Annual report of the Canada Pension Plan for fiscal year 2018 to 2019

On this page

- Fiscal year 2018 to 2019 at a glance

- Canada Pension Plan in brief

- Beneficiaries and benefits

- Benefit protection provisions

- Other features

- CPP enhancement

- International social security agreements

- Collecting and recording contributions

- Services to contributors and beneficiaries

- Appeals process

- Ensuring program integrity

- Ensuring financial sustainability

- Financial accountability

- Other expenses

- Looking to the future

- Canada Pension Plan consolidated financial statements

- List of tables

- List of figure

- List of acronyms

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

Her Excellency

The Governor General of Canada

May it please Your Excellency,

We have the pleasure of submitting the Annual Report of the Canada Pension Plan for the fiscal year 2018 to 2019.

Respectfully,

The Honourable William Francis Morneau

Minister of Finance

The Honourable Deb Schulte

Minister of Seniors

Note:

The following is the Annual Report of the Canada Pension Plan for the 2018 to 2019 fiscal year. This page is written to reflect the state of affairs as at March 31st, 2019.

Fiscal year 2018 to 2019 at a glance

The maximum pensionable earnings of the Canada Pension Plan (CPP) increased from $55,900 in 2018 to $57,400 in 2019. The contribution rate for the base CPP remained unchanged at 9.9%. The CPP enhancement began its 7-year phase-in on January 1, 2019, with a contribution rate of 0.3%, for a combined contribution rate of 10.2%.

CPP contributions totalled $51.2 billion this year.

This year, 5.9 million CPP beneficiaries were paid, representing a total annual benefit value of $46.5 billion of which:

- 5.2 million CPP retirement pensioners were paid $36.2 billionFootnote 1 and 1.4 million post-retirement beneficiaries were paid $553 million

- 1.1 million surviving spouses or common-law partners and 63,000 children of deceased contributors were paid $4.8 billion

- 340,000 people with disabilities and 83,000 of their children were paid $4.6 billion

- 166,000 death benefits totaling $377 million were paid

Operating expenses amounted to $1.8 billion, or 3.96% of the $46.5 billion in benefits

As at March 31, 2019, total CPP net assets were valued at $397 billion, of which $392 billion is managed by the CPP Investment Board

Note:

Figures above have been rounded. A beneficiary may receive more than one type of benefit.

Canada Pension Plan in brief

Employees in Canada over the age of 18 contribute either to the CPP or to its sister plan, the Quebec Pension Plan (QPP).

The CPP is managed jointly by the Government of Canada and Canada’s provincial governments. Quebec manages and administers its own comparable plan, the QPP, and participates in decision-making for the CPP. Benefits under either plan are based on pension credits accumulated under both plans.

As of January 1, 2019, the Plan consists of 2 components: the base (or original) component which began in 1966, and the enhanced component, which serves as a top-up to the base and began in 2019. (More details are available in the section Enhancement of the Canada Pension Plan, later in this report.)

For more information on the QPP, visit Retraite Québec.

Contributions

The CPP is financed through mandatory contributions from employees, employers and those who are self-employed, and through the revenue earned on CPP investments.

Workers start contributing to the Plan at age 18.Footnote 2 As shown in Table 1, the first $3,500 of annual earnings is exempted from contributions. Contributions are then made on earnings between $3,500 and $57,400, which is the earnings ceiling for 2019.

As of January 1, 2019, employees contribute at a rate of 5.10% (4.95% to the base CPP and 0.15% to the CPP enhancement), and employers match that with equal contributions. Self-employed individuals contribute at the combined rate for employees and employers of 10.2% (9.9% to the base and 0.3% to the enhancement) on net business income, after expenses.

While many Canadians associate the CPP with retirement pensions, the CPP also provides disability, death, survivor, children’s and post-retirement benefits. The CPP administers the largest long-term disability plan in Canada. It pays monthly benefits to eligible contributors with a disability and also to their dependent children.

Most benefit calculations are based on how much and for how long a contributor has paid into the CPP. With the exception of the post-retirement benefit, benefits are not paid automatically—everyone must apply.

| CPP contributions | Amount |

|---|---|

| Year’s maximum pensionable earnings (YMPE) | $57,400.00 |

| Year’s basic exemption (YBE) | $3,500.00 |

| Year’s maximum contributory earnings | $53,900.00 |

| Year’s maximum employee / employer contribution (5.1% each) | $2,748.90 |

| Year’s maximum self-employed person’s contribution (10.2%) | $5,497.80 |

Beneficiaries and benefits

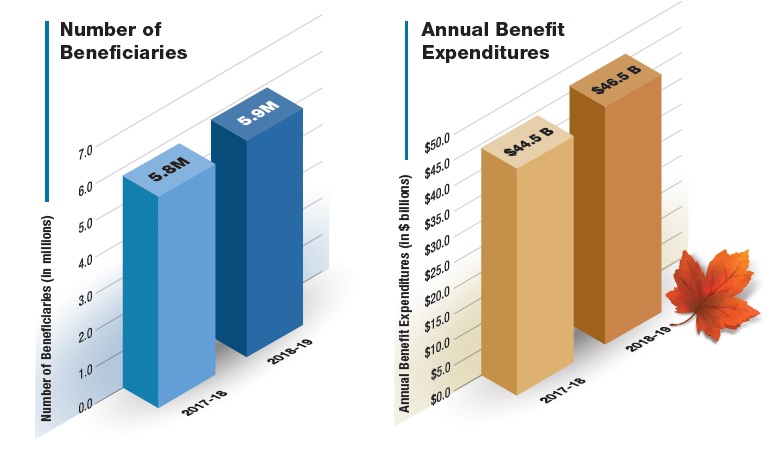

Given the aging of our population, the number of people receiving CPP benefits has increased steadily over the past decade. As a result, expenditures on benefits have also increased.

Figure 1 shows the increase in beneficiaries and expenditures between fiscal year 2017 to 2018 and fiscal year 2018 to 2019:

Text description of Figure 1: CPP: Beneficiaries and benefit expenditures by fiscal year

Text description of drawing 1:

Number of beneficiaries (in millions)

| Fiscal year | Number of beneficiaries (in millions) |

|---|---|

| 2017 to 2018 | 5.8 |

| 2018 to 2019 | 5.9 |

Text description of drawing 2:

Benefit expenditures (in $ billions)

| Fiscal year | Benefit expenditures (in $ billions) |

|---|---|

| 2017 to 2018 | 44.5 |

| 2018 to 2019 | 46.5 |

Figure 2 shows the percentage of expenditures by type of benefit

Text description of Figure 2

| Benefit type | Percentage of expenditures |

|---|---|

| Retirement (less net overpayments) | 77.8 |

| Disability | 9.8 |

| Survivor | 10.3 |

| Post-retirement | 1.2 |

| Death | 0.8 |

Drawing 2

| Benefit type | Percentage of expenditures |

|---|---|

| Disability (including post-retirement Disability) | 93.0 |

| Dependent children of contributors with disabilities | 7.0 |

| Benefit type | Percentage of expenditures |

|---|---|

| Survivor | 95.6 |

| Dependent children of deceased contributors | 4.4 |

Note: Numbers may not add up to 100% due to rounding.

Retirement benefits

The CPP provides 2 retirement benefits: the CPP retirement pension and the post-retirement benefit for individuals who continue to work and contribute while collecting the retirement pension. In fiscal year 2018 to 2019, retirement benefits (retirement pensions and post-retirement benefitsFootnote 3) represent 79.0% ($36.8 billion) of the total benefit amount paid out ($46.5 billion) by the CPP.

Retirement pensions

The monthly retirement pension is the CPP’s primary benefit. To begin receiving a retirement pension, the applicant must have made at least 1 valid contribution to the Plan and must have reached the age of 60. The amount of contributors’ retirement pensions depends on how much and for how long they have contributed and at what age they begin to receive their pension.

In fiscal year 2018 to 2019, the CPP paid a total of $36.2 billionFootnote 4 in retirement pensions to 5.2 million pensioners. In January 2019, the maximum monthly retirement pension at age 65 was $1,154.58. The average monthly payment in 2018 to 2019 was $580.68.

Adjustments for early and late receipt of a retirement pension

Canadians are living longer and healthier lives, and the transition from work to retirement is increasingly diverse. The CPP offers flexibility for older workers who are making the transition to retirement.

CPP contributors can choose when to start receiving their retirement pension based on their individual circumstances and needs. Contributors have the flexibility to take their retirement pension earlier or later than the standard age of 65. To ensure fair treatment of contributors and beneficiaries, those who take their retirement pension after age 65 receive a higher amount. This adjustment reflects the fact that these beneficiaries will, on average, make contributions to the CPP for a longer period of time but receive their benefits for a shorter period of time. Conversely, those who take their retirement pension before age 65 receive a reduced amount, reflecting the fact that they will, on average, make contributions to the CPP for a shorter period of time but receive their benefits for a longer period of time.

Retirement pension taken before age 65

For individuals who start receiving their retirement pension before age 65, the amount of their pension is permanently reduced by 0.6% per month. This means that a contributor who starts receiving a retirement pension at age 60 receives an annual retirement pension which is 36% less than if it were taken at age 65.

Retirement pension taken after age 65

For individuals who start receiving their retirement pension after age 65, the amount of their pension is permanently increased by 0.7% per month that they delay. This means that a contributor who delays receiving a retirement pension until age 70 receives an annual retirement pension that is 42% higher than if it were taken at age 65.

Table 2 shows the maximum monthly retirement payments in 2019 for pensions taken between the ages of 60 and 70 based on actuarial adjustment factors.

| Maximum monthly retirement pension before age 65 (0.6% adjustment reduction per month) | Maximum monthly retirement pension at age 65 | Maximum monthly retirement pension after age 65 (0.7% adjustment increase per month) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 |

| $739 | $822 | $905 | $988 | $1,071 | $1,155 | $1,252 | $1,349 | $1,446 | $1,543 | $1,640 |

| -36% | -28.8% | -21.6% | -14.4% | -7.2% | No adjustment | +8.4% | +16.8% | +25.2% | +33.6% | +42% |

Note: Numbers above have been rounded and calculated at the date the beneficiary turns the age referred to in the table (for example, at age 60 and 0 months).

Post-retirement benefits

The post-retirement benefit allows CPP retirement pension beneficiaries who keep working to increase their retirement income by continuing to contribute to the CPP, even if they are already receiving the maximum CPP retirement pension.

For Canadians between the ages of 60 and 64 who receive a CPP or QPP retirement pension and work outside of Quebec, the CPP contributions toward the post-retirement benefit are mandatory, while those between the ages of 65 and 70 who receive the retirement pension while working can choose whether to continue contributing. No contributions are made after age 70. Contributions toward a post-retirement benefit do not increase the amount of other CPP benefits and they do not determine eligibility for CPP benefits, other than the post-retirement disability benefit.

For a working beneficiary, each year of contributions results in a post-retirement benefit, which is payable the following year. It is added to any previously earned post-retirement benefits. The amount of these benefits increases with the cost of living and is payable until the death of the contributor.

In fiscal year 2018 to 2019, 1.4 million CPP retirement pensioners received a total of $553 million in post-retirement benefits. The maximum monthly benefit amount at age 65 in fiscal year 2018 to 2019, for a single post-retirement benefit, was $28.86. The average monthly payment in fiscal year 2018 to 2019, for a single post-retirement benefit, was $13.39.

Disability benefits

The CPP provides 3 disability benefits: the monthly CPP disability pension provided to working-age contributors with sufficient recent contributions who have a severe and prolonged disability; the new post-retirement disability benefit provided to retirement pension recipients under the age of 65 who meet the same disability criteria; and a flat rate benefit provided to the dependent children of disabled beneficiaries.

In fiscal year 2018 to 2019, a total of $4.6 billion in benefits was paid to 340,000 disabled beneficiaries and to 83,000 children of disabled beneficiaries. These benefits represented approximately 10% of the total benefits paid out by the CPP in fiscal year 2018 to 2019.

The disability pension includes a monthly flat-rate, which was $496.36 in 2019. It also includes an earnings-related portion, which is 75% of the retirement pension that would have been earned had the contributor not become disabled. In 2019, the maximum disability pension was $1,362.30 per month. The average monthly payment in fiscal year 2018 to 2019 was $922.61.

The post-retirement disability benefit, introduced in 2019, is a monthly flat-rate that is provided in addition to the individual’s retirement pension. The value of the post-retirement disability benefit is equal to the flat-rate component of the disability pension ($496.36 in 2019).

The benefit paid to dependent children of disabled beneficiaries is a flat-rate. In 2019, the amount was $250.27 per month. To be eligible, children must be under 18 years of age or under 25 and in full-time attendance at school or university.

Survivor benefits

The CPP provides 3 survivor benefits: the monthly survivor’s pension, the flat-rate child’s benefit and the one-time, lump-sum death benefit. In fiscal year 2018 to 2019, survivor benefits represented 11.1% ($5.2 billion) of the total benefits paid out by the CPP.

Survivor’s pensions are paid to the surviving spouse or common-law partner of a contributor who made sufficient contributions to the Plan. The benefit amount varies depending on a number of factors, including the deceased’s contributions to the Plan, the age of the surviving spouse or common-law partner and whether the survivor also receives other CPP benefits. As of 2019, survivor’s pensions are no longer reduced for childless survivors who are not disabled and were under the age of 45 at the time of the contributor’s death. Dependent children of deceased contributors may also be eligible for children’s benefits. In fiscal year 2018 to 2019, there were 1.1 million survivors and 63,000 children of deceased contributors receiving benefits.

There are special rules used to combine the CPP survivor’s pension with either the retirement or disability pension resulting in a single combined benefit. The maximum survivor’s pension for those under age 65 was $626.63 per month in 2019. This included a flat-rate portion of $193.66 and an earnings-related portion, which is 37.5% of the deceased contributor’s retirement pension. The maximum monthly amount at age 65 and over was $692.75, consisting of 60% of the deceased contributor’s retirement pension. For fiscal year 2018 to 2019, the average monthly payment for all survivor pensions was $336.24.

The benefit paid to dependent children of deceased contributors is a flat-rate. In 2019, the amount was $250.27 per month. To be eligible, children must be under 18 years of age or under 25 and in full-time attendance at school or university.

The CPP death benefit is a lump-sum payment provided to the estate of the contributor. Prior to 2019, the death benefit amounted to 6 times the amount of the deceased contributor’s monthly retirement pension, up to a maximum of $2,500. However, as of January 1, 2019, the value of the death benefit is no longer based on earnings and is a flat-rate of $2,500. In fiscal year 2018 to 2019, the average death benefit payment was $2,316.77.

Benefit summary

Table 3 below summarizes the maximum and average monthly amounts paid to beneficiaries by benefit type.

| Benefit type | Maximum monthly amount for 2019 | Average monthly amount (in fiscal year 2018 to 2019) |

|---|---|---|

| Retirement pension | $1,154.58* | $580.68 |

| Post-retirement benefit | $28.86* | $13.39 |

| Disability pension | $1,362.30 | $922.61 |

| Survivor’s pension - 65 and over | $692.75 | $317.87 |

| Survivor’s pension - younger than 65 | $626.63 | $412.98 |

| Death benefit (one-time payment) | $2,500.00 | $2,316.77 |

*at age 65

For up-to-date information on CPP amounts, refer to the CPP/OAS Quarterly Report.

Benefit protection provisions

The CPP includes provisions that help to compensate for periods when individuals may have relatively low or no earnings. Under the base CPP, dropping periods of low or no earnings from the calculation of average earnings increases the amount of one’s CPP benefit. The enhanced component of the CPP also provides similar protection by means of “drop-in” provisions that credit individuals with earnings in certain circumstances.

General drop-out

In the base component of the CPP, the general drop-out provision helps to offset periods of low or no earnings due to unemployment, schooling or other reasons. Up to 17% of a person’s contributory period with the lowest earnings, representing a maximum of 8 years, can be dropped from the benefit calculation. This increases the benefit amount for most people.

Over-65 drop-out

In the base component of the CPP, the over-65 drop-out provision allows periods of relatively low earnings before age 65 to be replaced by higher earnings after age 65. It may help to increase the benefit amounts of individuals who continue to work and make CPP contributions after reaching age 65, but do not yet receive the CPP retirement pension.

The value of the enhanced component of CPP benefits is based on an individual’s best 40 years of earnings. This calculation largely duplicates the effects of the general drop out and over-65 drop-out. For example, it means that the 7 years with the lowest earnings will be excluded from the calculation of the benefit for an individual who contributed to the enhancement between the ages of 18 and 65. Similarly, an individual who continues to work and contribute after age 65 will be able to use those earnings to determine the value of their benefit, replacing earlier years with lower earnings.

Child rearing provision

In the base component of the CPP, the child rearing drop-out provision excludes from the calculation of benefits the periods during which contributors remained at home, or reduced their participation in the workforce, to care for children under the age of 7. Every month until the child reaches 7 years of age can be excluded from the benefit calculation for a contributor who is eligible for this provision. In addition to increasing the amount of benefits, this provision may also assist those applying for survivor or disability benefits in meeting the contributory requirements for eligibility.

In the enhanced component of the CPP, the child rearing drop-in provision will provide credits to the parents of young children who remained at home or reduced their participation in the labour force to care for children under the age of 7. Specifically, a credit dropped in for every year in which the parent provides care for a child under 7 years of age, if this credit is higher than the parent’s actual earnings in that year. The value of the credit is based on the parent’s earnings in the 5 years before the adoption or birth of a child. These dropped in credits will increase the parent’s average earnings, which will increase the value of the enhanced component of their CPP benefits.

Disability exclusion and disability drop-in

In the base component of the CPP, periods during which individuals are disabled in accordance with the CPP legislation are not included in their contributory period. This ensures that individuals who are not able to pursue any substantially gainful work are not penalized.

In the enhanced component of the CPP, individuals who become disabled in 2019 or later will have a credit "dropped in" for the months that they are disabled in accordance with the CPP legislation. The value of the credit is based on the individual’s earnings in the 6 years before becoming disabled. These credits will be used to calculate the individual’s retirement pension or any subsequent survivor’s pension.

Other features

The CPP also includes many progressive features that recognize family and individual circumstances. These features include pension sharing, credit splitting, portability and indexation.

Pension sharing

Pension sharing allows spouses or common-law partners who are together and receiving their CPP retirement pensions to share a portion of each other’s pensions. This feature also allows 1 pension to be shared between them even if only 1 person has contributed to the Plan. The amount that is shared depends on the time the couple has lived together and their joint CPP contributory period. Pension sharing affords a measure of financial protection to the lower-earning spouse or common-law partner. Also, while it does not increase or decrease the overall pension amount paid, it may result in tax savings. Each person is responsible for any income tax that may be payable on the pension amount they receive.

Credit splitting

When a marriage or common-law relationship ends, the CPP credits accumulated by the couple during the time they lived together can be divided equally between them, if requested by or on behalf of either spouse or common-law partner. This is called “credit splitting.” Credits can be split even if only 1 partner contributed to the Plan. Credit splitting may increase the amount of CPP benefits payable, or even create eligibility for benefits. It may also reduce the amount of benefits for 1 of the former partners. Credit splitting permanently alters the Record of Earnings, even after the death of a former spouse or common-law partner.

Portability

No matter how many times workers change jobs, and no matter in which province they work, CPP and QPP coverage is uninterrupted.

Indexation

CPP payments are indexed to the cost of living. Benefit amounts are adjusted in January of each year to reflect increases in the Consumer Price Index published by Statistics Canada. As CPP beneficiaries age, the value of their CPP benefit is protected against inflation.

CPP enhancement

The Government of Canada worked with the provinces and territories to strengthen the retirement income system by enhancing the CPP. Following the signing of a historic agreement in principle by Canada’s Ministers of Finance, the CPP enhancement took effect on January 1, 2019

The CPP enhancement was designed to complement the base, or original, CPP. It serves as a top-up to the original part of the Plan, which first began in 1966. The CPP enhancement was designed to be fully funded, which means that benefits under the enhancement will build up gradually over time as individuals work and make contributions. Each year of contributions to the enhanced CPP will allow workers to accrue partial additional benefits. Fully enhanced benefits will generally become available after about 40 years of making contributions

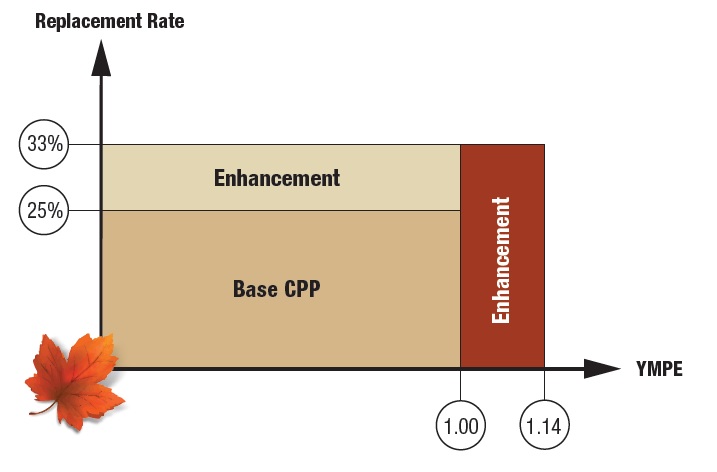

As illustrated in Figure 3, the fully enhanced CPP retirement pension will replace one-third of a contributor’s eligible average earnings, up from one-quarter today. The upper limit of eligible earnings covered by the CPP will also increase by 14%. Together, these changes once fully implemented will increase the maximum retirement pension by about 50%

The enhancement will not affect eligibility for CPP benefits or the amount of benefits that individuals are already receiving. Individuals who do not work and do not contribute to the CPP in 2019 or later will not be affected by the enhancement

Text description of Figure 3: Illustration of enhancement replacement rate

Figure 3 is a visual illustration of the CPP enhancement, showing that it is comprised of 2 components and how those components interact with the base CPP. The first component sits above the base CPP and increases the replacement rate from 25% to 33% over the same range of earnings. The second component provides 33% income replacement on earnings above the year’s maximum pensionable earnings (YMPE), up to 1.14% of the YMPE.

The enhancement will also increase post-retirement benefits as well as disability and survivor’s pensions based on an individual’s contributions.

Contributions under the CPP enhancement

The enhancement’s implementation is being phased in over the next 7 years.

The changes to contributions are illustrated in Figure 4 and include the following key elements:

- the CPP contribution rate that is applied to the current eligible earnings range (from $3,500 to the upper limit, which is set at $57,400 in 2019) will increase by 2 percentage points compared to the base CPP. This means the contribution rate will gradually increase to 11.9% by 2023 (shared equally by employers and employees, while self-employed individuals contribute at the full rate)

- in 2024, workers will begin contributing on an additional range of earnings. This range will start at the current earnings limit, called the Year’s Maximum Pensionable Earnings (YMPE), and will extend to a new limit which is 14% higher by 2025, phased in over 2 years. The contribution rate on earnings in this new range will be 8% (shared equally by employers and employees, with self-employed individuals contributing at the full rate)

Text description of Figure 4: Illustration of phase-in of contributions

Figure 4 is a visual illustration of the 2-step phase-in of the CPP enhancement and the increased contributions and how that interacts with the base CPP. The first step will gradually increase the contribution rate by 2% over 5 years, from 2019 to 2023, on the same earnings covered by the base CPP. When fully phased-in, this will result in a combined contribution rate of 11.9% on these earnings. The second step will introduce a new contribution rate of 8% on earnings above the YMPE, up to 114% of the YMPE. This new range will be phased in over 2 years, in 2024 and 2025.

* Office of the Chief Actuary projection

More information on the CPP enhancement is available by visiting the Canada Pension Plan Enhancement page.

International social security agreements

Many individuals have lived or worked in Canada and in other countries. Consequently, Canada has entered into social security agreements with other countries to help people in Canada and abroad to qualify for CPP benefits and pensions from partner countries. Further, social security agreements enable Canadian companies and their employees who are sent to work temporarily outside of Canada to continue to contribute to the CPP and eliminate the need to contribute to the social security program of the other country for the same work.

As of March 31, 2019, Canada has concluded social security agreements with 60 countries, of which 59 are in force (see Table 4). Negotiations towards social security agreements are ongoing with many other countries. Canada has concluded social security agreements with the following countries:

| Country name | Date of agreement |

|---|---|

| Antigua and Barbuda | January 1, 1994 |

| Australia | September 1, 1989 |

| Austria | November 1, 1987 |

| Barbados | January 1, 1986 |

| Belgium | January 1, 1987 |

| Brazil | August 1, 2014 |

| Bulgaria | March 1, 2014 |

| Chile | June 1, 1998 |

| China* | January 1, 2017 |

| Croatia | May 1, 1999 |

| Cyprus | May 1, 1991 |

| Czech Republic | January 1, 2003 |

| Denmark | January 1, 1986 |

| Dominica | January 1, 1989 |

| Estonia | November 1, 2006 |

| Finland | February 1, 1988 |

| France | March 1, 1981 |

| Germany | April 1, 1988 |

| Greece | May 1, 1983 |

| Grenada | February 1, 1999 |

| Hungary | October 1, 2003 |

| Iceland | October 1, 1989 |

| India | August 1, 2015 |

| Ireland | January 1, 1992 |

| Israel* | September 1, 2003 |

| Italy | January 1, 1979 |

| Jamaica | January 1, 1984 |

| Japan | March 1, 2008 |

| Jersey and Guernsey | January 1, 1994 |

| Korea | May 1, 1999 |

| Latvia | November 1, 2006 |

| Lithuania | November 1, 2006 |

| Luxembourg | April 1, 1990 |

| Malta | March 1, 1992 |

| Mexico | May 1, 1996 |

| Morocco | March 1, 2010 |

| Netherlands | October 1, 1990 |

| New Zealand | May 1, 1997 |

| North Macedonia (Republic of) | November 1, 2011 |

| Norway | January 1, 1987 |

| Peru | March 1, 2017 |

| Philippines | March 1, 1997 |

| Poland | October 1, 2009 |

| Portugal | May 1, 1981 |

| Romania | November 1, 2011 |

| Saint Lucia | January 1, 1988 |

| Saint Vincent and the Grenadines | November 1, 1998 |

| Serbia | December 1, 2014 |

| Slovak Republic | January 1, 2003 |

| Slovenia | January 1, 2001 |

| Spain | January 1, 1988 |

| St. Kitts and Nevis | January 1, 1994 |

| Sweden | January 1, 1986 |

| Switzerland | October 1, 1995 |

| Trinidad and Tobago | July 1, 1999 |

| Turkey | January 1, 2005 |

| United Kingdom* | April 1, 1998 |

| United States of America | August 1, 1984 |

| Uruguay | January 1, 2002 |

*The social security agreements with China, Israel and the United Kingdom provide an exemption from the obligation to contribute to the social security system of the other country for employers and their employees temporarily posted abroad. These agreements do not contain provisions concerning eligibility for pension benefits.

In addition, a social security agreement has been signed with Albania. It will enter into force once legal procedures have been completed in both countries.

Collecting and recording contributions

All CPP contributions are remitted to the Canada Revenue Agency (CRA). The CRA also assesses and verifies earnings and contributions, advises employers and employees of their rights and responsibilities, conducts audits and reconciles reports and T4 slips. To verify that contributory requirements are met, the CRA applies a compliance and enforcement process that can vary from a computerized data match to an on-site audit.

As of March 31, 2019, the CRA reported that there are 1,783,991 employer accounts. In fiscal year 2018 to 2019, the CRA conducted 45,281 examinations to promote compliance with the requirements to withhold, report and remit employer source deductions. For fiscal year 2018 to 2019, employers and employees account for approximately 95% of contributions, and the remaining 5% comes from the self-employed. In fiscal year 2018 to 2019, contributions amounted to $51.2 billion.

Services to contributors and beneficiaries

Within Employment and Social Development Canada (ESDC), Service Canada is the Government of Canada’s one-stop service delivery network. In partnership with other departments, it provides Canadians with easy access to a growing range of government programs and services.

In fiscal year 2018 to 2019, Service Canada continued its efforts to ensure that eligible Canadians are receiving public pension benefits to which they are entitled, and to encourage them to actively plan and prepare for their own retirement. Information on the CPP is available on the Internet, by phone, in person at Service Canada Centres and through scheduled and community outreach.

Service Canada promotes the use of online services through:

- targeted mailing of inserts, including seasonal mailing such as at tax-filing season

- messaging added to correspondence to Canadians

- messaging promoted through the Government of Canada website

- messaging provided by telephone through its pensions call centre network or by employees providing information in person at Service Canada Centres

Service Canada continues to advance its e-service agenda through enhancements in the online My Service Canada Account. CPP clients can easily access their personal information securely online. My Service Canada Account provides a single point of access for people to apply for a CPP retirement pension. In fiscal year 2018 to 2019, approximately 135,000 people, (representing 43% of all applications) applied for their CPP retirement pension online.

Using My Service Canada Account, CPP clients can make enquiries, conduct transactions and, if they live in Canada, update their mailing address, telephone numbers and direct deposit information online. CPP clients can also view and print copies of their tax slips for the current year and the previous 6 years, view and print an official copy of their Statement of Contributions view the last 2 years of their payments, print a benefit attestation letter, apply for a Federal Voluntary Tax Deduction and add, modify or delete their consent to communicate information related to an authorized person to act on their behalf. More information is available by visiting the Service Canada page.

Service Canada continues to implement a comprehensive CPP Service Improvement Strategy where Canadians will increasingly have more user-friendly electronic services and benefit from faster resolution of issues.

Processing benefits

Service Canada continues to deliver the CPP through a network of 10 processing centres located across the country. In fiscal year 2018 to 2019, Service Canada:

- processed over 7.3 million transactions, including 1.6 million transactions to put clients into pay for the first time and to renew benefits and another 5.7 million benefit adjustments/account revisions

- made over 69 million payments valued at $46.5 billion to approximately 5.9 million beneficiaries, including $4.6 billion to 423,000 CPP disability beneficiaries

- supported more than 135,000 Canadians to apply for CPP retirement benefits online and fully automated the adjudication of more than 920,000 new post-retirement benefits

- answered 2.4 million CPP and Old Age Security enquiries through its specialized call centre agents and resolved 3.1 million calls through its interactive voice response system

The timely payment of CPP benefits remains a priority. Overall, Service Canada aims to pay eligible clients their CPP retirement pension within their first month of entitlement with an objective of achieving this 90% of the time. In fiscal year 2018 to 2019, the Department exceeded this objective and put 96% of clients in pay for their first month of entitlement (see Table 5).

Following a comprehensive review, the Department implemented, in October 2016, the new and revised Canada Pension Plan disability service standards for speed and timeliness aimed at supporting client-centric service delivery. Since their implementation, the service standards have represented a significant commitment to enhance the delivery of Canada Pension Plan disability, particularly for people with a terminal illness or a grave condition (see Table 5).

Fiscal year 2018 to 2019 processing results

Application for Canada Pension Plan disability benefits

- Service Canada’s goal is to make a decision on applications for a Canada Pension Plan disability benefits within 120 calendar days of receiving a complete application. Service Canada aims to meet this standard 80% of the time (revised from 75% prior to October 2016)

- In fiscal year 2018 to 2019, Service Canada met this standard 63% of the time, and the average processing time was 102 calendar days, well below the 120 calendar day commitment

Canada Pension Plan disability benefit benefits for applicants with a terminal illness

- Service Canada’s goal is to make a decision for applicants with a terminal illness within 5 business days of receiving a complete terminal illness application. Service Canada aims to meet this standard 95% of the time. This service standard reflects the unique circumstances of terminally ill clients

- In fiscal year 2018 to 2019, Service Canada met this standard 91% of the time, and the average processing time was 4 business days, below the 5 business day commitment

Canada Pension Plan disability benefits for applicants with a grave condition

- Service Canada’s goal is to make a decision for applicants with a grave condition within 30 business days of receiving a complete application. Service Canada aims to meet this standard 80% of the time. This service standard reflects the unique circumstances of clients with a grave condition

- Service Canada prioritized processing these requests and met this standard 84% of the time. The average processing time was 24 calendar days, below the 30 business day commitment

Canada Pension Plan disability benefit reconsiderations

- Service Canada’s goal is to make a decision within 120 calendar days of receiving a reconsideration request. Service Canada aims to meet this standard 80% of the time (revised from 70% prior to October 2016)

- Service Canada met this standard 70% of the time, and the average processing time was 109 calendar days, below the 120 calendar day commitment

| Service standard | National objective | Fiscal year 2018 to 2019 national results | Average processing time |

|---|---|---|---|

| CPP retirement benefit applications Pay benefits within the first month of entitlement |

90% | 96% | 23 calendar days |

| CPP disability benefit applications Initial disability decisions are made within 120 calendar days of receiving a complete application |

80% | 63% | 102 calendar days |

| CPP disability benefit for applicants with a terminal illness Decisions for applicants with a terminal illness are made within 5 business days of receiving a complete terminal illness application |

95% | 91% | 4 business days |

| CPP disability benefit for applicants with a grave medical condition Decisions for applicants with a grave condition are made within 30 calendar days of receiving a complete application |

80% | 84% | 24 calendar days |

| CPP disability benefit reconsiderations Decisions on reconsideration requests are made within 120 calendar days of receiving the reconsideration request |

80% | 70% | 109 calendar days |

Appeals process

Clients who are not satisfied with the Minister’s reconsideration decisions pertaining to CPP benefits may appeal to the Social Security Tribunal of Canada (SST).

The SST is an independent administrative tribunal that makes quasi-judicial decisions on appeals related to the Canada Pension Plan, the Old Age Security Act and the Employment Insurance Act.

The SST is divided into 2 separate divisions: the General Division and the Appeal Division. The General Division is composed of 2 different sections: Income Security (CPP and OAS) and Employment Insurance.

The General Division Income Security is responsible for hearing new CPP appeals, and the Appeal Division hears appeals from the General Division.

General division income security

In fiscal year 2018 to 2019, the General Division Income Security Section received 2,233 new appeals related to CPP benefits. As of March 31, 2019, the General Division Income Security Section concluded 2,875 appeals related to CPP benefits.Footnote 5

Appeal division

In fiscal year 2018 to 2019, the Appeal Division received 272 appeals of decisions from the General Division Income Security Section related to CPP benefits. As of March 31, 2019, the Appeal Division concluded 370 appeals related to CPP benefits.Footnote 6

Ensuring program integrity

To ensure the accuracy of benefit payments, the security and privacy of personal information and the overall quality of service, ESDC continues to enhance the efficiency, accuracy and integrity of its operations.

Meeting the expectations of Canadians—that government services and benefits are delivered to the right person, for the right amount, for the intended purpose and at the right time while ensuring responsible stewardship of program funds and protecting personal information—is a cornerstone of ESDC’s service commitment. Enhanced and modernized integrity-related activities within the CPP are essential to meeting these expectations and ensuring the public’s trust and confidence in the effective management of this program.

Integrity-related activities detect and correct existing incorrect payments, reduce program costs by preventing incorrect payments and identify systemic impediments to clients receiving their correct and full benefit entitlement. These activities consist of risk based analysis measures, which ensure that appropriate and effective controls are in place and that the causes of incorrect payments are identified and mitigated. Integrity-related activities also make use of modern analytical techniques to improve business intelligence and ensure that errors and fraud are managed throughout the program’s life cycle.

As part of its effort to address overpayment situations, ESDC conducts reviews of benefit entitlements and investigations to address situations in which clients are suspected of receiving benefits to which they are not entitled. Through the recovery of overpayments and prevented future incorrect payments, these activities resulted in $15.5 million in accounts receivable as overpayments and prevented an estimated $11.7 million from being incorrectly paid in fiscal year 2018 to 2019. A further estimated $70.4 million has been prevented from being incorrectly paid for future years after fiscal year 2018 to 2019. The recovered overpayments are credited to the CPP, thereby helping to maintain the long term sustainability of the Plan.

The mitigation of risks associated with false or inaccurate claims regarding the true identity of an individual or an organization is fundamental to the integrity of the CPP program.

This is why the Department has a sound Identity Management Policy aimed at establishing and implementing integrated and consistent practices for the management of clients’ identity across multiple service delivery channels (in person, phone, mail and online). It aims to enhance program integrity while safeguarding and streamlining identity management processes. Under this policy, clients know what is expected from them when asked to confirm their identity. A consistent approach to identity management enhances data integrity and quality, improves security and the protection of personal information, and enhances the service experience for clients by reducing errors and eliminating inefficiencies, which could impact wait times for benefits.

Ensuring financial sustainability

As joint stewards of the CPP, Canada’s Ministers of Finance review the CPP’s financial state every 3 years and make recommendations as to whether benefits and/or contribution rates should be changed. This process is referred to as the CPP triennial review. The Ministers of Finance base their recommendations on a number of factors, including the results of an examination of the CPP by the Chief Actuary of Canada. The Chief Actuary is required under the legislation to produce an actuarial report on the CPP every 3 years (in the first year of the legislated ministerial triennial review of the Plan). The CPP legislation also provides that, upon request from the federal Minister of Finance, the Chief Actuary prepares an actuarial report any time a Bill is introduced in the House of Commons that has, in the view of the Chief Actuary, a material impact on the estimates in the most recent triennial actuarial report. This reporting ensures that the long-term financial implications of proposed Plan changes are given timely consideration by the Ministers of Finance.

Changes to the CPP legislation governing the level of benefits or the rate of contributions and changes to the Canada Pension Plan Investment Board Act can be made only through an Act of Parliament. Any such changes also require the agreement of at least two-thirds of the provinces, representing at least two-thirds of the population of all the provinces. The changes come into force only after a notice period, unless all of the provinces waive this requirement, and only after provinces have provided formal consent to the changes by way of Orders in Council. Quebec participates in decision-making regarding changes to the CPP legislation to ensure a high degree of portability of QPP and CPP benefits across Canada.

Funding approach

When it was introduced in 1966, the CPP was designed as a pay-as-you-go plan with a small reserve. This meant that the benefits for one generation would be paid largely from the contributions of later generations. This approach made sense under the demographic and economic circumstances of the time, due to the rapid growth in wages and labour force participation as well as the low rates of return on investments. However, demographic and economic developments, as well as changes to benefits and an increase in disability claims in the following 3 decades, resulted in significantly higher costs. Starting in the mid-1980s, the finances of the CPP came under increasing pressure as assets declined and increases in contribution rates became necessary. In 1993, it was projected that the pay-as-you-go rate would be 14.2% by 2030 and that the reserve fund would be depleted by 2015. Continuing to finance the CPP on a pay-as-you-go basis would have meant imposing a heavy financial burden on the future Canadian workforce. This was deemed unacceptable by the federal and provincial governments.

Amendments were therefore made in 1997 to gradually raise the level of CPP funding. Changes were implemented to: increase the contribution rates over the short term; reduce the growth of benefits over the long term; and invest cash flows not needed to pay benefits in the financial markets through the new CPP Investment Board (CPPIB) in order to achieve higher rates of return. A further amendment was included to ensure that any increase in benefits or new benefits provided under the CPP would be fully funded. The reform package agreed to by the federal and provincial governments in 1997 included:

- the introduction of steady-state funding – This replaced pay-as-you-go financing to build a reserve of assets and stabilize the ratio of assets to expenditures over time. According to the most recent triennial actuarial report on the CPP, the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015, the level of assets under steady-state funding is projected to stabilize at a level equal to about 6 years of expenditures until 2030, then gradually grow to about 7 years. Investment income from this pool of assets will help pay benefits as the large cohort of baby boomers retires. Steady-state funding is based on a constant contribution rate that finances the CPP without the full-funding requirement for increased or new benefits;

- the introduction of incremental full funding – This means that changes to the CPP that increase or add new benefits are fully funded. In other words, benefit costs are paid as benefits are earned, and any costs associated with benefits that are already earned and not paid for are amortized and paid for over a defined period of time, consistent with common actuarial practice. The sum of the steady-state and full funding rates is the minimum contribution rate required to fund the CPP. The minimum contribution rate was determined to be 9.79% for 2019 and thereafter in the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015.

If, at any time, the minimum contribution rate is higher than the legislated contribution rate, and if the Ministers of Finance do not recommend either to increase the legislated rate or maintain it, then automatic provisions would be triggered to sustain the CPP. An increase in the legislated rate would be phased in over 3 years, and benefit indexation would be suspended until the following triennial review.

The dual funding objectives for the CPP of steady-state and full funding were introduced to improve fairness across generations. The move to steady-state funding eases some of the contribution burden on future generations. Under full funding, each generation that receives benefit enrichments is more likely to pay for them in full and not pass on the cost to future generations.

In keeping with the dual funding nature of the Plan, the new enhanced portion of the CPP will be fully funded in order to ensure fairness across generations. The CPP enhancement, which commenced in 2019, is designed so that the new legislated additional contributions along with projected investment income will be sufficient to fully pay the projected benefits. The Chief Actuary determines the additional minimum contribution rates required to meet this objective. Regulations describing how the minimum rates are determined for the CPP enhancement have been formulated. These regulations, together with those for determining the minimum rates for the core or “base” CPP (the CPP prior to 2019), are provided in the Calculation of Contribution Rates Regulations, 2018, which were pre-published in the Canada Gazette.Footnote 7

Regulations concerning what happens if the CPP enhancement is not sustainable under the legislated additional contribution rates have been formulated in the Additional Canada Pension Plan Sustainability Regulations, which were also pre-published in the Canada GazetteFootnote 8. These new regulations will apply only in the event that the additional minimum contribution rates deviate to a certain extent from their respective legislated rates and no action is taken by the Ministers of Finance to address the deviation.

Both the Calculation of Contribution Rates Regulations, 2018 and the Additional Canada Pension Plan Sustainability Regulations will come into force once formal consent is received from all the provinces.

Actuarial reporting on the financial state of the CPP

The most recent triennial actuarial report on the CPP, the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015, prepared by the Office of the Chief Actuary (OCA), was tabled by the federal Minister of Finance in Parliament on September 27, 2016. This report was in respect of the base component of the CPP only, since the CPP enhancement had not yet commenced.

According to the financial projections of this triennial actuarial report, the annual amount of contributions paid by Canadians into the base component of the CPP is expected to exceed the annual amount of benefits paid out until 2020 inclusive, and to be less than the amount of benefits thereafter.

Funds not immediately required to pay benefits are to be transferred to the CPPIB for investment. Assets under the base component of the CPP are expected to accumulate rapidly over the following decades and, over time, will help pay for benefits as more and more baby boomers begin to collect their retirement pensions. In 2021 and thereafter, as baby boomers continue to retire and benefits paid begin to exceed contributions, investment income from the accumulated assets will provide the funds necessary to make up the difference. However, contributions will remain the main source of funding for benefits.

The report confirms that the current contribution rate of 9.9% is expected to remain sufficient, along with projected investment income, to financially sustain the base component of the Plan over the long term.

A panel of 3 independent Canadian actuaries, selected by the United Kingdom Government Actuary’s Department (GAD) through an arm’s length process, reviewed the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015. The external panel’s findings confirmed that the work performed by the OCA on the Report met all statutory requirements. The OCA also met all professional standards of practice, except that the study on the determination of the actuarial adjustment factors, mentioned in the Report, should have been published at the same time as the Report. The study on the actuarial adjustment factors has since been publishedFootnote 9. The external panel also stated that the assumptions and methods used for the Report were reasonable.

In addition to these main conclusions, the panel made a number of recommendations regarding the preparation and review of future actuarial reports. The GAD affirmed that the reviewers carried out a sufficiently thorough review and that the work was adequate and reasonable. As a result, Canadians can have confidence in the results of the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015 and the conclusions reached by the Chief Actuary about the long-term financial sustainability of the base component of the Plan.

A supplemental report, the Twenty-eighth Actuarial Report supplementing the Twenty-seventh Actuarial Report on the Canada Pension Plan as at 31 December 2015, was tabled in Parliament on October 28, 2016. This report was prepared by the Chief Actuary to show the effect of the Additional CPP Account introduced under Bill C-26 (An Act to amend the Canada Pension Plan, the Canada Pension Plan Investment Board Act and the Income Tax Act) which enacted the CPP enhancement and came into force on March 3, 2017. The report confirms that the legislated first additional contribution rate of 2.0% and second additional contribution rate of 8.0% are sufficient, along with projected investment income, to fully pay the projected expenditures of the CPP enhancement over the long term.

In addition, a subsequent supplemental report, the Twenty-ninth Actuarial Report supplementing the Twenty-seventh and Twenty-eighth Actuarial Reports on the Canada Pension Plan as at 31 December 2015, was tabled in Parliament on May 1, 2018. This supplemental report was prepared by the Chief Actuary to show the long-term financial implications of changes to CPP benefits as proposed under Bill C-74 – Budget Implementation Act, 2018, No. 1, introduced in Parliament on March 27, 2018, and given Royal Assent on June 21, 2018. These reforms were agreed to in principle by Canada’s Ministers of Finance in December 2017 as part of the 2016 to 2018 Triennial Review of the Plan. The supplemental report confirms that the changes would not require increases to the legislated contribution rates. These reforms were unanimously approved by the provincial governments and took effect in 2019 when the CPP enhancement began.

The next triennial actuarial report on the CPP, which will report on the financial state of each of the Plan’s components (the base and CPP enhancement) as of December 31, 2018, is due by December 2019.

To view the CPP’s actuarial reports, reviews and studies, visit the Office of the Chief Actuary.

Financial accountability

The CPP uses the accrual basis of accounting for revenues and expenditures. This method gives administrators a detailed financial picture and allows accurate matching of revenue and expenditures in the year in which they occur.

CPP accounts

Two separate accounts, the CPP Account and the Additional CPP Account, have been established in the accounts of the Government of Canada to record the financial elements of the base CPP and the enhanced CPP respectively (such as contributions, interest, earned pensions and other benefits paid, as well as administrative expenditures). The CPP accounts also record the amounts transferred to, or received from, the CPPIB. Spending authority, as per sections 108(4) and 108.2(4) of the CPP legislation, is limited to the CPP net assets, which includes both accounts. It is important to note, however, that funds cannot be transferred between accounts such that the base CPP will be wholly funded from the CPP Account, while the enhancement will be funded from the Additional CPP Account. The CPP assets are not part of the federal government’s revenues and expenditures.

In keeping with An Act to amend the Canada Pension Plan and the Canada Pension Plan Investment Board Act, which came into force on April 1, 2004, the CPPIB is responsible for investing the remaining funds after the CPP operational needs have been met. The CPP Accounts’ operating balances are managed by the Government of Canada.

CPP investment board

Created by an Act of Parliament in 1997, the CPP Investment Board (CPPIB) is a professional investment management organization with a critical purpose to help provide a foundation on which Canadians build financial security in retirement. The CPPIB invests the assets of the CPP not currently needed to pay pension, disability and survivor benefits.

The CPPIB is accountable to Parliament and to Canada’s Ministers of Finance. However, the CPPIB is governed independently from the CPP and operates at arm’s length from governments. The CPPIB’s legislated mandate is to maximize investment returns without undue risk of loss. In doing so, it is required to act in the best interest of contributors and beneficiaries, and take into account the factors that may affect the funding of the CPP and its ability to meet its financial obligations.

The CPPIB is headquartered in Toronto with offices in Hong Kong, London, Luxembourg, Mumbai, New York, São Paulo and Sydney.

For more information on the CPPIB’s mandate, governance structure and investment policy, visit the Canada Pension Plan Investment Board.

CPP assets and cash management

Pursuant to section 108.1 of the Canada Pension Plan and an administrative agreement between the CPP and the CPPIB, amounts not required to meet specified obligations of the CPP are transferred weekly to the CPPIB in order to gain a better return. The cash flow forecasts of the CPP determine the amount to be transferred to or from the CPPIB, and these forecasts are updated regularly.

ESDC continues to work closely with the CPPIB, various government departments and banks to coordinate these transfers and manage a tightly controlled process. A control framework is in place to ensure that the transfer process is followed correctly and that all controls are effective. For instance, ESDC obtains confirmation at all critical transfer points and can therefore monitor the cash flow from one point to the next.

CPP net assets

As at March 31, 2019, the CPP net assets totalled $397.0 billion. The Government of Canada held $5.0 billion of these assets to meet CPP pensions, benefits and operating expenses obligations. The remaining $392.0 billion is managed by the CPPIB. In terms of net assets, the CPP Fund ranks as one of the world’s largest retirement funds.

For the 10-year period ending March 31, 2019, the Fund held by the CPPIB had an annualized net nominal rate of return of 11.1%. Over that 10-year period, the CPPIB has contributed $239.0 billion in cumulative net income to the Fund, after all CPPIB costs.

Investing for our future

In 2006, the CPPIB made the strategic decision to move progressively away from largely index-based investments towards the more active selection of investments in order to capitalize on its comparative advantages. The CPPIB benefits from the CPP Fund’s exceptionally long investment horizon, certainty of assets and scale. It has also developed a world-class investment team, which is complemented with top-tier external partners that support its internal capabilities. The CPPIB takes a disciplined, prudent, long-term approach to managing the total portfolio.

In managing the Fund, the CPPIB pursues a diverse set of investment programs that stabilize performance and contribute to the long-term sustainability of the CPP. The CPPIB ensures that the Fund has both asset and geographic diversification to make the Fund more resilient to single-market volatility. In order to build a diversified portfolio of CPP assets, the CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. The CPPIB’s investments have become increasingly international, benefitting from positive global growth in the world’s largest investment markets, and having greater resiliency during periods of slow growth within specific regions.

CPP investment board reporting

The CPPIB reports its financial performance on a quarterly and annual basis. Legislation requires the CPPIB to hold public meetings every 2 years in each province, excluding Quebec, which operates the separate QPP.

The purpose of these meetings is for the CPPIB to present its most recent annual report and to provide the public with the opportunity to ask questions about the policies, operations and future plans of the CPPIB.

Other expenses

CPP expenses consist of pensions and benefits paid, operating expenses and benefit overpayments as detailed in the CPP Consolidated Statement of Operations for the year ended March 31, 2019.

Operating expenses

CPP operating expenses of $1.841 billion in fiscal year 2018 to 2019 represent 3.96% of the $46.5 billion in benefits paid. Table 6 presents the CPP’s operating expenses for the last 2 years.

| Department/Agency/Crown Corporation | Fiscal year 2018 to 2019 (In millions of dollars) | Fiscal year 2017 to 2018 (In millions of dollars) |

|---|---|---|

| CPP Investment Board (CPPIB)* | 1,203 | 1,053 |

| Employment and Social Development Canada | 378 | 369 |

| Canada Revenue Agency | 207 | 190 |

| Treasury Board Secretariat | 32 | 33 |

| Administrative Tribunals Support Service of Canada | 13 | 14 |

| Public Services and Procurement Canada | 5 | 6 |

| Office of the Superintendent of Financial Institutions (where the Office of the Chief Actuary is housed)/Finance Canada | 3 | 3 |

| Total | 1,841 | 1,668 |

*The operating expenses for the CPPIB do not include the transaction costs and investment management fees since these are presented as part of net investment income (loss). For more details, refer to "Canada Pension Plan Consolidated Statement of Operations" and in the Financial Statements of the CPPIB’s Annual report.

Overpayment of benefits

Consistent with its mandate to manage the CPP effectively, ESDC has procedures in place to detect benefit overpayments. During fiscal year 2018 to 2019, overpayments totalling $91 million were detected, $88 million in overpayments were recovered and debts of $37 million were forgiven. The above figures represent a net decrease of $34 million in the accounts receivable for the year.

Looking to the future

While workers need to apply in order to receive their CPP retirement pension, some eligible seniors either apply late or not at all and miss out on receiving their retirement pensions. To help Canadian workers receive the full value of the pension to which they contributed, the CPP is introducing measures starting in 2020 to proactively enroll CPP contributors who are 70 years old or older but who have not yet applied to receive their retirement pension.

Since some Canadians may prefer not to receive a CPP retirement pension—as it could reduce federal and provincial income-tested benefits—this measure will also extend the window to cancel receipt of the retirement pension period from 6 months to 12 months. This will ensure that Canadians who choose not to receive a CPP retirement pension are not disadvantaged by proactive enrollment.

The Canada Pension Plan is reviewed by Ministers of Finance every 3 years to ensure that it continues to meet the evolving needs of Canadians. The 2019 to 2021 Triennial Review will begin in late 2019, following the tabling of the Thirtieth Actuarial Report on the Canada Pension Plan as at December 31, 2018.

Canada Pension Plan consolidated financial statements

View the Canada Pension Plan consolidated financial statements for the year ended March 31, 2019.

List of tables

- Table 1: CPP contributions for 2019

- Table 2: Maximum monthly retirement pension payments between the ages of 60 and 70 for 2019

- Table 3: Monthly payments by benefit type

- Table 4: Social security agreements

- Table 5: Canada Pension Plan (CPP) service standards

- Table 6: CPP Operating Expenses for fiscal year 2018 to 2019 and for fiscal year 2017 to 2018

List of figures

List of acronyms

- CPP

- Canada Pension Plan

- CPPIB

- Canada Pension Plan Investment Board

- CRA

- Canada Revenue Agency

- ESDC

- Employment and Social Development Canada

- GAD

- Government Actuary’s Department

- OAS

- Old Age Security

- OCA

- Office of the Chief Actuary

- QPP

- Quebec Pension Plan

- SST

- Social Security Tribunal of Canada

- YBE

- Year’s basic exemption

- YMPE

- Year’s maximum pensionable earnings