HUMA Committee briefing binder: Appearance by the Minister of Employment, Workforce Development and Official Languages - May 6, 2024

Official title: Minister Of Employment, Workforce Development and Official Languages, Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA), Supplementary Estimates (C) for the Fiscal Year 2023 to 2024 and the Main Estimates for the Fiscal Year of 2024 to 2025. Date: May 6, 2024, 3:30-4:30 p.m.

On this page

- Opening remarks

- Background information

- Employment Insurance (EI) - Hot issues

- 3.a. Benefits Delivery Modernization

- 3.b. Employment Insurance (EI) modernization

- 3.c. Employment Insurance (EI) claims

- 3.d. New Employment Insurance (EI) Benefit for parents through adoption or surrogacy

- 3.e. Employment Insurance (EI) Premiums

- 3.f. New temporary measure for seasonal workers

- 3.g. Employment Insurance (EI) board of appeal

- 3.h. COVID benefit recovery and amnesty

- 3.i. Senate Bill S-244 EI council

- Temporary Foreign Worker Program - Hot issues

- 4.a. Temporary Foreign Worker Program (TFWP)

- 4.b. Work permits

- 4.c. Recognized employer pilot

- 4.d. Temporary Foreign Worker Program (TFWP) inspections

- 4.e. Temporary Foreign Worker Program (TFWP) operations - Labour Market Impact Assessment processing

- 4.f. Workforce solutions roadmap

- 4.g. Temporary Foreign Worker (TFW) accommodations

- Labour Market - Hot issues

- Students - Hot issues

- Estimates

1. Opening remarks

1.a. Minister's opening remarks

Speaking notes for the Honourable Randy Boissonnault, Minister of Employment, Workforce Development and Official Languages for Appearance before the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) in relation to the Main Estimate 2024-25 & Supps C 2023-24 - House of Commons.

May 6, 2024

Check against delivery.

Good morning/afternoon, Mr. Chair, and committee members.

Let me start by acknowledging that we are gathered on the traditional unceded territory of the Algonquin Anishinaabeg People. (if not already said). Thank you for inviting me today. It's a welcome opportunity for me to highlight the progress being made on developing Canada's future workforce-and our plans for overcoming the challenges we face.

We're all familiar with the challenges. The grey tsunami. An exodus of older workers leaving the work force quicker than we can replace them. The need for green collar workers of the future to be skilled in a world of automation, digitization, and generative Artificial Intelligence.

In a nutshell, we are faced with a rapid loss of experienced workers, coupled with a shortfall of workers equipped with the skill sets that will help drive the increase in productivity needed for a strong economy.

I didn't come here to be the voice of doom and gloom. Far from it. Our fundamentals are in great shape. International investors love us. It's why we've got the third highest foreign direct investment in the world right now. Divide that by our population and we're number one-ahead of all our G7 allies.

I have limited time, so I'd like to highlight a few items of special interest. And of course, I'd like to shine a light on some Budget 2024 measures.

We're working to bring more workers into the labour force. We're already supporting students with grants and interest-free loans. We intend to increase that with $1.1 billion in new funding. And programs like the Student Work Placement Program and Canada Summer Jobs are helping students and employers both to find "the right fit".

And for the skilled trades, we invest nearly $1 billion annually in apprenticeship supports through grants, loans, tax credits, Employment Insurance benefits during in-school training, project funding, and support for the Red Seal program.

Equity-deserving groups-women, persons with disabilities, Indigenous people, members of the 2SLGBTQI+ communities, newcomers, and racialized communities-are under-represented in the labour force.

We're unlocking their potential. We're supporting employers who hire from these groups. We're supporting training and opportunities for women in the skilled trades. And in Budget 2024, we announced our intention to invest $99.4 million each year through the co-developed Indigenous Skills and Employment Training Program to help Indigenous Peoples improve their skills and find better employment.

We're also reducing barriers for newcomers to join the workforce by recognizing their credentials, especially in the healthcare and construction sectors. We aim to speed up Foreign Credential Recognition across the country with a $50 million investment through Budget 2024.

As for those disruptions related to evolving technologies, we're working on that, too. We intend to support workers in industries that may be affected by artificial intelligence to provide new skills training, with a Budget 2024 investment of $50 million over four years.

Sustainable jobs

The labour force of the future is all about sustainable jobs and the opportunities those green collar jobs will offer Canadian workers.

Achieving our net-zero goals will depend on a workforce equipped with the right skills.

Mr. Chair, it's exactly why we tabled Bill C-50, the Canadian Sustainable Jobs Act-to ensure Canada meets its net-zero goals, without leaving workers behind.

The Government of Canada recently launched the Sustainable Jobs Training Fund, to support a series of training projects that will help over 15,000 workers upgrade or gain new skills for jobs in the low-carbon economy.

The Government will also launch a new Union Training and Innovation Program (UTIP) Sustainable Jobs stream under the Canadian Apprenticeship Strategy in the coming months, and is expected to benefit over 20,000 apprentices and journeypersons in the skilled trades.

I've seen the incredible work by unions, businesses, polytechnics, schools and institutions to train up the twenty-first century workforce. Our continued support for those efforts is essential to delivering on the great promise of Canada.

Thank you, Mr. Chair and committee members. I'll happily answer any and all questions.

-30-

2. Background information

2.a. Parliamentary environment scenario note

Overview

The Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) has invited you to appear in view of its study of the Supplementary Estimates (C), 2023-2024 and Main Estimates 2024-2025.

Committee proceedings

Your appearance is scheduled to take place on May 6, 2024, from 3:30 p.m. until 4:30 p.m. and will be followed by Minister Beech for the second panel on that day. Other ESDC Ministers will appear at earlier and later dates.

You will be accompanied by:

- Paul Thompson, Deputy Minister

- Tina Namiesniowski, Senior Associate Deputy Minister

- Brian Leonard, Director General and Deputy Chief Financial Officer

You have no outstanding follow up written responses due to the Committee.

HUMA has agreed that questioning of witnesses would be allocated as follows:

In round one, there are six minutes for each party in the following order:

- Conservative Party

- Liberal Party

- Bloc Québécois

- New Democratic Party

For the second and subsequent rounds, the order and time for questioning is as follows:

- Conservative Party, 5 minutes;

- Liberal Party, 5 minutes;

- Bloc Québécois, 2 and a half minutes;

- New Democratic Party, 2 and a half minutes;

- Conservative Party, 5 minutes; and

- Liberal Party, 5 minutes.

Parliamentary environment

HUMA members have consistently shown an interest in a number of your files, and as such, the range of questions you are expected to receive is quite broad but should coalesce around the five following themes:

Employment Insurance has been a consistent topic of discussion at HUMA and is expected to be the source of many questions, notably on:

- Employment Insurance modernization - maternity and parental benefits

- Employment Insurance Board of Appeal

- Covid benefit recovery

Temporary Foreign Worker Program

- Temporary Foreign Worker Inspections

- Adjustment to temporary measures under the Temporary Foreign Worker Program Workforce Solutions Road Map effective May 1, 2024

Implications of AI Technologies for the Canadian Labour Force: the committee has held a number of meetings on this topic and is currently drafting its report which is expected to be tabled shortly.

Labour Market Shortages:

- Potential rising unemployment

- Skilled trade workers to fill labour and skills shortages

Learning: ESDC officials were recently before the Standing Senate Committee on National Finance, and Senators had several questions pertaining to learning files.

- Canada Student Financial Assistance Program - debt write-off in the Supplementary Estimates (C)

- Skilled Trades Awareness and Readiness Program - funding

2.b. Placemat on Canada's socio-economic situation

List of acronyms

- BOC - Bank of Canada

- CMHC - Canada Mortgage and Housing Corporation

- CPI - Consumer Price Index

- GDP - gross domestic product

- LFS - Labour Force Survey

- MBM-N - Northern Market Basket Measure

- OECD - Organisation for Economic Co-operation and Development

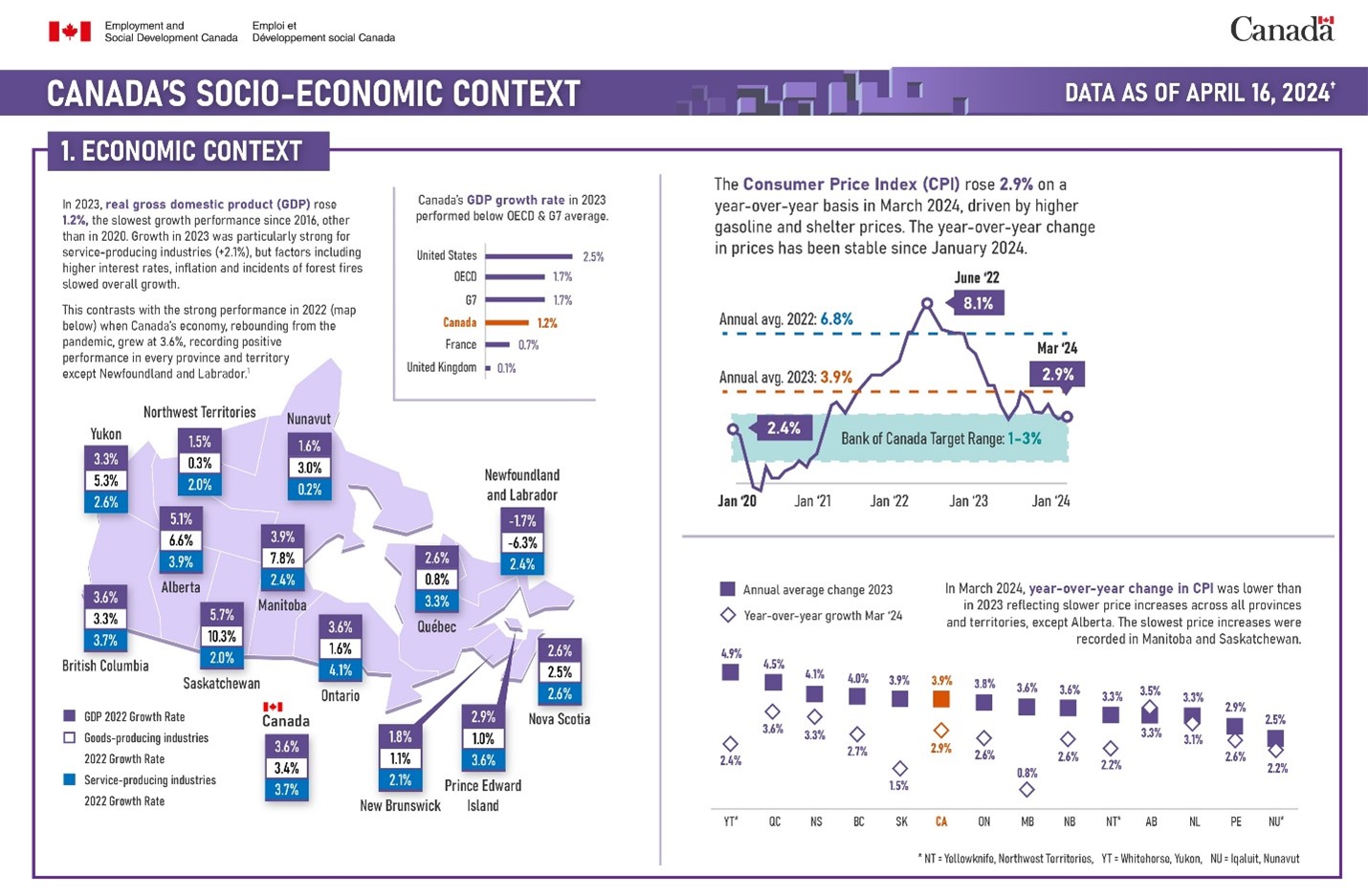

Canada's socio-economic context: economic context

Text description: Figure 1

Canada's socio-economic context: economic context (Data as of April 16, 2024*)

In 2023, real gross domestic product (GDP) rose 1.2%, the slowest growth performance since 2016, other than in 2020. Growth in 2023 was particularly strong for service-producing industries (+2.1%), but factors including higher interest rates, inflation and incidents of forest fires slowed overall growth.

This contrasts with the strong performance in 2022 when Canada's economy, rebounding from the pandemic, grew at 3.6%, recording positive performance in every province and territory except Newfoundland and Labrador.1

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Geography | GDP growth rate, 2022 (%) | GDP Goods-producing industries growth rate, 2022 (%) | GDP Service-producing industries growth rate, 2022 (%) |

|---|---|---|---|

| Canada | 3.6 | 3.4 | 3.7 |

| Newfoundland and Labrador | -1.7 | -6.3 | 2.4 |

| Prince Edward Island | 2.9 | 1.0 | 3.6 |

| Nova Scotia | 2.6 | 2.5 | 2.6 |

| New Brunswick | 1.8 | 1.1 | 2.1 |

| Quebec | 2.6 | 0.8 | 3.3 |

| Ontario | 3.6 | 1.6 | 4.1 |

| Manitoba | 3.9 | 7.8 | 2.4 |

| Saskatchewan | 5.7 | 10.3 | 2.0 |

| Alberta | 5.1 | 6.6 | 3.9 |

| British Columbia | 3.6 | 3.3 | 3.7 |

| Yukon | 3.3 | 5.3 | 2.6 |

| Northwest Territories | 1.5 | 0.3 | 2.0 |

| Nunavut | 1.6 | 3.0 | 0.2 |

Data source: Statistics Canada. Table 36-10-0402-02 Gross domestic product (GDP) at basic prices, by industry, provinces and territories, growth rates (x 1,000,000)

Canada's GDP growth rate in 2023 performed below OECD & G7 average.

| Country | GDP growth rate, (%) 2023 |

|---|---|

| United States | 2.5 |

| OECD | 1.7 |

| G7 | 1.7 |

| Canada | 1.2 |

| France | 0.7 |

| United Kingdom | 0.1 |

Data sources:

- Statistics Canada. Table 36-10-0434-03 Gross domestic product (GDP) at basic prices, by industry, annual average (x 1,000,000);

- Organisation for Economic Co-operation and Development (OECD). Quarterly real GDP growth

The Consumer Price Index (CPI) rose 2.9% on a year-over-year basis in March 2024, driven by higher gasoline and shelter prices. The year-over-year change in prices has been stable since January 2024.

| Period | Annual change in CPI (%) | Average annual change in CPI, 2022 (%) | Average annual change in CPI, 2023 (%) | Bank of Canada target (%) |

|---|---|---|---|---|

| January 2020 | 2.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| February 2020 | 2.2 | 6.8 | 3.9 | 1.0 - 3.0 |

| March 2020 | 0.9 | 6.8 | 3.9 | 1.0 - 3.0 |

| April 2020 | -0.2 | 6.8 | 3.9 | 1.0 - 3.0 |

| May 2020 | -0.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| June 2020 | 0.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| July 2020 | 0.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| August 2020 | 0.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| September 2020 | 0.5 | 6.8 | 3.9 | 1.0 - 3.0 |

| October 2020 | 0.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| November 2020 | 1.0 | 6.8 | 3.9 | 1.0 - 3.0 |

| December 2020 | 0.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| January 2021 | 1.0 | 6.8 | 3.9 | 1.0 - 3.0 |

| February 2021 | 1.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| March 2021 | 2.2 | 6.8 | 3.9 | 1.0 - 3.0 |

| April 2021 | 3.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| May 2021 | 3.6 | 6.8 | 3.9 | 1.0 - 3.0 |

| June 2021 | 3.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| July 2021 | 3.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| August 2021 | 4.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| September 2021 | 4.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| October 2021 | 4.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| November 2021 | 4.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| December 2021 | 4.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| January 2022 | 5.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| February 2022 | 5.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| March 2022 | 6.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| April 2022 | 6.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| May 2022 | 7.7 | 6.8 | 3.9 | 1.0 - 3.0 |

| June 2022 | 8.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| July 2022 | 7.6 | 6.8 | 3.9 | 1.0 - 3.0 |

| August 2022 | 7.0 | 6.8 | 3.9 | 1.0 - 3.0 |

| September 2022 | 6.9 | 6.8 | 3.9 | 1.0 - 3.0 |

| October 2022 | 6.9 | 6.8 | 3.9 | 1.0 - 3.0 |

| November 2022 | 6.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| December 2022 | 6.3 | 6.8 | 3.9 | 1.0 - 3.0 |

| January 2023 | 5.9 | 6.8 | 3.9 | 1.0 - 3.0 |

| February 2023 | 5.2 | 6.8 | 3.9 | 1.0 - 3.0 |

| March 2023 | 4.3 | 6.8 | 3.9 | 1.0 - 3.0 |

| April 2023 | 4.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| May 2023 | 3.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| June 2023 | 2.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| July 2023 | 3.3 | 6.8 | 3.9 | 1.0 - 3.0 |

| August 2023 | 4.0 | 6.8 | 3.9 | 1.0 - 3.0 |

| September 2023 | 3.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| October 2023 | 3.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| November 2023 | 3.1 | 6.8 | 3.9 | 1.0 - 3.0 |

| December 2023 | 3.4 | 6.8 | 3.9 | 1.0 - 3.0 |

| January 2024 | 2.9 | 6.8 | 3.9 | 1.0 - 3.0 |

| February 2024 | 2.8 | 6.8 | 3.9 | 1.0 - 3.0 |

| March 2024 | 2.9 | 6.8 | 3.9 | 1.0 - 3.0 |

Data source: Prepared from Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted

In March 2024, year-over-year change in CPI was lower than in 2023 reflecting slower price increases across all provinces and territories, except Alberta. The slowest price increases were recorded in Manitoba and Saskatchewan.

| Geography | Annual average, 2023 (%) | Year-over-year growth, March 2024 (%) |

|---|---|---|

| Canada | 3.9 | 2.9 |

| Newfoundland and Labrador | 3.3 | 3.1 |

| Prince Edward Island | 2.9 | 2.6 |

| Nova Scotia | 4.1 | 3.3 |

| New Brunswick | 3.6 | 2.6 |

| Quebec | 4.5 | 3.6 |

| Ontario | 3.8 | 2.6 |

| Manitoba | 3.6 | 0.8 |

| Saskatchewan | 3.9 | 1.5 |

| Alberta | 3.3 | 3.5 |

| British Columbia | 4.0 | 2.7 |

| Whitehorse, Yukon | 4.9 | 2.4 |

| Yellowknife, Northwest Territories | 3.3 | 2.2 |

| Iqaluit, Nunavut | 2.5 | 2.2 |

Data source: Prepared from Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted

Note:

1. 2023 annual data on gross domestic product for Provinces and Territories are expected later in 2024.

Canada's socio-economic context: key labour market issues

Text description: Figure 2

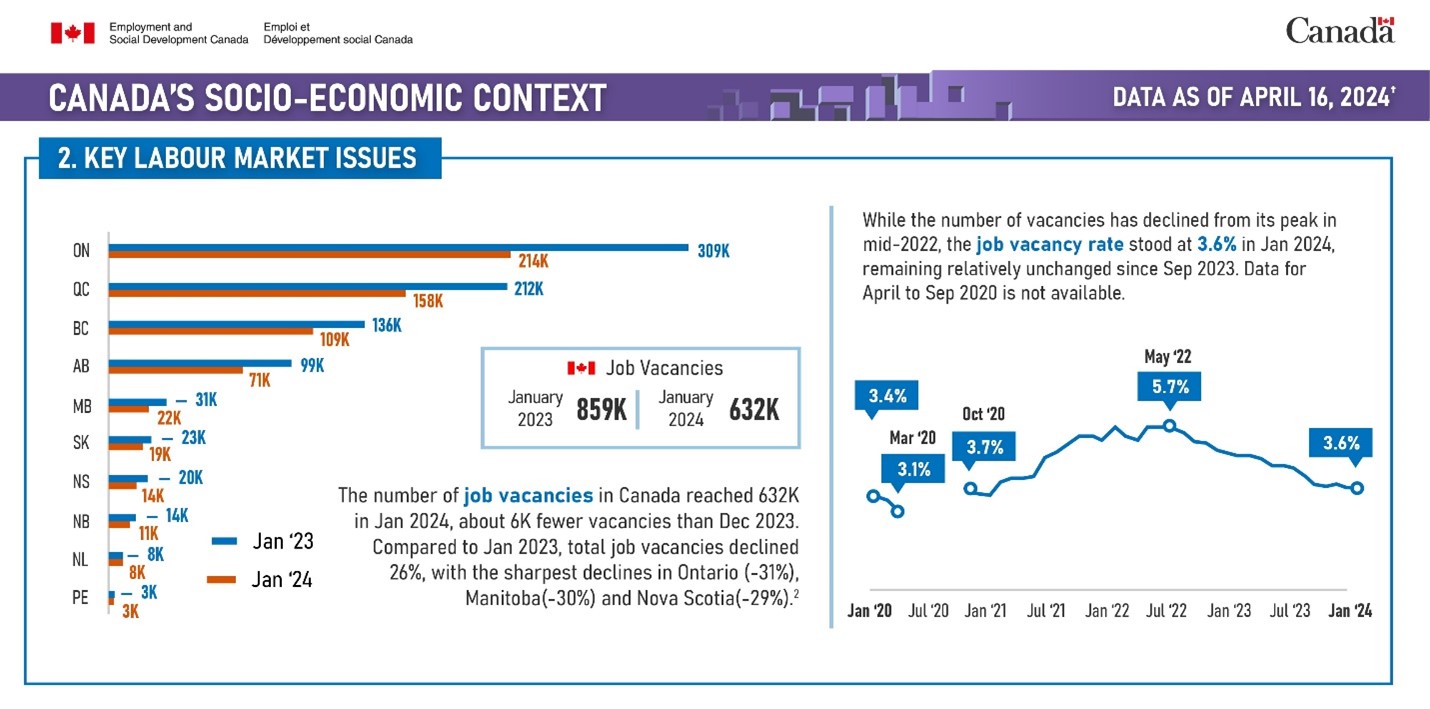

Canada's socio-economic context: key labour market issues (Data as of April 16 2024*)

The number of job vacancies in Canada reached 632,000 in January 2024, about 6,000 fewer vacancies than December 2023. Compared to January 2023, total job vacancies declined -26%, with the sharpest declines in Ontario (-31%), Manitoba (-30%) and Nova Scotia (-29%).2

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Geography | January 2023 | January 2024 |

|---|---|---|

| Canada | 858,820 | 632,105 |

| Newfoundland and Labrador | 7,560 | 7,520 |

| Prince Edward Island | 3,430 | 2,695 |

| Nova Scotia | 20,150 | 14,290 |

| New Brunswick | 14,365 | 11,230 |

| Quebec | 212,420 | 157,500 |

| Ontario | 308,635 | 213,955 |

| Manitoba | 30,765 | 21,620 |

| Saskatchewan | 23,165 | 18,510 |

| Alberta | 98,730 | 71,490 |

| British Columbia | 135,945 | 109,425 |

Data source: Statistics Canada. Table 14-10-0432-01 Job vacancies, payroll employees, and job vacancy rate by provinces and territories, monthly, adjusted for seasonality

While the number of vacancies has declined from its peak in mid-2022, the job vacancy rate stood at 3.6% in January 2024, remaining relatively unchanged since September 2023. Data for April to September 2020 is not available.

| Period | Job vacancy rate (%) |

|---|---|

| January 2020 | 3.5 |

| February 2020 | 3.4 |

| March 2020 | 3.2 |

| April 2020 | Not available |

| May 2020 | Not available |

| June 2020 | Not available |

| July 2020 | Not available |

| August 2020 | Not available |

| September 2020 | Not available |

| October 2020 | 3.7 |

| November 2020 | 3.6 |

| December 2020 | 3.6 |

| January 2021 | 3.6 |

| February 2021 | 3.9 |

| March 2021 | 4.1 |

| April 2021 | 4.1 |

| May 2021 | 4.2 |

| June 2021 | 4.8 |

| July 2021 | 4.9 |

| August 2021 | 5.2 |

| September 2021 | 5.4 |

| October 2021 | 5.4 |

| November 2021 | 5.3 |

| December 2021 | 5.7 |

| January 2022 | 5.4 |

| February 2022 | 5.3 |

| March 2022 | 5.7 |

| April 2022 | 5.7 |

| May 2022 | 5.7 |

| June 2022 | 5.6 |

| July 2022 | 5.5 |

| August 2022 | 5.2 |

| September 2022 | 5.2 |

| October 2022 | 5.0 |

| November 2022 | 4.9 |

| December 2022 | 4.8 |

| January 2023 | 4.8 |

| February 2023 | 4.7 |

| March 2023 | 4.5 |

| April 2023 | 4.5 |

| May 2023 | 4.4 |

| June 2023 | 4.2 |

| July 2023 | 4.0 |

| August 2023 | 3.9 |

| September 2023 | 3.6 |

| October 2023 | 3.7 |

| November 2023 | 3.7 |

| December 2023 | 3.6 |

| January 2024 | 3.6 |

Data source: Statistics Canada. Table 14-10-0432-01 Job vacancies, payroll employees, and job vacancy rate by provinces and territories, monthly, adjusted for seasonality

Note:

2. According to Statistics Canada, data for Territories should be used with caution or are sometimes too unreliable to be published.

Canada's socio-economic context: financial and housing pressures

Text description: Figure 3

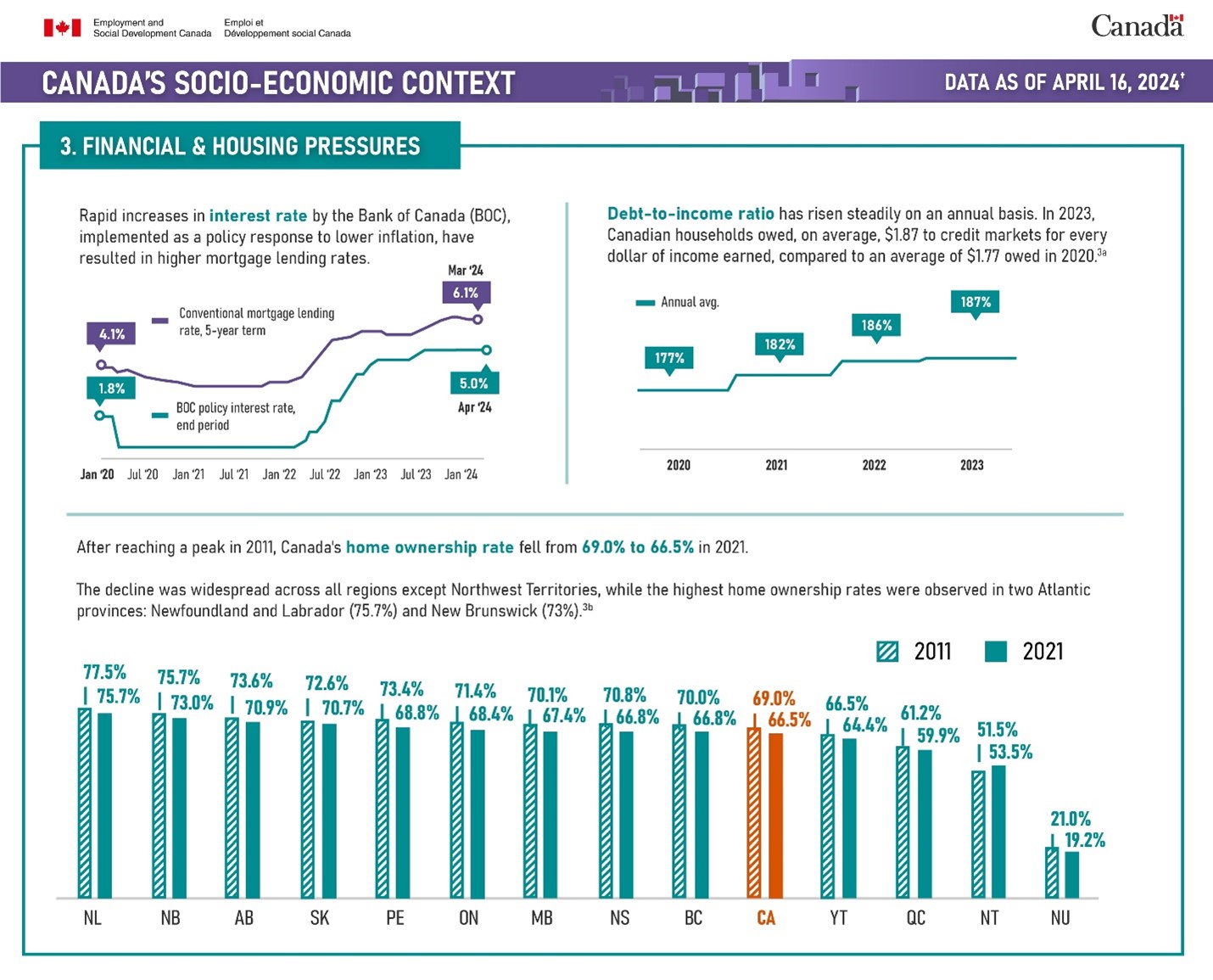

Canada's socio-economic context: financial & housing pressures (Data as of April 16, 2024*)

Rapid increases in interest rate by the Bank of Canada (BOC), implemented as a policy response to lower inflation, have resulted in higher mortgage lending rates.

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Period | Bank of Canada Policy Interest rate, end-period (%) | Conventional mortgage lending rate, 5-year term (%) |

|---|---|---|

| January 2020 | 1.8 | 4.1 |

| February 2020 | 1.8 | 4.1 |

| March 2020 | 0.3 | 3.9 |

| April 2020 | 0.3 | 4.0 |

| May 2020 | 0.3 | 3.9 |

| June 2020 | 0.3 | 3.8 |

| July 2020 | 0.3 | 3.6 |

| August 2020 | 0.3 | 3.6 |

| September 2020 | 0.3 | 3.5 |

| October 2020 | 0.3 | 3.5 |

| November 2020 | 0.3 | 3.4 |

| December 2020 | 0.3 | 3.3 |

| January 2021 | 0.3 | 3.3 |

| February 2021 | 0.3 | 3.3 |

| March 2021 | 0.3 | 3.3 |

| April 2021 | 0.3 | 3.3 |

| May 2021 | 0.3 | 3.3 |

| June 2021 | 0.3 | 3.3 |

| July 2021 | 0.3 | 3.2 |

| August 2021 | 0.3 | 3.2 |

| September 2021 | 0.3 | 3.2 |

| October 2021 | 0.3 | 3.3 |

| November 2021 | 0.3 | 3.4 |

| December 2021 | 0.3 | 3.5 |

| January 2022 | 0.3 | 3.4 |

| February 2022 | 0.3 | 3.6 |

| March 2022 | 0.5 | 3.8 |

| April 2022 | 1.0 | 4.2 |

| May 2022 | 1.0 | 4.6 |

| June 2022 | 1.5 | 5.1 |

| July 2022 | 2.5 | 5.5 |

| August 2022 | 2.5 | 5.6 |

| September 2022 | 3.3 | 5.6 |

| October 2022 | 3.8 | 5.8 |

| November 2022 | 3.8 | 5.9 |

| December 2022 | 4.3 | 5.9 |

| January 2023 | 4.5 | 5.9 |

| February 2023 | 4.5 | 5.8 |

| March 2023 | 4.5 | 5.8 |

| April 2023 | 4.5 | 5.8 |

| May 2023 | 4.5 | 5.7 |

| June 2023 | 4.8 | 5.9 |

| July 2023 | 5.0 | 6.0 |

| August 2023 | 5.0 | 6.2 |

| September 2023 | 5.0 | 6.3 |

| October 2023 | 5.0 | 6.4 |

| November 2023 | 5.0 | 6.5 |

| December 2023 | 5.0 | 6.4 |

| January 2024 | 5.0 | 6.3 |

| February 2024 | 5.0 | 6.2 |

| March 2024 | 5.0 | 6.1 |

| April 2024 | 5.0 | 6.1 |

Data sources:

- Statistics Canada. Table 34-10-0145-01 Canada Mortgage and Housing Corporation, conventional mortgage lending rate, 5-year term;

- Bank of Canada, Policy interest rate

Debt-to-income ratio has risen steadily on an annual basis. In 2023, Canadian households owed, on average, $1.87 to credit markets for every dollar of income earned, compared to an average of $1.77 owed in 2020.3a

| Period | Debt -to-Income ratio annual average (%) |

|---|---|

| 2020 | 177 |

| 2021 | 182 |

| 2022 | 186 |

| 2023 | 187 |

Data source: Prepared from Statistics Canada. Table 36-10-0664-01 Distributions of household economic accounts, wealth indicators, by characteristic, Canada, quarterly

After reaching a peak in 2011, Canada's home ownership rate fell from 69.0% to 66.5% in 2021. The decline was widespread across all regions except Northwest Territories, while the highest home ownership rates were observed in two Atlantic provinces: Newfoundland and Labrador (75.7%) and New Brunswick (73%).3b

| Geography | Abbreviation | Home ownership rate, 2011 (%) | Home ownership rate, 2021 (%) |

|---|---|---|---|

| Canada | CA | 69.0 | 66.5 |

| Newfoundland and Labrador | NL | 77.5 | 75.7 |

| Prince Edward Island | PE | 73.4 | 68.8 |

| Nova Scotia | NS | 70.8 | 66.8 |

| New Brunswick | NB | 75.7 | 73.0 |

| Quebec | QC | 61.2 | 59.9 |

| Ontario | ON | 71.4 | 68.4 |

| Manitoba | MB | 70.1 | 67.4 |

| Saskatchewan | SK | 72.6 | 70.7 |

| Alberta | AB | 73.6 | 70.9 |

| British Columbia | BC | 70 | 66.8 |

| Yukon | YT | 66.5 | 64.4 |

| Northwest Territories | NT | 51.5 | 53.5 |

| Nunavut | NU | 21.0 | 19.2 |

Data source: Statistics Canada`s National Household Survey, 2011 (5178), and Census of population 2021 (3901).

Note:

3a. The annual average data is derived from data published on quarterly basis. Data for 2023 includes up to Q3.

3b. The decline in homeownership rates from 2011 to 2021 was attributable to the number of renter households (+21.5%) growing at over twice the pace of owner households (+8.4%).

Canada's socio-economic context: demographic & labour market outcomes

Text description: Figure 4

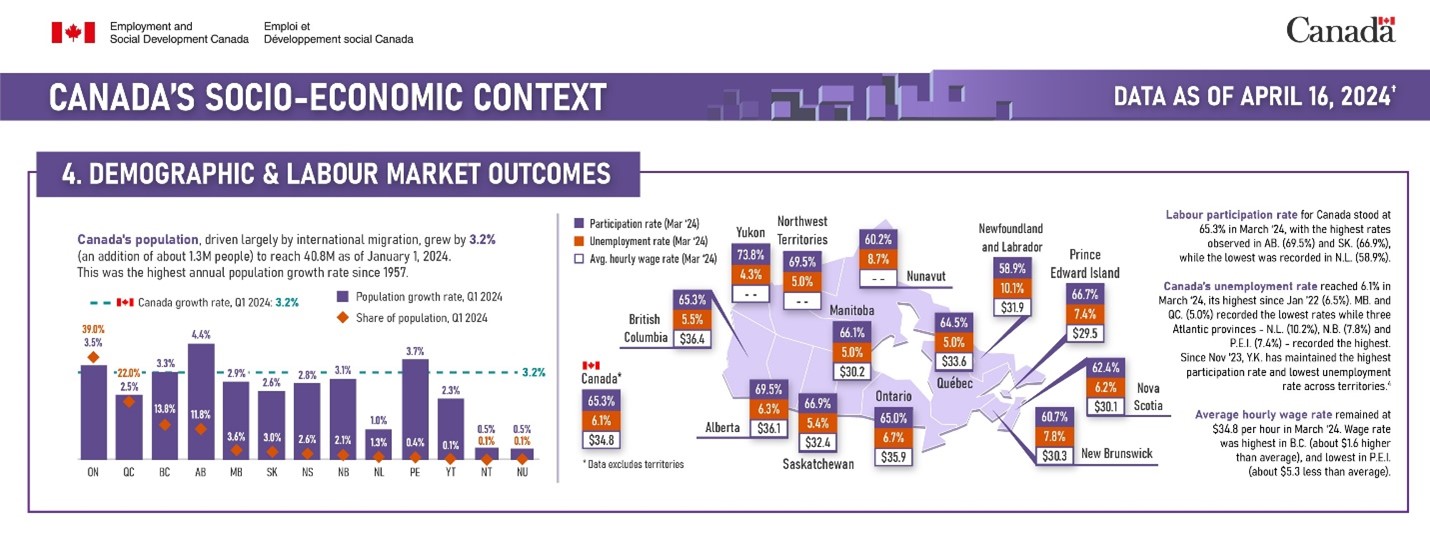

Canada's socio-economic context: demographic & labour market outcomes (Data as of April 16, 2024*)

Canada's population, driven largely by international migration, grew by 3.2% (an addition of about 1.3M people) to reach 40.8M as of January 1, 2024. This was the highest annual population growth rate since 1957.

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Geography | Abbreviation | Population growth rate, Q1 2024 (%) | Canada growth rate, Q1 2024 (%) | Share of population, Q1 2024 (%) |

|---|---|---|---|---|

| Canada | CA | 3.2 | 3.2 | 100.0 |

| Newfoundland and Labrador | NL | 1.0 | 3.2 | 1.3 |

| Prince Edward Island | PE | 3.7 | 3.2 | 0.4 |

| Nova Scotia | NS | 2.8 | 3.2 | 2.6 |

| New Brunswick | NB | 3.1 | 3.2 | 2.1 |

| Quebec | QB | 2.5 | 3.2 | 22.0 |

| Ontario | ON | 3.5 | 3.2 | 39.0 |

| Manitoba | MB | 2.9 | 3.2 | 3.6 |

| Saskatchewan | SK | 2.6 | 3.2 | 3.0 |

| Alberta | AB | 4.4 | 3.2 | 11.8 |

| British Columbia | BC | 3.3 | 3.2 | 13.8 |

| Yukon | YT | 2.3 | 3.2 | 0.1 |

| Northwest Territories | NT | 0.5 | 3.2 | 0.1 |

| Nunavut | NU | 0.5 | 3.2 | 0.1 |

Data source: Statistics Canada. Table 17-10-0009-01 Population estimates, quarterly

- Labour participation rate for Canada stood at 65.3% in March 2024, with the highest rates observed in Alberta (69.5%) and Saskatchewan (66.9%), while the lowest was recorded in Newfoundland and Labrador (58.9%).

- Canada's unemployment rate reached 6.1% in March 2024, its highest since January 2022 (6.5%). Manitoba and Quebec (5.0%) recorded the lowest rates while three Atlantic provinces - Newfoundland and Labrador (10.2%), New Brunswick (7.8%) and Prince Edward Island (7.4%) - recorded the highest. Since November 2023, Yukon has maintained the highest participation rate and lowest unemployment rate across territories.4

- Average hourly wage rate remained at $34.8 per hour in March 2024. Wage rate was highest in British Columbia (about $1.6 higher than average), and lowest in Prince Edward Island (about $5.3 less than average).

| Geography | Unemployment rate, March 2024 (%) | Participation rate, March 2024 (%) | Average hourly wage rate, March 2024 (current $) |

|---|---|---|---|

| Canada | 6.1 | 65.3 | 34.8 |

| Newfoundland and Labrador | 10.1 | 58.9 | 31.9 |

| Prince Edward Island | 7.4 | 66.7 | 29.5 |

| Nova Scotia | 6.2 | 62.4 | 30.1 |

| New Brunswick | 7.8 | 60.7 | 30.3 |

| Quebec | 5.0 | 64.5 | 33.6 |

| Ontario | 6.7 | 65.0 | 35.9 |

| Manitoba | 5.0 | 66.1 | 30.2 |

| Saskatchewan | 5.4 | 66.9 | 32.4 |

| Alberta | 6.3 | 69.5 | 36.1 |

| British Columbia | 5.5 | 65.3 | 36.4 |

| Yukon | 4.3 | 73.8 | Not available |

| Northwest Territories | 5 | 69.5 | Not available |

| Nunavut | 8.7 | 60.2 | Not available |

Data sources:

- Statistics Canada. Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months

- Statistics Canada. Table 14-10-0292-01 Labour force characteristics by territory, three-month moving average, seasonally adjusted and unadjusted, last 5 months

- Statistics Canada. Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality

Note:

4. Data for Provinces and Territories are not comparable due to different collection periods and methodologies. Further, Labour Force Survey (LFS) data does not include Indigenous people living on-reserve. Data are for both sexes, age 15 and over. Hourly wage rate data is unadjusted for seasonality.

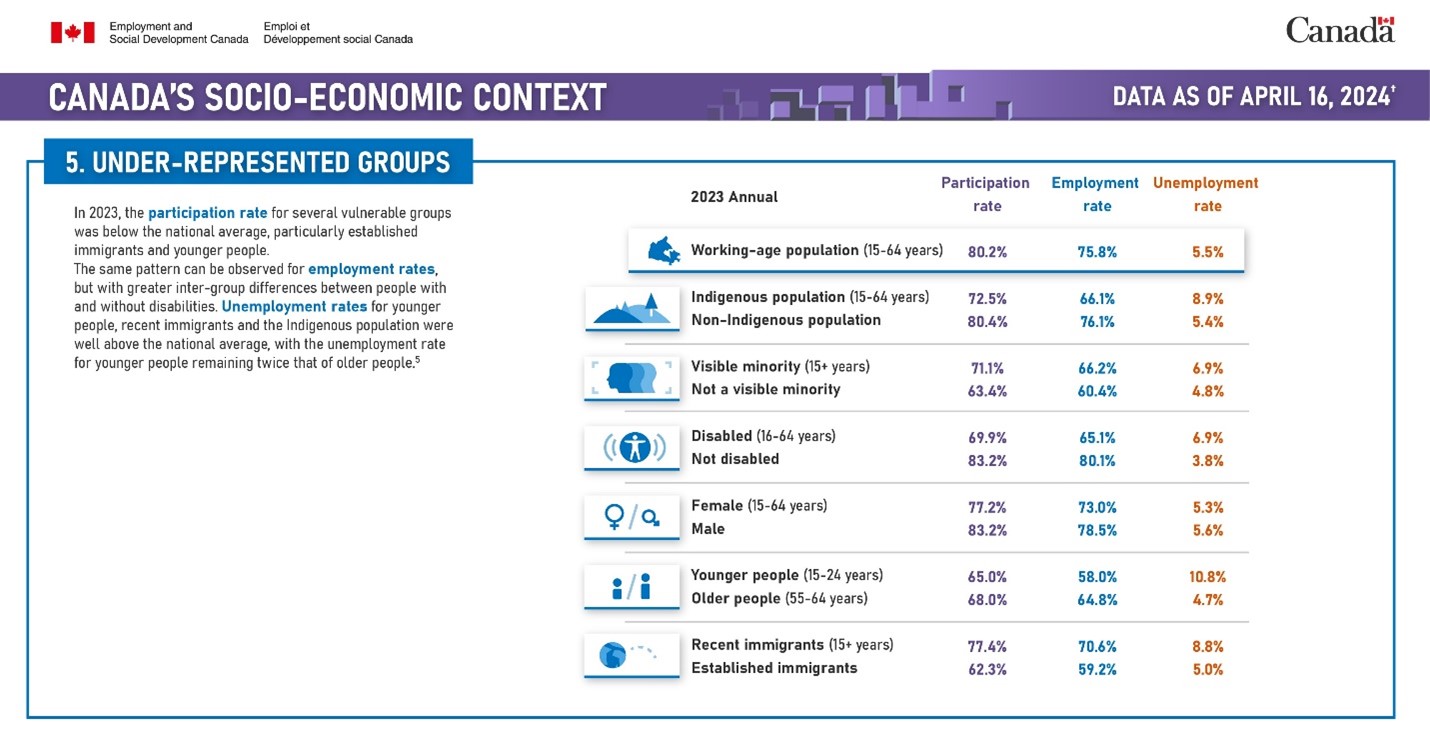

Canada's socio-economic context: under-represented groups

Text description: Figure 5

Canada's socio-economic context: under-represented groups (Data as of April 16, 2024*)

In 2023, the participation rate for several vulnerable groups was below the national average, particularly established immigrants and younger people. The same pattern can be observed for employment rates, but with greater inter-group differences between people with and without disabilities. Unemployment rates for younger people, recent immigrants and the Indigenous population were well above the national average, with the unemployment rate for younger people remaining twice that of older people.5

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Under-represented group | Participation rate, annual 2023 (%) | Employment rate, annual 2023 (%) | Unemployment rate, annual 2023 (%) |

|---|---|---|---|

| Working - age population (15-64 years) | 80.2 | 75.8 | 5.5 |

| Indigenous population (15-64 years) | 72.5 | 66.1 | 8.9 |

| Non-Indigenous population | 80.4 | 76.1 | 5.4 |

| Visible Minority (15 years and over) | 71.1 | 66.2 | 6.9 |

| Not a visible minority | 63.4 | 60.4 | 4.8 |

| Disabled (16-64 years) | 69.9 | 65.1 | 6.9 |

| Not disabled | 83.2 | 80.1 | 3.8 |

| Female (15-64 years) | 77.2 | 73.0 | 5.3 |

| Male | 83.2 | 78.5 | 5.6 |

| Younger people (15-24 years) | 65.0 | 58.0 | 10.8 |

| Older people (55-64 years) | 68.0 | 64.8 | 4.7 |

| Recent immigrants (15 years and over) | 77.4 | 70.6 | 8.8 |

| Established immigrants | 62.3 | 59.2 | 5.0 |

Data sources:

- Statistics Canada. Table 14-10-0327-01 Labour force characteristics by sex and detailed age group, annual

- Statistics Canada. Table 14-10-0365-01 Labour force characteristics by region and detailed Indigenous group

- Statistics Canada. Table 14-10-0440-01 Labour force characteristics by visible minority group, annual

- Statistics Canada Labour Force Survey (3701), Canadian Income Survey (5200) and Labour Market and Socio-economic Indicators (5377), Table 1 , Table 2

- Statistics Canada. Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months

- Statistics Canada. Table 14-10-0083-01 Labour force characteristics by immigrant status, annual

Note:

5. Estimates are percentages, rounded to the nearest tenth. Data for each group is presented in annual form for comparability as follows:

- Indigenous population - 15 -64 years, both sexes, annual 2023.

- Visible minority population - 15 years and over, both sexes, annual. 2023. Statistics Canada is replacing the term "visible minority" with "racialized group" but it is used here for reporting consistency.

- Disabled population - 16-64 years, both sexes, annual 2023.

- Gender - 15-64 years, annual 2023.

- Younger workers - 15-24 years, both sexes, annual 2023.

- Older workers - 55 -64 years, both sexes, average for January to December 2023.

- Immigration status - 15 years and over, both sexes, annual 2023.

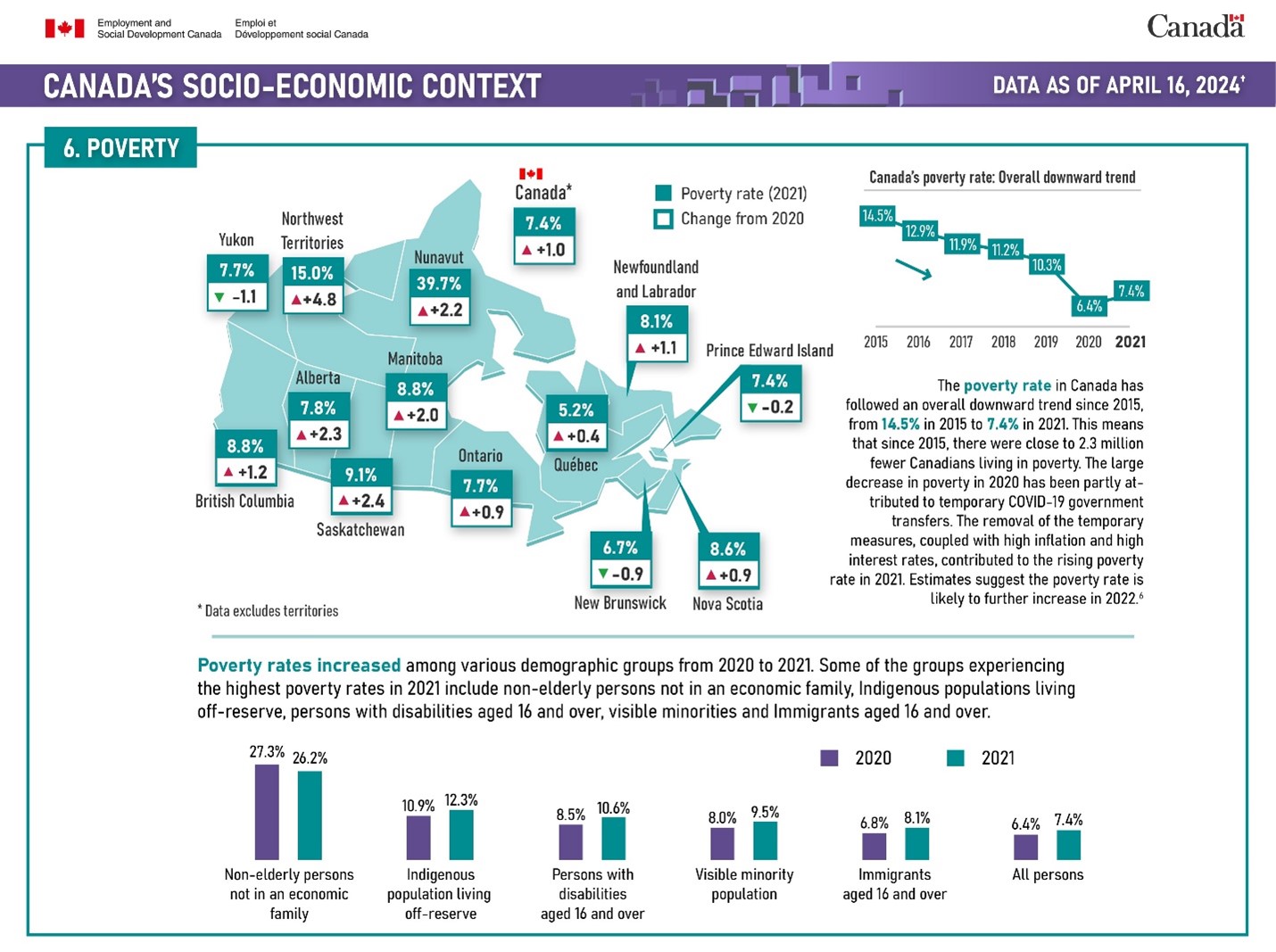

Canada's socio-economic context: poverty

Text description: Figure 6

Canada's socio-economic context: poverty (Data as of April 16, 2024*)

The poverty rate in Canada has followed an overall downward trend since 2015, from 14.5% in 2015 to 7.4% in 2021. This means that since 2015, there were close to 2.3 million fewer Canadians living in poverty. The large decrease in poverty in 2020 has been partly attributed to temporary COVID-19 government transfers. The removal of the temporary measures, coupled with higher inflation, contributed to the rising poverty rate in 2021. Estimates suggest the poverty rate is likely to further increase in 2022.6

*Note:

This document presents an overview of the socio-economic context of Canada's provinces and territories as at a given date, with emphasis on regional perspectives wherever possible. All data sources are from Statistics Canada unless otherwise noted, and reported at different frequencies depending on availability.

| Geography | Poverty rate, 2021 (%) | Change from 2020 (percentage points) |

|---|---|---|

| Canada | 7.4 | 1.0 |

| Newfoundland and Labrador | 8.1 | 1.1 |

| Prince Edward Island | 7.4 | -0.2 |

| Nova Scotia | 8.6 | 0.9 |

| New Brunswick | 6.7 | -0.9 |

| Quebec | 5.2 | 0.4 |

| Ontario | 7.7 | 0.9 |

| Manitoba | 8.8 | 2.0 |

| Saskatchewan | 9.1 | 2.4 |

| Alberta | 7.8 | 2.3 |

| British Columbia | 8.8 | 1.2 |

| Yukon | 7.7 | -1.1 |

| Northwest Territories | 15 | 4.8 |

| Nunavut | 39.7 | 2.2 |

Data sources:

- Statistics Canada. Table 11-10-0135-01 Low income statistics by age, sex and economic family type

- Statistics Canada`s Canadian Income Survey: Territorial estimates, Poverty rate for territories, 2020, 2021

Canada's poverty rate: Overall downward trend

| Period | Canada's Official Poverty rate (%) |

|---|---|

| 2015 | 14.5 |

| 2016 | 12.9 |

| 2017 | 11.9 |

| 2018 | 11.2 |

| 2019 | 10.3 |

| 2020 | 6.4 |

| 2021 | 7.4 |

Data source: Statistics Canada. Table 11-10-0135-01 Low income statistics by age, sex and economic family type,

Poverty rates increased among various demographic groups from 2020 to 2021. Some of the groups experiencing the highest poverty rates in 2021 include non-elderly persons not in an economic family, Indigenous populations living off-reserve, persons with disabilities aged 16 and over, visible minorities and Immigrants aged 16 and over.

| Demographic group | Poverty rate, 2020 (%) | Poverty rate, 2021 (%) |

|---|---|---|

| Non-elderly persons not in an economic family | 27.3 | 26.2 |

| Indigenous population living off-reserve | 10.9 | 12.3 |

| Persons with disabilities aged 15 and over | 8.5 | 10.6 |

| Visible minority population | 8.0 | 9.5 |

| Immigrants aged 15 years and over | 6.8 | 8.1 |

| All persons | 6.4 | 7.4 |

Data sources:

- Statistics Canada. Table 11-10-0135-01 Low income statistics by age, sex and economic family type,

- Statistics Canada. Table 11-10-0090-01 Poverty and low-income statistics by disability status,

- Statistics Canada. Table 11-10-0093-01 Poverty and low-income statistics by selected demographic characteristics

Note:

6. According to the Northern Market Basket Measure (MBM-N), 20.2% of the population living in the territories (about 24,200 people), were below the poverty line in 2021, up from 18.1% in 2020. More recent data from Statistics Canada are not available. The next update of the Canadian Income Survey for 2022 is expected spring 2024.

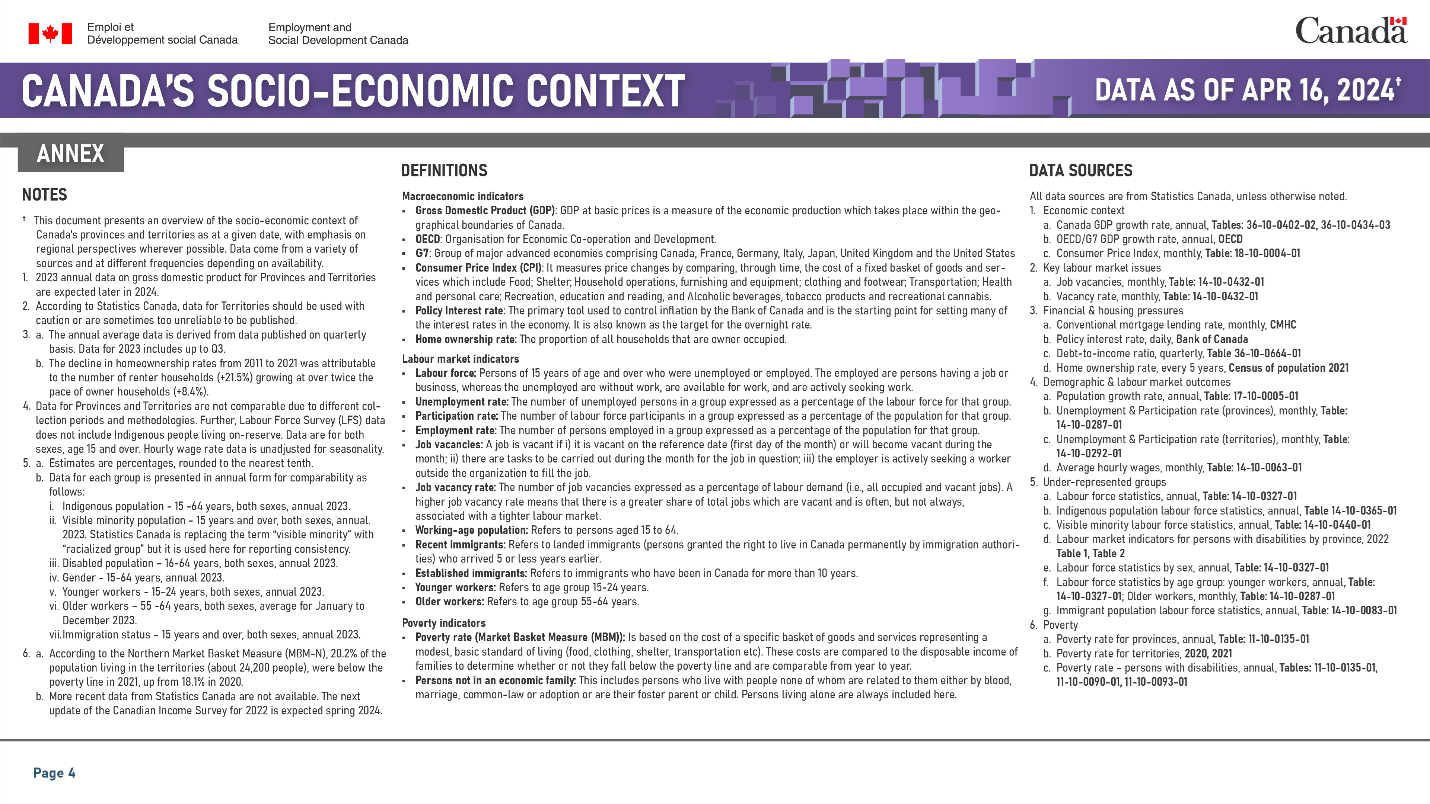

Canada's socio-economic context: annex

Text description: Figure 7

Canada's socio-economic context: annex

Definitions

- Macroeconomic indicators

-

- Gross Domestic Product (GDP):

- GDP at basic prices is a measure of the economic production which takes place within the geographical boundaries of Canada.

- OECD:

- Organisation for Economic Co-operation and Development.

- G7:

- Group of major advanced economies comprising Canada, France, Germany, Italy, Japan, United Kingdom and the United States

- Consumer Price Index (CPI):

- It measures price changes by comparing, through time, the cost of a fixed basket of goods and services which include Food; Shelter; Household operations, furnishing and equipment; clothing and footwear; Transportation; Health and personal care; Recreation, education and reading, and Alcoholic beverages, tobacco products and recreational cannabis.

- Policy Interest rate:

- The primary tool used to control inflation by the Bank of Canada and is the starting point for setting many of the interest rates in the economy. It is also known as the target for the overnight rate.

- Home ownership rate:

- The proportion of all households that are owner occupied.

-

- Labour market indicators

-

- Labour force:

- Persons of 15 years of age and over who were unemployed or employed. The employed are persons having a job or business, whereas the unemployed are without work, are available for work, and are actively seeking work.

- Unemployment rate:

- The number of unemployed persons in a group expressed as a percentage of the labour force for that group.

- Participation rate:

- The number of labour force participants in a group expressed as a percentage of the population for that group.

- Employment rate:

- The number of persons employed in a group expressed as a percentage of the population for that group.

- Job vacancies:

- A job is vacant if i) it is vacant on the reference date (first day of the month) or will become vacant during the month; ii) there are tasks to be carried out during the month for the job in question; iii) the employer is actively seeking a worker outside the organization to fill the job.

- Job vacancy rate:

- The number of job vacancies expressed as a percentage of labour demand (i.e., all occupied and vacant jobs). A higher job vacancy rate means that there is a greater share of total jobs which are vacant and is often, but not always, associated with a tighter labour market.

- Working-age population:

- Refers to persons aged 15 to 64.

- Recent immigrants:

- Refers to landed immigrants (persons granted the right to live in Canada permanently by immigration authorities) who arrived 5 or less years earlier.

- Established immigrants:

- Refers to immigrants who have been in Canada for more than 10 years.

- Younger workers:

- Refers to age group 15-24 years.

- Older workers:

- Refers to age group 55-64 years.

-

- Poverty indicators

-

- Poverty rate (Market Basket Measure (MBM)):

- Is based on the cost of a specific basket of goods and services representing a modest, basic standard of living (food, clothing, shelter, transportation etc). These costs are compared to the disposable income of families to determine whether or not they fall below the poverty line and are comparable from year to year.

- Persons not in an economic family:

- This includes persons who live with people none of whom are related to them either by blood, marriage, common-law or adoption or are their foster parent or child. Persons living alone are always included here.

-

Data sources

All data sources are from Statistics Canada, unless otherwise noted.

- Economic context

- Canada GDP growth rate, annual, Tables 36-10-0402-02, 36-10-0434-03

- OECD/G7 GDP growth rate, annual, 36-10-0434-03; OECD

- Consumer Price Index, monthly, Table 18-10-0004-01

- Key labour market issues

- Job vacancies, monthly, Table 14-10-0432-01

- Vacancy rate, monthly, Table 14-10-0432-01

- Financial & housing pressures

- Conventional mortgage lending rate, monthly, CMHC

- Policy interest rate, daily, Bank of Canada

- Debt-to-income ratio, quarterly, Table 36-10-0664-01

- Home ownership rate, every 5 years, Census of population 2021

- Demographic & labour market outcomes

- Population growth rate, annual, Table 17-10-0009-01

- Unemployment & Participation rate (provinces), monthly, Table 14-10-0287-01

- Unemployment & Participation rate (territories), monthly, Table 14-10-0292-01

- Average hourly wages, monthly, Table 14-10-0063-01

- Under-represented groups

- Labour force statistics, annual, Table 14-10-0327-01

- Indigenous population labour force statistics, annual, Table 14-10-0365-01

- Visible minority labour force statistics, annual, Table 14-10-0440-01

- Labour market indicators for persons with disabilities by province, 2022, Table 1, Table 2

- Labour force statistics by sex, annual, Table 14-10-0327-01

- Labour force statistics by age group: younger workers, annual, Table 14-10-0327-01; Older workers, monthly, Table 14-10-0287-01

- Immigrant population labour force statistics, annual, Table 14-10-0083-01

- Poverty

- Poverty rate for provinces, annual, Table 11-10-0135-01

- Poverty rate for territories, 2020, 2021

- Poverty rate - selected groups, annual, Tables 11-10-0135-01, 11-10-0090-01, 11-10-0093-01

2.c. Mandate letter tracker

Overview of Minister Boissonnault's Mandate Letter Commitments - May 6, 2024

Train 5,000 to 50,000 new Personal Support Workers

Train 5,000 to 50,000 new Personal Support Workers - Progress 1

The Government is taking a holistic approach to fulfilling this commitment through its existing suite of skills and training programs and initiatives. To begin with, as announced in the 2020 Fall Economic Statement, the Government is currently funding a $38.5 million pilot project to help address labour shortages in long-term and home care.

The Long Term and Home Care Pilot Project continues to provide training. As of October 2023, there were 2,000 students in online training. 1,427 students have received paid work placements, 822 have already graduated and 129 are pursuing PSW certification.

Additionally, it is estimated that approximately 2,500 Personal Support Workers benefit from the Labour Market Transfer Agreements for training purposes each year. This means that up to 7,500 Personal Support Workers could be trained through these agreements by October 2025. The Future Skills Centre also supports the training of personal support workers through investments in 3 projects, which are expected to benefit up to 150 personal support workers.

In addition to training opportunities, a National Occupational Standard for Personal Support Workers has been developed. It serves as a set of voluntary guidelines to address skills gaps within the occupation as well as inconsistencies across jurisdictions. It can be used as a guideline to create workplace standards, performance expectations, and as the basis for developing training curriculum.

Train 5,000 to 50,000 new Personal Support Workers - Next steps 2

The Department continues collaborate with Health Canada and provinces and territories to explore other opportunities to train Personal Support Workers.

Budget 2024 proposed a Sectoral Table on the Care Economy that will consult and provide recommendations to the federal government on concrete actions to better support the care economy, including personal support workers.

Budget 2024 also announced the Government's intention to launch consultations on the development of a National Caregiving Strategy.

Develop and implement a plan to modernize the EI system for the 21st Century

Develop and implement a plan to modernize the EI system for the 21st Century - Progress 1

Millions of Canadians rely on Canada's Employment Insurance (EI) program every year, including when they find themselves out of work, starting a family, taking time to care for a loved one, or need to get better themselves.

The Government has already taken important steps to improve the program including:

- the extension to EI sickness benefits from 15 to 26 weeks for new claims as of December 18, 2022; and,

- the announcement in the 2023 Fall Economic Statement of a new 15-week shareable EI adoption benefit, meeting a government commitment and making the program more inclusive of working parents.

While taking steps to build a more inclusive modernized EI, the Government has continued to provide supports for workers and employers in seasonal industries, making additional weeks of EI regular benefits available to seasonal claimants in 13 EI regions. These temporary measures will help to inform the longer-term improvements to the EI program for seasonal workers.

Develop and implement a plan to modernize the EI system for the 21st Century - Next steps 2

Work continues to explore options for improvements to the EI program. Informed by what was heard during 2 years of consultations, work is underway to build an EI program that is simpler, more responsive to the needs of workers and employers, and financially sustainable.

Budget 2024 proposed to extend previous changes to Employment Insurance-which provided up to 5 additional weeks of support (for a maximum of 45 weeks) for eligible seasonal workers in 13 targeted economic regions-until October 2026. The cost of this measure is estimated at $263.5 million over 4 years, starting in 2024-2025.

Implement a new EI benefit for self-employed Canadians

Implement a new EI benefit for self-employed Canadians - Progress 1

Informed by lessons learned from the pandemic and what was heard during the 2 years of EI consultations, work is underway to improve the EI program and ensure the program remains financially sustainable.

Implement a new EI benefit for self-employed Canadians - Next steps 2

The Government will continue to explore options for improvements to the EI program, which will take into consideration the realities of self-employed workers.

Implement a new EI benefit for adoptive parents

Implement a new EI benefit for adoptive parents - Progress 1

The 2023 Fall Economic Statement announced a new 15-week shareable EI adoption benefit, at an estimated cost of $48.1 million over 6 years, starting in 2023-24, and $12.6 million per year ongoing.

Amendments to the Employment Insurance Act and the Canada Labour Code were introduced on November 30, 2023, in the Fall Economic Statement Implementation Act, 2023 (Bill C-59), which is currently under consideration by Parliament.

Implement a new EI benefit for adoptive parents - Next steps 2

The Government will continue to work towards the implementation of the EI benefit for parents through adoption or surrogacy, including support for the legislative process.

The benefit is expected to provide approximately 1,700 Canadian families each year with additional time and flexibility as they carry out the responsibilities related to the placement of children or arrival of a newborn under their care and will make the program more inclusive for various types of Canadian families, including 2SLGBTQI+ parents and families.

Implement a new Career Insurance Benefit for long-tenured workers

Implement a new Career Insurance Benefit for long-tenured workers - Progress 1

Informed by lessons learned from the pandemic and what was heard during the 2 years of EI consultations, work is underway to improve the EI program and ensure the program remains financially sustainable.

Implement a new Career Insurance Benefit for long-tenured workers - Next steps 2

The Department will continue to explore options for improvements to the EI program, which will take into consideration the specific needs of long-tenured workers.

Increase the repayment assistance threshold to $50,000 for Canada Student Loan borrowers who are single and make appropriate adjustments to the thresholds for other family sizes

Increase the repayment assistance threshold to $50,000 for Canada Student Loan borrowers who are single and make appropriate adjustments to the thresholds for other family sizes - Progress 1

The Government of Canada has recently introduced a number of measures to make student loan repayment more affordable, including:

- Enhancement of the Repayment Assistance Plan (RAP) by increasing the zero-payment income threshold from $25,000 to $40,000 for a single person, with commensurate adjustments for larger family sizes; indexing the zero-payment thresholds to inflation annually; and lowering the cap on student loan repayments from 20% to 10% of gross family income. The thresholds have already been indexed once (currently $42,720) and will be indexed again effective August 1, 2024 (expected to increase to $44,388). RAP enhancement started in November 2023.

- The elimination of the accrual of interest on Canada Student Loans as of April 1, 2024;

- On August 1, 2022, expansion of eligibility for disability-related supports - including for borrowers in repayment - to include student loan borrowers with persistent or prolonged disabilities.

In fall 2023, the Government completed consultations with provinces and territories on the path forward to improve repayment supports.

Increase the repayment assistance threshold to $50,000 for Canada Student Loan borrowers who are single and make appropriate adjustments to the thresholds for other family sizes - Next step 2

The Government is committed to ensuring that post-secondary education is affordable and student debt is manageable for more borrowers, particularly those early in their careers who are earning less income than other workers, as well as those starting families, which adds to their financial obligations.

The changes to the disability definition, the RAP enhancements, and the elimination of interest provide a phased approach to improving RAP, the impacts of which will not be evident for several years.

The Government is working to advance this commitment in a way that complements other recent program enhancements, including giving consideration to the timing and sequencing of implementation which would require regulatory amendments and program delivery changes, in partnership with provincial/territorial governments and service delivery partners.

Allow new parents to pause repayment of their federal student loans until their youngest child reaches the age of five

Allow new parents to pause repayment of their federal student loans until their youngest child reaches the age of five - Progress 1

The Government of Canada has recently introduced a number of measures to make student loan repayment more affordable, including:

- Enhancement of the Repayment Assistance Program (RAP) by increasing the zero-payment income threshold from $25,000 to $40,000 for a single person with commensurate adjustments for larger family sizes, indexing the zero-payment thresholds to inflation annually, and lowering the cap on student loan repayments from 20% to 10% of gross family income. The thresholds have already been indexed once (currently $42,720) and will be indexed again effective August 1, 2024 (expected to increase to $44,388). RAP enhancement started in November 2023.

- The elimination of the accrual of interest on Canada Student Loans as of April 1, 2024;

- On August 1, 2022, expansion of eligibility for disability-related supports - including for borrowers in repayment - to include student loan borrowers with persistent or prolonged disabilities.

In fall 2023, the Government completed consultations with provinces and territories on the path forward to improve repayment supports.

Allow new parents to pause repayment of their federal student loans until their youngest child reaches the age of five - Next steps 2

The Government is committed to ensuring that post-secondary education is affordable and student debt is manageable for more borrowers, particularly those early in their careers who are earning less income than other workers, as well as those starting families, which adds to their financial obligations.

The August 2022 changes to the disability definition, the November 2022 RAP enhancements and the April 2023 elimination of interest provide a phased approach to changing RAP, the impacts of which will not be evident for several years. In particular, the 2022 RAP enhancements and the annual indexation of RAP thresholds for larger family sizes are expected to benefit families with young children.

The Government is working to advance this commitment in a way that complements other recent program enhancements, including giving consideration to the timing and sequencing of implementation which would require regulatory amendments and program delivery changes, in partnership with provincial/territorial governments and service delivery partners.

Improve access to health care and social services in rural communities through amendments to the Canada Student Loans Forgiveness program for medical practitioners working in rural or remote areas

Improve access to health care and social services in rural communities through amendments to the Canada Student Loans Forgiveness program for medical practitioners working in rural or remote areas - Progress 1

Budget 2022 included funding to implement the 50% increase, starting in 2023-24. After regulatory approval, this measure was implemented in November 2023.

Funding received through Budget 2023 will expand loan forgiveness to a greater number of rural communities, including all communities with populations of 30,000 or less. Pending regulatory approval, the measure will be implemented in 2024-2025.

Improve access to health care and social services in rural communities through amendments to the Canada Student Loans Forgiveness program for medical practitioners working in rural or remote areas - Next steps 2

The Government is committed to improving access to health care and social services in underserved rural and remote communities.

Budget 2024 announced the Government's intent to introduce amendments to the Canada Student Financial Assistance Act and the Canada Student Loans Act to permanently expand the reach of the Canada Student Loan Forgiveness Program to more health care and social services professionals working in rural and remote communities. This measure is estimated to cost $253.8 million over 4 years, starting in 2025-2026, plus $84.3 million per year ongoing.

The Canada Student Financial Assistance Program is consulting with its third-party service provider to determine the impact the proposed changes would have on existing systems and processes, and to identify potential solutions to administer an expanded benefit.

Supported by the Minister of Energy and Natural Resources, launch a Clean Jobs Training Centre to help workers across sectors upgrade or gain new skills

Supported by the Minister of Energy and Natural Resources, launch a Clean Jobs Training Centre to help workers across sectors upgrade or gain new skills - Progress 1

The 2022 Fall Economic Statement proposed to provide $250 million to fund several measures focusing on skills for a net-zero economy, including funding for Sustainable Jobs Training Centre. The Centre will bring together workers, unions, employers, and training institutions across the country to examine the skills of the labour force today, forecast future skills requirements, and help 15,000 workers upgrade or gain new skills for jobs in a low-carbon economy.

The Sustainable Jobs Training Centre, now labelled as a Fund, will focus on training 15,000 workers in specific areas in high demand, starting with Low-Carbon Energy and Carbon Management, Green Buildings and Retrofits and Electric Vehicle Maintenance and Charging Infrastructure.

Supported by the Minister of Energy and Natural Resources, launch a Clean Jobs Training Centre to help workers across sectors upgrade or gain new skills - Next steps 2

The Call for proposals for the Sustainable Jobs Training Fund in 2024 was launched on March 8, 2024, and will be open until May 15, 2024.

Projects are expected to start in winter 2024-2025.

Redesign and implement the Canada Training Benefit

Redesign and implement the Canada Training Benefit - Progress 1

The Government is working on an approach for the redesign and implementation of the Canada Training Benefit.

Engagement with key stakeholders was completed in August and September 2022, building on input from the 2019 consultations on the Canada Training Benefit.

Key stakeholders included employers and businesses, labour groups and unions, education and training providers, and not-for-profit organizations.

These consultations revealed broad support for offsetting training costs and general recognition that training is underfunded by governments and employers.

However, participants noted a number of concerns with the initial proposal, for example, that many working adults with training needs would likely not qualify for EI (e.g., part time workers, gig workers).

Bilateral engagement with provinces and territories launched in fall 2022 has concluded.

Redesign and implement the Canada Training Benefit - Next steps 2

Budget 2023 announced a Treasury Board-led cross-government effectiveness review of skills training and youth programming to determine whether improvements can be made to help more Canadians develop the skills and receive the work experience they need to have successful careers. Results of the review will inform future directions to redesign the Canada Training Benefit.

Address gaps in training and upskilling to ensure Canadians can take advantage of sustainable battery industry opportunities

Address gaps in training and upskilling to ensure Canadians can take advantage of sustainable battery industry opportunities - Progress 1

ESDC is working with other departments, such as Innovation, Science and Economic Development Canada and Natural Resources Canada, to support the skills dimension of the sustainable battery industry.

Launched in March 2022, the Sectoral Workforce Solutions Program (SWSP) funded a number of projects which supported various elements of the battery supply chain (e.g., mining, electric vehicles). The projects came to end on March 31, 2024.

In addition, the 2022 Fall Economic Statement proposed to launch a Sustainable Jobs Training Centre (now called Fund) to help workers upgrade or gain new skills for jobs in a low-carbon economy.

The Fund will focus on specific areas in high demand, starting with Low-Carbon Energy and Carbon Management, Green Buildings and Retrofits and Electric Vehicle Maintenance and Charging Infrastructure.

Address gaps in training and upskilling to ensure Canadians can take advantage of sustainable battery industry opportunities - Next steps 2

The Call for Proposals for the Sustainable Jobs Training Fund in 2024 was launched on March 8, 2024, and will be open until May 15, 2024.

Projects are expected to start in winter 2024-2025.

ESDC will continue to support the government's efforts to develop Canada's battery industry from a skills perspective, including by funding projects on electric vehicles and charging infrastructure through the Sustainable Jobs Training Fund.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, establish a Trusted Employer system for Canadian companies hiring temporary foreign workers

Supported by the Minister of Immigration, Refugees and Citizenship Canada, establish a Trusted Employer system for Canadian companies hiring temporary foreign workers - Progress 1

Budget 2022 announced $29.3 million over 3 years to introduce a Recognized Employer Model under the Temporary Foreign Worker Program, with the objective of reducing red tape for repeat employers in designated occupations with established labour shortages, who meet the highest standards for working and living conditions, worker protections and wages in high-demand fields.

To improve administrative efficiencies, the Recognized Employer Pilot (REP) is testing a more rigorous upfront application process for repeat employers hiring in 84 high-demand occupations. The Pilot also introduces longer Labour Market Impact Assessment (LMIA) validity periods of up to 36 months.

This enables recognized employers to better plan for their long-term labour needs over a 3-year period and reduces the number of LMIA applications needed to hire temporary foreign workers, without undermining worker protections.

Recognized employers will gain access to simplified LMIA applications to address future hiring needs.

Recognized employers will also benefit from a visual identifier on the Temporary Foreign Workers section of Job Bank that shows their recognized status.

The Recognized Employer Pilot was launched on August 8, 2023.

To ensure that employers were able to understand the Pilot's requirements, technical briefings with key program stakeholders took place in late summer and early fall 2024.

Phase 1 intake for primary agriculture employers commenced on September 12, 2023.

On November 22, 2023, the Department introduced a policy variation that allows employers who experienced COVID-19 shutdowns to draw from earlier calendar years to fulfill REP eligibility criteria.

Intake commenced on January 1, 2024, for all other designated occupations (including high-demand sectors, such as tourism, trucking and caregivers).

Supported by the Minister of Immigration, Refugees and Citizenship Canada, establish a Trusted Employer system for Canadian companies hiring temporary foreign workers - Next steps 2

The Recognized Employer Pilot will be evaluated to assess employer uptake, temporary foreign workers' experiences, and administrative efficiencies, and to inform future programming.

To manage application intake volumes and ensure that sufficient resources are available to meet expected employer demands, intake for the REP will close on Sep 16, 2024.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, continue to work with provinces, territories and regulatory bodies to improve foreign credential recognition

Supported by the Minister of Immigration, Refugees and Citizenship Canada, continue to work with provinces, territories and regulatory bodies to improve foreign credential recognition - Progress 1

Through the Foreign Credential Recognition Program, the Government is supporting the labour market integration of skilled newcomers.

Budget 2022 announced an additional $115 million over 5 years, with $30 million ongoing, to expand the Foreign Credential Recognition Program with an initial focus on supporting internationally educated health professionals (IEHPs) integrating into the Canadian labour market.

Since 2020, the Program has invested approximately $144 million in 36 projects focused on the labour market integration of IEHPs, including $89 million in 16 new projects announced in early 2024 to support systems improvements and provide Canadian work experience to IEHPs.

The Program has also issued over $20 million in foreign credential recognition loans as of January 2024, two-thirds of which were borrowers in the health sector.

Immigration, Refugees and Citizenship Canada (IRCC) continues to support our objectives, including advancing occupation specific Educational Credential Assessments and improving communications on foreign credential recognition to newcomers, so that internationally trained professionals can make informed decisions about immigrating to Canada.

Through Budget 2024, the Federal Government called on provinces and territories to expedite removal of their barriers to foreign credential recognition, and to urgently streamline their trades certification standards for interprovincial consistency.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, continue to work with provinces, territories and regulatory bodies to improve foreign credential recognition - Next steps 2

The Federal Government will also continue to engage with provinces, territories, and regulatory bodies to understand their needs and priorities and to share best practices, including those that support IEHPs.

Budget 2024 announced $50 million over 2 years, starting in 2024-2025, to support the Foreign Credential Recognition program. This funding will improve labour mobility and at least half will be used to streamline foreign credential recognition for workers in the construction sector. The remaining funding will support foreign credential recognition in the health sector.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, implement sector-based work permits to ensure the health and safety of temporary foreign workers

Supported by the Minister of Immigration, Refugees and Citizenship Canada, implement sector-based work permits to ensure the health and safety of temporary foreign workers - Progress 1

As part of plans to create a new foreign labour stream for Agriculture and Fish Processing, the Government has initiated consultations with key stakeholders on the design and implementation of measures that include a new sector-based work permit.

The sector-based work permit will help to improve worker protections as it will allow temporary foreign workers to move to another employer (with an approved LMIA) without need to first obtain a new work permit.

The sector-based work permit is a key feature of the foreign labour stream for Agriculture and Fish Processing, which was announced in Budget 2022. This important change will make it more feasible for workers to assert their rights, refuse poor working conditions, leave abusive employers, and better participate in enforcement processes.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, implement sector-based work permits to ensure the health and safety of temporary foreign workers - Next steps 2

The health and safety of temporary foreign workers is of the utmost importance to the Government of Canada. Like every worker in Canada, they deserve to be safe in their workplaces.

Since March 2024, the Government has been engaging with key partners and stakeholders on the design of certain stream features and timelines for implementation. The objective is to obtain detailed feedback on new stream requirements and features by fall 2024 / winter 2025.

This approach will ensure employers and workers have a gradual transition to new TFW Program requirements, limiting any disruption to workers and employers in these sectors.

Significant information technology systems changes and regulatory amendments to the Immigration and Refugee Protections Regulations will be required to implement the new sector-based work permit. The Government continues to advance this work, which first commenced in fall 2023, with the objective of issuing sector-based work permits to temporary foreign workers starting as early as 2027.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, strengthen the inspections regime to ensure the health and safety of temporary foreign workers

Supported by the Minister of Immigration, Refugees and Citizenship Canada, strengthen the inspections regime to ensure the health and safety of temporary foreign workers - Progress 1

Budget 2022 announced $14.6 million in 2022-23, and $3 million in remaining amortization, to improve the quality of employer inspections and hold employers accountable for the treatment of workers.

Budget 2023 provided $48.2 million in funding over 2 years to improve the employer compliance regime under the Temporary Foreign Worker (TFW) Program, including more program inspectors and the maintenance of the worker protection tip line.

The Department has continued strengthening the employer compliance regime by supporting the implementation of the following activities to better ensure the health and safety of foreign workers:

- Improved quality control and review functions, to better detect and correct substantive errors within the inspection process.

- Focusing inspections on high-risk areas and increasing on-site presence.

- A simplified online reporting form for temporary foreign workers and others was created in 2022 to further help report situations of potential abuse or mistreatment.

- An escalation process of any observed health and safety risks to temporary foreign workers to ensure that appropriate stakeholders, authorities and jurisdictions are aware of the situation.

The Government has the authority to suspend the processing of Labour Marker Impact Assessment applications for employers suspected of non-compliance with program requirements, and that non-compliance would, in the event of a work permit being issued, result in a serious risk to the health or safety of a temporary foreign worker.

Outreach and engagement sessions with employers, workers and key stakeholders to increase the awareness of employer obligations under the Program and the rights of temporary foreign workers while they are in Canada.

Supported by the Minister of Immigration, Refugees and Citizenship Canada, strengthen the inspections regime to ensure the health and safety of temporary foreign workers - Next steps 2

The 4-year compliance regime rebuild work is well underway, with the last year of implementation currently planned for 2025-26.

Efforts continue to build on measures including:

- The TFW Program Tip Line and Consulate Liaison Service continue to provide better intelligence that helps to ensure inspections focus on high-risk areas;

- Working on enhancing governance to address emerging issues affecting temporary foreign workers, bringing together stakeholders from policy, program, and service delivery to key interdepartmental and provincial tables to discuss and coordinate cross-cutting and emerging issues affecting the TFW Program; and,

- Continue to improve the quality of inspections, regionally and nationally, supported by a strong quality management plan and multi-year maturity model.

Future plans include the implementation of enhanced inspector training, post-training and quality monitoring processes and tools.

Simplify permit renewals for the Temporary Foreign Workers Program, uphold the two-week processing time and establish an employer hotline

Simplify permit renewals for the Temporary Foreign Workers Program, uphold the two-week processing time and establish an employer hotline - Progress 1

This mandate commitment is shared with the Minister of Immigration, Refugees and Citizenship, as work permit renewals are under his authority. It specifically relates to the Global Talent Stream of the TFW Program.

In April 2022, the maximum work duration for the Global Talent Stream Labour Market Impact Assessment was increased to 3 years, which will mean that fewer work permit renewals will be needed over time, and this allows temporary foreign workers the time they need to pursue permanent residence pathways if they choose to apply.

ESDC consistently meets or exceeds the 10-business day service standard for processing Labour Market Impact Assessments (LMIAs) under the Global Talent Stream.

An Employer contact centre hotline for the Temporary Foreign Worker Program is also already in place. Ongoing departmental modernization initiatives help prioritize higher LMIA application volumes, while improving national consistency in service delivery and processing times. The LMIA online portal became the default application method in April 2023, and over 99% of applications are now submitted online.

Global Skills Strategy (GSS) processing times were significantly reduced in the last year. For example, GSS processing times went from 41 days as of March 11, 2023, to 13 days as of March 9, 2024. This was achieved through strategies allowing for faster and more efficient decision-making, including identifying and grouping applications more efficiently, creating an automated triage tool to help with processing, reducing the burden of unnecessary or duplicative paperwork, and implementing calculated risk management procedures to minimize the need for additional document.

Simplify permit renewals for the Temporary Foreign Workers Program, uphold the two-week processing time and establish an employer hotline - Next steps 2

ESDC will continue to support Immigration, Refugees and Citizenship Canada's ongoing efforts towards reducing processing times for work permit applications under the Global Talent Stream (within 2 weeks, for 80% of applications received), and enhancing client experience for temporary foreign workers in relation to work permit renewals.

Immigration, Refugees and Citizenship Canada will continue to work towards reaching the 14-day processing commitment for the Global Skills Strategy, under the Global Talent Stream, including to introduce new automated tools to help process work permit extension applications.

Supporting the Minister of Agriculture and Agri-Food Canada, develop a sector-specific Agricultural Labour Strategy to address labour shortages

Supporting the Minister of Agriculture and Agri-Food Canada, develop a sector-specific Agricultural Labour Strategy to address labour shortages - Progress 1

The Department has been working with Agriculture and Agri-Food Canada on a path forward to address the Agricultural sector's chronic labour shortages.

The labour market context has improved in the sector - vacancy rates are down and wages have increased. The changes to the Temporary Foreign Worker program have also had a positive impact on addressing labour shortages in the agricultural sector particularly related to meeting demand for seasonal agricultural work.

The results of public consultations on the National Agricultural Labour Strategy can be found in the "What We Heard" report which was published in May 2023.

Supporting the Minister of Agriculture and Agri-Food Canada, develop a sector-specific Agricultural Labour Strategy to address labour shortages - Next steps 2

The Government will continue to advance this important work.

Supporting the Minister of National Resources Canada, move forward with legislation and comprehensive action to achieve a Just Transition

Supporting the Minister of National Resources Canada, move forward with legislation and comprehensive action to achieve a Just Transition - Progress 1

The Government released an interim Sustainable Jobs Plan in February 2023 that outlines ten current and planned actions to ensure Canada's workers and communities succeed in the economy of the future, including the commitment to introduce sustainable jobs legislation.

On June 15, 2023, the Government of Canada introduced Bill C-50, the Canadian Sustainable Jobs Act, which aims to facilitate and promote the creation of sustainable jobs and support workers and communities in Canada as the world advances toward a net-zero future. The bill puts workers and communities at the centre of federal policy and decision-making by establishing a framework for accountability, a governance structure and engagement mechanisms to guide effective federal action. The Bill is currently under consideration by Parliament.

In addition, the Sustainable Jobs Training Fund call for proposals was launched on March 8, 2024. As an action area under the interim Sustainable Jobs Plan, this initiative will support tens of thousands of workers across the country with a range of training projects to upgrade or gain new skills for jobs in the low-carbon economy.

Supporting the Minister of National Resources Canada, move forward with legislation and comprehensive action to achieve a Just Transition - Next steps 2

The Government will continue to advance sustainable jobs related initiatives. This includes advancing legislation and standing up key sustainable jobs mechanisms, notably the Sustainable Jobs Partnership Council and Secretariat, and publishing a Sustainable Jobs Action Plan in 2025, supporting comprehensive action to achieve a sustainable future.

Supporting the Minister of Women and Gender Equality and Youth, carry out the evaluation process of GBA Plus to enhance its framing and parameters

Supporting the Minister of Women and Gender Equality and Youth, carry out the evaluation process of GBA Plus to enhance its framing and parameters - Progress 1

Discussions continue between Women and Gender Equality Canada and other departments on enhancing Gender-Based Analysis Plus.

Supporting the Minister of Women and Gender Equality and Youth, carry out the evaluation process of GBA Plus to enhance its framing and parameters - Next steps 2

Going forward, the Government will continue to support the integration of intersectional analysis in departmental policies and programs by providing training to employees, and partnering with Women and Gender Equality Canada and other departments on knowledge sharing.

Met Commitments

Double the Union Training and Innovation Program and target greater participation from more diverse populations

Date Met 1

March 8, 2024

Note 2

This commitment was met with the approval of the last project under the Union Training and Innovation Program's Stream 2.

Permanently eliminate federal interest on Canada Student Loans and Canada Apprentice Loans

Date Met 1

April 1, 2023

Note 2

This commitment as met on April 1, 2023, when the legislation was put in place to eliminate interest on loans.

Require businesses supported through the Sectoral Workforce Solutions Program to include wrap-around supports

Date Met 1

December 31, 2022

Note 2

This commitment was met on December 31, 2023, when the first round of Sectoral Workforce Solutions Program projects, including wrap-around supports, launched.

Extend EI sickness benefits from 15 to 26 weeks

Date Met 1

December 18, 2022

Note 2

The commitment was met on December 18, 2022, when the changes to the Employment Insurance Act and Canada Labour Code came into force.

Advance the Canadian Apprenticeship Service so that Red Seal apprentices have sufficient work experience opportunities

Date Met 1

August 22, 2022

Note 2

This commitment was met when the new program funds were distributed to recipients on August 22, 2022.

Support the national campaign to promote the skilled trades as first choice careers

Date Met 1

March 31, 2022

Note 2