Briefing binder for the Deputy Minister of Finance on the occasion of his April 22, 2021, appearance before the Standing Committee on Public Accounts on “Report 7, Canada Emergency Wage Subsidy”

Table of Contents

Opening Statement

Standing Committee on Public Accounts (PACP) Appearance

Subject: Office of the Auditor General’s Report (Canada Emergency Wage Subsidy)

April 22, 2021

Thank you, Madam Chair, and members of the Committee, for the invitation to be here today alongside my colleagues, including Andrew Marsland, Senior Assistant Deputy Minister of Tax Policy and Maude Lavoie, Director General, Business Income Tax at Finance Canada.

As you know, the Department of Finance remains focused on supporting Canadians and Canadian businesses through the COVID-19 pandemic. And that is why I welcome this report from the Auditor General.

The Canada Emergency Wage Subsidy is one of the strongest pillars of government support that was established in the early days of the pandemic. It is also one of the largest initiatives the government has ever undertaken.

The program was initially designed to keep employees attached to their employer by subsidizing 75 percent of payroll, up to $847 per employee per week. The wage subsidy protects jobs, encourages employers to rehire workers previously laid off as a result of COVID-19 and helps position Canadian businesses for a robust recovery.

Through this initiative, well over five million Canadian employees have had their jobs supported, with over $74 billion paid out through the program as of April 11, 2021.

Through Budget 2021, it was proposed that this subsidy continue supporting Canadians until September 2021, alongside the Canada Emergency Rent Subsidy and Lockdown Support. It was also proposed to gradually decrease the subsidy rate, beginning in July, to ensure an orderly phase-out of the program as vaccinations are completed and the economy re-opens.

In addition to the CEWS extension, the Budget introduced the Canada Recovery Hiring Program, to help businesses hire more workers between June 6 and November 20, 2021. It will offer companies on the wage subsidy, as they begin opening up, a new alternative: a program to assist them in hiring by offsetting a portion of the costs of new employees.

Ms. Hogan’s audit focused on whether Finance Canada provided analysis on the wage subsidy during its initial development. I am pleased to note the audit’s conclusion that the Department worked within short timeframes to provide decision makers with information to assist them in developing the wage subsidy, and that it subsequently provided sound and complete analysis to inform adjustments to the program.

In the Department’s work in designing the wage subsidy, it collaborated with the Canada Revenue Agency to assess how the program could be implemented quickly and develop the legislation related to the subsidy. The analysis was done rapidly. The imperative at that time was to get help to our workers and businesses quickly. And it was the right imperative.

Finance Canada also proposed subsequent adjustments to the subsidy that were informed by sound and complete analysis, as well as input from businesses and employers. For example, revisions to the program made the subsidy accessible to a broader range of employers by including those with a revenue decline of less than 30 per cent, and providing a gradually decreasing base subsidy to all qualifying employers.

Although I was not at Finance at the time, the agility the department demonstrated in program design and in particular the willingness to constantly assess feedback from stakeholders and program recipients, and find opportunities to make adjustments and improve the reach and the rigour of the program is important and worth noting.

We also welcome the Auditor General’s recommendation to publish an economic evaluation of the wage subsidy programs. We have committed to undertake this evaluation and publish our findings in the 2022 Report on Federal Tax Expenditures.

Before I conclude my remarks, I must again credit public servants at both Finance Canada and the Canada Revenue Agency for their extraordinary efforts to design and deliver this important measure. Their dedication to supporting fellow Canadians, even as they endured their own pandemic-related challenges, was exemplary.

Thank you one again for the invitation to join you here today. I would be pleased to take any questions the Committee has with respect to Finance Canada’s contribution to the Canada Emergency Wage Subsidy program.

Thank you.

Summary and Key Findings

Key Findings

- The Auditor General found that despite facing a historic pandemic, the Department of Finance and the Canada Revenue Agency worked within short time frames to provide decision makers with information to assist them in developing the Canada Emergency Wage Subsidy and to implement the subsidy.

- The Auditor General recommended that Finance complete and publish an economic evaluation of its wage subsidy programs. The Department agreed with the recommendation. It will prepare an evaluation and publish its findings in the 2022 publication of the Federal Report on Tax Expenditures.

The CEWS audit focused on whether Finance provided analysis on the CEWS and whether the Canada Revenue Agency limited abuse by establishing appropriate controls in its administration of the program.

The Auditor General found that despite facing a historic pandemic, the Department of Finance and the Canada Revenue Agency worked within short time frames to provide decision makers with information to assist them in developing the Canada Emergency Wage Subsidy and to implement the subsidy. They concluded that the Department performed partial analysis of the initial wage subsidy program, working under extremely short time frames and in unusual circumstances, but later provided sound and complete analysis to inform adjustments to the subsidy.

The Auditor General recommended that Finance complete and publish an economic evaluation of its wage subsidy programs. The Department agreed with the recommendation. It will prepare an evaluation and publish its findings in the 2022 publication of the Federal Report on Tax Expenditures.

The audit emphasizes that the Auditor General is unable to provide Parliament with details of the Department’s analyses, because they were in secret and Cabinet documents and must be kept in strict confidence. Access to these documents has been a contentious issue in the past.

With respect to the performance of the Canada Revenue Agency (CRA), the Auditor General found that the CRA:

- had to balance pre-payment controls with the rapid delivery of the subsidy;

- was able to effectively build an information technology solution that allowed for the quick delivery of CEWS despite challenges;

- did not have all the information it needed to validate the reasonableness of applications before issuing payments;

- would have benefited from additional information about other subsidies and tax and payroll data that was more frequent and up-to-date;

- had limited ability to conduct automated validations before payments were issued because employers were not required to provide employee names or Social Insurance Numbers; and

- missed an opportunity by not conducting targeted audits during summer and fall 2020 based on the findings from its June 2020 business intelligence exercise.

The Auditor General recommended that the CRA:

- strengthen its efforts towards tax compliance for GST/HST in order to ensure that it has information needed to do validations for the programs it is administering (this is relevant as sales reported for GST/HST are used for validation of the reported revenue declines);

- use automated validations with a unique identifier across programs, in order to improve the integrity and validation efficiency of any future emergency programs; and

- strengthen the integrity of the Canada Emergency Wage Subsidy program by using business intelligence information as soon as it is available in order to conduct targeted audits.

The CRA agreed with the Auditor General recommendations and prepared an action plan.

Qs and As on the audit

Q1. Why did the Department of Finance only undertake partial analysis for the initial design of the program?

The Department of Finance worked within extremely short time frames to develop a wage subsidy program to address the economic effects of the COVID 19 pandemic. In particular, the initial development work had to be done quickly. This meant developing policy, conducting economic analysis, drafting legislation, and so on, within a matter of days. A broad range of considerations were nevertheless brought to the attention of the Government, for example regarding design options, how to mitigate compliance risks, eligibility requirements, cost, etc.

Q2. The report states that the Auditor General is not able to "provide Parliament with details of these analyses because they were in secret and Cabinet documents and must be kept in strict confidence". Why is the Department not transparent with Canadians on this important matter?

A2. The Department respects the role of the Auditor General and the importance of transparency.

The Department's analysis on the Canada Emergency Wage Subsidy was prepared and presented to the Minister of Finance and the Prime Minister for the purposes of making government policy decisions. This analysis was shared with the Auditor General. This analysis remains however a Cabinet Confidence, which is protected by law from public disclosure and which no official, whether from the Department or the Auditor General's Office, is at liberty to disclose.

That said some of the analysis shared with the Auditor General's Office was not a Cabinet confidence and was not subject to the same strict confidentiality requirements. For instance, the Auditor General's report discusses some of the work done by the Department in relation to feedback received from public consultations.

Q3. What specific actions is the Department taking to address the Auditor General's recommendation?

A3. The Department agreed with the recommendation of completing and publishing an economic evaluation of the wage subsidy programs. As such, the Department will prepare an evaluation and publish its findings in the 2022 publication of the Federal Report on Tax Expenditures.

Q4. According to the Auditor General, Finance Canada has analyzed the interactions between the CERB and the wage subsidy. What type of analysis did you do?

A4. The CEWS and the CERB programs shared common objectives, in terms of supporting individuals that were affected by the pandemic. While the CERB provided direct payment to individuals, the Canada Emergency Wage Subsidy can be used by the employer to provide support to furloughed employees, should they wish to maintain the employee-employer relationships rather than proceed with lay-offs. The Department analyzed the interactions between the two programs, for instance to make sure that those in receipt of CERB benefits would not also be receiving CEWS benefits via their employer.

Q5. The Report states that the input received during the consultations was taken into consideration. What did you hear? What changes have you made following the consultations?

A5. During the consultations in spring 2020, many stakeholders indicated that the CEWS was invaluable in keeping workers on the payroll and helping to bring workers back. They also mentioned many challenges encountered with the original CEWS, such as

- Cliff effect: Employers were worried about the "cliff effect" caused by the elimination of support at the 30-per-cent revenue drop threshold in the original CEWS design. There were concerns that it could induce inefficient decisions, in addition to being unfair. Many suggested that an effective way to deal with this would be to provide for a gradual reduction in the CEWS rate as revenues increase.

- Issue with the revenue test: Some employers found the 30 per cent revenue decline test too stringent. They argued that businesses that experience revenue drops of less than this amount might still be heavily affected by the pandemic. It was thought that this would also become more relevant as the economy reopens and activity increases, but remains lower than normal for some businesses.

- Need for an extension: Many employers worried that the initial 12-week extension until August 29 may not have been enough to help businesses that continue to struggle given the uneven impacts across economic sectors.

- Targeting for highly impacted firms: Under the original design, all firms that qualify were treated the same way once they qualify for the program, even though some may require more help. There was recognition among employers of a need to provide additional support for those that were particularly adversely impacted.

The Government took into consideration the feedback received and made several changes to the program (announced on July 17, 2020). For example:

- a new rate structure based on the level of revenue decline was introduced;

- a new top-up subsidy was introduced for employers that have been most adversely affected by the crisis;

- more flexibility for the drop-in-revenues test;

- the extension of the program.

Q6. Why did the Department of Finance ask the Canada Revenue Agency to wait until the Fall to start audits?

A6. The integrity of the wage subsidy is certainly an important matter. That said, the wage subsidy was put in place during a time of crisis. As the Auditor General notes in the report, the government promised that the Canada Emergency Wage Subsidy would be paid quickly and that the application process relied on the good faith of applicants, along with penalties for those that seek to abuse the system.

While this is a matter within the purview of the CRA, the conduct of detailed audits at the onset would have defeated this objective. Also, going through detailed audits while the pandemic is unresolved would add to the burden of businesses already going through difficult times.

Other Qs&As

Q7. Why are you not prohibiting businesses from paying themselves dividends when they receive wage subsidies?

A7. The Canada Emergency Wage Subsidy is helping employers of all sizes and in all industries affected by the pandemic. It is important to note that the wage subsidy is paid retroactively on the amount of wages actually paid by employers during a given period, ensuring that employees are retained and supported.

The objective of the wage subsidy is to encourage employers impacted by the pandemic to retain and rehire employees by delivering assistance as quickly as practical, recognizing the urgency of the situation created by the pandemic and the limited life of the program. To achieve this objective, the government kept conditions to a minimum, but notably required a decrease in revenue in order to make sure that the subsidy would be targeted to those in need.

Had additional conditions been introduced—for example, restrictions on the payment of dividends—the regime, together with anti-avoidance rules necessary to maintain the integrity of the conditions, would have been effectively equivalent to imposing conditions at the outset on the future performance and financial position of the employer. This would have created important uncertainty for employers. Moreover, such conditions could have made the program more complex, and could not have been implemented as quickly. Such complexity and the accompanying uncertainty for applicants would have undermined the objective and the effectiveness of the program.

Q8. Why are you introducing the requirement to repay the wage subsidy where there is an increase in top executive compensation only now, at a time when the program is being phased out? Why not a year ago? [*Included in Minister's Q&A]

A8. The wage subsidy was introduced and implemented quickly, at a time of crisis. Its simple eligibility criteria were developed with the objective of making sure that as many employers as possible could benefit from the subsidy and maintain their workforce. The Government has since then adjusted the program many times to reflect the evolving situation of the pandemic and feedback from stakeholders.

The country will very soon be entering a new phase, that of the economic recovery. It is important that during that time, the support that continues to be provided via the wage subsidy to support employment not be used for purposes such as increasing top executive compensation.

Q9. Won't publicly listed corporations simply defer the payment of bonuses to 2022 to avoid the new repayment requirement? Why didn't the government address this loophole?

A9. Outside of the pandemic context, and where businesses are no longer receiving Government support, it is not the Government's place to question the level of pay received by top executives.

The intent of the wage subsidy is to preserve and protect Canadians' jobs. The proposed requirement to repay ensures that businesses cannot be increasing compensation for their top executives while at the same time be receiving government assistance to subsidize their employees' wages. It is the government's view that such businesses are in a position to support their own employees and are no longer in need of the wage subsidy.

Q10. Why is the requirement for publicly listed corporations to repay wage subsidy amounts not retroactive?

A10. Unless relieving in nature (or clearly contrary to policy and well established practices), retroactive changes are generally not imposed. Doing so would be unfair to employers that made decisions on the basis of rules in place when these decisions were made. More generally, it is important that the rules of the wage subsidy be objective and predictable, to provide certainty to employers as they make planning decisions for their businesses.

Ministerial Q&As on the CEWS

1. With the country in the midst of a third wave of COVID-19 cases, why is the Government phasing out the wage and rent subsidies?

The government is extending the wage subsidy and the rent subsidy beyond June 2021 to help bridge Canadians through the rest of the crisis and into recovery. By gradually phasing out the subsidy rates over time, it will provide the certainty that businesses require to transition out of the programs in an orderly manner, while still providing support for those that need it.

The government is also taking steps to support businesses as they transition to recovery. As such, Budget 2021 proposes to introduce the new Canada Recovery Hiring Program, which will provide an alternative support for employers affected by the pandemic to help them hire more workers as the economy reopens. The hiring subsidy will be in place from June until November 2021, allowing firms to shift from the wage support to this new support.

The government will continue to monitor health and economic conditions and ensure that Canadian businesses and workers have access to the support they need to weather the pandemic. To that end, the government is seeking the legislative authority to have the ability to extend further the wage subsidy and the rent subsidy programs through regulations until November 20, 2021, should the economic and public health situations warrant it.

2. Why hasn't the Government prohibited [companies that pay dividends/foreign state-owned enterprises/organizations with ties to criminal or controversial elements] from receiving the wage and rent subsidies?

To be eligible for the wage or rent subsidy, an organization must meet all of the relevant eligibility criteria of the program. It is important to note that the subsidies are only provided in respect of eligible expenses incurred. For example, in the case of the wage subsidy, the amount received from the Government is a proportion of wages paid.

The objective of the subsidies is to encourage employers impacted by the pandemic to retain and rehire employees by delivering assistance as quickly as practical, recognizing the urgency of the situation created by the pandemic and the limited life of the program. To achieve this objective, the government kept conditions to a minimum, but notably required a decrease in revenue in order to make sure that the subsidy would be targeted to those in need. That being said, the government is committed to ensuring that the wage subsidy is used to preserve and protect Canadians jobs, and not to subsidize businesses that are able to give raises to their top executives. That is why this Budget is proposing to claw back wage subsidy amounts paid to any publicly listed corporation receiving the wage subsidy and found to be paying its top executives more in 2021 than it did in 2019.

3. In March, the Auditor General concluded that the Canada Revenue Agency "chose not to establish tighter controls, and it lacked the sub-annual and up-to-date earnings and tax information it needed to efficiently assess applications" for the CEWS. How does the Government intend to ensure the integrity of the CEWS going forward?

The government is continually improving the programs and services delivered to Canadians, and to this end, it welcomed the Auditor General's feedback and accepted all of the recommendations in their report.

When the wage subsidy was introduced, the government's priority was to help get Canadian workers back on their employers' payrolls. The Canada Revenue Agency (CRA) implemented the wage subsidy program in record time to meet urgent financial and economic needs during the pandemic, which will benefit our economy as recovery progresses.

The CRA developed an action plan to address the report's three recommendations for the Agency, which include: strengthening the development of future emergency programs, strengthening tax compliance, and using business intelligence to conduct audits. Consistent with the report's recommendation to strengthen tax compliance, ongoing audit and compliance activities will continue over the next several years, and the CRA will assess and determine how best to use automated validations with a common identifier across programs.

4. Under which circumstances would you consider extending the wage subsidy beyond September 25?

The government will continue to do whatever it takes to support Canadians through the pandemic.

The proposed phase-out is a reasonable path, considering the expected evolution of the vaccination campaign. That said, the government will monitor health and economic conditions and ensure that Canadian businesses and workers have access to the support they need, should the public health restrictions related to the pandemic last longer than currently anticipated.

To that end, the government is seeking the legislative authority to have the ability to extend further the wage subsidy and the rent subsidy programs through regulations until November 20, 2021, should the economic and public health situations warrant it.

[Other Q&As there were not included in the Ministerial Q&As]

5. Won't publicly listed corporations simply defer the payment of bonuses to 2022 to avoid the new repayment requirement? Why didn't the government address this loophole?

Outside of the pandemic context, and where businesses are no longer receiving Government support, it is not the Government's place to question the level of pay received by top executives.

The intent of the wage subsidy is to preserve and protect Canadians' jobs. The proposed requirement to repay ensures that businesses cannot be increasing compensation for their top executives while at the same time be receiving government assistance to subsidize their employees' wages. It is the government's view that such businesses are in a position to support their own employees and are no longer in need of the wage subsidy.

6. Why is the requirement for publicly listed corporations to repay wage subsidy amounts not retroactive?

Unless relieving in nature, retroactive changes are generally not imposed. Doing so would be unfair to employers that made decisions on the basis of rules in place when these decisions were made. More generally, it is important that the rules of the wage subsidy be objective and predictable, to provide certainty to employers as they make planning decisions for their businesses.

7. How much has the CEWS cost to date, and how much will the extension announced in the budget cost?

- As of April 4, $73.5 billion in CEWS subsidies have been paid out. [CRA stat]

- The estimated fiscal cost of the CEWS from March 15, 2020 to June 5, 2021 is $100.4 billion. [Not in budget, but can be derived from next two stats]

- The estimated fiscal cost of the CEWS extension announced in Budget 2021 from June 6 to September 25, 2021 is $10.1 billion. [Chapter 2, end of chapter table]

- Therefore, the total estimated fiscal cost of the CEWS is $110.5 billion, of which about $84.6 billion is for 2020-21 and $26 billion is for 2021-22. [Annex 1, Table A1.15]

Key Statistics on the CEWS

| Total applications approved | Unique applicants with approved claims | CEWS amounts approved | Average number of employees supported (P1 to P8) |

|---|---|---|---|

| 3,141,900 | 440,580 | $74.25 Billion | 4,531,300 |

Data was published online by CRA and reflects applications processed as of April 11th, 2021.

| Province | Applications Approved Since Launch | CEWS Amount Approved Since Launch ($) | Average number of employees supported (P1 to P8) |

|---|---|---|---|

| Alberta | 438,710 | 11,503,690,000 | 610,556 |

| British Columbia | 448,680 | 8,710,992,000 | 541,849 |

| Manitoba | 82,030 | 2,407,821,000 | 141,930 |

| New Brunswick | 59,880 | 1,141,776,000 | 78,240 |

| Newfoundland and Labrador | 34,460 | 641,706,000 | 40,335 |

| Northwest Territories | 2,230 | 55,111,000 | 3,101 |

| Nova Scotia | 63,090 | 1,276,681,000 | 83,055 |

| Nunavut | 630 | 17,274,000 | 1,146 |

| Ontario | 1,143,420 | 29,246,678,000 | 1,820,251 |

| Prince Edward Island | 14,660 | 249,326,000 | 18,328 |

| Quebec | 724,120 | 16,235,291,000 | 1,059,981 |

| Saskatchewan | 80,530 | 1,366,864,000 | 85,544 |

| Yukon | 3010 | 73248000 | 4,519 |

| Missing | 4,380 | 543,966,000 | 42,533 |

| TOTAL | 3,099,880 | 73,472,524,000 | 4,531,000 |

Data disaggregated by province was shared with the Department of Finance by CRA and reflects applications processed as of April 5thth, 2021. The sum of the data may not add to the total due to rounding. Province/Territory is determined by the business address of the applicant and may not fully reflect where the economic activity took place as some businesses will have employees and/or business activity in more than one jurisdiction.

| Industry | Applications Approved Since Launch | CEWS Amount Approved Since Launch ($) | Average number of employees supported (P1 to P8) |

|---|---|---|---|

| 11 Agriculture, Forestry, Fishing & Hunting | 77,470 | 1,112,820,000 | 68,939 |

| 21 Mining, quarrying, and oil and gas extraction | 23,200 | 2,173,812,000 | 92,019 |

| 22 Utilities | 1,100 | 37,103,000 | 1,555 |

| 23 Construction | 378,550 | 8,820,089,000 | 449,639 |

| 31-33 Manufacturing | 215,620 | 13,399,145,000 | 708,038 |

| 41 Wholesale Trade | 153,780 | 5,457,199,000 | 306,050 |

| 44-45 Retail Trade | 265,800 | 5,484,249,000 | 452,696 |

| 48-49 Transportation & Warehousing | 110,980 | 4,589,744,000 | 231,624 |

| 51 Information & Cultural Industries | 41,780 | 1,888,515,000 | 111,608 |

| 52 Finance & Insurance | 38,830 | 839,420,000 | 50,716 |

| 53 Real Estate & Rental & Leasing | 64,730 | 1,282,485,000 | 71,119 |

| 54 Professional, Scientific & Technical Services | 348,430 | 6,748,736,000 | 333,623 |

| 55 Management of Companies & Enterprises | 10,930 | 960,677,000 | 45,640 |

| 56 Administrative Support, Waste Management & Remediation Services | 129,860 | 3,557,908,000 | 251,376 |

| 61 Education Services | 58,960 | 1,082,291,000 | 65,674 |

| 62 Health Care & Social Assistance | 305,940 | 3,814,497,000 | 290,406 |

| 71 Arts, Entertainment & Recreation | 83,550 | 1,783,718,000 | 112,528 |

| 72 Accommodation & Food Services | 400,420 | 6,080,626,000 | 607,309 |

| 81 Other Services, except Public Administration | 304,320 | 3,460,361,000 | 223,574 |

| 91 Public Administration | 950 | 37,999,000 | 1,989 |

| Missing | 84,790 | 861,132,000 | 55,250 |

| TOTAL | 3,099,880 | 73,472,524,000 | 4,531,300 |

Data disaggregated by industry was shared with the Department of Finance by CRA and reflects applications processed as of April 5th, 2021. The sum of the data may not add to the total due to rounding.

CEWS Rates per Period

Maximum CEWS (Active Employees) Subsidy Rate by Period

| Period 17 (new) | Period 18 (new) | Period 19 (new) | Period 20 (new) | |

|---|---|---|---|---|

| June 6 to July 3, 2021 | July 4 to July 31, 2021 | August 1 to August 28, 2021 | August 29 to September 25, 2021 | |

| Revenue decline | ||||

| 70% and over | 75% | 60% | 40% | 20% |

| 50-69% | 40% + (revenue decline – 50%) x 1.75 | 35% + (revenue decline – 50%) x 1.25 | 25% + (revenue decline – 50%) x 0.75 | 10% + (revenue decline – 50%) x 0.5 |

| 11-49% | Revenue decline x 0.8 | (Revenue decline – 10%) x 0.875 | (Revenue decline – 10%) x 0.625 | (Revenue decline – 10%) x 0.25 |

| 1-10% | Revenue decline x 0.8 | 0% | 0% | 0% |

| CEWS Period | CERS Period | CRHP Period | Period Begins | Period Ends | Last Date to Apply |

| 1 | - | - | March 15, 2020 | April 11, 2020 | February 1, 2021 |

| 2 | - | - | April 12, 2020 | May 9, 2020 | February 1, 2021 |

| 3 | - | - | May 10, 2020 | June 6, 2020 | February 1, 2021 |

| 4 | - | - | June 7, 2020 | July 4, 2020 | February 1, 2021 |

| 5 | - | - | July 5, 2020 | August 1, 2020 | February 1, 2021 |

| 6 | - | - | August 2, 2020 | August 29, 2020 | February 25, 2021 |

| 7 | - | - | August 30, 2020 | September 26, 2020 | March 25, 2021 |

| 8 | 1 | - | September 27, 2020 | October 24, 2020 | April 22, 2021 |

| 9 | 2 | - | October 25, 2020 | November 21, 2020 | May 20, 2021 |

| 10 | 3 | - | November 22, 2020 | December 19, 2020 | June 17, 2021 |

| 11 | 4 | - | December 20, 2020 | January 16, 2021 | July 15, 2021 |

| 12 | 5 | - | January 17, 2021 | February 13, 2021 | August 12, 2021 |

| 13 | 6 | - | February 14, 2021 | March 13, 2021 | September 9, 2021 |

| 14 | 7 | - | March 14, 2021 | April 10, 2021 | October 7, 2021 |

| 15 | 8 | - | April 11, 2021 | May 8, 2021 | November 4, 2021 |

| 16 | 9 | - | May 9, 2021 | June 5, 2021 | December 2, 2021 |

| 17 | 10 | 1 | June 6, 2021 | July 3, 2021 | December 30, 2021 |

| 18 | 11 | 2 | July 4, 2021 | July 31, 2021 | January 27, 2022 |

| 19 | 12 | 3 | August 1, 2021 | August 28, 2021 | February 24, 2022 |

| 20 | 13 | 4 | August 29, 2021 | September 25, 2021 | March 24, 2022 |

| - | - | 5 | September 26, 2021 | October 23, 2021 | April 21, 2022 |

| - | - | 6 | October 24, 2021 | November 20, 2021 | May 19, 2022 |

Summary of Changes to the CEWS

List of All Key Changes to the CEWS Since Implementation

Original CEWS Design Announcement – April 2020

- 75% subsidy on wages paid by most types of employers (taxable corporations, unincorporated businesses, NPOs, Charities, etc).

- Maximum subsidy of $847 per week per employee

- Eligible employers had to have a minimum revenue decline of 15% in March and 30% in April, May and June compared to pre-pandemic period

- Ability to support both active and furloughed employees

- The employer portion of contributions in respect of the Canada Pension Plan, Employment Insurance, the Quebec Pension Plan, and the Quebec Parental Insurance Plan in respect of furloughed employees would be refunded to the employer.

- Originally in place for 3 periods of 4 weeks

May 15, 2020

- The program was extended by an additional 12 weeks to August 29, 2020.

- Broadening of eligibility retroactively to April 11, 2020, to:

- partnership as long as non-eligible members, taken together, do not hold a majority of the interests in the partnership,

- Indigenous government-owned corporations that are carrying on a business and are tax-exempt,

- National-level registered Canadian amateur athletic associations,

- Registered journalism organizations, and to

- Non-public educational and training institutions (including for-profit and non-for-profit institutions such as arts schools, language schools, driving schools, flight schools and culinary schools).

- Legislative amendments:

- to allow employers to choose one of two periods when calculating baseline remuneration,

- so that trusts with employees would continue to be eligible for the CEWS.

May 25, 2020

- Launch of consultations to seek information and feedback from businesses of all sizes, labour representatives, not-for-profits and charities on potential changes to the program, with a view to maximize employment in Canada and encourage growth.

July 2020

- Allow the extension of the CEWS until December 19, 2020, including redesigned program details until November 21, 2020.

- Following the comments and recommendations received during the consultation, a new subsidy rate structure was introduced:

- A base subsidy available to all eligible employers that are experiencing a decline in revenues, with the subsidy amount varying depending on the scale of revenue decline. The maximum base CEWS rate would be provided to employers with a revenue drop of 50 per cent or more. Employers with a revenue drop of less than 50 per cent would be eligible for a lower base CEWS rate. The maximum base CEWS rate would be gradually reduced from 60 per cent in Periods 5 and 6 (July 5 to August 29) to 20 per cent in Period 9 (October 25 to November 21).

- A top-up subsidy of up to an additional 25 per cent for those employers that have been most adversely affected by the COVID-19 crisis. For the purpose of the top-up CEWS, eligibility would generally be determined by the change in an eligible employer's revenues for a 3-month period.

- Beginning in Period 7 (August 30, 2020), CEWS support for furloughed employees would be adjusted to align with the benefits provided through the Canada Emergency Response Benefit (CERB) and/or Employment Insurance (EI).

- Create a safe harbour rule to provide certainty to employers that have already made business decisions for July and August by ensuring they would not receive a subsidy rate lower than they would have had under the previous rules for Periods 5 and 6 (July 5 to August 29, 2020).

- Legislative amendments that would generally apply as of March 15, 2020, were also announced:

- providing an appeal process based on the existing procedure for notices of determination that allows for an appeal to the Tax Court of Canada;

- providing continuity rules for the calculation of an employer’s drop in revenues in certain circumstances where the employer purchased all or substantially all the assets used in carrying on business by the seller;

- allowing prescribed organizations that are registered charities or non-profit organizations to choose whether to include government-source revenue for the purpose of computing their reductions in qualifying revenue; and

- allowing entities that use the cash method of accounting to elect to use accrual based accounting to compute their revenues for the purpose of the CEWS.

August 2020

- Extension of the existing wage subsidy for furloughed employees (maximum weekly subsidy of $847) extended for Period 7 (August 30 to September 26, 2020).

September 2020

- Extension of the existing wage subsidy for furloughed employees (maximum weekly subsidy of $847) extended for Period 8 (September 27 to October 24), 2020.

October 2020

- Parameters for Periods 9 and 10 (October 25 to December 19, 2020) announced.

- Previously announced phase-out suspended; rates kept at same level as Period 8 (September 27 to October 24, 2020), i.e., maximum subsidy rate of 65%.

- Legislative amendments:

- Top-up wage subsidy basis changed from 3-month revenue decline to 1-month revenue decline; safe harbour rule introduced for Periods 8 to 10 (September 27 to December 19, 2020).

- Benefits for furloughed employees aligned with EI benefits as of Period 9 (October 25, 2020 to November 21) (maximum weekly subsidy of $573).

November 2020

- Legislative amendments:

- Special baseline remuneration period introduced for employees returning from leave.

- New rule to allow an entity that purchases the assets of a business, or of a distinct part of a business, of an arm’s length seller to use the prior reference period revenues associated with those assets for the purpose of computing its revenue decline.

- Eligible employees limited to those employed primarily in Canada through a qualifying period.

- FES 2020 announced the parameters for Periods 11 to 13 (December 20, 2020 to March 13, 2021).

- Maximum subsidy rate for active employees increased from 65% to 75%.

- Maximum weekly subsidy for furloughed employees increases from $573 to $595, continues to be aligned with EI benefits.

February 2021

- Legislative amendment:

- Technical fix so that an applicant’s percentage revenue decline for Period 11 (December 20, 2020 to January 16, 2021) cannot be less than for Period 9 (October 25 to November 21, 2020).

March 2021

- Parameters for Periods 14 to 16 (March 14 to June 5, 2021) are announced.

- Subsidy rates for active employees remain unchanged (maximum 75%).

- Subsidy for furloughed employees remain unchanged, continues to be aligned with EI benefits.

- Legislative amendment:

- New alternative baseline remuneration period is proposed to provide more flexibility for furloughed and non-arm’s length employees.

April 2021

- Budget 2021 proposes to extend program by 16 weeks to September 25, 2021 and phase it out from July 4 to September 25, 2021.

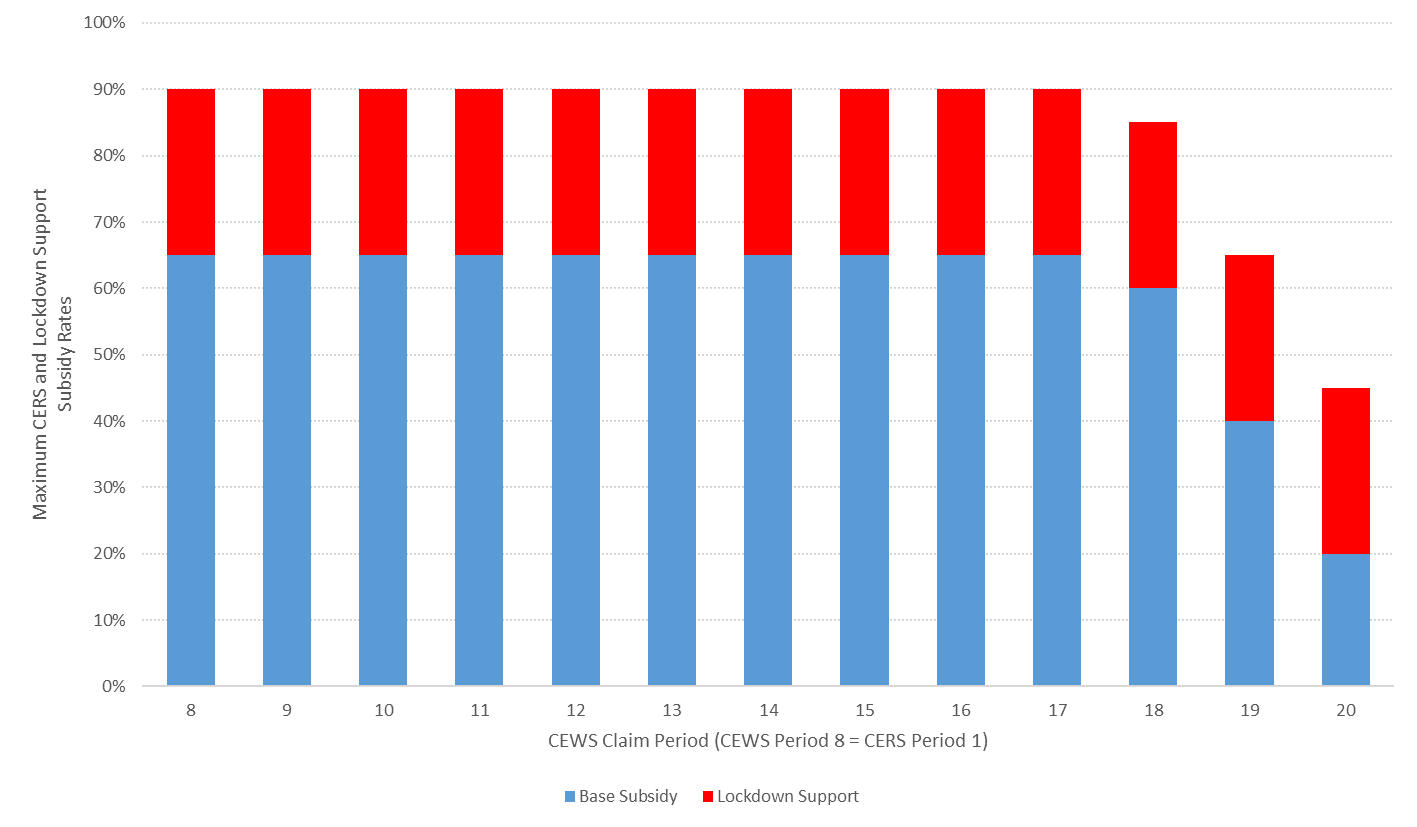

- Maximum subsidy rate for active employees unchanged for Period 17 (June 6 to July 3); decreases to 60% for Period 18 (July 4 to 31, 2021); 40% for Period 19 (August 1 to 28, 2021); 20% for Period 20 (August 29 to September 25, 2021). As of Period 18 (July 4 to 31, 2021), only employers with a decline in revenue greater than 10% would be eligible for a subsidy.

- New requirement for publicly listed corporations to repay wage subsidy amounts as of Period 17 (June 5, 2021) if their compensation paid to top executives in 2021 is higher than in 2019.

- Subsidy for furloughed employees remain unchanged, continue to be aligned with EI benefits until Period 19 (August 1 to 28, 2021).

- Changes to alternative baseline remuneration periods.

- Budget 2021 also proposed to introduce the Canada Recovery Hiring Program (CRHP) as of Period 17 (June 6, 2021). Employers receive the greater of the CRHP and the CEWS in a given period.

PACP Committee Members

PACP Membership

Chair

Kelly Block

Conservative

Carlton Trail—Eagle Creek (SK)

Vice-chair

Lloyd Longfield

Liberal

Guelph (ON)

Vice-chair

Maxime Blanchette-Joncas

Bloc Québécois

Rimouski-Neigette—Témiscouata—Les Basques (QC)

Luc Berthold

Conservative

Mégantic—L’Érable (QC)

Kody Blois

Liberal

Kings—Hants (NS)

Greg Fergus

Liberal

Hull—Alymer (QC)

Matthew Green

New Democratic Party

Hamilton Centre (ON)

Phillip Lawrence

Conservative

Northumberland—Peterborough South (ON)

Francesco Sorbara

Liberal

Vaughan—Woodbridge (ON)

Len Webber

Conservative

Calgary Confederation (AB)

Jean Yip

Liberal

Scarborough—Agincourt (ON)

Auditor General’s Report

2021 Reports of the Auditor General of Canada to the Parliament of CanadaReport 7—Canada Emergency Wage Subsidy

Annexes

Annex A: Other Witnesses' Opening Statements

Opening Statement of Karen Hogan, Cpa, Ca

Auditor General of Canada

Before The Standing Committee on Public Accounts

2021 Reports of The Auditor General of Canada

Report 7—Canada Emergency Wage Subsidy

22 April 2021

- Madam Chair, thank you for this opportunity to discuss our report on the Canada Emergency Wage Subsidy, which was tabled in the House of Commons on March 25. Joining me today are Philippe Le Goff, who was the principal responsible for the audit, and Mathieu Lequain, who led the audit team.

- As part of the response to the COVID-19 pandemic, the federal government announced the Canada Emergency Wage Subsidy in March 2020. The subsidy was meant to help maintain the employer-employee relationship during the pandemic and help position employers to resume normal operations when businesses can fully resume.

- The Canada Emergency Wage Subsidy program, one of the largest initiatives the government has ever undertaken, is expected to cost approximately $97.6 billion by the end of the 2021–22 fiscal year.

- This audit focused on whether the Department of Finance Canada provided analysis on the Canada Emergency Wage Subsidy program and whether the Canada Revenue Agency limited abuse by establishing appropriate controls in its administration of the program.

- Overall, we found the Department of Finance Canada and the Canada Revenue Agency worked together within short timeframes to support the development and implementation of the Canada Emergency Wage Subsidy.

- The Department of Finance Canada performed a partial analysis of the initial design of the subsidy program, and it later provided a sound and complete analysis to inform adjustments to the subsidy program made in July 2020. Although we were given access to all documents, we are unable to provide Parliament with details of these analyses because they were in secret and Cabinet documents.

- The design and rollout of the subsidy highlighted pre-existing weaknesses in the Canada Revenue Agency’s systems, approaches, and data. These weaknesses need to be addressed to strengthen Canada’s tax system.

- One of the weaknesses is related to the lack of up-to-date tax data. For example, we found that 28% of the subsidy applicants did not file a return for the goods and services tax or the harmonized sales tax for the 2019 calendar year. Given that GST and HST returns are important indicators of revenue, the lack of tax data means that the agency did not have all the relevant information for assessing the applications before issuing payments. This revenue information would have allowed the agency to validate the reasonableness of the revenue drop that was declared by applicants.

- To prioritize issuing payments quickly, the Canada Revenue Agency chose to forgo certain controls that it could have used to validate the reasonableness of subsidy applications. For example, the agency decided that it would not ask for social insurance numbers of employees, although this information could have helped prevent the doubling up of applications for financial support.

- The limitations of the agency’s information technology systems affected its ability to perform some pre-payment validations, as did the absence of complete and up-to-date tax information. As a result, the agency will have to perform more post-payment verification work, and we expect that the agency will have to rely mainly on costly comprehensive audits that will start in spring 2021. This post-payment work will be the subject of a future audit from my office.

- We made 3 recommendations to the Canada Revenue Agency and 1 recommendation to the Department of Finance Canada. The agency and the department agreed with the recommendations.

- Madam Chair, this concludes my opening remarks. We would be pleased to answer any questions the committee may have. Thank you.

ANNEX B: Backgrounder on Canada Emergency Rent Subsidy

Most recent update from Budget 2021:

Canada Emergency Rent Subsidy

The government introduced the Canada Emergency Rent Subsidy to provide direct relief to organizations that continue to be economically impacted by the COVID-19 pandemic. Under the rent subsidy, qualifying organizations that have experienced a decline in revenues are eligible for a subsidy on qualifying expenses.

Rate Structure

The maximum base rent subsidy rate is set at 65 per cent through the qualifying period ending on June 5, 2021.

Budget 2021 proposes the base rent subsidy rate structures set out in Table 4 for June 6, 2021 to September 25, 2021. As illustrated in the table, the subsidy rates would be gradually phased out starting on July 4, 2021. Furthermore, only organizations with a decline in revenues of more than 10 per cent would be eligible for the base rent subsidy and, as discussed below, the Lockdown Support.

|

Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

|

|---|---|---|---|---|

| Revenue decline: | ||||

| 70% and over | 65% | 60% | 40% | 20% |

| 50-69% |

40% + (revenue decline - 50%) x 1.25 (e.g., 40% + (60% revenue decline - 50%) x 1.25 = 52.5% subsidy rate) |

35% + (revenue decline - 50%) x 1.25 (e.g., 35% + (60% revenue decline - 50%) x 1.25 = 47.5% subsidy rate) |

25% + (revenue decline - 50%) x 0.75 (e.g., 25% + (60% revenue decline - 50%) x 0.75 = 32.5% subsidy rate) |

10% + (revenue decline - 50%) x 0.5 (e.g., 10% + (60% revenue decline - 50%) x 0.5 = 15% subsidy rate) |

| >10-50% |

Revenue decline x 0.8 (e.g., 30% revenue decline x 0.8 = 24% subsidy rate) |

(Revenue decline - 10%) x 0.875 (e.g., (30% revenue decline - 10%) x 0.875 = 17.5% subsidy rate) |

(Revenue decline - 10%) x 0.625 (e.g., (30% revenue decline - 10%) x 0.625 = 12.5% subsidy rate) |

(Revenue decline - 10%) x 0.25 (e.g., (30% revenue decline - 10%) x 0.25 = 5% subsidy rate) |

| 0-10% |

Revenue decline x 0.8 (e.g., 5% revenue decline x 0.8 = 4% subsidy rate) |

0% | 0% | 0% |

|

* Expenses for each qualifying period are capped at $75,000 per location and are subject to an overall cap of $300,000 that is shared among affiliated entities. ** Period 17 of the Canada Emergency Wage Subsidy would be the tenth period of the Canada Emergency Rent Subsidy. Period identifiers have been aligned for ease of reference. |

||||

Revenue-Decline Calculation

Both the rent subsidy and the wage subsidy use the same calculation to determine an organization's revenue decline. As a result, the same reference periods are used to calculate an organization's decline in revenues for the wage subsidy and the rent subsidy. Likewise, if an organization elects to use an alternative method for computing its revenue decline under the wage subsidy, it must use that alternative method for the rent subsidy.

Purchase of Business Assets

In order to qualify for the wage subsidy, an applicant must have had a payroll account with the Canada Revenue Agency (or engaged a qualifying payroll service provider). For the purpose of the rent subsidy, an applicant is required to have a business number with the CRA.

If certain conditions are met, the wage subsidy rules provide that an eligible entity that purchases the assets of a seller will be deemed to meet the payroll account requirement if the seller met the requirement.

Budget 2021 proposes to introduce a similar deeming rule that would apply in the context of the rent subsidy, where the seller met the business number requirement. This measure would apply as of the start of the rent subsidy.

Additional Information from November 5, 2020 Backgrounder:

Backgrounder

November 5, 2020

On October 9, the government proposed the new Canada Emergency Rent Subsidy to provide direct relief to businesses, non-profits, and charities that continue to be economically impacted by the COVID-19 pandemic. The new rent subsidy would be available retroactive to September 27, 2020, until June 2021.

The government is providing the proposed details for the first 12 weeks of the program, until December 19, 2020. The proposed program would, in many ways, mirror the successful Canada Emergency Wage Subsidy, providing a simple, easy-to-understand program for affected qualifying organizations. The new rent subsidy would provide benefits directly to qualifying renters and property owners, without requiring the participation of landlords.

This backgrounder provides information for organizations that have experienced a revenue decline and may qualify for the Canada Emergency Rent Subsidy. If your organization has been subject to a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws), you may be eligible for additional resources under the new Lockdown Support.

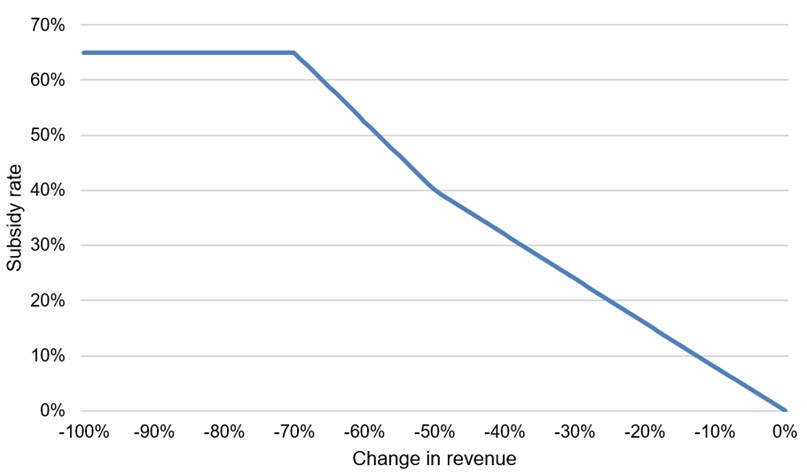

Rent Subsidy for Organizations Impacted by the Crisis

With the introduction of the new rent subsidy, qualifying organizations that have suffered a revenue drop would be eligible for a subsidy on eligible expenses. As shown in Table 1 and Figure 1, below, the maximum base rate subsidy would be 65 per cent, and available to organizations with a revenue drop of 70 per cent or more. The base rate would then decline to a rate of 40 per cent for organizations with a revenue drop of 50 per cent, and then would gradually reduce to zero for those not experiencing a decline in revenues. This structure mirrors the Canada Emergency Wage Subsidy rate structure.

| Revenue Decline | Base Subsidy Rate |

|---|---|

| 70% and over | 65% |

| 50% to 69% |

40% + (revenue drop - 50%) x 1.25 (e.g., 40% + (60% revenue drop – 50%) x 1.25 = 52.5% subsidy rate) |

| 1% to 49% |

Revenue drop x 0.8 (e.g., 25% revenue drop x 0.8 = 20% subsidy rate) |

Figure 1

Eligible Expenses

Eligible expenses for a location for a qualifying period would include commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages (subject to limits) for a qualifying property, less any subleasing revenues. Any sales tax (e.g., GST/HST) component of these costs would not be an eligible expense.

Eligible expenses would be limited to those paid under agreements in writing entered into before October 9, 2020 (and continuations of those agreements) and would be limited to expenses related to real property located in Canada. Expenses that relate to residential property used by the taxpayer (e.g., their house or cottage) would not be eligible. Payments made between non-arm's-length entities would not be eligible expenses. Mortgage interest expenses in respect of a property primarily used to earn, directly or indirectly, rental income from arms-length entities would not be eligible.

Expenses for each qualifying period would be capped at $75,000 per location and be subject to an overall cap of $300,000 that would be shared among affiliated entities.

Eligible Entities

Eligibility criteria for the new rent subsidy would generally align with the Canada Emergency Wage Subsidy program. Eligible entities include individuals, taxable corporations and trusts, non-profit organizations and registered charities. Public institutions are generally not eligible for the subsidy. Eligible entities also include the following groups:

- Partnerships that are up to 50 per cent owned by non-eligible members;

- Indigenous government-owned corporations that are carrying on a business, as well as partnerships where the partners are Indigenous governments and eligible entities;

- Registered Canadian Amateur Athletic Associations;

- Registered Journalism Organizations; and

- Non-public colleges and schools, including institutions that offer specialized services, such as arts schools, driving schools, language schools or flight schools.

In addition, an eligible entity must meet one of the following criteria:

- have a payroll account as of March 15, 2020 or have been using a payroll service provider;

- have a business number as of September 27, 2020 (and satisfy the Canada Revenue Agency that it is a bona fide rent subsidy claim); or

- meet other conditions that may be prescribed in the future.

Calculating Revenues

Revenues will be calculated in the same manner as under the Canada Emergency Wage Subsidy program.

- An entity's revenue for the purposes of the rent subsidy is its revenue from its ordinary activities in Canada earned from arm's-length sources, determined using its normal accounting practices. Revenues from extraordinary items and amounts on account of capital are excluded.

- For registered charities and non-profit organizations, the calculation includes most forms of revenue, excluding revenues from non-arm's length persons. These organizations are allowed to choose whether to include revenue from government sources as part of the calculation. Once chosen, the same approach would have to apply throughout the program period.

- Special rules for the computation of revenue are provided to take into account certain non-arm's-length transactions, such as where an entity sells all of its output to a related company that in turn earns arm's-length revenue.

- Affiliated groups that do not normally compute revenue on a consolidated basis may elect to do so.

Reference Periods for the Drop-in-Revenues Test

Eligibility would generally be determined by the change in an eligible entity's monthly revenues, year-over-year, for the applicable calendar month.

Alternatively, an entity can choose to calculate its revenue decline by comparing its current reference month revenues with the average of its January and February 2020 revenues.

Once an entity has chosen to use either the general or alternative approach, they must use that approach for each of the three periods. The approach chosen would apply to both the base Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy.

An eligible entity would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to determine its subsidy rate. This would provide certainty to businesses regarding their expected minimum subsidy rate and aligns with the practice under the Canada Emergency Wage Subsidy.

Table 2, below, outlines each qualifying period and the relevant reference period for determining the change in revenue.

| Qualifying period | General approach | Alternative approach | |

|---|---|---|---|

| Period 8 | September 27 to October 24, 2020 | October 2020 over October 2019 or September 2020 over September 2019 | October 2020 or September 2020 over average of January and February 2020 |

| Period 9 | October 25 to November 21, 2020 | November 2020 over November 2019 or October 2020 over October 2019 | November 2020 or October 2020 over average of January and February 2020 |

| Period 10 | November 22 to December 19, 2020 | December 2020 over December 2019 or November 2020 over November 2019 | December 2020 or November 2020 over average of January and February 2020 |

| Note: The period numbers align with those used for the Canada Emergency Wage Subsidy, for simplicity. Period 8 of the Canada Emergency Wage Subsidy program is the first period for which the rent subsidy will be in effect. | |||

All applications must be made on or before 180 days after the end of the qualifying period.

The estimated cost for the first three periods of the rent subsidy program, including the new Lockdown Support for locations significantly affected by public health restrictions, is $2.2 billion in 2020-21.

How Organizations Will Benefit

Example 1:

Sandy owns a kitchen supply store. The store was closed down in the initial stages of the pandemic in March and April, but has since reopened. With new safety precautions in place Sandy now limits the number of customers in her store. In September and October, her revenues are down 25 per cent compared to last year. She paid $5,000 in eligible rent costs during the first period of the rent subsidy. For this period, she will be eligible for a rent subsidy of 20 per cent, or $1,000.

Example 2:

Matt owns a local chain of three casual dining restaurants. With restrictions on dining room capacity, and patio business declining as cooler weather sets in, his revenues were down 40 per cent in September and 60 per cent in October, compared to the same time last year. Matt incurred $30,000 in eligible rent costs in respect of the first period of the rent subsidy. He will be eligible for a rent subsidy at a rate of 52.5 per cent, for a benefit of $15,750.

Example 3:

MovieCastle Group is a chain of six cinemas. MovieCastle Group fully owns each cinema, which are all incorporated separately. In September, revenues were down 70 per cent, and in October, revenues were down over 80 per cent. MovieCastle Group and its companies incurred rent costs of $600,000 in respect of the period.

Under the rent subsidy, MovieCastle Group will be eligible for a base subsidy rate of 65 per cent on a maximum of $300,000 of rent expenses per period. At each location, only the first $75,000 of rent expenses is eligible for the subsidy. MovieCastle Group members decide to divide the maximum $300,000 for the group equally amongst the six members, and each therefore can claim $50,000 in eligible expenses. The total group benefit will be $195,000 (or 65 per cent of $300,000).

ANNEX C: Backgrounder on Lockdown Support

Most recent update from Budget 2021:

Lockdown Support

For locations that must cease operations or significantly limit their activities under a public health order issued under the laws of Canada, a province or territory, the government introduced the Lockdown Support through the Canada Emergency Rent Subsidy program to provide additional help. In order to qualify for the Lockdown Support, an applicant must qualify for the base rent subsidy.

Budget 2021 proposes to extend, for the qualifying periods from June 6, 2021 to September 25, 2021, the current 25-per-cent rate for the Lockdown Support.

Additional Information from November 5, 2020 Backgrounder:

Lockdown Support for Businesses Facing Significant Public Health Restrictions

Backgrounder

November 5, 2020

On October 9, the government proposed new targeted, direct supports for businesses, non-profits and charities facing ongoing economic challenges amidst the second wave of the COVID-19 pandemic. For organizations that are subject to a lockdown and must shut their doors or significantly limit their activities under a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws), the government proposed a top-up under the new Canada Emergency Rent Subsidy to provide additional support while they face lockdowns.

The new Lockdown Support would be available retroactive to September 27, 2020, until June 2021, during periods when businesses are facing eligible public health restrictions. The government is providing the proposed details for the first 12 weeks of the program, until December 19, 2020. The proposed program would align with many aspects of the Canada Emergency Wage Subsidy to provide a simple, easy-to-understand program directly to renters and property owners.

This backgrounder provides information for organizations that have been significantly affected by public health restrictions and may be eligible for additional support for certain rent or property expenses. If your organization is not subject to qualifying public health lockdown restrictions, but you are currently experiencing a decline in revenues, you may still be eligible for the Canada Emergency Rent Subsidy.

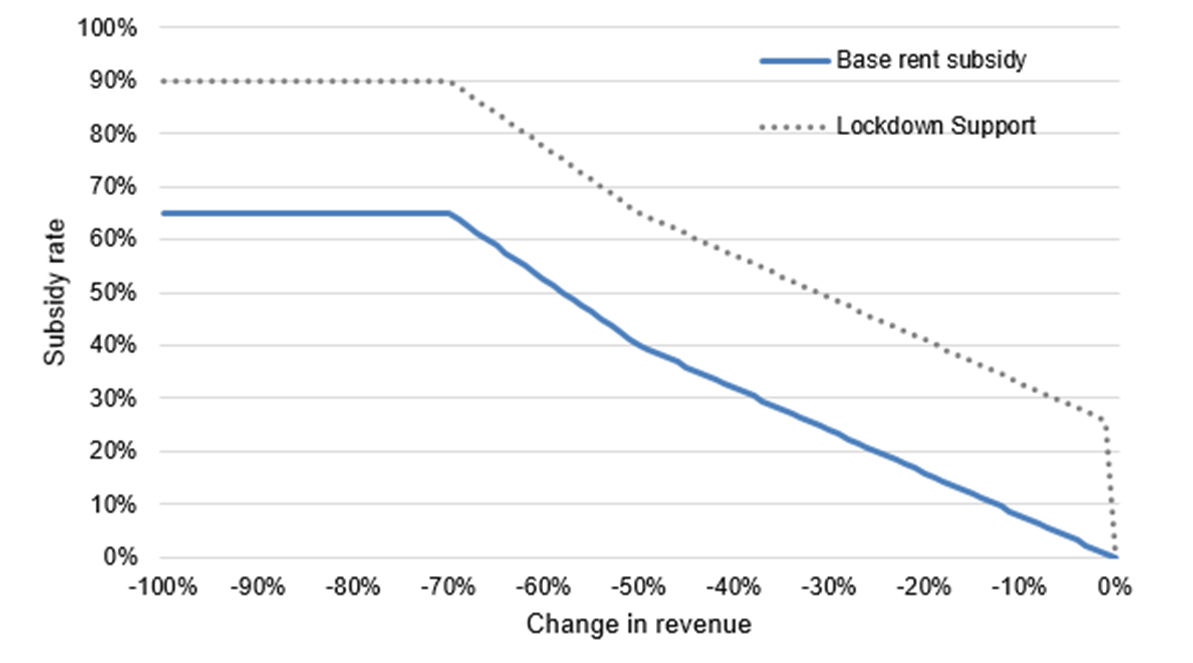

Base Rent Subsidy for Organizations Impacted by the Crisis

With the introduction of the new Canada Emergency Rent Subsidy, qualifying organizations that have suffered a revenue drop would be eligible for a subsidy on certain expenses. As shown in Table 1 and Figure 1, the maximum base rate would be 65 per cent, available to organizations with a revenue drop of 70 per cent or more. The base rate would then gradually decline to a rate of 40 per cent for organizations with a revenue drop of 50 per cent, and then would gradually reduce to zero for those not experiencing a decline in revenues. This structure mirrors the Canada Emergency Wage Subsidy rate structure for the relevant periods.

Lockdown Support for Locations Significantly Affected by Public Health Restrictions

The new Lockdown Support of 25 per cent would be available to organizations with locations that are temporarily forced to close or temporarily have their business activities significantly restricted by a public health order issued under the laws of Canada or a province or territory. This would include a shutdown of a location as a result COVID-19 outbreak (as declared by a provincial, territorial or regional health authority). This follows a commitment in the Speech from the Throne to provide direct financial support to businesses temporarily shut down as a result of a local public health decision.

Specifically, a public health restriction would be an order that meets the following conditions:

- it is made under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws) in response to the COVID-19 pandemic;

- it is limited in scope based on factors such as defined geographical boundaries, type of business or other activity, or risks associated with a particular location;

- non-compliance with the order is a federal, provincial or territorial offence or can result in the imposition of an administrative monetary penalty or other sanction imposed by the Government of Canada or a province or territory;

- it cannot result from a violation of an order that meets the above conditions; and

- it must be in effect, for a period of at least a week, so that some or all of the activities of the eligible entity at, or in connection with, the qualifying property are required to completely cease. In other words, limitations would be on the type of activity rather than the extent to which an activity may be performed or limits placed on the time during which an activity may be performed.

For an organization to qualify for the Lockdown Support for a qualifying property, the following conditions must apply:

- the organization qualifies for the base Canada Emergency Rent Subsidy; and

- the public health order requires that the organization

- completely shut down the location; or,

- cease some or all of the activities at the location and it is reasonable to conclude that the ceased activities, in the appropriate pre-pandemic prior reference period, were responsible for at least approximately 25 per cent of the revenues of the entity at that location.

If the organization is subject to a public health restriction and has to cease activities for only part of a qualifying period, the Lockdown Support would be pro-rated for the number of days in the period during which the relevant location was affected.

The following examples illustrate some common circumstances where an organization qualifying for the base subsidy may have qualifying property (i.e., a location) that would be eligible for the Lockdown Support.

- Restrictions on indoor dining: a restaurant that normally earns approximately 25 per cent or more of its revenues in connection with indoor dining could qualify due to its dining room being shut down even if it shifts its activities to take-out orders to make up some of the lost revenues from indoor dining.

- Closure of bars: a bar that is ordered to close down due to a regional public health restriction, and, anticipating low demand for take-out, does not continue operating, could qualify.

- Closure of fitness centres: a fitness center providing group fitness classes that is ordered to close down could qualify, even if, for instance, it moves to online instruction.

- Closure of retail stores: a retail store that is ordered to close down its location in a shopping mall, but that continues to operate providing online sales and curbside pick-up, could qualify so long as its in-store sales normally accounted for at least approximately 25 per cent of its revenues.

- Restrictions on types of personal services: an esthetics studio that earned most of its pre-pandemic revenues from services that cannot be performed while wearing a mask and can no longer be provided due to a public health restriction, could qualify.

- Other closures of certain indoor activities: a theater or an interactive museum that is ordered to close down would qualify.

- Closure in relation to a COVID-19 outbreak on the premises: a soup kitchen that is ordered to close down due to a specific public health restriction arising from a number of its employees contracting COVID-19 would qualify.

The following examples illustrate some common circumstances where an organization would generally not be eligible for the Lockdown Support:

- Reduction in business hours: a bar that is subject to a restriction requiring bars in a region to shut down by 10:00 pm each day would not qualify, as their activities would not be required to cease for a period of at least one week.

- Requirements for physical distancing: a restaurant that earns most of its revenues in connection with indoor dining would not qualify due to a public health restriction limiting patrons to six persons per table, as it could continue to carry on its indoor dining activities.

- Restrictions on travel: a bed and breakfast that sees a decrease in the number of clients due to travel restrictions would not qualify as it can continue to operate, and there is no order to cease its activities.

- Reduction in the number of clients at any one time: a movie theater that is required to limit the number of clients would not qualify, as it would not be required to cease any of its activities.

- Violation of a public health order: a factory that is required to close down due to violating a public health restriction would not qualify because the shut-down resulted from a contravention of public health orders.

| Revenue Decline | Base subsidy rate | Lockdown Support |

|---|---|---|

| 70% and over | 65% | 25% |

| 50% to 69% |

40% + (revenue drop - 50%) x 1.25 (e.g., 40% + (60% revenue drop – 50%) x 1.25 = 52.5% subsidy rate) |

25% |

| 1% to 49% |

Revenue drop x 0.8 (e.g., 25% revenue drop x 0.8 = 20% subsidy rate) |

25% |

Figure 1

Eligible Expenses

Eligible expenses for a qualifying property for a qualifying period would include commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages (subject to limits), less any subleasing revenues. Any sales tax (e.g., GST/HST) component of these costs would not be an eligible expense.

Eligible expenses would be limited to those paid under agreements in writing entered into before October 9, 2020 (and continuations of those agreements) and would be limited to expenses related to real property located in Canada. Expenses that relate to residential property used by the taxpayer (e.g., their house or cottage) would not be eligible. Payments made between non-arm’s-length entities would not be eligible expenses. Mortgage interest expenses in respect of a property primarily used to earn, directly or indirectly, rental income from arms-length entities would not be eligible.

For the purpose of the base subsidy, expenses for each qualifying period would be capped at $75,000 per location and be subject to an overall cap of $300,000 that would be shared among affiliated entities. For the purpose of the new Lockdown Support for those affected by public health restrictions, eligible expenses would be capped at $75,000 per location, but no overall cap would apply.

Eligible Entities

Eligibility criteria would generally align with the Canada Emergency Wage Subsidy program. Eligible entities include individuals, taxable corporations and trusts, non-profit organizations and registered charities. Public institutions are generally not eligible for the subsidy. Eligible entities also include the following groups:

- Partnerships that are up to 50 per cent owned by non-eligible members;

- Indigenous government-owned corporations that are carrying on a business, as well as partnerships where the partners are Indigenous governments and eligible entities;

- Registered Canadian Amateur Athletic Associations;

- Registered Journalism Organizations; and

- Non-public colleges and schools, including institutions that offer specialized services, such as arts schools, driving schools, language schools or flight schools.

In addition, an eligible entity must meet one of the following criteria:

- have a payroll account as of March 15, 2020 or have been using a payroll service;

- have a business number as of September 27, 2020 (and satisfy the Canada Revenue Agency that it is a bona fide rent subsidy claim); or

- meet other prescribed conditions.

Calculating Revenues

Revenues will be calculated in the same manner as under the Canada Emergency Wage Subsidy program.

- An entity's revenue for the purposes of the rent subsidy is its revenue from its ordinary activities in Canada earned from arm's-length sources, determined using its normal accounting practices. Revenues from extraordinary items and amounts on account of capital are excluded.

- For registered charities and non-profit organizations, the calculation includes most forms of revenue, excluding revenues from non-arm's length persons. These organizations are allowed to choose whether to include revenue from government sources as part of the calculation. Once chosen, the same approach would have to apply throughout the program period.

- Special rules for the computation of revenue are provided to take into account certain non-arm's-length transactions, such as where an entity sells all of its output to a related company that in turn earns arm's-length revenue.

- Affiliated groups that do not normally compute revenue on a consolidated basis may elect to do so.

Reference Periods for the Drop-in-Revenues Test

Eligibility would generally be determined by the change in an eligible entity's monthly revenues, year-over-year, for the applicable calendar month.

Alternatively, an entity can choose to calculate its revenue decline by comparing its current reference month revenues with the average of its January and February 2020 revenues.

Once an entity has chosen to use either the general or alternative approach, they must use that approach for each of the three periods. The approach chosen would apply for the purpose of both the base Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy.

An eligible entity would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to determine its subsidy rate. This would provide certainty and aligns with the practice under the Canada Emergency Wage Subsidy.

Table 2 below outlines each qualifying period and the relevant period for determining change in revenue.

| Qualifying period | General approach | Alternative approach | |

|---|---|---|---|

| Period 8 | September 27 to October 24, 2020 | October 2020 over October 2019 or September 2020 over September 2019 | October 2020 or September 2020 over average of January and February 2020 |

| Period 9 | October 25 to November 21, 2020 | November 2020 over November 2019 or October 2020 over October 2019 | November 2020 or October 2020 over average of January and February 2020 |

| Period 10 | November 22 to December 19, 2020 | December 2020 over December 2019 or November 2020 over November 2019 | December 2020 or November 2020 over average of January and February 2020 |

| Note: The period numbers align with those used for the Canada Emergency Wage Subsidy, for simplicity. Period 8 of the Canada Emergency Wage Subsidy program is the first period for which the rent subsidy will be in effect. | |||

All applications must be made on or before 180 days after the end of the qualifying period.

The estimated cost for the first three periods of the rent subsidy program, including the top-up for locations significantly affected by public health restrictions, is $2.2 billion in 2020-21.

How Organizations Will Benefit

Example 1:

Sonia is the owner of a gym that was fully locked down on September 20 under provincial order. In September, her revenues were down by 50 per cent because of the physical distancing measures, and her revenues in October will fall to zero. Her rent expenses for the period are $10,000. Sonia will be eligible for the 25 per cent Lockdown Support, or $2,500. In addition, Sonia will receive a base rent subsidy of 65 per cent, or $6,500, for a combined total of $9,000.

Example 2:

Restaurant Inc is a chain of restaurants with 10 locations. In September, revenues were down 70 per cent, and in October, revenues were down over 80 per cent when the dining rooms of six of their 10 locations were shut down under a regional public health order effective October 10. Restaurant Inc incurred rent costs of $400,000 in respect of the period, $120,000 of which related to the six locations closed by public health order. Under the rent subsidy, Restaurant Inc will be eligible for a base subsidy rate of 65 per cent plus the new Lockdown Support of 25 per cent with respect to the six locations closed by public health order for the days they were affected (in this case 15 days out of the 28-day period). As shown in Table 3 below, Restaurant Inc will be able to benefit from the base subsidy and the Lockdown Support. The base subsidy would apply on $300,000 in eligible expenses (the monthly cap), for a benefit of $195,000. The Lockdown Support is only capped per location, meaning it would apply on $120,000 of eligible expenses ($20,000 x 6), and is pro-rated to the number of days in the qualifying period that the business was affected by the public health order. As such, the benefit associated with the Lockdown Support would be of $16,071 ($120,000 x 25% x 15/28). This would result in a total rent subsidy of $211,071 for the month of October.

| Subsidy rate | Eligible expenses | Eligible days | Subsidy | |

|---|---|---|---|---|

| Base rent subsidy | 65% | $300,000 | 28 | 65% x $300,000 = $195,000 |

| Lockdown Support | 25% | $20,000 x 6 =$120,000 | 15/28 | 25% x $120,000 x 15/28 = $16,071 |

| Total | $211,071 |

*Redacted*

Annex E: CEWS, CERS, CRHP Rates by Period

Maximum CEWS (Active Employees) Subsidy Rate by Period

| Period 17 (new) | Period 18 (new) | Period 19 (new) | Period 20 (new) | |

|---|---|---|---|---|

| June 6 to July 3, 2021 | July 4 to July 31, 2021 | August 1 to August 28, 2021 | August 29 to September 25, 2021 | |

| Revenue decline | ||||

| 70% and over | 75% | 60% | 40% | 20% |

| 50-69% | 40% + (revenue decline – 50%) x 1.75 | 35% + (revenue decline – 50%) x 1.25 | 25% + (revenue decline – 50%) x 0.75 | 10% + (revenue decline – 50%) x 0.5 |

| 11-49% | Revenue decline x 0.8 | (Revenue decline – 10%) x 0.875 | (Revenue decline – 10%) x 0.625 | (Revenue decline – 10%) x 0.25 |

| 1-10% | Revenue decline x 0.8 | 0% | 0% | 0% |

Maximum CERS and Lockdown Support Subsidy Rate by Period

| Period 17 (new) | Period 18 (new) | Period 19 (new) | Period 20 (new) | |

|---|---|---|---|---|

| June 6 to July 3, 2021 | July 4 to July 31, 2021 | August 1 to August 28, 2021 | August 29 to September 25, 2021 | |

| Revenue decline | ||||

| 70% and over | 65% | 60% | 40% | 20% |

| 50-69% | 40% + (revenue decline – 50%) x 1.25 | 35% + (revenue decline – 50%) x 1.25 | 25% + (revenue decline – 50%) x 0.75 | 10% + (revenue decline – 50%) x 0.5 |

| 11-49% | Revenue decline x 0.8 | (Revenue decline – 10%) x 0.875 | (Revenue decline – 10%) x 0.625 | (Revenue decline – 10%) x 0.25 |

| 1-10% | Revenue decline x 0.8 | 0% | 0% | 0% |

CRHP Subsidy Rate by Period

| CEWS Period | CERS Period | CRHP Period | Period Begins | Period Ends | Last Date to Apply |

|---|---|---|---|---|---|

| 1 | - | - | March 15, 2020 | April 11, 2020 | February 1, 2021 |

| 2 | - | - | April 12, 2020 | May 9, 2020 | February 1, 2021 |

| 3 | - | - | May 10, 2020 | June 6, 2020 | February 1, 2021 |

| 4 | - | - | June 7, 2020 | July 4, 2020 | February 1, 2021 |

| 5 | - | - | July 5, 2020 | August 1, 2020 | February 1, 2021 |

| 6 | - | - | August 2, 2020 | August 29, 2020 | February 25, 2021 |

| 7 | - | - | August 30, 2020 | September 26, 2020 | March 25, 2021 |

| 8 | 1 | - | September 27, 2020 | October 24, 2020 | April 22, 2021 |

| 9 | 2 | - | October 25, 2020 | November 21, 2020 | May 20, 2021 |

| 10 | 3 | - | November 22, 2020 | December 19, 2020 | June 17, 2021 |

| 11 | 4 | - | December 20, 2020 | January 16, 2021 | July 15, 2021 |

| 12 | 5 | - | January 17, 2021 | February 13, 2021 | August 12, 2021 |

| 13 | 6 | - | February 14, 2021 | March 13, 2021 | September 9, 2021 |

| 14 | 7 | - | March 14, 2021 | April 10, 2021 | October 7, 2021 |

| 15 | 8 | - | April 11, 2021 | May 8, 2021 | November 4, 2021 |

| 16 | 9 | - | May 9, 2021 | June 5, 2021 | December 2, 2021 |

| 17 | 10 | 1 | June 6, 2021 | July 3, 2021 | December 30, 2021 |

| 18 | 11 | 2 | July 4, 2021 | July 31, 2021 | January 27, 2022 |

| 19 | 12 | 3 | August 1, 2021 | August 28, 2021 | February 24, 2022 |

| 20 | 13 | 4 | August 29, 2021 | September 25, 2021 | March 24, 2022 |