Counting Change: A Measurement Plan for the National Financial Literacy Strategy 2021-2026

Counting Change: A Measurement Plan for the

National Financial Literacy Strategy 2021-2026

A Call to Action to Collectively Monitor and Measure the Impact of the National Financial Literacy Strategy

To “Make Change that Counts” we need to figure out what works, and what does not work. To improve financial outcomes for Canadians, we must commit to measuring impact and meaningfully “Counting Change”.

The National Financial Literacy Strategy Measurement Plan guides you, the financial ecosystem stakeholder, through basic steps you can use to measure the impact of your financial literacy activities through the lens of the National Strategy.

Collectively counting change will lead to change that counts.

Why Do We Need to Measure?

The National Financial Literacy Strategy 2021-2026 is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways.

The ultimate goal of the National Strategy is financial resilience. Resilience is not a standalone outcome. In order to build resilience, Canadians need a financial ecosystem that works for them, and helps them build the skills, capacity, and behaviours that lead to financial resilience. The Strategy is focused on how financial literacy stakeholders—from government, community groups, non-profit organizations, or industry—can work together to reduce barriers, catalyze actions, and help consumers develop key building blocks so that we can collectively help Canadians achieve positive financial outcomes.

Underlying the Strategy is an evidence-based approach grounded in research and collaboration between all ecosystem stakeholders. Stakeholders like you can advance the Strategy by using measurable, outcome-driven initiatives combined with partnerships and cooperation, as well as increased investment in initiatives that have been proven to work. The National Strategy provides a roadmap to guide you in supporting this ambition and to help focus our combined efforts.

To understand the impact of our collective efforts, we need to find ways to associate your initiatives to changes in consumers’ financial outcomes. Traditionally, national surveys have been used to monitor trends at a population level, but they are limited in connecting changes in consumers' financial outcomes to stakeholders' efforts. In other words, we need to measure, both at the initiative-level and at the national level, what works to help Canadians achieve good financial outcomes, such that we scale that which does, and refine or stop that which does not.

This Measurement Plan is intended to define progress measures that we can all use to assess success against the outcomes of the National Strategy. It presents Strategy-Aligned Measures (SAMs) which are metrics that can provide direct and clear evidence of progress towards each of the 23 specific Target Outcomes and Key Consumer Building Blocks of the Strategy. These measures will be collected and updated regularly, will be made available to all stakeholders, and will be used to track high-level indicators of progress where possible.

The National Financial Literacy Strategy Measurement Plan will:

- Help identify and track indicators and progress towards achieving the outcomes of the National Financial Literacy Strategy

- Help gain collective agreement about how best to improve and evaluate the financial outcomes and resilience of Canadians

- Help stakeholders in the Financial Ecosystem scale the impact of their financial literacy initiatives

The importance of this Measurement Plan

The Strategy focuses on the ecosystem priorities and target outcomes needed to monitor progress and drive change, while the Measurement Plan will help FCAC and ecosystem stakeholders track impact.

As we implement the Strategy, it is crucial that we measure whether our implementation efforts are successful and use that understanding to refine our approach such that we may maximize our collective impact. Measures help us to define the current landscape, track progress and identify challenges, and set clear goals for the future.

The Strategy and associated Measurement Plan are intended to leverage the many strengths of stakeholders across the country to help gain collective agreement about how to evaluate and improve the financial resilience of Canadians, and to provide a platform through which our efforts can gain increased visibility, traction, and success.

The Measurement Plan is intended as an actionable guide to enable you to:

- Understand how to participate in advancing the National Strategy

- Take precise next steps aligned with your particular focus and situation

- See how your actions result in tangible outcomes and impact, and benefit your organizational goals

The Measurement Plan at a Glance

Figure 1: What Steps Can You Take?

Welcome, Stakeholder! You and your initiative are about to embark on a journey of outcomes measurement. Before you hit the road, this is what the journey could look like. Although the journey is designed for both new and existing initiatives, we encourage you to include measurement in the earliest phase of initiative development. When you are ready, jump to the starting point that looks most relevant to your initiative. Return to this map whenever you need to re-orient yourself. Bon Voyage.

Text version: Figure 1, What steps can you take?

Process description

Step 1. Decide which one of the following three scenarios describes you?

- Scenario 1. Use Strategy-Aligned Measures (SAMs). If you have an initiative and want to measure its impact to show that the intended outcomes have been achieved, then proceed to step 2 "Do you have measures already?".

- Scenario 2. Share your results. If you have an initiative, and have measured its impact, then proceed to step 5 "You have measured your initiative using SAMs?”.

- Scenario 3. Need some guidance? Consider reading the sections on "Why do we need to measure?" and “How can I contribution to the National Strategy”. If you are still unsure after reading them, reach out to FCAC at fcac.research-recherche.acfc@fcac-acfc.gc.ca

Step 2. Do you have measures already?

- If yes, then proceed to step 3 "Do your measures align with the Strategy?"

- If no, then proceed to either one of the following two:

- Step 2.1. Co-create with FCAC or others

- Step 2.2. Use existing measures from the Measures Library

Step 2.1. Co-create with FCAC or others

- Read sections "What should we be measuring" and "How to Make a Strategy-Aligned Measure (SAM)" before creating measures

- Upon completion, proceed to step 4 "Share your measures with FCAC using the Intake Form"

Step 2.2. Use existing measures from the Measures Library

- Read section "What should we be measuring" and adopt suitable measures

- Upon completion, proceed to step 4 "Share your measures with FCAC using the Intake Form"

Step 3. Do your measures align with the Strategy?

- If yes, then proceed to step 4 "Share your measures with FCAC using the Intake Form "

- If you are unsure about whether your measures align with the strategy, then read the section "How to Make a Strategy-Aligned Measure (SAM)" if you have not already done so, and revise your measures if necessary. Upon completion, proceed to step 4 "Share Strategy-Aligned-Measures with FCAC"

Step 4. Share your measures with FCAC using the Intake Form

- Read "BOX 1: Two Ways to Use SAMs" and share your measures with FCAC using the Intake Form

- Upon completion, proceed to step 5 “You have measured your initiative using SAMs?”

- Submitted measures that qualify as SAMs are included in the Measures Library for public viewing

Step 5. You have measured your initiative using SAMs?

- If yes, then proceed to step 6 “Share your SAMs and results with FCAC using the Intake Form”

- If no, then read the section “How to Make a Strategy-Aligned Measure (SAM)” for future initiatives

Step 6. Share your SAMs and results with FCAC using the Intake Form

- Read the section in the Measurement Plan titled "Step 3: Share your Organization’s Results" and share your SAMs and results with FCAC using the Intake Form

- Upon completion, proceed to step 7

Step 7. FCAC curates results from all stakeholders and distills them into high-level indicators to be profiled on the National Financial Literacy Strategy Dashboard for public viewing

- Read the section in the Measurement Plan titled "Step 3: Share your Organization’s Results" if you have not already done so

- Upon completion, stop

Measurements Aligned with the National Strategy’s Priorities

What Should We Be Measuring?

This Measurement Plan provides ecosystem stakeholders like you with an actionable guide to measure our collective progress towards achieving the outcomes of the National Strategy (see Annex II for the list of target outcomes). By using a guided and outcomes-based approach to measurement, we can ensure that we are measuring the true impact of our actions towards achieving the goals of the National Financial Literacy Strategy.

To be useful, measurements must be meaningful, applicable, and easy to understand. Importantly, they should align with at least one of the Strategy’s outcomes, be reliable over time, and lead to results that answer the intended questions. Every ecosystem stakeholder, regardless of size, can participate by embedding the right measurements into their initiatives and by using their expertise to help advance some of the outcomes.

Here are the steps you can follow:

Step 1: Use Strategy-Aligned Measures within initiatives

Step 2: Include key demographic and vulnerability questions within initiatives

Step 3: Share your initiatives, Strategy-Aligned Measures, and results with FCAC

Step 4: Reach out to FCAC or potential collaborators to identify next steps

Step 1: Use Strategy-Aligned Measures

Strategy-Aligned Measures (SAMs) are metrics that allow us to assess progress against the target outcomes of the Strategy. Typically, SAMs are questions embedded within initiatives/activities (see Annex I for examples). They can be directed at individual consumers or stakeholders and can be questions that are answered through many different types of stakeholder activities such tracking behaviours in apps or counting products and services tailored to vulnerable groups. They can, but do not need to, be questions that are answered directly by the consumer (e.g., via surveys or focus groups).

For details on How to Make a Strategy-Aligned Measure (SAM) see below and BOX 1: Two Ways to Use SAMs.

By definition, SAMs elicit results that are aligned with a specific target outcome of the Strategy. SAMs embedded within initiatives can help directly assess the impact of the initiative on the intended audience (either consumers or other financial ecosystem stakeholders). In other words, the data gathered from each SAM ought to provide the clearest and most direct evidence of progress (or failure—which is every bit as important!) toward the target outcome. The following is an example of a SAM that could be embedded within many kinds of initiatives (e.g., interventions, surveys, apps, courses, webinars, focus groups):

- Priority 1 (Communicate in ways people understand)

- Outcome 1 (More Canadians understand the key facts about financial products and services that are available to them)

- Example SAM: “True or false? Credit card protection insurance will always cover the outstanding balance on your credit card if your claim is approved.”

Correct answer: false

- Example SAM: “True or false? Credit card protection insurance will always cover the outstanding balance on your credit card if your claim is approved.”

- Outcome 1 (More Canadians understand the key facts about financial products and services that are available to them)

The answer to this question helps to directly determine whether ecosystem stakeholders have communicated effectively, or in other words, communicated key facts regarding credit card protection insurance in ways consumers understand. When combined with demographic and vulnerability information (see step 2), we can further glean if communication to specific groups of consumers requires additional work to enhance understanding. For instance, younger people or newcomers who are less familiar with these products may need tailored information to achieve the same level of comprehension.

Note that a given SAM could apply to more than one outcome. For example, the same SAM about credit card protection insurance could also be embedded in an initiative that addresses priority 6, target outcome 3 (More Canadians understand their rights and responsibilities when dealing with the financial services industry). Similarly, a SAM that assesses mortgage providers’ communication to consumers about key facts on homebuying (priority 1, target outcome 1) could also measure homebuyers’ skills, capacity, and behaviours that are essential to their financial resilience (see the Tracking Key Consumer Building Blocks as Measures of Impact section below).

To sufficiently assess the impact of your initiative against a certain target outcome, you are encouraged to use as many SAMs as necessary. For example, to measure priority 1, target outcome 2 (More Canadians understand which financial products and services are appropriate for their own situation and goals), asking consumers “Did you compare credit cards from more than one provider?” followed by “Did you compare them on X (e.g., product features or prices)?” will provide more accurate results. By asking two questions, your results will reflect the number of consumers who knowingly selected a credit card that suits them. Without the second question, you may get a potentially inflated number if some consumers have selected a credit card based on marketing schemes/promotional materials alone, rather than using relevant information to make an informed decision.

Embedding a SAM such as the one on credit card protection insurance in an intervention is a useful way to understand the efficacy and the impact of the intervention. For example, consumers could be asked this question both before and after an educational program aimed at improving their knowledge on the basics of credit cards. The change in consumers’ understanding of this key fact between the two time-points would indicate how successful the program was at communicating information in ways people understand.

In contrast, a question asking credit card holders “Are you satisfied with the credit limit on your credit card?” would not provide evidence of consumer understanding, and as such is not a SAM.

You are encouraged to explore various avenues to use SAMs (see BOX 1: Two Ways to Use SAMs), including in surveys, webinar polls, mobile apps, focus groups, and any other creative initiative that may ultimately prove successful and scalable.

BOX 1: Two Ways to Use SAMs

- Use an existing SAM: Before making and proposing a new SAM, check the Measures LibraryFootnote 1 for existing measures that your organization could use—also see What is the Measures Library? sidebar.

- Make and propose a new SAM: A new SAM may need to be created to address a measurement gap—i.e., instances where no measure or data is available. To do this, first use the section on How to Make a Strategy-Aligned Measure (SAM) below.

Once you have chosen existing SAMs or created new SAMs, update FCAC about your new initiative via the Intake Form for future inclusion in the National Financial Literacy Strategy Dashboard (National Strategy Dashboard)Footnote 2 .

Sidebar: What is the Measures Library?

The Measures Library contains a regularly updated list of SAMs, Initiatives, and High-Level Indicators (see BOX 3: High-Level Indicators) being used by ecosystem stakeholders. The High-Level Indicators are created and reported by FCAC. The SAMs are embedded within stakeholder initiatives and can be consumer- or stakeholder-facing. SAMs allow us to assess progress against the target outcomes of the Strategy (see What Should We Be Measuring? for details).

Step 2: Include Key Demographic and Vulnerability Questions

The National Strategy emphasizes financial vulnerability as a cross-cutting dimension. Anyone can become financially vulnerable, for example, due to a change in relationship status or an unanticipated event such as a loss of employment. While vulnerability is not limited to certain groups or demographics, systemic barriers have led to certain groups being more likely to face financial vulnerability, including: women, Indigenous Peoples, racialized Canadians, older Canadians, newcomers, linguistic minorities, and those with disabilities or cognitive challenges.

Almost no one is “average”—so focusing on the “average Canadian” is not as effective as meeting people where they are. Using tailored approaches will help to better serve the financial needs of diverse groups of people. As such, collecting demographic and vulnerability information is key to assessing whether we are moving forward in an inclusive and equitable manner, removing barriers, and enabling positive changes to see progress for all Canadians.

The following recommended questions are not, on their own, SAMs. However, they allow for a deeper analysis of SAMs by helping to disaggregate the results and so should be included whenever possible.

BOX 2 includes a non-exhaustive list of questions that you should consider including within your initiatives. You may tailor the list so that the questions are relevant to the audience of a given initiative.

Although these questions are not, on their own, SAMs, they allow for a deeper analysis of SAMs by helping to disaggregate the results and so should be included whenever possible. The use of these core demographic questions will collectively result in a better understanding of what different groups of Canadians need—and can therefore lead to improved and tailored financial products and services that better serve the needs of diverse Canadians.

BOX 2: Core Demographic / Vulnerability Questions

- Gender? (Female, Male, Non-binary, Another gender)

- Age group? (18-34, 35-44, 45-54, 55-64, 65+)

- Population group? What is your ethnic or cultural background? (African, Caribbean, Caucasian/European, East Asian, Indigenous, Latin American/Hispanic, Middle Eastern, South Asian, and other).

- Are you a visible minority? **The Employment Equity Act defines visible minorities as "persons, other than Aboriginal peoples, who are non-Caucasian in race or non-white in colour".

- Status or Non-Status Indigenous Person? (Yes, No)

- If yes (Status First Nation, Non-status First Nation, Inuit, Metis, Other)

- If yes (Do you live on a reserve?)

- What is your first language? (English, French, Other)

- Current marital status? (Married, Living with partner/common-law, Separated, Divorced, Widowed, Single (never married))

- Place of birth? (Canada, Outside Canada)

- If born outside Canada, when did you arrive in Canada?

- Immigration status? (Citizen, Landed Immigrant, Refugee, Undocumented, Other)

- Current province / territory of residence (NL, PE, NS, NB, QC, ON, MB, SK, AB, BC, YT, NT, NU) and/or first 3 characters of the postal code?

- Do you live in an urban (e.g., city, town, >10,000 population) or rural (e.g., country, small town, <10,000 population) area?

- Do you have access to high-speed internet? (Yes, No)

- Current work situation? (Employed full-time; Employed part-time; Self-employed; Temporary: term or contract, casual, gig, other temporary; Retired and not working; Not working)

- Education? (Did not complete high school, High school diploma, CEGEP diploma, Some College (not completed), College diploma, Some university (not completed), University undergraduate degree, University graduate degree (Master’s, PhD, including professional degree)

- Are you financially responsible for any children living in your household or currently living somewhere else? (Yes, No)

- What is your personal income? (<20k, 20-40k, 40-60k, 60-80k, 80-100k, 100-150k, 150-200k, +200k, don’t know)

- What is your household income? (<20k, 20-40k, 40-60k, 60-80k, 80-100k, 100-150k, 150-200k, +200k, don’t know)

- Do you identify as a person with a physical or mental disability? (including brain-related, cognitive, and mental health conditions that can restrict life choices)

- Would anyone else in your household identify as a person with a disability? (Yes, No)

Step 3: Share your Organization’s Results

Once your organization has collected the data from your initiatives using SAMs, share the results for inclusion in the National Strategy DashboardFootnote 2 (see Figure 2 for illustration). The Intake Form will guide you through the process of identifying and submitting your relevant results.

The most up-to-date list of SAMs and stakeholder initiatives (see Annex I for examples) is available to you in the Measures Library—see What is the Measures Library? sidebar.

BOX 3: High-Level Indicators

Results derived from using SAMs will be curated and distilled into High-Level Indicators by FCAC, which will be profiled and made available on the National Strategy DashboardFootnote 2 for public viewing. High-Level Indicators grouped under each of the Strategy’s priorities will be used to estimate and illustrate the progress made on advancing the priority as a whole.

e.g., Under priority 1 (Communicate in ways people understand) and outcome 1 (More Canadians understand the key facts about financial products and services):

Examples of High-Level Indicators could include: “X number of SAMs are available for measuring outcome 1”; “X number of stakeholders are using SAMs for outcome 1”. “According to the SAMs, between X-Y% of Canadians understood information that they were provided about the costs associated with homebuying”. (See Figure 2 for an illustration of the National Strategy Dashboard where High-Level Indicators will be displayed.)

Collectively, these High-Level Indicators provide estimates of stakeholder engagement, area coverage, and combined measures of key topics (e.g., homebuying) under priority 1, outcome 1. When combined with additional key topic Indicators, as well as Indicators from outcomes 2 and 3, High-Level Indicators help to monitor and evaluate progress toward achieving the goal of priority 1 over longer periods of time.

To share results from an initiative that used SAMs, highlight a new initiative that uses SAMs, or propose a new SAM, go to the Intake Form.

Intake Form submissions that meet the requirements for being Strategy-Aligned will be included in the National Strategy DashboardFootnote 2 .

Figure 2 illustrates an interactive dashboard that will display several High-Level Indicators for each target outcome related to stakeholder engagement (e.g., number of stakeholders using SAMs and total number of SAMs for each target outcome) as well as key topic areas (e.g., homebuying). Although the topic area example included in Figure 2 is focused on homebuying, many others will be included from the curated SAMs (e.g., understanding key facts about credit, loan products, etc.).

The SAMs themselves can be either consumer- or stakeholder-facing and can be embedded in any type of initiative. Results can come directly from consumer feedback (e.g., via surveys, focus groups), behaviour (e.g., via apps), or by monitoring the ecosystem itself (e.g., counting how many fintech apps are tailored to vulnerable consumers).

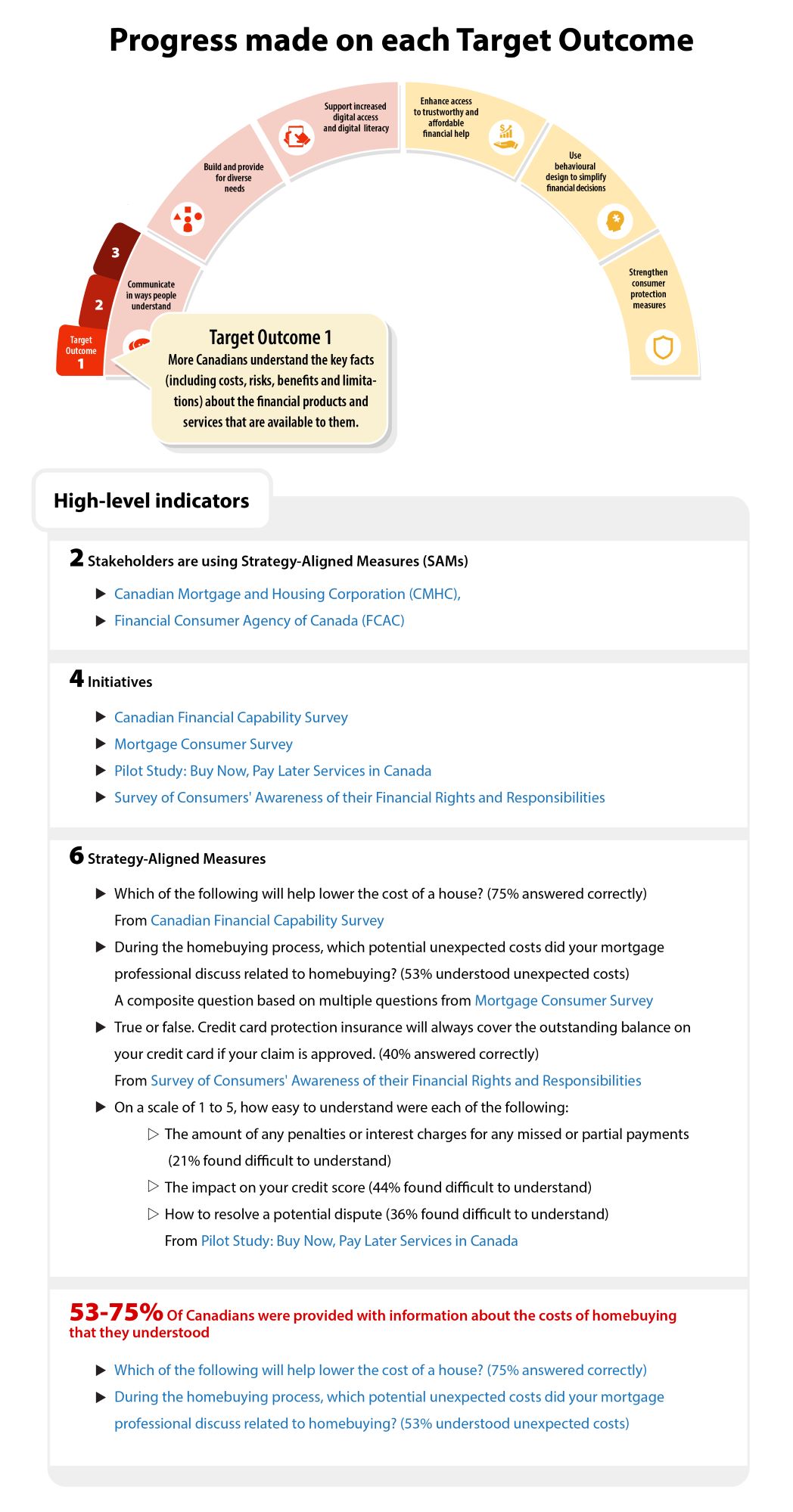

Figure 2: Illustration of National Strategy Dashboard

Text version: Figure 2, Illustration of National Strategy Dashboard

The visual here is for illustrative purposes only and does not represent the final design of the dashboard

Dashboard title: Progress made on each Target Outcome

For example, for Priority 1, Target Outcome 1 "More Canadians understand the key facts (including costs, risks, benefits and limitations) about the financial products and services that are available to them.", there could be four high-level indicators:

- 2 Stakeholders are using Strategy-Aligned Measures, or SAMs

- 4 Initiatives

- 6 Strategy-Aligned Measures

- 53-75% of Canadians were provided with information about the costs of homebuying that they understood

The first high-level indicator, 2 Stakeholders are using Strategy-Aligned Measures, expands into two stakeholders, including Canadian Mortgage and Housing Corporation (CMHC), and Financial Consumer Agency of Canada (FCAC).

The second high-level indicator, 4 Initiatives, expands into four initiatives, including Canadian Financial Capability Survey, Mortgage Consumer Survey, Pilot Study: Buy Now, Pay Later Services in Canada, and Survey of Consumers' Awareness of their Financial Rights and Responsibilities.

The third high-level indicator, 6 Strategy-Aligned Measures, expands into six measures, including:

- Which of the following will help lower the cost of a house? (75% answered correctly). From Canadian Financial Capability Survey.

- During the homebuying process, which potential unexpected costs did your mortgage professional discuss related to homebuying? (53% understood unexpected costs). A composite question based on multiple questions from Mortgage Consumer Survey.

- On a scale of 1 to 5, how easy to understand were each of the following:

The amount of any penalties or interest charges for any missed or partial payments (21% found difficult to understand). From Pilot Study: Buy Now, Pay Later Services in Canada. - On a scale of 1 to 5, how easy to understand were each of the following:

The impact on your credit score (44% found difficult to understand). From Pilot Study: Buy Now, Pay Later Services in Canada. - On a scale of 1 to 5, how easy to understand were each of the following:

How to resolve a potential dispute (36% found difficult to understand). From Pilot Study: Buy Now, Pay Later Services in Canada. - True or false. Credit card protection insurance will always cover the outstanding balance on your credit card if your claim is approved. (40% answered correctly). From Survey of Consumers' Awareness of their Financial Rights and Responsibilities.

The fourth high-level indicator, 53-75% of Canadians were provided with information about the costs of homebuying that they understood, expands into two results from stakeholders, including:

- Which of the following will help lower the cost of a house? (75% answered correctly)

- During the homebuying process, which potential unexpected costs did your mortgage professional discuss related to homebuying? (53% understood unexpected costs)

Step 4: Still Unsure? Get the Support You Need!

Reach out to FCAC if, after reading the steps above, you:

- Want to share your plans for a new initiative, but do not know which SAMs to use

- Are looking for a collaborator to help advance your initiative and choose the right SAMs

- Are still unsure of what to do next

Even after reading through the next section on How to Make a Strategy-Aligned Measure, it is optimal to check that the SAMs your organization intends to use will measure the intended impact and avoid common research and measurement pitfalls (see BOX 4: Avoiding Common Pitfalls! below).

Beyond using this Measurement Plan as a guide, reaching out to other experienced stakeholders for assistance in making, choosing, or validating SAMs to embed within initiatives, can be especially useful.

The National Strategy emphasizes the need for collaboration between all ecosystem stakeholders. It is through partnerships and cooperation, as well as increased investment in initiatives that work, that we will make change that counts.

The Measures Library provides a list of other stakeholders using similar approaches or SAMs, who may be able to provide additional insights or be interested in collaborating with you.

FCAC is building a Research, Data and Collaboration Platform that will aid ecosystem collaboration. In the meantime, if you would like to get in touch with us about a collaboration, are looking for a collaborator, or need help with your SAMs, please reach out to FCAC’s Behavioural Finance Lab at: fcac.research-recherche.acfc@fcac-acfc.gc.ca

How to Make a Strategy-Aligned Measure (SAM)

The financial ecosystem is a rapidly and continuously evolving space. With so much ground to cover, and new products and services emerging all the time, it is important to validate existing SAMs for new purposes or create new SAMs when needed.

You can use this section to:

- Make a new SAMFootnote 4 —for example, when no SAMs exist and/or there is a gap in knowledge

- Check if your measures qualify for inclusion as a SAM in the Measures Library

Before creating a SAM, you should read the What Should We Be Measuring? section above and have an initiative with a clear set of objectives in mind.

Figure 3: How to Make a SAM

Strategy-Aligned Measures for all 6 priorities are created using a Basic-4-Phase-Approach. All phases are necessary, but the order in which they are used is context dependent.

Text version: Figure 3, How to make a SAM

The 4-phase approach takes target outcomes relevant to an initiative as input, and includes the following four steps:

- impact

- identify

- inquire

- imagine

In the end, a strategy-aligned measure is the output and is ready to be embedded within your initiative!

Table 1: How to Make a SAM using a Basic-4-Phase-Approach

Phase 1: Impact

What impact do you want to have at the conclusion of the initiative?

✅ SAM (example):

Stakeholder X wants participants to understand how to lower the overall cost of purchasing a home by the end of the webinar.

❌ Not a SAM (example):

Stakeholder Y wants 100% of participants to say they found the webinar content useful.

*This is not a SAM because it is not aligned with the overall goal of the National Strategy to build financial resilience.

Phase 2: Identify

Identify the alignment between the objectives of your initiative and the Strategy’s target outcome(s).

✅ SAM (example):

Stakeholder X develops a webinar to educate Canadians about the basics of homebuying. They want to improve participants' understanding of key facts. (Priority 1, outcome 1: “More Canadians understand the key facts…about the financial products and services that are available to them”. See Annex II for complete wording of outcomes)

❌ Not a SAM (example):

Stakeholder Y is developing a webinar to educate Canadians about the basics of homebuying. They want to introduce participants to a new mortgage broker (not aligned with priority 1).

Phase 3: Inquire

Create the starting question that, if answered properly, will result in responses that allow you to measure the intended impact. (Note: More than one SAM may be needed to fully assess the impact of your initiative).

✅ SAM (example):

Use a multiple-choice question embedded in the webinar as a live poll that asks, “Which of the following will help lower the costs of a house?”

Potential answers:

- Make a larger down payment at the time of purchase

- Make a smaller down payment at the time of purchase

- Paying off the mortgage over a long period of time

- Agree to pay the current rate of interest on the mortgage for as many years as possible

*See Measures Library for additional examples of SAMs.

❌ Not a SAM (example):

Use a poll question asking “Did you understand the contents of the webinar?” or “Are you confident in your ability to lower the overall cost of purchasing a home?”

Potential answers:

- Yes

- No

*See BOX 4: Avoiding Common Pitfalls! for common mistakes and challenges to avoid when developing and testing new measures.

Phase 4: Imagine

Imagine the possible responses and verify that these align with the initiative’s intended impact and the Strategy’s target outcome.

✅ SAM (example):

Participants either answer correctly (answer A) or incorrectly, which directly reflects their understanding about homebuying, and in turn allows Stakeholder X to assess whether they communicated in ways people understand.

❌ Not a SAM (example):

Participants will answer ‘yes’ or ‘no’, but neither answer is an aligned outcome to assess an “understanding of key facts”, nor can it confirm the impact of the initiative. Stakeholder Y will be unable to assess if they communicated in ways people understand.

Table 2: How SAMs measure priorities provides additional examples of SAMs that are aligned with a target outcome.

Once the new SAM is built, you should go to the Checklist: How Can I Contribute to the National Strategy? section to ensure that you have completed all the available steps.

BOX 4: Avoiding Common Pitfalls!

Beyond the Basic-4-Phase Approach above, there are many research design challenges and common mistakes to consider in advance.

Using a SAM to its fullest potential goes beyond collecting data. The best use of SAMs requires a careful consideration of the audience (e.g., “Am I asking the right group of consumers?”), the context (e.g., “Am I using the most effective initiative or measurement?”, “Have I considered how the SAMs I’m using together might affect responses?”), and the timing (“Would I get different answers if I presented these SAMs at a different time?”).

Where possible, you should consider these potential challenges during the earliest phases of an initiative’s development, as overlooking them can result in misinterpretations or missing data.

(A more detailed discussion can be found in Measuring impact by design: A guide to methods for impact measurement by the Privy Council Office Impact and Innovation Unit, and additional documents can be found in the References and Resources section below).

The following is a brief, non-exhaustive, list (in alphabetical order) of some of the most common considerations that may be overlooked when doing research:

Alternative approaches for a broader reach. Some common approaches to collecting data (e.g., online surveys) can exclude many users. To engage everyone—especially those with vulnerabilities—alternative approaches could help reach the widest possible audience. For example, consumers are more likely to participate in the financial ecosystem when cultural considerations are taken into account (e.g., providing materials in languages other than French or English, addressing distrust, understanding cultural practices). Using alternative approaches, such as sending workbooks by mail, using in-person meetings/focus groups, or collaborating closely with organizations most familiar with a given vulnerable population, can lead to increased inclusion.

Biases. Everyone wants to avoid biases—their prevalence and persistence in our lives is a testament to how difficult they are to see—as they are hidden sources of error that can lead us away from correct conclusions. The best assumption for any initiative is that it contains sources of bias. When biases exist unchallenged, they can reduce or negate the impact and validity of our evaluations. To identify and avoid them, use strategies that decrease the impacts of such biases (e.g., objective quantitative measures of behaviours and decisions in addition to self-reports; non-self-selected groups of consumers; analysts who are unfamiliar with the objectives of the initiative).

Choice of research method. There is no shortage of research methods—including experiments or randomized controlled trials, (which can provide the greatest control of variables and potential biases), quasi-experimental methods (where a random assignment of participants is not possible, but greater flexibility can make collecting data easier), and qualitative methods (that record individual experiences). Each method has advantages and limitations and choosing the right method depends on many factors. You should choose the method that strikes the best balance between rigour and practicality—while emphasizing the need to collect information that is Strategy-Aligned and that can help us collectively assess our impact on consumers’ financial resilience.

Cross-sectoral collaboration. Effective consumer protection will require a strong system of stakeholders from across the ecosystem. These collaborations are needed to close existing gaps and improve alignment between stakeholder and consumer expectations and needs. When creating new SAMs, or embedding existing SAMs within new initiatives—particularly those that have strong cross-sectoral impacts—you should try to collaborate with appropriate financial service providers, government bodies, community groups, academics or other key players that have relevant knowledge and experience. Examples of such organizations can be found in Annex I.

Human-centred design. Human behaviour is especially complex. Human-centred design places the spotlight on the end-user throughout the creative and implementation phases of product development. In the present context, a human-centred design lens emphasizes the consideration of the end-user from the earliest phases of development to the final delivery of the product (and use of SAMs). You should consider the inclusion of behavioural insights into your initiatives where possible. Many prior examples and approaches have been provided by experts such as the OECD, BEAR, and BIT.

Operational definitions. Working definitions provide a good high-level starting point for each complex term (see Working Definitions section below). However, operational definitions help to describe how terms are defined and measured in the specific context of your initiative—especially complex terms like “affordable”, “appropriate”, and “trustworthy”. They are key to communicating your findings, identifying your assumptions, and allowing others to follow your lead. Exploring and comparing different ways to assess each concept may also increase the likelihood of achieving the target outcome. For instance, an “affordable” product could be defined in one initiative as “no-cost financial products available for those individuals who fall below Canada’s Official Poverty Line”, and in another as “costs not exceeding 30% of total pre-tax household income” (an example of affordable housing).

Pre- and post-testing. When using measurements to assess changes in knowledge or behaviours (e.g., surveys, polls), administering a pre- and post-initiative test helps to better quantify the amount of change (e.g. 40% understood a key fact before; 70% understood it afterward). Without a pre-test, it is difficult or impossible to estimate the degree of change. Comparisons to a national average can be helpful in some cases but can also be misleading (e.g., when the group being studied in the initiative is very different than the group of people studied at the national level). Therefore, using pre- and post-tests where possible will help assess change.

Timing. Asking questions at different times or in different orders can change the responses you get. For example, if someone is asked a question immediately after hearing the answer (e.g., via a webinar or disclosure document), they will likely get the question right even though they may not remember, or use, that same fact at a later time. Therefore, asking questions at a time that corresponds to their real-world use (e.g., at the point-of-decision), where possible, will provide more valid results.

When looking to identify long-term changes or trends, you should collect longitudinal data. When we compare cross-sectional data (i.e., a snapshot at one point in time) it can be tempting to compare findings across time, even if the participant groups are different. For example, we might want to look at how financial advice aims to change long-term behaviours to improve financial outcomes. Because these behavioural changes often require sustained action (e.g., consumers need to save a portion of many paycheques), it is important to try and use SAMs that track consumer behaviour over a longer-term, and for the same participants, where possible.

When seeking to identify changes that require sustained action (e.g., consumers need to save a portion of many paycheques before seeing a positive impact on their financial resilience) or persistence of behaviour change, you should collect longitudinal data where possible. Longitudinal data tracks the behaviour of the same participants and so can provide a window into how an intervention affects behaviours over time. For example, in an initiative that aims to link financial advice to improved financial outcomes for consumers, SAMs that measure saving behaviour could be used. These SAMs would generate longitudinal data if used with the same group of consumers every month for a year to assess if the saving behaviour persists.

Cross-sectional data capture a snapshot at a point in time by measuring a group of people only once. Although cross-sectional data can also be collected repeatedly, such as an annual national survey, the data typically come from different respondents, and therefore can only be used to identify overall trends. Findings such as "Canadians are growing more confident about their financial knowledge" do not show why the change happened.

Table 2: How SAMs Measure Priorities

This Table illustrates how SAMs measure progress made on priorities and sample target outcomes (see Annex II for complete wording of outcomes) and provides examples of SAMs from ecosystem stakeholders. For a recent list of SAMs, go to the Measures Library. To submit a measure for consideration as a SAM, go to the Intake Form.

Priority 1

Example target outcome

Target outcome 1: More Canadians understand the key facts (including costs, risks, benefits, and limitations) about the financial products and services that are available to them.

Example of a Strategy-Aligned Measure

True or False: Credit card protection insurance will always cover the outstanding balance on your credit card if your claim is approved?

(Survey of Consumers' Awareness of their Financial Rights and Responsibilities, FCAC)

Priority 2

Example of target outcome

Target outcome 2: More Canadians, particularly those with diverse needs or one or more forms of vulnerability, are involved and consulted in the development and delivery of financial products and services, which in turn leads to higher levels of inclusion.

Example of a Strategy-Aligned Measure

What is too complicated about the process of opening a Registered Disability Savings Plan?

(Survey on Savings for Persons with Disabilities, StatCan)

Priority 3

Example of target outcome

Target outcome 1: More Canadians are equipped with the digital literacy and skills required to manage their finances online.

Example of a Strategy-Aligned Measure

Count of individuals who set up direct deposit to their bank account for at least one source of income (e.g., paycheques, government benefits, tax refunds).

(Indicators for Financial Empowerment, Prosper Canada)

Priority 4

Example of target outcome

Target outcome 2: More Canadians who access relevant and unbiased financial advice experience positive financial outcomes.

Example of a Strategy-Aligned Measure

Total amount of debt paid down by individuals (total amount of debt payments, such as interest, fees, and principal that the individual made while receiving financial empowerment services.)

(Indicator for Financial Empowerment, Prosper Canada)

Priority 5

Example of target outcome

Target outcome 2: More Canadians use tools that use behavioural insights in the design and presentation of financial decisions to facilitate and motivate choices leading to better outcomes.

Example of a Strategy-Aligned Measure

Track how many users respond to daily ‘tap to save’ cards in an app and therefore take action to save money based on a behavioural nudge in the app.

(QUBER)

Priority 6

Example of target outcome

Target outcome 3: More Canadians understand their rights and responsibilities when dealing with the financial services industry, and how and where to seek resolution when they experience a problem.

Example of a Strategy-Aligned Measure

To the best of your knowledge, does the government of Canada have a department or agency dedicated to protecting financial consumers?

(Survey on Canadians’ Use of Banking Products and Services, FCAC)

Tracking Key Consumer Building Blocks as Measures of Impact

The National Strategy identifies 5 key consumer building blocks that have been proven to help consumers develop the skills, capacity, and behaviours that lead to financial resilience. They are:

- Skills: Navigating the Financial Marketplace

- Capacity: Build Just-In-Time Financial Knowledge and Confidence

- Behaviour: Managing Expenses

- Behaviour: Managing Debt

- Behaviour: Managing Savings

These Building Blocks cut across the Strategy’s priorities and should be built into your initiatives, where possible, to help achieve the Strategy’s target outcomes.

When your organization is ready to report SAM-related results, propose a new SAM, or to signal the creation of a new initiative that uses SAMs, you will be asked to identify which key consumer building blocks are addressed. This will provide an additional way to track the actions and impact made by all ecosystem stakeholders.

A great advantage of SAMs is that they are capable of tracking progress on different priorities and key consumer building blocks—sometimes simultaneously. As mentioned in What Should We Be Measuring, a given SAM can help track progress on multiple priorities and key consumer building blocks. For example, the SAM “Which of the following will help lower the costs of a house?” (see Table 1) would apply most directly to “managing expenses” and “managing debt”, but could also apply to “build just-in-time financial knowledge” if respondents have identified homebuying as a personal goal.

To share results from an initiative using SAMs, propose a new SAM, or signal a new initiative with SAMs—go to the Intake Form.

To help Canadians take individual action toward building financial resilience, you can target one or more of these key building blocks in your initiatives. To measure your impact, you should use SAMs that include direct measures where possible. Testing different strategies, educational approaches, and engagement tactics, will help to zero in on the initiatives that help the most.

Checklist: How Can I Contribute to the National Strategy?

This checklist summarizes the questions to consider to help advance the priorities of the National Financial Literacy Strategy 2021-2026.

It also serves as a reference to the relevant sections within this document (e.g., How to Make a Strategy-Aligned Measure), the tools needed to act (e.g., Measures Library, National Strategy Dashboard, Intake Form), and other helpful resources (e.g., Behavioural Finance Lab contact information, References).

Working Definitions

Accessible

Easy for consumers to locate, navigate and understand.

Source: Guideline on Complaint-Handling Procedures for Banks and Authorized Foreign Banks - Canada.ca

Affordable Financial Help

Help or advice that takes consumers’ finances into consideration. This includes products and services that are available at low- or no-cost to consumers, particularly for consumers who have financial challenges and few resources with which to meet those challenges.

Appropriate products and services

Financial products and services that have regard for consumers’ circumstances, including their financial needs. FCAC has developed a Guideline on Appropriate Products and Services for Banks and Authorized Foreign Banks, which sets out its expectations with respect to implementation of the appropriate product or service provisions in the Bank Act and the Financial Consumer Protection Framework Regulations.

Source: Guideline on Appropriate Products and Services for Banks and Authorized Foreign Banks - Canada.ca

Barrier

“Anything—including anything physical, architectural, technological or attitudinal, anything that is based on information or communications or anything that is the result of a policy or a practice—that hinders the full and equal participation in society of persons with an impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment or a functional limitation.”

Source: Accessible Canada Act

Fair treatment

The Bank Act prohibits specific practices such as coercive tied selling or charging for products or services without the consumer’s express consent. However, there are currently no provisions requiring fair treatment of consumers or prohibiting unfair treatment. Best practices include, but are not limited to: the fair treatment of financial consumers at all stages of their relationship with the financial service provider; the disclosure of key information; and the prohibition of misleading practices, such as misleading advertising.

Source: Report on Best Practices in Financial Consumer Protection - Canada.ca

Financial Resilience

Financial resilience is the ability to adapt or persevere through both predictable and unpredictable financial choices, difficulties, and shocks in life. Just as psychological resilience allows people to recover and get past negative life events, financial resilience allows people to recover and get past negative financial events.

Initiative

The term initiative is used to reflect any activities that stakeholders use to interact with consumers or other stakeholders. These can include, but are not limited to: surveys, webinar polls, mobile Apps, focus groups, experiments, interventions, workshops, or ethnographic studies. Stakeholders are the true experts of their domain and their clientele, and so are encouraged to engage in any creative initiatives that may ultimately prove successful and scalable.

Initiatives using SAMs come broadly in two forms: 1) Those that result in reference measures, to track consumers’ beliefs, knowledge, and/or behaviours at a single moment in time, 2) Those that result in intervention-related measures, to track changes in consumers’ beliefs, knowledge, and/or behaviours before and after a targeted intervention.

High-Level Indicator

High-Level Indicators will be used to monitor and evaluate our collective progress toward achieving the Strategy’s priorities and outcomes (e.g., X number of stakeholders are using SAMs for outcome 1”, “According to the SAMs, between X-Y% of Canadians understand the costs associated with homebuying.”) As FCAC works to create High-Level Indicators to track our collective progress– both quantitative and qualitative – we will draw on ethnographic research, surveys, experiments, interventions, and the advice of experts. See BOX 3: High-Level Indicators for more details.

Key facts about products and services

Key facts about products and services are the characteristics of a product or service that financial consumers need to understand to determine which financial products and services are appropriate for their own situation. These facts include, but are not limited to: costs, risks, benefits, and limitations.

Measure

A measure is the standard, system, or unit, used in the process of observing and recording the observations that are collected as part of a research effort. There are different types of measures including, but not limited to: survey questions, interview questions, or constructed situations. Measures help us to define the current landscape, identify and anticipate challenges, and set clear goals for the future.

Strategy-Aligned Measures (SAMs)

Measures that are aligned to the National Financial Literacy Strategy’s (2021-2026) priorities and outcomes and are, at their core, questions posed under ideal conditions—e.g., embedded within initiatives that are directed at the right group of people at just the right time. See Table 2 for some examples and the How to Make a SAM section for more details.

Outcomes-Based Approach

An outcomes-based approach focuses on characterising and quantifying (where possible) the results from an ideal end-goal perspective. In the National Strategy, 18 target outcomes (three for each of the six priorities) have been identified. The five key consumer building blocks are representative of additional consumer-focused outcomes. The ultimate vision of the Strategy is a “Canada where everyone can build financial resilience in an increasingly digital world.”

Trustworthy Financial Help

Relevant and unbiased financial help or advice that can be an important catalyst for good financial decisions, which result in positive outcomes and improved financial resilience.

Vulnerabilities

Vulnerability is the susceptibility to negative financial outcomes. There are many reasons that consumers may experience financial vulnerability, which broadly consist of: the financial circumstances of consumers, including life-changing events, psychological and physical characteristics, and social barriers that increase the risk of poor financial outcomes.

References and Resources

FCAC Publications

- For a complete list, see Research reports and studies

- Make Change that Counts: National Financial Literacy Strategy 2021-2026

- Guideline on Appropriate Products and Services for Banks and Authorized Foreign Banks

- Guideline on Complaint-Handling Procedures for Banks and Authorized Foreign Banks

- Annual bank reports on the implementation of the Code of Conduct for the Delivery of Banking Services to Seniors

- Canadians’ Financial Well-being: Summary of FCAC survey findings

- Highlights: Key findings from the Survey on Banking of Canadians

- Canadians and their Money: Key Findings from the 2019 Canadian Financial Capability Survey, the full questionnaire is available in the methodologies report

- Financial Consumers’ Rights and Responsibilities Survey – 2016

- Survey of Consumers’ Awareness of their Financial Rights and Responsibilities

- Financial well-being in Canada: Survey results

FCAC Tools

- Financial tools and calculators

- Canadians’ Financial Well-being: Summary of FCAC survey findings

- Self-assessment quiz - Canada.ca (fcac-acfc.gc.ca)

- Canadian Financial Literacy Database - Canada.ca (fcac-acfc.gc.ca)

- Your Financial Toolkit

- Financial wellness in the workplace

Government of Canada Resources

- Measuring impact by design: A guide to methods for impact measurement (Impact and Innovation Unit)

- Experimentation Works - Canada.ca

- Experimentation Works – Medium

- Data literacy training (statcan.gc.ca)

- Gender, diversity and inclusion statistics (statcan.gc.ca)

- 2021 Census questionnaires (statcan.gc.ca)

External research references

- OECD / INFE National Strategies for Financial Education Resources: National Strategies for Financial Education - OECD

- OECD / INFE Evaluation of National Strategies for Financial Literacy Report International Gateway for Financial Education - Organisation for Economic Co-operation and Development (oecd.org)

Annex I: Examples of Initiatives to Drive and Measure the Priorities

There are many types of initiatives that can be used to drive and measure the priorities of the National Strategy—from surveys, interventions, experiments, programs, and conferences to stand-alone speaking events, focus groups, and courses—and stakeholders like you have been, and continue to be, the real experts when it comes to developing and delivering them!

The key to monitoring the impact of your initiatives is to take measurements, where possible, that are in direct alignment with the National Strategy. By selecting from, or helping to co-create, Strategy-Aligned Measures (SAMs), and incorporating them into initiatives, stakeholders work together to ensure that the target outcomes of the National Strategy are being achieved.

During our discussions with stakeholders, FCAC put out a broad call for Early Adopters—i.e., organizations interested in helping to advance the goals of the National Financial Literacy Strategy, at the earliest implementation phase of the Measurement Plan, through some of the following activities:

- Helping to identify and/or make new SAMs

- Sharing measures and results

- Incorporating and testing SAMs

- Advising on how to best collect results

- Participating in stakeholder surveys

The following are vignettes of current or future stakeholder initiatives that Early Adopters shared with FCAC. Ideal initiatives include SAMs and enough demographic and vulnerability-related information to interpret the results in context.

For more details, we encourage you to contact the initiative leader directly.

(*Note: The following examples are not meant as templates, or as alternatives to a comprehensive program evaluation.)

Priority 1—Communicate in Ways People Understand

West Neighbourhood House and Prosper Canada have partnered to implement the use of a financial coaching/counselling platform. The goal is to develop a platform that seamlessly integrates all functions, from the first point of consumer contact to the financial coach’s/counsellor’s ongoing support of their client. Assessing and monitoring clients’ financial wellbeing is of key significance, and will help tailor support to consumers’ needs and understanding of key facts (e.g., how much they spend on fees). The focus will be primarily on low-income Canadians and aims to track knowledge changes over the course of the client-coach/counsellor relationship. This example also includes elements from each of the five consumer building blocks.

The Canada Mortgage and Housing Corporation (CMHC) monitors mortgage and consumer trends using its Mortgage Consumer Survey. Surveying around 3,500 Canadians, this tool has helped monitor consumers’ understanding of housing and mortgages. Questions associated with the costs of homebuying, knowledge of the First-Time Home Buyer Incentive, and actions people have taken to further understand the appropriateness of products and services to meet their needs, are all in alignment with this priority.

PennyDrops is a student-led non-profit organization that aims to equip youth with the knowledge and confidence to make informed financial decisions. Through peer-to-peer mentoring, PennyDrops has reached more than 17,000 high school students and 6,500 university students across Canada by delivering workshop-based sessions by trained university students. PennyDrops has also partnered with Indigenous empowerment organizations to develop programs that deliver financial literacy lessons to Indigenous youth. To track their impact, PennyDrops uses pre- and post-training surveys to assess the change in participants’ knowledge.

Priority 2—Build and Provide for Diverse Needs

Families Canada is working to connect women living on low incomes with financial literacy programs that meet their needs. Through national research and consultations, they have identified gender-specific barriers that prevent women living on low incomes (particularly those that have experienced trauma and violence) from accessing financial literacy information and financial products and services. They will use the insights gained to promote trauma and violence-informed approaches in financial literacy programming, incorporate more SAMs and to develop future projects—for instance, helping financial literacy program facilitators incorporate trauma and violence-informed approaches into their work.

Black Moms Connection launched FinLitU in 2020. It is an 8-week financial literacy masterclass designed for Black mothers and is led by Black financial professionals. The program leaders consult with consumers and financial professionals from the Black community to ensure a highly tailored approach that aims to improve confidence and rates of inclusion in the financial system. They use qualitative and quantitative feedback to assess consumers’ access and use of financial products and services, as well as to get a sense of the kinds of negative experiences that Black consumers may face.

Equifax Canada Co.— a global data, analytics, and technology company — helps financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Equifax is currently focused on acquiring rental data in Canada to support the credit underserved. Canadians who rent their homes are often paying more than they would pay for a mortgage, but don’t get credit for consistently making those payments. Adding this to the mix can paint a more accurate picture for those who don’t have data traditionally used to describe financial health, helping them have more equitable access to credit.

Priority 3—Support Increased Digital Access and Digital Literacy

Fintech Cadence supports the financial literacy ecosystem—and, in turn, promotes increased digital access and digital literacy—by helping to build and sustain the Fintech community. They promote the education of Fintech talent, support early-stage start-ups, and develop collaborations with financial institutions to help solve industry challenges. They track the FinTechs in Canada, their areas of specialty, what kinds of products and services they provide, as well as details about their target audiences.

Innovation, Science and Economic Development (ISED) Canada runs the Digital Literacy Exchange Program. It supports initiatives that teach fundamental digital literacy skills and promotes inclusion for Canadians from underrepresented groups who lack the fundamental digital literacy skills to participate in the digital economy and society. The program tracks many SAMs, including the percentage of Canadians that are under-represented in the digital economy, and the percentage of program users that have increased their confidence and day-to-day use, as well as those who report not having the necessary skills and training to use the Internet.

Priority 4—Enhance Access to Trustworthy and Affordable Financial Help

Prosper Canada works with cross-sectoral stakeholders to support financial empowerment, particularly for the financially vulnerable. Their work touches upon all of the Strategy’s priorities, and often involves a focus on enhancing access to financial help. For example, their Financial Literacy Evaluation Resource Kit includes SAMs that gather information about the frequency and kinds of financial help opportunities that consumers engage in. Their Indicators for Financial Empowerment serve as a resource for ecosystem stakeholders to track progress in a systematic way. For example, community financial counselling services in many provinces use Prosper Canada's Indicators to regularly track the number of tax returns completed and the resulting tax refunds and credits received by their clients.

Monkiri is a mobile app focused on delivering free financial literacy to consumers. It uses modular gamified lessons that aim to improve both consumer knowledge and skills, using unbranded and neutral content, without offering or recommending specific financial products or services. They collect basic demographic information and track users' behavioural performance over time, including completion times and changes in confidence. Monkiri also empowers other organizations to create their own lessons which can be distributed and tracked through the mobile app. Given its focus on improving understanding and confidence using gamification techniques, this app also contributes to priorities 1 and 5.

FP Canada certifies and oversees professional financial planners and leads the advancement of financial planning in Canada. As part of its IMAGINE 2030 vision of financial wellness for all Canadians, FP Canada has committed to conducting an annual survey to measure Canadians’ financial health through indices tracking four areas: financial well-being; financial confidence; access to financial advice; and trust in financial professionals. The results of the inaugural survey were published in the IMAGINE 2030 Benchmark Report, released in May 2022. FP Canada will provide a progress report each year until 2030.

Priority 5—Use Behavioural Design to Simplify Financial Decisions

QUBER is a personal finance app that encourages saving through gamification. They use savings challenges, lotteries, and matched savings programs to nudge people to save more. Working with employers, they are able to capture key demographic and vulnerability-related information (e.g., people without emergency funds or those living paycheque-to-paycheque), as well as SAMs on the success, and number, of users completing challenges that track saving amounts, frequencies, fees paid, and confidence levels. They have also partnered with other organizations, such as Momentum, to provide tailored matched-saving programs to those at lower income levels.

Seedwell is also a personal finance app using behavioural insights to help consumers. Provided by employers, the app provides a central hub to help employees navigate the financial marketplace starting directly from their paycheque deposit. Consumers are provided with nudges (e.g., anticipating their pay and identifying ways they could use those funds), and access to financial literacy material and financial advisors, without being recommended specific products.

Behavioural Economics in Action at Rotman (BEAR) is an academic centre at the University of Toronto researching decision-making and behavioural change, including within the financial sector. They publish guides and reports for stakeholders on how to apply behavioural insights, as well as engage in financial consumer research—for example, collecting data on credit card choice and ways to effectively promote savings behaviours.

Priority 6—Strengthen Consumer Protection Measures

CanAge is a national seniors’ advocacy organization that also engages in activities related to consumer financial protection. For example, they work with government and financial service providers to identify challenges that frontline employees face when trying to provide optimal service for, and fair treatment of, seniors. This work is particularly relevant in supporting banks’ compliance with the Code of Conduct for the Delivery of Banking Services to Seniors.

The Canadian Center for Women's Empowerment (CCFWE) is developing tools and programs for customers who have experienced domestic economic abuse. For example, they are currently working with financial service providers, social service agencies, policymakers and family lawyers to build tools and resources that will help them identify and respond to signs of domestic economic abuse for victims of intimate partner violence.

Annex II: List of Ecosystem Priorities and Target Outcomes

Ecosystem priority 1: Communicate in Ways People Understand

- Target outcome 1: More Canadians understand the key facts (including costs, risks, benefits, and limitations) about the financial products and services that are available to them.

- Target outcome 2: More Canadians understand which financial products and services are appropriate for their own situation and goals.

- Target outcome 3: Fewer Canadians experience negative financial outcomes related to not understanding key facts (including costs, risks, benefits, and limitations) or an inability to determine which financial products and services are good for their own situation (including their needs, risk tolerance, and budget constraints).

Ecosystem priority 2: Build and Provide for Diverse Needs

- Target outcome 1: More Canadians have access to, and use, financial products and services that are tailored to their needs, vulnerabilities, and resource constraints.

- Target outcome 2: More Canadians, particularly those with diverse needs or one or more forms of vulnerability, are involved and consulted in the development and delivery of financial products and services, which in turn leads to higher levels of inclusion.

- Target outcome 3: Fewer Canadians experience a low quality of service (including disrespect or not being offered a product or service appropriate for their needs) when accessing financial products or services.

Ecosystem priority 3: Support Increased Digital Access and Digital Literacy

- Target outcome 1: More Canadians are equipped with the digital literacy and skills required to manage their finances online.

- Target outcome 2: More Canadians are aware of how to protect their financial information online and proactively take steps to keep their data safe.

- Target outcome 3: Fewer Canadians, especially those with one or more vulnerabilities, experience barriers to managing their finances as a result of lack of access to digital tools and technology.

Ecosystem priority 4: Enhance Access to Trustworthy and Affordable Financial Help

- Target outcome 1: More Canadians have access to, and use, relevant and unbiased financial advice that is affordable.

- Target outcome 2: More Canadians who access relevant and unbiased financial advice experience positive financial outcomes.

- Target outcome 3: Fewer Canadians receive financial advice that is inappropriate for their circumstances and financial needs.

Ecosystem priority 5: Use Behavioural Design to Simplify Financial Decisions

- Target outcome 1: More ecosystem stakeholders use behavioural insights and design research to test and deploy consumer-facing materials that demonstrably help Canadians make financial decisions that will lead to positive financial outcomes.

- Target outcome 2: More Canadians use tools that use behavioural insights in the design and presentation of financial decisions to facilitate and motivate choices leading to better outcomes.

- Target outcome 3: Fewer Canadians purchase or use financial products and services that are not in their own best interest due to the misuse of behavioural design elements.

Ecosystem priority 6: Strengthen Consumer Protection Measures

- Target outcome 1: More stakeholders in the financial services industry adopt concrete measures to prioritize financial consumer protection and the fair treatment of consumers, including the protection of consumer data, selling appropriate products and services, and effective complaint resolution.

- Target outcome 2: More Canadians benefit from an appropriate level of consumer protection and market conduct standards whether they deal with new or existing providers of digital products, services, or practices.

- Target outcome 3: More Canadians understand their rights and responsibilities when dealing with the financial services industry, and how and where to seek resolution when they experience a problem.