Quarterly Financial Report for the Quarter Ended June 30, 2025

Table of contents

- Introduction

- Highlights of fiscal quarter and fiscal year-to-date results

- Risks and uncertainties

- Significant changes to operations, personnel and programs

- Approval by senior officials

- Appendices

1. Introduction

This quarterly financial report has been prepared by Canada Economic Development for Quebec Regions (CED) as required under section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board.

This report should be read in conjunction with the 2025–26 Estimates and the 2025–2026 Departmental Plan.

This document has not been subject to external audit or review.

1.1 Authorities, mandate and programs

The mission of Canada Economic Development for Quebec Regions (CED) is to promote the long-term economic development of the regions of Quebec by giving special attention to those where slow economic growth is prevalent or opportunities for productive employment are inadequate.

CED is the key federal organization for economic development in the regions and among small and medium-sized enterprises (SMEs) in Quebec. It aims to stimulate the start-up and growth of businesses to make the regions more innovative, productive and competitive. CED thus offers adapted services and fosters local collaboration. This support also attracts investments for greater economic prosperity in Quebec and Canada.

CED plays a crucial role in dynamizing regional economies by drawing on regional strengths. We help communities diversify their economies, especially those hit by economic shocks. We support SMEs and NPOs through strategic investments.

CED offers advisory services adapted to the needs of businesses, NPOs and communities. Specialized advisors provide personalized guidance to facilitate access to funding, establish partnerships and support the growth of Quebec businesses. CED also offer information services to help small businesses and future entrepreneurs develop.

CED keeps abreast of the needs of Quebec’s regions and businesses through its 11 business offices across the province and through the links it establishes with other economic development players.

CED has three categories of programs that support its core responsibility:

- Regional Innovation

- Community Vitality

- Targeted or Temporary Support

Additional information about CED’s authority, mandate and programs can be found in the 2025–26 Estimates and the 2025–2026 Departmental Plan.

1.2 Basis of presentation

This quarterly report was prepared by CED using an expenditure basis of accounting. The accompanying Statement of Authorities includes CED’s spending authorities granted by Parliament and used by CED, consistent with the 2025–2026 Main Estimates. This quarterly report was prepared using a special-purpose financial reporting framework designed to meet financial information needs regarding the use of spending authorities.

Prior authority from Parliament is required before funds can be spent by the Government. Authorities available for use are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act gives the Governor General the power, under certain conditions, to issue a special warrant authorizing the government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

CED uses the full accrual method of accounting to prepare and present its annual financial statements that make up part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis of accounting.

1.3 Financial structure of Canada Economic Development for Quebec Regions (CED)

CED manages its expenditures under two annual votes:

- Vote 1 – Net operating expenditures, which includes CED authorities related to personnel costs and operating and maintenance expenditures

- Vote 5 – Grants and contributions, which includes all authorities related to transfer payments

Expenses under budgetary statutory authorities, for which payments are made under legislation previously approved by Parliament and which are not part of the annual appropriations bills, include items such as the employer’s share of the employee benefit plan.

2. Highlights of fiscal quarter and fiscal year-to-date results

This section presents a variety of financial information as at June 30, 2025, including the authorities available for the year and expenditures incurred during the first quarter, as compared with the previous fiscal year.

The explanation of variances is based on the premise that discrepancies of less than 5% have a minimal impact on the interpretation of results.

Details regarding this financial information can be found in sections 2.1 and 2.2, and in the tables in the appendices.

2.1 Analysis of authorities

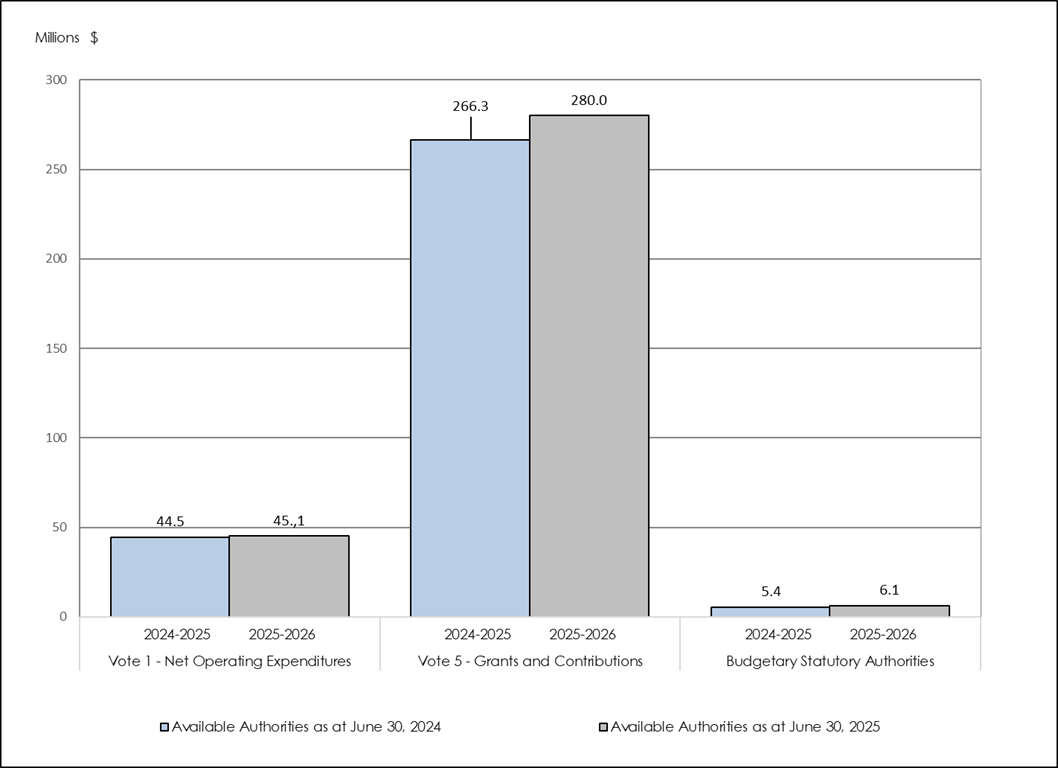

Authorities as at June 30, 2025, totalled $331.2M, compared with $316.2M as at June 30, 2024.

This year’s variance of $15.0M (+4.7%) is due to the following changes:

- Vote 1 – Net operating expenditures: +$0.6M

- Vote 5 – Grants and contributions: +$13.7M

- Budgetary statutory authorities: +$0.7M

NB: Totals in the report may not add up because of rounding off.

The chart below shows the annual budgetary appropriation authorities as at June 30, 2025, compared with the previous fiscal year.

Graphic 1 - Text version:

Analysis of annual budgetary appropriation authorities: subdivided into three sections, this graph provides an overview of net available budgetary authorities (Vote 1 – Net Operating Expenditures; Vote 5 – Grants and Contributions; and Budgetary Statutory Authorities) as at June 30, 2025, including a comparison as at June 30, 2024.As at June 30, 2025, annual authorities under Vote 1 – Net Operating Expenditures, Vote 5– Grants and Contributions, and Budgetary Statutory Authorities, totalled $45.1M ($44.5M in 2024-2025), $280.0M ($266.3M in 2024-2025) and $6.1M ($5.4M in 2024 2025), respectively.

Vote 1 authorities (Operating expenditures)

As at June 30, 2025, authorities totalled $45.1M, compared with $44.5M as at June 30, 2024. This represents an increase of $0.6M this year. The 1.3% variance is considered insignificant.

Vote 5 authorities (Grants and contributions)

As at June 30, 2025, grant and contribution (G&C) authorities totalled $280.0M, compared with $266.3M as at June 30, 2024, representing a net increase of $13.7M (+5.1%) this year. This variance consists of a number of items, some of which varied upward, others downward.

The most significant variances are:

- Increase in funding (+$23.5M)

- Regional Economic Growth through Innovation (REGI) program top-up: +$8.3M

- Regional Artificial Intelligence Initiative: +$6.6M

- Regional Homebuilding Innovation Initiative: +$6.3M

- Northern Isolated Communities Initiatives Fund: +$1.1M

- Black Entrepreneurship Program: +$0.6M

- Other: +$0.6M

- Decrease in, or end of, funding (-$9.8M)

- Support for Regional Quantum Innovation Initiative: -$3.3M

- International Sustainability Standards Board: -$2.7M

- Modernisation of the slipway at the port of Cap-aux-Meules on the Magdalen Islands: $-2.0M

- Hurricane Fiona Recovery Fund: $-1.8M

Budgetary statutory authorities

As at June 30, 2025, authorities totalled $6.1M, compared with $5.4M as at June 30, 2024. This represents an increase of $0.7M (+13.0%) this year. This increase is due to an adjustment to the actual effective rate for the employee benefit plan.

2.2 Analysis of expenditures

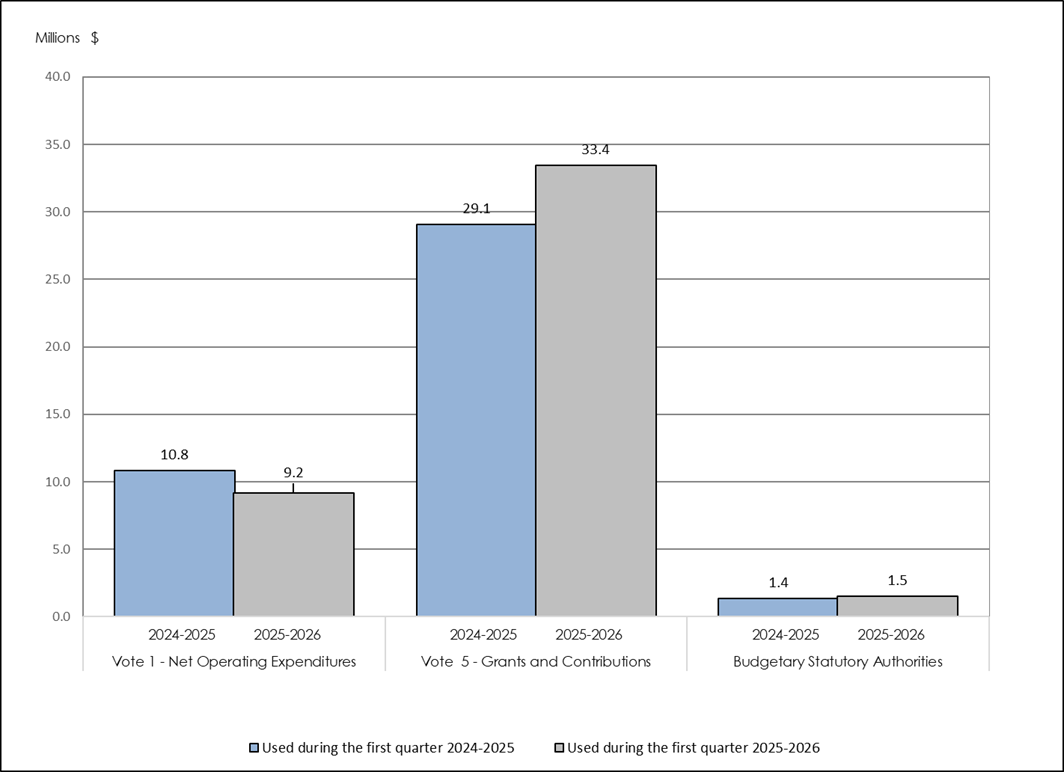

CED expenditures in the first quarter of 2025–2026 totalled $44.1M, compared with $41.3M in the same period in the previous year. This represents a net year-over-year increase of $2.8M (+6.8%).

This variance can be broken down as follows:

- Vote 1 – Net operating expenditures: -$1.6M

- Vote 5 – Grants and contributions: +$4.3M

- Budgetary statutory authorities: +$0.1M

The chart below shows expenditures in the first quarter of 2025–2026 by budgetary appropriation, compared with the previous fiscal year.

First-quarter expenditures by budgetary appropriation, 2025–2026, compared with 2024–2025

Graphic 2 - Text version:

Analysis of first quarter expenditures and presentation of year-to-date expenditures by budgetary appropriation as at June 30, fiscal year 2025-2026, compared with 2024-2025: subdivided into three sections, namely Vote 1 – Net Operating Expenditures, Vote 5 – Grants and Contributions, and Budgetary Statutory Authorities. This graph shows expenditures incurred during the first quarter of 2025-2026 and includes a comparison with fiscal year 2024-2025.

In the first quarter of 2025-2026, expenditures under Vote 1 (Net Operating Expenditures), Vote 5 (Grants and Contributions), and Budgetary Statutory Authorities, amounted to $9.2M ($10.8M in 2024-2025), $33.4M ($29.1M in 2024-2025) and $1.5M ($1.4M in 2024-2025), respectively.

Vote 1 expenditures (Net operating expenditures)

CED’s net operating expenditures for the first quarter of 2025–2026 totalled $9.2M, compared with $10.8M in 2024–2025. This represents a decrease of $1.6M (-14.8%) this year.

Operating expenditures decreased in the first quarter of 2025–2026 as a result of the Agency’s efforts under the government-wide initiative to refocus spending on government priorities. To this end, the department adopted a strict travel policy and reduced the size of its workforce through attrition, e.g., retirements, or employees whose contracts have ended. This resulted in a decrease in salary and travel expenses, which explains the variation.

Vote 5 expenditures (Grants and contributions)

Grant and contribution expenditures for the first quarter of 2025–2026 totalled $33.4M, compared with $29.1M in 2024–2025, representing a net increase of $4.3M (+14.8%) this year.

Spending on temporary and targeted initiatives increased in the first quarter of 2025–2026 as a result of the launch of new initiatives in the previous year. CED also recorded an increase in spending under the Community Futures Program following the negotiation of agreements with Community Futures Development Corporations (CFDCs) and Business Development Corporations (BDCs) in the first quarter of 2024–2025. Overall, these adjustments resulted in a net increase in grants and contributions of 14.8%.

Expenditures under budgetary statutory authorities

Spending on statutory authorities in the first quarter of 2025–2026 totalled $1.5M, compared with $1.4M as at June 30, 2024, representing a year-over-year increase of $0.1M (7.1%). Spending remained stable, with no major variations between the two quarters.

(For further details on these expenditures, see the table entitled “Departmental budgetary expenditures by standard object” in Appendix 6.2.)

3. Risks and uncertainties

In a context of economic uncertainty and government transformation, CED must deal with certain risks that could affect its ability to achieve its objectives and ensure the optimal delivery of its mandate.

Financial situation

Budgetary constraints, combined with the public service expenditure review and the uncertainty surrounding the availability of funds over the next few years, could pose challenges for CED in terms of its response capacity. To mitigate this risk, CED will ensure the rigorous and sustained management of its human and financial resources; focus on simplifying its internal processes and modernizing its digital environment, thereby generating efficiency gains; and pursue the transformation of certain business models, notably the recovery model.

Programs and services

The current context, and in particular the global economic situation and changes to government programs for SMEs, has increased the challenges faced by CED’s clients and poses a risk to the Agency’s ability to effectively respond across the entire continuum of economic development projects. To address these challenges, CED is adjusting its programs; pursuing its collaboration with its partners and other levels of government in order to strengthen its capacity to identify and carry out strategic projects; and simplifying access to its services, notably through the gradual roll-out of its transactional portal.

IT security

As cyberthreats intensify, CED remains exposed to the risk of a cybersecurity incident that could disrupt its activities or damage its reputation. To build its resilience, the organization is continuing to implement targeted cybersecurity training courses, update business continuity plans, hold simulation exercises and assess potential impacts on key organizational functions.

4. Significant changes to operations, personnel, and programs

CED is continuing its efforts as part of the government-wide initiative to refocus spending on government priorities. No other major changes occurred during the quarter.

5. Approval by senior officials

The purpose of this section is to provide the approval of senior officials, as required by the Policy on Financial Management, as follows:

Approved by:

_____________________________________

Sony Perron

Deputy Minister / President

Montréal, Canada

__________________________________

Maxime Garon

Chief Financial Officer

Montréal, Canada

6 Appendices

6.1 Statement of authorities (unaudited)

| Total available for use for the year ended March 31, 2026* | Used during the quarter ended June 30, 2025 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Vote 1 – Net operating expenditures | 45,101 | 9,191 | 9,191 |

| Vote 5 – Grants and contributions | 279,995 | 33,440 | 33,440 |

| Total budgetary statutory authorities | 6,133 | 1,533 | 1,533 |

| Total authorities | 331,229 | 44,164 | 44,164 |

| Total available for use for the year ended March 31, 2025* | Used during the quarter ended June 30, 2024 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Vote 1 – Net operating expenditures | 44,487 | 10,857 | 10,857 |

| Vote 5 – Grants and contributions | 266,262 | 29,084 | 29,084 |

| Total budgetary statutory authorities | 5,440 | 1,360 | 1,360 |

| Total authorities | 316,189 | 41,301 | 41,301 |

| *Includes only authorities available for use and granted by Parliament at quarter-end. | |||

6.2 Departmental budgetary expenditures by standard object (unaudited)

| Planned expenditures for the year ended March 31, 2026 | Expenditures during the quarter ended June 30, 2025 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Expenses: | |||

| Personnel* | 46,219 | 9,946 | 9,946 |

| Transport and communications | 318 | 121 | 121 |

| Information | 225 | 28 | 28 |

| Professional and special services | 2,869 | 187 | 187 |

| Rentals | 887 | 400 | 400 |

| Repair and maintenance services | 46 | 12 | 12 |

| Utilities, materials and supplies | 49 | 8 | 8 |

| Acquisition of machinery and equipment | 621 | 10 | 10 |

| Transfer payments | 279,995 | 33,440 | 33,440 |

| Other grants and payments | 0 | 12 | 12 |

| Total net budgetary expenditures | 331,229 | 44,164 | 44,164 |

| *Includes employee benefit plans (EBPs) | |||

| Planned expenditures for the year ended March 31, 2025 | Expenditures during the quarter ended June 30, 2024 | Year-to-date used at quarter-end | |

|---|---|---|---|

| Expenses: | |||

| Personnel* | 44,864 | 11,198 | 11,198 |

| Transport and communications | 341 | 263 | 263 |

| Information | 218 | 62 | 62 |

| Professional and special services | 3,024 | 188 | 188 |

| Rentals | 763 | 381 | 381 |

| Repair and maintenance services | 19 | 17 | 17 |

| Utilities, materials and supplies | 58 | 28 | 28 |

| Acquisition of machinery and equipment | 640 | 36 | 36 |

| Transfer payments | 266,262 | 29,084 | 29,084 |

| Other grants and payments | 0 | 44 | 44 |

| Total net budgetary expenditures | 316,189 | 41,301 | 41,301 |

| *Includes employee benefit plans (EBPs) | |||