Departmental plan for fiscal year 2023 to 2024

On this page

- From the Ministers

- Plans at a glance

- Core responsibilities: planned results and resources

- Social Development

- Pensions and Benefits

- Learning, Skills Development and Employment

- Working Conditions and Workplace Relations

- Information Delivery and Services for Other Government Departments

- Internal services: planned results

- Overall Risks and Mitigation Strategies

- Planned spending and human resources

- Planned spending

- ESDC’s financial framework

- Planned human resources

- Estimates by vote

- Future-oriented condensed statement of operations

- Statutory annual reports

- Corporate information

- Organizational profile

- Raison d’être, mandate and role: who we are and what we do

- Operating context

- Reporting framework

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

From the Ministers

Employment and Social Development Canada (ESDC) is proud to present the 2023 to 2024 Departmental Plan.

In the wake of the Department’s extraordinary work to address the pandemic challenges of the past three years, it is more important than ever that we remain focused on helping prepare Canadians to succeed in today’s challenging labour market and delivering the critical programs and services that help improve the standard of living and quality of life for all Canadians.

The job market is changing, making it essential for Canada’s Employment Insurance (EI) program to better adapt to the needs of workers and employers. Consultations with Canadians and lessons learned from the pandemic will help us continue to modernize the EI system.

ESDC is the largest federal service delivery organization in Canada, and the programs and services we deliver are essential and make a difference in the lives of Canadians. Canadians expect high-quality, easy-to-access, simple and secure services, whether offered online, through call centres or in person. Our systems and approaches must be modern, resilient, secure and reliable, so that Canadians can access these programs and services regardless of where they live. Over the past 10 months, Service Canada has made significant strides in restoring access for Canadians to timely and efficient passport services. Since reaching a peak in August 2022, the backlog of passport applications has been virtually eliminated. This year, we will look into every possible option, including new technology, to improve delivery of services to clients, especially for passport services.

Creating a diverse, inclusive and efficient labour market will capitalize on different skill sets, address labour shortages and foster creativity. Through programs such as the Youth Employment and Skills Strategy, the Opportunities Fund for Persons with Disabilities, the Skills for Success Program, the Women’s Employment Readiness pilot program and the Canada Service Corps, we will help Canadians get the skills, training and opportunities they need to find and keep good jobs.

We know pursuing a post-secondary education can add financial pressure on families. Starting April 1, 2023, we will permanently eliminate interest on all federal student and apprentice loans.

To promote equality and diversity, and help identify and eliminate barriers to employment opportunities in federally regulated workplaces, we will continue our work to modernize the Employment Equity Act and advance new pay transparency measures that will shine a light on pay gaps experienced by women, Indigenous peoples, persons with disabilities and members of visible minorities. To improve working conditions in the transportation sector, we’re addressing driver misclassification, which can deny employees important rights, benefits and protections. We’re also moving forward on prohibiting the use of replacement workers. We recently wrapped up consultations and will introduce legislation by the end of 2023.

Workers deserve to feel protected, safe and respected. This year, we ratified International Labour Organization Convention 190, the Violence and Harassment Convention, 2019, the first-ever global treaty to help end violence and harassment in the workplace. This, along with other measures, such as ensuring access to menstrual products and ensuring that mental health is taken as seriously as physical health, will help make workplaces safer and more welcoming for everyone.

To help foreign workers better understand and exercise their rights while living in Canada, we will launch the Migrant Worker Support Program through the Temporary Foreign Worker Program. In addition, to address the health human resource crisis, the Foreign Credential Recognition Program will assist thousands of internationally trained health care professionals to have their credentials recognized and find work in their fields.

Everyone has a right to participate fully in their society, which is why actions under Canada’s Disability Inclusion Action Plan will continue to advance. Through the Opportunities Fund for Persons with Disabilities, we will implement Canada’s Employment Strategy for Persons with Disabilities. As well, the Disability Inclusion Business Council will begin to design and set up a self-governed independent business network to prioritize accessibility and disability inclusion in the workplace. To support financial security, stakeholders will continue to be engaged on the design of the proposed Canada Disability Benefit.

Making life more affordable for all Canadians remains a priority. Through targeted support measures, we will help families cope with the increasing costs of everyday items, such as rising prices at the checkout counter. As we continue to implement a Canada-wide early learning and child care system and reduce fees toward an average of $10 a day, we will provide jobs for workers, many of whom are women, thereby enabling parents, particularly mothers, to reach their full economic potential. We recognize and value the professional early childhood educators who make this system possible. That is why Canada-wide agreements include investments directed toward improving conditions for those working in the regulated child care system. We will also continue collaborating with First Nations, Inuit and Métis Nation governments and organizations to support Indigenous-led early learning and child care programs and services across the country. Additionally, we will continue our engagement with provinces, territories, municipalities, Indigenous partners and stakeholders to explore the development of a national school food policy.

To better serve those most in need and to address inequalities, we will focus on innovative approaches. We will work to enhance the capacity of social purpose organizations through funding programs such as the Supporting Black Canadian Communities Initiative, the New Horizons for Seniors Program and the Social Innovation and Social Finance Strategy. We have also asked the National Seniors Council to serve as an expert panel to provide advice to the federal government on ways to further support older Canadians to age at home.

This summer, Canada will deliver its second Voluntary National Review on the progress made toward implementing the United Nations 2030 Agenda for Sustainable Development. Our programs and policies will continue to support the Sustainable Development Goals and to address today’s social, economic and environmental challenges to build stronger, safer and more inclusive communities that leave no one behind.

With uncertainty about what the future may have in store, one thing is certain: we will continue to focus on ensuring that Canadians have the supports they need when they need it the most.

Minister of Employment, Workforce Development and Disability Inclusion, Carla Qualtrough

Minister of Families, Children and Social Development, Karina Gould

Minister of Labour, Seamus O’Regan Jr.

Minister of Seniors, Kamal Khera

Plans at a glance

Employment and Social Development Canada (ESDC) will help build a stronger and more inclusive Canada. We will continue to focus on programs and planned activities that help Canadians live productive and rewarding lives and improve Canadian’s standard of living. A few examples of this work are listed below.

The department will make sure it supports Canadians as they, and the country, recover from the economic and social impacts of the COVID-19 pandemic. This includes making the labour force more inclusive, so all Canadians can take part. It also includes supports for Canadians who are making hard economic choices as they face high levels of inflation and a labour market that requires a greater range and higher level of skill. Investments in technology will continue as clients’ expectations to access services and supports through digital services continues to grow. Furthermore, programs, such as the Passport Program, will be modernized to improve the delivery of services to clients.

The department will continue to work with the provinces and territories to reduce child care

fees towards an average of $10-a-day and to create 250,000 new regulated child care spaces by March 2026.

Accessible and inclusive communities will be supported through the production of alternate format reading materials. Social Development Partnerships Program - Disability funding will result in the creation of approximately 4,000 new alternate format documents, improving access to reading materials for persons with print disabilities.

Student loan forgiveness will increase for family doctors and nurses who are working in eligible underserved rural and/or remote communities. Nurses may qualify for up to $30,000 in loan forgiveness and doctors up to $60,000 starting this year.

This year, the Indigenous Skills and Employment Training Program will aim to serve at least 40,000 new Indigenous participants and support at least 16,500 Indigenous people find employment. This work will be done using Indigenous-led solutions and self-determination practices through a distinctions-based approach to meet the specific needs of First Nations, Métis and Inuit participants as well as urban and non-affiliated Indigenous people. This supports the department’s ongoing efforts to advance reconciliation with Indigenous peoples.

The Temporary Foreign Worker Program will reduce the administrative burden for trusted repeat employers to hire temporary foreign workers so they can quickly bring in workers to fill short-term labour market gaps. The department will also work to improve the quality, timeliness and reach of inspections to ensure the health and safety of foreign workers as well as continue efforts to rebuild the program’s compliance regime.

Among other contributions, the Age Well at Home initiative will help to provide practical services to low-income or otherwise vulnerable seniors. It will also help seniors navigate and access additional services.

The department will address the misclassification of employees in the road transportation industry to protect Canadian truck drivers in precarious work. This will improve work conditions for thousands of workers including newcomers and racialized Canadians.

This year, the department will continue its delivery of programs and services to each and every Canadian throughout their lives in a significant way.

Operating context

The COVID-19 pandemic is less likely to impact the department’s operations in fiscal year 2023 to 2024 than in previous years. Even so, new challenges will shape the economy and labour market.

In June 2022, inflation reached a 40-year high and by November 2022 the national inflation rate had slowed to 6.8% (year-over-year change). These high levels of inflation are being influenced by domestic and global factors. These factors include labour shortages in Canada, the Russia-Ukraine war, and global supply chain issues resulting in higher prices for energy, food and other goods. While wages increased during this period, their growth has not kept pace with inflation. This has left most households with lower purchasing power. The higher costs of basic necessities, particularly housing, coupled with the phasing-out of pandemic relief supports, are likely to put upward pressure on poverty rates. The Bank of Canada has been increasing its interest rate to counter inflation. These interest rate increases are putting more pressure on household finances, as the cost of borrowing has gone up. In October 2022, the Bank of Canada restated that it expects inflation to decline to around 3% in late 2023.

The Canadian economy has experienced a strong recovery. Real gross domestic product (GDP) surpassed pre-pandemic levels earlier than expected, and grew faster than that of other Organisation for Economic Co-operation and Development and Group of Seven countries in the second quarter of 2022 before slowing to grow at a similar rate in the third quarter of 2022. GDP growth is expected to slow in Canada and around the world in the last quarter of 2022 as well as in 2023. In addition, the risk of recession has risen.

The Canadian labour market has emerged strongly from the COVID-19 pandemic. Employment surpassed pre-pandemic levels and the unemployment rate reached record low levels. Nevertheless, labour market trends that existed before the pandemic continue to impact the economy and Canadians. In recent years, the population has been getting older. There are currently more individuals 65 and over than children under 15 in Canada. With the population aging, the participation rate is still below pre-pandemic levels.

Employers in Canada are facing difficulties filling job vacancies. The number of job vacancies was near-record high at 960,000 in the third quarter of 2022. At that time, there were only 1.1 unemployed persons for every job vacancy, compared to 2.3 in the first quarter of 2020, prior to COVID-19. This indicates that there were fewer unemployed persons available to fill job vacancies. Due in part to a shrinking pool of unemployed workers, employers faced significant hiring challenges leading to a higher number of occupations in shortage. Some of the labour shortages may be temporary. Others are likely a result of factors such as aging population, new technologies and consumer behaviour changes. These factors will continue to put pressure on the labour market in the long-term.

The pool of workers with extensive job-related knowledge and experience will continue to shrink as older workers retire. To reduce labour market pressures, it will be important to integrate new entrants in the Canadian labour market. This includes new immigrants and youth graduating from the Canadian education system. Increasing the labour market participation of underrepresented groups, such as women, persons with disabilities, visible minorities and Indigenous Peoples, is vital to address future labour market needs and for economic growth. It is also important to encourage experienced workers to remain active in the labour market longer.

The labour market will likely continue to require higher levels and greater range of skills. There is also the need for new skill sets to tackle items such as the transition to an economy with net-zero carbon emissions to fight climate change. These challenges, combined with the need for inclusive and sustainable economic growth, are informing the department’s priorities and planned results for fiscal year 2023 to 2024.

Since the onset of the COVID-19 pandemic, the number of Canadians who rely on online interactions with the government has increased. Clients’ expectations for timely, accessible and high-quality digital services will continue to grow, which will lead to further investments in technology and increase the importance of online delivery. Canadians expect their government to be both efficient and also effective in delivering its services and meeting its own service standards. Reducing wait times, minimizing backlogs and increasing processing speeds will remain central to service improvements. The department has already made significant investments and tangible progress has been achieved in addressing technical debt and modernizing Information Technology (IT) legacy infrastructure, which will improve our service performance. This trend will continue.

Apart from the high expectation for enhanced clients online experience and efficient delivery, the challenge of ensuring that all Canadians have access to government programs will still shape the service environment. Canadians need to be able to access these programs regardless of their ability or means to transact online. This will require us to increase our understanding of specific challenges and service barriers that prevent marginalized and underserved populations from receiving the benefits to which they are entitled. Timely and efficient access to accurate information, benefits and supports have a tangible impact on the lives of Canadians, particularly those who are now making hard economic choices.

Also, as demonstrated by the swift implementation of new measures to support Canadians in need during the pandemic and when responding to elevated demand for Passports following a rapid withdrawal of public health restrictions, the need for flexibility, creativity, and innovation in delivering government services will remain as high as ever.

Given this context, and with pandemic-related lessons in mind, the department will focus its efforts on 3 areas:

- technical debt elimination and continued investment in service transformation

- seamless digital service experience for clients

- reaching all Canadians, including the marginalized and underserved, by improving access to benefits to which they are entitled

Service Excellence Highlights

1. Modernizing IT and addressing technical debt

Since the onset of the COVID-19 pandemic, Canadians have increasingly engaged with the government online. Now more than ever, they need secure, high quality, and accessible digital services. The department continues to leverage digital technologies to improve the delivery of its programs and services. This requires addressing the issue of technical debt and modernizing and replacing IT ageing infrastructure. In the fiscal year 2023 to 2024, the department will take several steps to advance IT modernization:

- continue to transform its Information Technology (IT) systems through the Benefits Delivery Modernization Programme. This includes improved readiness of the Common Benefits Delivery platform toenable a modern, standardized, robust and secure foundation for the delivery of benefits to Canadians

- continue to migrate the first benefit, Old Age Security, onto the new Common Benefits Delivery Platform. This new platform will eventually replace the current ageing systems. In future phases of the Benefits Delivery Modernization Programme, the platform will be expanded to include additional benefits, including Employment Insurance and the Canada Pension Plan

- modernize the technology used to deliver teletypewriter (TTY) services to clients. These changes will improve citizens' experience by increasing the number of calls that the department can receive at the same time. It will also increase the number of call centre officers to address clients’ needs

- continue to expand Digital Identity Projects. These projects will provide citizens with immediate and secure access to online services and programs. A key example of this work is the new Trusted Digital Identity Agreement which will allow individuals with Quebec digital (provincial) identities to have access to the department’s service offerings such as Employment Insurance, Canada Pension Plan and Old Age Security, and Canada Student Financial Assistance

- continue to explore the evolution of the systems required to efficiently and effectively support ESDC’s management of Grants and Contributions programming with a client-centered approach

- continue to implement its Network Modernization initiatives and recovery solutions to address technical debt and modernize its systems and infrastructure. This will also improve network performance and reduce the risk to service delivery caused by aging IT

Fall Economic Statement 2022

Proposed investments from the Fall Economic Statement, released in November 2022, also support service excellence:

- Proposed funding of $1.02 billion to Service Canada to process Employment Insurance and Old Age Security claims faster while reducing the Employment Insurance claims backlog. An additional $574 million is proposed to reduce Employment Insurance and Old Age Security call centre wait times

- Proposed funding of $495 million over 6 years to support Old Age Security and Employment Insurance Operations

2. Improving the client service experience and outcomes, supported by increasingly seamless digital services.

Improvements in the quality of services offered to Canadians will continue to be one of the department’s highest priorities. The service delivery landscape is evolving, thus it is essential that we keep abreast of client needs and the latest service preferences. Client service experience matters – it impacts the achievement of program objectives and enhances trust in government. Canadians expect services to be responsive, secure, digitally enabled, and accessible through many service channels. The department will continue to improve service design and delivery by utilizing client feedback. Examples of the work that will improve client service experience are:

- ensuring consistent quality of service design and delivery by collecting client’s feedback:

- Service Canada Labs will allow citizens and those using our services to interact with prototypes before they become live services Feedback from these interactions will improve product and service delivery

- independent professionals from across the government will review Service Canada’s digital services to ensure they meet the Government of Canada Design Standards and deliver value to clients

- the department will monitor and analyse data and user feedback to improve the quality of clients’ and employees’ web and digital experience. The feedback will be used to inform changes to online programs that are served by My Service Canada Account (MSCA) and My Business Account

- understanding clients’ needs and improving services:

- by examining the registration and authentication process used to access My Service Canada Account (MSCA). This work will lead to the implementation of data-driven and measurable improvements so that more individuals are able to access their services through MSCA

- the Life Journey Program will help map the end-to-end user experience of their interaction with Service Canada during major life events

- a community partnership pilot will be established to reach diverse research participants who can inform the design of accessible and inclusive services. This will lead to the development of a common Service Canada Design System focused on meeting the needs of vulnerable users. Recognizing the need to design with accessibility from the start, this pilot will work to provide consistent digital experiences for all clients

- providing authenticated clients on the new My Service Canada Account (MSCA) with the opportunity to test out a ‘beta’ version of the MSCA that has a personalized landing page. This new service, known as the Service Canada Hub(SCH) has a new dashboard that will make it easier for clients to manage their benefits and information. This will be the first step in replacing what clients see when accessing Service Canada through MSCA Account. The beta version of SCH will allow for testing of early assumptions on how clients will engage with the digital channel in the future

- making improvements to the Hosted Contact Centre Solution. The post call survey will invite callers to voluntarily complete a survey on the automated system once they have completed their call. Virtual hold will allow callers to request that the telephone system calls them back once a call centre officer is available. This removes the need for clients to wait on the phone to speak with a client service officer

- examining and implementing every possible option to expedite the intake and processing of passport applications, including modernizing the program, to help Canadians get their passports in a timely way. This will ensure the department maintains its service standards and keeps pace with increased demand

- collaborating with the Northwest Territories on implementing Vital Events Linkages. This initiative provides a secure and timely digital exchange of client vital statistics information between the Social Insurance Number (SIN) program and Vital Statistic Agencies in the provinces and territories. Implementation will start by enabling the sharing of regular death notifications from the territory. Next, the newborn registration service will allow parents to bundle the birth registration of their baby with an application for a SIN. Finally, birth certificate information collected in SIN applications will be validated in real time. Through the sharing of timely and accurate birth and death information, fully established vital events linkages with all provinces and territories will foster enhanced, streamlined, and secure service delivery to Canadians across all jurisdictions, while also reducing administrative burden to those provincial and territorial partners

3. Reaching all Canadians

Improving access to services and benefits for all eligible Canadians will continue to be a priority. More than ever, the department is also committed to increasing its understanding of service barriers that prevent marginalized and underserved Canadians from receiving the benefits to which they are entitled. These most vulnerable clients, including children, low-income seniors, families, and Indigenous communities, are often not aware of available benefits. They have also traditionally faced the most challenges in accessing government services. Over the next year, the department will work on reducing barriers to accessing essential supports and increasing benefit uptake for eligible Canadians by:

- continuing to deliver the Reaching All Canadians initiative:

- working with the Canada Revenue Agency and Statistics Canada to gain insights into hard-to-reach populations and gaps in benefit uptake

- expanding its collaboration with community organizations that are positioned to identify and refer hard-to-reach Canadians to Service Canada for support

- implementing the Accessibility Plan for Client Service. This plan proposes 17 measures to be put in place between 2023 and 2025. The measures are aimed at improving the accessibility of service delivery channels (in-person, online, phone) for persons with disabilities

- improving access to information for underserved populations:

- the Find Support Service will provide information about benefits relevant to a client’s situation. This will help service providers assist vulnerable populations access the services and benefits to which they are entitled

- Estimate Eligibility is an anonymous, self-serve tool. It can be used by Canadian citizens navigating a life event. For example, the death of a partner or retirement. It provides a personalized estimate of the financial support a user may be entitled to depending on their circumstances. Initially this tool will be released for Old Age Security and Guaranteed Income Supplement

- continue to improve access to grants and contributions programs for all Canadians through the following initiatives:

- in 2023 to 2024, the multi-year Grants and Contributions Applicants Client Experience Research project will allow the department to measure client satisfaction and strengthen program design and service delivery based on client feedback

- simplify and streamline the grants and contribution application process

- improve navigation, design and content of the department’s grants and contribution funding web page. The department will improve the user-experience by enhancing its analytical tools. This will allow the department to better anticipate and manage workload and resources across program delivery

- continue implementation of the Youth Digital Gateway (YDG) project to provide youth with information, services, and other supports to help them find a job, build their skills, go to school, participate in training, and serve their communities. The YDG will also support the broader youth ecosystem, including youth-serving organizations that deliver programming funded by the Government of Canada

- expanding the Secure Portal for Verified Partners to stakeholders at the provincial and federal levels who support vulnerable populations in Canada. The portal provides a secure and timely channel for verified users, for example provincial and territorial Public Trustees, to request SIN confirmations, new first-time SINs, and relevant Social Insurance Register information for individuals under their care

Service Canada Regional Service Delivery

Service Canada Regions Service Delivery actively supports the delivery of key government commitments by responding to the needs of citizens in the areas they serve. Through partnerships with the provinces, territories, municipalities, and communities, regional offices deliver a wide array of essential services at hundreds of Service Canada Centres across the country. Service Canada regional offices will continue to expand outreach efforts that take into account clients' evolving needs. This year, Service Canada will pursue the following initiatives in each region:

Western Canada and Territories

- Open the first Passport Operations Centre located in the west. This facility will increase the capacity to process passport applications and ensure business continuity

- Collaborate with Inuit peoples, communities and partners in Nunavut through participation in a co-developed virtual Nunavut Labour Market Forum. The region will work in partnership with the Government of Nunavut, federal funding programs agreement holders and industry representatives. This will help to increase Inuit participation in government employment, reduce competition among service providers situated in Nunavut and streamline employment funding for Indigenous Skills and Employment Training (ISET) and Indigenous Early Learning and Child Care (IELCC) Programs

- Deliver outreach services in partnership with Indigenous communities, other government departments and community partners. This will help to identify gaps in service and increase uptake in federal benefits for Indigenous, remote and rural communities

Ontario Region

- Passport services will be incorporated into the Toronto North York Flagship Service Centre, expanding the existing suite of Flagship Service offerings. The Flagship Client Service Experience will utilize technologies to create a more inclusive environment for both clients and employees. Roving Officers who are equipped with tablets, roving carts and two-way radio headsets will provide clients with the full suite of services without being restricted to a traditional workstation

- Additional expedited passport services at Service Canada Centre locations will be assessed for further expansion. These additional points of service will improve client access to passport services for Canadians in both rural and remote areas

- The region will increase automation and aim for first contact resolution. For example, clients will be able to upload documents to expedite processing for Employment Insurance claims

Quebec Region

- Improve and facilitate access to programs and services for people facing barriers. Region-wide projects will be launched to support liaison and partnership activities and strengthen the relationships with provincial, municipal, community and Indigenous partners through information sharing, meetings, etc.

- In partnership with Indigenous community organizations, various pilot projects will be launched to address the needs of Indigenous people in urban settings. For example, the Montreal urban area will have mobile clinics jointly set up with other federal departments and provincial governments, aiming to break down barriers and improve access to services and benefits.

- To support Indigenous communities and partners, the region will collaborate with innovation labs to co‑develop solutions that will improve access to services, programs and benefits based on the specific needs and aspirations of Indigenous partners.

Atlantic Region

- The Charlottetown Service Canada Centre will be converted to a full Passport Office by January 2024. The services provided will include urgent and express service, and passport printing. This will ensure residents of Prince Edward Island have the same access to passport services as all other provinces

- The region will continue to inspect employers’ compliance to protect the health and safety of temporary foreign workers. Onsite visits will be done in the region, and virtual inspections will be done both inside and outside the region. Additionally, inspections will target industry areas that are more at risk of non-compliance

- Official language accessibility for stakeholders, communities and organizations will be increased. Bilingual capacity will be increased through hiring and second language training

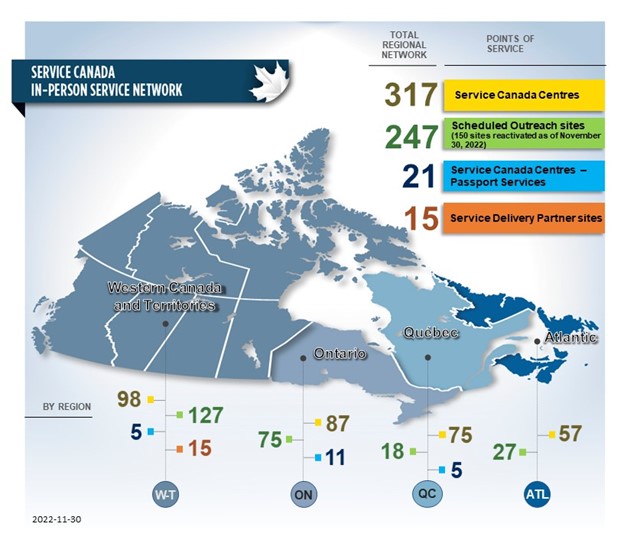

Text description of figure 1

This graphic shows the distribution of Service Canada’s in-person service network by the type of office and regional distribution. Information in the graphic is valid as of November 30, 2022. The offices are distributed as follows:

Service Canada Centres

- Western Canada and Territories: 98

- Ontario: 87

- Québec: 75

- Atlantic: 57

- total: 317

Scheduled Outreach Sites (150 sites reactivated as of November 30, 2022)

- Western Canada and Territories: 127

- Ontario: 75

- Québec: 18

- Atlantic: 27

- total: 247

Service Canada Centres - Passport Service Sites

- Western Canada and Territories: 5

- Ontario: 11

- Québec: 5

- Atlantic: 0

- total: 21

Service Delivery Partner Sites

- Western Canada and Territories: 15

- Ontario: 0

- Québec: 0

- Atlantic: 0

- total: 15

Information in graphic valid as of November 30, 2022.

For more information on Employment and Social Development Canada’s plans, see the “Core responsibilities: planned results and resources” section of this plan.

Core responsibilities: planned results and resources

This section contains information on the department’s planned results and resources for each of its core responsibilities.

Social Development

Description

Increase inclusion and opportunities for participation of Canadians in their communities.

Planning highlights

In fiscal year 2023 to 2024, the department will undertake the following activities to advance this core responsibility.

Affordability of early learning and child care is increased

The department will continue to work with the provinces and territories to increase access to high-quality, affordable, flexible and inclusive early learning and child care. The program will continue to support work to reduce child care fees towards an average of $10-a-day and to create 250,000 new regulated child care spaces by March 2026.

The department will support the work of the newly established National Advisory Council on Early Learning and Child Care, which was announced by the Minister of Families, Children and Social Development on November 24, 2022. This Council brings together a committed and diverse group of 16 members, including academics and advocates, practitioners and caregivers. The Council will serve as a forum for consultations on issues and challenges facing the early learning and child care sector and will provide third-party expert advice to the Government of Canada.

The department will also continue to support communities and organizations exploring innovative approaches to help improve the life outcomes of children through projects funded by the Early Learning and Child Care Innovation Program. These projects explore, test and develop new approaches that aim to improve the quality, accessibility, affordability, inclusivity and flexibility of early learning and child care programs and services. Data and research initiatives, including the development of a data and research strategy specific to early learning and child care, will also continue.

Finally, the department will work to implement the Budget 2022 commitment to create an Early Learning and Child Care Infrastructure Fund. This fund is for provinces and territories to make additional child care investments to support the implementation of a Canada-wide early learning and child care system.

Guided by the co-developed Indigenous ELCC Framework, the department will continue to collaborate with First Nations, Inuit and Métis Nation governments and organizations. This will support Indigenous-led Early Learning and Child Care (IELCC) programs and services delivered in communities across the country. Under the IELCC Initiative, Indigenous partners make decisions on their priorities each year. In fiscal year 2023 to 2024, many partners will continue to offer wraparound supports, including literacy, nutrition, health and parenting support, to ensure Indigenous families receive holistic and integrated services. Indigenous governance of the initiative will continue to be strengthened through capacity funding. The department will continue to support safe and healthy facilities by providing funds for repairs and renovations. New infrastructure funding will help to build new centres and replace old ones where needed. In addition, the department will support Indigenous-led quality improvement projects. These projects will develop and promote best practices or innovative models to strengthen the quality of IELCC programs and services in communities. For example, designing of governance models to support Indigenous-led early learning and child care decision-making and designing new ways to measure results and success.

Barriers to accessibility for persons with disabilities are removed

The department will continue to implement the Accessible Canada Act (the Act). It will work on development of accessibility regulations in the area of Information and Communication Technologies (ICT), further enabling persons with disabilities to participate in Canada’s digital economy.

The Federal Data and Measurement Strategy for Accessibility will help the department to measure its progress in implementing the Act. The strategy will include a framework to measure the department’s performance in identifying, removing and preventing barriers to accessibility across three priority areas: employment, ICT, and transportation.

Projects in the accessibility services sector will be funded to further enhance accessibility and inclusion. For example, this could be a project to increase the overall number of professional sign language interpreters and translators in Canada.

The department will also continue efforts to shift the culture from ‘accessibility as an add-on’ to ‘inclusive from the start’. This will be done by supporting inclusively-designed solutions in communities and workplaces so everyone, including persons with disabilities, can participate. Efforts include celebrations and awareness campaigns under National AccessAbility Week, for example the annual Canadian Congress on Disability Inclusion.

The department will continue to remove barriers faced by persons with disabilities by implementing the Disability Inclusion Action Plan (DIAP), released on October 7, 2022. The plan contains actions to improve the lives of persons with disabilities in Canada and is organized under four pillars:

- financial security

- employment

- accessible and inclusive communities

- modern approach to disability

To support financial security, stakeholders will be engaged on the design of the proposed Canada Disability Benefit. Stakeholders to be consulted include Canadians with disabilities, National Disability organizations, Provincial and Territorial governments, First Nations, Metis and Inuit representatives, and Modern Treaty holders.

The department will support accessible and inclusive communities by producing alternate format reading materials. The Social Development Partnerships Program - Disability is continuing to provide funding to the Centre for Equitable Library Access and National Network for Equitable Library Service. This will result in the creation of about 4,000 new alternate format documents, improving access to reading materials for persons with print disabilities. In addition, in spring 2023, the department will continue to work with Statistics Canada on administering an accessible print materials survey. The survey will help the department to better understand the needs and challenges faced by persons who require written documents in alternate formats such as Braille, e-books, audiobooks, or large print. The department will also hold roundtable discussions with stakeholders such as the Centre for Equitable Library Access and the National Network for Equitable Library Service, persons with print disabilities, and industry leaders in accessible technology.

The department will also, through the Enabling Accessibility Fund, increase accessibility in communities and workplaces in 2023 to 2024 by funding youth-led projects, mid-sized projects, and additional small projects from the small projects 2022 inventory.

Poverty is reduced

The department will continue its work to reduce poverty by implementing Opportunity for All: Canada’s First Poverty Reduction Strategy. This includes:

- supporting the National Advisory Council on Poverty in the development of an annual report on poverty to be tabled in Parliament, in providing advice to the Minister of Families, Children and Social Development on poverty reduction, and in continuing a national dialogue with Canadians on poverty

- addressing key gaps in poverty measurement in Canada and measuring progress towards the strategy’s poverty reduction targets

- working with First Nations, Inuit, and Métis to better understand poverty among Indigenous populations in Canada

The department will develop a National School Food Policy, informed by engagement with provinces, territories, municipalities, Indigenous partners, stakeholders and Canadians. Once developed, the policy will encourage additional collaboration, coordination and investment, so that more children have access to nutritious food in school.

Capacity to address social issues is enhanced

The department will continue to enhance the capacity of social purpose organizations, including charities, not-for-profit organizations, co-operatives and for-profit social enterprises, to address social issues. The Social Development Partnership Program – Disability will continue to fund projects that improve the social inclusion of persons with disabilities. For example, projects that develop understanding and capacity among community-based partners, and leaders in the health care, finance, justice, and social service sectors, about how to identify, arrange for, and deliver supports for people with intellectual disabilities.

The Social Development Partnership Program – Children and Families will continue to fund projects that improve the financial wellbeing of low-income adults and the social inclusion and wellbeing of vulnerable children and youth who are at risk of social isolation.

The Supporting Black Canadian Communities Initiative (SBCCI) will continue to increase social inclusion, reduce systemic barriers, and strengthen social cohesion within Canadian society. Specifically, the department will:

- promote inclusiveness by working closely with the SBCCI’s National Funders to support the long-term sustainability of community-based organizations

- work with the SBCCI’s External Reference Group to implement the SBCCI. The External Reference Group is made up of seven members of African descent from the not-for-profit, education, public and private sectors

- establish the National Institute for People of African Descent to inform policy and program development from a Black-centric perspective. An announcement regarding the implementation of the Institute could be made in fiscal year 2022 to 2023. The selected organization will then begin work to establish the Institute.

The department will continue to provide funding to community-based organizations through the New Horizons for Seniors Program. With this funding, organizations will help seniors improve their quality of life and their feeling of inclusion in society. This includes activities that support active living and social participation among seniors. Collaboration amongst organizations to address the needs of seniors in their communities will also be supported.

The department will support the National Seniors Council (NSC), which will serve as the expert panel to examine measures, including a potential aging at home benefit that could further support older Canadians to age at home. The objectives of the Expert Panel – Supporting Aging at Home project are to identify existing measures as well as international best practices that help seniors age at home; identify the factors that prevent seniors from aging at home and assess the areas of greatest needs to help identify domains of actions; and identify and assess current and potential new measures that could address the areas of greatest need to support aging in place. The final report containing advice for ministerial consideration is scheduled to be delivered to Minister Khera and Minister Duclos in September 2023.

The Social Innovation and Social Finance Strategy will continue to support not for profit organizations and communities. The Investment Readiness Program has been extended into 2023 to 2024 to provide continued to support social purpose organizations (SPOs). This support helps SPOs develop the skills and capacities needed to access social finance. Access to social finance will allow the SPOs to address pressing social and environmental issues, to benefit Canadians. This year investment from the Social Finance Fund start to reach SPOs, helping them innovate and scale-up their social impact.

The department will continue to advance the rights, wellbeing and social inclusion of people of African descent as part of Canada’s commitment towards the United Nations International Decade for People of African Descent (2015 to 2024).

Following a competitive selection process for the Black-led Philanthropic Endowment Fund, one national Black-led and Black-serving organization will be selected by the Minister of Housing and Diversity and Inclusion and provided with an endowment of $199,476,227 for a minimum duration of 10 years. The recipient of the endowment fund will be responsible for investing and managing the assets of the fund, and will use the income generated to issue grants to Black community organizations. The endowment Fund will begin its operations in 2023.

The department will continue to lead Canada’s implementation of the United Nations 2030 Agenda for Sustainable Development. This includes developing Canada’s second Voluntary National Review to the United Nations. The review will highlight Canada’s progress in advancing the 2030 Agenda. The Sustainable Development Goals (SDG) Funding Program will support projects across Canada to advance the SDGs. The department will also ensure that Canada’s implementation of the 2030 Agenda reflects Indigenous perspectives and contributes to reconciliation through ongoing engagement protocol agreements with the Assembly of First Nations, Inuit Tapiriit Kanatami and the Métis National Council. The department will also continue to engage with the whole of Canadian society to build awareness of and promote the 2030 Agenda and the SDGs.

Services to Canadians

In fiscal year 2023 to 2024, the department will continue improving services to Canadians under this core responsibility.

Through the Age Well at Home initiative,selected organizations will receive financial support for local projects that provide practical services such as meal preparation, housekeeping, yard work and transportation to low-income or otherwise vulnerable seniors. The organizations will also help seniors navigate and access additional services provided by other local organizations. In addition, the initiative will support regional or national projects to expand existing services that have already demonstrated results in helping seniors stay in their homes.

In support of the Accessible Canada Act, the department will continue its efforts to simplify and update the language used in grants and contribution program web pages. It will also continue to consult persons with disabilities to inform new programs and program updates.

Gender-based analysis plus

As part of the Indigenous Early Learning and Child Care (IELCC) Initiative, the department will work with First Nations, Inuit and Métis partners to identify disaggregated data that could be collected to create new program indicators. The program indicators would allow for a better understanding of results achieved by the IELCC initiative.

Gender-based analysis plus (GBA plus) will continue to inform implementation of the Accessible Canada Act (the Act). For example, when developing a framework for national accessibility action, the department will consider that many individuals with disabilities also identify with other groups. These groups could include Indigenous peoples, visible minorities, and/or 2SLGBTQI+. Multiple and diverse intersecting identity factors can shape the experiences and perspectives of persons with disabilities. Additionally, efforts to increase sign language interpretation and translation capacity will focus on increasing the number of Black, Indigenous and deaf interpreters.

Data is being collected from Social Development Partnerships Program – Disability (SDPP-D) funded projects to conduct GBA plus analysis. At the end of fiscal year 2023 to 2024, the department will have access to 4 years of data from 28 national disability organizations. This data will be used to identify gaps and challenges faced by these organizations in delivering programs. Analysis will be used to inform program improvements. The department expects to report on these findings in 2024 to 2025.

The Disability Inclusion Action Plan (DIAP) will use GBA plus analysis to inform an intersectional approach to serve populations experiencing disability. This means that it will take into account the fact that an individual may identify with more than one social identity. To support the intersectional approach, the department is engaging with National Indigenous Organizations and holders of Modern Treaty and Self-Government Agreements. This is to ensure the specific concerns of Indigenous populations are addressed in a culturally appropriate manner and meet all necessary modern treaty obligations and commitments. The department also reviews government proposals to ensure that the perspectives and needs of persons with disabilities are fully integrated into policies, programs, and initiatives.

The Social Innovation and Social Finance Strategy uses GBA plus to ensure that it supports Social Purpose Organisations (SPOs) that are led by, and serve, equity deserving populations. The department will work collaboratively with social finance wholesalers to track investments that advance gender equality and social equity. Further, the department is working to collect disaggregated data on the leadership of, and the population served, by the organizations applying for the Investment Readiness Program. The program will also collect data on the populations the social finance intermediaries and SPOs serve. This will enable the program to monitor and ensure that funds reach a diversity of organizations and populations.

The organization selected to administer the Black-led Philanthropic Endowment Fund will be required to apply a GBA plus lens when making funding decisions. This is to ensure that the fund meets the needs of Black communities. The department will collect data from the endowment fund including the number of funded projects broken down by gender, ability, region, province or territory, and official language. In addition, it will also collect data on the number of Black women, girls and members of the 2SLGBTQI+ community served by funded projects.

The National Advisory Council on Poverty takes an inclusive and intersectional approach to its stakeholder engagement and when conducting information and data analysis. This work informs the Council’s annual report and recommendations. Specifically, the Council examines the relationships between poverty, equity, gender diversity, racialized populations other social, economic and demographic variables.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In fiscal year 2023 to 2024, the department will contribute to advancing the Sustainable Development Goals through the following programs:

End poverty in all its forms everywhere (SDG 1)- The proposed Canada Disability Benefit would reduce poverty and support the financial security of working-age persons with disabilities. It would also contribute to SDG 10 (reduce inequality within and among countries). Working-age Canadians with disabilities experience poverty at twice the rate of working-age Canadians without disabilities. Among that population, some sub-populations are at particular risk of poverty. This includes people with severe and very severe disabilities, women, Indigenous Peoples, visible minorities, and people living alone.

Quality education (SDG 4) –The Early Learning and Child Care and Indigenous Early Learning and Child Care programs will ensure that families Canada-wide have access to high-quality, affordable, flexible, and inclusive early learning and child care no matter where they live.

Decent work and economic growth (SDG 8) - The Accessible Canada Act (the Act) will lead to the identification and removal of barriers to employment, particularly for persons with disabilities. The Act also contributes to SDG 9 (Industry, Innovation and Infrastructure). Over time, the Act will lead to the removal of barriers in areas such as employment, Information Communication Technologies, and transportation.

The Social Innovation and Social Finance Strategy supports social purpose organizations so that they can innovate, grow, and access flexible financing opportunities. The strategy also contributes to SDG 10 (reduce inequality within and among countries) by benefitting diverse groups of people. It also supports SDG 17 (Strengthen the means of implementation and revitalize the Global Partnership for Sustainable Development) by promoting effective partnerships between social purpose organizations, private organizations, and public institutions.

Peace, justice and strong institutions (SDG 16) - The Black-led Philanthropic Endowment Fund is led by Black Canadians for Black Canadian communities. This helps to increase the autonomy of Black Canadian communities to respond to the challenges they face, including combatting anti-Black racism.

The initiatives listed above all support Canada’s Federal Implementation Plan for the 2030 Agenda crosscutting objective of leaving no one behind by advancing gender equality, empowering women and girls, and advancing diversity and inclusion.

Innovation

The department is continuing its innovative approach to distribute funding under the Accessible Canada Partnerships stream. Phase 1 will identify projects that demonstrate positive outcomes. To move to Phase 2, successful projects will need to submit plans to expand their reach and to sustain activities in the long term, after federal funding ends. Plans may include expanding and/or adapting project activities to benefit more persons with disabilities and/or within other communities, as well as incorporating activities in new or additional settings (e.g., workplace and educational settings) to maximize the scale of investments. A committee, made up of persons with disabilities, will be established to review the outcomes of Phase 1. Results of this review will help inform the identification of promising projects for funding for Phase 2.

Planned results for Social Development

The following shows, for Social Development, the planned results, the result indicators, the targets and the target dates for 2023 to 2024, and the actual results for the three most recent fiscal years for which actual results are available.

Departmental result 1 of 4: not for profit organizations, communities and other groups have an enhanced capacity to address a range of social issues such as the social inclusion of persons with disabilities, the engagement of seniors and support for children and families.

Departmental result indicator: newly developed partnerships as a percentage of all partnerships developed by recipient organizations to address a range of social issues such as the social inclusion of persons with disabilities, children and families and other vulnerable populations.

Target: at least 35%.

Date to achieve target: March 2024.

2019 to 2020 actual result: result to be achieved in the future.

2020 to 2021 actual result: result to be achieved in the future.

2021 to 2022 actual result: result to be achieved in the future.

Departmental result 2 of 4: barriers to accessibility for persons with disabilities are removed.

Departmental result indicator: number of community spaces and workplaces that are more accessible due to Enabling Accessibility Fund funding.

Target: 322 (see note 1 below).

Date to achieve target: March 2024.

2019 to 2020 actual result: 376.

2020 to 2021 actual result: 386.

2021 to 2022 actual result: 1,290 (see note 2 below).

Departmental result 3 of 4: affordability of early learning and child care is increased.

Departmental result indicator: average child care fees for regulated early learning and child care spaces.

Target: average fee of $10-a-day (see note 3 below).

Date to achieve target: March 2026.

2019 to 2020 actual result: not applicable.

2020 to 2021 actual result: not applicable.

2021 to 2022 actual result: not yet available (see note 4 below).

Departmental result 4 of 4: clients receive high quality, timely and efficient services that meet their needs (see note 5 below).

Departmental result indicator: number of targets that are being met for the published service standards of Social Development programs.

Target: 3 out of 3.

Date to achieve target: March 2024.

2019 to 2020 actual result: 1 out of 1.

2020 to 2021 actual result: 1 out of 1.

2021 to 2022 actual result: 2 out of 3 (see note 6 below).

Notes

- The target was lowered from 870 (2022 to 2023) to 322 (2023 to 2024) due to Budget 2021 funding sunsetting in 2022 to 2023. As such, the program does not have any funding in addition to its base funding of $20.65M (Gs&Cs), which limits the number of projects the program is able to fund.

- Under the EAF program, ESDC funded 1,290 projects, more than 3 times the number of projects it supported in 2020 to 2021. The program funded more projects than projected due to the $100 million in additional funding received through Budget 2021.

- In Budget 2021, the commitment was made to establish a new Canada-wide early learning and child care system, with a goal that families in Canada have access to regulated early learning and child care for an average cost of $10-a-day, which resulted in new agreements with provinces and territories covering 2021 to 2022 to 2025 to 2026. This indicator and associated target reflect this commitment and related agreements.

- Compilation of results across the country are based on annual reports provided by provinces and territories in the fall of the following fiscal year. Due to the timing of agreements with provinces and territories, there will be no results available for 2019 to 2020 and 2020 to 2021. However, results for fiscal year 2021 to 2022 will become available in the future.

- Service standards are published on www.canada.ca.

- Notification of funding is the only service standard not met.

The financial, human resources and performance information for the Employment and Social Development Canada’s program inventory is available on GC InfoBase.

Planned budgetary spending for Social Development

The following table shows, for Social Development, budgetary spending for 2023 to 2024, as well as planned spending for that year and for each of the next 2 fiscal years.

| Categories | Main Estimates 2023 to 2024 | Planned spending 2023 to 2024 | Planned spending 2024 to 2025 | Planned spending 2025 to 2026 |

|---|---|---|---|---|

| Planned Gross Spending | 6,905,105,617 | 6,905,105,617 | 7,778,688,635 | 8,475,529,775 |

| less: Planned Spending in Specified Purpose Accounts | 0 | 0 | 0 | 0 |

| less: Planned Revenues netted against expenditures | 0 | 0 | 0 | 0 |

| Planned Net Spending | 6,905,105,617 | 6,905,105,617 | 7,778,688,635 | 8,475,529,775 |

|

Notes: The increase in planned spending is mainly explained by investments to build a Canada-wide early learning and child care system with provinces and territories. Please refer to the department's Financial Framework for a complete description of the departmental financial profile, including an explanation of gross planned spending. |

||||

Financial, human resources and performance information for Employment and Social Development Canada’s program inventory is available on GC InfoBase.

Planned human resources for Social Development

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023 to 2024 and for each of the next 2 fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 511 | 488 | 435 |

Financial, human resources and performance information for Employment and Social Development Canada’s program inventory is available on GC InfoBase.

Pensions and Benefits

Description

Assist Canadians in maintaining income for retirement, and provide financial benefits to survivors, people with disabilities and their families.

Planning highlights

In fiscal year 2023 to 2024, the department will undertake the following activities to advance this core responsibility.

Seniors have income support for retirement

The department will ensure that seniors have income support for retirement through the Old Age Security (OAS)program. Benefits under the OAS program include:

- the OAS pension, paid to all persons aged 65 or over who meet the residence requirements

- the Guaranteed Income Supplement (GIS) for low-income OAS pensioners

- Allowances for low-income Canadians aged 60 to 64 who are the spouses or common-law partners of GIS recipients, or who are widows or widowers

The department will also ensure that eligible seniors receive income support for retirement from the contributory Canada Pension Plan (CPP). This year the federal government will work with provincial partners to conduct the 2022 to 2024 Triennial Review of the Canada Pension Plan. The review will examine the Plan’s fiscal state and the benefits it provides to Canadians. The review is done to make sure that the Plan is sustainable over the long term and that the benefits it provides continue to meet the needs of Canadians. The review will conclude with a statement of the financial health of the Plan, and may include recommendations to improve the Canada Pension Plan.

Persons with disabilities and their families have financial support

The department will ensure eligible contributors with disabilities and their families have financial support through the Canada Pension Plan Disability (CPPD) Program. This program will improve how it helps Canadians with disabilities by:

- working with internal and external partners to advance program objectives and improve the client experience.

- continuing to make changes to improve the client appeal process at the Social Security Tribunal. This will make the process more efficient, effective and client centred.

- expanding the quality assurance program beyond initial decisions, so that other file types, such as reconsideration decisions and terminal illness applications, are reviewed. This will help ensure that medical decisions are appropriate and consistent for CPPD applicants.

- promoting modernization of the CPPD program through experimentation so that it responds to the needs of Canadians with severe and prolonged disabilities. For example, CPPD is designing a Return to Work Pilot project that will test improved supports for beneficiaries in their attempts to return to work.

Services to Canadians

In fiscal year 2023 to 2024, the department will strive to ensure that clients receive high quality, timely and efficient services that meet their needs.

Since January 1, 2019, Canadians have contributed more to the Canada Pension Plan (CPP). This change, known as the CPP enhancement, will provide today’s workers and the seniors of tomorrow with higher benefits and greater financial stability. The department successfully paid Canadians the first enhanced portion of their CPP benefits in fiscal year 2022 to 2023. This fiscal year, the department will continue to prepare for the second enhanced portion of the CPP that will come into effect in 2024.

The department will migrate Old Age Security (OAS) to the new Benefits Delivery Modernization platform. This will simplify the experiences of everyone who engages with the OAS program. This includes seniors that receive benefits and employees who administer them. The migration of the OAS to the new platform will be done through several releases over the next 2 fiscal years. The first release, planned for fiscal year 2023 to 2024, will include a new case management system. It will provide employees with new tools to support Foreign Benefit recipients in obtaining pension income from international jurisdictions.

An online self-serve OAS benefits estimator will be launched in 2023. This tool will help estimate how much money beneficiaries could get from OAS, the Guaranteed Income Supplement, Allowance and Allowance for the Survivor. It is anticipated that this tool will increase the number of people applying for and receiving these benefits by making them more aware of available supports.

Gender-based analysis plus

Although beneficiaries of the Old Age Security pension are gender-balanced, slightly more women (59%) than men (41%) benefit from the Guaranteed Income Supplement. The portion of women (86%) who benefit from the allowances is noticeably higher than men (14%).

There are some noted gender differences in the benefits men and women receive from the Canada Pension Plan (CPP). For example, slightly more women (52%) than men (48%) receive a CPP retirement pension. Even so, the average monthly pension for men ($731) is higher than that of women ($536). This reflects that men have, historically, had higher earnings during their working years. However, there are considerably more women (80%) receiving the CPP survivor’s pension than men (20%), reflecting the differences in life expectancy. Given this information, all potential options considered during the Canada Pension Plan’s 2022 to 2024 Triennial Review will be examined through a lens of Gender-based analysis plus. Elements such as gender, household income level, past labour force attachment, family status and widowhood will be considered. This will ensure that all options put forward for the Canada Pension Plan promote gender equality, diversity and inclusiveness.

The department uses Gender based analysis plus to understand the socio-demographic make-up of individuals who are using the Registered Disability Savings program. This includes information on beneficiaries’ age, sex, official language, place of residence (urban or rural) and province/territory. This information is used to determine if and how efforts to raise awareness of this program could be strengthened through the following activities:

- delivering information sessions to an expanded audience

- sending information letters to a more diverse group of eligible persons with disabilities

- identifying program improvements to benefit hard-to-reach populations by creating linkages with other datasets

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In fiscal year 2023 to 2024, the department will contribute to advancing the Sustainable Development Goals (SDGs) through the following programs:

End poverty in all its forms everywhere (SDG 1) - The Canada Disability Savings Program (CDSP) will continue to support the long-term financial security of eligible persons with disabilities. The CDSP encourages long-term savings through the provision of federal disability savings incentives, namely the Canada Disability Savings Bond, and the Canada Disability Savings Grant.

In addition, the Old Age Security program and the Guaranteed Income Supplement will help to reduce the number of seniors with low income.

Achieve gender equality and empower all women and girls (SDG 5)– The Guaranteed Income Supplement provides a monthly payment to low-income Old Age Security pensioners. The Allowances provide benefits to low-incomes 60- to 64-year-old individuals who are either the spouse or common-law partner of a GIS recipient, or who are a widow/widower. Women are more likely to meet the eligibility criteria for these supports therefore, as a result, the benefits help more women than men.

All of the examples above support Canada’s Federal Implementation Plan for the 2030 Agenda crosscutting objective of leaving no one behind by advancing gender equality, empowering women and girls, and advancing diversity and inclusion.

Innovation

The Canada Pension Plan Disability (CPPD) program’s existing suite of return-to-work (RTW) supports, which includes a 3-month work trial and vocational rehabilitation supports, are intended to facilitate the labour market transition of beneficiaries who wish to attempt a return to work. Ongoing analysis of best practices, consultations with stakeholders and CPPD outcomes identified opportunities that might be more successful in supporting our clients. As a result, CPPD is designing a new pilot. The project will gather information about, and then identify, the best combination of work transition supports for CPPD beneficiaries who have the potential to return to work.

Planned results for Pensions and Benefits

The following shows, for Pensions and Benefits, the planned results, the result indicators, the targets and the target dates for 2023 to 2024, and the actual results for the three most recent fiscal years for which actual results are available.

Departmental result 1 of 3: seniors have income support for retirement.

Departmental result indicator: percentage of seniors living in poverty.

Target: at most 6.1%.

Date to achieve target: December 2030.

2019 to 2020 actual result: 5.6% (2018).

2020 to 2021 actual result: 5.4% (2019).

2021 to 2022 actual result: 3.1% (2020).

Departmental result indicator: percentage of seniors receiving the Old Age Security Pension at age 65 and over in relation to the estimated total number of eligible seniors aged 65 and over (OAS pension take-up rate).

Target: at least 94%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 97.2% (2017).

2020 to 2021 actual result: 97.1% (2018).

2021 to 2022 actual result: 96.8% (2019).

Departmental result indicator: percentage of seniors receiving the Old Age Security pension at age 70 and over in relation to the estimated total number of eligible seniors aged 70 and over (OAS pension take-up rate 70+).

Target: at least 97%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 99% (2017).

2020 to 2021 actual result: 99% (2018).

2021 to 2022 actual result: 99% (2019).

Departmental result indicator: percentage of seniors receiving the Guaranteed Income Supplement in relation to the estimated total number of eligible seniors.

Target: at least 90%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 91.1% (2017).

2020 to 2021 actual result: 91.2% (2018).

2021 to 2022 actual result: 92.2% (2019).

Departmental result indicator: percentage of Canada Pension Plan contributors aged 70+ receiving retirement benefits.

Target: at least 99%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 99% (2017).

2020 to 2021 actual result: 99% (2018).

2021 to 2022 actual result: 99%.

Departmental result 2 of 3: persons with disabilities and their families have financial support.

Departmental result indicator: percentage of Canada Pension Plan contributors who have contributory eligibility for Canada Pension Plan Disability benefits and therefore have access to financial support in the event of a severe and prolonged disability.

Target: at least 66%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 65% (2018).

2020 to 2021 actual result: 65% (2019).

2021 to 2022 actual result: 65% (2020).

Departmental result indicator: percentage of Canadians approved for the Disability Tax Credit who have a Registered Disability Savings Plan to encourage private savings (see note 1 below).

Target: 35%.

Date to achieve target: December 2023.

- 2019 to 2020 actual result: 35% (2020) (see note 2 below).

2020 to 2021 actual result: 35% (2021) (see note 2 below).

2021 to 2022 actual result: not yet available (2022).

Departmental result indicator: percentage of Registered Disability Savings Plan beneficiaries that have been issued a grant and/or a bond to assist them and their families to save for their long-term financial security (see note 3 below).

Target: at least 77%.

Date to achieve target: December 2023.

2019 to 2020 actual result: 84% (2019).

2020 to 2021 actual result: 80% (2020).

2021 to 2022 actual result: 78% (2021).

Departmental result 3 of 3: clients receive high quality, timely and efficient services that meet their needs (see note 4 below).

Departmental result indicator: number of targets that are being met for the published service standards of Pensions and Benefits programs.

Target: 10 out of 10.

Date to achieve target: March 2024.

2019 to 2020 actual result: 5 out of 10.

2020 to 2021 actual result: 5 out of 10.

2021 to 2022 actual result: 5 out of 10.

Departmental result indicator: percentage of Canada Pension Plan Retirement Benefits paid within the first month of entitlement.

Target: at least 90%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 97%.

2020 to 2021 actual result: 98%.

2021 to 2022 actual result: 95.9%.

Departmental result indicator: percentage of decisions on applications for a Canada Pension Plan disability benefit within 120 calendar days.

Target: at least 80%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 54%.

2020 to 2021 actual result: 61%.

2021 to 2022 actual result: 87.2%.

Departmental result indicator: percentage of Old Age Security basic benefits paid within the first month of entitlement.

Target: at least 90%.

Date to achieve target: March 2024.

2019 to 2020 actual result: 91%.

2020 to 2021 actual result: 91%.

2021 to 2022 actual result: 89.5%.

Notes

- This indicator refers to the Registered Disability Savings Plan take up rate among individuals who are aged 0 to 49 years.

- The calendar years listed for this indicator’s results do not align with the same fiscal year in previous reports because data are provided on a calendar year basis. Once the data become available, results are updated and reported under the fiscal year which they most closely align with.

- This indicator specifically refers to beneficiaries who are aged 0 to 49 years.

- Service standards are published on www.canada.ca.

The financial, human resources and performance information for the Employment and Social Development Canada’s program inventory is available on GC InfoBase.

Planned budgetary spending for Pensions and Benefits

The following table shows, for Pensions and Benefits, budgetary spending for 2023 to 2024, as well as planned spending for that year and for each of the next 2 fiscal years.

| Categories | Main Estimates 2023–2024 | Planned spending 2023–2024 | Planned spending 2024–2025 | Planned spending 2025–2026 |

|---|---|---|---|---|

| Planned Gross Spending | 78,300,964,798 | 140,587,342,781 | 149,258,869,253 | 157,879,606,510 |

| less: Planned Spending in Specified Purpose Accounts | 0 | 62,286,377,983 | 66,037,578,657 | 69,783,792,910 |

| less: Planned Revenues netted against expenditures | 310,569,907 | 310,569,907 | 282,750,843 | 277,198,220 |

| Planned Net Spending | 77,990,394,891 | 77,990,394,891 | 82,938,539,753 | 87,818,615,380 |

|

Notes: The increase in planned spending is mainly attributable to an increase to Old Age Security pension, to Guaranteed Income Supplement statutory payments and to Canada Pension Plan benefits, mainly explained by an expected increased number of beneficiaries due to the aging population. Please refer to the department's Financial Framework for a complete description of the departmental financial profile, including an explanation of gross planned spending. |

||||