Canada Student Loans Program annual report 2016 to 2017

On this page

Alternate formats

Canada Student Loans Program Annual Report for the 2016 to 2017 fiscal year [PDF - 2.4 MB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

Message from the Minister

The global economy is changing and joining today's labour market demands higher education credentials. For that reason, post-secondary education has never been more important than it is now.

We want to ensure all Canadians have equal access to the education and training they need for a fair chance at success - whether they are going to college or university for the first time, returning to school or upgrading their skills. Through the Canada Student Loans Program, we are committed to making post-secondary education accessible and affordable for the people who need it most.

We made significant progress through 2016-2017, disbursing over $1 billion in Canada Student Grants to 380,000 Canadian post-secondary students. We also provided $2.6 billion in loans to 497,000 students, and 306,000 borrowers received support under the Repayment Assistance Plan.

Finally, we have provided $20.6 million in student loan forgiveness to doctors and nurses working in rural or remote communities to encourage more medical professionals to practice outside of Canada's urban centres. More than 4,600 individuals benefitted from this initiative, an increase of 21.5%.

We also launched the Skills Boost initiative in January 2018 that will help an additional 43,000 Canadians annually. Since September 2018, Skills Boost provides additional financial support for adult learners who have been out of school for 10 years or more to go back to school, upgrade their skills and succeed in the workforce.

Each year, the Canada Student Loans Program helps hundreds of thousands of students achieve their goals through post-secondary education. Together, these new investments will ensure all Canadian students, in particular, from underrepresented groups, have equal access to the education and training they need for a fair chance at success.

The Honourable Patty Hajdu, P.C., M.P.

Minister of Employment, Workforce Development and Labour

Introduction

This annual report serves to inform Parliament and Canadians about student financial assistance for post-secondary education under the Canada Student Loans Program (CSLP). It provides information and data on grants, loans, repayment assistance and other program benefits during the 2016–2017 loan year (August 1, 2016, to July 31, 2017).

Further detailed information, including historical data on federal student financial assistance over the past number of years, is available on the Government of Canada website: Canada Student Loans Program reports.

Vision and mission

Employment and Social Development Canada

The mission of Employment and Social Development Canada (ESDC), including the Labour Program and Service Canada, is to build a stronger and more inclusive Canada, to support Canadians in helping them live productive and rewarding lives and to improve Canadians' quality of life.

To fulfill its mission, the Department is responsible for:

- developing policies that ensure all can use their talents, skills and resources to participate in learning, work and their community;

- delivering programs that help Canadians move through life's transitions, from school to work, from one job to another, from unemployment to employment, from the workforce to retirement;

- providing income support to seniors, families with children and Employment Insurance beneficiaries;

- fostering inclusive growth by providing opportunity and assistance to Canadians with distinct needs, such as Indigenous people, people with disabilities, homeless people and recent immigrants;

- overseeing labour relations, occupational health and safety, labour standards, employment equity and workers' compensation in the federal jurisdiction; and

- delivering programs and services on behalf of other departments and agencies, such as passport services delivered on behalf of Immigration, Refugees and Citizenship Canada and services to veterans delivered on behalf of Veterans Affairs Canada.

Canada Student Loans Program

The CSLP provides non-repayable and repayable student financial assistance (grants and loans) to eligible students to help them access and afford post-secondary education. The Program also offers repayment assistance to borrowers who have difficulty repaying their student loans.

Program highlights

The Government of Canada recognizes the importance of ensuring that student financial assistance addresses the diverse needs of post-secondary students so that they may achieve their educational goals and, ultimately, succeed as contributing members of a productive workforce.

Budget 2016

Budget 2016 introduced a package of reforms to the CSLP intended to make Post-Secondary Education more affordable for students from low- and middle-income families and ensure that student debt loads are manageable.

Changes introduced for the 2016–2017 academic year included:

- Effective August 1, 2016, Canada Student Grant (CSG) amounts increased by 50 percent:

- From $2,000 to $3,000 per year for students from low-income families;

- From $800 to $1,200 per year for students from middle-income families; and

- From $1,200 to $1,800 per year for part-time students.

- Effective November 1, 2016, the loan repayment threshold under the CSLP’s Repayment Assistance Plan (RAP) was increased to ensure that no single borrower will have to repay their Canada Student Loans (CSL) until they are earning at least $25,000 per year.

Additional changes announced in Budget 2016 and to be implemented in 2017–2018 included:

- The CSG for Students from Low-Income Families and the CSG for Students from Middle-Income Families would be replaced by the Canada Student Grant for Full-Time Students (CSG-FT), which would have a more generous, progressive threshold, and the grant amounts will gradually decrease based on income and family size.

- A new fixed student contribution model to replace the previous system of assessing student income and financial assets and allows students to work and gain valuable labour market experience without having to worry about a reduction in their level of financial assistance.

In the 2016–2017 loan year, over 627,000 post-secondary students received financial assistance from the CSLP, in the form of grants, loans or in-study interest subsidies.

Following are the key highlights of the components of the CSLP in the 2016–2017 loan year.

Canada Student Grants

- 380,000 students received financial assistance they will not have to pay back, which is 3% more than the previous year.

- The total amount of grants awarded to students in the 2016–2017 loan year was $1.0 billion; a significant increase of 41% from the previous year, as a result of increases in grant amounts.

Canada Student Loans

- In the 2016–2017 loan year, the CSLP provided over 497,000 students with $2.6 billion in loans.

- The number of students receiving Canada Student Loans in the 2016–2017 loan year increased only slightly, while the value decreased by 3%.

- A total number of 593,000 students received in-study interest subsidies from the federal government on the Canada Student Loans that they had borrowed up to 2016–2017, for which they do not pay interest on while enrolled in full- or part-time study.

Repayment Assistance Plan

- Nearly 306,000 borrowers received support under the Repayment Assistance Plan in the 2016–2017 loan year; an increase of 11% from the previous year.

Support for students with permanent disabilities

- In the 2016–2017 loan year, the CSLP disbursed $94.3 million, totalling 47,400 grants, to support students with permanent disabilities, an increase of 8% from the previous year.

- More than 22,100 individuals received support under the Repayment Assistance Plan for Students with a Permanent Disability, and a further 580 borrowers had loan obligations forgiven by means of the Severe Permanent Disability Benefit.

Loan forgiveness for doctors and nurses

In the 2016–2017 fiscal year, $20.6 million of student loans were forgiven under the forgiveness measure for family doctors, residents in family medicine, nurse practitioners and nurses who work in rural or remote communities. More than 4,600 individuals benefitted from this initiative, an increase of 22% from the previous fiscal year.

Setting the context

The CSLP enables Canadians to meet the costs of higher education by offering financial support in the form of:

- Canada Student Grants;

- Canada Student Loans; and

- repayment assistance and loan forgiveness.

Canada Student Grants are a form of non-repayable assistance available to students from low- and middle-income families, students with permanent disabilities, students with dependants, as well as to part-time students.

In contrast, Canada Student Loans are repayable assistance. The Government of Canada pays the interest on Canada Student Loans while borrowers are in school. Interest is charged to borrowers upon leaving school, although repayment is not required until six months following the end of studies.

The Repayment Assistance Plan supports borrowers who need help in repaying their loans.

Direct government financing and portfolio growth

Since 2000, the Government of Canada has provided student financial assistance directly to borrowers, unlike earlier CSLP lending regimes that were administered by financial institutions.

Under direct lending, the Government of Canada finances and administers the CSLP, contracting with a private-sector service provider (the National Student Loans Service Centre (NSLSC)) to manage student loan accounts from disbursement to repayment.

The direct loan portfolio has grown substantially during the past decade, with increasing numbers of students receiving financial assistance to help meet the costs of their post-secondary studies. The value of direct loan portfolio almost doubled in the last decade, from $9.3 billion as of July 31, 2007 to $18.2 billion as of July 31, 2017.

Working with partners

The Government of Canada works collaboratively with participating provincial and territorial governments to deliver student financial assistance to Canadian students. Applicants in participating jurisdictions are assessed for federal and provincial grants and loans through a single application process. For students in full-time study, approximately 60% of their assessed financial need is funded by the Government of Canada, while the province or territory covers the remaining 40%.

As a result of integration agreements negotiated between the Government of Canada and provinces, the borrowing experience for students has been significantly streamlined and simplified. Students in integrated provinces (British Columbia, Saskatchewan, Ontario, New Brunswick and Newfoundland and Labrador) benefit from having a single, integrated loan, and are not required to manage two separate (federal and provincial) loans.

Students in these five integrated provinces comprise more than 80% of Canada Student Loan borrowers. Both federal and provincial portions of their loans are administered under one account, with the NSLSC as their one point of contact.

Quebec, Nunavut and the Northwest Territories do not participate in the CSLP but receive alternative payments from the Government of Canada to operate their own student financial assistance programs.

The total amount of alternative payments for the 2016–2017 loan year of $338.6 million is higher than the previous year’s payment of $269.5 million. This increase reflects the impact of the 50% increase in Canada Student Grants for low- and middle-income students, as well as the increase of RAP thresholds announced in Budget 2016. As non-participating jurisdictions, the amount of alternative payments to:

- Quebec was $334.4 million – representing an increase of 25.6% from last year’s payment of $266.2 million;

- Nunavut was $1.9 million – representing an increase of 27.7% from last year’s payment of $1.5 million; and

- the Northwest Territories was $2.2 million – representing an increase of 23.3% from last year’s payment of $1.8 million.

Service delivery

The Government of Canada is dedicated to continuously streamlining and modernizing the CSLP, as well as improving services for students. In collaboration with provincial and territorial partners, the CSLP is working to implement a new electronic service delivery model aimed at providing students with simple, easy-to-manage access to financial assistance. Measures include improved online services, application and repayment processes, and communications.

The modernization initiative aims to significantly enhance the loan experience for borrowers by:

- providing more timely disbursements of financial assistance;

- reducing or eliminating, where possible, the paper-based administrative burden for borrowers;

- increasing the readability and understanding of the rights and obligations of borrowers; and

- producing greater efficiencies within the student financial assistance delivery system.

The initial focus of this work is to allow full-time students to have their identity verified, and receive and sign their student loan agreement online rather than having to authenticate and mail their documents at designated Canada Post outlets.

The Government of Canada recognizes the importance of informing Canadians in the pursuit of higher education about the availability, benefits and requirements of student financial assistance. The CSLP acts to guide students and their families in how to plan and pay for post-secondary education by undertaking outreach activities mainly through web-based communications and online materials. A key objective of the CSLP is to improve awareness of programs for students who have traditionally faced barriers in accessing post-secondary education. Another objective is to leverage the existing relationship with the Canada Revenue Agency (CRA) to raise awareness of loan rehabilitation.

Information about the CSLP is available on Canada.ca, including information to help Canadians save, plan and pay for their post-secondary education. The website includes step-by-step application instructions, financial assistance estimators and databases on academic programs and scholarships.

The Government of Canada website also links to the NSLSC website, which enables borrowers to conveniently and securely access their loan accounts, receive communications concerning their account, confirm their enrolment, customize their repayment and, if necessary, apply for repayment assistance.

Program results

Included in this section is key data about the level and type of financial assistance provided to students in the 2016–2017 loan year, as well as information about loan recipients entering repayment following the completion of their studies.

A. Canada Student Grants

Canada Student Grants do not have to be repaid, which helps make student debt more manageable. Grants are targeted towards students from low- and middle-income families, with eligibility based on family income and financial circumstances. Income threshold levels are adjusted annually to reflect cost of living and family size in each jurisdiction. Eligibility is assessed at the time the student applies for Canada Student Loans.

Canada Student Grants are also available to students with dependants. Full-time students with dependants can receive up to $200 each month for every dependent child they have per year of full-time studies. Part-time students with dependants can receive up to $1,920 per school year. They may receive this grant for each year of their studies, at both the undergraduate and graduate level, as long as they qualify.

Students with a permanent disability are entitled to a grant of $2,000 per academic year. Additional funding of up to $8,000 is available for those who require special services or equipment. While the number of full-time grant recipients increased by a modest 3% in the 2016–2017 school year, the value increased by 41% as a result of increases announced in Budget 2016. The number of part-time grants increased by 10% to 19,200 and increased in value by 48% to $28.6 million.

The following table summarizes the distribution of each type of grant provided in the 2016–2017 loan year.

Table 1: Distribution of grants provided in 2016–2017, by type of grant

| Number of grants 2015–2016 | Value ($M) 2015–2016 | Number of grants 2016–2017 | Value ($M) 2016–2017 | |

|---|---|---|---|---|

| Students from low-income families | 237,667 | 451.3 | 242,171 | 688.5 |

| Students from middle-income families | 97,564 | 73.5 | 101,994 | 115.1 |

| Full-time students with dependants | 35,347 | 86.3 | 35,322 | 87.7 |

| Students with permanent disabilities | 34,104 | 65.0 | 37,263 | 71.0 |

| Students with permanent disabilities – equipment and services | 9,894 | 23.5 | 10,125 | 23.3 |

| Total full-time grants | 414,576 | 699.7 | 426,875 | 985.6 |

| Number of grants 2015–2016 | Value ($M) 2015–2016 | Number of grants 2016–2017 | Value ($M) 2016–2017 | |

|---|---|---|---|---|

| Part-time students | 17,432 | 19.4 | 19,155 | 28.6 |

| Part-time students with dependants | 408 | 0.4 | 332 | 0.3 |

| Total part-time grants | 17,840 | 19.8 | 19,487 | 29.0 |

| Number of grants 2015–2016 | Value ($M) 2015–2016 | Number of grants 2016–2017 | Value ($M) 2016–2017 | |

|---|---|---|---|---|

| Total number of grants | 432,416 | 719.5 | 446,362 | 1,014.6 |

| Total unique grant recipients | 368,940 | 719.5 | 379,606 | 1,014.6 |

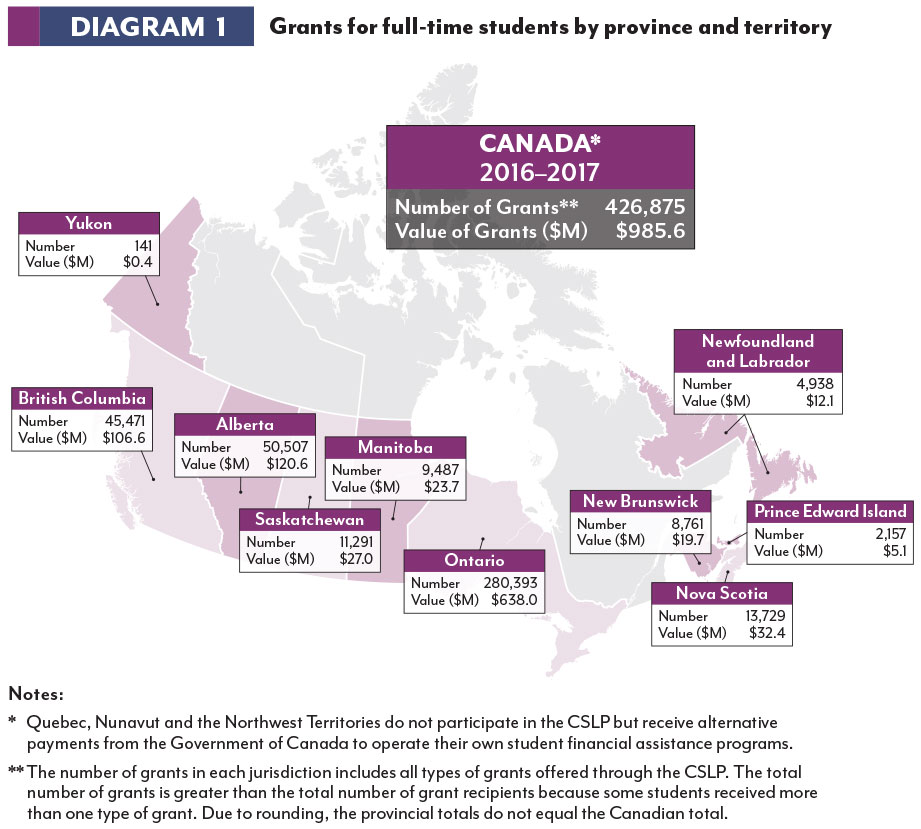

Diagram 1: Grants for full-time students by province and territory

The diagram below illustrates the distribution of Canada Student Grants for full-time students by province and territory in 2016–2017.

Text description of diagram 1: Grants for full-time students by province and territory

| Province of issue | Number of grants | Value of grants ($M) |

|---|---|---|

| Newfoundland and Labrador | 4,938 | 12.1 |

| Prince Edward Island | 2,157 | 5.1 |

| Nova Scotia | 13,729 | 32.4 |

| New Brunswick | 8,761 | 19.7 |

| Ontario | 280,393 | 638.0 |

| Manitoba | 9,487 | 23.7 |

| Saskatchewan | 11,291 | 27.0 |

| Alberta | 50,507 | 120.6 |

| British Columbia | 45,471 | 106.6 |

| Yukon | 141 | 0.4 |

| Total | 426,875 | 985.6 |

Notes:

- Quebec, Nunavut and the Northwest Territories do not participate in the CSLP but receive alternative payments from the Government of Canada to operate their own student financial assistance programs.

- The number of grants in each jurisdiction includes all types of grants offered through the CSLP. The total number of grants is greater than the total number of grant recipients because some students received more than one type of grant. Due to rounding, the provincial totals do not equal the Canadian total.

B. Canada Student Loans

Canada Student Loans are available to Canadian students enrolled in degree, diploma or certificate programs at designated post-secondary educational institutions in Canada and abroad. To be eligible, a student must demonstrate financial need and reside in a province or territory that participates in the Program for at least 12 consecutive months prior to submitting their first loan application, regardless of whether their school is abroad or not. Recipients are provided with interest subsidies, whereby the Government of Canada pays the interest on their loans while they are enrolled in school. Repayment begins six months after the end of studies.

Demographic overview

In the 2016–2017 loan year, the Program provided $2.6 billion in loans to over 490,000 full-time post-secondary students. The demographic profile of Canada Student Loan recipients remained consistent with that of previous years. In the 2016–2017 loan year:

- the majority (54%) of full-time students with loans were 21 years of age or younger; 34% were between 22 and 29 years of age; and 12% of full-time borrowers were 30 years or older;

- 89% of full-time students were single;

- female students comprised 59% of loan recipients, while male students represented 41% of recipients; and

- almost two-thirds of full-time students (65%) were residents of Ontario. Students from Alberta (13%) and British Columbia (10%) comprised the next two highest proportions of loan recipients. The remaining 12% were from the other seven participating jurisdictions.

| Province or territory | Number of borrowers (full-time students) 2015–2016 | Total value ($M) 2015–2016 | Average Canada Student Loan 2015–2016 | Number of borrowers (full-time students) 2016–2017 | Total value ($M) 2016–2017 | Average Canada Student Loan 2016–2017 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 6,102 | 28.9 | 4,732 | 6,009 | 27.9 | 4,637 |

| Prince Edward Island | 2,663 | 17.0 | 6,381 | 2,601 | 16.3 | 6,268 |

| Nova Scotia | 16,313 | 113.9 | 6,982 | 16,583 | 114.9 | 6,929 |

| New Brunswick | 11,500 | 63.6 | 5,527 | 11,946 | 56.0 | 4,686 |

| Ontario | 322,386 | 1,722.7 | 5,344 | 317,803 | 1,636.5 | 5,149 |

| Manitoba | 10,052 | 48 | 4,776 | 9,875 | 45.6 | 4,616 |

| Saskatchewan | 11,642 | 71 | 6,102 | 12,542 | 75.0 | 5,981 |

| Alberta | 55,900 | 318.3 | 5,693 | 61,925 | 338.7 | 5,469 |

| British Columbia | 53,207 | 313.8 | 5,898 | 50,978 | 296.4 | 5,814 |

| Yukon | 170 | 1.0 | 5,761 | 139 | 0.8 | 5,826 |

| Total | 489,935 | 2,698.2 | 5,507 | 490,401 | 2,608.0 | 5,318 |

As noted in Table 2, in the 2016–2017 loan year the number of full-time Canada Student Loan borrowers increased by about 470 from the previous year. The average Canada Student Loan amount was $5,318, which is lower than the amount of $5,507 in the previous loan year, as an increased portion of students’ financial needs were met by Canada Student Grants.

Where do borrowers go to school?

In the 2016–2017 loan year, the vast majority of student loan recipients remained in their home province or territory to pursue post-secondary education. Approximately 9% of recipients studied outside their home province or territory or went abroad to study.

Student borrowers from large provinces were less likely to study outside their home province. For example, just under 5% of recipients from Ontario studied outside their province. In contrast, students from smaller jurisdictions were more likely to use their Canada Student Loan at an institution outside their home province: 78% of student borrowers from Yukon and 43% of student borrowers from Prince Edward Island studied outside their home jurisdictions.

Almost 11,700 Canada Student Loan recipients, accounting for approximately 2% of the total number of borrowers, studied outside Canada in the 2016–2017 loan year. Half of these students undertook study programs in the United States, while the other half were enrolled in schools in other countries.

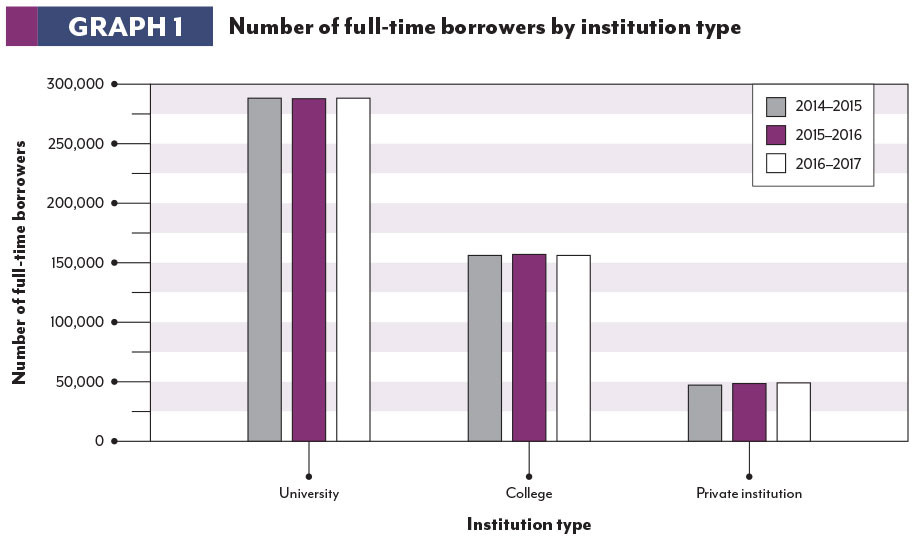

What types of institutions do borrowers attend?

In the 2016–2017 loan year:

- 59% of full-time student borrowers attended university;

- 32% attended college; and

- 9% attended a private institution.

These numbers remained virtually unchanged from the previous loan year. The average loan amount disbursed in 2016–2017 continued to be highest among borrowers attending a private institution ($7,390) and lowest among college attendees ($4,488).

The following graph illustrates a breakdown of full-time borrowers at universities, colleges and private schools for 2016–2017 and the two previous years.

Graph 1: Number of full-time borrowers by institution type

Text description of graph 1: Number of full-time borrowers by institution type

| Institution type | Number of borrowers 2014–2015 | Number of borrowers 2015–2016 | Number of borrowers 2016–2017 |

|---|---|---|---|

| University | 288,692 | 287,768 | 288,594 |

| College | 155,869 | 156,791 | 155,450 |

| Private institution | 44,220 | 45,376 | 46,357 |

| Total | 488,781 | 489,935 | 490,401 |

What level of study are borrowers enrolled in?

In the 2016–2017 loan year, most full-time student borrowers (60%) were enrolled in undergraduate programs, while 35% were enrolled in certificate or diploma programs and 5% were masters or doctoral students. These proportions are similar to those from the previous loan year.

Average loan amounts were higher for full-time students in programs at the master’s level ($7,308) or doctorate level ($8,114), as compared to those at the undergraduate level ($5,237) or in non-degree programs ($5,167).

Support for part-time studies

The vast majority of CSLP borrowers are full-time students, as evidenced by the amount of loans for full-time students ($2.6 billion) as compared to that for part-time students ($19.2 million).

In the 2016–2017 loan year, $19.2 million in part-time loans were provided to 11,800 students. This represents a decrease of 20% in the value of loans and 14% in the number of part-time students from the previous year. This decrease in loans is mainly due to the 50% increase in the value of non-repayable part-time grants.

The majority of part-time students (66%) with loans were 25 years of age or younger. Thirty-four percent were older than 25, in comparison to full-time borrowers, of whom only 21% were older than 25.

The average loan amount for part-time students was $1,631. Although students attending private institutions only represent 4% of all part-time students, their average loan is significantly higher ($4,324) than loans of those attending universities ($1,468) or colleges ($1,629).

The following table illustrates the uptake of student loans for part-time studies over the past three years.

| Loan year | Number of borrowers | Value of loans ($M) |

|---|---|---|

| 2014–2015 | 12,086 | $20.9 |

| 2015–2016 | 13,712 | $24.1 |

| 2016–2017 | 11,790 | $19.2 |

C. Loan repayment and repayment assistance

Unlike traditional loans, Canada Student Loans do not accrue interest while the borrower is in school. It is only once a borrower completes their studies that interest begins to accumulate.

To help with the transition from school into the labour force, borrowers are not required to make payments in the first six months upon completion of their studies. Once six months have elapsed, borrowers begin to repay their loans through monthly payments, typically over a 114-month period (9.5 years). Depending on their financial situation and income level, borrowers may revise their repayment terms to pay more quickly or to extend the payment period to reduce their monthly payments (up to a maximum of 14.5 years).

The average Canada Student Loan balance at the time of leaving school was $13,456 for the 2016–2017 loan year, which is an increase of 1.1% from the previous year ($13,306). Nearly half of Canada Student Loan borrowers (49%) had a balance of less than $10,000, and 23% of Canada Student Loan borrowers had a balance greater than $20,000. These loan balances reflect only the federal portion of the loan. Borrowers may also have had loans from a province or territory, as well as from private sources.

Differences in loan balances reflect each student’s particular situation. Loan balance is measured at the time of leaving school, which includes students who graduate, as well as those who do not complete their program of study. Among the key factors are the type and location of institution as well as the program of study. In the 2016–2017 loan year, the average loan balance of university students ($17,113) was higher than that of college students ($10,358) and of those at private institutions ($10,994). This difference is partly because university programs generally tend to take longer to complete.

Canada Student Loan balances also differ by student province or territory of residence, ranging from an average of $9,853 (Manitoba) to $17,749 (Prince Edward Island). The large variation in the average debt across jurisdictions can be attributed to a combination of factors including tuition fees, cost of living and the proportion of students studying away from home. For example, tuition fees in Manitoba are lower than those in Prince Edward Island. For students pursuing their post-secondary education outside of their province, higher travel and living costs are reflected in higher borrowing amounts.

Repayment Assistance Plan

The Repayment Assistance Plan (RAP) allows borrowers to manage their student debt by reducing their monthly payments. Depending on their family income, family size and loan balance, borrowers may apply and be approved for a reduced monthly payment or may not have to make any monthly payments for the duration of their six-month RAP term. In the event that repayment assistance is still required, borrowers can re-apply for RAP in 6 month increments.

RAP is provided in two stages, which are seamless to the borrower. Under Stage 1, the Government of Canada covers the outstanding interest not covered by the borrower’s reduced monthly payments. Borrowers that have received 60 months of RAP, or have been out of school for more than 10 years, will begin to receive Stage 2 assistance, whereby the Government of Canada covers both the principal and interest amounts not covered by the borrower’s reduced monthly payments. This ensures that the balance of the loan is gradually paid off and that borrowers on RAP on a long term basis do not take longer than 15 years to repay their loan.

The Repayment Assistance Plan for Borrowers with a Permanent Disability (RAP-PD) is designed to assist borrowers with disabilities experiencing difficulty meeting their repayment obligations. The Government of Canada covers the principal and interest amounts not covered by the approved borrower’s reduced monthly payments. This ensures that a borrower on RAP-PD on a long term basis does not have remaining student loan debt after 10 years. In addition, RAP-PD allows borrowers to claim disability-related expenses, which are taken into consideration when the application is assessed.

Budget 2016 announced increases to the loan repayment thresholds to ensure that no student would have to repay their loan until they are earning at least $25,000 per year, up from the previous $20,210. Single borrowers who apply for RAP would be eligible to make no payments if they made under this amount and the thresholds for borrowers with larger family sizes were also increased proportionally. These new thresholds took effect in November 2016.

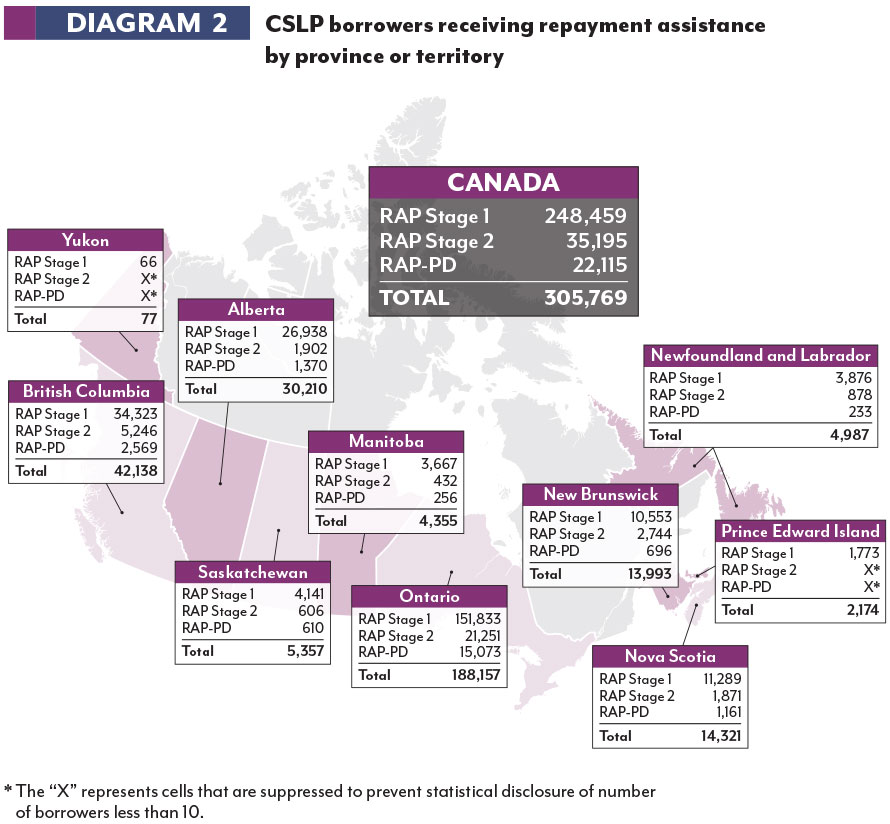

Diagram 2: CSLP borrowers receiving repayment assistance by province or territory

Text description of diagram 2: CSLP borrowers receiving repayment assistance by province or territory

| Province or territory | RAP Stage 1 | RAP Stage 2 | RAP-PD | Total |

|---|---|---|---|---|

| Newfoundland and Labrador | 3,876 | 878 | 233 | 4,987 |

| Prince Edward Island | 1,773 | xa | xa | 2,174 |

| Nova Scotia | 11,289 | 1,871 | 1,161 | 14,321 |

| New Brunswick | 10,553 | 2,744 | 696 | 13,993 |

| Ontario | 151,833 | 21,251 | 15,073 | 188,157 |

| Manitoba | 3,667 | 432 | 256 | 4,355 |

| Saskatchewan | 4,141 | 606 | 610 | 5,357 |

| Alberta | 26,938 | 1,902 | 1,370 | 30,210 |

| British Columbia | 34,323 | 5,246 | 2,569 | 42,138 |

| Yukon | 66 | xa | xa | 77 |

| Total | 248,459 | 35,195 | 22,115 | 305,769 |

Table notes:

- The “X” represents cells that are suppressed to prevent statistical disclosure of number of borrowers less than 10.

As indicated in Diagram 2, nearly 306,000 borrowers received assistance under RAP in the 2016–2017 loan year, which is an increase of 11% from those who benefitted from RAP in the previous loan year. Women represented 65% of RAP recipients. The vast majority (81%) of borrowers accessing RAP were approved under Stage 1, whereby they received Government support for the interest portion of their loan payment(s). Eighty-eight percent of all RAP recipients were not required to make any monthly payments for the duration of their RAP term.

Severe Permanent Disability Benefit

In very particular cases, borrowers with a severe permanent disability may be eligible for loan forgiveness. The Severe Permanent Disability Benefit makes it possible to cancel the repayment obligations of borrowers who have a severe permanent disability. A medical assessment must be completed by a physician or nurse practitioner stating that the severe disability prevents a borrower from performing the daily activities necessary to participate in studies at a post-secondary school level or in apprenticeship training, and in the labour force, and that the disability is expected to continue throughout the borrower’s life.

In the 2016–2017 loan year, $8.7 million in Canada Student Loans were forgiven under this measure for just under 580 individuals, with an average loan balance of $15,099 per borrower.

Loan forgiveness for family doctors and nurses

In 2013, the Government of Canada introduced Canada Student Loan forgiveness for eligible family doctors, residents in family medicine, nurse practitioners and nurses who work in rural or remote communities. This benefit is aimed at helping more Canadians access the health care they need.

Family doctors or residents in family medicine may receive up to $40,000 in Canada Student Loan forgiveness over a maximum of five years ($8,000 per year), and nurses or nurse practitioners may receive up to $20,000 in loan forgiveness over a maximum of five years ($4,000 per year).

For the 2016–2017 fiscal year, more than 4,600 applications were approved, enabling health professionals working in various rural and remote regions to reduce amounts owing on their Canada Student Loans by an average of $4,407.

Measuring program performance

The CSLP is responsible for ensuring that financial support effectively assists Canadian students, and that taxpayers’ investment in the Program is properly managed. As such, the Program regularly measures and reports on:

- client satisfaction;

- portfolio performance;

- loan rehabilitation;

- loan write-off;

- program integrity; and

- program evaluation.

Client satisfaction

- The CSLP is committed to ensuring that clients receive quality service. An annual client satisfaction survey is used to assess clients’ satisfaction with the services related to their Canada Student Grants and Loans.

- In the 2016–2017 loan year, 80% of clients said they were satisfied with the overall quality of service they received with regards to their Canada Student Grant or Loan. Satisfaction levels have remained high over the past number of years.

Portfolio performance

The CSLP actively manages the Canada Student Loans portfolio to ensure the health of the portfolio and to minimize the value of loans going into default. Although the vast majority of students repay their loans in full and on time, some borrowers experience difficulty in repayment. A loan is deemed in default when in arrears for more than 270 days (roughly equivalent to missing nine monthly payments). The CSLP uses a three-year default rate as a main indicator of the performance of the portfolio. This rate compares the value of the loans that enter repayment in a given loan year, and default within three years, to the value of all the loans that entered repayment in that loan year.

As noted in Table 4, the default rate has decreased significantly over the last few years. The introduction of grants and the RAP has helped a greater number of students manage their repayment obligations, leading to a lower default rate.

| Years | 2007–2008 | 2008–2009 | 2009–2010 | 2010–2011 | 2011–2012 | 2012–2013 | 2013–2014 | 2014–2015 | 2015–2016 |

|---|---|---|---|---|---|---|---|---|---|

| Rates | 15% | 14% | 15% | 14% | 13% | 12% | 11% | 10% | 9% |

Loan rehabilitation

The CSLP offers loan rehabilitation as a way for borrowers to bring their defaulted loans back into good standing. Borrowers can rehabilitate their defaulted loans by paying their outstanding interest, plus two regular monthly payments. The CSLP works closely with the CRA to raise awareness of loan rehabilitation.

A targeted communication campaign was implemented in June 2016, and used behavioural insights to nudge borrowers who are most likely to be eligible for rehabilitation. As a result, the CSLP has seen an increase in the number of approved cases since the rehabilitation promotion was implemented. From July 2016 to June 2017, 6,699 borrowers rehabilitated $63 million in student loans. This represents a 73% increase in borrowers who rehabilitated their loans than before the campaign.

Loan write-off

As per standard accounting practice, the Government of Canada must write-off Canada Student Loans that have been deemed unrecoverable after all reasonable collection efforts have been made. The majority of the write-off value is comprised of loans that have not received payment or acknowledgement of debt for six years. Other reasons for write-off include bankruptcy, extreme financial hardship, and compromise settlements.

The value of loans written-off in 2017 was $174.8 million, approximately 1% of the overall value of the directly financed Canada Student Loan portfolio, consistent with the 2016 write-off ($172 million). Borrowers who have had their loans written-off are restricted from further student financial assistance until they are able to bring their loan back into good standing by paying all outstanding interest, plus two regular monthly payments.

Program integrity

The CSLP strives to safeguard the integrity of the Program and protect the investments made by borrowers in their post-secondary education. Safeguarding integrity means ensuring that all aspects of the Program are operating within the legal framework of the Canada Student Financial Assistance Act and the Canada Student Loans Act. The CSLP is also a responsible steward of taxpayer dollars.

The Program has in place a number of policies and activities designed to ensure its integrity and to enhance governance and accountability:

- Administrative measures may be taken when individuals knowingly misrepresent themselves to obtain student financial assistance; including being restricted from receiving student financial assistance for a specified period, being required to immediately repay any money obtained as a result of false information and having their grants converted to repayable loans. If warranted, further action may be taken such as criminal investigation or civil litigation. In the 2016–2017 school year, 27 cases of misrepresentation were confirmed as abuse.

- In keeping with provisions of the Canada Student Financial Assistance Act, the Office of the Chief Actuary conducts a statutory actuarial review of the Program in order to provide a long term forecast of the portfolio and program costs. The most recent Actuarial Report (2017) (PDF format) is available on the website of the Office of the Superintendent of Financial Institutions.

- The Designation Policy Framework establishes Canada-wide criteria for designation—the process whereby post-secondary educational institutions are deemed eligible for student financial assistance programs. The Framework ensures that federal and provincial and territorial student financial assistance portfolios operate within the principles and practices of reasonable financial stewardship. As a part of this framework, the CSLP calculates and tracks the repayment rates of Canada Student Loans for designated Canadian institutions. The 2017 repayment rate for borrowers who entered repayment in 2015–2016 was 91%, which is higher than the previous year, and the highest it has been over the past 13 years.

Program evaluation

As a standard practice, evaluations are conducted periodically and are available on the ESDC website. A summative evaluation of the CSLP took place from 2006 to 2010 and covered loan years 2000–2001 to 2007–2008. The evaluation found the CSLP to be achieving desired program results and included minor recommendations for improvement.

A summative evaluation of the Budget 2008 CSLP enhancements was completed in May 2016, which examined the effectiveness of the enhancements introduced in Budget 2008. Overall, the enhancements were perceived as positive changes to the CSLP.

ESDC is committed to ensuring that the CSLP is fully responsive to the needs of Canada’s post-secondary students, and it continues to explore ways to improve and enhance the design and delivery of the Program in collaboration with partners and stakeholders. The findings and recommendations of these evaluations inform and support that work.

Appendix A – Other government funding

Support for apprentices

The Canada Apprentice Loan (CAL) was launched in January 2015 to provide additional financial support to apprentices registered in trades designated under the Red Seal Program during periods of block release technical training. CAL is designed to help these apprentices complete their apprenticeship training and to encourage more Canadians to consider a career in the skilled trades.

Apprentices in skilled trades complete up to 85% of their learning during on-the-job paid employment. However, they are also required to participate in technical training for short periods of time, generally ranging from six to eight weeks each year. Apprentices can face significant costs to complete these periods of technical training, including educational fees, tools and equipment, living expenses and forgone wages.

Eligible apprentices may apply for loans of up to $4,000 per period of technical training, for a maximum of five periods. Given the timing of technical training requirements in their province, apprentices in Quebec do not qualify for CAL. The province of Quebec is compensated with an annual special payment.

In the 2016–2017 loan year, nearly 17,000 CALs, amounting to $65.6 million, were disbursed to 15,300 apprentices. Approximately 79% of disbursed loans went to apprentices from three provinces: Alberta (48%), British Columbia (19%) and Ontario (12%).

The CAL complements other Government of Canada supports to assist apprentices in completing their apprenticeship training, including the tradesperson’s tools deduction, the tuition tax credit, and Employment Insurance, which is available to eligible apprentices while attending block release technical training. The Government of Canada also provides the Apprenticeship Incentive Grant and Apprenticeship Completion Grant to apprentices registered in trades designated under the Red Seal Program.

Government funding

Although the CSLP is the largest program offering student financial assistance to Canadians, other funding sources exist at the federal, provincial and territorial levels.

Supports offered by ESDC include the following:

- The Canada Education Savings Grant encourages Canadians to save for their children’s post-secondary education by awarding grants to beneficiaries of the Registered Education Savings Plan (RESP).

- The Canada Learning Bond provides a grant to low-income families to begin an RESP and encourages parents to save for their children’s post-secondary education.

- Individuals who receive Employment Insurance benefits can be eligible for courses, training programs or other support to make it easier for them to return to the labour market, while still receiving income support during that period. This service is either co-managed with the provinces and territories, or provided by the provinces and territories through federal transfer payments.

- Provinces and territories may choose not to participate in the CSLP. These provinces and territories receive an alternative payment to assist in the cost of delivering a similar student financial assistance program.

Other federal programs and initiatives related to post-secondary education include the following:

- The Canada Social Transfer is a federal transfer of funds to provinces and territories in support of post-secondary education, social assistance and social services.

- Indigenous Services Canada assists Indigenous students with the costs of tuition, books and travel, and provides living allowances through the Post-Secondary Student Support Program.

- The University College Entrance Preparation Program provides financial assistance to Indigenous students enrolled in university or college entrance programs. The purpose of the Program is to help them obtain the grades they require to enter a degree or diploma program.

- Post-secondary institutions also receive support through the Post-Secondary Partnerships Program to develop and deliver special programs for Indigenous people.

- Tax relief is available to all individuals with federal or provincial and territorial student loans through a federal tax credit on the annual interest paid on these loans.

- The tuition tax credit provides tax relief for students’ expenditures towards tuition fees.

- The Education and Textbook Tax Credits provided non-refundable tax credits for post-secondary students. As announced in Budget 2016, these tax credits were sunset on January 1, 2017, to reallocate funding to targeted supports for students through the CSLP. Unused credits prior to 2017 can be carried forward to be claimed in future years.

- The Official Languages Support Program helps provinces and territories fund minority-language education and second-language instruction.

- Innovation, Science and Economic Development Canada offers scholarships and fellowships under the Natural Sciences and Engineering Research Council of Canada and the Social Sciences and Humanities Research Council of Canada.

Provincial, territorial and other funding:

- Provincial and territorial governments offer grants, loan scholarships, tax credits and repayment assistance measures; and

- Students may also apply for scholarships and bursaries from their educational institutions, financial institutions and community groups.

Appendix B – Financial data: Consolidated report on the Canada Student Loans Program

Consolidated report on the Canada Student Loans Program

In August 2000, the CSLP moved from the risk-shared financing arrangements in place with financial institutions between 1995 and July 2000 to a direct student loan financing plan. The Government of Canada provides funding to students, and a private-sector service provider administers the loans.

Reporting entity

The entity detailed in this report is the CSLP only and does not include departmental operations related to the delivery of the CSLP. Expenditure figures are primarily statutory in nature, made under the authority of the Canada Student Financial Assistance Act and the Canada Student Loans Act.

Basis of accounting

The financial figures are prepared in accordance with generally accepted accounting principles and as reflected in the Public Sector Accounting Handbook of the Canadian Institute of Chartered Accountants.

Table 5: Consolidated Canada Student Loans Programs – Combined programs

Legend:

- DL = Direct loans

- RS = Risk-shared loans

- GL = Guaranteed loans

| Revenues | 2014–2015 Actual (in million $) |

2015–2016 Actual (in million $) |

2016–2017 Actual (in million $) |

|---|---|---|---|

| Interest revenue on direct loansa | 614.4 | 627.1 | 650.0 |

| Recoveries on guaranteed loans | 12.0 | 10.5 | 8.6 |

| Recoveries on put-back loans (RS)b | 6.0 | 5.9 | 4.9 |

| Total loan revenue | 632.5 | 643.5 | 663.5 |

| Expenses | 2014–2015 Actual (in million $) |

2015–2016 Actual (in million $) |

2016–2017 Actual (in million $) |

|

|---|---|---|---|---|

| Transfer payment | Canada Study Grants, Canada Access Grants and Canada Student Grants | 706.8 | 713.9 | 974.6 |

| Loan administration | Collection costs (all regimes)c | 22.3 | 22.3 | 24.1 |

| Program delivery costs (DL) | 81.8 | 76.0 | 84.9 | |

| Risk premium to financial institutions (RS) | 0.0 | 0.0 | 0.0 | |

| Put-back to financial institutions (RS) | 2.1 | 1.8 | 1.1 | |

| Administrative fees to provinces and territories and Special Investment Fund (DL) | 31.3 | 31.8 | 30.2 | |

| Total loan administration expenses | 137.5 | 131.7 | 140.4 | |

| Cost of Government support benefits to students | In-study interest borrowing expense (Class A – DL)c | 133.8 | 104.2 | 100.8 |

| In repayment interest borrowing expense (Class B – DL)c | 150.7 | 123.9 | 126.0 | |

| In-study interest subsidy (RS and GL) | 0.3 | 0.2 | 0.1 | |

| Repayment assistance programs | 157.0 | 165.8 | 182.1 | |

| Claims paid and loans forgiven (all regimes) | 22.6 | 27.8 | 41.0 | |

| Total cost of government support benefits to students | 464.3 | 421.8 | 450.0 | |

| Bad debt expensed | Debt reduction in repayment expense (DL) | 106.5 | 231.2 | 87.4 |

| Bad debt expense (DL) | -1.5 | 94.1 | 203.7 | |

| Total bad debt expense | 105.0 | 325.3 | 291.0 | |

| Total loan expenses | 1,413.6 | 1,592.8 | 1,856.0 | |

| Net operating results | 2014–2015 Actual (in million $) |

2015–2016 Actual (in million $) |

2016–2017 Actual (in million $) |

|---|---|---|---|

| Net operating results | 781.2 | 949.2 | 1,192.5 |

| Alternative payments to non-participating provinces (DL)e | 332.2 | 258.4 | 305.4 |

| Final net operating results | 1,113.3 | 1,207.6 | 1,497.8 |

Table notes

- The interest revenue which is calculated on the overall repayment portfolio on an accrual basis is $650.0 million, but the actual interest payments received are valued at $345.4 million. The difference is mainly due to RAP (interest portion of payments), loans forgiven, write-offs and consolidated interest after the grace period.

- Under the risk-shared agreements, the Government will purchase from the participating financial institutions any loans that 1) were issued between August 1, 1995 and July 31, 2000, 2) that are in default of payments for at least 12 months after the period of study, and 3) that in aggregate, do not exceed 3% of the average monthly balance of the lender's outstanding student loans in repayment. The amount paid is set at 5% of the value of the loans in question. The figures represent the recovery of principal and interest on these loans.

- These costs are related to Canada Student Direct Loans but reported by the Department of Finance.

- This represents the annual expense against the provisions for bad debt and repayment assistance payments—principal as required under accrual accounting.

- The figures represent the annual expense recorded under the accrual accounting as opposed to the actual amount disbursed to the non-participating provinces. In the 2015–2016 loan year, the total amount disbursed as alternative payments was $269.5 million.

Glossary

- Canada Apprentice Loans

- In January 2015, the Government launched this initiative. Borrowers can apply for up to $4,000 in loans per period of technical training, for up to five technical training periods. Loans are available to help pay for tuition, tools, equipment and living expenses, to cover forgone wages and to help support families during training.

- Canada Student Grants

-

Canada Student Grants are non-repayable student financial assistance. The following Grants were available in the 2016–2017 loan year:

- Grant for students from low-income families: $375 per month of study;

- Grant for students from middle-income families: $150 per month of study;

- Grant for low-income students with dependants: $200 per month of study for each dependant under 12 years of age (or for each dependant over 12 years of age with a permanent disability).

- Grant for students with permanent disabilities: $2,000 per year for full-time or part-time students with permanent disabilities; and

- Grant for services and equipment for students with permanent disabilities: up to $8,000 per year to cover exceptional education-related costs such as tutors, note-takers, sign interpreters, Braillers and technical aids.

- Grant for part-time studies: up to $1,800 per loan year;

- Grant for part-time students with dependants:

- Students with 1 or 2 dependants may receive up to $40 per week of part-time study, up to a maximum of $1,920.

- Students with 3 or more dependants may receive up to $60 per week of part-time study, up to a maximum of $1,920.

- Consolidation

- Borrowers consolidate their student loan(s) six months after completing their post-secondary studies (or ending full-time studies). Repayment begins once they have consolidated their loans.

- Default

- A loan is deemed in default when it is in arrears for greater than 270 days under the direct lending regime.

- Default rate

- The CSLP measures default using a three-year default rate. This rate shows the proportion of loan dollars that enter repayment in a given loan year and default within three years. For example, the 2015–2016 default rate represents the proportion of loan dollars that entered repayment in the 2015–2016 loan year and defaulted before August 1, 2018.

- Designated Educational Institution

- A designated post-secondary educational institution meets provincial and territorial and federal eligibility criteria, and students attending these schools can apply for government-sponsored student financial assistance, such as Canada Student Grants and Loans.

- Direct loans

- As of August 2000, the federal government issues Canada Student Loans under the direct loans regime. Loans are directly financed by the Government and a third-party service provider administers the loan process.

- Full-time

- A full-time student is a student enrolled in at least 60% of a full course load (or 40% for students with permanent disabilities) in a program of study of at least 12 consecutive weeks at a designated post-secondary educational institution.

- Guaranteed loans

- Between 1964 and 1995, Canada Student Loans were provided by financial institutions (such as banks) under the guaranteed loans regime. If a student defaulted on a guaranteed loan, the Government paid out the bank and the student’s debt was then owed directly to the Government.

- Integrated province

- In integrated provinces, federal and provincial loans are combined so borrowers receive and repay one federal and provincial integrated loan. The federal and provincial governments work together to make applying for, managing and repaying loans easier. The CSLP has integration agreements with five provinces: British Columbia, Saskatchewan, Ontario, New Brunswick and Newfoundland and Labrador.

- In-study

- The status of borrowers attending full-time or part-time studies at a post-secondary institution, or who have finished school less than six months ago.

- In-study interest subsidy

- The Government of Canada covers the interest on Canada Student Loans while borrowers are in school and have in-study status.

- Loan forgiveness for family doctors and nurses

-

In 2013, the Government of Canada began Canada Student Loan forgiveness for eligible family doctors, residents in family medicine, nurse practitioners and nurses who work in rural or remote communities. This benefit is aimed at helping more Canadians access the health care they need.

Family doctors or residents in family medicine may receive up to $40,000 in Canada Student Loan forgiveness over a maximum of five years ($8,000 per year), and nurses or nurse practitioners may receive up to $20,000 in loan forgiveness over a maximum of five years ($4,000 per year).

- Loan year

- August 1 to July 31.

- National Student Loans Service Centre

- The National Student Loans Service Centre (NSLSC) is the main point of contact for borrowers in managing their Canada Student Loans, from loan disbursement to repayment and repayment assistance. The NSLSC is administered by a third-party service provider. It manages all Canada Student Loans issued on or after August 1, 2000, as well as integrated student loans for:

- New Brunswick and Newfoundland and Labrador issued on or after August 1, 2000;

- Ontario and Saskatchewan issued on or after August 1, 2001; and

- British Columbia issued on or after August 1, 2011.

- Part-time

- A part-time student is a student taking between 20% and 59% of a full course load. Students with permanent disabilities may be accorded part-time status if they are taking between 20% and 39% of a full course load (and if they are taking between 40% and 59% of a full course load they can elect to be considered either as a full-time or part-time student for the purpose of the CSLP).

- Participating provinces and territories

- The provinces and territories that choose to deliver financial assistance to students within the framework of the CSLP include Newfoundland and Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Ontario, Manitoba, Saskatchewan, Alberta, British Columbia and Yukon.

- Province or territory of residence

- A student’s province or territory of residence is the province or territory where they have most recently lived for at least 12 consecutive months prior to starting post-secondary education. For example, an individual from Manitoba studying in Ontario would be considered a Manitoba student.

- Post-secondary education

- Levels of education following secondary school (high school) at all designated public or private post-secondary institutions.

- Repayment

- The status of borrowers who have begun repaying their Canada Student Loans. Repayment begins six months following the end of studies.

- Repayment Assistance Plan

- On August 1, 2009, the Repayment Assistance Plan (RAP) replaced the CSLP’s previous debt management programs (Interest Relief and Debt Reduction in Repayment). The RAP is a temporary repayment assistance measure where a borrower repays an affordable monthly amount (or none) based on family income, family size and outstanding loan balance. The RAP ensures that the repayment period will not exceed 15 years (or 10 years for a borrower with a permanent disability). Under RAP, eligible borrowers receive assistance for periods of six months and can reapply as long as they remain eligible.

- Repayment rate

- The repayment rate is the percentage of the total principal amount of Canada Student Loans consolidated in a given loan year that is repaid or in good standing at the end of the subsequent loan year.

- Revision of terms

- A means of allowing borrowers to manage their loan repayment in a way that is responsive to their situation. It can be used to decrease monthly payments (extending the loan term to a maximum of 14.5 years), or to increase loan payments allowing the borrower to pay off the loan sooner.

- Risk-shared loans

- Between 1995 and 2000, Canada Student Loans were provided by financial institutions (such as banks) under the risk-shared loans regime. Under this regime, financial institutions assumed responsibility for a portion of the possible risk of defaulted loans in return for a payment from the Government.

- Severe Permanent Disability Benefit

- In certain cases, some borrowers may be eligible for loan forgiveness. The Severe Permanent Disability Benefit makes it possible to cancel the repayment obligations of borrowers whose permanent disability is expected to remain with them for life and prevents them from studying at a post-secondary level and taking part in the labour force.

- Student financial assistance

- Student financial assistance is any form of financial aid provided by the Canada Student Loans Program to students while they are enrolled in designated post-secondary education institutions, including Canada Student Grants, Canada Student Loans and in-study interest subsidies.