Annex 2: Employment Insurance benefits data tables

From: Employment and Social Development Canada

Official title: Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2018 and ending March 31, 2019: Annex 2 Employment Insurance benefits and data tables

On this page

- List of abbreviations

- Annex 2.1 – Employment Insurance benefits – Concepts and definitions

- Annex 2.2 – Employment Insurance maximum number of benefit weeks entitlement

- Annex 2.3 – Employment Insurance benefits

- Annex 2.4 – Employment Insurance benefits by EI economic region

- Annex 2.5 – Regular benefits

- Annex 2.6 – Regular benefits (by industry)

- Annex 2.7 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment)

- Annex 2.8 – Regular benefits (by Employment Insurance economic region)

- Annex 2.9 – Seasonal regular claimants

- Annex 2.10 – Fishing benefits

- Annex 2.11 – Special benefits

- Annex 2.12 – Special benefits (by Employment Insurance economic region)

- Annex 2.13 – Firms and Employment Insurance regular and special benefits (by industry)

- Annex 2.14 – Maternity benefits

- Annex 2.15 – Parental benefits (biological and adoptive)

- Annex 2.16 – Sickness benefits

- Annex 2.17 – Sickness benefits (by industry)

- Annex 2.18 – Compassionate care benefits

- Annex 2.19 – Family caregiver benefit for adults

- Annex 2.20 – Family caregiver benefit for children

- Annex 2.21 – Work-Sharing benefits

- Annex 2.22 – Work-Sharing benefits (by industry)

- Annex 2.23 – Family Supplement

- Annex 2.24 – Working while on claim

- Annex 2.25 – Completed pure and combined Employment Insurance claims, by types of benefits, Canada

- Annex 2.26 – Employment Insurance benefit repayment

- Annex 2.27 – Contributors to the Employment Insurance program

- Annex 2.28 – Adjusted benefits-to-contributions (B/C) ratios

- Annex 2.29 – Unemployment rates used for the purpose of the Employment Insurance program (by Employment Insurance economic region)

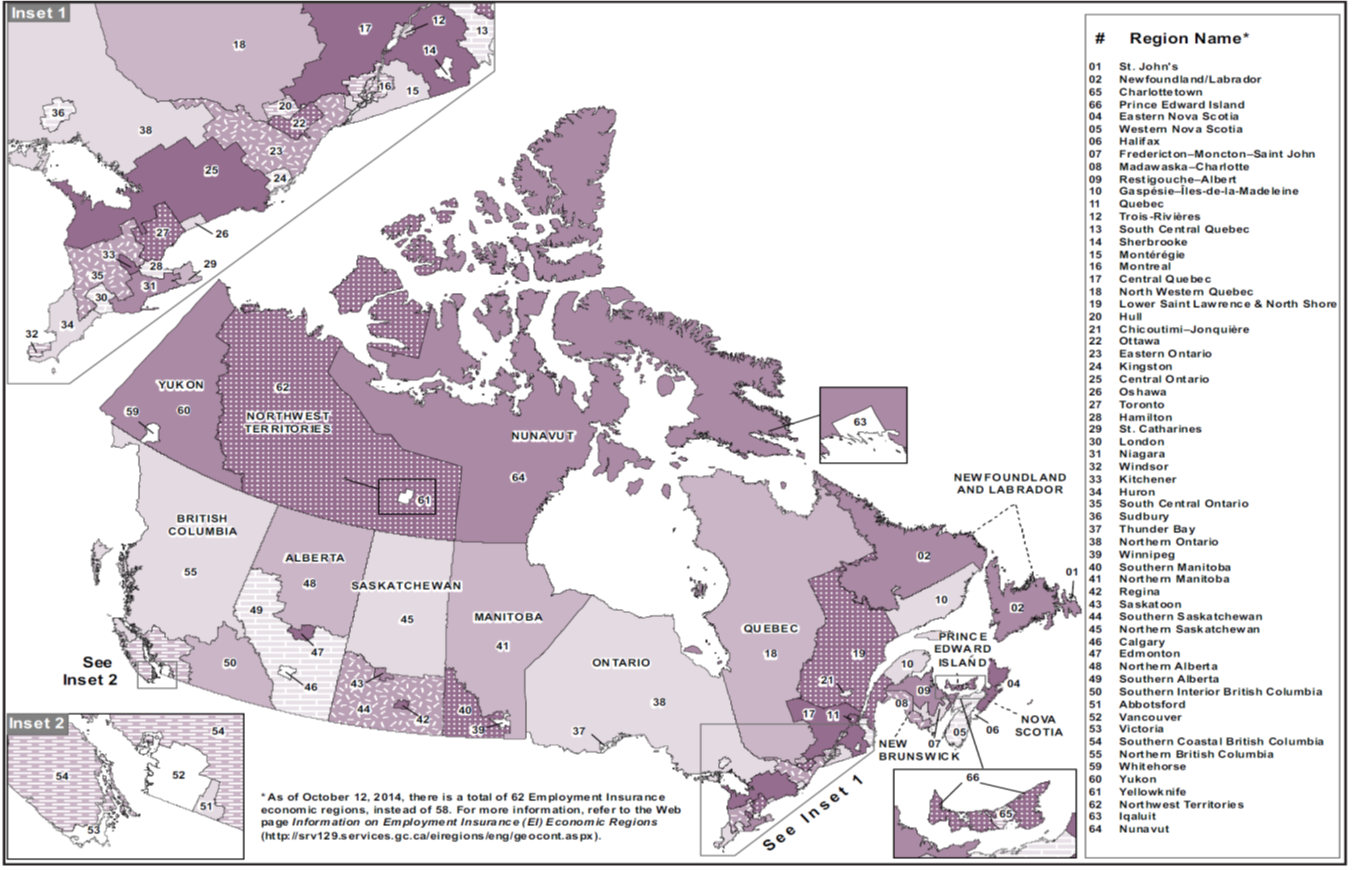

- Annex 2.30 – Employment Insurance economic regions map – FY1819

List of abbreviations

This is the complete list of abbreviations for the Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2018 and ending March 31, 2019.

Abbreviations

- ASETS

- Aboriginal Skills and Employment Training Strategy

- ATSSC

- Administrative Tribunals Support Service of Canada

- B/C Ratio

- Benefits-to-Contributions ratio

- B/U Ratio

- Benefits-to-Unemployed ratio

- B/UC Ratio

- Benefits-to-Unemployed Contributor ratio

- BDM

- Benefit Delivery Modernization

- CANSIM

- Canadian Socio-Economic Information Management System

- CAWS

- Citizen Access Workstation Services

- CCAJ

- Connecting Canadians with Available Jobs

- CCB

- Canada Child Benefit

- CCDA

- Canadian Council of Directors of Apprenticeship

- CEIC

- Canada Employment Insurance Commission

- COLS

- Community Outreach and Liaison Service

- CSO

- Citizen Service Officer

- CPI

- Consumer Price Index

- CPP

- Canada Pension Plan

- CRA

- Canada Revenue Agency

- CRF

- Consolidated Revenue Fund

- CUSMA

- Canada-United States-Mexico Agreement

- CX

- Client Experience

- EBSMs

- Employment Benefits and Support Measures

- ECC

- Employment Contact Centre

- EF

- Enabling Fund

- EI

- Employment Insurance

- EI PAAR

- Employment Insurance Payment Accuracy Review

- EI PRAR

- Employment Insurance Processing Accuracy Review

- EICS

- Employment Insurance Coverage Survey

- eROE

- Electronic Record of Employment

- ESDC

- Employment and Social Development Canada

- FLMM

- Forum of Labour Market Ministers

- FY

- Fiscal Year

- G7

- Group of Seven

- GDP

- Gross Domestic Product

- HCCS

- Hosted Contact Centre Solution

- HRSDC

- Human Resources and Social Development Canada

- IQF

- Individual Quality Feedback

- IVR

- Interactive Voice Response

- LFS

- Labour Force Survey

- LMDA

- Labour Market Development Agreements

- LMI

- Labour Market Information

- LMP

- Labour Market Partnerships

- MIE

- Maximum Insurable Earnings

- MSCA

- My Service Canada Account

- NAICS

- North American Industry Classification System

- NAFTA

- North American Free Trade Agreement

- NAS

- National Apprenticeship Survey

- NERE

- New-Entrant/Re-Entrant

- NESI

- National Essential Skills Initiative

- NIS

- National Investigative Services

- NOS

- National Occupational Standards

- NQCP

- National Quality and Coaching Program for Call Centres

- OAS

- Old Age Security

- OECD

- Organization for Economic Co-operation and Development

- PPEs

- Clients who are Premiums Paid Eligible

- P/Ts

- Provinces and Territories

- PPTS

- Percentage points

- PRP

- Premium Reduction Program

- QPIP

- Quebec Parental Insurance Plan

- RAIS

- Registered Apprenticeship Information System

- ROE

- Record of Employment

- RSOS

- Red Seal Occupational Standards

- SA

- Social Assistance

- SCC

- Service Canada Centres

- SDP

- Service Delivery Partner

- SEPH

- Survey of Employment, Payrolls and Hours

- SIN

- Social Insurance Number

- SIR

- Social Insurance Registry

- SME

- Small and medium sized enterprises

- SO

- Scheduled Outreach

- SST

- Social Security Tribunal

- STDP

- Short-term disability plan

- SUB

- Supplemental Unemployment Benefit

- UV

- Unemployed-to-job-vacancy ratio

- VBW

- Variable Best Weeks

- VER

- Variable Entrance Requirement

- WWC

- Working While on Claim

Annex 2.1 – Employment Insurance benefits – Concepts and definitions

Chapter II and Annex 2 provide information on the numbers of new claims established, the average actual duration, the average weekly benefit rate, the amount paid in benefits, employment insurance claimant categories (long-tenured workers, occasional claimants, frequent claimants), seasonal regular claimants and claim status (active, open, completed, terminated, dormant and combined). These concepts are defined below.

New claims established

New claims established refer to new Employment Insurance claims that have been received, processed and approved by Employment and Social Development Canada (via Service Canada) for which at least $1 in benefits was paid to an Employment Insurance claimant.

To avoid double counting, each claim established is counted only once. Thus, a claim that was established, for example, in November 2017 (which is in FY1718) and for which benefits paid to an Employment Insurance claimant began in December 2017 (also in FY1718) and ended in June 2018 (which is in FY1819) is included in the FY1718 statistics, but is not counted in the FY1819 statistics.

New claims established designate a different concept from new applications submitted to Employment and Social Development Canada (and received by the organization). An application may be submitted, but not necessarily established. This is the case, for example, when the application is rejected because not all of the eligibility requirements are met.

It should be noted that the number of new claims established during a fiscal year does not necessarily correspond to the number of new Employment Insurance claimants because a claimant can have more than 1 Employment Insurance claim established annually.

New claims established are also referred to under other names such as: new claims established, benefits, claims and claims established. The terms "new," "benefits" and "established" are sometimes omitted so as not to complicate the text. In all cases, these terms refer to the same concept.

Average actual duration

The average actual duration of Employment Insurance claims refers, in regard to these claims, to the average number of weeks of benefits per claim during which at least 1 dollar in benefits was paid to an Employment Insurance claimant.

For claims associated with most benefits types, the average actual duration is calculated by dividing the sum of the number of weeks of benefits during which at least 1 dollar was paid per claim by the number of claims that were completed based on the variable assessed (that is, the average actual duration for Ontario is equal to the sum of the number of weeks of benefits paid in Ontario for all claims completed during a fiscal year divided by the number of claims that were completed in Ontario during the same period.

Average actual duration for claims for Employment Insurance fishing benefits and family caregiver benefits for adults and children are calculated using claims established during the reference period rather than claims completed during the reference period.

The average actual duration is a different concept than the average maximum duration: the latter is the maximum number of weeks during which benefits may be paid (under sections 12 and 152.14 of the Employment Insurance Act, and Section 8 of the Employment Insurance (Fishing) Regulations), while the former is the number of weeks for which benefits are actually paid.

Average weekly benefit rate

The average weekly benefit rate, or level of EI benefits, refers to the rate of weekly benefits payable on average for an Employment Insurance claim.

The average weekly benefit rate is calculated by dividing the sum of the weekly benefit rate of each claim by the number of claims that were established.

The Family Supplement is always included in the calculation of the average weekly benefit rate, unless otherwise specified.

The average weekly benefit rate is not necessarily equal to the amount of benefits actually paid on average per claim established. The amount paid may be less than the benefit rate, especially if the weekly benefits are reduced because the claimant worked while on claim (for more information, see subsection 2.2.7 of Chapter II relating to the Working While on Claim provision).

Amount paid

The amount paid refers to the sum of benefit payments that claimants who have established an Employment Insurance claim have received. In other words, it is the value of Employment Insurance benefits that were paid to Employment Insurance claimants.

The amount paid is always reported on a cash basis, meaning that they are reported in the year in which they were paid regardless of when the claim was established. Thus, the amount paid in benefits to an Employment Insurance claimant who, for example, had a claim established in November 2017 (i.e. in FY1718) and received payment starting in December 2017 (i.e. in FY1718) and ending in June 2018 (i.e. in FY1819) are included in the fiscal year statistics for FY1718 and FY1819. If this claimant received $200 per week for 17 weeks between December 2017 and March 2018, and $200 per week for 12 weeks between April and June 2018, an amount of $3,400 will be allocated to FY1718 and $2,400 will be allocated to FY1819.

Long-Tenured workers

Long-Tenured workers are Employment Insurance (EI) claimants who have paid at least 30% of the maximum annual EI premiums in 7 of the past 10 years and who, over the last 5 years, have collected EI regular or fishing benefits for 35 weeks or less.

Frequent claimants

Frequent claimants are EI claimants who have had 3 or more EI regular or fishing claims and have collected benefits for a total of more than 60 weeks in the past 5 years.

Occasional claimants

Occasional claimants are EI claimants who do not meet the requirements for either long-tenured workers or frequent claimants.

Seasonal claimants

EI claimants who had at least 3 regular or fishing claims within past 5 years from the reference year, with at least 2 of these claims having started during the same period of the year as the current claim, are referred to as seasonal claimants.

A claim is considered to have been established at the same time of year if it was established between 8 weeks before and 8 weeks after the week in which the reference year claim was established.

Active claims

Active claims are claims for which benefits are still being paid during the reference period.

With regards to the subsection 2.2.4 Extension of Employment Insurance regular benefits for workers in regions affected by the downturn in commodity prices, active claims represent those that were established after January 4, 2015 in the 15 EI economic regions targeted by the Budget Implementation Act, 2016, No.1 and that were still open by the time the implementation act came into effect on July 3, 2016.

Open claims

Open claims are those for which the claimants are still receiving or still can receive EI benefits.

Completed claims

Completed claims refer to claims that are terminated and those that are dormant.

Terminated claims

Terminated claims are those that have ended and for which claimants are no longer eligible to receive Employment Insurance benefits. The main reasons associated with the termination of claims is either that all weeks of benefits the claimant was entitled to be paid or that the claim reached the last week of the benefit period, that is the last week for which Employment Insurance benefits could be paid.

Dormant claims

Dormant claims are those that, as of August of the reference year following the reporting fiscal year, are open but are not active.

Combined or mixed claims

A combined or mixed claim refers to an Employment Insurance claim for which the claimant receives more than 1 type of benefit during the claimant’s benefit period. The 8 types of benefits available under the Employment Insurance program as stipulated in Chapter II and Annex 2 are:

- regular benefits

- fishing benefits

- maternity benefits

- parental benefits

- sickness benefits

- compassionate care benefits

- family caregiver benefit for adults

- family caregiver benefit for children, and

- Work-Sharing benefits

Regular and fishing benefits can never be combined in the same claim.

A claim for which a claimant receives both regular benefits and maternity benefits during its benefit period is treated as 2 separate claims in cases where information on regular benefits or maternity benefits is reported separately (as in the case of Annexes 2.5 and 2.14, which report data on the 2 types of benefits separately; in this example, each of the 2 annexes would add 1 claim to its totals). Conversely, if aggregated information is presented, the claim is considered a single claim (as in the case of Annex 2.3, which presents data on all Employment Insurance benefits).

| Number of hours of insurable employment in qualifying period | Regional rate of unempl.: 6% and under | Regional rate of unempl.: More than 6% but not more than 7% | Regional rate of unempl.: More than 7% but not more than 8% | Regional rate of unempl.: More than 8% but not more than 9% | Regional rate of unempl.: More than 9% but not more than 10% | Regional rate of unempl.: More than 10% but not more than 11% | Regional rate of unempl.: More than 11% but not more than 12% | Regional rate of unempl.: More than 12% but not more than 13% | Regional rate of unempl.: More than 13% but not more than 14% | Regional rate of unempl.: More than 14% but not more than 15% | Regional rate of unempl.: More than 15% but not more than 16% | Regional rate of unempl.: More than 16% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 420-454 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 26 | 28 | 30 | 32 |

| 455-489 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 24 | 26 | 28 | 30 | 32 |

| 490-524 | 0 | 0 | 0 | 0 | 0 | 0 | 23 | 25 | 27 | 29 | 31 | 33 |

| 525-559 | 0 | 0 | 0 | 0 | 0 | 21 | 23 | 25 | 27 | 29 | 31 | 33 |

| 560-594 | 0 | 0 | 0 | 0 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 |

| 595-629 | 0 | 0 | 0 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 |

| 630-664 | 0 | 0 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 |

| 665-699 | 0 | 15 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 |

| 700-734 | 14 | 16 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 |

| 735-769 | 14 | 16 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 |

| 770-804 | 15 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 |

| 805-839 | 15 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 |

| 840-874 | 16 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 |

| 875-909 | 16 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 |

| 910-944 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 |

| 945-979 | 17 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 |

| 980-1,014 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 |

| 1,015-1,049 | 18 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 |

| 1,050-1,084 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 |

| 1,085-1,119 | 19 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 |

| 1,120-1,154 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 |

| 1,155-1,189 | 20 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 |

| 1,190-1,224 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 |

| 1,225-1,259 | 21 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 |

| 1,260-1,294 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 |

| 1,295-1,329 | 22 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 |

| 1,330-1,364 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 |

| 1,365-1,399 | 23 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 |

| 1,400-1,434 | 24 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 | 45 |

| 1,435-1,469 | 25 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 | 45 |

| 1,470-1,504 | 26 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 | 45 | 45 |

| 1,505-1,539 | 27 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 | 45 | 45 |

| 1,540-1,574 | 28 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 | 45 | 45 | 45 |

| 1,575-1,609 | 29 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 | 45 | 45 | 45 |

| 1,610-1,644 | 30 | 32 | 34 | 36 | 38 | 40 | 42 | 44 | 45 | 45 | 45 | 45 |

| 1,645-1,679 | 31 | 33 | 35 | 37 | 39 | 41 | 43 | 45 | 45 | 45 | 45 | 45 |

| 1,680-1,714 | 32 | 34 | 36 | 38 | 40 | 42 | 44 | 45 | 45 | 45 | 45 | 45 |

| 1,715-1,749 | 33 | 35 | 37 | 39 | 41 | 43 | 45 | 45 | 45 | 45 | 45 | 45 |

| 1,750-1,784 | 34 | 36 | 38 | 40 | 42 | 44 | 45 | 45 | 45 | 45 | 45 | 45 |

| 1,785-1,819 | 35 | 37 | 39 | 41 | 43 | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

| 1,820+ | 36 | 38 | 40 | 42 | 44 | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

- Source: Employment Insurance Act, Schedule I.

Annex 2.3 – Employment Insurance benefits

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%) FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 81,230 | 85,910 | 74,000 | 81,090 | 86,070 | +6.1 |

| Prince Edward Island | 21,950 | 22,140 | 22,540 | 22,720 | 22,480 | -1.1 |

| Nova Scotia | 79,550 | 82,410 | 82,710 | 85,300 | 84,570 | -0.9 |

| New Brunswick | 85,020 | 88,670 | 88,910 | 91,130 | 89,820 | -1.4 |

| Quebec | 491,160 | 496,680 | 483,700 | 482,990 | 473,060 | -2.1 |

| Ontario | 561,200 | 569,620 | 552,030 | 562,570 | 556,900 | -1.0 |

| Manitoba | 57,000 | 64,660 | 59,250 | 61,440 | 64,020 | +4.2 |

| Saskatchewan | 47,840 | 57,110 | 49,850 | 51,250 | 54,210 | +5.8 |

| Alberta | 169,840 | 235,470 | 201,610 | 170,270 | 188,870 | +10.9 |

| British Columbia | 208,320 | 216,790 | 197,770 | 200,820 | 198,240 | -1.3 |

| Yukon | 2,450 | 2,410 | 2,300 | 2,200 | 2,310 | +5.0 |

| Northwest Territories | 2,250 | 2,320 | 2,380 | 2,420 | 2,310 | -4.5 |

| Nunavut | 990 | 1,230 | 1,290 | 1,340 | 1,470 | +9.7 |

| Men | 994,200 | 1,075,810 | 984,150 | 974,660 | 988,250 | +1.4 |

| Women | 814,600 | 849,610 | 834,190 | 840,880 | 836,080 | -0.6 |

| 24 years old and under | 181,910 | 194,270 | 178,010 | 172,810 | 170,480 | -1.3 |

| 25 to 44 years old | 871,570 | 933,430 | 883,950 | 876,270 | 882,780 | +0.7 |

| 45 to 54 years old | 391,140 | 402,020 | 370,360 | 363,410 | 352,640 | -3.0 |

| 55 years old and over | 364,180 | 395,700 | 386,020 | 403,050 | 418,430 | +3.8 |

| Canada | 1,808,800 | 1,925,420 | 1,818,340 | 1,815,540 | 1,824,330 | +0.5 |

- Note: Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes Family caregiver benefits for adults and children due to the incompatibility of administrative data sources.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Category | FY1415 | FY1516 | FY1617 | FY1718r1 | FY1819 | Change (%) FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 435 | 448 | 445 | 456 | 464 | +1.7 |

| Prince Edward Island | 416 | 428 | 432 | 436 | 437 | +0.1 |

| Nova Scotia | 419 | 425 | 426 | 431 | 437 | +1.5 |

| New Brunswick | 412 | 424 | 426 | 431 | 440 | +1.9 |

| Quebec | 420 | 428 | 433 | 443 | 454 | +2.5 |

| Ontario | 431 | 441 | 451 | 459r1 | 473 | +3.1 |

| Manitoba | 422 | 435 | 440 | 444 | 453 | +1.8 |

| Saskatchewan | 452 | 466 | 465 | 468r1 | 477 | +1.8 |

| Alberta | 472 | 486 | 485 | 488r1 | 499 | +2.2 |

| British Columbia | 429 | 442 | 447 | 455r1 | 468 | +2.9 |

| Yukon | 474 | 490 | 498 | 502 | 517 | +2.9 |

| Northwest Territories | 495 | 505 | 510 | 519 | 520 | +0.2 |

| Nunavut | 469 | 472 | 485 | 504r1 | 500 | -0.9 |

| Men | 457 | 469 | 473 | 480 | 492 | +2.3 |

| Women | 398 | 409 | 416 | 423r1 | 433 | +2.6 |

| 24 years old and under | 394 | 407 | 400 | 403 | 421 | +4.4 |

| 25 to 44 years old | 442 | 455 | 460 | 468r1 | 478 | +2.2 |

| 45 to 54 years old | 434 | 446 | 452 | 460 | 472 | +2.6 |

| 55 years old and over | 417 | 428 | 433 | 440 | 452 | +2.8 |

| Canada | 431 | 443 | 447 | 454r1 | 465 | +2.6 |

- Note: Percentage change is based on unrounded numbers. Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes family caregiver benefits for adults and children due to incompatibility of administrative data sources and extended parental benefits which are paid at a lower benefit rate (33% of average weekly insurable earnings) than other types of benefits.

- 2 Takes into account Family Supplement top-ups paid to Employment Insurance claimants.

- r1 Revised data to reflect the exclusion of extended parental benefits which have been available at a lower benefit rate since December 3, 2017.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%) FY11718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 862.8 | 958.6 | 1,040.2 | 1,185.2 | 1,022.9 | -13.7 |

| Prince Edward Island | 211.4 | 228.1 | 230.7 | 248.1 | 231.1 | -6.9 |

| Nova Scotia | 748.1 | 833.0 | 841.3 | 892.2 | 845.1 | -5.3 |

| New Brunswick | 824.0 | 904.0 | 919.0 | 954.0 | 869.6 | -8.9 |

| Quebec | 3,507.1 | 3,649.7 | 3,430.7 | 3,558.2 | 3,106.0 | -12.7 |

| Ontario | 5,270.5 | 5,478.3 | 5,443.2 | 5,657.7 | 5,240.4 | -7.4 |

| Manitoba | 498.2 | 573.4 | 587.3 | 631.3 | 619.2 | -1.9 |

| Saskatchewan | 437.4 | 572.7 | 671.5 | 700.9 | 624.7 | -10.9 |

| Alberta | 1,507.0 | 2,362.3 | 3,158.3 | 2,655.3 | 2,171.0 | -18.2 |

| British Columbia | 1,862.8 | 2,031.1 | 2,064.2 | 2,089.5 | 1,878.1 | -10.1 |

| Yukon | 30.4 | 25.9 | 27.3 | 27.8 | 25.0 | -9.8 |

| Northwest Territories | 29.3 | 28.8 | 29.9 | 30.9 | 31.1 | +0.9 |

| Nunavut | 15.1 | 16.2 | 17.6 | 23.6 | 21.0 | -11.1 |

| Men | 8,088.4 | 9,411.7 | 9,868.8 | 9,678.0 | 8,416.6 | -13.0 |

| Women | 7,715.7 | 8,250.3 | 8,592.2 | 8,976.6 | 8,268.7 | -7.9 |

| 24 years old and under | 1,316.1 | 1,523.7 | 1,522.2 | 1,443.0 | 1,284.6 | -11.0 |

| 25 to 44 years old | 8,525.3 | 9,497.1 | 9,869.4 | 9,908.0 | 9,038.7 | -8.8 |

| 45 to 54 years old | 3,069.2 | 3,341.4 | 3,450.0 | 3,431.5 | 2,883.7 | -16.0 |

| 55 years old and over | 2,893.5 | 3,299.8 | 3,619.4 | 3,872.1 | 3,478.3 | -10.2 |

| Canada | 15,804.1 | 17,662.0 | 18,461.0 | 18,654.7 | 16,685.3 | -10.6 |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes family caregiver benefits for adults and children due to incompatibility of administrative data sources.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.4 – Employment Insurance benefits by EI economic region

| EI economic region | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%) FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| St. John's | 14,810 | 16,190 | 16,210 | 16,620 | 15,260 | -8.2 |

| Newfoundland - Labrador | 66,420 | 69,720 | 57,790 | 64,470 | 70,810 | +9.8 |

| Prince Edward Island2 | 9,530 | n/a | n/a | n/a | n/a | n/a |

| Charlottetown2 | 2,960 | 5,470 | 5,860 | 5,570 | 5,680 | +2.0 |

| Prince Edward Island (excluding Charlottetown)2 | 9,460 | 16,670 | 16,680 | 17,150 | 16,800 | -2.0 |

| Eastern Nova Scotia | 27,660 | 28,370 | 28,580 | 30,060 | 30,890 | +2.8 |

| Western Nova Scotia | 33,860 | 35,120 | 34,740 | 35,660 | 33,640 | -5.7 |

| Halifax | 18,030 | 18,920 | 19,390 | 19,580 | 20,040 | +2.3 |

| Fredericton-Moncton-Saint-John | 26,280 | 28,070 | 27,670 | 28,250 | 28,170 | -0.3 |

| Madawaska-Charlotte | 14,250 | 14,270 | 13,880 | 14,380 | 14,410 | +0.2 |

| Restigouche-Albert | 44,490 | 46,330 | 47,360 | 48,500 | 47,240 | -2.6 |

| Gaspésie-Îles-de-la-Madeleine | 26,520 | 27,320 | 27,780 | 27,900 | 27,020 | -3.2 |

| Quebec | 40,290 | 40,400 | 38,730 | 40,490 | 39,530 | -2.4 |

| Trois-Rivières | 9,900 | 10,060 | 9,550 | 9,650 | 9,310 | -3.5 |

| South Central Quebec | 9,760 | 9,190 | 9,950 | 8,780 | 8,870 | +1.0 |

| Sherbrooke | 10,850 | 10,060 | 9,870 | 10,150 | 9,960 | -1.9 |

| Montérégie | 30,970 | 33,220 | 32,400 | 31,710 | 30,950 | -2.4 |

| Montréal | 176,270 | 179,760 | 174,100 | 174,490 | 170,940 | -2.0 |

| Central Quebec | 87,010 | 87,800 | 86,170 | 86,950 | 85,820 | -1.3 |

| North Western Quebec | 23,260 | 22,520 | 21,010 | 21,210 | 20,750 | -2.2 |

| Lower Saint Lawrence and North Shore | 49,550 | 50,290 | 49,020 | 47,100 | 46,140 | -2.0 |

| Hull | 13,420 | 13,320 | 12,980 | 12,630 | 12,700 | +0.6 |

| Chicoutimi-Jonquière | 13,360 | 12,740 | 12,140 | 11,930 | 11,070 | -7.2 |

| Ottawa | 33,180 | 34,370 | 33,210 | 32,610 | 32,410 | -0.6 |

| Eastern Ontario | 26,590 | 27,780 | 26,630 | 26,410 | 25,490 | -3.5 |

| Kingston | 5,730 | 5,110 | 5,520 | 5,140 | 5,570 | +8.4 |

| Central Ontario | 58,200 | 61,340 | 60,350 | 59,150 | 58,130 | -1.7 |

| Oshawa | 17,890 | 17,760 | 17,770 | 18,760 | 16,100 | -14.2 |

| Toronto | 207,290 | 211,410 | 205,510 | 204,230 | 204,030 | -0.1 |

| Hamilton | 29,230 | 29,400 | 29,650 | 29,240 | 29,040 | -0.7 |

| St. Catharines | 19,580 | 20,760 | 20,330 | 20,380 | 20,090 | -1.4 |

| London | 19,400 | 18,920 | 19,270 | 20,780 | 19,090 | -8.1 |

| Niagara | 17,520 | 18,080 | 17,240 | 17,280 | 17,390 | +0.6 |

| Windsor | 19,480 | 13,630 | 12,200 | 19,440 | 21,290 | +9.5 |

| Kitchener | 20,450 | 20,340 | 20,980 | 21,820 | 21,540 | -1.3 |

| Huron | 17,570 | 17,710 | 20,100 | 19,450 | 17,880 | -8.1 |

| South Central Ontario | 18,560 | 19,210 | 19,310 | 21,680 | 20,780 | -4.2 |

| Sudbury | 7,870 | 8,760 | 7,290 | 7,430 | 7,860 | +5.8 |

| Thunder Bay | 6,510 | 6,540 | 6,000 | 6,370 | 5,900 | -7.4 |

| Northern Ontario | 36,150 | 38,500 | 30,670 | 32,400 | 34,310 | +5.9 |

| Winnipeg | 31,990 | 36,060 | 32,910 | 34,580 | 34,910 | +1.0 |

| Southern Manitoba | 15,120 | 18,200 | 17,150 | 17,180 | 17,750 | +3.3 |

| Northern Manitoba | 9,890 | 10,400 | 9,190 | 9,680 | 11,360 | +17.4 |

| Regina | 8,510 | 9,830 | 10,260 | 10,470 | 10,310 | -1.5 |

| Saskatoon | 12,220 | 14,780 | 13,940 | 13,430 | 13,990 | +4.2 |

| Southern Saskatchewan | 13,080 | 15,310 | 12,210 | 12,750 | 13,820 | +8.4 |

| Northern Saskatchewan | 14,030 | 17,190 | 13,440 | 14,600 | 16,090 | +10.2 |

| Calgary | 54,040 | 74,310 | 63,390 | 55,710 | 57,720 | +3.6 |

| Edmonton | 57,710 | 81,150 | 67,740 | 61,260 | 68,520 | +11.9 |

| Northern Alberta | 14,890 | 20,620 | 22,770 | 13,900 | 16,540 | +19.0 |

| Southern Alberta | 43,200 | 59,390 | 47,710 | 39,400 | 46,090 | +17.0 |

| Southern Interior British Columbia | 38,600 | 43,030 | 36,590 | 36,700 | 40,710 | +10.9 |

| Abbotsford | 10,690 | 10,790 | 11,090 | 10,750 | 9,760 | -9.2 |

| Vancouver | 90,310 | 90,370 | 84,900 | 87,510 | 82,480 | -5.7 |

| Victoria | 12,660 | 12,990 | 12,090 | 12,870 | 12,360 | -4.0 |

| Southern Coastal British Columbia | 30,380 | 32,410 | 31,280 | 30,000 | 30,350 | +1.2 |

| Northern British Columbia | 25,680 | 27,200 | 21,820 | 22,990 | 22,580 | -1.8 |

| Yukon2 | 1,120 | n/a | n/a | n/a | n/a | n/a |

| Whitehorse2 | 740 | 1,560 | 1,420 | 1,340 | 1,480 | +10.4 |

| Yukon (excluding Whitehorse)2 | 590 | 850 | 880 | 860 | 830 | -3.5 |

| Northwest Territories2 | 1,330 | n/a | n/a | n/a | n/a | n/a |

| Yellowknife2 | 310 | 810 | 870 | 840 | 830 | -1.2 |

| Northwest Territories (excluding Yellowknife)2 | 610 | 1,510 | 1,510 | 1,580 | 1,480 | -6.3 |

| Nunavut2 | 510 | n/a | n/a | n/a | n/a | n/a |

| Iqaluit2 | 100 | 300 | 230 | 320 | 290 | -9.4 |

| Nunavut (excluding Iqaluit)2 | 380 | 930 | 1,060 | 1,020 | 1,180 | +15.7 |

| Canada | 1,808,800 | 1,925,420 | 1,818,340 | 1,815,540 | 1,824,330 | +0.5 |

- Note: Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes Family caregiver benefits for adults and children due to the incompatibility of administrative data sources.

- 2 As of October 12, 2014, there is a total of 62 EI economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into 2 EI economic regions, 1 consisting of the capital area and the remaining consisting of the non-capital area.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| EI economic region | FY1415 | FY1516 | FY1617 | FY1718r1 | FY1819 | Change (%) FY1617 to FY1718 |

|---|---|---|---|---|---|---|

| St. John's | 441 | 456 | 464 | 463 | 468 | +1.0 |

| Newfoundland - Labrador | 434 | 447 | 440 | 454 | 463 | +1.9 |

| Prince Edward Island | 409 | n/a | n/a | n/a | n/a | n/a |

| Charlottetown3 | 402 | 413 | 406 | 405 | 408 | +0.6 |

| Prince Edward Island (excluding Charlottetown)3 | 428 | 433 | 441 | 446 | 447 | +01 |

| Eastern Nova Scotia | 435 | 439 | 440 | 446 | 449 | +0.7 |

| Western Nova Scotia | 407 | 413 | 416 | 418 | 426 | +1.8 |

| Halifax | 415 | 426 | 425 | 431 | 439 | +1.8 |

| Fredericton-Moncton-Saint-John | 403 | 414 | 416 | 424 | 432 | +2.0 |

| Madawaska-Charlotte | 398 | 411 | 411 | 420 | 425 | +1.2 |

| Restigouche-Albert | 421 | 434 | 436 | 439 | 449 | +2.2 |

| Gaspésie-Îles-de-la-Madeleine | 432 | 437 | 443 | 451 | 460 | +2.1 |

| Quebec | 427 | 435 | 441 | 454 | 467 | +2.7 |

| Trois-Rivières | 409 | 415 | 419 | 436 | 441 | +1.2 |

| South Central Quebec | 419 | 429 | 437 | 443 | 451 | +1.9 |

| Sherbrooke | 412 | 418 | 430 | 435 | 452 | +3.9 |

| Montérégie | 415 | 424 | 432 | 439 | 452 | +3.1 |

| Montréal | 419 | 427 | 433 | 442 | 452 | +2.3 |

| Central Quebec | 412 | 420 | 426 | 436 | 447 | +2.3 |

| North Western Quebec | 428 | 433 | 438 | 446 | 464 | +4.0 |

| Lower Saint Lawrence and North Shore | 425 | 433 | 435 | 445 | 456 | +2.3 |

| Hull | 431 | 439 | 452 | 458 | 470 | +2.6 |

| Chicoutimi-Jonquière | 422 | 423 | 427 | 437 | 448 | +2.5 |

| Ottawa | 448 | 455 | 465 | 469r1 | 480 | +2.4 |

| Eastern Ontario | 424 | 431 | 441 | 441r1 | 460 | +4.4 |

| Kingston | 425 | 421 | 437 | 441 | 466 | +5.5 |

| Central Ontario | 419 | 432 | 444 | 448 | 461 | +2.8 |

| Oshawa | 449 | 452 | 466 | 476r1 | 486 | +2.0 |

| Toronto | 433 | 445 | 455 | 465r1 | 478 | +2.8 |

| Hamilton | 433 | 444 | 455 | 464 | 479 | +3.2 |

| St. Catharines | 409 | 413 | 428 | 435r1 | 450 | +3.3 |

| London | 426 | 427 | 439 | 451r1 | 463 | +2.8 |

| Niagara | 425 | 438 | 444 | 456r1 | 468 | +2.7 |

| Windsor | 448 | 437 | 433 | 468r1 | 485 | +3.7 |

| Kitchener | 438 | 444 | 458 | 460r1 | 480 | +4.3 |

| Huron | 421 | 435 | 441 | 450r1 | 467 | +3.8 |

| South Central Ontario | 429 | 440 | 455 | 461 | 474 | +2.9 |

| Sudbury | 434 | 453 | 453 | 456r1 | 481 | +5.6 |

| Thunder Bay | 439 | 459 | 467 | 475r1 | 483 | +1.7 |

| Northern Ontario | 432 | 445 | 442 | 451 | 469 | +3.9 |

| Winnipeg | 425 | 436 | 448 | 448r1 | 456 | +1.8 |

| Southern Manitoba | 416 | 434 | 432 | 441 | 449 | +1.7 |

| Northern Manitoba | 417 | 435 | 428 | 438 | 448 | +2.3 |

| Regina | 457 | 466 | 480 | 477r1 | 490 | +2.7 |

| Saskatoon | 459 | 466 | 469 | 473r1 | 482 | +2.1 |

| Southern Saskatchewan | 444 | 464 | 459 | 468 | 472 | +0.8 |

| Northern Saskatchewan | 450 | 467 | 455 | 458r1 | 468 | +2.3 |

| Calgary | 473 | 485 | 484 | 486r1 | 496 | +1.9 |

| Edmonton | 474 | 489 | 492 | 496r1 | 505 | +1.9 |

| Northern Alberta | 484 | 494 | 498 | 495r1 | 508 | +2.5 |

| Southern Alberta | 465 | 479 | 472 | 476r1 | 490 | +3.1 |

| Southern Interior British Columbia | 434 | 450 | 443 | 455 | 464 | +1.8 |

| Abbotsford | 383 | 391 | 407 | 409 | 423 | +3.3 |

| Vancouver | 424 | 435 | 451 | 456 | 471 | +3.3 |

| Victoria | 436 | 450 | 453 | 463 | 478 | +3.3 |

| Southern Coastal British Columbia | 433 | 444 | 443 | 452r1 | 465 | +2.8 |

| Northern British Columbia | 454 | 467 | 459 | 467 | 482 | +3.1 |

| Yukon3 | 471 | n/a | n/a | n/a | n/a | n/a |

| Whitehorse3 | 478 | 485 | 504 | 503 | 517 | +2.7 |

| Yukon (excluding Whitehorse)3 | 474 | 498 | 487 | 501 | 517 | +3.2 |

| Northwest Territories3 | 488 | n/a | n/a | n/a | n/a | n/a |

| Yellowknife3 | 499 | 505 | 511 | 523 | 528 | +1.0 |

| Northwest Territories (excluding Yellowknife)3 | 507 | 506 | 509 | 517 | 516 | -0.3 |

| Nunavut3 | 464 | n/a | n/a | n/a | n/a | n/a |

| Iqaluit3 | 497 | 499 | 524 | 517 | 541 | +4. |

| Nunavut (excluding Iqaluit)3 | 470 | 463 | 477 | 500r1 | 489 | -2.2 |

| Canada | 431 | 443 | 447 | 454r1 | 465 | +2.6 |

- Note: Percentage change is based on unrounded numbers. Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes Family caregiver benefits for adults and children due to the incompatibility of administrative data sources and extended parental benefits which are paid at a lower benefit rate (33% of average weekly insurable earnings) than other types of benefits.

- 2 Takes into account Family Supplement top-ups paid to Employment Insurance claimants.

- 3 As of October 12, 2014, there is a total of 62 EI economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into 2 EI economic regions, 1 consisting of the capital area and the remaining consisting of the non-capital area.

- r1 Revised data to reflect the exclusion of extended parental benefits which have been available at a lower benefit rate since December 3, 2017.

- Source: Employment and Social Development Canada, Employment Insurance (EI)administrative data. Data are based on a 10% sample of EI administrative data.

| EI economic region | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%) FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| St. John's | 130.5 | 146.2 | 167.4 | 191.6 | 163.2 | -14.8 |

| Newfoundland - Labrador | 732.4 | 812.4 | 872.7 | 993.6 | 859.7 | -13.5 |

| Prince Edward Island2 | 153.1 | 13.1 | n/a | n/a | n/a | n/a |

| Charlottetown2 | 11.1 | 46.9 | 52.3 | 50.1 | 47.0 | -6.1 |

| Prince Edward Island (excluding Charlottetown)2 | 47.1 | 168.1 | 178.4 | 198.0 | 184.0 | -7.0 |

| Eastern Nova Scotia | 286.4 | 328.9 | 335.5 | 362.0 | 356.5 | -1.5 |

| Western Nova Scotia | 298.5 | 321.4 | 322.3 | 337.6 | 307.3 | -9.0 |

| Halifax | 163.1 | 182.6 | 183.5 | 192.5 | 181.3 | -5.8 |

| Fredericton-Moncton-Saint-John | 225.5 | 257.6 | 263.4 | 259.3 | 246.4 | -5.0 |

| Madawaska-Charlotte | 120.5 | 125.2 | 117.1 | 124.6 | 121.4 | -2.6 |

| Restigouche-Albert | 478.0 | 521.2 | 538.5 | 570.1 | 501.8 | -12.0 |

| Gaspésie-Îles-de-la-Madeleine | 273.8 | 291.4 | 290.4 | 322.5 | 280.2 | -13.1 |

| Quebec | 240.7 | 259.0 | 237.7 | 254.8 | 231.5 | -9.1 |

| Trois-Rivières | 65.3 | 66.6 | 58.2 | 63.4 | 58.0 | -8.6 |

| South Central Quebec | 57.6 | 57.0 | 53.5 | 51.9 | 46.7 | -10.0 |

| Sherbrooke | 67.2 | 66.7 | 61.9 | 62.1 | 59.0 | -4.9 |

| Montérégie | 195.7 | 218.8 | 207.6 | 210.1 | 184.1 | -12.4 |

| Montréal | 1,289.1 | 1,331.2 | 1,273.9 | 1,288.5 | 1,114.3 | -13.5 |

| Central Quebec | 569.7 | 585.3 | 533.1 | 596.1 | 519.9 | -12.8 |

| North Western Quebec | 176.4 | 180.1 | 164.2 | 163.6 | 149.0 | -8.9 |

| Lower Saint Lawrence and North Shore | 390.9 | 397.4 | 372.8 | 370.3 | 311.7 | -15.8 |

| Hull | 89.7 | 95.1 | 91.9 | 91.4 | 80.4 | -12.1 |

| Chicoutimi-Jonquière | 91.0 | 101.0 | 85.6 | 83.6 | 71.2 | -14.8 |

| Ottawa | 333.4 | 352.9 | 341.9 | 344.7 | 328.2 | -4.8 |

| Eastern Ontario | 217.3 | 238.4 | 229.5 | 231.2 | 222.2 | -3.9 |

| Kingston | 51.4 | 46.0 | 48.1 | 47.7 | 47.2 | -1.0 |

| Central Ontario | 487.6 | 503.2 | 505.7 | 541.4 | 495.8 | -8.4 |

| Oshawa | 162.7 | 167.4 | 167.5 | 181.8 | 153.1 | -15.8 |

| Toronto | 2,161.6 | 2,224.3 | 2,178.7 | 2,244.7 | 2,087.5 | -7.0 |

| Hamilton | 258.6 | 275.6 | 275.9 | 289.9 | 270.8 | -6.6 |

| St. Catharines | 164.1 | 163.1 | 168.8 | 174.3 | 154.1 | -11.6 |

| London | 179.3 | 174.5 | 169.7 | 193.3 | 177.1 | -8.4 |

| Niagara | 142.2 | 166.7 | 154.9 | 159.5 | 156.6 | -1.8 |

| Windsor | 129.6 | 147.5 | 108.2 | 125.7 | 135.6 | +7.9 |

| Kitchener | 202.2 | 194.7 | 199.1 | 210.4 | 206.8 | -1.7 |

| Huron | 142.4 | 148.1 | 162.2 | 166.0 | 147.8 | -10.9 |

| South Central Ontario | 165.2 | 169.4 | 177.3 | 189.2 | 189.7 | +0.3 |

| Sudbury | 69.2 | 75.4 | 94.2 | 84.0 | 70.5 | -16.1 |

| Thunder Bay | 54.5 | 55.9 | 55.3 | 57.3 | 51.6 | -10.0 |

| Northern Ontario | 349.1 | 375.2 | 406.2 | 416.7 | 345.7 | -17.0 |

| Winnipeg | 272.4 | 321.0 | 312.1 | 332.4 | 326.0 | -1.9 |

| Southern Manitoba | 122.1 | 143.0 | 152.5 | 155.0 | 156.5 | +1.0 |

| Northern Manitoba | 103.6 | 109.3 | 122.6 | 144.0 | 136.7 | -5.0 |

| Regina | 76.8 | 93.7 | 106.6 | 118.0 | 109.0 | -7.6 |

| Saskatoon | 111.3 | 144.1 | 177.0 | 187.0 | 160.2 | -14.3 |

| Southern Saskatchewan | 106.2 | 142.8 | 169.9 | 170.9 | 147.2 | -13.9 |

| Northern Saskatchewan | 143.0 | 192.2 | 217.9 | 225.0 | 208.2 | -7.5 |

| Calgary | 510.1 | 786.2 | 1,057.4 | 917.0 | 716.3 | -21.9 |

| Edmonton | 515.4 | 781.3 | 1,037.9 | 922.1 | 785.2 | -14.8 |

| Northern Alberta | 139.3 | 225.5 | 323.4 | 236.9 | 199.2 | -15.9 |

| Southern Alberta | 342.3 | 569.3 | 739.5 | 579.3 | 470.3 | -18.8 |

| Southern Interior British Columbia | 321.9 | 386.2 | 439.6 | 433.6 | 380.8 | -12.2 |

| Abbotsford | 86.7 | 88.6 | 93.0 | 93.3 | 82.7 | -11.3 |

| Vancouver | 852.0 | 866.0 | 830.6 | 867.7 | 810.7 | -6.6 |

| Victoria | 115.5 | 124.0 | 119.8 | 119.5 | 112.9 | -5.5 |

| Southern Coastal British Columbia | 258.9 | 297.7 | 279.6 | 281.9 | 258.3 | -8.4 |

| Northern British Columbia | 227.9 | 268.6 | 301.6 | 293.4 | 232.7 | -20.7 |

| Yukon2 | 24.0 | 2.7 | n/a | n/a | n/a | n/a |

| Whitehorse2 | 3.2 | 14.3 | 18.4 | 19.0 | 15.9 | -16.0 |

| Yukon (excluding Whitehorse)2 | 3.2 | 9.0 | 8.9 | 8.8 | 9.1 | +3.5 |

| Northwest Territories2 | 24.8 | 3.6 | n/a | n/a | n/a | n/a |

| Yellowknife2 | 1.2 | 7.7 | 10.1 | 9.3 | 10.1 | +7.8 |

| Northwest Territories (excluding Yellowknife)2 | 3.3 | 17.5 | 19.8 | 21.5 | 21.1 | -2.1 |

| Nunavut2 | 12.8 | 1.3 | n/a | n/a | n/a | n/a |

| Iqualuit2 | 0.6 | 2.7 | 3.0 | 4.1 | 3.9 | -5.1 |

| Nunavut (excluding Iqaluit)2 | 1.7 | 12.1 | 14.6 | 19.5 | 17.1 | -12.4 |

| Canada | 15,804.1 | 17,662.0 | 18,461.0 | 18,654.7 | 16,685.3 | -10.6 |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes all claims for which at least $1 of EI benefits was paid.

- 1 Excludes Family caregiver benefits for adults and children due to the incompatibility of administrative data sources.

- 2 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into 2 EI economic regions, 1 consisting of the capital area and the remaining consisting of the non-capital area. Amounts paid were registered in FY1516 in the 4 former EI economic regions in spite of the change in EI economic region boundaries because some claims established just prior to that change had continued to be paid in FY1516.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.5 – Regular benefits

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 63,410 | 67,880 | 55,590 | 62,170 | 66,680 | +7.3 |

| Prince Edward Island | 16,560 | 16,790 | 16,910 | 16,430 | 15,540 | -5.4 |

| Nova Scotia | 60,730 | 62,020 | 62,610 | 63,880 | 61,800 | -3.3 |

| New Brunswick | 68,930 | 72,030 | 70,120 | 70,610 | 68,320 | -3.2 |

| Quebec | 423,840 | 422,200 | 405,460 | 399,080 | 384,500 | -3.7 |

| Ontario | 391,380 | 390,830 | 366,810 | 373,130 | 363,620 | -2.5 |

| Manitoba | 37,280 | 41,810 | 39,310 | 40,230 | 42,610 | +5.9 |

| Saskatchewan | 31,500 | 39,580 | 34,090 | 35,190 | 37,570 | +6.8 |

| Alberta | 105,780 | 167,800 | 141,140 | 112,400 | 127,090 | +13.1 |

| British Columbia | 139,040 | 146,080 | 124,830 | 122,410 | 120,860 | -1.3 |

| Yukon | 1,880 | 1,840 | 1,750 | 1,610 | 1,640 | +1.9 |

| Northwest Territories | 1,680 | 1,550 | 1,740 | 1,760 | 1,580 | -10.2 |

| Nunavut | 600 | 680 | 770 | 810 | 810 | +11.1 |

| Men | 826,410 | 896,610 | 806,660 | 788,880 | 791,220 | +0.3 |

| Women | 516,200 | 534,480 | 514,470 | 510,830 | 501,490 | -1.8 |

| 24 years old and under | 129,700 | 140,640 | 126,880 | 118,750 | 113,780 | -4.2 |

| 25 to 44 years old | 592,390 | 639,540 | 588,420 | 571,930 | 568,800 | -0.5 |

| 45 to 54 years old | 323,840 | 329,800 | 298,500 | 289,420 | 278,900 | -3.6 |

| 55 years old and over | 296,680 | 321,110 | 307,330 | 319,610 | 331,230 | +3.6 |

| Long-tenured workers1 | 261,760 | 380,460 | 329,290 | 310,270 | 294,820 | -5.0 |

| Occasional claimants1 | 776,150 | 742,840 | 706,150 | 699,370 | 700,580 | +0.2 |

| Frequent claimants1 | 304,700 | 307,790 | 285,690 | 290,070 | 297,310 | +2.5 |

| Canada | 1,342,610 | 1,431,090 | 1,321,130 | 1,299,710 | 1,292,710 | -0.5 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 See Annex-2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819p | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 25.8 | 26.0 | 31.8 | 32.7r | 28.4 | -12.9 |

| Prince Edward Island | 22.8 | 23.3 | 23.3 | 23.1r | 22.2 | -3.9 |

| Nova Scotia | 23.1 | 23.7 | 23.3 | 22.7r | 21.8 | -3.8 |

| New Brunswick | 23.8 | 24.0 | 23.6 | 22.4r | 20.4 | -9.2 |

| Quebec | 18.7 | 18.6 | 18.2 | 16.8r | 15.4 | -8.7 |

| Ontario | 19.0 | 18.3 | 18.9 | 17.6r | 16.7 | -5.2 |

| Manitoba | 17.2 | 17.9 | 19.3 | 19.3r | 18.4 | -4.7 |

| Saskatchewan | 18.2 | 18.3 | 24.8 | 26.0r | 22.5 | -13.5 |

| Alberta | 16.4 | 17.4 | 24.5 | 28.5r | 21.3 | -25.2 |

| British Columbia | 18.5 | 18.4 | 20.3 | 19.9r | 17.6 | -11.1 |

| Yukon | 24.2 | 21.6 | 21.0 | 21.7r | 19.4 | -10.8 |

| Northwest Territories | 24.2 | 26.6 | 21.6 | 22.3 | 22.5 | +1.2 |

| Nunavut | 31.4 | 27.0 | 31.2 | 32.8r | 28.2 | -14.1 |

| Men | 19.6 | 19.6 | 20.9 | 20.5r | 18.4 | -10.2 |

| Women | 19.2 | 18.9 | 20.3 | 19.8r | 17.9 | -9.6 |

| 24 years old and under | 17.6 | 17.6 | 18.7 | 17.7r | 16.3 | -8.3 |

| 25 to 44 years old | 18.6 | 18.5 | 19.6 | 19.3r | 17.2 | -10.7 |

| 45 to 54 years old | 19.9 | 19.8 | 21.4 | 20.9r | 18.8 | -9.9 |

| 55 years old and over | 21.3 | 21.1 | 22.9 | 22.5r | 20.3 | -9.7 |

| Long-tenured workers2 | 18.0 | 17.4 | 20.0 | 21.1r | 17.7 | -15.8 |

| Occasional claimants2 | 18.9 | 19.0 | 20.1 | 19.1r | 17.6 | -8.1 |

| Frequent claimants2 | 22.0 | 22.1 | 23.1 | 22.1r | 20.5 | -7.4 |

| Canada | 19.4 | 19.3 | 20.7 | 20.3r | 18.2 | -9.9 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 The reported duration estimates are based on completed claims that included those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 2 See Annex-2.1 for definitions related to EI claimant categories.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 430 | 444 | 434 | 447 | 456 | +1.9 |

| Prince Edward Island | 407 | 419 | 419 | 426 | 433 | +1.5 |

| Nova Scotia | 417 | 423 | 422 | 427 | 433 | +1.5 |

| New Brunswick | 413 | 426 | 430 | 437 | 447 | +2.2 |

| Quebec | 426 | 434 | 440 | 450 | 462 | +2.6 |

| Ontario | 435 | 445 | 454 | 462 | 477 | +3.2 |

| Manitoba | 424 | 438 | 441 | 449 | 456 | +1.5 |

| Saskatchewan | 458 | 472 | 468 | 471 | 481 | +2.0 |

| Alberta | 484 | 495 | 493 | 496 | 507 | +2.1 |

| British Columbia | 434 | 449 | 451 | 459 | 472 | +2.9 |

| Yukon | 478 | 494 | 501 | 500 | 519 | +3.8 |

| Northwest Territories | 498 | 507 | 511 | 527 | 523 | -0.7 |

| Nunavut | 472 | 469 | 486 | 514 | 502 | -2.5 |

| Men | 458 | 470 | 474 | 481 | 493 | +2.4 |

| Women | 395 | 406 | 412 | 419 | 432 | +3.1 |

| 24 years old and under | 405 | 419 | 412 | 416 | 433 | +4.1 |

| 25 to 44 years old | 445 | 458 | 462 | 470 | 481 | +2.3 |

| 45 to 54 years old | 437 | 449 | 454 | 463 | 475 | +2.7 |

| 55 years old and over | 420 | 431 | 435 | 442 | 455 | +3.0 |

| Long-tenured workers2 | 472 | 482 | 489 | 495 | 503 | +1.6 |

| Occasional claimants2 | 420 | 428 | 429 | 437 | 452 | +3.4 |

| Frequent claimants2 | 436 | 446 | 453 | 464 | 477 | +2.7 |

| Canada | 433 | 446 | 449 | 457 | 469 | +2.7 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 See Annex-2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Category | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 666.5 | 749.5 | 822.2 | 953.6 | 799.2 | -16.2 |

| Prince Edward Island | 147.5 | 162.6 | 161.2 | 175.5 | 160.3 | -8.6 |

| Nova Scotia | 534.1 | 603.0 | 595.5 | 642.5 | 595.2 | -7.4 |

| New Brunswick | 640.9 | 712.5 | 703.0 | 729.6 | 632.2 | -13.3 |

| Quebec | 3,115.2 | 3,227.0 | 2,974.1 | 3,043.3 | 2,577.5 | -15.3 |

| Ontario | 3,093.1 | 3,200.8 | 3,069.9 | 3,183.3 | 2,775.9 | -12.8 |

| Manitoba | 277.2 | 338.3 | 352.1 | 386.2 | 371.1 | -3.9 |

| Saskatchewan | 246.3 | 361.3 | 450.8 | 473.3 | 393.0 | -17.0 |

| Alberta | 746.9 | 1,499.9 | 2,274.7 | 1,804.8 | 1,331.3 | -26.2 |

| British Columbia | 1,081.5 | 1,219.0 | 1,217.0 | 1,193.0 | 988.5 | -17.1 |

| Yukon | 22.7 | 18.7 | 18.8 | 18.9 | 16.5 | -12.9 |

| Northwest Territories | 20.5 | 20.2 | 19.3 | 20.8 | 21.4 | +3.0 |

| Nunavut | 9.5 | 9.4 | 11.5 | 15.8 | 11.7 | -25.7 |

| Men | 7,032.7 | 8,253.4 | 8,612.3 | 8,359.3 | 7,072.5 | -15.4 |

| Women | 3,569.3 | 3,868.8 | 4,057.8 | 4,281.2 | 3,601.3 | -15.9 |

| 24 years old and under | 966.1 | 1,153.7 | 1,158.1 | 1,076.1 | 922.7 | -14.3 |

| 25 to 44 years old | 4,603.5 | 5,345.2 | 5,548.9 | 5,449.7 | 4,585.2 | -15.9 |

| 45 to 54 years old | 2,604.6 | 2,844.6 | 2,921.7 | 2,876.7 | 2,335.9 | -18.8 |

| 55 years old and over | 2,427.9 | 2,778.8 | 3,041.3 | 3,238.0 | 2,830.0 | -12.6 |

| Long-tenured workers2 | 2,136.9 | 3,141.1 | 3,681.5 | 3,343.6 | 2,467.4 | -26.2 |

| Occasional claimants2 | 5,735.6 | 6,118.7 | 6,220.2 | 6,272.5 | 5,505.2 | -12.2 |

| Frequent claimants2 | 2,729.5 | 2,862.3 | 2,768.4 | 3,024.4 | 2,701.2 | -10.7 |

| Canada | 10,602.0 | 12,122.2 | 12670.1 | 12,640.5 | 10,673.8 | -15.6 |

- Note: Totals may not add up due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 See Annex-2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.6 – Regular benefits (by industry)

| Industry | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Goods-producing industries | 511,030 | 565,610 | 484,720 | 502,080 | 505,200 | +0.6 |

| Agriculture, forestry, fishing and hunting | 56,880 | 57,360 | 51,910 | 53,760 | 52,440 | -2.5 |

| Mining and oil and gas extraction | 28,900 | 38,250 | 24,430 | 21,340 | 24,980 | +17.1 |

| Utilities | 4,420 | 4,230 | 3,980 | 4,150 | 4,150 | 0.0 |

| Construction | 274,140 | 316,290 | 273,380 | 288,870 | 292,720 | +1.3 |

| Manufacturing | 146,690 | 149,480 | 131,020 | 133,960 | 130,910 | -2.3 |

| Service-producing industries | 748,370 | 821,740 | 762,630 | 764,150 | 764,220 | 0.0 |

| Wholesale trade | 44,050 | 48,240 | 43,600 | 39,790 | 38,920 | -2.2 |

| Retail trade | 72,850 | 83,500 | 76,300 | 79,090 | 69,330 | -12.3 |

| Transportation and warehousing | 56,270 | 67,950 | 59,470 | 60,190 | 62,640 | +4.1 |

| Finance and insurance | 13,820 | 15,500 | 14,080 | 15,020 | 12,630 | -15.9 |

| Real estate and rental and leasing | 18,030 | 20,220 | 18,640 | 17,720 | 18,270 | +3.1 |

| Professional, scientific and technical services | 54,690 | 61,630 | 54,190 | 52,690 | 50,950 | -3.3 |

| Business, building and support services1 | 93,310 | 100,250 | 88,740 | 86,380 | 88,130 | +2.0 |

| Educational services | 146,040 | 156,100 | 153,460 | 157,110 | 163,030 | +3.8 |

| Health care and social assistance | 47,160 | 47,610 | 45,740 | 46,590 | 45,870 | -1.5 |

| Information, culture and recreation2 | 39,470 | 41,320 | 38,030 | 39,080 | 40,250 | +3.0 |

| Accommodation and food services | 58,550 | 63,840 | 60,630 | 63,840 | 63,280 | -0.9 |

| Other services (except public administration) | 40,730 | 45,900 | 42,020 | 40,340 | 42,010 | +4.1 |

| Public administration | 63,400 | 69,680 | 67,730 | 66,310 | 68,910 | +3.9 |

| Unclassified3 | 83,210 | 43,740 | 73,780 | 33,480 | 23,290 | -30.4 |

| Canada | 1,342,610 | 1,431,090 | 1,321,130 | 1,299,710 | 1,292,710 | -0.5 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 2 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- 3 For some claims, this information was not available in the data.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Industry | FY1415 | FY1516 | FY1617 | FY1718r | FY1819p | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Goods-producing industries | 19.1 | 19.3 | 20.7 | 20.1 | 17.9 | -10.9 |

| Agriculture, forestry, fishing and hunting | 21.4 | 21.6 | 22.0 | 22.0 | 20.4 | -7.2 |

| Mining and oil and gas extraction | 20.7 | 20.8 | 23.9 | 26.9 | 21.0 | -21.8 |

| Utilities | 18.5 | 17.6 | 18.4 | 19.3 | 16.4 | -14.6 |

| Construction | 18.1 | 18.4 | 19.6 | 19.3 | 17.3 | -10.4 |

| Manufacturing | 20.0 | 20.0 | 21.9 | 19.8 | 17.8 | -10.4 |

| Service-producing industries | 19.5 | 19.3 | 20.5 | 20.2 | 18.4 | -9.3 |

| Wholesale trade | 23.1 | 22.7 | 23.7 | 23.9 | 21.7 | -9.2 |

| Retail trade | 22.2 | 21.9 | 22.8 | 22.8 | 21.1 | -7.2 |

| Transportation and warehousing | 19.1 | 18.9 | 20.9 | 20.1 | 18.3 | -9.1 |

| Finance and insurance | 24.4 | 23.3 | 24.3 | 24.3 | 23.7 | -2.2 |

| Real estate and rental and leasing | 22.3 | 22.0 | 22.9 | 24.0 | 21.0 | -12.6 |

| Professional, scientific and technical services | 21.2 | 20.9 | 22.7 | 22.4 | 19.5 | -12.8 |

| Business, building and support services2 | 21.3 | 21.2 | 22.0 | 21.4 | 19.6 | -8.1 |

| Educational services | 11.7 | 11.9 | 12.4 | 12.5 | 11.8 | -6.2 |

| Health care and social assistance | 21.2 | 21.0 | 22.3 | 21.4 | 19.7 | -7.7 |

| Information, culture and recreation3 | 20.4 | 20.0 | 20.7 | 20.9 | 18.9 | -9.4 |

| Accommodation and food services | 22.0 | 22.1 | 22.7 | 22.6 | 20.8 | -8.2 |

| Other services (except public administration) | 21.1 | 20.9 | 22.4 | 22.4 | 20.0 | -11.0 |

| Public administration | 20.4 | 20.1 | 21.7 | 22.0 | 20.0 | -9.1 |

| Unclassified4 | 22.4 | 19.7 | 22.8 | 22.9 | 20.8 | -9.2 |

| Canada | 19.4 | 19.3 | 20.7 | 20.3 | 18.2 | -9.9 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 The reported duration estimates are based on completed claims that included those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 2 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 3 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- 4 For some claims, this information was not available in the data.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Industry | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Goods-producing industries | 467 | 480 | 485 | 493 | 503 | +2.1 |

| Agriculture, forestry, fishing and hunting | 416 | 429 | 431 | 441 | 459 | +4.0 |

| Mining and oil and gas extraction | 510 | 522 | 528 | 531 | 541 | +1.8 |

| Utilities | 501 | 516 | 524 | 532 | 538 | +1.3 |

| Construction | 487 | 498 | 505 | 512 | 521 | +1.6 |

| Manufacturing | 439 | 448 | 453 | 464 | 474 | +2.2 |

| Service-producing industries | 413 | 425 | 430 | 434 | 447 | +3.0 |

| Wholesale trade | 424 | 440 | 447 | 449 | 462 | +2.9 |

| Retail trade | 368 | 374 | 386 | 386 | 405 | +4.9 |

| Transportation and warehousing | 403 | 425 | 417 | 420 | 431 | +2.7 |

| Finance and insurance | 445 | 462 | 463 | 481 | 493 | +2.5 |

| Real estate and rental and leasing | 421 | 432 | 440 | 449 | 469 | +4.3 |

| Professional, scientific and technical services | 463 | 479 | 482 | 488 | 497 | +1.7 |

| Business, building and support services2 | 409 | 419 | 422 | 429 | 447 | +4.2 |

| Educational services | 449 | 457 | 466 | 473 | 479 | +1.3 |

| Health care and social assistance | 394 | 402 | 408 | 414 | 423 | +2.1 |

| Information, culture and recreation3 | 401 | 413 | 414 | 418 | 435 | +4.1 |

| Accommodation and food services | 341 | 352 | 355 | 359 | 374 | +4.3 |

| Other services (except public administration) | 394 | 416 | 418 | 422 | 439 | +4.0 |

| Public administration | 437 | 446 | 451 | 460 | 468 | +1.7 |

| Unclassified4 | 412 | 419 | 423 | 427 | 440 | +3.1 |

| Canada | 433 | 446 | 449 | 457 | 469 | +2.7 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 3 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- 4 For some claims, this information was not available in the data.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Industry | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| Goods-producing industries | 4,379.8 | 5,337.1 | 5,397.7 | 5,343.6 | 4,473.4 | -16.3 |

| Agriculture, forestry, fishing and hunting | 500.7 | 520.4 | 515.6 | 578.2 | 496.8 | -14.1 |

| Mining and oil and gas extraction | 238.9 | 445.0 | 448.8 | 310.0 | 274.2 | -11.5 |

| Utilities | 41.1 | 39.1 | 42.2 | 48.2 | 36.4 | -24.6 |

| Construction | 2,376.7 | 2,934.7 | 3,001.5 | 3,113.4 | 2,640.3 | -15.2 |

| Manufacturing | 1,222.4 | 1,397.9 | 1,389.6 | 1,293.7 | 1,025.7 | -20.7 |

| Service-producing industries | 5,656.9 | 6,487.5 | 6,687.7 | 6,998.6 | 5,995.6 | -14.3 |

| Wholesale trade | 421.0 | 497.1 | 515.1 | 492.3 | 402.6 | -18.2 |

| Retail trade | 607.0 | 685.4 | 712.3 | 763.4 | 620.9 | -18.7 |

| Transportation and warehousing | 400.3 | 520.5 | 556.8 | 533.3 | 466.0 | -12.6 |

| Finance and insurance | 155.9 | 166.5 | 177.9 | 193.9 | 155.0 | -20.0 |

| Real estate and rental and leasing | 163.7 | 191.8 | 208.1 | 207.3 | 175.4 | -15.4 |

| Professional, scientific and technical services | 505.4 | 630.5 | 666.4 | 601.1 | 479.4 | -20.2 |

| Business, building and support services2 | 787.0 | 881.9 | 876.9 | 871.4 | 768.8 | -11.8 |

| Educational services | 634.6 | 711.6 | 695.1 | 850.0 | 774.6 | -8.9 |

| Health care and social assistance | 362.2 | 371.2 | 389.6 | 424.0 | 349.6 | -17.5 |

| Information, culture and recreation3 | 318.3 | 336.2 | 337.1 | 377.7 | 324.7 | -14.0 |

| Accommodation and food services | 427.2 | 498.2 | 496.3 | 559.9 | 487.2 | -13.0 |

| Other services (except public administration) | 334.4 | 399.4 | 424.4 | 421.5 | 371.7 | -11.8 |

| Public administration | 539.9 | 597.3 | 631.5 | 702.7 | 619.7 | -11.8 |

| Unclassified4 | 565.3 | 297.6 | 584.7 | 298.4 | 204.8 | -31.4 |

| Canada | 10,602.0 | 12,122.2 | 12,670.1 | 12,640.5 | 10,673.8 | -15.6 |

- Note: Totals may not add up due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 3 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- 4 For some claims, this information was not available in the data.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment)

Annex 2.7.1 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): New claims established

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

| Regional unemployment rate1 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 6.0% and under | 273,380 | 218,020 | 171,350 | 384,230 | 411,230 | +7.0 |

| 6.1% ~ 7.0% | 158,060 | 363,660 | 363,170 | 425,580 | 479,030 | +12.6 |

| 7.1% ~ 8.0% | 329,870 | 279,030 | 299,000 | 134,750 | 129,350 | -4.0 |

| 8.1% ~ 9.0% | 236,460 | 216,290 | 169,290 | 110,860 | 40,770 | -63.2 |

| 9.1% ~ 10.0% | 78,450 | 75,660 | 65,480 | 31,660 | 13,870 | -56.2 |

| 10.1% ~ 11.0% | 55,950 | 50,430 | 35,420 | 7,990 | 36,950 | +362.5 |

| 11.1% ~ 12.0% | 44,380 | 16,740 | 21,420 | 60,140 | 49,040 | -18.5 |

| 12.1% ~ 13.0% | 7,660 | 43,880 | 35,300 | 13,420 | 4,070 | -69.7 |

| 13.1% ~ 14.0% | 470 | 16,910 | 11,350 | 28,240 | 6,980 | -75.3 |

| 14.1% ~ 15.0% | 25,870 | 23,650 | 38,190 | 24,020 | 17,860 | -25.6 |

| 15.1% ~ 16.0% | 25,100 | 31,980 | 25,370 | 10,270 | 24,980 | +143.2 |

| 16.1% or greater | 106,960 | 94,840 | 85,790 | 68,550 | 78,580 | +14.6 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Hours of insurable employment from previous employment | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 420 to 559 | 15,540 | 16,070 | 20,010 | 18,660 | 18,220 | -2.4 |

| 560 to 699 | 48,850 | 51,100 | 56,330 | 47,490 | 41,930 | -11.7 |

| 700 to 839 | 88,530 | 91,000 | 102,770 | 104,810 | 102,040 | -2.6 |

| 840 to 979 | 115,160 | 116,610 | 113,880 | 110,790 | 110,600 | -0.2 |

| 980 to 1,119 | 127,920 | 132,800 | 119,850 | 114,140 | 117,460 | +2.9 |

| 1,120 to 1,259 | 128,290 | 131,700 | 122,760 | 120,710 | 122,190 | +1.2 |

| 1,260 to 1,399 | 117,920 | 126,290 | 113,860 | 114,510 | 114,270 | -0.2 |

| 1,400 to 1,539 | 127,610 | 134,580 | 125,170 | 125,090 | 129,220 | +3.3 |

| 1,540 to 1,679 | 109,360 | 115,230 | 103,540 | 105,730 | 106,130 | +0.4 |

| 1,680 to 1,819 | 109,480 | 119,890 | 103,900 | 106,150 | 107,350 | +1.1 |

| 1,820 or more | 353,950 | 395,820 | 339,060 | 331,630 | 323,300 | -2.5 |

| Canada | 1,342,610 | 1,431,090 | 1,321,130 | 1,299,710 | 1,292,710 | -0.5 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.2 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Average actual duration (number of weeks)

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

| Regional unemployment rate2 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819p | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 6.0% and under | 15.7 | 17.2 | 19.0 | 14.8r | 15.3 | +3.8 |

| 6.1% ~ 7.0% | 18.0 | 15.9 | 18.9 | 17.5r | 15.5 | -11.0 |

| 7.1% ~ 8.0% | 18.2 | 19.2 | 18.9 | 19.9r | 19.1 | -3.9 |

| 8.1% ~ 9.0% | 19.5 | 19.4 | 19.7 | 23.4 | 22.3 | -4.8 |

| 9.1% ~ 10.0% | 19.7 | 19.2 | 21.0 | 22.7r | 23.1 | +2.1 |

| 10.1% ~ 11.0% | 21.4 | 21.3 | 22.9 | 22.5 | 20.4 | -9.6 |

| 11.1% ~ 12.0% | 21.2 | 23.8 | 24.9 | 25.8r | 23.2 | -10.2 |

| 12.1% ~ 13.0% | 23.6 | 19.8 | 24.2 | 30.2r | 28.3 | -6.3 |

| 13.1% ~ 14.0% | 25.1 | 19.7 | 24.0 | 22.5r | 23.6 | +5.0 |

| 14.1% ~ 15.0% | 26.7 | 27.9 | 26.1 | 25.9r | 25.9 | -0.1 |

| 15.1% ~ 16.0% | 28.0 | 26.6 | 28.6 | 26.8r | 25.1 | -6.5 |

| 16.1% or greater | 25.2 | 26.4 | 32.0 | 33.1r | 29.5 | -10.8 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 The reported duration estimates are based on completed claims that included those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 2 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Hours of insurable employment from previous employment | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 420 to 559 | 25.9 | 26.6 | 28.3 | 28.6 | 26.1 | -8.7 |

| 560 to 699 | 20.6 | 20.8 | 21.6 | 22.2r | 20.6 | -7.1 |

| 700 to 839 | 18.8 | 18.5 | 19.2 | 18.7r | 16.7 | -10.5 |

| 840 to 979 | 19.4 | 19.2 | 20.4 | 19.7r | 17.8 | -9.3 |

| 980 to 1,119 | 19.4 | 19.0 | 20.2 | 19.7r | 18.1 | -7.9 |

| 1,120 to 1,259 | 18.5 | 18.4 | 19.6 | 19.3r | 17.6 | -8.6 |

| 1,260 to 1,399 | 18.2 | 17.8 | 19.2 | 18.5r | 17.3 | -6.2 |

| 1,400 to 1,539 | 16.7 | 16.8 | 17.8 | 17.2r | 15.8 | -7.6 |

| 1,540 to 1,679 | 18.4 | 18.3 | 19.4 | 18.9r | 17.2 | -9.4 |

| 1,680 to 1,819 | 19.8 | 19.6 | 21.2 | 20.4r | 18.0 | -11.5 |

| 1,820 or more | 21.2 | 21.1 | 22.8 | 22.7r | 20.0 | -11.6 |

| Canada | 19.4 | 19.3 | 20.7 | 20.3r | 18.2 | -9.9 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 The reported duration estimates are based on completed claims that included those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.3 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Average weekly benefit rate ($)

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

| Regional unemployment rate2 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 6.0% and under | 452 | 452 | 454 | 459 | 471 | +2.8 |

| 6.1% ~ 7.0% | 433 | 456 | 453 | 454 | 472 | +3.9 |

| 7.1% ~ 8.0% | 428 | 439 | 446 | 468 | 466 | -0.5 |

| 8.1% ~ 9.0% | 426 | 443 | 451 | 460 | 476 | +3.4 |

| 9.1% ~ 10.0% | 436 | 427 | 443 | 462 | 491 | +6.1 |

| 10.1% ~ 11.0% | 430 | 447 | 466 | 462 | 474 | +2.5 |

| 11.1% ~ 12.0% | 419 | 481 | 449 | 456 | 459 | +0.8 |

| 12.1% ~ 13.0% | 434 | 448 | 478 | 461 | 472 | +2.3 |

| 13.1% ~ 14.0% | 506 | 442 | 432 | 448 | 457 | +2.2 |

| 14.1% ~ 15.0% | 422 | 431 | 429 | 436 | 443 | +1.4 |

| 15.1% ~ 16.0% | 431 | 433 | 443 | 442 | 456 | +3.2 |

| 16.1% or greater | 429 | 444 | 433 | 445 | 455 | +2.3 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Hours of insurable employment from previous employment | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 420 to 559 | 328 | 340 | 334 | 333 | 342 | +2.8 |

| 560 to 699 | 353 | 369 | 365 | 370 | 382 | +3.3 |

| 700 to 839 | 367 | 379 | 380 | 377 | 388 | +2.9 |

| 840 to 979 | 387 | 397 | 402 | 405 | 421 | +4.0 |

| 980 to 1,119 | 402 | 411 | 417 | 424 | 441 | +3.8 |

| 1,120 to 1,259 | 417 | 427 | 436 | 445 | 457 | +2.6 |

| 1,260 to 1,399 | 434 | 446 | 451 | 462 | 473 | +2.4 |

| 1,400 to 1,539 | 452 | 462 | 472 | 481 | 493 | +2.5 |

| 1,540 to 1,679 | 452 | 463 | 472 | 482 | 493 | +2.3 |

| 1,680 to 1,819 | 457 | 471 | 478 | 488 | 498 | +2.2 |

| 1,820 or more | 478 | 491 | 499 | 505 | 516 | +2.2 |

| Canada | 433 | 446 | 449 | 457 | 469 | +2.7 |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.4 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Amount paid ($ million)

For accessibility reasons, the table has been simplified. Consult the PDF version for the full table.

| Regional unemployment rate2 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 6.0% and under | 2,848.1 | 4,089.6 | 1,381.8 | 2,329.3 | 2,931.4 | +25.9 |

| 6.1% ~ 7.0% | 1,855.8 | 2,836.0 | 3,092.1 | 3,453.9 | 3,341.8 | -3.2 |

| 7.1% ~ 8.0% | 2,661.5 | 1,572.8 | 2,511.9 | 1,751.9 | 1,135.3 | -35.2 |

| 8.1% ~ 9.0% | 461.9 | 727.7 | 2,022.7 | 1,367.9 | 599.1 | -56.2 |

| 9.1% ~ 10.0% | 534.0 | 526.8 | 539.5 | 527.8 | 186.0 | -64.7 |

| 10.1% ~ 11.0% | 444.9 | 194.9 | 337.2 | 275.9 | 287.9 | +4.3 |

| 11.1% ~ 12.0% | 112.5 | 294.4 | 282.4 | 522.9 | 590.9 | +13.0 |

| 12.1% ~ 13.0% | 24.8 | 60.8 | 460.1 | 350.0 | 54.3 | -84.5 |

| 13.1% ~ 14.0% | 227.4 | 235.3 | 165.6 | 275.9 | 118.5 | -57.0 |

| 14.1% ~ 15.0% | 379.2 | 378.3 | 345.7 | 364.1 | 232.6 | -36.1 |

| 15.1% ~ 16.0% | 604.6 | 459.2 | 295.1 | 205.9 | 207.4 | +0.7 |

| 16.1% or greater | 447.4 | 746.2 | 1,235.9 | 1,215.2 | 988.7 | -18.6 |

- Note: Totals may not add up due to rounding. Totals include amounts paid for claims where data on hours of insurable employment are missing. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

| Hours of insurable employment from previous employment | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| 420 to 559 | 127.2 | 144.0 | 175.8 | 207.5 | 169.7 | -18.2 |

| 560 to 699 | 361.1 | 380.7 | 437.8 | 460.8 | 351.5 | -23.7 |

| 700 to 839 | 592.5 | 625.3 | 720.0 | 812.3 | 679.4 | -16.4 |

| 840 to 979 | 829.4 | 879.3 | 917.6 | 946.5 | 823.6 | -13.0 |

| 980 to 1,119 | 931.0 | 1,001.5 | 1,002.1 | 1,015.7 | 900.8 | -11.3 |

| 1,120 to 1,259 | 903.0 | 985.0 | 1,001.8 | 1,065.4 | 927.8 | -12.9 |

| 1,260 to 1,399 | 851.0 | 931.2 | 950.8 | 999.5 | 875.9 | -12.4 |

| 1,400 to 1,539 | 872.5 | 976.4 | 996.0 | 1,037.2 | 932.5 | -10.1 |

| 1,540 to 1,679 | 836.3 | 932.8 | 958.5 | 973.3 | 830.0 | -14.7 |

| 1,680 to 1,819 | 924.4 | 1,075.4 | 1,107.4 | 1,076.9 | 915.2 | -15.0 |

| 1,820 or more | 3,373.4 | 4,190.5 | 4,401.8 | 4,045.4 | 3,267.2 | -19.2 |

| Canada | 10,602.0 | 12,122.2 | 12,670.1 | 12,640.5 | 10,673.8 | -15.6 |

- Note: Totals may not add up due to rounding. Totals include amounts paid for claims where data on hours of insurable employment are missing. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.8 – Regular benefits (by Employment Insurance economic region)

| EI economic region | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | Change (%)

FY1718 to FY1819 |

|---|---|---|---|---|---|---|

| St. John’s | 10,550 | 12,290 | 12,510 | 12,900 | 11,510 | -10.8 |

| Newfoundland – Labrador | 52,860 | 55,590 | 43,080 | 49,270 | 55,170 | +12.0 |

| Prince Edward Island1 | 6,940 | n/a | n/a | n/a | n/a | n/a |

| Charlottetown1 | 2,320 | 4,070 | 4,420 | 3,820 | 3,730 | -2.4 |

| Prince Edward Island (excluding Charlottetown)1 | 7,300 | 12,720 | 12,490 | 12,610 | 11,810 | -6.3 |

| Eastern Nova Scotia | 22,110 | 22,420 | 22,580 | 23,760 | 24,190 | +1.8 |

| Western Nova Scotia | 26,450 | 27,000 | 26,950 | 27,020 | 24,810 | -8.2 |

| Halifax | 12,170 | 12,600 | 13,080 | 13,100 | 12,800 | -2.3 |

| Fredericton-Moncton-Saint-John | 19,230 | 20,920 | 19,800 | 20,180 | 19,270 | -4.5 |

| Madawaska-Charlotte | 11,370 | 11,240 | 10,700 | 10,940 | 10,840 | -0.9 |

| Restigouche- Albert | 38,330 | 39,870 | 39,620 | 39,490 | 38,210 | -3.2 |

| Gaspésie-Île-de-la Madeleine | 23,830 | 24,740 | 24,990 | 25,180 | 24,030 | -4.6 |

| Québec | 34,200 | 33,750 | 31,470 | 32,950 | 30,760 | -6.6 |

| Trois-Rivières | 8,620 | 8,430 | 7,930 | 7,820 | 7,550 | -3.5 |

| South Central Quebec | 8,160 | 7,480 | 7,900 | 6,820 | 6,820 | 0.0 |

| Sherbrooke | 9,210 | 8,230 | 7,990 | 8,000 | 7,690 | -3.9 |