Evaluation of the Opportunities Fund for Persons with Disabilities – Phase 2

On this page

- List of figures

- List of tables

- Executive summary

- Key findings

- Recommendations

- Program background

- Evaluation scope

- Profile of participants

- Labour market outcomes: Employment income

- Labour market outcomes: Employment

- Labour market outcomes: Social assistance

- Net impact analysis

- Net impact analysis: Employment income

- Net impact analysis: gender

- Net impact: Incidence of employment

- Net impact: Social assistance

- Summary of net impacts

- Program reforms

- Effects of program reforms

- Cost-benefit analysis

- Social return on investment

- Key findings: Needs

- Key findings: Awareness

- Key Findings: Retaining employees

- Conclusions

- Recommendations

- Management response / Action plan

- Annex A: Methodology

- Annex B: Study limitations

- Annex C: Summary of net impacts

- Annex D: Outcomes and net impacts

- Annex E: Phase I questions and findings

- Annex F: Outcome indicators

- Annex G: Works cited

Alternate formats

List of figures

- Figure 1: Gender distribution

- Figure 2: Age distribution

- Figure 3: Distribution of disability type among Opportunities Fund clients, 2011-2012 Cohort

- Figure 4: Income distribution of the 2012 Canadian population with a disability

- Figure 5: Income distribution of the Opportunities Fund 2011-2012 cohort 1 year before program start

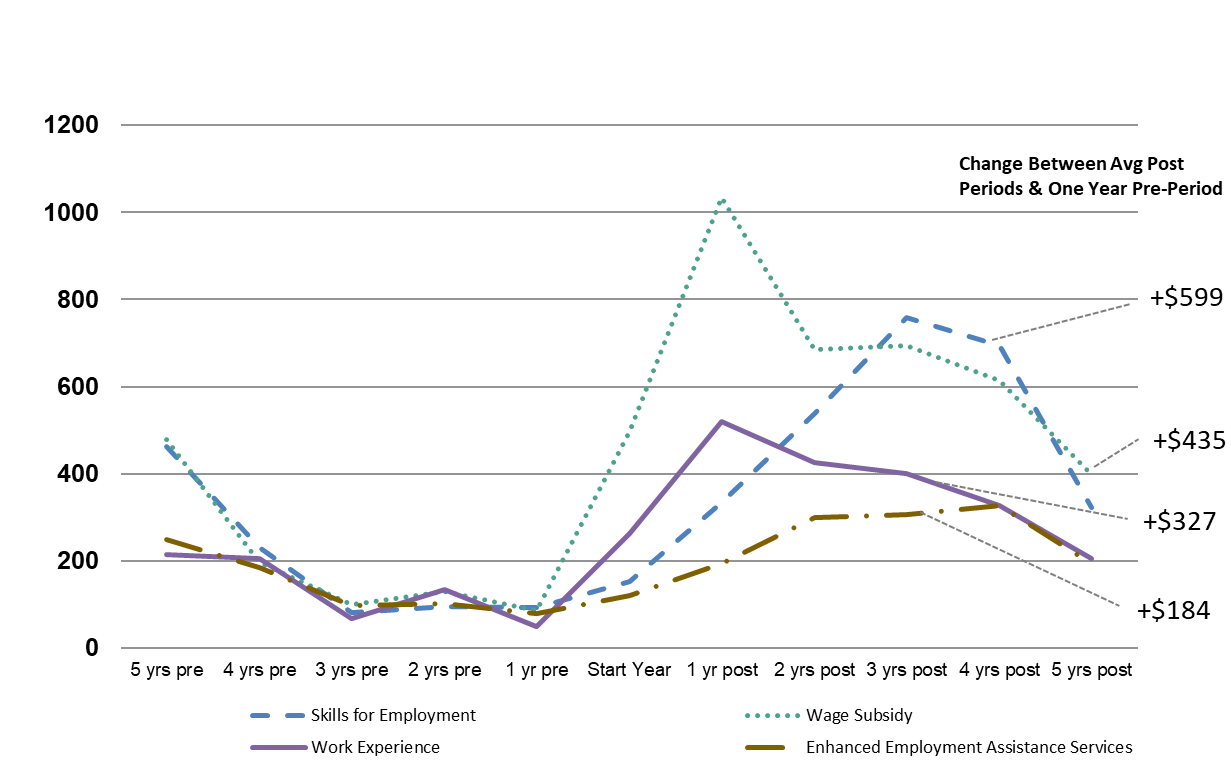

- Figure 6: Average annual employment income by intervention, 5 years pre-participation to 5 years post-participation

- Figure 7: Proportion of participants employed by intervention type, 5 years pre-participation to 5 years post-participation

- Figure 8: Average annual social assistance income use by intervention, 5 years pre-participation to 5 years post-participation

- Figure 9: Impact on participants’ employment income (5-Year post-participation period – annual average

- Figure 10: Change in earnings for men and women participants (annual average earnings over 5 years post-participation, 2013 to 2017)

- Figure 11: Impact on participants’ incidence of employment (5-year post participation period - annual average)

- Figure 12: Impact on participants’ use of social assistance (5-year post-participation period – annual average

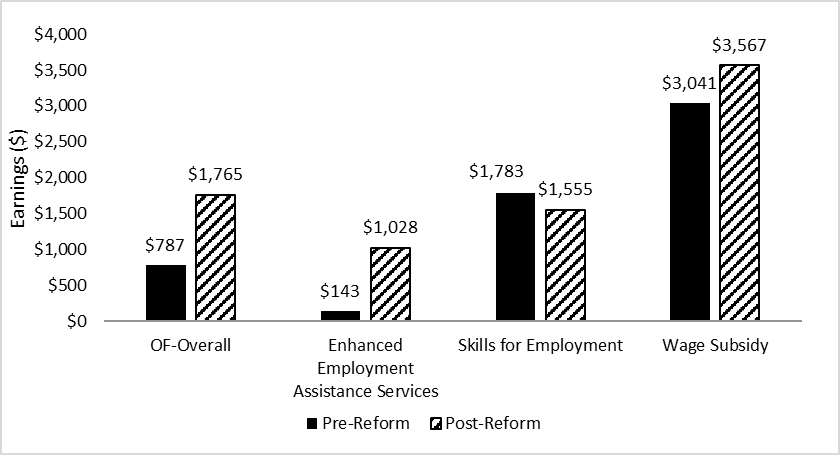

- Figure 13: Short-term comparison of net impact on earnings between 2015 and 2011 to 2012 Opportunities Fund participants (1-year post participation)

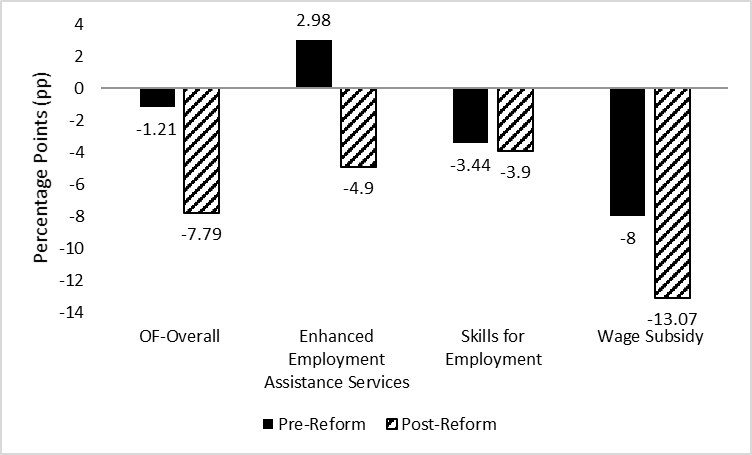

- Figure 14: Short-term comparison of net impact on dependence on income support between 2015 and 2011 to 2012 Opportunities Fund participants (1-year post participation)

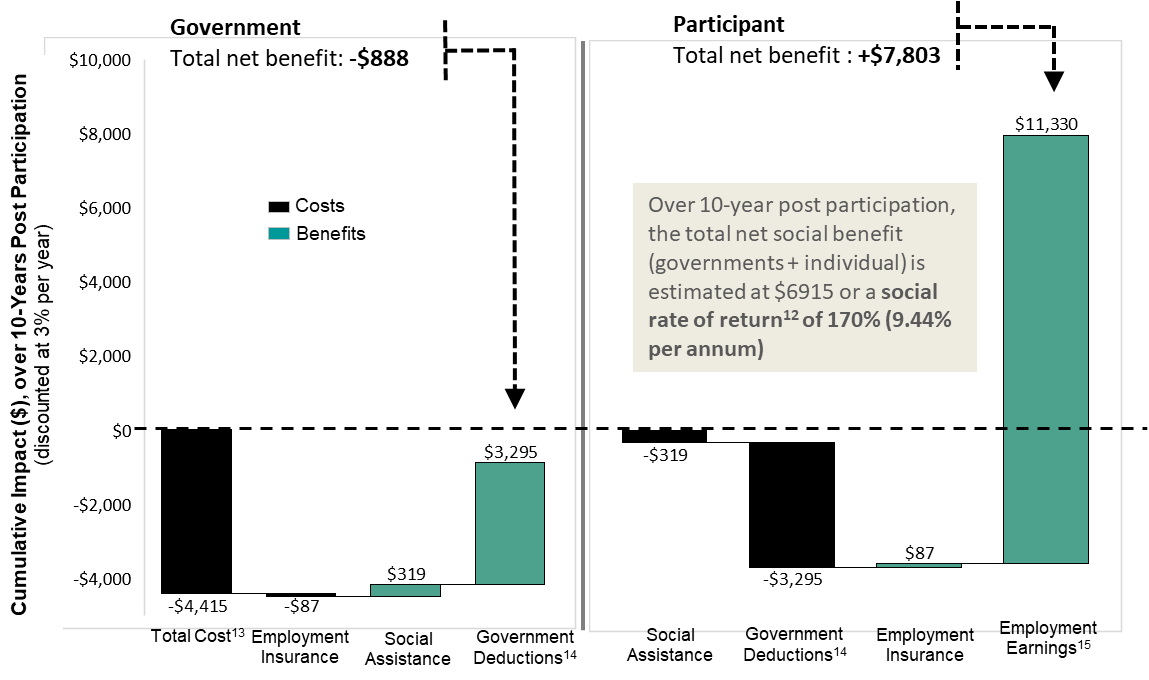

- Figure 15: Cost-benefit analysis from the perspective of government and participant

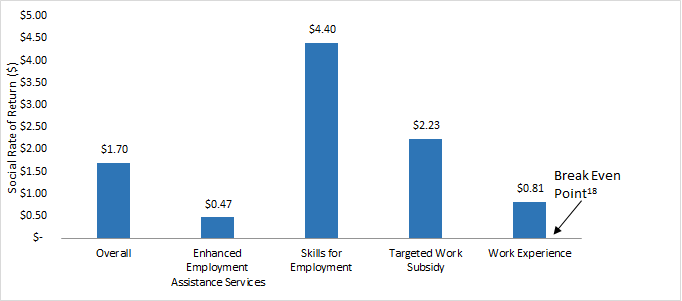

- Figure 16: Social return from investing in different types of Opportunities Fund intervention

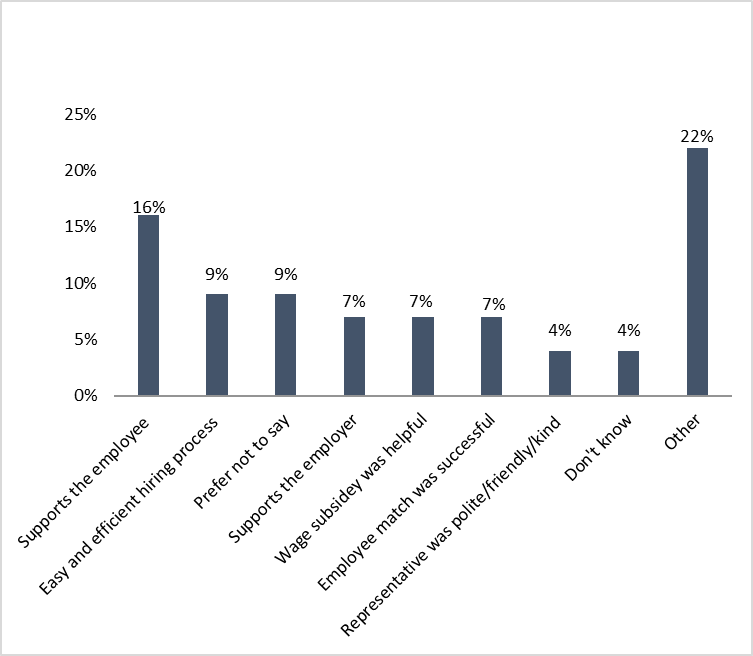

- Figure 17: Reasons the program met employers’ needs

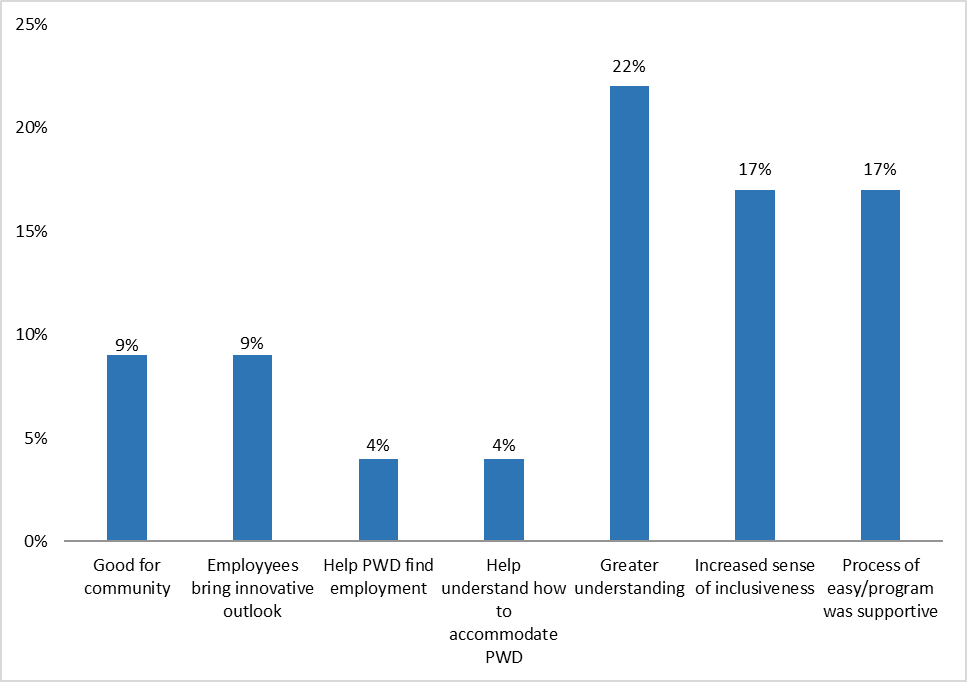

- Figure 18: Reasons employers gave for increased likelihood of hiring PWD in the future

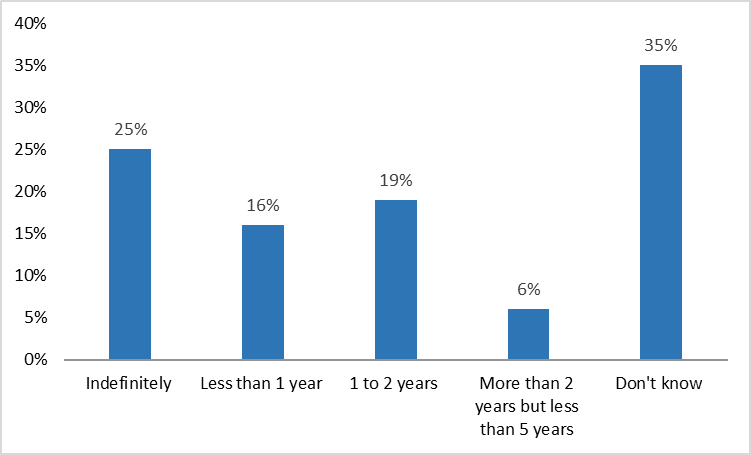

- Figure 19: How long were employees retained?

Executive summary

This report presents Phase 2 of the evaluation of the Opportunities Fund for Persons with Disabilities. Introduced in 1997, the program was designed to fill a gap in federal supports for persons with disabilities who are not eligible for the Employment Insurance program or training support under Employment Insurance Part II.

The first phase of the evaluation, published in September 2018, found that the Opportunities Fund provided persons with disabilities the ability to:

- acquire or develop skills

- obtain paid employment experience

- obtain assistance to become self-employed

The second phase of the evaluation examines how the Opportunities Fund affects labour market outcomes for participants over a 5-year period, using net impact analysis. It also presents the results of a survey examining how the program:

- addresses employer needs, and

- increases employer awareness of the benefits of employing persons with a disability

Key findings

The following are the key findings that emerged from this evaluation:

- overall, the Opportunities Fund had a positive and lasting impact on the labour market attachment of participants. Positive impacts were relatively larger for men

- positive impacts are consistent across intervention types and demographic subgroups. This suggests that the program is helping people across a broad spectrum of characteristics

- over the 5-year post-participation period, the average annual earnings of participants increased by 38% due to participation in the program. This translates to about $1,100 higher earnings than non-participants with similar characteristics

- Skills for Employment and Wage Subsidy were the most effective interventions at improving participants’ employment opportunities and decreasing reliance on social assistance benefits

- social assistance remained an important source of income for Opportunities Fund participants, both before and after participation in an Opportunities Fund intervention

- preliminaryFootnote 1 findings suggest that, overall, the 2014 to 2015 reform appears promising. The reform has strengthened the impact of the Opportunities Fund on labour market attachments one year after participation

- when taking into account costs and benefits for both governments and participants, the Opportunities Fund yielded a positive social return on investment over the 10 years, post-participation

- from a societal perspective, benefits outweigh their associated costs in less than 4 years. Overall, $1 investment in Opportunities Fund program yields $1.7 in return over a 10-year period following the intervention

- investing $1 in Skills For Employment yields $4.40 in return over 10 years following the intervention. This includes 5 years observed plus 5 years projected

- employers see the program as useful in meeting their business needs and in increasing their awareness of persons with disabilities as employees

Recommendations

- The program should examine the means by which the department can directly access employers participating in Opportunities Fund programming. This is for the purpose of evaluation and performance measurement. Explore different ways to collect more granular data on the Skills for Employment intervention. This would allow for an increased understanding of what elements contribute to changes in employment and employment earnings

- Re-examine the 6-month limit placed on training programs as a result of the 2014 to 2015 program reforms. Given that the participants in the Skills for Employment intervention experienced a lower average income after the reforms than before, the preliminary evidence suggests that this decision may not have had its intended effect

Program background

The Opportunities Fund for Persons with Disabilities gives funding to support a range of projects. This is to ensure that eligible persons with disabilities can access the assistance needed to integrate or re-integrate into the labour market, Third-party organizations known as Community Coordinators design and deliver most projects. Community Coordinators, also referred to as funding or contribution recipients, act as intermediaries between participants and employers.

The program includes the following interventions as seen in Table 1.Footnote 2

| Intervention | Share of Participants in 2011-2012 | Share of Participants in 2017-2018 |

|---|---|---|

| Enhanced Employment Assistance Services: A mixture of pre-employment activities tailored to meet the needs of persons with disabilities and help them integrate into employment. |

63% | 36% |

| Skills for Employment: Short-duration training and basic to advanced skills development relating to a specific job opportunity in a stable or expanding sector |

13% | 17% |

| Wage Subsidy: Financial incentives to encourage employers to hire persons with disabilities whom they would not normally hire. |

8% | 28% |

| Work Experience:Footnote 3 Positions created but where there is no expectation that the host employer would retain the participant after the subsidy ended. |

10% | 16% |

| Self-Employment:Footnote 4 Technical and consultative expertise to participants who have developed a business concept or are interested in self-employment. | 5% | 4% |

| Total distribution of clients in interventions | 8,866 | 10,384 |

Source: ESDC, 2007-2019 Common Systems for Grants and Contributions – Client File

Evaluation scope

This evaluation addresses the following questions:

- questions Concerning Participants of the Opportunities Fund for Persons with Disability Program:

- What are participants’ post-program economic and labour market outcomes after participating in the Opportunities Fund Disability Program interventions?

- Which groups or sub-groups of participants benefit the most from their participation in the program?

- How, and to what degree, does the program fit the needs of persons with disabilities?

- To what extent have the program reforms contributed to improve participants’ post-program outcomes?

- What are the overall socio-economic costs and benefits of the program?

- questions Concerning Employers Who Participate in the Opportunities Fund for Persons with Disability Program:

- Has the program increased awareness of the benefit of hiring persons with disabilities among employers?

- How, and to what degree, does the program fit the needs of employers?

Profile of participants

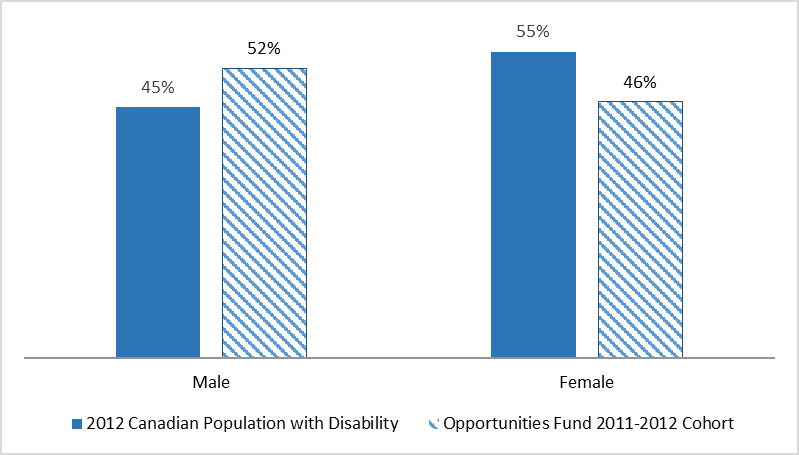

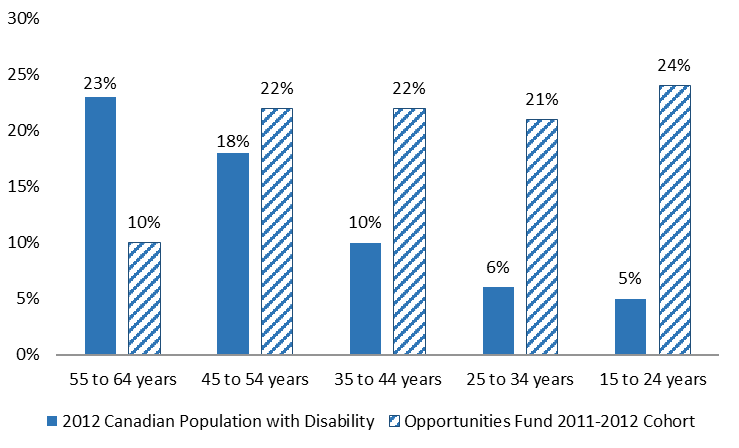

The proportion of male participants relative to female was greater in the Opportunities Fund than in the Canadian population who have a disability. Opportunities Fund participants were notably younger compared to the working-age population with disabilities.

Text description of figure 1

| Gender | 2012 Canadian population with disability | Opportunities Fund 2011-2012 cohort |

|---|---|---|

| Male | 45% | 52% |

| Female | 55% | 46% |

Source: ESDC, Common Systems for Grants and Contributions – Client File; Statistics Canada. Table 13-10-0362-01 Employment income for adults with and without disabilities

Text description of figure 2

| Age group | 2012 Canadian population with disability | Opportunities Fund 2011-2012 cohort |

|---|---|---|

| 55 to 64 years | 23% | 10% |

| 45 to 54 years | 18% | 22% |

| 35 to 44 years | 10% | 22% |

| 25 to 34 years | 6% | 21% |

| 15 to 24 years | 5% | 24% |

Source: ESDC, Common Systems for Grants and Contributions – Client File; Statistics Canada. Table 13-10-0362-01 Employment income for adults with and without disabilities

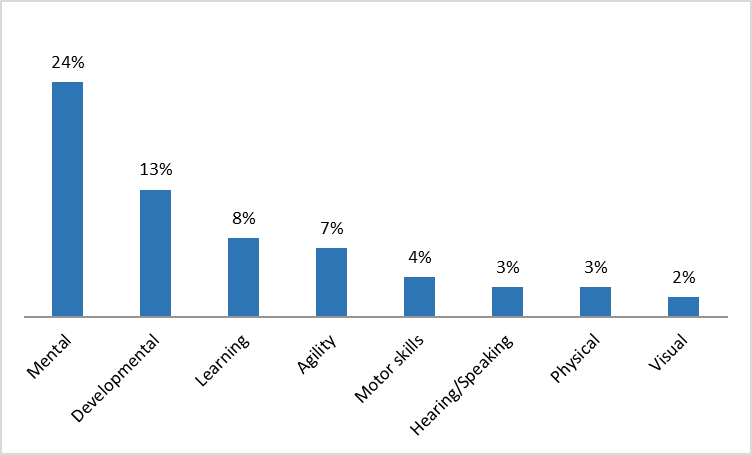

Mental and developmental disabilities were the most commonly identified disabilities reported by Opportunities Fund participants.

Text description of figure 3

| Disability type | % Opportunities Fund clients, 2011 to 2012 |

|---|---|

| Mental | 24% |

| Developmental | 13% |

| Learning | 8% |

| Agility | 7% |

| Motor skills | 4% |

| Hearing/Speaking | 3% |

| Physical | 3% |

| Visual | 2% |

Note: Participants were only permitted to identify one disability type. Approximately 37% of clients were reported as having “Other” or “Unknown” disability types and are not captured in the above chart.

Source: ESDC, Common System for Grants and Contributions – Client File

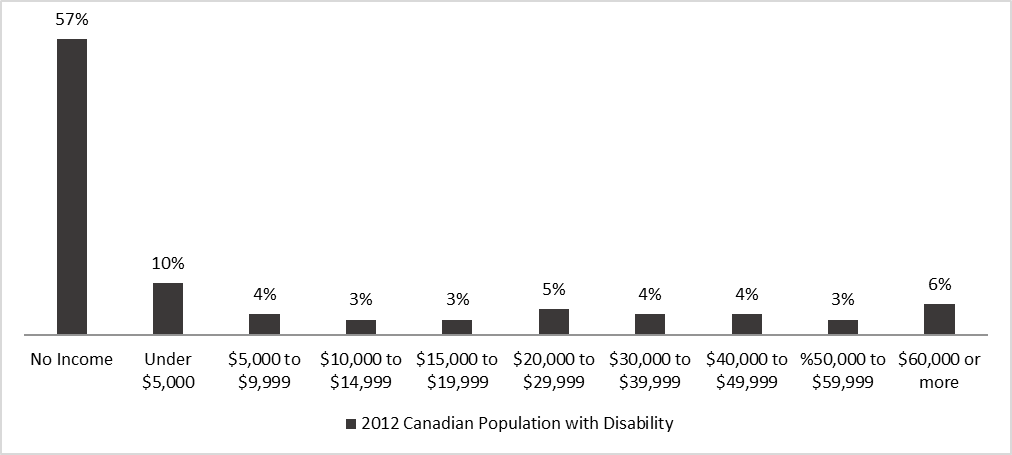

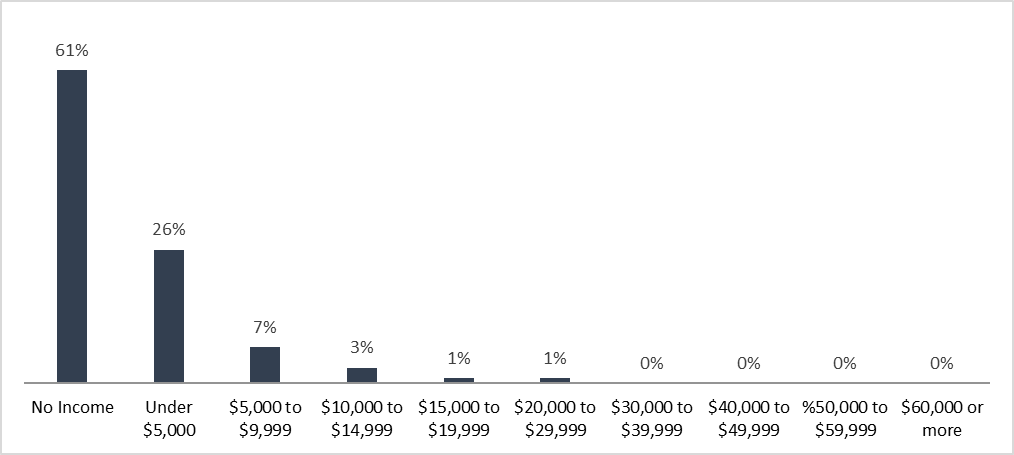

Opportunities Fund participants were less likely to have employment income (61% versus 57%). They typically earned less than the overall Canadian population with a disability.

Text description of figure 4

| Income category | 2012 Canadian Population with Disability |

|---|---|

| No income | 57% |

| Under $5,000 | 10% |

| $5,000 to $9,999 | 4% |

| $10,000 to $14,999 | 3% |

| $15,000 to $19,999 | 3% |

| $20,000 to $29,999 | 5% |

| $30,000 to $39,999 | 4% |

| $40,000 to $49,999 | 4% |

| $50,000 to $59,999 | 3% |

| $60,000 or more | 6% |

Source: Common Systems for Grants and Contributions linked to Canada Revenue Agency T4s data; Statistics Canada. Table 13-10-0362-01 Employment income for adults with and without disabilities.

Text description of figure 5

| Income category | % Opportunities Fund clients, 2011to 2012 |

|---|---|

| No income | 61% |

| Under $5,000 | 26% |

| $5,000 to $9,999 | 7% |

| $10,000 to $14,999 | 3% |

| $15,000 to $19,999 | 1% |

| $20,000 to $29,999 | 1% |

| $30,000 to $39,999 | 0% |

| $40,000 to $49,999 | 0% |

| $50,000 to $59,999 | 0% |

| $60,000 or more | 0% |

Source: Common Systems for Grants and Contributions linked to Canada Revenue Agency T4s data; Statistics Canada. Table 13-10-0362-01 Employment income for adults with and without disabilities.

Labour market outcomes: Employment income

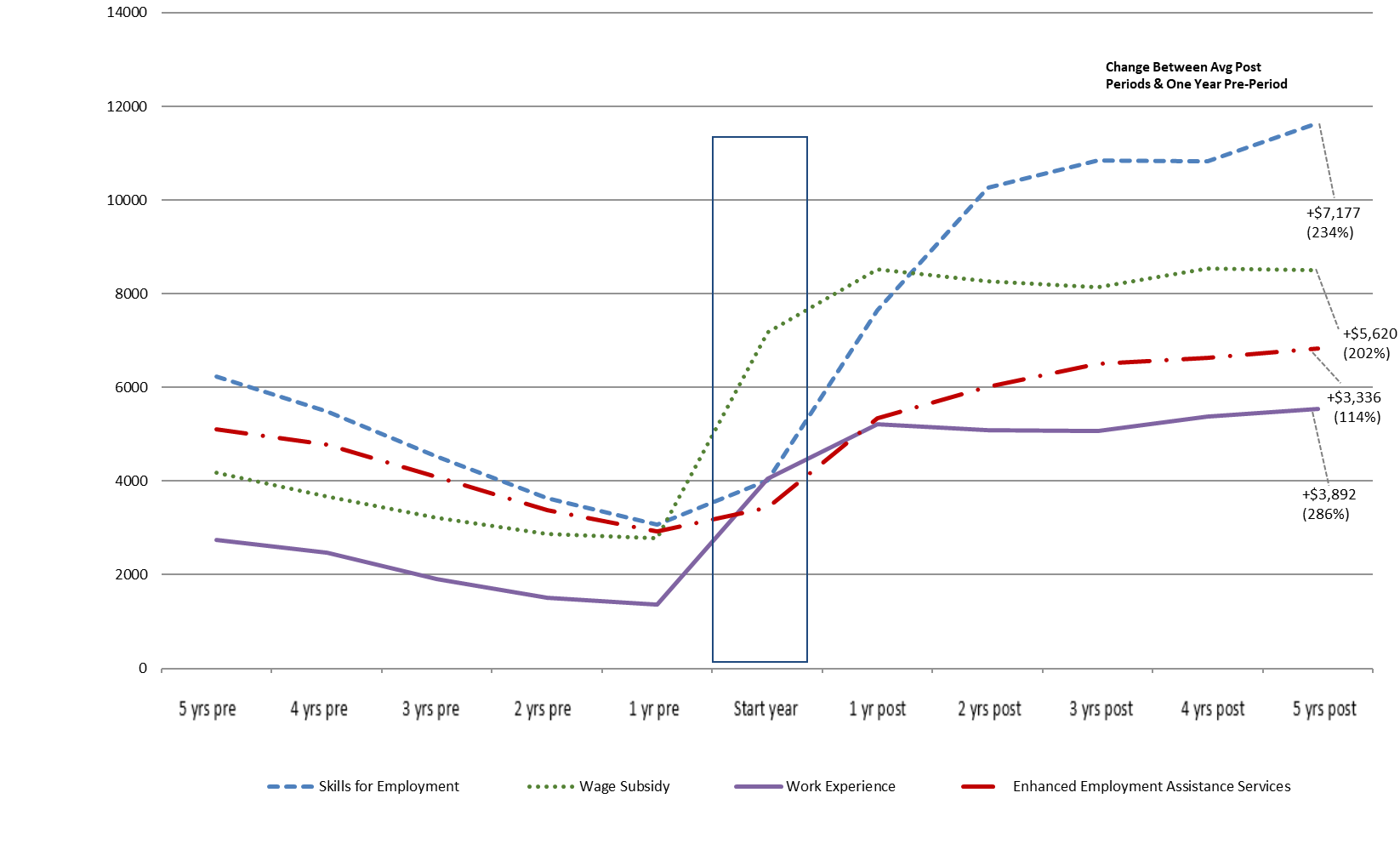

Overall, program participants increased their average employment income after participating in the program. The size of the increase varied by the type of intervention.

- Examining trends in the 5 years prior to and after the intervention provides a compelling snapshot of the overall positive trend of all interventions on employment earnings. These results are based on participants only and do not refer to the net impact of the program

- The Skills for Employment and Wage Subsidy shows the largest overall increase in employment income, compared to participants’ income one year prior to their interventions

- Participants who received Skills for Employment interventions saw their income grow by an average annual increase of $7,177 (234%) compared to the year prior to participating in the intervention

Text description of figure 6

| Program period | Participation | Skills for Employment | Wage Subsidy | Work Experience | Enhanced Employment Assistance Services |

|---|---|---|---|---|---|

| Pre-program period | 5 yrs pre | $6,238 | $4,170 | $2,737 | $5,102 |

| Pre-program period | 4 yrs pre | $5,496 | $3,676 | $2,464 | $4,782 |

| Pre-program period | 3 yrs pre | $4,530 | $3,223 | $1,916 | $4,094 |

| Pre-program period | 2 yrs pre | $3,632 | $2,862 | $1,501 | $3,375 |

| Pre-program period | 1 yrs pre | $3,068 | $2,779 | $1,363 | $2,932 |

| Program period | Start year | $4,009 | $7,176 | $4,047 | $3,439 |

| Post-program period | 1 yr post | $7,651 | $8,524 | $5,211 | $5,348 |

| Post-program period | 2 yr post | $10,261 | $8,271 | $5,088 | $6,021 |

| Post-program period | 3 yr post | $10,840 | $8,143 | $5,069 | $6,504 |

| Post-program period | 4 yr post | $10,833 | $8,547 | $5,376 | $6,639 |

| Post-program period | 5 yr post | $11,642 | $8,511 | $5,533 | $6,828 |

| Change between Post and Pre periods | ($) | $7,178 | $5,620 | $3,893 | $3,336 |

| Change between Post and Pre periods | (%) | 234% | 202% | 286% | 114% |

Source: Common Systems for Grants and Contributions – Client File linked to Canada Revenue Agency T1 and T4 data.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

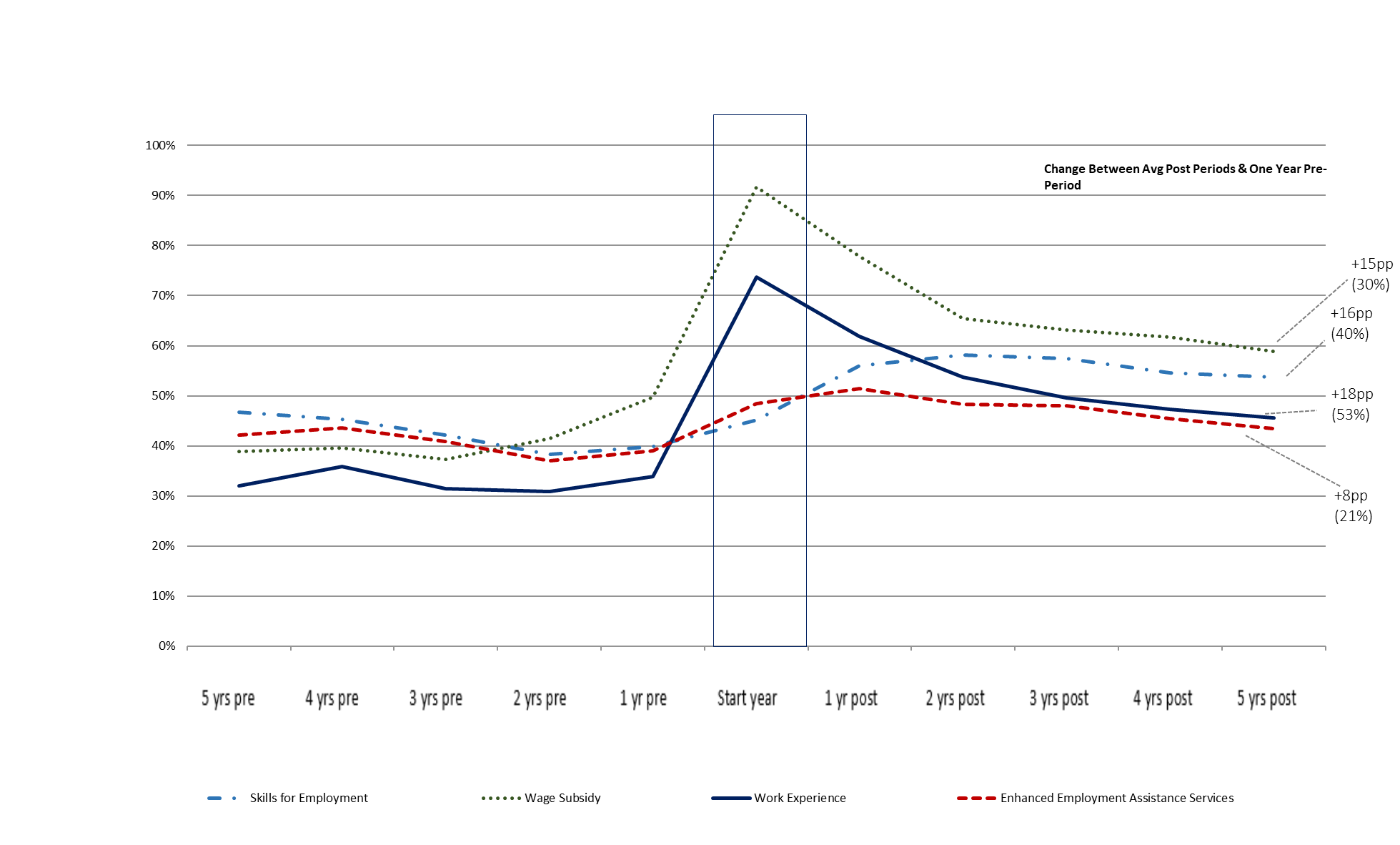

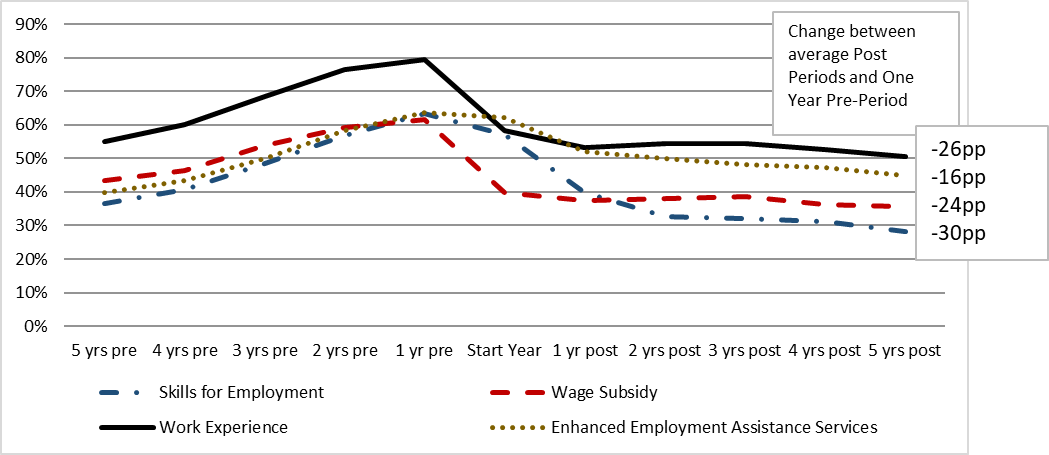

Labour market outcomes: Employment

Overall, participants’ employment chances improved after participation in the program. Results vary by type of interventions and participants’ characteristics.

While all interventions led to an overall positive trend on employment for Opportunity Fund participants, the strongest positive trends were experienced by participants who received:

- Work Experience

- Skills for Employment, and

- Wage Subsidy interventions

These outcomes are based on participants only and do not refer to the net impact of the program.

- Growth in the proportion of participants employed before and after these interventions increased by 15 to 18 percentage points

- For example, participants in the Wage Subsidy experienced an average annual increase of 15 percentage points (or 30%)Footnote 6 in the probability of finding employment compared to the year prior to the intervention

Text description of figure 7

| Program period | Participation | Skills for Employment | Wage Subsidy | Work Experience | Enhanced Employment Assistance Services |

|---|---|---|---|---|---|

| Pre-program period | 5 yrs pre | 47% | 39% | 32% | 42% |

| Pre-program period | 4 yrs pre | 45% | 40% | 36% | 44% |

| Pre-program period | 3 yrs pre | 42% | 37% | 31% | 41% |

| Pre-program period | 2 yrs pre | 38% | 41% | 31% | 37% |

| Pre-program period | 1 yrs pre | 40% | 50% | 34% | 39% |

| Program period | Start year | 45% | 92% | 74% | 48% |

| Post-program period | 1 yr post | 56% | 78% | 62% | 52% |

| Post-program period | 2 yr post | 58% | 65% | 54% | 48% |

| Post-program period | 3 yr post | 57% | 63% | 50% | 48% |

| Post-program period | 4 yr post | 55% | 62% | 47% | 45% |

| Post-program period | 5 yr post | 54% | 59% | 46% | 43% |

| Change Between Avg Post Periods & One Year Pre-Period | Percentage Point Change | 15pp | 16pp | 18pp | 8pp |

| Change Between Avg Post Periods & One Year Pre-Period (%) | % change | 30% | 40% | 53% | 21% |

Source: Common Systems for Grants and Contributions – Client File linked to Canada Revenue Agency T1 and T4 data.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

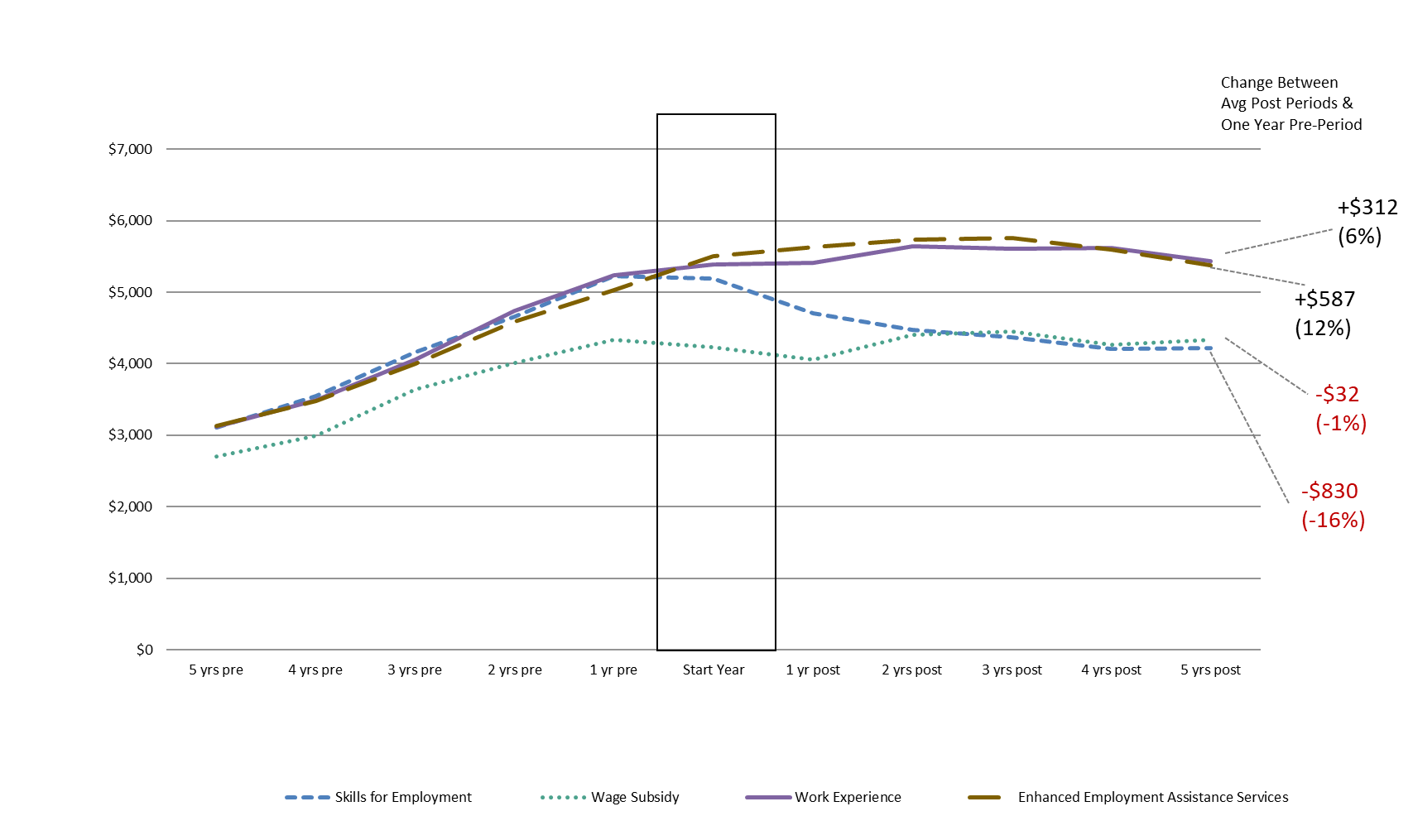

Labour market outcomes: Social assistance

Overall, participants reduced their use of social assistance after participating in the program, depending on the intervention.

- Figure 8 examines trends in social assistanceFootnote 7 income 5 years pre- and 5 years post-intervention. These outcomes are based on participants only and do not refer to the net impact of the program

- With the exception of Work Experience and the Enhanced Employment Assistance Services, there is a decrease in social assistance income for the interventions

- For example, participants in Skills for Employment experienced an annual average decrease in social assistance income of approximately $830 (16%). This is compared to the year before participating in the intervention

Text description of figure 8

| Program period | Participation | Skills for Employment | Wage Subsidy | Work Experience | Enhanced Employment Assistance Services |

|---|---|---|---|---|---|

| Pre-program period | 5 yrs pre | $3,109 | $2,700 | $3,124 | $3,130 |

| Pre-program period | 4 yrs pre | $3,548 | $2,988 | $3,493 | $3,476 |

| Pre-program period | 3 yrs pre | $4,158 | $3,644 | $4,062 | $3,998 |

| Pre-program period | 2 yrs pre | $4,655 | $4,011 | $4,741 | $4,587 |

| Pre-program period | 1 yrs pre | $5,222 | $4,337 | $5,232 | $5,030 |

| Program period | Start year | $5,186 | $4,226 | $5,390 | $5,502 |

| Post-program period | 1 yr post | $4,700 | $4,061 | $5,416 | $5,626 |

| Post-program period | 2 yr post | $4,470 | $4,403 | $5,642 | $5,730 |

| Post-program period | 3 yr post | $4,371 | $4,456 | $5,609 | $5,760 |

| Post-program period | 4 yr post | $4,203 | $4,264 | $5,623 | $5,592 |

| Post-program period | 5 yr post | $4,216 | $4,339 | $5,432 | $5,377 |

| Change between Post and Pre periods | ($) | $830 | $32 | $312 | $587 |

| Change between Post and Pre periods | (%) | -16% | -1% | 6% | 12% |

Source: Common Systems for Grants and Contributions – Client File linked to Canada Revenue Agency T1 and T4 data.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

Net impact analysis

The Opportunities Fund had a positive impact on participants’ labour market attachments.

In general, any intervention from the Opportunities Fund was found to improve participants’ labour market attachment. During the 5-year period following their participation, the program led to an average annual:

- increase of 5.47 percentage points in their incidence of employment

- increase of $1,094 (38%) in their employment income

- a decline of $41 (0.8%) in social assistance benefits

| Type of Intervention | Incidence of Employment (pp.) (Annual average) |

Employment Income (Annual average) |

Social Assistance Income (Annual average) |

|---|---|---|---|

| OF – Overall | 5.47*** | $1,093.87*** | -$40.64 |

| Enhanced Employment Assistance Services | 3.05** | $567.22*** | $182.19 |

| Skills for Employment | 9.82*** | $3,691.99*** | -$395.14*** |

| Wage Subsidy | 16.45*** | $2,163.28*** | -$339.20* |

| Work Experience | 10.14*** | $744.33** | -$290.00 |

Statistically significant at the 1% Confidence Level ***, at the 5% Confidence Level **, at the 10% Confidence Level*

Statistically non-significant results are still valid in terms of informing the direction of the impact (negative or positive)

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

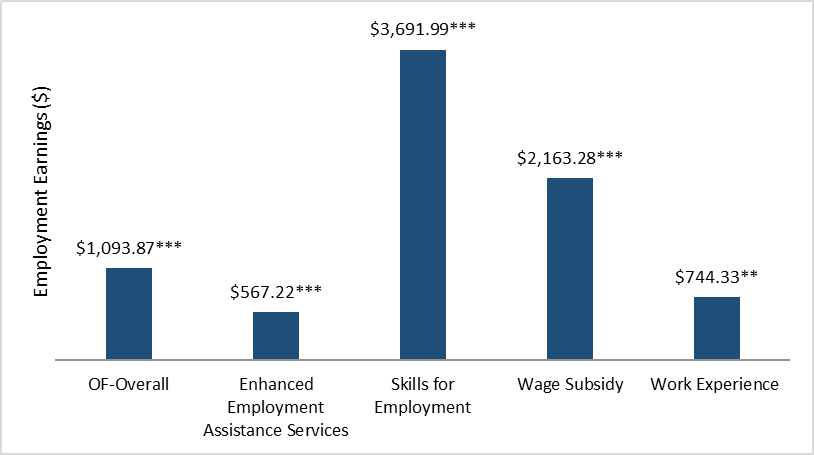

Net impact analysis: Employment income

Each intervention has a positive net impact on employment income with Skills for Employment having the most positive impact on earnings.

- There is a positive net impact of the Opportunities Fund on employment income of $1,094, on average, over 5 years post-program. This is equal to a 38% increase from one year prior to the start of the intervention

- Skills for Employment was the most effective for increasing employment income on average by $3,691 (120%) over 5 years post-program

- The Wage Subsidy also had a positive, but lower, net impact at $2,163 (78%)

- Enhanced Employment Assistance Services and Work Experience had the lowest impact at $526 (18%) and $744 (55%)

Text description of figure 9

| OF intervention | Employment earnings |

|---|---|

| OF-Overall | $1,093.87*** |

| Enhanced Employment Assistance Services | $567.22*** |

| Skills for Employment | $3,691.99*** |

| Wage Subsidy | $2,163.28*** |

| Work Experience | $744.33** |

Significance level ***1% **5% *10%

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

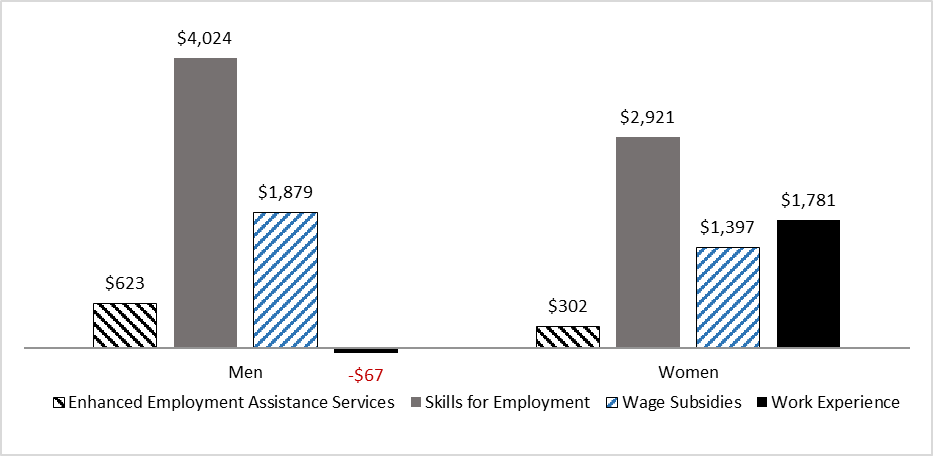

Net impact analysis: gender

Among participants, incremental positive impacts were generally larger for men relative to those found for women.

Text description of figure 10

| OF intervention | Men | Women |

|---|---|---|

| Enhanced Employment Assistance Services | $623 | $302 |

| Skills for Employment | $4,024 | $2,921 |

| Wage Subsidies | $1,879 | $1,397 |

| Work Experience | -$67 | $1,781 |

Note: additional analyses by type of disability were not included because small cell sizes mean that the results are unreliable.

Note: For the purposes of conducting subgroup analysis, the results of participants within one of the subgroups are compared with the results of a control group consisting of that subgroup only with similar observable characteristics. For example, the results for female participants are compared with the results of a control group consisting only of women.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

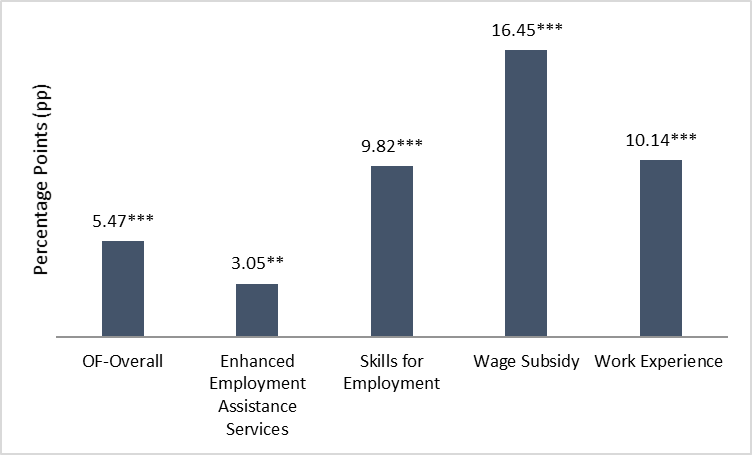

Net impact: Incidence of employment

The Opportunities Fund had a positive impact on employment. Participants across all interventions show a significant increase in their incidence of employment.Footnote 8

- Overall, the Opportunities Fund is associated with an annual increase of 5.4 percentage points (14%)Footnote 9 in employment among participants

- The Wage Subsidy was the most effective, increasing the incidence of employment by 16.5 percentage points (or 33%)

- Skills for Employment and Work Experience were associated with an increase in the incidence of employment by approximately 10 percentage points each (25% and 29%, respectively)

- Finally, Enhanced Employment Assistance Services had the smallest effect, increasing the incidence of employment by 3.05 percentage points (or 8%)

Text description of figure 11

| OF intervention | Change on incidence of employment |

|---|---|

| OF-Overall | 5.47*** |

| Enhanced Employment Assistance Services | 3.05** |

| Skills for Employment | 9.82*** |

| Wage Subsidy | 16.45*** |

| Work Experience | 10.14*** |

Significance level ***1% **5% *10%

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report Prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

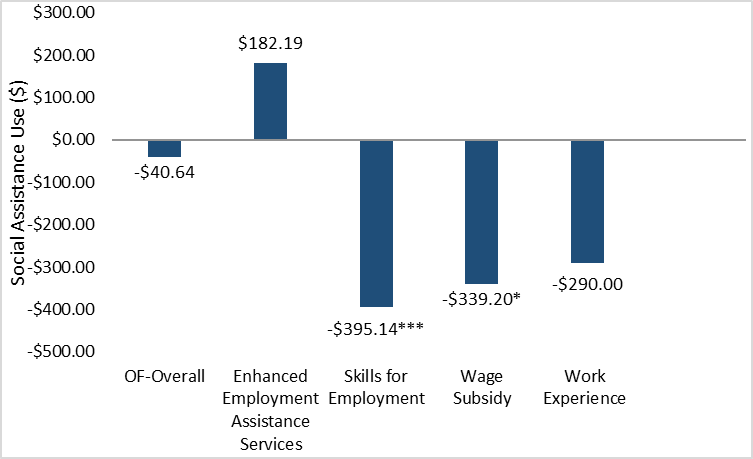

Net impact: Social assistance

Participation in Skills for Employment and Wage Subsidy were the most effective at reducing participants’ use of social assistance.

- The overall net impact on social assistance was $-40.64 (or a 0.8% decrease since the start of the intervention) over 5 years

- Skills for Employment was the most effective for decreasing the use of social assistance by $395 (or 8%), on average, over 5 years

- An average reduction of social assistance of $395 may be a small amount at an individual level. However, this may result in a substantial saving for the government when aggregated across populations over time

- Wage Subsidy interventions also showed a significant decrease in social assistance by an average of $339 (or 8%) over 5 years

- While Enhanced Employment Assistance Services showed an increase in social assistance, this result was not statistically significant

Text description of figure 12

| OF intervention | Impact on participants |

|---|---|

| OF-Overall | -$40.64 |

| Enhanced Employment Assistance Services | $182.19 |

| Skills for Employment | -$395.14*** |

| Wage Subsidy | -$339.20* |

| Work Experience | -$290.00 |

Significance level ***1% **5% *10%

Source: “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities”, 2020. Available on request.

Summary of net impacts

| Net Impact Variable | Employment Earnings (Annual average post-participation, $) |

Incidence of Employment (Annual average post-participation, percentage points, %) |

Social Assistance (Annual average post-participation, $) |

|---|---|---|---|

| Overall | $1,094* | 5.47 pp* | -$41 |

| Intervention: Enhanced Employment Assistance Program | $567* | 3.05 pp* | $182* |

| Intervention: Skills of Employment | $3,692* | 9.82 pp* | -$395* |

| Intervention: Wage Subsidy | $2,163* | 16.45 pp* | -$339* |

| Intervention: Work Experience | $744* | 10.14 pp* | -$290 |

| Sub-group: Male | $925* | 5.54 pp* | $69 |

| Sub-group: Female | $799* | 3.99 pp* | -$152 |

| Sub-group: Developmental Disability | $745* | 6.25 pp* | -$281 |

| Sub-group: Learning Disability | $2,123* | 2.12 pp | $545 |

| Sub-group: Mental Disability | $1,111* | 1.72 pp | $508* |

| Sub-group: Physical Disability | $1,004* | 7.17 pp* | $218 |

| Sub-group: Unspecified Disability | $1,240* | 6.28 pp* | -$395* |

*Results are statistically significant.

The remaining results, while not statistically significant, are valid in terms of informing the direction of the impact (negative or positive).

Program reforms

Reforms introduced in Budgets 2012, 2013, and 2014 resulted in the following operational changes:

- Employment experience is now included in all projects except Employer Awareness projects and can include either wage subsidies or self-employment activities

- Wage subsidies can only be acquired for jobs that are:

- part of an employer’s normal operations and

- likely to lead to a permanent job

- Short duration (6 months) training programs can only be supported if they help participants develop skills:

- “related to a specific employment opportunity

- in a stable or expanding sector, and

- where there is a reasonable expectation of employment”

- Allowing employers to hire students with disabilities on a part time basis

- All projects except stand alone Employer Awareness must have a minimum of 8 participants

- For multi-year projects, the number of clients employed, self-employed, or returned to school is measured after 6 and 12 months post-intervention, rather than after 24 weeks

- Applicants who include an alternative social innovation model as a framework for project activities do not have to leverage funding from non-Departmental sources

Effects of program reforms

Post-program reforms show positive results.

The 2014 to 2015 reforms show evidence of increased earnings and reduced dependence on income support one year after the program.

- Average earnings were 124% higher for program participants in the post-reform period then in the pre-reform period

- Similarly, dependence on income support dropped 5-fold in the post-reform period than in the pre-reform period (-7.79 percentage points in the post-reform period versus -1.21 in the pre-reform period)

- Note that the comparison is only 1-year post reform

Text description of figure 13

| OF intervention | Pre-reform | Post-reform |

|---|---|---|

| OF-Overall | $787 | $1,765 |

| Enhanced Employment Assistance Services | $143 | $1,028 |

| Skills for Employment | $1,783 | $1,555 |

| Wage Subsidy | $3,041 | $3,567 |

Note: This analysis did not include the Work Experience intervention, which ended after 2015.

Note: the choice of examining one-year post-program instead of 2-years was out of caution. Fluctuations in outcome measure, post-intervention, can be misleading unless there are sufficient amount of post-intervention observations.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

Text description of figure 14

| OF intervention | Pre-reform | Post-reform |

|---|---|---|

| OF-Overall | -1.21 | -7.79 |

| Enhanced Employment Assistance Services | 2.98 | -4.9 |

| Skills for Employment | -3.44 | -3.9 |

| Wage Subsidy | -8 | -13.07 |

Note: This analysis did not include the Work Experience intervention, which ended after 2015.

Note: the choice of examining 1-year post-program instead of 2-years was out of caution. Fluctuations in outcome measure, post-intervention, can be misleading unless there are sufficient amount of post-intervention observations.

Source: ESDC Technical Report. “Estimating the Incremental Impact of the Opportunities Fund program using Administrative Data: Technical Report prepared under the Evaluation of the Opportunities Fund Program for Persons with Disabilities,” 2020. Available on request.

Cost-benefit analysis

The Opportunities Fund program yielded a positive return on investment over the 10 year post-program period for individuals and society as a whole.

The incremental impact analysis, presented earlier, assesses the success of interventions focusing on the first 5 years following an intervention (up to 2017). As a result, this type of analysis does not inform the longer term impacts that such interventions may have on participants. Nor does it indicate whether the benefits associated with the interventions outweigh its costs.

To assess the longer-term impacts associated with the Opportunities Fund, a cost-benefit analysis was conducted. To that end, observed incremental impacts 5 years following an Opportunities Fund intervention were projected for an additional 5 years. For detailed methodology, see the cost-benefit analysis technical report. This analysis reports on the net present value and the benefit-cost ratio from the government, the individual and the society’s perspectives.

- From the government’s perspective, costs are incurred up-front and consist of program costs. On the other hand, benefits accrue over time in the form of increased tax revenues and decreased outlays from support programs (for example, social assistance)

- From the individual’s perspective, benefits accrue over time and take the form of higher earnings which may contribute to improved social outcomes

- From the society’s perspective, the total net benefits of both the government’s and the individual’s perspectives are taken into account (government + individual)

On this basis, the number of years necessary for the accrued benefits to equal the up-front costs (hereafter referred to as ‘break-even’) can be estimated as well as the rate of return.

Cost-benefit Analysis: Other Intangible Benefits

- The cost-benefit analysis is based on main quantifiable costs and benefits. Therefore, it does not include intangible benefits such as higher well-being for individuals associated with better health outcomes and reduced criminality. For instance, in addition to producing improvements in labour market indicators, it is likely that active labour market programming such as the Opportunities Fund have positive influences on additional social outcomes such as health and crime. According to research-based evidence, labour market participation and higher income is associated with better health outcomes (see Canadian Institute for Health Information, 2015; Saunders et al., 2017) and lower risk of criminal activity (see Nilsson & Agell, 2003; Machin and Meghir, 2000)

- Expanding the cost-benefit framework to include potential savings resulting from improved health outcomes (for example, reduced health system expenditures) and decreases in criminal justice system contact (such as, reduced costs of policing, courts, and correctional services) could yield additional positive impacts for both individuals and the government beyond what is directly measured. Therefore, the estimated cost benefit indicators, such as the social rate of return (the ratio between the net benefit accrued to the society and the direct cost of the program), are conservative estimates for the success of the Opportunities Fund program

The Opportunities Fund program yielded a positive return on investment over the 10 year post program period for individuals and society as a whole.

The social benefit (government + participant) from the Opportunities Fund program is $6,915, yielding an average social rate of return of 170%. This represents 9.4% per annumFootnote 11 over 10 years post participation.

For participants, the total net benefit is $7,803; and, on the other hand, the total net benefit for governments is -$888.

Overall, from a societal perspective, the discounted benefits of the Opportunities Fund program exceeds the direct program cost in 3.8 years after participation period.

Text description of figure 15

| Beneficiary | Benefit type | Cumulative impact ($) on government |

|---|---|---|

| Government | Total costFootnote 13 | -4,415 |

| Government | Employement Insurance | -$87 |

| Government | Social assistance | $319 |

| Government | Government deductionsFootnote 14 | $3,295 |

| Participant | Social assistance | -$319 |

| Participant | Government deductions | -$3,295 |

| Participant | Employment Insurance | $87 |

| Participant | Employment earningsFootnote 15 | $11,330 |

Note: Over 10 years post-participation, the total net benefit (governments and individual) is estimated at $6,915 or a social rate of returnFootnote 12 of 170% (9.44% per annum).

Source: Administrative Data - Labour Market Program Data Platform cohorts of Opportunity Fund participants from January 1, 2011 to December 31, 2012.

Social return on investment

Social return is an indicator which shows how much net benefit accrued to the society due to a $1 investment in a government program. All types of Opportunities Fund interventions yield positive returns over time.Footnote 16

- Overall, $1 investment in the Opportunities Fund program yields $1.7 in return over a 10-year period following the intervention

- Skills for Employment yields the highest social return among all types of interventions

These are conservative estimates for the social return. Some of the intangible benefits such as improved health outcomes, lower crime rates, well being effects etc. were not incorporated in benefit calculation.Footnote 17

Text description of figure 16

| Overall | Enhanced Employment Assistance Services | Skills for Employment | Targeted Work Subsidy | Work experience |

|---|---|---|---|---|

| $1.70 | $0.47 | $4.40 | $2.23 | $0.81Footnote 18 |

Source: Administrative Data - Labour Market Program Data Platform cohorts of Opportunity Fund participants from January 1, 2011 to December 31, 2012.

Key findings: Needs

Nearly all employers surveyed indicated the program met their needs.

- The majority of employers surveyed 97% (31) indicated that the program met their needs either ‘effectively’ or ‘very effectively’

- Figure 17 presents the reasons for participating in the program

- Willingness to recommend the program to other employers was measured as a subjective rating on a 1 to 10 scale, with 10 being the most likely to recommend. Reponses were grouped into four categories based on their scores: Promoters (9-10); Passives (7-8); Detractors (1-6)

- Most (69%) employers were ‘promoters’ of the program, meaning they were highly likely to recommend the program to a colleague or business associate

- 25% of employers were only moderately enthusiastic about recommending the program

- 6% were classified as ‘detractors,’ meaning that they were not enthusiastic about recommending the program

Text description of figure 17

| Reason program met employer needs | % employers |

|---|---|

| Supports the employee | 16% |

| Easy and efficient hiring process | 9% |

| Prefer not to say | 9% |

| Supports the employer | 7% |

| Wage subsidy was helpful | 7% |

| Employee match was successful | 7% |

| Representative was polite/friendly/kind | 4% |

| Don't know | 4% |

| Other | 22% |

Source: ESDC Technical Report. “Survey of Employers: Evaluation of the Opportunities Fund for Persons with Disabilities” Technical report in support of the Evaluation of the Opportunities Fund for Persons with Disabilities, 2019. Report available on request.

Key findings: Awareness

Most employers indicated that participating in the program increased:

- their awareness of the abilities of persons with disabilities

- the likelihood that they would hire persons with disabilities in the future

Most employers agree that their awareness of the abilities of persons with disabilities has increased due to their participation in the program.

- 44% strongly agree

- 44% somewhat agree

Similarly, most employers agree that their awareness of the availability of persons with disabilities in the labour force has increased due to their participation in the program.

- 47% strongly agree

- 38% somewhat agree

Most employers indicated that they would likely hire a person with a disability in the future.

- 59% said it was very likely

- 38% said it was somewhat likely

No respondents said they would not hire a person with a disability in the future.

Text description of figure 18

| Reason for hiring disabled persons | % response |

|---|---|

| Good for community | 9% |

| Employees bring innovative outlook | 9% |

| Help PWD find employment | 4% |

| Help understand how to accommodate PWD | 4% |

| Greater understanding | 22% |

| Increased sense of inclusiveness | 17% |

| Process of easy/program was supportive | 17% |

Source: ESDC Technical Report. “Survey of Employers: Evaluation of the Opportunities Fund for Persons with Disabilities.” Technical report in support of the Evaluation of the Opportunities Fund for Persons with Disabilities, 2019. Report available on request.

Key Findings: Retaining employees

Nearly three-quarters of surveyed employers indicated that they had retained employees hired through Opportunities Fund programs.

- The majority of employers (72%) indicated that they had retained employees they had hired through their Opportunities Fund-funded program

- About one-third (34%) of employers indicated that they had retained at least half of the employees that they had hired

- 25% of employers stated that they retained their employees indefinitely

Text description of figure 19

| Length of time employees retained | % |

|---|---|

| Indefinitely | 25% |

| Less than one year | 16% |

| 1 to 2 years | 19% |

| More than two years but less than 5 years | 6% |

| Don't know | 35% |

Source: ESDC Technical Report. “Survey of Employers: Evaluation of the Opportunities Fund for Persons with Disabilities.” Technical report in support of the Evaluation of the Opportunities Fund for Persons with Disabilities, 2019. Report available on request.

Conclusions

- Overall, the Opportunities Fund had a positive and lasting impact on the labour market attachment of participants. Positive impacts were relatively larger for men

- Over the 5-year post-participation period, the average annual earnings of participants increased by 38% due to participation in the program. This translates to about $1,100 higher earnings than non-participants with similar characteristics

- Skills for Employment and Wage Subsidy were the most effective interventions at improving participants’ employment opportunities and decreasing reliance on social assistance benefits

- Social assistance remained an important source of income for Opportunities Fund participants, both before and after participation in an Opportunities Fund intervention

- Preliminary findings suggest that, overall, the 2014 to 2015 reform appears promising and has strengthened the impact of the Opportunities Fund on labour market attachments one year after participation

- When taking into account costs and benefits for both governments and participants, the Opportunities Fund yielded a positive social return on investment over the 10 years, post-participation

- From a societal perspective, benefits outweigh their associated costs in less than four years. Overall, $1 investment in Opportunities Fund program yields $1.7 in return over a 10-year period following the intervention

- Moreover, $1 of investment in Skills For Employment yields $4.40 in return over 10 years following the intervention (5 years observed plus 5 years projected)

- Employers see the program as useful for both:

- increasing their awareness of persons with disabilities as employees, and

- meeting their own business needs

Recommendations

- The program should examine the means by which the department can directly access employers participating in Opportunities Fund programming for the purpose of evaluation and performance measurement

- Explore different ways to collect more granular data on the Skills for Employment intervention. This would allow for an increased understanding of what elements contribute to changes in employment and employment earnings

- Re-examine the 6-month limit placed on training programs as a result of the 2014 to 2015 program reforms. Given that the participants in the Skills for Employment intervention experienced a lower average income after the reforms than before, the preliminary evidence suggests that this decision may not have had its intended effect

Management response / Action plan

Overall Management Response

Employment and Social Development Canada's Skills and Employment Branch and Program Operations Branch thank the Evaluation Division for conducting Phase 2 of the evaluation of the Opportunities Fund for Persons with Disabilities. Also acknowledged are the contributions of the service providers that collected the administrative data on which this evaluation is based.

Projects funded by the Opportunities Fund give participants the opportunity to acquire or develop employment readiness skills and/or to obtain employment experience or assistance in becoming self-employed. The program gives supports to:

- increase employer awareness of the contributions that persons with disabilities bring to the workplace

- assist employers to develop and improve policies and practices to recruit, employ and retain persons with disabilities

- help with workplace accommodations

The Program had a positive and lasting impact on the labour market attachment and employment outcome of participants. The evaluation also points to improvements that will allow the program to continue building on the positive employment outcomes for persons with disabilities.

Employment and Social Development Canada is already addressing some of the findings identified in this Phase 2 report. For example, reporting tools have been developed and implemented to collect performance data on employer-focused activities and measure the impacts of these interventions. The program is analyzing data collected using these tools so that they can be further refined.

Additionally, plans for engagement are underway to seek input from a range of key stakeholders on the design and delivery of the program. Plans include increasing women’s participation in Opportunities Fund projects and improving their employment outcomes. Future programming efforts will also seek to strengthen services to women with disabilities.

Recommendation #1

The program should examine the means by which the department can directly access employers participating in Opportunities Fund programming for the purpose of evaluation and performance measurement.

Management response

Employment and Social Development Canada agrees with this recommendation. As part of the Skills and Employment Branch’s commitment to demonstrate results and support performance measurement and evaluation, options will be explored to give direct access to employers participating in the program’s third party-delivered projects, taking into account privacy requirements. This will be done in collaboration with the Program Operations Branch and with input from service providers to ensure effective implementation. Additionally, as the program evolves the Performance Information Profile (PIP) will be updated to ensure the appropriate indicators are in place to track employer-focused activities.

Action item 1.1: Engage employers to consult on employer-focused interventions.

To be completed in June 2021.

Action item 1.2: Revise the program’s Logic Model and PIP to reflect the new policy directions of the employer-focused activities under the new National Workplace Accessibility program of the Opportunities Fund. To be completed in October 2021.

Recommendation #2

Explore different ways to collect more granular data on the Skills for Employment intervention. This would allow for an increased understanding of what elements contribute to changes in employment and employment earnings.

Management response

Employment and Social Development Canada agrees with this recommendation. The Skills and Employment Branch will explore ways to refine existing tools to allow the collection of more detailed information on Skills for Employment interventions. This work will be undertaken in the context of updating the program’s PIP and refining tracking and reporting tools. The tool(s) to be developed in collaboration with POB will be shared with service providers for feedback to ensure feasibility and effective implementation and minimize the reporting burden.

Action item 2.1: Review and update the reporting tools to be implemented for new projects in the next CFP.

To be completed in October 2021.

Recommendation #3

Re-examine the 6-month limit placed on training programs as a result of the 2014 to 2015 program reforms. Given that the participants in the Skills for Employment intervention experienced a lower average income after the reforms than before, the preliminary evidence suggests that this decision may not have had its intended effect.

Management response

Employment and Social Development Canada agrees with this recommendation. SEB will reassess the time limit on training to give service providers more flexibility to deliver tailored interventions that best meet the needs of persons with disabilities (different disability types and varying degrees of severity) to achieve better employment outcomes for persons with disabilities. A consultation process will be used to engage third-party service providers, which is part of planned stakeholder engagement activities, to inform the design and delivery of the program including preparation for the next Call for Proposals.

Action item 3.1: Work in collaboration with POB to solicit feedback from service providers.

To be completed in October 2021.

Action item 3.2: Change the time limit and provide new directives accordingly. To be completed in October 2021.

Annex A: Methodology

Phase 2 of the evaluation is based on 2 lines of evidence:

Survey of employers

- A convenience sample drawn from a list of organizations that received Opportunities Fund funding

- Total sample was 88 NGOs and 32 employers

- Web-based questionnaire

Net impact analysis

- Labour Market Program Data Platform

- Opportunities Fund administrative data were integrated with:

- CRA income tax dataFootnote 19

- EI Part 1 data

- EI Part 2 data

- N=8866 Opportunities Fund clients

- Difference-in-Difference statistical analysis

- Propensity score matching

- Use of a control group

Administrative data and incremental impact methodology

The administrative data used to measure the effect of the program for participants on key outcomes consisted of linking together the three following data sources:

- the client administrative data, consisting of socio-demographic and labour market intervention type and duration related variables

- Employment Insurance Part 1 and Part 2 data

- Canada Revenue Agency T1 and T4 data

The evaluation removed personal identifiers to protect privacy and confidentiality.

The data were thoroughly assessed and transformed into high-quality analytical files. that included a large number of variables relevant to individuals’ labour market experiences. These variables included:

- socio-demographic characteristics of both participant and comparison cases

- age

- gender

- marital status

- disability

- province of residence

- background qualifications

- occupational group

- industry codes

- labour market history

- use of EI benefits

- employment/self-employment earnings

- use of social assistance

- incidence of employment in the 5-year pre-participation period

To assess incremental impact, the evaluation compared the outcomes of a treatment group of Opportunities Fund participants with a comparison group using other services. The treatment group participated in an intervention during the reference period of January 2011 and December 2012. The comparison group included:

- individuals who shared the same eligibility criteria as OF participants

- who received only minor interventions via Employment Assistance Services (EAS) as part of the Labour Market Development Agreements (LMDA)

The evaluation used the same reference period for both groups.

Some participants had multiple interventions during the observation period. These were categorised based on the most intensive intervention, and therefore the most salient one with respect to incremental impacts. This strategy for developing the comparison group was applied in many previous ESDC evaluations. Evaluators measured performance using 5 outcome indicators:

- probability of employment

- aggregate employment earnings

- amount of employment insurance benefits received

- amount of Social Assistance benefits received, and

- reliance on income support

The proposed methodology is built on the same framework as the evaluation of the Labour Market Development Agreements (LMDA). The procedure for estimating net impacts is based on a non-experimental approach that measures the success of the program by comparing the actual outcomes for the participants in the interventions to their counterfactual outcomes (such as, the outcomes they would have experienced in the absence of the intervention). Because one cannot measure a given individual’s outcomes under both participation and non-participation in an Opportunity Fund intervention, one needs an appropriate comparison group to “stand in” as the counterfactual.

For all counterfactual comparisons, the net impact results were produced using a state-of-the-art combination of difference-in-differences estimation and propensity score kernel matching methods (Heckman et al., 1997). Given the breadth of background variables available in the linked data files, one can be reasonably confident that the impact estimates are robust (Lechner & Wunsch, 2013).

The main advantage of this evaluation methodology is that the universe of the comparison group is very large. This makes it possible to obtain close matches to program participants in terms of their observable characteristics. After consulting external academic experts (peer reviewers), evaluators selected a subset of EAS clients. This group was the best choice because of data availability and the fact that ESDC has considerable experience in using it as a comparison group.

A potential limitation of the analysis is that it is not feasible to measure the effectiveness of the Opportunities Fund for clients with different types and severity of disability. The impacts of Opportunities Fund for an individual with a single or mild disability will be different from the impacts for individuals with many or severe disabilities. Unfortunately, there is virtually no information in the administrative database to identify these individuals. However, the previous Opportunities Fund summative evaluation indicated that approximately equal proportions of survey participants reported a mild, moderate, or severe disability.

Lastly, one limitation of propensity score matching is that it is impossible to completely rule out the influence of unobserved factors on the results. This limitation applies to all non-experimental approaches to estimating treatment effects and techniques. However, given:

- the strength of the administrative data

- the wealth of covariates used in the analysis, and

- the ability of DID to control to some extent for unmeasured factors

We can be reasonably sure that the magnitude and direction of the estimates will not be greatly affected by the presence of unobserved confounders.

Cost-benefit analysis

The reference period for the cost-benefit analysis consists of participants who started their intervention between January 2011 and December 2012. This analysis looked at the labour market outcomes during the year of participation in the intervention. It continued to observe the labour market outcomes for 5 years after the participants had completed their intervention. Observed outcomes over the 5-year post-participation period are then projected for an additional 5 years, for a total period of 10 years post participation.

The cost-benefit analysis reports on the net present value and the benefit-cost ratio from the perspectives of:

- the individual

- the government, and

- society (individual + government)

An accounting framework determined who bore a particular cost or benefit. All benefits were discounted (by a rate of 3%) after the participation start year.

Limitations: The cost-benefit analysis is based on major quantifiable costs and benefits available in the:

- administrative database, and

- Employment Insurance Monitoring and Assessment Report

It does not include intangible benefits such as higher well-being for individuals related to better health outcomes and reduced criminality.

In addition to producing improvements in labour market indicators, it is likely that active labour market programming such as the Opportunities Fund also has positive influences on additional social outcomes such as health and crime. According to research evidence, labour market participation and higher income is associated with better health outcomes (for example, Canadian Institute for Health Information, 2015; Saunders and al. 2017) and lower risk of criminal activity (for example, Nilsson & Agell, 2003; Machin & Meghir, 2000). Expanding the cost-benefit framework to include potential savings resulting from improved health outcomes (in other words, reduced health system expenditures) and decreases in criminal justice system contact in other words, reductions in the costs of policing, courts, and correctional services) could yield additional positive impacts for both individuals and the government beyond what is directly measured.

Annex B: Study limitations

The agreement between ESDC and Opportunities Fund participants did not allow the Evaluation Directorate to contact employers directly to ask them to participate in the survey. So, we had to rely on third-party organizations to contact employers. This excluded the possibility of a truly random sample where each element has an equal and known chance of being selected into the sample.

The survey of employers coincided with the onset of covid-19 in March, 2020, making it difficult for employers to participate in the survey.

Assessment of the effects of the 2014 to 2015 program reforms were limited by the absence of data post 2016. In addition, there is no statistical control for differences between cohorts which could change the size of the observed differences.

It is not feasible to measure the success of Opportunities Fund for clients with different types and levels of disability severity. The impacts of the Opportunities Fund for an individual with a single or mild disability will be different from the impacts for individuals with many or severe disabilities.

The cost benefit analysis is based on major quantifiable costs and benefits available in the administrative database and Employment Insurance Monitoring and Assessment Report. It does not include intangible benefits such as improvement of participants’ mental and physical well-being associated with increased incomes and reduced duration of unemployment. Other benefits could include reducing crime, increasing the labour supply, and reducing pressure on wages. In addition, shortening the duration of job loss and improving incomes may have spin-off benefits that improve the psychological and social impacts on partners and families.

Annex C: Summary of net impacts

Opportunities Fund Programs

Enhanced Employment Assistance Services

- Key elements of the program: A tailored mixture of pre-employment activities to facilitate a person with disabilities’ integration into employment . These pre-employment activities can include (but are not limited to): providing labour market information, identification of barriers to employment, case management services, employment counselling, job placement services, and essential skills training

- Employment:Footnote 20 increase

- Employment earnings:Footnote 21 increase

- EI use:Footnote 22 non-significant increase

- Social Assistance:Footnote 23 non-significant increase

- Income support:Footnote 24 non-significant increase

Skills for Employment

- Key elements of the program: Short-duration training (6 months or less) related to a specific employment opportunity in a stable or expanding sector. Training can be full- or part-time, and could be distance or internet based courses if in-person instruction is not available, but it must lead to a certificate, diploma, or degree

- Employment:Footnote 25 increase

- Employment earnings:Footnote 26 increase

- EI use:Footnote 27 increase

- Social Assistance:Footnote 28 decrease

- Income support:Footnote 29 decrease

Wage Subsidy

- Key elements of the program: Provides a financial incentive for employers to hire persons with disabilities in positions that are likely to lead to a permanent job with the host employer and that are a part of the employer’s normal business operations

- Employment:Footnote 30 increase

- Employment earnings:Footnote 31 increase

- EI use:Footnote 32 increase

- Social Assistance:Footnote 33 decrease

- Income support:Footnote 34 decrease

Work Experience

- Key elements of the program: Financial support is given to employers to encourage them to provide work experience opportunities for persons with disabilities. There is no expectation that an employer keep a participant as an employee after the intervention is complete

- Employment:Footnote 35 increase

- Employment earnings:Footnote 36 increase

- EI use:Footnote 37 non-significant increase

- Social Assistance:Footnote 38 non-significant decrease

- Income support:Footnote 39 decrease

Self Employment

- Key elements of the program: Gives participants technical and consultative expertise to improve their chance of success, and to more effectively implement their business plans

- Employment:Footnote 40 non-significant decrease

- Employment earnings:Footnote 41 non-significant decrease

- EI use:Footnote 42 decrease

- Social Assistance:Footnote 43 non-significant increase

- Income support:Footnote 44 non-significant increase

Annex D: Outcomes and net impacts

The proportion of participants receiving employment insurance during the in-program period increased for all intervention types and then tapered off over the post-participation period.

Text description of figure D1

| Program period | Participation | Skills for Employment | Wage Subsidy | Work Experience | Enhanced Employment Assistance Services |

|---|---|---|---|---|---|

| Pre-program period | 5 yrs pre | $464 | $479 | $215 | $250 |

| Pre-program period | 4 yrs pre | $230 | $196 | $206 | $184 |

| Pre-program period | 3 yrs pre | $82 | $99 | $69 | $98 |

| Pre-program period | 2 yrs pre | $95 | $129 | $136 | $102 |

| Pre-program period | 1 yrs pre | $94 | $86 | $49 | $80 |

| Program period | Start year | $153 | $497 | $263 | $121 |

| Post-program period | 1 yr post | $334 | $1,035 | $521 | $193 |

| Post-program period | 2 yr post | $538 | $685 | $426 | $300 |

| Post-program period | 3 yr post | $758 | $695 | $401 | $307 |

| Post-program period | 4 yr post | $694 | $613 | $328 | $326 |

| Post-program period | 5 yr post | $323 | $399 | $205 | $193 |

| Post-program period | Average Post-Program | $529 | $685 | $376 | $264 |

| Change between Post and Pre periods | ($) | $436 | $600 | $327 | $184 |

Source: Common Systems for Grants and Contributions linked to Canada Revenue Agency T4s data

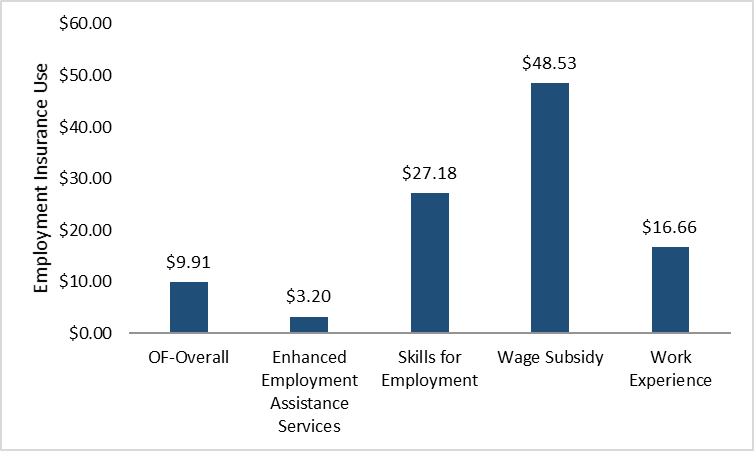

Skills for Employment, Wage Subsidy and Self-Employment interventions show an increase in Employment Insurance, compared to those receiving minimal services.Footnote 45 Positive results could be interpreted as an increase in work hours sufficient to qualify for Employment Insurance.

Text description of figure D2

| OF intervention | Change in use of Employment Insurance |

|---|---|

| OF-Overall | $9.91* |

| Enhanced Employment Assistance Services | $3.20 |

| Skills for Employment | $27.18* |

| Wage Subsidy | $48.53** |

| Work Experience | $16.66 |

Significance level ***1% **5% *10%

Source: ESDC (April 2020). “Opportunities Fund for Persons with Disabilities: highlights of Report on Participant Profiles, Outcomes and Net Impact.”

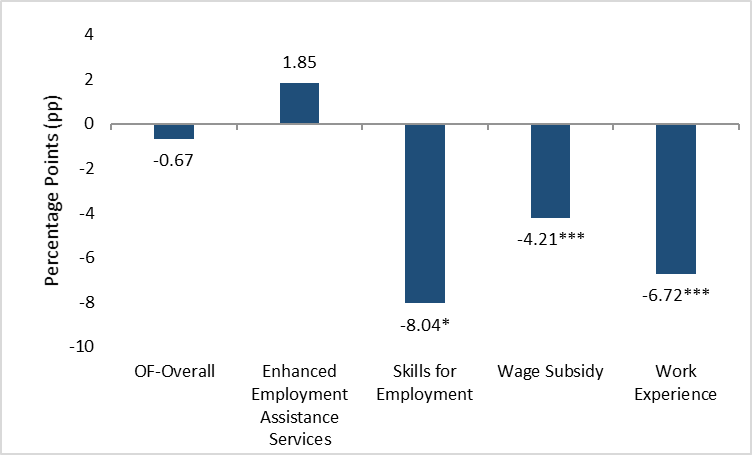

Participants experienced a drop in their dependence on income support (Employment Insurance benefits plus social assistance) across all intervention types in the 5 years following program participation.

Text description of figure D3

| Program period | Participation | Skills for Employment | Wage Subsidy | Work Experience | Enhanced Employment Assistance Services |

|---|---|---|---|---|---|

| Pre-program period | 5 yrs pre | 36% | 43% | 55% | 40% |

| Pre-program period | 4 yrs pre | 41% | 46% | 60% | 43% |

| Pre-program period | 3 yrs pre | 48% | 54% | 68% | 50% |

| Pre-program period | 2 yrs pre | 57% | 59% | 76% | 58% |

| Pre-program period | 1 yrs pre | 63% | 61% | 79% | 64% |

| Program period | Start year | 57% | 40% | 58% | 62% |

| Post-program period | 1 yr post | 40% | 37% | 53% | 52% |

| Post-program period | 2 yr post | 33% | 38% | 54% | 50% |

| Post-program period | 3 yr post | 32% | 39% | 54% | 48% |

| Post-program period | 4 yr post | 31% | 36% | 53% | 47% |

| Post-program period | 5 yr post | 28% | 36% | 50% | 45% |

Source: Common Systems for Grants and Contributions linked to Canada Revenue Agency T4s data

The dependence on income (Employment Insurance and social assistance) support generally decreased in the post-program period for all programs except for Self-Employment.Footnote 47 The net decreases were up to -8.04 percentage points over 5 years.

Text description of figure D4

| OF intervention | Change in dependence |

|---|---|

| OF-Overall | -0.67 |

| Enhanced Employment Assistance Services | 1.85 |

| Skills for Employment | -8.04* |

| Wage Subsidy | -4.21*** |

| Work Experience | -6.72*** |

Significance level ***1% **5% *10%

Source: ESDC (April 2020). Opportunities Fund for Persons with Disabilities: highlights of Report on Participant Profiles, Outcomes and Net Impact.

Annex E: Phase I questions and findings

- Has progress been made towards achieving expected outcomes? Is the program delivered in a cost-effective manner?

- Phase 1 showed that the program meets the needs of its clients. Even if awareness of support provided to workers with disabilities was not well known among employers. In terms of costs, the cost-per-beneficiary was comparable, if not lower, than similar labour force support programs. These included the Aboriginal Skills and Employment Training Strategy and the Youth Employment Strategy.

- To what extent has the reformed OF program, including Ready, Willing and Able and CommunityWorks, been implemented as designed?

- Evidence indicated that most participants gain work experience in small and medium sized enterprises. However, there appeared to be a deficit in demand-driven training. In addition, work placements were seen as too short in length. Both Ready, Willing and Able and CommunityWorks faced implementation challenges.

- To what extent does OF address demonstrable needs of program participants, as well as needs of employers? To what extent do these specific needs persist?

- There is evidence that the Opportunities Fund could be better known among service providers and potential clients, including employers. The Phase I report also revealed that meeting the needs of participants can sometimes require additional resources that have to be obtained through other programs or organizations.

- What are pre-program, in-program and post-program labour market outcomes for PWDs who participate in the OF Program, by intervention type and overall? (Incidence of Employment, Earnings, SA use, SA benefits, EI use, EI benefits).

- The percentage of participants who were employed, self-employed or returned to school, up to 12 months after their last program intervention, increased progressively from 42% in 2012 to 2013 to 55% in 2016 to 2017. On average, during this period, the Program served 4,316 persons with disabilities every year; of these, 41% (1,791) were employed or self-employed, and 6% (253) had returned to school after the end of an intervention. On average, 53% (2,272) of participants were neither employed, self-employed nor returned to school after the Program.

- To what extent do Opportunities Fund objectives reflect ESDC strategic outcomes and broad federal government policy directions and priorities? To what extent does Opportunities Fund continue to align with federal and departmental roles and responsibilities?

- The Opportunities Fund continues to align with the priorities, roles and responsibilities of Employment and Social Development Canada and the federal government. This is reflected in the government’s engagement towards the elimination of barriers to employment for persons with disabilities and the recent tabling of new federal accessibility legislation.

- What is the reach of the Opportunities Fund?

- The Opportunities Fund served approximately 4,300 clients per year, on average, from fiscal year 2012 to 2013 to fiscal year 2016 to 2017. As of 2012 (most recent estimates available), approximately 103,300 Canadians aged 15 to 64 had a disability and had never worked or had not worked in the previous 5 years despite having the potential to work.

- Has progress been made towards achieving expected key outcomes of the Opportunities Fund program?

- Evidence indicates that progress is being made towards achieving the program’s direct outcomes. From 2012 and 2013 to 2016 and 2017, the percentage of participants who were employed, self-employed or returned to school (up to 12 months after their last intervention) increased progressively from 42% to 55%.

- What is the quality of Opportunities Fund project administrative data?

- Administrative data were found to be of good quality, while gaps were identified in relation to up-to-date participant contact information and information on employers in general.

Annex F: Outcome indicators

Average Annual Employment Income: This indicator is derived from CRA data (T4 supplementary and T1 tax return records). It shows the yearly average of all types of employment income for the 2011 to 2012 OF participants, consisting of income from:

- paid employment

- self-employment

- net farming

- net fishing

- net commission

- net professional

- aboriginal earnings, and

- other employment income

The income is measured in constant dollars, with 2011 as the base year.

Proportion of Participants Employed

To examine the proportion of participants who were employed during the pre- and post-program periods, we created a binary variable of “employment status.” The variable takes on the value “1” if the individual had employment earnings within a given calendar year (in either the pre- or post-participation period); and “0” if not. Using this variable, we can estimate the yearly fraction of employed participants.

Average Annual Employment Insurance (EI) Benefit:

This indicator measures the average yearly EI benefits received by participants during the pre- and post-program periods and is extracted from EI Part I data. The total EI benefit is measured in constant dollars, with 2011 as the base year.

Average Annual Social Assistance (SA) Benefit:

This indicator measures the average yearly amount of SA benefits received by participants during the pre- and post-program periods. The total yearly SA benefit received by participants was used to derive this indicator, taken from T1 tax return records. The total SA benefit is measured in constant dollars, with 2011 as the base year.

Dependence on Income Support: This is defined as the following ratio:

Dependence on Income Support =

- (EI Benefits + Social Assistance)

- (EI Benefits + Social Assistance + Total Earnings)

where “Total Earnings” includes wages and salaries as well as income from self-employment.

Annex G: Works cited

Canadian Institute for Health Information (2018). National Health Expenditure Trends, 1975 to 2018. Ottawa, ON: CIHI.

Heckman, James J. and Jeffrey A. Smith (1999). “The Pre-Program Earnings Dip and the Determinants of Participation in a Social Program: Implications for Simple Program Evaluation Strategies.” Economic Journal, 109(457), 313–348.

Lechner, Michael and Conny Wunsch (2011). “Sensitivity of Matching-Based Program Evaluations to the Availability of Control Variables.” Working Paper No. 3381. Munich: CESifo.

Nilsson, Anna and Jonas Agell (2003). “Crime, unemployment and labor market programs in turbulent times.” Working Paper 2003:14. Uppsala, Sweden: Institute for Labour Market Policy Evaluation.

Machin, Stephen and Costas Meghir (Fall 2004). “Crime and Economic Incentives.” The Journal of Human Resources, 39(4), 958-979.

Saunders, Matthew, Ben Barr, Phil McHale, and Christoph Hamelmann (2017). Key policies for addressing the social determinants of health and health inequities. Health Evidence Network Synthesis Report 52. Copenhagen: WHO Regional Office for Europe.