Quarterly financial report for the quarter ended December 31, 2022

On this page

- 1. Introduction

- 2. Highlights of Fiscal Quarter and Fiscal Year-to-Date results

- 3. Risks and uncertainties

- 4. Significant changes in operations, personnel and program

- 5. Approval by senior officials

- Table 3: Statement of authorities (unaudited)

- Table 4: Departmental budgetary expenditures by standard object (unaudited)

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subject to an external audit or review and should be read in conjunction with the Main Estimates for the current year authority, mandate and programs.

The mission of Employment and Social Development Canada (ESDC), including the Labour Program and Service Canada, is to build a stronger and more inclusive Canada, to support Canadians in helping them live productive and rewarding lives and improving Canadians’ quality of life.

The Ministers responsible for Employment and Social Development Canada are:

- the Minister of Employment, Workforce Development and Disability Inclusion

- the Minister of Families, Children and Social Development

- the Minister of Labour

- the Minister of Seniors

ESDC delivers programs and services to each and every Canadian throughout their lives in a significant capacity. ESDC fulfills its mission by:

- developing policies that ensure Canadians can use their talents, skills and resources to participate in learning, work and their community

- delivering programs that help Canadians move through life’s transitions, from school to work, from one job to another, from unemployment to employment, from the workforce to retirement

- providing income support to seniors, families with children and those unemployed due to job loss, illness or caregiving responsibilities

- helping Canadians with distinct needs, such as Indigenous people, persons with disabilities, homeless people, travelers and recent immigrants

- ensuring labour relations stability through the provision of dispute prevention and resolution services

- promoting fair, safe and healthy workplace conditions, promoting decent work and employment equity, and fostering respect for international labour standards

- delivering programs and services on behalf of other departments and agencies

Further details on ESDC’s authority, mandate and programs can be found in Part II of the Main Estimates and in the Departmental Plan.

1.1 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities (Table 3) includes ESDC’s spending authorities granted by Parliament, consistent with the Main Estimates and the budgetary authorities used by the Department for the fiscal year ending March 31, 2023. This quarterly report has been prepared using a special-purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authorities for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.2 ESDC’s Financial Structure

ESDC has a complex financial structure, with various funding mechanisms used to deliver its mandate. This includes budgetary authorities, comprised of voted and statutory authorities, as well as non-budgetary authorities.

The voted budgetary authorities include:

- Vote 1 (Operating Expenditures)

- Vote-Netted Revenues

- Vote 5 (Grants and Contributions)

The statutory authorities are mainly comprised of:

- the Old Age Security (OAS) Program

- the Canada Student Financial Assistance Program

- the Canada Education Savings Program

- the Canada Disability Savings Program

- the Canada Recovery Benefits

- the Canada Worker Lockdown Benefit

- the Wage Earner Protection Program

- Federal Workers’ Compensation

- Employee Benefit Plans (EBP)

The non-budgetary authorities consist of loans disbursed under the Canada Student Financial Assistance Act and the Apprentice Loans Act.

The Department is financed by 4 main sources of funds:

- appropriated funds from the Consolidated Revenue Fund (CRF)

- the Employment Insurance (EI) Operating Account

- the Canada Pension Plan (CPP)

- other government departments and Crown corporations

EI and CPP benefits and related administrative costs are charged against revenues earmarked in separate specified purpose accounts and not through appropriations from government. The EI Operating Account and the CPP are financed by employers and employees, and, in the case of the CPP, income from its investments. Federal administrative costs incurred by departments in the delivery of programs related to EI and CPP are charged to the respective accounts and reported as revenues credited to the vote. While presented in the Departmental Plan, the EI Operating Account and the CPP are excluded from ESDC’s Main and Supplementary Estimates. Accordingly, these accounts are not reflected in the Quarterly Financial Report.

The Department of Employment and Social Development Act was amended in June 2018 to broaden the Department’s mandate to include service delivery to the public with a view to improve services to Canadians. As such, the Department has the legislative authority to deliver services to the public for partners on a cost-recovery basis as well as to deliver select services for the Government of Canada, such as per example, Passport services.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

Within the environment described above, this section highlights the significant items that contributed to the net decrease in resources available for the year and the net decrease in actual expenditures for the quarter ending December 31, 2022.

ESDC’s total budgetary authority available in the third quarter ending December 31, 2022 was $87,323 million, which represents an overall decrease of $11,220 million from the previous year. Much of this decrease relates to COVID-19 statutory measures provided under the Canada Recovery Benefits Act in the third quarter of the fiscal year ending March 31, 2022. Total Year-to-Date (YTD) budgetary authorities used as of the third quarter ending December 31, 2022 were $64,651 million. In comparison, total YTD budgetary authorities used as of the third quarter of the previous year were $73,613 million, representing a year-over-year decrease of $8,962 million.

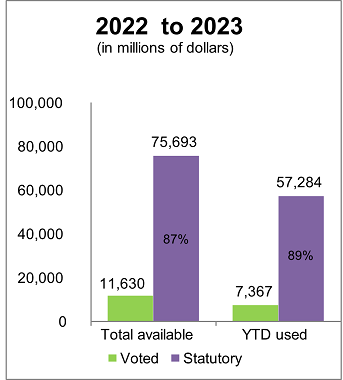

Figure 1: Quarter ended December 31, 2022

Figure 1 Text description – 2022 to 2023 (in millions of dollars)

| Authorities | Total available | % Total available | YTD used | % YTD Used |

|---|---|---|---|---|

| Voted | 11,630 | 13 % | 7,367 | 11 % |

| Statutory | 75,693 | 87 % | 57,284 | 89 % |

| Total | 87,323 | 100 % | 64,651 | 100 % |

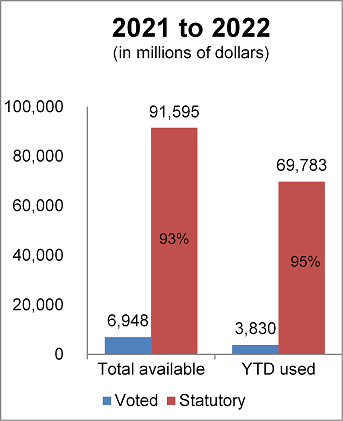

Figure 2: Quarter ended December 31, 2021

Figure 2 Text description – 2021 to 2022 (in millions of dollars)

| Authorities | Total available | % Total available | YTD used | % YTD Used |

|---|---|---|---|---|

| Voted | 6,948 | 7 % | 3,830 | 5 % |

| Statutory | 91,595 | 93 % | 69,783 | 95 % |

| Total | 98,543 | 100 % | 73,613 | 100 % |

2.1 Significant Changes to Authorities

ESDC’s budgetary authorities available for use decreased by $11,220 million compared to the third quarter of the fiscal year ending March 31, 2022 (see details in Table 3 and Table 4).

Approximately $17,626 million of the decrease in the authorities available for use is due to 3 statutory temporary recovery benefits: the Canada Recovery Benefit, which ended October 23, 2021, the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit, which ended May 7, 2022.

Other measures totalling $4,451 million were funded for one year only through the Budget Implementation Act (BIA) 2021:

- a decrease of $2,648 million in statutory funding to ensure that new Early Learning and Child Care (ELCC) investments were provided as soon as Canada-wide bilateral agreements were reached with the provinces and territories in the year ending March 31, 2022

- a decrease of $1,673 millionFootnote 1 for a one-time taxable payment of $500 provided to seniors who were 75 years old or older to help them meet their immediate needs until a permanent 10 percent increase to the monthly OAS pension was implemented in July 2022; and $130 million to provide support to the Government of Quebec to offset the cost of aligning the Quebec Parental Insurance Plan with the temporary measures that have made Employment Insurance maternity and parental benefits more generous and easier to access for some claimants.

An additional decrease of $3 million is for various other statutory authorities.

Offsetting these decreases are increases totalling $10,860 million, mainly related to:

- forecasted OAS pension, Guaranteed Income Supplement (GIS) and Allowance payments represent an increase of $5,432 million, owing to expected changes in the average monthly benefit payments and in the number of beneficiaries

- an increase of $4,596 million in voted grants and contributions (Vote 5) is mainly due to voted funding received to continue to build a Canada-wide Early Learning and Child Care system in partnership with provinces, territories and Indigenous governments; and providing a one-time, non-taxable payment to alleviate the financial hardship of Guaranteed Income Supplement (GIS) and Allowance recipients who received pandemic benefits in 2020

- an increase of $646 million in the Canada Student Financial Assistance Program and Canada Apprentice Loans authorities mainly attributed to an extension of the doubling of Canada Student Grants for an additional 2 years until July 31, 2023 in response to the COVID-19 pandemic

- an increase of $85 million in voted operating expenditures (Vote 1) is mainly due to voted funding received for the processing and payment sectors and the delivery of new programs, as well as increases in operation and maintenance such as information technology (IT) related expenditures

- an increase of $70 million for Canada Education Saving Grant resulting from the strong performance of financial markets, which is encouraging some families to invest more in Registered Education Savings Plans; and

- an increase of $31 million in contributions to employee benefit plans as a result of a planned increase in personnel spending

| Details | (in millions of dollars) |

|---|---|

| Total budgetary authorities available for use for the fiscal year ending March 31, 2022 | 98,543 |

| Changes to authorities available for use | n/a |

| Canada Recovery Benefits (including Sickness and Caregiving Benefits) | (17,626) |

| Statutory funding for payment to provinces and territories for Early Learning and Child Care | (2,648) |

| Transfer payments in connection with the Budget Implementation Act – Supplementary payments to seniors and Payment to the Government of Quebec for the Parental Insurance Plan | (1,803) |

| Other statutory authorities | (3) |

| Old Age Security benefits | 5,432 |

| Vote 5 – Grants and contributions | 4,596 |

| Canada Student Financial Assistance Program and Canada Apprentice Loans | 646 |

| Vote 1 – Operating expenditures | 85 |

| Canada Education Saving Grants | 70 |

| Contributions to employee benefit plans | 31 |

| Sub-Total – Changes to authorities available for use | (11,220) |

| Total budgetary authorities available for use for the fiscal year ending March 31, 2023 | 87,323 |

With respect to non-budgetary loans, there is a net decrease in authorities of $1,163 million in the fiscal year ending March 31, 2023 compared to the fiscal year ending March 31, 2022, mainly due to the temporary COVID-19 measure, which increased the limit on Canada Student Loans from $210 to $350 per week, ending in July 2021. In addition, amount of net non-budgetary Canada Student Loans disbursed under the Canada Student Financial Assistance Act is negative as loan repayments have resumed while loan disbursements have decreased.

As shown in Table 4, decrease in the Department total authorities between the third quarter ending on December 31, 2022 and the third quarter of the previous year, ending on December 31, 2021, is mainly related to transfer payments (standard object 10) and is caused by variations in statutory items as described in the paragraphs above. Variances to other operating expenditures (standard objects 02, 03, 04, 05, 06, 07, 09, 12) are the result of adjustments made to authorities available for use to align them with actual historical spending trends.

2.2 Significant Changes to Expenditures

Overall, the proportion of ESDC’s total budgetary expenditures as of December 31, 2022 is comparable to the usual spending reported in the third quarter, with approximately 74% of the authorities available for use expensed.

Compared to the previous year, total budgetary expenditures as of the quarter ending December 31, 2022 have decreased by $8,962 million (12%) from $73,613 million to $64,651 million (refer to Table 3 and Table 4).

This 12% decrease is mostly explained by the reduction in statutory expenditures from $69,783 million for the third quarter in the fiscal year ending March 31, 2022 to $57,284 million for the same period in the fiscal year ending March 31, 2023. This is representing an $12,499 million decrease as of the end of the third quarter of the fiscal year ending March 31, 2023.

- This decrease is primarily related to payments under the Canada Recovery Benefits Act, which include the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit, which have decreased by $15,596 million as of the third quarter of the year ending March 31, 2023.

- One-time payment for older seniors issued during the third quarter in the fiscal year ending March 31, 2022 to OAS pensioners who had turned 75 years old as of June 30, 2022, accounts for $1,679 million of the decrease.

- Payments to provinces and territories for Early Learning and Child Care accounts for $1,360 million of the decrease.

- Offsetting this decrease, the OAS Program, including the GIS and Allowance, has increased by $5,993 million. The main factors explaining this increase are the aging population and higher average monthly amounts paid to beneficiaries.

- An additional $111 million increase to the Canada Student Financial Assistance Program and Canada Apprentice Loans is mainly attributed to an extension of the doubling of Canada Student Grants for an additional 2 years until July 31, 2023 in response to the COVID-19 pandemic.

- Other smaller changes to statutory expenditures, totalling an increase of $32 million, also contribute to the variance.

In addition, grant and contribution expenditures under Vote 5 have increased by $3,297 million compared to the spending at the end of the same quarter in the fiscal year ending March 31, 2022. This increase is mainly attributable to the one-time, non-taxable payment to alleviate the financial hardship of GIS and Allowance recipients who received pandemic benefits in 2020 and expenditures to continue to build a Canada-wide Early Learning and Child Care system in partnership with provinces and territories. Offsetting this increase is a decrease in spending related to Reaching Home, which has been transferred to the Office of Infrastructure of Canada during the year ending March 31, 2022.

Operating expenditures under Vote 1 have increased by $240 million and is mainly attributable to salary increases in the processing and payment sectors and in the delivery of new programs, as well as increases in operation and maintenance such as information technology (IT) related expenditures.

| Details | (in millions of dollars) |

|---|---|

| Total budgetary authorities used as of December 31, 2021 | 73,613 |

| Changes in authorities used | n/a |

| Canada Recovery Benefits (including Sickness and Caregiving Benefits) | (15,596) |

| Payment to seniors (OAS 75+) pursuant to the Budget Implementation Act | (1,679) |

| Payments to provinces and territories for Early Learning and Child Care | (1,360) |

| Old Age Security benefits | 5,993 |

| Canada Student Financial Assistance Program and Canada Apprentice Loans | 111 |

| Other statutory expenditures | 32 |

| Vote 5 — Grants and contributions | 3,297 |

| Vote 1 — Operating Costs | 240 |

| Sub-Total - Changes in authorities used | (8,962) |

| Total budgetary authorities used as of December 31, 2022 | 64,651 |

In Table 3, the net amount of non-budgetary loans disbursed under the Canada Student Financial Assistance Act has increased by $96 million at the end of the third quarter, primarily due to a decrease in loans reimbursements.

In Table 4, the decrease in transfer payments (standard object 10) are in line with explanations provided in previous paragraphs regarding the changes in statutory items and voted grants and contributions (Vote 5) expenditures.

3. Risks and Uncertainties

As the Department strives to ensure that Canadians receive high quality and efficient services, it must remain mindful of the changing environment in which it operates as well as the risks that may delay or prevent it from achieving its mission. Across the portfolio, the Department uses standard risk management practices, oversight committees, consultation and training to anticipate and mitigate the probability and impact of negative events. The Department’s top corporate risks and the efforts being taken to mitigate them are described in the “Overall risks and mitigation” sub-section of ESDC’s Departmental Plan for the fiscal year ending March 31, 2023.

At this time, ESDC, like many organizations, is focused on the future of work post pandemic and the adoption of a flexible work model. This is to ensure it remains a high performing organization that is agile, inclusive and responsive to the needs of Canadians. To address risks related to the implementation of the new work model, the Department has created a dedicated secretariat to support the organization’s approach to the future of work.

In addition, ESDC recognizes that change management is a necessary part of the transition to new ways of working, including changes resulting from program delivery modernization. The Department set up a change management office to help managers introduce changes to employees to mitigate the risk of changes having a negative impact on employees’ wellness and on their productivity.

Subsequently, the Department must find the best way to allocate limited financial and human resources to accomplish ESDC’s mandate and priorities. In addition, there is tremendous competition across all sectors for qualified workers. This creates the risk that some improvements will be delayed until the right people can be found. To address risks related to planning and priority setting, the Department is currently reviewing the way it is organized for decision-making.

4. Significant Changes in Operations, Personnel and Programs

The conclusion of the Canada Worker Lockdown Benefit (CWLB), the Canada Recovery Caregiving Benefit (CRCB) and the Canada Recovery Sickness Benefit (CRSB) occurred in fiscal year 2022 to 2023.

The Department continues to implement a Canada-wide early learning and child care system with provinces and territories that improves access to high quality, affordable, flexible and inclusive early learning and child care.

The Department increased the OAS and the GIS, because of an expected increased number of OAS pensioners due to the aging population and increases to the average monthly amounts paid, particularly resulting from the 10 percent increase to the monthly OAS pension for seniors aged 75 and over (as of July 2022), as well as from the indexation of benefits.

Finally, Canadians had many other concerns on their mind and travel limits imposed during COVID-19 resulted in an 80% decrease in demand for passport services when compared to pre-pandemic forecasts for those years. What this means is, that over the course of the pandemic 3 million clients did not apply for or renew adult and child applications. The Passport Program saw 20% of regular volume during this period.

With the easing of restrictions and the resumption of travel, Service Canada has seen an increase in passport applications across the country. Through the Passport Revolving Fund, Service Canada has put a number of measures in place to make it easier for Canadians to access passport services, improve processing and increase resources. The Passport Program operates on a cost-recovery basis through a revolving fund, financing its operations entirely from the fees charged for passport and other travel document services.

5. Approval by Senior Officials

Original document was signed in Gatineau, Canada by:

- Karen Robertson, Chief Financial Officer, on February 20, 2023

- Jean-François Tremblay, Deputy Minister, on February 21, 2023

| Vote | (in thousands of dollars) | Total authorities available for use for the year ending March 31, 20231 | Authorities used during the quarter ended December 31, 2022 | Fiscal Year 2022 to 2023 Year to date authorities used at quarter-end | Total authorities available for use for the year ending March 31, 20221 | Authorities used during the quarter ended December 31, 2021 | Fiscal Year 2021 to 2022 Year to date authorities used at quarter-end |

|---|---|---|---|---|---|---|---|

| 1 | Operating expenditures | 1,390,007 | 294,127 | 947,080 | 1,304,835 | 215,891 | 706,822 |

| 5 | Grants and contributions | 10,239,422 | 1,924,642 | 6,420,162 | 5,642,800 | 1,088,449 | 3,123,616 |

| (S) | Contributions to employee benefit plans | 402,730 | 72,488 | 217,464 | 371,953 | 70,193 | 210,578 |

| (S) | Minister of Employment, Workforce Development and Disability Inclusion – Salary and motor car allowance | 92 | 23 | 69 | 90 | 23 | 68 |

| (S) | Minister of Families, Children and Social Development – Salary and motor car allowance | 92 | 23 | 69 | 90 | 15 | 60 |

| (S) | Minister of Labour – Salary and motor car allowance | 92 | 23 | 69 | 90 | 30 | 68 |

| (S) | Minister of State (Seniors) – Motor car allowance | 2 | 1 | 2 | 2 | - | 1 |

| (S) | Old Age Security Payments (Old Age Security Act) | 51,854,000 | 14,332,826 | 40,910,782 | 47,189,124 | 12,379,977 | 36,312,417 |

| (S) | Guaranteed Income Supplement Payments (Old Age Security Act) | 15,435,000 | 4,240,665 | 11,771,133 | 14,613,979 | 3,543,625 | 10,389,728 |

| (S) | Payments related to the Canada Recovery Benefits Act | 388,500 | 39,326 | 380,912 | 18,014,997 | 2,510,789 | 15,976,954 |

| (S) | Canada Student Grants to qualifying full and part-time students pursuant to the Canada Student Financial Assistance Act | 3,414,308 | 414,294 | 1,952,014 | 2,997,188 | 357,396 | 1,839,624 |

| (S) | Payments to provinces and territories for early learning and child care pursuant to the Budget Implementation Act, 2021, No. 1 | - | - | - | 2,648,082 | 1,359,827 | 1,359,827 |

| (S) | Transfer payments in connection with the Budget Implementation Act, 2021, No. 1 | - | 19 | 409 | 1,803,251 | 805 | 1,679,077 |

| (S) | Payments related to the direct financing arrangement under the Canada Student Financial Assistance Act | 1,296,269 | 60,782 | 153,287 | 1,067,777 | 61,439 | 160,602 |

| (S) | Canada Education Savings grant payments to Registered Education Savings Plan (RESP) trustees on behalf of RESP beneficiaries to encourage Canadians to save for post-secondary education for their children | 1,050,000 | 215,644 | 662,369 | 980,000 | 229,887 | 702,352 |

| (S) | Allowance Payments (Old Age Security Act) | 617,000 | 148,178 | 412,081 | 670,775 | 128,375 | 398,994 |

| (S) | Canada Disability Savings Grant payments to Registered Disability Savings Plan (RDSP) issuers on behalf of RDSP beneficiaries to encourage long-term financial security of eligible individuals with disabilities | 491,473 | 91,997 | 312,109 | 472,004 | 87,350 | 312,261 |

| (S) | Canada Disability Savings Bond payments to Registered Disability Savings Plan (RDSP) issuers on behalf of RDSP beneficiaries to encourage long-term financial security of eligible individuals with disabilities | 199,577 | 17,969 | 60,108 | 216,737 | 17,645 | 79,833 |

| (S) | Spending of revenues pursuant to subsection 5.2(2) of the Department of Employment and Social Development Act | 252,129 | 105,827 | 240,296 | 223,509 | 53,677 | 135,192 |

| (S) | Canada Learning Bond payments to Registered Education Savings Plan (RESP) trustees on behalf of RESP beneficiaries to support access to post-secondary education for children from low-income families | 181,000 | 23,234 | 131,124 | 180,000 | 19,536 | 121,930 |

| (S) | One-time payment to persons with disabilities pursuant to An Act respecting further COVID-19 measures | - | (9) | (48) | 56,109 | 4,031 | 30,669 |

| (S) | Wage Earner Protection Program payments to eligible applicants owed wages and vacation pay, severance pay and termination pay from employers who are either bankrupt or in receivership as well as payments to trustees and receivers who will provide the necessary information to determine eligibility | 49,250 | 6,885 | 15,603 | 49,250 | (1,779) | 9,077 |

| (S) | Payments of compensation respecting government employees (Government Employees Compensation Act) and merchant seamen (Merchant Seamen Compensation Act) | 31,445 | 9,457 | 38,768 | 31,445 | 22,652 | 57,358 |

| (S) | Payments for the Canada Worker Lockdown Benefit pursuant to the Canada Worker Lockdown Benefit Act | 21,120 | 1,770 | 16,243 | - | - | - |

| (S) | The provision of funds for interest and other payments to lending institutions and liabilities under the Canada Student Financial Assistance Act | 4,405 | 5,028 | 5,114 | 5,107 | (14) | 1,017 |

| (S) | Payments related to direct financing arrangement under the Apprentice Loans Act | 3,208 | 106 | 2,199 | 2,564 | 280 | 1,896 |

| (S) | Spending pursuant to section 12(4) of the Canada Education Savings Act | 1,230 | - | - | 1,266 | 880 | 880 |

| (S) | Civil Service Insurance actuarial liability adjustments | 145 | - | - | 145 | - | - |

| (S) | Spending of proceeds from the disposal of surplus Crown assets | 235 | - | - | 218 | 55 | 57 |

| (S) | The provision of funds for interest payments to lending institutions under the Canada Student Loans Act | 32 | 1 | 2 | 46 | 1 | 7 |

| (S) | Universal Child Care Benefit (Universal Child Care Benefit Act) | 660 | 466 | 1,852 | 40 | 842 | 2,236 |

| (S) | Refunds of amounts credited to revenues in previous years | 650 | 315 | 650 | 1,143 | 730 | 1,143 |

| (S) | The provision of funds for liabilities including liabilities in the form of guaranteed loans under the Canada Student Loans Act | (1,342) | (464) | (1,263) | (1,613) | (369) | (876) |

| (S) | Payment pursuant to section 24(1) of the Financial Administration Act for the Temporary Foreign Worker Program under the Public Health Events of National Concern Payments Act | - | - | - | - | (10) | (20) |

| N/A | Sub-total—Statutory items1 | 75,693,301 | 19,786,874 | 57,283,417 | 91,595,368 | 20,847,888 | 69,783,010 |

| N/A | Total budgetary | 87,322,730 | 22,005,643 | 64,650,659 | 98,543,003 | 22,152,228 | 73,613,148 |

| N/A | Non-Budgetary | n/a | n/a | n/a | n/a | n/a | n/a |

| (S) | Loans disbursed under the Canada Student Financial Assistance Act | (217,915) | (163,400) | 566,363 | 937,194 | (154,825) | 470,365 |

| (S) | Loans disbursed under the Apprentice Loans Act | 12,271 | 1,569 | 952 | 19,997 | 772 | (890) |

| N/A | Total Non-Budgetary | (205,644) | (161,831) | 567,315 | 957,191 | (154,053) | 469,475 |

1. Includes only authorities available for use and granted by Parliament at quarter-end.

| Expenditures (in thousands of dollars) | Planned expenditures for the year ending March 31, 20231 | Expended during the quarter ended December 31, 2022 | Fiscal year 2022 to 2023 Year to date used at quarter-end | Planned expenditures for the year ending March 31, 20221 | Expended during the quarter ended December 31, 2021 | Fiscal year 2021 to 2022 Year to date used at quarter-end |

|---|---|---|---|---|---|---|

| (01) Personnel | 3,144,741 | 834,798 | 2,447,047 | 3,050,764 | 746,555 | 2,199,612 |

| (02) Transportation and communications | 76,560 | 16,020 | 43,764 | 94,029 | 13,337 | 31,918 |

| (03) Information | 89,122 | 20,697 | 40,400 | 101,025 | 19,641 | 41,648 |

| (04) Professional and special services | 1,325,951 | 240,515 | 592,526 | 1,564,821 | 253,671 | 548,618 |

| (05) Rentals | 305,032 | 61,819 | 175,646 | 296,816 | 65,244 | 173,338 |

| (06) Repair and maintenance | 7,581 | 733 | 1,850 | 13,985 | 653 | 1,666 |

| (07) Utilities, materials and supplies | 10,906 | 1,728 | 3,479 | 10,889 | 837 | 1,876 |

| (09) Acquisition of machinery and equipment | 107,299 | 11,072 | 18,285 | 143,034 | 11,984 | 32,764 |

| (10) Transfer payments | 85,106,491 | 21,478,478 | 63,034,068 | 96,134,815 | 21,773,765 | 72,475,514 |

| (12) Other subsidies and payments | (117,910) | 16,773 | 126,164 | (120,635) | 4,045 | (3,884) |

| Total gross budgetary expenditures | 90,055,773 | 22,682,642 | 66,483,229 | 101,289,543 | 22,889,732 | 75,503,070 |

| LESS: Revenues netted against expenditures | n/a | n/a | n/a | n/a | n/a | n/a |

| Recoverable expenditures on behalf of the Employment Insurance Operating Account | (2,208,464) | (553,569) | (1,479,396) | (2,213,076) | (601,650) | (1,516,467) |

| Recoverable expenditures on behalf of the Canada Pension Plan | (522,779) | (123,430) | (353,175) | (532,564) | (135,621) | (372,975) |

| Other amounts recoverable from provincial and territorial governments, other departments or other programs within a department | (1,800) | - | - | (900) | (233) | (480) |

| Total revenues netted against expenditures | (2,733,043) | (676,999) | (1,832,570) | (2,746,540) | (737,504) | (1,889,922) |

| Total net budgetary expenditures | 87,322,730 | 22,005,643 | 64,650,659 | 98,543,003 | 22,152,228 | 73,613,148 |

1. Includes only authorities available for use and granted by Parliament at quarter-end.