Appearance before the Standing Committee on International Trade (CIIT)

About this publication

Publication author: Canada Economic Development for Quebec Regions

Publish date: June 6, 2024

Table of Contents

- Speaking Points

- CED Intervention Data

- Quantum Strategy to Support SME Competitiveness

- North American Platform Program (NAPP)

- Business Profile by Industry Grouping

- Project examples

- Program Framework

- CED export support

- The Export Ecosystem in Quebec and the Regional Export Promotion Organizations (ORPEXes)

- The Federal Export Support Ecosystem

- The role of the Government of Quebec in supporting exports

- Industrial and Technological Benefits (ITB) Policy

- Portrait of Quebec's exports (SUB NAV)

- Quebec Export Issues (SUB NAV)

- Support during trade missions

- Fact sheet for the appearance at the Standing Committee on International Trade (SCIT)

- Question Period Cards

Speaking Points

Speaking Points for

Sony Perron,

Deputy Minister / President

Canada Economic Development for Quebec Regions

Appearance before the Standing Committee on International Trade

Ottawa

February 6, 2024

Duration: 5 minutes

Check against delivery

- Thank you for inviting me to testify about the work done by Canada Economic Development for Quebec Regions (CED) to help Quebec businesses break into global markets. I am accompanied by Marie-Claude Petit, Operations Vice-President.

- But first, I wish to acknowledge that we are gathered on the traditional territory of the Algonquin Anishinabeg Nation.

- My speech consists of two sections:

- Why CED supports businesses to take advantage of international trade;

- How CED supports these businesses.

- The agency's mandate is to support the economic development of all regions of Quebec by paying particular attention to those with less growth potential.

- We support SMEs and the organizations that support them in projects that have a positive impact in their regions.

- Market development is a preferred way for companies to grow by accessing new customers and integrating into global value chains. In doing so, they generate new revenue that is invested in the regions that benefit from them.

- That said, these SMEs, which make up the vast majority of businesses, face challenges in achieving their full potential through exporting and internationalizing their operations.

- Quebec SMEs are facing several kinds challenges:

- their production capacity to meet the demand and requirements of major contract givers—such as increased compliance with various standards, including environmental standards;

- costs and risks associated with exporting procedures, as well as a lack of expertise, knowledge and market access;

- a fast-changing and complex world characterized by:

- a changing geopolitical context;

- rising protectionism; and

- supply chain disruptions.

- In fact, exports, which accounted for 27% of Quebec’s gross domestic product in 2022, have been declining since 2000, when they amounted to 39% of GDP.

HOW DOES CED SUPPORT SMEs?

- To help SMEs meet these challenges, the Agency uses three approaches:

- innovation assistance programs;

- support for the ecosystem that helps businesses;

- referral and networking services, including the implementation of the Industrial and Technological Benefits Policy.

- And in all cases, CED provides services tailored to the reality on the ground in the region. Each region of Quebec has its strengths and challenges.

- CED's 12 business offices, located across the province, are community-focused and understand the features and needs of small and medium-sized enterprises and economic organizations in their respective areas.

- Through the Regional Economic Growth through Innovation program, CED can invest across the entire business development and growth continuum to make businesses competitive, from start-up and the deployment and adoption of technologies, to the marketing and export of products and services.

- For example, CED supported Chicoutimi-based CONFORMiT Technology Inc. in the international marketing of innovative health, safety and environmental software platforms.

- Second, we support the ecosystem that supports SMEs and provides the referrals and market information they need to grow.

- For example, CED supports 18 regional export promotion organizations, the ORPEXes, which provide Quebec SMEs with local and front‑line services to facilitate their efforts to develop international markets.

- CED also supports incubators and accelerators, and College Technology Transfer Centres.

- Third, CED itself provides referral and networking services to businesses.

- We do so, for example, by guiding SMEs to good sources of funding or support, including our federal partners, and for business information.

- CED also implements the Industrial and Technological Benefits Policy in Quebec.

- Through this policy on national defence procurement, CED supports SMEs to help them integrate into the global supply chains of major stakeholders in the defence and security sector.

- I want to emphasize that we work in close collaboration with key players in the ecosystem, including the Government of Quebec, with whom we have excellent relations, and our federal government partners, such as:

- Global Affairs Canada;

- Export Development Canada;

- Innovation, Science and Economic Development Canada;

- Indigenous Services Canada; and

- Business Development Bank of Canada.

CLOSING

- CED supports businesses at every stage of their development, encouraging them to take advantage of international trade to contribute to Quebec regional prosperity.

- This is how we help them grow, leverage their competitive advantages and integrate global supply chains.

- We would be pleased to answer any questions you may have.

CED Intervention Data

- TAKE AWAY: CED’s interventions deliver results for SMEs.

- Since 2017–2018, under the Regional Economic Growth through Innovation (REGI) program, CED has invested nearly $121 million in 390 marketing projects that generated nearly $582 million in investments.

- An independent study by Statistics Canada showed that, compared to non-client firms, the proportion of businesses supported by CED that exported for the first time is 15% higher, and 95% of exporting businesses continue to export longer.

INFORMATION

Direct and indirect export support: Under the REGI, CED has invested nearly $121 million in 390 marketing projects that generated nearly $582 million in investments.

| Fiscal year | Number of projets | Total project cost | Approved assistance |

|---|---|---|---|

| 2017-2018 | 12 | $ 22,142,931 | $ 9,144,830 |

| 2018-2019 | 116 | $ 127,154,225 | $ 27,436,778 |

| 2019-2020 | 77 | $ 108,762,532 | $ 16,633,538 |

| 2020-2021 | 57 | $ 103,309,586 | $ 21,449,031 |

| 2021-2022 | 51 | $ 122,277,758 | $ 24,258,585 |

| 2022-2023 | 32 | $ 53,325,966 | $ 10,794,979 |

| 2023-2024 | 45 | $ 44,748,146 | $ 10,821,000 |

| Overall total | 390 | $ 581,721,144 | $ 120,538,741 |

Outcomes of CED’s interventions:

- The RDAs, including CED, commissioned Statistics Canada to conduct a study on how their interventions impact businesses. This study compares businesses supported by CED between 2018 and 2021 to other similar non-client firms.

- The study succeeded in showing that CED’s intervention has a statistically significant impact on the performance of these businesses. For example, they outperform non-client firms in terms of turnover (+9.4%) and productivity (+4.8%).

- From an export perspective, the study concludes that, compared to non-client firms, the proportion of businesses supported by CED that exported for the first time is 15% higher, and 95% of exporting businesses continue to export longer.

ORPEX

- As for CED’s indirect export assistance, it is provided mainly through the 18 Quebec ORPEXes, which CED supports in assisting SMEs that show potential or wish to export through the export marketing process.

- For the past three years, CED’s financial assistance for the export mandate of ORPEXes will total $12.3 million as of March 31, 2024.

- They support 2,500 individual businesses annually across Quebec, including 700 for export plans and one-on-one consulting services.

- About 30% of these businesses are new exporters.

- They support 2,500 individual businesses annually across Quebec, including 700 for export plans and one-on-one consulting services.

- According to an economic study on exports in Quebec conducted by the ORPEX network of Commerce International Québec (CIQ):

- Of the surveyed firms that did not export before receiving support from an ORPEX, 82% reported that ORPEXs enabled them to take a successful first step as exporters.

Productivity Projects

- CED has authorized $557 million in financial assistance through REGI for 994 productivity and production capacity projects, which generated $3.8 billion in investments.

- This represents almost 61% of all of its investments under this program or 44% of the investments of REGI and QEDP.

Quantum Strategy to Support SME Competitiveness

TAKE AWAY: In close collaboration with the Government of Quebec and the federal partners of the National Quantum Strategy, CED supports the development of the province’s quantum ecosystem and its businesses in their entrepreneurial, technological and market development.

INFORMATION

- 2021 Federal Budget - Launching a National Quantum Strategy (NQS)

- Goal: Grow Canadian technology, businesses and talent and strengthen Canada's global leadership

- Budget of $360 million over 6 years (2022-23 to 2027-28)

- The National Quantum Strategy (NQS) rests on three pillars:

- Research: Building research capacity in Canada ($132.5M), delivered by the Natural Sciences and Engineering Research Council of Canada (NSERC)

- Marketing: Helping Canadian companies grow and market quantum technologies at home and abroad ($168M), delivered by Innovation, Science and Economic Development (ISED), the National Research Council of Canada (NRC) and four Regional Development Agencies (RDAs) as follows:

- Innovation Superclusters Initiative - Innovation, Science and Economic Development (ISED) ($14M)

- Innovative Solutions Canada - Innovation, Science and Economic Development (ISED) ($35M)

- Challenges program - National Research Centre of Canada (NRC) ($50M)

- REGI program - four Regional Development Agencies (RDAs) ($70M)

- CED - $23.3M

- Talent: developing the talent pool to support the growth of a national ecosystem ($45.4M), delivered by NSERC and ISED

- Quebec Context:

- Quebec has announced a Quantum Innovation Zone in Sherbrooke and plans to invest significant amounts of money into it.

Furthermore, the quantum industry in Quebec is in its infancy, and most firms are more in the start-up phase and developing products that are not yet ready to go to market.

- Quebec has announced a Quantum Innovation Zone in Sherbrooke and plans to invest significant amounts of money into it.

- Objectives at CED:

- Help businesses grow and market quantum technologies in key regional hubs (Montréal Sherbrooke and Quebec)

- Strengthening the ecosystem and supporting growing companies to compete globally in quantum technologies

- CED's Implementation Strategy:

- To ensure businesses grow, a support ecosystem must be developed (entrepreneurship, mentoring, state-of-the-art equipment, computing capacity, etc.). We are working with the Government of Quebec to make our interventions complementary.

- By dedicating 75% of the budget to this type of project (ecosystem), we are ensuring that we support a significant number of businesses in their entrepreneurial, technological and market development.

- Since demand exceeds our budgetary capacity, CED prioritizes ecosystem support projects whose goal is to incubate new businesses, set up shared-access equipment that maximizes technology transfers, and promote Quebec's quantum capabilities by supporting the marketing of our businesses and know-how.

- CED’s balance sheet: On a total grants and contributions budget of $22.1M, 11 projects are approved (8 NPOs and 3 SMEs) for $15.7M, 1 NPO project is under development for $100K, and there remains an uncommitted balance of $6.3M

- Examples of projects:

- SME: Anyon Systems Inc. The project consists in expanding the quantum computing business by marketing technologies resulting from research and development. The project is focused on building a quantum computer demonstrator that showcases the capabilities of quantum technologies and marketing activities. The total cost of the project is $995,000, and CED's contribution is $497,500.

- NPO: Numana. The project’s goal is to set up testbeds for a quantum communications network in Sherbrooke, Montréal and Québec City. The key activities of this quantum infrastructure project include acquiring equipment, operating and coordinating the project, supporting specific projects, as well as national and international prospecting and marketing. The project will allow companies to test their technologies on these tastebuds, thereby facilitating their development and marketing. The total cost of the project is $13,210,000, and CED's contribution is $3,600,000.

North American Platform Program (NAPP)

TAKE AWAY: The North American Platform Program (NAPP), which aims to advance Canadian trade, investment and innovation across North America and brings together nine federal organizations, including CED, is an excellent example of productive collaboration between Government of Canada actors to support export-oriented businesses.

INFORMATION

- CED is working with other federal departments to boost the presence of Quebec businesses on world markets. In particular, the United States and Mexico are priority export markets for Canadian businesses. The Government committed to actively deepening North American trade relations by, among other things, signing of the Canada-United States-Mexico Agreement (CUSMA).

- The objectives of the North American Platform Program (NAPP) address government priorities by advancing Canadian trade, investment and innovation across North America.

- The North American Platform Program (NAPP) is a partnership initiated and coordinated by GAC. It aims to facilitate access to the North American market for Canadian SMEs, promote Canadian interests in the United States and Mexico, and foster an integrated approach to better coordinate policy and policy discussions within the Government of Canada.

- The partnership brings together several federal agencies, including CED and eight others: the Atlantic Canada Opportunities Agency (ACOA); Innovation, Science and Economic Development Canada (ISED); Agriculture and Agri-Food Canada (AAFC); Environment and Climate Change Canada (ECCC); Export Development Canada (EDC); Natural Resources Canada (NRCan); Canadian Heritage (PCH); and, of course, Global Affairs Canada (GAC). The current agreement expires on March 31, 2025.

- This partnership allows companies to benefit from specialized support to successfully network with prime contractors, particularly in the context of trade missions or buyer reception.

- One example of a project carried out by CED as part of this partnership is the support offered to 5 Quebec companies that participated in the Advanced Clean Transportation Expo in 2023, the largest event on advanced transportation technologies and clean vehicle fleets in North America. Several meetings were organized between Quebec SMEs and potential prime contractors and partners, particularly from California’s clean transportation industry.

Business Profile by Industry Grouping

INFORMATION

The five industry groupings most supported by CED in recent years (direct assistance to businesses) were, in order:

- Metal products

- Comprises establishments primarily engaged in forging, stamping, forming, turning and assembling ferrous and non-ferrous metal components for the manufacture of, for example, cutlery and hand tools, architectural and structural metal products, boilers, tanks, shipping containers, hardware, wire springs and products, turned products, nuts, bolts and screws.

- Food processing

- Comprises establishments primarily engaged in crop production, support activities for agriculture, food manufacturing, beverage manufacturing, service organizations connected to the agri-food sector and equipment manufacturers.

- Aerospace

- Comprises establishments primarily engaged in manufacturing equipment (new products or reconstruction) for transporting people and goods by air. Also includes establishments primarily engaged in manufacturing air transport-related machinery, engines, turbines or compressor pumps. Establishments primarily engaged in providing public passenger and cargo services by aircraft are also part of this industry as are service organizations related to the aerospace industry.

- Computer systems

- Comprises establishments producing goods and providing services for acquiring, storing, transmitting and transporting electronic information in various forms, including ICT-related service organizations.

- Other manufacturing sectors

- Comprises projects not qualifying for the first 17 industry groupings (above) or the 19th and 20th (below).

- The table below provides a profile of the businesses supported in these industry groupings

Industry groupings Number of employees (median) Turnover (median) Other manufacturing sectors 20 $2,993,985 Metal products 28 $4,508,232 Food processing 16 $1,680,730 Aerospace 25 $3,331,430 Computer systems 12 $499,880

- Export markets

The ORPEXes focus on awareness-raising and customized support for SMEs that do not export or those that wish to export to new markets.

- They support 2,500 individual businesses annually across Quebec, including 700 for export plans and one-on-one consulting services.

- About 30% of these businesses are new exporters

- CED’s agreements with the 18 ORPEXes for the export mandate represent a financial commitment of $12.3 million over 3 years.

- The assistance offered, with CED’s financial support, enables SMEs to develop and structure their export strategy.

Supporting Business Competitiveness - Productivity and Production Capacity:

CED invests in improving the productivity and production capacity of businesses in order to, for example, improve their business practices, provide value-added jobs and better meet the needs of their clients. Doing so makes it easier for them to integrate the value chains of major prime contractors and to develop new markets.

- Since April 1, 2018, CED has authorized $557 million in financial assistance through REGI for 994 productivity and production capacity projects, which has generated $3.8 billion in investments.

- This represents almost 61% of all of its investments under this program or 44% of the investments of REGI and QEDP

Project examples

TAKE AWAY: CED supports very fine companies throughout Quebec, enabling them to grow, particularly in international markets.

- Under the Regional Economic Growth through Innovation (REGI) program, CED has invested nearly $121 million in 390 marketing projects that have generated investments of nearly $582 million.

- An independent study by Statistics Canada showed that CED’s support helped these businesses become exporters (3.6%) and that, although the impact on their exports is not always significant, CED’s clients are more likely to remain exporters in the longer term than non-clients (94.9%).

INFORMATION

Examples of direct export assistance

- In June 2022, under REGI, CED authorized Prevtech Innovations Inc., a Saint-Hyacinthe value-added services business that developed an electrical fault detection device intended primarily for small agricultural operations and family farms, repayable assistance of $250,000 to merchandise its products in new markets.

- In October 2022, under REGI, CED authorized Disanko Inc., a start-up in Longueuil that developed an intelligent energy storage system, a repayable contribution of $125,000 to deploy an international marketing strategy.

- GRB Technologies Inc. (Sphaira) is an innovative Quebec City start-up that develops and markets technological solutions that help control the spread of infectious agents by, for instance, neutralizing bioaerosols in hospitals, schools and public places. The $50,000 contribution is intended in part to ensure that Underwriters Laboratories (UL) grants its new air disinfection system (LIFA) certification in optical and electrical safety so that it can be distributed freely and marketed in North America.

Examples of projects – networking with major prime contractors

CED supports organizations that help Quebec businesses access market opportunities offered by major prime contractors in order to diversify their markets.- CED to the business competitiveness is its support for the activities of Sous-traitance industrielle du Québec (STIQ), a multi-sectoral association of Quebec businesses whose mission is to improve the competitiveness of manufacturing supply chains. For more than 20 years, CED provided assistance to STIQ 18 times for a total of $11.5 million to finance prospecting activities with major prime contractors for the benefit of Quebec manufacturing SMEs.

- CED is providing funding to the Réseau des Femmes d’affaires du Québec (RFAQ) to support businesses owned or led by women to make it easier for them to grow and access new markets. Since 2000, the RFAQ has received a total of more than $1.9M in non-refundable assistance, which has made it possible to offer support activities that facilitate networking with major prime contractors and turn into market opportunities.

Example of a North American Platform Program (NAPP) project

- CED provided support to 5 Quebec companies that participated in the Advanced Clean Transportation Expo in 2023, the largest event on advanced transportation technologies and clean vehicle fleets in North America. Several meetings were organized between our Quebec SMEs and potential prime contractors and partners, particularly from California’s clean transportation industry.

Sample project for SME certification to integrate into the value chain

Example of an organization

- CED supports organizations so that they can help businesses obtain certification.

- In July 2020, as part of the REGI, CED authorized a non-repayable contribution of $4,939,095 to the Aluminum Association of Canada for a project to promote the marketing of Canadian aluminum products through the development of a traceability system to authenticate and document the "smelted and poured" origin of Canadian aluminum throughout the value chain.

- The Aluminum Association of Canada is a non-profit organization that represents the Canadian primary aluminum industry towards the population, aluminum users, public authorities, and key economic and environmental stakeholders. The Canada-United States-Mexico Agreement (CUSMA) favours North American aluminum, and Canada has been granted an exception to waive tariffs under certain conditions. Accordingly, one of the issues in the current context of the aluminum trade with the U.S. is the ability to prove the origin of the exported metal.

- The primary industry must trace the origin of its production in order to prove compliance with volumes in accordance with CUSMA. Processors will need to prove that the aluminum used in their products is of North American origin and not Chinese or Russian.

- The C3i Centre is a non-profit organization whose mission is to support life sciences companies that develop and market cell therapies. C3i provides biotech companies with its expertise and value-added services to bridge biomedical research, treatment discovery, clinical studies and the marketing phase.

- The $2.5M in non-repayable financial assistance is intended to help C3i obtain a Drug Establishment License (DEL) from Health Canada and to comply with GMP (Good Manufacturing Practices) standards. So far, there are no licensed manufacturing and development facilities in Canada with a contract to conduct cell therapy research.

Examples of businesses that received help for certification to integrate into global markets

- Secure Exchanges Inc. is a Drummondville start-up that has developed a secure integrated data transfer solution directly through Microsoft Outlook, Gmail or the SE online platform.

- The repayable contribution of $250,000 is intended in part to obtain cyber/information security certification (ISO-27001). More and more organizations are demanding supply chain certification, and, in some countries, it is even a legal requirement.

- The Laiterie de l’Outaouais produces pasteurized milk in various formats and varieties.

- The repayable contribution of $203,825 is meant, among other things, to help introduce and obtain an agri-food processing certification (GFSI) to eventually allow the company to export its products as a subcontractor.

- Electrobac Inc. is a Montréal-based technology company working in the circular economy. Its recycling bins are located in various public spaces, allowing individuals to recycle more than 150 electronic products, and its buy-back and device-management program for corporate clients account for the majority of its turnover. This includes life-cycle management and the refurbishment of smartphones and tablets collected mainly from corporate clients.

- The repayable contribution of $250,000 is for acquiring equipment and implementing a marketing strategy in the United States. Among the authorized costs, CED supports the client's efforts to obtain R2V3 certification. This is industry standard without which the client would have difficulty accessing the U.S. market. For example, this certification ensures that end-of-life e-waste is not exported to developing countries, as the United States has not ratified the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal. To obtain this certification, businesses must first meet various ISO standards.

- SmartD Technologies is a start-up that designs and manufactures engine power management modules to more effectively control the power of industrial electric motors, thereby increasing their energy efficiency and extending their useful life.

- The $300,000 repayable assistance is partly to cover the cost of certification fees to access the U.S. and European markets.

Examples of supported projects that improve the energy performance of the manufacturing sector or produce more energy-efficient equipment or materials.

- 9474-9785 Québec Inc. (Carbonité Inc.) is a start-up company that will build a biochar production plant in Port-Cartier. Biochar is a coal-replacement product sold in the form of pellets and powder that increases the value of forest biomass for the soil (fertilizer), construction materials (concrete additive) and metallurgical processes markets, thereby reducing GHGs.

- The repayable contribution of $3 million is for acquiring and installing production equipment.

- Les Carrières de Saint-Dominique Ltd. specializes in the manufacture of crushed stone, prepared concrete, roller-compacted concrete (RCC) and magnesian lime. It also produces combined sand called Eco-Sable Sando. The company has a broad customer base that includes concrete plants, precast concrete plants, asphalt plants, farmers (agricultural lime) and various civil engineering players. The new manufacturing process will allow the client to reduce its environmental footprint (waste recovery and reduced water consumption), the footprint of their customers who use the product (reduced transport and GHGs) and the negative impacts on the natural environments from which natural sand is extracted.

- The $2 million repayable contribution will enable the client to improve its productivity and increase its capacity to produce Eco-Sable Sando by acquiring state-of-the-art digital equipment.

- The Duravit plant in Matane will become the world’s first carbon-neutral sanitary ceramics plant. It relies on Quebec hydroelectricity instead of gas as a source of energy for its furnaces in its manufacturing process. The client estimates that the use of electric ovens, the recovery of the heat produced to heat the plant and the proximity of the production site to the target market will contribute to a reduction of 9,500 tons of CO2 emissions each year. The installation of electric ovens will be a world first in this industry.

- CED has authorized a repayable contribution of $19 million for the construction of the plant and the acquisition of production equipment.

- Uniboard Canada Inc. is a manufacturer of engineering products for construction companies. It has panel plants in Mont-Laurier, Sayabec and Val-d'Or and a resin plant also in Val-d'Or. As part of the forest industry value chain, its plants are certified as Eco-Certified Composite (ECC) by the Composite Panel Association (CPA). Its products help sequester one million tons of carbon annually.

- The repayable contribution of $10 million is for acquiring new equipment that incorporates new technologies to reduce fibre and resin use, greenhouse gases and, as a result, the company’s carbon footprint.

- Optima Aero Inc. (Optima) specializes in refurbishing helicopter parts and engines. By expanding its parts refurbishment activities by purchasing helicopters at the end of their useful life, it will contribute to reducing the sector's carbon footprint, seeing as new parts represent 18% of carbon emissions (vs. a fraction of emissions for reworked existing parts), while developing in-house expertise on new aircraft models.

- The repayable contribution of $3.5 million will go to acquiring equipment and marketing activities.

- Solar CAP Technologies has developed solar-powered modules for electrically powered vehicles to recharge batteries with clean energy. It targets mainly organizations with fleets, such as those providing microtransit services, hotels, airports, cities and fleets.

- The non-repayable assistance of $99,000 will go to supporting the start-up of production activities by purchasing equipment.

- Located in Saint-Jérôme, DZD Hardwood is a family business specializing in hardwood production and processing.

- The repayable contribution of $416,000 is for acquiring equipment that will help increase the client’s production capacity. Replacing old natural gas equipment with electric dryers will enable the company to significantly reduce its carbon emissions.

Examples of Regional Quantum Innovation

CED supports business expansion and marketing quantum technologies in key regional hubs (Montréal, Sherbrooke and Quebec)

- The project consists in expanding Anyon Systems Inc., a quantum computing business, by marketing technologies resulting from research and development. The project is focused on building a quantum computer demonstrator that showcases the capabilities of quantum technologies and marketing activities.

- The total cost of the project is $995,000, and CED's contribution is $497,500.

CED promotes the strengthening of the ecosystem to enable businesses to compete globally in quantum technology fields.

- Numana’s project consists in setting up test beds for a quantum communications network in Sherbrooke, Montréal and Québec City. The key activities of this quantum infrastructure project include acquiring equipment, operating and coordinating the project, supporting specific projects, as well as national and international prospecting and marketing. The project will allow companies to test their technologies on these tastebuds, thereby facilitating their development and marketing.

- The total cost of the project is $13,210,000, and CED's contribution is $3,600,000.

Program Framework

TAKE AWAY: CED's mandate is to support the economic development of all regions of Quebec by paying particular attention to those with less growth potential. CED support SMEs and the organizations that support them in projects that have a positive impact in their regions.

International trade is a preferred way for companies to grow by accessing new markets and integrating into global value chains. In doing so, they generate new revenue that is invested in the regions to their benefit.

To support the development of international trade, CED can intervene in a number of ways to address the various obstacles faced by businesses, particularly SMEs, seeking to export, join major value chains or strengthen their assets.

INFORMATION

- The mission of Canada Economic Development for Quebec Regions (CED) is to promote the economic development of all regions of Quebec by paying particular attention to those with less growth potential.

- CED accomplishes its mission through its grants and contributions programs. It also relies on the presence and expertise of its twelve (12) business offices throughout Quebec, its understanding of economic issues and regional dynamics, as well as its knowledge of key players and ongoing collaboration with the Government of Quebec.

- The Regional Economic Growth through Innovation (REGI) program is the main vehicle through which CED supports the expansion of businesses, most of which are SMEs. Through the REGI, CED provides financial support to Canadian businesses to help them join supply chains and take advantage of opportunities in global markets.

- REGI’s objectives include accelerating innovation and business growth by supporting businesses’ efforts to strengthen their capacity to innovate by, for example, demonstrating, adopting or adapting technologies and bringing them to market, or by increasing their productivity, and expanding and enhancing their competitiveness in domestic and international markets.

- REGI also aims to create, grow and nurture inclusive regional ecosystems that support business needs and foster an entrepreneurial environment conducive to innovation, growth and competition.

- This program allows CED to intervene on the entire business development continuum, from start-up, through technology development or adoption, to the marketing and export of products and services.

- This assistance is provided directly by providing financial support to SMEs and, indirectly, through ecosystem organizations that support SMEs.

- CED’s support is tailored to regional realities, assets and needs.

- CED’s interventions will be different in Montréal, which is teeming with technology and export businesses, than in the Centre-du-Québec region, which is the heart of Quebec manufacturing, or in Gaspésie, historically a resource region facing significant economic development challenges.

- CED’s support complements the existing supply of other federal and provincial programs.

- In line with its mandate, CED does not have a sectoral approach and focuses on projects that maximize economic benefits in Quebec’s regions. That is why CED focuses especially on high-value-added manufacturing and service businesses targeting foreign markets in recognition that exports are an important driver of growth and innovation for SMEs.

- Through REGI, CED helps businesses export in a number of ways that aim to address the various obstacles associated with exporting or to strengthen the enabling factors of exporting.

- First, CED provides direct support, through repayable contributions, to businesses seeking to increase their export performance.

- As such, CED focuses on SME-led projects to develop or diversify international markets and to market innovative products or products that are part of a global value chain.

- Activities that can be supported through these projects include:

- Implementing a marketing strategy (product, price, distribution, promotion), including the creation of promotional material (website, kiosk) adapted to the target markets;

- Developing a distribution network (branch, subsidiary, subcontractor, representative), including prospecting visits to identify a representative;

- Developing a prototype tailored to a target country;

- Hiring a consultant to support accreditation activities that facilitate access to foreign markets.

- These interventions reduce the significant procedural risks and investment costs of exporting for SMEs.

- CED indirectly supports regional innovation ecosystem stakeholders, including non-profit organizations (NPOs), through non-repayable contributions that support innovative businesses increase their export performance.

- As such, CED focuses on NPO-led projects, particularly those led by regional export promotion organizations (ORPEXes), that support SMEs that want to break into or diversify their markets in terms of marketing and international market development.

- Activities that can be supported through these projects include:

- Awareness and training;

- Consulting services for developing and structuring an export strategy;

- Conducting export market research and diagnostics;

- Networking and business contacts.

- These interventions give SMEs access to expertise, knowledge and networks that they can often develop on their own.

- In addition to its direct and indirect support for SME export, CED also helps businesses compete and innovate, which is essential to successfully market products internationally and integrate them into major value chains.

- This is done primarily through projects that involve acquiring and integrating advanced technologies as well as developing new value-added goods and services. Investments in these projects should, among other things, enable the business to enhance its technological skills and competitive advantages.

- Activities that can be supported through these projects include:

- Acquiring and installing equipment, computer tools and technologies to increase productivity or production capacity;

- Improving manufacturing processes (production, procurement, logistics) and operations management;

- Prototyping, proof of concept, demonstration, technology showcases for new products;

- Improving existing products and services.

- As with export assistance, competitiveness and innovation assistance can be direct (repayable contributions to SMEs) or indirect (non-repayable contributions to organizations supporting SMEs, such as research or technology transfer centres).

- CED also supports organizations through non-repayable contributions that foster networks between ecosystem stakeholders and create winning conditions for exporting or integrating value chains.

- Examples of activities that can be supported through these projects include the creation of clusters, alliances and strategic partnerships between businesses to respond to calls for tender from major prime contractors, or activities to support a business or group of businesses to become part of a prime contractor’s supply chain.

- Attracting foreign investment, which CED supports through the Quebec Economic Development Program (QEDP), can also be considered in this category. By attracting foreign companies and prime contractors to Quebec, new growth and value chain integration opportunities are created for local SMEs, for whom contact is now easier.

- CED is also implementing the Industrial Technological Benefits (ITB) policy in Quebec, which aims to optimize the economic spinoffs generated by government defence and security purchases in Canada and is a lever for innovative SMEs to join international global supply chains.

- Finally, CED’s support for the tourism sector through the QEDP, particularly in terms of supply development and marketing, helps attract international tourists and their spending (exports). This generates economic benefits and helps SMEs and regions linked to this economic sector diversify and grow.

CED export support

TAKE AWAY: To help Quebec SMEs export, diversify their markets and position themselves in global supply chains, CED will:

- Financially support their international marketing efforts, as well as their investments to innovate and compete in these markets;

- Support ecosystem organizations that provide opinions, advice and support to SMEs in these efforts, including by promoting stakeholder networking and synergy;

- Implement the Industrial and Technological Benefits (ITB) policy in Quebec, which gives SMEs access to the supply chains of major defence contractors.

- Refer SMEs to the right sources of funding or support and to sources of market information.

INFORMATION

- Through REGI, CED helps businesses export in a number of ways that aim to address the various obstacles associated with exporting or to strengthen its enabling factors by:

- Reducing the significant procedural risks and investment costs of exporting for SMEs;

- Providing SMEs with access to expertise, knowledge (including the context of the target market) and networks that they often cannot develop on their own.

- Ensuring that SMEs have the production capacity and operational performance necessary to meet the requirements of the prime contractors.

- CED directly supports businesses seeking to increase their export performance by providing repayable contributions, supporting projects to develop or diversify international markets, market innovative products or integrate products into a global value chain.

- CED indirectly supports organizations in the regional innovation ecosystem, through non-repayable contributions, that support SMEs that want to break into, diversify and develop their international markets. This support takes the form, for example, of awareness-raising sessions and training, consulting services for the development and structuring of an export strategy, or the conduct of market studies and export diagnostics, and is mainly provided by Quebec’s 18 regional export promotion organizations (ORPEXes) (see Tab 6).

- CED also intervenes to support the competitiveness and innovation of businesses, by directly or indirectly (through organizations) helping SMEs acquire and integrate advanced technologies and develop new value-added goods and services. Investments in these projects must allow the business to, among other things, enhance its technological skills and competitive advantages.

- CED also supports, through non-repayable contributions, organizations that foster networking of innovation ecosystem players and create winning conditions for exporting or integrating value chains, for example, by facilitating the creation of strategic clusters, alliances and partnerships between businesses to promote their integration into a major prime contractor’s supply chain.

- CED is also implementing the Industrial Technological Benefits (ITB) policy in Quebec, which aims to optimize the economic spinoffs generated by government defence and security purchases in Canada and is a lever for innovative SMEs to join international global supply chains.

- Finally, small businesses and future entrepreneurs in Quebec can rely on CED to refer them to the right sources of funding or support and to sources of market information. These services are free of charge.

- CED has come to an agreement to cooperate with the network of regional export promotion organizations (ORPEXes) so that the businesses they support can have access to market information to help them export. This allows them to plan and maximize their chances of success in international markets and to make informed decisions about their business plans.

- CED has access to various sources of information, including databases, to meet the market information needs expressed by entrepreneurs.

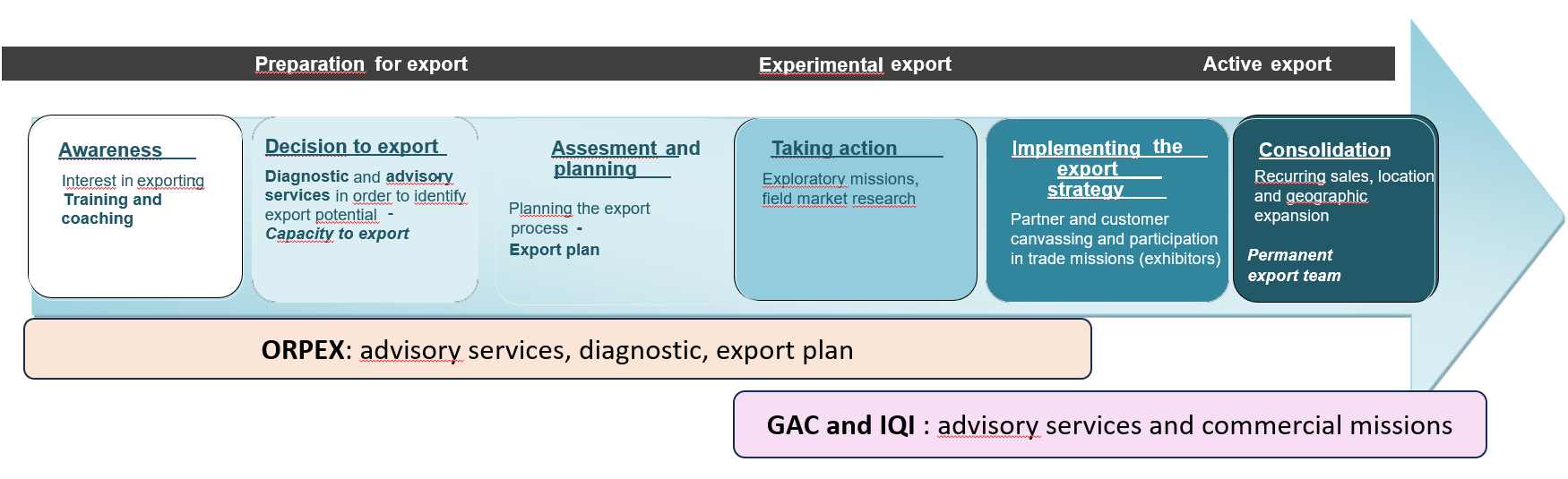

The Export Ecosystem in Quebec and the Regional Export Promotion Organizations (ORPEXes)

TAKE AWAY: The export ecosystem in Quebec is well organized and provides businesses with support that can meet their various needs at all stages of development and export maturity.

CED contributes to this continuum of service, particularly by supporting the 18 regional export promotion organizations (ORPEXes), which accompany SMEs that show potential or seek to export so that they can successfully market their products internationally.

For the past three years, CED’s financial assistance for the export mandate will total $12.3 million as of March 31, 2024.

INFORMATION

- Quebec, in the form of regional export promotion organizations (ORPEXes), has a unique Canadian ecosystem of organizations that help businesses export and are anchored in each of Quebec’s regions.

- Regional export promotion organizations (ORPEXes) contribute to the Government of Canada's export growth objectives. Distributed throughout the province, they play a unique role in Quebec in the export services continuum, providing specialized support to regional businesses to complement the services of GAC and IQI trade commissioners.

- Regional export promotion organizations (ORPEXes) focus on awareness-raising and personalized support for SMEs that do not export or those that seek to export to new markets.

- They support 2,500 individual businesses annually across Quebec, including 700 for export plans and one-on-one consulting services.

- About 30% of these businesses are new exporters.

- CED supports 18 regional export promotion organizations (ORPEXes) that offer Quebec SMEs a front-line and local service to make it easier for them to develop international markets.

- CED's agreements with the 18 regional export promotion organizations (ORPEXes) for the export mandate represent a financial commitment of $12.3 million over 3 years.

- The assistance offered, with CED’s financial support, enables SMEs to develop and structure their export strategy.

- According to an economic study on exports in Quebec conducted by the regional export promotion organizations of Commerce International Québec (CIQ):

- The support of regional export promotion organizations (ORPEXes) enables the vast majority of surveyed businesses to reduce export risks and formulate a better value proposition to their international clients.

- Risks that are mitigated include the importance of regulatory compliance, understanding of customs mechanisms and factors associated with financial transactions (e.g., defaults, taxation, exchange rates)

- Among surveyed firms that did not export before receiving support from a regional export promotion organization (ORPEX), 82% reported that the regional export promotion organization (ORPEX) allowed them to successfully complete the process of exporting for the first time.

- The support of regional export promotion organizations (ORPEXes) enables the vast majority of surveyed businesses to reduce export risks and formulate a better value proposition to their international clients.

The Federal Export Support Ecosystem

TAKE AWAY: The federal government has implemented a comprehensive suite of programs and initiatives to improve Canada’s performance in international markets.

In supporting exports, CED, like the other regional economic development agencies across the country, works closely with the relevant federal stakeholders, primarily Global Affairs Canada, its Trade Commissioner Service and the CanExport program, to ensure that Quebec SMEs receive the support they need when they need it.

INFORMATION

- The work of the regional development agencies (RDAs) is part of the continuum of support for Canadian businesses—in particular by complementing the Industrial Research Assistance Program, the Strategic Innovation Fund and the Trade Commissioner Service.

- In particular, interventions by the regional development agencies (RDAs), through the Regional Economic Growth through Innovation (REGI) program, help business grow by exporting.

- In line with its regional economic development mandate and in addition to what other federal stakeholders offer, CED supports export projects based on regional benefits and works with many other federal stakeholders that offer their services (e.g., trade commissioners) or funding (e.g., Export Development Canada).

- Government of Canada-related stakeholders that support exports:

- Global Affairs Canada (GAC) promotes exports, international trade and economic development. Its main programs are the Trade Commissioner Service and CanExport. CED also works with Global Affairs Canada (GAC) to ensure that business projects comply with the Softwood Lumber Agreement and to share GAC programs with CED clients.

- Innovation, Science and Economic Development Canada (ISED), in addition to supporting science and innovation, supports SMEs, capacity building, increasing Canada’s presence in global markets and promoting tourism. Innovation, Science and Economic Development Canada (ISED) is helping to organize Canada’s participation in trade shows and is leading the Global Hypergrowth Project and the Accelerated Business Growth Service.

- Transport Canada (TC) is responsible for the National Trade Corridors Fund and the National Supply Chain Office, which includes the development and implementation of a National Supply Chain Strategy.

- Export Development Canada (EDC) has a mission to support and develop Canada’s export trade and Canadian capacity to engage in that trade and to respond to international business opportunities. This Crown corporation offers, among other things, an export guarantee program to support the working capital of exporting businesses.

- The regional development agencies (RDAs), including CED, promote exports through their joint REGI program, but also foreign direct investment, as well as international tourism, which allows funds to flow to Canada’s regions. For example, ACOA’s Atlantic Trade and Investment Growth Strategy seeks to increase exports and stimulate foreign direct investment.

- International trade and supply chains as federal priorities: support from the regional development agencies (RDAs), including CED, complements the government’s many recent investments and measures, notably led by these stakeholders, whose objective is to help Canadian businesses compete. This includes:

- Preferential access to global markets through 15 free trade agreements, covering 51 countries with nearly 1.5 billion consumers, representing two thirds of the global economy.

- Support for the transition to a clean, net-zero economy (particularly in support of critical minerals and battery sector development):

- $3.8 billion for the Canadian Critical Minerals Strategy and $1.5 billion for the Critical Minerals Infrastructure Fund.

- The Clean Technology Investment Tax Credit ($4.5 billion over five years and $6.6 billion ongoing) and the Clean Hydrogen Investment Tax Credit ($5.6 billion over five years and $12.1 billion ongoing) are part of a suite of measures to minimize the potential negative impacts in Canada of the U.S. Inflation Reduction Act.

- Launching the $15 billion Canada Growth Fund; and

- Creating the Canada Innovation Corporation, which aims to help Canadian businesses capture “important segments of global supply chains that will help drive Canada’s economic growth and create good jobs.”

- $603 million over five years in Budget 2022 to build more resilient and efficient supply chains, including an additional $450 million for the National Trade Corridors Fund, totalling $4.6 billion in infrastructure investments since 2017.

The role of the Government of Quebec in supporting exports

TAKE AWAY: The Government of Quebec is a key player in developing the province's exports and has set the ambitious objectives of doubling foreign investment in Quebec and increasing Quebec's exports to 50% of GDP.

To maximize its impact on the ground with businesses and in public policy considerations, CED works closely and has cooperative mechanisms with various Quebec government agencies involved in exporting, for example the Ministère de l’Économie, de l’Innovation et de l’Énergie and Investissement Québec International.

INFORMATION

- Under constitutional law, intra-provincial trade and corporate governance are generally under provincial jurisdiction, while the Canadian Parliament has the authority to influence interprovincial and international trade.

- In terms of helping businesses develop export markets or attract foreign investment, the governments of Canada and Quebec are seeking to harmonize their interventions.

- It is in this spirit, and in keeping with its mission “to promote cooperation and complementarity with Quebec and communities in Quebec,” that CED has set up and participates in cooperative mechanisms with several Quebec government organizations.

- This Canada-Quebec cooperation and alignment can be seen in the support for regional export promotion organizations (ORPEXes), for Montréal International and Québec International, or in joint funding for projects by SMEs seeking to diversify or increase their exports.

- Government of Quebec Strategic Directions

- In 2021, the Government of Quebec unveiled the Plan d’action pour la relance des exportations, with a budget of $503 million over 5 years, including $122 million in 2023-2024.

- Half of the budget is allocated to Investissement Québec’s (IQ) own funds and the other half to redesigning the assistance programs for ecosystem support organizations of the Ministère de l’Économie, de l’Innovation et de l’Énergie (MEI).

- The plan aims to double foreign investment in Quebec and increase Quebec's exports to 50% of GDP.

- The proposed measures are based on tailored consulting support and a range of support suited to the development stage of export businesses.

- Key measures include enhanced export financing and better support for sector organizations and regional business partnerships, including ORPEXes.

- The MEIE chose as an outcome indicator that the firm sales outside Quebec generated by supported businesses reach $2.3 billion in 2023-2024 and $3.9 billion in 2026-2027.

- Investissement Québec International’s (IQI) central role is affirmed. It leads and coordinates the efforts of government partners and organizations that support exporting businesses.

- The network of Quebec’s 34 trade commissioners abroad (in 19 countries and in Canada) of the Ministère des Relations internationales and of Investissement Québec International (IQI) branches is also called upon in the Action Plan.

- Although the Plan does not directly involve the Government of Canada, a complementary approach is desired between federal and provincial interventions.

- In 2021, the Government of Quebec unveiled the Plan d’action pour la relance des exportations, with a budget of $503 million over 5 years, including $122 million in 2023-2024.

- Stakeholders with ties to the Government of Quebec who support trade and exports:

- Ministère de l’Économie, de l’Innovation et de l’Énergie (MEIE), whose mandate includes designing and implementing economic development policies and strategies and assistance programs as well as formulating Quebec’s positions and defending its interests when negotiating or implementing trade agreements or trade disputes.

- Objective of the 2023-2027 Strategic Plan: Support export growth and business internationalization in collaboration with IQ and MRI.

- Investissement Québec (IQ) has been solely responsible for managing and implementing the Government of Quebec's financial products for businesses since 2019. IQ can support export market development activities with its own funds or as an agent of government programs. The “export” component cannot be isolated.

- Overall outcomes according to the 2022-2023 annual report: IQ used its own funds almost 1,300 times for a total of over $1.8 billion and, as an agent of the Government of Quebec, made nearly 2,200 financial interventions totalling $2.4 billion.

- Investissement Québec International (IQI), whose mandate is to prospect for and attract foreign investments while supporting businesses seeking to increase and diversify their sales of products and services outside Quebec. In 2022-2023, IQI’s prospecting activities resulted in 125 foreign business projects worth $6 billion. The networking and business meetings initiated by IQI contributed to $3.1 billion in firm sales by the supported businesses.

- Ministère des Relations internationales et de la Francophonie (MRIF) has a mandate to conduct economic diplomacy and influence activities to advance Quebec’s interests in international trade and foreign investment prospecting, and to promote settlement and retention of international organizations and foreign government representatives on the territory of Quebec.

- Objectives of the 2023-2027 Strategic Plan:

- Focus on targeted promotion and prospecting activities; establish strong links with prime contractors abroad; and provide the ecosystem with access to strategic information and information on joining global value chains in collaboration with all partners.

- Promote the internationalization and marketing of Quebec innovations, particularly in the fields of artificial intelligence, quantum technologies, life sciences, aerospace, transportation electrification and renewable energy.

- Ministère de l’Économie, de l’Innovation et de l’Énergie (MEIE), whose mandate includes designing and implementing economic development policies and strategies and assistance programs as well as formulating Quebec’s positions and defending its interests when negotiating or implementing trade agreements or trade disputes.

Industrial and Technological Benefits (ITB) Policy

TAKE AWAY: By aiming to internationalize innovative SMEs into the globalized supply chains of major defence contractors, technological industrial benefits (ITB) are an important lever for economic development and exports and fully adhere to CED’s mandate to support the growth of Quebec’s regions.

INFORMATION

- Objective: The objective of the ITB Policy is to maximize the economic benefits of government defence and security procurement in Canada.

- ITB Policy Framework: The ITB Policy is linked to the Defence Procurement Strategy, which provides the framework within which the Canadian Armed Forces and the Canadian Coast Guard are authorized to acquire equipment and obtain services.

- The business selected in these procurement processes will be required to conduct business activities in Canada equal to the value of the contract it was awarded.

- Through its procurement processes, the government favours bidders who meet the policy’s conditions and maximize their business activities in Canada.

- It is not a grants and contributions program.

- Role of the RDAs, including CED: To enable SMEs to capitalize on the economic benefits of the defence and Canadian Coast Guard markets to generate economic growth in the regions and jobs for Canadians.

- CED fulfills this role by:

- Providing advice regarding the development of procurement processes and participating in the evaluation of bids;

- Acting as a business facilitator with prime contractors to inform them about Quebec’s capabilities (particularly companies in supply chains and centres of expertise);

- Informing and advising companies and research centres about business opportunities and networking possibilities; and

- Encouraging information sharing with partners.

- CED delivers on its mandate by working in collaboration with various partners:

- Federal: ISED, DND, PSPC, CCG, GAC, ISC and other RDAs

- Provincial: MEI, IQI

- Industrial: STIQ, Aéro Mtl, Propulsion Qc, CADSI, etc.

Portrait of Quebec's exports

OBJECTIVE: Provide data on Quebec exports for CED’s Deputy Minister to appear before the Standing Committee on International Trade on February 6, 2024, as part of a study on Canadian businesses in supply chains and in global markets.

TOPICS

- Importance of exports to Quebec

- Quebec vs. Canada

- Canada vs. G7 countries

- Breakdown of exports by sector and type of enterprise

- Destination of exports of goods

- Quebec's regional export dynamics

1. Importance of exports to Quebec

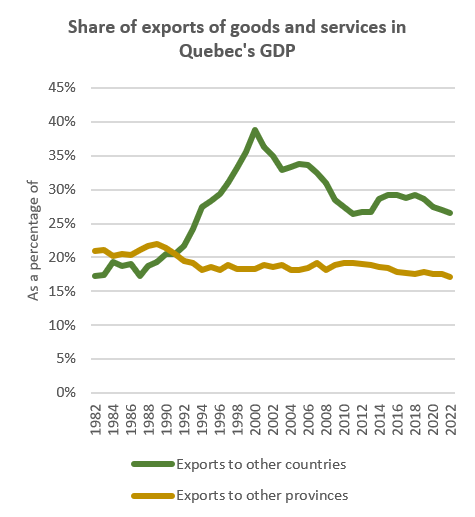

International exports accounted for 27% of Quebec's GDP in 2022. They increased significantly in the 1990s to 39% in 2000 and then declined thereafter.

However, they remain significantly higher than the share of exports to other Canadian provinces (17% in 2022).

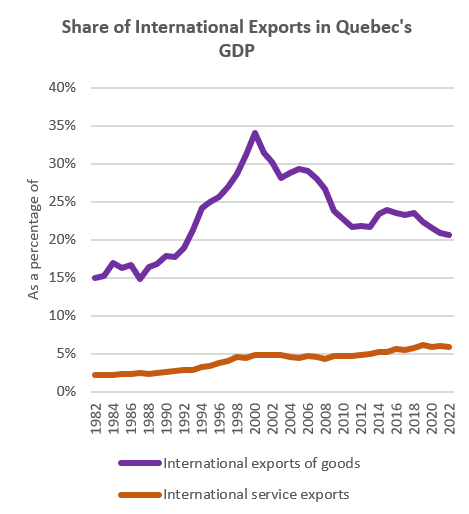

International exports, measured as a percentage of GDP, are dominated by exports of goods (21%); exports of services are much lower (6%).

The relative decline in Quebec's international exports since 2000 is exclusively attributable to exports of goods; exports of services have followed an upward trend in recent decades.

Text version: Share of exports (goods and services) in Quebec’s GDP

| Year | Exports to other countries | Exports to other provinces |

|---|---|---|

| 1982 | 17% | 21% |

| 1983 | 17% | 21% |

| 1984 | 19% | 20% |

| 1985 | 19% | 21% |

| 1986 | 19% | 20% |

| 1987 | 17% | 21% |

| 1988 | 19% | 22% |

| 1989 | 19% | 22% |

| 1990 | 20% | 21% |

| 1991 | 21% | 21% |

| 1992 | 22% | 20% |

| 1993 | 24% | 19% |

| 1994 | 27% | 18% |

| 1995 | 28% | 19% |

| 1996 | 29% | 18% |

| 1997 | 31% | 19% |

| 1998 | 33% | 18% |

| 1999 | 36% | 18% |

| 2000 | 39% | 18% |

| 2001 | 36% | 19% |

| 2002 | 35% | 19% |

| 2003 | 33% | 19% |

| 2004 | 33% | 18% |

| 2005 | 34% | 18% |

| 2006 | 34% | 18% |

| 2007 | 33% | 19% |

| 2008 | 31% | 18% |

| 2009 | 28% | 19% |

| 2010 | 27% | 19% |

| 2011 | 26% | 19% |

| 2012 | 27% | 19% |

| 2013 | 27% | 19% |

| 2014 | 29% | 19% |

| 2015 | 29% | 19% |

| 2016 | 29% | 18% |

| 2017 | 29% | 18% |

| 2018 | 29% | 18% |

| 2019 | 29% | 18% |

| 2020 | 27% | 18% |

| 2021 | 27% | 18% |

| 2022 | 27% | 17% |

Text version: Share of International Exports in Quebec's GDP

| Year | International exports of goods | International service exports |

|---|---|---|

| 1982 | 15% | 2% |

| 1983 | 15% | 2% |

| 1984 | 17% | 2% |

| 1985 | 16% | 2% |

| 1986 | 17% | 2% |

| 1987 | 15% | 2% |

| 1988 | 16% | 2% |

| 1989 | 17% | 2% |

| 1990 | 18% | 3% |

| 1991 | 18% | 3% |

| 1992 | 19% | 3% |

| 1993 | 21% | 3% |

| 1994 | 24% | 3% |

| 1995 | 25% | 3% |

| 1996 | 26% | 4% |

| 1997 | 27% | 4% |

| 1998 | 29% | 5% |

| 1999 | 31% | 4% |

| 2000 | 34% | 5% |

| 2001 | 31% | 5% |

| 2002 | 30% | 5% |

| 2003 | 28% | 5% |

| 2004 | 29% | 5% |

| 2005 | 29% | 4% |

| 2006 | 29% | 5% |

| 2007 | 28% | 5% |

| 2008 | 27% | 4% |

| 2009 | 24% | 5% |

| 2010 | 23% | 5% |

| 2011 | 22% | 5% |

| 2012 | 22% | 5% |

| 2013 | 22% | 5% |

| 2014 | 23% | 5% |

| 2015 | 24% | 5% |

| 2016 | 24% | 6% |

| 2017 | 23% | 6% |

| 2018 | 24% | 6% |

| 2019 | 22% | 6% |

| 2020 | 22% | 6% |

| 2021 | 21% | 6% |

| 2022 | 21% | 6% |

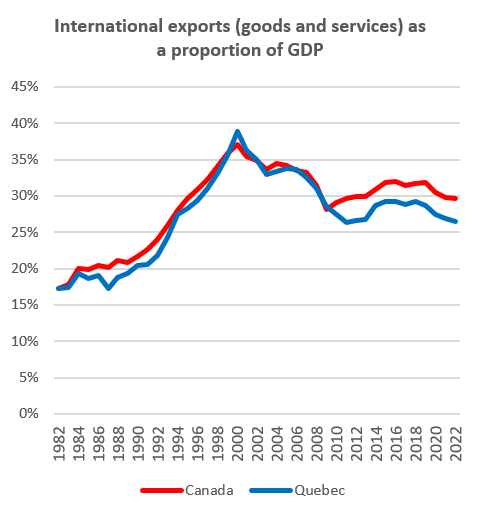

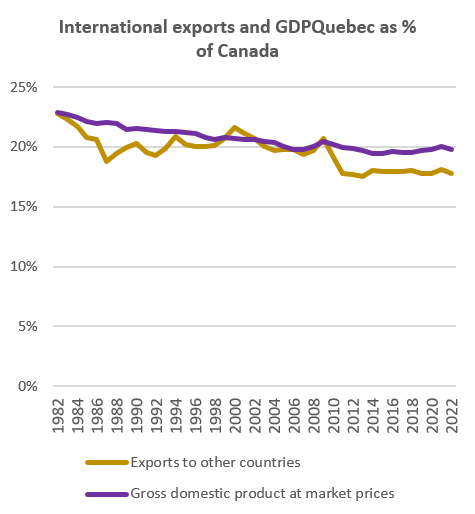

2. Quebec vs. Canada

- International exports of goods and services as a share of the GDPs of Quebec and Canada have evolved similarly over the past 40 years and, until 2009, reached similar levels. However, since 2009, Canada has pulled ahead by about three percentage points.

- As a result, Quebec’s share of Canada’s international exports of goods and services remained around 20% from 1985 to 2010 before dropping off to around 18% since then.

- In comparison, in terms of GDP, Quebec went from 23.0% in 1982 to 19.8% in 2022. Between 2000 and 2010, Quebec's share of exports was quite consistent with that of GDP. But since 2012, Quebec's share of exports has been lower.

- Quebec’s share of the international export of goods (therefore excluding services) stagnated/declined compared to Canada and was 15% in 2022. However, Quebec has done better in the manufacturing sector, especially in the past 5 years, and is now at about 23%.

Text version: International exports (goods and services) as a proportion of GDP

| Year | Canada | Quebec |

|---|---|---|

| 1982 | 17% | 17% |

| 1983 | 18% | 17% |

| 1984 | 20% | 19% |

| 1985 | 20% | 19% |

| 1986 | 20% | 19% |

| 1987 | 20% | 17% |

| 1988 | 21% | 19% |

| 1989 | 21% | 19% |

| 1990 | 22% | 20% |

| 1991 | 23% | 21% |

| 1992 | 24% | 22% |

| 1993 | 26% | 24% |

| 1994 | 28% | 27% |

| 1995 | 30% | 28% |

| 1996 | 31% | 29% |

| 1997 | 32% | 31% |

| 1998 | 34% | 33% |

| 1999 | 36% | 36% |

| 0 | 37% | 39% |

| 1 | 35% | 36% |

| 2 | 35% | 35% |

| 3 | 34% | 33% |

| 4 | 34% | 33% |

| 5 | 34% | 34% |

| 6 | 34% | 34% |

| 7 | 33% | 33% |

| 8 | 31% | 31% |

| 9 | 28% | 28% |

| 2010 | 29% | 27% |

| 2011 | 30% | 26% |

| 2012 | 30% | 27% |

| 2013 | 30% | 27% |

| 2014 | 31% | 29% |

| 2015 | 32% | 29% |

| 2016 | 32% | 29% |

| 2017 | 31% | 29% |

| 2018 | 32% | 29% |

| 2019 | 32% | 29% |

| 2020 | 31% | 27% |

| 2021 | 30% | 27% |

| 2022 | 30% | 27% |

Text version: Internatinal exports and GDP Quebec as % of Canada

| Year | Exports to other countries | Gross domestic product at market prices |

|---|---|---|

| 1982 | 23% | 23% |

| 1983 | 22% | 23% |

| 1984 | 22% | 22% |

| 1985 | 21% | 22% |

| 1986 | 21% | 22% |

| 1987 | 19% | 22% |

| 1988 | 20% | 22% |

| 1989 | 20% | 22% |

| 1990 | 20% | 22% |

| 1991 | 20% | 21% |

| 1992 | 19% | 21% |

| 1993 | 20% | 21% |

| 1994 | 21% | 21% |

| 1995 | 20% | 21% |

| 1996 | 20% | 21% |

| 1997 | 20% | 21% |

| 1998 | 20% | 21% |

| 1999 | 21% | 21% |

| 0 | 22% | 21% |

| 1 | 21% | 21% |

| 2 | 21% | 21% |

| 3 | 20% | 20% |

| 4 | 20% | 20% |

| 5 | 20% | 20% |

| 6 | 20% | 20% |

| 7 | 19% | 20% |

| 8 | 20% | 20% |

| 9 | 21% | 20% |

| 2010 | 19% | 20% |

| 2011 | 18% | 20% |

| 2012 | 18% | 20% |

| 2013 | 18% | 20% |

| 2014 | 18% | 19% |

| 2015 | 18% | 19% |

| 2016 | 18% | 20% |

| 2017 | 18% | 20% |

| 2018 | 18% | 20% |

| 2019 | 18% | 20% |

| 2020 | 18% | 20% |

| 2021 | 18% | 20% |

| 2022 | 18% | 20% |

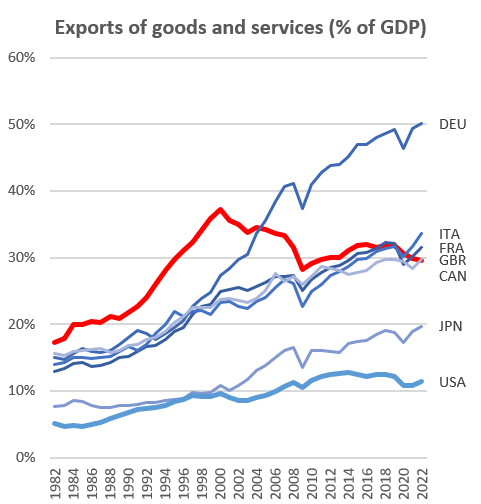

3. Canada vs. G7 countries

Until 2000, Canada had the highest share of exports in the G7 as a share of GDP. Since then, European countries have caught up with it and even surpassed it, especially Germany. (The change from the Deutsche Mark to the euro has done a lot for Germany in terms of exports.)

The United States, given the size of its economy, is more independent, as is Japan.

Moreover, while the weight of exports is on the rise in the other G7 countries, it is declining in Canada.

Text version: Exports of goods and services (% of GDP)

| CAN | FRA | DEU | ITA | JPN | GBR | USA | |

|---|---|---|---|---|---|---|---|

| 1982 | 17% | 13% | 15% | 14% | 8% | 16% | 5% |

| 1983 | 18% | 13% | 15% | 14% | 8% | 15% | 5% |

| 1984 | 20% | 14% | 16% | 15% | 9% | 16% | 5% |

| 1985 | 20% | 14% | 16% | 15% | 8% | 16% | 5% |

| 1986 | 20% | 14% | 16% | 15% | 8% | 16% | 5% |

| 1987 | 20% | 14% | 16% | 15% | 8% | 16% | 5% |

| 1988 | 21% | 14% | 16% | 15% | 7% | 16% | 6% |

| 1989 | 21% | 15% | 17% | 16% | 8% | 16% | 6% |

| 1990 | 22% | 15% | 18% | 17% | 8% | 17% | 7% |

| 1991 | 23% | 16% | 19% | 16% | 8% | 17% | 7% |

| 1992 | 24% | 17% | 19% | 17% | 8% | 18% | 7% |

| 1993 | 26% | 17% | 18% | 19% | 8% | 18% | 7% |

| 1994 | 28% | 18% | 19% | 20% | 9% | 19% | 8% |

| 1995 | 30% | 19% | 20% | 22% | 9% | 20% | 8% |

| 1996 | 31% | 20% | 21% | 21% | 9% | 21% | 9% |

| 1997 | 32% | 22% | 23% | 22% | 10% | 23% | 9% |

| 1998 | 34% | 23% | 24% | 22% | 10% | 23% | 9% |

| 1999 | 36% | 23% | 25% | 22% | 10% | 23% | 9% |

| 2000 | 37% | 25% | 27% | 23% | 11% | 24% | 10% |

| 2001 | 36% | 25% | 28% | 23% | 10% | 24% | 9% |

| 2002 | 35% | 25% | 30% | 23% | 11% | 24% | 9% |

| 2003 | 34% | 25% | 30% | 22% | 12% | 23% | 9% |

| 2004 | 35% | 26% | 34% | 23% | 13% | 24% | 9% |

| 2005 | 34% | 26% | 36% | 24% | 14% | 25% | 9% |

| 2006 | 34% | 27% | 38% | 25% | 15% | 28% | 10% |

| 2007 | 33% | 27% | 41% | 27% | 16% | 26% | 11% |

| 2008 | 31% | 27% | 41% | 26% | 17% | 27% | 11% |

| 2009 | 28% | 25% | 37% | 23% | 13% | 26% | 11% |

| 2010 | 29% | 27% | 41% | 25% | 16% | 27% | 12% |

| 2011 | 30% | 28% | 43% | 26% | 16% | 29% | 12% |

| 2012 | 30% | 28% | 44% | 27% | 16% | 28% | 12% |

| 2013 | 30% | 29% | 44% | 28% | 16% | 28% | 13% |

| 2014 | 31% | 30% | 45% | 29% | 17% | 27% | 13% |

| 2015 | 32% | 31% | 47% | 30% | 17% | 28% | 12% |

| 2016 | 32% | 31% | 47% | 30% | 18% | 28% | 12% |

| 2017 | 32% | 31% | 48% | 31% | 18% | 29% | 12% |

| 2018 | 32% | 32% | 49% | 31% | 19% | 30% | 12% |

| 2019 | 32% | 32% | 49% | 32% | 19% | 30% | 12% |

| 2020 | 31% | 29% | 46% | 30% | 17% | 29% | 11% |

| 2021 | 30% | 30% | 49% | 32% | 19% | 28% | 11% |

| 2022 | 30% | 32% | 50% | 34% | 20% | 30% | 11% |

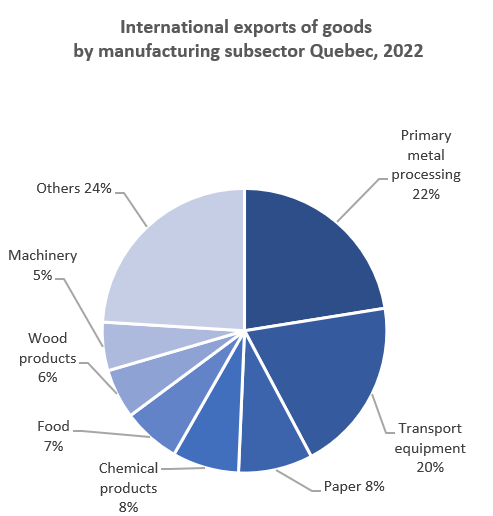

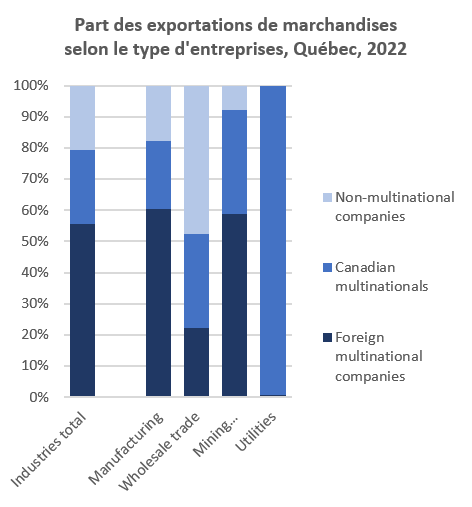

4. Breakdown of exports by sector and type of enterprise

- In Quebec in 2022, manufacturing accounted for 84% of exports. Since 2000, this share has varied from 77% to 87%.

- The balance is mainly attributable to wholesale trade (7%), mining (4%) and public services (1%).

- In manufacturing, 7 of 21 subsectors accounted for more than 75% of the sector’s export value. However, these seven main subsectors accounted for less than half of the number of exporting establishments.

- The vast majority of exporting establishments are SMEs (98.7%), but they account for only 65% of the value of exports. Conversely, large companies account for 35% of the value of exports, while they account for only 1% of businesses.

- In Quebec, in 2022, 56% of Quebec exports were generated by foreign multinationals, 24% by Canadian multinationals and 21% by other businesses (other than multinationals).

- The importance of foreign multinationals varies from sector to sector: Sixty percent for manufacturing, 22% for wholesale trade, 1% for public services.

- Thirty-seven percent of exports are between related parties, i.e., where one party to the transaction owns, holds or controls at least 10 % of the other party. This share varies greatly from industry to industry: Sixty-three percent for mines, 39% for manufacturing.

Text version: International exports of goods by manufacturing subsector Quebec, 2022

| 2022 | |

|---|---|

| Primary metal processing | 20,300 |

| Transport equipment | 17,857 |

| Paper | 7,628 |

| Chemical products | 6,844 |

| Food | 5,943 |

| Wood products | 5,095 |

| Machinery | 4,977 |

| Others | 21,703 |

Text version: Share of merchandise exports by business type, Quebec, 2022

| Industries total | Manufacturing | Wholesale trade | Mining… | Utilities | |

|---|---|---|---|---|---|

| Foreign multinational companies | 56% | 60% | 22% | 59% | 1% |

| Canadian multinationals | 24% | 22% | 30% | 33% | 99% |

| Non-multinational companies | 21% | 18% | 48% | 8% | .. |

5. Destination of exports of goods

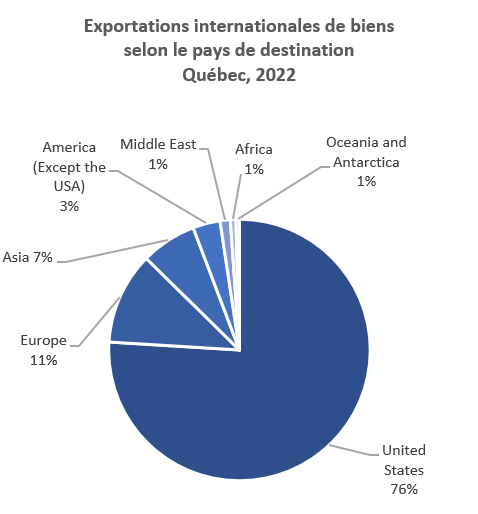

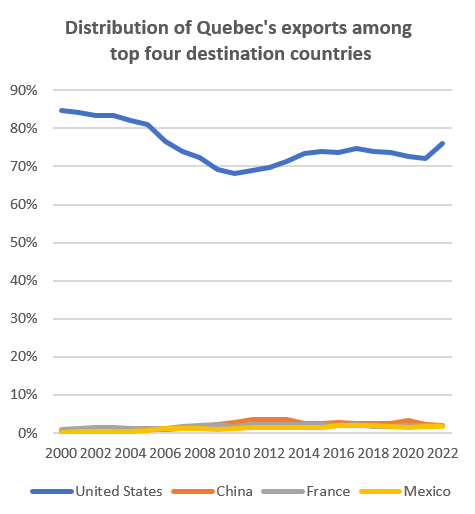

- More than 75% of Quebec's exports go to the United States (essentially the same share as the Canadian average). Since 2010, this share has fluctuated between 68% and 85%. It is too early to tell whether the 2022 surge is part of a new trend.

- The four U.S. states that import most of Quebec’s goods are New York, Texas, Ohio and Pennsylvania.

- Over the past ten years, China and France have ranked second and third as Quebec's main trading partners.

- However, their importance is only marginal (both below 2% in 2022) and on a downward trend.

Text version: International exports of goods by destination country Quebec, 2022

| 2022 | |

|---|---|

| United States | 81,650 |

| Europe | 12,235 |

| Asia | 7,398 |

| America (Except the USA) | 3,626 |

| Middle East | 1,364 |

| Africa | 739 |

| Oceania and Antarctica | 460 |

Text version: Distribution of Quebec's exports among top four destination countries

| Year | United States | China | France | Mexico |

|---|---|---|---|---|

| 2000 | 85% | 1% | 1% | 0% |

| 2001 | 84% | 1% | 1% | 0% |

| 2002 | 84% | 1% | 1% | 0% |

| 2003 | 83% | 1% | 2% | 0% |

| 2004 | 82% | 1% | 1% | 1% |

| 2005 | 81% | 1% | 1% | 1% |

| 2006 | 76% | 1% | 1% | 1% |

| 2007 | 74% | 1% | 2% | 1% |

| 2008 | 72% | 1% | 2% | 1% |

| 2009 | 69% | 2% | 2% | 1% |

| 2010 | 68% | 3% | 2% | 1% |

| 2011 | 69% | 4% | 2% | 2% |

| 2012 | 70% | 4% | 2% | 1% |

| 2013 | 71% | 3% | 2% | 1% |

| 2014 | 73% | 3% | 2% | 1% |

| 2015 | 74% | 3% | 2% | 2% |

| 2016 | 74% | 3% | 2% | 2% |

| 2017 | 75% | 2% | 2% | 2% |

| 2018 | 74% | 2% | 2% | 2% |

| 2019 | 74% | 2% | 2% | 2% |

| 2020 | 73% | 3% | 2% | 1% |

| 2021 | 72% | 2% | 2% | 2% |

| 2022 | 76% | 2% | 2% | 2% |

6. Quebec's regional export dynamics

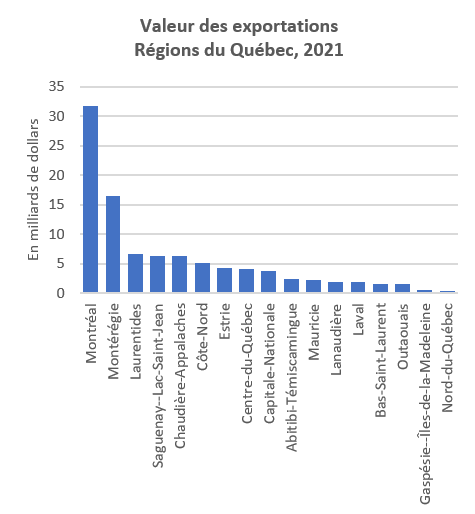

- In terms of value, the administrative regions of Montréal and Montérégie account for about half of exports, followed by the Laurentians, Saguenay–Lac-Saint-Jean, Chaudière-Appalaches, etc.

- Depending on the number of exporting establishments, Montréal and Montérégie still dominate, followed by the Chaudière-Appalaches, Laval and Laurentian regions.

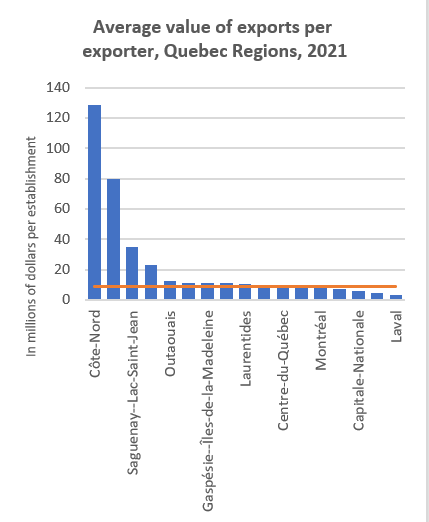

- In terms of the average value of exports by exporting establishment, Côte-Nord easily prevails ($129 million per exporting establishment), followed by Nord-du-Québec ($79 million) and Saguenay–Lac-Saint-Jean ($35 million). The Quebec average (the red line) was $8.7 million per exporting establishment in 2021.

- Note that Montréal and Montérégie are below the Quebec average, with $7.7 million and $7.4 million respectively. The average value appears to be strongly influenced by the type of exported product.

- Manufacturing, as a share of the value of exports, dominates in most Quebec regions. In 12 of the 17 regions, it is more than 85%. The Quebec average is 80%, and only one region (Côte-Nord) is below 60%.

Value of exports Quebec Regions, 2021

Text version: Value of exports Quebec Regions, 2021

2021 Gaspésie--Îles-de-la-Madeleine 0.5 Bas-Saint-Laurent 1.6 Capitale-Nationale 3.7 Chaudière-Appalaches 6.3 Estrie 4.2 Centre-du-Québec 4.1 Montérégie 16.4 Montréal 31.7 Laval 1.9 Lanaudière 2.0 Laurentides 6.6 Outaouais 1.5 Abitibi-Témiscamingue 2.4 Mauricie 2.3 Saguenay--Lac-Saint-Jean 6.3 Côte-Nord 5.1 Nord-du-Québec 0.4 Inconnu 0.2 TOTAL 97.2 Average value of exports per exporter, Quebec Regions, 2021

Text version: Average value of exports per exporter, Quebec Regions, 2021

2021 Gaspésie--Îles-de-la-Madeleine 11.4 Bas-Saint-Laurent 11.4 Capitale-Nationale 5.6 Chaudière-Appalaches 10.1 Estrie 8.0 Centre-du-Québec 9.4 Montérégie 7.4 Montréal 7.7 Laval 3.0 Lanaudière 4.4 Laurentides 10.6 Outaouais 12.6 Abitibi-Témiscamingue 22.9 Mauricie 11.1 Saguenay--Lac-Saint-Jean 35.0 Côte-Nord 128.7 Nord-du-Québec 79.5 Unknown 7.3 TOTAL 8.7 - Some regions are more dependent on exports. For Côte-Nord, the value of exports represents nearly 60% of GDP, followed by Saguenay-Lac-Saint-Jean (47%) and Centre-du-Québec (35%). The Quebec average is 21%.

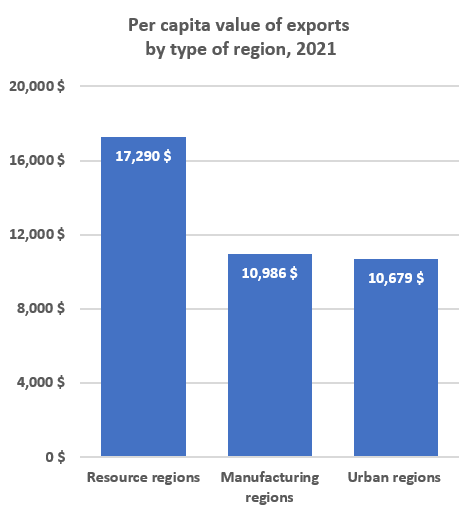

- On a per capita basis, the Côte-Nord region also accounts for the largest amount of exports ($56,868 per capita), followed by Saguenay–Lac-Saint-Jean ($22,653).

- The Quebec average is $11,297. With the exception of Nord-du-Québec, the order is essentially the same.

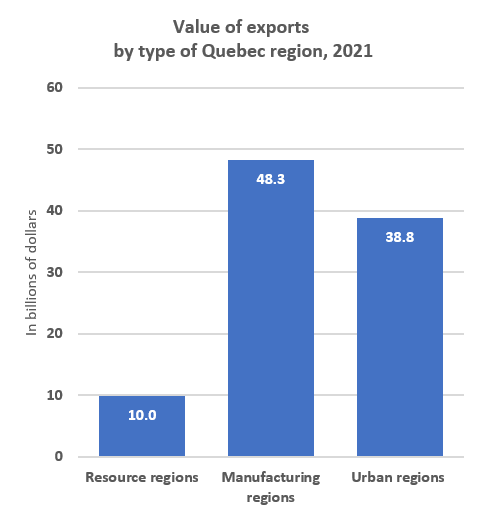

- Depending on the type of region,* manufacturing regions generate half of international goods exports, followed by urban regions (40%) and resource regions (10%).

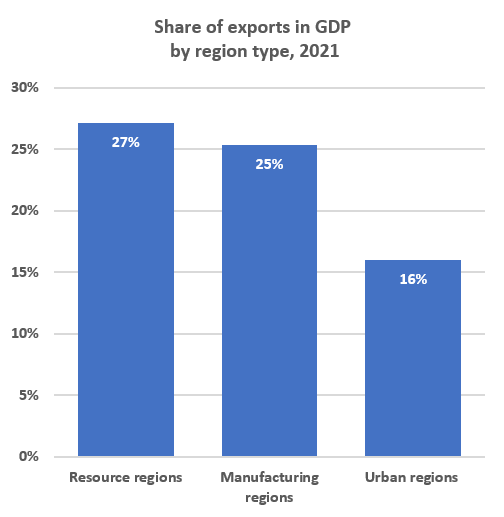

- But, in relative terms, the share of exports in GDP, or their per capita value, suggests that resource-rich regions are more dependent on exports.

Text version: Value of exports by type of Quebec region, 2021

| Exports 2021 | |

|---|---|

| Resource regions | 10 |

| Manufacturing regions | 48 |

| Urban regions | 39 |

*: According to a Quebec government typology, regions are grouped into three categories: 1) resource regions = Bas-Saint-Laurent, Abitibi- Témiscamingue, Côte-Nord, Nord-du-Québec and Gaspésie–Îles-de-la-Madeleine; 2) manufacturing regions = Saguenay–Lac-Saint-Jean, Mauricie, Estrie, Chaudière-Appalaches, Lanaudière, Laurentides, Montérégie and Centre-du-Québec; and 3) urban regions = Capitale-Nationale, Montréal, Outaouais and Laval.

Text version: Share of exports in GDP by region type, 2021

| Exports | GDP | Share of exports | |

|---|---|---|---|

| Resource regions | 9,965,668,900 | 36,673,076 | 27% |

| Manufacturing regions | 48,261,566,100 | 190,255,261 | 25% |

| Urban regions | 38,798,174,800 | 242,004,663 | 16% |

*: According to a Quebec government typology, regions are grouped into three categories: 1) resource regions = Bas-Saint-Laurent, Abitibi- Témiscamingue, Côte-Nord, Nord-du-Québec and Gaspésie–Îles-de-la-Madeleine; 2) manufacturing regions = Saguenay–Lac-Saint-Jean, Mauricie, Estrie, Chaudière-Appalaches, Lanaudière, Laurentides, Montérégie and Centre-du-Québec; and 3) urban regions = Capitale-Nationale, Montréal, Outaouais and Laval.

Text version: Per capita value of exports by type of region, 2021

| Exports | Population | Exports per capita | |

|---|---|---|---|

| Resource regions | 9,965,668,900 | 576,396 | $ 17,290 |