Evaluation of the Consumer Product Safety Program

Table of Contents

- Executive summary

- Findings

- Recommendations

- Program description

- Evaluation scope and approach

- Conclusions and recommendations

- Management Response and Action Plan

- Annex A: Methodology

- Annex B: Case study summaries

- Annex C: Strategic partnerships and collaborations

- Annex D: Financial information

Acronyms

- AMP

- Administrative Monetary Penalty

- CBSA

- Canada Border Services Agency

- CCPSA

- Canada Consumer Product Safety Act

- CHPSD

- Consumer and Hazardous Products Safety Directorate

- CPSP

- Consumer Product Safety Program

- FCSAP

- Food and Consumer Safety Action Plan

- FDA

- Food and Drugs Act

- HECSB

- Healthy Environments and Consumer

- Safety

- Branch

- MYCET

- Multi-Year Compliance and Enforcement Transformation Strategy

- NGO

- Non-Governmental Organizations

- OECD

- Organisation for Economic Co-operation and Development

- OSI

- Office of Second Interest

- PHAC

- Public Health Agency of Canada

- ROEB

- Regulatory Operations and Enforcement Branch

- TVPA

- Tobacco and Vaping Products Act

- VALI

- Vaping Associated Lung Injuries

Executive summary

Evaluation purpose and scope

In Canada, consumer products, as defined in the Canada Consumer Product Safety Act (CCPSA), and cosmetics, as defined in the Food and Drugs Act (FDA), are not subject to pre-market approval. Industry is responsible for ensuring that the consumer products and cosmetics they make, import, advertise, or sell are safe. The Consumer Product Safety Program (CPSP) at Health Canada promotes, monitors, verifies, and enforces compliance through relevant legislation and regulations, in order to help make sure consumer products and cosmetics available in Canada are safe.

The evaluation covers the period from 2017-18 to 2021-22, examines the impact and efficiency of the CPSP, and the ways in which the CPSP's strategic partnerships have influenced the achievement of their goals.

Findings

Impact

Overall, the CPSP has engaged in activities to improve consumer awareness, compliance among industry, and enhance their capacity to better detect and prioritize activities in response to health and safety risks and emerging issues. The CPSP has also worked collaboratively with its external partners to encourage a high level of voluntary compliance with consumer product and cosmetic requirements, supported by the timely assessment of health and safety risks and recall communications.

However, increasing consumer purchases from online and international marketplaces (e-commerce) is an emerging issue that may require new approaches and dedicated attention in order to be addressed.

Efficiency

The CPSP design and delivery is seen as efficient, supported by robust governance and directed effort in high-impact or high-risk areas. The Program efficiently selects tools to address emerging issues and challenges, with a focus on industry co-operation as a first course of action. Flexible features of the Acts and Regulations for consumer products, cosmetics, and vaping products, including general prohibitions, allow the CPSP to respond to health or safety risks in a timely manner. It will be important to continue to revisit supporting legislation and regulations as they age, as to ensure they continue to respond to a rapidly-evolving consumer marketplace.

There were many examples of innovation and experimentation in program delivery, though for many of these initiatives, quantifiable evidence of the efficiency gained through these approaches was not yet available. Measuring impacts on efficiency will be important to identify and advance successful practices in the future.

Strategic partnerships

The CPSP maintains relationships with international partners, non-governmental organizations (NGOs), and other federal departments to enhance the effectiveness and efficiency of program activities. In addition, they collaborate with industry to support information sharing and to address health and safety risks. Partnerships and collaborations have supported activities across CPSP business lines. The CPSP can continue to increase transparency by providing the general public, consumer organizations, and industry representatives with more information on how risk assessments are conducted, and increased detail on the process for choosing instruments during risk management.

Recommendations

Recommendation 1

- Given the relevance and increasing importance of e-commerce as an issue in consumer product safety, consider ways to expand current efforts in this area to help address key issues.

More consumers are turning to online retailers. Often, these retailers do not have a domestic presence and therefore it is more difficult to verify compliance with Canadian regulations and legislation. Building on the strong foundation of work already underway, the CPSP should expand its efforts to address consumer safety for online products. These efforts could include, among others, a special section or group within the Program dedicated to this issue, increased consumer outreach, leveraging international best practices like a voluntary pledge from online retailers, and requiring a domestic presence to sell products in Canada.

Recommendation 2

- Examine ways to increase transparency on CPSP processes, for example by providing more information on how risk assessments are conducted and increased detail on the process for choosing instruments during risk management.

The evaluation found that partnerships and collaborations with external partners have helped to increase effectiveness across the CPSP's main business lines. While the CPSP has taken steps to promote transparency in its activities, there is an opportunity to share more information with the general public, consumer organizations, and industry representatives on the decision-making process for risk assessments, and to provide more detail on how the CPSP selects risk management instruments when responding to consumer safety issues.

Recommendation 3

- As the program continues to introduce innovative practices, develop and implement performance metrics to determine the success and scalability of projects.

The CPSP has recently developed and began implementing innovative approaches to its work; however, performance metrics are not yet available for most initiatives. It will be important to integrate ongoing measurement of the impacts of innovative approaches, as it will allow the CPSP to identify and advance successful projects.

Program description

Addressing consumer product safety in Canada

Consumer products generally refers to a wide range of manufactured goods purchased primarily for use for non-commercial purposes. Some examples include products such as apparel, furniture, toys, household appliances, canoes and kayaks, detergents, and sporting and athletic goods.

A cosmetic is any substance used to clean, improve or change the complexion, skin, hair, nails, or teeth. Cosmetics include beauty preparations (e.g., make-up, perfume, skin cream, nail polish) and grooming aids (e.g., soap, shampoo, shaving cream, deodorant).Footnote 1 Some products that are often assumed to be cosmetics may be classified differently. For example, a beauty product or grooming aid is usually a cosmetic, but may meet the definition of a drug under the Food and Drugs Act, if it makes any claims to modify body functions, or to prevent or treat disease.Footnote 2

In Canada, consumer products and cosmetics are not subject to pre-market approval. Canada's approach to consumer product safety is based on a post-market regime; industry is responsible for ensuring that the consumer products and cosmetics it makes, imports, advertises, or sells are safe. A post-market regulatory framework protects Canadians from health or safety risks that may be associated with consumer products and cosmetics. The Consumer Product Safety Program (CPSP) at Health Canada promotes, monitors, verifies, and enforces compliance with relevant acts and regulations in order to help to mitigate any health or safety risks posed by consumer products and cosmetics.

The CPSP is co-administered by the following Health Canada branches: the Consumer and Hazardous Products Safety Directorate (CHPSD) in the Healthy Environments and Consumer Safety Branch (HECSB), and the Consumer Products and Controlled Substances Directorate in the Regulatory Operations and Enforcement Branch (ROEB). CHPSD helps to protect the health or safety of Canadians by identifying, assessing, managing, and communicating health or safety risks posed by consumer products and cosmetics.Footnote 3 ROEB informs Canadians, and protects them from health risks through, regulatory oversight, inspections, and outreach.Footnote 4 Together, these branches deliver the CPSP with a focus on the following main areas: active prevention, targeted oversight, and rapid response:

Active prevention

The CPSP works with industry, standards development organizations, and international counterparts to develop consensus-based standards and share best practices, as appropriate.

The CPSP promotes consumer awareness of the safe use of certain consumer products and cosmetics to support informed decision making.

Targeted oversight

The CPSP undertakes regular reviews of industry compliance to relevant legislation and regulations as it relates to selected product categories and takes enforcement actions as necessary. It also analyzes and responds to issues identified through mandatory reporting, market surveys, lab results, and other means.

Rapid response

When an unacceptable health or safety risk from consumer products or cosmetics is identified, the CPSP aims to act quickly to help protect the public and take appropriate risk management actions, including issuing consumer advisories, and working with industry to negotiate recalls or other corrective measures. For consumer products, the CPSP has the authority to order mandatory recalls if the CPSP determines that a consumer product poses a danger to human health or safety.

Legislation and regulations addressing consumer product safety

Between 1969 and May 2011, numerous product-specific regulations were made under the authority of the Hazardous Products Act, but there was no specific definition provided for the term 'consumer product'. Long-standing legislation such as the Food and Drugs Act (FDA) and associated Cosmetic Regulations set out prohibitions; ingredient restrictions; and safety, labelling and notification requirements for cosmetic products.

In December 2007, in response to a growing number of product recalls and concerns about food safety, the Government of Canada launched its Food and Consumer Safety Action Plan (FCSAP). The Action Plan promised to strengthen laws and regulations, improve industry oversight, respond more quickly to health or safety risks, and provide better product information to Canadians. In response to the goals of the FCSAP, the Government of Canada introduced the Canada Consumer Product Safety Act (CCPSA), which came into force in June, 2011. The CCPSA replaced Part I and Schedule I of the Hazardous Products Act, and included a specific definition for 'consumer products'. The existing product-specific regulations were also transferred under the CCPSA. The CCPSA prohibits the manufacturing, import, sale, or advertising of any consumer product that poses a danger to human health or safety, or does not comply with the requirements of applicable regulations. It also established mandatory reporting requirements for industry when they are aware of a consumer product safety incident, and gives Health Canada the authority to order mandatory recalls and other corrective measures.Footnote 5

Vaping products that do not make a therapeutic claim are also consumer products, and are subject to both the Tobacco and Vaping Products Act (TVPA) as well as the CCPSA.Footnote 6 The TVPA was enacted in 2018 to regulate the manufacturing, sale, labelling, and promotion of tobacco products and vaping products in Canada, replacing the former Tobacco Act (originally enacted in 1997). The TVPA provides new regulatory powers to support plain and standardized packaging for tobacco products.Footnote 7

Since 2016, Health Canada has held a series of public consultations seeking input on modernizing the Department's approach to regulating self-care products, including cosmetics. The proposed regulatory changes aim to improve labelling and introduce a proportional risk-based approach. These changes would help Canadians make more informed choices and support the safe use of self-care products.Footnote 8 Figure 1 depicts the timeline of legislative and regulatory developments for consumer product and cosmetics.

Figure 1 - Text description

This image provides a brief timeline of regulatory and legislative development related to consumer product safety and cosmetics. The timeline contains the following dates and descriptions:

- In January 1969, the Hazardous Products Act (HPA) is enacted. Part 1 and Schedule 1 of the HPA prohibits import, sale, or advertisement of regulated consumer products in Canada.

- January 1977: Cosmetic Regulation under the Food and Drugs Act (FDA) came into force, outlining requirements for import, ingredient labelling, directions for safe use, warnings and cautions, notifications, and specific ingredient requirements for cosmetics products in Canada.

- January 1985: The Food and Drugs Acts (FDA) was part of the Revised Statutes of Canada.

- December 2007: The Food and Consumer Safety Action Plan (FCSAP) was launched, with the goal of modernizing and strengthening Canada's safety system for food, health products and consumer products.

- June 2011: The Canada Consumer Product Safety Act (CCPSA) came into force, replacing Part 1 and Schedule 1 of the HPA and giving Health Canada the ability to order recalls or other corrective actions for non-regulated consumer products.

- May 2018: The Tobacco and Vaping Products Act (TVPA) was enacted to regulate the manufacture, sale, labelling, and promotion of tobacco and vaping products sold in Canada, replacing the original 1997 Tobacco Act.

- April 2021: The launch of the Phase 1 of the three-phase Self-Care Framework, aiming to update Health Canada's regulatory approach to self-care products, including cosmetics.

Evaluation scope and approach

The evaluation was conducted to provide guidance and information to the CPSP in its continuous improvement efforts, and covers its activities from 2017-18 to 2021-22. Health Canada's consumer product safety activities were previously evaluated in 2013, shortly after the Canada Consumer Product Safety Act (CCPSA) came into force. Nearly 10 years later, this evaluation aims to answer the following questions related to the impact of the CPSP, the efficiency of its delivery, and the contributions of strategic partnerships:

Impact: What impact have the CPSP's main activities (i.e., active prevention, targeted oversight rapid response activities) had on the achievement of the CPSP's intended objectives?

How efficient is the CPSP's current program delivery?

- How are activities prioritized given available resources and program complexity? Does the CPSP have the right mix of activities? Should any be stopped, added, or implemented differently?

- Are tools such as the legislative framework responsive to challenges facing the CPSP?

- What role do experimentation and innovation play in achieving efficiency?

- What measures and processes are in place to ensure a coordinated effort by HECSB, ROEB, and other partners?

Strategic Partnerships: How do various collaborations with partners influence program delivery and the achievement of its goals? How could these partnerships be further leveraged?

The evaluation draws on evidence from multiple data sources, including a survey of industry respondents, interviews with both internal and external key informants, document and file review, case studies, performance data, and financial data. For more information on methodology, refer to Annex A.

Findings

Impact: To what extent have the CPSP's main activities affected their intended outcomes?

Key takeaways

Overall, the CPSP has demonstrated progress towards its goals of improved awareness among Canadians, industry compliance, and safer consumer products and cosmetics on the Canadian market.

Through activities across its main business lines of active prevention, targeted oversight, and rapid response, in collaboration with its external partners, the CPSP has helped promote a high level of voluntary compliance with the acts and regulations applicable to consumer products and cosmetics, which can be expected to result in a safer marketplace for consumers.

Active prevention

Through active prevention, the CPSP has undertaken activities with the aim of improving awareness among consumers and industry, and promoting industry compliance. In an effort to reach consumers and improve their level of awareness about various aspects of consumer product and cosmetic safety, the CPSP has used social media platforms and the Canada.ca website to promote its messages. The CPSP has also leveraged communications efforts by partner organizations. To promote awareness and compliance among industry, the CPSP has engaged in several information-sharing activities, including directly responding to industry inquiries, hosting informational webinars, and participating in trade shows.

The evaluation found that the CPSP has generated interest in, and awareness of consumer safety issues for Canadians by leveraging social media and storytelling approaches. For example, in response to injuries and deaths associated with fire pots, Health Canada collaborated with a family member of an individual who died from injuries associated with these products to develop a narrative-driven awareness video.Footnote 9 This video was viewed often, with approximately 250,000 impressions on Facebook and Twitter, and over 14,000 engagements (i.e., liking, sharing or clicking through on the video). Canadians' awareness of the health or safety information that Health Canada provides about consumer products has increased from a baseline of 54% in 2016, to 62% in 2020, exceeding the target of 60%.

The Program has performed well on key performance metrics related to awareness promotion among consumers.

Performance indicators of awareness

Canadian awareness: In 2020, 35% of Canadians reported that they commonly found information on consumer product safety from Health Canada.

Canadian use of information: In 2020, 59% of Canadians used health or safety information for consumer product safety on labels.

Industry awareness: In 2019-20, 76% of inspected industry contacts indicated that they were aware of the CCPSA and its regulations prior to being contacted for the first time by the CPSP.

While there have been moderate increases in awareness of the CPSP's activities among consumers over time, some internal and external key informants noted that there remains room for improvement. Specifically, the CPSP could focus on improving consumer education about Health Canada's role in consumer products, and how to protect themselves from injury. However, these informants noted that improvements to product design (e.g., through regulations and voluntary standards) likely have a greater impact on consumer protection than increasing awareness through outreach and education initiatives, as product design improvements address the root cause of a product safety issue without requiring behaviour change on the part of consumers.

To that end, during the period covered by this evaluation, Health Canada participated in standards development for consumer products, including barbeque brushes, flammability and labelling requirements for tents, and corded window coverings, among others. Health Canada prioritizes participation in standards development, with consideration of several factors, including whether the standard is recommended for risk mitigation for products that would otherwise be prohibited by the general prohibitions under the CCPSA.

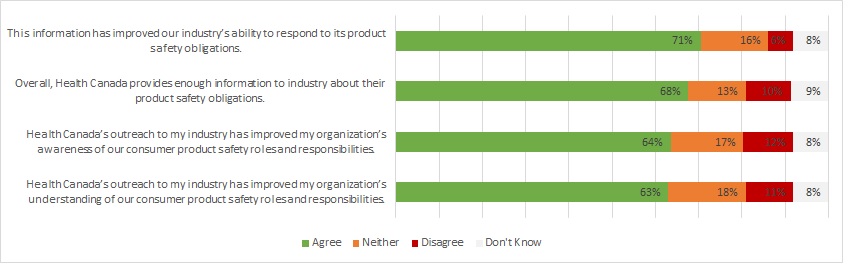

The CPSP also aims to improve industry awareness of their obligations through education and other compliance promotion activities. Results from performance metrics and the survey of industry respondents demonstrated positive impacts of CPSP awareness promotion activities. Program documents show that 95% of attendees at awareness sessions, such as webinars held between 2019-20 and 2020-21, indicated an increased awareness of the session topic. A survey of industry members asked respondents about their level of agreement with 4 statements about the impacts of consumer product safety awareness and promotional materials. More than 6 in 10 respondents agreed with these statements (See Figure 2).

Figure 2 - Text description

This figure shows different types of survey responses to four statements concerning the perceived impacts of awareness promotion material. Survey responses were grouped as "Agree", "Neither", "Disagree", and "Don't know".

Responses to the statement, "This information has improved our industry's ability to respond to its product safety obligations."

- Agree: 71%

- Neither: 16%

- Disagree: 6%

- Don't know: 8%

Responses to the statement, "Overall, Health Canada provides enough information to industry about their product safety obligations."

- Agree: 68%

- Neither: 13%

- Disagree: 10%

- Don't know: 9%

Responses to the statement, "Health Canada's outreach to my industry has improved my organization's awareness of our consumer product safety roles and responsibilities."

- Agree: 64%

- Neither: 17%

- Disagree: 12%

- Don't know: 8%

Responses to the statement, "Health Canada's outreach to my industry has improved my organization's understanding of our consumer product safety roles and responsibilities."

- Agree: 63%

- Neither: 18%

- Disagree: 11%

- Don't know: 8%

Furthermore, survey results show that more than 9 in 10 industry respondents (92%) reported that they were somewhat or very aware of the regulations under the CCPSA that applied to their products, and 91% responded that they understood these regulations. A strong majority (82%) found Health Canada's various information products for industry to be useful, comparable to 89% in 2012. Footnote 10 Similarly, most (71%) agreed that these products were of high quality. Lastly, when comparing results between the 2021 and 2013 survey of industry members, data demonstrates that there have been improvements in industry's awareness and understanding of mandatory incident reporting requirements. For example, 80% of respondents agreed that members of their company were aware of incident reporting requirements under the CCPSA in 2021, compared to 75% in 2013, and 72% indicated members knew how to report a consumer product incident, compared to 66% in 2013.

Internal key informants, along with those working with industry associations, spoke positively about compliance promotion with industry. In particular, many of these key informants identified this compliance promotion with industry to be a strength that helped the CPSP effectively respond to emerging issues. Though some industry key informants felt that there were opportunities, at times, for improved specificity in terms of the guidance the CPSP provides, they indicated that Health Canada was responsive to their questions and provided additional information when requested.

Targeted oversight

Through its targeted oversight activities, the CPSP has enhanced its capacity to better detect and prioritize activities in response to health or safety risks and emerging issues. Targeted oversight refers to a host of activities related to surveillance of consumer product safety issues (consumer and industry reporting of health or safety issues, market surveys, media monitoring, etc.) and targeted activities aiming to determine compliance (compliance verification projects, inspections, etc.). Evidence from key informant interviews and program documents suggests that, in the past 5 years, Health Canada has increased its capacity to conduct surveillance and detect potential consumer product safety issues through partnerships. For example, some internal key informants noted that Health Canada received surveillance data from Canadian Poison Centres and the Canadian Hospitals Injury Reporting and Prevention Program, which helped inform detection of potential consumer product safety incidents. Documents show that surveillance of incident report activities is shared with program management through dashboards, and to Canadians through annual reports. These products were described by some internal key informants as a source of information to identify emerging issues and high risk products.

There is also evidence that targeted oversight has allowed the CPSP to focus its activities on higher-risk areas. For example, some internal key informants indicated that surveillance information collected through targeted oversight feeds into the selection of compliance verification projects, where inspectors sample items they suspect may be non-compliant. These projects tend to detect high rates of non-compliance. Between 2017-18 and 2020-21, Health Canada completed and reported on 41 compliance verification projects involving 2,678 products. Of these, 971 (36%) products were identified as non-compliant and resulted in some corrective action such as a voluntary recall, stop-sale, halting distribution, or a public advisory. While these compliance verification projects cover a wide range of product categories, some have been repeated on a periodic basis and demonstrate how CPSP has been able to better target and select products which they predict may be non-compliant for sampling. For example, the CPSP conducted compliance verification projects every 2 years targeting children's jewellery and testing for lead and cadmium levels, finding non-compliance in between 12 to 18% of products sampled (See Table 1)

| 2016-17 | 2018-19 | 2020-21 | |

|---|---|---|---|

| Number of products tested | 25 | 22 | 36 |

| Number (%) non-compliant | 3 (12%) | 4 (18%) | 6 (17%) |

In addition to improvements in capacity to conduct surveillance, and the high levels of non-compliance detected through compliance verification projects, the CPSP has also achieved improved awareness among industry stakeholders of Health Canada's post-market activities for targeted oversight, including surveillance, inspections, compliance verification, and market surveys compared to the previous evaluation. Approximately ¾ of industry survey respondents (76%) rated their awareness of these activities as moderate or better, as compared to 60% in 2013. Overall, the evidence suggests that the CPSP's targeted oversight activities have supported the detection of unsafe products.

Rapid response

Through its rapid response activities, the CPSP has worked collaboratively with its external partners to promote a high level of voluntary compliance with consumer product and Cosmetic Regulations, supported by timely risk assessments and recall communications. Rapid response refers to the range of enforcement activities Health Canada may implement to respond to an identified health or safety risk associated with a consumer product or cosmetic. These include issuing consumer advisories, working with industry to negotiate recalls, and other corrective measures.

In general, the CPSP has achieved a high level of voluntary compliance from industry, therefore mandatory corrective measures are not commonly used. When an unacceptable health or safety risk is identified, the CPSP collaborates with industry to ensure the removal of dangerous consumer goods as a first course of action. Most internal key informants spoke to the voluntary compliance approach, noting that most stop-sales and recalls are initiated by industry. During the period covered by this evaluation (2016-17 to 2021-22), Health Canada communicated 1,123 consumer product recalls, all of which were voluntarily carried out by industry.

While the CPSP seeks voluntary action first, Health Canada does have the ability to order mandatory action if industry is unwilling or unable to voluntarily comply. Under the CCPSA, if the Minister believes, on reasonable grounds, that a consumer product is a danger to human health or safety, they may either issue an order for recall, or otherwise order the establishment manufacturing, importing, advertising, or selling the product to take measures such as stopping manufacture and sale, or other specific remedies to address non-compliance.Footnote 11 In the period covered by this evaluation, the CPSP issued fewer than 10 orders to take such measures. Administrative monetary penalties were associated with 4 of these orders. There was an increasing awareness among industry of the enforcement actions that Health Canada may pursue to address identified risks. In 2021, 81% of respondents rated their awareness as moderate or higher, compared to 67% in 2013, which is an increase of 14 percentage points.

During the years for which data was available, Health Canada triaged consumer safety incidents and communicated recalls in a timely manner.Footnote 12 The CPSP has performed well in response to its key indicators for the timely communication of recalls.Footnote 13 The most common reasons for delays in communicating recalls were requests from industry for additional time, and delays resulting from changes to the approach (e.g., where the recall was originally planned to be posted as a joint recall with international partners, but then switched to a domestic recall to enable it to be posted in a timelier manner).

Timeliness of triage and communication for consumer products

Timely triage: Between 2019-20 and 2020-21, 94% of all incidents involving death were triaged within the service standard of 1 day. (Target: 95%).

Timely communication: Between 2018-19 and 2020-21, 87% of consumer product recalls were communicated within the service standard. (Target: 85%)

Figure 3 - Text description

This figure shows different types of survey responses to four statements concerning the industry perception of effectiveness. Survey responses were grouped as "Agree", "Neither", "Disagree", and "Don't know".

Responses to the statement, "Overall, Health Canada's regulatory activities have helped increase the safety of consumer products."

- Agree: 70%

- Neither: 11%

- Disagree: 6%

- Don't know: 14%

To the right, an arrow indicates that the proportion of respondents that "Agree" has increased 16% since 2013.

Responses to the statement, "Overall, Health Canada's regulatory activities are responsive to changes in health and safety risks associated with consumer products."

- Agree: 64%

- Neither: 13%

- Disagree: 10%

- Don't know: 13%

To the right, an arrow indicates that the proportion of respondents that "Agree" has increased 14% since 2013.

Responses to the statement, "Health Canada is effective at communicating information to the consumer products industry about the regulations, requirements and policies that affect it."

- Agree: 61%

- Neither: 15%

- Disagree: 16%

- Don't know: 8%

Responses to the statement, "Overall, over the past five years, Health Canada has responded in a timely manner to identified health and safety risks related to consumer products."

- Agree: 56%

- Neither: 17%

- Disagree: 9%

- Don't know: 18%

To the right, an arrow indicates that the proportion of respondents that "agree" has increased 11% since 2013.

Responses to the statement, "Health Canada does enough to monitor the safety of consumer products on the market."

- Agree: 54%

- Neither: 17%

- Disagree: 13%

- Don't know: 15%

Responses to the statement, "Health Canada's compliance and enforcement activities are timely."

- Agree: 54%

- Neither: 20%

- Disagree: 9%

- Don't know: 17%

Responses to the statement, "Health Canada does enough to enforce its consumer products regulations."

- Agree: 51%

- Neither: 20%

- Disagree: 14%

- Don't know: 15%

To the right, an arrow indicates that the proportion of respondents that "Agree" has increased 11% since 2013.

As mentioned above, targeted oversight activities include surveillance of consumer product safety issues; however, the CPSP does not currently conduct market-wide surveillance of consumer products for compliance with the CCPSA, FDA, TVPA, and relevant regulations. Market-level compliance surveillance is not feasible due to the broad scope of products considered "consumer products" and cosmetics. Furthermore, as a post-market program, the exact number and type of products available is not known until products are available on the shelf. As such, data on the impacts of rapid response activities on overall market compliance rates is not available. However, on some issues, the CPSP's efforts in recalls, in combination with consumer advisories and active prevention awareness activities, had demonstrated impacts on reduced incidents of hospitalization. For example, after the onset of the COVID-19 pandemic, Health Canada launched an awareness campaign in the summer of 2020 to inform Canadians about how to clean safely with bleach. An analysis of poison centre data found that, following this awareness campaign, poisoning incidents associated with bleach fell from a monthly average of 685 to 461, a decrease of 39%.

How has the CPSP identified and addressed key challenges and emerging issues?

Key takeaways

The CPSP has leveraged partnerships to detect and respond to many emerging issues from high-risk products and changing trends in consumer products and cosmetics, and consumer behaviour. However, dedicated attention and new approaches may be required to address the challenges emerging from increasing consumer preference for online purchases from international marketplaces (e-commerce) as this trend continues to grow.

Consumer product safety is a constantly-evolving environment. New health or safety risks can come from changes in the way that consumers use or purchase consumer products, or may emerge from new types of products entering the market. The CPSP uses its targeted surveillance to detect emerging issues through media monitoring, incident reports from consumers and industry, and monitoring compliance verification projects. Data sharing agreements are also in place with international, national, and regional partners.

Key informants across all categories identified several consumer product safety issues that have emerged or increased in prominence over the last 5 to 10 years. The most impactful and commonly referenced ones were:

Internet of things

This refers to the wide variety of products ranging from thermostats to kitchen stoves becoming 'internet enabled.' There are an increasing number and variety of such products in, or entering, the Canadian marketplace. With this, new risks, such as hacking, are introduced. While the risk of hacking itself falls outside the scope of human health or safety risks typically addressed by the CPSP, such as burns, cuts, or asphyxiation, the consequence of such hacking could pose a danger to human health or safety. As a result of the complexity of this emerging issue, the CPSP is collaborating with several federal government departments to address it.

Innovative and hybrid products

Producers of consumer products and cosmetics are responding to consumer demand for efficiency and innovation with new products, and combination (i.e., 2-in-1 or 4-in-1) products that may transcend multiple product categories. Industry's pace in terms of generating such products may potentially exceed the rate at which regulators and standards development organizations are able to identify and respond to any health or safety risks that these products pose to Canadians. When a novel product transcends multiple product categories, this creates difficulties for the CPSP in terms of their ability to make sure it complies with relevant regulations and safety guidelines or standards. Several internal key informants described issues with multi-use products marketed to children and infants that may serve multiple functions, such as sleeping devices, strollers, playpens, and toys. While these products represent an innovative response to a consumer demand, they may pose new risks if not compliant with all relevant regulations: for example, some internal key informants pointed to an international 2-in-1 tricycle and stroller which was recalled due to the fact that it did not have the safety features required of a stroller in that country, and posed a risk of injury due to uncontrolled rolling.Footnote 15

E-Commerce

Consumers have been increasingly turning to digital rather than brick-and-mortar retailers for their consumer goods, a trend which has intensified following public health measures introduced in response to the COVID-19 pandemic. E-commerce accounted for about 1.5% of retail purchases in 2011, the year after the CCPSA came into force, and peaked at 11.4% in April 2020.Footnote 16Footnote 17 This trend presents a number of issues for consumer safety. Through online shopping, consumers are now able to purchase directly online from international markets that may not offer the same protections as domestic, in-store retail. If the seller does not have a Canadian presence, and if there is a health or safety concern with the product, Health Canada would be limited in the actions it can take against that company as specified under the CCPSA and associated regulations, the Food and Drug Act and the Cosmetic Regulations. Furthermore, when Canadians make purchases from companies that are entirely outside of Canada, they are in fact both "importers" and "consumers". As such, these individuals would be considered to be importers under the CCPSA, with the duties and responsibilities that entails.Footnote 18

For many key informants, e-commerce was considered to be the most important issue in the area of consumer product safety. While online shopping is certainly not a new phenomenon, the recent and significant increase in consumer preference for online purchases will likely pose new challenges in the future, as this trend continues to grow. A number of potential opportunities to address this issue were identified. Several internal and external key informants pointed to an international best practice in place in Australia and the European Union, where online retailers sign a voluntary "e-pledge" committing to adhere to, and support regulators to enforce, laws, regulations, and standards on their online platform.Footnote 19Footnote 20 Encouraging online retailers, especially those who do not have a domestic presence in Canada, to make this pledge could help to mitigate risk to consumers. Some key informants also suggested that requiring a domestic presence to sell in Canada could help avoid jurisdictional issues with international sellers. Furthermore, a few key informants highlighted the importance of continuing education informing Canadians about the risks and benefits of online shopping for consumer products and cosmetics. Finally, a few internal key informants noted that, as consumers continue to shift from brick-and-mortar to online stores to purchase their consumer goods and cosmetics, dedicated attention and resources within the CPSP may be needed to continue to address this issue, building on existing activities.

Otherwise, internal and external key informants generally responded positively about CPSP's ability to detect and respond to emerging issues. Internal key informants noted that, once new consumer safety issues are identified, the CPSP triages and prioritizes their response, escalating if needed. Several pointed to a positive example from 2019. Following consumer reports and international surveillance, CPSP detected and began investigating issues related to the emerging issue of flame jetting associated with portable fire pots that use pourable fuels. Following an initial risk assessment, Health Canada worked with standards development organizations to support improvements to the safe design of these devices. After additional injuries and deaths occurred in Canada, the CPSP escalated its response with risk management actions (as described in Box 1). Industry survey responses also indicate positive perceptions of Health Canada's response to emerging issues, with approximately 70% of respondents agreeing that overall, Health Canada responds effectively to emerging issues in their industry. Footnote 21

Box 1: Flame jetting

- Flame jetting can occur when liquid or gel fuel is poured into a fire pot or similar product while the reservoir is still burning or hot, which may be difficult to see. The flame or hot reservoir ignites the fuel vapours from the stream of fuel and travels up the stream into the fuel container, which can result in a violent burst of flaming fuel jetting from the container at a distance and speed at which users and bystanders cannot react quickly enough to move away from, posing a serious fire and burn risk to anyone in the area.

- After learning about domestic flame jetting incidents, the CPSP began an investigation of fuel containers and fire pots. The Department worked to increase consumer awareness, adding flame jetting information to their website, and supported measures to develop voluntary standards to mitigate the new risk of an unregulated hazard.

- In 2019, following additional Canadian flame jetting incidents resulting in death, and further engagement with family members of those affected, Health Canada notified industry that certain containers of pourable alcohol based fuel without a flame arrestor were a danger to human health or safety, and were now prohibited for manufacture, import, advertisement, or sale under the general prohibitions of the CCPSA.

- CPSP worked with industry associations to get the message out to stop sales immediately and remove unsafe products from retail shelves. They also collaborated with a family member of a flame jetting victim to produce a narrative-driven awareness video accompanied by a targeted social media campaign in the summer of 2020.

Efficiency

How are activities prioritized, given available resources and program complexity? Does the CPSP have the right mix of activities? Should any be stopped, added, or implemented differently?

Key takeaways

The CPSP has policies and tools in place to strategically prioritize program activities. Factors such as risk and likeliness of impact drive decisions about where and how to allocate time and effort (e.g., engaging in outreach and compliance promotion, or compliance and enforcement activities, or both). The CPSP has also identified higher-risk consumer groups, including children and seniors, and has integrated special considerations for these groups to inform prioritization of activities across its business lines. In general, the mix of current activities was seen as appropriate and adequately prioritized, given the scope of regulated products and the available resources.

The CPSP prioritizes its response to identified consumer product health or safety risks by using a strategic approach codified in policies for detecting and triaging emerging issues, risk assessment, and risk management.

When the CPSP detects a potential issue, prioritization is built into the triage and risk assessment process. The policy guiding this process specifies considerations that will elevate prioritization of an issue: for example, children are affected, the product is intended for children, the magnitude of actual or potential harms, or the incident has involved an actual or alleged death. The prioritization process also includes consideration of the importance of the incident to Canadians, as measured by the frequency of media coverage on the topic, or the topic's relation to senior management priorities. This process is embedded into risk calculation through the "prioritization tool." Following the triage process, the case is given a priority level from Trivial to Severe. All cases involving a death must be processed within 1 business day from the date they are received by the CPSP. Incidents receiving a higher score will be referred for risk assessment, whereas incidents with low scores may be monitored by surveillance with no further risk assessment required. If a risk assessment is not needed, the case will still be tracked in the CPSP's case management system. When a risk assessment is needed, prioritization is also embedded into this process, based on principles outlined in Health Canada's risk assessment framework for consumer products and cosmetics.Footnote 22

The CPSP has recently developed strategies to support the prioritization of active prevention activities, partnerships and outreach. For example, they developed tools like the International Engagement Framework, which helps prioritize international partnerships, the Outreach Strategic Plan, which establishes priority populations for outreach to consumers, and the draft Compliance Education Strategic Plan, which identifies target audiences for compliance promotion activities. Some internal key informants indicated that this strategic approach to prevention is still relatively new, therefore impacts are not yet known. Anecdotally, these efforts have been seen as positive developments. Additionally, work on standards development and updates is also prioritized. For example, CPSP's participation will be prioritized when the standard addresses a consumer safety issue that poses a risk of injury for children or other vulnerable populations (See Box 2).

Box 2: Addressing vulnerable populations

The Program has identified high-risk groups and integrated consideration of these groups into their activities across its business lines.

Children, particularly infants, were a primary at-risk population. Children are considered across the business lines. For example, Health Canada released joint statements and awareness projects with external partners on safe sleep for infants, and age considerations are built into prioritization calculations in risk assessments. In 2021, the CPSP also developed target audience plans for consumer product safety awareness outreach for Indigenous populations, seniors, youth, low-income households, new Canadians, and young families. Of note, these various vulnerable populations are similar to those identified by external key informants as those being most at risk.

When describing prioritization of activities in the CPSP, comments from internal and external key informants were generally positive. However, some internal key informants noted that there are products that overlap product categories. For example, some industry and internal key informants reported that there is a known overlap for products like toothpaste, which could be considered a natural health product, cosmetic, or non-prescription drug, depending on ingredients and/or claims made about the product. This may contribute to some duplication of effort in engagement (i.e., through consultations) and compliance verification (i.e., through inspections). Work is underway to address this challenge through the Self-Care Framework, which will introduce risk-based regulatory oversight to addresses stakeholder concerns around the disparity between the regulation of cosmetics, natural health products, and non-prescription drugs.Footnote 23

Among internal key informants who offered their feedback on the appropriateness of prioritization, many highlighted the importance of prioritization for consumer product safety in particular because the range of items considered to be "consumer products" is extremely broad. The CCPSAdefines a consumer product as any product "that may reasonably be expected to be obtained by an individual and used for non-commercial purposes, including for domestic recreation and sports purposes, and includes its packaging."Footnote 24 The broad range of items that fall under the purview of the CPSP also includes cosmetics, and some labelling requirements and other responsibilities related to vaping products.Footnote 25 Generally, there was a perception among internal key informants that the CPSP was operating as efficiently as possible, given available resources and the scope of consumer products, cosmetics, and vaping products included under the CCPSA, FDA, and TVPA. Furthermore, a review of their financial information reveals that the CPSP used almost all (98.3%) of its available resources to complete its planned activities during the period covered by the evaluation. A description of current program expenditures, both planned and actual, is provided in Annex D.

Are tools such as the legislative framework responsive to challenges facing the CPSP?

Key takeaways

A variety of tools are in place to respond to consumer product safety issues, ranging from regulatory tools to outreach and compliance promotion. The CPSP uses voluntary measures as a first step to address non-compliance with relevant consumer product and cosmetics legislative and regulatory requirements. Regulatory tools are supported by flexibilities that enable responsiveness to emerging issues such as new and innovative products, changing consumer behaviour, or industry activities. It will be important to continue to revisit supporting legislation and regulations as they age, as to ensure they continue to respond to a rapidly-evolving consumer marketplace.

Key informants working within the CPSP identified a variety of tools in place to respond to challenges in the area of consumer product safety, which include legislative and regulatory tools, risk management tools, and non-regulatory tools. As previously noted, the CPSP typically addresses issues through non-regulatory tools and voluntary compliance by industry as a first course of action when responding to consumer safety issues under the CCPSA. There was general support from both internal and external key informants for this approach as it allows industry to proactively address consumer safety concerns.

The evaluation found several examples of administrative tools that support flexible application of the legislation to a variety of products without developing new regulations. For example, the CPSP uses an administrative tool called the Cosmetic Ingredient Hotlist to inform manufacturers and others that certain substances are prohibited or restricted for use in cosmetics. The Hotlist, based on the general prohibitions under the FDAand Cosmetic Regulations, is a flexible tool that allows Health Canada to continue to adapt to innovative new ingredients used in cosmetics.Footnote 26

Similarly, while Schedule 2 of the CCPSA contains a list of products such as lawn darts and baby walkers that are prohibited from being manufactured, imported, advertised, or sold in Canada, the Department has also made use of flexibilities in the general prohibitions to keep records of potential or known dangers to human health or safety. Health Canada's online guidance "Information for Regulated Parties on the Enforcement Approach for the General Prohibitions under the Canada Consumer Product Safety Act" includes a list of some products identified as hazards of concern, the possible dangers to human health or safety, and products for which a notice of danger to human health or safety has been issued. Since Health Canada began publishing a list of prohibited products, 10 products have been listed. For example, portable fire pots that use pourable fuels and containers of pourable alcohol-based fuelsFootnote 27 are included under the notice of danger to human health or safety table, and are prohibited unless they meet specified product safety standards to mitigate the risk of flame jetting.Footnote 28 The CPSP has also taken steps to adapt to the changing environment as much as permissible under the respective Acts and regulations, such as conducting virtual inspections during the COVID-19 pandemic.

While the flexibility of these tools and the voluntary-first approach were generally viewed positively by internal and external key informants, several internal key informants identified opportunities for improvement related to legislation and regulations that address consumer product safety issues in Canada. Among some internal key informants, there was also concern that older legislation and regulations may need to be updated to respond to a radically innovating consumer marketplace. This issue is also important in the context of cosmetics, where regulations came into force under the FDA in 1977, although they have been amended through a number of modernization efforts, and updates are currently underway. For example, amendments to the Cosmetic Regulations are currently being proposed in some areas (e.g., disclosure of fragrance allergens on cosmetic labels) which creates an opportunity to assess where further updates may be necessary.Footnote 29

Although the CCPSA is relatively new, the rapid pace of innovation in the marketplace has put strain on the Act and its regulations. Many internal and external key informants noted that there are limits to what actions Health Canada can take in response to addressing non-compliance from retailers or importers selling products from international markets via e-commerce channels. The CCPSA, FDA, TVPA and their associated regulations apply equally to in-person and online retailers of consumer products, cosmetics, and vaping products. However, an internal key informant noted there is no specific regulation addressing consumer products marketed online in Canada, which was far less common at the time that these tools were designed. Several internal key informants observed that the legislation and tools to address non-compliance were designed with flexibility, but a few expressed concern that, although regulatory reviews are done, regulations may not be adequately "future proofed" to address enforcement issues related to emerging issues such as e-commerce.

What role does experimentation and innovation play in achieving efficiency?

Key takeaways

In recent years, there have been many notable examples of innovative and experimental approaches to program delivery. While tangible measures of impact are not yet available for newer innovations, evidence from an earlier experimental approach (i.e., PRODigy) showed improved outcomes. As innovative pilot projects are implemented, it will be important to measure key variables to ensure that projects resulting in efficiency gains can be advanced.

During the period covered by the evaluation, the CPSP encouraged employees to share their ideas about how to change program delivery to enhance efficiency though initiatives such as the innovation showcase, resulting in proposals for innovative approaches to routine work. For example, some employee-initiated projects included:

Document Access Modernization Project

A dynamic guide was created using OneNote to help inspectors quickly locate key documents such as standard operating procedures, information about regulations, and enforcement tools. This tool is currently being rolled out to inspectors.

Optical Character Recognition Project for Cosmetic Labels

This project proposes opportunities to increase efficiency and accuracy of compliance verification for cosmetics at the border by implementing label inspection supported by an artificial-intelligence-enabled optical character recognition tool. This project is in the planning phase.

Administrative Monetary Penalties and Orders Process Modernization Project

Inspectors indicated that the process to initiate Orders and Administrative Monetary Penalties (AMPs) under the CCPSA was complex. The proposed project aims to simplify the process, add performance standards, and produce a streamlined process to efficiently use these tools to address non-compliance.

In addition to employee-initiated innovations, there were several examples of branch-wide innovations. For example, CPSP has fostered innovation in the implementation of the Multi-year Compliance and Enforcement Transformation (MYCET) and the Regulatory Operations and Enforcement Branch's (ROEB) "Build Back Better" plans aim to transform ROEB's compliance and enforcement capacity to keep up with the pace of scientific innovation and technological advances. While implementing these initiatives, ROEB encouraged innovative approaches and leadership at all levels. Stemming from this, all employees in ROEB were empowered to come forward with their ideas on how to improve program operations.

These innovative projects have sprung up to address some identified challenges in the CPSP. For example, while the CPSP predominantly relies on voluntary measures as a first course of action to achieve compliance with the CCPSA, the ability to order a recall or corrective measure and the use of AMPs for non-compliance are important powers embedded in the Act. According to some internal key informants, there is hesitancy to use punitive tools such as AMPs due to the complexity of the process to initiate these actions. The AMPs and Orders Modernization Project described above was implemented to address this challenge by simplifying the process for inspectors.

Furthermore, following public health restrictions and changing consumer behaviours due to COVID-19, the CPSP adapted to this new context: for example, shifting to increase sampling from online retailers for cyclical compliance verification projects, and piloting virtual inspections after 2020. Some internal key informants indicated that this approach has been viewed as successful, and while it will be important to continue on-site inspections, there is interest in continuing some virtual inspections after the pandemic to more efficiently conduct compliance verification, with the cooperation of industry.

Due to the relatively recent implementation of many of the innovative approaches to program delivery, quantitative evidence of efficiency gains were not yet available. It will be important to integrate ongoing measurement of impacts of innovative approaches, including future phases of PRODigy and the innovation showcase projects described above, beyond proof of concept. This information will support integration of successful approaches into routine work and will increase efficiency gains by allowing the CPSP to identify and advance successful projects. Results from PRODigy (Box 3) demonstrate improved achievement of a desired outcome through an experimental approach.Footnote 30

What measures and processes are in place to ensure a coordinated effort by the Healthy Environments and Consumer Safety Branch (HECSB), ROEB, and other partners?

Key takeaways

Co-delivery of the CPSP is well supported by a robust governance system, resulting in strong coordination to support coordinated decision making, and a clear understanding of roles and responsibilities.

The CPSP is co-delivered by the following branches within Health Canada: HECSB and ROEB. Governance is in place, through various committees, to support coordination at multiple levels, from operational to strategic. Together, these committees provide opportunities to access expertise across the Department and promote information sharing. The governance structure, depicted in Figure 4, provides a forum for coordination at all levels, from senior executives and directors to the operational levels, in order to address program implementation and emerging issues.

Internal key informants were generally positive about the impacts of coordination across the branches, stating that they have worked effectively together.

Figure 4 - Text description

The image shows the governance structure of the Consumer Product Safety Program on a three-level hierarchical chart.

The top level is the Consumer Product Executive Joint Management Table.

The next level is the Consumer Product Joint Directors Forum.

The lowest level contains two types of committees. These are the Consumer Product Compliance and Enforcement Committees, and the National Product Committees.

Several internal key informants noted that roles and responsibilities were clear and well understood. A review of a sample of meeting records indicated that these governance bodies provided a regular setting in which to strategize and respond to new issues: for example, the DG and Directors forum was used to share updates on best practices for emerging issues associated with the Internet of Things.

Despite this, some felt that, at times, certain high-level strategic goals were not well aligned between the branches. For example, a few internal key informants pointed to ROEB's MYCET plan, noting that the MYCET plan has implications on the work of the CHPSD at HECSB, yet it was not developed with adequate collaboration with HECSB.

Several internal key informants noted that the working-level committees, including the 5 compliance and enforcement committees and 14 national product committees, have improved program delivery by connecting staff with appropriate expertise to guide work effectively outside the branches. National Product Committees, in particular, were seen as a strong mechanism for providing expert advice and recommendations to CHPSD and ROEB staff about risk management, and for planning and implementing specific risk management instruments and specific deliverables related to the specified products, classes, or hazards, in support of CPSP staff and management decisions. While the working-level governance was viewed positively overall, a few internal key informants noted that high turnover in committees has made it difficult to find the appropriate counterparts at times.

A few internal key informants noted opportunities to improve coordinated response to industry enquiries. Enquiries can be received by either ROEB or HECSB, and maintaining consistency in responses across branches can be difficult. This concern was also echoed by a few external key informants who reported receiving differing responses from different branches of Health Canada. A recent proposal to streamline enquiry management through a centralized system aims to address this issue, and is slated to begin in 2022-23. Similarly, a couple of industry key informants reported that there were opportunities to improve the efficiency of regulatory coordination for products that could potentially span multiple categories: for example, toothpaste which could be considered either cosmetic, natural health product, or non-prescription drug, depending on claims made by the producer. It is hoped that this issue will be addressed through the Self-care Framework, which will introduce risk-based rules for all self-care products, thus reducing the regulatory burden on industry.Footnote 31

Strategic partnerships

Key takeaways

The CPSP maintains relationships with international partners, NGOs and other federal departments to enhance the effectiveness and efficiency of program activities. In addition, they maintain relationships with industry to support information sharing and collaborate to address risks. Partnerships and collaborations have supported activities across the CPSP's business lines of active prevention, targeted oversight, and rapid response. The CPSP could continue to increase transparency: for example, providing more information on how risk assessments are conducted and providing increased detail on the instrument choice process during risk management.

The CPSP maintains relationships with a variety of partners and collaborators, including international governments, non-governmental organizations, other federal government departments, medical and front-line organizations, and industry associations.Footnote 32 While the evaluation did not find many examples of partnerships with provincial and territorial partners that advanced program objectives, due to the fact that consumer product and cosmetic safety are federal responsibilities, there was evidence that such partnerships have taken place when needed, such as addressing issues related to vaping-associated lung injuries, a response which included multiple jurisdictions and federal departments.Footnote 33These partnerships and collaborations are intended to help address a variety of consumer product safety issues across the CPSP's main business lines: active prevention, targeted oversight, and rapid response.

Active prevention

Some internal and external key informants believe that the CPSP's active prevention activities have been strengthened thanks to partnerships with non-governmental, medical and front-line organizations. Working with these organizations has amplified the CPSP's messaging around consumer product safety concerns, specifically issues of safe sleep for infants and ingestion of powerful rare earth magnets. Effective outreach to consumers is a critical component of active prevention, and the CPSP has done a good job of identifying and working with a variety of key partners in order to best reach consumers.

As the consumer product marketplace becomes increasingly global, Health Canada's work on regulatory development and international standards development, in collaboration with international organizations (e.g., OECD), has become all the more important. Due to the shared marketplace with countries such as Mexico and the US, consumer product safety issues in a given country inevitably affect consumers in the others. Several internal key informants, as well as key informants working with industry and NGOs, pointed out that Canada was playing an active role in the development of standards and regulations, in collaboration with international partners. Some international key informants described the impacts of such initiatives as the CPSP as pushing the global safety agenda forward and supporting a consistent approach to consumer product safety across North America.

Establishing and fostering collaborations with industry is also an important facet of active prevention. Active prevention depends on open lines of communication between industry and the CPSP. Key informants working within industry associations described their collaborative role as consisting of aggregating questions from their members with respect to new regulations or changes to product requirements, and then sharing this with the CPSP. Industry also reaches out to its members in order to share information from Health Canada with them. Taken together, these activities on the part of industry demonstrate how information flows between industry members and Health Canada, to the benefit of both groups. Survey results indicate that, in general, industry stakeholders were mostly satisfied with their collaborations with Health Canada. Approximately 7 in 10 industry survey respondents agreed to positive statements about the impact of these collaborations (See Figure 5).

Figure 5 - Text description

This figure shows different types of survey responses to four statements concerning the industry perception of satisfaction regarding collaborations with Health Canada. Survey responses were grouped as "Strongly agree or Agree," "Neither," "Disagree," "Don't know," and "N/A".

Responses to the statement, "These collaborations with Health Canada improved our understanding of our industry's consumer product safety roles and responsibilities."

- Agree: 77%

- Neither: 16%

- Disagree: 2%

- Don't know: 5%

Responses to the statement, "Theses collaborations improved our industry's ability to respond to its product safety obligations."

- Agree: 74%

- Neither: 14%

- Disagree: 5%

- Don't know: 7%

Responses to the statement, "These collaborations helped improve the health and safety of Canadians."

- Agree: 67%

- Neither: 16%

- Disagree: 5%

- Don't know: 9%

- N/A: 3%

Responses to the statement, "These collaborations helped make Canadians more aware of product safety risks."

- Agree: 63%

- Neither: 19%

- Disagree: 9%

- Don't know: 9%

Targeted oversight

Partnerships have also enhanced the CPSP's targeted oversight activities. For example, the CPSP collaborates with medical and front-line organizations and international partners. This involves the sharing of consumer product safety data related to surveillance and compliance between parties. This ultimately provides the CPSP with better quality surveillance and compliance data than it would have had access to otherwise. For example, when collaborating to address vaping-associated lung injuries and e-liquids, several internal key informants characterized the relationship with Canadian Poison Centres as being valuable, with the CPSP receiving better situational awareness of products that are poisoning Canadians. Having higher-quality surveillance and compliance data facilitates the detection of consumer product safety issues, including injuries. Furthermore, as an internal key informant noted, there is a shared benefit in capacity development as technical expertise is shared between surveillance partners. This improved oversight may also confer an efficiency gain, as the CPSP is able to leverage existing surveillance rather than duplicating efforts by conducting this work on its own.

Moreover, medical and front-line organizations play an important role in providing information on consumer product safety incidents resulting in injuries or death. A few key informants noted that expanding partnerships for information sharing with health professionals and first responders could help continually improve targeted oversight activities because these groups are the injured consumer's first point of contact, rather than Health Canada.

Rapid response

The CPSP does not enter into direct partnerships with industry to conduct its work; however, collaboration with industry associations and participation in non-governmental organizations that include industry representation (i.e., standards development organizations) have helped the CPSP respond quickly to health or safety issues. These collaborations with industry associations and NGOs have allowed for timely communication about safety issues, and this has enabled the swift removal of unsafe products from the retail shelves. For example, some key informants from industry associations indicated that because Health Canada shared information related to flame jetting with industry associations, retailers were able to remove dangerous products from shelves even before a notice of danger to human health or safety was published.

Health Canada also collaborates with international and domestic government partners. To enhance the reach and impact of recalls, Health Canada regularly coordinates joint recalls with international governments, including that of the US. Between 2018-19 and 2020-21, the CPSP posted an average of 212 recalls online each year, and approximately one-third of these were joint recalls with an international partner. Several internal key informants also noted that Health Canada has responded to emerging issues, such as the increasing popularity of e-commerce and the trend towards internet-enabled products, by establishing partnerships with other Canadian federal government departments, such as the intergovernmental working group on the Internet of Things.

Opportunities for improvement

While the above examples demonstrate that the CPSP's work towards strategic partnerships in the past 5 years has facilitated success, some opportunities for continued improvement were identified, including an opportunity for increased information sharing and transparency. Specifically, several internal and external key informants, particularly those working with industry, highlighted their desire for Health Canada to share details about the decision-making process for risk assessments and their determination, as well as their instrument choice when risk management is needed. Key informants and industry survey respondents offered a variety of potential ways to increase transparency and information sharing, including:

- publication of risk assessment decisions for consumer products, similar to what is done under the Chemicals Management Plan, and disclosing the risk assessment process;Footnote 34

- disclosing the process used to determine whether to include particular ingredients on the Cosmetic Ingredient Hotlist;

- providing the opportunity to track and follow up on incidents submitted by consumers, or when industry submits an enquiry, and providing messaging to relevant industry partners when a review or assessment is complete, including potentially sharing information on the findings, if appropriate;

- increasing the opportunities for ongoing engagement, consultations, and collaborations with industry and non-governmental organizations;

- examining opportunities to share data with those who may be able to produce useful tools or fill knowledge gaps, such as academics, researchers, and universities; and

- saving and sharing recordings of compliance promotion and awareness webinars targeting industry.

With respect to the Instrument Choice Framework, a consumer advocacy organization has expressed a desire for increased clarity and transparency on how risk management instruments are selected to manage risks associated with consumer products. Also, they note that Health Canada's primary mandate is to protect consumers, while the current instrument choice framework describes tools "to mitigate risks while supporting a fair, safe, and competitive economy."Footnote 35 In other words, they were concerned that the focus was not truly on protecting consumers and that other concerns (i.e., the economy) might be playing too big of a role in decision making. As well, engaging consumers in instrument choice was suggested as a potential improvement to enhance the selection of effective risk management tools once consumer product safety issues are identified.Footnote 36

Among several of these key informants, there was also an acknowledgement that there is a need to maintain a balanced relationship with industry involved in producing, importing, advertising, and selling consumer products. It is important to note that both internal and external stakeholders believe there is value in mindful cooperation and information sharing between Health Canada and industry, while maintaining the appropriate regulator-regulated relationship. Building on the success of the past 5 years, the CPSP should continue to leverage partner organizations' existing expertise to address consumer product safety issues across its business lines.

Conclusions and recommendations

Conclusions

Impact

The CPSP's activities across its main business lines have supported progress towards their goals of protecting consumers through industry compliance and consumer awareness. The CPSP Evaluation findings illustrate various positive impacts, including enhanced surveillance capacity to detect emerging issues, and high levels of voluntary compliance on the part of industry. Consumers have some awareness of Health Canada's role, but there are opportunities to further expand consumer awareness in partnership with other organizations, and empower consumers to make safe choices, particularly in the area of online shopping, which is a growing issue that may require new approaches.

Efficiency

The CPSP's design and delivery is seen as efficient, supported by robust governance and directed effort in high-impact or high-risk areas. The CPSP efficiently selects tools to address emerging issues and challenges in the area of consumer product safety, with focus on industry cooperation as a first course of action. Flexible features of the Acts and Regulations for consumer products, cosmetics, and labels for vaping products, including the general prohibitions, allow the CPSP to respond to health or safety risks in an appropriate manner, responsive to various situations. It will be important to revisit supporting legislation as it ages to ensure it continues to respond to a rapidly-evolving consumer marketplace. There were many examples of innovation and experimentation in program delivery, though for many of these initiatives quantifiable evidence of the efficiency gains of these approaches was not yet available. Measuring impacts on efficiency will be important to identify and advance successful practices in the future.

Strategic partnerships

Partnership with a variety of stakeholders has supported effectiveness by amplifying messaging, expanding intelligence, and expediting responses to safety issues. While information sharing did take place, external organizations that collaborate with Health Canada in the area of product safety, including industry and consumer organizations, would appreciate more transparency around processes and factors informing decision making in areas such as risk assessment and risk management.

Recommendations

Recommendation 1

Given the relevance and increasing importance of e-commerce as an issue in consumer product safety, consider ways to expand current efforts in this area to help address key issues.

There has been a significant shift in consumer behaviour, with more and more consumers turning to online retailers for their consumer product purchases relative to brick and mortar stores. This shift increasingly enables access to a global marketplace. If consumers purchase products from a seller that does not have a domestic presence, the supplier may not be compliant with Canadian legislation and regulations. Building on the strong foundation of work already underway to address this challenge, Health Canada should consider examining various ways to address and expand their efforts in addressing this increasingly important issue. These efforts could include, among others: a special section/group within the Program to address the issue, increased consumer outreach, and leveraging international best practices such as a voluntary pledge from online retailers and requiring a domestic presence to sell products in Canada.

Recommendation 2