipients have made significant investments in digital technology but the return on investment has been low. Digital sales remain a small proportion of total sales. This is consistent with the trend in the book industry in Canada overall. Digital sales in the English-language market has been consistently higher than their French-language counterparts.

Overall, the design and delivery of the program contributed to the achievement of the Program's objective to ensure access to a diverse range of Canadian-authored books nationally and internationally, by fostering a strong book industry that publishes and markets Canadian-authored books.

Recipients have a high level of satisfaction with the funding formula and its flexibility. However, during the period of the evaluation, SFO had a high level of commitment to supporting recurrent applicants and established ongoing or recurrent projects, including annual book-related events in Canadian communities across the country. As a result, SFO encountered a challenge in terms of its ability to fund new applicants and new or innovative projects.

Key informants suggested a range of design and delivery improvements. However, no strong trend emerged in terms of the options presented. Best practices by CBF recipients included innovations in e-commerce solutions and collaborative marketing.

In examining provincial support to the book publishing industry, the models vary across the country. Some provinces have programs specifically directed to the book publishing industry, which may include operational support to publishers and/or project-specific support to book publishers for activities such as marketing, professional development, author tools and participation in conferences and books fairs, which is consistent with the model of the CBF. Other provinces provide support to the publishing industry under cultural industries/arts programs. Four provinces provide tax credits to eligible book publishers.

The design and delivery approaches of the CCA and Ontario Creates to support the Canadian book publishing industry differ from the approach taken by the CBF in terms of their review of applications for funding. Whereas the CBF assesses all applications internally, depending on the type of application both organizations use a combination of internal assessment and external peer reviews when assessing applications. Furthermore, the CBF determines funding for individual publishers based on a largely objective formula-funding model, whereas CCA (the other main GC funding source available to book publishers) provides funding based on more subjective, literary merit considerations.

Efficiency

The Program was delivered efficiently. The administrative costs to deliver the CBF remained consistent during the evaluation period. The program met service standards for acknowledgement of receipt of applications, and improved the timeliness of funding decisions. Improvements such as the use of multi-year funding agreements (SFO), delegation of authority for approval of SFP formula funding and CBF projects under $75,000 and the piloting of an on-line application portal for SFP-Business Development have contributed to greater efficiency. However, there are opportunities to further improve the efficiency of the application review and decision process for SFO. The majority of recipients reapply annually for recurrent activities. Opportunities exist to make greater use of the streamlined review process, multi-year funding and grants, instead of contributions, for low-risk applicants.

Other evaluation issues

Diversity and inclusion

The CBF supports the GC diversity and inclusion priority by supporting both official language sectors, OLM and Indigenous publishers. However, there is limited data available on diversity within the publishing industry. The Program has a role to play in supporting PCH efforts to integrate GBA+ in its program design and to support the industry in promoting increased participation of diverse groups.

The GC has adopted the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired or Otherwise Print Disabled (Marrakesh Treaty). PCH also has a role to play in working with publishers and industry stakeholders to promote concrete actions to ensure the production and distribution of accessible reading material.

Experimentation

The CBF has actively participated in PCH's experimentation initiative by putting forward some experiments. However, at this time, it is premature to derive conclusions on the basis of these experimentation projects.

Recommendations

Recommendation 1

Redirect focus from production to marketing and promotion

Canadian-authored books compete for attention in a crowded marketplace and on a variety of platforms. In addition, digital infrastructure, largely created by multinational companies, does not effectively recognize Canadian books. Dedicating support to discovery, marketing and promotion is essential to grow the sales of Canadian-authored books.

Publishers are experimenting with various approaches to market and promote their books in a concentrated digital and on-line marketplace without reliable information to guide them in terms of what marketing strategies are most effective. Many small publishers also lack capacity in terms of resources and marketing expertise. The CBF has the opportunity to provide leadership by helping the industry to identify and implement innovative and effective strategies for the discovery, marketing and promotion of Canadian-authored books.

It is recommended that the Senior Assistant Deputy Minister for the Cultural Affairs Sector take measures to support the Canadian-owned book publishing industry to address issues associated with the discovery, marketing and promotion of their Canadian-authored books, including addressing information need, the capacity and skills gaps and issues related to marketing infrastructure.

Recommendation 2

Address the oversubscription in SFO (Support for Organizations)

SFO is oversubscribed. A large portion of SFO spending is committed to supporting annually recurring or ongoing projects, so there is little flexibility to accept new and innovative projects that could support the industry in addressing the issues associated with the discovery, marketing and promotion of Canadian-authored books. There is limited evidence to conclude that some of the recurrent marketing projects/activities currently funded through SFO contribute to the consumption of Canadian-authored books.

It is recommended that the Senior Assistant Deputy Minister for the Cultural Affairs Sector assess opportunities to enable the entry of new and innovative projects to the SFO stream.

Recommendation 3

Further increase the efficiency of the SFO application assessment process

The SFO stream has increased its efficiency and has made some progress in its use of multi-year funding and of the more streamlined review process. However, the majority of SFO applicants are low risk recurrent clients with recurrent activities that are applying and being assessed annually. To further increase efficiency, consideration should be given to greater use of multi-year funding, greater application of the existing streamlined assessment process or to the introduction of another mechanism to assess applications from recurrent, low-risk clients whose activities are recurrent.

It is recommended that the Senior Assistant Deputy Minister for the Cultural Affairs Sector continue to increase the efficiency of the assessment process for recurrent, low risk SFO applications with annually recurring activities.

1. Introduction

This document presents the findings of the evaluation of the CBF. The evaluation was carried out as indicated in the Canadian Heritage's Departmental Evaluation Plan 2018-19 to 2022-23 and covered six years (2012-13 to 2017-18). The evaluation examined the relevance, effectiveness and efficiently of the CBF, as required by the FAA, the Treasury Board Policy on Results (2016) and commitments made in the 2014 Treasury Board Submission to evaluate the Program in 2018-19.

The report is divided into six sections, including the introduction. Section 2 provides the program profile. Section 3 describes the approach and methodology for the evaluation. Section 4 presents the evaluation findings. Section 5 summarizes the main conclusions. Section 6 lists the recommendations arising from the evaluation, and presents the management response, and action plan.

2. Program profile

2.1. Overview

The CBF provides Gs&Cs to the Canadian-owned book industry to support the creation and dissemination of Canadian-authored books and to encourage their consumption by readers everywhere. The Program has two funding streams, each designed to support the activities of a different recipient population.

Support for Publishers ($30.7M)

The SFP stream has two components: Publishing Support and Business Development.

- The Publishing Support component provides financial assistance to Canadian-owned book publishers (mainly for profit) in all market segments of the industry (educational, scholarly and trade) to support the sustainable production, marketing and distribution of Canadian-authored books by offsetting the high costs of publishing in Canada and building the capacity and competitiveness of the sector in a global market. Funding is distributed through a sales-based funding formula that rewards publishers' success in delivering content to consumers.

- The Business Development component provides project funding to support internships and business planning projects.

Support for Organizations ($5.6M)

SFO helps to develop the Canadian book industry and the market for its products by supporting collaborative projects that offer a broad benefit to book industry stakeholders and value-for-money from efficiencies possible through concentrated public investment in collective initiatives.

SFO supports industry associations and related organizations to undertake collective marketing initiatives and to strengthen the infrastructure of the industry through professional development, internships and technology-driven projects and services.Footnote 3

In addition, funding through SFO ($750 000 annually) is also given to LCB to administer on behalf of PCH the Foreign Rights Marketing Assistance Program (FRMAP).

2.2. Program history and changes since the last evaluation

The CBF was launched in 1979 as the Canadian Book Publishing Development Program to support the creation and dissemination of Canadian books through industrial support to encourage growth and improve the financial viability in Canada's domestic book publishing industry. The Program has served as the Government's main support mechanism for Canadian books for forty years. The Program was renamed the Book Publishing Industry Development Program in 1986 and in 2010, the CBF. The latter change reflected the more mature state of the industry and recognized that that Program was now a supporter of an established industry. Following an evaluation in 2008, the Program was renewed in 2009 for the years 2010-11 through 2014-15 with changes to its structure, streamlining from four to the current two funding streams SFP and SFO, to reduce the administrative burden and to improve client service.

A Cultural Industries Cluster Evaluation (Canada Music Fund and Canada Book Fund) covering the period 2007-08 to 2011-12 was completed in July 2014. Since the last evaluation, the Program was renewed in 2014. The renewal focussed on international competitiveness and digital innovation and program changes encouraged greater production, marketing and sales of digital books. The $9M in supplemental funding the CBF had been receiving since 2001 via "Tomorrow stART today" was made permanent. These funds supplemented the CBF's ongoing financial support enabling the Program to meet its key challenge: to continue innovating to succeed under rapidly changing market conditions. Resources supported projects and services that improved the efficiency of the supply chain for books in Canada, enhanced support for collective initiatives, including expanded support for book export activities; and augmented the CBF's formula-based aid to publishers, helping ensure that Canadian-owned book publishers had the capital to invest in new technologies to more effectively serve the changing market.

2.3. Program objective and expected results

Table 1 provides the objective of the CBF and the associated expected immediate, intermediate and ultimate results.

| Objective | Immediate results | Intermediate result | Ultimate result |

|---|---|---|---|

| To ensure access to a diverse range of Canadian-authored books nationally and internationally, by fostering a strong book industry that publishes and markets Canadian-authored books. |

A broad range of Canadian-owned publishers invest in ongoing publishing operations Marketing initiatives build demand for Canadian authored books Collective projects foster technological innovation and encourage the adoption of best practices industry-wide |

Readers everywhere have access to a broad range of Canadian-authored books | Readers everywhere consume a broad range of Canadian-authored books |

2.4. Target population, stakeholders and delivery partner

Table 2 describes the primary targets, stakeholders and delivery partner of the CBF.

| Target population |

The specific individuals or organizations intended to be influenced by and to benefit from the program.

|

|---|---|

| Key stakeholders |

Agencies, organizations, groups or individuals who have a direct or indirect interest in the program intervention or its evaluation. The CBF's key stakeholders include major funding recipients and associations and organizations in the areas of the Program's focus:

|

| Delivery partner |

|

2.4.1. Canada Book Fund context

The CBF supports two distinct publishing sectors in Canada: French-language and English-language. The largest number of English-language publishers are located in Ontario. The industry has been impacted by consolidation of ownership and a significant contraction in traditional independent book retail.Footnote 4 The retail landscape is now dominated by one retail chain Chapters/Indigo.

French-language publishers account for almost 1/3 of Canadian-owned firms. The French-language sector differs from the English language sector in that the ownership landscape is completely different; there are fewer foreign-owned publishersFootnote 5 and there is the presence of vertically integrated multimedia companies (Quebecor, Transcontinental). As is the case in the English-language sector, there is one dominant retail chain – Renaud-Bray Archambault. The French-language sector has experienced greater stability due to Loi 51Footnote 6 which requires institutions such as schools and libraries to buy books from accredited bookstores. There is also tradition of Salons du Livre which provides opportunities for the public to meet authors and buy books directly from publishers.

2.4.2. Profile of SFP recipients

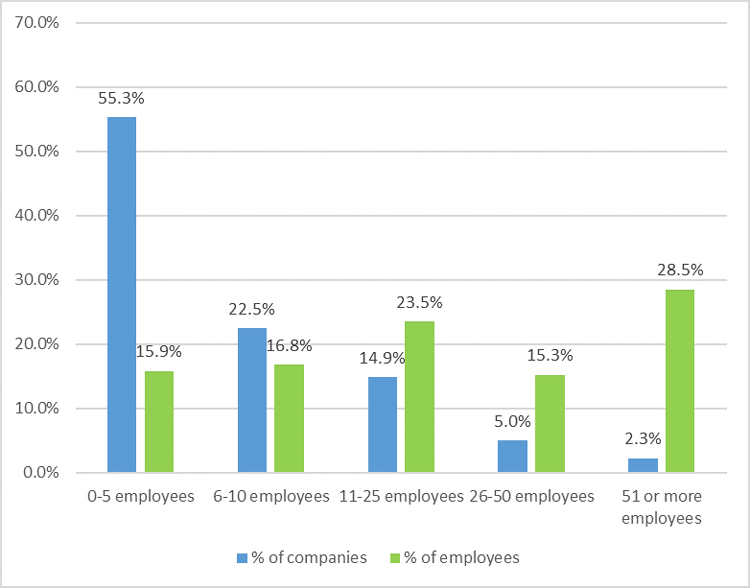

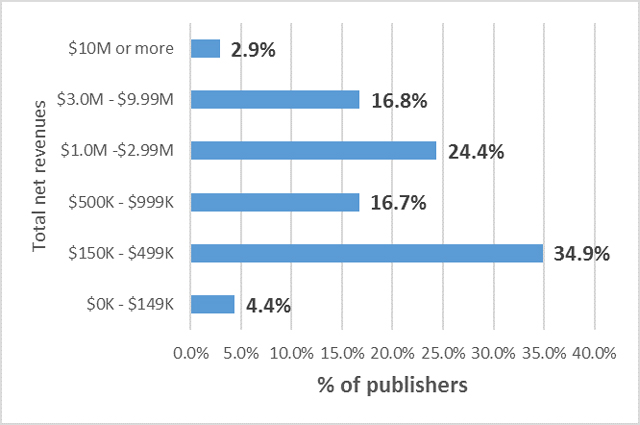

Recipients of the SFP stream are Canadian-owned and Canadian-controlled book publishers that have their headquarters and the vast majority of their employees in Canada. The CBF supports predominately small and medium-sized publishers. As shown in Figure 1, smaller publishers with fewer than 10 employees make up the majority of CBF recipients (77.8%). A few larger CBF recipients (>25 employees) (7.3%) are responsible for the largest proportion (43.8%) of employment. Furthermore, as shown by Figure 2, 56% of CBF recipients had total revenues of less than $1 million.

Source: CBF administrative data

Figure 1: SFP – distribution of companies and employees, 2013-14 to 2017-18 – text version

| % of companies | % of employees | |

|---|---|---|

| 0-5 employees | 55.3% | 15.9% |

| 6-10 employees | 22.5% | 16.8% |

| 11-25 employees | 14.9% | 23.5% |

| 26-50 employees | 5.0% | 15.3% |

| 51 or more employees | 2.3% | 28.5% |

Source: CBF administrative data

Source: CBF administrative data

Figure 2: SFP – distribution of publishers by revenues, 2013-14 to 2017-18 – text version

| Total net revenues | % of publisher |

|---|---|

| $0K - $149K | 4.4% |

| $150K - $499K | 34.9% |

| $500K - $999K | 16.7% |

| $1.0M -$2.99M | 24.4% |

| $3.0M - $9.99M | 16.8% |

| $10M or more | 2.9% |

Source: CBF administrative data

Between 2013-14 and 2017-18, the average annual number of full-time and part-time employees and interns employed in Canada by CBF-SFP recipients was 2,511. Comparing 2013-14 to 2017-18, the number of employees has declined by 11.4%. The trade market segment employed 53% of employees (Annex B, Figure A: Distribution of employees in Canada (full-time, part-time, interns) by market segment, 2013-14 to 2017-18).

Employment is centered primarily in Quebec (47.3%), Ontario (36.9%) and British Columbia (7.9%). See Annex B, Table A: Distribution of employees by province and territory, 2012-13 to 2017-18 for more details.

2.4.3. Profile of SFO recipients

Recipients of the SFO stream are Canadian-owned and Canadian-controlled organizations, professional associations, businesses and other groups representing or related to the Canadian book industry, such as writers' festivals or other literary events.

Funding is provided to projects undertaken on behalf of a group of publishers or other industry stakeholders developing new or existing markets for Canadian-authored books or improving the book industry's ability to deliver content to those markets.

Between 2012-13 and 2017-18, SFO received 460 applications from 124 unique organizations. Of that number, 339 projects were approved and were delivered by 77 organizations. An organization could receive funding for multiple projects in any given year.

Table 3, below, shows the distribution of applicant and recipient organizations and projects delivered by province. Many of the organizations based in Ontario served the entire English-language market, explaining in part why many of the funded organizations were concentrated in this region. As well as having a large number of organizations serving the specific needs of the French-language publishing industry, Quebec is also home to many salons du livre and book-related festivals, which received funding.

| Province | Distribution of organizations which applied for funding | # of applications | Distribution of organizations with approved applications | # of approved applications |

|---|---|---|---|---|

| Alberta | 4 | 17 | 2 | 11 |

| British Columbia | 11 | 45 | 6 | 33 |

| Manitoba | 4 | 13 | 2 | 7 |

| New Brunswick | 4 | 16 | 4 | 15 |

| Nova Scotia | 8 | 21 | 3 | 13 |

| Ontario | 43 | 148 | 28 | 113 |

| Prince Edward Island | 1 | 4 | 1 | 3 |

| Quebec | 44 | 183 | 28 | 134 |

| Saskatchewan | 5 | 13 | 3 | 10 |

| Total | 124 | 460 | 77 | 339 |

Source: Grants and Contributions Information Management System (GCIMS)

2.5. Program management and governance

Accountability for the CBF lies with the Senior Assistant Deputy Minister, Cultural Affairs Sector while the responsibility rests with the Director General, Cultural Industries Branch of the Cultural Affairs Sector. The Cultural Industries Branch is responsible for policies and programs that foster the creation of and access to Canadian cultural expressions and content at home and abroad. This Branch supports Canadian cultural industries in adapting to a changing and challenging global marketplace. This is achieved through the delivery of grants, contributions and tax credits as well as policy, regulatory and legislative measures. Fostering the competitiveness and creative output of these industries ensures that Canadian and international audiences access a range of Canadian content across a variety of formats and platforms and contributes to the Canadian economy.

The Book Publishing Policy and Programs Directorate is responsible for both the SFP and the SFO streams, as well as for policy development, under the Director of Book Publishing Policy and Programs.

The CBF's Terms and Conditions (Ts&Cs), approved in November 2014, guide program delivery. The Ts&Cs include an articulation of program objectives and expected outcomes, application requirements, the nature of eligible expenditures, and contribution maximum amounts.

2.6. Program resources

For the period covered by the evaluation, the CBF had total expenditures of approximately $239.7M (Table 4) for an annual average of $39.9M.

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | Total | |

|---|---|---|---|---|---|---|---|

| Budgeted | - | - | $39.6M | $39.6M | $39.6M | $40.5M | - |

| Actual | $39.5M | $39.9M | $39.2M | $39.7M | $39.9M | $41.2M | $239.7M |

Source: PCH Financial Management Branch.

During the period of the evaluation, the core budget was periodically augmented by additional funding to support PCH and GC priorities. For example, $500,000 were allocated in 2016-17 and $1.3 million in 2017-18 to promote Canadian-authored books in foreign markets.

During 2013-2014 to 2017-18, a total of $200,000 was reserved from existing funds to encourage collective projects with a dedicated focus on promoting Canadian history titles.

Full-time equivalents ranged between 29.5 and 32.2 (Table 5).

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|

| 29.9 | 32.1 | 30.5 | 30.7 | 29.5 | 32.2 |

Source: PCH Departmental Performance Reports (DPR)/Departmental Results Reports (DRR)

3. Approach and methodology

As required by the FAA and the Treasury Board Policy on Results (2016), the evaluation assessed the relevance, effectiveness and efficiency of the Program, with a focus on the impact of the Program.Footnote 8 The methodology included a combination of qualitative and quantitative data collection and used primary and secondary sources of information designed to address the evaluation issues and questions.

3.1. Scope, timeline and quality control

The evaluation was undertaken in accordance with the 2018-19 to 2022-23 Departmental Evaluation Plan, and covered a six-year period from 2012-13 to 2017-18.

The evaluation was launched in May 2018. Data collection occurred between September 2018 and February 2019. Analysis of findings, preparation and presentation of preliminary findings and report writing occurred between February and April 2019.

Several quality assurance measures were undertaken during the evaluation including developing a clear description of the evaluation methodology and its limitations so that the data collected could be evaluated reliably and satisfactorily, using multiple sources of primary and secondary data to ensure that findings were reliable and defensible, and engaging representatives of the Program to discuss evaluation issues and to validate the preliminary findings.

3.2. Calibration

The evaluation was calibrated as follows:

- The evaluation focused on the performance of the SFP stream as it represented the bulk of annual CBF funding ($30.7M) to support the production and marketing of Canadian-authored books by Canadian-owned publishers. In contrast, SFO allocates $5.6M to organizations to market books and strengthen the industry infrastructure.

- The evaluation relied on existing data sources. Additional data was collected when insufficient information was available from existing sources or to validate the available secondary data.

- Interviews were conducted in two stages. Initially interviews were conducted with representatives of organizations representing publishers. Findings were then validated through a second round of interviews with publishers themselves; and

- The file review was limited to a small sample of SFO GCIMS files to obtain a better understanding of the types of projects funded through this stream.

3.3. Evaluation questions

The scope of the evaluation and evaluation questions were developed following meetings with the Program managers to determine their information needs. As a result of these meetings, it was decided that the evaluation would explore the following general areas:

- Is the objective of the CBF – to ensure access to a diverse range of Canadian-authored books nationally and internationally, by fostering a strong book industry that publishes and markets Canadian-authored books – still relevant? Given the maturity of the Canadian book industry, should the CBF shift its focus from production and sales to marketing and discoverability?

- How can the CBF effectively support the Canadian book publishing industry to achieve its ultimate outcome to increase the discoverability and consumption of Canadian-authored books?

- What options exist for managing oversubscription of the SFO stream? Are there opportunities for greater efficiency? Should the CBF review the weight it currently gives to collective initiatives compared to support for individual publishers?

Additional detail about the evaluation questions, indicators and data collection methods are available in the evaluation matrix in Annex A.

3.4. Data collection methods

A mixed-method approach was used for this evaluation including a document review, a literature review, a scan of data relating to the Canadian book publishing industry, an administrative data review, and interviews with recipients and stakeholders. The following describes each of the data collection methods.

3.4.1. Document review

The document review included, but was not limited to, PCH and GC documents (e.g. Memoranda to Cabinet, Ts&Cs, Speeches from the Throne, Federal Budgets, DPs and DRRs etc., Program documents such as briefing notes and studies commissioned by the Program (e.g., Turner-Riggs (2013)Footnote 9, Edinova (2014))Footnote 10, and annual industry consultation decks.

3.4.2. Literature review

ESD conducted a preliminary literature review to inform key informant interviews. The review included recently published literature, reports, industry association websites, public opinion research and other sources. The PCH Knowledge Centre was engaged to obtain articles and reports from respected journals through academic research databases. The Policy Research Group (PRG) augmented the literature review by conducting a more targeted review in support of specific evaluation questions.

3.4.3. Data scan

PRG also conducted an analysis of quantitative datasets related to the Canadian book publishing industry over the period of 2012-13 to 2017-18, including data from Statistics Canada and from public opinion research firms.

3.4.4. Administrative data review

The CBF administrative data was reviewed for the evaluation. This included:

- Data provided by the Program, including sales data, annual administrative data, and data on the number of titles produced;

- Data entered into the PCH GCIMS;

- Financial data provided by Finance; and

- Service standard compliance data from the Gs&Cs Centre of Expertise reported on the PCH website.

3.4.5. Key informant interviews

A total of 38 Interviews were conducted with both internal and external stakeholders. A total of 7 interviews were conducted with PCH program personnel, and 31 interviews were conducted with external stakeholders (13 with national and provincial industry associations, 13 with publishers and 5 with other stakeholders including the CCA and TWUC). Stakeholders represented regions across Canada, and included French and English, OLM and Indigenous publishers.

Based on the frequency of responses, the following guidelines were used in the analyses and to report results from the interviews:

- All/almost all – findings reflect 90% or more of the observations;

- Large majority/most – findings reflect 75% but less than 90% of the observations;

- Majority – findings reflect at least 51% but less than 75% of the observations; and

- Half – findings reflect 50% of the observations;

- Some – findings reflect at least 25% but less than 50% of the observations; and

- Few – findings reflect less than 25% of the observations.

3.5. Constraints, limits and mitigation strategies

The following outlines the key constrains and limits of the evaluation process and identifies the mitigation strategies used to minimize the impact of these limitations:

- The majority of the external interviewees were recipients (26/31). As a result, there could be a positive response bias. To mitigate this issue, the evaluation used multiple lines of evidence to validate findings and themes from key informant interviews.

- The results of the key informant interviews, particularly for publishers, cannot be assumed to be representative of a wider population because of the limited number of interviewees compared to the total number of publishers. However, publishers' responses highlight some themes which were then triangulated with responses from representatives of national and regional associations which represent publishers.

- There were limitations associated with the administrative data, including the following:

- Results cannot be solely attributed to PCH since organizations received funding from various other sources. To mitigate this challenge, the evaluation examined the amount of CBF funding relative to other sources of funding, and, during interviews, asked recipients about the viability of their operations in the absence of funding from the CBF.

- GCIMS data and Program data may not always be consistent due to the timing and way information is captured (e.g., factors such as multi-year funding agreements). The report identifies the source of data – GCIMS or CBF administrative files.

- Changes to the SFP reporting format in 2013-14. As a result, for a small number of indicators, data for 2012-13 were unavailable. As the evaluation covers a six-year period, trends are unlikely to be impacted by the absence of one year of data.

- Availability of results data for the SFO stream's collective projects. Collective projects are varied and each has unique objectives. In terms of results, projects are assessed on the basis of the extent to which they have achieved their objectives and projects are categorized simply as "met", "partially met" or "unmet". The evaluation was unable to assess the extent to which these projects contributed to the achievement of program results. This constraint was mitigated by asking key informants about the impact of the collective projects on their operations.

4. Findings

The following sections present the evaluation findings relating to relevance, effectiveness and efficiency. It also covers other relevant evaluation issues, including the extent to which the Program supports the GC diversity priority and the CBF's contribution to the PCH experimentation initiative.

4.1. Relevance

This section presents the evaluation findings regarding the relevance of the CBF, including the ongoing need for the Program and the Program's responsiveness to the challenges and needs experienced by the Canadian-owned book publishing industry. The key findings have been organized by evaluation question. Supporting themes and evidence are provided below each table.

4.1.1. Relevance: ongoing need for the program

Evaluation question: Is there a need for continued investment in the Canadian-owned book publishing industry?

Key findings:

As part of the Canadian book publishing ecosystem, the CBF remains relevant. The Canadian book publishing industry plays an economically and culturally significant role in Canada that warrants public support to create Canadian content and to maintain a viable and competitive book industry. In 2017, books contributed $756.6M to Canada's GDP and supported 9,570 jobs in Canada.

There is a demonstrated need for continued investment in the Canadian-owned book publishing industry to foster an environment in which Canadian-owned publishers can continue to adapt to industry challenges, remain competitive and innovate and take risks in today's digital and international markets. The need may be even greater now as a result of significant trends that have disrupted the industry in recent years. Small to medium-sized companies, which are the main recipients of CBF support, are under pressure from changing market conditions. Indicators of financial health indicate that these companies would be vulnerable without CBF support.

The GC has indicated its support for the cultural industries and the CBF. The CBF aligns with the GC's vision for the creative industries by maintaining a viable and competitive industry that creates and provides access to a diverse range of Canadian-authored books in Canada and abroad.

Finally, Canadians consumers value and enjoy Canadian books but are not necessarily aware which books are Canadian. There is a need to develop and implement effective approaches to support the discovery and marketing of Canadian-authored books and the need to build industry capacity in terms of marketing and promotion.

Evidence from the document review, key informant interviews and the literature review confirmed the continued relevance of the CBF. The Canadian-owned publishing industry plays an economically and culturally significant role to Canada. The Canadian publishing ecosystem includes large, foreign-owned publishers as well as Canadian-owned publishers. Canadian and foreign-owned book publishers contributed to the Canadian economy by adding an estimated $756.5M to Canada's GDP in 2017 and supported 9,570 jobs.Footnote 11 The Canadian-owned book publishing industry contributed to $1.6B in revenues and were responsible for 46.2% of the $1.4B in book sales generated in 2016. Of that number, 53.8% was attributable to foreign firms.Footnote 12 In 2016, the Canadian book publishing industry paid out $379.7M in salaries, wages, commissions and benefits.

French and English-language publishers and Indigenous publishers contribute to Canadian culture and education and bring Canadian stories to the world. By supporting the production and promotion of content from Indigenous communities and Official Language Minority Communities (OLMC) the CBF supports Canada's linguistic duality and the diversity of cultural expressions.

Changing market conditions are creating pressures on Canadian-owned book publishers and challenging publishers' competitiveness. Some of the developments and challenges which have had an impact on the Canadian publishing industry during the period of the evaluation, and which will continue to impact the industry, include:

- Changes to the publishing and retail landscapes;

- Rapid technological changes, including digitization of the industry;

- Discoverability of Canadian-authored books and how to market and promote them; and

- Copyright and fair dealing exceptions.

The basis for many of the challenges associated with the production, marketing and distribution of Canadian books noted, by key informants and in the document and literature reviews, included Canada's relatively small population; the fact that the industry encompasses two languages; proximity to the United States; and competition from well-established multinational publishers and non-traditional sales channels like Amazon and Indigo who are backed by significant resources.Footnote 13

Publishing and retail landscapes

Canadian-owned book publishers compete with large multinational publishing houses, which have a major presence in the Canadian publishing marketplace. In both language markets, the principal competitive challenge is the share of foreign-authored book sales.

Canadian-owned firms are typically much smaller than their multinational competitors operating in Canada, and this limits Canadian-owned firms' opportunities for economies of scale in book production, marketing and distribution. The Canadian-owned firms also lack the financial resources to compete against the large multinationals for successful Canadian authors.

Changes to the retail landscape have also had a significant impact on the Canadian book publishing industry. Despite the gravitation of consumers online and the declining market share of traditional book retail, traditional book retail channels still account for the majority of consumer book sales in Canada and most publishers still consider this channel as the most important for sales. Therefore, to be successful in today's marketplace, publishers must continue to focus on both digital and print books.Footnote 14

Publishers have had to adapt to changes to the retail sector including reduced and concentrated traditional bookstore spaceFootnote 15; widespread consolidation in global book publishing, distribution and retail (Chapters/Indigo, Renaud-Bray Archambault); increased non-traditional retail (big box such as, for example, Costco and Walmart) and online retail (for example, Amazon). Selling books via these non-traditional channels is often not a simple or viable option for small publishers. Dominant and non-traditional retail accounts tend to be more selective, only accept a small number of titles – already best-sellers, and impose demanding terms of trade (e.g. significant price discounts, cooperative marketing contributions, etc.) leading to increased pressures on operating margins for Canadian book publishers.

Technological changes

The increasing popularity of digital devices that facilitate the consumption of books and the reliance on digital platforms for all aspects of the book supply chain (production, distribution, marketing and sales, and how trading partners do business and track sales) has introduced opportunities, as well as significant costs and challenges for Canadian-owned book publishers as they seek to adapt.Footnote 16

Digital technologies have contributed to on-line shopping and a demand for e-books, both of which have had an impact on business models. Publishers have made significant investments to adapt their businesses to the digital environment while maintaining traditional markets and their core business model for print books.Footnote 17 There was consensus among industry stakeholders interviewed, and supported by the document and literature reviews that their investment in digital platforms has not generated a significant return on investment as print books continue to be their primary revenue source.Footnote 18,Footnote 19,Footnote 20The perception is that people who like to read books in their leisure time will not likely replace the traditional book for e-books.

On-line retail provides another channel to reach consumers and is growing as the number of independent bookstores shrink and consumers are increasingly buying their books online. Similar to non-traditional retail, online retail favors larger publishers. On-line success often results from obtaining favorable co-op promotion and merchandising (how publishers secure retailers' cooperation in presenting or pricing books to encourage sales). Often publishers have to pay for merchandizing and bigger publishers have larger budgets for this, as well as stronger and more direct working relationships with retailers.Footnote 21

Discoverability of Canadian books and marketing

The concentrated print and the digital and on-line marketplace has had an impact on the discoverability of Canadian-authored books and has created marketing and promotion challenges for book publishers. Diminishing leisure time and competition for readers' attention with other forms of entertainment and changes to the way consumers discover and obtain books have had an impact on how Canadian book publishers market their books. Furthermore, as some consumers gravitate online and adopt e-books and e-book reading devices book publishers are faced with new and more selective sales channels. Building industry capacity in terms of marketing and promotion, and the availability of tools and effective approaches to support the discovery and marketing of Canadian-authored books, were identified as important needs by a majority of industry key informants.

Based on Statistics Canada data, average household expenditures on reading materials and other printed matter has declined between 2013 and 2017. Canadians are continuing to buy books, predominately in traditional (print) format and purchasing sites (offline). E-book consumption is low relative to print, but continues to grow. A 2015 BookNet Canada survey of English-language book readers found that more than half (52%) of Canadians purchase books in person and 45% purchase online. Paperbacks are the most purchased format (55% of sales), followed by hardcover (25%), e-book (17%), audiobook (2%) and other formats (2%).Footnote 22 Based on Statistics Canada data, among digital reading products (e-books, audiobooks, podcasts, online newspapers and magazines), e-books are the most popular digital reading product purchased by Canadians.Footnote 23

A 2016 BookNet Canada survey of the English-language book readers found that reading remains an important pastime for Canadians in which all demographic groups and in all regions participate in regularly.Footnote 24 Of Canadians aged 18-34, 86% report having read a book in the past year, compared with 81% of other demographic groups. Millennials read books in all formats, with print being the predominate format: 89% report reading print books, 54% e-books, and 11% report using their mobile phone as their primary reading device, a number that is growing. Footnote 25 A 2017 Scholastic Canada study found children also prefer print to e-books. The study found that 80% of children aged 6-17 will always want to read print books even though e-books are available, with this sentiment particularly felt among frequent and moderately frequent readers. In addition, of the 40% of children aged 6-17 who have read an e-book, 67% prefer print, 23% have no preference and only 10% prefer e-books.Footnote 26

However, books compete with other forms of leisure activity. In terms of how Canadians spend their leisure time, the 2017 edition of an annual BookNet Canada survey found that when respondents were asked about their top two leisure activities, reading appeared as one of the top two activities for 21% of respondents, in fourth place behind spending time with family, watching TV, and browsing the Internet, but ahead of watching a movie. More than 8 out of 10 survey respondents (81%) said they had read or listened to a book in the last year. This number has been slowly decreasing year over years (by no more than 1% annually) since 2015.Footnote 27

In terms of reading Canadian-authored books, in 2017, a large majority of English-speaking Canadian book buyers are interested in reading books by Canadian authors (84%)–this is up from 75% in 2012.Footnote 28 While Canadian consumers value and enjoy reading books, there is lack of awareness of which books are Canadian. A high percentage of readers (43% of women and 46% of men) reported reading at least one Canadian book in the previous 12 months. However, 37% of women and 24% of men surveyed did not know or were unsure whether they had read a Canadian book.Footnote 29

While Canadians are interested in reading Canadian-authored books, fewer traditional bookstores, the emergence of non-traditional retail, on-line markets and e-books have reduced the visibility of Canadian books. Canadian publishers face challenges to get books noticed (discoverability) in these new channels. Evidence from the literature review, key informant interviews and the document review identified the following challenges:

- Fewer opportunities to reach consumers as a result of the contraction of traditional (bricks and mortar) retail, which focuses primarily on selling books and which consumers use as the main discovery and purchasing site.

- Increasing competition for "shelf space" in non-traditional retail and online retail platforms, not only from within Canada but also from the large volume of titles, predominately from the USA and Great Britain, which enter the Canadian market each year, and in the case of the French-language sector, from France. Distribution channels lack structures and practices that promote Canadian-authored books.

- Declining media coverage, including reduced book coverage by traditional media outlets (e.g., newspapers, TV, radio, etc.). Obtaining coverage is highly competitive and costly.

- The discovery realm is more fragmented as a result of the rise and breadth of on-line options and the many ways to market books. Digital and on-line has introduced new ways to reach consumers but has also contributed to a proliferation of accounts and business models.

- Digital infrastructure, largely created by multinational companies inherently favors non-Canadian content and does not effectively recognize Canadian books.Footnote 30

Fair dealing exceptions within the Copyright Modernization Act

A few Industry key informants raised the issue of the disruption to the business model in the educational sector as a result of copyright and fair dealing exceptionsFootnote 31 within the Copyright Modernization Act (2012).Footnote 32 Canadian publishers indicate that they have been damaged by the Copyright Modernization Act and Fair Dealing GuidelinesFootnote 33 which K12 schools and post-secondary institutions in Canada, except Québec, have decided to adopt. Organizations like the ACP and TWUC, in presentations before the Standing Committee on Industry, Science and Technology, have argued that Canada's schools, universities and colleges use publishers' works far beyond legal limits without paying for them beyond those limits, or not paying the reasonable and affordable collective licenses of Canada's commercial authors and publishers, thereby causing economic damage to publishers and writers.Footnote 34,Footnote 35

Viability of the industry

Changes to the industry have had an impact on revenue streams, production, readership, distribution and business models and continue to create pressures on publishers as they seek to understand the implications and adapt and innovate. The combination of reduced and concentrated traditional bookstore space, an increasing selection of books in Canada and the rise of new more selective sales channels have contributed to reduced overall domestic sales for Canadian publishers, reduced market access for small firms, reduced visibility of Canadian titles and low profit margins, compared to the industry overall.

Almost all industry key informants indicated that the CBF continues to be essential to respond to challenges and to ensure the continued financial viability of the Canadian-owned book publishing industry. The initial purpose of the Canada Book Fund when it was created forty years ago was to support a fledgling Canadian publishing industry and offer Canadians and international readers Canadian-authored books. Presently, there is an established Canadian publishing industry, yet it remains fragile. Small publishers are more vulnerable in terms of their access to capital, bargaining power, cash flow and exposure to market fluctuations.

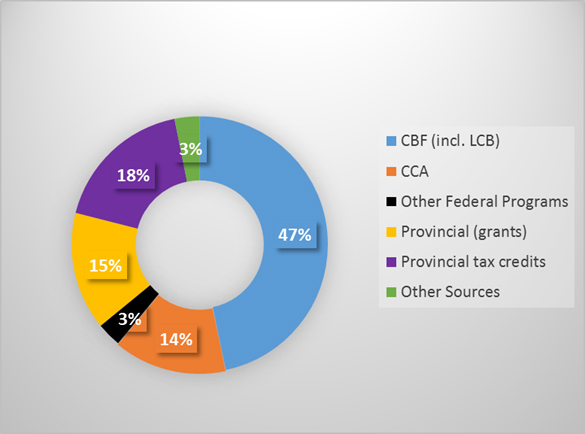

Indicators of financial health, including revenues and profit margins provide evidence that the financial health of CBF recipients is fragile. The vast majority of industry key informants indicated that the CBF is essential to their continued financial viability and their ability to innovate and take risks. Publishers reported receiving funding from various government sources. CBF administrative data showed that, overall, the CBF represented 47% of total government support, followed by provincial funding (grants and tax credits (33%)) and the Canada Council for the Arts (CCA) (14%) (Figure 3). CBF support averaged 5% of recipients' total revenues (2013-14 to 2017-18). However, as shown by Annex B, Table B: CBF as a % of total government funding and % total net revenues, 2013-14 to 2017-18, CBF support was higher for small firms and lower for larger firms.

Source: CBF administrative data

Figure 3: SFP recipients – sources of government funding (all publishers) – text version

| CBF (incl. LCB) | CCA | Other Federal Programs | Provincial (grants) | Provincial tax credits | Other Sources |

|---|---|---|---|---|---|

| 47% | 14% | 3% | 15% | 18% | 3% |

Source: CBF administrative data

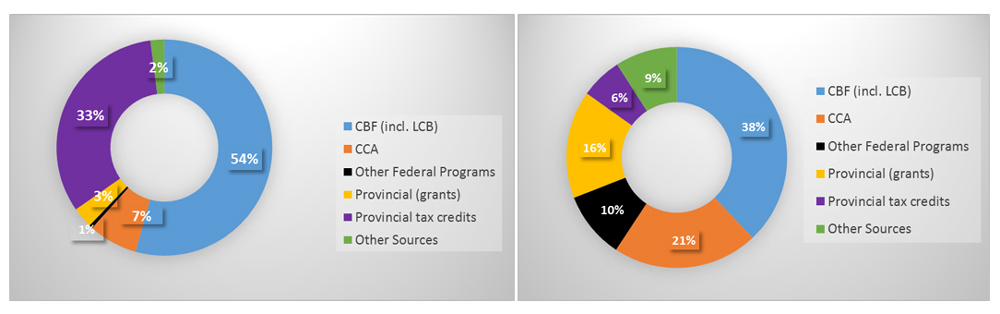

For indigenous publishers, the CBF represented a greater source of government support (54%) compared to the industry overall. While the CBF still represented the largest source of government funding (38%), CBF support to OLM publishers was lower than that of the industry overall. OLM publishers reported a larger proportion of their government support (21%) coming from the Canadian CCA compared to 7% for Indigenous publishers and 14% for the industry overall (Figure 4).

Source: CBF administrative data

Figure 4: SFP – sources of government funding of Indigenous and OLM publishers – text version

| Source of funding | Indigenous publishers | OLM publishers |

|---|---|---|

| CBF (incuding LCB) | 54% | 38% |

| CAC | 7% | 21% |

| Other Federal Programs | 1% | 10% |

| Provincial (grants) | 3% | 16% |

| Provincial tax credits | 33% | 6% |

| Other sources | 2% | 9% |

Source: CBF administrative data

Annex B, Figure B: Revenues of CBF recipients, 2012-13 to 2017-18, illustrates the revenues for CBF recipients between 2012-13 and 2017-18. While the revenues for the Canadian book publishing industry overall decreased by 0.6% between 2014 and 2016Footnote 36 CBF-recipients saw a greater decline in revenues than the industry overall. CBF recipients experienced an overall downward trend of 1.5% in 2017-18 compared to the 2012-13 high of $594.6M. This decline was in the English-language sector which had an overall decline in revenues of 3.8% between 2012-13 and 2017-18 whereas the French-language sector revenues increased by 1.6%. However, between 2016-17 and 2017-18, CBF data shows revenues increasing for both the English and French language sectors for an overall increase of 1.1%.

Between 2013-14 and 2017-18, the CBF on average constituted 7.5% of Indigenous publishers' and 6.5% of OLM publishers' total revenues.

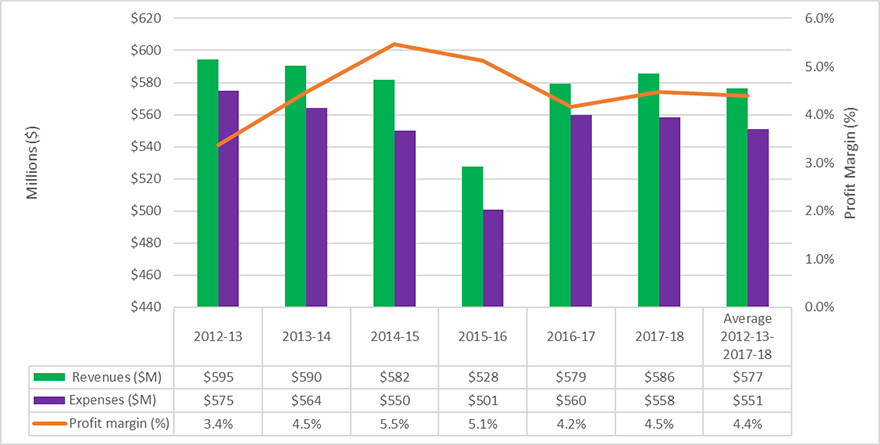

An analysis of profit margins, another indicator of financial health, found that the profit margin for CBF recipients was significantly lower than that of the Canadian book publishing industry overall. The profit margin for the industry was 10.2% in 2016, an increase from 9.6 in 2014.Footnote 37 As shown by Figure 5, CBF recipients' profit margin was 4.47% in 2017-18 and averaged 4.39% between 2012-13 and 2017-18.

Source: CBF administrative data

Figure 5: profit margin for SFP recipients – text version

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | Average 2012-13-2017-18 | |

|---|---|---|---|---|---|---|---|

| Revenues ($M) | $595 | $590 | $582 | $528 | $579 | $586 | $577 |

| Expenses ($M) | $575 | $564 | $550 | $501 | $560 | $558 | $551 |

| Profit margin (%) | 3.4% | 4.5% | 5.5% | 5.1% | 4.2% | 4.5% | 4.4% |

Source: CBF administrative data

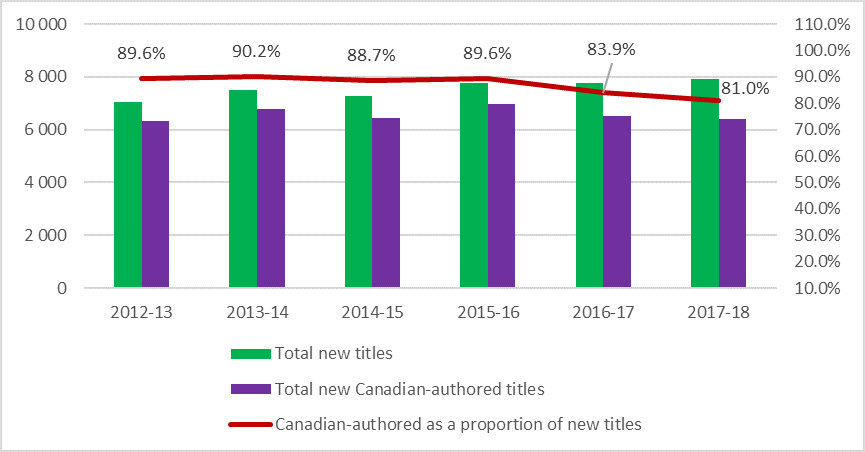

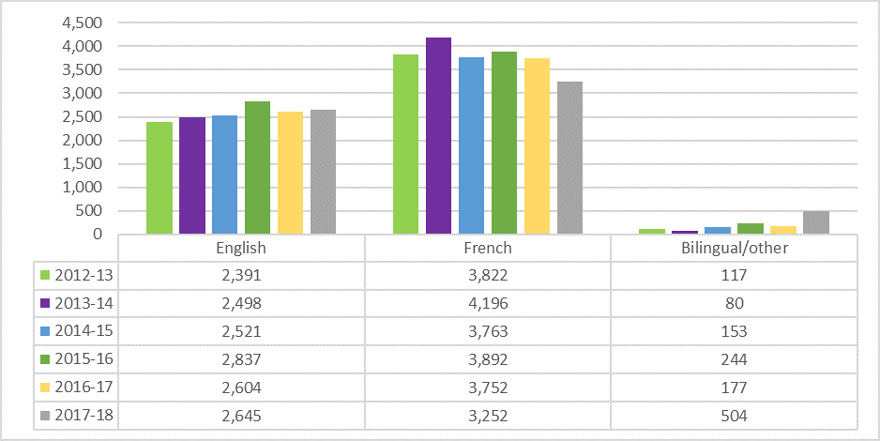

CBF recipients produced the majority of titles by Canadian-controlled book publishers. In 2017, CBF recipients produced 7,904 new titles and 6,401 new Canadian authored titles.

As shown in Annex B, Figure C: Profit margins of English and French-language markets and Indigenous and OLM publishers, the French-language market had a higher average profit margin (4.8%) when compared to the English language sector (4.1%). At 4.9% and 5.4% respectively, average profit margins of Indigenous and OLM publishers exceeded the average profit margin for CBF recipients (4.39%). The higher profit margin for the Indigenous and OLM publishers may be attributed to a higher percentage of revenues coming from the public sector.

Profit margins varied by market segment, with the educational and trade market segments averaging 4.9% and 3.8% respectively between 2012-13 and 2017-18. The scholarly market segment had the lowest profit margin averaging 1.4% for 2012-13 and 2017-18.

Generally, the largest publishers ($3.0M or greater) had the highest profit margins. Among publishers with less than $150 000 in revenues, the average profit margin was negative between 2014-2015 and 2017-2018. However, in 2013-2014, these small publishers had an average profit margin of over 6%. This was due to three of the nine publishers having profit margins of over 12% during this year, and this average is an anomaly in the period studied (Annex B, Table C: Profit margin by company size).

The CBF continues to be relevant in that it aligns with Government's vision for the creative industries by ensuring access to a diversity of Canadian-authored books domestically and abroad. During the evaluation period, the GC has repeatedly demonstrated support for the creative industries generally, and for the CBF more specifically, as a tool to advance the Government's vision and priorities for the cultural sector.

- The Minister's mandate letter speaks to the importance of the cultural sector on the Canadian economy and reflects the GC's commitment to strengthen and promote the cultural and creative industries.

- In 2013-14, the GC announced new measures to promote Canadian history. This included making available $200,000 per year for SFO to encourage collective projects with a focus on Canadian history. In 2015-16, 14 SFO projects included a history initiative. In 2016-17, this increased to 17. To support of the GC's Canada 150 priority, the SFO funded six projects which included a Canada 150 component.

- Budget 2014 announced the permanent renewal of $9M per year, beginning in 2015-16, of supplementary funds for the CBF, as part of a larger announcement of permanent funding renewal for cultural programs. The $9M had been supplementary since 2001.

- Budget 2016 proposed to invest $35M over two years in existing funding programs, beginning in 2016-17, to support the promotion of Canadian artists and cultural industries abroad. The CBF received an additional $500,000 per year, for five years, to promote Canadian-authored books in foreign markets. These funds will be used primarily to support Canada's participation as guest of honor at the 2020 Frankfurt Book Fair.

- The CBF supports two of the key pillars of the Creative Canada Policy Framework announced by the Government in 2017: invest in Canadian creators and their stories, and promote discovery and distribution globally.

The CBF also helps to fulfill the PCH mandate to foster and promote "Canadian identity and values, cultural development and heritage" and contributes to the achievement of key results under Core Responsibility 1 of the Departmental Results Framework (DRF).Footnote 39 Starting in 2017-18, the CBF fell under Core Responsibility 1 – Creativity, Arts and Culture and under the Program – Cultural Industries Support and Development. CBF supports the delivery of key result under this core responsibility: Creative industries are successful in the digital economy, foster creativity and contribute to economic growth; Canadians are able to consume Canadian content on multiple platforms; and creative industries are successful in global markets.Footnote 40

Between 2012-13 and 2017-18, the CBF contributed to PCH priorities relating to adapting to a global and digitized environment, specifically, engage and innovate: Canada's creative and cultural industries drive Canada's economic growth, by supporting innovative technology-driven collective marketing projects that help consumers discover Canadian content in the digital marketplace (2016-17).Footnote 41

CBF supported and helped to advance the following 2017-18 PCH priorities:

- Implement a plan to support the creative sector in adapting to the digital shift and in promoting Canadian culture that reflects Canada's diversity at home and abroad;

- Promote diversity and inclusion to enhance Canadian's sense of belonging and pride and to promote inclusive economic growth; and

- Strengthen Canada's linguistic duality; and promote and celebrate Indigenous culture (...).Footnote 42

4.1.2. Relevance: CBF responsiveness to the needs of the Canadian-owned book publishing industry

Evaluation question: Is the CBF responsive to the challenges/needs of the Canadian-owned book publishing industry?

Key finding:

The CBF was responsive to the needs of the Canadian book-publishing industry. Between 2012-13 and 2017-18 the CBF supported the production, marketing and distribution of Canadian-authored books by providing a total of $220.6M in Gs&Cs to the industry. During this period, the CBF adjusted application guidelines and its funding formula to respond to industry challenges and needs, and to CBF, PCH or government priorities. Although the CBF supported the publishing industry to address issues, the evaluation identified some unmet needs, particularly in relation to the ability to respond to the requests for funding support through the SFO stream. Recipients also expressed the need to address challenges associated with the discoverability of Canadian-authored books and issues of capacity related to marketing and promotion.

The CBF provided a total of $220.6M in Gs&Cs to Canadian-owned publishers in all sectors of the industry for the production, marketing and distribution of Canadian-authored books and to industry associations and related organizations to undertake collaborative projects of broad benefit to book industry stakeholders.

The administrative data indicated that the CBF was responsive to the needs of publishers. As shown in Table 6, during the evaluation period, the vast majority (97.6%) of applications for SFP – Publishing Support were deemed eligible. All applications which met eligibility requirements were approved and received funding. The small number who were not approved did not meet eligibility requirements. SFP is formula-based, so the approval rate is high. Once eligibility criteria are met, applications are approved. SFP recipients have, within program parameters, flexibility in how they spend their contribution to offset the costs related to the production, marketing and distribution of their books. As a result of this flexibility, SFP recipients can use their funding to address their specific needs and challenges.

SFP-Business Development Support which represents a small portion of SFP funding ($0.4M), for business planning and for publishing and technology internships, was less responsive. As shown in Table 6, between 2012-13 and 2017-18, an average of 40 applications for Business Development Support were received annually and 63.6% of applications were approved. Further analysis showed that the majority of publishing internship applications (80%) were approved. Fewer business planning applications (56.5%) and technology internship applications (59.1%) were approved although there was a greater number of applications for these. Business Development approval depends on the extent to which applicants meet the set priorities. Also, a certain percentage of applicants apply to the Business Development component every year. Applicants who received money in the previous year normally don't receive money for the following year. This contributes to a lower approval rate.

SFP – Business Development support applicants received 58.2% of the total amount requested. Over the period of the evaluation, the total amount of funding requested was over one and a half (1.64x) times the amount available.

| Publishing Support | Business Development Support | SFP Total | |

|---|---|---|---|

| Total Applications (#) | 1486 | 239 | 1725 |

| Total Requested ($) | -Footnote 43 | $3.9M | - |

| Total Applications Approved (#) | 1450 | 152 | 1602 |

| Total Applications Approved (%) | 97.6 | 63.6 | 92.9 |

| Total Approved ($) | $180.2M | $2.3M | $182.5M |

| Total Approved (%) | - | 58.2 | 98.8 |

Source: GCIMS data

In 2017-18, the annual allocation for SFO projects was $5.6M, or 14% of the CBF budget. SFO was only partially responsive to the needs of the industry as the demand for funding exceeded the funds available. Between 2012-13 and 2017-18, SFO had 460 applications, averaging 77 projects annually.

The SFO stream received 318 applications for marketing projects (77.3% of SFO applications), averaging 53 projects annually. 77% were approved. Of the 23 % that were not approved, some were rejected because they did not meet the criteria of the program or because the merit of the application could not be demonstrated. Still others were rejected because the program budget was insufficient. The total application amount requested was $41.0M of which $28.5M was approved (69.4%). On average, successful recipients received 88.4% of the amount they requested (Table 7).

The SFO stream also provided funding for technology projects, internships and professional development. Between 2012-13 and 2017-18, a total of 142 applications were received for an average of 24 applications annually. 66.2% were approved. Once again, among the 33.8% who were not approved, some applications were rejected because they were not eligible or because their merit was not demonstrated and others were rejected because the program budget was insufficient. During this period, the total application amount requested was $18.4M of which $8.6M or 46.6% was approved.

| SFO - Marketing | SFO - Others | Total- SFO | |

|---|---|---|---|

| Total Applications (#) | 318 | 142 | 460 |

| Total Requested ($) | $41.0M | $18.3M | $59.4M |

| Total Applications Approved (#) | 245 | 94 | 339 |

| Total Applications Approved (%) | 77.0 | 66.2 | 73.7 |

| Total Approved ($) | $28.4M | $8.5M | $37.0M |

| Total Approved % | 69.4 | 46.6 | 62.3 |

Source: GCIMS data

There have been increased funding pressures on SFO, particularly from new projects proposed by existing recipients, increased funding requested for projects and requests for funding from new applicants.

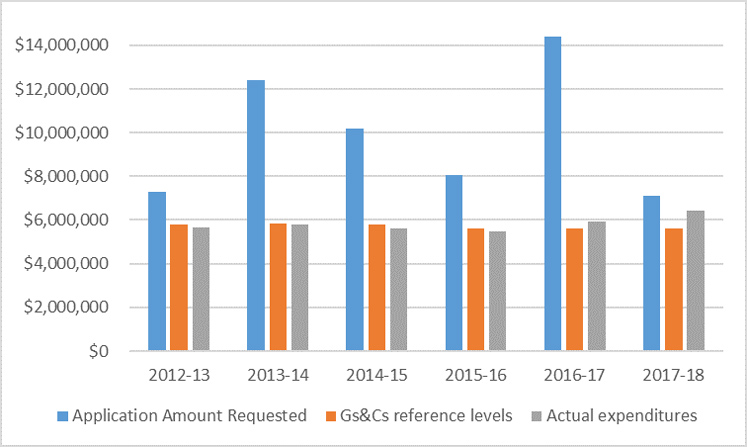

Between 2012-13 and 2017-18, the demand for funding was consistently higher than available funds. Over this period, the total funding requested by applicants was 1.7 times the funds available. In 2017-18, for example, the value of applications received was $7,126,998, which exceeded the annual budget of $5.6M by approximately 30% (Figure 6).

Source: FMB, GCIMS

Figure 6: SFO oversubscription – text version

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | |

|---|---|---|---|---|---|---|

| Application Amount Requested | $7,284,788 | $12,391,203 | $10,188,650 | $8,071,123 | $14,377,147 | $7,126,998 |

| Gs&Cs reference levels | $5,813,050 | $5,860,000 | $5,815,000 | $5,600,000 | $5,600,000 | $5,600,000 |

| Actual expenditures | $5,638,151 | $5,810,521 | $5,606,225 | $5,497,887 | $5,936,509 | $6,406,489 |

Source: FMB, GCIMS

SFO has a high level of commitment to supporting established ongoing or recurrent projects. Examples of recurring projects include the Salons du livre, writers' festivals, professional development activities, export support through Livres Canada Books and technology projects which support marketing infrastructure.

In any given year, the majority (92%) of SFO applications stemmed from recurrent applicants (ranging from a low of 85% to 100%). Of the 336 applications approved between 2012-13 and 2017-18, 99% of approved applications stemmed from recurrent applicants. Recurrent applications stemming from recurrent applicants received 99.9% of the funding approved (Table 8). As a result, at current funding levels, there is little flexibility to accept new innovative projects or new applicants.

Further analysis found that 77 organizations were responsible for delivering the 336 approved projects between 2012-13 and 2017-18 and that 38 or 49% received funding for 4 or more of the 6 years of the evaluation period and accounting for 80% of the approved funding.

| # Recurrent applications stemming from recurrent applicants (2012-13 to 2017-18) | % Recurrent applications stemming from recurrent applicants (2012-13 to 2017-18) | # New applications stemming from new applicants (2012-13 to 2017-18) | % New applications stemming from new applicants (2012-13 to 2017-18) | |

|---|---|---|---|---|

| Total number and % of applications | 423 | 92% | 37 | 8% |