Audit of Accounts receivable phase I – Governance, establishment, monitoring and reporting

Executive summary

The audit of Accounts Receivable (A/R) was included in the 2014–2017 Risk-Based Internal Audit Plan. Sections 24 and 25 of the Financial Administration Act (FAA), sections 4 to 9 of Debt Write-off Regulations, Treasury Board of Canada Secretariat (TBS) Directive on Receivables Management and Guideline on Collection of Receivables set out key legal and policy requirements to manage the A/R lifecycle.

According to section 6.2.1 of the Directive on Receivables Management, the Chief Financial Officer is responsible for ensuring that internal controls for the administration of A/R are established, are in place and include, at a minimum:

- The appropriate segregation of duties related to credit-granting, collections, maintenance of accounting records, the handling and reconciling of money, and write-offs;

- The provision of complete audit trails to track all claims from the transaction that gave rise to the receivable through to its final settlement;

- The establishment and monitoring of results-based measurement mechanisms; and

- The preparation and distribution to management of periodic reports on the financial and non-financial activities of the portfolio, including receivable ageing statements.

The main programs generating overpayments, A/R and recoveries at Employment and Social Development Canada (ESDC) are Canada Student Loans (CSL), Employment Insurance (EI), Canada Pension Plan (CPP), Old Age Security (OAS), Wage Earner Protection Program (WEPP) and Grants and Contributions (Gs and Cs).

Audit objective

The objective of this audit was to assess the adequacy of the management control framework of A/R.

Summary of key findings

- There is an adequate governance structure at the Branch level to manage program overpayments. There is also an adequate governance framework within the Chief Financial Officer Branch (CFOB) to manage A/R that have been transferred to the Departmental Accounts Receivable System (DARS).

- Opportunities exist to improve the consistency of practices among programs as it relates to file documentation, timeliness in establishing overpayments, and communication with clients.

- Key controls exist for cash receipts and deposits, bank reconciliations, clearing of suspense accounts and credit refunds, however these processes are not standardized nor fully documented.

- The integrity of financial A/R information could be strengthened by improving reconciliations/monitoring between program source systems that generate A/R and the DARS.

- The implementation of corrective actions to address the findings outlined above will enable the Department to ensure oversight and integrity of departmental A/R activities.

Audit conclusion

The audit concluded that the management control framework of A/R requires some adjustments to improve the accuracy, completeness and reliability of A/R information.

Recommendations

-

CFOB, in collaboration with Assistant Deputy Ministers (ADM) of programs generating overpayments, should:

- Develop appropriate requirements to address issues pertaining to overpayments supporting documentation practices, timeliness in establishing overpayments, and communication with clients.

- Establish a mechanism to enhance data integrity between DARS and program systems.

- CFOB should standardize processes and document key controls pertaining to cash handling, bank reconciliations, credit refunds, and suspense accounts.

1.0 Background

1.1 Context

The audit of Accounts Receivable was included in the 2014–2017 Risk-Based Internal Audit Plan. Sections 24 and 25 of the FAA, sections 4 to 9 of Debt Write-off Regulations, TBS Directive on Receivables Management and Guideline on Collection of Receivables set out key legal and policy requirements to manage the A/R lifecycle.

According to section 6.2.1 of the Directive on Receivables Management, the Chief Financial Officer is responsible for ensuring that internal controls for the administration of A/R are established, are in place and include, at a minimum:

- The appropriate segregation of duties related to credit-granting, collections, maintenance of accounting records, the handling and reconciling of money, and write-offs;

- The provision of complete audit trails to track all claims from the transaction that gave rise to the receivable through to its final settlement;

- The establishment and monitoring of results-based measurement mechanisms; and

- The preparation and distribution to management of periodic reports on the financial and non-financial activities of the portfolio, including receivable ageing statements.

The main departmental programs generating overpayments, A/R and recoveries are CSL, EI, CPP, OAS, WEPP and Gs and Cs.

Management of A/R and recoveries from overpayments is a shared responsibility among the program areas, the Processing and Payment Services Branch (PPSB), the CFOB, external service providers and the Canada Revenue Agency (CRA). Program areas and PPSB manage client accounts and establish overpayments in their respective benefit payment systems. The National Accounts Receivable (NAR) group within CFOB maintains account balances in DARS, reviews and approves write-offs (under $25,000). DARS is the financial system of record for financial reporting and for collection activities. Financial statement reporting, including monitoring of internal controls over A/R also reside within CFOB.

1.2 Audit objective

The objective of this audit was to assess the adequacy of the management control framework of A/R.

1.3 Scope

The scope of this audit focused on the governance, establishment, monitoring and reporting of A/R for CSL, OAS, CPP, EI, WEPP and Gs and Cs. The audit was not designed to express an opinion on the accuracy of the financial A/R information reported in the departmental financial statements.

1.4 Methodology

The audit was conducted using a number of methodologies including document review, interviews, on-site observations, walkthroughs, data mining and analysis as well as sampling and testing. Travel to regional processing centres located in Moncton, Quebec, Boucherville, Cornwall, Scarborough and Mississauga took place between May and August 2015.

2.0 Audit findings

2.1 There is a need to adopt more consistent practices within and among programs in the establishment of overpayments

Governance

A/R for EI, CPP, OAS, and Gs and Cs, included in the scope of this audit, are normally triggered by overpayments resulting from incorrect information reported by the claimant, computer processing errors, administrative errors or manual entry errors. For CSL, it is frequently the expiration of the grace period after the end of studies that gives rise to a loan receivable. For WEPP, participation in the program leads to the creation of an A/R.

Branches are responsible for managing program overpayments within their respective areas. They carry out these responsibilities by establishing guidelines and processes to establish overpayments, calculating overpayments and penalties when applicable, inputting these into their programs’ system, and sending notification letters to clients.

The audit team found there is an adequate governance framework at the Branch level which provides policies, guidelines and practices on how to identify and establish overpayments within each individual program.

The CFOB is responsible for the accounting functions once the information is transferred to DARS from the program source systems. Other CFOB responsibilities include maintaining integrity and accountability of the information in DARS. CFOB also monitors transactions using sampling techniques to verify that proper procedures were followed in order to recommend debt for write-offs.

The audit team found an adequate governance framework within CFOB, including roles, responsibilities and policies, for managing A/R once the accounts have been transferred to DARS.

The audit team noted the absence of requirements for overpayments to be set up as an A/R and be recorded into DARS which have led to inconsistent practices among programs. These inconsistencies, which are described below, pertain to file documentation practices, timeliness to establish overpayments, and communication with clients.

Supporting documentation and file maintenance

Branches are responsible for maintaining adequate documentation to support the establishment of program overpayments. The audit conducted walkthroughs and file reviews which revealed that overpayments and A/R documentation practices in program systems are inconsistent. These inconsistencies were observed between programs and sometimes within the same program, from file to file, depending on the agent who worked on the file.

Some files were well organized, and contained key documents such as the rationale supporting the overpayment, the overpayment calculation, delegated authority to modify the file, and communication with the client. Other files did not contain any key documents. Retaining adequate documentation on file would enable the Department to support and demonstrate the legitimacy of overpayments and A/R.

Timeliness

The identification and establishment of program overpayments is a Branch responsibility. Overpayments are identified through multiple avenues including: investigation activities performed by the Integrity Services Branch, payment accuracy reviews performed by PPSB and updated information about the claimant. Examples of updated information include changes in marital status and earnings.

The audit reviewed the process for the establishment of overpayments and noted that the timeliness of this activity varies among programs. For example, the file review for WEPP showed that overpayments were recorded in a timely manner. There was an approximate two week time difference between the identification of the overpayment and its establishment in the program system, which is sent automatically to DARS. In contrast, the EI file review revealed delays resulting in a backlog for establishing overpayments. The auditors were informed that the backlog may cause delays which, at times, may lead to exceeding the legislated time limit to recover overpayments. An ageing analysis of EI A/R within DARS as of March 31, 2015 showed that 18 % of EI A/R was past the legislative collection time limit of six years. The analysis we conducted on March 31, 2015 also showed that 19 % of CPP accounts are older than six years. While CPP accounts are not constrained by legislative timelines the audit does not consider the likelihood of collection for these accounts to be high.

Timeliness is a determining factor in identifying, accounting for, collecting and reporting on A/R. Establishing overpayments in a timely manner plays a fundamental role in increasing the likelihood of recovery, both when the claimant is still receiving benefits (active) and when the claimant is no longer receiving benefits (inactive). It is in the best interest of the client that the Department identifies, establishes and adjusts any benefit paid as early as possible.

Communication and notification

When an overpayment is identified, programs are required to notify the claimant in writing of their debt. The audit reviewed this communication process with the client and noted some inconsistencies. For example, EI has standardized letters which are automatically generated and sent to the client. Other programs require officers to access a database, choose the appropriate letter template, customize it to the case being worked on and manually print and send the letter to the client.

Our file review showed that the level of detail contained in those letters varies between programs and within programs. For example, some letters provided useful information such as an explanation of the reason behind the overpayment, the total amount owed, the client’s new entitlement amount, the date the new entitlement becomes effective, and a request that the client inform the program as soon as possible if the proposed recovery rate will cause financial hardship. Other letters reviewed by the audit team contained only minimal information.

The file review also showed that updated client information is not always shared between programs. For example, we found instances where benefits were stopped for one program as a result of a claimant death, but benefits continued for another program for the same claimant. The likelihood of collection is higher when benefits are stopped as early as possible and collection is attempted shortly thereafter.

We were informed, through interviews, of cases where the notification of overpayment was sent simultaneously to different parties such as insurance companies, the CRA, and the estate to recoup the amount owed to the Department. Interviews indicated this practice has led to the receipt of payments from multiple sources which resulted in the creation of a credit account. The audit team encourages departmental programs to assess the magnitude of this situation, and take corrective action, where appropriate. Communication between all different parties involved is important. When it is performed properly, it may increase the likelihood of recovering the debt.

Recommendation

CFOB, in collaboration with ADM of programs generating overpayments, should develop appropriate requirements to address issues pertaining to overpayments supporting documentation practices, timeliness in establishing overpayments, and communication with clients.

Management response

CFOB agrees with the recommendation. As part of the Accounts Receivable Modernization initiative, a governance lead by an ADM committee will be established with all necessary stakeholders. CFOB will work with program areas to develop guidelines with key minimal requirements for overpayment establishment. The first ADM committee is to take place in June 2016. Actions are expected to be completed by April 2019.

2.2 Data integrity could be enhanced by improving the reconciliations between some program source systems and DARS

Once it has been determined that a program overpayment needs to be created, it is recorded in the source system and then transferred to DARS. A myriad of systems feed DARS, some feeds are automatic, some are manual, and some are a combination of both (see details in Appendix A). These systems are designed to support program operations. According to CFOB, CSL and the bulk of EI transactions represent approximately 90 % of A/R in DARS. These transactions flow through a two way interface. Checks and balances are incorporated in the systems and exception reports are generated and reviewed by CFOB staff. However for other programs which do not flow through a two way interface the quality of financial A/R information could be improved by reconciling these systems to DARS and vice versa on a regular basis.

One of DARS’ functions is to access and retrieve A/R data for reporting, it is the primary system used by the Department to enable A/R collection. It is important to note that for active accounts, programs are undertaking collection activities. For inactive accounts, CRA will not collect accounts that are not recorded in DARS. Therefore accurate and up to date information in DARS is of critical importance to the overall life cycle management of A/R.

The audit revealed that the quality of information contained in DARS depends on the timeliness, completeness, accuracy and reliability of data from program source systems. These systems have varying levels of control and rigour and are outside of the CFOB span of control. Interviews with program staff involved in the identification and establishment of overpayments showed these individuals do not always have a clear and full understanding of the impact of their work on the departmental A/R life cycle management.

During our audit, we noted that the Corporate Payment Management System (CPMS), which was implemented in 2014, was not interfacing properly with DARS. This resulted in variances in A/R. It also caused errors with names and addresses between the two systems. As a result CRA is not collecting these CPP A/R. To address this issue, CFOB and PPSB have begun correcting rejected transactions which did not transfer properly from CPMS to DARS.

The audit also showed that Gs and Cs overpayments are not established in the Common System for Grants and Contributions (CSGC) program module. Gs and Cs overpayments are created by a manual entry directly in DARS. This means that without a full file analysis for a given grant or contribution, there would be no indication that an A/R exists in the CSGC program module for that grant or contribution.

Recommendation

CFOB, in collaboration with ADM of programs generating overpayments, should establish a mechanism to enhance data integrity between DARS and program systems.

Management response

CFOB agrees with the recommendation. For those systems that are fully automated with a two-way interface (i.e. EI, CSL, WEPP, CSGC-client module) between the program system and DARS, no further work is required. This represents approximately 90 % of the A/R currently in DARS. With system controls and built in edit checks within the interface, any transactions that do not meet the file specifications are reported on a daily report screen for manual correction. Thus, the level of risk is low and there is no value added in doing any additional verification.

For those systems in which a two- way interface does not exist (i.e. CPMS) which represents 10 % of the A/R currently in DARS, a working group has been established to analyse the issues and to take corrective action. Considerable effort over the years has been made in resolving most system variances identified. For the remainder, periodical meetings with the Directors General of PPSB and CFOB are underway to provide regular updates and to ensure that progress is being made. Continued monitoring is done to ensure data integrity until such time as a two-way interface has been created. Actions are expected to be completed by April 2019.

2.3 Accounts receivable centers’ activities could be strengthened by standardizing and documenting key processes

Cash receipts and deposits

The NAR group is responsible for many aspects of the management of A/R through three national A/R sites based in Moncton, Toronto, and the National Capital Region. The audit reviewed key processes for cash receipts and deposits, bank reconciliations, credit refunds, and the clearing of suspense accounts.

The cash receipt process is initiated when the cash bags/packages are received from Canada Post. Officers receive the packages and count the cash once they return to their office. The officers will access SharePoint to print the Public Money Transfer Record (PMTR) prepared by Service Canada Centers (SCC), which includes debits, credits, cash and cheques and will match it with the packages received to ensure the total amount of cash on hand is equal to the total amount listed on the PMTR. Any difference is investigated immediately. When the cash amount in the package agrees to the amount listed on the PMTR, the officer signs off the PMTR. A second officer will verify the totals and sign off.

We noted during walkthroughs and process examinations that there are controls over the handling of cash. Examples of controls include opening the package and counting the cash in a restricted zone, the requirement to have two employees present at all times during the cash handling cycle, and locking funds in a safe between the reception and deposit. However this process is neither fully documented nor standardized between the different sites visited by the audit team.

Protected

Bank reconciliations

Bank reconciliation is a fundamental control in the cash handling and banking process. Timely, properly documented and completed bank reconciliations help to detect fraud and/or errors pertaining to cash. The audit reviewed this process and found that it is performed in a timely manner. Financial officers at A/R sites complete bank reconciliations on a daily basis, and any variances or unusual transactions are investigated and corrective actions are undertaken.

Controls in place include using journal vouchers to correct accounting errors, contacting the bank to discuss uncommon transactions and correcting discrepancies that are not due to timing differences between the date the data is recorded in the accounting books and at the bank. However, the audit noted that the bank reconciliation process is not standardized across A/R sites and key controls are not fully documented. There is neither a record kept of periodic reconciliations, nor managerial sign-off or approval of reconciliations.

Suspense accounts and credit refunds

Occasionally payments are received before A/R are established in DARS. In these situations any payment received would end up in a suspense account and would require further analysis to determine which A/R it relates to. Credit refunds generally occur when the Department receives multiple payments for an A/R or more than what was owed.

The auditors conducted walkthroughs of both processes and found that controls were sufficient. The processes were not fully documented. When they were documented, processes were site specific. For example, suspense account clearing is a common process across sites; however no common process documentation has been developed.

By standardizing common processes, efficiencies might be gained and each site could be better positioned to act as a backup site for business continuity planning purposes should one site go offline. The audit noted that efforts are underway by CFOB to standardize common processes within the NAR.

Recommendation

CFOB should standardize processes and document key controls pertaining to cash handling, bank reconciliations, credit refunds, and suspense accounts.

Management response

CFOB is in agreement with the recommendation. One of the priorities of CFOB, and in particular NAR, since consolidating the receivables function to three sites has been to standardize its business processes. In fiscal year 2015–2016, additional resources were hired to review 2-3 processes within NAR with the goal of standardizing the processes across the regional sites. This work will continue into fiscal year 2016–2017. Actions are expected to be completed by March 2017.

3.0 Conclusion

The audit concluded that the management control framework of A/R requires some adjustments to improve the accuracy, completeness and reliability of A/R information.

4.0 Statement of assurance

In our professional judgement, sufficient and appropriate audit procedures were performed and evidence gathered to support the accuracy of the conclusions reached and contained in this report. The conclusions were based on observations and analyses at the time of our audit. The conclusions are applicable only for the A/R governance, establishment, monitoring and reporting. The evidence was gathered in accordance with the Internal Auditing Standards for the Government of Canada and the International Standards for the Professional Practice of Internal Auditing.

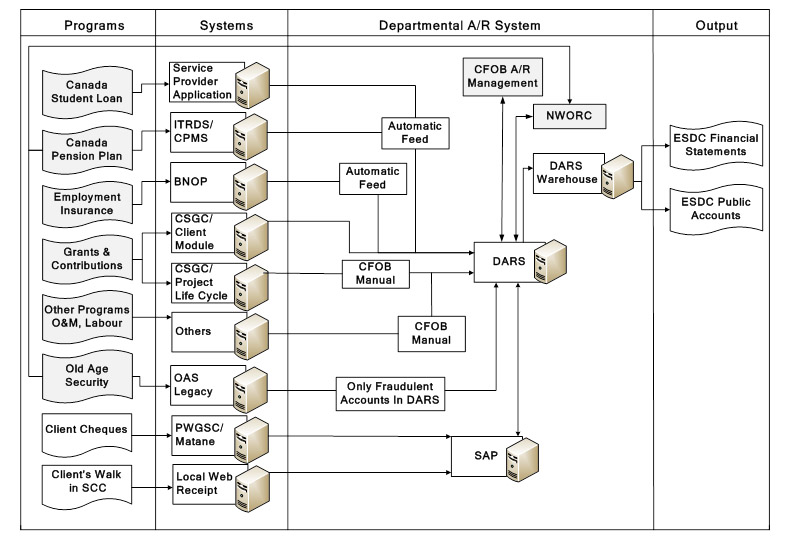

Appendix A: Accounts receivable data flow

Text description of Appendix A: Accounts receivable data flow

The first program is the Canada Student Loans for which overpayments and loans receivable are initially established in the service provider application and then transferred automatically to the Departmental Accounts Receivable System (DARS). This information in DARS is used by the Chief Financial Officer Branch (CFOB) to manage Accounts Receivable (A/R), and establish Employment and Social Development Canada’s (ESDC) Financial Statements and Public Accounts.

The second program is the Canada Pension Plan for which overpayments are initially established in the Information Technology Renewal Delivery System/ Corporate Payment Management System and then transferred automatically to DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The third program is the Employment Insurance for which overpayments are initially established in the Benefits and Overpayments system and then transferred through an automatic feed to DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The fourth program is Grants and Contributions for which overpayments to recipient organizations are established in the Project Life Cycle module of the Common System for Grants and Contributions (CSGC) and then manually entered in DARS. Overpayments to individual recipients are established initially in the Client Module of CSGC and then transferred through an automatic feed to DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The fifth program includes other programs, operations and maintenance, as well as Labour. Overpayments are established initially in other systems and are manually transferred to DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The sixth program is the Old Age Security (OAS) for which overpayments are established in the OAS legacy system, only fraudulent accounts are transferred to DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The seventh program includes Client cheques that are processed by Public Works and Government Services Canada /Matane which updates the Systems, Applications and Products (SAP) and DARS. This information in DARS is used by CFOB to manage A/R, and establish ESDC’s Financial Statements and Public Accounts.

The eighth program refers to client’s walking in Service Canada Centers. Payments from these clients are processed through the Local Web Receipt program which automatically updates SAP and DARS. This information in DARS is used by CFOB to manage A/R, and to establish ESDC’s Financial Statements and Public Accounts.

Appendix B: Audit criteria assessment

Text description of Appendix B: Audit criteria assessment

Audit criteria

It was expected that the Department has:

- A governance structure and processes to adequately monitor the life cycle of A/R

- Rating (By Program):

- CPP and OAS: controlled, but should be strengthened, medium risk exposure

- EI: controlled, but should be strengthened, medium risk exposure

- CLS: controlled, but should be strengthened, medium risk exposure

- WEPP: controlled, but should be strengthened, medium risk exposure

- Gs and Cs: controlled, but should be strengthened, medium risk exposure

- Rating (By Program):

- Roles, responsibilities, and accountabilities that are clearly defined and communicated

- Rating (By Program):

- CPP and OAS: controlled, but should be strengthened, medium risk exposure

- EI: controlled, but should be strengthened, medium risk exposure

- CLS: controlled, but should be strengthened, medium risk exposure

- WEPP: controlled, but should be strengthened, medium risk exposure

- Gs and Cs: controlled, but should be strengthened, medium risk exposure

- Rating (By Program):

- Policies, guidelines, tools and guidance available to establish A/R across programs in a consistent manner

- Rating (By Program):

- CPP and OAS: controlled, but should be strengthened, medium risk exposure

- EI: controlled, but should be strengthened, medium risk exposure

- CLS: controlled, but should be strengthened, medium risk exposure

- WEPP: controlled, but should be strengthened, medium risk exposure

- Gs and Cs: controlled, but should be strengthened, medium risk exposure

- Rating (By Program):

- Oversight mechanisms to provide adequate monitoring and reporting of departmental A/R activities

- Rating (By Program):

- CPP and OAS: controlled, but should be strengthened, medium risk exposure

- EI: controlled, but should be strengthened, medium risk exposure

- CLS: controlled, but should be strengthened, medium risk exposure

- WEPP: controlled, but should be strengthened, medium risk exposure

- Gs and Cs: controlled, but should be strengthened, medium risk exposure

- Rating (By Program):

Appendix C: Glossary

- ADM

- Assistant Deputy Ministers

- A/R

- Account Receivable

- BNOP

- Benefits and Overpayments

- CFOB

- Chief Financial Officer Branch

- CPMS

- Corporate Payment Management System

- CPP

- Canada Pension Plan

- CRA

- Canada Revenue Agency

- CSGC

- Common System for Grants and Contributions

- CSL

- Canada Student Loans

- DARS

- Departmental Accounts Receivable System

- EI

- Employment Insurance

- ESDC

- Employment and Social Development Canada

- FAA

- Financial Administration Act

- Gs and Cs

- Grants and Contributions

- ITRDS

- Information Technology Renewal Delivery System

- NAR

- National Accounts Receivable

- NWORC

- National Write Off and Remissions Review Committee

- O and M

- Operation and Maintenance

- OAS

- Old Age Security

- PMTR

- Public Money Transfer Record

- PPSB

- Processing and Payment Services Branch

- PWGSC

- Public Works and Government Services Canada

- SAP

- Systems, Applications and Products

- SCC

- Service Canada Centers

- TBS

- Treasury Board of Canada Secretariat

- WEPP

- Wage Earner Protection Program