Audit of Leave, Travel, Hospitality Expenditures and Related Proactive Disclosure for Level 1s (or Equivalent) and Above

August 2021

1259-3-0057 - ADM(RS)

Reviewed by ADM(RS) in accordance with the Access to Information Act. Information UNCLASSIFIED.

Alternate Formats

Assistant Deputy Minister (Review Services)

- ACS

- Automated Cashier System

- ADM(Fin)

- Assistant Deputy Minister (Finance)

- ADM(IM)

- Assistant Deputy Minister (Information Management)

- ADM(RS)

- Assistant Deputy Minister (Review Services)

- ATIA

- Access to Information Act

- BHA

- Blanket Hospitality Authorities

- BTA

- Blanket Travel Authorities

- CAF

- Canadian Armed Forces

- CDS

- Chief of the Defence Staff

- CFO

- Chief Financial Officer

- Corp Sec

- Corporate Secretary

- DGFOS

- Director General Financial Operations and Services

- DGSFG

- Director General Strategic Financial Governance

- DKIM

- Director Knowledge and Information Management

- DM

- Deputy Minister

- DND

- Department of National Defence

- DRMIS

- Defence Resource Management Information System

- EHRF

- Event/Hospitality Request Form

- EIA

- Expenditure Initiation Authority

- FAA

- Financial Administration Act

- FAM

- Financial Administration Manual

- FY

- Fiscal Year

- L1

- Level 1

- NLT

- No later than

- OCI

- Office of Collateral Interest

- OGP

- Open Government Portal

- OPI

- Office of Primary Interest

- SDM

- Senior Departmental Manager

- SOP

- Standard Operating Procedure

- T&H

- Travel and Hospitality

- TB

- Treasury Board

- TBS

- Treasury Board Secretariat

- TD

- Temporary Duty

- THCEE

- Travel, Hospitality, Conference and Events Expenditures

Executive Summary

Travel, Hospitality, Conference and Event Expenditures (THCEE) and Leave Overview

The Department of National Defence and the Canadian Armed Forces (DND/CAF), as Canada’s largest federal government organization, incur significant THCEE each year to support the delivery of core programs and services to Canadians. The department’s total annual expenditures on travel, hospitality and conference fees for fiscal year (FY) ending March 31, 2020 was approximately $354 million. With regard to leave, the Defence Team, including senior management, is accorded leave benefits in accordance with their terms and conditions of employment.

DND has a responsibility to ensure that leave is effectively administered, complies with relevant legislative requirements, and that THCEE planning, approval, recording and reporting respects the four Treasury Board (TB) guiding principles of Public Scrutiny, Value for Money, Accountability and Transparency.

Project Objective and Importance

ADM(RS) was requested to perform an audit of Defence Team senior management to determine whether travel, including spousal travel, hospitality and conference expenditures, and leave for Level 1 (L1) and above positions were in compliance with the requirements set forth in the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures, the Directive on Terms and Conditions of Employment for Executives as well as its own internal policies. Additional information on the audit and its methodology are included in Annex B.

With the Government of Canada committed to enhancing public transparency through the Open Government Policy, and the relative dollar value of expenditures in comparison to other government departments, there is a high level of scrutiny on THCEE expenses incurred by the Defence Team, in particular for L1s and above. To ensure proper stewardship, it is essential that the Department be transparent and be able to demonstrate prudence and compliance with key legislation and policies.

Key Findings

THCEE incurred for L1s and above was found to be mostly eligible and approved by the appropriate authority with some noted exceptions. Improvements are required to provide comprehensive information for decision making and to strengthen compliance with policies and guidelines that demonstrate the prudent use of public funds.

While proactive publication on the Open Government Portal (OGP) is generally done on a timely basis, in some instances disclosures were found to be incomplete and/or inaccurate. A formal oversight and validation process for the management of THCEE and proactive publication was not yet fully implemented at the time of the audit, and availability of key information to support oversight is hindered by current system functionality limitations.

Overall Conclusion

THCEE incurred for L1s and above are generally eligible and approved by the appropriate authority. Opportunities exist to improve timeliness of approvals and reporting, completeness of information for decision making, transparency and compliance, as well as oversight and monitoring.

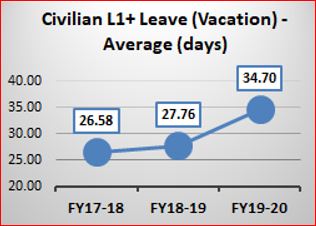

With regard to leave, it was noted that civilian senior executives have accumulated greater leave balances in recent years. This important decrease in leave taken may have broad and long-term implications to well-being (e.g., risk of burnout) and may create a financial liability on the department (e.g., pay-out of accrued vacation leave).

Streamlining guidance, as well as ensuring consistent use of updated travel forms and templates that better align with policy will improve the management of THCEE and proactive publication. Implementing oversight and validation processes will help ensure accurate, complete and timely proactive publication, as well as improve the management of THCEE.

Key Findings and Recommendations

| FINDINGS | RECOMMENDATIONS |

|---|---|

Expense Management While THCEE incurred are mostly eligible and approved by the appropriate authority, improvements are required to provide sufficient information for decision making and to better demonstrate compliance with policies and guidelines. |

|

Oversight and Monitoring A formal oversight and validation process for the management of THCEE and proactive publication was not yet fully implemented at the time of the audit. Availability of key information to support oversight is hindered by current system functionality limitations. |

|

Leave Controls and oversight processes to manage leave recording and balances exist. |

N/A |

Table 1 Summary

Context

| Stakeholders | Roles and Responsibilities |

|---|---|

Assistant Deputy Minister (Finance)/Chief Financial Officer (ADM(Fin)/CFO) Director General Financial Operations and Services (DGFOS) Director General Strategic Financial Governance (DGSFG) |

ADM(Fin)/CFO is the functional authority for DND/CAF proactive disclosure of travel and hospitality expenses, policy authority on THCEE including providing policy direction for all travel and hospitality expenses, and disseminating updates and changes in TB THCEE policies to the department; approving the departmental total annual budgets for travel, hospitality and conferences; conducting oversight and monitoring of financial information including THCEE; and managing non-compliance issues with the publication of travel and hospitality (T&H) expenses. |

Corporate Secretary (Corp Sec) |

Corp Sec is the functional authority for the administration of the Access to Information Act (ATIA) and the Privacy Act and is responsible for providing direction to DND/CAF on the implementation of proactive publication requirements. Corp Sec is also responsible for reporting to senior executive governance committees issues of non-compliance or poor performance with regard to the timely proactive publication of T&H expenses. |

Assistant Deputy Minister (Information Management (ADM(IM)) Director Knowledge and Information Management (DKIM) |

DKIM is the functional authority for the Open Government program in DND/CAF and is responsible for publishing the information online on a monthly basis. DKIM is also responsible for preparing performance reports on submitted proactive disclosures. |

Level 1 Advisors (military equivalents, and above ranks) |

As L1s are accountable for their own budgets, and as individuals who incur travel and hospitality expenditures, they are responsible for ensuring that:

|

Treasury Board |

Key policy authority for the Government of Canada THCEE and any internal policies or guidance should align with TB Directives and Guides which are promulgated by the Treasury Board Secretariat (TBS). A template for reporting THCEE proactive disclosure has been created by the TBS that is currently in use by DND/CAF. |

Table 2 Summary

THCEE Management & Proactive Publication Process

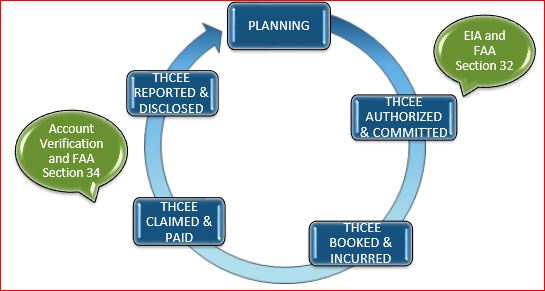

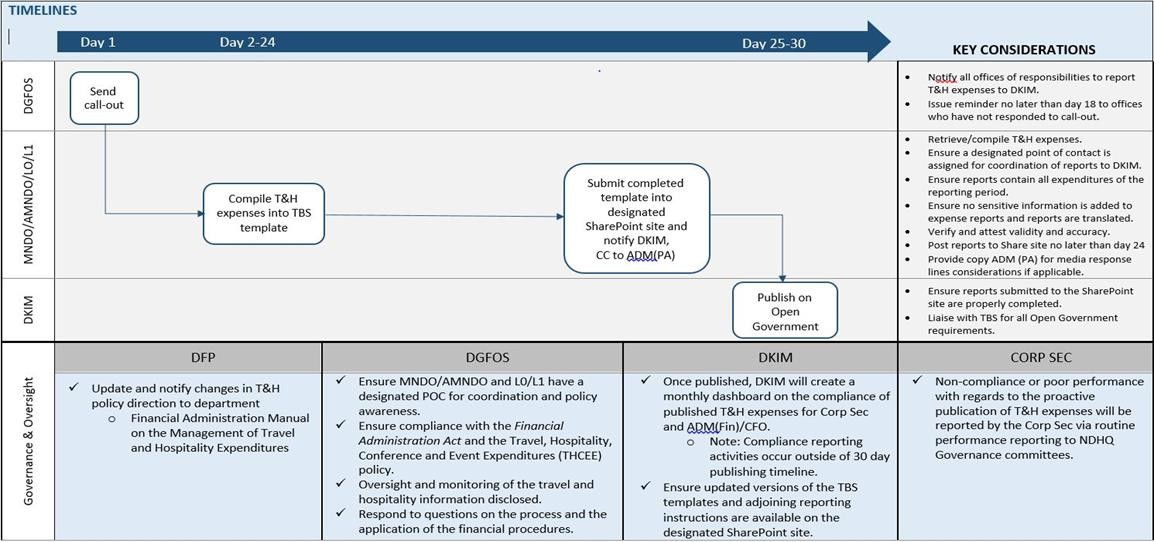

Figure 1 Summary

DRMIS |

Departmental system of record for all financial transactions. |

|---|---|

ClaimsX |

Legacy web-based travel claim management application, which tracks and processes DND/CAF travel claims. While it captures key travel information, its use is not mandatory. |

Automated Cashier System (ACS) |

Electronic ledger system relying on paper forms and manual processing of payments. Directly processes travel claims where ClaimsX is not available or used, occurring most often on bases and in the regions. |

Table 3 Summary

The THCEE management process begins when a requirement for travel and/or hospitality event is identified, followed by obtaining cost estimates, quotes and other relevant information. This information is consolidated to seek approval in two, often concurrent steps: expenditure initiation authority (EIA) and funds commitment approval (Section 32), ensuring sufficient funds are set aside for reimbursement or payment after the completion of the travel or hospitality activity. Expenses may only be incurred and funds committed once approval is obtained. After the completion of travel or hospitality, invoices and receipts are presented for verification to confirm that all terms and conditions of contracts have been satisfied, and expenses are legitimate and can be paid and reimbursed (Section 34). The reimbursement of expenses triggers the proactive publication process.

Senior departmental managers (SDM) are required to proactively disclose incurred travel and hospitality expenditures as prescribed in the ATIA and the TB Guide to Proactive Publication of Travel and Hospitality Expenses. For the Defence Team, this includes civilian and military senior executives and officers, namely Level 0s, Level 1s, all EX-04s and EX-05s, Major General and above ranks, Governor in Council appointees, and all individuals who act in these positions. The proactive publication process is done through the monthly completion of a TB-issued template and subsequently uploaded onto DKIM’s SharePoint site for publication to the OGP. The document completed by every individual L1 and above is then uploaded within 24 days following when the travel and hospitality expense was reimbursed. SDMs also sign an attestation to confirm that their submissions are valid, accurate and complete. Refer to Annex C for additional details on the proactive publication process.

Key Themes

The Key Findings were aligned with three themes as follows:

- Expense Management

- Oversight and Monitoring

- Leave

Expense Management

Authorization elements for Travel

- objective

- category of travel

- type of traveller

- virtual presence options

- number and rationale of travellers

- mode of and rationale for transportation

- chosen accommodations and rationale

- meals

- incidentals and other costs

Background

THCEE management is based on the four core guiding principles of Public Scrutiny, Value for Money, Accountability and Transparency, which are demonstrated by providing rationales on why the expenditure is necessary for the department to achieve its objectives, that the most cost-effective method is considered and selected, that there is effective oversight and controls in place to monitor the expenditures, and that supporting information is documented and available for accurate and complete disclosure. Approval is obtained using departmentally approved forms for travel requests and for hospitality, conferences and events. Information required includes the purpose and nature of the travel or hospitality and all required authorization elements.

Hospitality requests require rationalization for the provision of hospitality and must be deemed necessary for reasons of courtesy, diplomacy or protocol, or to facilitate the achievement of the business of the government as per the TB Directive on Travel, Hospitality, Conference and Event Expenditure (TB Directive). To help the Department demonstrate compliance with TB financial management and THCEE policies and principles, typical supporting documentation for travel and hospitality files include cost estimates, quotes, itineraries, receipts and invoices, as well as list of attendees for hospitality events.

Accurate and transparent reporting relies on the correct classification and categorization of expenditures when managing travel and hospitality activities. For example, for travel, one of the five categories defined in the TB Directive on THCEEs must be selected: (1) Operational Activities, (2) Key Stakeholders, (3) Internal Governance, (4) Training or (5) Other Travel. While ‘Operational Activities’ category is the default category for travel, ‘Key Stakeholders’ or ‘Internal Governance’ are to be selected when they represent the main purpose of the travel, even if the trip includes some aspects of operational activities.

Why It Matters

- Adherence to Government of Canada financial and THCEE policies enables demonstration of stewardship and prudence in the use of public funds.

- Transparency and inclusion of key information for expenditure approval authorities support senior management decision making and accountability.

- Maintaining documentation and supporting information to enable approval, certification and verification of expenditures is a compliance requirement with the Government of Canada comptrollership function and record retention policies, and also minimizes financial or reputational risk to the claimant and department.

FINDING 1: While THCEE incurred are mostly eligible and approved by the appropriate authority, improvements are required to provide sufficient information for decision making and to better demonstrate compliance with policies and guidelines.

What We Found

Key Approval Forms

Individual Travel Authorization is used for civilian travel approval while the TD Request form is used for military travel. The Event/Hospitality Request Form (EHRF) is used for hospitality requests for both civilian and military.

Key steps in THCEE planning include ensuring expenditure approval is obtained and funds are available. While approval is generally evidenced, the timeliness of approval was a noted issue often being obtained after funds were committed and/or expenses incurred. Recognizing that L1 travels are often unpredictable and required on short notice, it is important for approval to be obtained prior to committing funds or incurring expenses as it provides assurance that the expenses are relevant and necessary, and that funds are available.

The majority of expenditures were eligible and supported by documentation with some noted exceptions. The Defence Team Financial Administration Manual (FAM) requires quotes be obtained above given thresholds to demonstrate value for money which was not consistently evidenced. In addition, the templates used do not enable the differentiation of personal versus work-related travel, where applicable. It is also important for delegation of authority to be valid and used correctly as they directly impact the initiation, budgeting and disbursement of public funds. Travel and hospitality transactions reviewed were generally approved by the appropriate approval authority with some minor exceptions. For example:

- Individuals may not approve a transaction for an event they will attend or host; and

- Approval was granted by individuals without valid or applicable delegation of authority on the fund or cost centre charged.

The majority of travel files did not include all required authorization elements, primarily due to forms not being fully completed (e.g., rationales to justify accommodation city limits being exceeded were not provided). The Temporary Duty (TD) Request, used for military travel, does not include all the necessary information fields. While the EHRF for hospitality approval is consistently used, the form lacks a rationale field to justify the provision of hospitality, which is particularly important for specific types of hospitality such as when attendees are primarily or exclusively public servants, or for hospitality deemed exceptional which requires higher levels of approval. Gifts, including the provision of accommodations, are sensitive by nature as is the provision of alcohol, both of which are common for conferences and summits hosted by foreign nations. Gifts were not always disclosed as part of the travel request package. In addition, gifts generally warrant a higher level of approval which was not always evidenced.

What We Found

BTAs and BHAs are alternative approval instruments designed to pre-approve travel and hospitality of a repetitive nature based on set parameters (such as category of travel and geographic location) to improve administrative efficiency. Any element that falls outside the parameters requires independent approval. In many instances, some travel elements fell outside BTA parameters, requiring the standard approval process be followed.

Controls and oversight are expected including documentation and monitoring of BTA/BHA per TB Directive and the FAM. BTAs and BHAs have not been formally tracked, documented or reviewed, as required. Additionally, L1s have not been sending quarterly BHA expenditures to ADM(Fin) for review, or BTA/BHAs to ADM(Fin) for annual tracking/monitoring, as required. A recommendation on oversight is included in the oversight and monitoring section.

Conferences are a type of event that may be classified as either an operational activity or an event. Should it be classified as an event, the approval involves the consolidation of all participants’ costs which may require higher approval levels. In many instances, attendance at conferences were presented as individual travel requests with limited justification to enable classification as operational or event. To safeguard value for money and transparency, conferences are to be approved in a consolidated manner to ensure that the Defence Team is not over-represented at the event.

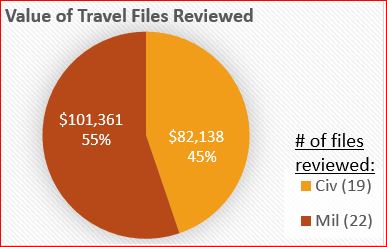

Figure 2 Summary

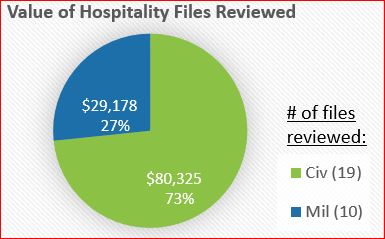

Figure 3 Summary

ADM(RS) Recommendation

ADM(RS) Recommendation

Oversight & Monitoring

Background

The passing of Bill C-58 in June 2019 led to increased openness and transparency of government information. In accordance with this legislation, L1s and above are required to publish their travel and hospitality expenditures on OGP, including when a trip has been cancelled. This proactive disclosure information must accurately include all data elements outlined in the policy, such as the purpose and dates of travel, places visited, airfare and other transportation costs, and lodging, amongst others.

The current proactive disclosure process involves a monthly call-out by ADM(Fin) to all L1 organizations reminding them of their disclosure responsibilities under the ATIA. The call-out includes various guidance materials including the TB travel and hospitality reporting template. The document completed by every individual L1 and above is then uploaded within 24 days following when the travel and hospitality expense was reimbursed (refer to Annex C for proactive publication process map).

The Joint Deputy Minister/Chief of the Defence Staff (DM/CDS) Directive describes ADM(Fin)/CFO as the functional authority of all T&H expenses, including monitoring the management of any compliance issues with regard to THCEE.

Why It Matters

- Oversight and monitoring of travel, hospitality and related proactive disclosure enables DND/CAF to meet various legislative requirements under the ATIA and the Proactive Publication legislation.

- An oversight and validation process allows DND/CAF to ensure transparency and compliance including proactive disclosure of T&H expenditures, as well as identify and address guidance and policy gaps, and support ongoing improvements to processes and systems.

FINDING 2: A formal oversight and validation process for the management of THCEE and proactive publication was not yet fully implemented at the time of the audit.

What We Found

A review of DKIM’s monthly compliance dashboards from June 2019 to May 2020 showed that the majority of SDMs’ submissions were received on a timely basis with an exception rate of approximately 10 percent. Submissions can still be disclosed retroactively or amended where errors have been identified. Information must be proactively published based on when the THCEE was incurred. This was found to not always be accurate or complete, partly due to the differing interpretations of “incurred”. For example, some L1s interpreted “incurred” hospitality expenses based on their attendance at the event, however the proactive publication of hospitality expenditures is based on the L1s incurring the expenses under their responsibility centre.

Completion of the TB reporting template is a manual process that relies on L1s’ knowledge of proactive publication requirements, access to the L1’s travel and hospitality files and access to applicable systems of records to validate figures reported. Accurate coding of transactions was a noted issue in terms of travel category. An existing control is the attestation letter signed by SDMs when submitting their disclosures to confirm its completeness, validity and accuracy.

Some errors or omissions were noted between OGP data and the supporting documentation, with common errors and omissions for travel disclosures including discrepancies in travel dates, destinations and cost elements as well as not disclosing exceptional elements such as the use of government-owned aircraft (Service Air). The most common omissions in hospitality disclosures were providing sufficient details on type and reason for hospitality, omitting gratuities and taxes in the total cost and using estimates rather than actual figures. These errors and omissions may be addressed through both improved guidance and systematic validation of entries through the establishment of an oversight and validation process.

Up-to-date lists of SDMs is a key component for ensuring timely and complete proactive publication. Currently, this requires the consolidation of reports from both civilian and military human resource data sets and does not include acting appointments less than four months.

A formal oversight and validation process was under development by ADM(Fin) at the time of the audit. This process would enable ADM(Fin) to better ensure compliance with the FAA and the THCEE Directive, and monitor the accuracy and completeness of THCEE in line with the Proactive Publication Process Map at Annex C. Leveraging monitoring results would support improvements to the process, such as streamlining guidance and policies. Corp Sec may support ADM(Fin)’s oversight efforts by identifying and reporting non- compliance or poor performance issues regarding the proactive publication submissions and their timeliness.

FINDING 3: Availability of key information to support oversight is hindered by current system functionality limitations.

Given the multiple applications in use and the way SDMs data relative to THCEE is tagged in the systems, complete information on THCEE transactions cannot directly be obtained from the systems of records. While existing financial management and related systems capture the required data elements to support THCEE proactive publication at the departmental level, existing capabilities and data points to support individual-level identification is limited. Approximately fifty-five percent (55%) of travel expenditures are processed using ClaimsXFootnote 1 , which lacks mechanisms to readily identify employees within the SDMs group. Forty percent (40%) of departmental travel expenditures are processed through the ACS. The balance of five percent (5%) of travel expenses are processed through DRMIS and accounts mainly for ministers and exempt staff transactions. While DRMIS is the departmental system of record housing all financial transactions, the records are not linked to specific Human Resources information such as claimant’s name, personnel record identifier, rank or position. For this reason, while departmental-level travel and hospitality spending can be extracted from DRMIS, person-specific travel data to adequately support individual disclosures is not currently feasible. Enhancements and standardization to travel processes and systems as part of the wider enterprise resource modernization programme will better support future oversight and monitoring efforts to ensure compliance with TB proactive publication policies.

Various ongoing improvement efforts were noted including:

- Development of a list of senior managers required to disclose travel and hospitality expenses, and method to extract and validate transactions for this specific group of individuals across different systems to assess overall compliance;

- ADM(Fin) has begun the process of tracking and monitoring BTAs/BHAs;

- Given that TB and internal policies and guidance on proactive publication triggers had various interpretations and applications across L1s, ADM(Fin) has clarified expectations with TB and updated their monthly call-out letter to the L1 groups; and

- ADM(Fin) has updated their monthly call-out letter to the L1 groups to 1) request updates/changes to the list of SDMs; and 2) request financial coding information associated with transactions used to record travel and hospitality expenses proactively published.

ADM(RS) Recommendation

Leave

Background

Civilian

Civilian executive leave is managed between the L1s and the DM. Leave plans are generally raised in a bilateral setting with the DM for informal approval or through email, after which L1s submit their leave requests through PeopleSoft for formal approval. Leave for the L1s and Associate DM is approved by the DM, and the DM’s leave is submitted to ADM(Fin)/CFO for approval. Prior to 2016, EXs received yearly notices of their leave and the process to follow to carryover leave in excess of the permitted maximum. Assistant Deputy Minister (Human Resources – Civilian) identified L1s with excess balances to ensure cash-out or to seek DM approval to carry over the excess balances beyond their annual entitlements. As of 2016, due to ongoing issues with the Phoenix Pay System, a postponement of automatic cash-outs was implemented. As such, all civilian senior executives have been allowed to carry over more than the previously permitted maximum. This postponement period is slated to expire in FY 2021/22.

Military

Military L1 leave is approved by the Vice Chief of the Defence Staff and the CDS’ leave is approved by the Minister of National Defence. Military leave, once approved, is sent to each group’s respective Orderly Rooms for processing and entry into the military Human Resource Management System (Guardian). Unlike civilian senior executives with the pause on automatic cash-outs since 2016, Senior Officers are required to take their leave each fiscal year. Provided that the member can demonstrate that they were not able to take their designated leave due to operational reasons, Senior Officers can carry over a maximum of 25 days of accumulated leave.

Why It Matters

- Recording leave accurately in the context of THCEE allows for the delineation of work versus personal components of travel to determine the eligibility of expenses.

- Oversight processes to ensure leave is recorded on a timely basis, as incurred, enables accuracy of leave balances.

- Monitoring and managing leave balances ensures that executives and senior officers are taking sufficient annual leave to support their overall mental health and well-being.

- A large accumulated leave balance may present financial liabilities for the department should executives cash-out their leave at the end of the postponement period for civilian L1s and above.

FINDING 4: Controls and oversight processes to manage leave recording and balances exist.

What We Found

Business travel may include a personal leave component, in particular for long distance travel. Sampled travel transactions of longer duration showed that, where applicable, leave had been duly recorded. The determination of the personal component relies on correspondence and/or itinerary, if available, rather than being specified in travel request forms. Proactively disclosing personal components to business trips, in particular the inclusion of dates, would facilitate the determination of expense eligibility.

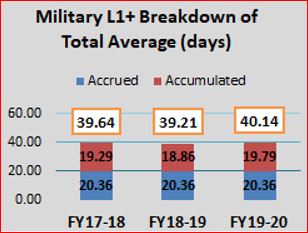

In terms of accrued leave balances for civilian L1s and above, accrual reports and a notification is sent to L1s to ensure leave is utilized or to request plans for its use. Although year-end leave balances for L1s have been relatively stable during the three FYs reviewed, an increase has been noted in the average civilian balances for FY ending 2019/2020. There were nine civilian L1s that exceeded their annual entitlements due to the pause on automatic cash-outs.

Military leave is not centrally tracked with the onus placed on the individual L1 to monitor their own leave balances. Leave audits are carried out on a yearly basis, and validated by obtaining signed military leave statements. In a number of instances, statements were not signed, indicating that leave audits may not be done with sufficient regularity. There were seven military L1s who had a maximum accumulated balance of 25 days as of March 31, 2020. Military senior officers cannot carry over more than 25 days of leave. For those with a higher overall balance, this is due to historical accrued leave.

Opportunities for Improvement

The inclusion in the travel request form of personal leave, as applicable, would facilitate the determination of expenses eligibility and reconciliation to leave records. Guidance on when leave should be submitted in PeopleSoft or alternative evidence to demonstrate leave has been requested where it is not practical to do so in PeopleSoft on a timely basis would improve controls, recordkeeping and oversight of civilian senior executive leave. Finally, a reporting or oversight process requiring the systematic signing of military leave statements would better support accuracy and timeliness of recordkeeping for military senior officers.

Both graphs capture all L1s employed during the three consecutive FYs.

Figure 4 Summary

Figure 5 Summary

Overall Conclusion

DND incurs significant THCEE each year to support core operations and programs to Canadians. Recent legislative developments, as a result of The Government of Canada’s commitment to enhancing transparency of governmental information, required increased frequency of reporting T&H expenditures. To respond to these requirements, the audit aimed to determine whether THCEE and leave for L1 and above positions were in compliance with the requirements set forth in the relevant policies and guidance on THCEE and proactive disclosure.

While THCEE incurred were generally eligible and approved by the appropriate authority, the elements of completeness, consistency, timely approval-seeking and record-keeping should be strengthened to better support compliance with policies, thereby better demonstrating stewardship and prudence in the use of public funds. Standardizing the management of THCEE across L1s by using consistent travel forms and providing streamlined guidance would help reduce instances of non-compliance. Additionally, improvements to travel request forms and templates would help to further alignment with relevant policies.

Areas for improvement were also identified in the accuracy, completeness and timely reporting of proactive publication, which could be enhanced by implementing a formal oversight and validation process. Broader oversight and monitoring of high-risk instruments such as BTAs/BHAs would also improve the management of THCEE.

With regard to executive leave balances and management thereof, the civilian leave postponement period commencing in 2016, coupled with the high demands on L1 and above executives, have contributed to a rise in vacation leave balances, which could impact mental health and well-being, and pose a financial liability to the department. Ensuring a plan is in place to account for the well-being of executives and the financial implications of increasing leave balances would benefit the Department. Formalizing civilian senior executive leave requests and ensuring military leave statements are reviewed and signed would improve controls, recordkeeping and oversight.

Annex A – Management Action Plan

ADM(RS) Recommendation

Management Action

During the course of the audit, ADM(Fin) worked with ADM(RS) to update and improve departmental guidance on THCEE and processes supporting proactive publication requirements. Key activities since the audit sample period include:

- ADM(Fin) developed departmental Standard Operating Procedures (SOP) to support DND FAMs related to THCEE, which have been updated to address audit observations. SOPs will be finalized, published and sent to L1 organizations no later than (NLT) September 30, 2021.

- ADM(Fin) updated departmental guidance related to proactive publication requirements for SDMs’ travel and hospitality expenses to address audit observations. Updates include clarifying TBS guidance related to when SDMs are required to proactively publish expenses for travel (i.e., when it is their own) and hospitality (i.e., when it is charged to their responsibility centre, regardless of their participation/attendance). Departmental guidance was updated and sent to L1 Comptrollers and SDM support staff in February 2021 as part of the monthly call letter on proactive disclosure requirements. Further updates to departmental guidance will be considered, based on a review of audit observations, and provided NLT September 30, 2021.

- ADM(Fin) will provide departmental guidance and direction related to the process for completing and seeking approval for BTAs and BHAs, including a reminder to L1 organizations of the requirement to submit BHA and BTA requests and associated expenditures to the ADM(Fin) for review and tracking. This guidance and direction will be provided NLT September 30, 2021.

- ADM(Fin) will develop and provide departmental THCEE training material to be published NLT March 31, 2022.

- ADM(Fin) will provide departmental “checklists” that specify the required documentation to support THCEE approvals NLT March 31, 2022.

Recommendation #1 will be completed when SOPs are developed, departmental guidance is updated for travel and hospitality, departmental guidance for BTAs and BHAs is developed, THCEE training material is published and departmental checklists are provided.

OPI: ADM(FIN)/CFO

Target Date: March 31, 2022

ADM(RS) Recommendation

Management Action

During the course of the audit, ADM(Fin) worked with ADM(RS) on the review of departmentally approved T&H forms. Key activities since the audit sample period include:

- ADM(Fin), in collaboration with ADM(IM) and various L1 organizations, developed and tested new departmentally approved hospitality forms with electronic signature capability, including EHRF (April 2020), BHA (May 2021) and Bundle EHRFs (May 2021), which were published on the Defence Forms Catalogue with supporting guidance provided on the ADM(Fin) website. These forms were updated to respond to specific audit observations associated with capturing TB mandated data authorization elements (e.g., the inclusion of data fields to request rationale for all hospitality expenditures). Further updates will be made NLT March 31, 2022.

- ADM(Fin) will review and update, as required, departmentally approved travel forms (e.g., Individual Travel Authorization, TD Request form, Travel Plan) to address audit observations and ensure all TB-mandated data authorization elements are included NLT March 31, 2022.

- ADM(Fin), in collaboration with ADM(IM) and the Corp Sec, will review existing OGP reporting templates and supporting departmental guidance material to ensure all required proactive publication elements are captured. As the OGP reporting templates are standardized across all government departments and agencies, any proposed changes to these templates would be forwarded to TBS for consideration NLT March 31, 2022.

Recommendation #2 will be completed when approved travel and hospitality forms including all required data authorization elements are implemented, and departmental guidance and OGP reporting templates are updated in consultation with TBS.

OPI: ADM(FIN)/CFO

OCI: ADM(IM)

Target Date: March 31, 2022

ADM(RS) Recommendation

Management Action

During the course of the audit, ADM(Fin) collaborated with ADM(RS) on the methods for obtaining information from the financial system to support oversight and validation processes, and updating the list of SDMs. Key activities since the audit sample period include:

- ADM(Fin) developed an internal Proactive Publication Monitoring SOP to ensure accurate, complete and timely submission of SDM T&H expenses. To assist with monitoring efforts, ADM(Fin) updated the existing SDM attestation documents for proactive publication of T&H expenses to request information associated with amounts disclosed (e.g., responsibility centre, transaction numbers). These documents were updated and sent to L1 Comptrollers and SDM support staff in February 2021 as part of the monthly call letter on proactive disclosure requirements. Although monitoring processes have been developed and the sampling and review of SDM travel and hospitality expenses has already begun, an ongoing oversight and validation process for proactive publication monitoring will be established NLT March 31, 2022. This process may include departmental reporting of non- compliance or poor performance through the Corp Sec.

- ADM(Fin) will engage the L1 Comptrollership through the Defence Comptrollership Council NLT September 30, 2021 to discuss the implementation of oversight and validation processes within comptroller organizations to enable the accurate, complete and timely proactive publication of SDM T&H expenses. ADM(Fin) will support L1s in developing SDM travel and hospitality validation processes by providing departmental guidance and training material NLT March 31, 2022.

- ADM(Fin) to collaborate with ADM(IM) to review THCEE processes and systems to address audit observations. Where feasible, preliminary enhancements will be made to processes and systems to clarify requirements, enhance data reliability and ensure greater consolidation NLT March 31, 2022, with ongoing efforts to identify improvement beyond this date.

Recommendation #3 will be completed when SOPs and an oversight and validation process are established to monitor proactive disclosure requirements, departmental guidance and training for L1 comptrollers is developed, and THCEE processes and systems are reviewed.

OPI: ADM(FIN)/CFO

OCI: Corp Sec/All L1 Organizations

Target Date: March 31, 2022

Annex B – About the Audit

The findings and recommendations of this report were derived from multiple sources of evidence collected throughout the planning and conduct phase of the project. These sources of evidence were verified with the OPIs to ensure their validity. The methodology used in this audit were as follows:

Document Review

The audit team completed a review of relevant internal/governmental policies, legislations, directives, communications, procedures, guidelines and templates. Documents were maintained for evidence, as required, and were substantiated with other methods of evidence collection.

Interviews

The audit team conducted interviews with key stakeholders. These responses were used to improve the team’s understanding of areas of concern, existing processes and controls, and risks.

Data Analysis

The audit team retrieved extracts of all SDM-disclosed T&H expenditures from Open Government for FY 2017/18 to FY 2019/20. This data was used for trend analysis, including further extraction of L1-specific transactions. A total of 70 files (41 travel and 29 hospitality) between January 1, 2019 and March 31, 2020 were selected for review and assessment of overall compliance with applicable policies/directives.

Audit Criteria

- Expenditures are authorized by the appropriate approval authorities prior to incurring the expenditure or committing funds.

- Expenditures incurred are correctly classified and in accordance with applicable policies and directives.

- THCEE files contain the required supporting documentation to enable approval, certification and verification in accordance with applicable policies and directives.

- Controls are in place and functioning as intended to monitor and promote compliance with reporting and proactive publication policies.

- Leave incurred during work-related travel is submitted timely and accurately in accordance with applicable policies and directives. Controls are in place to effectively manage leave balances.

Audit Scope and Timeframe

The audit reviewed samples of T&H expenditures using public funds, incurred by or on behalf of SDMs/officers, for the period of January 1, 2019 to March 31, 2020:

- DM, CDS, Associate DMs;

- All L1s (or equivalent) and above who incur T&H expenses;

- Persons such as spouses and dependents accompanying the senior officers/executives;

- Sample consisted of 41 Travel and 29 Hospitality transactions across all 24 L1+ groups.

The audit also reviewed T&H proactive disclosure publications, as well as leave transactions and balances for L1s (and equivalent) and above over 3-year period FY 2017/18 to FY 2019/20.

Audit conduct work started in October 2020 and was substantially completed in April 2021.

Scope Exclusion

Travel for personal reasons (e.g., medical leave), and those related to military relocation or postings and payment/reimbursement of T&H expenses are excluded from the scope of this engagement.

Further, the audit did not examine transactions related to the following:

- ADM(RS) and Departmental Audit Committee members due to independence considerations;

- Military Judges Compensation Committee as it is an independent judicial organization;

- Military Grievances External Review Committee and Military Policy Complaints Commission due to their direct reporting relationship to Parliament; and

- Members of the Independent Review Panel for Defence Acquisition and the Minister and staff as they fall outside the audit mandate.

Statement of Conformance

The audit findings and conclusions contained in this report are based on sufficient and appropriate evidence gathered in accordance with procedures that meet the Institute of Internal Auditors’ International Standards for the Professional Practice of Internal Auditing. The audit thus conforms to the Internal Auditing Standards for the Government of Canada as supported by the results of the quality assurance and improvement program. The opinions expressed in this report are based on conditions as they existed at the time of the audit and apply only to the entity examined.

Annex C – Proactive Publication Process Map: Travel & Hospitality Expenses

Figure 6 Summary

Source: Corporate Secretary – Directorate Access to Information and Privacy “Proactive Publishing Requirements – Travel & Hospitality Expenses”