Health Canada Quarterly Financial Report - For the quarter ended December 31, 2017

Table of Contents

- Introduction

- Basis of Presentation

- Highlights of Fiscal Quarter and Fiscal Year to Date Results

- Risks and Uncertainties

- Significant Changes in Relation to Operations, Personnel and Programs

- Statement of Authorities (unaudited)

- Departmental Budgetary Expenditures by Standard Object (unaudited)

Introduction

Health Canada is the federal department responsible for helping Canadians maintain and improve their health. In keeping with the Department’s commitment to making this country’s population among the healthiest in the world as measured by longevity, lifestyle and effective use of the public health care system, its main responsibilities are as a regulator, a service provider, a catalyst for innovation, a funder, and an information provider. A summary of Health Canada’s programs may be found in Part II of the Main Estimates. Health Canada administers the Canada Health Act which embodies national principles to ensure a universal and equitable publicly-funded health care system.

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act in the form and manner prescribed by the Treasury Board, and should be read in conjunction with the Main Estimates, Supplementary Estimates A, and Supplementary Estimates B.

This quarterly report has not been subject to an external audit or review.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting and using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities. The accompanying Statement of Authorities presents the spending authorities granted to Health Canada by Parliament and those used by the Department consistent with the Main Estimates and Supplementary Estimates for the 2017-2018 fiscal year.

The authority of Parliament is required before any money can be spent by the Government. Such authorities are given in the form of annually-approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, Health Canada prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian public sector accounting standards. The spending authorities voted by Parliament remain on an expenditure basis.

Highlights of Fiscal Quarter and Fiscal Year to Date Results

This quarterly financial report reflects the results of the current fiscal period in comparison to the authorities provided in the combination of the Main Estimates, Supplementary Estimates A, and Supplementary Estimates B for fiscal year 2017-2018, as well as budget adjustments approved by Treasury Board up to December 31, 2017.

A. Significant Changes to Authorities

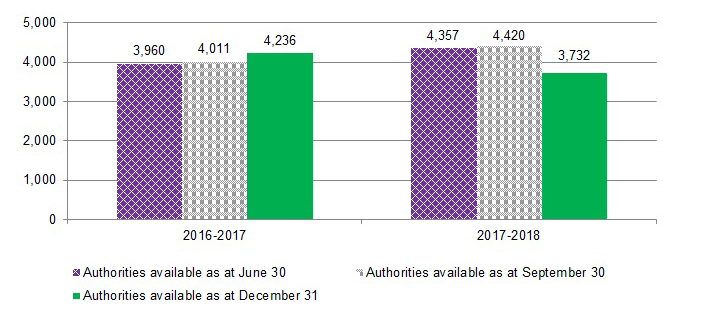

The following graph provides a comparison of net budgetary authorities available for spending at the end of each quarter of the current and previous fiscal years.

Figure 1 - Text Description

Bar chart showing a comparison of net budgetary authorities as at June 30, September 30 and December 31 of fiscal years 2016-2017 and 2017-2018 in millions of dollars.

2016-2017 Net budgetary authorities as at June 30 = 3,960; 2016-2017 Net budgetary authorities as at September 30 = 4,011; 2016-2017 Net budgetary authorities as at December 31 = 4,236; 2017-2018 Net budgetary authorities as at June 30 = 4,357; 2017-2018 Net budgetary authorities as at September 30 = 4,420; 2017-2018 Net budgetary authorities as at December 31 = 3,732.

The following table provides a comparison of year to date authorities by vote at the end of the third quarter of the current and previous fiscal years.

| Authorities available (in millions of dollars) | 2016-2017 | 2017-2018 | Variance |

|---|---|---|---|

| Vote 1 – Operating expenditures | 1,975 | 1,683 | (292) |

| Vote 5 – Capital expenditures | 37 | 41 | 4 |

| Vote 10 – Grants and contributions | 2,004 | 1,789 | (215) |

| Statutory | 220 | 219 | (1) |

| Total authorities | 4,236 | 3,732 | (504) |

Year to date authorities available for spending in fiscal year 2017-2018 were $3,732 million at the end of the third quarter as compared with $4,236 million at the end of the third quarter of 2016-2017, representing a net decrease of $504 million, or 11.9%. This decrease is primarily attributable to:

- $1,034.0 million decrease including statutory authorities for the transfer of the First Nations and Inuit Health Branch to the newly created Department of Indigenous Services Canada effective November 30, 2017, per Order in Council P.C. 2017-1465; and,

- $12.0 million decrease in statutory spending authority for disbursements to Canada Health Infoway Inc.

These decreases are partially offset by the following increases:

- $99.5 million increase for Jordan’s Principle – A Child-First Initiative interim reforms to enable access to social and health services and supports for First Nations children;Footnote *

- $90.9 million increase for growth in First Nations and Inuit health programs and services;Footnote *

- $45.1 million increase in funding related to collective agreements;Footnote *

- $43.4 million increase in funding to implement and administer a federal framework to legalize and strictly regulate cannabis;

- $40.7 million increase in funding for the Non-Insured Health Benefits Program for First Nations and Inuit;Footnote *

- $38.2 million in funding to support infrastructure and programs for Indigenous early learning and child care;Footnote *

- $30.0 million increase in statutory spending authority for disbursements in connection with the Patent Act to enhance the Pan-Canadian Pharmaceutical Alliance;

- $29.0 million increase in funding for Canada Health Infoway for the implementation of e-prescribing technology and telehomecare;

- $27.1 million increase in funding to build healthier First Nations and Inuit communities;Footnote *

- $24.6 million increase in funding to provide immediate and targeted mental wellness support to First Nations and Inuit;Footnote *

- $21.0 million increase in funding to promote a more innovative health care system;

- $19.9 million increase in funding to maintain and upgrade federal infrastructure assets; and,

- $11.8 million increase in the Department's operating and capital budget carry forwards.

The fluctuations in authorities available for spending are most notable in the following standard objects: personnel; transportation and communications; professional and special services; utilities, materials and supplies; acquisition of lands, buildings and works; acquisition of machinery and equipment; transfer payments; and revenues for services of a non-regulatory nature.

B. Significant Changes in Year to Date Expenditures

The following graph provides a comparison of net budgetary authorities and year to date spending by quarter for the current and previous fiscal years.

Figure 2 - Text Description

Bar chart showing a comparison of net budgetary authorities and year to date expenditures for the quarters ended June 30, September 30 and December 31 of fiscal years 2016-2017 and 2017-2018 in millions of dollars.

2016-2017 Net budgetary authorities = 4,236; 2016-2017 Year to date expenditures to June 30 = 1,216; 2016-2017 Year to date expenditures to September 30 = 2,059; 2016-2017 Year to date expenditures to December 31 = 3,055; 2017-2018 Net budgetary authorities = 3,732; 2017-2018 Year to date expenditures to June 30 = 1,273; 2017-2018 Year to date expenditures to September 30 = 2,248; 2017-2018 Year to date expenditures to December 31 = 3,099.

The following table provides a comparison of year to date spending by vote at the end of the third quarter of the current and previous fiscal years.

| Year to date expenditures (in millions of dollars) |

2016-2017 | 2017-2018 | Variance |

|---|---|---|---|

| Vote 1 – Operating expenditures | 1,308 | 1,353 | 45 |

| Vote 5 – Capital expenditures | 6 | 8 | 2 |

| Vote 10 – Grants and contributions | 1,582 | 1,577 | (5) |

| Statutory | 159 | 161 | 2 |

| Total year to date expenditures | 3,055 | 3,099 | 44 |

At the end of the third quarter of 2017-2018, total budgetary expenditures were $3,099 million compared with $3,055 million reported for the same period of 2016-2017, representing an increase of $44 million or 1.5%.

Year to date net operating expenditures have increased by approximately $45 million or 3.4% when compared to the third quarter of 2016-2017. The significant variances in operating expenditures are as follows:

- $70.5 million increase in personnel costs primarily due to signing bonuses and retroactive salary payments resulting from the signing of collective agreements; and,

- $31.0 million decrease in expenditures due to the transfer of the First Nations and Inuit Health Branch to the Department of Indigenous Services Canada.

There was a decrease in Vote 10 – Grants and contributions year to date expenditures of $5 million or 0.3%, resulting from the following offsetting factors:

- $26.9 million decrease in spending due to the transfer of the First Nations and Inuit Health Branch to the Department of Indigenous Services Canada;

- $7.7 million decrease in contributions to the Canadian Partnership Against Cancer as a result of an approved reprofile of funding to future fiscal years; and,

- $29.0 million increase related to timing of disbursements to Canada Health Infoway Inc.

Statutory year to date expenditures have increased by $2 million or 1.6% from $159 million in 2016-2017 to $161 million in 2017-2018, which is not significant, but is comprised of the following offsetting components:

- $30.0 million increase in transfer payments in connection with the Patent Act to enhance the Pan-Canadian Pharmaceutical Alliance;

- $12.0 million decrease in transfer payments made to Canada Health Infoway Inc. which are disbursed in accordance with the organization’s cash flow needs; and,

- $9.0 million decrease related to the timing of allocation of expenditures incurred as part of the Shared Services Partnership with the Public Health Agency of Canada against statutory authorities.

C. Quarterly Variances

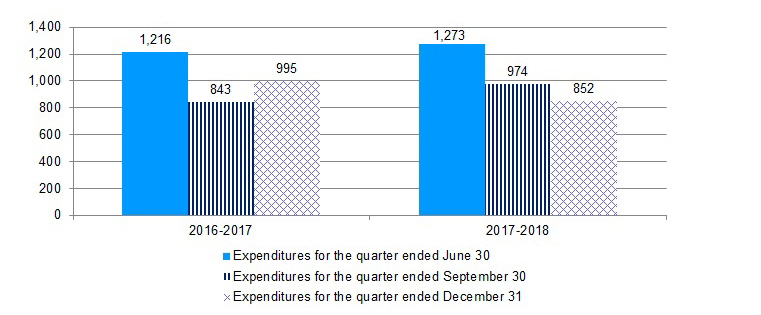

The following graph presents a comparison of quarterly spending by quarter and by fiscal year.

Figure 3 - Text Description

Bar chart showing a comparison of quarterly expenditures for the quarters ended June 30, September 30 and December 31 of fiscal years 2016-2017 and 2017-2018 in millions of dollars.

2016-2017 Expenditures for the quarter ended June 30 = 1,216; 2016-2017 Expenditures for the quarter ended September 30 = 843; 2016-2017 Expenditures for the quarter ended December 31 = 995; 2017-2018 Expenditures for the quarter ended June 30 = 1,273; 2017-2018 Expenditures for the quarter ended September 30 = 974; 2017-2018 Expenditures for the quarter ended December 31 = 852.

Expenditures in the third quarter of fiscal year 2017-2018 were $852 million compared with $995 million for the third quarter of 2016-2017, representing a decrease of $143 million or 14.4% in quarterly spending.

The decrease in quarterly spending is due primarily to the following offsetting components:

- $215.9 million decrease in spending due to the transfer of the First Nations and Inuit Health Branch to the Department of Indigenous Services Canada;

- $30.0 million increase in statutory transfer payments in connection with the Patent Act to enhance the Pan-Canadian Pharmaceutical Alliance;

- $29.0 million net increase in Vote 10 transfer payments related to the timing of disbursements to Canada Health Infoway Inc.; and,

- $15.7 million increase in personnel costs primarily due to signing bonuses and retroactive salary payments resulting from the signing of collective agreements.

Risks and Uncertainties

Health Canada is dedicated to enhancing the health and well-being of Canadians. It operates in a dynamic and complex environment characterized by internal and external drivers of change, which could potentially be disruptive to the Department’s ability to achieve its objectives (e.g. new innovative products, technologies, substances, foods and emerging product categories, evolving relationships between First Nations and Inuit and various levels of government, unforeseen health crises, scientific and technological change, and cyber security).

Health Canada recognizes that its success in fulfilling its mandate is directly related to the effective management of risk. Sound risk management equips the Department to respond proactively to change and uncertainty by using risk-based information to support effective decision-making, resource allocation, and, ultimately, better results for Canadians. Additionally, it can lead to more effective service delivery, better project management, and an increase in value for money.

As a result, the Department employs integrated risk management tools, including the development of an annual Corporate Risk Profile and monitoring of risk management strategies, to proactively and systematically recognize, understand, accommodate and capitalize on new challenges and opportunities, with a focus on results. In addition, the Department has appropriate internal control systems in place, proportionate to the risks being managed.

Prudent management within a constrained fiscal environment, is required to manage potential impacts on departmental programs and services. Health Canada continues to manage through effective engagement across the Department, a sound governance structure, as well as through the use of longer-term planning. The Department’s executive-level committee on Finance, Investment Planning and Transformation recommends overall direction for financial management and control, and ensures alignment of investments with departmental strategies and transformation initiatives. Each branch is required to have a multi-year financial management plan that has been reviewed by this committee to confirm that it has a plan in place to address the financial context.

Program expenditures experience natural fluctuations from year to year depending on a variety of factors beyond program control (e.g. drug pricing, location of provincial and territorial health services), thus creating risk. Growth in the Non-Insured Health Benefits Program is based on 5% growth on actual (annual) expenditures from the prior fiscal year. Enhanced monitoring of expenditures is undertaken, including assessment of expenditures against projected spending as well as previous years’ trends and available resources to manage these risks. Cost management and planning are also in place and are reported regularly to senior management for decision making.

The provision of health care services to First Nations and Inuit was transferred to the Department of Indigenous Services Canada on November 30, 2017. This represents a significant change, and the Department is assessing how to manage associated risks and uncertainties within the branches that are affected by this change.

Also as announced in Budget 2017, Health Canada is engaged in a review of the Department’s programs, operations, and resources. As part of the Treasury Board Policy on Results, the review is intended to take stock of the Department and its programs, ensure that Health Canada is well-aligned to deliver results, and examine options on how to make the best use of available resources.

Significant Changes in Relation to Operations, Personnel and Programs

Effective November 30, 2017, the Department transferred the control and supervision of the First Nations and Inuit Health Branch to the Department of Indigenous Services Canada. Revenues and expenses attributed to the Department of Indigenous Services Canada from the effective date have been excluded in the current year’s figures on this Quarterly Financial Report. 2016-2017 comparative figures have not been restated and remain the same as previously reported.

There have been no other significant changes in relation to operations, personnel and programs during this quarter.

Approved by:

Original signed by Simon Kennedy

Simon Kennedy

Deputy Minister

Ottawa, Canada

Date: February 27, 2018

Original signed by Randy Larkin

Randy Larkin

Assistant Deputy Minister and Chief Financial Officer

Ottawa, Canada

Date: February 21, 2018

Statement of Authorities (Unaudited)

| Total available for use for the year ending March 31, 2018Table 3 - Footnote * |

Used during the quarter ended December 31, 2017 |

Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 – Operating expenditures | 1,682,606 | 429,958 | 1,352,859 |

| Vote 5 – Capital expenditures | 41,545 | 5,447 | 8,031 |

| Vote 10 – Grants and contributions | 1,788,612 | 342,079 | 1,577,222 |

| Table 3 - Footnote (S) Contributions to employee benefit plans | 110,609 | 27,473 | 87,195 |

| Table 3 - Footnote (S) Minister of Health – Salary and motor car allowance | 84 | 21 | 70 |

| Table 3 - Footnote (S) Spending of proceeds from the disposal of surplus Crown assets | 280 | 35 | 77 |

| Table 3 - Footnote (S) Refunds of amounts credited to revenues in previous years | 146 | 16 | 146 |

| Table 3 - Footnote (S) Canada Health Infoway Inc. | 25,848 | - | 25,848 |

| Table 3 - Footnote (S) Payments in connection with the Patent Act (Patented medicines) | 30,000 | 30,000 | 30,000 |

| Table 3 - Footnote (S) Collection agency fees | 1 | - | 1 |

| Table 3 - Footnote (S) Court awards | 1,188 | 3 | 1,188 |

| Table 3 - Footnote (S) Spending of revenues pursuant to section 4.2 of the Department of Health Act | 51,463 | 16,602 | 16,602 |

| Total authorities | 3,732,382 | 851,634 | 3,099,239 |

Pursuant to Order-in-Council P.C. 2017-1465 effective November 30, 2017, $1.02 billion excluding statutory authorities for employee benefit plans, is deemed to have been appropriated to the Department of Indigenous Services Canada (Votes 1, 5 and 10), which results in a reduction for the same amount in Health Canada, Votes 1, 5 and 10 respectively, Appropriation Act No.1, 2017-2018. To date $306.3 million expenditures have been incurred on behalf of the Department of Indigenous Services Canada (Vote 1 - $110.9 million, Vote 5 - $0.2 million, Vote 10 – $195.2 million).

| Total available for use for the year ending March 31, 2017Table 4 - Footnote * |

Used during the quarter ended December 31, 2016 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Vote 1 – Operating expenditures | 1,974,784 | 492,663 | 1,308,465 |

| Vote 5 – Capital expenditures | 36,587 | 3,590 | 5,971 |

| Vote 10 – Grants and contributions | 2,003,665 | 456,627 | 1,581,663 |

| Table 4 - Footnote (S) Contributions to employee benefit plans | 130,109 | 31,341 | 94,023 |

| Table 4 - Footnote (S) Minister of Health – Salary and motor car allowance | 84 | 35 | 56 |

| Table 4 - Footnote (S) Spending of proceeds from the disposal of surplus Crown assets | 356 | 7 | 74 |

| Table 4 - Footnote (S) Refunds of amounts credited to revenues in previous years | 125 | 20 | 126 |

| Table 4 - Footnote (S) Canada Health Infoway Inc. | 37,878 | - | 37,878 |

| Table 4 - Footnote (S) Collection agency fees | 1 | - | 1 |

| Table 4 - Footnote (S) Transfer payments in connection with the Budget Implementation Act | 747 | 358 | 747 |

| Table 4 - Footnote (S) Spending of revenues pursuant to section 4.2 of the Department of Health Act | 51,463 | 10,810 | 25,644 |

| Total authorities | 4,235,799 | 995,451 | 3,054,648 |

Departmental Budgetary Expenditures by Standard Object (Unaudited)

| Planned expenditures for the year ending March 31, 2018 | Expended during the quarter ended December 31, 2017 | Year to date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

Personnel |

894,676 | 243,039 | 697,040 |

Transportation and communications |

202,424 | 49,936 | 164,532 |

Information |

17,801 | 1,798 | 4,539 |

Professional and special services |

480,014 | 100,138 | 316,755 |

Rentals |

5,289 | 4,919 | 11,998 |

Repair and maintenance |

17,260 | 3,920 | 8,856 |

Utilities, materials and supplies |

453,109 | 98,871 | 373,882 |

Acquisition of land, buildings and works |

8,001 | 2,064 | 2,197 |

Acquisition of machinery and equipment |

33,346 | 9,028 | 26,655 |

Transfer payments |

1,844,460 | 372,079 | 1,633,069 |

Other subsidies and payments |

9,215 | 4,679 | 14,257 |

Total gross budgetary expenditures |

3,965,595 | 890,471 | 3,253,780 |

| Less revenues netted against expenditures: | |||

Rights and privileges |

61,518 | 11,584 | 28,171 |

Services non-regulatory |

108,776 | 14,416 | 91,090 |

Services regulatory |

62,919 | 12,837 | 35,157 |

Services to other government departments |

- | - | 123 |

Total revenues netted against expenditures |

233,213 | 38,837 | 154,541 |

| Total net budgetary expenditures | 3,732,382 | 851,634 | 3,099,239 |

| Planned expenditures for the year ending March 31, 2017 | Expended during the quarter ended December 31, 2016 | Year to date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

Personnel |

909,742 | 234,128 | 633,354 |

Transportation and communications |

300,619 | 72,943 | 175,293 |

Information |

13,715 | 1,722 | 3,533 |

Professional and special services |

544,106 | 124,245 | 338,819 |

Rentals |

8,978 | 2,240 | 9,189 |

Repair and maintenance |

24,247 | 2,815 | 7,787 |

Utilities, materials and supplies |

640,244 | 141,649 | 394,395 |

Acquisition of land, buildings and works |

24,773 | 1,041 | 1,648 |

Acquisition of machinery and equipment |

11,760 | 11,701 | 26,945 |

Transfer payments |

2,042,290 | 456,984 | 1,620,288 |

Other subsidies and payments |

3,207 | 4,932 | 10,457 |

Total gross budgetary expenditures |

4,523,681 | 1,054,400 | 3,221,708 |

| Less revenues netted against expenditures: | |||

Rights and privileges |

57,570 | 13,136 | 28,275 |

Services non-regulatory |

170,447 | 34,524 | 106,508 |

Services regulatory |

59,865 | 10,148 | 30,993 |

Services to other government departments |

- | 1,141 | 1,284 |

Total revenues netted against expenditures |

287,882 | 58,949 | 167,060 |

| Total net budgetary expenditures | 4,235,799 | 995,451 | 3,054,648 |

Page details

- Date modified: