Evaluation of the Federal Workers' Compensation Service

Official title: Evaluation of the Federal Workers' Compensation Service: Phase I, September 2018

On this page

- List of figures

- List of tables

- List of acronym

- Executive summary

- Management response and action plan

- 1. Introduction

- 2. Program description

- 3. Key findings

- 4. Operational and compensation costs

- 5. Conclusion and recommendations

- Annex 1: Evaluation questions

- Annex 2: Evaluation methods

- Annex 3: Program logic model (2017)

- Annex 4: Details of regular and third-party claim processes

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of figures

Figure 1: Multiple stakeholders in the federal workers' claim management process

Figure 2: Claims submitted by gender and age group, fiscal year 2016 to 2017

Figure 5: Average reporting times (between fiscal years 2010 to 2011 and 2015 to 2016)

Figure 9: Third-party claims – subrogation process

List of tables

List of acronym

FWCS: Federal Workers' Compensation Service

Executive summary

This report presents the findings and recommendations of the Phase I evaluation of the Federal Workers' Compensation Service (referred to hereafter as "the Program") under the Labour Program of Employment and Social Development Canada. The Program is responsible for administering the Government Employees Compensation Act (referred to hereafter as "the Act") by ensuring effective claim management, monitoring and reporting on outcomes as well as enabling timely actions from different stakeholders. The ActFootnote 1 establishes the authority for federal injured employees to receive compensation benefits at the same rates and under the same conditions as provincially regulated employees working in the same jurisdiction. The adjudication and provision of compensation benefits including wage replacement are currently made by each provincial Workers' Compensation Board (referred to hereafter as "provincial Boards") on behalf of the Program through Service Agreements.

A two-phased evaluation approach was developed and presented to the Performance Measurement and Evaluation Committee in July 2016. The evaluation is conducted in accordance with the Treasury Board's Policy on Results.

Phase I of the evaluation assessed evaluation questions related to the extent to which the changes made or being implemented by the Program addressed the challenges associated with reporting times, stakeholders' engagement and the support provided to employersFootnote 2 as part of the modernization of the workers' compensation practices. The coverage of the Phase I evaluation period is from fiscal year 2012 to 2013 to fiscal year 2016 to 2017.

Past program reviews noted the need to streamline the Program's claim management processes to ensure that federal injured employees receive their compensation benefits and return to work in a timely manner. These reviews also recommended modernizing the administration of the Act to reduce its administration costs. Since 2012, the Program has brought major changes to its structure, including the creation of the Program Integrity Unit, and the centralization of its operations at National Headquarters in fiscal year 2013 to 2014. In 2015, the Program also started new Service Agreements negotiations with provincial Workers' Compensation Boards to help manage the claims more efficiently.

Overall, the Phase I evaluation noted that the creation of the Program Integrity Unit as well as the centralization of the program operations at Headquarters resulted in improvements to the Program's operations relating to the administration of the Act. However, the evaluation could not assess the impact of program activities on its outcomes given the limited data available. For example, the unavailability of data on the date when claims are adjudicated by provincial Boards and the date when employees return to work prevents any quantitative assessments of the impact of timely intervention and income continuity. The findings from the data quality assessment of National Injury Compensation System administrative data (between fiscal years 2010 to 2011 and 2016 to 2017) also show that about 14,000 (10%) of the claims records had to be removed from the reporting time analysis due to missing, invalid values or data entry errors. Above all, the negotiations and the implementation of the new Service Agreements are still underway.

Phase II of the evaluation will assess the extent to which the modernization is having an impact on the achievement of the Program's expected results while addressing concerns identified in various program reviews and the recommendation of Phase I. In addition, the Phase II evaluation will also examine injured employees' outcomes using gender-based analysis plus (GBA+) lens. The planned completion date of the Phase II evaluation has been postponedFootnote 3 to fiscal year 2022 to 2023 with a view to allow the Program sufficient time to implement recently recommended changes and to finalize the negotiation and implementation of the new Service Agreements with provincial Boards.

Key findings

The key findings of the evaluation are summarized as follows:

- Recent changes to the program operations resulted in improvements such as:

- The Program Integrity Unit has initiated a formal and regular reporting process on key performance indicators to inform senior management as well as to engage employers.

- The centralization of the claim processing operations at National Headquarters resulted in the harmonization of the countersigning and third-party claim triage processes.

- Collaboration with the Dispute Resolution Services within Legal Services for the subrogation has led to a significant reduction in litigation costs and inventory of third-party claims.

- Recently 4 new Service Agreements were signed with 4 provinces (British Columbia, Saskatchewan, Alberta, and Newfoundland and Labrador) but their implementation has encountered challenges related to direct reporting, sharing data using technology as well as the triage and determination of third-party claims.

- Evaluation findings show that between fiscal years 2010 to 2011 and 2016to 2017, the Program received about 126,000 work-related injury or illness claims. The bodily reaction (24.5%), fall on the same level (16.8%) and overexertion (11.4%) are the most common types of accidents, and they often cause sprains, strains, tears and bruises.

- In fiscal year 2016 to 2017, the average reporting time was 54 days while the median reporting time was 12 days. The large difference between the average and median reporting time show that a small portion of claims with certain types of injuries requiring a long time to observe and diagnose (for example, hearing loss and asbestosis) are skewing the results such that the average no more represents the reporting time of most claims.

- According to the Treasury Board Secretariat Guidelines, employers subject to the Government Employees Compensation Act must report work-related injuries within 3 days of occurrence to the Program. However, unlike the provincial workers' compensation acts, the Act currently does not have any enforcement mechanisms if employers fail to comply with this time frame. In fiscal year 2016 to 2017, about 15% of claims were reported within 3 days by employers to the Program.

- Federal employees received uneven workers' compensation benefits given:

- The duration of injury-on-duty leave (wage replacement) to injured federal employees can vary significantly from 1 employer to another as provisions for injury-on-duty leave are negotiated through the process of collective bargaining.

- By relying on provincial Boards to adjudicate workers' compensation claims and to provide benefits and services, federal employees are provided the same coverage as other employees working in the same province. However, since each provincial Board has its own adjudication and compensation policies, this can result in Boards rendering different decisions on similar claims (for example, mental health issues such as chronic stress).

Future research may help inform the extent to which federal employees received uneven benefits across provinces and territories. - Currently, the legacy database (the National Injury Compensation System) is limited in its capacity to collect and provide the needed performance information such as compensation period and the date of return to work. While a comprehensive data system (Integrated Labour System) for the entire Labour Program is being developed, Federal Workers' Compensation Service is developing a complementary data collection tool to assess the Program's expected outcomes.

Recommendations

The evaluation findings show that the legacy database is limited in its capacity to collect and provide the information required to monitor performance and results. Given the available information, for example, "average reporting time" indicator may not provide a representative picture of the reporting time of most claims and the Program currently does not collect outcome data such as the date when an employee start receiving compensation and the date when the same employee returns to work, the following recommendation has been developed:

- Continue working towards a more comprehensive data management framework to support reporting activities as well as monitoring performance and outcomes.

Management response and action plan

Overall management response

The Federal Workers' Compensation Service (FWCS) is responsible for administering the Government Employees Compensation Act, the statute which provides for compensation for federal workers whose injuries or illnesses arise out of and in the course of employment. FWCS is responsible for the oversight of the Program including reporting times of injuries as established in the Treasury Board Guideline on Workers' Compensation. FWCS currently uses a legacy system to collect information related to the thousands of claims processed each year. The Program agrees that the current legacy system is limited in its capacity to collect and provide performance data, and has already initiated work on improving its data quality and extending the scope of the data it collects. Over the last year, the Program has taken a number of steps to improve the integrity of the data that is captured through the current system. In addition, the Program has developed a logic model and performance measurement framework that outlines the additional performance information that needs to be collected. To address the gaps in information that cannot be filled with the current system, the Program is currently developing a complementary system that will allow the collection of additional information, as described in the Management Response below.

Recommendation

The evaluation findings show that the legacy database is limited in its capacity to collect and provide the information required to monitor performance and results. Given the available information, for example, "average reporting time" indicator may not provide a representative picture of the reporting time of most claims and the Program currently does not collect outcome data such as the date when an employee start receiving compensation and the date when the same employee returns to work, the following recommendation has been developed:

- Continue working towards a more comprehensive data management framework to support reporting activities as well as monitoring performance and outcomes.

Management response

The Program agrees with the recommendation and has taken a number of steps to improve the quality of the data that is being collected through the current system and to complement this data with additional performance-focused information. Quality assurance procedures have been developed to ensure the integrity of the data that is reported to stakeholders. The Program has also developed a methodology to limit the impact of outliers on the "average reporting time" indicator. This indicator was reported under the People Management component of the Management Accountability Framework (MAF) for the first time in fiscal year 2016 to 2017 and the methodology was applied to the data provided to the Treasury Board Secretariat for this exercise. The Program will continue to refine the methodology as needed in advance of the next MAF cycle. The Program is also working with Workers' Compensation Boards, the bodies responsible for adjudicating and managing federal workers' compensation claims, to develop Information Sharing Agreements that will allow FWCS to obtain additional outcome data such as the date when employees start receiving compensation and when they return to work.

To accommodate the capture of the additional information, a new data collection tool is under development and data has been actively collected since the beginning of fiscal year 2017 to 2018 using the first of multiple data collection modules. Other modules are under development and are expected to be launched by the end of fiscal year of 2018 to 2019.

Management action plan

1.1 Develop a new data collection tool:

1.1.1 New claim module: the completion date was in mid-April 2018

1.1.2 Third party modules: the completion date will be September 30, 2018

1.1.3 Disbursement module: the completion date will be October 31, 2018

1.1.4 FWCS client service module: the completion date will be December 31, 2018

1.1.5 Board outcome module: the completion date will be February 28, 2019

1. Introduction

This report presents the findings and recommendations of Phase I of the evaluation of the Federal Workers' Compensation Service of the Labour Program of Employment and Social Development Canada. In the last few decades, various program reviews indicated that there is a need for the Program to streamline its claim management processes to ensure that federal injured employees receive their compensation benefits and return to work in a timely manner. These reviews also recommended modernizing the administration of the Government Employees Compensation Act to reduce its administration costs.

Since 2012, the Program made major changes consisting of 1) the creation of the Program Integrity Unit to better monitor and report on performance indicators and financial costs; 2) the centralization of its operations at National Headquarters in fiscal year 2013 to 2014; and 3) the beginning of the negotiation of Service Agreements with the provincial Boards in 2015. The Phase I evaluation attempted to assess to what extent the results of modernization efforts addressed the challenges associated with reporting times, stakeholder engagement, and support provided to employers.

The second phase of the evaluation will consider the impact of program changes (for example, Service Agreement implementation and the integration of the administrative data into the Integrated Labour System) on the expected results to reduce reporting times, maintain injured employees' income continuity; increase support and guidance provided to employers to improve their disability management practices; and faster return of injured employees to work.

The evaluation questions are provided in Annex 1. Phase I of the evaluation employed 3 lines of evidence including document review, administrative data analysis and key informant interviews. See Annex 2 for a description of data collection methods. The coverage of the Phase I evaluation period is between fiscal years 2012 to 2013 and 2016 to 2017.

2. Program description

2.1 Administration of the Government Employees Compensation Act

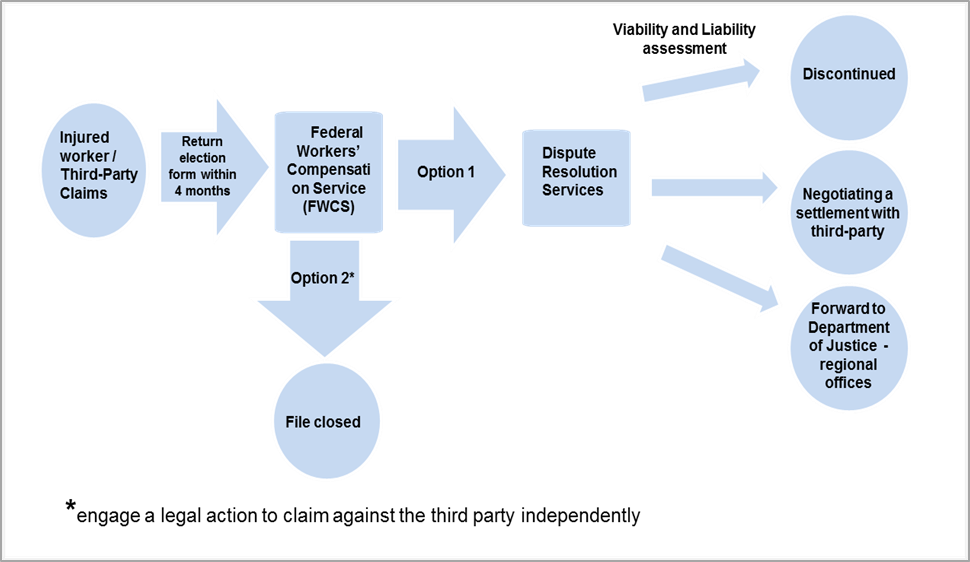

The Federal Workers' Compensation Service within the Labour Program of Employment and Social Development Canada is responsible for administering the Government Employees Compensation Act which was enacted in 1918. The Act aims to provide timely compensation benefits to federal employees who sustain a work-related injury or illness arising out of, or in the course of their employment. According to the Act, federal injured employees receive compensation benefits at the same rates and under the same conditions as provincially regulated employees in the same jurisdiction. In each jurisdiction, the adjudication and provision of compensation benefits including wage replacement are made by each provincial Workers' Compensation Board on behalf of the Program through Service Agreements. When a third party has been determined to be fully or partially responsible for the federal employee's injury, the Program collaborates with Dispute Resolution Services and/or the Department of Justice to try to settle and recover money from the third party, which is referred to as the "third-party claims" subrogation process.

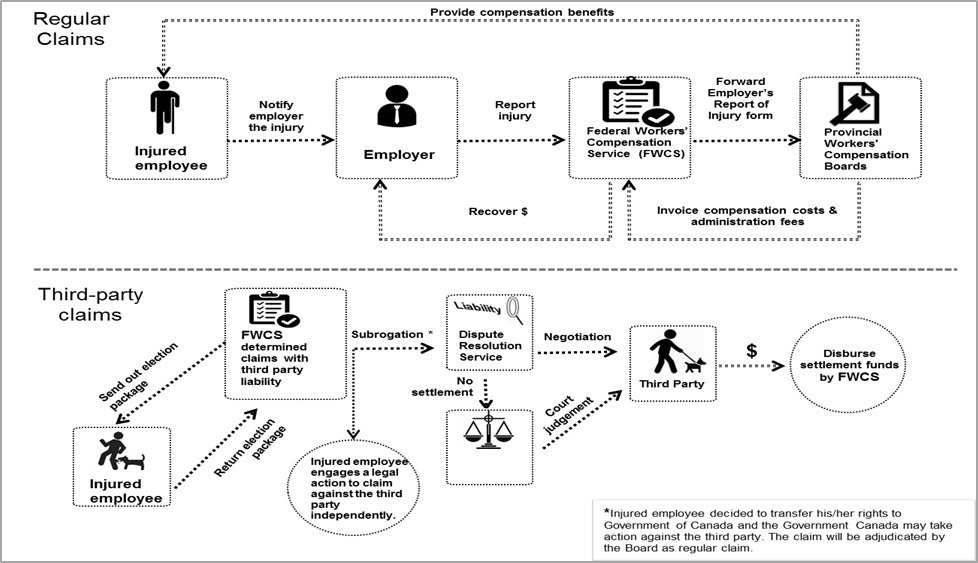

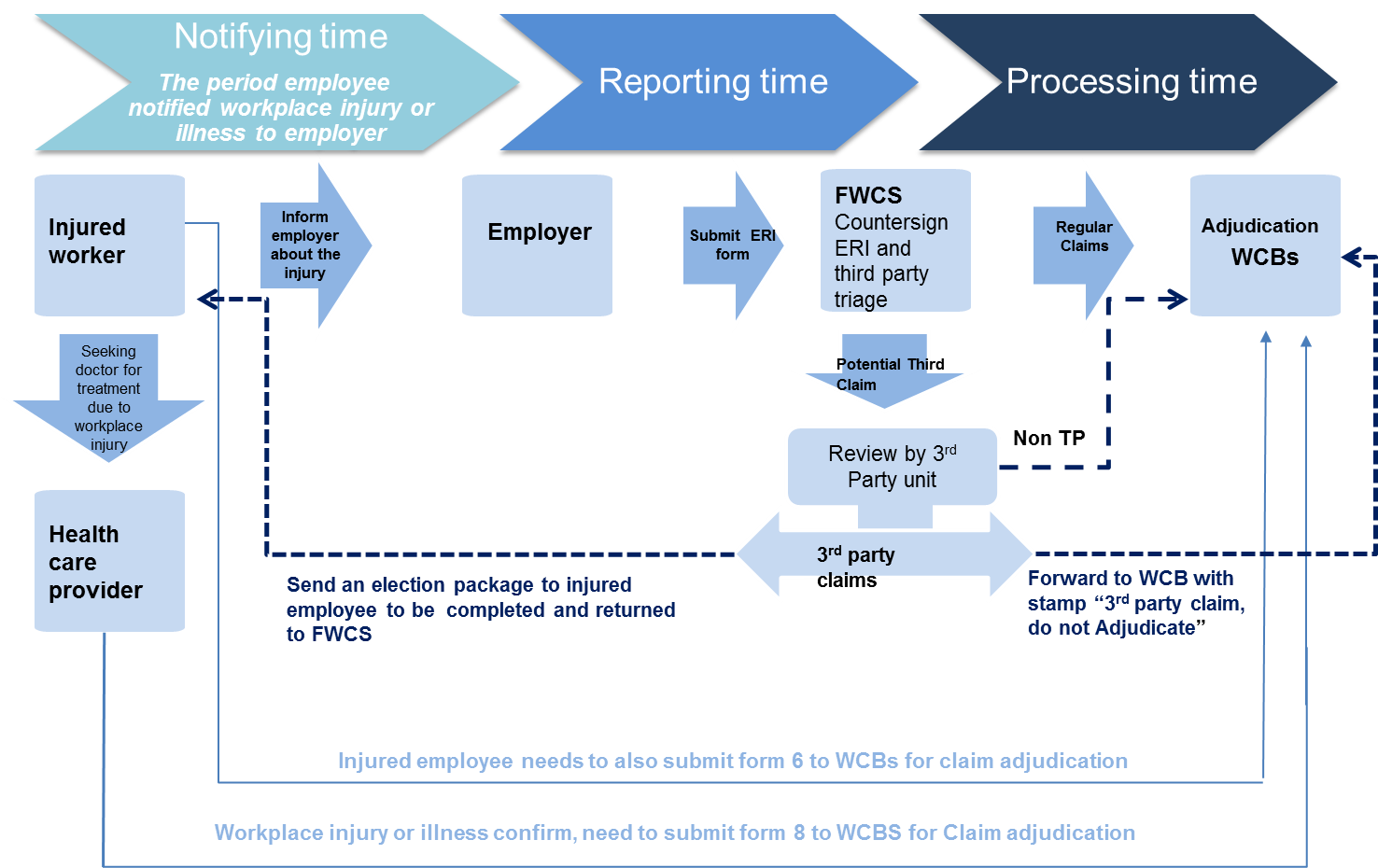

The compensation process involves multiple stakeholders including 1) the injured employee; 2) his/her employer who must report the injury; 3) the Federal Workers' Compensation Services which countersign Employer's Report of Injury, pay the Boards and recover money paid from employers; 4) the provincial Boards which adjudicate and pay compensation benefits; and 5) the Dispute Resolution Services and/or the Department of Justice which support the Program to recover money from third parties fully or partially responsible for the injury. Employees whose injury is confirmed by the provincial Boards in accordance with the Act are also entitled to income replacement benefits under provisions of the Injury on Duty Leave in line with Treasury Board policy guidelines and the various collective agreements (see section Policy inconsistencies in wage replacement). Figure 1 highlights the claim management activities of the Act and depicts how the Program and multiple stakeholders are engaged in the process.

Source: Chart created for this evaluation report.

Text description of figure 1

Figure 1 illustrates how multiple stakeholders are involved in regular and third-party claims process.

The claim process begins with an injured employee notifies his/her employer the injury or illness. The employer then reports the injury or illness by filling out an Employer's Report of Injury form and sends it to the Federal Workers' Compensation Service (FWCS). After the Program determines whether the claim is a regular claim or a third-party claim, the regular claim is forwarded to relevant provincial workers' compensation board for adjudication. The workers' compensation board also provides compensation benefits to injured employee. The board charges the Program for the benefits paid to injured employees plus the administration fee. The Program recovers the costs from employer of the injured employee.

Once if the injury claim is determined as a third-party claim, the Program sends out election package to injured employee. In returning election package to the Program, injured employee needs to decide either engages a legal action to claim against the third party independently or transfers his/her rights to Government of Canada and the Government of Canada may take action against the third party — subrogation. The Dispute Resolution Service assesses the third party's liability and viability. If there is a possibility to have settlement, it could be done either through Dispute Resolution Service with the third party to negotiate a settlement or through Department of Justice with the third party for a court judgement. The amount of settlement is disbursed by the Federal Workers' Compensation Service to the Employment Social Development Canada, employer and lastly injured employee if there is excess payment.

Overall, the ongoing activitiesFootnote 4 of the Program relate to claims processing and overseeing the administration of the Act. In particular, the Program acts as an intermediary and operational body between provincial Workers' Compensation Boards, employers and injured employees.

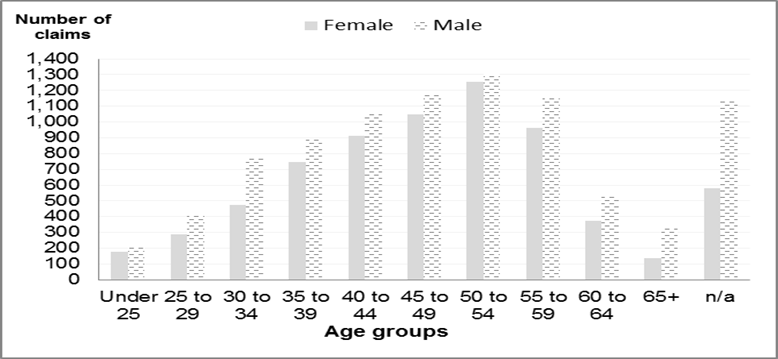

In fiscal year 2016 to 2017, under the Act, approximately 330,000 full-time equivalent federal employees were covered and the Program received about 16,000 work-related injury or illness claims, of which 56% were submitted by male employees. Generally, the number of submitted claims increases with age (up to 54 years) among working age group employees. For instance, more than half (52%) of claimants were between the age of 35 and 54. As shown in Figure 2, across all age groups, male employees submitted more claims than female employees, with the largest differences observed among younger and older employees. In particular, among employees aged between 30 and 34 years of age, about two-thirds (66%) of claimants were male employees. Similarly, among employees aged 65 years and older, 70% of claims were submitted by male employees.Footnote 5

Source: National Injury Compensation System. Data extraction date: April 03, 2017.

Text description of figure 2

Figure 2 illustrates the number of claims submitted to the Federal Workers' Compensation Service by gender and different age groups in fiscal year 2016 to 2017.

| Age | Female | Male |

|---|---|---|

| Under 25 | 176 | 208 |

| 25 to 29 | 289 | 411 |

| 30 to 34 | 475 | 773 |

| 35 to 39 | 748 | 899 |

| 40 to 44 | 910 | 1,049 |

| 45 to 49 | 1,049 | 1,170 |

| 50 to 54 | 1,254 | 1,306 |

| 55 to 59 | 962 | 1,159 |

| 60 to 64 | 374 | 534 |

| 65+ | 136 | 331 |

| n/a | 578 | 1,140 |

The Program is also responsible for administering Section 7 of the Act, which applies to locally engaged employees outside of Canada, the Merchant Seamen's Compensation ActFootnote 6, the Public Service Income Benefit Plan for Survivors of Employees Slain on Duty, and assessment of compensation for death and disability in accordance with the Corrections and Condition Release Regulations through a memorandum of agreement with Correctional Service Canada.

2.2 Program's core activities

Prior to 2012, the Program was responsible for administering the Act via its regional offices and National Headquarters. Since 2012, these activities have been centralized at National Headquarters.

2.2.1 Administration of the Government Employees Compensation Act

The document review pointed out that, as the administrator of the Act and its provisions, the Program is responsible for managing the funding as well as continuously improving the claim processing through updated Service Agreements with provincial Boards and providing appropriate supports to the Boards and employers while ensuring that injured federal employees receive timely compensation. The ongoing modernization efforts which include the current renegotiation of Service Agreements with the provincial workers' compensation Boards and recent changes to the Program as described later in the report are intended to support the Program in fulfilling these core responsibilities.

2.2.2 Claim processing

The document review and the key informant interviews indicated that, to administer federal workers' compensation operations, the Program receives and reviews the Employer's Report of Injury formsFootnote 7 from federal employers (federal departments, agencies, and Crown Corporations). The informationFootnote 8 is then entered manually into the Program's administrative database that is the National Injury Compensation System. Claim officers also assess whether the occupational injury or illness claim is a regular claim or a third-party claim. Once the employer is confirmed as an employer covered under the Act, the Employer's Report of Injury forms for regular claims are forwarded to the appropriate provincial Board for adjudication and provision of workers' compensation benefits to the injured employee on behalf of the Program. Once the claims are adjudicated and the benefits paid, the provincial Boards then charge the Program for the services provided (compensation costs and administration fee). The Chief Financial Officer Branch recovers these costs from the employer of the injured employee.

When a third party is involved in the occupational injury or illness, the injured employees receive an "election package" and they have 90 days to make a decision on whether: 1) to receive compensation benefits under the Act, or 2) to engage in legal action against the third party independently. In the first scenario, the injured employees subrogate their rights to the Government of Canada to take action against the third party and the matching Employer's Report of Injury form is sent to provincial Board for adjudication. The Program in collaboration with the Dispute Resolution Service under ESDC's Legal Service Branch and/or Department of Justice assesses the claims and negotiates settlements or litigation. If the employees decide to sue the third party independently to claim compensation benefits, the claim is considered closed.Footnote 9

3. Key findings

As per the Government Employees Compensation Act, the federal government relies on provincial Boards to adjudicate claims and provide compensation benefits to federal injured employees. In that context, the Program plays a key role as the administrator of the Act by ensuring effective claim management, monitoring and reporting on employers' performance as well as enabling timely actions from different stakeholders. This is consistent with the broader Government of Canada and ESDC's objective of ensuring safe, healthy, fair and productive workplaces.

This section summarizes the evaluation findings on the Program's planned or implemented changes since 2012 and also the main steps taken towards the modernization of the program.

3.1 Recent changes to the program

3.1.1 Creation of the program integrity unit

In 2012, the Program Integrity Unity was created in response to the findings of an internal review in order to provide sound financial management, stronger governance and accountability, monitoring and tracking data, measure performance and ensuring an appropriate Information Technology strategy to support the Program. To that end, the Program Integrity Unit reviews financial processes, including the funding processes whereby the Program, in collaboration with the Chief Financial Officer Branch, pays the amounts charged by the provincial Boards and recovers those amounts from the concerned employers.

To monitor the Program's and employers' performance, the Unit drafted a logic model and performance measurement strategy, which includes performance indicators, a framework to identify data sources and data collection methods. The performance measurement strategy has been incorporated into the program's Performance Information Profile (July 2017). In addition, prior to 2014, the Unit also tried to understand and map operational and financial processes and controls.

Some interviewees identified issues related to the Program Integrity Unit's ability to perform its mandated tasks:

- Under the current organizational structure, the Program Operations Unit and Program Integrity Unit are under the same division (in other words, both report to the same Director). This proximity is perceived by some interviewees as a potential risk that could prevent the Program Integrity Unit from fulfilling its mandate. For example, 1 of the Integrity Unit's objectives is to monitor the performance of Operational Unit. This may call for the arbitration and resolution of conflicting ‘objectives' pursued by operations and integrity activities, under the same Division.

- It was noted that the Program Integrity Unit lacks the capacity (especially due to high turnover) to analyze the data collected under the National Injury Compensation System. In addition, the National Injury Compensation System does not have data related to employees' outcomes (in other words, date when an employee starts receiving compensation benefits, time loss and date when this same employee returns to work). The Unit is developing data collection tool to collect this type of information.

Report on performance and data quality control

As explained, the Program Integrity Unit initiated activities to monitor and report on the Program's performance. As of fiscal year 2013 to 2014, the Unit started producing quarterly dashboards on employers' reporting time and the costs of administering the Act to inform senior management. In addition, the Unit, using data from the National Injury Compensation System maintained by the Program, started producing the Performance Measurement ToolFootnote 10 for high-risk organizations to make them aware of their long reporting time and frequent occurrences of work-related injuries or illnesses. Other reports have also been produced for members of the Public Service Management and Administration Committee (PSMAC) and for employers covered by the Management Accountability Framework.

Key informant interviewees indicated that some employers questioned the quality and accuracy of the data used to produce their Performance Measurement Tools. This issue about the data quality in the National Injured Compensation System was confirmed by the data quality assessment conducted as part of this evaluation. The findings from the evaluation showed that 10% of the data assessed either had missing values or contained data entry errors. For this reason, these data were removed from the data analysis. However, the share of removed data varies across employers and regions, which may create potential bias, particularly when conducting analysis at a more granular level. To address this data quality issue, the Program has already introduced a new activity whereby the entered data is reviewed by a second person to ensure its accuracy and quality.

3.1.2 Centralization of operations at headquarters

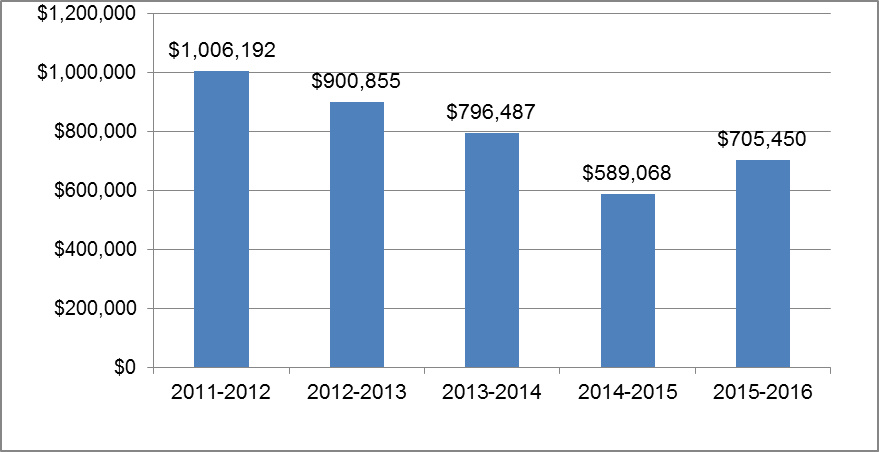

The Program centralized claim processing operations at National Headquarters aiming to improve the claim process and to reduce the costs associated with the administration of the Act. This was initiated as part of Economic Action Plan 2012. Since then the Program has also started collaborating with Dispute Resolution Services to manage third-party claims in order to reduce litigation costsFootnote 11 (which were rising), third-party claims inventories and processing times, as well as to optimize recovery possibilities (Figure 3).

During the centralization process, the Program noted that there were some inconsistencies across regional offices related to claim processes as well as a backlog of claims. As a result, some adjustments were made to standardize different procedures and meet the Program's service standard for processing time (in other words, 48 hours to process the Employer's Report of Injury forms). The guides are being developed or revised to standardize the review of Employer's Report of Injury forms as well as the third-party claims.

Source: Chief Financial Officer Branch, March 2017.

Text description of figure 3

Figure 3 illustrates litigation costs for the third-party claims (between fiscal years 2011 to 2012 and 2015 to 2016)

| Fiscal year | Dollars |

|---|---|

| 2011 to 2012 | 1,006,192 |

| 2012 to 2013 | 900,855 |

| 2013 to 2014 | 796,487 |

| 2014 to 2015 | 589,068 |

| 2015 to 2016 | 705,450 |

In addition, findings from the administrative data analysis and key informant interviews indicated that, since 2012, the Program started its collaboration in the subrogation of third-party claims with ESDC's Dispute Resolution Legal Services which has resulted in a reduction of litigation costs and third-party claims inventories as well as optimization of recovery possibilities. In particular, this collaboration is achieved via the Dispute Resolution Services assessing third party claims and negotiating settlements prior to forwarding them to the Department of Justice. Figure 3 shows that non-salary third party litigation spending has decreased from $1 million dollars in fiscal year 2011 to 2012 to about $0.7 million dollars in fiscal year 2015 to 2016, or about a reduction of 30%.

3.1.3 New activities as a result of recent changes

Employer engagement and new data collection

In 2016, the Program developed an Engagement Strategy for employers to better understand their obligations under the Government Employees Compensation Act especially the importance of timely reporting of work-related injuries or illnesses and the consequence of late injury reporting on the costs paid by the employers. The Strategy also aims to provide support to employers to improve their disability management to facilitate injured employees to return to work in a timely manner.

The Program also started engagement activities with employers through the following interdepartmental committees:

- Interdepartmental Consultation Committee for the Federal Workers' Compensation Service:Footnote 12 This Committee is a way for the Program to engage stakeholders and to discuss or share emerging issues (for example, negotiation and implementation of the new Service Agreements).

- Public Service Management Advisory Committee: This Committee is made up of Deputy Ministers from across federal departments. In fall 2016, the Program had an opportunity to inform employers of new Service Agreements as well as to promote the understanding of injury reporting and disability management obligations for employers during a Committee meeting. Subsequently, "Mini-Reports" were produced for members of this Committee to communicate individual reporting times and other information. According to key informant interviews, as a result, the reports created further activities in making the employers aware of their reporting time. For instance, 1 of the employers followed up with the Program and indicated it would streamline its internal process of submitting the Employer's Report of Injury form in order to report the injury to the Program on a timely basis.

The Program also made presentations in various fora to inform employers of modernization initiatives (for example, new Service Agreements), and obligations and claim processes with respect to the claims under the Act. These venues included: Department of National Defence Disability Management Learning Symposium, the Disability Management Practitioners' Community and the Human Resources Council meetings.

In addition, the Program engages with stakeholders on various aspects of claim processing. Key informant interviewees indicated that the Program's Operations Unit interacts with provincial Boards on a daily basis. Service quality issues are routinely addressed between the Program's director, manager and team leaders. According to the Program's estimation, the Operations Unit receives about 4,000 phone calls and 3,000 email inquiries annually. Recently, the Program has started to collect data on these types of inquiries as they are important to its role as an enabler.

Reporting and monitoring program performance

1) Issues with the data system, data quality and quantity

Findings from the document review and key informant interviews indicated that the National Injury Compensation System is not a complete database as the quality and quantity of its data and its functionality are limited. The National Injury Compensation System is a legacy database dating back to the mid-1990s and data collected is not sufficiently comprehensive to allow the Program to assess and report on its performance/effectiveness. The analysis of National Injury Compensation System administrative data (between fiscal years 2010 to 2011 and fiscal year 2016 to 2017) revealed that 14,013 (10%) of the claims records had to be removed from the analyses due to missing, invalid values or data entry errors. In particular, the database has no information on key indicators such as the claim adjudication date, the date of return to work, or the duration of the compensation period.

Recent efforts by the Program to address these data issues include the introduction of quality control of data entry and the development of a new temporary tool to collect data which is not captured by the National Injury Compensation System and that will support the monitoring of Program performance and costs.

2) Employers' performance on reporting injury

Profile of injury claims

As described in Section 2, the Government Employees Compensation Act establishes the authority to provide compensation, such as medical expenses, treatments and wage replacement to federal government employees for work-related injuries and occupational illnesses. Federal government employees include those employees in federal departments, agencies, and Crown corporations.

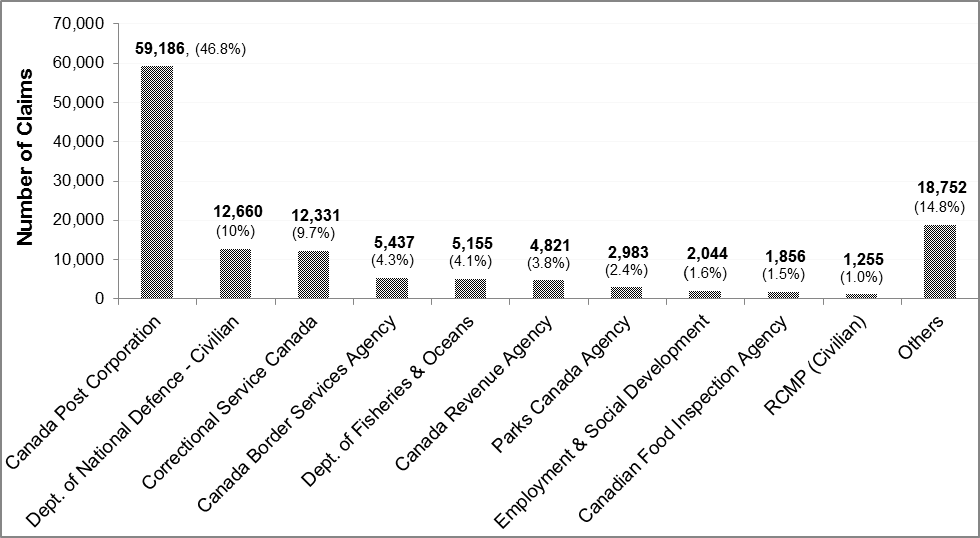

The Program received more than 126,000 claims between fiscal years 2010 to 2011 and 2016 to 2017. As shown in Figure 4, between fiscal years 2010 to 2011 and 2016 to 2017, nearly half of claims (59,186) were made by employees from the Canada Post Corporation. While there are about 180 employers covered under the Act, about 85% of claims (107,728) were from 10 employers.

The evaluation findings from the administrative data analysis show that more than half of claimants (52%) were between the ages of 35 and 54 and were more likely to be male (56%) in fiscal year 2016 to 2017. The data also show that between fiscal years 2010 to 2011 and 2016 to 2017, bodily reaction (24.5%), fall on the same level (16.8%) and overexertion (11.4%) are the most common types of accidents, and they often cause sprains, strains, tears and bruises.

Number of claims: 126,480

Source: National Injury Compensation System. Data extraction date: April 03, 2017.

Text description of figure 4

Figure 4 presents the top 10 sources of workers compensation claims reported to the Federal Works Compensation Service and the shares of total claims from April 2010 to March 2017.

| Source | Number of claims | Percentage |

|---|---|---|

| Canada Post Corporation | 59,186 | 48.8 |

| Department of National Defence Civilian only | 12,660 | 10 |

| Correctional Service Canada | 12,331 | 9.7 |

| Canada Border Services Agency | 5,437 | 4.3 |

| Department of Fisheries and Oceans | 5,155 | 4.1 |

| Canada Revenue Agency | 4,821 | 3.8 |

| Parks Canada Agency | 2,983 | 2.4 |

| Employment and Social Development Canada | 2,044 | 1.6 |

| Canadian Food Inspection Agency | 1,856 | 1.5 |

| Royal Canadian Mountie Policy Civilian only | 1,255 | 1.0 |

| Others | 18,752 | 14.8 |

Reporting time

One of the employer's key performance indicators is the period between the date an injury or illness occurs and the date the Program receives the Employer's Report of Injury form. This is referred to as reporting time. According to Treasury Board Guidelines, the reporting time should be within 3 days of injury occurrence.

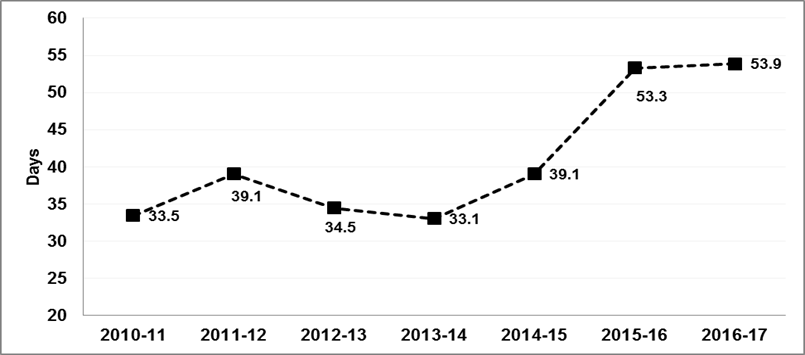

Source: National Injury Compensation System. Data extraction date: April 03, 2017.

Text description of figure 5

Figure 5 presents annual average reporting time between the date an employer is notified of an injury or illness and the date the Program receives the Employer's Report of Injury form.

| Fiscal year | Average reporting times |

|---|---|

| 2010 to 2011 | 33.5 days |

| 2011 to 2012 | 39.1 days |

| 2012 to 2013 | 34.5 days |

| 2013 to 2014 | 33.1 days |

| 2014 to 2015 | 39.1 days |

| 2015 to 2016 | 53.3 days |

| 2016 to 2017 | 53.9 days |

The reporting time defined and used for this evaluation is the period between the date an employer is notified of a work-related injury or illness and the date the Program receives the Employer's Report of Injury form. As shown in Figure 5, the average reporting times between fiscal years 2010 to 2011 and 2016 to 2017 increased from 33.5 days to close to 54 days.

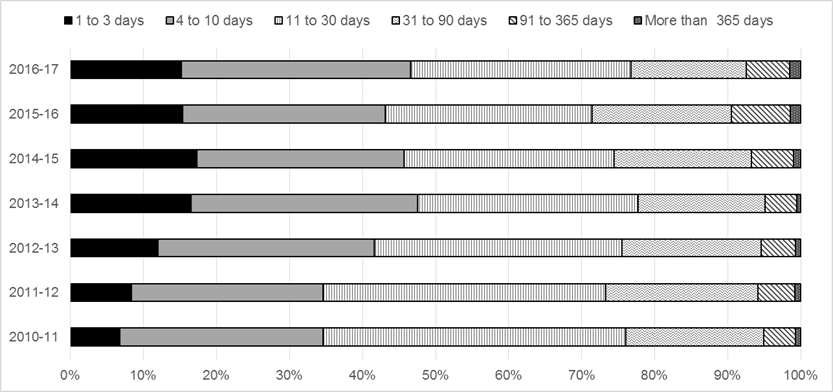

Text description of figure 6

Figure 6 illustrates the distribution of reporting times by different length of the period from fiscal year 2010 to 2011 through fiscal year 2016 to 2017.

| Fiscal year | 1 to 3 days | 4 to 10 days | 11 to 30 days | 31 to 90 days | 91 to 365 days | More than 365 days |

|---|---|---|---|---|---|---|

| 2010 to 2011 | 6.78% | 27.85% | 41.39% | 18.86% | 4.39% | 0.73% |

| 2011 to 2012 | 8.46% | 26.17% | 38.68% | 20.76% | 5.12% | 0.80% |

| 2012 to 2013 | 12.06% | 29.60% | 33.85% | 19.06% | 4.68% | 0.74% |

| 2013 to 2014 | 16.54% | 31.04% | 30.13% | 17.33% | 4.36% | 0.59% |

| 2014 to 2015 | 17.37% | 28.36% | 28.67% | 18.82% | 5.80% | 0.97% |

| 2015 to 2016 | 15.45% | 27.70% | 28.31% | 18.98% | 8.12% | 1.43% |

| 2016 to 2017 | 15.28% | 31.37% | 30.05% | 15.80% | 5.98% | 1.52% |

The administrative data analysis conducted for this evaluation revealed that the average reporting time can be "skewed" by claims with long reporting time, for example, latent conditions such as hearing loss and asbestosis which are generally diagnosed at a later stage following the date of occurrence (for example, 10 years later). This results in a long reporting time which significantly affects the average reporting time. Figure 6 shows the distribution of reporting times by the length of the notification period. While the average reporting time was 54 days in fiscal year 2016 to 2017, more than 75% of claims were reported within 30 days. The remaining 25% have a longer period of reporting time, which lengthens the average reporting time. The distribution reveals that most of the increase in the average reporting time observed in fiscal years 2015 to 2016 and 2016 to 2017 is due to an increase in the number of latent claims with reporting time of more than 3 years as indicated in Table 1.

Table1 shows that half of injuries and illnesses (median) were reported within 14 days between fiscal years 2010 to 2011 and 2016 to 2017. The median reporting time in fiscal year 2016 to 2017 was 12 days, while the average reporting time was 54 days. Therefore, the tracking of the average reporting time alone is not an appropriate way to reflect the reporting time reality. It may be complemented by other indicators of its distribution (for example, median) and the key factors that affect the reporting time (for example, type of injury). This may help senior management and employers to have better understanding of the impact of some types of claims on the reporting time and their potential cost implications. In particular, claims associated with latent health conditions could be reported separately.

| Fiscal year | 2010 to 2011 | 2011 to 2012 | 2012 to 2013 | 2013 to 2014 | 2014 to 2015 | 2015 to 2016 | 2016 to 2017 |

|---|---|---|---|---|---|---|---|

| Average reporting time with all claims (maximum: 20,127 days) | 33.5 | 39.1 | 34.5 | 33.1 | 39.1 | 53.3 | 53.9 |

| Average reporting time excluding claims with reporting time longer than 20 years (7,300 days) | 33.5 | 35.6 | 34 | 30.2 | 36.3 | 42.5 | 40.5 |

| Average reporting time excluding claims with reporting time more than 3 years | 29.1 | 31 | 28.8 | 26 | 31.1 | 37.2 | 33.1 |

| Median | 16 | 16 | 15 | 12 | 13 | 14 | 12 |

Source: National Injury Compensation System. Data extraction date: April 03, 2017.

Table 1 also indicates that by excluding claims with reporting time longer than 3 years, the average reporting time has been reduced by about 20 days. Provincial Boards' requirement to report an injury varies from 3 to 5 business days. Similarly, Treasure Board's guidelines require reporting an injury within 3 business days. However, as shown in Table 1, from fiscal year 2013 to 2014 onwards half of injuries were still reported by employers within 14 days. This points to a continued need for an engagement and awareness strategy around the importance of timely reporting of injury and its impact on employers' costs and injured employees.

3.2 Modernization of Federal Workers' Compensation Practices

Over the last 2 decades, provincial workers' compensation schemes have continued to evolve including the usage of up-to-date technology in service delivery, while updates to the operations associated with the management of the Act have been piecemeal. The document review indicated that provincial Boards have been taking a more holistic approach to workers' compensation which integrates employer awareness training, disability management, and occupational health and safety. While the role of the Program differs from provincial Boards it has also recently initiated steps to modernize the administration of the Act, to minimize the impact of work-related injuries and illnesses on federal government employees, via the renewal of Service Agreements with provincial Boards as well as greater collaboration with employers and the introduction of a new Engagement Strategy.

With the new Service Agreements, the Program's intent is to shift from its current role of administrator to an enabler. According to document review findings, for the Program, "the administrator is reactive and transactional, whereas an enabler influences and empowers, develops capacity, partners with client departments, assists in articulating needs, identifies problems, and explores resolution strategies."Footnote 13

3.2.1 Negotiation of new Service Agreements with provincial Boards

Findings from the document review show that current work-related injury and illness reporting processes are mainly paper-based and involve multiple stakeholders which have led to delays in claims reporting in the past, in particular due to some employers taking a relatively long time before reporting injuries to the Program. The delays limit early intervention and timely return to work, also increase human costs (for example, finding or training replacement employees) and financial costs such as wage replacement. In addition, key informant interviewees also pointed out that current agreements with provincial Boards are dated and do not reflect modern disability management practices which would support timely return to work of injured employees.

The renewal of the Service Agreements aims to address issues related to late reporting of work-related injury by employers and the exchange of informationFootnote 14 between the Program and the provincial Boards. Through the renewal, the Program is also attempting to ensure that federal workers are given the same consideration as provincial workers where presumption is used. In addition, the expectation is that the new Service Agreements would lead to cost savings and shorter work-related injury reporting times.

Findings from the document review and key informant interviews indicated that the negotiation of the new Service Agreements which started in 2015 focussed on early intervention, safe and timely return-to-work and the physical and mental health of workers as better outcomes for injured or ill workers. Findings from the document review and key informant interviews indicated that new streamlined processes, as a result of the new Service Agreements, would allow employers to report directly and share data via provincial Boards' portals. This would allow the Program to access relevant data from the Boards to support and facilitate the monitoring and reporting on the Program performance.

3.2.1.1 Progress and challenges with the new service agreement negotiation process

Negotiations and implementation of new signed agreements

In 2016, 4 provincial Boards (namely British Columbia, Alberta, Saskatchewan and Newfoundland and Labrador) signed new agreements which include how the agreements should be implemented. However, the negotiation of new Service Agreements with the other 6 Boards was put temporarily on hold due to the challenges encountered during the implementation of the new agreements.

Findings from the key informant interviews conducted in fall 2017 indicated that, the expectations and interpretation of the new Service Agreements were not the same for the Program and the provincial Boards. According to some key informant interviewees, this may partly be due to issues around the negotiation process where the Boards might not have fully grasped the scope of the agreements and all key stakeholders on both sides (program and Board) were not adequately involved in the negotiations.

Key informants pointed out that the responsibility for the third-party claims triage was not understood in the same way between the Program and provincial Boards. Under the signed agreements, all 4 provincial Boards would be in charge of triaging the third-party claims, "in accordance with guidelines provided by the Labour Program". Three out of 4 provincial Boards, except Alberta, were to then to determine the third-party claims and provide election package to the claimant.Footnote 15 During a pilot conducted with the provincial Board in British Colombia, WorkSafeBC, it was discovered that some potential third-party claims were not processed as they should have been. The pilot has since been stopped to address the issue of third-party claim processing.

Use of technologies

The exchange of information between each provincial Board and the Program is considered as 1 of the key elements under the new agreement to better monitor and report on the program's performance. However, key informant interviewees pointed out that it takes time to assess the security requirement of each portal. For security reasons, all provincial Boards' transfer tools and portals need to be assessed against the Government of Canada's security standards which has caused delays in implementing the new agreements.

Direct reporting pilot project with WorkSafeBC

Since July 2015, there has been an ongoing pilot project with the provincial Board in British Columbia — WorkSafeBC — to test partially the implementation of new Service Agreements. The pilot tested the impact of eliminating the Program's countersignature requirement for the Employer's Report of Injury. The new claim process allows a direct injury reporting by the employer to the provincial Board aiming to speed up the adjudication of claims. Eleven federal employersFootnote 16 in British Columbia sent Employer Reports of Injury forms directly to WorkSafeBC instead of the Program.

According to some key informant interviewees, direct reporting faced challenges of increased unmatched claims between the National Injured Compensation System and WorkSafeBC's records due to the difficulty in transmitting timely Employer's Report of Injury forms to the Program. Some interviewees also pointed out that the pilot project revealed that back-end work was created in terms of third-party claim triaging, leading to some claims which were not correctly adjudicated.

Beginning in spring 2017, the Program undertook a joint assessment of the direct reporting pilot project with WorkSafeBC. The results of the assessment indicated that employers and WorkSafeBC were overall positive about the direct reporting and the relationships between employers and WorkSafeBC were good. However, the assessments also pointed out that some staff of WorkSafeBC involved in the pilot were not well informed about the direct reporting process.

In addition, the assessments noted that although the average reporting time is still above the standard (3 days), some improvements were observed. Most of the employers participating in the pilot found that the direct reporting from employers to the Board contributed to streamlining the claims process.

3.3 Steps for the program moving forward

3.3.1 Complete the new service agreement negotiations and implementation

Key informant interviews and the document review indicated that the negotiation of new Service Agreements is a key step in addressing some issues raised in previous program reviews regarding the claim management process of occupational injury or illness for federal employees. The new Service Agreements will support the Program's efforts in improving claim management in the following way:

- Streamline the reporting process through direct reporting.

- Provide access to more comprehensive data on injured employees' outcomes.

- Continue engaging employers and boards to seek solutions to issues as they arise.

The Program will need time to address the issues encountered during the implementation of new signed Service Agreements. These issues include use of technology to share data, quick access to claim information to support invoicing process, assessment of portals where they exist, and solve the third-party claims triage and determination.

3.3.2 Review of the Government Employees Compensation Act

One of the issues identified through the document review and key informant interviews for this evaluation included the need for a stronger enforcement mechanism for employers who are late in claim reporting.

Enforcement mechanism

One of the challenges identified in various program reviews is that late claim reporting by employers prevents early intervention, which may result in higher costs to employers and negatively affect a timely return to work of injured employees.

According to Treasury Board Secretariat Guidelines, employers must submit the Employer's Report of Injury form to the Program within 3 days of occurrence. Some key informant interviewees indicated that 3 days is not a requirement under the Act, and unlike all provincial Workers Compensation Acts, the Government Employees Compensation Act does not include an enforcement mechanism to ensure the 3 days requirement is respected by employers. For instance, under Manitoba's Workers Compensation Act, if an employer failed to report a work-related injury within 5 business days of becoming aware of the injury, the employer is liable to pay a $500 fine.Footnote 17

3.3.3 Policy inconsistencies in wage replacement

The majority of federal employees such as employees of federal departments and agencies who suffer an occupational injury or illness are entitled to injury-on-duty leave benefits which are negotiated through collective agreements, as per the Treasury Board Secretariat Guidelines.Footnote 18 The intent of the Guidelines is to ensure that no pay interruption occurs from the time an employee sustains an occupational injury or illness to when the employee begins receiving income replacement benefits and other services from a provincial Board.

Under the Guidelines, a claim must be submitted and adjudicated by a provincial Board under the Government Employees Compensation Act before injury-on-duty leave is granted to an employee. Injury-on-duty leave may be paid for up to 130 working days, at which time, a review by the employer is recommended. When the injury-on-duty leave ceases, the employee receives benefits directly from their provincial Board according to the rates and conditions of their jurisdictionFootnote 19 (for example, 85% of net income up to a maximum earnings of $88,500 in Ontario in 2017).

Federal departments treat the injury-on-duty leave payments as 100% of the injured employee's salary, whereas some crown corporations (that is Canada Post) provide the payments at a lower rate than 100%.

Currently, the Program does not have access to all data on injury-on-duty leave which makes it difficult to have a good estimate of the real costs to the government related to federal injured workers. This information is important for monitoring the administration of the Act.

According to the Act, federal employees who suffer from occupational injury or illness are compensated in the same manner as their fellow workers in the same province where they work. However, some key informant interviewees indicated that some types of illness (for example, related to mental health issues) are not covered by all provinces or if covered, they are treated differently.

4. Operational and compensation costs

As earlier findings suggested, the centralization of service delivery streamlined the process, and reduced the litigation costs on claims with subrogation and its inventories. However, with limited information available on operational cost per claim, it was difficult to determine whether or not the Program is operating more efficiently over time. Qualitatively, key informant interviews indicated that the Program requires more resources to support its activities such as the implementation of Service Agreements, monitoring and reporting of program performance and outcome as well as financial management in recovering costs from employers. This section provides a trend analysis of the Program's operational costs and a snapshot of detailed compensation costs for fiscal year 2015 to 2016.

4.1 Program's operational costs

As shown in Table 2, the total operational spending of the Program fluctuates over time. The actual operation spending reached its highest about $4 million in fiscal year 2012 to 2013, including salary and non-salary spending caused by workforce adjustment. As the centralization of service delivery to Headquarters started in fiscal year 2013 to 2014, both salary and non-salary costs went up compared to the previous year (fiscal year 2012 to 2013). After the completion of centralization in December 2014, operational spending decreased by $0.7 million from $4.5 million in fiscal year 2013 to 2014 to $3.8 million in fiscal year 2014 to 2015. However, in fiscal year 2015 to 2016, the operation cost increased about a half million compared to the year before.

The operational cost data available does not include further breakdown for the salary costs (in other words, by different Units under the Program and number of full-time equivalent). In terms of the key components driving salary costs up, from fiscal year 2011 to 2012 to fiscal year 2015 to 2016, modest wage increases took effect in fiscal year 2011 to 2012, 2012 to 2013 and 2013 to 2014. For fiscal year of 2014 to 2015 and fiscal year 2015 to 2016, fiscal year 2013 to 2014 salary levels remained in effect since collective agreements in the Core Public Administration had expired in fiscal year 2013 to 2014 and had not been renewed. Additional information on the occupational and pay structure of the Program would be required to inform whether increased salary costs relate to an increase in full-time equivalents. The findings from the key information interviews indicated that when Claims Operations was centralized, not all experienced regional claim officers agreed to be relocated to Headquarters. There was a backlog of injury claims in fiscal year 2014 to 2015 waiting to be countersigned and triaged. For these 2 reasons, there has been a gradual increase of employees overtime.

| Fiscal year | 2011 to 2012 | 2012 to 2013 | 2013 to 2014 | 2014 to 2015 | 2015 to 2016 |

|---|---|---|---|---|---|

| Salary | $2,992,919 | $3,743,154* | $3,359,794 | $3,038,641 | $3,483,091 |

| Non-salary** | $191,627 | $222,998*** | $333,372 | $147,388 | $117,403 |

| Total | $3,184,546 | $3,966,152 | $3,693,166 | $3,186,029 | $3,600,494 |

* The salary costs include $736,964 caused by the department's workforce adjustment strategy.

** Non-salary exclude the third party litigation expenses.

*** The non-salary costs include $35,989 caused by the departmental workforce adjustment strategy

Source: Chief of Financial Officer Branch, March 2017.

4.2 Estimated costs of the Government Employees Compensation Act

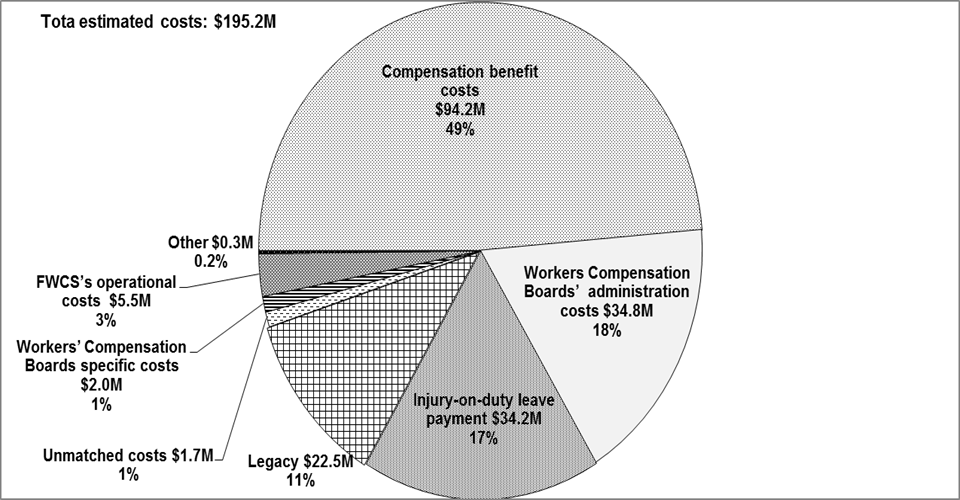

As described in the Program overview (Section 2), federal employees' work-related injury claims are adjudicated by provincial Boards. The Program recovers most of the costs from employers (federal departments, agencies and Crown Corporations). In general, the costs of administering Government Employees Compensation Act include the following (see Figure 7):

- Workers' compensation costs ($94.2 million, 49%): benefit costs, including medical costs, rehabilitation costs, pension costs, compensation costs for loss of income, lump sum costs and other costs. The amount of benefit costs varies and depends on the types of injuries and on different Workers' Compensation Boards' policies.

- Workers' Compensation Boards' administration costs ($ 34.8 million, 18%): administration fee paid to WCBs for adjudicating claims, in accordance with the terms and conditions set out in the Service Agreement with WCBs.

- Injury-on-Duty Leave payment ($34.2 million, 17%): full salary paid to injured employees by their employer.Footnote 20, Footnote 21

- Legacy costs ($22.5 million, 11%): compensation costs paid for all injuries or illnesses that have occurred prior to the implementation of the Workers' Compensation Cost recovery Program in 1998. A decision was made that these costs cannot be recovered from employers. In the case of hearing loss, for example, if exposure to noise occurred prior to April 1, 1998, costs associated with this claim would fall under legacy costs, even if the claim was submitted this year.

- Operational costs of the Program ($5.5 million, 3%): Costs accrued by the Program to administer the Act and third party claims.

- Workers' Compensation Boards specific costs ($2 million, 1%): this includes amounts such as costs for audit of financial statement in Manitoba.

- Unmatched benefits costs ($ 1.7 million, 1%): these are costs accrued by the Boards that cannot be matched to a file in the National Injury Compensation System because the Program has not yet received the Employer's Report of Injury form.

- Other costs ($0.3 million, 0.2%).

As shown in Figure 7, estimated benefit costs contribute to almost half (49%) of the total costs for fiscal year 2015 to 2016. The estimated administration fees paid to the Boards,Footnote 22 which constitutes another important expenditure category, add up to about 18% of the total estimated costs, and are followed by injury-on-duty leave (about 17%). The program's operational cost took fairly small portion of the total costs, 3%.

It is important to note that the injury-on-duty leave figure only represents the portion equivalent to what the provincial Boards would have paid in benefits had the employee not received injury-on-duty leave (income replacement rate). The "employer top-up" is missing (in other words, the amount between the Board income replacement and full salary paid through injury-on-duty leave).

Source: Data provided by the Program on June 30, 2017.

Text description of figure 7

Figure 7 illustrates the shares of different types of estimated costs in fiscal year 2015 to 2016.

| Types of costs | Percentage | Estimated costs ($ million) |

|---|---|---|

| Compensation benefit costs | 48.7 | 94.2 |

| Workers Compensation Boards' administration costs | 17.6 | 34.8 |

| Injury-on-duty leave payment | 17.3 | 34.2 |

| Legacy | 11.4 | 22.5 |

| Unmatched costs | 1.0 | 1.7 |

| Workers' Compensation Boards specific costs | 1.0 | 2.0 |

| FWCS's operational costs | 2.8 | 5.5 |

| Other | 0.2 | 0.3 |

4.3 Total compensation costs, administration costs and recoveries

Between fiscal years 2011 to 2012 and 2016 to 2017, the total payments of employees compensation and administration costs to the provincial Boards were about $157 million, except for fiscal year 2013 to 2014 and fiscal year 2016 to 2017 where costs were about $165 million (see Table 3). Both compensation and administration costs have gone up in fiscal year 2013 to 2014, then gradually dropped to the level as fiscal year 2011 to 2012 in fiscal year 2015 to 2016. At the same time, the total recovery amounts from employers fluctuated between a low of $113 million in fiscal year 2011 to 2012 and a high of $127.6 million in fiscal year 2016 to 2017. Statutory net costs have also fluctuated over time, from $44 million in fiscal year 2011 to 2012 to $30 million in fiscal year 2015 to 2016, and then to $40 million in fiscal year 2016 to 2017.

| ($ Millions) | 2011 to 2012 | 2012 to 2013 | 2013 to 2014 | 2014 to 2015 | 2015 to 2016 | 2016 to 2017 |

|---|---|---|---|---|---|---|

| A. Compensation costs | 124.1 | 120.6 | 125.0 | 120.6 | 122.5 | 126.5 |

| B. Administration costs paid to provincial Boards | 33.3 | 36.3 | 38.7 | 36.3 | 34.8 | 38.7 |

| A+B* | 157.4 | 157.0 | 163.7 | 156.9 | 157.3 | 165.2 |

| Recoveries | 113.5 | 114.5 | 123.1 | 119.5 | 127.6 | 125.0 |

| Net expenditures | (43.9) | (42.5) | (40.5) | (37.4) | (29.7) | (40.2) |

*As shown in the Public Accounts.

Source: Government of Canada, Public Accounts of Canada, Volume III, Section 11, 2012 to 2017.

4.4 Program resources

Key informant interviewees indicated that centralization led to a reduction of program resources ($0.7 million). In addition, the lack of proper data collection mechanisms and tools have resulted in delaying collection and analyses of data relating to program results and performance including the reporting times and time loss period between injury and return to work. Key informants also identified the shortage of resources as a challenge in completing certain key activities such as supporting the implementation of the new Service Agreements, financial management of workers compensation including paying cost to provincial Boards and recovery from employers.

5. Conclusion and recommendations

The Federal Workers' Compensation Service has taken steps to improve the administration of the Government Employees Compensation Act. These steps include upfront validation procedures to ensure the quality of administrative data, the standardization of certain operations related to claim administration, performance improvements in meeting claims processing time standards and the collection of additional data. In doing so, the Program made progress towards streamlining the claim operations and modernizing the workers' compensation practices as recommended by previous program reviews.

Since 2015, the Program has started negotiating new Service Agreements with provincial Workers' Compensation Boards with the intent to modernize workers' compensation practices. The Program is making progress in building clear accountability with a focus on tracking outcomes, better communication with stakeholders as well as data sharing practices and timely delivered services to injured workers. The implementation of 4 negotiated Service Agreements has encountered challenges related to direct reporting, sharing data using new technology as well as the triage and determination of third-party claims. These challenges required immediate attention before resuming the negotiation of the remaining agreements.

The Program collects information on federal injured workers using a legacy system (the National Injury Compensation System) which makes it difficult to collect and provide all necessary data to support effective program management including monitoring the total costs of compensation.

The Treasury Board Secretariat's guideline on injury-on-duty leave does not cover all federal employers under the Government Employees Compensation Act and it gives employers the discretion in determining the duration of injury-on-duty-leave as per individual collective agreements.

While the Program is making progress, additional work needs to be done to adequately assess the program outcomes in ensuring the timely compensation and income continuity as well as to minimize the impact of work-related injuries and illnesses on federal government employees. Phase II of the evaluation of the Program will look into these issues to address questions regarding the Program is administering the Act effectively and efficiently.

Recommendation

The evaluation findings show that the legacy database is limited in its capacity to collect and provide the information required to monitor performance and results. Given the available information, for example, "average reporting time" indicator may not provide a representative picture of the reporting time of most claims and the Program currently does not collect outcome data such as the date when an employee start receiving compensation and the date when the same employee returns to work, the following recommendation has been developed:

- Continue working towards a more comprehensive data management framework to support reporting activities as well as monitoring performance and outcomes.

Annex 1. Evaluation questions

- To what extent is the Program aligned with federal roles and responsibilities, government priorities, and departmental strategic outcomes of safe, healthy, fair, and productive workplaces?

- To what extent is the Program supporting employers to improve their disability management activities?

- To what extent have changes made or being implemented (centralization of service delivery at National Headquarters), negotiation of new Service Agreements with the Workers' Compensation Boards, implementation of the Program Integrity Unit to ensure monitoring of financial accounts and reporting for performance and accountability and the development of a Stakeholder Engagement Strategy) addressed the challenges associated with reporting times, stakeholder engagement, and support provided to employers?

- Is there evidence that the Program governance (operational structure/processing) and service delivery are sound and appropriate to support program effectiveness?

- To what extent do the new claims reporting processes negotiated and implemented with Workers' Compensation Boards and employers ensure injured employees' income continuity and facilitate a safe and timely return to work?

- To what extent is the Program being delivered more efficiently and economically after the changes made or being implemented (centralization of service delivery at NHQ, negotiation of Service Agreements with Workers' Compensation Board s, implementation of the Program Integrity Unit to ensure monitoring of financial accounts and reports for performance and accountability, and the development of a stakeholder engagement strategy)?

Annex 2: Evaluation methods

Three lines of evidence including: document review, administrative data analysis and key informant interviews were used to gather data and information for Phase I evaluation.

1. Document review

The document review was conducted using the documents provided by the Federal Workers' Compensation Service Program and other relevant sources. Those documents were expected to assist in understanding the Program's current context and activities. The review helped understand the extent to which recent changes made to the Program have improved its ability to deliver on its mandate and achieve its expected outcomes as indicated in its recently developed logic model. The document review was completed in fall 2017.

Limitations

The document review technical study was developed based on available documents which were not always up-to-date at the time of the review and analyses. Therefore, the descriptions of some program elements were not complete or accurate. To address these issues, another line of evidence, the key informant interviews, included questions to increase the understanding of the Program activities and expected outcomes.

2. Administrative data analysis

The data extracted in April 2017 from the National Injury Compensation System was used for data quality assessment and the administrative data analysis to support Phase I evaluation. The database contained information on compensation claims, claimants and cost information between fiscal years 2009 to 2010 and 2016 to 2017. The data analysis was conducted in summer 2017.

Limitations

Due to the limitation of the National Injured Compensation System which does not record various dates related to claim processes and adjudication; it was not possible to assess the income discontinuity or the efficiency (in terms of the impact of the injury or illness on the employee or real costs to employers). Excluding inconsistent records could also create bias in the data and lead to a misrepresentation of reality.

3. Key informant interviews

Eleven (11) key informant interviews were conducted to collect program representatives' views and perspectives on the Program's activities, operation and outcomes. The key informant interviews were conducted between September and October 2017.

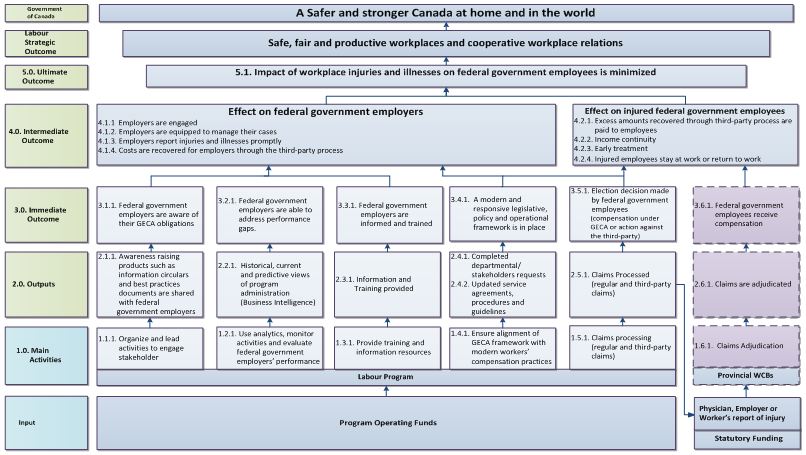

Annex 3: Program logic model (2017)

Text description of annex 3

Annex 3 illustrates the logic model of the Federal Workers' Compensation Service which outlines, from the bottom to the top, its inputs, activities, outputs, immediate outcomes, intermediate outcomes, ultimate outcome and the strategic outcome the program intends to achieve or to which it intends to contribute.

The logic model indicates that there are two separated streams according to the origin of the funds used to perform the activities, produce outputs and accomplish outcomes. 1) the Program Operating Funds stream presents activities performed by FWCS while the 2) Statutory Fund stream presents activities performed by provincial Workers' Compensation Boards pursuant to Government Employees Compensation Act and Service Agreements. A workers' compensation claim could be initiated through the combination of the physician, employer, and employee report of injury.

1.0. The activities conducted by FWCS

1.1.1. Organize and lead activities to engage stakeholder

1.2.1. Use analytics to monitor activities and evaluate federal government employers' performance

1.3.1. Provide training and information resources

1.4.1. Ensure alignment of GECA framework with modern workers' compensation practices

1.5.1. Claims processing (regular and third-party claims)

The activities performed by provincial Workers' Compensation Boards

1.6.1 Claims Adjudication — performed by Provincial Workers' Compensation Boards and out of FWCS' influence

2.0. Outputs

Activity 1.1.1. is expected to produce the following output: 2.1.1. Awareness raising products such as information circulars and best practices documents are shared with federal government employers

Activity 1.2.1. is expected to produce the following output: 2.2.1. Historical, current and predictive views of program administration (in other words, business intelligence)

Activity 1.3.1. is expected to produce the following output: 2.3.1. Information and Training provided

Activity 1.4.1. is expected to produce the following outputs: 2.4.1. Completed departmental /stakeholders requests and 2.4.2. Updated Service Agreements, procedures and guidelines

Activity 1.5.1. is expected to produce the following output: 2.5.1. Claims Processed (regular and third-party claims)

Activity 1.6.1. is expected to produce the following output: 2.6.1. Claims are adjudicated — performed by Provincial Workers' Compensation Boards and out of FWCS' influence

3.0. Immediate outcomes

Output 2.1.1. is expected to achieve the following immediate outcome: 3.1.1. Federal government employers are aware of their GECA obligations

Output 2.2.1. is expected to achieve the following immediate outcome: 3.2.1. Federal government employers are able to address performance gaps

Output 2.3.1. is expected to achieve the following immediate outcome: 3.3.1. Federal government employers are informed and trained

Output 2.4.1. and 2.4.2 are expected to achieve the following immediate outcome: 3.4.1. A modern and responsive legislative, policy and operational framework is in place

Output 2.5.1. is expected to achieve the following immediate outcome: 3.5.1. Election decision made by federal government employees (compensation under GECA or action against the third-party) and contribute to output 2.6.1: claims adjudication which is performed by provincial Workers' Compensation

Output 2.6.1. is expected to achieve the following immediate outcome: 3.6.1. Federal government employees receive compensation — performed by Provincial Workers' Compensation Boards and out of FWCS' influence

4.0. Intermediate outcome

Immediate outcomes 3.1.1., 3.2.1., 3.3.1., 3.4.1., and 3.5.1.produce a combined effect on federal government employers including:

- 4.1.1. Employers are engaged

- 4.1.2. Employers are equipped to manage their cases

- 4.1.3. Employers report injuries and illnesses promptly

- 4.1.4. Costs are recovered for employers through the third-party process

Immediate outcomes 3.4.1., 3.5.1., and 3.6.1 as well as the improvements to employer reporting times will produce a positive combined effect on injured federal government employees including:

- 4.2.1. Excess amounts recovered through the third party process are paid to employees

- 4.2.2. Income continuity

- 4.2.3. Early treatment

- 4.2.4. Injured employees stay at work or return to work

5.0. Ultimate outcome

The intermediate outcomes are expected to contribute to the ultimate outcome: 5.1 Impact of workplace injuries and illnesses on federal government employees is minimized

FWCS engages in activities whose outcomes are designed to not only support the departmental strategic outcome: safe, fair and productive workplaces and cooperative workplace relations but also contribute to the Government of Canada's objective: a safer and stronger Canada at home and in the world.

Annex 4. Details of regular and third-party claim processes

A worker's compensation claim could be triggered by an Employer's Report of Injury form submitted by an employer to the Program followed by an injured employee notify the injury immediately to his/her employer. Meanwhile, the employee also needs to fill out a specific form, the Worker's Report of Injury, and submit it to the relevant Board. When seeking medical attention, the injured employee also needs to inform his/her healthcare provider that their injury or illness is related to work; the healthcare provider (usually a physician) will have to submit a specific form, the Physician's or Healthcare provider's Report, to the Board.

As shown in Figure 8, when a federal employee suffers from an occupational injury or illness, the employee needs to notify his/her employer. The employer must complete an Employer's Report of Injury form (ERI) and then mail or fax the formFootnote 23 to the Federal Workers' Compensation Service (FWCS). The Claim Operations Unit within FWCS will verify and confirm whether the employer of the injured employee is a Government Employment Compensation Act employer and, if so, enter the claim data in National Injured Compensation System, countersign the Employer's Report of Injury form, and determine whether the claim is a ‘regular' claim or a ‘third party' claim (so called when a third party is involved).