Executive summary - Evaluation of the Labour Market Development Agreements

On this page

1. Introduction

Employment and Social Development Canada (ESDC) worked jointly with 12 Provinces and Territories (P/Ts) to undertake the 2012-2017 second cycle for the Labour Market Development Agreement (LMDA) evaluation. The first cycle of LMDA evaluation was carried out between 1998 and 2012 and involved the conduct of bilateral formative and summative evaluations in all P/Ts. Under the second cycle, the evaluation work consisted of conducting two to three studies per year on the Employment Benefits and Support Measures (EBSMs) similar programming delivered under these agreements. The studies generated evaluation evidence on the effectiveness, efficiency and design/delivery of EBSMs for Canada overall and for the twelve P/Ts that opted for a joint evaluation process with CanadaFootnote 1.

Under LMDAs, Canada transfers $2.14B in Employment Insurance (EI) Part II funds to P/Ts for the design and delivery of programs and services to help unemployed individuals, mainly eligible under EI, to find and maintain employment.

Programs and services delivered by P/Ts have to correspond to the EBSM categories defined under the EI Act. The following is a short description of the five programs and services examined in the evaluation:

- Skills Development (including Apprenticeship) helps participants obtain employment skills by giving them financial assistance in order to attend classroom training.

- Targeted Wage Subsidies help participants obtain on-the-job work experience by providing employers with a wage subsidy.

- Self-Employment provides financial assistance and business planning advice to participants to help them start their own business.

- Job Creation Partnerships provide participants with opportunities to gain work experience that will lead to ongoing employment. Employment opportunities are provided by projects that contribute to developing the community and the local economy.

- Employment Assistance Services such as counselling, job search skills, job placement services, the provision of labour market information and case management.

Three additional programs and services are available under the LMDA and they are: Labour Market Partnerships, Research and Innovation and Targeted Earnings Supplements. They were not evaluated as part of this evaluation. The Targeted Earnings Supplements program is used in one province only while Labour Market Partnerships, and Research and Innovation will be evaluated at a later stage.

Table 1 provides an overview of the share of funding allocated to the five EBSMs examined under the second cycle for LMDA evaluation and the average cost per participant.

| Program and service | Share of funding 2014-2015 |

Average cost per participant 2002-2005 |

|---|---|---|

| Skills Development | 51% | $7,150 |

| Employment Assistance Services | 35% | $700 |

| Targeted Wage Subsidies | 6% | $4,700 |

| Self-Employment | 6% | $11,100 |

| Job Creation Partnerships | 2% | $8,400 |

| Total | 100% | n/a |

Sources: EI Monitoring and Assessment Reports 2002-2003 to 2014-2015.

This report presents a summary of the findings from nine national level studies. Similar reports will be available for each province and territory in 2017 and 2018. Results are presented for active and former EI claimants, and for long-tenured workersFootnote 2, youth (under 30 years old) and older workers (55 years old and over). Active EI claimants were actively on EI at the time of their EBSM participation. Former EI claimants received EI up to three years before staring their EBSM participation.

2. Key findings

2.1 Effectiveness and efficiency of EBSMs

Incremental impacts and cost-benefit analyses addressed EBSM effectiveness and efficiency.

Overall, incremental impacts demonstrate that LMDA programs and services are improving the labour market attachment of active and former EI claimant participants, including youth and older workers. As well, social benefits of participation exceeded the cost of investments for most interventions over time. Finally, providing Employment Assistance Services interventions earlier during an EI claim (first four weeks) produced larger impacts on earnings and employment and facilitated earlier return to work. This demonstrates the importance of targeting early participation of EI active claimants.

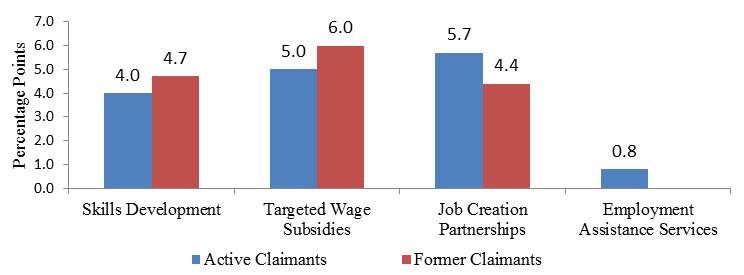

Figure i presents the incremental impacts on the incidence of employment for active and former claimants by type of program. The estimates can be interpreted as a change in the probability of being employed following participation. For example, participation in Skills Development increases the probability of being employed by 4 percentage points for active EI claimants relative to unemployed non- participants.

Figure i illustrates the probability of being employed (in percentage points) for active and former employment insurance claimants relative to non-participants by program type.

Figure i -Text description

| Percentage points | Skills Development | Targeted Wage Subsidies | Job Creation Partnership | Employment Assistance Services |

|---|---|---|---|---|

| Active claimants | 4 | 5 | 5.7 | 0.8 |

| Former claimants | 4.7 | 6 | 4.4 | n/a |

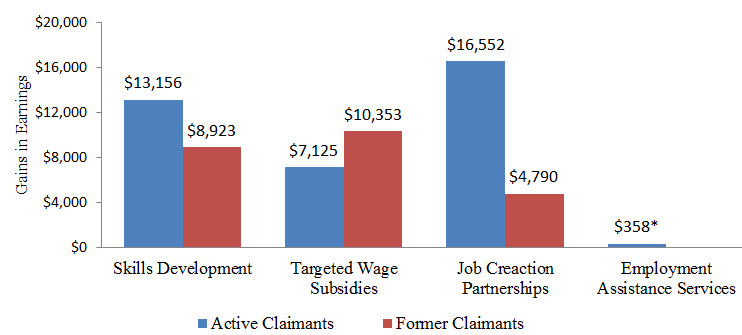

Figure ii presents the cumulative increase in employment earnings for active and former claimants over the 5 years post-participation. It is noted that Employment Assistance Services are relatively modest activities and, by themselves, are not expected to lead to substantial effects on labour market outcomes. In other words, these services aim to support the return to work of unemployed participants and not necessarily to secure a better paying job than pre-participation. However, as demonstrated later in the report, providing Employment Assistance Services earlier during the EI claim (first 4 weeks) produced larger impacts on earnings and employment and facilitated earlier returns to work.

Figure ii illustrates the cumulative earnings for active and former employment insurance claimants relative to non-participants by program type.

Figure ii -Text description

| Gains in earnings | Skills Development | Targeted Wage Subsidies | Job Creation Partnership | Employment Assistance Services |

|---|---|---|---|---|

| Active claimants | $13,156 | $7,125 | $16,552 | $358* |

| Former claimants | $8,923 | $10,353 | $4,790 | n/a |

* The incremental impact on earnings for Employment Assistance Services participants is not statistically significant at the 95% level.

Table 2 presents the number of years required for the social benefits to exceed program cost. Social benefits to participation exceeded investment costs in a period ranging between the 2nd year of program participation to about 10 years after participation. This excludes former claimants who participated in Job Creation Partnerships for whom the investment costs are not likely to be recouped before 25 years. However, this group represented only 0.3% of new EBSM interventions in 2014-2015.

| Skills Development | Targeted Wage Subsidies | Job Creation Partnerships | Employment Assistance Services | |

|---|---|---|---|---|

| Active claimants | 7.4 | 5.9 | 5.9 | 10.9 |

| Former claimants | 8.6 | 2nd participation year | Over 25 years | n/a |

2.2 Lessons learned about program design and delivery

Key informants interviews with service providers and program managers as well as the documents reviewed and the questionnaires filled by provincial/territorial representative also generated a few lessons about program design and delivery:

Skills Development

- Key informants confirmed that most P/Ts take steps to direct Skills Development funding towards training for occupations in demand in the labour market. In particular, as part of the application process, prospective participants have to justify their choice of training program by demonstrating that labour market demand exists. Five provinces/territories may not approve applications for training leading to employment in low demand occupations.

- According to key informants, the main challenges related to Skills Development include:

- Lack of capacity to case manage and monitor individuals facing multiple barriers to employment.

- Access to the program is limited due to the EI eligibility criteria.

- Participant’s ability to access and complete training is often limited by a lack of essential skills, learning disabilities, literacy issues and other factors such as living in remote locations and lack of transportation.

- Unemployed individuals lack awareness about the program and early engagement of EI claimants is difficult since Service Canada does not refer recent claimants to provincial/territorial offices.

Skills Development for Apprentices

- Existing Canadian literature showed that there is a fairly high non-completion rate among apprentices (40-50%)Footnote 3. Furthermore, subject matter literature revealed that despite the growth in apprenticeship registrations in Canada, there has not been a corresponding increase in completion ratesFootnote 4. While it is not possible with available data to generate a reliable estimation of the completion rate of Skills Development-Apprentices participants, key informants involved in apprenticeship delivery confirmed the stagnation in completion rates.

- According to key informants, apprenticeship drop-out is due to factors such as low level of essential skills, financial difficulties (for example, not being able to live on EI benefits while on training) and delays in getting EI benefits (for example, EI eligibility is not confirmed until training is almost complete).

Targeted Wage Subsidies

- Key informants confirmed that participation in Targeted Wage Subsidies can be driven by either unemployed individuals or employers looking to fill a new position. Key informants also confirmed that in most P/Ts covered by the evaluation, the subsidized employers are generally hiring those they would not have otherwise hired without the help of the program.

- While evaluation results have demonstrated the effectiveness of Targeted Wage Subsidies, its use has been falling in recent years. According to the EI Monitoring and Assessment Reports, the proportion of new Targeted Wage Subsidies interventions decreased from 3% to 1% of all new interventions between 2002/03 and 2014/15. Reasons identified by key informants to explain this decline include:

- The frequent and time consuming reporting requirements for the employers.

- Lack of awareness about the program among employers.

- Employers having a negative perception of the quality of the candidates.

- Difficulty in matching employers’ needs to the skills of available candidates.

Employment Assistance Services

- According to key informants, challenges with the design and delivery of Employment Assistance Services include:

- Lack of awareness about Employment Assistance Services among potential participants.

- Current budget allocation is not enough to support the delivery of Employment Assistance Services and has led some service providers to eliminate services.

- Service providers cannot provide all the services needed for participants facing multiple barriers to employment. They have to refer these individuals to other organizations.

3. Recommendations

A total of 9 recommendations emerge from the evaluation findings. They are as follows:

- The study on the timing of Employment Assistance Services participation showed that receiving assistance early after starting an EI claim can lead to better labour market impacts. However, key informants repeatedly reported a lack of awareness about the program.

- Recommendation 1: Consideration should be given to providing P/Ts with timely access to data on new EI recipients for supporting targeting and increasing awareness.

- Recommendation 2: Since ESDC has access to Records of Employment and EI data, it should explore what active role it could play in raising program awareness among new EI recipients.

- Key informants reported that lack of essential skills, learning disabilities and literacy issues are common barriers to accessing and completing training.

- Recommendation 3: Consideration should be given to remove barriers to accessing and completing training such as literacy/essential skills training and learning disability assessments. The measures would help individuals with multiple barriers to prepare for vocational training and to reintegrate the labour market. The measures should be reported separately from other Skills Development interventions given their unique objectives.

- Incremental impact results show that Targeted Wage Subsidies is improving the earnings and employment of participants. However, its use has been falling over the years. According to key informants, the decline is related to employers not using the program due to the administrative processes, lack of awareness about the program and difficulty in finding suitable candidate.

- Recommendation 4: P/Ts should explore ways of removing barriers to employer participation in Targeted Wage Subsidies.

- Key informants confirmed the necessity of having labour market information to support the delivery of Employment Assistance Services. They, however, pointed to the difficulty of accessing or producing labour market information at the regional/local level.

- Recommendation 5: Consideration should be given to enhance the capacity of service providers to access or produce, when needed, relevant labour market information.

- The evaluation was not able to produce a conclusive assessment of Self-Employment effectiveness and efficiency since the data used to assess impacts on earnings may not be the best source of information available to reflect the financial wellbeing of the participants. As well, little is known about the design and delivery of this program. Overall, it is not clear whether participant’s success in improving their labour market attachment through self-employment is more closely associated with their business idea and their entrepreneurship skills than the assistance provided under Self-Employment.

- Recommendation 6: Consideration should be given to examine in more detail the design and delivery of Self-Employment and whether the performance indicators for this program are appropriate.

- Job Creation Partnerships was found to be particularly effective at improving earnings and incidence of employment of active claimants. However, the evaluation has not yet examined the design and delivery of this program. Therefore, a lot remains unknown about how this program operates and the factors that contribute to its effectiveness.

- Recommendation 7: Consideration should be given to examine the design and delivery of Job Creation Partnerships in order to better understand how this program operates.

- Overall, the LMDA evaluation was able to produce a sound assessment of EBSM effectiveness and efficiency because the team had access to rich data on EI claimants and was capable of linking them to EBSM participation data and Canada Revenue Agency taxation files. However, some data gaps limited the evaluation’s ability to assess how EBSMs operate.

- Recommendation 8: Improvements in the data collection is recommended to address key program and policy questions of interest to the federal and provincial/territorial governments. Specifically:

- Mandatory reporting of the highest level of education as part of the EI claim application.

- Collect data on whether participants are members of designated groups including Indigenous peoples, persons with disabilities and recent immigrants.

- Collect data on the type of training funded under Skills Development and the type of assistance provided under Employment Assistance Services. ESDC should work with P/Ts to define common categories for both EBSMs.

- Collect detailed data on the cost of interventions.

- ESDC should consider securing access to provincial/territorial social assistance records in order to enrich the administrative data with patterns of social assistance use for participants and non-participants.

- Recommendation 8: Improvements in the data collection is recommended to address key program and policy questions of interest to the federal and provincial/territorial governments. Specifically:

- The data assessment process revealed some gaps regarding data quality and integrity. These documented gaps can be addressed by defining clear roles and responsibilities.

- Recommendation 9: Considerations should be given to assign responsibility for a specific unit within ESDC to manage data integrity, including validating data uploads and documenting changes over time.