Assistance holdback amount and repayment obligation

Disclaimer: RDSP issuers

The information contained on this page is technical in nature and is intended for Registered Disability Savings Plan (RDSP), Canada Disability Savings Grant (CDSG) and Canada Disability Savings Bond (CDSB) issuers. For general information, visit the RDSP section.

Official title: Technical and system development guide for RDSP providers | Assistance holdback amount (AHA) and repayment obligation

Alternate formats

Issuers and authorized agents are responsible for identifying situations that require the repayment of incentives and for calculating the repayment obligation to be returned to the Government of Canada where required. Incentives must be repaid using electronic transactions submitted to the Canada Disability Savings Program (CDSP) system. This document is intended to guide issuers and authorized agents in the calculation of repayment obligations and the submission of system transactions in this regard by elaborating on the rules guiding the identification of an assistance holdback amount (AHA) event and period and the repayment amount of Canada Disability Savings Grant (CDSG) and Canada Disability Savings Bond (CDSB).

This document is to be used in conjunction with the Registered Disability Savings Plan (RDSP) Provider User Guide, Chapter 3-6 (Repayments).

On this page

- 1. Overview

- 2. Repayment rules, AHA events and AHA

- 3. Determining the AHA period

- 3.1 Type of date

- 3.2 Event occurring in the year a beneficiary is 60 years of age or older

- 3.3 Event occurring during a time of Disability Tax Credit (DTC) eligibility

- 3.4 Event occurring during a time of DTC ineligibility and beneficiary is 49 years of age or less

- 3.5 Event occurring during a time of DTC ineligibility and beneficiary is between the ages of 50 to 59

- 3.6 Event following a DTC event

- 3.7 Contract signature date limitation

- 3.8 AHA periods overlap

- 4. Identifying CDSG and CDSB paid within an AHA period

- 5. Attributing of CDSG and CDSB repaid

- 6. Calculating the AHA

- 7. Calculating the repayment obligation

- Footnotes

List of abbreviations

- AHA

- Assistance holdback amount

- CDSG

- Canada Disability Savings Grant

- CDSB

- Canada Disability Savings Bond

- CDSP

- Canada Disability Savings Program

- CRA

- Canada Revenue Agency

- DAP

- Disability assistance payment

- DTC

- Disability Tax Credit

- FVM

- Fair market value

- LDAP

- Lifetime disability assistance payment

- RDSP

- Registered Disability Savings Plan

- RPD

- Registered Plans Directorate

- SIR

- Social Insurance Registry

List of tables

- Table 1: CDSG and CDSB paid within the AHA period for multiple withdrawals

- Table 2: CDSG and CDSB paid within the AHA period for multiple withdrawals

- Table 3: AHA and overlapping periods – withdrawal, loss of DTC and contract closure

- Table 4: AHA and repayment followed by re-adjudication

- Table 5: AHA and overlapping periods – withdrawal and contract closure – beneficiary is between age 50 and 59 at the time of the AHA events

- Table 6: Overlapping AHA periods - Repayment obligation for withdrawal and contract closure events

- Table 7: Repayment surplus due to excessive repayment

- Table 8: Repayment surplus due to re-adjudication

List of figures

1. Overview

The Canada Disability Savings Regulations outline the issuer’s obligation to repay the CDSG and CDSB to the Government of Canada.

On March 19, 2019, Budget 2019 announced changes to the RDSP, which address the concerns raised by stakeholders and Canadians with disabilities. These changes will better protect the long-term savings of persons with disabilities.

The first change in Budget 2019 is to eliminate the requirements to close a RDSP and to repay the AHA when the beneficiary no longer qualifies for the DTC.

The second change is to modify the period of the AHA. Commencing on January 1, 2021, the AHA period will remain 10 years and begin prior to January 1 of the first year of the period of consecutive years of DTC ineligibility. This 10-year period will then be reduced by 1 year, for each year that the beneficiary’s age at the end of the year of the AHA event exceeds 50 years of age until the beginning of the year the beneficiary turns 60, when it becomes nil.

1.1 Approach

Repayment obligations, as well as AHA periods, vary in relation to the type of event for which a repayment must be made (refer to section 2.1 for a list of events), the DTC eligibility status as well as the age of the beneficiary at the time the event occurs. Section 2 explains the repayment rules and the related AHA events. Sections 3 through 7 contain a series of steps to enable issuers to meet their repayment obligations, consisting of:

- determining the AHA period

- identifying CDSG and CDSB paid within the AHA period

- attributing amounts repaid to the CDSG and CDSB paid in the applicable AHA period

- calculating the AHA

- calculating the repayment obligation

2. Repayment rules, AHA events and AHA

This section outlines the rules to determine the various events that require repayment of CDSG and CDSB.

2.1 Repayment rules and AHA events

The repayment rules require all or a portion of the CDSG and CDSB paid into a RDSP to be repaid. The repayment is triggered by the occurrence of the following AHA events:

- a withdrawal from a RDSP

- a RDSP is deregistered

- a RDSP is closed for a reason other than a transfer

- a beneficiary dies

The following events referred to as ‘DTC events’ are no longer considered events that trigger a repayment of CDSG and CDSB. However, these ‘DTC events’ will continue to affect the determination of the AHA period start date for any of the AHA events listed above with event dates prior to January 1, 2021. See section 3.6 for further details and examples:

- a beneficiary is not eligible for the DTC for 2 full consecutive years after the year of contract signature date and no DTC election is made (DTC event)Footnote 1, or

- where a DTC election has been made, the beneficiary is not DTC eligible for 5 full consecutive years after the year of contract signature date (DTC event)Footnote 2

2.2 Assistance holdback amount

In order to meet the requirements of the repayment rule, issuers must set aside an amount equivalent to the total of CDSG and CDSB paid into a RDSP within a period (normally 10 years) before a particular date, less any amount of CDSG and CDSB paid into the RDSP during that period that was repaid to the Government of Canada.

2.3 AHA and proportional repayment

The full AHA must be repaid when any of the events listed under section 2.1 occur, with the exception of withdrawals (section 2.1 (i)) dated after December 31, 2013, which are subject to the proportional repayment rule ($3 to be repaid for each $1 withdrawn up to a maximum of the AHA). For additional information on the Proportional Repayment Rule, refer to chapter 3-6 of the RDSP user guide.

3. Determining the AHA period

Establishing the AHA period start and end dates from an event described above is fundamental in determining the AHA and the amount subject for repayment. These dates are dependent on the type of event for which the AHA is being calculated, the beneficiary's DTC status prior to and during the event, as well as the beneficiary’s age at the time of the event.

3.1 Type of date

Definitions

- AHA start date

- The start of the period for which CDSG and CDSB payments, less any amounts repaid, are subject to repayment due to an event listed in 2.1.

- AHA end date

- The end of the period for which CDSG and CDSB payments, less any amounts repaid, are subject to repayment due to an event listed in 2.1.

- Contract signature date

- The date the contract was signed with the issuer.

- Current date

- The present calendar date. It corresponds to the AHA end date for any of the events listed in 2.1, with the exception of withdrawals. This is since all payments made after RDSP deregistration, closure, or death of beneficiary must be repaid to the Government of Canada.

- Disability assistance payment (DAP) date

- The date on which the DAP was processed and paid to the beneficiary by issuer as reported to the Government of Canada.

- Lifetime disability assistance payment (LDAP) date

- The date on which the LDAP was processed and paid to the beneficiary by the issuer as reported to the Government of Canada.

- Event date

-

- DAP date where the event is a DAP

- LDAP date where the event is an LDAP

- Deregistration date reported by the Canada Revenue Agency (CRA), where the event is contract deregistration

- Date the contract was closed with the issuer, where the event is contract closure

- Date of death, as reported by the Social Insurance Registry (SIR), where the event is death of beneficiary

- Payment date

- Date found in position 58-65 of the 901 transaction processing file corresponding to the date that the CDSG and/or CDSB was paid.

- Repayment date

- Date reported by the issuer in position 67-74 of the 401-10 repayment of CDSG and/or CDSB transaction.

3.1.1 AHA end date

The AHA period end date for events identified in section 2.1 is defined as the current date in all situations except withdrawals where the end date is the date of the withdrawal.

Note: In order to reflect system processing logic, the current date is used as the AHA period end date in many of the examples as information (relating to repayments, contract closures, etc.) may not always be reported or received in a timely fashion. The use of current date ensures that any CDSG and/or CDSB paid after an event are considered for the purpose of calculating the repayment obligation.

3.1.2 AHA start date

This section explains the AHA start date and provides examples of how to determine the date for different or multiple events.

Determining the AHA start date

Event: Withdrawal from a RDSP

- Event date: DAP/LDAP date

- Event source: Reported by the issuer

- AHA start date: 10 years prior to the event date

Event: RDSP is deregistered

- Event date: Deregistration date reported by the CRA

- Event source: Registered Plans Directorate (RPD)

- AHA start date: 10 years prior to the event date

Event: RDSP is closed for a reason other than transfer

- Event date: Date the contract was closed with the issuer

- Event source: Issuer

- AHA start date: 10 years prior to the event date

Event: Beneficiary dies

- Event date: Date of death, as reported by SIR

- Event source: SIR

- AHA start date: 10 years prior to the event date

‘DTC events’, as defined in Section 2.1, will continue to affect the determination of the AHA period start date for any AHA event with an event date prior to January 1, 2021. The start date of a ‘DTC event’ is 10 years prior to January 1 of the first year of the consecutive years of DTC ineligibility.

3.2 Event occurring in the year a beneficiary is 60 years of age or older

When the AHA event occurs on or after January 1, 2021, there is no longer a requirement to calculate the AHA period for any AHA event that occurs in the year a beneficiary turns 60 years of age or older.

3.3 Event occurring during a time of Disability Tax Credit (DTC) eligibility

When the following criteria are met:

- the event occurs in a year where the beneficiary is 59 years of age or less

- the beneficiary is DTC eligible in the year of the event

The AHA period start date is 10 years prior to and including the AHA event date. Depending on the type of event, the event date will be 1 of the following:

- DAP date or LDAP date reported by the issuer

- deregistration date reported by the CRA

- contract closure date reported by the issuer

- date of beneficiary death reported by SIR

Example 1: Withdrawal during a time of DTC eligibility

A RDSP is opened in 2010 and receives CDSG and CDSB until 2020. In 2021, the beneficiary is DTC eligible but no CDSG or CDSB is paid in that year. A withdrawal from the plan is made on July 5, 2021 when the beneficiary is 45 years of age.

The AHA period is 10 years prior to the withdrawal, that is from July 6, 2011 to July 5, 2021.

Example 2: Contract closure during a year of DTC eligibility

A RDSP is opened in 2020, when the beneficiary is 40 years of age, and receives CDSG and CDSB until 2029. The beneficiary is DTC eligible. The plan is closed (or is deregistered or the beneficiary dies) on June 6, 2035, when the beneficiary is 55 years of age.

The AHA period starts 10 years prior to the event date, that is June 7, 2025, and the end date is the current date.

Example 3: Contract closure during a year of DTC eligibility – beneficiary has episodic DTC eligibility profile

A RDSP is opened in 2020, when the beneficiary is 40 years of age, and receives CDSG and CDSB until 2024. In 2025, the beneficiary is DTC ineligible until 2032 and no further CDSG or CDSB is paid into the plan. The beneficiary regains DTC eligibility in 2033 at the age of 53. The plan is closed (or is deregistered or the beneficiary dies) on June 6, 2035.

Because the contract closure occurs during a time of DTC eligibility, the AHA period starts 10 years prior to the event date, that is June 7, 2025, and the end date is the current date.

3.4 Event occurring during a time of DTC ineligibility and beneficiary is 49 years of age or less

When the following criteria are met:

- the event occurs in a year where the beneficiary is 49 years of age or less

- the beneficiary is DTC ineligible in the year of the event

The AHA period start date is 10 years prior to January 1 of the year of the event or, if the event occurs during a period of consecutive years of DTC ineligibility then, the AHA period start date is 10 years prior to January 1 of the first year of the period of consecutive years of DTC ineligibility.

Example 4: Withdrawal during a single year of DTC ineligibility

A 30-year-old beneficiary opens a RDSP in 2010 and receives CDSG and CDSB until 2020. In 2021, the beneficiary is DTC ineligible and no CDSG or CDSB is paid in that year.

A withdrawal is made from the plan on July 5, 2021 when the beneficiary is 41 years of age. Since the withdrawal occurs during a single year of DTC ineligibility, the AHA period is from January 1, 2011 to July 5, 2021.

Example 5: Contract closure during a period of consecutive years of DTC ineligibility

A 30-year-old beneficiary opens a RDSP in 2010 and receives CDSG and CDSB until 2020. In 2021 and all subsequent years, the beneficiary is DTC ineligible. The plan is closed (or is deregistered or the beneficiary dies) on July 5, 2025 when the beneficiary is 45 years of age.

Since the event occurs during a period of consecutive years of DTC ineligibility, the AHA period start date is 10 years prior to January 1 of the first year of the period of consecutive years of DTC ineligibility, that is January 1, 2021. The AHA period is January 1, 2011 to the current date.

3.5 Event occurring during a time of DTC ineligibility and beneficiary is between the ages of 50 to 59

When the following criteria are met:

- the event occurs in a year where a beneficiary is between the ages of 50 and 59 as of the end of that year

- there was continuous DTC ineligibility from the year the beneficiary turned 49 or earlier to the year that the event occurred

The AHA period start date is 10 years prior to January 1 of the first year of the period of consecutive years of DTC ineligibility. This 10-year period will then be reduced by 1 year, for each year that the beneficiary’s age at the end of the year of the AHA event exceeds 50 years of age.

Example 6: Contract closure where there was a period of continuous DTC ineligibility from the age of 49 or earlier

A 38-year-old beneficiary opens a RDSP in 2013 and receives CDSG and CDSB until 2022. In 2023, and for all subsequent years, the beneficiary is DTC ineligible. The plan is closed (or deregistered or the beneficiary dies) on July 5, 2032 when the beneficiary is 57 years of age.

Since the event occurs when the beneficiary is 57 years of age and there has been continuous DTC ineligibility since the year the beneficiary turned 48 years of age, the AHA period start date is 10 years prior to January 1 of the first year of the period of consecutive years of DTC ineligibility. This 10-year period is then reduced by 7 years (1 year, for each year that the beneficiary’s age at the end of the year of the AHA event exceeds 50 years of age).

The AHA period is January 1, 2020 to the current date.

When the following criteria are met:

- the event occurs in a year where a beneficiary is between the ages of 50 to 59 as of the end of that year

- there was not continuous DTC ineligibility from the year the beneficiary turned 49 or earlier to the year that the event occurred

The AHA period start date is 10 years prior to January 1 of the year of the event.

Example 7: Contract closure where there was not continuous DTC ineligibility from the age of 49 or earlier

A 40-year-old beneficiary opens a RDSP in 2015 and receives CDSG and CDSB until age 49 in 2024. In 2028, and for all subsequent years, the beneficiary is DTC ineligible. The plan is closed (or deregistered or the beneficiary dies) on July 5, 2030 when the beneficiary is 55 years of age.

Since the event occurs when the beneficiary is 55 years of age and there has not been continuous DTC ineligibility since the year the beneficiary turned 49 years of age or earlier, the AHA period start date is 10 years prior to January 1 of the year of the event, that is 10 years prior to January 1, 2030.

The AHA period is January 1, 2020 to current date.

3.6 Event following a DTC event

‘DTC events’, as defined in Section 2.1, are no longer considered events that trigger a repayment of CDSG and CDSB. However, these ‘DTC events’ will continue to affect the determination of the AHA period start date for any AHA event with an event date prior to January 1, 2021.

If there exists at least 1 ‘DTC event’, any subsequent AHA event, with an event date prior to January 1, 2021, will have a start date that is equal to the start date of the first ‘DTC event’.

Note: Any AHA event with an event date that is on or after January 1, 2021, need not consider prior ‘DTC events’ when determining the AHA period start date.

Example 8: Death of beneficiary following 2 years of DTC ineligibility

A 30-year-old beneficiary opens a RDSP on December 31, 2008. In 2018 and 2019 the beneficiary is DTC ineligible and no election is made to keep the plan open (DTC event). The beneficiary returns to DTC eligibility in 2020 and dies on February 1, 2020.

Since the event date of the beneficiary’s death is prior to January 1, 2021 and there exists a DTC event prior to the AHA event, the AHA period start date will be equal to the start date of the DTC event.

The start date of a DTC event is 10 years prior to January 1 of the first year of the consecutive years of DTC ineligibility, that is 10 years prior to January 1, 2018. However, due to the plan signature date limitation (as defined in Section 3.7), the AHA period start date will be the contract signature date.

The AHA period is December 31, 2008 to current date.

3.7 Contract signature date limitation

The AHA period start date cannot be earlier than the contract signature date (of the earliest contract in a transfer situation) therefore, the AHA period start date for an event is the later of:

- the start date as determined in section 3.3 to 3.6, or

- the contract signature date

Example 9: Withdrawal during a single year of DTC ineligibility, with later contract signature date

A RDSP is opened on February 3, 2015 and receives CDSG and CDSB until 2020. In 2021, the beneficiary is DTC ineligible and no CDSG or CDSB is paid in that year. A withdrawal from the plan is made on July 5, 2021 when the beneficiary is 45 years of age.

The AHA period is from February 3, 2015, to July 5, 2021.

3.8 AHA periods overlap

The AHA periods for 2 distinct events are always determined independently and could cover all or a portion of the same period of time.

Example 10: 2 events that overlap a period of time

A DAP is made on January 1, 2019, (AHA period is from January 2, 2009 to January 1, 2019). The beneficiary dies and the plan is closed on December 30, 2021, (AHA period is from December 31, 2011, to the current date) resulting in a December 31, 2011 to January 1, 2019 overlap of the 2 AHA periods.

4. Identifying CDSG and CDSB paid within an AHA period

Section 4 highlights the rules used to determine the amount of CDSG and CDSB paid within a period.

After determining the start and end dates of the AHA period, the amount of CDSG and CDSB that was paid during that period can be calculated. All CDSG and CDSB paid with a payment date on or after the start date and on or before the end date must be included.

When a plan is part of a resolved transfer, CDSG and CDSB paid to the relinquishing plan are included in the calculation of AHA and repayment obligation for events occurring under the receiving plan.

Example 11: CDSG and CDSB paid within the AHA period for a withdrawal

A RDSP is opened in 2010 and receives $17,000 in CDSG and CDSB from August 1, 2011 until December 31, 2020. In 2021, the beneficiary is DTC eligible but no CDSG or CDSB is paid. A withdrawal from the plan is made on July 5, 2021. The AHA period is from July 6, 2011 to July 5, 2021.

The CDSG and CDSB paid within the AHA period is the entire $17,000.

Example 12: CDSG and CDSB paid within the AHA period for multiple withdrawals.

A RDSP is opened in 2010 and receives $17,000 in CDSG and CDSB from August 15, 2011 until February 16, 2020.

| Payment date | CDSG & CDSB paid |

|---|---|

| August 15, 2011 | $1,000 |

| September 16, 2012 | $1,000 |

| October 16, 2013 | $1,000 |

| November 15, 2014 | $1,000 |

| January 15, 2015 | $2,000 |

| March 16, 2016 | $2,000 |

| January 17, 2017 | $2,000 |

| January 16, 2018 | $2,000 |

| February 16, 2019 | $2,500 |

| February 16, 2020 | $2,500 |

| 2021 | $0 |

| 2022 | $0 |

| 2023 | $0 |

| 2024 | $0 |

| 2025 | $0 |

In 2021 to 2025, the beneficiary is DTC eligible but no CDSG or CDSB is paid. 2 withdrawals from the plan are made for $2,000 each on July 5, 2021, and June 20, 2025.

Since the withdrawals occur during a time of DTC eligibility, the applicable overlapping periods and the CDSG and CDSB paid within those periods are:

| Withdrawal | AHA period | CDSG and CDSB paid |

|---|---|---|

| July 5, 2021 | July 6, 2011 to July 5, 2021 | $17,000 |

| June 20, 2025 | June 21, 2015 to June 20, 2025Footnote 3 | $11,000 |

5. Attributing of CDSG and CDSB repaid

Section 5 highlights the rules used to determine the amount of CDSG and CDSB repaid within a period.

5.1 Factors influencing attribution

Similar to the calculation of CDSG and CDSB paid, the attribution of CDSG and CDSB repaid is dependent on prior events for which a repayment must be made and the AHA period for each event. In addition, repayments are attributed within a period on the basis of:

- the repayment date

- event type (in section 2.1), and

- sequence of events that occurred under the plan (or plans in the case of a transfer)

5.2 Attribution

CDSG and CDSB repayments are attributed within AHA periods according to the following set of rules:

- calculate the total amount of CDSG and CDSB repayments made under the plan (or plans in a resolved transfer situation)

- identify the events under the plan(s) that require CDSG and CDSB repayment (section 2.1)

- for each event, determine the AHA period (section 3)

- for each event, consider the CDSG and CDSB paid (section 4), and

- attribute the repayments to the CDSG and CDSB paid

Starting from the earliest event and continuing to the later events, determine the event type and:

- if the event is a withdrawal dated after December 31, 2013, attribute the amounts repaid to the CDSG and CDSB paid within the AHA period based on the order in which they were paid, from the earliest date to the latest

- the proportional repayment rule is applied and $3 repaid is attributed to the CDSG and CDSB paid within the period for each $1 withdrawn

- if the event is other than a withdrawal dated after December 31, 2013, attribute the amounts repaid to the CDSG and CDSB paid within the AHA period based on the order in which they were paid, from the earliest date to the latest

- repayments are attributed to all CDSG and CDSB paid within the period

Note: The CDSG and CDSB paid and repaid may fall within the AHA period of more than 1 event (i.e. the AHA periods overlap). In this circumstance, the CDSG and CDSB paid and repaid are included in the AHA calculation of all overlapping events (refer to section 6); however, the obligation to repay the CDSG and CDSB is associated with the earliest of the overlapping events (refer to section 7).

6. Calculating the AHA

This section lays out the rules for the calculation of the AHA applicable to a given event.

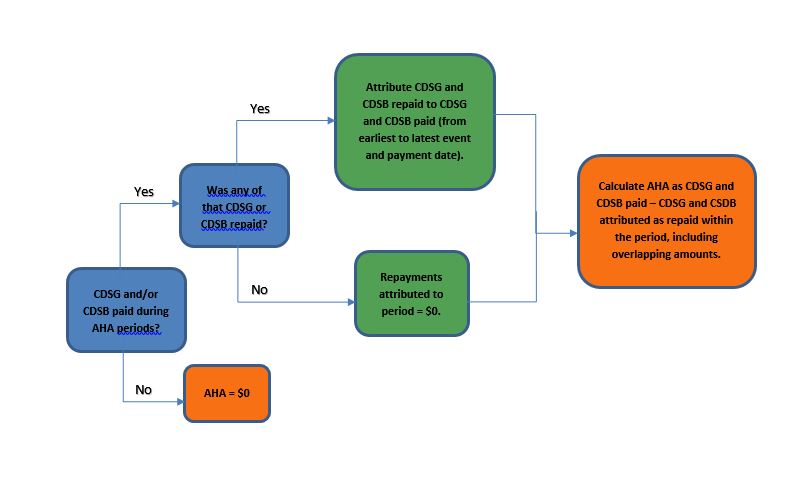

The following diagram illustrates the logic applicable to the AHA calculation.

Description of figure 1

The diagram illustrates the logic applicable to the AHA calculation.

First question: CDSG and/or CDSB paid during AHA periods?

- Yes…second question: Was any of that CDSG or CDSB repaid?

- Yes, attribute CDSG and CDSB repaid to CDSG and CDSB paid (from earliest to latest event and payment date). Calculate AHA as CDSG and CDSB paid minus CDSG and CSDB attributed as repaid within the period, including overlapping amounts

- No, repayments attributed to period equal to 0. Calculate AHA as CDSG and CDSB paid minus CDSG and CSDB attributed as repaid within the period, including overlapping amounts

- No…AHA amount equal to 0

6.1 Factors impacting the calculation of the AHA

The following considerations allow the identification of the factors impacting the calculation of AHA:

- events for which a repayment of CDSG and CDSB must be made (section 2.1)

- AHA period for each event (section 3)

- CDSG and CDSB paid within each AHA period (section 4), and

- CDSG and CDSB which have been repaid (section 5)

As illustrated in the diagram in Section 6, before the AHA for an event can be accurately calculated, 2 additional rules must be considered:

- the first falls under the provision in section 5.2 (i): when attributing CDSG and CDSB repayments within an AHA period, only the total amount of repayments made (based on CDSP system processing date) on or before the end date of the AHA period should be considered

- the CDSG and CDSB paid and attributed as repaid in overlapping AHA periods are counted for each individual overlapping AHA period (i.e. if an amount was paid and must be repaid on account of 2 events whose period overlaps, it is counted in the AHA of both events)

6.2 AHA formula

The equation for a given event is:

AHA = CDSG paid + CDSB paid – CDSG repaid – CDSB repaid and is completed by:

- determining the AHA period (as in section 3)

- calculating the CDSG and CDSB paid (as in section 4)

- calculating the amount of CDSG and CDSB repaid that is applicable to the AHA period (as in section 5 with the additional clauses in section 6.1)

Example 13: AHA with no repayment

A RDSP is opened in 2008 and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2014, $1,000 is withdrawn from the RDSP and no repayment is made to date. The beneficiary is 40 years of age at the time of the withdrawal.

In this case, the AHA as of the date of the withdrawal is $4,000.

Example 14: AHA with repayment after event date

A RDSP is opened in 2008 and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2014, $1,000 is withdrawn from the RDSP. The beneficiary is 40 years of age at the time of the withdrawal. The required repayment of $3,000 (proportional repayment rule is applied where $3 is repaid for each $1 withdrawn) is made on January 1, 2015.

The application of the AHA formula, in light of rule #1 in section 6.1 (only repayments made on or before the end date of the event being considered are part of the AHA for that event), leads to the calculation of the AHA as $4,000.

Example 15: AHA and overlapping periods – withdrawal and contract closure

A RDSP is opened on February 5, 2010 and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2014, $1,000 is withdrawn from the RDSP. The beneficiary is 20 years of age at the time of the withdrawal. The required repayment of $3,000 is made on January 1, 2015. The beneficiary is DTC eligible until 2021 with an additional $1,000 being paid on February 15 of every year from 2014 to 2021.

In 2022 to 2024 the beneficiary is DTC ineligible.

The plan is closed on March 1, 2024 when the beneficiary is 34 years of age. A repayment of $9,000 is processed on May 15, 2024.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|

| March 15, 2010 | $1,000 | $0 | Yes | n/a |

| February 15, 2011 | $1,000 | $0 | Yes | n/a |

| February 15, 2012 | $1,000 | $0 | Yes | n/a |

| February 15, 2013 | $1,000 | $0 | Yes | n/a |

| January 1, 2014 | n/a | n/a | Yes | $1,000 withdrawal |

| February 15, 2014 | $1,000 | $0 | Yes | n/a |

| February 15, 2015 | $1,000 | $3,000 | Yes | n/a |

| February 15, 2016 | $1,000 | $0 | Yes | n/a |

| February 15, 2017 | $1,000 | $0 | Yes | n/a |

| February 15, 2018 | $1,000 | $0 | Yes | n/a |

| February 15, 2019 | $1,000 | $0 | Yes | n/a |

| February 15, 2020 | $1,000 | $0 | Yes | n/a |

| February 15, 2021 | $1,000 | $0 | Yes | n/a |

| February 15, 2022 | $0 | $0 | No | n/a |

| February 15, 2023 | $0 | $0 | No | n/a |

| March 01, 2024 | n/a | n/a | No | Contract closure |

| May 15, 2024 | $0 | $9,000 | No | n/a |

The AHA period for the withdrawal is from February 5, 2010 (contract signature date) to January 1, 2014 and the AHA is $4,000.

The AHA period relating to the contract closure is from January 1, 2012 to the current date and the AHA is $9,000.

Example 16: AHA and repayment followed by re-adjudication

A RDSP is opened on February 5, 2020, and, by January 1, 2024, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2024, $1,000 is withdrawn from the RDSP.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|

| March 15, 2020 | $1,000 | $0 | Yes | n/a |

| February 15, 2021 | $1,000 | $0 | Yes | n/a |

| February 15, 2022 | $1,000 | $0 | Yes | n/a |

| February 15, 2023 | $1,000 | $0 | Yes | n/a |

| January 1, 2024 | n/a | n/a | Yes | $1,000 withdrawal |

The AHA period for the withdrawal is from February 5, 2020, (contract signature date) to January 1, 2024, and the AHA is $4,000.

A “no residency” update for 2022 and 2023 is received from the CRA after 2025 resulting in the automatic re-adjudication of the February 15, 2022, and February 15, 2023, payments of $2,000, which are reclaimed. The AHA applicable to the withdrawal is, as a consequence, automatically updated to $2,000.

Example 17: AHA and overlapping periods – withdrawal and contract closure – beneficiary is between age 50 and 59 at the time of the AHA events

A RDSP is opened on January 2, 2015 and, by February 15, 2026, $12,000 in CDSG and CDSB is paid into the plan.

In 2027, at the age of 47 and onwards, the beneficiary is DTC ineligible.

On January 31, 2034, when the beneficiary is 54 years of age, $1,000 is withdrawn from the RDSP. The required repayment of $3,000 is made on January 1, 2035.

The contract is closed on March 1, 2037 when the beneficiary is 57 years of age. A repayment of $3,000 is processed on May 15, 2038.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Age of beneficiary | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|---|

| February 15, 2015 | $1,000 | $0 | Yes | 35 | n/a |

| February 15, 2016 | $1,000 | $0 | Yes | 36 | n/a |

| February 15, 2017 | $1,000 | $0 | Yes | 37 | n/a |

| February 15, 2018 | $1,000 | $0 | Yes | 38 | n/a |

| February 15, 2019 | $1,000 | $0 | Yes | 39 | n/a |

| February 15, 2020 | $1,000 | $0 | Yes | 40 | n/a |

| February 15, 2021 | $1,000 | $0 | Yes | 41 | n/a |

| February 15, 2022 | $1,000 | $0 | Yes | 42 | n/a |

| February 15, 2023 | $1,000 | $0 | Yes | 43 | n/a |

| February 15, 2024 | $1,000 | $0 | Yes | 44 | n/a |

| February 15, 2025 | $1,000 | $0 | Yes | 45 | n/a |

| February 15, 2026 | $1,000 | $0 | Yes | 46 | n/a |

| February 15, 2027 | $0 | $0 | No | 47 | n/a |

| February 15, 2028 | $0 | $0 | No | 48 | n/a |

| February 15, 2029 | $0 | $0 | No | 49 | n/a |

| 2030 | $0 | $0 | No | 50 | n/a |

| 2031 | $0 | $0 | No | 51 | n/a |

| 2032 | $0 | $0 | No | 52 | n/a |

| 2033 | $0 | $0 | No | 53 | n/a |

| 2034 | $0 | $0 | No | 54 | n/a |

| January 31, 2034 | n/a | n/a | No | 54 | $1,000 withdrawal |

| January 01, 2035 | $0 | $3,000 | No | 55 | n/a |

| 2035 | $0 | $0 | No | 55 | n/a |

| 2036 | $0 | $0 | No | 56 | n/a |

| 2037 | $0 | $0 | No | 57 | n/a |

| March 01, 2037 | n/a | n/a | No | 57 | Contract closure |

| May 15, 2038 | $0 | $3,000 | No | 58 | n/a |

The AHA period for the withdrawal is from January 1, 2021 (10 years prior to January 1 of the first year of the period of consecutive years of DTC - reduced by 1 year for each year that the beneficiary’s age exceeds 50) to January 31, 2034 and the AHA is $6,000.

The AHA period relating to the contract closure is from January 1, 2024 (10 years prior to January 1 of the first year of the period of consecutive years of DTC - reduced by 1 year for each year that the beneficiary’s age exceeds 50) to the current date and the AHA is $6,000.

7. Calculating the repayment obligation

This section outlines the rules for the calculation of the CDSG and CDSB that must be repaid for an event, as well as the amount of the obligation that has been repaid to date.

While the AHA constitutes the amount of CDSG and CDSB that the issuers must set aside to meet repayment obligations, when 1 of the events listed in section 2.1 occurs, a portion or the entire amount must be repaid to the Government of Canada. For each event in a plan (or plans if in a transfer situation), 4 repayment obligation amounts may be calculated:

- repayment obligation

- amount of obligation that has already been repaid

- outstanding repayment obligation, and

- repayment surplus (if any)

7.1 Repayment obligation

A repayment obligation (what must be repaid to the Government of Canada) is calculated as follows:

- if the event is other than a withdrawal dated after December 31, 2013, the CDSG and CDSB paid within the AHA period, minus the amount of that CDSG and CDSB that is also a repayment obligation under an earlier event, or

- if the event is a withdrawal dated after December 31, 2013, the lesser of:

- $3 for each $1 withdrawn

- CDSG and CDSB paid within the AHA period, minus the amount of that CDSG and CDSB that is also a repayment obligation under an earlier event

- FMV - If a repayment obligation is greater than the fair market value of the plan, losses are reported as termination adjustments on the repayment

7.2 Amount of obligation already repaid

This is equal to the amount of the current repayment obligation that has already been repaid to the Government of Canada. Repayments that have been remitted up to the current date on the plan (or plans in a transfer situation) must be considered.

7.3 Outstanding repayment obligation

The outstanding repayment obligation for a given event is equal to the repayment obligation, calculated as per the rules in section 7.1, minus the amount of that obligation that has already been repaid, as determined in accordance with the rules in section 7.2.

7.4 Repayment surplus

Should outstanding repayments be a negative amount, the CDSG and CDSB amount allocated as having been repaid on account of an event (section 7.2) is in excess of the repayment obligation for the same event (section 7.1).

Any successfully processed repayment transactions which lead to the surplus repayment should be reversed and resubmitted with the correct repayment amount.

7.5 Calculating the repayment obligation – examples

Example 18: Repayment obligation with no repayment

A RDSP is opened on February 5, 2010, and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the account. On January 1, 2014, $1,000 is withdrawn from the RDSP and no repayment is made.

In this case, the amount that must be repaid for the withdrawal is $3,000. The amount that has been repaid is $0 and the outstanding obligation is $3,000.

Example 19: Overlapping AHA periods; Repayment obligation for withdrawal and contract closure events

A RDSP is opened on February 5, 2010 for a 10-year-old beneficiary, and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2014, $1,000 is withdrawn from the RDSP. The required repayment of $3,000 is made on February 15, 2015. The beneficiary is DTC eligible until 2021 and $1,000 in CDSG and CDSB is paid on February 15 of every year between 2014 and 2021.

In 2022 the beneficiary becomes DTC ineligible.

The plan is closed on March 1, 2024, and a repayment of $9,000 made on May 15, 2024.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|

| March 15, 2010 | $1,000 | $0 | Yes | n/a |

| February 15, 2011 | $1,000 | $0 | Yes | n/a |

| February 15, 2012 | $1,000 | $0 | Yes | n/a |

| February 15, 2013 | $1,000 | $0 | Yes | n/a |

| January 01, 2014 | n/a | n/a | Yes | $1,000 withdrawal |

| February 15, 2014 | $1,000 | $0 | Yes | n/a |

| February 15, 2015 | $1,000 | $0 | Yes | n/a |

| February 15, 2015 | $0 | $3,000 | Yes | n/a |

| February 15, 2016 | $1,000 | $0 | Yes | n/a |

| February 15, 2017 | $1,000 | $0 | Yes | n/a |

| February 15, 2018 | $1,000 | $0 | Yes | n/a |

| February 15, 2019 | $1,000 | $0 | Yes | n/a |

| February 15, 2020 | $1,000 | $0 | Yes | n/a |

| February 15, 2021 | $1,000 | $0 | Yes | n/a |

| 2022 | $0 | $0 | No | n/a |

| 2023 | $0 | $0 | No | n/a |

| March 01, 2024 | n/a | n/a | No | Contract closure |

| May 15, 2024 | $0 | $9,000 | No | n/a |

Repayment obligations:

-

Withdrawal

The AHA period for the withdrawal is from February 5, 2010, (contract signature date) to January 1, 2014, and the AHA is $4,000. The amount that must be repaid is $3,000. The amount that has been repaid is $3,000 and the outstanding obligation is $0.

-

Contract closure

The AHA period relating to the contract closure is from January 1, 2012 to the current date. The CDSG and CDSB paid and repaid for the year 2012 has been repaid as part of the repayment obligation for the withdrawal (AHA periods overlap). Therefore, the payments of CDSG and CDSB from February 15, 2013, to February 15, 2021, are used to calculate the repayment obligation for the contract closure event. The amount that must be repaid is $9,000. The amount that has been repaid is $9,000 and the outstanding obligation is $0.

Example 20: Repayment surplus due to excessive repayment

A RDSP is opened on February 5, 2010, and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the plan. On January 1, 2014, $1,000 is withdrawn from the RDSP. A $4,000 repayment is made on February 15, 2014.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|

| March 15, 2010 | $1,000 | $0 | Yes | n/a |

| February 15, 2011 | $1,000 | $0 | Yes | n/a |

| February 15, 2012 | $1,000 | $0 | Yes | n/a |

| February 15, 2013 | $1,000 | $0 | Yes | n/a |

| January 01, 2014 | n/a | n/a | Yes | $1,000 withdrawal |

| February 15, 2014 | $0 | $4,000 | No | n/a |

The AHA period for the withdrawal is from February 5, 2010, (contract signature date) to January 1, 2014. The repayment, at $4,000, is $1,000 in excess of the amount that must be repaid for the withdrawal (proportionate repayment rule requiring $3 be repaid for each $1 withdrawn), resulting in a repayment surplus.

In this situation, the surplus repayment should be reversed and resubmitted with the correct repayment amount.

Example 21: Repayment surplus due to re-adjudication

A RDSP is opened on February 5, 2010 and, by January 1, 2014, $4,000 in CDSG and CDSB is paid into the account. On January 1, 2014, $1,000 is withdrawn from the RDSP and the required $3,000 repayment due to the proportionate repayment rule is processed on February 15, 2014.

| Date | CDSG and CDSB paid | CDSG and CDSB repaid | DTC eligibility | Event requiring repayment of CDSG and CDSB |

|---|---|---|---|---|

| March 15, 2010 | $1,000 | $0 | Yes | n/a |

| February 15, 2011 | $1,000 | $0 | Yes | n/a |

| February 15, 2012 | $1,000 | $0 | Yes | n/a |

| February 15, 2013 | $1,000 | $0 | Yes | n/a |

| January 01, 2014 | n/a | n/a | Yes | $1,000 withdrawal |

| February 15, 2014 | $0 | $3,000 | No | n/a |

The AHA period for the withdrawal is from February 5, 2010, (contract signature date) to January 1, 2014.

A “no residency” update for 2012 and 2013 is received from the CRA after February 15, 2014, resulting in the automatic re-adjudication of the February 15, 2012, and February 15, 2013, payments of $2,000, which are reclaimed. As a consequence, the amount that must be repaid for the withdrawal event is automatically updated to $2,000. However, the amounts paid for 2012 and 2013 that have been repaid is $3,000, resulting in a repayment surplus of $1,000. The repayment should be reversed and resubmitted with the correct repayment amount.